Abbott is Associate Director of the Edwin Meese III Center for Legal and Judicial Studies and John, Barbara and Victoria Rumpel Senior Legal Fellow at The Heritage Foundation. Shanker Singham is Chief Executive Officer of the Competere Group and Director of Economic Policy at the Legatum Institute.

Acknowledgments

The availability of the entire index and its database online at www.heritage.org/index has greatly expanded the reach and accessibility of the publication over the years. Senator Jim DeMint, President of the Heritage Foundation, and Bret Bernhardt, Executive Vice President of the Heritage Foundation, have been enthusiastic supporters and great sources of encouragement in the production of this annual publication.

Executive Highlights

KEY FINDINGS OF THE 2016 INDEX

The global average economic freedom score of 60.7 is the highest recorded in the 22-year history of the Index. Score improvements in eight countries were significant enough to earn upgrades in the countries' economic freedom status in the Index.

2016 ECONOMIC FREEDOM RANKINGS

Most of the countries ranked - 116 economies - have economic freedom scores between 50 and 70. The three Baltic states - Estonia (9), Lithuania (13) and Latvia (36) - continue to gain in economic freedom. .

Economic Freedom

The Proven Path to Prosperity

ECONOMIC FREEDOM EMPOWERS INDIVIDUALS

Kim, 2016 Index of Economic Freedom (Washington, DC: The Heritage Foundation and Dow Jones & Company, Inc., 2016), http://www.heritage.org/index, and Legatum Institute Foundation, “2015 Legatum Prosperity Index, 2016; ” 2015, http://www.li.com/activities/publications/2015-legatum-prosperity-index (accessed December 8, 2015).

Economic Freedom Promotes Entrepreneurial Dynamism

Advancing Economic Freedom Leads to Higher Economic Growth

Kim, 2016 Index of Economic Freedom (Washington, DC: The Heritage Foundation and Dow Jones & Company, Inc., 2016), http://www.heritage.org/index, and International Monetary Fund, Outlook Database World Economic Forum, http://www.imf.org/external/ns/cs.aspx?id=28 (accessed 8 December 2015).

Economic Freedom and Prosperity

As Chart 2 shows, there is a robust relationship between improving economic freedom and achieving faster economic growth. Whether long-term (20 years), medium-term (10 years) or short-term (five years), the relationship between changes in economic freedom and economic growth rates is consistently positive.

ECONOMIC FREEDOM IMPROVES LIVING STANDARDS

The average annual per capita economic growth rate of countries where economic freedom has grown the most is at least 50 percent higher than that of countries where freedom has stagnated or slowed.

ECONOMIC FREEDOM ALLEVIATES POVERTY AND FOOD INSECURITY

As Economic Freedom Rises, the Global Economy Expands and Poverty Falls

As shown in Figure 6, economic freedom is a necessary ingredient in increasing food security.

ECONOMIC FREEDOM PROMOTES HUMAN DEVELOPMENT

Economic Freedom and Food Security

Economic Freedom and Poverty Intensity

The task is multidimensional and closely linked to achieving agricultural development, economic growth, institutional stability, openness to trade and overall social progress. As Figure 7 shows, governments that choose policies that increase economic freedom set their societies on a path toward more educational opportunities, better health care, and higher living standards for their citizens.

ECONOMIC FREEDOM ENCOURAGES ENVIRONMENTAL PROTECTION

ECONOMIC FREEDOM FACILITATES INCLUSIVE DEMOCRATIZATION

Greater Freedom Means Greater Performance by Several Measures

Kim, 2016 Index of Economic Freedom (Washington, DC: The Heritage Foundation en Dow Jones & Company, Inc., 2016), http://www.heritage.org/index; Cornell Universiteit, INSEAD, en World Intellectual Property Organisation, The Global Innovation Index 2015 (Geneva: World Intellectual Property Organisation, 2015), https://www.globalinnovationindex.org/content/page/GII-Home (8 Desember 2015 geraadpleeg) ); en Yale Universiteit, "2014 Environmental Performance Index," http://epi.yale.edu/epi (8 Desember 2015 geraadpleeg).

Economic Freedom, Innovation, and the Environment

ECONOMIC FREEDOM

ENSURES UPWARD MOBILITY

Economic Freedom and Democratic Governance

Economic Freedom and Social Progress

THE WAY FORWARD

PROSPERITY THROUGH ECONOMIC FREEDOM

Defining Economic Freedom

MEASURING ECONOMIC FREEDOM

Higher tax rates reduce the ability of individuals and businesses to pursue their goals in the marketplace, thereby reducing overall private sector activity. This process depends on transparency in the market and the integrity of the information available.

