Kim is a Senior Policy Analyst at the Center for International Trade and Economics at The Heritage Foundation. Roberts is a research fellow for Freedom and Economic Growth at the Center for International Trade and Economics at The Heritage Foundation.

Preface

This great global revival of freedom has enormously important consequences: suddenly people, and even economists, began to realize that the human mind was the real engine of economic prosperity and development, and that the human mind basis of its economic development. most creative when it was free. Looking back on my 20 years of involvement with the Index of Economic Freedom, I feel deeply blessed to have played a part in the global struggle for economic freedom.

Acknowledgments

The continued support of Phil Truluck, Executive Vice President of The Heritage Foundation; Becky Norton Dunlop, Vice President, External Relations; Mike Franc, vice president, government studies; Genevieve Wood, Vice President, Marketing; and Michael Gonzalez, Vice President, Communications, are greatly appreciated. Finally, we would like to express our appreciation to the many people who respond so enthusiastically to the Index of Economic Freedom year after year.

Executive Highlights

The Rule of law

The woRld Rankings

Since the peak in 2008, when the average economic freedom score reached 60.2 on the Index 0–100 scale, global economic freedom has not improved, and this year's average score of 59.6 is no better than the score that ' was not achieved a full decade ago. 2003. Notably, in the 2013 index, Jordan became a "mostly free" economy for the first time, and Georgia recorded the largest score improvement over the past year.

Economic Freedom

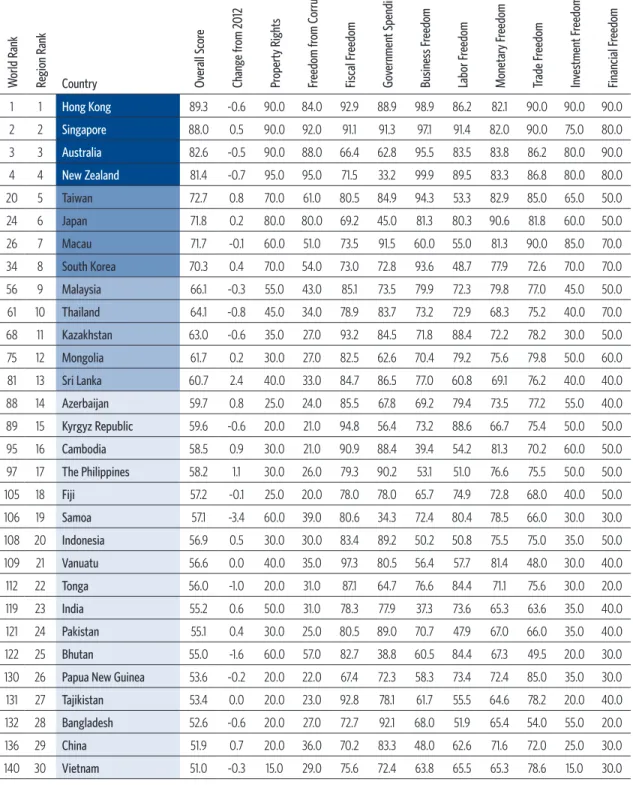

Hong Kong was able to maintain its position as the world's freest economy, a position it has held for 19 consecutive years. With another strong advance in economic freedom, Singapore remains a close second and has narrowed the gap between it and Hong Kong.

Global and Regional Patterns

Five of the top performing companies are in the Asia-Pacific region, with Taiwan coming in at number 20, joining global leaders Hong Kong, Singapore, Australia and New Zealand. Feulner, Index of Economic Freedom 2013 (Washington, D.C.: The Heritage Foundation and Dow Jones & Company, Inc., 2013), http://www.heritage.org/index.

Global Average Economic Freedom

Each region continues to be represented by at least one of the 20 most free economies, but some notable realignments have made it so. Losing its status as one of the world's 10 freest economies, Ireland has fallen to 11th place.

Higher Government Spending Equals Lower Economic Growth

Greater Economic Freedom, Higher Standard of Living

Their impact is more striking within developing and developing countries than for more advanced economies (correlation coefficient 0.70 vs. 0.53), perhaps because there is more variability in scores between developing and developing countries . Thus, the Index considers the rule of law as a fundamental aspect of economic freedom, essential for achieving economic progress and social prosperity.

Economic Freedom Promotes Prosperity

Greater levels of economic freedom have had a large positive impact on poverty levels in the last decade. Based on the United Nations Multidimensional Poverty Index, the intensity of poverty in countries whose economies are considered predominantly free or moderate.

Four Clear Trends: Economic Freedom Is Key to Overall Well-Being

The social benefits of economic freedom extend far beyond higher incomes or reduced poverty. Countries with higher levels of economic freedom enjoy higher levels of human development, including better education and more comprehensive health care.

