The Role of Ownership Concentration, its Types

and Firm Performance: A Quantitative Study of

Financial Sector in Pakistan

Kashif Rashid, Dr., Associate Professor

COMSATS Institute of Information Technology Abbottabad, Pakistan

E-mail: mkrashid[at]ciit[dot]net[dot]pk

Seep Nadeem, Research Scholar

COMSATS Institute of Information Technology Abbottabad, Pakistan

E-mail: seepnadeem[at]ciit[dot]net[dot]pk

Abstract: The issue of ownership concentration has attracted a lot of attention in an emerging economy. The aim of this study is to investigate the impact of ownership concentration and its different types on the performance of a firm. For this purpose a panel data of 27 firms of banking and financial services sector of Pakistan listed at Karachi Stock Exchange (KSE) is used as a sample for the period from 2007 to 2011. Ownership concentration and types of ownership are used as

independent variables. Tobin’s Q is used as a proxy for the

shareholders in the selected market. The types of ownership have a positive relationship with the firm performance supporting stewardship theory. On the contrary, higher

leverage and aged firms deteriorate the shareholder’s value

in Pakistan. The results of incremental regression analysis show that the firm size is the most important variable in affecting the value of a firm. These results are valuable to researchers and policy makers in Pakistan.

Keywords: Ownership concentration; firm performance; banking and

financial sector; Pakistan; Tobin’s Q and leverage.

JEL: G2, G21, G29.

Introduction

Financial sector in Pakistan has a broad range of financial institutions such as commercial banks, investment banks, specialized banks, Islamic banks, development financial institutions, and national savings schemes, stock exchanges, leasing companies, corporate brokerage houses, micro-finance institutions and discount houses. They offer a wide range of commodities and assistance both on the assets and liabilities side.

The first Code of Corporate Governance was finalized and implemented by the Securities and Exchange Commission of Pakistan (SECP) in March 2002. This code was subsequently incorporated in all the listed companies of the three stock exchanges. Establishment of Pakistani Institute of Corporate Governance in public private partnership was the first step by SECP in 2004. Corporate governance has become an issue of global importance. In reinforcing the foundation for the long-term economic performance of countries and corporations, the improvement of corporate governance practices is identified as one of the vital elements.

that the agency conflict between equity investors and managers lessen through block ownership and, in consequence, make certain that financiers get an appropriate return for their investment in the firm (Boone et al., 2010). Shleifer and Vishny (1997) also identified concentrated ownership as an important element of a good corporate governance system. Ownership concentration is a measure of the extent to which the ownership in the firm is condensed in the hands of a single investor. It refers both to considerable minority shareholders as well as to large shareholders having complete command over the firm (Heugens and Essen, 2008).

Literature on the corporate governance also draws attention towards types of concentrated ownership. It focuses that the cost of exerting control over managers vary considerably for different types of owners, which implies that the types of concentrated ownership are an important elements of company performance. Different types of ownership may include ownership by banks, financial institutions and individual ownership.

There is no study conducted to investigate the relationship of ownership concentration and its types with the firm performance in banking and financial services sectors of Pakistan. The relationship between ownership concentration and firm performance has got attention in majority of the studies. The literature lacks an empirical study on the relationship between ownership concentration and firm performance in Pakistan. The aim of this study is to examine the empirical relationship of ownership concentration and its different types with the firm performance in banking and financial services sectors of Pakistan.

The main objective of the study is as follows:

To test the relationship between ownership concentration and firm performance in banking and financial services sectors.

To test the relationship between ownership by bank/financial institution and firm performance in banking and financial services sectors; and

To check the relationship between individual/family ownership and firm performance in banking and financial services sectors.

After the introduction, which is discussed in Section 1 above, Section 2 describes review of literature. Data source and methodological framework is presented in Section 3. Results are discussed in Section 4 and final Section (5) concludes the study.

LITERATURE REVIEW

Corporate Governance and its Development in Pakistan

Corporate governance has a significant importance in both developing and developed countries due to the fact that good corporate governance can lead to the enhanced performance of a firm. It is concerned with the efficient utilization of resources, ensures accountability and safeguards the interests of shareholders.

Additionally, it ensures that the companies are performing in accordance with the rules, laws and practices, which provide a system to

control and monitor manager‘s and director‘s behavior through the

corporate accountability; this in turn safeguards the interests of investors. It is essential that managers carryout their responsibilities and duties with full commitment and carefulness and in the best interest of the shareholders and the company.

Review of Theories

aim to understand how they are linked to the governance. There are several theories that have highlighted the purpose of the firm and how the firm should be responsible in meeting its commitments. There are four main theories which have influenced the corporate governance development.

Agency Theory

This theory is also known as the principal-agent theory. It is argued that the agency problem has been the most principal issue in corporate governance and this theory is usually treated as the starting point of this debate. Jensen and Meckling (1976) assert that as a result of principal-agent problem, agency cost takes place in the firm. The managers as agents do not work in the interests of shareholders (principals) and agents are committed in building their own empires. Consequently their opinions do not enhance the value of the shareholders.

Stewardship Theory

Stewardship theory provides an alternative to principal-agent theory by suggesting that there exists no agency cost between the management (agent) and the shareholders (principal). When there is concurrence of interests between the principal and the agent then there is no need to

control or discipline the management for the purpose of shareholder‘s

Stakeholder Theory

The aim of stakeholder theory is to strike a balance between the interests of the stakeholders of a corporation and their satisfaction (Freeman et al., 2004). It tries to find out the purpose of the firm. Freeman et al. (2004), by shedding the light on the responsibility of firm towards its stakeholders, state that it pressurizes the management to formulate and implement suitable methodologies to identify the nature of the relationship between the management and the concerned parties in order to deliver on their purpose. Authors further argue that there is an understanding that economic value is created by the people who join

together by their own will, cooperate and therefore, enhance everyone‘s

state of affairs.

Transaction Cost Economics

Ownership Concentration

Ownership structure is one of the most important instruments in determining the corporate governance system of any country. This is because it determines the nature of the agency conflict, that is whether the prevailing conflict is between controlling and minority shareholders or between managers and shareholders (Zhuang, 1999).

Blockholding is a type of ownership concentration in mitigating principal-principal conflicts or the principal-agent conflicts. Blockholding is not only the form of concentrated ownership; with the specific skills, expertise and principal-principal clash, but also the blockholders have strong incentive to monitor the management (Barclay and Holderness, 1991; Gibson, 2003). Blockholders may discipline the management that

in turn improves the overall value of shareholders in the form of ―shared benefit of control‖ (Denis and McConnell, 2003).

