Decision Model for Life Cycle Assessment of

Power Transformer during Load Violation

1

S. S. BHANDARI *, 1N. CHAKPITAK, 1T. CHANDARASUPSANG 1

College of Arts, Media & Technology, Chiang Mai University, Chiang Mai, Thailand *

Corresponding author: E-mail: sachin_camt@hotmail.com; Phone: +66-884095990

Abstract

Utility have normally planned the power transformer based on its designed load demand for the long term. Due to unexpected penetration, the actual load profile does not always follow the designed load and load violation will occur at some points during the life cycle of the power transformer for which the utility is inevitably required to make strategic decision. In the past, the decisions were mainly focused on the technical condition of the asset without any consideration to investment budget limitation. In this paper, an alternative methodology comprising of knowledge based model, financial model and decision criteria is proposed to make an optimal decision during load violation. A generic power system similar to Nepal Electricity Authority’s context was utilized as a case study. The result depicts that this model can effectively assess the life cycle of power transformer balancing both the financial and technical constraints.

Keywords: Asset Management, Decision Model, Economic Value Added, Life Cycle Management, Power Transformer.

Introduction

Asset management is the systematic and coordinated activities and practices to optimally manage their assets, and their associated performance, risks and expenditures over their life cycle attaining their organizational strategic plan [1], [2]. However, utility’s portfolio comprise of a very large and diversified group of assets resulting in difficulty to manage their assets systematically. Therefore, effective asset management is inevitable to the utility from both financial and technical aspects. In this study, power transformer is selected because it is regarded as one of the critical and expensive asset in power system operation. This is because sudden failures may cause disruption in power supply resulting in higher costs, revenue losses, environmental and collateral damage. This leads to significant investment each year [3]-[8]. Transformer operated at peak load affects the hot spot temperature of transformer as a result of reducing insulation life [10]. Moreover, life cycle management of power transformer becomes more important due to economical and engineering value [5], [9], [11].

Typically, the management and decision making activities of the power transformer operating in a power system are based on the normal load growth with some certain degree of reserve capacity. However, in reality the actual load profile does not always follow this designed load due to unexpected penetration. This includes for examples, construction of new business and /or industrial areas, migration of population or sudden changes in economic conditions. Ultimately, load violation will occur at some points during the life cycle of the power transformer for which the utility require to make strategic decision. In addition, financial subsidies are not quite promising to the utility so they need to survive within the available financial resources. Also, utility authority does not have knowledge about the status of each asset in the portfolio in terms of its technical and financial value. In such situation, the utility authority must make optimal decision on power transformer considering both financial and technical constraints.

postponement of new transformer investment can be achieved by raising the temporary overload operational limits [14]. It needs additional investment on condition monitoring tools and techniques. In addition, asset management fuzzy logic has been applied for assessing the life cycle of power transformer considering only remnant life and aging factors [10]. The life cycle decision is made on existing asset in the network through financial calculation considering only technical constraints such as operation and maintenance cost, energy losses; energy not supplied cost [15]. The financial model has applied to make decision for the end of life management of asset which include depreciation cost, maintenance cost, outage cost, safety health and environment cost [16]. The life time management of power transformer can be done by using monitoring and diagnosis systems and maintenance strategies resulting reduction in the life cycle costs and the postponement of reinvestment [17]. Life management of transformer can be done through a continuous assessment and evaluation of condition of transformer [18].

Most of the existing practices have considered the case for those assets that have almost reached to their end of life. The existing methods have not properly managed the asset in-stock. In addition, the decisions were made on the basis of the cheapest market price of the assets without any consideration to investment budget limitation thinking only of the technical performance of the asset [19], [20]. Moreover, the decisions become infeasible from the financial perspective. Consequently, the assets have not been fully utilized over their life cycle.

In this context, this paper is aimed to provide alternative methodology, comprising both a financial and a knowledge based model, for an effective life cycle assessment of the power transformer with the aim of maximizing its utilization during its life cycle. This paper has mainly focused on the financial model. This methodology can systematically assess the life cycle of the power transformer satisfying both the financial and engineering requirements with the utilization of hidden knowledge.

