DISCLAIMER AT THE END OF THE DOCUMENT Mota-Engil 1/51

SEE MORE INFORMATION AT WWW.FE.UNL.PT

Sof

ia

A

lex

andra

Duarte A

nt

un

es

M

st16

0

00

12

7

@

fe.

u

nl.pt

Advi

so

r:

R

os

ár

io An

dr

é

Jun

e

2010

Mota

-Engil

Divestme

nt Opp

ort

u

nity

Rep

o

rt

This report points out a brief description of a well-known group, whose activities are spread in 19 countries, from an internal as well as external view. Its main business areas are Engineering & Construction, Environment & Services as well as Transport Concessions. Furthermore, the market was also relevant to be analyzed to contextualize the company in its proper markets and industries with its competitors in order to find opportunities of development or divestments to be made for the improvement of the company, to create value for its shareholders, adding value for the company as a whole.

Mota-Engil

Construction & Materials

Private and Confidential Mota-Engil | Table of Contents 2/51

Table of Contents

Table of Contents ... 2

Executive Summary... 3

Mota-Engil Overview ... 4

Mota-Engil Business Portfolio ... 5

Contribution per Business Unit ... 8

Competitive Advantages in Each Business Unit ... 11

Mota-Engil Presented Strategic Plan ... 12

Market Analysis – per Business Unit ... 14

Market Characteristics, Value and Trends ... 15

Main Players ... 22

Success Conditions and Growth Opportunities ... 24

Divestment Opportunity ... 27

Proposed Divestment Transaction (Buyer and Seller Perspective) ... 27

Target Company Overview ... 30

Success Conditions of the Transaction ... 32

Valuation of Proposed Divestment Transaction ... 32

Considerations on the Negotiation Process ... 33

Appendices ... 35

Mota-Engil Valuation ... 35

Mota-Engil Proforma Financials... 41

Martifer Valuation ... 43

Private and Confidential Mota-Engil | Executive Summary 3/51

Executive Summary

On request of Mota-Engil board of directors, this paper is the result of an analysis on the viability of a divestment in Martifer stake.

The divestment would result in the sale of 37,5% of Martifer (total stake owned by Mota-Engil), which can be interpreted as a divestment in participations in non core activities. Mota-Engil activities are related to Engineering and Construction, Environment and Services and Transport Concessions, while Martifer business areas are Metallic Construction, Energy Systems, and Electricity Generation through Renewables. Excluding Metallic Construction there is no apparent connection in terms of synergies presented between these companies. Moreover, as business areas are really different from the ones of Mota-Engil it is difficult to influence its long-term strategy. That is, this is a divestment in an area in which Mota-Engil does not have a big influence in operational terms (its expertise and know-how are just more connected with Metallic Construction with which there are some synergies).

Consequently, there must be an industrial player in the market that gives more value and increases its own company valuation, through synergies with this one. It can be in a position of high understanding of Martifer businesses and it can have Human Resources, in number and competence, which bring additional values to the recent business areas, leading them to optimal ones. New projects require good leadership and projects coordination. Otherwise, they can become value destructive. The buyer can also achieve a strong market share, economies of scale and scope (operational) and strategic goals in terms of growth with this takeover.

The transaction make sense for Mota-Engil if it must be, at least, 3,13€ per share, but this value is above actual market price. Economic agents are putting a high risk premium in the stock at the moment. However, when during the year it achieves the previous value or a higher one the participation can be sold, as an all, through an IPO, according to the rules of CMVM for this transaction.

In numerical terms, this sale of Martifer stake brings € 51,83 millions as a transaction gain to

Private and Confidential Mota-Engil | Mota-Engil Overview 4/51

59,70% 5,36%

5,06% 29,88%

Capital Structure

Mota Family

Company -Owned Shares

Private Holding

Free Float

Figure 1: Mota-Engil Capital Structure

Source: Mota-Engil Report 2009

Mota-Engil Overview

Mota-Engil is a multinational, multi-services group with a proper strategy at a national and international level, being its businesses present in nineteen countries through branches and subsidiaries. Its main objective is to be market leader in every business area in which it acts in the national market.

