Procedia Computer Science 64 ( 2015 ) 594 – 600

1877-0509 © 2015 The Authors. Published by Elsevier B.V. This is an open access article under the CC BY-NC-ND license (http://creativecommons.org/licenses/by-nc-nd/4.0/).

Peer-review under responsibility of SciKA - Association for Promotion and Dissemination of Scientific Knowledge doi: 10.1016/j.procs.2015.08.572

ScienceDirect

Conference on ENTERprise Information Systems / International Conference on Project

MANagement / Conference on Health and Social Care Information Systems and Technologies,

CENTERIS / ProjMAN / HCist 2015 October 7-9, 2015

The ERP surge of hybrid models - an exploratory

research into five and ten years forecast

Pedro Ruivo

a*, Jorge Rodrigues

a, Tiago Oliveira

aa

NOVA IMS, Universidade Nova de Lisboa, Campus de Campolide, 1070-312 Lisbon, Portugal

Abstract

This study focuses in analysing firm strategies and planning to transition the usage of ERP on-premises to software as a service (SaaS), including hybrid models. The participants in this study where 53 C-level executives (such as CIO, COO and CEO) from EMEA region surveyed at the CEBIT 2014 event in Germany. Accordingly with these executives the move to ERP as SaaS is underway, and by 2025 only a minority of firms will stay with a single on-premises. However, these firms still have very limited plans on how to prepare the change in personnel readiness, business processes (re)engineering and technology architecture and SLAs. Also, the lack of clarity in vendors’ roadmaps is a major constraint to increased adoption of ERP as SaaS, when at the same time the main driver is the management pressure to reduce IT spend. Accordingly with the majority of the interviewed the hybrid ERP is strongly positioned for adoption in the next five years. However, moving all business functions to the cloud is something that is considered to be forecasted mainly in a ten years period. Moreover, outsourcing all ERP components is minor. This study also provides implications and recommendations on moving from traditional ERP on-premise to an ERP as SaaS.

© 2015 The Authors. Published by Elsevier B.V.

Peer-review under responsibility of SciKA - Association for Promotion and Dissemination of Scientific Knowledge.

Keywords: Cloud, Hybrid cloud, SaaS, ERP.

*Corresponding author. Pedro Ruivo Tel. +351210491063 E-mail address: pruivo@novaims.unl.pt

© 2015 The Authors. Published by Elsevier B.V. This is an open access article under the CC BY-NC-ND license (http://creativecommons.org/licenses/by-nc-nd/4.0/).

1. Introduction

Among the business applications for enterprises, integrated management systems, also known as Enterprise Resource Planning (ERP) systems, are an important innovation which is usually expected to bring significant benefits to firms of all sizes [1-4]. With the advances of cloud computing [5, 6], the ERP in Software as a Service (SaaS) model is fast becoming a cost effective way of delivering business applications, especially in small and medium enterprises (SMEs) [7, 8]. With potential benefits including reduced costs, ease of access to increased innovations and scalability, ERP in SaaS is an attractive option to balance the resource constraints and business processes complexity which is frequently embedded in the traditional on-premise model [9] .

There is significant interest among practitioners on ERP in SaaS but empirical research in its adoption and use is still limited [8, 10] with, however, specific suggestions from researchers [11, 12] showing that it is gaining increased traction among researchers. While deployment of IT innovations is expected to enhance firm performance, studies on the adoption and post-adoption impacts of ERP systems are limited and from usage and firm performance impact of ERP in SaaS are rare [13-15]. Also recently some researchers, practitioners and analysts [16-18] started to analyse the emergence of hybrid cloud models for the ERP, in which sensitive or business critical applications are kept on-premise and other less critical components are deployed in cloud computing.

Worldwide IT spending is forecast to reach $ 4.2 trillion by 2017 and the enterprise application software market is expected to reach $ 320 billion in 2015 [19]. While relatively small in proportion to the overall enterprise application software market, SaaS is projected to reach a market volume of $ 21 billion in 2015 [20]. ERP in SaaS deployment is less prevalent compared to other SaaS deployments, but is gaining momentum [21]. The expected growth rate in two of the fastest developing economies (India and China) is 11 % [22]. These SaaS based models are predicted to be used not only for non-critical and operational level applications but also for some strategic core business functions [23]. These forecast an expanding SaaS market and that this model will have more significant impact on organizations (both large and small) meaning that research into the determinants and challenges of SaaS based models is necessary.

This exploratory research study aims to add knowledge and clarify firm’s strategies around ERP distribution models choices and more precisely on how these firm’s will transition from using ERP functions on-premise only to new ways of consuming ERP capabilities both in pure play SaaS only and hybrid models. To do this we start in the next section with the study concepts, then we explain the methodology and present the results, followed by the discussion section and concluding with recommendations, limitations and suggestions for future research.