Regional vaRiaTions

Economic Freedom, Economic Growth, and Poverty

The Ten Economic Freedoms: A Global Look

Feulner, Index of Economic Freedom 2013 (Washington, D.C.: The Heritage Foundation and Dow Jones & Company, Inc., 2013), http://www.heritage.org/index; World Bank Group, World Development Indicators Online, http://econ.worldbank.org/WBSITE/EXTERNAL/EXTDEC/0,menuPK:.

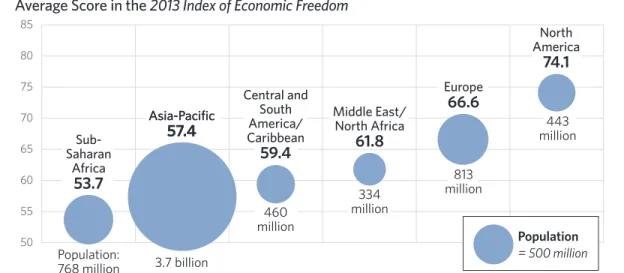

Economic Freedom by Region, with Population

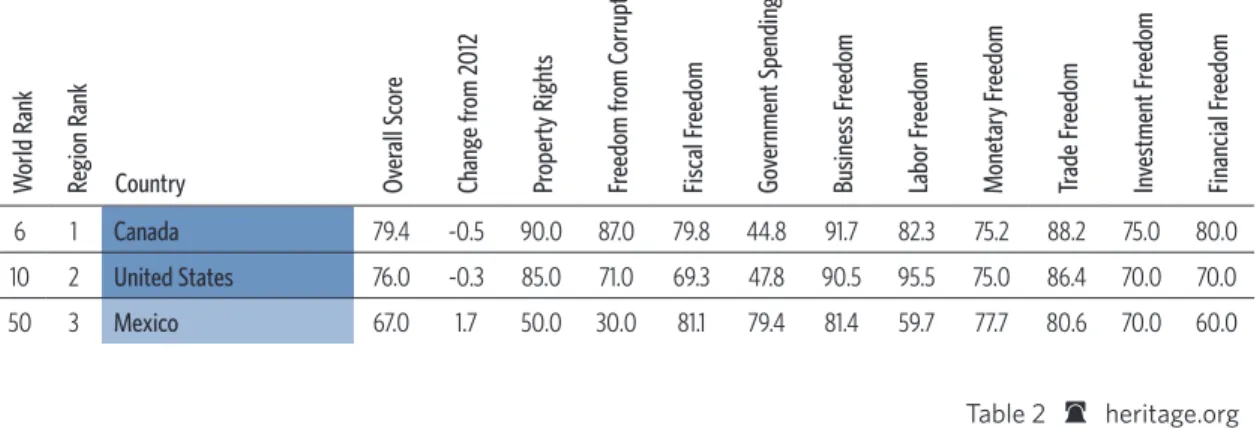

North America

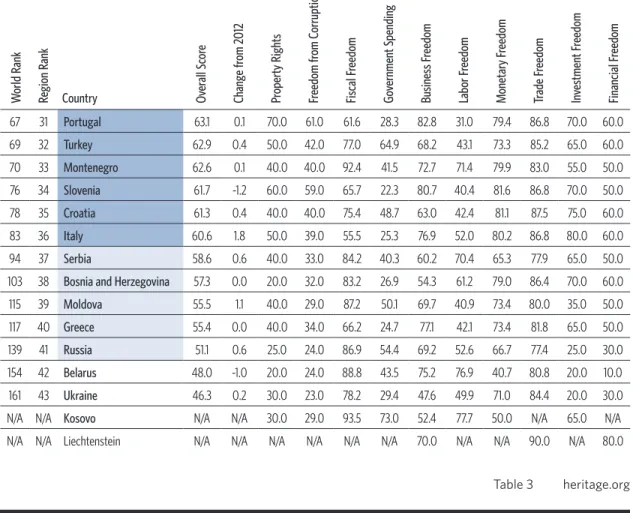

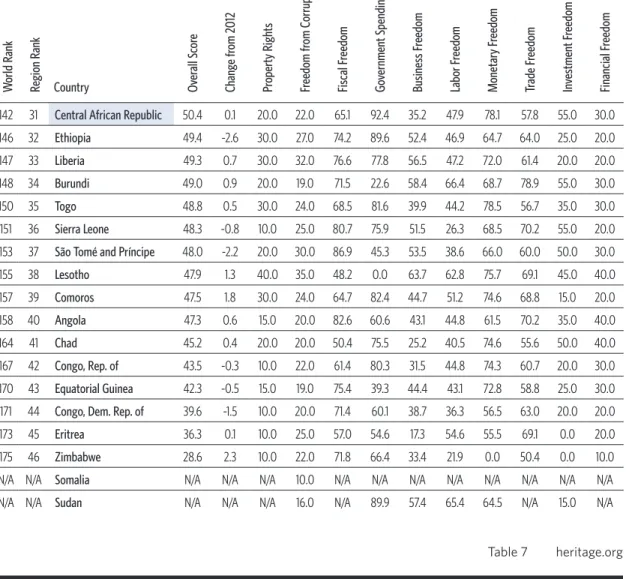

Switzerland remains the only "free" economy in the region, and some 81 percent of the 43 European countries score between 60 and 80 and are considered both. There are five European countries whose economic freedom status has notably changed in the 2013 Index.