This Mota-Engil Group was founded in 2000, from the merger of Mota & Companhia, S.A. and Engil – Sociedade de Construção Civil, S.A.. Two years later, this previous process starts having its main effects with the growing of this Portuguese biggest construction company (the highest

business volume, approximately € 890 millions) and, onwards, its diversification strategy was intensified, whose major emphases was on Environment and Services as well as Transport Concessions.

The entrance in the Euronext Lisbon Index, in PSI-20, occurred in 2005 with the objective of gaining visibility, stability and potentiality of share appreciation (not happening in 2009 having, indeed, the worst performance in the PSI-20 Index), moreover, opening horizons for growth and investment attraction with the access of long term capitals for a possible company recapitalization.

Some recognition has been attested to the Group, by the market and even by some stakeholders, through the award of a reasonable number of prizes and diverse recognitions due to the quality / excellence of the services that Mota-Engil provide in its sectors and its contribution to the national economy and to the projection of the image of

Portuguese companies around the world. For example, Vasco da Gama Bridge was an emblematic work.

There is stability in the shareholders structure. It’s a familiar, 64-year-old-company which allows consistency in the strategy. Moreover, Mota-Family was presented in bringing capital to the company in the past. In terms of private holding part, it can be sold in a near future to Mota-Family or attributed to other banks to sell that part (brokerage) because that actual vehicle is managed by Banco Privado Português, a bank in dissolution. So it is difficult to continue sustaining it (constituted by participations in Mota-Engil, Cimpor and Hamburg port).

Private and Confidential Mota-Engil | Mota-Engil Overview 5/51 Mota-Engil, SGPS,

S.A.

Engineering & Construction

Environment & Services

Transport Concessions

Metallic Construction Energy Systems

Electricity Generation

(Martifer Group)

Tourism

(Amarante)

Shared Services Figure 2: Group Structure

Mota-Engil Business Portfolio

Mota-Engil Group structure includes Engineering and Construction, Environment and Services and Transport Concessions as the main three business areas. However, despite being different, they are correlated among each other. There are synergies, for instance: Engineering and Construction and Environment and Services (waste and multiservices) deals with municipal councils, as clients, which sometimes imply cross-selling projects; in Engineering and Construction more than half of the order backlog in Portugal and in Poland involves also Transport Concessions (greenfield projects). With Martifer, a Mota-Engil subsidiary that operates in the industry and energy sector, it keeps a strategic partnership. In the field of tourism, it keeps some activities in the sports and leisure and the hotels and restaurants sectors.

Mota-Engil has its businesses internationalized, operating in the Portuguese-speaking countries of Africa (with the biggest emphases to Angola), in Central and Eastern Europe and in some countries of the American continent, such as Mexico, Brazil, Peru.

The following chart summarizes the fields of work in which they are engaged per business unit. Figure 3: Chart of business areas

Engineering & Construction (E&C)

All its activities in this unit are presented not only in Portugal but also in Spain, Ireland, Central and Eastern Europe (Poland, Romania, Hungary, Czech Republic, Slovakia), Africa (Angola, Cape Verde, Sao Tome e Principe, Mozambique, Malawi) and America (USA, Peru, Mexico, Brazil). Its market share as an all is between [3%, 5%], being market leaders in Portugal.

Engineering & Construction

Infrastructures Railways Real Estate Specialized Sections

Environment & Services

Waste Water Ports & Logistics

Multi-Services

Transport Concessions

Motorways & Expressways

Railways Bridges

Metro Source: Mota-Engil

Private and Confidential Mota-Engil | Mota-Engil Overview 6/51

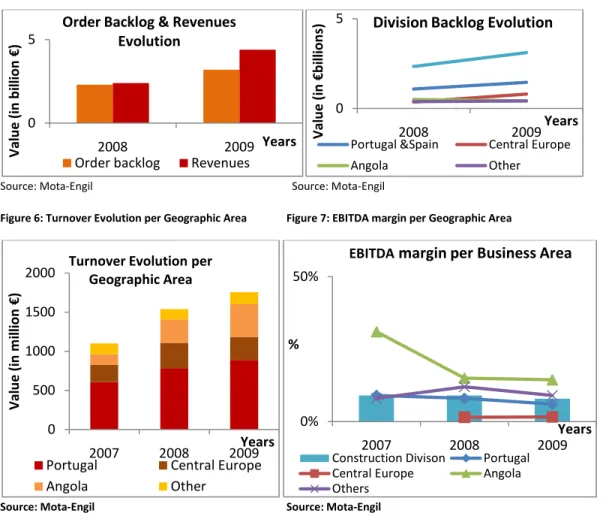

In this area the revenues and order backlog increased from 2008 to 2009. Division backlog increased in all regions, excluding Angola, but it did not imply a decrease in its turnover. EBITDA margin are being reduced.

