Customer Value Assessment of Sichuan Mobile

WANG Yingjie

Thesis submitted as partial requirement for the conferral of

Doctor of Management

Supervisor:

Professor Conceição Santos, Senior Lecturer ISCTE-IUL, Departamento de Marketing, Operações e Gestão Geral

Co-supervisor:

Professor KOU Gang, Full Professor, University of Electronic Science and Technology of China, School of Management and Economics

January 2012

- Spine –

Cu

sto

m

er

V

al

ue

Ass

es

sme

nt

of S

ic

hu

an

Mo

bil

e

WA

N

G

Y

in

g

ji

e

Customer Value Assessment of Sichuan Mobile

WANG Yingjie

Thesis submitted as partial requirement for the conferral of

Doctor of Management

Supervisor:

Professor Conceição Santos, Senior Lecturer ISCTE-IUL, Departamento de Marketing, Operações e Gestão Geral

Co-supervisor:

Professor KOU Gang, Full Professor, University of Electronic Science and Technology of China, School of Management and Economics

January 2012

The present research aims to contribute with the evaluation and a segmentation index criterion of the customer group value in order to improve knowledge to the telecommunication industry, in value assessment and in market subdivision based on customer value. This thesis gives practical instrument measure and guiding suggestions to a deeper customer value assessment, combining characteristics of the communication industry in China, based on outstanding domestic and foreign research results and taking the group customers of China Mobile Sichuan Company.

A first brief crossing between theoretical backgrounds of customer value assessment, segmentation concept and group customer, allowed the selection and choices of the methodology and the variables that influence group customer value. The following empirical step complemented the development of the assessment index system to calculate the group customer value and the following cluster analysis. The results obtained included the industry experts' experience, which help the identification of the 14 factors that influence the group customer value and the data analysis from 2000 group customers, which has been extracted from the mobile BOSS system. Factor analysis and analytic hierarchy process (AHP) method are used to calculate weights of indexes.

Finally, based on current value, potential value, social value and the total value, clusters with typical characteristics are discovered using K-means clustering method. And corresponding marketing strategy is put forward.

Key-words: Customer value assessment; Customer segmentation; Factor analysis; Analytic Hierarchy Process (AHP).

Esta tese avalia o Valor de grupos de clientes, no âmbito da grande empresa chinesa de telecomunicações móveis, a Sichuan Mobile. O presente estudo contribui para a análise da avaliação e segmentação de grupos de clientes, nomeadamente no mercado das telecomunicações. Este, sugere, ainda, um instrumento prático de medida; um índice de medida do valor de grupo de clientes é proposto e construído com base em análise de dados secundários do sector e do mercado chinês e primários baseados opiniões de peritos do sector e de resposta a um inquérito dos grupos de clientes da China Mobile.

Após uma breve revisão do enquadramento teórico de conceitos inseridos na Gestão do Marketing, como Valor do Cliente, Segmentação e cliente-grupo, foram analisadas e seleccionadas as opções metodológicas e as variáveis que podem influenciar a avaliação do valor de um grupo de clientes. O desenvolvimento do índice de ponderação do valor de grupo de clientes foi elaborado após vários passos. Em primeiro lugar foram identificados, junto de peritos do sector, 14 factores que influenciam a avaliação do valor de grupo de clientes; Depois, efectuou-se um inquérito a 2000 grupos de clientes, retirados do sistema móvel BOSS da empresa Sichuan Mobile. Por fim realizou-se à base de dados obtida análises estatísticas como Análise Factorial e de Hierarquia (AHP), métodos que permitiram obter a ponderação do índice.

Finalmente, com base no índice de valor corrente, valor potencial, valor social e valor total foram identificados os clusters. A análise destes clusters permitiu ainda sugerir estratégias de marketing em adaptação a cada cluster.

Palavras-chave: valor de cliente, segmentação de clientes, Análise Factorial, processo hierárquico (AHP)

Influential accomplishment of this thesis shall owe to care and assistance from many teachers and classmates.

Firstly, I would like to show my gratitude to my thesis supervisors, Prof. Kou and Prof. Santos, who have given my great direction and assistance during the whole process. They have paid lots of effort on the selection of a subject, opening speech, design to material collection, produce and even finalization. And they have precise and practical scientific attitude, serious and earnest educational spirit and the work style of ceaselessly pursuing that have left a profound impression on me and will encourage me to ceaselessly study.

When reading for DBA of UESTC, I received intimate care and circumspective direction from teaching professors and teachers, precise educational attitude, profound knowledge and active thinking modes of whom have benefited me a lot. Meanwhile, during those years’ study, teachers and leaders from DBA center of UESTC have worked a lot with their shoulders to collars, creating excellent study conditions for us and helping us to improve theoretical attainment and enhance our working ability, causing me to spend those years in UESTC.

During the whole process, families, schoolmate and friends have given me utmost support and help, with which I could conquer all difficulties with courage at any moment and finally put a perfect end to study as a Ph. D. candidate. In the future, I will work harder and live happier, ceaselessly enriching and perfecting my life.

Finally, thank you very much, all my experts who read and appraise this thesis and attend my oral defense, who give me precious direction when you are so busy.

