Fundação Getúlio Vargas

Escola Brasileira de Economia e Finanças

Cristina Tessari

Dois Ensaios em Finanças

Cristina Tessari

Dois Ensaios em Finanças

Dissertação submetida à Escola

Brasileira de Economia e Finanças

como requisito parcial para a

obtenção do grau de Mestre em

Economia

Área de concentração: Finanças

Orientador: Caio Ibsen Rodrigues

de Almeida

Ficha catalográfica elaborada pela Biblioteca Mario Henrique Simonsen/FGV

Tessari, Cristina

Dois ensaios em finanças / Cristina Tessari. – 2016. 81 f.

Dissertação (mestrado) - Fundação Getulio Vargas, Escola de Pós- Graduação em Economia.

Orientador: Caio Ibsen Rodrigues de Almeida. Inclui bibliografia.

Agradecimentos

Agradeço,

Ao meu orientador Caio Almeida, pela fundamental contribuição para o desenvolvi-mento e conclusão deste trabalho, pelas ideias, sempre brilhantes, pela compreensão, força, amizade, e carinho. Sou grata pela extrema gentileza, disponibilidade e grandiosas sugestões e ideias para os artigos, pela paciência, e por me mostrar que o único caminho possível era o da dedicação.

Aos membros da Banca Examinadora, pelo tempo dispensado na leitura deste trabalho e pelos comentários e críticas.

Ao meu co-autor Bernardo Ricca, pela grande dedicação, objetivas e cruciais con-tribuições no segundo capítulo desta dissertação.

A todo o corpo docente da EPGE, por me ensinar uma nova maneira de pensar, pelo compromisso com a excelência acadêmica e pela vital contribuição para a minha formação.

Aos funcionários da EPGE, por todo o apoio.

A todos os meus colegas da EPGE, pelas conversas e debates no hall dos elevadores,

pelas muitas dúvidas tiradas, pela amizade e companheirismo durante esses anos de con-vivência.

Aos meus pais Celso e Aidi, por estarem sempre por perto, pelo apoio, carinho e compreensão ao longo de toda a minha vida, por sempre terem acreditado na minha capacidade, enquanto muitos outros duvidaram, por terem me dado plena liberdade para fazer as minhas escolhas, mesmo sem entender muitas delas, e por nunca terem interferido nas minhas decisões.

Sumário

1 Option Pricing under Multiscale Stochastic Volatility 10

1.1 Introduction . . . 11

1.2 A Model for the Stock Price Dynamics . . . 13

1.2.1 The Model . . . 13

1.2.2 Pricing Equation . . . 15

1.2.3 The Variogram and Time Scales in Market Data . . . 17

1.2.4 Implied Volatility Asymptotic and Calibration . . . 19

1.3 Numerical Results. . . 21

1.3.1 Data Description . . . 21

1.3.2 Mean-Reversion Rates and Block Bootstrap . . . 22

1.3.3 Calibration Results . . . 24

1.3.4 Numeric Examples . . . 31

1.3.5 Application: Pricing an Exotic Derivative . . . 35

1.4 Concluding Remarks . . . 35

Appendix . . . 36

1.A Properties of the Variogram Estimator . . . 36

1.B First-Order Perturbation Theory . . . 39

2 Idiosyncratic Moments and the Cross-Section of Stock Returns in Brazil 46 2.1 Introduction . . . 47

2.2 Data and Variables . . . 50

2.2.1 Data Description . . . 50

2.2.2 Construction of Variables . . . 51

2.3 Constructing Moment-Based Portfolios . . . 61

2.3.1 Sorting Stock Returns on Expected Idiosyncratic Skewness . . . 61

2.3.2 Sorting Stock Returns on Realized Idiosyncratic Skewness . . . 63

2.3.3 Sorting Stock Returns on Realized Idiosyncratic Volatility . . . 65

2.4 Robustness Analysis . . . 68

2.4.1 Tercile Portfolios . . . 68

2.4.3 Return Reversal . . . 73

2.5 Concluding Remarks . . . 75

Lista de Figuras

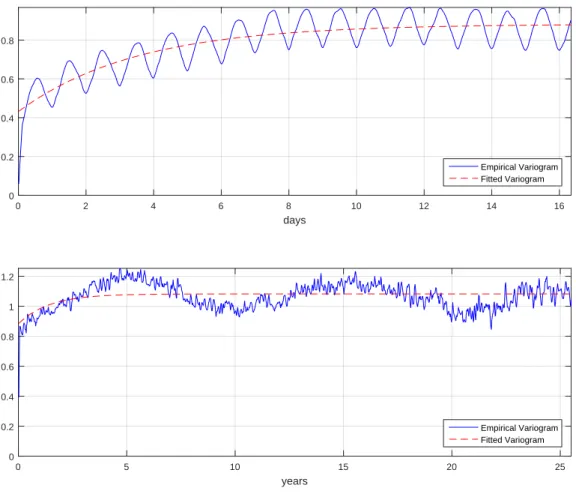

1.1 The empirical variogram for the S&P 500 volatility process . . . 23

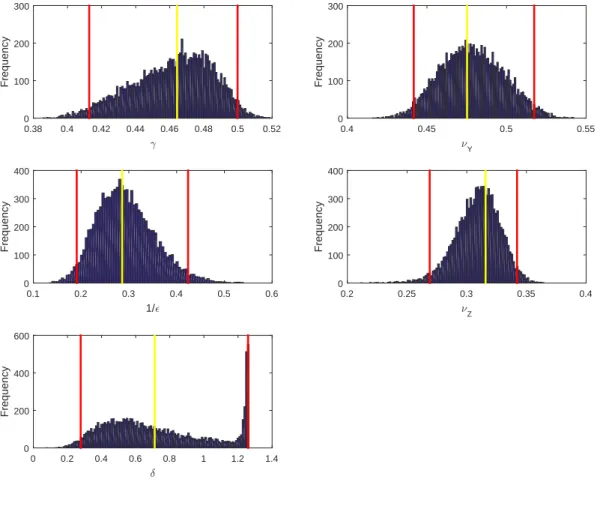

1.2 Bootstrap distributions of the sample parameters . . . 25

1.3 Data and calibrated fit on November 03, 2015. . . 27

1.4 Data and calibrated fit on November 03, 2015 (slow scale). . . 28

1.5 Implied volatility fit of S&P 500 index options on November 03, 2015. . . 29

2.1 Cumulative returns of the three Fama-French factors . . . 52

2.2 Cross-sectional distribution of firm-level volatility . . . 55

Lista de Tabelas

1.1 Summary statistics of the estimates of the model variogram (1.26). . . 24

1.2 Estimated values of the group market parameters . . . 30

1.3 Root mean square error (RMSE) . . . 31

1.4 Ratio between the correction termP1 and the total price P∗ . . . 31

1.5 Parameters and initial conditions used in the two-factor stochastic volatility model (1.3). . . 32

1.6 Root mean square error (RMSE) . . . 33

1.7 Ratio between the correction termP1 and the total price P∗ . . . 34

2.1 Descriptive statistics of the three Fama-French factors . . . 51

2.2 Significance of the three Fama-French factors across regressions . . . 54

2.3 Descriptive statistics of skewness predictor variables . . . 58

2.4 Skewness predictive regressions . . . 60

2.5 Root mean squared error (RMSE) . . . 61

2.6 Summary statistics for portfolios formed on expected idiosyncratic skewness 64 2.7 Summary statistics for portfolios formed on realized idiosyncratic skewness 66 2.8 Summary statistics for portfolios formed on realized idiosyncratic volatility 67 2.9 Summary statistics for portfolios formed on expected idiosyncratic skewness 70 2.10 Summary statistics for portfolios formed on realized idiosyncratic skewness 71 2.11 Summary statistics for portfolios formed on realized idiosyncratic volatility 72 2.12 Summary statistics for equally-weighted portfolios sorted on idiosyncratic moments . . . 74

