Optimization of Export Support Systems

How to Promote Exports from Portugal to Germany in the Area of

Information Technology and Electronics

- Appendices -

Jürgen Thomas Weber - 1769

A Project carried out under the Supervision of:

Professor Alexandre Dias da Cunha

1

Appendices

FIGURE 01: SLIDE NUMBER 04, TAKEN FROM THE PROJECT-POWERPOINT ... 2

FIGURE 02: SLIDE NUMBER 06, TAKEN FROM THE PROJECT-POWERPOINT ... 2

FIGURE 03: SLIDE NUMBER 10, TAKEN FROM THE PROJECT-POWERPOINT ... 3

FIGURE 04: SLIDE NUMBER 14, TAKEN FROM THE PROJECT-POWERPOINT ... 3

FIGURE 05: SLIDE NUMBER 12, TAKEN FROM THE PROJECT-POWERPOINT ... 4

FIGURE 06: SLIDE NUMBER 15, TAKEN FROM THE PROJECT-POWERPOINT ... 4

FIGURE 07: SLIDE NUMBER 17, TAKEN FROM THE PROJECT-POWERPOINT ... 5

FIGURE 08: OVERVIEW OF THE SUBSECTORS ... 5

FIGURE 09: SLIDE NUMBER 36, TAKEN FROM THE PROJECT-POWERPOINT ... 6

FIGURE 10: SLIDE NUMBER 37, TAKEN FROM THE PROJECT-POWERPOINT ... 6

FIGURE 11: SLIDE NUMBER 46, TAKEN FROM THE PROJECT-POWERPOINT ... 7

FIGURE 12: SLIDE NUMBER 49, TAKEN FROM THE PROJECT-POWERPOINT ... 7

FIGURE 13: SLIDE NUMBER 39, TAKEN FROM THE PROJECT-POWERPOINT ... 8

FIGURE 14: SLIDE NUMBER 40, TAKEN FROM THE PROJECT-POWERPOINT ... 8

FIGURE 15: SLIDE NUMBER 47, TAKEN FROM THE PROJECT-POWERPOINT ... 9

FIGURE 16: SLIDE NUMBER 50, TAKEN FROM THE PROJECT-POWERPOINT ... 9

FIGURE 17: SLIDE NUMBER 51, TAKEN FROM THE PROJECT-POWERPOINT ... 10

FIGURE 18: SLIDE NUMBER 58, TAKEN FROM THE PROJECT-POWERPOINT ... 10

FIGURE 19: SLIDE NUMBER 53, TAKEN FROM THE PROJECT-POWERPOINT ... 11

FIGURE 20: SLIDE NUMBER 54, TAKEN FROM THE PROJECT-POWERPOINT ... 11

FIGURE 21: SLIDE NUMBER 60, TAKEN FROM THE PROJECT-POWERPOINT ... 12

FIGURE 22: SLIDE NUMBER 61, TAKEN FROM THE PROJECT-POWERPOINT ... 12

FIGURE 23: SLIDE NUMBER 63, TAKEN FROM THE PROJECT-POWERPOINT ... 13

FIGURE 24: BRIEF DESCRIPTION OF AN ADDITIONAL BUSINESS OPPORTUNITY ... 13

FIGURE 25: IMPLEMENTATION PROPOSAL: COMPETENCE CENTRE

–

BIG DATA ... 14

FIGURE 26: EXPANSION POSSIBILITIES OF THE ESI PLATFORM ... 14

FIGURE 27: SLIDE NUMBER 07, TAKEN FROM THE PROJECT-POWERPOINT ... 15

FIGURE 28: SLIDE NUMBER 56, TAKEN FROM THE PROJECT-POWERPOINT ... 15

2

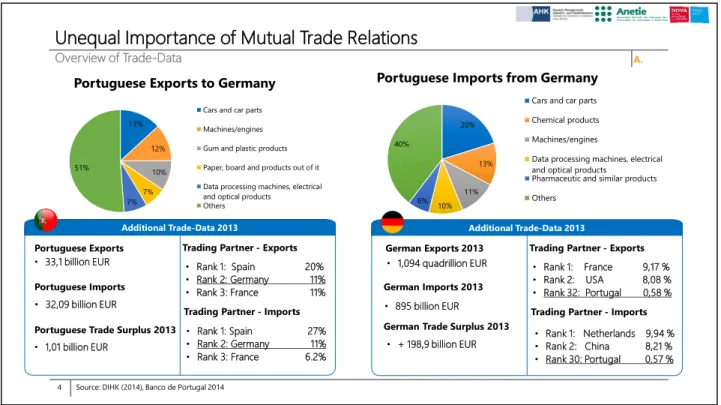

Unequal Importance of Mutual Trade Relations

4

Overview of Trade-Data

Source: DIHK (2014), Banco de Portugal 2014

A.

13%

12%

10%

7% 7% 51%

Portuguese Exports to Germany

Cars and car parts

Machines/engines

Gum and plastic products

Paper, board and products out of it

Data processing machines, electrical and optical products

Others

20%

13%

11% 10% 6% 40%

Portuguese Imports from Germany

Cars and car parts

Chemical products

Machines/engines

Data processing machines, electrical and optical products

Pharmaceutic and similar products

Others

Additional Trade-Data 2013

Portuguese Exports

Portuguese Imports • 33,1 billion EUR

• 32,09 billion EUR

Trading Partner - Exports

Trading Partner - Imports • Rank 1: Spain 20% • Rank 2: Germany 11% • Rank 3: France 11%