One-Year Freedom Score Change

Despite some progress in limiting government spending in the past year, European countries have fallen almost five points below the global average fiscally. Europe is going through tumultuous and uncertain times, epitomized by the ongoing sovereign debt crisis in the Eurozone.

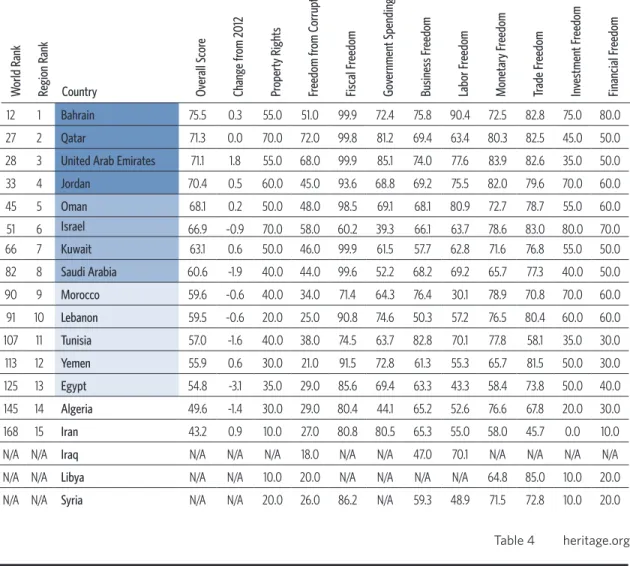

While no country in the region was among the world's 10 most improved countries in the 2013 Index, Egypt recorded the third largest drop in scores. Reflecting the fragile foundations of economic freedom in the region, scores on the rule of law have continued to deteriorate.

The United Arab Emirates and Jordan have moved up to the "largely free" category, while Lebanon and Morocco have fallen back to "largely unfree".

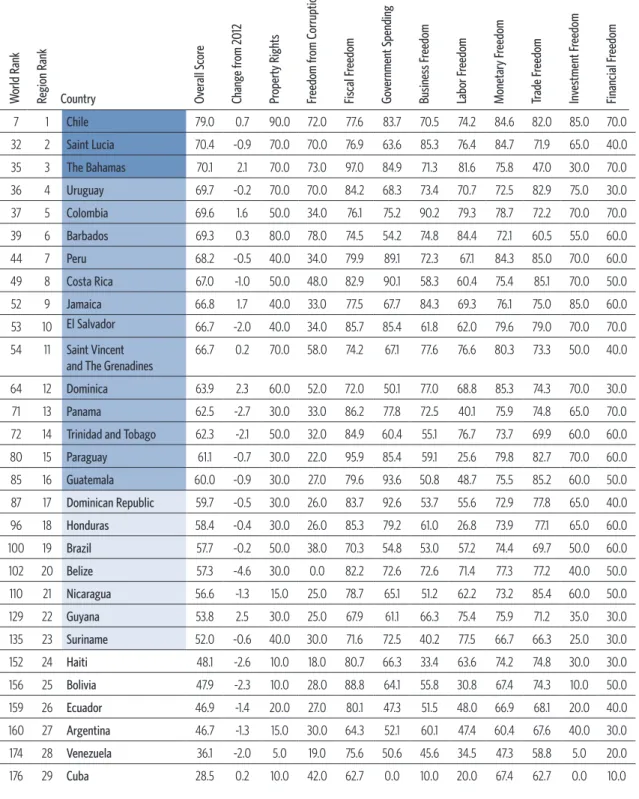

South and Central America/Caribbean

On average, the countries of South and Central America/Caribbean perform better than the world average in only three of the 10 components of economic freedom: fiscal freedom, control of public spending and monetary freedom. The region continues to lag behind the world average in the other seven areas of economic freedom, par-.

Half of the top ten declines in economic freedom recorded in the 2013 Index came from this region, recorded in Belize, Panama, Haiti, Bolivia and Trinidad and Tobago. Corruption and lack of protection of property rights are major problem areas, reflecting the region's long-standing problems of poor governance and political instability.

