Who on the Russian steel market shows the best results in terms of the mentioned efficiency. Starting with an overview of the steel market in Russia and the main trends, defining the concept of efficiency and reviewing the literature with basic research on the efficiency of steel production. The specifications of these models are then determined, as well as the main inputs and outputs of the model.

MARKET REVIEW AND LITERATURE REVIEW

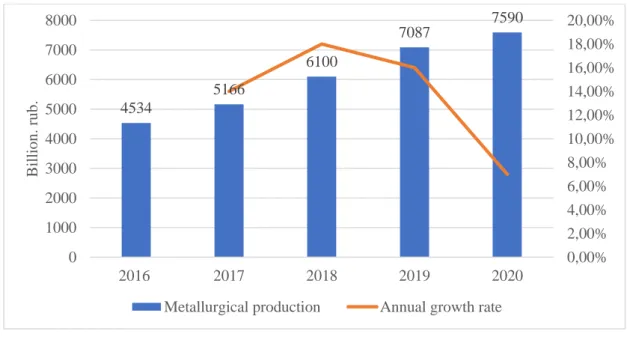

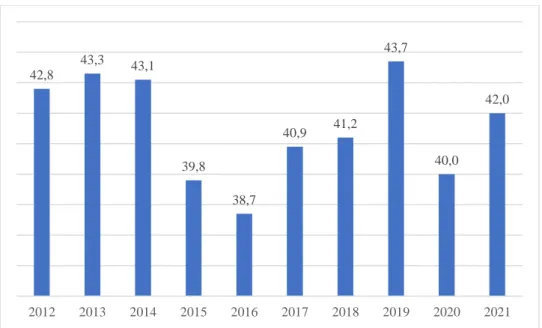

Overview of Russian steel production sector and main trends

One of the solutions in this area could be the development of a customer base and the creation of joint institutions with the main steel consumers in Russia. One of the next steps to improve business processes can be the introduction of Industry 4.0 technologies. In the next part, we will talk about the application of management theory and the formation of the concept of efficiency in this work.

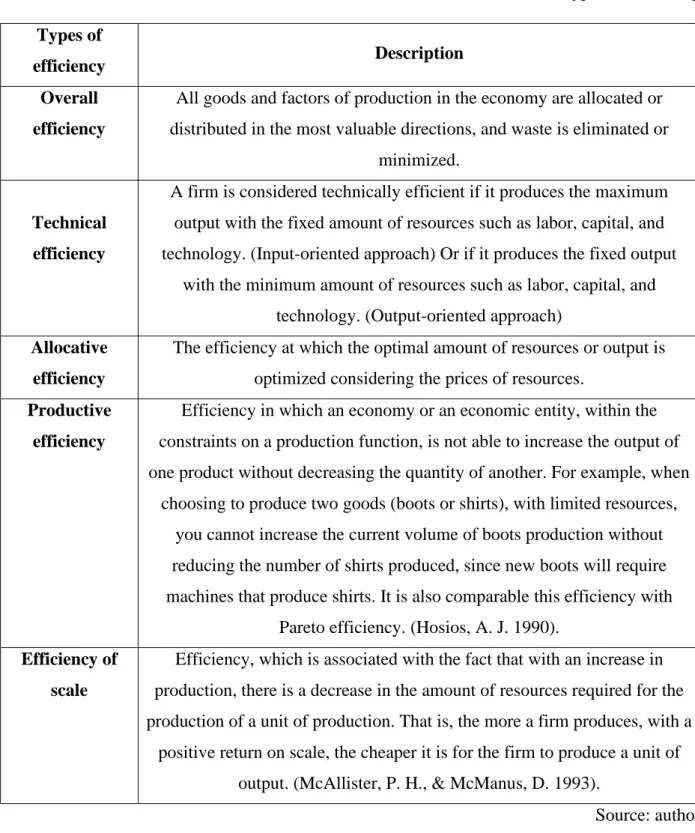

Defining efficiency concept and applying management theories

A firm is considered technically efficient if it produces the maximum amount of output with a fixed amount of resources such as labor, capital, and technology. Or if it produces a fixed output with a minimum amount of resources such as labor, capital and technology. Although technical efficiency allows you to optimize the amount of resources used in production, different resources.