Chapter 1: Introduction ... 1

1.1 Research Theoretical and Industry Background ... 1

1.2 Main Goals of the Research ... 3

1.3 The Research Steps and Methodological Choices ... 5

1.4 Structure of the Thesis ... 6

Chapter 2: History and Current Situation of Telecom Operators in China ... 9

2.1 History of Telecom Operators in China ... 9

2.2 History of China Mobile ... 12

2.3 Operational Environment of Domestic Telecommunication Market ... 13

2.4 Competition in Domestic Customer Market ... 16

2.5 Status Quo of China Mobile Sichuan ... 20

2.6 Current Situation of the Study in China and Abroad ... 22

2.6.1 Domestic Study about Customer Value ... 22

2.6.2 Oversea Studies about Customer Value ... 24

Chapter 3: Relevant Concepts of Group Customer ... 27

3.1 Definition of Group Customer ... 27

3.2 Characteristics of Group Customer Market ... 32

3.3 The Importance of Group Customer ... 35

3.4 The Importance of Developing Group Customer Market ... 38

3.5 Product Classification and Characteristics in Group Customer Market ... 39

3.6 Advantages and Disadvantages of China Mobile in Group Customer Market Competition ... 42

Chapter 4: Assessment of Group’s Customer Value ... 47

4.1 Implication of Customer Value ... 47

4.2 Significance and Demand of Value Assessment ... 50

4.3 Major Objective of Value Assessment ... 52

4.4 Main Direction of Value Assessment ... 53

4.5 Standard of Value Assessment ... 55

4.6 Principle of Value Assessment ... 57

Chapter 5: Customer Segmentation ... 59

5.1 Theoretical Sources of Customer Segmentation ... 59

5.5 General Method and Process of Customer Segmentation ... 65

5.6 Definition of Market Segmentation in Telecom Market ... 70

5.7 Function of Market Segmentation in Telecom Industry ... 71

Chapter 6: Introduction to Research Methods... 73

6.1 Data Pre-processing ... 73

6.2 Calculating Weight of Indexes Methods ... 77

6.3 Principal Component Analysis ... 79

6.4 Principal Component Analysis & Factor Analysis ... 85

6.5 Factor Analysis Implemented in SPSS Software ... 86

6.6 Analytic Hierarchy Process (AHP) ... 87

6.7 Customer Segmentation Method ... 90

6.7.1 Cluster Analysis Methods in Data Mining ... 90

6.7.2 K-means Cluster ... 91

Chapter 7: Empirical Analysis ... 93

7.1 Data Collection ... 93

7.2 Data Pre-process ... 96

7.3 Dimensions Reduction of Index ... 97

7.3.1 Specific Process of Factor Analysis ... 97

7.3.2 Result of Factor Analysis ... 98

7.4 Construction of Assessment Index System ... 101

7.5 Calculation of Weight of Assessment Index ... 101

7.5.1 Calculation of Subjective Weight of Assessment Index ... 101

7.5.2 Calculation of Combination Weight of Indexes ... 105

7.6 Calculation of Group Customer Value ... 106

7.7 Cluster Analysis and Interpretation of Result ... 107

Chapter 8: Marketing Strategies ... 113

8.1 Layered Services Strategy ... 113

8.2 Credit Grading Strategy ... 114

8.3 Other Strategies ... 117

Chapter 9: Future Implications of the study ... 121

Bibliography ... 123

Table 2-1 History of China Mobile (Shown in Annexes) ... 12

Table 2-2 Comparison of Post-restructuring Services and Subscribers ... 19

Table 2-3 Comparison of Post-restructuring Service Revenue and Profit ... 19

Table 3-1 Comparison of Characteristics of Group customer and Individual Customer31 Table 3-2 Main Group Products Promoted by China Mobile Sichuan ... 41

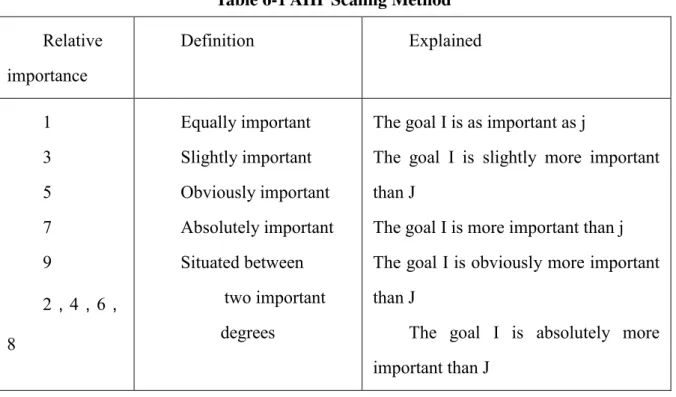

Table 6-1 AHP Scaling Method ... 90

Table 7-1 Influencing Index of Group Customer Value ... 93

Table 7-2 Index Definition (Shown in Annexes) ... 94

Table 7-3 Descriptive Statistics ... 95

Table 7-4 Social Influence of Different Administrative Levels ... 96

Table 7-5 Selection of Parameters ... 97

Table 7-6 Output KMO Value and the Result of Bartlett’s Test of Sphericity (Shown in Annexes) ... 98

Table 7-7 Total Variance Explained (Shown in Annexes) ... 99

Table 7-8 Communalities (Seven Factors) (Shown in Annexes) ... 99

Table 7-9 Communalities (Ten Factors) (Shown in Annexes) ... 99

Table 7-10 Rotated Component Matrixes (Shown in Annexes) ... 99

Table 7-11 Name and Weight of Factors ... 100

Table 7-12 Group Customer Value Assessment System ... 101

Table 7-13 Weight of Indexes on First Layer ... 102

Table 7-14 Weight of Indexes on Second Layer ... 104

Table 7-15 Weight of indexes ... 104

Table 7-16 Objective, subjective and combination weight ... 105

Table 7-17 Group customer value ... 107

Table 7-18 Cluster Results (K=5) ... 107

Table 7-19 Typical Characteristics of Cluster ... 109

Table 7-20 Typical Characteristics of Cluster(K=9) ... 111

Table 7-21 Summaries of Typical Characteristics of Cluster ... 111

Table 8-1 Grading of Group Member ... 114

Table 8-2 Content of Layered Services (1) (Shown in Annexes) ... 114

Table 8-3 Content of Layered Services (2) (Shown in Annexes) ... 114

Table 8-4 Credit rating classification ... 115

Table 8-5 Standard for credit services ... 115

Figure 1-1 Research Steps ... 5

Figure 7-1 Variables of Factor Analysis (Shown in Annexes) ... 97

Figure 7-2 Screen Plot (Shown in Annexes) ... 99

Figure 7-3 Group Customer Value Assessment Model (Shown in Annexes)... 102

Figure 7-4 Comparison among Indexes on First Layer (Shown in Annexes) ... 102

Figure 7-5 Consistency Check of Indexes on First Layer (Shown in Annexes) ... 102

Figure 7-6 Comparison among Indexes on Second Layer (Shown in Annexes) ... 103

Figure 7-7 Consistency Check of Indexes on Second Layer (Shown in Annexes) ... 103

Figure 7-8 Comparison among Indexes on Second Layer (2) (Shown in Annexes) ... 103

Figure 7-9 Consistency Check of Indexes on Second Layer (2) (Shown in Annexes) ... 103

Figure 7-10 Cluster Results (K=5) ... 108

Figure 7-11 ClusterResults (K=7) ... 109

Figure 7-12 Cluster Results (K=9) ... 110

Figure 7-13 Cluster Results (K=10) (Shown in Annexes) ... 111

Figure 7-14 Cluster Results (K=15) (Shown in Annexes) ... 111

Along with the innovation and reorganization of telecom industry, competition among telecom enterprise is increasingly fierce. Only telecom operators with deep understanding on market demand and customer features can obtain leading advantages in competition.

The present research aims to contribute to improve knowledge of telecommunication, in particular focusing on the Chinese market and the Sichuan Mobile Company. Taking profit of the professional experience in this industry and by the management of this big firm in the Mobile market, a study was carried out from consumption data of 2000 group customers of Sichuan Mobile Company. The background theory was combined with the point of view of experts from the market, from a previous exploratory study. The first chapters of this thesis summarized corresponding theories such as group customer value and customer segmentation, putting forward value assessment mode. Afterwards, dimension reduction on influencing factors of group customer value by means of factor analysis was carried out, by resorting to SPSS software. Meanwhile, calculation of objective weight of each factor was achieved as well. Then by dint of Super Decisions software, subject weight of each factor was realized by means of step analysis. Finally, customer segmentation was reached by K-means cluster, digging out typical group customer cluster, providing corresponding market strategy.