Arosa et al. (2010) argued that corporate ownership structure is the most important and determining factor in corporate mechanism, which

impacts the firm‘s performance. There are diverse concepts regarding the

significance of corporate ownership structure. Principal-agent theory suggested that greater ownership concentration offers the opportunity for the controlling shareholders to use their power to start the activities projected to gain personal profit at the cost of small shareholders (Miller, 2007). Ownership structure means disbursement of ownership (the stock

of companies) among the corporation‘s owners (shareholders), which can

be evaluated into two perspectives (Jiang, 2004). One perspective is the concentrated ownership and other perspective is the composition of ownership.

small shareholders as well as other stakeholders of the firm bear the costs (Shleifer and Vishny, 1997; La Porta et al., 1999).

The presence of concentrated ownership on the other hand may not necessarily be catastrophic to the firm. The basic principle behind this suggests that there is concentrated ownership disciplining the management, which reduces the free-rider problem of monitoring the management team mitigating the agency costs (Shleifer and Vishny, 1986). The study of ownership concentration, its different types and their impact on different corporate performance measures is even more important when the emerging markets are considered.

Ownership Concentration and Firm Performance

The association between ownership and firm performance is viewed as going through the power distribution and interaction between the owners and managers of firms (Kocenda and Svejnar, 2002). The relationship between ownership concentration and firm performance is one that has gained momentous attention in finance literature (Jiang, 2004). Different authors using varying samples and applying alternate methodologies often ended up with different and even contradictory conclusions. Berle and Means (1932) argued that the dispersion of

ownership leads to the decline of firm‘s performance. When the owner

increased assistance at the cost of the shareholders.

McConnell and Servaes (1990) found a significant roof-shaped relationship between ownership by managers and directors and firm

performance. They used Tobin‘s Q and return on assets as measures of

performance. Cho (1998) argued that ownership structure fixes investments level, which in turn determines corporate performance and which again, impacts the ownership structure. He further identified that

Tobin‘s Q improves significantly until concentration approaches to a

certain limit and then starts to diminish while accounting for this type of endogeneity.

Jensen and Meckling split the shareholders into external shareholders (investors without voting right) and internal (investors with management right). The findings of their research revealed that the value of a firm is related to the ownership of shares by internal shareholders, which is known as ownership structure. Theoretically, with the increase in the ownership of shares by internal shareholders, the firm value increases. The researchers also classified firm value as a function of ownership structure (Jiang, 2004). Pedersen and Thompson (1997) and Zeitun and Tian (2007) declared that ownership structure has an

impact on a firm‘s performance and its default risk.

The matter of ownership structure and firm performance has been researched widely (Morck et al., 1988; Davies et al., 2005). Moreover, for a long period of time, it was universally perceived that ownership structures of companies are diversified. However, the researches conducted during the last decade have come to entirely change this perception. In fact, the ownership structure around the world shows that many firms have concentrated shareholders, who in many cases are powerful enough to control firm decisions and management (La Porta et al., 1999).

the impact of ownership structure on the performance of commercial banks in Ethiopia. They analyzed whether the ownership structure of banks significantly impacts bank performance. Eight Ethiopian commercial banks were used as a sample from the period of 2001 to 2008. Both parametric and nonparametric tests of differences were employed among private and public sector banks. To investigate the relationship of determining the various attributions of the performance indicators of Ethiopian commercial banks, their ownership patterns were the objectives of the study. In order to gain knowledge whether ownership structure is the determinant factor of the performance of commercial banks, the study used financial statements of private and public and commercial banks in Ethiopia.

The findings of earlier empirical studies have shown that the ownership concentration has a dual impact on the firm performance. On one side, the concentrated ownership can offer control of management in a better way, as the size of ownership stake and the inducement to monitor are positively associated. As a result, it should enhance firm performance and likewise benefit minority shareholders. On the other side, the owners having controlling shares might try to accomplish their additional benefits at the cost of small shareholders (Warokka et al., 2012). We follow agency theory and expect a negative relationship between ownership concentration and the value of a firm in Pakistan and base our hypothesis as follows:

H1: Higher ownership concentration deteriorates the value of firm in Pakistan.

Ownership Types

types of ownership have different preferences for how to cope with

manager‘s agency conflicts and different investment priorities. In the

same way, Bolbol et al. (2003) and Javid and Iqbal (2008) argued that the connection between large shareholders and firm performance depends on who the large shareholders are.

The ownership structure of a firm affects its performance for numerous reasons. Firstly, the variation in concentration and resource endowments among owners establish their relative ability, power and incentives to monitor managers. The well-known examples of this phenomenon encompass shareholdings by individuals, banks, mutual funds, corporations and government. Secondly, different owners have different goals and consequently they have different influence on the performance of a firm. The financial shareholders may show their interest in short-term returns on investment, while corporate shareholders may show serious behavior towards establishing a long-term relationship (Douma et al., 2003). The study conducted by Klein et al. (2004) proved that ownership type does not have any impact on the firm performance in Canada. Their results revealed that none of the variables indicating ownership type was ever statistically significant.

Bank/Financial

Institution

Ownership

and

Firm

Performance

The studies conducted to evaluate the relationship between banks/ financial institution ownership end up with varied findings. Dzanic (2012) investigated that firms which have financial institutions as largest

blockholder end up with significantly higher value of Tobin‘s Q compared

to the other. Similarly, Uchida (2009) argued that banks avert firms from undertaking risky projects that have a positive net present value (NPV),

as these banks are likely to monitor the firm in the creditor‘s interests

that a positive relationship exists between financial institution ownership and firm performance.

Lichtenberg and Pushner (1994) found that there exists a positive relationship between ownership by financial institutions and firm

performance. Hiraki et al. (2003) also investigated that bank‘s

shareholdings have a positive effect on the firm value. Institutional shareholders such as financial institutions who have huge stakes in a firm can have the benefits of costly monitoring as they are released from free-riding problems (Shleifer and Vishny, 1986). This concept gives rise to the anticipation that institutional ownership has a positive relationship with the firm profitability. Among various institutional shareholders, banks can perform effective monitoring due to their access to the inside information of the firm (James, 1987; Lummer and McConnell, 1989; Aoki et al., 1994; Lichtenberg and Pushner, 1994).

Ownership by banks clearly encourages company‘s access to the

capital of bank, which can be very valuable during market turmoil (Kang and Shivdasani, 1995). Many studies have found support for the perception that banks can actively monitor and discipline borrowers and improve the performance of a firm in developed economies (Welch, 1997; Kang et al., 2000 and Kroszner and Strahan, 2001). Banks may be able to improve firm performance in developed economies where laws and business practices facilitate banks to play an observant monitoring role (Lin et al., 2009). Studies on developed economies generally are in agreement that bank ownership is beneficial for companies (Barth et al., 2008).

of a firm from a sample of 27 developed countries. The results revealed that there exists a higher value of firms in countries with better protection of minority shareholders.

