The volatile nature of the jet fuel market also makes planning ahead difficult. This research investigates the possible strategic scenarios that can be derived regarding the supply of jet fuel in Europe and the main uncertainty factors that can be identified for the price of jet fuel for 2040. Using the Oxford scenario planning approach, this multi-stakeholder approach identifies strategic options and derives strategic implications for the European airline industry regarding jet fuel pricing and fuel supply.

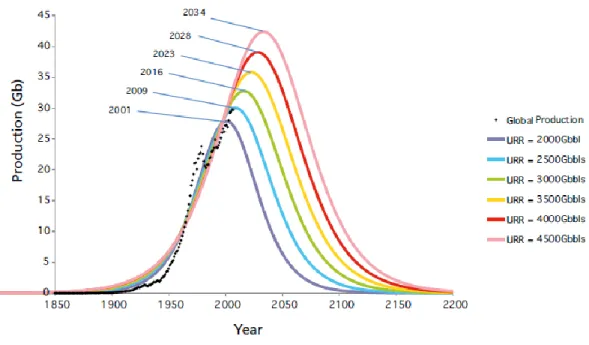

One of the most turbulent and uncertain markets today is the oil market and the associated jet fuel market. This raises the questions: What strategic scenarios can be derived regarding the supply of jet fuel in Europe by the European aviation industry. What key drivers of uncertainty are identified by European commercial airlines for the 2040 jet fuel price.

The first chapter comprises an overview of the European aviation industry, a scenario analysis and a PESTEL analysis of the jet fuel market. The European aviation industry and its market characteristics are described, with an emphasis on jet fuel dependence.

Literature Review

European Airline Market Overview

This liberalization of the European airline industry has drastically increased competition in all member countries' internal markets. Recently, airlines located outside the European Union began to operate more intensively in Europe. Gulf airlines claimed more market share in the European market, for example, by buying equity of European airlines.

The example of Etihad, which has major interests in two European companies, Air Berlin and Alitalia, has shown that Middle Eastern airlines are gaining direct access to the European market. Overall, the European passenger aviation industry is dominated in terms of market share by the following leading airlines: Air France-KLM, Deutsche Lufthansa AG, EasyJet plc and International Consolidated Airlines Group S.A. The Air France-KLM group consists of the two main airline brands, Air France and KLM, which have been merged into one group.

In order to compete and improve their market position, three of the aforementioned companies are part of an alliance (Euromonitor, 2016). In the segment of conventional airlines, alliances are necessary due to market deregulation and low-cost competition.

Airline Dependency on Conventional Jet Fuel

Finally, the airline industry and its stakeholders are working on alternatives to conventional jet fuel (EASA, 2016). Nevertheless, the industry is currently still highly dependent on conventional jet fuel due to availability and cost reasons.

Scenario-based analysis

Since this combination initially ended up in wishful thinking scenarios rather than reasonable future scenarios, the development towards scenarios emerged as a learning process (Ramírez & Wilkinson, 2016; Van der Heijden, Bradfield, Burt, Cairns, & Wright, 2002 ). Several airline scenario analyzes have been done before, partly by organizations and companies in recent years. The majority of research in airline scenario planning focuses on the global level (Berghof et al., 2005; Franke &.

The previously mentioned research will be discussed in more detail below. 2005) discusses scenarios developed for the global aviation industry in the long-term development of the industry and emissions. The research illustrated the main players and the segmentation that will influence global emissions in the aviation industry. The scenario created by Franke and John (2011) focuses on the change in business models in the past and the prediction of crisis management in the future regarding economic recessions.

As a result, the research predicts a consolidation of the European market, a change in travel behavior and increasing competition from Middle Eastern airlines in long-haul destinations. The studies mentioned also look at the aviation sector, which shows a growing awareness of the importance of the oil factor in the tourism and aviation industry.