2. Background frame

This study considers two assumptions: 1) SaaS model is defined as an application or service that is deployed from a centralised data centre across a network, providing access and use on a recurring fee basis, where users normally rent the applications/services from a central provider” [9]. In this model, a provider delivers an application based on a single set of common code and data definitions, which are consumed in a one-to-many model by all contracted consumers anytime. They use the service on a pay-for-use basis or on a subscription basis [10] as per the conditions negotiated in the contract and receive in return the service promised in the service level agreement. 2) We will ground our frame in Gartner’s [19] and PWC’s [18] definitions of the IT environments to ERP systems:

On-premises: This reflects the situation now, where the ERP is suite-focused. There is a quest for reduced instances and a quest for a "single version of the truth" for business processes. The ERP strategy is equated with a single, dominant ERP vendor.

Outsourced: Many organizations have elected to outsource their IT environments, and there will be increased adoption of business process outsourcing (BPO) for ERP processes. This is driven by newer process-enhancing technologies and services, in which BPO providers can become the primary consumers of cloud-based ERP (which they then bundle with BPO services to clients).

architecture. This environment includes the option where firms "flips" to the cloud. Instead of having on-premises core solutions that are complemented by innovation or differentiating processes being supported outside of ERP, now all commodity best-practice business processes will be delivered as cloud services. This will leave a much reduced IT organization free to focus on building the innovative and differentiating business processes required. In this case, on-premises, integrated mega suites cease to exist.

With these in mind, we next explain the methodology that was used to understand how and what are firms actually doing to move to a modern ERP solution.

3. Methodology and results

A survey instrument was designed to investigate firm’s strategies to move or not to a modern ERP solution. A questionnaire based survey was delivered to CEBIT’s 2014 attendees in Germany. In total 53 validated complete responses were selected. The sample is stratified by 15 European countries, by firm size, by vendor’s ERP, and by industry type. Table 1 show a summary of the characteristics of the sample.

Table 1. Characteristics of the sample.

Additionally, Table 1 also shows that the respondents were individuals qualified to speak about the firm’s ERP strategy (C-level executives), which suggests the good quality of the data.

The questions were developed on the basis of the theoretical frame discussed in the previous section, as shown in Table 2. The results from the survey by each item-question are also shown in Table 2. Respondents were asked to

Characteristics (N) (%)

Country

Austria 3 5.7

Belgium 2 3.8

Denmark 4 7.5

France 5 9.4

Germany 8 15.1

Ireland 2 3.8

Italy 4 7.5

Netherlands 4 7.5

Norway 2 3.8

Poland 3 5.7

Portugal 2 3.8

Spain 3 5.7

Sweden 4 7.5

Switzerland 2 3.8

United Kingdom 5 9.4

Industry type

Retail 8 15.1

Manufacturing 6 11.3

Finance 7 13.2

Professional services 12 22.6

Energy and utilities 5 9.4

Telco and information technology 10 18.9

Public sector 5 9.4

Respondent´s position

CEO 10 18.9

CIO 12 22.6

COO 11 20.8

CFO 8 15.1

IT/IS manager 12 22.6

Firm size (employees)

10 to 50 10 18.9

51 to 100 13 24.5

101 to 250 16 30.2

Above 251 14 26.4

identify their organizations' current ERP solution model and their future expected and/or planned ERP solution model for five- and 10-year time ahead, in terms of on-premise, outsourced or hybrid models. Alongside their plans to manage the move in regards to employees, processes and technology, as well as the main driver and constraint for adopt a cloud ERP solution model.

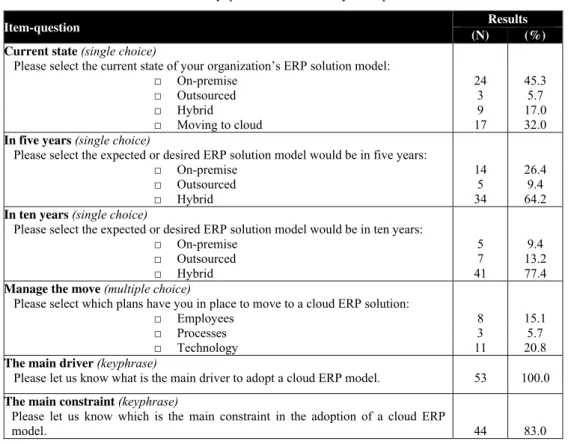

Table 2. Survey questions and results by item-question.

4. Discussion

In this section we discuss the results of Table 3 by presenting the main findings.