Capítulo 1

Option Pricing under Multiscale

Stochastic Volatility

Abstract

In this paper, we test some stochastic volatility models using options on the S&P 500 index. First, we demonstrate the presence of a short time-scale, on the order of days, and a long time-scale, on the order of months, in the S&P 500 volatility process using the empirical structure function, or vari-ogram. This result is consistent with findings of previous studies. The main contribution of our paper is to estimate the two time-scales in the volatility process simultaneously by using nonlinear weighted least-squares technique. To test the statistical significance of the rates of mean-reversion, we bootstrap

pairs of residuals using the circular block bootstrap of Politis and Romano

(1992). We choose the block-length according to the automatic procedure of

Politis and White (2004). After that, we calculate a first-order correction to the Black-Scholes prices using three different first-order corrections: (i) a fast time scale correction; (ii) a slow time scale correction; and (iii) a multiscale (fast and slow) correction. To test the ability of our model to price options, we simulate options prices using five different specifications for the rates or mean-reversion. We did not find any evidence that these asymptotic models perform better, in terms of RMSE, than the Black-Scholes model.

1.1

Introduction

Asset return volatility is a central concept in finance, whether in asset pricing, portfolio selection, or risk management. Although many well-known theoretical models assumed

constant volatility (seeMerton,1969;Black and Scholes,1973), sinceEngle(1982) seminal

paper on ARCH models, the financial literature has widely acknowledge that volatility is

time-varying, in a persistent fashion, and predictable (seeAndersen and Bollerslev,1997).

From the point of view of derivative pricing and hedging, continuous time stochastic volatility models, which can be seen as continuous time versions of ARCH-type models, have become popular in the last twenty years. The idea of using stochastic volatility models to describe the dynamics of an asset price comes from empirical evidence indicating that asset price dynamics is driven by processes with time-varying volatility. In fact, two

phenomena are observed: (i) a non-flat implied volatility surface when the Black and

Scholes (1973) model is used to interpret financial data, and (ii) skewness and kurtosis are present in the asset price probability density function deduced from empirical data. These phenomena stands in empirical contradiction to the consistent use of a classical Black-Scholes approach to price options and similar securities, as the Black–Scholes model fails to correctly describe the market behavior.

Stochastic volatility models relax the constant volatility assumption of the Black-Scholes model by allowing volatility to follow a random process. In this context, the market is incomplete because the volatility is not traded and the volatility risk cannot be fully hedged using the basic instruments (stocks and bonds). To preclude arbitrage, the market selects a unique risk neutral derivative pricing measure, from a family of possible measures. As a result, in contrast to the Black-Scholes model, the stochastic volatil-ity models are able to capture some of the well-known features of the implied volatilvolatil-ity surface, such as the volatility smile and skew.

The presence of volatility factors is well documented in the literature using underlying

returns data (seeAlizadeh et al.,2002;Andersen and Bollerslev,1997;Chernov et al.,2003;

Engle and Patton,2001;Fouque et al.,2003b;Hillebrand,2005;LeBaron,2001;Gatheral,

2006, for instance). While some single-factor diffusion stochastic volatility models such as

Heston(1993) enjoy wide success, numerous empirical studies of real data have shown that the two-factor stochastic volatility models can produce the observed kurtosis, fat-tailed

return distributions and long memory effect. For example,Alizadeh, Brandt, and Diebold

(2002) used ranged-based estimation to indicate the existence of two volatility factors

including one highly persistent factor and one quickly mean-reverting factor. Chernov,

that two factors are necessary for log-linear models. Those evidences, among others, have motivated the development of multiscale stochastic volatility models as an efficient way to capture the principle effects on derivative pricing and portfolio optimization of randomly varying volatility.

In this paper, motivated by both the popularity and appeal of stochastic volatility models and by the difficulty associated with their estimation, we compare the performance

of three different specifications of theFouque, Papanicolaou, and Sircar(2000)’s stochastic

volatility model for pricing European call options. We assume that the underlying asset

evolves according to a geometric Brownian motion, as in the Black and Scholes (1973)

model, but with stochastic volatility. We use S&P 500 data to demonstrate that the volatility of this index is driven by two diffusions: one fast mean-reverting and one slow-varying. In order to identify these scales, we analyze low- and high-frequency data using the empirical structure function, or variogram, of the log absolute returns. To retrieve the scale on the order of months, we use daily closing prices of the S&P 500 over several

years. To extract the scale on the order of days, we follow Fouque et al. (2003a) and use

high-frequency, intraday data.

In their work, Fouque, Papanicolaou, and Sircar (2000) show that multiscale

stochas-tic volatility models lead to a first-order approximation of the implied volatility surface and derivative prices. By using a combination of singular and regular perturbations to approximate prices when the volatility is driven by short and long time-scale factors, they derive a first-order approximation for European options prices and their induced implied volatilities. This first-order approximation is composed by the Black-Scholes price and the first-order correction involves only Greeks. In terms of implied volatility, this pertur-bation analysis translates into an affine approximation in the log-moneyness to maturity ratio (LMMR). This perturbation method allows a direct calibration using real data of the group market parameters, which are exactly those needed to price exotic contracts at this level of approximation. The advantage of this approach is that the resulting formula for the option price does not depend on the unobserved current value of the volatil-ity. However, calibration of this model requires information on near-the-money implied volatilities.

We have three different goals in this work. First, to demonstrate the presence of a well-identified short time-scale (on the order of a few days) and a long time-scale (on the order of months) in the S&P 500 volatility process. In order to do that, we show that the fast time-scale and the slow time-scale can be simultaneously estimated by using two different datasets, making use of the empirical structure function, or variogram. To test the statistical significance of the speeds of mean-reversion, we use the circular block

block-length selection of Politis and White (2004). The second goal, conditional on the market supporting evidence of a multiscale stochastic volatility process, is related to the calibration of the model using option data on the underlying. At this stage, we compare the observed prices with the corrected Black-Scholes prices by using three different first-order corrections: (i) a fast time scale correction; (ii) a slow time scale correction; and (iii) a multiscale correction (fast and slow). Finally, the third goal of this paper is to simulate trajectories of corrected prices and price an exotic derivative (digital option).

The rest of this paper proceeds as follows. In Section 2, we describe the class of multiscale stochastic volatility models that we will work with. In Section 2.3, we present the empirical structure function, or variogram, which is used as an estimator of the speed of mean reversion. In Section 2.4, we present the first-order approximation derived in

Fouque, Papanicolaou, and Sircar (2000), which is valid for any European-style option. Additionally, we present an explicit formula for the implied volatility surface induced by the option pricing approximation. In Section 3, we report the numerical results. In Section 4, we show how the corrected Black-Scholes prices can be used to price exotic options. Finally, Section 5 concludes.