Figure 4: Order Backlog and Revenues Evolution Figure 5: E&C Backlog Evolution per Geographic Area

Source: Mota-Engil Source: Mota-Engil

Figure 6: Turnover Evolution per Geographic Area Figure 7: EBITDA margin per Geographic Area

Source: Mota-Engil Source: Mota-Engil

Mota-Engil Engineering and Construction expects to be leader in the national market (although it has leadership in civil construction and public works) and an European reference, to have an increase of its margins (EBITDA margin: 6,27% in 2007 to 10% in 2013) as well as an improvement of the EBITDA contribution .

Environment & Services (E&S)

The group has a leading position in the privatized urban waste management market as well as in the logistics and ports, through Suma (Mota-Engil subsidiary). They are not leaders in water treatment. Mota-Engil Environment and Services main aim is to be leader in all the sectors in which it works, despite being a really difficult task. This area is still in growth and there is the possibility of much more to do before being in maturity. Essentially it can be expanded in terms of business volume, order book, through internationalization and even in this national context. As far as internationalization is concerned, this May was a new reaffirmation of the area through the acquisition of 50% of the social capital of GeoVision, Soluções Ambientais e Energia of Waste

0 5 2008 2009 Va lu e (i n b il li on € ) Years Order Backlog & Revenues

Evolution

Order backlog Revenues

0 5 2008 2009 Va lu e (i n € b il li on s) Years Division Backlog Evolution

Portugal &Spain Central Europe Angola Other 0 500 1000 1500 2000

2007 2008 2009

Va lu e (i n m il li on € ) Years Turnover Evolution per

Geographic Area

Portugal Central Europe

Angola Other

0% 50%

2007 2008 2009

%

Years

EBITDAmargin per Business Area

Private and Confidential Mota-Engil | Mota-Engil Overview 7/51 Figure 8: E&S Backlog Evolution (2007 excludes ports and water concessions)

Source: Mota-Engil 0

200 400

2007* 2008 2009

Val

u

e

(i

n

€

m

il

li

o

n

s)

Years Division Backlog Evolution

Treatment, mainly working in San Paulo (Brazil), by Suma. The operation involved € 21 millions, in

a company whose business volume last year was approximately € 45 millions. However, just before this acquisition, in April there were other acquisitions: three companies in Portugal (Correia & Correia; Transporlixos; Enviroil) and one in Poland (Ekosrodowisko). According to the President of Suma, its expansion was crucial due to the “strangulation of private sector in the waste management area so there was a need to grow through new acquisitions and through international market, which represents 10% of its all actual activity”. Suma has a 50% market share in waste unit which is difficult to expand, just if there were more municipal councils privatizing the sector, which is being a slowly process. In Peru, the group increased order books after gaining, in consortium, the adjudication of the Paita Port, the second more important of the country. The modernization of the port would be via concession, and involves around 230 million dollars in 30 years. This is the major Portuguese investment in this country.

Order backlog was increasing along time.

Transport Concessions (TC)

Mota-Engil Transport Concessions anticipates being a global operator in this business unit. It has an aggressive politics in finding strategic markets and helps the strategy of growth of Ascendi. In 2009, the group turns out to be the major shareholder of LUSOPONTE with

38,02% of the company’s capital. This company has the concession of the two crossings over Tejo River until March 2030. So, its Transport Concessions in Portugal under exploration are: Concessão Norte, Costa da Prata, Beiras Litoral e Alta, Grande Porto, Grande Lisboa,LUSOPONTE and Metro Sul do Tejo. In Mexico AE Construção Perote-Banderilla is in construction and, in Brazil, Marechal Rondon Lest is being explored.

Moreover, European Accounting Court gave prior approval to the Douro Interior concession, a concession that involves the conception, construction, financing, maintenance and exploration, without toll collection, of some hauls of principal and supplementary itineraries. However, Mota-Engil consortium reduced the value of the proposal, from € 757,33 million to € 696,57 million. Anyway, it is in construction too.