In this paper, there are some interesting variation trends summarized as follows: The current value of all groups has little difference whatever K is equal to each value; The total value of group customers is mainly influenced by the group potential value; There is no perfect correlation between group customer value and group administrative level but the customers with the highest or lowest value have a middle administrative level; There are not many group customers of high quality.

Altogether, the theoretical and empirical analysis of this thesis, allow great contribution not only to the scientific academia, namely in theory summarize and empirical methods, but also to the business management, especially within the Telecommunication industry.

The most contribution issues on theory are the following:

as well definition and function of customer segmentation in telecom industry, etc; The most contribution issues on measuring and empirical issues are:

Calculation on index weight and customer value, after the following steps: first according to questionnaire survey and by means of Super Decisions software, calculate objective weight of factors by AHP and calculate combination weight of factor integrating with objective weight acquired through factor analysis; after, based on standard factor score and combination weight of factors of 2000 groups, calculate the current value, potential value, social value and total value of group customer

Customer segmentation, digging out clusters with typical features , where segment group customers by K-means, dig out group customer cluster with typical features; put forward layered service, credit ratings grading and other strategies aiming at them.

Chapter 1: Introduction

1.1 Research Theoretical and Industry Background

During recent 30 years since the reform and opening-up, communication industry in China has gained quite great progress, especially in respect of mobile communication, which currently has over 800 million subscribers through years of development (Wang, A. L., 2010). Telecommunication enterprises shall not only simply provide network transmission services to the market and consumers, but also need to develop new product, new function and new business continually. On the other hand, as the role of information industry becomes more and more significant and all-service licenses are issued, it becomes necessary for communication enterprises to keep optimizing their personalized products to attract more quality customers. In addition, they shall continuously strengthen management of group market, deeply build the concept of “follow the mainline of development and the tenet of quality services” (Wang, A. L., 2010), set up brand new enterprise images by new services, so as to win the market and get developed.

At the same time, the situations where “three comparative power stand like tripod legs” expands the operators’ choices of clients and group customers. The academics put forward an idea which says "customers are a resource of enterprises, which means more than material resources of the enterprise"(Wang, A. L., 2010). Such idea was soon applied to the reality, which resulted in the subject of Customer relationship management, CRM in short.

Customers, especially core customers, are the key factor for the core competitiveness of an enterprise. Major telecom operators began to pay more and more attention on how to raise their income and profits by improving the satisfaction and loyalty of individual clients and group customers and increasing client values. This was especially obvious in the group customer market. The intense competition on group customers in 2008 and 2009 is clear evidence (Wang, A. L., 2010). Telecom operators which are currently within their strategic transformation period have become more and more aware of the significance of CRM to their development. To telecom operators, the maintenance and improvement of client values is actually a business

strategy aiming to increase business income, optimizing profitability and increase customer satisfaction. The ultimate purpose of CRM is to help telecom operators to gradually shift from the past product- and service- oriented operating mode to a new one with customers and market as the orientation, and finally turn to an intensified business mode.

Winning customers is the essential for existence and development of enterprises; however, it does not mean that customers can secure an enterprise. The most important thing is to organize enterprise resources effectively based on actual customer demands, to cultivate potential values of customers, and to maintain long-term cooperation. Present enterprises has gradually become aware of such change, and transferred from “service-oriented” to “customer-oriented”. In other words, now they are trying to satisfy personalized demands of customers, improve customer loyalty and retention rate, realize the goals of shortening sales cycle, reducing sales cost, increasing sales income, and expanding market, so as to completely promote enterprise profitability and competitiveness.

Featuring high communication cost and significant social influence, group customers of the telecommunication industry are the major source of income and profit for telecom operators, as well as the main battlefield to combat with their competitors. Group customers weigh more and more in the business achievements of telecom operators, and have become the focus of competition among telecom operators. During this process, operators have generally accepted the CRM theories and applied them in their organizational structures. Furthermore, as all-service operation develops continuously, operators keep adjusting their organizational structures that are applied on group customers.

To sum up, competition in the telecommunication industry becomes more and more intense, competition methods become more and normalized, and quality differences between services more and more imperceptible. Price is no longer the major consideration of customers. Therefore, customizing marketing schemes based on customer requirements becomes a significant measure of telecommunication enterprises to win the war.

1.2 Main Goals of the Research

China Mobile now has the No. 1 network scale and customer scale in the world. Nonetheless, it suffers from pressure coming from the two domestic competitors, i.e., China Telecom and China Netcom. It is urgent for China Mobile to find a way to maintain existing customers and utilize customer resources in hand.

To efficiently manage customers, it is necessary to clearly identify customer value by classifying them into high-value customers and low-value ones. Use limited marketing resources on important customers, and quit some unimportant ones. In addition, after identifying high-value customers, subdivide them to provide differentiated marketing services and get better marketing effectiveness.

As the mobile communication market develops fast and competition becomes more and more intense, telecom operators begin to focus on the market of group customers with great potential. Contest over group customer resources is getting more and fiercer (Feng, X. H., 2008). Therefore group customer resources become an important reflection of an enterprise’s competitive strength. High-value customers are especially the key factor for an enterprise to grow rapidly. Seizing advantageous customers has great strategic meaning to the development of the enterprise. In other words, group customers weigh more and more for the development and profiting of operators.

Through researching group customer value assessment and market subdivision, we can identify customer value, scientifically assess customer value and precisely apply such values, set up an assessment system that is truly oriented at application in enterprise management, avoid disjunction between fundamental work and application work, and realize the openness of value assessment work efficiency and results. At the same time, it helps us to focus on high-value group and VIP customers, make customer classification more reasonable, pertinent and efficient.

Assessment of group customer value has the following significant meanings:

Mobile.

At present there is no complete theoretical system and unified standards for customer value assessment, especially for the telecommunication industry, there is no complete assessment method or practice experience for customer value definition.

Our research firstly defines the scope of customer value. Then we analyze the factors that influence the values of group customer of Sichuan Mobile. Based on characteristics of the communication industry in China, combining experts' experience and factor analysis method, a group customer value assessment system is set up.

2. Give a summary to related concept of group customer and group customer value.

Concept of group customer is such as follows: characteristics of market, importance, product of group customer market, etc.