1.2

A Model for the Stock Price Dynamics

1.2.1

The Model

Let (Ω,F,P,{Ft}t≥0) be a complete probability space with a filtration satisfying the

usual conditions. We consider a family of stochastic volatility models (Xt, Yt, Zt), where

Xt is the underlying price, and Yt and Zt are two mean-reverting Ornstein–Uhlenbeck

(OU) processes. Under the physical probability measure P, our model can be written as

the following system of stochastic differential equations (SDE):

dXt =µXtdt+f(Yt, Zt)XtdWt0, dYt = 1ǫα(Yt)dt+ √1ǫβ(Yt)dWt1, dZt =δc(Zt)dt+

√

δg(Zt)dWt2,

(1.1)

where (W(0), W(1), W(2)) are correlated

P-Brownian motions with

dWt(0)dWt(i) =ρidt, i= 1,2, dWt(1)dW

(2)

t =ρ12dt, (1.2)

and |ρ1| < 1, |ρ2| < 1, |ρ12| < 1, and 1 + 2ρ1ρ2ρ12 −ρ21 −ρ22 − ρ212 > 0 in order to

underlying price Xt evolves as a diffusion with geometric growth rate µ and stochastic

volatilityσt =f(Yt, Zt).1 The fast volatility factorYt evolves with a mean reversion time

ǫ, while the slow volatility factor Zt evolves with a time scale 1/δ. In order to have a

separation of scales, we must assume thatδ ≪1/ǫ.

Here, it is worth mentioning that this model characterizes an incomplete market, in

contrast to the Black and Scholes (1973) model, since the volatility presents its own

in-dependent sources of uncertainty, Yt and Zt. The introduction of these two new sources

of randomness give rise to a family of equivalent martingale measures that will be

pa-rameterized by the market price of risk,λ(y, z) = (µ−r)/f(y, z), and two market prices

of volatility risk, which we denote by ξ(y, z) and ζ(y, z), associated with Yt and Zt,

re-spectively. All these market prices are not determined within the model, but are fixed exogenously by the market. To preclude arbitrage, we assume that the market chooses

one measureP∗ through the combined market price of volatility risk (ξ, ζ).

Under the risk neutral measure P∗, an application of the Girsanov theorem provides

that our model can be written as

dXt =rXtdt+f(Yt, Zt)XtdWt0∗, dYt =

1

ǫα(Yt)−

1

√

ǫβ(Yt)Λ1(Yt, Zt)

dt+ √1

ǫβ(Yt)dW

1∗

t , dZt =

δc(Zt)− √

δg(Zt)Λ2(Yt, Zt)

dt+√δg(Zt)dWt2∗,

(1.3)

wheref is a positive function, bounded above and away from zero, r ≥0 is the risk-free

rate of interest, and the combined market prices of volatility risk associated with Yt and

Zt are

Λ1(y, z) =ρ1λ(y, z) +ξ(y, z)

q

1−ρ2

1, (1.4)

Λ2(y, z) =ρ2λ(y, z) +ξ(y, z)ρ12+ζ(y, z)

q

1−ρ2

2−ρ212. (1.5)

In our model, the coefficientsα(y) =mY −y and β(y) =νY√2 describe the dynamics

of Y under the physical measure P and the coefficients c(z) =mZ−z and g(z) =νZ√2

describe the dynamics of Z under P. Their particular form does not play a role in

the perturbation analysis provided that they are defined so that the processes Y and

Z are mean-reverting and have a unique invariant distribution denoted by ΦY and ΦZ,

respectively. SinceY andZare OU processes, it can be shown that ΦY is the density of the

normal distributionN(mY, νY2), where νY2 =β2/2α, and ΦZ is the density of the normal

1

If σt is constant, then Xt is a geometric Brownian motion and corresponds to the classical model

distribution N(mZ, νZ).2 Finally, the P∗-standard Brownian motions (Wt0∗, Wt1∗, Wt2∗)

present the same correlation structure as between theirP-counterparts in Equation (1.2).

1.2.2

Pricing Equation

Consider a European option with smooth and bounded payoff functionh(x) and

expira-tion dateT. The fact that the discounted price ˜Pt=e−rtPtis aP∗-martingale guarantees

that the no-arbitrage pricing function of this option at timet < T is given by

Pǫ,δ(t, Xt, Yt, Zt) =E∗ n

e−r(T−t)h(XT)

Xt, Yt, Zt o

, (1.6)

where the expectation E∗{·} is taken under the risk-neutral pricing measure P∗, and the

Markov property of (Xt, Yt, Zt) is used. By an application of the Feynman-Kac formula,

we obtain a characterization of Pǫ,δ as the solution of the parabolic partial differential

equation (PDE)

∂Pǫ,δ

∂t +L(X,Y,Z)P

ǫ,δ −rPǫ,δ = 0, (1.7)

with terminal conditionPǫ,δ(T, x, y, z) =h(x), whereL

(X,Y,Z)is the infinitesimal generator

of the Markov processes (Xt, Yt, Zt). Define the infinitesimal generator Lǫ,δ as

Lǫ,δ = ∂t∂ +L(X,Y,Z)−r, (1.8)

so that (1.7) can be written as

Lǫ,δPǫ,δ = 0, (1.9)

with terminal condition Pǫ,δ(T, x, y, z) = h(x). It is convenient to re-write the operator

Lǫ,δ as a sum of components that are scaled by the different powers of the small parameters

(ǫ, δ) that appear in the infinitesimal generator of (X, Y, Z) as

Lǫ,δ = 1ǫL0+ 1

√

ǫL1+L2+ √

δM1+δM2+

s

δ

ǫM3, (1.10)

where the operators are defined as

L0 = 1

2β

2(y) ∂2

∂y2 +α(y)

∂

∂y, (1.11)

L1 =β(y) ρ1f(y, z)x

∂2

∂x∂y −Λ1(y, z) ∂ ∂y

!

, (1.12)

2

L2 =

∂ ∂t+

1

2f

2(y, z)x2 ∂2

∂x2 +r x

∂ ∂x − ·

!

, (1.13)

M1 =g(z) ρ2f(y, z)x

∂2

∂x∂z −Λ2(y, z) ∂ ∂z

!

, (1.14)

M2 = 1

2g

2(z) ∂2

∂z2 +c(z)

∂

∂z, (1.15)

M3 =β(y)ρ1,2g(z)

∂2

∂y∂z. (1.16)

Note thatL2 is the Black-Scholes operator, corresponding to a constant volatility level

f(y, z). The Black-Scholes price CBS(t, x;σ), the price of a European claim with payoff

h at the volatilityσ, is given as the solution of the following PDE

LBSCBS = 0, (1.17)

with terminal condition CBS(T, x;σ) = h(x). If we are able to calculate the solution

of the PDE given by Equation (1.9), then we know how to price derivatives under the

proposed model. However, for general coefficients (f, α, β, c, g,Λ1,Λ2), we do not have

an explicit solution to this equation. In this context, Fouque, Papanicolaou, and Sircar

(2000) developed an asymptotic approximation for the option price in the neighborhood

of the Black-Scholes price that made the calibration problem computationally tractable.

In order to obtain the first-order approximation, they expand Pǫ,δ in powers of √ǫ and

√

δ as follows:

Pǫ,δ(t, x, y, z) = X j≥0

X

i≥0

√

ǫi√δjPi,j(t, x, y, z), (1.18)

where P0,0 = PBS is the Black-Scholes price, P1ǫ,0 =

√

ǫP1,0 is the first-order fast scale

correction, andPδ

0,1 =

√

δP0,1 is the first-order slow scale correction. In the Appendix, we

present the derivation of this first-order correction to the Black-Scholes solution.

