This Capstone Project was prepared and approved under the leadership of the Group's Capstone Project Manager, Dr. In addition, this paper briefly explored the strengths and weaknesses of each of the elements mentioned in the study. The information and insights contained in this document can be of great value to aviation executives, as the impacts (ie financial, strategic, operational) of fleets and financing structures are often extremely important to an airline's operations.

Making an adequate decision will most likely determine the success or downfall of the airline. Therefore, it is essential to understand the variety and nuances of the many sources of aviation asset financing available in the market. The reader will find in this capstone a multidisciplinary approach to the most important factors to consider while planning to address fleet financing within the airline perspective.

Maintenance reserves are the funds usually collected by the lessor during the term of an asset's lease to cover the costs associated with such assumed maintenance events. Redelivery costs are the costs associated with the process of returning a particular asset from the person and/or entity that has leased such asset to the person and/or entity to which that asset belongs at the end of the agreed term of the lease. . In determining the best structure, airline management must be aware not only of the pros and cons, but also of the risks associated with each decision.

Such conclusions include, but are not limited to, theoretical and practical implications in the aviation industry of aircraft financing decisions, implications and study barriers to be explored further.

Review of Literature

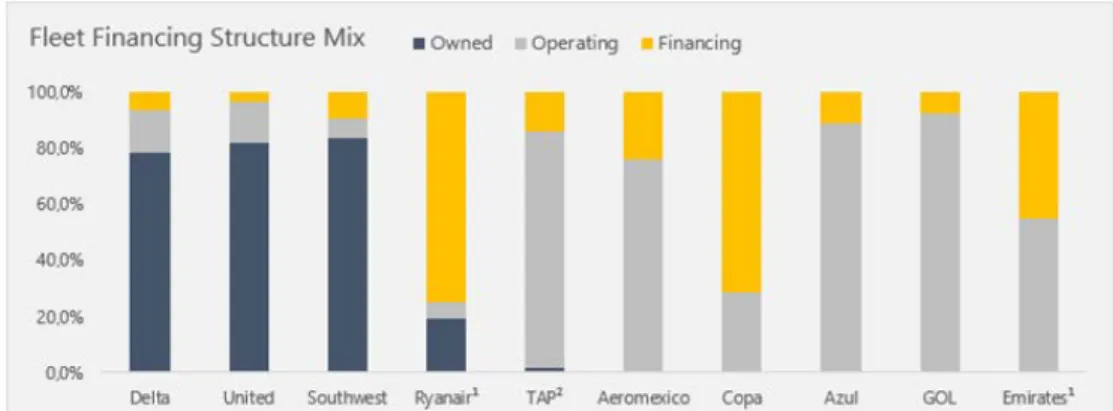

According to IATA (2017), the number of aircraft operating leases represented less than 5% of the total aircraft market in the 1980s. The percentage is expected to increase to more than 50% of the total market in the coming years. 2011) stated that direct maintenance costs account for 11% of the total operating costs of an aircraft.

Moreover, according to IATA (2013), fuel and oil represent about 33% of total airline costs. The C-checks include operational and functional system checks, cleaning and servicing of the aircraft systems, and some minor structural inspections. A cost breakdown from IATA (2018) shows that 42% of aircraft maintenance costs involve engine overhauls and 23% with C and D-Checks.

Changes in the intervals and requirements in a maintenance program affect the total operational cost of the aircraft. It is reported that 80% and 3% of CO2 emissions come from civil aviation, according to Eren Baharozu, Gurkan Soykan and Baris Ozerden (2017). In addition, Hu Rong, Xiao Y-bin, Jiang, and Changmin (2018) state that air travel accounts for up to 9% of the total climate change impact.