Connotation of group customer value including objective, standard and principle of value assessment, etc;

3. Improve knowledge to the telecommunication industry in market subdivision based on customer value.

As the competition in the telecommunication industry becomes more and more intense, operators are facing more challenges from the market. Customer requirements become personalized. They ask for more standardized telecommunication business and services, and higher overall quality of telecommunication services.

To get the first chance, operators must thoroughly analyze the consumption behaviors of customers, precisely identify and subdivide the customer market, and make different service marketing plans for different levels of customers. Only in such a way they can best utilize values of all parties and realize win-win.

This thesis assesses group customer value in a scientific and objective way, understands the main characteristics of group customers, and subdivides the customer by their values, and therefore realizes customer classification, service grouping and channel distribution in customer management and marketing management.

assessment.

After description about group customer, customer value and customer segmentation, according to empirical analysis, and practical instrument measure and guiding suggestions will be put forward.

1.3 The Research Steps and Methodological Choices

There are 12 main steps in this research, including building assessment index system, calculating weight of indexes, calculating value of group customers, and so on.

Figure 1-1 Research Steps

1.Sort out factors of influence

2.Collect data

3.Data pre-process

4.Factor analysis

6.objective weight 8.subjective weight of factors 5.assessment index system 9.combined weight 10.value of group customers 11.Customer segmentation 12.marketing strategy 7.standard score of factors

1. Sort out factors of influence: By means of reading historic documents, news reports, blogs, discussion with experts, etc. sort the factors that may have influence on the value of group customers, including individual ARPU, the number of group employees, the number of VPMN users, etc.;

2. Collect data: According to factors of influence on the value of group customers, randomly select information from 2000 group customers from BOSS system, including

individual ARPU, the number of group employees, the number of VPMN users, etc.;

3. Data pre-process: Format of some indexes taken from BOSS system is quite special, like "Date of join", "administrative level". To make it easier for further analysis and process, these indexes shall firstly be converted;

4. Factor analysis: Use SPSS software to conduct factor analysis for pre-processed data so as to sort out public factors;

5. Build assessment index system: Categorize public factors that are analyzed and sorted from the factors into three types: current value, potential value and social value, and build group customer value assessment system;

6. Calculate objective weight: Calculate objective weight of factors based on factor characteristic root obtained in factor analysis;

7. Calculate standard score of factors: The procedure can be automatically completed by SPSS software. The default standard method is "central standard";

8. Calculate subjective weight of factors: Design questionnaire according to assessment index system, and calculate subject weight of factors in hierarchical analysis method by using Super Decisions software;

9. Calculate combined weight of factors: Combine objective weight and subjective weight of factory;

10. Calculate the value of group customers: Calculate current value, potential value, social value and total value based on standard factor score and factor combination weight;

11. Customer segmentation: Based on customer's current value, potential value, social value and total value, use K-means method to subdivide customers, and find out group clusters with typical characteristics by changing the number of clusters, that is, the value of k;

12. Propose marketing strategy: Propose corresponding marketing strategy according to group clusters obtained through Customer segmentation.

1.4 Structure of the Thesis

Structure of the thesis is listed below according to the study background and method: Chapter I: Introduction. The chapter states the thesis's background of the study, meanings

and objectives of the study, current situations of the study in the country and the world, as framework and contents of the study, and points out creation in the thesis.

Chapter II contains an overview of China Mobile Sichuan, analysis of market environment of the industry, and analysis of competitions, which build realistic foundations for further analysis in the next chapters.

Chapter III and IV firstly give relative concepts of group customers, including definition of group customer, market features, importance, meanings of development and group products, etc.; then elaborates theoretic bases of value assessment for group customers, including definition of customer value, meanings, objectives and standards of assessment of value of group customers, etc.;

Chapter V describes the concept of Customer segmentation, objective, applications and theoretic sources of Customer segmentation, definition and functions of Customer segmentation in telecommunication industry, etc.

Chapter VI elaborates study method used in the thesis, including data pre-process method, index weight calculation method and Customer segmentation method;

Chapter VII is verification and analysis. It describes in details data collection, data pre-process, index sort-out, and the process of dimensional reduction, as well as how to calculate the value of group customer from multi-dimensions, how to subdivide customers so as to find out clusters with typical characteristics;

Chapter VIII proposes strategies related to establishment, maintenance and development of group customers in accordance with the result of subdivision of customers of China Mobile - Sichuan.

Chapter IX is the summery and future work. The chapter is a summary of the thesis and future work. It points out major contribution and existing deficiency of the study, and states the direction of further study.

Chapter 2: History and Current Situation of Telecom Operators

in China

2.1 History of Telecom Operators in China

In November 1949, Ministry of Posts and Telecommunication was set up as the first telecom operator in China. It was the first organization that centrally manages national post and telecommunication services of the People's Republic of China. The Ministry of Posts and Telecommunication was later divided into the GPO (general post office) and GAT (General Administration of Telecommunications). The Ministry of Posts and Telecommunication was then re-established in 1973 in hope to develop the telecommunication industry. To sum up, the telecommunication industry of China has gone through ups and downs.

After that, the telecommunication industry experienced a vigorous growth lasting over two decades. In 1994, in order to keep up with the development of market economy and to increase the competitive strengths of Chinese telecom operators, the Ministry of Electronics Industry jointly with the Ministry of Railways founded China Unicom and began to operate a GSM network step by step. In year 1998, for another time post services were separated from and telecommunication services. In addition, the telecommunication industry began to apply the “government functions separating from enterprise management” (Zhang, H. Y., 2007) mechanism, under which the Ministry of Information Industry and China Telecom undertook industry supervision and service operation respectively.

Several years passed, and a lot of changes occurred to telecommunication operation in China. In 2000, China Mobile Communications Corporation (“China Mobile” hereinafter) came into being; China Tietong and China Satcom were also set up in the year. At that time only China Mobile and China Unicom provided mobile communication services. China Telecom and China Tietong mainly operated fixed telephone and paging services, while China Satcom focused on two major services, i.e., satellite communications radiated television and digital clustering emergency command scheduling communications. In year 2002, China Telecom was divided into two parts, one covered south China area and the other, which covered ten provinces

in north China, was named China Netcom.

China Unicom, set up in 1994 as mentioned before, has been constantly increasing its overall strength (Zhang, H. Y., 2007). Initial services included mobile phone (GSM) and wireless paging, and now it provides mobile phone (GSM and CDMA), long distance call, local call, data communication (including Internet services and IP calls), telecommunication value-added services, as well as other services relative to the main business. Following the latest advancement of global telecommunication technologies, China Unicom kept releasing new services that are based on high and new technologies, such as prepayment of mobile phone, mobile Internet, mobile phone IP calls, mobile banking, WAP, GPRS, etc. In 2000 China Unicom got listed at NYSE and HKSE, being the IPO with the largest scale in HongKong history, as well as the largest in Asia area excluding Japan. It paved a solid foundation for China Unicom to enter the international market.