The bank ownership can present significant economies of scope that may be vital to particular stages of national development. However, though banks offer firms with easy access to funds for expansion, relationship investors have been censured for their personal involvement

with executives in deteriorating the company‘s value (Macey and Miller,

1997). The study conducted by Harris and Raviv (1990) presents proof that German banks are hesitant to discipline managers in client companies, especially when they are connected to these companies through cross shareholding system. Banks as representatives of board and or having shares in a firm are considered to protect their investments by supporting enormous internal cash transfers into hidden reserves within German firms that can be used to support diminishing firm income in a crisis. This accounts to banks making an alliance with managers to keep down dividends payable to the outside shareholders (Baums, 1993).

Additionally, there is verification that bank holdings deform investment decisions as Thomas and Waring (1999) conducted study in Japan and Germany and reported that the investment decisions in firms with bank ownership are affected more by liquidity considerations as compared to expected investment return. Baums (1993) argued that banks might join together with controlling parties who give more priority to profit retention over distributing dividends.

Rajan (1992) argued that banks with their monopoly power

expropriate firm‘s shareholder‘s value. Earlier studies have shown

minority shareholders. It is expected that ownership by banks have an adverse impact on the value of a firm. Studies showed that the firms that experience a significant turn down in bank ownership results in an increased accounting performance. Further, the findings of Uchida (2009) revealed that ownership by Japanese banks negatively affect firm

performance. A bank/financial institution may deform management‘s

incentives; persuade companies to move away from the optimal operational and financial decisions, and harm company valuation (Limpahayom and Polwitoon, 2004, Fok et al., 2004 and Mahrt-Smith, 2006). Banks may not be able to play an effective monitoring role in emerging markets as they perform in developed markets, due to the extreme differences in the cultural and legal background between the developed and emerging markets (Barth et al., 2008). We support agency theory and base our hypothesis for this study as follows:

H2: Bank and financial institution ownership deteriorates the value of a firm in Pakistan.

Individual/Family Ownership and Firm Performance

Agency theory presents a mixed perspective on agency conflicts in firms where there is a family ownership. One perspective is that families are assumed to be the active and good monitors of managers as compared to the other types of large shareholders. This suggests the divergence of interests between owners (principal) and managers (agents), which leads to an agency conflict. It might be less common in family ownership than non-family ownership (Anderson and Reeb, 2003). The other perspective is that when families are the controlling shareholders they may have a strong power to extract private incentives at the expense of minority shareholders (Fama and Jensen, 1983; Shleifer and Vishny, 1997).

controlling shareholders. These shareholders might be the pioneers of the firms, their sibling or private investors. Research in the area of family controlled businesses has gain significant attention in recent times which indicates the recognition of the significance of businesses under family ownership in economic activity together with their role in creating jobs, investing in new ventures and generating GDP (Glassop and Waddell, 2005). The study conducted by Claessens et al. (2000), which investigated the extent of separation and control in nine East Asian countries, revealed the presence of high level of family ownership, control and monitoring in more than half of the East Asian companies. Family firms presume a considerable role in the economic development, and improved understanding of the governance of family firms.

According to Dzanic (2012) individuals and families have large incentive to prevent the conflicts and to monitor management and activities, which leads to a higher firm profitability, as it is typically the main source of income for them. The largest shareholders put their interests before the interests of other shareholders. Therefore, the study conducted by Dzanic (2012) examined that family ownership has a

positive and statistically significant impact on the Tobin‘s Q. Moreover, in

order to increase the firm value, families do not hire extra labor and pay entrenchment higher than the optimal and try to attain maximum possible labor efficiency.

investment decisions by managers. Moreover, the historical presence of families, control of management and large equity position place them in a superior position from where they can influence and monitor the firm.

Anderson and Reeb (2003) identified the obvious gains from concentrated ownership in the firms controlled by families. The findings showed that family ownership mitigates the classical agency conflict between managers and owners. The improved profitability of the firms, achieved with active family control and monitoring suggests that management in case of family ownership may drastically increase the efficiency of the firms, though this significant improvement is not imitated in the firm value and therefore may not accrue to minority shareholders.

According to Wiwattanakantang (2001) family ownership do not result in higher expropriation costs; it seems to provide good monitoring to that of other stakeholders. Javid and Iqbal (2008) examined that the owner-managers exert positive and significant impact on the firm performance and this is in agreement with Sarkar and Sarkar (2000) who

identified that blockholding by director‘s results in improved firm value.

Individual ownership is perceived as an ideal corporate governance instrument with the residual claimant having very strong motivation to monitor the management (Kocenda and Svejnar, 2002).

blockholder does not contribute to the better performance of a firm. According to Peres-Gonzalez (2001) the negative impact of family ownership on firm value could be even greater when family members hold executive positions in the firm. When individual/family member does not have the expertise, ability or aptitude to run the business then the family member holding the position of the Chief Executive Officer (CEO)

can have a significant impact on the firm‘s profitability.

Some researchers argue that when there is family ownership in firms, the family members do active monitoring which results in lower agency costs (Fama and Jensen, 1983; DeAngelo and DeAngelo, 1985). Disciplining and monitoring the management by the family members may be efficient not only because the family members have close and long term relation with the top management of the firm, but also because family members have excellent information about the firm (Smith and Amoako-Adu, 1999). We support stewardship theory and base our hypothesis relevant to this study as follows:

H3: Individual/family ownership improves the value of a firm in Pakistan.

Leverage and Firm Performance

The corporate governance literature suggests that debt offers a

motivation to managers to improve the firm‘s performance because poor

the companies that have less liquidity and also provides cushion to the companies that are in financial trouble.

Karaca and Eksi (2012) found a significant positive relationship between debt-to-asset ratio and firm performance. This is consistent with the findings of Rashid (2011) who proved a positive relationship between debt ratio and firm performance under market based performance measure. Warokka et al. (2012) also concluded a positive relationship

between leverage and Tobin‘s Q which is consistent with the incentive

signaling approach. According to this approach, leverage can be used to provide a signal to the market that firm is prospected and equity issues may provide a negative signal to the market

On the contrary, the study conducted by Tam and Tan (2007) revealed that a negative relationship exists between leverage and firm performance. Ward and Price (2006) investigated that an increased leverage ratio improves shareholder returns in a profitable business but at the same time increases risk. Additionally, its disadvantage suggests that with the increase in interest rates, the impact of debt on firm value decreases to a point where it becomes negative. Myers and Majluf (1984) argued that companies, which are successful, do not depend much on the external financing, as these show more dependence on internal financing. Consequently, there exists a negative relationship between leverage and firm profitability. The studies conducted by Dzanic (2012) and Foroughi and Fooladi (2013) also showed that a negative relationship exists between financial leverage and firm performance.