If we define Dk as

Dk=xk ∂k

∂xk, (1.19)

then, for nice payoff functions h, Fouque, Papanicolaou, and Sircar(2000) show that the

corrected call price P∗ for European options using a combination of singular and regular

perturbations is given by

P∗ =PBS∗ + (T −t) V0δ(z)∂PBS∗ ∂σ +V

δ

1(z)D1

∂P∗

BS ∂σ +V

ǫ

3(z)D1D2PBS∗ !

, (1.20)

where Pǫ,δ = P∗ +O(ǫ+δ). Note that this formula involves only Greeks of the

Black-Scholes price P∗

BS evaluated at σ∗(z). In addition, observe that only the group market

parameters (σ∗, Vδ

and Vδ

1 are of order

√

δ and Vǫ

3 is of order

√

ǫ. Thus, the main advantages of this

price approximation are the ease of implementation and the parsimony in the number of

parameters. In addition, ifδ= 0, then only the group market parametersσ∗(z) andVǫ

3(z) are needed to compute the contribution due to the fast time scale rather than the full

specification of the stochastic volatility model. Similarly, ifǫ= 0, then the slow time scale

contribution to P∗ is contained in only two parameters, Vδ

0(z) and V1δ(z). Accordingly,

the corrected price (1.20), which is obtained when we consider a two-factor stochastic

volatility model, includes the correction due to the fast time scale and the correction due to the slow time scale as its particular cases.

1.2.3

The Variogram and Time Scales in Market Data

In order to identify the time scales in the volatility, this section introduces the var-iogram, or empirical structure function, as a tool for estimating the speeds of mean-reversion.

Consider a discrete version of time, with ∆t=tn−tn−1, 0≤n ≤N, and letXndenote

the S&P 500 data recorded at timetn. Adopting a discrete version of Equation (1.1), we

define the normalized fluctuation of the data, ¯Dn, as

¯

Dn=

1

√

∆t

∆Xt

Xt − µ∆t

!

=σt

∆Wt

∆t , (1.21)

whereXn,Yn,Znand Wn represent the processesXt,Yt,Ztand Wtsampled at time n∆t,

σt=f(Yt, Zt), t≥ 0, is the (positive) volatility process, µ is a constant, and ∆Wt is the

increment of a Brownian motion. From the basic properties of a Brownian motion, we

are able to model ¯Dn by

¯

Dn=f(Yn, Zn)ǫn, (1.22)

where {ǫn} is a sequence of i.i.d. N(0,1) random variables. To obtain an expression

similar to that inFouque, Papanicolaou, and Sircar(2000), we assume that the stochastic

volatility can be written as f(y, z) = f1(y)f2(z). This functional form was proposed by

Fouque, Papanicolaou, Sircar, and Solna (2003c) for the case in which the correlation

between the instantaneous volatility components is zero.3 In this case, to obtain an

additive noise process, we define the log absolute value of the normalized fluctuations as

Fn = log|D¯n|= log|f1(Yn)|+ log|f2(Zn)|+ log|ǫn|. (1.23)

3

Machuca (2010) demonstrated that this equation remains valid even when the correlation between

Thus, the empirical structure function or variogram of Fn, which is a measure of the

correlation structure of the sampled version of the process log (f(Yt, Zt)), is given by

VjN = 1 Nj

X

n

(Fn+j−Fn)2, (1.24)

wherej is the lag for which we are measuring the correlation andNj is the total number

of points for each lag.

In this paper, we consider a model with two components driving the volatility, one fast and other slow. In this case, the stochastic volatility model is given by

f(Yt, Zt) = eYt+Zt, (1.25)

where {Yt} and {Zt} are independent OU processes. Fouque, Papanicolaou, and Sircar

(2000) show that, for each j = 1,2, . . . , J, the empirical variogram VN

j is an unbiased

estimator of

Vj = 2γ2+ 2νY2

1−e−αj∆t+ 2νZ2 1−e−δj∆t, (1.26)

where α ≡ 1/ǫ, γ2 = Var(log|ǫ|), ν2

Y is the variance of the stationary distribution of

the process logf1(Yt) and νZ2 is the variance of the stationary distribution of the process

logf2(Zt).

Note that, for the range of lags that we are looking at, that isj∆t up to a week, δj∆t

is small and the last term is negligible. Hence, we can use the following approximation in order to obtain the component of fast mean-reversion:

VjN ≈2γ2+ 2νY2 1−e−αj∆t. (1.27)

At the opposite extreme, if we had looked at a longer data sample and included larger

lags, then the term related toαin (1.26) would be sufficiently large. In this case, we could

consider the following approximation to obtain the component of slow mean-reversion:

VjN ≈2(γ2+νY2) + 2νZ2 1−e−δj∆t. (1.28)

By using the results above, we are able to estimate the rates of mean reversion of

the volatility process, 1/ǫ and δ, by nonlinear regression methods. Note that Equations

(1.27) and (1.28) share a parameter, γ. In order to take this fact into account, we fit

two different datasets to two different equations with a shared parameter. For the high

frequency dataset, we use the empirical variogram from Equation (1.22) as the dependent

variable, and adjust it to the functional form given in Equation (1.27). At the same time,

given by Equation (1.28). The resulting estimates are reported in Section 3.

1.2.4

Implied Volatility Asymptotic and Calibration

It is common practice to quote option prices in units of implied volatility, by inverting the Black-Scholes formula for the European option with respect to the volatility parame-ter. This quantity is a convenient change of unit through which to view the departure of market data from the Black-Scholes theory.

The multiscale asymptotic theory developed in Fouque, Papanicolaou, and Sircar

(2000) is designed to capture some of the important effects that fluctuations in the

volatil-ity have on derivative prices. In their work, they propose a first order approximation for the implied volatility function obtaining a very nice linear relation between implied volatility and the ratio log-moneyness to time to maturity, from which we can estimate

the parameters of Equation (1.20). This procedure is robust and no specific model of

stochastic volatility is actually needed.

In order to obtain the implied volatilities, we consider a European call option with

strike K and maturity T. In this case, the corresponding payoff function is given by

h(x) = (x−K)+, and the Black-Scholes price at the corrected effective volatility σ∗ is

P∗

BS =xN(d∗1)−Ke−rτN(d∗2), (1.29)

whereτ =T−tis the time to maturity,N is the cumulative standard normal distribution

and

d∗1,2 =

log(x/K) +r±12σ∗2τ

σ∗√τ . (1.30)

Given an observed European call option price Cobs, the implied volatility I is defined

to be the value of the volatility parameter that must go into the Black-Scholes formula

(1.29) in order to haveCBS(t, x;K, T;I) =Cobs. Thus, as ∂P

∗

BS

∂σ =τ σ∗D2PBS∗ for European

vanilla options, we can rewrite the corrected price (1.20) as

P∗ =PBS∗ +τ V0δ+τ V1δD1+

Vǫ

2

σ∗D1

∂P∗ BS

∂σ , (1.31)

where ∂PBS

∂σ =

x√τ e−d21/2

√

2π .