• Rank 1: Spain 27% • Rank 2: Germany 11% • Rank 3: France 6.2%

Additional Trade-Data 2013

German Exports 2013

German Imports 2013 • 1,094 quadrillion EUR

• 895 billion EUR

Trading Partner - Exports

Trading Partner - Imports • Rank 1: France 9,17 % • Rank 2: USA 8,08 % • Rank 32: Portugal 0,58 %

• Rank 1: Netherlands 9,94 % • Rank 2: China 8,21 % • Rank 30: Portugal 0,57 % German Trade Surplus 2013

• + 198,9 billion EUR Portuguese Trade Surplus 2013

• 1,01 billion EUR

Figure 2: Slide number 06, taken from the project-PowerPoint

Detect the German Needs and the Portuguese Delivery Potential

6

Matching Process

*Given instructions: Small and medium sized companies in the areas of information technology and electronics are subject to the present study

B.

German

Ecomomy

Portuguese

Economy

M

at

ch

Raising market opportunities

Less competitive

niches

Need to go beyond

the “traditional”

Portuguese export products*

Raise and combine potentials within

the country Where are

specific competencies

needed

Changing of the mindset and access new markets

Identify the demand of German companies

Identify the export potential of Portuguese companies

Both countries can benefit from each other. To achieve this, potential demand and supply opportunities have to be evaluated

3

Macro- and Micro-Trends Define the Future Change and Growth Perspectives of the Markets

10

Current and Prospective Major Challenges

Source: ARTEMIS Industry Association & ITEA Office Association (2013)

C. 1

Political

• Industrial spying

• Open markets (e.g. European Integration, TTIP, etc.)

• Changing world order (Emerging countries gain political power)

Environmental

• Climate change • Scarcity of resources • Pollution

Economic • Financial and economic crisis in Europe • Emerging countries gain economic power Technological •• Comprehensive broadband coverage

Increasing automation Socio-cultural • Ageing society/Healthcare

• Decreasing number of working population

S

T

E

E

P

Scanning the macro environment

developments: seen from the

German perspective

• Urbanization

• Digital society

• Mobility

Figure 4: Slide number 14, taken from the project-PowerPoint

Breakdown of Industrie 4.0 into its Integral Components

14

Technology Fields of Industry 4.0

Source: BITKOM 2014, CPS = Cyber Physical Systems

C. 2

Industry 4.0

Embedded

Systems/CPS* IT- Security

Cloud

Computing Smart Factory

Reliable Communication

Networks

•

Intelligent

Products

•

M2M

Interaction

•

Sensors

TECHNOLOGY FIELDS

•

Data

Protection

•

Information

Security

•

Real-Time

Data

•

Virtual

Storage

•

Apps

•

Big Data

•

IPv6

•

Social

Machines

•

Digitization/

Virtualization

•

Automation

•

Human

–

Machine

Interface

•

Low-Cost-Automation

•

Broadband

•

Mobile

Communications

•

Mobile Devices

4

The German Answer to Adapt to the New Opportunities

12

Industry 4.0*

Source: Roland Berger –Think Act (March 2014), Germany Trade & Invest (July 2014), acatech (April 2013)