Proposed Methodology

The proposed methodology comprises of financial model, knowledge based model and decision criteria to effectively assess the life cycle of power transformer during the load violation meeting both financial and engineering requirements. The general framework of methodology is shown in figure 1.

Figure 1: General Framework of Methodology.

Knowledge Based Model

based model. Hence, it can provide both technical knowledge of power transformer for maintaining engineering requirements and financial benefits by saving some portion of the cost incurring during its life cycle.

Financial Model

It provides the financial status of each power transformer within the network. It included acquisition cost, operation and maintenance cost, payback period, gross revenue, book value and net profit. In addition, the net profit facilitates executives or engineers to make decision on power transformer during load violation.

Acquisition Cost: It is the cost associated with acquiring the power transformer before supplying energy to the consumers [22], [23]. For new power transformer, it is equivalent to the asset price and is determined from the contract documents. However, the acquisition cost of existing power transformer is the sum of transportation cost, installation cost, operation and maintenance set up, visual inspection learning, corrective maintenance learning, preventive maintenance learning, training cost and commissioning cost.

Wheeling Charge: It is defined as the use of a utility’s transmission facilities to transmit power for other buyers and sellers. It is the amount or percent charged by one electrical system to transmit the energy of, and for, another system or systems [24]. The supply contributes only 18% of its domestic electricity bill [25]. The power transformer contributes about 60% of the total investment in the supply [3]. Hence, the wheeling charge for the power transformer is given below:

Wheeling charge = contribution of supply costs to the electricity bill * contribution of power transformer (1)

Gross Revenue: It is the income from each power transformer after selling energy to the consumers. The gross revenue is determined using the following equation:

Gross revenue = Average tariff rate * 8760 *Average load in MVA * Power Factor * Wheeling charge (2)

Book Value: It is the value at which an asset is carried out in a balance sheet. Initially, the book value is equal to an asset price. It is declined after each year of operation of an asset because the value of an asset is depreciated. The depreciation of power transformer is calculated using the straight line depreciation method below:

Depreciation = (asset price – salvage value) / FDL (3) The book value is depreciated to zero at the end of financial designed life [26]. The financial designed life is captured from the documents of power utility. During the financial designed life, the manufacturer has guaranteed about the cash flow. However, the technical designed life is greater than the financial deigned life [27].

Mortgage Cost: It is the cost to be paid each year for borrowing the soft loan to procure the power transformer. Utility get the money as a soft loan for the period of financial designed life. The mortgage cost of power transformer is determined [28] using the following equation:

Mortgage cost = PMT (soft loan interest, financial designed life, asset price) (4)

Net Profit: It assists executives/or engineers to make decision during load violation. Economic Value Added (EVA) is used to determine the net profit of power transformer after its investment over its life cycle. It measures of a firm’s true economic profits, and can be argued to reflect economic reality more accurately than conventional measures [29]. Mathematically, it can be expressed as [28], [30]:

EVAt = NOPAT – CIC = NOPAT – (ATIR * BV in year t-1) (5) NOPAT = Gross Revenue – OC – Depreciation – Mortgage cost – Taxes (6) ATIR = (1 –tax rate) * Interest rate (7)

Decision Criteria

Replacement:It means that the existing power transformer in the network must be replaced by either new power transformer or existing power transformer from another location or stock. The power transformer operating in a network has no margin to operate it further after load violation because the net profit of new power transformer is greater than the lost opportunity of existing power transformer. The expected lead for a replacement of power transformer is about 8 months [33]. The equations of net profit of new and existing power transformer during replacement are shown below:

NPETR =

AFDL

LV i

ALD i

)

(EVA

NPV

– TMCLV + NSUHKR – AC (8)NPNTR =

AFDL LV i ALD i)

(EVA

NPV

– TMCLV + NSUHKR (9)EFDLE = IYE + FDL (10)

TMCLV = NSLV * Mortgage Cost (11)

NSLV = EFDLE – LV +1 (12)

AFDL = EFDLE + NSA (13)

Use Up:It means using the power transformer until the end of its financial designed life. It is operated with its rated capacity after load violation. It cannot serve the increased load demand beyond its rated capacity. It is assumed that there is no penalty and value of loss load for not supplying energy to the consumers. It has margin to operate it further because the lost opportunity of existing power transformer is greater than the net profit of new power transformer. The lost opportunity is the lost of not supplying energy from the existing power transformer to the consumers after load violation i.e. making it idle. It is expressed in equation 13. LOER = (NP due to ALD – NP due to DLD) =

AFDL LV i ALD i)

(EVA

NPV

-

AFDL E IY i DLD i)

(EVA

NPV

(14)Figure 2: Decision Algorithm for Assessing the PT during Load Violation.