ECONOMIC FREEDOM: AN END IN ITSELF, A MEANS FOR PROGRESS

In an environment where individuals and companies can freely choose where and how they want to invest, capital can flow in the best possible way: to the sectors and activities where it is most needed and where the returns are greatest. Government action to divert the flow of capital and limit choice is an imposition on the freedom of both the investor and the seeker of capital.

ENDNOTES

Freedom from Poverty

New Directions in

Economic Development

GOVERNMENTS: BEGINNING TO WORK FOR YOU

Officials in the capital aren't the only ones feeling the sting of political competition. Citizens in developing countries have found bondholders unexpected allies in monitoring government performance.

ECONOMIC POLICY

You may still be wondering: What government in its right mind would use taxpayers' money to pay for gasoline consumed by the rich?. Many do—and spend more on it than on primary schooling for the poor.).

THE ORTHODOXY BEHIND THE HETERODOXY

No wonder that impact evaluation in its many forms, and despite its many critics, has become the methodology of choice in the new development economy. According to some estimates, more than half of all international trade currently takes place within a global value chain, but to be invited onto the chain, suppliers must be competitive on cost, quality, speed and reliability - as failure to deliver these affects everyone along the chain.

SOCIAL POLICY: NEW WEAPONS FOR AN OLD WAR

You can argue whether or not the distribution should be universal – the wealthy are citizens too – and it is true that in many cases the size of the dividend may not be large. On the one hand, the history of using resource revenues in developing countries is not a happy one.

TIME TO ADAPT, NOT QUIT

THE TAKE-HOME MESSAGE

This optimistic view of the world is not without danger; calamities, natural or otherwise, may very well take us away. Marcelo Giugale and Nga Thi Viet Nguyen, "Money for the People: Estimates of the Potential Scale of Direct Dividend Payments in Africa," Center for Global Development Policy Paper No.

Out of the Shadows: Measuring Informal Economic Activity

DEFINING THE SHADOW ECONOMY

MEASURING THE SHADOW ECONOMY 5

DRIVING FACTORS OF THE SHADOW ECONOMY

MIMIC Model Estimation Results Independent Variables

Unemployment rate, defined as total unemployment as a percentage of the total labor force (expected positive sign). Labor force participation, which is the proportion of the population that is employed.

SIZE OF THE SHADOW ECONOMY FOR 162 COUNTRIES 15

Considering the indicator variables, the growth rate in the total labor force is statistically significant, as is the growth rate in GDP per capita. inhabitant. One of the most interesting trends in the data is the overall reduction in the size of the shadow economy over time.

SUMMARY AND CONCLUSIONS

It is clearly seen that for all country groups (25 OECD countries, 112 developing countries, 25 transition countries) there is a decrease in the size of the shadow economy. The regional results for the size of the shadow economy also follow closely with the regional breakdown of economic freedom scores.

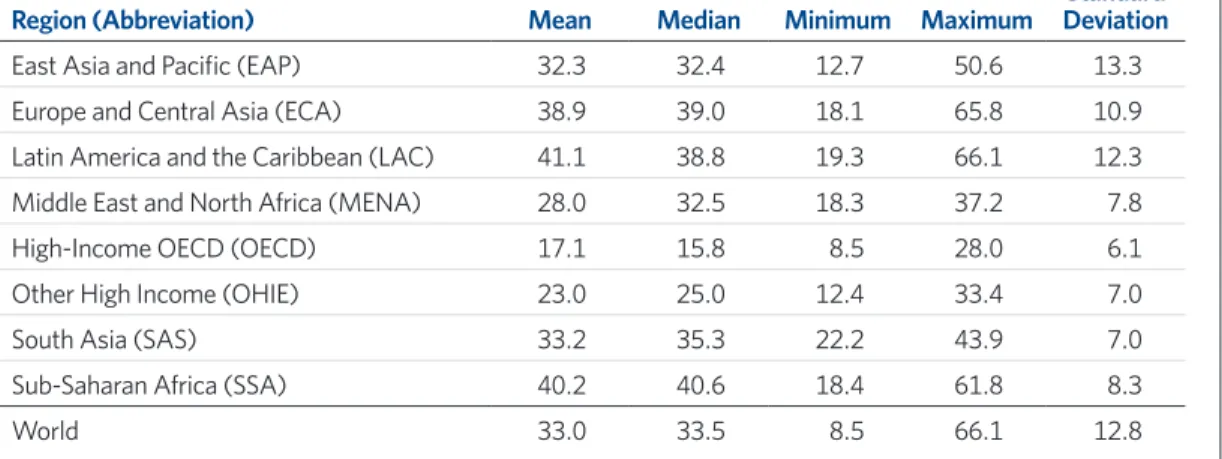

Average Informality by World Bank’s Regions

The average size of the shadow economies of the 162 countries was 34.0 percent of official GDP (unweighted measure) in 1999 and fell to 31.2 percent of official GDP in 2007. Equally important, however, is the clearly negative trend in the size of the economies. the shadow economy over time.