Finding 1 – On-premises ERP is still the current predominant model. The results show that the on-premises monolith, single-vendor strategy is still the predominant ERP model. 45.3% of participants said that they have an on-premises model, yet another 32% said they were currently moving to cloud some of the ERP components. And 17% already adopted a hybrid ERP model. Adoption of everything outsourced is still limited, currently with only 5.7% claiming this as the current model. Most current on-premises ERP installations are still used to standardize and integrate firm’s business processes. Hence, the move to a modern ERP is dependent on the previous readiness on ERP functionalities in order to exploit additional ERP capabilities.

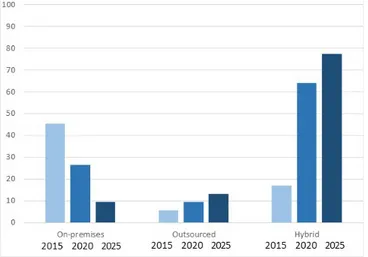

Finding 2 – The hybrid ERP model is expected to dominate firm’s IT strategy. The survey results show that 64.2% of firms are planning to move into hybrid ERP model in five years, and 77.4% claims that in ten years they expect to adopt a hybrid model (see Figure 1). The dominant on-premises monolithic ERP model is found in only one third of organizations by the end of this decade, and by 2025 will be found in a minority of organizations (9.4%). Most firms already note that a modern ERP perceive the strategy as on-premises monolith, the reality is that they might already adopted a hybrid scenario grounded on the on-premises ERP system. In general the components perceived as critical in an ERP are left in on-premises whereas the non-critical are moved into the cloud.

Item-question Results

(N) (%)

Current state (single choice)

Please select the current state of your organization’s ERP solution model:

Ƒ On-premise 24 45.3

Ƒ Outsourced 3 5.7

Ƒ Hybrid 9 17.0

Ƒ Moving to cloud 17 32.0

In five years (single choice)

Please select the expected or desired ERP solution model would be in five years:

Ƒ On-premise 14 26.4

Ƒ Outsourced 5 9.4

Ƒ Hybrid 34 64.2

In ten years (single choice)

Please select the expected or desired ERP solution model would be in ten years:

Ƒ On-premise 5 9.4

Ƒ Outsourced 7 13.2

Ƒ Hybrid 41 77.4

Manage the move (multiple choice)

Please select which plans have you in place to move to a cloud ERP solution:

Ƒ Employees 8 15.1

Ƒ Processes 3 5.7

Ƒ Technology 11 20.8

The main driver (keyphrase)

Please let us know what is the main driver to adopt a cloud ERP model. 53 100.0

The main constraint (keyphrase)

Please let us know which is the main constraint in the adoption of a cloud ERP

Finding 3 - Everything outsourced model is not prominent in firms plans. The results show that outsource everything adoption is expected to grow from 5.7% to 13.2% in ten years. Currently, the combination of ERP provisions coupled with BPO services from a BPO provider is immature. Most offerings that combine process-enhancing technologies and services with BPO services are add-ons to ERP functionality rather than full replacements. Hence, the maturity of service provider offerings will be key and, presently as they are still in early stages of their life cycle, this might be the reason for these flat results.

Figure 1. ERP model evolution, from today to 5 years, to 10 years.

Finding 4 – Firms are not developing plans to manage the move to a modern ERP model. The results show that whereas 20.1% of firms (although few) claim to have plans regarding technology (such as applications, SaaS models, SLAs), only 15.1% claim to have plans (for readiness and training) to prepare firm’s personnel to consume these ERP capabilities and 5.7% claim to have plans to manage the move at firms business processes level (such as review specific customizations/verticals).

Finding 5 – The main driver to move to a cloud ERP are costs. The result show that for all participants the main reason for their firm to move to a cloud ERP is the business pressure from business owner and business stakeholders to reduce IT costs. Although, it is crucial that firm’s strategy should consider how business needs will be met and supported, and how they will be controlled and managed, including a lifetime view of costs and benefits.

Finding 6 – The main constraint to move to a cloud ERP is the lack of a road map. The results show that for 83% of the participants the main constraint to move to a cloud ERP is the lack of clarity on vendor/solution partner’s roadmap. It is known that long-term roadmaps from solution vendors/partners is a barrier to long-term planning from customer’s point of view. Equally, when organizations observed that their ERP vendor/partner’s plans are unclear the trust in the solutions/model is lost. Hence, ERP vendor/partners must probe current and potential road maps at functionality level, as well as the commitment to support these.

