AN ANALYSIS OF THE PERCEPTION OF CHARTERED ACCOUNTANT TRAINEES REGARDING ACCESS TO THE ACCOUNTING PROFESSION AND PROFESSIONAL TRAINING NEEDS

Bunea Ştefan, Săcărin Marian, Gîrbină Maria Mădălina

Department of Accounting and Economic and Financial Analysis, Faculty of Accounting and Management Information Systems, Academy of Economic Studies, Bucharest, Romania

stefanbunea@cig.ase.ro sacarinm@gmail.com mgirbina@cig.ase.ro

Abstract: In Romania, the certification of the quality of chartered accountant is accomplished by CECCAR(i). It is conditioned by the completion of the period of

initial training. A part of this period is provided by the universities, while the other part is provided by CECCAR through the national 3-year internship programme. The objective of our survey was to analyse the way in which chartered accountant trainees perceive the access to the accounting profession, their own limitations in terms of competences, the need for professional training, and the benefits ensured by the professional training within CECCAR. Being a member of IFAC(ii), CECCAR

has implemented the requirements of the international education standards. The results of the survey confirm that due to differences in their educational backgrounds trainees perceived certain barriers preventing their access to the accounting profession. They also considered that the training of chartered accountants should be provided by CECCAR rather than by the universities. The self-assessed competence level of trainees in fields such as accounting, taxation, or IT was appreciated as at least good, while the competences regarding organizations and businesses, international financial reporting, corporate governance, and financial markets were appreciated as modest. The need for professional training is assessed by trainees considering the immediate practice and not the expectations regarding future career development or future evolutions of accounting practices. The trainees in our survey do not consider necessary any investment in competences that they cannot use immediately at the level required by small and medium-sized businesses they work for. This implicates that results should be interpretated with caution and other factors (such as long term trends and expectations) should be considered in establishing the educational needs of future accountants.

Keywords:accounting education; access requirements; technical skills; personal skills; professional training needs

JEL classification:M41, I21, I25

1. Introduction

In Romania, the professional training required in order to acquire the title of chartered accountant starts at the university level but continues with the internship programme provided by CECCAR.

internship access examination. The requirements for the access to the accounting profession are defined by CECCAR taking into account the knowledge and competences provided by the universities for the graduates of the faculties in this field, but also the requirements of the international education standards (IES 1 "Entry requirements to professional accounting education programmes" and IES 2 "Content of professional accounting education programmes"), as well as the recommendations of the Ministry of Public Finance, the Ministry of Justice, and those of the business environment.

Over the past few years, the access to the accounting profession has been

facilitated by the protocols concluded by CECCAR with the accounting Master’s

programmes provided by many of the universities in Romania. In order to access the internship programme without an entrance examination, it is necessary as the

curriculum of the Master’s programme in question to comprise at least 5 of the 7

disciplines for which one needs to take an exam in order to access the internship programme, and for the applicant to pass the examinations with a mark of 7 (out of 10) or above.

The CECCAR trainees come from different generations and have been educated at different universities. That is why it is very likely that they may perceive the access to the accounting profession in different ways. Irrespective of the way of access, the trainees meet to a reasonable degree the minimal requirements imposed by CECCAR. However, entry into the profession is perceived as being easy by some of the trainees and as difficult by others. The expectations in terms of the professional acquisitions within the internship programme also differ. The personal needs in terms of professional training may differ significantly, depending on the perspectives offered by the labour market, on the current activity of the trainees, on

their predisposition to intellectual effort, and the individual’s own standards

regarding personal education and development. 2. Literature review

In Romania, the scientific preoccupations regarding accounting education have been around for only a few years. These most often involve either the analysis of the

coherence of the universities’ curriculums with IFAC’s international Education

standards, or the analysis of the degree to which universities prepare graduates for the needs of the labour market.

Investigating whether the education of the young graduates ensured by the Romanian universities is adequate or not, in terms of the curriculum, to the

employers’ requirements, Diaconu P. et al. (2011) points out that the curriculums of

the Romanian universities in the field of economics, although adequate in terms of theoretical knowledge, ought to be adjusted taking into account the needs of practice, especially in terms of the development of the personal skills which are very important in a competitive selection process: communication, initiative, motivation, honesty, capacity for analysis and synthesis, organization, etc.