Asian Giants Lag in Economic Freedom

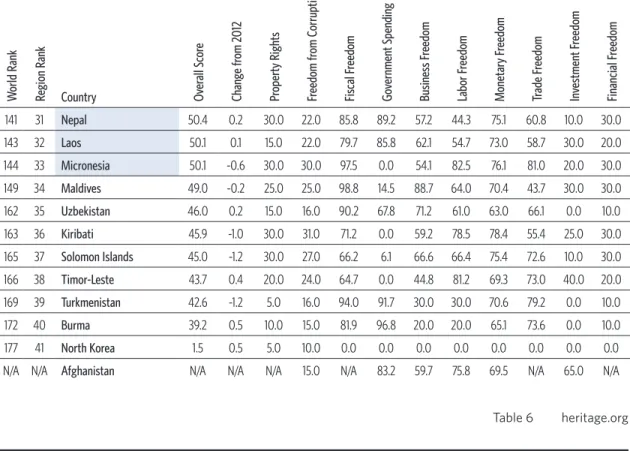

In the 2013 index, the scores of 19 countries in the region improved, and those of 20 declined. Note: Western Sahara is not depicted because its economy is not in the Index of Economic Freedom.

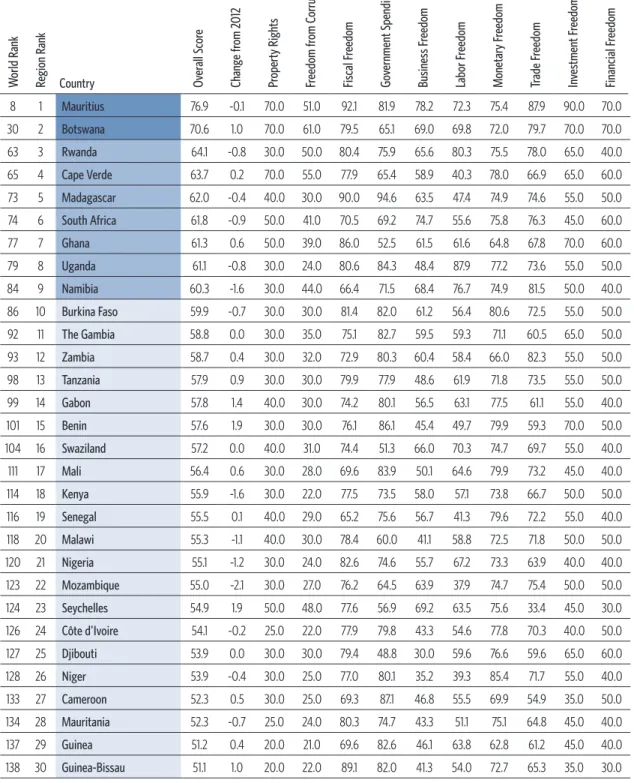

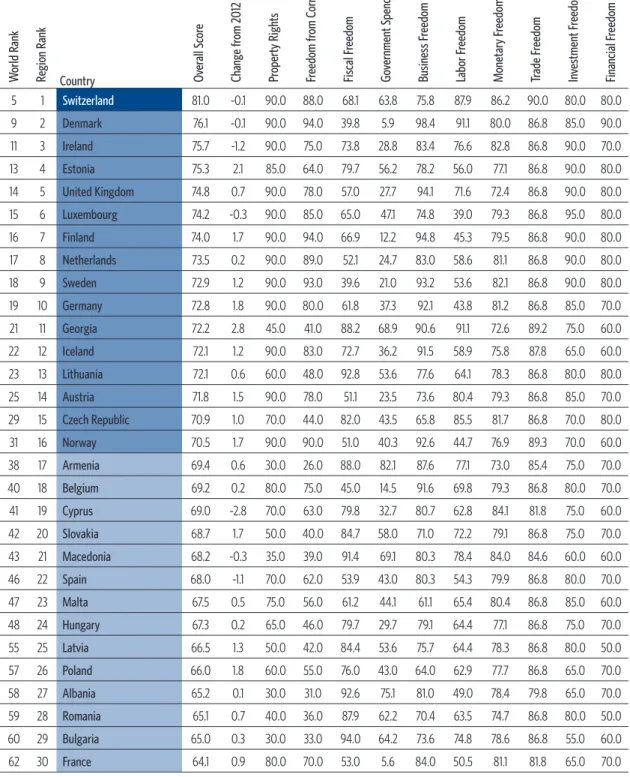

Sub-Saharan Africa

Most countries in the region are ranked as "mostly unfree" with scores between 50 and 60, or as "repressed" with scores below 50. Ironically, however, the region is worse than the global average for fiscal freedom.

Time To Renew commiTmenT To economic fReedom

The Rule of Law

The Rule of law and developmenT

Special FocuS Section Rule of law

The Rule of law and democRacy

The Effective Rule of Law Propels Prosperity

Stronger Rule of Law Boosts Foreign Investment, Lowers Unemployment

The foundaTion of economic fReedom and gRowTh

Holmes in Melanie Kirkpatrick, Indeks ekonomske svobode 2000 (Washington, D.C.: The Heritage Foundation in Dow Jones & Company, Inc., 2000).