C. 2

Internet of Things in Manufacturing Smart Internet

Industrial Internet

Smart Production

Advanced Manufacturing

The German government formulated a national strategy to prepare the industry

to face the upcoming challenges

• Private projects are being supported by public funding of 200 million EUR until 2020

• Cyber-Physical Systems (CPS) are connecting intelligent machines, production systems and processes to a sophisticated network

• Shift from a centralized to a decentralized production

• They key to increase productivity and efficiency to compete with emerging economies

• Despite large scale production, the production will be highly flexible and allow the individualization of products

• The link of production and value-adding services by generating and using new data sources

Governments and big companies around the world approach the topic in a similar way, but call it differently

Industry 4.0

Encouraging theGerman and European economy to cooperate

in order to stay competitive in the

future

Figure 6: Slide number 15, taken from the project-PowerPoint

The Industry 4.0 Industry Life Cycle and Expected Impact on the Industry

15

Further Implications of Industry 4.0

Source: Project team analysis, acatech (April 2013), Interviewees (e.g. Deputy head of a German research institute), PWC (2014)

C. 2

Introduction Growth Maturity Decline

S

a

le

s

Time

• Significant productivity and efficiency gains

• New business opportunities and rethinking of existing business models needed

• Shift to Software and services

• Shrinking margins for hardware

• Industrie 4.0 is a network topic

• Cross-industry cooperation is necessary/Merging of industries

• Potential value creation in Germany until 2025: 78,77 billion EUR

• The German industry invests until 2020 40 billion EUR/Year

• Nearly 50 % of the total investments in machinery and equipment until 2020 will be invested in Industrie 4.0 solutions

It has already started

• Within five years, 80 % of the companies will have digitalized their value chain

5

Narrowing down Industry 4.0 to Promising Subsectors

17

Pre-Segmentation

Source: *Interviewees in the German market, *In the following called ESI

C. 3

German Market

The identified

subsectors are

subject to the further

analysis

Segments

IT Sector

Industry 4.0

Technology Fields

IT Security

Embedded Systems Implementation*

Big Data

Cloud

Figure 8: Overview of the subsectors (Summary, based on the project-PowerPoint content)

IT Security

Embedded Systems Implementation

Big Data

Cloud

• German experts and the German government expect a large number of business opportunities in the area of Big Data • Even though Industry 4.0 is just starting, the revenues of software

companies in Germany increased 2014 by 59% to a current sector turnover of 6.1 billion EUR

• So far, there is just a small number of Portuguese Big Data companies

• Big Data is a highly attractive topic for start-ups, which makes it very interesting for the innovative startup companies in Portugal • Practically all experts agreed that IT Security is the most promising

sector in Germany within the area of Industry 4.0

• Industry 4.0 factories are exposed to any kind of cyber-attacks, which creates many opportunities for IT Security solutions • Germany is lacking competencies and resources for IT Security; it is

almost impossible to find qualified IT security experts in Germany • Unfortunately, there are only a few spin offs in Portugal which

could provide network security solutions

• Due to the increasing networking required by Industry 4.0, the data volume increases rapidly

• 90% of the German companies increased in 2014 their amount of data by an average of 22%. This led to the fact, that 79% of the German companies invested in storage capacity and the market for business cloud solutions grew by 46% to 6,4 Billion EUR

• A spy affair destroyed the trust of the German companies in US firms, which dominated the market until the spy affair became public. European firms are the only viable alternative • There are around five Portuguese Cloud data center in Portugal • Basically, every device with processor is an embedded system • The criteria is, that a pre-defined task is performed, e.g. to control,

regulate or to monitor a system

• Cyber-physical systems consist of embedded systems. This makes

embedded systems the „heart“ of Industry 4.0. • Experts expect a high demand for embedded systems

implementation services upcoming

• There are no specialized firms to provide such services in Germany • Several Anetie members operate in the field of embedded software