Muţiu A. and Tiron A. (2009) conducted an evaluation of the stage of the curriculum

relatively unimportant to hybrid accountants in the first two years, but they gain a certain degree of relevance by 2009. From the analysis of the company websites, the requirements for IFRS knowledge occur mostly in the case of the branches of certain foreign entities. The authors identify a series of institutional, technical, and global factors, which determine an evolution toward the hybridization of the tasks that accountants have. They also analyse if the implementation of the IFRS is associated with any changes in the skills required by the employers or if they lead to

the hybridization of the accountants’ tasks.

The image and the role of professional accountants depend on certain stereotypes. In this context, there have been conducted studies with regard to appreciating whether the universities train specialists that correspond to the existing stereotypes of the accountant or if the universities take on an active role in the betterment of the image of professional accountants in society, in agreement with the tendencies followed by the profession (Albu et al., 2012).

It is the aim of the present survey to expand the area of investigation in terms of accounting education so as to include the manner in which future chartered accountants perceive the access to the accounting profession and the postgraduate professional trainees.

3. Research methodology

The main objective of our survey was to analyse the way in which chartered accountant trainees perceive the entry into the profession, the professional requirements that need to be met in order for one to acquire the title of chartered

accountant, and CECCAR’s role in satisfying these needs through the internship

programme.

In order to achieve this objective, we have tried to find out the following:

- Which are the fields of competence relevant to the access to the profession and which are either not represented or just poorly represented in the initial training stage

(undergraduate/Master’s level)?

- Which are the fields of competence which the trainees perceived as barriers hindering entry into the profession?

- Who should provide the training of the future chartered accountants (the universities or rather CECCAR)?

- How was the practical experience acquired?

- How do the trainees appreciate the level of competence in the various fields defined in the IES 2 standard issued by the IFAC?

-What are one’s own professional training needs?

- Do the competences of a chartered accountant exceed the needs of the small and medium-size enterprise practices? Etc.

For this purpose we have put together a questionnaire with 19 questions, of which 15 are closed and 4 are open.

The questionnaire was distributed to a number of 200 trainees included in

CECCAR’s collective internship programme (either direct, during the technical

training courses, or by e-mail). The questionnaire targeted trainees who passed the examination for access to the internship programme, who are enrolled with

CECCAR’s territorial branches (other than the Bucharest Branch and the Ilfov

Branch), and who work in small and medium-sized enterprises (SMEs), but also in

Mehedinţi, Bihor, Satu Mare, Tîrgu Mureş, Arad, Timişoara, Vrancea, Bacău, Ialomiţa, and Constanţa.

146 responses were received (response rate 73%), of which 18 were cacelled because they were incomplete. Consequently, the sample is made up of 128 respondents, of which 29 are men (22.65%) and 99 – women (77.35%). The structure by years of internship: 34.38% first year, 21.88% second year, 43.73% third year. The structure by age: 33.59% between 20 and 30 years of age; 39.06% between 30 and 40; 27.34% over 40.

60.93% of the respondents are graduates of a faculty of accounting or other departments in this field. 56.81% of the first year trainees have not graduated from a faculty/department in this field, while 71.42% of the second year trainees hold a degree in this speciality.

4. Survey results

A little more than half of the respondents consider that the accumulation of specialty knowledge and professional experience needed to obtain the professional qualifications in the field of accounting should be provided as part of the internship programme provided by CECCAR (58.59%) rather than by the universities (41.41%).

These expectations regarding CECCAR’s educational programme are more evident

in the case of first year trainees (61.36%) and drop slightly in the case of second year (60.71%) and third year (55.36%) trainees.

Most of the respondents who are third year trainees and fall into the 20-30 years of age group consider that training in the field of accounting should be accomplished at the university (72.73%) rather than by the internship programme provided by CECCAR, while the trainees who fall into the age group of over 40 years are of the other opinion (78.57%).