Analysis of existing efficiency studies in steel industry including SFA and DEA

- Investigation of operational efficiency of steel companies around the world

- Global SFA Research on the Effectiveness of Steel Companies

- Global DEA Research on the Effectiveness of Steel Companies

20 efficiency, but also in the acquisition of resources that are not efficient in terms of price. In their work, they not only calculated facts proving an increase in the technical efficiency of steel companies, but also based on these figures the overall cumulative effect of the Chinese government's support for steel companies, as well as the effects of increased technical efficiency calculate. . This work is interesting for you, as it uses an exponential model that can be applied in other studies, and also provides practical conclusions about the optimization of technical efficiency, which consists in the maximum privatization of the steel industry by individuals.

22 Cobb-Douglas functions, this work will also confirm the correctness of the approach in terms of improving technical efficiency. Also, this work breaks down companies into classifications by territory and concludes on the basis of territorial availability of materials as a basis for success in technical efficiency of production. In this work, the author also focused on the geographical development of regions from the point of view of technical efficiency.

This work is interesting to us primarily because in this work not only the fact of the growth of the technical efficiency of steel companies is analyzed, but also given various factors that could have influenced it (technological progress). Nguyen & Nguyen, 2020) in their work, we used DEA analysis with the addition in the form of gray system theory to analyze the effectiveness of the Vietnamese steel industry during that period. The result is an improvement in technical efficiency over all previous results through the pooling of resources and economies of scale.

In the next chapter, the methodological part of the work will be explained, the model will be characterized, as well as the necessary data and the necessary interval for conducting the research.

METODOLOGY OF THE RESEARCH

Specification of data and sample for analysis

This will allow us to understand what production capacity companies are approaching steel production with and will allow us to determine assets that may not be required to generate the required amount of revenue. This indicator is characterized as input data, since steel enterprises use fixed assets for the production of the main product - steel. Another input is Operating Costs, the company's costs directly related to the production of products, which directly include the costs of creating the metal, but also the costs of managing and selling goods.

Also, many companies are implementing projects to improve sales, which can also affect this indicator and make the company more effective. This parameter is considered an input, as it is a direct cost that the company invests in steel production. The first output is Net Sales, which includes all the revenue that the steel companies receive.

This indicator is considered as an output data, since the main way to obtain income from steel companies is the sale of steel, it also allows us to consider the fact that steel companies have differentiated products, so companies with products with a high added value will not hold in the case of the choice of input data as inefficiently as the volume of steel products produced. The second and final output is net profit, which takes into account the profitability of steel companies and considers those making positive profits as successful. It is important to consider this indicator, since companies with large revenues cannot always be profitable, since the market for steel products is very volatile.

There is a simple solution to this problem, which is to normalize the variables, thus the surplus will be in values from 0 to 1 and will not include negative values, while the model will use natural or normalized values without difference.

Selection of research methods and specification

27 With this indicator there are some limitations in our model, so the profit cannot be negative for the model. This approach, the previous experience in the literature and the availability of the necessary data allow us to perform the analysis with both methods, which in the next section we will do and compare both approaches. In the literature, there are already known works on the analysis of the efficiency of steel enterprises, which used both methods Wang & Feng (2011). Both gave similar results in the sample; the exponential distribution was used as the model for SFA.

As an approach for the DEA model, the approach of the SKR, a subsection of the SKR-I was chosen. This method will allow us to assess only the technical efficiency of steel enterprises, not the economic one. This model also takes into account the effect of scale, which is particularly important if we consider only a few of the largest companies, which have a share of 87% of the steel market.

At the same time, from the point of view of practical recommendations, due to the data-driven approach, we will be able to formulate more accurate recommendations, which consist of reducing certain inputs. This is a more realistic recommendation than a revenue or profit increase type recommendation. This method is also common in many studies on the efficiency of steel production in a literature review: Mitra Debnath & Sebastian (2014), Yayar et al.

Plan of empirical research

In this chapter we looked at data selection and time interval, including the specification of variables selected as input and output data. The advantages and disadvantages of choosing quantitative analysis as the primary method are also described. DEA and SFA were then described and proven as the analytical methods used, including the different advantages and disadvantages of one and the other analytical method.

Also, the specifications of each of the models were chosen based on logic and prior experience from the literature. In the next chapter, we will conduct research based on our current understanding of patterns and research methods.