Uncertainty factors

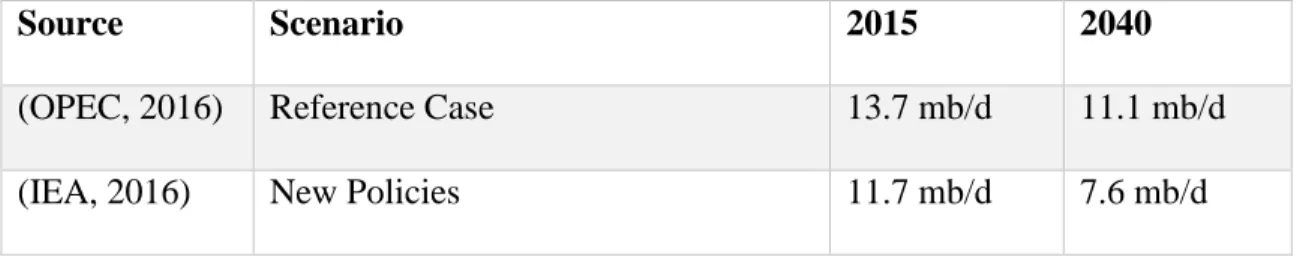

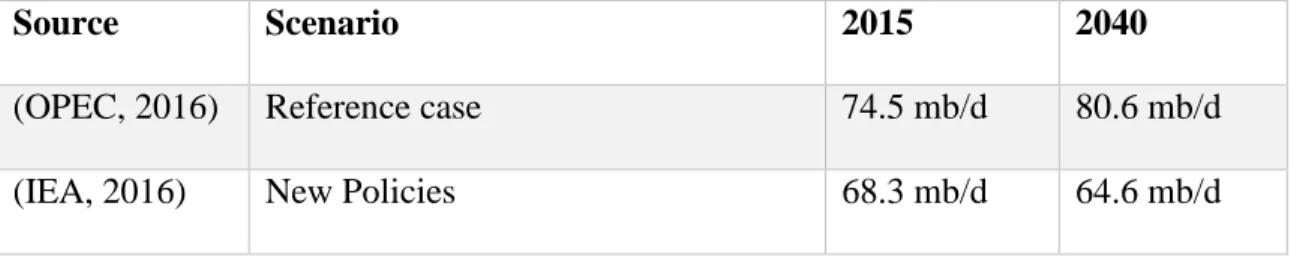

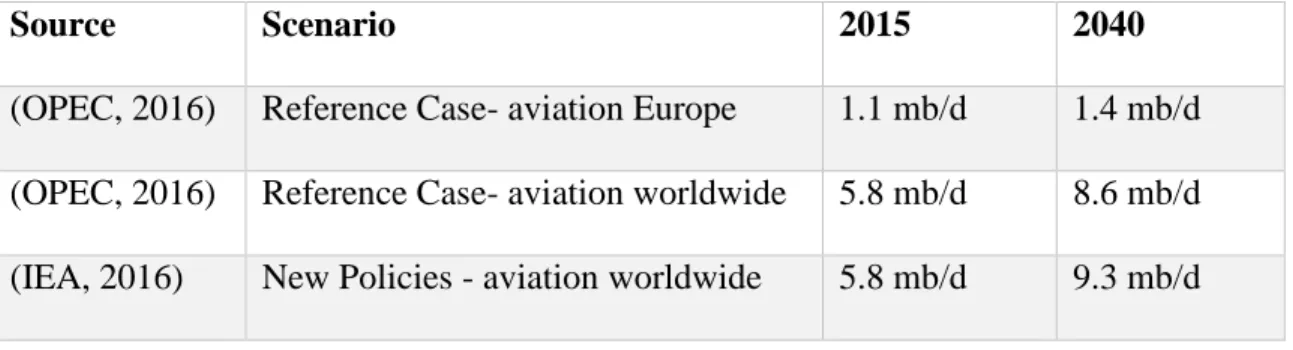

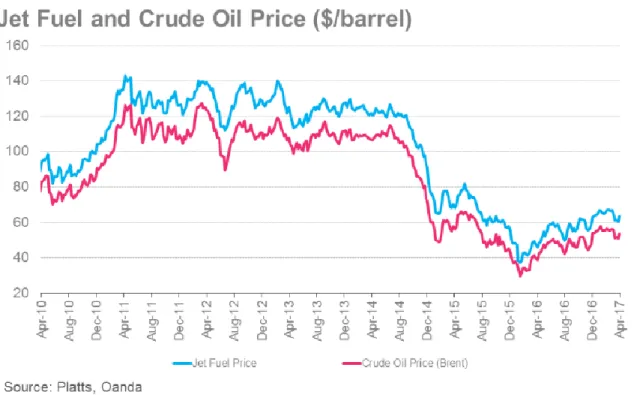

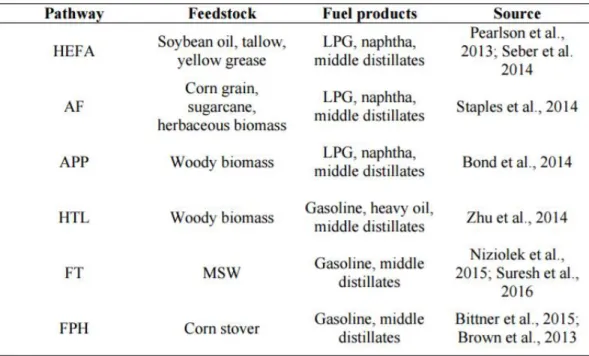

As the graph shows, the price of jet fuel has a clear correlation with the price of crude oil. Jet fuel procurement is managed in different ways depending on the airport handling the jet fuel and its connectivity. Annex A shows a table of currently existing aviation fuel pipelines in the EU28 and the respective airports.