The biggest sub-concession released by Estradas de Portugal, in terms of construction volume and investment, Pinhal Interior, was recently attributed to a consortium with Mota-Engil in leadership.

The investment associated was approximately € 1.429 millions and will be managed by Ascendi

Private and Confidential Mota-Engil | Mota-Engil Overview 8/51

Contribution per Business Unit

The final 2009 earnings evidences strong final results and with good prospects to remain growing, influenced by the Order Book growth, by the acquisitions in the Environment and Services area and by new developments in the Transport Concessions area. The potential of growth in this last referred to area will come from foreign economies due to the fact that the investment in motorways in Portugal is being revaluated.

The group expects to close 2010 with € 3 thousand millions in order books, supported by the international activity. Last year the group net profit doubled to € 71,7 millions, where Martifer was relevant. The operational cash-flow reduced around 2%, and this occurred because the company was not able to replicate in the last trimester of 2009 the excellent performance of the homogeneous period. Essentially the business (revenue) growth in 2009 was achieved due to the growth of approximately 15% in Engineering and Construction (while its EBITDA margin fell to 7,91% and its EBITDA grew around 3% to 134 million euros) and 17% in Environment and Services (strong improvement in the fourth quarter). Transport Concessions turnover appears to be relatively stable. The order book reached an historic maximum of € 3.600 million at the end of

December, about € 1 million above the existing one in the previous year. The company is going to distribute dividends related to the exercise of 2009 from April 30 onwards. The gross value of dividends is € 0,11 per share, the same as in the previous year, which means a dividend yield of 3,27%.

Analyzing the provenience of turnover in the total one of the company from 2007 to 2009, more than 75% of it comes from Engineering and Construction, a value that is marginally growing; less than 8% and slowly reduced in Transport Concessions; and between the interval [15%; 18%] in Environment and Services. However, looking attentively to EBITDA contribution Transport Concessions area is noted in second place of importance, just after Engineering and Construction in the last two years.

Figure 9: % Turnover Contribution per business area Figure 10: % EBITDA Contribution per business area

Source: Mota-Engil Source: Mota-Engil 0%

20% 40% 60% 80%

2007 2008 2009

%

Years Percentual Turnover Contribution

E & C E & S T C

0% 10% 20% 30% 40% 50%

2007 2008 2009

%

Years Percentual EBITDA Contribution

Private and Confidential Mota-Engil | Mota-Engil Overview 9/51 Figure 11: EBITDA Margin Evolution per Business Areas

0% 20% 40% 60% 80% 100%

2007 2008 2009

%

Years EBITDA Margin Evolution

E & C E & S T C Group Martifer

Source: Mota-Engil and Martifer reports In terms of Engineering and Construction,

on the one hand, and influenced by the currency, the performance of Eastern Europe continue to be limited. On the other hand, there was a favorable evolution in Angola, which registered a growth of around 40%, to € 421 millions. Peru, Mozambique and Malawi reduced their velocity, but their growth and margins still continued above the area average. Indeed, there was a strong turnover in all markets, excluding Central Europe. But in Portugal during the last

quarter of 2009 revenues decreased while at the same time in Central Europe it occurred the reverse, with an increase of 10%. However, this area backlog was € 3,2 billions, Portugal grew 14% last year, Central Europe turnover got € 300 millions, having a positive EBITDA. Overall, the area got positive, good results in an environment of problems in macro economy and in sector. Figure 12: E&C Geographic EBITDA Contribution for the Segment Figure 13: E&S EBITDA Evolution per Segment