Size and Development of the Shadow Economy

The unweighted average size of the shadow economies of all 162 countries (developing countries, Eastern Europe, Central Asia and OECD high-income countries) fell from 34.0 percent of official GDP in 1999 to 31.2 percent of official GDP in 2007. The full implementation of such policies, including those highlighted in this Index as likely to increase economic freedom, could stabilize or even reduce the size of the shadow economy.

Size of the Shadow Economy (% of GDP)

APPENDIX

Feld and Friedrich Schneider, "Survey on Shadow Economy and Undeclared Earnings in OECD Countries," German Economic Review, Vol. Tedds, Taxes and the Canadian Underground Economy (Toronto/Ontario: Canadian Tax Foundation, 2002); Feld and Schneider, “Survey of shadow economy and undeclared earnings in OECD countries”; and Schneider and Williams, The Shadow Economy.

Anticompetitive Policies Reduce Economic Freedom

Addressing and publicizing the economic impact of these regulatory abuses must be given a higher priority to promote economic freedom and prosperity. We briefly summarize research (much of it supported in recent years by the World Bank) that estimates the nature and magnitude of the economic welfare costs of anticompetitive regulations.

NATURE AND EFFECTS OF ANTICOMPETITIVE MARKET

We then describe the efforts of two major international organizations, the OECD5 and the International Competition Network (ICN),6 to develop methods to identify competition-restrictive rules and provide justifications for removing these restrictions. The Indian government's stockpiling of a certain amount of grain under a public procurement program, with "surplus" grain sold on the global market, constitutes a domestic subsidy that both distorts domestic production incentives and lowers the price of Indian grain relative to the rest of the world .

OECD AND ICN EFFORTS TO CATEGORIZE AND COMBAT

By setting below-market domestic prices for "essential" drugs, the Indian government is largely preventing foreign competitors from serving the Indian market, discouraging innovative pharmaceutical research, and limiting access to better quality drugs for the people of India, harming consumer welfare in the long run . Chinese government restrictions on upward adjustment of cotton prices in the 1970s and 1980s created market distortions.

ANTICOMPETITIVE REGULATIONS

These reports indicated that the regulations had been slightly but insufficiently modified in light of the CNC measures and that they still allowed very little room for competition in the transport sector, as concessions were renewed almost automatically. Shortly after the 2010 reports were published, the CNC demanded that the two regional governments take action to address the lack of competition in their concessions.

WORLD BANK AND OTHER STUDIES OF THE EFFECTS OF

The CNC met with key stakeholders, including potential participants, incumbents, consumers, the Ministry of Public Works and regional governments conducting their own tenders. In 2010, the CNC issued two follow-up monitoring reports on concessions at national and regional level.

ANTICOMPETITIVE REGULATIONS 20

Eliminating lawyers' exclusive rights to perform certain basic services would reduce overall legal costs in Australia by 12 percent. A growing number of scholarly articles that focus on international comparisons between countries across sectors (not just within a sector) are in harmony with the research efforts of the World Bank.

PRODUCTIVITY SIMULATOR

In a similar vein, a 2013 study based on data from 15 OECD countries and 20 sectors found clear evidence that anticompetitive regulations in upstream sectors impede multifactor productivity growth downstream and determined that the effect of increasing competition by such immediate and complete elimination link. regulations would be to increase multi-factor productivity growth by between 1 percent and 1.5 percent per year;27 and. A 2007 study of occupational licensing restrictions within the United States estimated their cost at between $34.8 billion and $41.7 billion per year and noted that by limiting competition, those restrictions reduced the rate of job growth by an average of 20 percent. 31 As the percentage of the US workforce subject to occupational licenses has increased since 2007, it is likely that these welfare costs have increased significantly.32.

A BROAD MEASURE OF

Key factors in fostering domestic competition include the competitiveness of the labor market, the efficiency of the regulatory process and the level of infrastructure competition.34. Improving all measures of regulatory quality to the level of the most competitive regulatory framework in the world would raise India's GDP per capita from $1,500 to $29,691 – a staggering 1,875 percent gain.