China Mobile, set up in 2000, is the only communication operator that is dedicated in mobile communication technologies in China. Both of its network size and client scale rank 1st in the world till now. China Mobile mainly provides mobile voice, data, IP call and multimedia services. It was granted with dual rights to operate as both an international networking organization and an international outgoing/incoming service provider of computer Internet. In addition to basic voice services, China Mobile also provides various value-added services such as fax, data and IP call. It owns several well-known brands including “GoTone”, “Easy Own” and “M-zone”. It covers mobile phone number segments of 139, 138, 137, 136 and 135. China Mobile (HongKong) Co., Ltd. is one of the companies with the largest market capitalization in all overseas listed Chinese enterprises.

Telecommunication industry in China has come through slow development before reform and opening-up, when telephones are mainly used by government offices and some state-owned businesses as office accommodations. During the 29 years from 1949 to 1978, telephone subscriber in China increased by 1.7 million only. Till mid 20th century, there were only 230,000 telephone subscribers in China, most among which were using fixed telephones (Zhang, H. Y., 2007).

telecommunication industry presented a rapid growth, and telephones became popular in the daily life of common Chinese families. Mobile phones showed up in China in 1987. In 1989 there are only 10,000 mobile phone subscribers nationwide. We predicted this number would rise to 800,000 in 2000, and the real number in year 2000 was 87 million, more than 100 times over the estimation. Since then, the telecommunication industry of China has experienced rapid development with the total number of fixed telephone subscribers coming to No. 1 of the world.

From beginning of the 21st Century, the number of telephone subscribers in China increased in a fast while stable way by about 100 million annually. According to the statistics from former Ministry of Information Industry, such number reached 900 million in October 2007, including 370 million fixed telephone subscribers and 530 million mobile phone subscribers (Gao, D. N., 2008). Till July 2009, there were over 1 billion telephone subscribers in China. Accumulated net increase of subscribers was 43 million in the first half of the year, making the total amount of 1 billion. Among them, 330 million were fixed telephone subscribers, with a reduction of 10.43 million (including 9.59 million wireless local call telephone subscribers), and 695 million were mobile phone subscribers, with an increase of 54 million. Such a rapid rise kept the amount of telephone subscribers in China at top of the world; however, the popularizing rate in China still lagged far behind advanced countries (He, F., 2010).

As mobile phone subscribers increased continuously and non-voice services grew constantly, the simple voice services could not satisfy users’ demands any more (Gao, D. N., 2008). More personalized and applicable requirements were generated. Therefore, telecommunication users are gradually divided into two extremely opposite groups, i.e., high valued and low valued. Business volume and traffic volume are the ultimate goals of competition between telecom operators. The price war that is going on can only impose hidden dangers on the development of the telecommunication industry in China.

Till the last half of 2009, all administrative villages in China would be on the telephone, and till 2020, the goal of “every household on the telephone” will be achieved (Zhou, J., 2010). At the same time, telecommunication expenses keep reducing, pushing the communication industry progressing greatly. Till end 2009, the number of fixed telephone subscribers reduced

by 22 million annually, and the ratio of such subscribers fell to 15% from 20% in the end of last year. Accumulated net increase of mobile phone subscribers was 97.30 million, making the total mobile subscriber amount of 740 million. Income from mobile communication was 13% higher than the same period of last year, and its ratio among the major telecommunication business income was 5% higher than that of the same period of last year (Zhou, J., 2010).

Along with the sharp rise of amount of telephone subscribers in China, value-added services, such as voice, SMS and WAP business, of the telecommunication industry in China also grew fast. Till end 2007, there were about 22,000 value-added telecommunication enterprises in China. In year 2007, basic telecommunication enterprises realized an income of CNY 153.6 billion from value-added telecommunication services, with a year-to-year increase of 34%. Its ratio among the total revenue rose to 21% from 16% in the end of last year. Among the telecommunication business revenue, CNY 225 billion came from non-voice business, and its service income was ratio among the total revenue rose to 31% from 27.5% in the end of last year.

As restructuring of the telecommunication industry and all-service operation are approaching, competition in the telecommunication industry is becoming more and more intense. How to keep the current client scale, and how to utilize the current client resources became the immediate concern of China Mobile. It is imperative to set up a reasonable client value system through research, so as to build a favorable environment for the competition of the telecommunication industry in China.

2.2 History of China Mobile

In 1949 the Ministry of Posts and Tele Communication was set up; in 2000 China Mobile Communications Corporation was founded; and in 2008, China Mobile became one of the three major telecom operators in China. In several decades, China Mobile has been grown steadily, making itself the largest competitor of China Telecom and China Unicom (He, F., 2010).

The following is the chronicle of China Mobile:

2.3 Operational Environment of Domestic Telecommunication Market

The relation between a company and operational environment of market is like that between fish and water. Any marketing activity of a company cannot be successfully engaged by ignoring the environment. According to the "Grand Marketing Management" theory (Zhang, H. Y., 2007), the management expert who is honored as the father of modern marketing, any company that intends to enter a specific market successfully should harmoniously utilize economy, psychology, politics, public relations and other approaches strategically to receive cooperation and supports from each and every aspect and create an easy external environment for marketing activities. Analysis of operational environment of mobile telecommunication market is the foundation for drafting market competition strategy. Telecommunication is a strategically and pillar industry in the development of national economy. Its development is under influences of many factors (Zhao, J. Y., 2009).

On May 24, 2008 Ministry of Industry and Information Technology, National Development and Reform Commission, and Ministry of Finance jointly issued "A Notice about Deepening Structural Reform in Telecommunication Industry" (Zhao, J. Y., 2009), and started the forth structural reform for the industry in the country. The guiding idea of this reform was to take opportunities in development 3G mobile telecommunication, rationally arrange existing telecommunication networks, realize total business operation, form a suitable and healthy pattern of marketing competition so as to both preventing monopoly and avoid over competition and repeated construction, and shape three competitors with national networks, relatively equal strength and scale, total business operation capacity and strong competitiveness. Supportive policies and measures included forcefully support independent creation; enhance supervision on telecommunication industry and take necessary unsymmetrical administrative measures; and promote coordinated development of the industry, actively advance the fusion of three networks, encourage cross competition in business, etc(Zhao, J. Y., 2009).

In 2010 IOT Expo China, spokesman of NDRC pointed out that the twelfth five-year plan of the government had explicitly proposed to develop the next generation national

infrastructure with broad band, fusion and safety, and promote applications of "Internet of things"( Zhou, J ., 2010). It means that the central government keeps increasing the importance of informatization, which would have important and deep influences on promotion of national economy and social informatization, and that demands of the society on information telecommunication technology network and services will continuously increase, and the development of telecommunication industry will be presented with historic opportunities.