Results

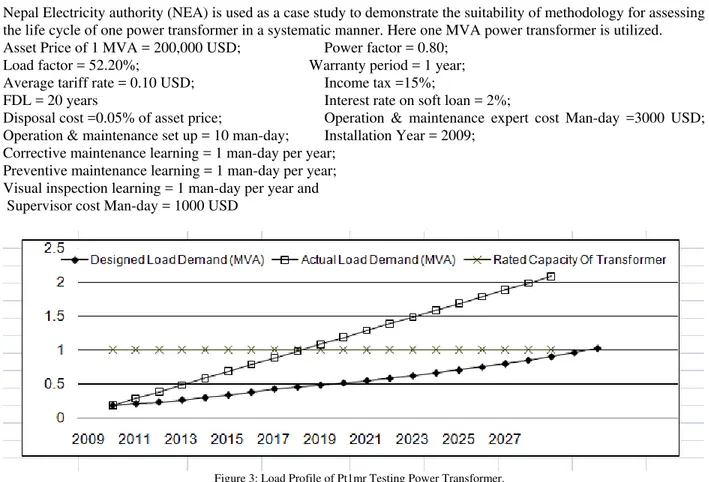

Nepal Electricity authority (NEA) is used as a case study to demonstrate the suitability of methodology for assessing the life cycle of one power transformer in a systematic manner. Here one MVA power transformer is utilized. Asset Price of 1 MVA = 200,000 USD; Power factor = 0.80;

Load factor = 52.20%; Warranty period = 1 year; Average tariff rate = 0.10 USD; Income tax =15%;

FDL = 20 years Interest rate on soft loan = 2%;

Disposal cost =0.05% of asset price; Operation & maintenance expert cost Man-day =3000 USD; Operation & maintenance set up = 10 man-day; Installation Year = 2009;

Corrective maintenance learning = 1 man-day per year; Preventive maintenance learning = 1 man-day per year; Visual inspection learning = 1 man-day per year and Supervisor cost Man-day = 1000 USD

Figure 3: Load Profile of Pt1mr Testing Power Transformer.

The load violation of Pt1mr occurs before the end of financial designed life and is obtained from the actual load demand curve in their load profile. If the transformer is not kept in the network after load violation, it cannot serve the energy during this period. Hence, the lost opportunity of this power transformer is determined using equation 14 and shown in table 1.

TABLE 1: Lost Opportunity of Pt1mr.

Name LV EFDL Mortgage

Cost (USD)

Net Profit Due to ALD (USD)

Net Profit Due to DLD (USD)

LOER = Lost

Opportunity (USD)

Pt1mr 2018 2028 $12,231.34 $354,928.46 $37,570.63 $317,357.83

If the power transformer Pt1mr is to be replaced by new power transformer, it is in stock for 11 years. The reusable hidden knowledge is utilized during the operation and maintenance stage. The net profit of new power transformer is evaluated using equation 9 during this interval and is presented in table 2.

TABLE 2: Net Profit of New Power Transformer of Capacity of 3 MVA in Pt1mr after Load Violation.

Name NS

(Years) TMC (USD)

Net Profit After Load Violation (NPALV)

NPNTR = (NPALV –

TMC)

New Transformer

From the table 1 and table 2, it can be found that new power transformer could not provide more profit than the existing power transformer. Hence, the existing power transformer Pt1mr can have still margin to operate it beyond load violation with its rated capacity. The hidden knowledge is utilized to fulfill the engineering requirement of existing power over its life cycle. Finally, the executives must make a decision of Use Up for the existing power transformer Pt1mr during the year 2018.

