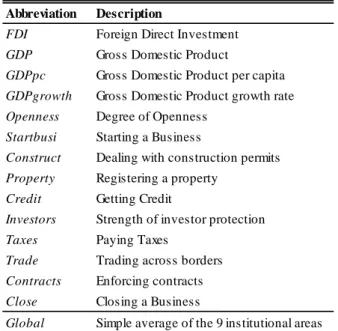

The influence of Doing Business’ institutional variables in Foreign Direct Investment

Texto

Imagem

Documentos relacionados

No entanto alguns estudos demonstram que após um acidente de trabalho ou doença profissional os trabalhadores experienciam vários sentimentos em relação ao trabalho, geradores

Therivel (2004) afirma mesmo que embora existam muitas outras definições para AAE estas são apenas variações desta, como a de Partidário (2007) que define AAE

A conceptualização deste modelo abrangente, correspondente ao modelo integrado DEA e BSC retocado (com as ponderações das perspectivas do BSC, da eficiência da Óptica dos

O PEARLS é o acrônimo para um grupo de indicadores financeiros de avaliação das atividades operacionais das cooperativas de crédito, quais sejam: Proteção,

Alguns dos fatores de associação à marca que mais influenciaram a satisfação, como os de organizadores, fãs, história, interação social e sucesso do evento,

A mesma legislação define limites para a quantidade de Publicidade exibida durante os intervalos comerciais (S. O artigo 40º, nº1, elucida para o tempo que pode

[r]

Esta afirmação é reforçada por re- cente trabalho de Sacardo (16) que, a partir da análise dos discursos de pessoas hospitalizadas em hospital público da região metropolitana de