Firm Age and Firm Performance

Rashid (2011) found that firm age has a significant positive relationship with the firm performance when he used market based performance measure. Himmelberg et al. (1999) also found that firm age

experience in managerial knowledge and economies of scale, the growth in firm assets is utilized in a better way. Dzanic (2012) argued that the old firms seem to be more valued by the market as compared to the new ones.

Pervan et al. (2012) proved a significant positive relationship between firm age and firm performance. This statistically significant and positive coefficient of age suggested that the older Croatian listed firms performed in a better way when compared with the younger firms.

The relationship between firm‘s age and firm performance is

confusing. On one hand, the researchers suggested that older firms have higher resources, experience and expertise and can accrue the benefits of training and learning, and as a result can enjoy better performance (Majumdar, 1997; Loderer and Waelchli, 2009 and Pervan et al., 2012). On the other hand, researchers argued that older firms are static; they do not have any flexibility to adapt to new situations and advanced technologies and consequently are most likely to be outperformed by more flexible and younger firms.

Firm Size and Firm Performance

Najjar (2012) found that firm size has an impact on firm‘s

performance. The study conducted by Javid and Iqbal (2008) showed that the firms with large size are more likely to attain better performance. Similar results are established by Bolbol et al. (2003) when they conducted research in Arab countries. The findings of Tam and Tan (2007) revealed a positive relationship between firm size and firm performance in Malaysia.

Foroughi and Fooladi (2013) endorsed a positive relationship

between size of company and company‘s stock return. A firm with bigger

risks. On the other hand, uncertainties have superior chances to balance random losses (Surajit and Saxena, 2009). Moreover, large size of the firm brings the power of bargaining over the competitors and suppliers. A firm with bigger size can invest in better opportunities; can buy best sites with related advantage, the advanced technology and skilled professional experts because of its control over the market.

Empirical Researches Conducted in Pakistan

There is a little work done to examine the relationship of ownership concentration and ownership types with firm performance in case of Pakistan. Cheema et al. (2003) only classified the nature of corporate ownership structure in Pakistan without investigating its effect on corporate performance. Javid and Iqbal (2008) investigated whether the ownership structure matters in case of Pakistan and provided its implications for corporate governance and corporate performance. To evaluate the relationship between ownership structure and corporate governance at firm level, the data for 60 non-financial firms listed at Karachi Stock Exchange (KSE) was selected. The selected firms were the most active and representative of all the non-financial sectors. The data was collected from the annual reports of these firms over the period from 2003 to 2008. Firm performance was used as dependent variable and

was measured by ROA, ROE and Tobin‘s Q. The ownership concentration

was divided into four separate groups: individual ownership, foreign ownership, financial institutional ownership and family ownership. The findings of the study showed a weak legal environment in Pakistan due to which the corporations have more concentration of ownership. The ownership concentration seemed to have a positive impact on

performance measures and firm‘s profitability. The results also revealed

Hasan and Butt (2009) analyzed the impact of corporate governance and ownership structure on capital structure of 58 Pakistani non-financial companies listed at Karachi Stock Exchange from the period between 2002 and 2005. The results of this study revealed that managerial shareholding and board size have a significant negative relationship with debt to equity ratio. They also found that the corporate financing behavior do not have any significant impact of the presence of non-executive directors on board and CEO/chairman duality. Finally, they suggested that the instruments of corporate governance such as managerial shareholding, size of the board of directors and ownership structure play an important role in determining the capital structure of these firms.

Anwar and Tabassum (2011) conducted a study to examine the impact of concentration of ownership on the operating performance of Pakistani firms listed on the Karachi Stock Exchange. The sample of 50 non-financial Pakistani firms was selected from the KSE-100 index. Ownership was used as an independent and ROA as a dependent variable. Descriptive and regression analysis were used to test the hypothesis. The results of descriptive analysis showed that there exists an enormous level of concentration of ownership in Pakistani firms. The results of regression analysis endorsed a positive relationship between

ownership concentration and firm‘s operating performance. This finding

confirmed their hypothesis that concentration of ownership leads to a better operating performance.

Wahla et al. (2012) conducted a study with an objective to examine the significant relationship between ownership structure and firm performance by taking the sample of 61 non- financial companies listed at Karachi Stock Exchange over the period from 2008 to 2010. Managerial ownership and concentrated ownership were used to represent the ownership structure. Firm performance was measured by

control variables. Panel data estimation technique was used to anticipate the significant relationship among the variables. The findings of the study showed a negative relationship between managerial ownership and firm performance.

The relationship of ownership concentration is ambiguous due to the contradicting hypotheses. The concentration of ownership lead to convergence of interest and this could lead to active monitoring and control of management and consequently, to an enhanced firm performance. Conversely, it could also lead to the de-motivation of managers, which results in a negative impact on firm performance. Additionally controlling shareholders may use their power to extract their personal benefits at the expense of minority shareholders and firm performance. The studies conducted to investigate the relationship between types of ownership and firm performance also ended up with contradicting conclusions. This legitimizes the need of a new empirical study to test the blockholders and the value of a firm relationship in Pakistan.

DATA SOURCE AND METHODOLOGICAL FRAMEWORK

The current study about the ownership concentration, its different

types and firm‘s performance is based on the financial market of

Pakistan. The data is collected for the companies listed in banking and financial services sectors at Karachi Stock Exchange of Pakistan. Forty five companies were listed out of which twenty seven companies are selected due to unavailability of data on ownership concentration and its various types.

to 2011). The data for ownership concentration, bank/financial institution ownership, individual/family ownership and firm size is collected from

firm‘s balance sheets. The information about the firm age and leverage is collected from the company‘s annual reports. The data for market capitalization, which is used to calculate the Tobin‘s Q, is collected from

Business Recorder website. Regression analysis is used as an instrument for testing hypothesis and to identify the relationship among dependent, independent variables and control variables used in the study. We applied multiple regression analysis technique, following Tam and Tan (2007), Ongore (2011), Anwar and Tabassum (2011) and Wahla et al. (2012).