Source: Mota-Engil Source: Mota-Engil

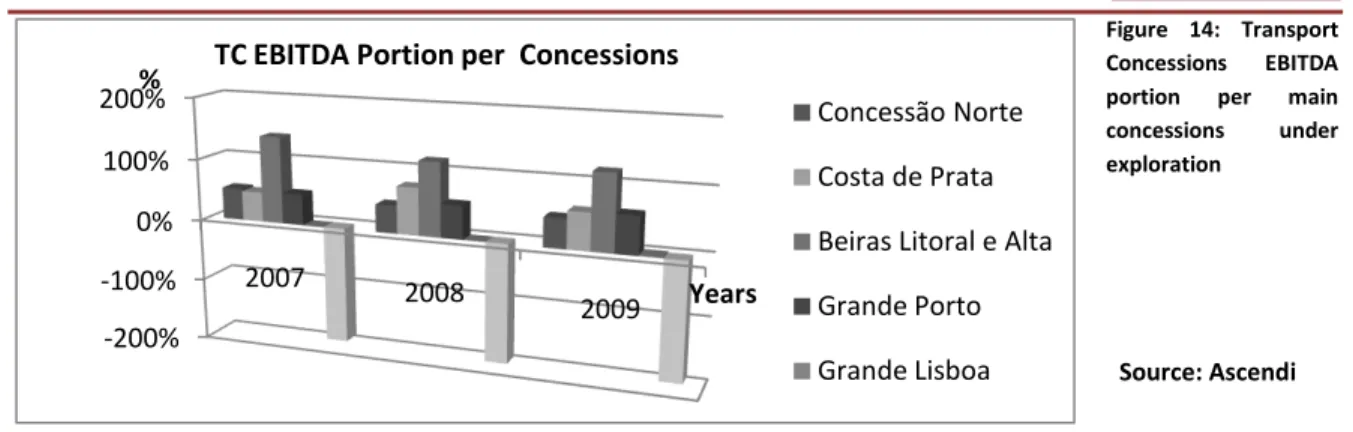

Looking carefully at Environment and Services area, it can be shown that the performance in all segments was satisfactory in the last quarter of the year. EBITDA was similar to the one verified in 2008 and this area had a backlog of 363 million euros. Multi-Services set aside a strong growth, whose EBITDA margin was 7% and logistics turnover grew 2% but at any case its EBITDA margin went down to 16%. Water business grew up its importance through Indaqua and, to finish this brief description of the division, in terms of waste business, its growth was positively influenced by the first consolidation of an Angolan subsidiary (Vista Waste) and turnover grew 11% last year. As far as Transport Concessions under exploration are concerned, the most rentable ones were the Beira Litoral e Alta and Costa de Prata, with an EBITDA in total of 121% and 76%, respectively. In absolute values, turnover was unchanged even with a decrease in Beiras Litoral e Alta that was offset by other concessions performances, such as Concessão Norte that registered a magnificent growth, for instance. Nevertheless, AADT (Annual Average Daily Traffic) still grew in all concessions explored. Its EBITDA margin was 89,3%, which was smaller than 99,8% verified in 2008.

-50% 0% 50% 100%

2007 2008

2009 %

Years E&C EBITDA Portion Evolution

per Geographic Area

Portugal Central Europe

0% 20% 40% 60%

2007 2008

2009 %

Years E&S EBITDA Portion per Segment

Private and Confidential Mota-Engil | Mota-Engil Overview 10/51 Figure 14: Transport Concessions EBITDA portion per main concessions under exploration

Continuing with the previous area it requires more debt involved, so that in 2009 invested capital in this area was € 1,362 billion, which was more than half of the global amount. Along time net debt was growing.

Figure 15: Net Debt in value per business area Figure 16: Net Debt/EBITDA per business area

Source: Mota-Engil Source: Mota-Engil

Figure 17: Invested Capital evolution per business area Figure 18: Operating Cash-Flow Evolution