In economic environment, macro national economy increases steadily. In 2011, although under influences of unfavorable factors in international financial crisis, GDP of the country kept the increase speed of 9.6% for the first six months; Social investment in fixed assets increased 25.6% on year-to-year scale; social retail goods increased 16.8% in total on year-to-year scale; disposable income per capita of urban citizens was CNY 11,041, at 13.2% on year-to-year scale, and the actual increase was 7.6% with price factors excluded; cash income per capita of rural citizens was CNY 3,706, at 20.4% on year-to-year scale, and the actual increase was 13.7% with price factors excluded (Zhao, J. Y., 2009).

With the growth of national economy, consumer power of society enhances and disposable income of rural and urban residents increases, giving rise to increasing demand for communications and information and laying an economic foundation for the development of telecommunications sector.

From a cultural perspective, the Culture Industry Promotion Plan, adopted by the State Council in September 2009, defines work in eight aspects for now and the short future. The 7th aspect, developing newly-emerging cultural sectors, requires the deployment of digital and network technologies to vigorously promote culture industry upgrading. It also stipulates that we should support the development of mobile mass media broadcasting, network broadcasting, digital mass media broadcasting and cellphone broadcasting; that we should develop value-added services such as mobile cultural information service and digital entertainment products for portable display terminals; that we should do a better job in constructing the next generation broadcasting (NGB) and give full play to the third generation mobile telecommunications network, broadband, fiber and other network infrastructure; and

that we should formulate and improve network standards, promote inter-connection and resources sharing so as to push forward the tri-networks integration (the integration of telecommunications networks, cable TV networks and the Internet). The unveiling of Plan has in brought in god-given opportunities for development of cellphone broadcasting industry, and will indirectly drive the development of telecommunications industry and gradual formation of social cultural environment.

With the development and maturity of relevant technologies, the integration of the Internet, mobile phones and other cultures like the micro blog has been all the more close. Particularly with the advent of the 3G Generation, the mobile phone has become a powerful media and also an individualized style of life and entertainment. Serving as a telecommunicator and a bearer of culture, the mobile phone has gradually evolved into a new type of media called the Fifth Media. It exerts great influence on people’s cultural life styles and even the operation of society. It dual functions not only meet the increasing cultural demand of the people, but also reflect the progress of knowledge-based economy and science and technology, a sign that culture and technology are becoming all the more interwoven in the information age.

From the technological perspective, the telecom industry is highly technology-intensive. New technologies and the combination, integration and innovation of new services will have a huge influence on the industry.

The telecommunications is developing towards broadband-based and mobility-based. New demand for broadband arises as some customers need much data traffic and highly real-time services such as videoconferencing. In the meantime, increase of subscribers needs to be supported by corresponding broadband. People need telecommunications anywhere anytime by their sides, a fact that encourages telecom companies to develop new technologies and services based on the mobile network. The multi-media and multi-functions embedded in mobile terminals enable diversified mobile information services and enrich user experience. With the issuance of 3G licenses in early 2009, China Telecom, China Unicom and China Mobile have adopted different 3G technology standards. Currently, the three major operators are busy with 3G work. It will become more obvious that the scale application of 3G will

move towards broadband-based and mobility-based.

Various telecommunication technologies are all the more integrated to support new services. Technological integration also creates favorable conditions for the integration of networks, of services and even of industries. Market demand has shifted from pure telecommunications demand to comprehensive informationized solutions, with more cooperators getting involved into the industry chain of telecommunications to promote the development of this industry.

2.4 Competition in Domestic Customer Market

The domestic telecommunications market had previously undergone three restructurings respectively in 1994, 1998 and 2001 before it witnesses the fourth one in May 2008. In face of the new challenges and opportunities after the restructuring, major operators compete in their own fields with their comparative advantages. Due to difference in network distribution, target groups and development trends of different operators are varied, with China Telecom orienting at family and group customers, China Mobile advantageous in individual customers and China Unicom including all three kinds of subscribers in its service (He, F., 2010).

Before the fourth restructuring of the domestic telecommunications market, there were six telecommunication companies, China Telecom, China Mobile, China Unicom, China Netcom, China Tietong and China Satcom. All of the six companies carried out group customer marketing, complementing one another with their own scales and competitiveness for common development. Analysis of market share and revenue shows that the ranking of the six operators has undergone great changes, with China Mobile occupying the leading position with its absolute advantage in the market share of individual customers, followed by China Telecom, China Netcom, China Unicom, China Tietong and China Satcom (Feng, X. H., 2008).

After the issuance of three 3G licenses, the license problem that once hindered the development of 3G industry chain was eliminated. China Mobile acquired TD-SCDMA license, China Unicom, WCDMA license, and China Telecom, CDMA2000 license. China Mobile merged with China Tietong, China Unicom with China Netcom, and China Telecom,

after acquiring C Network service of China Unicom, emerged with China Satcom. Therefore, three competitors with all-round services and similar scale and competitiveness emerged in the market. Hence the domestic telecommunications industry ushered in a new era where the three major operators compete with one another.

China Telecom has for long set being the first comprehensive information service provider as its core strategy. Unfortunately, it has not achieved any remarkable results before the issuance of the 3G license. However, after combining its traditional advantage in landline broadband with mobile internet service, China Telecom broke through traditional voice services and began to orient towards commercial subscribers, enterprises and regional groups. In the meantime, while tri-networks integration leaned towards broadcasting and television, China Telecom and China Power ushered in a new phase in their discussion about fiber net cooperation. The integration of various networks has brought China Telecom enclosure benefits in rural informatization, urban network, corporate information solutions and the construction of commercial logistics network. With its all-around progress in services, China Telecom bridged the gap with China Mobile in value-added services (value-added market) and saw bright prospects in trans-industrial cooperation in information service with oil, railway, finance, electric power and civil aviation sectors. Notwithstanding, China Telecom is too reserved to make enough innovations, which will pose great hindrance to its advantages displaying in the era of all-round services.

After the 2008-2009 integration period, China Unicom gained momentum. Fully aware that resources shortage is the greatest bottleneck for developing all-round services in the value-added filed, China Unicom in 2010 began to make breakthroughs in particularly defined areas, enhanced performance in markets where it enjoyed advantages and boosted its storage market. It totally occupied the landline broadband market in Northern China where it enjoyed advantages and prevented the entry of China Mobile and China Telecom by all means. Apart from its total control in this regard, China Unicom also developed information programs that are at the central concern of governments at all levels in the “Twelfth Five Year” Plan period, including such programs targeted at local governments, big companies, big communities and major industrial bases as “Wireless City”, “Digital City”, “Digital

Community”, “Online Society”, “Corporate Platform for Information Sharing”, “Open Government E-Administration” and “Urban Safety and Emergency Response System”. However, imperfections of its internal system have greatly hindered the development of its advantages in all-round services. Its lack of innovation and failing comprehensive capability incompatible with market expansion will become all the more acute with market competition.