The following regression model is developed for estimation:

Firm Performance = f (OC and types, control variables, error term)

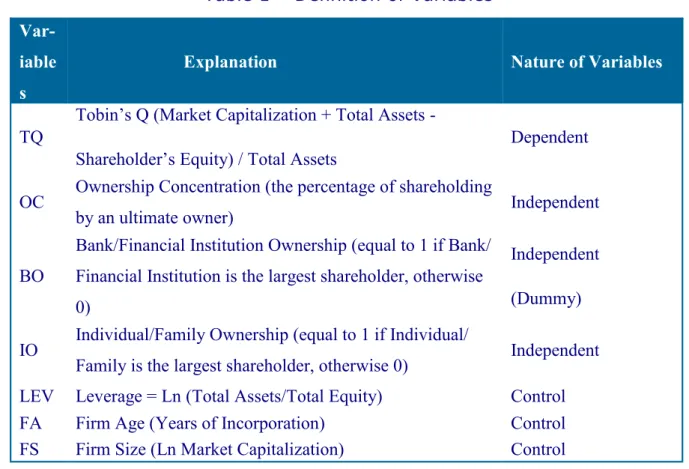

Table 1— Definition of Variables

Var-iable s

Explanation Nature of Variables

TQ Tobin’s Q (Market Capitalization + Total Assets

-Shareholder’s Equity) / Total Assets Dependent

OC Ownership Concentration (the percentage of shareholding

by an ultimate owner) Independent

BO

Bank/Financial Institution Ownership (equal to 1 if Bank/ Financial Institution is the largest shareholder, otherwise 0)

Independent

(Dummy)

IO Individual/Family Ownership (equal to 1 if Individual/

The performance of firm is dependent on ownership concentration

and its different types. Tobin‘s Q is used as the indicator for firm

performance. The types of ownership concentration which are used as independent variables along with ownership concentration (OC) are bank/ financial institution ownership (BO) and individual/family ownership (IO). Literature on ownership concentration has mixed evidence regarding its relationship with the firm performance, but majority of the studies conducted in emerging markets revealed that there exists a positive relationship between ownership concentration and firm performance in countries where shareholder protection is low.

In order to investigate the relationship of ownership concentration and its types with firm performance in Pakistan, dependent, independent and control variables are used in the model. Firm performance is used as a dependent variable and ownership concentration and its different types are used as independent variables. Leverage, firm age and firm size are used as the control variables in this study.

Dependent Variable

Firm performance is used as a dependent variable, which is indicated by the variable discussed below.

Tobin’s Q

Tobin‘s Q presents the financial strength of a company. The variable

is measured by adding market capitalization and total assets and then

subtracting the value by shareholder‘s equity and finally dividing this value by the total assets. The value of Tobin‘s Q greater than one represents that a company creates value for its shareholder‘s which leads to a better firm performance. On the contrary, the value for Tobin‘s Q

deteriorating the value of shareholders.

Researchers have used Tobin‘s Q as a proxy for firm‘s performance

while conducting study in emerging economies such as Tam and Tan (2007), Barzegar and Babu (2008), Javid and Iqbal (2008), Dzanic (2012), Rashid (2011), Warokka et al. (2012) and Wahla et al. (2012).

Tobin‘s Q is calculated as follows:

Tobin‘s Q = (Market Capitalization + Total Assets

– Shareholder‘s Equity) / Total Assets

The value of Tobin‘s Q between 0 and 1 show that the value of a firm‘s stock is less than the cost to replace its assets. This means that

the stock is undervalued, whereas, the value of Tobin‘s Q greater than 1

shows that the cost to replace firm‘s assets is less than the value of a firm‘s stock. This means that the stock is overvalued.

Independent Variables

The independent variables used in the study are as follows:

Ownership Concentration

shareholding by an ultimate owner following Tam and Tan (2007). The data on concentration of ownership is collected from the annual reports of the companies listed on the Karachi Stock Exchange.

Bank/Financial Institution Ownership

Bank/financial institution ownership is defined as the percentage of shares of firm owned by bank/financial institution. A firm is said to be bank-owned when bank/financial institutions are the controlling shareholders. In the current study bank/financial institution ownership is represented by the dummy variable that is when bank/financial institution is the largest shareholder in the firm, the value of dummy variable is equal to 1, otherwise 0. The data on bank/financial institution ownership is collected from the annual reports of the companies listed on the Karachi Stock Exchange. Data on individual/family ownership is

presented in the annual reports under the heading of ―Categories of Shareholders‖.

Individual/Family Ownership

(2007). The data on individual/family ownership is collected from the annual reports of the companies listed on the Karachi Stock Exchange.

Control Variables

The control variables included in the study are as follows:

Leverage

Leverage is defined as the amount of debt used by a firm to finance its assets. Leverage measures the capability of an organization to cope with business shocks and shows that a firm with high leverage is more exposed to business shocks as it has less capability to meet the obligations. According to Dzanic (2012) management can take decision to have high leverage in order to enhance investments and improve

shareholder‘s wealth. But, if a firm fails to do so, credit risk and interest

expense can reduce the wealth. Leverage is measured as the natural logarithm of total debt divided by natural logarithm of total equity in this study, as measured by Tam and Tan (2007) and Dzanic (2012). The data on leverage is collected from the balance sheets of the companies.

Firm Age

Firm age is expressed in terms of the years of firms‘ incorporation. In this study, firm age is calculated as the number of years of firm‘s

Firm Size

The size of the firm can affect the performance as a large firm can have the benefits of economies of scale (Dzanic, 2012). According to Najjar (2012) as the firm size increases, firm has to face more risks. Therefore, in order to provide more investor protection, higher corporate governance mechanisms should be implemented. Firm size is measured by natural logarithm of market capitalization in this study, as measured by Tam and Tan (2007). Data on firm size is collected from the annual reports of the listed companies and checked against the data available on Business Recorder.

RESULTS AND DISCUSSION

This section explains the empirical findings of the study. The descriptive statistics about the variables is explained which includes mean and median of the variables. The results of correlation, regression and incremental regression are also discussed in this section. Finally the results are tested for the presence of autocorrelation, multicollinearity and heteroskedasticity.

Data

Descriptive Statistics

In descriptive statistic analysis we have selected mean, median, maximum and minimum values. The results are interpreted in the following way:

Table 2 — Descriptive Statistics (Source: Self estimates)

Ownership Concentration

Table 2 shows the mean and median of ownership concentration. The value of mean for ownership concentration is 0.31 and median of 0.216. This shows that the firms listed in banking and financial services sectors have concentrated shareholdings. The maximum value of ownership concentration for the sample size is 0.957.

Bank and Financial Institution Ownership

The value of mean for bank and financial institution ownership is 0.21 and median of 0. This shows that the majority of firms listed at Karachi Stock Exchange in banking and financial services sectors of

Variables Mea

n

Medi-an

Maxi-mum

Minimum No

Ownership Concentration 0.31 0.216 0.957 0.001 135 Bank & Financial Institutions

Owner-ship

0.21 0.00 1 0 135

Individual & Family Ownership 0.84 1.00 1 0 135 Leverage 1.58 1.78 4.39 -2.29 135

Firm Age 19.28 16 69 1 135

Firm Size 15.23 15.32 19.05 10.38 135

Pakistan do not have bank and financial institution as blockholders. The maximum value of bank and financial institution ownership for the sample size is 1 and the minimum value is 0.

Individual and Family Ownership

The value of mean for individual and family ownership is 0.84 and median of 1. This shows that the majority of the sample firms have individual and family as blockholders. The maximum value of the individual and family ownership for the sample size is 1 and the minimum value is 0.