This perception is determined by the fact that, over the past few years, the universities (especially those in the larger university centres) brought the curriculums of their faculties/departments in this field closer to the requirements for access to the profession. Access to the profession is perceived as being easier by the young trainees than it is by those who are part of the last age group. At the same time, the young trainees perceive the added value ensured by the completion of the internship programme provided by CECCAR less strongly than do those in the last age group.

The concluding of protocols between CECCAR and the Master’s programmes of

many universities with a view to facilitating access to the internship programme without the need of an examination is appreciated very favourably by the trainees. These protocols involve the development, as part of the curriculum of the accredited

Master’s programmes, of the nucleus of competences that are absolutely necessary

for access to the profession (at least 5 of the 7 disciplines required for the internship access examination need to be comprised by the curriculum, and the examinations need to be passed with a mark of 7 out of 10 or above).

examination for access to the internship programme with a view to acquiring the title of chartered accountant allows the selection of candidates with a reasonable and comparable level of knowledge, in accordance with the CECCAR requirements. These requirements involve the acquisition of knowledge and competences ensured by the faculties/departments in this field. These requirements are covered by the graduates of faculties other than the faculties in this field through individual effort, practical experience, and the support provided by CECCAR in the training of the candidates for the access examination.

The respondents consider that the larger part of their specialty knowledge and competences are the result of the professional experience acquired with the aid of the employers and of a favourable work environment (56.82% of the first year trainees and 60.71% of the second and third year trainees, respectively).

The percentage of those who consider that the current professional level is rather a result of the internship programme provided by CECCAR increases from one internship year to the next (9.09% of the first year trainees, 17.85% of the second year trainees, and 25% of the third year trainees). This evolution confirms an increase in the awareness of the existence of the added value ensured by

CECCAR’s educational programme as one advances inside this programme.

However, the respondents tend to assign importance especially to the knowledge and competences used in the professional activity and they consequently attribute the greater part of their professional acquisitions either to specialty practice or to individual effort.

A reverse evolution in comparison to the one mentioned above is noted in terms of attributing the current professional level to the universities. It is the first year trainees who consider that a large part of the professional acquisitions were ensured by the universities (34.09%). The percentage drops as the trainees progress in their attending the internship programme provided by CECCAR and the respondents accumulate relevant practical experience (21.43% of the second year trainees and 14.29% of the third year trainees).

An analysis by age groups confirms the opinions collected according to internship years. The young specialists (age group 20-30) attribute their current professional level to the universities (44.19%). The same proportion (44.19%) of respondents in this age group attributes the professional level to enterprise practice. This situation is explained by the fact that 51.16% of the respondents comprised in this age category are graduates of a faculty in this field, the rest being graduates from faculties in other fields (48.84%).

The education programme provided by CECCAR is more appreciated by the respondents who fall into the latter age groups (by 18% of the ones aged 30-40 and 25.71% of those aged over 40) than it is by the ones of the first age group (11.63% of the ones aged 20-30).

The respondents were asked to appreciate how they acquired the practical experience that they have. Regardless of the internship year and age group, the perception of the respondents is that the role of the employer and the existence of a favourable work environment, on the one hand, and also the existence of mentors, on the other hand, are the essential factors in the acquisition of relevant practical experience (from 70.45% in the case of first year trainees to 83.33% in the case of third year trainees). It is the first year trainees who insisted that their practical experience was the result of their individual effort, in a situation where no one was willing to provide any help in this sense (29.55%). In terms of age group, it is the especially those in the first group (26.19%) and those in the last group (28.57%) who have the same perception.

This perception is much weaker among the third year trainees (16.67%), but also among those aged 30-40 (14.29%).

Given the differences that still exist among the curriculums of the faculties in this field but also given the differences in the manner of the approach of the content elements of the disciplines involved in the access examination for the acquisition of the title of chartered accountant organized by CECCAR, we have tried to identify those competence domains which were either not represented or just poorly represented in the curriculums and in the content elements during the initial education

(undergraduate and/or Master’s level, as the case may be).