FINDINGS AND MANAGERIAL RECOMMENDATIONS

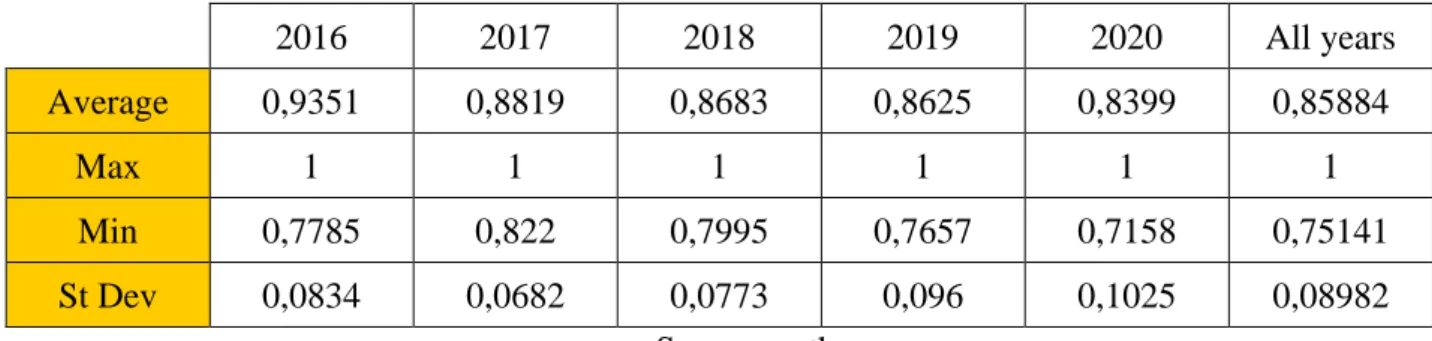

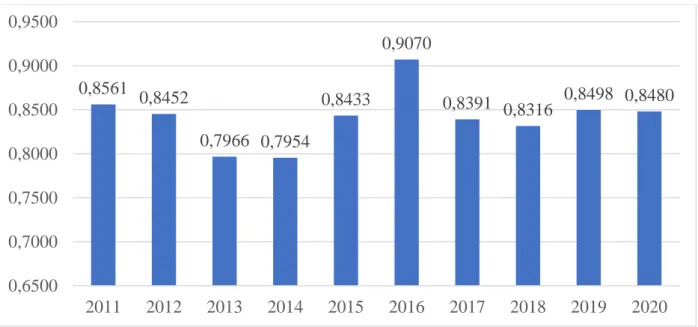

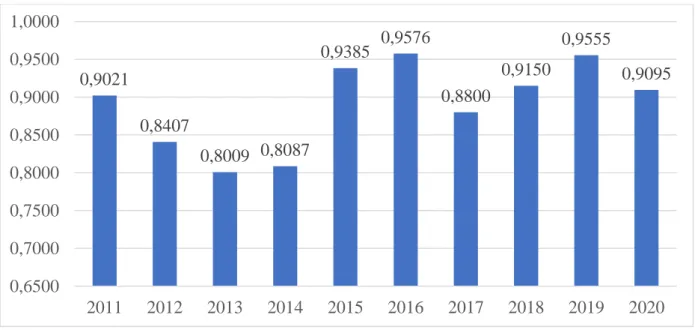

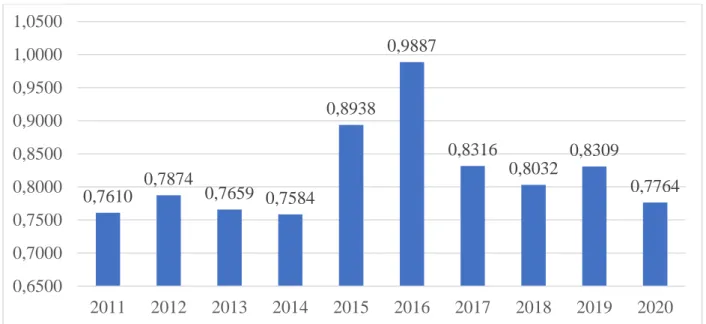

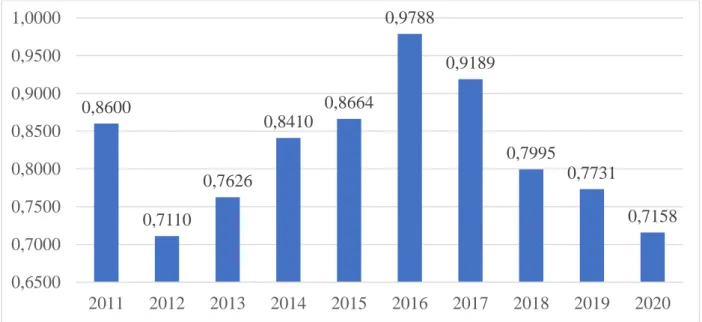

- Operational efficiency of Russian steel companies with DEA approach

- Finding best performers among Russian steel companies and recommendations

- Impact of product portfolio, company size and number of plants on the efficiency of steel

- Operational efficiency of Russian steel companies with SDA approach

In the next part, we will consider each company in detail using DEA analysis and give practical recommendations for each of the companies. The company specializes in the production of sheet metal and high-value-added products, such as galvanized steel. The company has three production facilities, two of which are located in the central part of Russia and one in the Urals.