Democracy, Law and Order, and Economic Growth

In addition, black market participants typically lose access to useful public services, such as official contract enforcement. The stress on property rights and the legal system does not provide clear implications about the relationship between economic performance and the size of government.

In this context, an expansion of democracy, seen as a mechanism to check the power of the central government, can improve property rights and thereby encourage economic activity. Theoretical reasoning suggests that improved property rights and the rule of law will encourage economic activity.

The main reason for the decline in the world average of the Freedom House political-rights measure after 1960 was the experience in Sub-. Note: The values shown are averages for each year across countries from the Freedom House and Polity indicators of democracy, both converted to a 0-to-1 scale.

World Averages for Democracy Indicators, 1960–2010

The graph shows that the mean of the Polity Democracy Index has a pattern similar to that for Freedom House, except that the Polity mean started at a lower value (0.49 in 1960), and the. The Freedom House average for its political-rights indicator is for 138 countries since 1972, with 1981 data missing and therefore interpolated.

As a general trend, countries that are strong in terms of law and order (and also low corruption and high bureaucratic efficiency) tend to be strong in terms of democracy indicators from Freedom House and Polity. Note: The values presented are indicators for each year in all countries of the International Political Risk Services Country Risk Guide, indicators of law and order (formerly called rule of law), official corruption and quality of bureaucracy.

World Averages for Indicators of Institutional Quality, 1982–2010

For example, in 2010, the correlation of the law and order indicator with Freedom House's democracy variable was only 0.3. So there are many cases in which the law and order indicator is high while the democracy variable is low and vice versa.

Cases for 1982 or 1985 in which the law-and-order indicator was high relative to the Freedom House political-rights variable (with a gap of 0.5 or more) include Burma, Chile, Hong Kong, Hungary, Poland , Singapore in , and Taiwan. Countries in which the Freedom House democracy indicator was high relative to the law and order variable (with a gap of 0.5 or more) in 1982 or 1985 include Bolivia, Colombia, Cyprus, Dominican Republic, Greece, Honduras, Israel, Jamaica, Peru, Sri Lanka, Trinidad and Venezuela.

These cross-country differences between law and order and democracy make it possible to empirically distinguish the effects of these institutional/political variables on economic growth. For 2010, countries with these large positive gaps between law and order and democracy included Burma, China, Ethiopia, Iran, Jordan, Russia, Saudi Arabia, Singapore, Syria, Tunisia and Vietnam.

Growth Rate and Starting Level of Per Capita GDP

These values are expressed relative to the mean of this growth rate variable in the entire sample. The values in the graph are expressed relative to the average of this filtered growth rate variable in the entire sample.

Relation Between Growth Rate and Starting Level of GDP Holding Other Explanatory Variables Constant

Unlike Chart 3, these growth rates were filtered by the growth rate predicted by 12 other explanatory variables as estimated in Robert J. As in Chart 4, these growth rates were filtered by the growth rate predicted by 12 other explanatory variables (in addition to the law and order indicator, but including the lagged logarithm of GDP per capita), as estimated in Robert J.

Partial Relation Between Growth Rate and

These values are expressed relative to the mean of this variable in the entire sample. The black line is the fitted relationship between the filtered growth rate and the law-and-order variable.

Law-and-Order Indicator from International Country Risk Guide

The overall relationship between economic growth and democracy is weak, as is clear from the fitted curve in the graph. This relationship, shown by the fitted curve in the graph, is only marginally significant in a statistical sense.

This environment also confirmed the idea that progress in GDP per capita and years of education predict the expansion of democracy. Thus, after 40 or more years, the level of democracy is determined almost entirely by economic and schooling variables—the kinds of influences that Aristotle and Lipset emphasized—and very little by the country's longer-term history of democracy.

Partial Relation Between Growth Rate and Freedom House Democracy Indicator

Through these channels, an improvement in public order would lead to more democracy in the long run. An extension of my recent empirical research also led me to the conclusion that expansions of democracy do not predict an increase in the indicator of law and order.

Moreover, in the long run, the rule of law tends to generate sustainable democracy by first promoting economic development. So, even if democracy is the main goal in the long term, the best way to proceed is to encourage the rule of law in the short term.

Economic Freedom and Economic Privilege

If this is not immediately obvious, it may be because the advocates of economic freedom often fail to emphasize it. Too often, those of us who argue for freedom emphasize the fact that taxes are crushing, that regulations are burdensome, and that government involvement in the economy is an impediment to progress.

Types of pRivilege

While this is usually true, it is also true that tax dollars are funneled into the pockets of some well-connected companies, that regulations often allow some companies to profit at the expense of customers and competitors, and that almost any intervention in the market creates both losers and winners. If we are to advance economic freedom, I believe it is imperative that we understand how special interests benefit from its absence.

The cosTs of pRivilege

The amount of money wasted looking for rent depends on the value of the rent. Before discussing some of the other implications of privilege, it's important to highlight the characteristics of winners and losers.