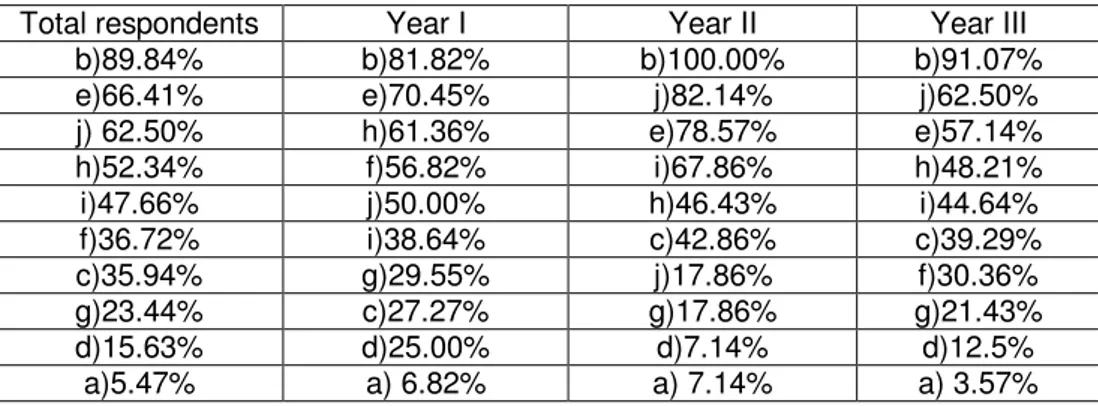

Table 1: The domains not represented or poorly represented in the curriculums

during the initial education period (undergraduate and/or Master’s level).

Competence domains: a) Financial Accounting compliant with the European directives; IFRS; c) Management Accounting; d) Performance Management; e) Consolidated Accounts; f) Audit; g) Evaluation; h) Forensic Accounting; i) Law; j) Professional Ethics.

Total respondents Year I Year II Year III

b)89.84% b)81.82% b)100.00% b)91.07%

e)66.41% e)70.45% j)82.14% j)62.50%

j) 62.50% h)61.36% e)78.57% e)57.14%

h)52.34% f)56.82% i)67.86% h)48.21%

i)47.66% j)50.00% h)46.43% i)44.64%

f)36.72% i)38.64% c)42.86% c)39.29%

c)35.94% g)29.55% j)17.86% f)30.36%

g)23.44% c)27.27% g)17.86% g)21.43%

d)15.63% d)25.00% d)7.14% d)12.5%

a)5.47% a) 6.82% a) 7.14% a) 3.57%

Because 39.07% of the respondents are not graduates of a faculty in this field, we have tried to check if the general order is also validated in the case of the group made up of the respondents who have a university degree in this field. The conclusion is that the order is confirmed in the case of 3 of the 4 disciplines (the opinion regarding Forensic Accounting was not validated). At present, most

faculties/departments in this field have included in their undergraduate or Master’s

curriculums the discipline of Forensic Accounting.

The requirements of the examination for access to the internship with a view to acquiring the title of chartered accountant must be formulated taking into account the knowledge and competences ensured by the initial (i.e. undergraduate) education process. Despite all this, the respondents perceive the existence of certain barriers hindering access to the profession.

The evaluation of the knowledge and competences taken into account in order to define the minimal requirements for the access examination involves the curriculums of the faculties in this field from the large university centres, especially those of the Academy of Economic Studies, Bucharest. Although there is a certain degree of

convergence among the universities’ curriculums, the de facto convergence is much

weaker.

In descending order, the perception of the respondents regarding the existence of barriers hindering access to the profession involves the following competence domains: IFRS (86,71%), Consolidated Accounts (72,65%), Law (39,06%), the Taxation (34,37%), Audit (31,25%), Professional Ethics and Doctrine (30,46%), Forensic Accounting (29,68%), Management Accounting and Performance Management (13,28%), Evaluation (12,5%), and Financial Accounting compliant with the European directives (10,93%).

The perception of the existence of these barriers is the consequence of several factors:

the trainees belong to different generations and were educated at different schools (for instance, those who enter the profession after several years

after they’ve completed their undergraduate studies perceive more acutely

the existence of certain barriers, as a result of the fact that they need to cover a significant part of the requirements through individual effort;

those who graduated from universities other than the Academy of Economic Studies, Bucharest, perceive the existence of certain barriers in terms of the requirements connected with IFRS and Consolidated Accounts);

At the Bucharest Academy of Economic Studies’ Faculty of Accounting and

Management Information Systems, the undergraduate curriculum includes three disciplines which are meant to develop competences for the understanding and application of IFRS (Financial Accounting compliant with IFRS, Consolidated Accounting, and Accounting Policies and Choices).