After the restructuring, China Mobile became a monopoly in the individual customer market. Its absolute advantage enabled it to enjoy revenue and capital expenditure that are more than the aggregate of new China Telecom and new China Unicom. However, compared with the latter two, China Mobile are inferior in traditional landline and especially in broadband, which will pose obstacles for future development. Immaturity of TD technology will also put China Mobile at a disadvantageous position in 3G competition. China Mobile, as a new comer in corporate subscriber market, has no advantage against competitors who have abundant experience. Notwithstanding its large number of individual customers that will maintain its strong ability in profit making in the next three years, China Mobile will surely face slowdown of revenue growth with China Telecom and China Unicom promoting 3G services and competitions. An insider of China Mobile in 2009 observed: “China Mobile is a monopoly in individual customer market, but is in a disadvantageous position in corporate subscriber market.” He also pointed out that although the three major operators all provide all-round services, China Telecom and China Unicom have their own SI companies and strong technical teams for operation and maintenance; once they acquire off-the-rack mobile telecommunications network, they will be able to give full play to their advantages, which will surely broaden the gap between China Mobile and themselves in corporate subscriber market (Feng, X. H., 2008).

Table 2-2 shows post-restructuring services and subscribers of the three major operators (Zhou, J., 2010); Table 2-3, their respective service revenues and profits (Zhou, J., 2010).

Table 2-2 Comparison of Post-restructuring Services and Subscribers

Post-restructuring New Telecom New China Mobile New China Unicom Number of landline

subscribers in 2010

170 million 27.745 million 96.635 million

Number of Mobile service subscribers in 2010 90 million subscribing CDMA 615.6 million subscribing GSM 153.4 million subscribing GSM Number of broadband subscribers in 2010

60 million 10 million 47.224 million

3G license in 2010 CDMA2000 CDMA2000 WCDMA

Table 2-3 Comparison of Post-restructuring Service Revenue and Profit Post-restructuring New Telecom New China Mobile New China Unicom

Revenue of 2010 219.367 billion 485.231 billion 171.3 billion Profit of 2010 15.262 billion 150.754 billion 3.85 billion Capital Expenditure

of 2010

43.037 billion 124.3 billion 70.19 billion

Table 2-2 and 2-3 suggest that China Telecom has obvious advantage in family and corporate subscribers, making it more adaptable to competition in all-round services in the future. Brands such as “BizNavigator” targeted at government and corporate subscribers and “My e-Home” targeted at families have already been established while initial results have been achieved in corporate and family gateways, creating favorable conditions for providing indoor digital services in the future. Therefore, China Telecom is the biggest rivalry of China Mobile.

No matter where their respective advantages lie, the three major operators will prioritize corporate subscriber service as it can promote development and bring larger profits. It will be a focal point in their competition to not only maintain current corporate subscribers but only

stretch out for new ones. Corporate subscriber service is an integral part for all the three operators.

2.5 Status Quo of China Mobile Sichuan

On July 28, 1999, China Mobile Group Sichuan Co., Ltd. (hereinafter referred to as Sichuan Mobile) was formally established. As approved by the State Council and arranged by China Mobile Group, Sichuan Mobile successfully became a listed company in HKSE and NYSE in June 2002, thus completing major reforms in its operational system. Hence, Sichuan Mobile became a subsidiary wholly owned by China Mobile Group. Since its establishment, Sichuan Mobile has acted in accordance with its long-term strategy, “being a world class telecommunications company” and sought development in line with its guideline, “moving forward step by step without stop” (Tan, X, H., 2010).

Currently, Sichuan Mobile is the largest mobile telecommunications operator in Southeast China. According to the arrangement of China Mobile Group, Sichuan Mobile is in charge of the network development plan, project construction, and network maintenance and service delivery in Sichuan. It has such famous brands as “Go Tone”, “Easyown” and “M-Zone”. Mobile phone numbers starting with 139, 138, 137, 136, 135 and 134 have been popular among households. In 2005, new numbers starting with 150, 151, 152, 158, 159, 187 and 147 were added, and in 2009, numbers starting with 188 were designed especially for G3 users. Sichuan Mobile has a registered capital of CNY 7.483 billion, assets scale of CNY 29.6 billion, 5,286 staff members and branches in 21 cities and autonomous prefectures and 192 counties. Sichuan Mobile, with its center on customers, provides differentiated services. Its business concentrates on constructing and investing in the mobile telecommunications network within the province, voice, data and multi-media services, IP telephone services, linking computer network with international networks, various value-added services based on mobile telecommunications, related services in system integration, roaming settlement, technology development and other telecom and information services.

By 2010, number of mobile subscribers of the company exceeded 30 million, occupying a market share of 80%. Base stations grew from 1,100 in the beginning to 13,062, with more

than 37,000 carrier and 9.68 million lines of GSM exchange capacity. Urban areas, scenic spots highways and rural areas all enjoy 100% coverage. Currently, the company has initiated international roaming services with 292 operators from more than 220 countries and regions to meet customers’ growing demand. All network quality indicators have met world-class standards (Zhou, J., 2010).

Currently, Sichuan Mobile has established a top-notch mobile telecommunications network of wide coverage, high-quality and varied services. The number of subscribers has exceeded 35 million. It has also initiated international roaming service with 404 operators in 237 countries and regions. By May 2010, 21 cities, autonomous prefectures counties and townships in the province enjoy 100% coverage; highways, national tourist resorts and hot spots enjoy continual coverage; and Chengdu, together with some other cities, enjoys TD-SCDMA coverage (Zhou, J., 2010).

Sichuan Mobile sticks to its strategy of “becoming a world-class telecommunications company” and its target of “becoming the best company in the Sichuan’s telecommunications industry” (Zhou, J., 2010). It has kept innovating to strengthen its capability, evolving into a competitive and culturally-advanced company that is responsible to society. By now, Sichuan Mobile has become the largest mobile telecommunications operator in western China, occupying the dominant position in the industry.

Currently, Sichuan Mobile’s all-round services are still in a fledging stage. In face of the new landscape after the restructuring, Sichuan Mobile has, according to the strategy and guidance from China Mobile Group, put the operation of all-round services at the top of its strategic agenda. The operation of all-round services requires the full integration of the operator, services and contents. In this respect, Sichuan Mobile will build upon its initial progress in all-round services and develop with the trend.