Olson used his theory to explain the relative decline of the United Kingdom throughout the 20th century. had amassed a large number of powerful and entrenched interest groups. In the 30 years since Olson's study, one could argue that powerful interest groups have again begun to ensnare Germany and Japan.).

Long accustomed to ordering its banks to provide loans to the larger South Korean conglomerates ("chaebols"), South Korea's government has persuaded too many banks to invest excessively in the expansion of the semiconductor, steel and chemical industries. When the financial crisis that began in Southeast Asia during the summer of 1997 spread to South Korea, the country's banks and, more importantly, the companies that had borrowed to expand, were so overbooked that the South Korean economy came close to collapse.44 .

22 Kevin Murphy, Andrei Shleifer en Robert Vishny, "The Allocation of Talent: Impplications for Growth," Quarterly Journal of Economics, Vol. Sien ook Stephan Haggard en Jongryn Mo, "The Political Economy of the Korean Financial Crisis," Review of International Political Economy, Vol.

Property Rights Can Solve the “Resource Curse”

It is also the best system to combat the negative effects of the resource curse. Although the early literature on the resource curse led to the counter-intuitive conclusion that natural resource abundance leads to economic stagnation, later work has shown that, like other inputs to growth, institutional power plays a large (almost completely dominant) role in how the abundance of natural resources affects growth.

Their model divides the entrepreneurs in an economy into two groups: "grabbers," who spend their resources trying to skim off as much monopoly income as possible from the natural resources, and "producers," who spend their time trying to to use the resources to create and produce additional wealth. It is a country's institutions that determine whether an economy will be grab-heavy or producer-heavy, and the fate of an economy therefore depends on the kind of incentives those institutions create.

The ResouRce cuRse

For example, Norwegian economists Halvor Mehlum, Karl Moene, and Ragnor Torvik argued that institutional strength is the real determinant of how countries grow.9 Their resistance to the simple resource curse thesis stems from a number of notable exceptions: countries that, with large amounts of natural resources, also experience above-average growth.

In general, countries with high levels of commodity exports tend to score worse on property rights and corruption.

The Connection Between Commodity Exports, Property Rights, and Corruption

Zimbabwe is perhaps the most compelling recent example of the impact of volatility on growth potential. Despite having one of Africa's most educated populations and a large share of natural resources, Zimbabwe remains one of the poorest countries in the world.

The resource curse is an unfortunate consequence of poor institutions exploiting great potential, and the only way to cure it is to focus on improving policy at the top of the institutional structure. The information they gather, the tools they use and the decisions they make will have a significant impact not only on the growth of their business, but also on the economic growth, job creation and development success of countries competing for their investment dollars. companies.

In a global marketplace, these executives must consider where to invest, operate and expand their product and service offerings while competing for market share with the brightest and best the world has to offer. Market size, openness to trade, workforce skills, labor costs, tax structure and a host of other criteria play a role in any company's investment decisions, but what ultimately determines the viability of their investments – and their staying power – can be summarized as the presence or lack of a rule of law.

Good Business

Demands Good Governance

These are the companies that have a sustainable business plan, pay their taxes, adopt advanced labor and environmental standards, create jobs and have roots in the communities where they do business. They are companies that base their decision to invest in a particular market on the existence of a strong rule of law regime.

Rule of law is cRiTical To business decisions

Case Study: Ecuador

But for a country to apply the rule of law in a balanced, coherent, consistent and transparent manner, it must first understand what is meant when the private sector refers to the rule of law.

Investors must have confidence that the laws will be upheld and applied equally with the government as well as the private sector and civil society: for example, anti-bribery and anti-corruption issues. When disputes inevitably arise, they should not be resolved by ad hoc arrangements or special interventions, but in a fair, transparent and predetermined process.

The need foR

Once businesses are up and running, they too often have to face the rule of law challenges entirely on their own. New metrics would give these companies an evidence-based tool to defend their corporate position with well-considered arguments to address rule of law denial.

Defining Economic Freedom

The Index of Economic Freedom provides a broad and comprehensive picture of country performance, measuring ten distinct areas of economic freedom. For analytical convenience and clarity, the ten economic freedoms are grouped into four broad categories or pillars of economic freedom:

RULE OF LAW

Some aspects of economic freedom that are evaluated relate to a country's interactions with the rest of the world – for example, the degree to which an economy is open to global investment or trade. A country's total economic freedom score is a simple average of the scores on the ten individual freedoms.

LIMITED GOVERNMENT

REGULATORY EFFICIENCY

This applies just as much to the labor market as to the commodity market. State intervention causes the same problems in the labor market as in any other market.

OPEN MARKETS

This process depends on transparency in the market and the integrity of the information made available. For example, when the government intervenes in the stock market, it counters the choices of millions of individuals by interfering with the pricing of capital – the most critical function of a market economy.

