To conduct an empirical research on the relationship between business of the board directors/CEO and performance of the company;. To conduct an empirical research on the relationship between business of the board directors/CEO and performance of the company;.

CHAPTER. THE PHENOMENON OF MULTIPLE DIRECTORSHIP

Corporate governance

- Board of directors

- CEO

Many researchers have tried to investigate the relationship between various characteristics of the board of directors and the financial performance of the company. However, the effect of CEO employment on company performance shows conflicting results.

Multiple directorship

Various researches provide evidence on the relationship between the personal characteristics of the CEO and the financial results of the organization. Therefore, this paper will contribute to the existing literature and investigate how CEO representation on the boards of directors of other companies is interrelated with the company's activities and financial performance. It enables them to develop human capital and raise the overall reputation of the organization.

So far, a cornerstone in the study of the multiple directorship is a question of whether it has a detrimental or beneficial effect on company performance. Review of the previous research on the relationship between multiple directorships and company financial performance. 2003) find evidence that the past performance of the companies in which the director worked is positively associated with the number of seats the director holds on boards of other companies.

It is worth mentioning that the number of authors suggested the presence of a non-linear relationship between various directorships and various indicators of the company's performance. In paper (Ahn, Jiraporn, Kim, 2010), authors discovered that the relationship between directors' business and financial performance of the company is irrelevant as long as the number of director positions does not reach a certain level, after which the association becomes negative. The authors of the study (Chen, Lai, Chen, 2015) also make the assumption that there is a non-linear relationship between the multiple appointments of directors and financial performance.

Specifics of corporate governance in Russia

In 2010, about 60% of the largest companies had a single shareholder (including the state) holding a majority stake. However, the development of a corporate culture has proven difficult for many Russian companies, while the implementation of the Corporate Governance Code of Conduct varies between corporations. This results in a lower level of corporate governance for many corporations, lower value for minority shareholders, and consequently lower value of the firms as a whole (Wright et al., 2003).

For this reason, determining an optimal structure of the board of directors and the choice of the right company management is an important point. It highlights the role of the boards of directors, which are considered a crucial element in strengthening investor confidence in the credibility of Russian companies. Within companies that focus on long-term development, especially where shareholders withdraw from business operations, the role of the board of directors is increasing sharply.

Therefore, this research aims to provide valuable insight into a question of particular importance – “Is there a relationship between the financial performance of Russian public companies and multiple board directors and CEOs?”. In Chapter 1, we discussed one of the main directions of researchers in the field of corporate governance – the phenomenon of multiple directorships or tenure. However, there are also concerns about the CEO's employment given his unique role in the company.

CHAPTER. FINANCIAL PERFORMANCE MEASURES

- Financial performance measurement definition

- Accounting-Based Measurements

- Market-Based Measurements

- Summary

For example, in (Core et al., 1999), ROA is used as a measure of operating performance of the company. Return on assets also appears frequently in the research, affecting the independence of the board. It appeared that the average board independence has a positive direction of the relationship with the operating performance of the company.

Some analysts consider the difference between ROE and cost of capital to evaluate company performance. In this regard, along with ROE, investors should consider additional indicators of the company's fundamental performance. This figure is considered one of the most important in evaluating the company's profitability.

ROI along with business growth creates value through increased cash flow. As the difference between the market value of the company and its capital (the most common approach). It is closely related to the concept of company values and measures of absolute scale assessed by the market future performance of the company.

CHAPTER. EMPIRICAL RESEARCH

Methodology

As we discussed in Chapter 1, we define a board of directors as occupied if the majority of its members hold three or more outside board positions. A third variable commonly used in comparable studies is the percentage of directors holding three or more directorships (Cashman et al., 2012). Another problem with such a measure is the extreme skewness in the distribution of the busyness among drivers.

Vector 𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠𝑖, The components of the vector are slightly different depending on which variable - Tobin's Q or ROA - is tested. Furthermore, there is the argument that the firm's market value can be affected by its operating performance, therefore, we include lagged ROA as an explanatory variable when testing Tobin's coefficient.

In addition, extensive empirical studies have shown that various corporate governance aspects of the board of directors can be associated with the company's financial performance. The average age of directors is another characteristic that has been studied for its relationship to company performance. It is therefore assumed that the age of directors is negatively related to company performance.

Sample selection

On the contrary, some of the outside directors are expected to have a positive relationship with the company's performance. According to Dalton (1998), external directors play a crucial role in explaining the efficient control exercised by board committees. Much empirical evidence supports the fact that external directors enhance supervisory and advisory functions (Weisbach, 1988; Cho & Kim, 2007).

Furthermore, such directors are likely to be more connected to the interests of outside investors, to better monitor top management decisions and thus lead to better corporate performance. Wiesema and Bantel (1992) report a negative relationship between the average age of board members and changes in corporate strategy. For the research purposes of this study, it was necessary to obtain data on the personal characteristics of board members and CEOs.