The company has the only production plant in Russia, which is located in the central part of Russia, in the city of Cherpeovets. Metalloinvest - one of the largest mining and metallurgical holdings in Russia, has several factories in the southern part of Russia, which are mainly specialized in long distances. The Mechel Group is a global mining and metallurgical company with production in the city of Chelyabinsk, specializing in long products and steel billets.

From the table of resource reduction recommendations we can see that Mechel has the lowest operational cost efficiency, this is related to the product basket of this company, and it is recommended to err on the side of product differentiation and increase products in the portfolio. We can also see that small companies are also more likely to underperform mid-sized companies, this may be due to the fact that there are economies of scale in the average company. Over the past five years of our sample, you can see that companies specializing in high-value-added products have become more efficient.

Although our best, specializing in low-value-added products, has recently been established by high-value-added companies, this tells us that, in terms of efficiency, companies producing sheet and galvanized steel will be more efficient. in the future. As can be seen in Table 9, our top performer from the previous analysis also made the list 3 times, and more interestingly, companies were also on the list. This tells us that companies specializing in high value-added products are more efficient compared to other companies in the steel industry.

DISCUSSION OF THE FINDINGS

Research implications

Research limitations

43 Secondly, the conclusions and metrics from the model do not allow for a 100% correct conclusion and recommendations to change the situation for the better, the proposed improvements are based on an assessment of the current market situation and trends together with the data obtained, so such conclusions should not be generalized. Future researchers can increase the number of observations in the next study, for example, by adding not only Russian companies to the study, but also CIS companies for more accurate analytics. Impact of Energy Efficiency Programs on Productivity in Developing Countries: Evidence from Iron and Steel Firms in China.

Environmental regulations, environmental governance efficiency and green transformation of China's iron and steel enterprises. Using DEA optimization algorithms and gray system theory in strategic partner selection: An empirical study in Vietnam's steel industry. Estimating the Cost-Efficiency of the Italian Banking System: What Can Be Learned from the Joint Application of Parametric and Nonparametric Techniques.

Paper presented at the 2011 2nd International Conference on Artificial Intelligence, Management Sciences and Electronic Commerce, AIMSEC 2011 - Proceedings, 328-331. Regional technical efficiency of Chinese iron and steel industry based on bootstrap network data envelopment analysis. Data Envelopment Analysis Approach for Measuring Efficiency of ISO500 Companies: Iron-Steel Base Metal Industry.

Basic parameters of steel companies in Russia

Financial data of Russian steel companies

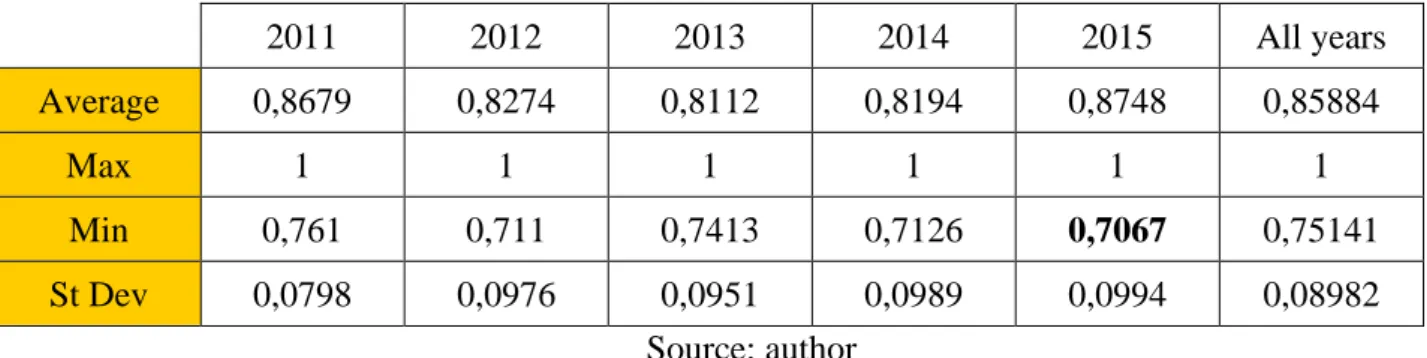

Evaluating the effectiveness of companies using the SFA method