Discussion

The results of the study depicts that the proposed methodology works well in assessing the life cycle of power transformer systematically during load violation. The net profit of power transformer can be used to make optimal decision on it during load violation. It is computed with the modeling of EVA. Finally, the decision model can assist the executives or engineers of power utility to select the optimal life cycle decision on power transformer during load violation using the proposed decision criteria. Furthermore, it has depicted that the power transformer can be fully utilized over its life cycle with the utilization of hidden knowledge during the financial designed life. In addition, the results illustrate that this methodology can systematically manage power transformer in the network.

Conclusion

Complexity of the power system makes difficulty for the utility to manage their assets systematically. This results in utility finding the easy way out and focusing on the cheapest market price. The proposed methodology provides both financial and technical status of each power transformer in the network. The EVA facilitates to make decision from the financial perspective. The knowledge based model provides the hidden knowledge in order to make the decision technically and financially viable. Moreover, the decision model can facilitate the executives of power utility to make optimal decision on power transformer during load violation with the aim of maximizing the profit and minimizing the cost of keeping it in stock.

In conclusion, utility can make better contingency plan of their whole assets over their life cycle to achieve the organization strategic plan.

Appendix

t Time in year

PT Power Transformer

OC Operation and Maintenance Cost NOPAT Net Operating Profit After Taxes NP Net Profit

AC Acquisition Cost DLD Designed Load Demand ALD Actual Load Demand FDL Financial Designed Life AFDL Actual Financial Designed Life EFDL Estimated Financial Designed Life

EFDLE Estimated Financial Designed life of Existing Power Transformer EFDLRL Estimated Financial Designed life of being Relocated Power Transformer CIC Cost of Invested Capital

BV Book Value

ATIR After Tax Interest Rate

NSLV Number of Years keeping on Stock in case of Replacement after LV NSRL Number of Years keeping on Stock in case of no Relocation NSA Number of Years Already Kept in Stock

LOER Lost opportunity of existing power transformer during Replacement TMCLV Total Remaining Mortgage Cost of Power Transformer to have load violation LV Load Violation

NSUHKR Net Savings from Utilizing Hidden Knowledge during Replacement IYE Installation Year of Existing Power Transformer

Acknowledgment

The authors wish to acknowledge the assistance and support of College of Arts, Media and Technology (CAMT). References

[1] R.E. Brown and B. G. Humphrey, “Asset Management for Transmission and Distribution”, IEEE Power & Energy Magazine, pp. 39-45, 2005.

[2] British Standards Institution, PAS 55-1: Asset Management. “Part 1: Specification for the Optimized Management of Physical Infrastructure Asset”, 2004.

[3] D. J. Woodcock, “Condition Appraisals of Power Transformers”, CINERGY, Indianapolis, Indiana, 2000

[4] M. Arshad, S.M. Islam and A. Khaliq, “Power Transformer Asset Management”, International Conference on Power System Technology, Singapore, 2004.

[5] J. Q. Feng, J.S. Smith, Q.H. Wu and J. Fitch, “Condition Assessment of Power System Apparatuses Using Ontology Systems”, IEEE/PES Transmission and Distribution Conference & Exhibition, Dalian, China 2005

[6] Summary Report, “International Conference on Large Power Transformers- Modern Trends in Application, Installation, Operation & Maintenance”, New Delhi India, 2006.

[7] R. Schwarz and M. Mutr, “Diagnostic Methods for Transformer”, International Conference on Condition Monitoring and Diagnosis, China, 2008.

[8] Q. Xil, Y. Liu, Y. Li and F. Lv, “Research on Failure Risk Assessment and Maintenance Tactics of Transformer Based on the Extension Engineering Method and IAHP”, International Conference on High Voltage Engineering and Application, Chongqing, China, 2008. [9] M. Wang, A. J. Vandermaar and K.D. Srivastava, “Review of Condition Assessment of Power Transformer in Service”, IEEE Electrical

Insulation Magazine, 18(6):12-25, 2002.

[10] M. Arshad and S.M. Islam, “A Novel Fuzzy Logic Technique for Power Transformer Asset Management”, IEEE Industry Applications Conference, Tampa, FL, USA, 2006.