Leverage

The value of mean for leverage is 1.58 and median of 1.78. This shows that the firms selected for sample uses lower leverage. The maximum value of leverage for the sample size is 4.39 and the minimum value is -2.29.

Firm Age

Firm Size

The value of mean for firm size is 15.23 and the median of 15.32. This shows that majority of the sample firms have high market share which leads to ease in buying and selling of shares of a company. The minimum value of firm size for the sample size is 10.38 and the maximum value is 19.05.

Tobin’s Q

The value of mean for Tobin‘s Q is 1.14 and the median of 0.99. The value of Tobin‘s Q is greater than 1, which means that these firms are

performing well, healthy and creating value for the shareholders. The

maximum Tobin‘s Q value for the sample is 4.20 and minimum value is

0.42.

Correlation

The results of correlation analysis are presented in Table 3 below.

OC BO IO LEV FA FS TQ OC Pearson Correlation

Sig. (2-tailed)

N

1.000

.

135

- - -

-BO Pearson Correlation

Sig. (2-tailed)

N -.006 .941 135 1.000 . 135 - - - -

-IO Pearson Correlation

Sig. (2-tailed)

N .058 .504 135 -.613** .000 135 1.000 . 135 - - -

-LEV Pearson Correlation

Sig. (2-tailed)

N -.016 .853 135 -.001 .992 135 -.127 .151 135 1.000 . 135 - -

-FA Pearson Correlation

Sig. (2-tailed)

N .369* * .000 .360** .000 135 -.417** .000 .224* .010 135 1.000 . 135 -

-FS Pearson Correlation

Sig. (2-tailed)

N -.012 .895 135 .280** .001 135 -.463** .000 135 .211* .016 135 .387* * .000 135 1.00 0 . 135

-TQ Pearson Correlation

Sig. (2-tailed)

Firm size and leverage have a positive correlation (0.211) and is

significant at the significance level of 0.05. Leverage and Tobin‘s Q have

a negative correlation (-0.287). It is significant at the significance level of 0.01. This result is consistent with the findings of Tam and Tan (2007). Finally, firm age has a significant (0.01) and positive correlation (0.387) with firm size.

The variables bank and financial institution ownership and individual and family ownership show strongest negative correlation (-0.613) between each other. On the contrary, ownership concentration has the weakest negative correlation (-.164) with the firm performance.

Regression Analysis

The regression analysis is performed by using the panel data. The results of the regression analysis are presented in the Table 4 below. The Table presents the regression coefficients, t values and p values. The R-squared value of the model is 58.3%. This value shows that the 58.3%

variation in Tobin‘s Q i.e., the dependent variable, is shown by the

Table 4 — Results of Regression

R-Squared: 0.583267

F-statistic: 18.59495

Prob (F-statistic): 0.000000

Mean dependent var: 1.051565

Source: Self estimates

Ownership Concentration

The first variable used in the model relevant for this study is the ownership concentration. This is measured as the percentage of shareholding by an ultimate owner (bank and financial institution or individual and family). The result of the ownership concentration shows a significant and negative relationship with firm performance which is

measured by Tobin‘s Q. The result leads to the acceptance of hypothesis

H1 for the study supporting agency theory. The result shows that the value of coefficient is -0.267 and the variable is significant with a probability of 0.065. The finding shows that in an emerging economy where the rights of the minority shareholders are not safeguarded, the owners with controlling shareholders try to extract their personal benefits

Variables Coefficient t-Statistic Prob.

C -1.686811 -1.903123 0.0601

OC -0.267774 -1.940531 0.0654

BO 0.321661 3.978899 0.0138 IO 0.536701 4.762900 0.0157 LEV -0.147617 -2.638827 0.0113

FA -0.014786 -2.685099 0.0132

at the cost of minority shareholders which lead to decrease in the firm performance.

Additionally, the result shows that concentrated shareholding plays a negative role in affecting the value of firm. This is due to the lack of good corporate governance system and presence of additional imperfections in Pakistan. The managers with controlling shares are not stewards, which leads to the deterioration of the firm performance. This result is in line with the findings of Barzegar and Babu (2008), Rashid and Islam (2010), Dzanic (2012), Ongore (2011), Foroughi and Fooladi (2013) and Pervan et al. (2012).

Bank and Financial Institution Ownership

Individual and Family Ownership

The third variable is individual and family ownership, which is measured as a dummy variable. If individual and family is the largest shareholder it is valued as 1, otherwise as 0. Individual and family ownership shows a significant and positive relationship with firm performance. The result leads to the acceptance of hypothesis H3 supporting stewardship theory. The result shows that the value of coefficient is 0.536 and the variable is significant with a significance level of 0.015. The finding shows that the interests/fortunes of individuals or families who have controlling share are linked to the success of the company. They try to control and monitor the management, align the interests of the management, which reduces the agency cost in the market. Therefore, improvement in the ownership of individual/family increases the performance of the firm. This result is consistent with the findings of Wiwattanakantang (2001), Earle et al. (2005), Javid and Iqbal (2008) and Dzanic (2012).

Leverage

(2009), Dzanic (2012) and Foroughi and Fooladi (2013).

Firm Age

Firm age is quantified as the years of incorporation of a firm. The variable has a negative relationship with the performance of a firm and has a coefficient value of -0.014 significant at 5% level of significance. This shows that as the age of firm increases, the firm performance decreases. Older firms do not have any flexibility to adapt to new situations and advanced technologies and consequently are most likely to be outperformed by more flexible and younger firms.

Firm Size

Firm size is measured as the natural logarithm of market capitalization in this study. This variable has a significant positive relationship with the firm performance. The variable has a coefficient value of 0.199 and is significant at a 5% level of significance. This shows that as the size of the firm increases, the firm performance also increases. This result is consistent with the findings of Bolbol et al. (2003), Tam and Tan (2007), Javid and Iqbal (2008) and Foroughi and Fooladi (2013).

Multicollinearity

Table 5 — Tolerance and Variance Inflation Factors Results

The values for the variance inflation factor for the variables ownership concentration (OC), bank and financial institution ownership (BO), individual and family ownership (IO), leverage (LEV), firm age (FA) and firm size (FS) are 1.256, 4.505, 5, 1.143, 1.395 and 1.639, respectively. This shows that these variables have minimum collinearity with each other.

Similarly, the values of tolerance factor for the variables ownership concentration (OC), bank and financial institution ownership (BO), individual and family ownership (IO), leverage (LEV), firm age (FA) and firm size (FS) are 0.796, 0.222, 0.2, 0.875, 0.717 and 0.61 respectively. This shows that these variables show minimum collinearity with each other.

Incremental Regression

Incremental regression is conducted to analyze the importance of individual independent variable in affecting the performance of a firm

(Tobin‘s Q). We have used six models for this purpose. The incremental

regression is performed by dropping individual independent variables one by one from the selected regression model and capturing the effect on the value for the R-squared.