Remember that σ∗ solves P∗

BS = CBS(σ∗). Thus, by expanding the difference I −σ∗

between the implied volatility I and the volatility used to compute P∗

BS in powers of

√ ǫ

for the implied volatility, I ≈σ∗+√ǫI

1,0+

√

δI0,1, takes the simple form

I ≈b∗+τ bδ+aǫ+τ aδLMMR, (1.32)

where LMMR, the log-moneyness to maturity ratio, is defined by

LMMR = log (K/x)

T −t =

log (K/x)

τ . (1.33)

The parameters (b∗, bδ, aǫ, aδ) depend on z and are related to the group parameters

(σ∗, Vδ

0, V1δ, V3ǫ) by

b∗ =σ∗+ V3ǫ

2σ∗

1− 2r

σ∗2

, (1.34)

bδ =V0δ+ V δ

1 2

1− 2r

σ∗2

, (1.35)

aǫ = V ǫ

3

σ∗3, (1.36)

aδ = V δ

1

σ∗2. (1.37)

The coefficients b∗ and aǫ are due to the fast volatility factor, while the coefficients

bδ and aδ are due to the slow volatility factor, which becomes more important for large

maturities. If we ignore the slow scale, then the implied volatility can be approximated by

I ≈b∗+aǫ(LMMR), (1.38)

which corresponds to assuming δ= 0. On the other hand, if we assume ǫ= 0, then

I ≈σ∗+bδτ+aδ(LM), (1.39)

where we denote LM = τ(LMMR), the log-moneyness. The estimated parameters for

Equations (1.32), (1.38) and (1.39) will be presented in Section 2.3. In Section ??, we

show that these same parameters are exactly those needed to price exotic derivatives.

Thus, in the regime whereǫandδ are small, corresponding to stochastic volatility models

1.3

Numerical Results

In this section, we briefly describe the dataset that will be used in this paper and the numerical results of our analysis. First, we present the results related to the dynamics of the volatility and price processes of the S&P 500 index. Second, we report the results related to the calibration of the two-scale stochastic volatility model using option data on the S&P 500 index. Finally, we present a numerical experiment using synthetic data and apply the framework developed in this paper to price exotic options.

1.3.1

Data Description

We are interested in estimating the rates of mean-reversion of the S&P 500. In order to find the scale on the order of days, we use high frequency, 1-min data, from October 23, 2014, to October 23, 2015. To extract the fast scale, we average the data over 5-min intervals so that we have 72 data points per day. We collapse the time by eliminating overnights, weekends and holidays, so that we have 252 trading days with 18,072 data points per year. To estimate the time scale on the order of months, we use daily closing prices from January 02, 1980, to October 23, 2015. In this case, we average the data over 5-day intervals so that we have 50 data points per year.

To perform the fitting procedure described in Section 1.2.4, we use options data on

the S&P 500 on November 03, 2015, obtained from the Bloomberg database. Our dataset contains S&P 500 index option quoted bid-ask prices, implied volatilities, and contract details such as strikes and expiration dates. We shall present results based on European call options, taking the average of bid and ask quotes to be the current price. Through-out the empirical analysis, we will restrict ourselves to options between 0.95 and 1.05 moneyness so as to be on the safe side of liquidity issues.

In order to remove inconsistencies and unreliable entries, we roughly follow the

data-cleaning procedure described inFouque, Papanicolaou, Sircar, and Solna(2011). We filter

bid quotes less than $0.50 and options with no implied volatility value. We also remove the implied volatilities with the shortest maturity from our dataset (21 days). To smooth the jump between the implied volatility curves coming from calls or puts with the same

maturity, we follow the general procedure described in Figlewski (2009), blending the

implied volatility values for options with strikes between certain cutoffs L and H, with

L < H. We chooseL= 0.95 andH = 1.05. For strikes less thanL, we use only puts; for

strikes greater than H, we use only calls; and for strikes betweenL and H, we blend the

1.3.2

Mean-Reversion Rates and Block Bootstrap

In a previous study,Fouque, Papanicolaou, Sircar, and Solna (2003a) identified a fast

rate of mean-reversion for the returns’s volatility of the S&P 500 index. Empirical evidence also show that the S&P 500 index exhibits long memory, for example, the reader can refer toChronopoulou and Viens(2012). In this context, our goal in this subsection is to verify whether the volatility of the S&P 500 index is driven by two factors simultaneously: one factor mean-reverting on a short scale and the other on a long scale.

At this point, based on the procedure described in Section 1.2.3, we employ the

vari-ogram to estimate the rates of mean reversion of the volatility: 1/ǫ and δ.4 To do that,

we fit the variogram given by Equation (1.24) by solving the following nonlinear weighted

least-squares problem:

min

θ X

j ωj

VjN −Vj(θ) 2

, (1.40)

where θ = (γ, νY, νZ, α, δ)′ is the vector of parameters to be estimated. We choose ωj as

theCressie(1985)’s weights, which are given by an approximation for the variance ofVN j :

ωj =

1

Var(VN

j ) ≈ Nj

[Vj(θ)]2

. (1.41)

Note that the Cressie’s weights put the highest emphasis on variogram estimates that

are based on a large number of points (where Nj is large) and on values near j = 0

(where Vj(θ) is small). In Figure 1.1, we present the empirical and the fitted variogram

for the S&P 500, using the discrete model described in Section 2.2. The dashed line is

a fitted exponential obtained by nonlinear weighted least-squares regression. It is worth

mentioning that, if the variograms in Figure1.1 were flat, we would conclude there is no

fast and/or slow time scale on the S&P 500 index.

To obtain the sample distribution of the estimated parameters, we bootstrap the pairs of residuals of the nonlinear regressions solved to obtain the variograms given by Equations

(1.27) and (1.28). We use the circular block bootstrap ofPolitis and Romano(1992), with

10,000 bootstrap samples. The block size was chosen according to the procedure

devel-oped by Politis and White (2004). Table 1.1 presents the estimated values and standard

deviations for the parameters, as well as the 95% bootstrapped confidence interval. The

4

days

0 2 4 6 8 10 12 14 16

0 0.2 0.4 0.6 0.8

Empirical Variogram Fitted Variogram

years

0 5 10 15 20 25

0 0.2 0.4 0.6 0.8 1 1.2

Empirical Variogram Fitted Variogram

Figure 1.1: The empirical variogram for the S&P 500 volatility process

sample distribution of the estimated parameters is shown in Figure 1.2.

Table 1.1: Summary statistics of the estimates of the model variogram (1.26).

Parameter Estimate Mean Std Dev 95% Confidence Interval

LB UB

γ 0.4643 0.4614 0.0233 0.4128 0.4998

νY 0.4752 0.4783 0.0199 0.4417 0.5174

1/ǫ 0.2860 0.2933 0.0600 0.1908 0.4240

νZ 0.3158 0.3091 0.0186 0.2690 0.3421

δ 0.7114 0.7321 0.3104 0.2775 1.2590

Note: This table presents the summary statistics of the estimated parameters of the S&P

500 variogram given by Equation (1.26). The parameters were estimated by using weighted least-squares regression. We fit Equation (1.27) using 5-min data and Equation (1.28) using 5-day data simultaneously by performing the procedure described in Section1.2.3. The mean, standard deviation, and 95% confidence interval of each parameter were obtained by using a circular block bootstrap with 10,000 bootstrap samples. LB indicates the lower bound of the confidence interval, whereas UB indicates the upper bound.