The Accounting and Management Information Systems Department of the Faculty of Economic and Administrative Sciences, Alexandru Ioan Cuza University, Iaşi, does not have in its curriculum the disciplines dedicated to the study of IFRS.

Elements regarding consolidated accounting are developed as part of the Master’s

programmes. Certain elements regarding IFRS are developed by the teaching staff in the context of the teaching of the discipline of Financial Accounting (in compliance with the European directives), as part of some comparative analyses of accounting policies, without being explicitly present in the syllabuses. Detailed knowledge regarding fiscal legislation is developed as part of the discipline Enterprise Fiscal Operations Accounting. The disciplines Forensic Accounting and Accounting Ethics and Doctrine are not included in the undergraduate curriculum but rather in the

Master’s level curriculums.

At the specialization Accounting and Management Information Systems within the Faculty of Economics and Business Administration of the West University of

Timişoara, the discipline Consolidated Accounting, although optional, is selected by

most of the students. The disciplines dedicated to the study of IFRS are developed

as part of the Master’s programmes. Elements regarding the understanding and

application of IFRS are developed, by the choice of the teaching staff, as part of the discipline Financial Accounting. The discipline Forensic Accounting is mandatory. The study of Ethics and Deontology of the Accounting Profession is not included in

the undergraduate curriculum, but is developed as part of the Master’s programmes.

The candidates must update, most often through their own efforts, the legislation right up to the date of the access examination (for instance, fiscal legislation undergoes changes at the turn of each year, and they are included in the new approved subjects, which are, however, not covered by the initial (i.e. undergraduate) education;

Having the respondents meet the minimal requirements for access to the profession demanded by CECCAR, we have tried to check in what manner they appreciate that they possess reasonable knowledge, taking into account the list of competence domains provided by IES 2. Consequently, we asked the respondents to appreciate on a 1-5 scale the level of knowledge in the fields stipulated by IFAC for the complementing of the competences necessary for acquiring the title of chartered accountant.

The competence domain where most of the respondents appreciate themselves as

having a level that’s at least “good” is Accounting and Financial Reporting for

Businesses (Ministry of Public Finance Order no. 3055/2009 with the subsequent amendments) (level 4). In fields such as Taxation, Management information

Systems, CECCAR’s Professional Standards, Human Resources, and Management

Accounting, the level is satisfactory. However, of the total respondents, 43.75%

appreciate themselves as having a level that’s at least “good” in the case of Taxation,

41.40% in the case of Management Information Systems, and 32.81% in the case of

CECCAR’s Professional Standards. Much fewer are those who appreciate that they

have a competence level that’s at least “good” in the case of Management

Accounting (26.15% of the total) and Human Resources (7.81%).

We note that, for this set of competences, the percentage of those who have a level greater than 3 increases from one internship year to the next, which means that

CECCAR’s educational programme, doubled by the practical experience, contributes to the betterment of the respondents’ perception with regard to their own

The competences in the case of which the respondents appreciate themselves as having at least a reasonable level are the ones used in their current activity, most of these respondents being employed in small and medium-sized entities or small accounting offices (SMPs). With regard to Human Resources compentences, it could be a misperception, because the respondents confine this competence domain to keeping the employee register and to calculating their salaries and social contributions and related taxes.

Public Institutions Accounting and Bank Accounting are fields which a year ago were not included in the set of minimal requirements formulated by CECCAR for the internship access examination with a view to acquiring the title of chartered accountant. At the moment, these requirements are limited, although most of the faculties in this field have included these disciplines among the mandatory disciplines in their undergraduate curriculums. This is the main cause that explains the very poor self-assessment level in these two domains. Only 7 of the respondents work in a public institution and only 4 in a credit institution.