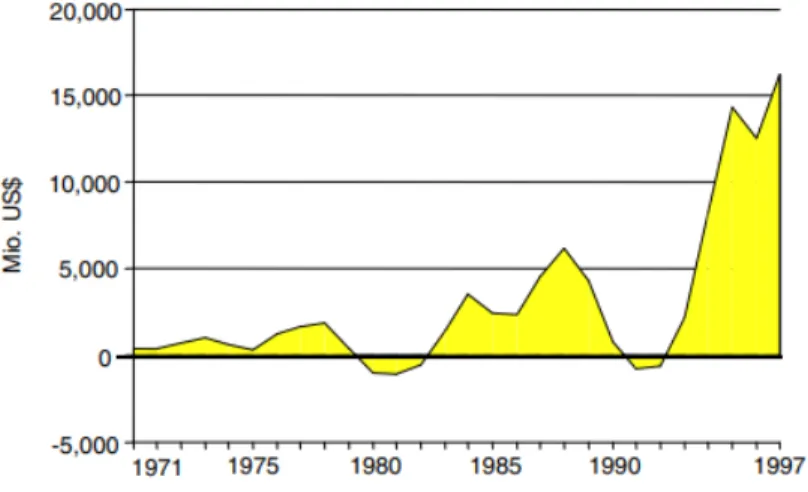

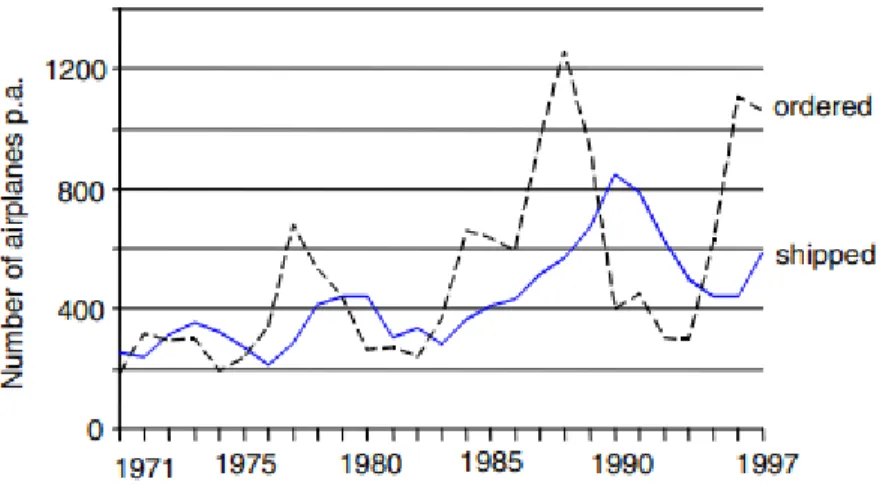

It is easier to understand these cycles when you focus the analysis on the factor that transforms some strategies in the Arline market to success. These topics could guide airlines to a potentially profitable and sustainable scenario as one of the consequences of making the most appropriate fleet acquisition decision. This is the opposite of the short-term fluctuations in macroeconomic variables such as fuel prices, interest rates or exchange rates.

As recently as 2001, the vast majority of traffic was carried by 'network carriers', such as Lufthansa, United Airlines and Delta, with regional networks and global international connections. Many of the early airlines were created as related sub-companies by existing transportation-oriented organizations. The proliferation of low cost airlines (LCC), such as Ryanair, Easyjet and others, in the early 2000s led to the diversification of the business model involving both.

Methodology

Since it is not fully amortized, a balloon payment is required at the end of the term to repay the remaining principal balance of the loan. Security Deposit: A deposit required by landlords as a condition precedent to the lease which can be set off at the end of the lease against remaining payments owed by the tenant to the landlord. End of Lease (EOL) Rates: Rates to be considered upon redelivery of the aircraft to bring the aircraft back to contractual level of maintenance and conditions.

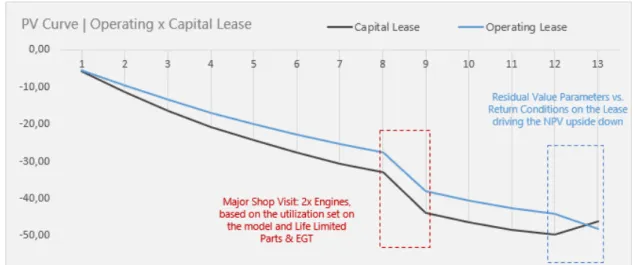

Analyzing different scenarios, it is known that the most sensitive components of cash flows are: Discount rate and aircraft usage for general assumptions;. Eventually, some of the aircraft on the order book will be delivered when the airline is experiencing shrinking demand or when finances are not favorable. On the other hand, leasing companies and aircraft investors have a more straightforward view of the same asset.

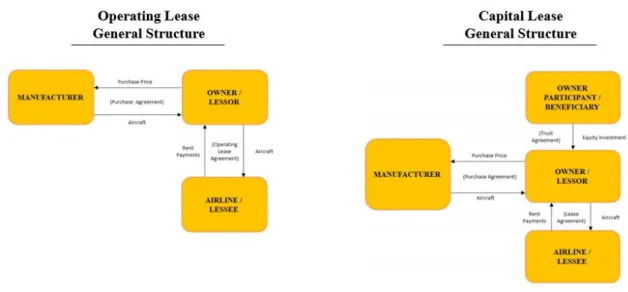

The risk factors for investors are also different compared to airlines as they basically lie on the residual value of the aircraft and the chance of being exposed to an airline default. It is crucial for companies with weaker balance sheets and impaired credit ratings, thus becoming very attractive regardless of the premium built into the rent. It is basically a contract in which the airline and the lessor agree, among other things, on commercial terms, a monthly rental payment, the duration of the contract and the conditions for returning the aircraft at the end of the lease.

In an SLB transaction, an airline sells an aircraft from its order book to a prospective lessee or lessor, who then immediately leases the aircraft back to the airline without disrupting the operation of the aircraft. In the short term, it can free up some of the equity tied up in the aircraft, which is usually a very sensitive issue for airlines. Less flexibility in managing capacity in harsh environments, as subleasing an aircraft to another airline requires prior approval from the lessor.