CONCLUSION

Srinvasa Rangan and Robert Bradley, “The Effect of Anti-Competitive Market Distortions (ACMD) on Global Markets,” Concurrences, no. Guglielmo Barone and Federico Cingano, “Services Regulation and Growth: Evidence from OECD Countries,” The Economic Journal, Vol.

Global and Regional Developments

The global distribution of economic freedom is largely bell-shaped, but tilted toward lower ratings. Kim, 2016 Index of Economic Freedom (Washington, DC: The Heritage Foundation and Dow Jones & Company, Inc., 2016), http://www.heritage.org/index.

Global Economic Freedom

Five (Hong Kong, Singapore, New Zealand, Switzerland and Australia) were labeled "free" with scores above 80.

Economic Freedom by Category

Economic Freedoms: A Global Look

The average top individual income tax rate for all countries in the world is about 28.5 percent, and the average top corporate tax rate is 24.4 percent. The average level of gross public debt for countries covered in the index is equivalent to around 50 percent of GDP.

One–Year Freedom Score Change

Per-Capita Income by Region

Ninety-seven countries, most of them least developed, gained greater economic freedom over the past year; 32 countries, including Burma, Germany, India, Israel, Lithuania, the Philippines, Poland and Vietnam, achieved their highest economic freedom scores ever in the 2016 Index; and 12 of these 32 countries, including Angola, Cabo Verde, Sierra Leone and Togo, come from Sub-Saharan Africa. Declining economic freedom was reported in 74 countries, including 19 advanced economies such as the United States, Japan and Sweden.

REGIONAL HIGHLIGHTS

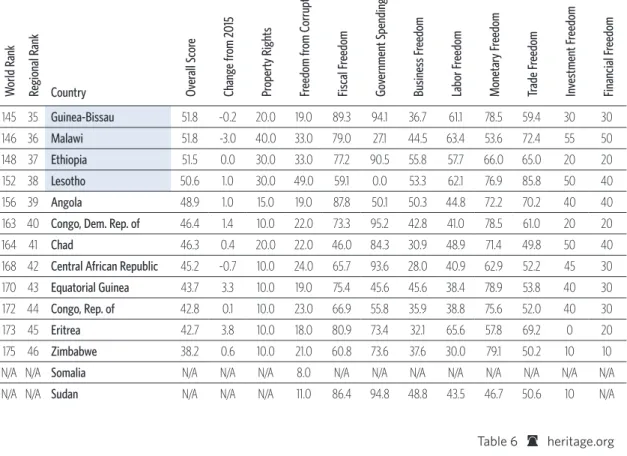

Two sub-Saharan countries, Ivory Coast and the Seychelles, have moved up the ranks of the.