6

IT Security ESI* Big Data Cloud Market size

Market growth

Pricing trends

Cost of market entry

Differentiating opportunities

Supplier power

Threat of substitutes

Intensity of competition

Expected customer loyalty

Assessment

+++

++

++

++

The Market Attractiveness Assessment Shows Relatively Homogenous Results

36

Market Attractiveness Ranking

*ESI = Embedded System Implementation, General remark: The table reflects, how favorable the individual market attractiveness factors are for the chosen subsectors C. 3.5

Market attractiveness

factors

Porter’s

Five Forces (adapted)

Key to the symbols:

• Very favorable

• Favorable

• Average favorable

• Less favorable

• Not favorable

• The market attractiveness assessment proofs the results of the expert interviews

• All identified sub-sectors show promising and very promising market opportunities

• It depends on the Portuguese resources and capabilities, which sub-sector(s) should be chosen

• IT Security is the only outstanding subsector in terms of market perspectives

• The assessment highlights furthermore the importance to follow a narrow niche strategy in each sub-sector

Figure 10: Slide number 37, taken from the project-PowerPoint

Embedded System Implementation is the Best Choice for Portuguese Exporters

37

Comparative Analysis: Market Attractiveness and Portuguese Competencies and Marketability

*ESI = Embedded System Implementation

C. 3.5

M

a

rke

t

A

tt

ra

ct

iv

e

n

e

ss

Portuguese Competencies and Marketability IT

Security

ESI*

Matching area between market attractiveness

and Portuguese delivery potential

Embedded System Implementation is the product/service to export and

will therefore be subject to the development of a business idea in

section E

Big

7

A Practical and Simplified Example of Embedded System Implementation

46

Embedded System Implementation

Source: Project team analysis, Machine image taken from www.engelglobal.com

E. 1

Cyber Physical System

within a factory

(simplified image)

“Conventional” machine

1

2

3

Machine with an implemented embedded system

Especially SMEs are in need of external know-how to Implement embedded systems

Figure 12: Slide number 49, taken from the project-PowerPoint

• Portuguese employees are considered to have an “innovative and

problem-solving” mind

• Portuguese employees are better in solving Industry 4.0related

problemsthan Germans

• Several groups are working on innovative technologies • High-qualifiedlabor is relatively cheap compared to Germany

• The productivity is approaching to the German level • Several multinational companies are about to create competence

centers in Portugal • Flexible workforce

• Employees have very good English skills

• Availability and willingness for international cooperation's • Nonational Industry 4.0 positioning strategy

• Low level of industrialization compared to other European countries

• Very few private initiatives to coordinate national competencies

• Companies face an awareness problem abroad. German companies are lacking information in which areas Portuguese firms are good in

• Firms have difficulties to apply their competencies internationally • Lack of information about the German market

• Unawareness of the business opportunities in Germany

• Difficultiesin ensuring their product services abroad • Portuguese companies are relatively small

• Firms have problems to enter the German market, since it is difficult to start business relations

• Difficulties to find suitable partners

Return to Mind, the Initial Situation of Portugal Regarding its Export Potential

49

Remember

Source: Interviewees (e.g. IT Manager, German Blue-chip company in Portugal; Professor, polytechnic institute in Portugal and technology expert), Portugal Outsourcing (2013) E. 2

8

The Selection Criteria for the Market Focus

39

Market Focus Framework

*The higher the degree of individualization and complexity of the products, the more demand individual firms have for embedded system solutions, the more data will be generated

D.

1. Selection criteria

Target niche market

Machinery andEquipment Companies

Potential Markets

Automobile Suppliers

Aeronautics Suppliers

Result

3. Selection criteria4. Selection criteria

Proportion of firms with less than 500 employees in the industry

Degree of individualization and complexity of the produced products (reflected in the demand of the

industry area for embedded systems)*

2. Selection criteria

Market size in Germany

Expected growth opportunities due to Industry 4.0

The criteria “less than

500 employees” serves

as an orientation, since smaller companies do

usually not have the needed IT know-how

Figure 14: Slide number 40, taken from the project-PowerPoint

Machinery and Equipment Companies Identified as the most Promising Target Market

40

Application of the Market Focus Framework

Sources: Expert interviews and Experton Group (2014), PWC (2014), BMWi website, VDA website, BDLI website, *According to a BITKOM survey

D.