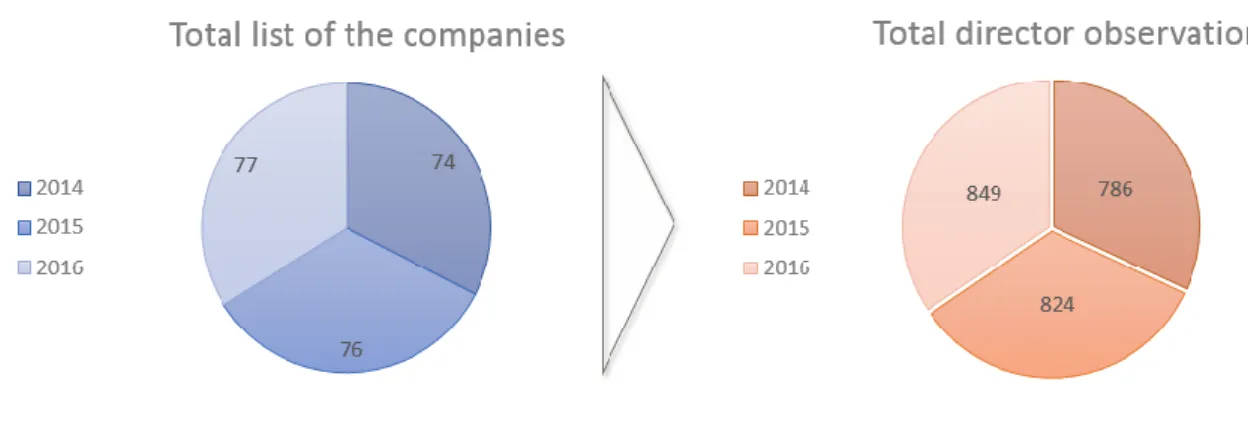

The only way to collect this data was to manually examine the quarterly reports of the companies in the sample; public companies in Russia are obliged to disclose information about their board members and chief executives. Overall, there were 2,459 observations of board members and CEOs of each company in the sample. Next, these data were processed and aggregated across companies, so we could analyze multiple management and board characteristics across firms.

Descriptive statistics of variables

The following table provides summary statistics on the engagement of board directors and CEOs from the sample. Engagement of board directors and CEOs of Russian public companies Variable Observations Mean Std. The chart below shows the distribution of directors according to the number of additional boards they serve at the same time.

For this reason, even if none of the other board members hold multiple board positions, the average busyness of the board is still high. If we look at the distribution of CEOs according to the number of external boards they serve, we can note the same trend. The following chart (Figure 11) provides information on what percentage of CEOs and boards from the sample studied can be classified as busy.

Insiders represent 21% of the board directors, and only 27% of the board members can be classified as busy. A member of the board serves on average 2.75 extra positions on the boards of other companies. For Indian companies, the business of the board members means equivalent to 4.4 (Sarkar, Sarkar, 2005), while in Turkey director holds an average of 3 additional positions (Arioglu, Kaya, 2014).

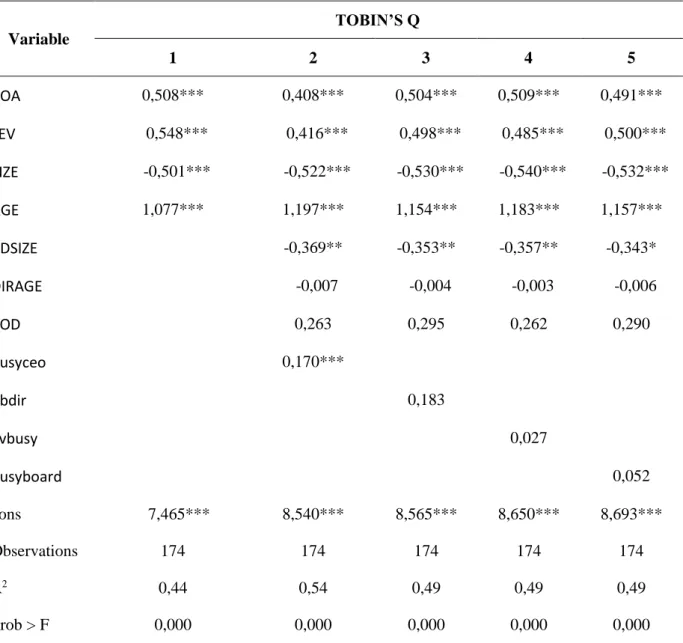

Econometric analysis

Furthermore, signs of parameter estimates for all variables were robust to the addition or removal of different variables. Columns 1 to 5 reveal that not all the variables in the base model are statistically significant. Overall, the results in the table indicate that none of the controls for board characteristics are statistically significant.

Furthermore, column 2 reports the results of the model that takes into account the relationship between CEO employment and firm performance. Columns 3 to 5 show the results of the model that takes into account director occupancy. The signs of the parameter estimates for the variables were robust to the addition or removal of different variables in the model.

The sign of the coefficient is negative, allowing to conclude that larger boards are not preferable. The results of models 3 to 5 show that none of the variables describing the tenure of the corporate board and its members are statistically significant. Therefore, we are unable to draw conclusions about the relationship between busy boards/directors and company market performance.

Main findings

Based on the analysis of the previous literature and with regard to the specifics of business management in Russia, we were able to propose several hypotheses for the research. We have argued that more appointments of board members are associated with lower operating and market results. The econometric analysis presented in Chapter 3 revealed the positive relationship between CEO multiple appointments and market-based measure of firm performance - Tobin's Q.

The fact that business of the CEO is associated with higher market-based estimation of the company's performance provides support for reputation hypothesis. Current study gives theoretical contribution to the existing literature on the corporate governance in Russia and provides theoretical framework of the specific characteristic of the board and CEO. Business of the board members must be controlled as it has a detrimental effect on company performance.

In this regard, further research may take into account specifications of the firms that count for directors' busyness. In summary, it can be stated that the aim of the research was carried out. Current study provides valuable insights on multiple board positions in Russian public companies and its association with corporate financial performance.