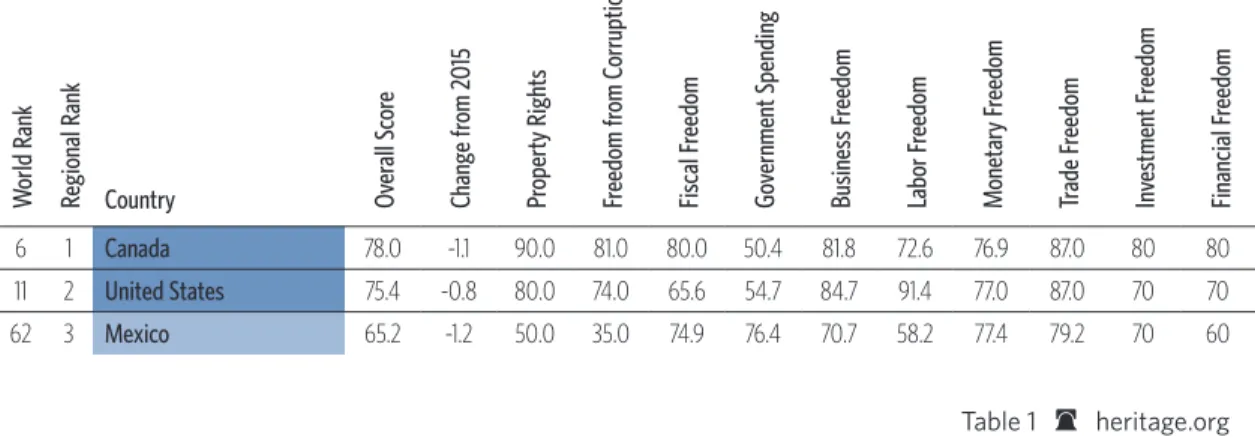

North America

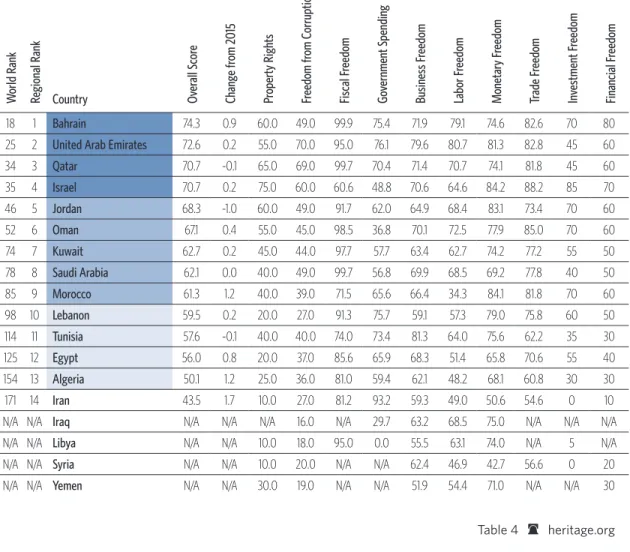

Despite the ongoing economic and political turmoil in a number of countries in the Middle East and North Africa, the region as a whole still achieved an average economic freedom score slightly above 60 due to high ratings of economic freedom in Bahrain, the United Arab Emirates, and Qatar, boosted by improved scores in Israel, Egypt and Morocco. Average economic freedom scores in South and Central America/Caribbean, the Asia-Pacific region and sub-Saharan Africa are still below 60.

NORTH AMERICA

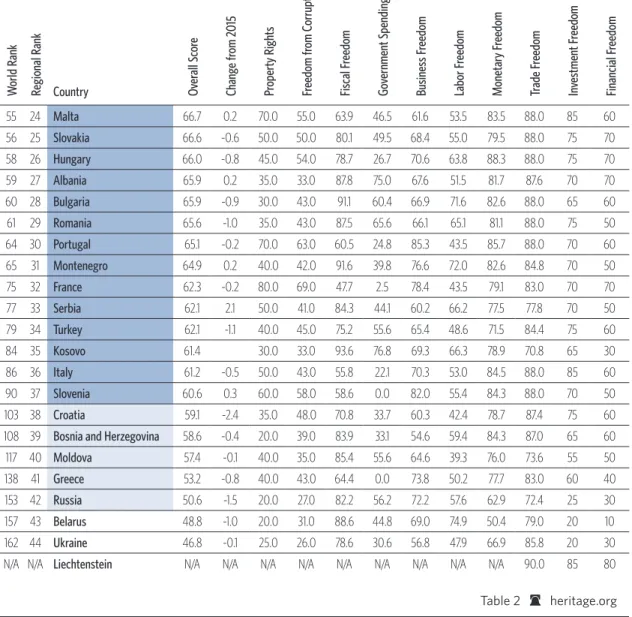

EUROPE

Somewhat insulated from the eurozone crisis and monetary uncertainty in the region, the UK has demonstrated a high level of economic resilience. Disciplined fiscal adjustments have helped to restore the country's economic dynamism and propel it to 10th place in the index.

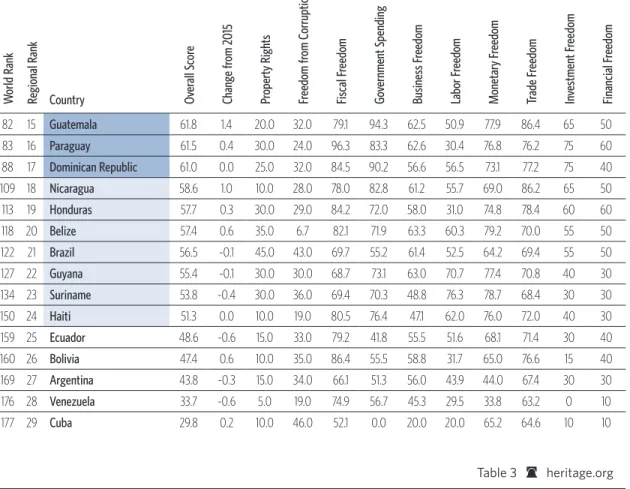

SOUTH AND CENTRAL AMERICA/CARIBBEAN

Notable countries: The three Baltic states (Estonia, Lithuania and Latvia) continue to gain more and more economic freedom.

South and Central America/Caribbean

All but eight countries received an economic freedom score between 50 and 70 in the 2016 index, and 14 countries fall into the middle economic freedom category of "moderately free". Notable countries: Several notable policy measures implemented in recent years threaten Chile's long-established tradition of economic freedom.