Machinery and equipment companies

• Highest economic potential for embedded systems (*22,6 %)

• Investment in Industry 4.0 until 2020: 3,5 % of annual turnover

• Sector turnover 2013: 206 billion EUR, Number of companies: 6.393, 87 % <250 employees, production of single pieces or in small series

Small and medium

sized companies

with less than 500 employees

are considered as the most promising target group

Precondition: segmentation of targeted customers according to the number of

employees by company

Industrial field selection determinants: besides domestic competencies regarding existing technologies in Portugal,

several other factors should be taken into consideration. The crucial factor is the degree of individualization and

complexity of the produced products

Small and medium sized companies lack the know-how needed to prepare their production lines and products for Industry 4.0.

Additionally, their customers are the drivers of

the industrial revolution, which leads to implementation pressure.

Consequently, these companies will be in need of implementation services for embedded systems*

• Machinery and equipment companies

• Less than 500 employees**

Summarized effects on this study: final characteristics for the target niche market

as provided below Outcome

Alternative 1: Automobile supplier

• Second highest potential for embedded systems (*4,2 %) • Investment in Industry 4.0 until 2020: 2,9 % of annual turnover • High volume and standardized production, Sector turnover 2013: 70

€billion EUR, 75 % <500 employees (commercial vehicles)

Alternative 2: Aeronautics supplier

• Third highest potential for embedded systems (*2,8 %) • Standardized production

9

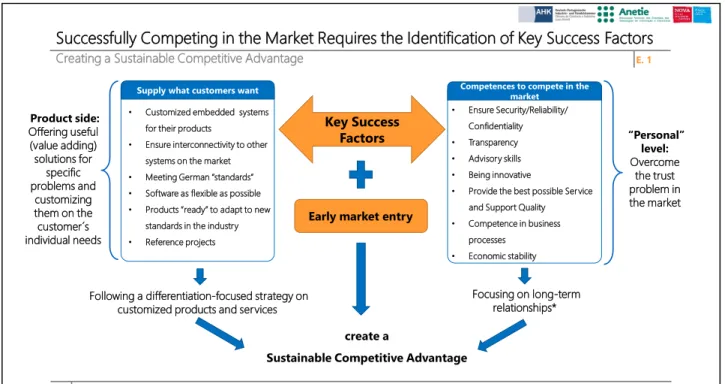

Successfully Competing in the Market Requires the Identification of Key Success Factors

47

Creating a Sustainable Competitive Advantage

*The implementation of embedded systems into products of machinery and equipment companies (production lines and machinery) is a continuously ongoing process E. 1

Key Success

Factors

create a

Sustainable Competitive Advantage

Supply what customers wantFollowing a differentiation-focused strategy on customized products and services Product side:

Offering useful (value adding) solutions for

specific problems and

customizing them on the customer´s individual needs

Focusing on long-term relationships*

“Personal” level: Overcome

the trust problem in the market

Early market entry

Competences to compete in the market

• Customized embedded systems for their products

• Ensure interconnectivity to other systems on the market

• Meeting German “standards”

• Software as flexible as possible

• Products “ready” to adapt to new

standards in the industry

• Reference projects

• Ensure Security/Reliability/ Confidentiality

• Transparency • Advisory skills

• Being innovative

• Provide the best possible Service and Support Quality

• Competence in business processes

• Economic stability

Figure 16: Slide number 50, taken from the project-PowerPoint

Cooperation and Coordination to Support the Export of ESI* Solutions

50

The Embedded Systems Implementation Platform

**Companies working in the field of embedded software, *ESI = Embedded System Implementation

E. 2

Common Strategy

Embedded System Implementation Firms**A

ss

o

cia

tio

n

s

Un

iv

e

rs

iti

e

s

an

d

R

e

se

ar

ch

I

n

sti

tu

te

s

Domestic Machinery and Equipment Companies

German

Customer:

Machinery and

Equipment

Companies

Uniform Corporate Identity Joint Communication

Pooling of Skills

Market Access through Partnerships Offering a Customized Solution

10

In order to Bundle Skills, Knowledge and Resources, Coordination is Required

51

Step 1: Coordination within Portugal

E. 212 Phase 3

3

10 Phase 1

Phase 2

Time Required (in months) Phases Tasks to put Step 1 into Practice: Coordination within Portugal

Development of a Proof of Concept

• Prototype/Proof of Concept

• Comply with industry requirements and needs • Certificates

• Safety marking • Quality seals (DIN, CE, etc.)

E. 2.a

Platform Composition

• Members • Roles • Tasks

Simultaneously start to perform Step 2: Reaching the customer in Germany

Common Strategy E. 2.b

• Vision • Values • Mission

E. 2.c

Organizational Structure

• Structure • Responsibilities

• Competences (internal/external)

E. 2.f

Local Company Representative

E. 2.d E. 2.e

Organizational Activities and Other

• Branding

• Pooling resources and know-how • Legal form

• Qualified employees • Contractual arrangements

• Local Branch Office in Germany, or • Joint Venture

• Due to the high density of companies in southern Germany, the local representation should be located in Bavaria or Baden-Wuerttemberg

• Use case

• Customers expect a German-speaking person in charge

Figure 18: Slide number 58, taken from the project-PowerPoint

The Market Entrance Requires several Consecutive Steps

58

Step 2: Entering the German Market

E. 3E. 3.c E. 3.a

12

18

12 Phase 1

Phase 2

Phase 3

E. 3.b

Time Required Phases

Building Personal Relationships

Tasks to put Step 2 into Practice: Entering the German Market

• Get in personal contact with associations, research

institutions and companies • Delegation visits

• Visit Trade fairs and conferences in Germany

Reputation Building and R&D

• R&D with a local partner as the “door opener” to the

German market (and long-term differentiation point) • Preparation of advanced use cases for concrete

solution

The Reference Project

• Working out the first practical solution and obtaining the first order of German machinery and equipment company • Based on the practical experience, improving the trust agreement of E. 2.d (market-ready version) for the purpose of

“trust building”

• Visits to trade fairs and conferences, advertising the reference project • Continue advertisement in technical journals, highlighting the reference project • The reference project gives credibility to receive further orders from German companies • After 12 months in the market, the first conclusion can be drawn (achievement of objectives E. 2.b)

E. 3.d

11

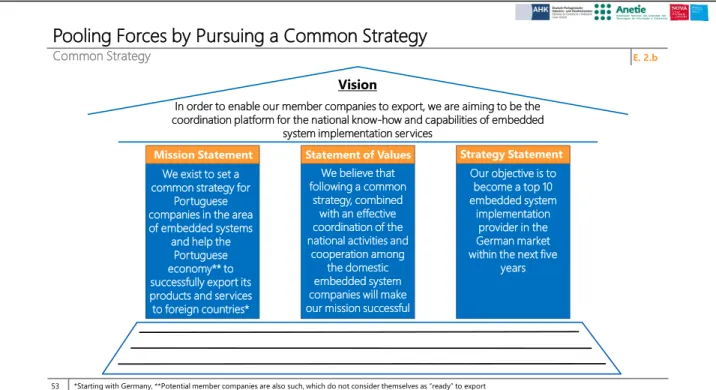

Pooling Forces by Pursuing a Common Strategy

53

Common Strategy

*Starting with Germany, **Potential member companies are also such, which do not consider themselves as “ready” to export

E. 2.b

Vision

Mission Statement Statement of Values Strategy Statement We exist to set a

common strategy for Portuguese companies in the area of embedded systems

and help the Portuguese economy** to successfully export its products and services to foreign countries*

Our objective is to become a top 10 embedded system

implementation provider in the German market within the next five

years In order to enable our member companies to export, we are aiming to be the coordination platform for the national know-how and capabilities of embedded

system implementation services

We believe that following a common

strategy, combined with an effective coordination of the national activities and

cooperation among the domestic embedded system companies will make our mission successful