[11] Draft Final Report Rev. 2, “Guidelines for Life Management Techniques for Power Transformers”, CIGRE Working Group 12.18 Life Management of Transformers, 2002.

[12] L.M. Geldenhuis, “Power Transformer Life Management”, CIRED 18th International Conference on Electricity Distribution”, Turin, Italy, 2005.

[13] Y. Oue, Y. Hasegawa and T. Kobayashi, “Life management of transformers in Japan-Japanese practices of maintenance and refurbishment”, IEEE/PES Transmission & Distribution Conference and Exhibition, Yokohama, Japan, 2002.

[14] Y. Hasegawa ,T. Kobayashi, H. Okubo, Y. Oue and K. Uehara, “Optimization of Substation Assets By Reviewing Dynamic Loading Criteria”, On behalf of CIGRE Work Group B3-2: Substations, (CIGRE Paris 2004).

[15] J. Ostergaard and A. Norsk Jensen, “Can we Delay the Replacement of this Component? - An Asset Management Approach to the Question”, CIRED 16th International Conference & Exhibition on Electricity Distribution, Amsterdam, The Netherlands, 2001. [16] H. Picard, J. Verstraten, M. Hakkens and R. Vervaet, “Decision Model for End of Life Management of Switchgears”, 4th European

Conference on Electrical and Instrumentation Applications in the Petroleum and Chemical Industry, Paris, France, 2007.

[17] C. Summereder, M. Muhr and B. Körbler, “Life Time Management of Power Transformers”, e & i Elektrotechnik und Informationstechnik, 120(12):420-423, 2003.

[18] J. Schneider, A. J. Gaul, C. Neumann, J. Hogräfer, et.al, “Asset Management Techniques”, International Journal of Electrical Power and Energy Systems, 28(9):643-654, 2006.

[19] J. J. Smith, B. Quak and E. Gulski, “Integral Decision Support for Asset Management of Electrical Infrastructures”, IEEE International Conference on Systems, Man and Cybernetics, Taipei, Taiwan, 2006.

[20] R. E. Brown and J. H. Spare, “Asset Management, Risk, and Distribution System Planning”, IEEE/PES Power Systems Conference and Exposition, New York, USA, 2004.

[21] S.S. Bhandari and T. Chandarasupsang, “Alternative Life Cycle Assessment of Power Transformer”, 3rd International Conference on SKIMA-09, Fes, Morocco, 2009.

[22] J. L. Goudie and W. J. Chatterton, “Environmental and Life Cycle Considerations for Distribution and Small Power Transformer Selection and Specification”, International Symposium on Electrical Insulation, Boston, USA, 2002.

[23] C.E. Ebeling, “An Introduction to Reliability and Maintainability Engineering”, MC Graw Hill (1997)

[24] W. J. Lee, C.H. Lin and L.D. Swift, “Wheeling Charge under a Deregulated Environment”, IEEE Trans. on Industry Applications, 37(1):178-183, 2001.

[25] P. William and G. Strbac, “Costing and pricing of electricity distribution services”, Power Engineering Journal, 15(3):125-136, 2001. [26] W. Li, E. Vaahedi and P. Choudhury, “Power System Equipment Aging”, IEEE Power and Energy Magazine, 4(3):52-58, 2006. [27] G. Swift and T. Molinski, “Power Transformer Life-Cycle Cost Reduction”, In Electricity Toady (Canadian Electricity Forum), Toronto,

Canada, 1997.

[28] L. Blank and A. Tarquin, “Engineering Economy”, McGraw-Hill (2002).

[30] J.L. Grant, “Foundation of Economic Value Added”, John Wiley & Sons Inc. (2003).

[31] T. Kawamura, M. Ichikawa, N. Hosokawa, N. Amano and H. Sampei, “Site Maintenance Operations on Oil-Immersed Transformers and The State of Renewal for Low-Cost Operations in Japan”, CIGRE WG A2-209, Paris, France, 2004.

[32] “IEEE Standard 657.91-1995: Guide for Loading Mineral Oil Immersed Transformer”, IEEE (1995).