MIDDLE EAST/NORTH AFRICA

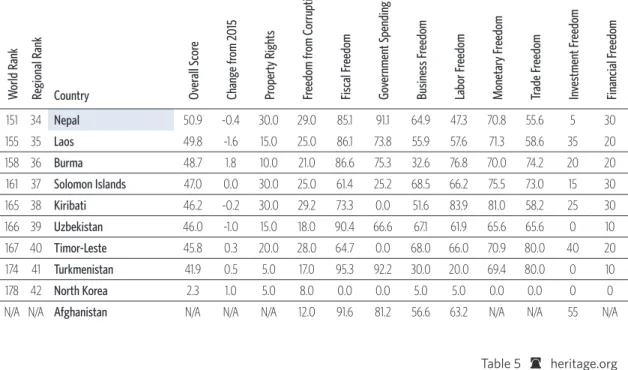

ASIA–PACIFIC

Reforms have included the partial privatization of state-owned enterprises, the liberalization of trade and investment regimes, and the modernization of the financial sector.

SUB-SAHARAN AFRICA

The pace of job creation has been hampered by bureaucratic rigidity and corruption in the economy, which leads. Note: Western Sahara is not depicted because its economy is not in the Index of Economic Freedom.

Sub-Saharan Africa

This chapter reports data on economic freedom for each of the countries included in the 2016 Index of Economic Freedom. Countries ranked are given a score ranging from 0 to 100 for each of the 10 components of economic freedom, and these scores are averaged (by used equal weights) to calculate the final economic freedom score of each country.

The Countries

For more than two decades, the Index of Economic Freedom has recorded and benchmarked the many factors underlying economic freedom in countries around the world. The country profiles in the Index provide many examples of the impact, both positive and negative, of government economic policies.

DEFINING THE “QUICK FACTS”

COMMONLY USED ACRONYMS

AFGHANISTAN

Due to the severe underdevelopment of the financial system, the government has very limited influence on monetary policy. The transfer of security responsibility to Afghan forces and planned phase-out of international troops increase uncertainty as the government confronts high levels of corruption, heavy and persistent drug trafficking, weak institutional capacity and a severely underdeveloped justice system.

ALBANIA

Albania's average tariff rate is only 1.2 percent, and its trade and investment policies are much more open than the global average. The top income tax rate is now 23 percent and the top corporate tax rate is 15 percent.

ALGERIA

Despite some improvement in the business environment, significant bureaucratic obstacles to entrepreneurial activity and economic development remain. The public debt corresponds to slightly less than 10 percent of the size of the economy, and public spending is 38 percent of GDP.

ANGOLA

Angola's average tariff rate is 4.9 percent, and its trade and investment policies are less open than the global average. However, public use of banking services remains low; only about 10 percent of the population has a bank account.

ARGENTINA

The government rejected IMF censorship and underreported official inflation statistics, and increased deficit spending on energy and other subsidies ahead of the 2015 presidential election. A wide range of non-tariff barriers and foreign investment restrictions give Argentina one of the world's worst trade and investment climates.

ARMENIA

The state no longer has an ownership stake in any bank, but the banking sector, which represents more than 90 percent of all financial sector assets, still finds it difficult to provide adequate long-term lending. Government spending fell to 25.4 percent of total domestic production, and budget deficits remain relatively small.

AUSTRALIA

Australia's regulatory environment, one of the world's most transparent and efficient, is highly conducive to entrepreneurship. With an average tariff rate of 1.8 percent, low non-tariff barriers, and few restrictions on foreign investment, Australia has some of the world's most open trade and investment policies.

AUSTRIA

Austria screens investment in some strategic sectors, but its overall trade and foreign investment climate is one of the most open in the world. Government consumption continues to account for more than half of total domestic output, and public debt is about 87 percent of GDP.

AZERBAIJAN

Despite progress in streamlining the business start-up process, other time-consuming requirements undermine the overall regulatory efficiency. The top individual income tax rate is 25 percent and the top corporate income tax rate is 20 percent.

THE BAHAMAS

Starting a business costs about 10 percent of the level of average annual income, and no minimum capital is required. The government screens new foreign investment and restricts investment in certain sectors of the economy.

BAHRAIN

Bahrain has several anti-corruption laws, but enforcement is weak and senior officials suspected of corruption are rarely punished. A March 2015 IMF report estimated that Bahrain's subsidy programs covering natural gas for industrial users, food items, water and electricity consume more than 12.5 percent of GDP.

BANGLADESH

Most sectors of the economy are open to foreign investment, but state-owned enterprises distort the economy. Despite ongoing financial sector reforms, government ownership and interference remains significant, undermining much-needed efficiency gains.