Figure 20: Slide number 54, taken from the project-PowerPoint

All Parties should be Formally Involved

54

Organizational Structure

*Machinery and Equipment Companies, **Universities and Research institutes, ***Company representative in Germany or joint venture (see Step 1, Phase 3)

E. 2.c

Associations Management: Executive Board

•Executive board consists of three members

•Each of the mentioned groups is represented by one member

•Platform members elect the executive board

•Majority decisions within the management

Academic

Institutions** Companies*

Projects in Germany Advisory Body

Companies

Advisory Body

Academic

Institutions**

Internal Placing of Orders

• Incoming orders: Member companies undergo a bidding procedure

• Outgoing offers: Member companies submit an offer

Marketing/Sales/Services*** •

Makes offers

• Takes orders

• After-sales services Advice Advice

Internal processing of orders

12

Consecutive Steps to Build Reputation

60

Phase 1 : Processes to be Followed

E. 3.a+b• Establish personal contact with people of interest

• Publish specialist articles

• Participating in a R&D project (does not need to be completed to progress) E. 3.b) Reputation

building approach

E. 3.a) Building personal relationships Initial concept

(E. 2.e) as the precondition for following

steps

✓

• Delegations, trade fairs and conferences

• Being exhibitor at trade fairs • Prepare advanced use cases

Figure 22: Slide number 61, taken from the project-PowerPoint

The Reference Project as the Basis for the Product Introduction

61

The Reference Project

Source: Several interviewees

E. 3.c+d

Product introduction

Market entry without a reference

project

Market entry after completing

the first project

Product introduction

• Intensively advertising the platform solutions by visiting trade fairs and conferences

• Using the participation in a R&D project as “flagship” of our competences

• Starting advertisement in technical journals

Objective is to engage in a first practical project, which

will subsequently

13

The Achievement of Goals, Objectives and the Timeframe

63

Evaluation of Success

*Quantitative measurement by market share

E. 4

Start 3

months

13 months

25 months

43 months

55 months

✓

• Platform composition

• Common strategy

• Organizational structure

• Organizational activities and other

• Development of an initial concept

• Local company representative

• Building personal relationships

• Reputation building and R&D • Product introduction and Distribution

• Top 10 in the German market*

• The reference project

Figure 24: Brief description of an additional business opportunity

• The US-government had spied on German politicians and companies with the help of US IT companies

• Before the spy affair, American Cloud provider were the market leader

• Nowadays, American Cloud provider are not a viable option anymore

• Due to the Internet of Things, manufacturing enterprises start to demand Industry 4.0 software solutions (e.g. Big Data) which require Cloud

• It follows that increasing demand for Cloud provider focused on startups which develop solutions for small manufacturing enterprises is foreseeable

• Large data volumes require centralized and cheap storage capacities, which leads to strongly rising demand for Cloud

• Startups for Industry 4.0 software solutions are not yet recognized as exclusive target group by Cloud provider > Chance to differentiate

• The only organization specialized on Industry 4.0 software start-ups is using Cloud infrastructure of

an US company > Which is a “No-Go” for German

SMEs

• Portugal as a European country, has a “Trust”

advantage due to EU-law

• Using the momentum > First mover advantage

Specialized on Industry 4.0 Software Start-ups

Tr

u

st

„US Clouds are nowadays a

No-Go for German manufacturing enterprises“

> Startups for Industry 4.0 software need an

alternative

US-firms

Business Opportunity

Specialized on Industry 4.0 Software Start-upsUS-firms

Market Demand

Tr

u

st

The “spy affair” and the raising demand for Industry 4.0 software (e.g. Big Data) creates a

new market segment for specialized Cloud

data center

14

Interrelationships among Competence Centers and Stakeholders further down the Value Chain

The “Competence Centre Big Data” as Part of the Platform

Key to the symbols:

• Mutually profitable long-term partnership

• Relationship towards the pointed entity ESI Big Data Pr ov id es “A cc es s” to M ac hi ne -D a ta E xp e nd s t h e ra ng e o f s e rv ic e s O ff e rs t h e d is tr ib uti o n sy st e m A d d iti o na l Lo ng -T e rm R e ve n u e s “Competence Centers”

within the ESI Platform

M a chin e ry a n d Equ ip me n t C o mp a n ie s M a n u fa ct u rin g En te rpris e s

Long-Term Revenues Long-Term Revenues

Infrastructure Cyber-Physical Systems

(ESI solutions) Industry 4.0 “Ready” Machinery Software-as-a-Service Solutions Software-as-a-Service Solutions

(Outsourced to a "Third Party Supplier")

Provides the Data Basis for Big Data Access to Machine-Data

Figure 26: Expansion possibilities of the ESI Platform

ESI Solutions Constitute the Basis for Additional Service-Offers on the Platform

Expansion Possibilities of the ESI Platform

ESI

ESI

ESI ESI

Big Data

The extension possibilities show that the ESI Platform has the potential to serve as the starting point to strengthen the Portuguese export economy

Big Data Cloud Big Data Cloud

?

ESI focused Platform By providing Big Data

services, the ESI Platform uses the potential of machine-data generated from embedded systems

From the present point of

view: By adding “Cloud

Services”, the ESI Platform maximizes the Portuguese export potential Industry

4.0 provides

As the work project shows, there are many market opportunities

expected to arise in the near future. Anticipating the upcoming market chances can strengthen the

15

Different Sources of Data Needed to Achieve the Project Outcome

7

Phases of the Matching Process

Source: *Selection criteria are based on Roland Berger (May 2013, p. 40): German market dimension, Missing resources in Germany, Potential in Portugal, Available Resources in Portugal

B.

• Identification of the current and future demand of the German companies regarding Industrie 4.0*

• Determines the targeted niche market*

• Identification of the location factors and competitive advantages of Portugal

Derive the MATCH between the Portuguese and German economy

and make Recommendations

• Bringing together the Portuguese supply capabilities and the potential German demand

Second Phase Fourth Phase

Performed simultaneously

• Interviewees are chosen based on the identified niche market

• Identification of Portuguese know-how in the relevant areas*

• Evaluation of the Portuguese competencies and resources for future positioning*

Third Phase First Phase

• Detect market potential in Germany*

• As sources serve all kind of publications like company reports, research paper, trend analysis, etc.

Macro-trends, identified by research, determine the project

topic

Expert interviews with Portuguese decision-makers of small and medium sized IT companies Expert interviews with German decision-makers within the identified Industry Expert Interviews with multinational companies in Portugal

Figure 28: Slide number 56, taken from the project-PowerPoint

In order to Meet the German Expectations, the Prototype System has to be Tested and Certified

56

Development of a Proof of Concept

Source: VDMA

E. 2.e

Development of a Proof of

Concept Prototype System Comply with industry requirements and needs Necessary certificates for imports to Germany Safety marking Quality seals

(DIN, CE, etc.) Preparation of use cases for concrete solutions

To make sure that the prototype meets

the market requirements, it is recommended to contact the German

Engineering Federation (VDMA)

The prototype system for a concrete solution is needed to enter the German market to show the necessary competences

and know-how

Even though the technical formalities are legally just needed for the actual market introduction of a product, the German companies and institutions require the fulfilment of the requirements to proof the

expertise and compliance with German “standards”

The prototype system serves furthermore as the basis for use cases, which have to be shown to potential partner institutions and

16

Personally Conducted Interviews

67

Position and Institution/Company Type of Interview

Deputy head of a German research institute Conducted by phone

German business development executive in an US American IT company I Conducted by phone

German manager executive briefing center in an US American IT company II Conducted by phone

Head of strategic management and marketing of an industrial software company Conducted by phone

IT manager in a German Blue-Chip company in Portugal Conducted personally

Operations manager industrial products in one of the Big Four Conducted by email

Partner and head of industrial production of one of the Big Four Conducted by email

Project assistant Cyber-Physical-Systems in a German SME Conducted by email

President of the executive board of a German research institute in Portugal Conducted by phone

Project manager I-4.0 in a major business association in Germany Conducted by phone

Research assistant in a product engineering research group I Conducted by phone