In particular, a proximity to a crude oil pipeline facilitates a direct jet fuel pipeline to the airport. The price difference varies depending on the feedstock used and was compared to a 5-year average of conventional jet fuel prices. The price difference regarding this process with $1.43 per liter is quite high compared to conventional jet fuel prices (Bann et al., 2017).

With a price difference of $2.14, it is cost-effective as an alternative to conventional jet fuel. This jet gas process is at the lowest level of costs at $0.51 per liter compared to conventional jet fuel prices (Bann et al., 2017).

Summary

Research Design

Research Method

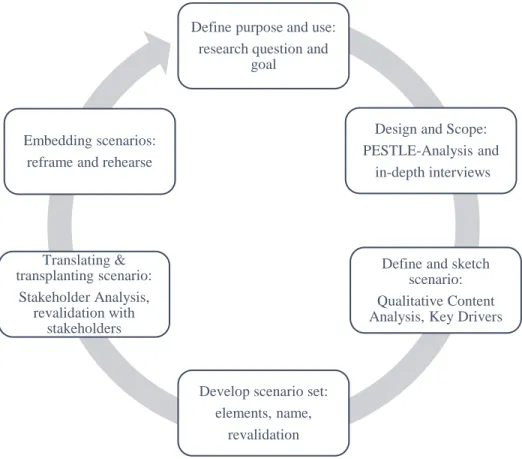

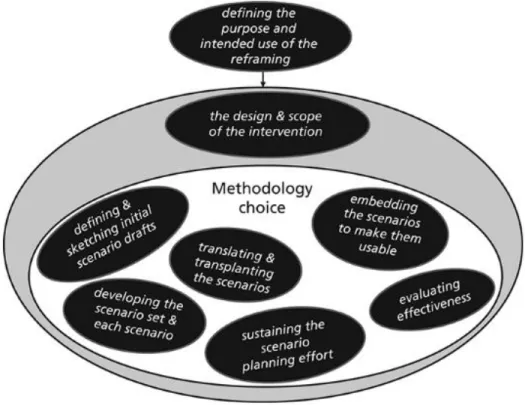

Furthermore, the CO2 offsetting scheme will be effective in 2040 and will be reflected in the costs. Both depend heavily on the available resources and who is involved in the scenario planning (Ramírez. & Wilkinson, 2016). Before the inclusion of industry experts, the environment has been studied using a PESTEL analysis of the jet fuel market to identify factors from the present and the past to gain a better understanding of the current situation, which can be found in Chapter 1.4.

In the second step, the main uncertainties for the future of the European airline industry are developed by conducting in-depth interviews with industry experts. Four in-depth interviews were conducted with managers in the strategy department of European commercial airlines. Thus, several organizations are involved in research to identify the main uncertainties and how these factors are related.

Assuming a positive outcome: If things go well, if you are optimistic but realistic, what would you see as a desirable outcome for the European aviation industry and jet fuel prices. Lessons from the past: Looking back, what would you describe as the significant events in the evolution of jet fuel prices that led to the current situation. In the fifth step, translating and transplanting the scenarios, the scenarios are further developed to suit a wider range of stakeholders and see their context.

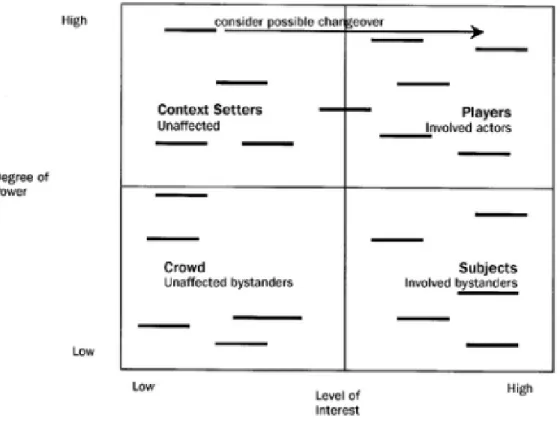

To translate and transplant the scenarios, other interested parties who did not participate in the construction of the scenario were interviewed to confirm or challenge the framework created. Regarding the business problem, the degree of power and interest of the stakeholders is defined and described in a matrix (see Figure 6) (Van der Heijden et al., 2002). This involves reformulating and iterating the created scenarios based on feedback from scenario participants and other stakeholders (Ramírez & Wilkinson, 2016).