BARBADOS

With strong foundations of economic freedom backed by relatively low levels of corruption and an efficient judiciary, Barbados' economic policies have attracted international corporations. With chronically high budget deficits averaging more than 4 percent of GDP, government debt has risen to about the size of the economy.

BELARUS

The simplification of registration formalities and the removal of the minimum capital requirement have facilitated business formation, but state intervention and the dominance of the public sector in the labor market still hinder the overall entrepreneurial environment. It is a member of the Eurasian Customs Union, which includes Armenia, Kazakhstan, Kyrgyzstan and Russia.

BELGIUM

Prime Minister Dean Barrow of the United Democratic Party is serving his second consecutive five-year term until 2017, and his popularity may prompt him to try for a third term. The government's record on structural reforms is uneven, and persistent policy weaknesses in many parts of the economy are hampering more dynamic growth.

BELIZE

Despite some streamlining of the process of setting up a business and meeting regulatory requirements, challenges such as poor trade code enforcement and lack of transparency often discourage entrepreneurial activity. In September 2015, the government signed its second $375 million Millennium Challenge Corporation pact to increase energy generation in a country where two-thirds of the population has no access to electricity.

BENIN

The government's inability to honor contractual obligations, guarantee an independent judiciary and accept unfavorable court decisions undermines the business environment. The government subsidizes cotton production, and low-priced petrol and diesel are smuggled in from Nigeria and subsidized by the Nigerian government.

BHUTAN

BACKGROUND: President Evo Morales enacted a new constitution in 2009 to expand his powers and increase the state's participation in the economy. Bolivia is one of the world's largest producers of coca leaves and a major transit area for Peruvian cocaine.

BOLIVIA

Overall corruption and deficiencies in the legal framework keep the rule of law fragile and uneven across the economy. BACKGROUND: The Dayton Accords of 1995 ended three years of war in the former Yugoslavia and finalized Bosnia and Herzegovina's independence.

BOSNIA AND HERZEGOVINA

Although public procurement is one of the main sources of corruption and fraud in Bosnia and Herzegovina, the government largely ignored the calls of a major anti-corruption movement for reforms in 2014. The labor market is inefficient and the unemployment rate, especially among young people, is one of the highest in the region.

BOTSWANA

There have been no bank failures and the banking sector continues to expand, although access to financial services remains low. Since the advent of "real plan" money in the 1990s and the end of hyper-inflation, poverty rates have fallen, but heavy government intervention in the economy continues to limit development.

BRAZIL

BACKGROUND: President Dilma Rousseff of the leftist Workers' Party began her second term in January 2015. The oil and gas industry accounts for over half of GDP and 90 percent of government revenue.

BRUNEI

However, this only provides for a small fraction of employment, and most of the population works directly for the government. Brunei is one of the world's last remaining autocracies, and the sultan has wide powers.

BULGARIA

Bulgaria remains one of the poorest countries in the EU and adoption of the euro is unlikely. Burkina Faso is one of the poorest countries in the world and relies heavily on cotton and gold exports.

BURKINA FASO

In September 2015, members of the elite Regiment of Presidential Security, considered loyal to Compaoré, ousted the interim government in a coup, but then relinquished control, and elections were postponed. Heavy government interference in the economy has made Burma one of the world's poorest countries.

BURMA

Banking is dominated by state-owned banks, although several private banks have been in operation. Total tax revenue corresponds to 6.1 percent of GDP, although income tax revenue has been increasing in recent years.

BURUNDI

The economy is dominated by subsistence farming and more than half the population lives below the poverty line. Foreign aid accounts for about 50 percent of the government budget and public debt equals 30 percent of GDP.

CABO VERDE

Substantial restructuring and the relatively reliable rule of law facilitated Cape Verde's transition to a more open and flexible economic system. Cape Verde has relatively high levels of transparency and low levels of corruption compared to other African countries.

CAMBODIA

Nominally a democracy, Cambodia has been ruled by former Khmer Rouge member and Vietnamese ally Prime Minister Hun Sen since 1993. Public spending accounts for 20.5 percent of gross domestic product, but the budget balance remains under control.

CAMEROON

The non-bank financial sector remains small and stock market capitalization is modest. With the addition of 30 new seats in the House of Commons to increase representation for counties with growing populations, Trudeau's Liberal Party claimed 184 of the now 338 seats in parliament.

CANADA

Canada's 13 provinces and territories enjoy significant autonomy due to the country's diversity and large geographic size. More than half of the population lives in rural areas and depends on subsistence agriculture.

CENTRAL AFRICAN REPUBLIC

Chad has sent security forces to assist peacekeeping missions in Darfur, the Central African Republic, Mali and the Democratic Republic of the Congo and is the main component of the multinational force fighting Boko Haram in Nigeria. Chad hosts nearly 500,000 refugees, mainly from Sudan and the Central African Republic, and has been on the UN.