In Table 1.1, observe that the estimate of the fast time scale, 1/ǫ, is 0.286, with

standard deviation equal to 0.023, meaning an average decoupling time of 3.497 days,

with a 95% confidence interval [2.358,5.241]. The estimated slow time-scale, δ, is 0.711,

which corresponds to a mean-reversion time of 16.868 months, with a confidence interval

[9.531,43.243]. Notice that these speeds of mean reversion indicate that the S&P 500

volatility process is driven by a fast reverting diffusion and a slowly varying

mean-reverting process. The volatility of the invariant distribution of the OU process Y was

estimated to be 0.475, while the volatility of the OU processZ was estimated to be 0.316.

Note the oscillatory nature of the variograms in Figure 1.1. This characteristic is

related to intra-day variation of volatility, and this was already noticed in Fouque et al.

(2000). For a discussion of this cycles from an implicit-volatility viewpoint, see Fouque

et al.(2004).

1.3.3

Calibration Results

In this section, we report the results of the calibration of the group market parameters to the market implied volatility data on a specific day, following the procedure outlined in Section 2.4. Our goal is to demonstrate the improvement in fit of the models’s predicted

.

0.38 0.4 0.42 0.44 0.46 0.48 0.5 0.52

Frequency

0 100 200 300

8Y

0.4 0.45 0.5 0.55

Frequency

0 100 200 300

1/0

0.1 0.2 0.3 0.4 0.5 0.6

Frequency

0 100 200 300 400

8Z

0.2 0.25 0.3 0.35 0.4

Frequency

0 100 200 300 400

/

0 0.2 0.4 0.6 0.8 1 1.2 1.4

Frequency

0 200 400 600

Figure 1.2: Bootstrap distributions of the sample parameters

In order to do that, we consider three different models:

• Model 1: in this model, we assume that the volatility is driven by a single

mean-reverting OU process, Zt, fluctuating on a slow time scale;

• Model 2: at the opposite extreme, in this model we assume that the volatility process

is only driven by a fast mean-reverting OU process, Yt;

• Model 3: in this model, we assume that the volatility is driven by two different

factors, one fluctuating on a fast time scale, Yt, and a other fluctuating on a longer

time scale, Zt.

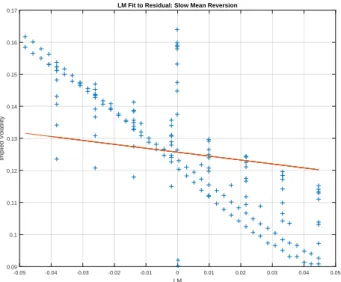

We first look at the performance of Model 1, which considers only a slow volatility

factor. In Figure 1.3a, we show the results of the calibration using only the slow-factor

approximation given by Equation (1.39), which corresponds to assuming ǫ = 0. In line

with the findings of Fouque, Papanicolaou, Sircar, and Solna (2011), we observe that

Model 1 fails to capture the range of maturities. In Figure1.3b, we look at the performance

of Model 2, which uses only the fast-factor approximation given by Equation (1.38).

Again, note that Model 2 fails to capture the range of maturities.

Finally, in fitting the Model 3, which uses the two-factor volatility approximation

(1.32), we follow the two-step procedure of Fouque, Papanicolaou, Sircar, and Solna

(2011). First, we fit the skew to obtain ˆai and ˆbi for different maturities τi. In the

second stage, these estimates are then fitted to an affine function of τ to give estimates

of b∗, bδ, aǫ, and aδ. A plot of this second term-structure fit on November 03, 2015, is

shown in Figure1.4a along with the calibrated multiscale approximation (1.32) to all the

data on November 03, 2015 in Figure1.4b.

In Figure 1.4b, note that the ability of Model 3 to capture the range of maturities is

much improved when compared to Models 1 and 2. Thus, the two-scale volatility model with its additional parameters performs better than either of the one-scale models.

Table1.2 reports the estimated parameters of the correction to the Black-Scholes price

for each one of the three models presented in this section. Observe that in the regime

where our approximation is valid, the parameters aǫ,aδ, andbδ are expected to be small,

while b∗ is the leading-order magnitude of volatility. The first parameter, σ∗, can be

interpreted as an indicator of the “average” S&P 500 volatility level. Here,r is the

risk-free rate, which we assume to be known and constant. Throughout our analysis, we use

r= 0.34%, which is the value of the interest rate released by the Federal Reserve (FED)

LM

-0.05 -0.04 -0.03 -0.02 -0.01 0 0.01 0.02 0.03 0.04 0.05

Implied Volatility

0.09 0.1 0.11 0.12 0.13 0.14 0.15 0.16

0.17 LM Fit to Residual: Slow Mean Reversion

(a) τ-adjusted implied volatility I −bδτ.

LMMR

-0.4 -0.3 -0.2 -0.1 0 0.1 0.2 0.3 0.4

Implied Volatility

0.08 0.1 0.12 0.14 0.16 0.18

0.2 Pure LMMR Fit: Fast Mean Reversion

(b) S&P 500 implied volatilities.

Figure 1.3: Data and calibrated fit on November 03, 2015.

In Figure (a), we plot the maturity adjusted implied volatility as a function of the log-moneyness, LM. The plus signs are from S&P 500 data and the lineσ∗+aδ(LM) shows the result using the estimated parameters from only a slow factor fit. In figure (b), we present the S&P 500 implied volatilities as a function of the LMMR. The plus signs are from S&P 500 data, and the line

= (years)

0 0.5 1 1.5 2 2.5

a

-0.6 -0.5 -0.4 -0.3 -0.2

-0.1 a = a

0

+ a/ =

= (years)

0 0.5 1 1.5 2 2.5

b

0.12 0.13 0.14 0.15 0.16 0.17 0.18

0.19 b = b

$ + b/

=

(a) Term-structure fits.

LMMR

-0.4 -0.3 -0.2 -0.1 0 0.1 0.2 0.3 0.4

Implied Vol

0.06 0.08 0.1 0.12 0.14 0.16 0.18

0.2 Fitted Surface and Data

(b) Data and calibrated fit.

Figure 1.4: Data and calibrated fit on November 03, 2015 (slow scale).

LMMR

-0.5 0 0.5

Implied Vol

0.05 0.1 0.15

0.2 45 days

LMMR

-0.5 0 0.5

Implied Vol 0.08 0.1 0.12 0.14 0.16

0.18 73 days

LMMR

-0.2 0 0.2

Implied Vol

0.1 0.12 0.14 0.16

0.18 108 days

LMMR

-0.2 0 0.2

Implied Vol

0.1 0.12 0.14 0.16

0.18 136 days

LMMR

-0.1 0 0.1

Implied Vol

0.12 0.14 0.16

0.18 226 days

LMMR

-0.05 0 0.05 0.1

Implied Vol 0.13 0.14 0.15 0.16 0.17

0.18 318 days

LMMR

-0.05 0 0.05

Implied Vol 0.14 0.15 0.16 0.17 0.18

0.19 409 days

LMMR

-0.05 0 0.05

Implied Vol

0.15 0.16 0.17 0.18

0.19 444 days

LMMR

-0.05 0 0.05

Implied Vol

0.16 0.17 0.18

0.19 591 days

LMMR

-0.02 0 0.02 0.04

Implied Vol

0.16 0.17 0.18 0.19

0.2 773 days

Figure 1.5: Implied volatility fit of S&P 500 index options on November 03, 2015.