Variables Variance Inflation Factor Tolerance Factor

OC 1.256 0.796

BO 4.505 0.222

IO 5 0.2

LEV 1.143 0.875

FA 1.395 0.717

Table 6 — Results of Incremental Regression (Self Estimated)

The result presented in the Table 6 above shows that highest change in the value for the R-squared of original regression model is caused by the removal of firm size as the value for the R-squared of original regression model drops from 58.32% to 48.04%. This means that size of a firm is the most important variable in affecting the value of a firm in the selected model.

Conclusions

The findings of the current study revealed that concentration of ownership has a negative impact on the firm performance. This relationship might be due to the reason that in Pakistan the rights of the minority shareholders are not safeguarded and the owners with controlling shareholders try to extract their personal benefits at the cost of minority shareholders leading to the lower value of a firm. The study further concluded that there exists a positive relationship between bank/ financial ownership and firm performance. This result implies that banks/ financial institutions as blockholders can play an active role in monitoring due to their access to the inside information of the firm and provide guidance on the strategic direction and decide about the financial policies of the firm which leads to an increased firm performance. The findings of the study also prove that individual/family ownership have a positive relationship with the performance of a firm. This shows that the individual and family ownership control and monitor the management and align the interests of the management, which reduces the agency cost and leads to an improved firm performance. The results further

R-Squared (Original) 58.32%

suggest that firm age and higher debt deteriorate the value of a firm in

Pakistan. On the other hand, bigger firm size improves shareholder‘s

value in Pakistan.

In the light of the conclusion, it is recommended that companies that fall under banking and financial services sectors of Pakistan should advocate for dispersed shareholding and discourage ownership concentration as it deteriorates the performance of a firm. Furthermore, the types of ownership that is bank/financial institution ownership and individual/family ownership should be preferred in financial firms as they enhance the firm performance by active monitoring and control.

References

[1] Ahunwan, B. (2003), ―Globalization and Corporate Governance

in Developing Countries‖, Transnational Publishers, New York.

[2] Anderson, R. C. and Reeb, D. M. (2003), ―Founding-Family

Ownership and Firm Performance: Evidence from the S&P 500‖,

Journal of Finance, Vol. 58, No. 3, pp.1301-1328.

[3] Anwar, W., and Tabassum, N. (2011), ―Impact of Ownership Concentration on the Operating Performance of Pakistani

Firms‖, Asian Economic and Financial Review, Vol. 1, No. 3,

pp.147-150.

[4] Aoki, M., Patrick, H., and Sheard, P. (1994), ―The Japanese

Main Bank System: An Introductory Overview‖, (Eds.), The

Japanese Main Bank System: Its Relevance for Developing and Transforming Economies, Oxford University Press, New York, pp.3-50.

[5] Arosa, B., Iturralde, T., and Maseda, A. (2010), ―Ownership Structure and Firm Performance in Non-listed Firms: Evidence

[6] Barclay, M. J., and Holderness, C. (1991), ―Negotiated Block

Traders and Corporate Control‖, The Journal of Finance, Vol. 46,

No. 3, pp. 861-878.

[7] Barth, J. Caprio, G., and Levine, R. (2008), ―Rethinking Bank

Regulation, Till Angels Govern‖, Cambridge University Press.

[8] Barzegar, B., and Babu, K. N. (2008), ―The Effects of Ownership

Structure on Firm Performance: Evidence from Iran‖, The Icfai

Journal of Applied Finance, Vol.14 No. 3, pp:.43-55.

[9] Baums, T. (1993), ―Takeovers versus Institutions in Corporate

Governance in Germany‖, in: D.D.Prentice and P.R.J. Holland,

eds., Contemporary Issues in Corporate Governance, (Clarendon Press, Oxford), pp: 151-183.

[10] Bebchuk, L.A., and Fried, J.M. (2004), ―Pay without Performance – The Unfulfilled Promise of Executive

Compensation‖, Harvard University Press: Cambridge, MA.

[11] Berglöf, E., and Perotti, E. (1994). ―The Governance Structure

of Japanese Keiretsu‖, Journal of Financial Economics, vol. 35,

pp: 45-57.

[12] Berle, A., and Means, G. (1932), ―The Modern Corporation and

Private Property‖, New York: Macmillan, pp: 123–154.

[13] Bolbol, A., Fatherldin, A., and Omran, M. (2003), ―Ownership Structure, Firm Performance, and Corporate Governance:

Evidence from Selected Arab Countries‖, unpublished.

[14] Boone, N., Colombage, S., and Gunasekarage, A. (2010), ―Block

Shareholder Identity and Firm Performance in New Zealand‖,

Proceedings of the 2010 AFAANZ Conference, 4 July 2010 to 6 July 2010, AFAANZ, Carlton Vic Australia, pp: 1-37.

[15] Chen, Z. (2005). ―Ownership Concentration, Firm Performance,

and Dividend Policy in Hong Kong‖, Pacific-Basin Finance Journal, Vol. 13, No. 4, pp.431– 449.

[16] Cheema, A., Bariand, F., and Saddique, O. (2003). ―Corporate

Governance in Pakistan: Ownership, Control and the Law‖,

[17] Cho, M. (1998), ―Ownership Structure, Investment, and the

Corporate Value: An Empirical Analysis‖, Journal of Financial

Economics, vol. 47, pp: 103-121.

[18] Claessens, S., and Djankov, S. (1999), ―Ownership Concentration and Corporate Performance in the Czech

Republic‖, CEPR Discussion Paper No. 2145.

[19] Claessens, S., Djankov, S., and Lang, L. H. (2000). ―The Separation of Ownership and Control in East Asian

Corporations‖, Journal of Financial Economics, Vol. 58, No. 1 &

2, pp. 81-112.

[20] Coffee, J. (1991), ―Liquidity versus Control: The Institutional

Investor as Corporate Monitor‖, Columbia Law Review, Vol. 91,

pp. 1277-1368.

[21] Cull, R., and Xu, L.C. (2000), ―Bureaucrats, State Banks, and the Efficiency of Credit Allocation: The Experience of Chinese State-owned Enterprises‖, Journal of Comparative Economics, Vol. 28, pp. 1-31.

[22] Cull, R., and Xu, L.C. (2005), ―Institutions, Ownership, and Finance: The Determinants of Profit Reinvestment among

Chinese Firms‖, Journal of Financial Economics, Vol. 77, pp. 117

-146.

[23] Davies, J.R., Hiller, D., and McColgan, P. (2005), ―Ownership

Structure, Managerial Behavior and Corporate Value‖, Journal of

Corporate Finance, Vol. 11 No. 4, pp. 645-660.