It is equally important that economic freedom, with its 10 freedoms that interact and complement each other, is also a multidimensional process of achieving economic progress. Governments that choose policies that increase economic freedom put their societies on a path to more meaningful and productive work, higher incomes and better living standards for all.

The Countries

Secondary sources include World Bank, World Development Indicators Online 2012; Economist Intelligence Unit, Data Tool; Asian Development Bank, Asian Development Outlook 2012; and the national statistical agency and/or central bank. Secondary sources are the Economist Intelligence Unit, Data Tool; Asian Development Bank, Asian Development Outlook 2012; and the national statistical agency and/or central bank.

AFGHANISTAN

The budget deficit has remained below 2 percent of GDP on average, and the government has produced a surplus for the past two years. The protection of property rights is weak due to the lack of property registries or a database of land designations, disputed land titles and the low capacity of commercial courts.

ALBANIA

THE TEN ECONOMIC FREEDOMS

ALGERIA

The trade-weighted average rate stands at 8.6 percent, and industry barriers hinder imports of meat, construction equipment and other products. National debt is equivalent to about 10 percent of the size of the economy, and government spending is 43.1 percent of GDP.

ANGOLA

However, public use of banking services remains low; only about 10 percent of the population has a bank account. Legal fees and property registration can be prohibitively expensive, and overall protection of property rights is weak.

ARGENTINA

The government regulates electricity, water and gas distribution prices at the retail level, putting pressure on companies to adjust prices and wages. The financial system remains blocked by state intervention and uncertainty about the direction of economic policies.

ARmENIA

The state no longer has a stake in any bank, but the banking sector, which accounts for more than 90 percent of total financial sector assets, continues to struggle to provide sufficient long-term credit. The budget deficit fell to 2.7 percent of GDP, and public debt was reduced to around 35 percent of GDP.

AuSTRALIA

Australia's regulatory environment, one of the most transparent and efficient in the world, is highly conducive to entrepreneurship. The well-developed financial sector is highly competitive and healthy; all banks are privately owned.

AuSTRIA

Average inflation has risen slightly, but remains below the euro area and EU averages. Austria's trade policy is the same as that of other European Union members, and the total weighted average EU tariff rate is 1.6 percent.

AzERBAIjAN

The trade-weighted average tariff is 3.9 percent, and non-tariff barriers such as arbitrary customs administration increase trade costs. The top individual income tax rate is 30 percent and the top corporate tax rate is 20 percent.

THE BAHAmAS

The labor market is relatively flexible, and the application of the labor codes is somewhat lax. Dependence on tariffs for revenue results in an average tariff rate of 21.5 percent which is one of the world's highest.

BAHRAIN

The king has some decision-making authority within the legal system, but the judiciary is generally well-regarded and impartial. Expansionary government spending, in part to help quell social unrest, has reached 30.3 percent of total domestic output.

BANGLADESH

Numerous non-tariff barriers and the government's reliance on tariffs as a source of revenue increase the cost of trade. The top income tax rate is 25 percent, and the top corporate tax rate is 45 percent.

BARBADOS

There are criminal sanctions for official corruption and government enforcement of anti-corruption measures is generally effective. Hiring and firing regulations are not burdensome, and union influence is limited.

BELARuS

Simplification of registration formalities and abolition of the minimum capital requirement have facilitated business formation, but the overall entrepreneurial environment remains hampered by government interference and the dominance of the public sector in the labor market. Public spending has fallen slightly to 43.4 percent of gross domestic product, with public debt at around 50 percent of GDP.

BELGIum

The costs of establishing a company are reduced below 20 percent of the amount of the average annual income, and establishing a company takes only three days and four procedures. Uncertainty remains high surrounding Dexia, the Brussels-based Franco-Belgian bank, following the nationalization of its Belgian unit in 2011.

BELIzE

Since it was expropriated by the state, the electricity company has been subject to price controls below production costs. Public debt fell below 80 percent of GDP as the budget deficit narrowed, but falling oil revenues threaten the fiscal outlook.

BENIN

Much of the fuel sold in Benin is illegally smuggled from Nigeria, and Nigeria's decision to end domestic subsidies for petroleum products has caused a sharp increase in fuel prices in Benin as well. Benin is a member of the West African Economic and Monetary Union, which maintains high tariffs.

BHuTAN

Still, property rights are generally better protected than in most other South Asian countries. Government spending has risen to 45.2 percent of gross domestic product, with public debt accelerating to 82 percent of GDP.

BOLIvIA

Competing land title claims and the lack of reliable dispute resolution make real estate acquisition risky. The trade-weighted average rate stands at 5.4 percent, with numerous non-tariff barriers increasing trading costs.

BOSNIA AND HERzEGOvINA

The labor market is not efficient and the unemployment rate, especially among young people, is one of the highest in the region. Due to the strict currency board regime in Bosnia and Herzegovina, inflation has remained relatively low.