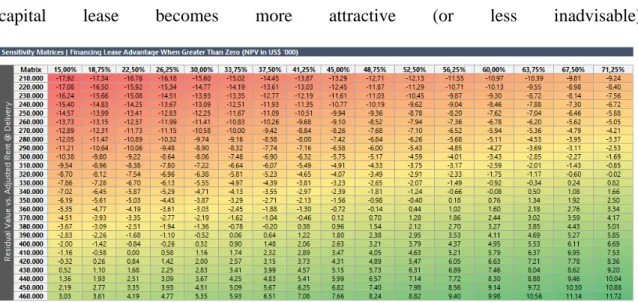

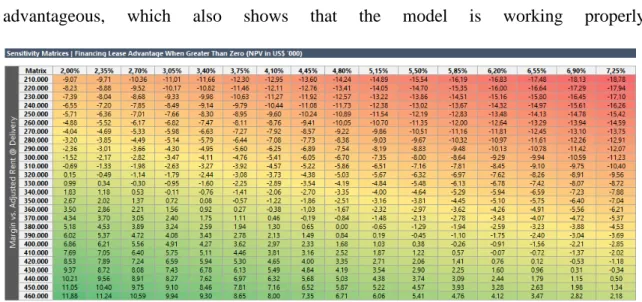

The above risk is often seen in sale and leaseback transactions where the lessor/investor also finances the PDP of the aircraft. Operating leases provide the airline with less initial cash outlay as the lessor/investor will be responsible for purchasing the asset. Another approach to sensitizing the two proposals is based on a matrix of interest rates for capital leases versus adjusted rents for commercial leases.

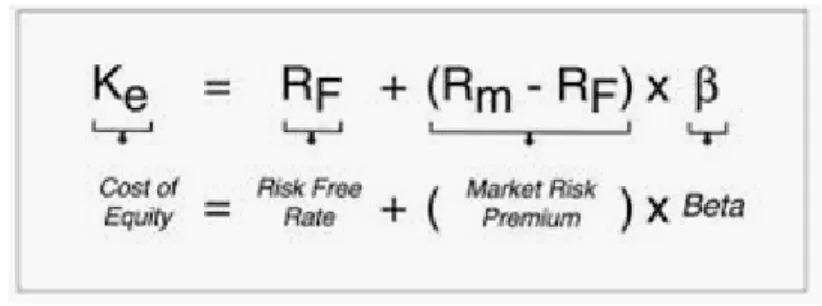

Either way, regardless of the discount rate approach, rate awareness is an important tool that should feed into the business case and converge towards the decision. In MCS, it is important to not only run the simulations, but also weigh each cash flow component into the final NPV.

Conclusions

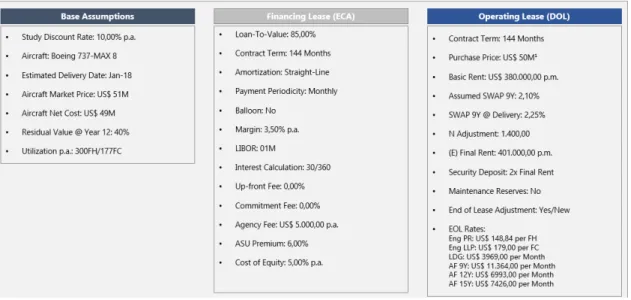

The most important points for an airline during the negotiation of the financial lease - according to the model developed in the study - are the interest rates, the part of the equity required to buy the aircraft - once the creditors usually finance up to 85% of the costs, the possibility of having a balloon payment, tenor, and the upfront fees required by agencies, such as the ASU fee required by the Ex-Im Bank of the United States. To provide the reader with a comparison between the main topics mentioned in this Chapter IV, we present – based on the assumption determined by the authors in Chapter III – a sensitivity analysis that includes some of the key factors mentioned in the capital leasing perspective compared to the lease rent of an operating lease agreement.

Recommendations

The airline retains the ability to dispose of the asset in the event of excess capacity. Considering the characteristics of the asset is also key, as the liquidity and residual value are important elements of it. Operating leases tend to be beneficial to the airline from a cash flow perspective, especially in the short term.

The highest costs are concentrated closer to the lease expiration date associated with the asset return process. Thus, in most cases, when the airline is in better financial shape, it is not fully focused on avoiding capital expenditures. This is mainly due to lower financing costs, the lender's business-driven credit analysis, and the possibility of having the capacity available, assuming early debt repayment.

The market perception and the overall liquidity of the assets to be financed should also be taken into account, as the airline retains the assets and their respective residual value after the full repayment of the associated debts. In line with the above recommendations, it is absolutely clear that deciding which type of financing to choose is complex and requires extensive analysis of the positives. Under normal market conditions and, barring extraordinary micro or macro events (such as the Covid-19 pandemic, the September 11 terrorist attacks), a diversified portfolio of asset financing structures would most likely be the optimal answer, as the airline would not be exposed to a single set of risks, with a balance between fleet flexibility and lower financial costs.

In that sense, investigating the optimal accounting solution for each financing structure available is a must. Especially for publicly traded airlines, as market analysts will always keep an eye on the airline's debt. Multi-disciplinary considerations: managing an airline's fleet of aircraft is a challenging task as it requires vast knowledge and a diversified set of skills.

The starting point of the work is most often the choice of the funding structure.