[24] Davis, J., Schoorman, F., and Donaldson, L. (1997), ―Toward a

Stewardship Theory of Management‖, Academy of Management

Review, Vol. 22 No. 1, pp. 20-47.

[25] DeAngelo, H., and DeAngelo, L. (1985), ―Managerial Ownership of Voting Rights: A Study of Public Corporations with Dual

Classes of Common Stock‖ Journal of Financial Economics, Vol.

14, pp. 33–69.

[26] Demsetz, H. (1983), ―The Structure of Ownership and the

Theory of the Firm‖, Journal of Law and Economics, Vol. 26, No.

[27] Demsetz, H., and Lehn, K. (1985), ―The Structure of

Ownership: Causes and Consequences‖, Journal of Political

Economy, Vol. 93, No .6, pp. 1155-1177.

[28] Denis, K. D., and McConnell, J. J. (2003), ―International

Corporate Governance‖, Journal of Financial and Quantitative

Analysis, Vol. 38, pp. 1–30.

[29] Dicke, L. A. (2000), ―Accountability in Human Services

Contracting: Stewardship Theory and the Internal Perspective‖,

University of Utah.

[30] Douma, S., George, R., and Kabir, R. (2003), ―Foreign and Domestic Ownership, Business Groups and Firm Performance:

Evidence from a Large Emerging Market‖, unpublished.

[31] Dzanic, A. (2012), ―Concentration of Ownership and Corporate

Performance: Evidence from the Zagreb Stock Exchange‖,

Journal of Financial Theory and Practice, Vol. 36 No.1, pp.29-52.

[32] Earle, J. S., Kucsera, C., and Telegdy, A. (2005), ―Ownership Concentration and Corporate Performance on the Budapest

Stock Exchange: Do too many Cooks Spoil the Goulash?‖,

Corporate Governance, Vol. 13, No. 2, pp.254-264.

[33] Fama, E. F., and Jensen, M. C. (1983), ―Separation of

Ownership and Control‖, Journal of Law and Economics, Vol. 25,

No. 2, pp: 301-325.

[34] Fok, R., Chang, Y-C., and Lee, W.T. (2004), ―Bank Relationships and their Effects on Firm Performance around the Asian

Financial Crisis‖, Journal of Financial Management, Vol. 33, pp:

89-112.

[35] Foroughi, M. and Fooladi, M. (2013), ―Concentration of

Ownership in Iranian Listed Firms‖, International Journal of

Social Science and Humanity, Vol. 2, No. 2, pp. 112-116.

[36] Freeman, R. E., Wicks, C. A., and Parmar, B. (2004),

―Stakeholder Theory and the Corporate Objective Revisited‖,

Business‖, Heidelberg Press, Australia.

[38] Gibson, M. S. (2003), ―Is Corporate Governance Ineffective in

Emerging Markets?‖, Journal of Financial and Quantitative

Analysis, Vol. 38 No. 1, pp. 231-250.

[39] Gorton, G., and Schmid, F. A. (2000), ―Universal Banking and

the Performance of German Firms‖, Journal of Financial

Economics, Vol. 58, pp. 29–80.

[40] Gujarati, D. (2003). ―Basic Econometrics‖, 3rd ed, McGraw Hill, New York.

[41] Gujarati, D. (2006), ―Essentials of Econometrics‖ 5rd ed., McGraw Hill, New York.

[42] Harris, M., and Raviv, A. (1990), ―Capital Structure and the

Information Role of Debt‖, Journal of Finance, Vol. 45, pp: 321 -350.

[43] Hasan, A. and Butt, S.A. (2009). ―Impact of Ownership Structure and Corporate Governance on Capital Structure of

Pakistani Listed Companies‖, International Journal of Business

and Management, vol.4 No.2, pp: 50-57.

[44] Heugens, P. and Essen, M. (2008), ―Meta-analyzing Ownership Concentration and Firm Performance in Asia: Towards a More Fine-grained Understanding‖, Asia Pacific Journal of Management, Vol. 26, pp. 481-512.

[45] Himmelberg, C. P., Hubbard, R. G. and Palia, D. (1999),

―Understanding the Determinants of Managerial Ownership and the Link between Ownership and Performance‖, Journal of

Financial Economics, Vol. 53, pp. 353–384.

[46] Hiraki, T. et al., (2003), ―Corporate Governance and Firm Value

in Japan: Evidence from 1985 to 1998‖, Pacific Basin Finance

Journal, Vol. 11, No. 3, pp. 239–265.

[47] Ibrahim, Q., Rehman, R., and Raoof, A. (2010), ―Role of Corporate Governance in Firm Performance: A Comparative Study between Chemical and Pharmaceutical Sectors of

Pakistan‖, International Research Journal of Finance and

[48] James, C. (1987), ―Some Evidence on the Uniqueness of Bank

Loans‖, Journal of Financial Economics, Vol. 19, pp. 217-235.

[49] James, H. (1999). ―Owner as Manager, Extended Horizons and

the Family Firm‖, International Journal of the Economics of

Business, Vol. 6, pp. 41–56.

[50] Javid, A.Y., and Iqbal, R. (2008), ―Ownership Concentration, Corporate Governance and Firm Performance: Evidence from

Pakistan‖, The Pakistan Development Review, Vol. 47 No. 4, pp.

643–659.

[51] Jiang, P. (2004), ―The Relationship between Ownership Structure and Firm Performance: An Empirical Analysis over Heilongjiang Listed Companies", Nature and Science, Vol. 2 No. 4, pp. 86-90.

[52] Jensen, M. C., and Meckling, W. H. (1976), ―Theory of the Firm:

Managerial Behavior, Agency Costs and Ownership Structure‖,

Journal of Financial Economics, Vol. 3, pp. 305–360.

[53] Kang, J.K., and Shivdasani, A. (1995), Firm Performance,

Corporate Governance, and Top Executive Turnovers in Japan‖,

Journal of Financial Economics, Vol. 38, No. 1, pp. 29-58.

[54] Kang, J.K., Shivdasani, A., and Yamada, T. (2000), ―The Effect of Bank Relations on

[55] Investment Decisions: An Investigation of Japanese Takeover

Bids‖, Journal of Finance, Vol. 55, No. 5, pp. 2197-2218.

[56] Kapur, D., and Gualu, A. (2012), ―Financial Performance and

Ownership Structure of Ethiopian Commercial Banks‖, Journal of

Economics and International Finance, Vol. 4 No. 1, pp.1–8. [57] Karaca, S. S., and Eksi, I. H. (2012), ―The Relationship between

Ownership Structure and Firm Performance: An Empirical

Analysis over İstanbul Stock Exchange (ISE) Listed Companies‖,

International Business Research, Vol. 5 No. 1, pp. 172-181. [58] Klein, P., Shapiro, D., and Young, J. (2004), ―Corporate

Governance, Family Ownership and Firm Value: the Canadian