Table 1.2: Estimated values of the group market parameters

σ∗ aǫ aδ b∗ bδ V0δ V1δ V3ǫ

Model 1 0.1257 -0.1223 0.0308 0.0313 -0.0019

Model 2 0.1434 -0.1192 0.1426 -0.0004

Model 3 0.1318 -0.1383 -0.2049 0.1311 0.0274 0.0285 -0.0035 -0.0003

Note: In this table, we report the estimated parameters from the fit of implied volatilities

to log-moneyness to maturity ratio for Models 1 to 3 on November 03, 2015. For Models 1 and 2, we fit respectively Equations (1.38) and (1.39) to data using ordinary least-squares regression. The estimated parameters for Model 3 result from the fit of Equation (1.32) to data following the 2-step procedure suggested by Fouque, Papanicolaou, Sircar, and Solna

(2011). The last three columns were obtained through the inversion of Equations (1.34) to (1.37).

To measure the quality of the price forecasts, we use the root mean square error

(RMSE). Table1.3reports the RMSE for Black-Scholes prices and total (corrected) prices.

Panel A reports the RMSE for Black-Scholes prices obtained by using the volatilities

derived from each stochastic volatility model (Models 1 to 3).5 Panel B presents the

RMSE between total prices and observed prices. Among all the alternative models, the one that achieves the smallest RMSE is the Black-Scholes Model 2. Overal, there is no model that dominates the others in terms of RMSE.

In Table1.4, we present the average ratio between the correction termP1 and the total

price P∗ given in Equation (1.20), in percentage terms. Note that the correction is, in

average, greater than 8% of the total price for all the models considered, indicating that for a market maker, for instance an investment bank, a robust model that accounts for volatility randomness should be considered in order to price and hedge European options.

5

Table 1.3: Root mean square error (RMSE)

Call Put

Panel A: RMSE of Black-Scholes prices

BS Model 1 10.8640 28.4907

BS Model 2 9.4018 30.3767

BS Model 3 9.7651 34.9973

Panel B: RMSE of corrected prices

Model 1 10.1323 28.7596

Model 2 18.0968 15.7600

Model 3 18.6714 15.1292

Note: This table presents the root mean square error (RMSE) between estimated prices and observed prices. Panel A reports the RMSE between Black-Scholes prices and observed prices when Black-Scholes prices are estimated by using the volatilities derived from each model of first-order correction. Panel B presents the RMSE between final prices (corrected) and observed prices.

Table 1.4: Ratio between the correction term P1 and the total price P∗

Call Put

Model 1 19.7600 8.6089

Model 2 9.5989 12.9864

Model 3 63.9428 19.3682

Note: This table presents the ratio between the correction term P1 and the total price P∗

given in Equation (1.20). All values are reported in percentage terms.

1.3.4

Numeric Examples

The goal of this section is to present a numerical experiment using synthetic data (i.e.,

synthetic option prices) in order to show the validity of the asymptotic theory ofFouque,

We will denote asN∗ the true number of volatility scales that generate the data, while

N will be the value with which we do the estimation. In this paper, we will generate

synthetic data assuming that N∗ = 2 under five possible parameter settings. Relevant

parameters and functions for the two-factor stochastic volatility model (1.3) are specified

in Table 1.5. Most parameters are chosen roughly as the same order as found in Fouque

and Han (2004), and instant correlation coefficients ρ1 and ρ2 are chosen to be negative.

The volatility risk prices Λ1 and Λ2 are chosen as zeros for simplicity. The volatility

functionf is chosen as a cut-off exponential function, which is referred as a log-AR type

model in econometric literature. Initial conditions and option parameters are also given

in Table 1.5. The price computations will be done with various values of the time scales

parametersα ≡1/ǫ and δ.

In the estimation, we will useN = 1 (Model 1 and Model 2) or N = 2 (Model 3). For

each combination of input parameters we generate 1500 sample paths for the returns and

volatilities by using the stochastic volatility model (1.3). Each path is simulated for 5000

periods by using an Euler scheme with time-step size ∆t = 10−4. To generate a

cross-section of options prices, we consider options with maturities that range from 2 months

up to 36 months (τ ∈ {2,3,6,12,18,24,36}). For each maturity, we simulate option

prices for 21 different strike prices. Here, strike prices are chosen so that the moneyness

is between 0.95 and 1.05, i.e., K ∈ [0.95S0,1.05S0], where S0 is the initial price of the

underlying. Thus, our final dataset will be composed by 147 option prices.

Table 1.5: Parameters and initial conditions used in the two-factor stochastic volatility

model (1.3).

r my mz νy νz ρ1 ρ2 ρ12 Λy Λz f(y, z) Y0 Z0 S0

0.1 -0.8 -0.8 0.5 0.8 -0.02 -0.2 0 0 0 exp(y+z) -1 -1 55

In Table 1.6, we present the RMSE for Black-Scholes prices and final prices. Panel

A reports the RMSE for Black-Scholes prices obtained by using the volatilities derived from each model of first-order correction. Panel B presents the RMSE between final prices (corrected) and “true” prices. True prices are obtained as a result of Monte Carlo

simulations with 1500 sample paths generated for each set of parameters. In Table 1.7,

we present the average ratio between the correction termP1 and the total priceP∗ given

in Equation (1.20), in percentage terms.

In Table 1.6, note that the RMSE of all models decrease from regime (1) through

Table 1.6: Root mean square error (RMSE)

Call Put Call Put Call Put Call Put Call Put

(1) α= 100, δ= 0.01 (2) α= 50, δ= 0.05 (3) α= 20, δ = 0.1 (4)α= 10, δ= 0.1 (5) α= 5, δ= 1

Panel A: RMSE of Black-Scholes prices

BS Model 1 2.1727 3.3384 1.6911 2.3190 1.3232 1.3786 1.1821 0.8771 1.3720 1.1163 BS Model 2 2.8808 3.1327 2.3107 2.1525 1.8103 1.2445 1.5545 0.7886 1.8427 1.0008 BS Model 3 2.4028 3.3524 1.8757 2.3734 1.4728 1.3974 1.2955 0.8814 1.5339 1.0833

Panel B: RMSE of corrected prices

Model 1 2.0281 3.5910 1.8645 2.3272 1.5350 1.3072 1.2869 0.8417 1.5181 1.0767 Model 2 2.4438 3.0054 1.9439 2.0148 1.4785 1.1618 1.2265 0.7684 1.4424 0.9628 Model 3 2.1615 3.9698 2.0887 2.4612 1.6309 1.3309 1.2766 0.8240 1.5325 1.0286

Note: This table presents the root mean square error (RMSE) between estimated prices and true prices. Panel A reports the RMSE between

Black-Scholes prices and observed prices when Black-Scholes prices are estimated by using the volatilities derived from each model of first-order correction. Panel B presents the RMSE between final prices (corrected) and observed prices.

Table 1.7: Ratio between the correction term P1 and the total price P∗

Call Put Call Put Call Put Call Put Call Put

(1)α = 100, δ= 0.01 (2) α= 50, δ= 0.05 (3) α= 20, δ = 0.1 (4) α= 10, δ = 0.1 (5) α= 5, δ = 1

Model 1 78.3991 26.8277 29.4919 23.1520 14.3242 19.0513 8.1298 13.1969 10.6647 14.9557 Model 2 12.2209 17.1074 9.6905 48.6363 7.7229 24.0813 7.4471 29.3634 8.0624 25.8560 Model 3 304.4928 76.9366 101.4560 38.1709 30.8587 26.6432 14.0525 20.9301 17.3343 22.0662

Note: This table presents the ratio between the correction term P1 and the total price P∗ given in Equation (1.20). All values are reported in

percentage terms.