Centered on customers, Sichuan Mobile provides differentiated services that are tailored to individual customer need. It has developed WAP, “E Mobile Terminal” and “Qunying Group” services for Go Tone subscribers, mobile games, music and entertainment services for young people, “Holiday Roaming Package” and “Campus V Network” for college students, and FNS and “Happy Family” set for individual customers. In recent years, Sichuan Mobile

ranks favorably in its charging support system, 10086 service hotline, business hall services, group informatization and network quality (Xie, L. Q., 2009).

While its profits are snow-balling, Sichuan Mobile has not forgotten its responsibility towards society. In return, it has initially evolved into a competitive and culturally-advanced company that is responsible to society. Looking into the future, under the leadership of China Mobile Group and interests from the Provincial Committee and Government, Sichuan Mobile will unswervingly deliver its commitment to promoting local economy and the construction of informatization. It will also take an active part in public benefit activities and charity work, so as to make a contribution to the construction of a harmonious society and the realization of leaping development in local economy.

2.6 Current Situation of the Study in China and Abroad

2.6.1 Domestic Study about Customer Value

The study by Chen Mingliang (2001) involved the issues of customer value. The author used customer profit and customer purchase as two indexes to describe customer value, categorized customer by customer value and customer loyalty, suggested to use transaction amount and profit as the characteristic variables to indicate the level of customer relationship, and divided customer's life cycle into four stages: study stage, formation stage, stable stage and regression stage. At the same time customer value (net cash flow) synchronized with fluctuation of loyalty and trust, and formed a curve like an inverted "U". It means that current loyalty/trust of customer can, to some extent, be used to forecast the change of indirect calculation evaluation of the customer's value for some time in the future. If current loyalty/trust of the customer is quite high, it means his monetary value will take a trend to increase in some time after this; or, on the contrary, it will take a trend to drop. One of the meanings of the variable of customer relation characteristics lies in that it can provide enterprises with a shortcut to judge potential value of customers in the future. Keeping valuable customers in stable stage for a long term can maximize the lifetime value and bring long term profit to a company.

Qi Jiayin (2002) thought that customer value could be shown in two aspects: firstly, in customer's current value, that is, customer's current net cash flow; secondly, in customer's potential value, that is, the potential of net cash flow of customer in the future. The study stated that customer value should refer to the overall capability of a company's key decision maker to sense current and future net cash flow from customer under the conditions of management for him. Customer value assessment index system should be built by using current value and potential value as overall indexes so as to assess customer's value to a company. The study set off from quantitative approach, used dynamic variables to shape CLV model of typical customers and of any individual customer under dynamic conditions, and proposed the best investment plan for companies and general rules of customer investment in full life cycle for companies.

Other scholars conducted further study on the base of predecessors' studies. For example, Tan Yuexiong, Zhou Na and others (2005) thought that on the base of analyzing current studies in customer life cycle value model and influences brought about by the changes of parameters in the model, by introducing dynamic customer preservation rate and related customer life cycle time, discussed the extension of customer life cycle value model, applied the extended model in subdivision of company customers, and proposed company Customer segmentation and customer relation management strategy based on customer value. Based on customer value assessment theory and aiming at specific features of customers of telecommunication carrier group, Guo Liang and Zheng Feng (2006) conducted analysis and research, and designed group customer value assessment index system, value calculation method and customer division method that include 3 current value indexes and 6 potential value indexes. Lv Zhiguo and Jin Yongsheng (2008) designed an index system for measuring the value of group customers, and proposed marketing strategy to increasing the value of group customers. Cao Qingyuan and Yin Tao (2009) utilized hierarchical analysis method to discuss models for subdividing the value of VIP customers of carriers, and conducted marketing tests in field. Meanwhile, they proposed marketing strategy in accordance with features of value of different VIP customers. The effect of channel marketing, services marketing, product business marketing and other specific measure can provide references for

subdivision of customer value and featured marketing strategy for telecommunication carriers in the future. Xie Liqin (2009) made overall discussion about customer value assessment method in related study documentations, analyzed current customer value and the study of current conditions of customers subdivision, established corresponding customer value assessment system, combined customer value subdivision and customer activities subdivision together, proposed Customer segmentation based on customer value, and drafted flow for customer value analysis and development strategy according to the subdivision. Yang Nanfei (in 2010) studied marketing strategy of group customers of China Mobile CD, and proposed marketing strategy, competition strategy and implementation plan for the market of group customers. Principal component analysis was used to prove and analyze the current value - future value structure of group customers, and 4 types of values of group customers were divided according to high value and low value in two dimensions of current value - future value of group customers. Zhou Jian (2010) used China Mobile ZG as the object of study, utilized customer related management theory to build group customer value assessment model, defined index system for value assessment from three dimensions: customer contribution, customer property and customer influence, and built group customer value assessment model for China Mobile ZG, in which group customers were subdivided into three categories and five levels including high value customers, strategic customers, model customers, etc.

2.6.2 Oversea Studies about Customer Value

The study of group customer management was originated from the study of VIP customers by western scholars. In 1980s "Important Account" (Fioeea, 1952), "Major Account" (Colletti & Tubridy, 1957) and "National Account" (Shapiro, Moriary, 1985) were mainly used. McDonald (2002) thought management of VIP customers should refer to "the process to allocate and organize resources by balancing specific customers that are helpful for reaching the company's targets or are very important and key for reaching the company's target so as to achieve the most optimized transaction". Gosselin and Heene (2005) proposed the concept of strategic customer management, and believed that "strategic customer management should refer to identify and select strategic customers, and establish the proposition of a series of unique value by capability construction and leverage in the

partnership with strategic customers." A lot of scholars conducted studies about the management of group customers.

There are also a lot of studies overseas about group customer value assessment. For example, Shapiro (1993) believed that customer value should be the difference between the price paid by customers and the costs invested by a company, which is customer profit. Conway and Fitzpatri (1999) defined customer value as customer profit, and elaborated five sources of customer value. Meanwhile, the study used customer value and customer loyalty as two indexes to subdivide customers, structured customer category matrix into golden customers (that is, high-high), risky customers (that is, high-low), marginal customers (that is, low-high) and customers without extra services (that is, low-low), and proposed different customer relationship development strategies for different types of customers. The study used customer value and customer loyalty as two separate variables. Customer value stilled referred to customer's current net cash flow, and customer loyalty implied forecast about the potential of customer's cash flow in the future. But, the two variables were not put together into customer value. Hogan, Lemon and Libai (2003) believed that there were two direct sources of customer value: primary consumption value and periodic consumption value. After customer's purchase, there were little relations or no relations at all between customers and companies. Thus, the contribution of value only existed in primary consumption value. While for services, there might be not only primary consumption value, but also value of periodic consumption or periodic use expenses.