BOTSwANA

Starting a business costs less than 2 percent of the level of average annual income and requires no minimum capital. The financial sector is one of Africa's most advanced, and the Botswana stock exchange has grown.

BRAzIL

Foreign investors are generally given national treatment, but their activity is limited to certain sectors. The standard corporate tax rate is just 15 percent, but a financial transaction tax, 10 percent surtax and 9 percent social contribution on net profits take the effective rate to 34 percent.

BuLGARIA

Respect for constitutional provisions guaranteeing property rights and providing for an independent judiciary is somewhat lax. The legal system does not effectively enforce property rights, and inconsistent enforcement of laws discourages private investment.

BuRkINA FASO

BuRmA

Trade freedom is limited by a host of non-tariff barriers that increase the cost of trade. Total tax revenue is estimated to be less than 5 percent of GDP, although income tax revenue has grown rapidly in recent years.

BuRuNDI

The constitution guarantees the independence of the judiciary, but judges are appointed by the executive branch and are subject to political pressure. Foreign aid makes up about 50 percent of the public budget, and the public debt corresponds to 35 percent of GDP.

CAmBODIA

The non-salary costs of employing a worker are low, but enforcement of many aspects of the labor code is inefficient. Government spending amounts to 19.7 percent of total domestic production, but the budget balance remains under control.

CAmEROON

Protection of property rights is weak due to widespread corruption and an ineffective legal system. Public spending equals 20.7 percent of gross domestic product, and a budget deficit of 2.6 percent of GDP has pushed public debt to 12.9 percent of GDP.

CANADA

The trade regime is highly competitive, with a low average tariff of 0.9 percent and few non-tariff barriers. Government spending is equivalent to 42.9 percent of gross domestic product, with deficits recorded in recent years.

CAPE vERDE

The banking sector continues to expand and the number of non-performing loans has fallen. Government efficiency remains low and the management of public finances has deteriorated.

CENTRAL AFRICAN REPuBLIC

The Central African Republic's economic freedom score is 50.4, making its economy the 142nd freest in the 2013 index. Economic freedom has grown in the Central African Republic over the past five years, but from a very low base.

CHAD

Protection of private property is weak and the rule of law remains uneven across the country. The average trade-weighted tariff rate is high at 14.7 percent, and countless non-tariff barriers further weaken trade freedom.

CHILE

Persistent concerns about intellectual property rights relate to patent and copyright protection, even though the government has amended its copyright laws, ratified the Trademark Law Treaty and adopted the International Convention for the Protection of New Varieties of Plants. The trade-weighted average rate is 4 percent and non-tariff barriers are relatively low.

CHINA

The trade-weighted average rate is 4 percent, and layers of non-tariff barriers increase trading costs. The state continues its tight control over the financial system as the primary means of governing the rest of the economy.

COLOmBIA

With no minimum capital required, starting a business costs about 7 percent of the level of average annual income. Public consumption has stabilized at around 29 percent of total domestic production, with the budget deficit falling to 2.1 percent of GDP.

COmOROS

DEmOCRATIC REPuBLIC OF CONGO

The Democratic Republic of Congo (DRC) has an economic freedom score of 39.6, making it the 171st freest economy in the 2013 Index. The Republic of Congo's economic freedom score is 43.5, which ranks the economy of the Republic of the Congo ranks 167th in the freest economy in the 2013 Index.

REPuBLIC OF CONGO

Congo ranks 42nd out of 46 countries in the sub-Saharan African region, and its overall score is well below the global and regional averages. In the absence of a modern and independent legal system, traditional courts often deal with local disputes.

COSTA RICA

The average trade-weighted tariff rate is quite low at 2.4 percent and there are relatively few non-tariff barriers. Public debt remains low at 30 percent of GDP, but persistent deficits have prompted structural reforms, particularly in tax administration.

CôTE D’IvOIRE

The average trade-weighted tariff rate is 7.3 percent, and non-tariff barriers further impede trade. Rising spending and lower oil tax revenues have widened the deficit to more than 5.7 percent of GDP.

CROATIA

The trade-weighted average rate is quite low at 1.2 percent, but non-tariff barriers increase trading costs. The top income tax rate is 40 percent and the top corporate tax rate is 20 percent.

CuBA

The trade regime remains largely non-transparent and imports and exports are dominated by the state. Foreign investment must be approved by the government, which exercises extensive control over economic activity.

CyPRuS

The Czech Republic's economic freedom score is 70.9, making its economy the 29th freest in the 2013 index. The Czech Republic is ranked 15th out of 43 countries in the European region, and its overall score is higher than the regional and global averages .

CzECH REPuBLIC

The Czech Republic has weathered the effects of the global economic downturn and the European sovereign debt turmoil relatively well, with the economy showing a high degree of resilience. The Czech Republic separated from Slovakia in the "Velvet Divorce", became an independent nation in 1993 and joined the European Union in 2004.