1.3.5

Application: Pricing an Exotic Derivative

In this section, we present an application of the model for pricing a binary or digital

option with no exercise option, using the calibration obtained in Section1.3.3 for options

in and close to the money.

Consider a cash-or-nothing call that pays a fixed amount Q on the dateT if XT > K,

and zero otherwise. Its payoff function is

h(x) = Q1{x>K}, (1.42)

where1A is the indicator function of a set A.

According to the perturbation theory developed in Fouque, Papanicolaou, Sircar, and

Solna(2011), the stochastic volatility-corrected price is given by

˜

P(t, x, z) = P0(t, x, z) +P1(t, x, z) =Qe−r(T−t)N(d2) +P1(t, x, z), (1.43)

where

P1(t, x, z) = (T −t) V0δ

∂ ∂σ +V

δ

1D1

∂ ∂σ

!

+V3ǫD1D2

!

PBS∗ , (1.44)

and P∗

BS =Qe−r(T−t)N(d2).

1.4

Concluding Remarks

In this paper, we present an empirical study of the American equity market, adopting

three specifications of the stochastic volatility model proposed inFouque, Papanicolaou,

and Sircar (2000). The main idea of this asymptotic model is to use perturbation tech-niques to correct constant volatility models in order to capture the effects of stochastic volatility. From the theoretical viewpoint, the model is consistently built under the as-sumptions of no-arbitrage and of the appearance of large and small time scales in the stochastic volatility models. From the practical viewpoint, it is parsimonious and easy to calibrate.

FollowingFouque, Papanicolaou, and Sircar (2000), we derive a first-order asymptotic

In the first part of our empirical study, we used S&P 500 data to show that the volatility

process of this index is driven by two diffusions: one fast mean-reverting,Yt, and one slow

mean-reverting,Zt. We found a fast time scale of 3.5 days, and a slow time scale of 16.9

months. These time-scales are statistically significant, and therefore cannot be ignored in option pricing and hedging. Thus, we can conclude that the American market is under a fast mean-reverting regime, but it is also under a slow mean-reverting regime.

Finally, in order to test the robustness of these models to different specifications, we simulate options prices using Monte Carlo simulations. We assume that the true volatility is driven by two diffusions. After that, we derived three different first-order price approximations. We did not find any evidence that these asymptotic models perform better, in terms of RMSE, than the Black-Scholes model.

However, there are many possible limitations in our analysis. First, we did not use any variance reduction technique in the Monte Carlo simulations. Second, due to computa-tional issues, we simulated a small number trajectories in our numerical exercise. Finally, we did not compare the performance of these models with other models typically used in the literature, like the Heston model, for instance.

Although theFouque, Papanicolaou, Sircar, and Solna(2011)’s models do not perform

well in terms of RMSE between corrected prices and true prices, our paper is the first

one to test the performance of three different specifications of theFouque, Papanicolaou,

Sircar, and Solna (2011)’s models. This paper gives one possible direction for further research on the improvement of these asymptotic models.

Appendix

1.A

Properties of the Variogram Estimator

In this section, we will study some properties of the variogram estimator given by

Equation (1.26). In order to do that, consider the following lemmas:

Lemma 1. Let s < t, then

Eh(Yt−E[Yt]) (Ys−E[Ys]) i

=νY2e−α(t−s)1−e−2αs, (1.45)

Eh(Zt−E[Zt]) (Zs−E[Zs]) i

Proof.

Eh(Zt−E[Zt]) (Zs−E[Zs]) i

=E νY

√

2α

Z t

0 e

−α(t−u)dW(1)

u νZ √

2α

Z s

0 e

−α(s−u)dW(1)

u

= 2ανY2e−α(t+s)E

Z t

0 e

αudW(1)

u

Z s

0 e

αu)dW(1)

u

= 2ανY2e−α(t+s)E

Z s

0 e

αudW(1)

u

Z s

0 e

αudW(1)

u +

+ 2ανY2e−α(t+s)E

Z t s e

αudW(1)

u

Z s

0 e

αudW(1)

u

= 2ανY2e−α(t+s)E

Z t

0 e

αudW(1)

u

Z s

0 e

αudW(1)

u

= 2ανY2e−α(t+s)E

Z t

0 e

αudW(1)

u 2

= 2αν2

Ye−α(t+s)E Z t

0 e

2αudt2

=νY2e−α(t+s)(e2αs−1)

=νZ2e−δ(t−s)1−e−2δs.

Similarly, we can get (1.45).

By using the previous Lemma, we can conclude that

Ehlogf1( ¯Yj) logf1( ¯Y0)

i

≈νY2e−αj∆t,

Ehlogf1( ¯Y)2

i

≈νY2.

(1.47)

Similarly, we have

Ehlogf1( ¯Zj) logf1( ¯Z0)

i

≈νZ2e−αj∆t,

Ehlogf1( ¯Z)2

i

≈νZ2, (1.48)

where ¯Y and ¯Z denote the asymptotic distributions of the OU processes given by (1.1).

Lemma 2. For the model presented in this paper, if s < t, then

Eh(Yt−E[Yt]) (Zs−E[Zs]) i

= 2

√ α√δ

α+δ ρ˜12νYνZ

e−α(t−s)−e−αte−δs. (1.49)

Otherwise, if s > t,

Eh(Yt−E[Yt]) (Zs−E[Zs]) i

= 2

√ α√δ

α+δ ρ˜12νYνZ

Proof. Suppose thats < t, then

Eh(Yt−E[Yt]) (Zs−E[Zs]) i

=E νY

√

2α

Z t

0 e

−α(t−u)dW˜(1)

u νZ √

2δρ˜12

Z s

0 e

−δ(s−u)dW˜(1)

u

+E νY

√

2α

Z t

0 e

−α(t−u)dW˜(1)

u νZ √

2δ√1−ρ˜12

Z s

0 e

−δ(s−u)dW˜(2)

u

=E νY

√

2α

Z s

0 e

−α(t−u)dW˜(1)

u νZ √

2δρ˜1,2

Z s

0 e

−δ(s−u)dW˜(1)

u

+E νY

√

2α

Z s

0 e

−α(t−u)dW˜(1)

u νZ √

2δ√1−ρ˜12

Z s

0 e

−δ(s−u)dW˜(2)

u

=√2ανY

√

2δνZρ˜12e−αte−δs

Z s

0 e

(α+δ)udu

= 2

√ α√δ

α+δ νYνZρ˜12e

−αte−δs

e(α+δ)s−1

= 2

√ α√δ

α+δ ρ˜12νYνZ

e−δ(s−t)−e−αse−δt.

By following Fouque, Papanicolaou, Sircar, and Solna (2011) and using the previous

Lemma, we get

Ehlogf1( ¯Y) logf2( ¯Z)

i

≈ 2 √

α√δ

α+δ ρ˜12νYνZ, (1.51)

Ehlogf1( ¯Yj) logf2( ¯Z0)

i

≈ 2 √α√δ

α+δ ρ˜12νYνZe

−αj∆t, (1.52)

Ehlogf1( ¯Y0) logf2( ¯Zj)

i

≈ 2 √α√δ

α+δ ρ˜12νYνZe

−δj∆t. (1.53)

Proposition 1.

En(Fn+j−Fn)2 o

≈2c2Y + 2νY2(1−e−αj∆t) + 2νZ2(1−e−δj∆t)+

+4

√α√δ

α+δ ρ˜12νYνZ

2−e−αj∆t−e−δj∆t.