5. Conclusions

should be applied to the enterprise in five and ten years, with an assessment on the extent and scope of hybridization as business users adopt cloud solutions. Firms should start planning now based on future possible scenarios, especially in long lead-time areas such as internal skills. While respondents expressed a desire to adopt or move to hybrid ERP model, there are several issues to overcome (including but not limited to, integration, new skills, data management and process change), before this model become a reality in their firms.

6. Limitations and recommendations for future research

The limited number of organizations interviewed calls for a wider research. There could be differences among different regions, also according to the level of maturity in the adoption of ERP systems and respective degree of complexity regarding functionalities, areas and processes addressed. The conclusions also need to be further analysed especially regarding the degree of adoption of hybrid and pure-play ERP in SaaS models, which seems to be different between small, medium and large companies. There seems to be a trend towards ERP in SaaS pure-play as companies are smaller but this needs to be confirmed through further research. The same applies to the distinction between different market segments or industries. Finally it will be important also to have further research regarding the different areas of specializations (types of functionalities) or verticals which are expected to be increasingly adopted as SaaS modules complementing the core ERP on-premises modules.

References

1. Ruivo, P., et al., Differential effects on ERP post-adoption stages across Scandinavian and Iberian SMEs. Journal of Global Information Management, 2013. 21(3): p. 1-20.

2. Ruivo, P., T. Oliveira, and M. Neto, ERP use and value: Portuguese and Spanish SMEs. Industrial Management & Data Systems, 2012. 112(7): p. 1008-1025.

3. Ruivo, P., T. Oliveira, and M. Neto, Examine ERP post-implementation stages of use and value: Empirical evidence from Portuguese SMEs. International Journal of Accounting Information Systems, 2014. 15(2): p. 166-184.

4. May, J., G. Dhillon, and M. Caldeira, Defining Value-based Objectives for ERP Systems Planning. Decision Support Systems, 2013. 55(1): p. 98-109.

5. Oliveira, T., M. Thomas, and M. Espadanal, Assessing the determinants of cloud computing adoption: An analysis of the manufacturing and services sectors. Information & Management, 2014. 51(5): p. 497-510.

6. Stantcheva, L. and V. Stantchev, Addressing Sustainability in IT-Governance Frameworks. International Journal of Human Capital and Information Technology Professionals (IJHCITP), 2014. 5(4): p. 79-87.

7. Seethamraju, R., Adoption of Software as a Service (SaaS) Enterprise Resource Planning (ERP) Systems in Small and Medium Sized Enterprises (SMEs). Information Systems Frontiers, 2014. 8: p. 1-18.

8. Rodrigues, J., P. Ruivo, and T. Oliveira, Software as a Service Value and Firm Performance - a literature review synthesis in Small and Medium Enterprises. Procedia Technology 2014. 16: p. 206-211.

9. Addo-Tenkorang, R. and P.T. Helo, ERP SaaS value chain: a proposed SaaS model for manufacturing SCM networked activities. International Journal of Business Information Systems, 2014. 17(3): p. 355-372.

10. Johansson, B. and P. Ruivo, Exploring Factors for Adopting ERP as SaaS. Procedia Technology 2013. 9: p. 94-99.

11. Benlian, A. and T. Hess, Opportunities and risks of software-as-a-service: Findings from a survey of IT executives. Decision Support Systems, 2011. 52(1): p. 232-246.

12. Benlian, A., T. Hess, and P. Buxmann, Drivers of SaaS-Adoption – An Empirical Study of Different Application Types. Business & Information Systems Engineering, 2009. 1(5): p. 357-369.

13. Engelstätter, B., It is not all about performance gains – enterprise software and innovations. Economics of Innovation and New Technology, 2011. 21(3): p. 223-245.

14. Bahl, P., et al. Advancing the state of mobile cloud computing. in Proceedings of the third ACM workshop on Mobile cloud computing and services. 2012. ACM.

15. Yang, H. and M. Tate, A descriptive literature review and classification of cloud computing research. Communications of the Association for Information Systems, 2012. 31: p. 35-60.

16. Johansson, B., et al. Cloud ERP Adoption Opportunities and Concerns: A Comparison between SMES and Large Companies. in Pre-ECIS 2014 Workshop" IT Operations Management"(ITOM2014). 2014.

19. Gartner, Gartner says worldwide IT spending on pace to reach $3.8 trillion. 2014.

20. Gartner, Forecast: Enterprise Software Markets, Worldwide, 2008-2015. Gartner Group, 2011.

21. Castellina, N., SaaS and Clould ERP observations: is Cloud ERP right for you?, A. Group, Editor. 2012.

22. Gartner. Gartner says worldwide SaaS revenue within the enterprise application software market to surpass. Gartner Press Releases http://www.gartner.com/it/page.jsp?id=1739214 2010;