Most of the respondents accuse the fact that neither in the initial education period nor within the educational programme provided by CECCAR is enough attention paid to the development of knowledge and especially competences regarding

organizations and businesses, business administration, and the accountant’s role in

a business. Certain respondents considered that the interdisciplinary approach is lacking. Many of the respondents do not understand why they should invest in the development of competences in domains such as international finance, financial markets, enterprise finance, given the fact that the outlook does not justify such an effort (these domains are considered as being relevant to professionals who work in large organizations, strongly integrated in the financial system and connected to international trade).

Corporate governance is perceived as a theoretical discipline par excellence, useful in the development of management culture rather than having consequences in terms of the operation of organizations and risk management. The place and role of the professional accountant in corporate governance is a topic in connection with which most of the respondents are unable to express themselves. This field is

developed by most universities as part of their Master’s programmes. Elements of

corporate governance are the object of presentations as part of management, finance, and audit courses.

These competences regarding organizations and businesses are not included in the

trainees’ training programme but are part of CECCAR’s national continuing

professional development programme. Each year, chartered accountants must attend, as part of this programme, at least 40 hours of continuing professional training.

5. Conclusions

of the internship programme provided by CECCAR less strongly than do those in the last age group.The disciplines most often indicated for not passing the access examination were, in this order: Law, The Fiscal System, Forensic Accounting, Accounting, Evaluation, Audit, and the Ethics and Doctrine of the Accounting Profession. These opinions are coherent with the ones shown by the respondents with regard to the perception of the existence of barriers to the access exam. The self assessed competence level in fields such as accounting, the fiscal system,

and IT was appreciated as at least “good” while the competences regarding

organizations and businesses, IFRS, corporate governance, and financial markets was appreciated as deficient. The need for professional training was assessed based on the immediate practice and not on the expectations regarding career development or future evolutions in accounting practice. The trainees do not consider necessary any investment in competences that they cannot use immediately and at the level required by small and medium-sized businesses. Most of the respondents consider that the level of professional knowledge and competences acquired by chartered accountants in Romania as a result of passing the skills examination organized by CECCAR is superior to the competences required by the practical activity in a small or medium-sized enterprise (57.81%). Only 35.39% consider that these competences are adequate to the needs of small and medium-sized enterprises.. This implicates that results should be interpretated with caution and other factors (such as long term trends and expectations) should be considered in establishing the educational needs of future accountants.

The main limitation of our research is the fact that we have not considered the Bucharest-Ilfov region trainees. We intend to conduct a separate study for these trainees as we expect some of them to hold more complex and demanding jobs. In addition, most of them are graduates of ASE Bucharest and it is likely that their perception on these issues be different.

We intend to obtain additional information and relevant conclusions using superior statistical tools. We want to expand the field of research on the elements of competence perceived as having the greatest contribution to enhancing the usefulness of professional accountants.

6. Acknowledgements

This work was supported by CNCSIS – UEFISCSU, project number PN II-RU TE_337/2010, Title "A model of the factors influencing the professional profile of the Romanian accountants in business. A study on the profession's adaptation to the current business environment and a forecast".

(i)CECCAR = Corpul Experţilor Contabili şi Contabililor Autorizaţi din România (i.e., The Body of Chartered Accountants and Licensed Accountants of Romania)

References

Albu, C.N., Albu, N., Faff, R. and Hodgson, A. (2011) "Accounting Competencies and the Changing Role of Accountants in Emerging Economies: The Case of Romania",Accounting in EuropeVol. 8, No. 2, pp.155–184;

Albu, N., Albu C.N. and Gîrbină M.M. (2011) "Can the Stereotype of the Accountant

be Changed Through Accounting Education? Some conjectures on educating accounting students in Romania", International Journal of Business ResearchVol. 11 Issue 1, pp.156;

Diaconu, P., Coman, N., Gorgan, C., Gorgan, V. and Şandru, C (2011) "The Needs

of the Financial Labour Market in Romania and the Answer of the Local Universities to This Social Demand", Journal of Accounting and Management Information SystemsVol. 10, No. 1, pp. 55–73;

Diaconu, P. (2008) “Directions of the Accounting Educational Curricula in the

Romanian Universities and the Conformity with the International Educational

Standards Provided by IFAC”,Journal of Accounting and Management Information

Systems, Suppl., pp. 920-929;