Source: Mota-Engil Source: Mota-Engil

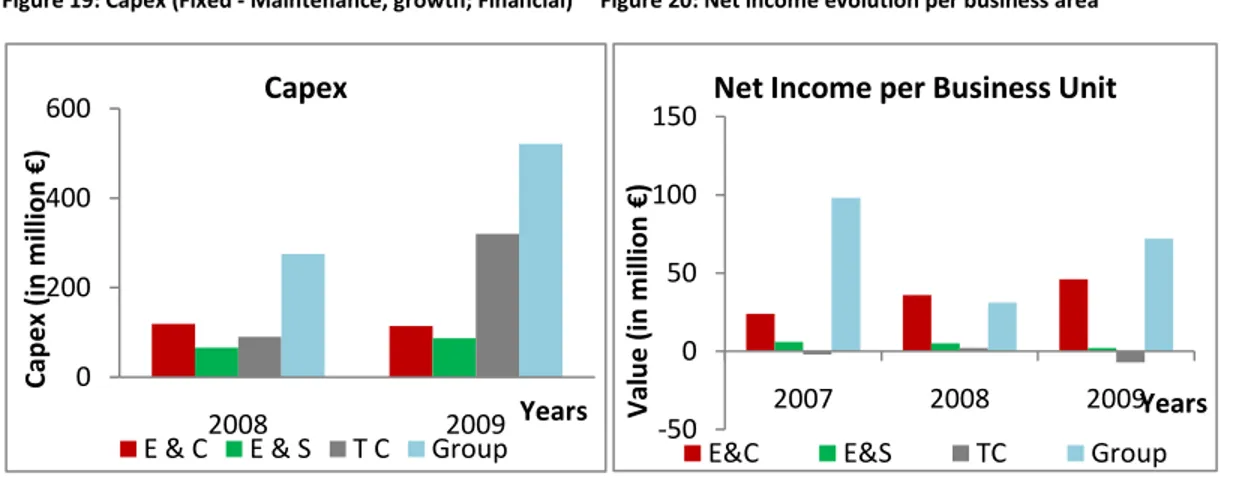

The investment in capital expenditures in 2009 was € 516 millions, from which € 86 millions was spent to reinforce the participation in Lusoponte and the remaining one majorly invested in Transport Concessions.

-2.000 4.000

2007 2008 2009

Ne t d eb t (i n m il li on € ) Years Net Debt

E & C E & S T C Group

-10,0 20,0

2007 2008 2009

N e t d e b t/ E B ITD A ( in x) Years Net Debt/EBITDA

E & C E & S T C Group

-2.000 4.000 2008 2009 In v e ste d Cap ital (i n m il li o n € ) Years Invested Capital

E & C E & S T C Group

-200 400

2007 2008 2009

Op e rating CF (i n m il li o n € ) Years Operating Cash-Flow

E & C E & S T C Group -200% -100% 0% 100% 200% 2007 2008 2009 % Years TC EBITDA Portion per Concessions

Concessão Norte Costa de Prata Beiras Litoral e Alta Grande Porto

Private and Confidential Mota-Engil | Mota-Engil Overview 11/51 Figure 19: Capex (Fixed - Maintenance, growth; Financial) Figure 20: Net income evolution per business area

Source: Mota-Engil Source: Mota-Engil

To sum up this part, it is imperative to evidence net income attributable to the group, which was

€71,738 millions in 2009. There is an increase of 134,7% compared to the year 2008. Concretely, it is vital to evidence a strong net income in Engineering and Construction and a net loss of € 7 millions in Transport Concessions. This evidences a strong evolution in an economic scenario of crisis but still bellow the expectations of numerous analysts that have put the bar at € 80 millions for that period.

Competitive Advantages in Each Business Unit

Mota-Engil Group has some competitive advantages in its sectors and this is why it is leader in most of its activities. According to a SWOT (Strengths, Weaknesses, Opportunities and Threats) analysis, some characteristics can be pointed out to the entire company as all.

Not only does the company have more than 60 years of experience but also it has a recognized original spirit in terms of construction techniques, which makes Mota-Engil Engineering responsible for running very important engineering projects, such as bridges/dams (Vasco da

Gama Bridge, for instance), highways/expressways, railways/ports/airports, canals/tunnels, sundry infrastructures in the environment, health, commerce as well as industry fields. Indeed, Mota-Engil has actually relevant strengths: versatility, quality, capacity for innovation given its large specialized skills in all areas of Engineering, then putting it in the vanguard in Portugal and in a good position for future positive developments as far as international growth is concerned. Furthermore, Environment and Services in Mota-Engil, with its diversified and large number of services, put it as a leader in Portugal in terms of privatized solid urban waste management market (Waste and Urban Cleaning Segments) and in a foremost position in the Portuguese port operations market (this company also provides complementary services in this area, that is, it gives a variety of logistic integration services and it is known as the first operator to go in the carriage of goods by the railway sector. Additionally, it has as strength the capability to bid complex projects and to get financing for them. It can withdraw non-recourse debt, which do not

0 200 400 600

2008 2009

C

ap

e

x

(in

m

il

li

o

n

€

)

Years Capex

E & C E & S T C Group -50

0 50 100 150

2007 2008 2009

Va

lu

e

(i

n

m

il

li

on

€

)

Years Net Income per Business Unit

Private and Confidential Mota-Engil | Mota-Engil Overview 12/51

create growth restrictions and have a high level of auto financing. Besides that, there are multidisciplinarity and business quality that let them have productivity and be competitive in the market. In a few words, the group has leadership, recognition in the market, technical capacity, strong presence in Angola, for instance and strategy.