CHAD

Its economy is heavily dependent on oil and agriculture, with the former accounting for 60 percent of export earnings. The financial sector is underdeveloped, and domestic credit balances amount to less than 1 percent of GDP.

CHILE

Foreign investment in some sectors of the economy may be controlled by the government. Debt at various levels of the economy has also accumulated, posing risks to long-term economic expansion.

CHINA

The government has recently backed away from measures to limit borrowing by provincial and local governments. The government has also set up a 40 billion yuan fund to help emerging market economy sectors.

COLOMBIA

The number of defaulted loans has fallen, and the tax on financial transactions is planned to be reduced. Public consumption has stabilized at around 29.2 percent of total domestic output, and public debt remains below 40 percent of GDP.

COMOROS

BACKGROUND: The three-island union of the Comoros has seen more than 20 coup attempts since independence in 1975, most recently in 2013. A 2001 constitution gave each island increased autonomy and stipulated that the presidency rotate between the three islands.

DEMOCRATIC REPUBLIC OF CONGO

The DRC's vast natural resources, including copper and diamonds, have fueled conflict rather than lasting economic development. The Republic of Congo remains a poorly diversified commodity producer, heavily dependent on oil.

REPUBLIC OF CONGO

As of December 2014, Congo hosted around 55,000 refugees from Angola, the Central African Republic, Chad, the Democratic Republic of the Congo and Rwanda. Public expenditure is 38.4 percent of GDP, and public debt is equivalent to about 40 percent of the domestic economy.

COSTA RICA

Thanks to strong institutions, corruption is lower than elsewhere in the region, but public dissatisfaction with the state of the country's democracy, allegations of official corruption and rising crime linked to Mexican drug cartels is growing. A legal dispute with Ghana over oil drilling in the Gulf of Guinea is being heard by the International Court of Law of the Sea.

CÔTE D’IVOIRE

Côte d'Ivoire is West Africa's second largest economy and a leading producer of cocoa and cashew nuts. Freedom House reports that 80 percent of all government procurement was awarded in unbidden tenders in 2013, up from 40 percent in 2012.

CROATIA

Few meaningful steps have been taken to reduce or control public spending, and the bloated public sector is seriously undermining private sector dynamism and prolonging the economic downturn in the absence of necessary reforms. BACKGROUND: Fidel Castro's 84-year-old brother Raúl heads both the government and the Cuban Communist Party.

CUBA

Access to credit for entrepreneurial activities is uneven and further hindered by the superficiality of the financial market. The Republic of Cyprus joined the European Union in 2004 and serves as the island's internationally recognized administration.

CYPRUS

The independent judiciary in the Republic of Cyprus operates in accordance with the British tradition and upholds due process. The Czech Republic is an export-based economy, and growth far exceeded expectations in early 2015.

CZECH REPUBLIC

The Czech Republic separated from Slovakia in 1993 and joined NATO in 1999 and the EU in 2004. Although not a member of the euro, Denmark has felt the impact of the European economic crisis.

DENMARK

The complex tax regime finances the vast range of government activity through various direct and indirect taxes, and the overall tax burden is one of the highest in the world. The economy is one of the most open in the world in terms of foreign investment and investment. the code is transparent and efficiently administered.

DJIBOUTI

Power is still heavily concentrated in the hands of the president, and repression of political opposition has increased. Reforms, which include simplifying the process of setting up companies and lowering the corporate tax rate, have helped to improve the overall investment environment.

DOMINICA

A comprehensive restructuring of the economy to meet IMF requirements, including the elimination of price controls, has been underway for more than a decade. Corruption and erratic enforcement of the law continue to erode commercial confidence and undermine economic dynamism.

DOMINICAN REPUBLIC

The judiciary is not independent, and the Inter-American Commission on Human Rights has criticized Ecuador for restricting press freedom. It is also rumored that the government would like to abandon the use of the dollar as legal tender.

ECUADOR

Despite having only a small amount of arable land, agriculture is an important part of Egypt's relatively well-diversified economy, employing about 30 percent of the labor force. The government's commitment to institutional and structural reforms will be key to strengthening progress and ensuring the long-term transformation of the economy.

EGYPT

The subsequent period of political instability included dissolution of parliament in 2012, repeated street demonstrations and a military coup that ousted the government of Mohamed Morsi of the Muslim Brotherhood's Freedom and Justice Party in 2013. After years of political upheaval that left the economy in tatters, Egypt has made progress in restoring confidence.