The scenarios are then used to formulate strategic implications for the long-term development of the European aviation industry in relation to the development of jet fuel prices. In maintenance scenario planning capabilities, the goal is to continuously improve capabilities by developing and testing new methods and applications (Ramírez & Wilkinson, 2016). In general, Oxford's approach to scenario planning involves an open methodological approach that suits the purpose of the learners.

Results

- Key Drivers

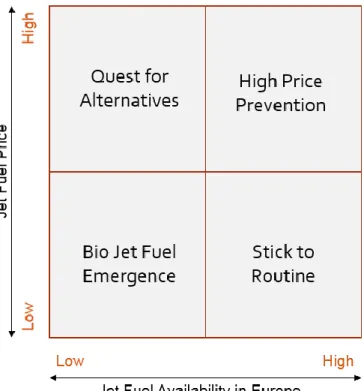

- Scenarios

- Stakeholder Analysis

- Reframing

- Strategic Implications

As an alternative approach to jet fuel, biofuel for jet engines is an option being considered in the European aviation industry. Therefore, bioreactive fuel can be an option to reduce carbon emissions and replace conventional jet fuel in the long term. After a detailed discussion of each scenario, the stakeholder analysis shows the stakeholders involved in the jet fuel market.

The energy loss can be replaced by new players in bio jet fuel production. Therefore, aircraft fuel consumption and efficient use will be a factor to consider. As the price of jet fuel is high and availability is low, the focus will be on finding alternatives.

In general, the cost of purchasing jet fuel will be high beyond the high market prices. External stakeholders in the conventional jet fuel market have a strong influence on the scenario (Interview 2, ll. 165-174). Trading CO2 emissions will have an impact and increase costs if conventional jet fuel is used further in the long term.

This gives them a high level of power and a low level of interest in the jet fuel market. These stakeholders are indirect and are not directly affected by changes in the jet fuel market. In the scenario of the creation of biofuel for jet engines, a partnership with producers of biofuel for jet engines is recommended.

A partnership agreement or owning a corporate interest in a bio-jet fuel producer will be especially advisable. By integrating the supply chain and thus conventional aviation fuel purchasing, long-term availability is assured. Cost reduction is the first priority, as the availability of conventional aviation fuel is secured.

This means the lowest available cost will be allocated to the conventional jet fuel supply chain. Moreover, in the case of high jet fuel prices, an integration of the refinery process can further reduce costs.

Implications

Practical Implications

61 Furthermore, the analysis performed on the external environment of jet fuel shows that there is a clear dependence on conventional jet fuel. With no viable alternatives, conventional jet fuel appears to be the only viable source of fuel for aircraft today. By expanding the stakeholders in the translation and transplantation step and thereby creating scenarios based on multiple actors, this research can also provide oil companies with an insight into possible future developments in the airline sector and the market. jet fuel.

Theoretical Implications

Research limitations

Conclusion

The study confirms the dependence of the European airline industry on jet fuel and demonstrates the necessary further research needed on the availability and accessibility of jet fuel, especially in remote locations. In addition, the use can also be extended to stakeholders to see possible future developments in the European airline industry.

Bibliography

Retrieved from http://www.clh.es/clhps/staff/section.cfm?id=1&side=2349&l ang=en. Retrieved from http://ec.europa.eu/public_opinion/archives/ebs/ebs_416_en.pdf European Commission. Retrieved from http://www.iata.org/pressroom/facts_figures/fact_sheets/Documents/fact-sheetses.pdf.

Retrieved from https://www.ief.org/_resources/files/events/sixth-iea-ief-opec-symposium-on- energy-outlooks/ief-duke-global-energy-outlooks-comparison-paper.pdf. Retrieved from http://www.milanomalpensa- Airport.com/en/download?_fname=/AssetsProtected/contentresources_2/genericp age/444/C_2_genericpage_1572_attachmentslist_attachmentitem_0_document.pd f&_ofname=XRS-.pdf20%% Retrieved from https://www.viennaairport.com/ .com/jart/prj3/va/uploads/data- uploads/Konzern/Umwelt_und_Luftfahrt_de.pdf.

Retrieved from http://www.worldenergy.org/news-and-media/news/embracing-the-new-frontiers-for-energy/.

Appendices