About weaknesses, it can mainly be pointed out its capital structure dependence. It has high leverage ratios, shown later on. Furthermore, the company has to be careful about the evolution of its debt.

There are also opportunities to be exploited nationally, such as the requalification of towns/cities or the ones created by the construction or exploration of some infrastructures being publicly launched, capitalizing the benefits to an enforcement of the international strategy and, internationally, the big potential of transport concessions sector in Poland (as well as Central Europe as an all), the high potential of the new markets in which it is entering through new acquisitions and stable partnerships. In Portugal there are also some big projects in which Mota-Engil can take part in the future, such as the New Airport in Lisbon and ANA privatization, High Speed Railway, new road sub concessions.

Threats are obviously presented too. A change in political opinion is one that can be referred to. Furthermore, the risk that project finance stop being sustainable in the long term, which can stop financing public works due to market illiquidity or being no more viable to it. Another threat is the fact that in Angola there is almost 67% of long term debt without hedging because of the immaturity of its institutions. Moreover, there is a degree of risk to establish partnerships in other countries with companies that are not large enough or do not have special relationships with the State or are not included in the top ones for the achievement of the best projects, that is, the ones that allow the highest margins. In Portugal, the political risks of the motorways of Centre and

other large infrastructures’ projects. There are always fear about materials price plus market of construction materials, international crisis trends, the exposition of the Portuguese market of construction and, why not, Spanish companies. The last but not the least important one can be its businesses in some geographic areas in which they can get small/tiny margins due to lack of knowledge. Anyway, there are some specific risks, such as: financial risk management, interest rate risk, exchange rate risk, liquidity risk and credit risk.

Mota-Engil Presented Strategic Plan

Mota-Engil Group has some basic strategic guidelines stated in its “Ambition 2013” Strategic Plan, comprising the period: 2009-2013. Its four main pillars are sustainable growth, diversification of its businesses, internationalization as well as development of its human capital. The aim of all these items is to create value for shareholders.

Private and Confidential Mota-Engil | Mota-Engil Overview 13/51

ore manipulation. They receive cash, but they want an exchange for the project equity in a near future. There is also some interest in mini-dams, construction and mines.

Figure 21: Expected Turnover (2013) Figure 22: Expected EBITDA Margin (2013)

Source: Mota-Engil Source: Mota-Engil

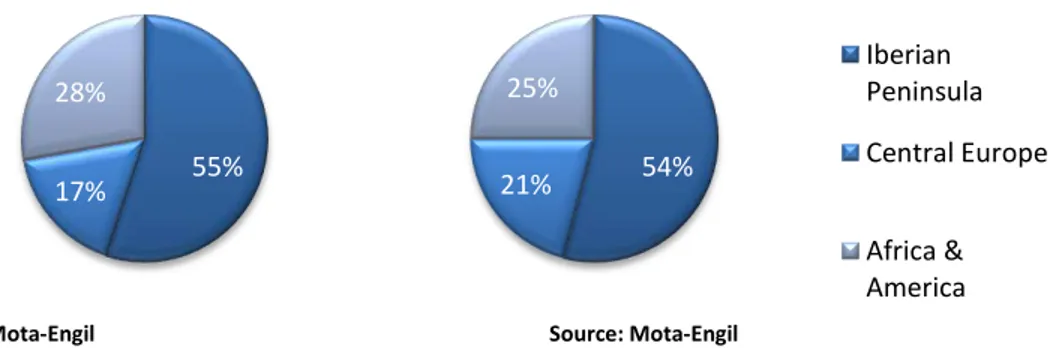

Internationalization is related with the presence of Mota-Engil in three geographic poles, which are: Central Europe, Africa and America. Mota-Engil, SGPS has constituted specific structures, choosing representatives with responsibilities over the previous defined geographic poles, creating a connection between the different business units and the markets (potential for synergies). Mota-Engil, through its subsidiaries, has a vast number of international acquisitions examples that sustain this pillar.

Figure 23: Turnover by Geographic Segment in 2009 Figure 24: Expected Turnover by Geographic Segment in 2013

Source: Mota-Engil Source: Mota-Engil

Then, it appears the development of its human capital, which in reality was translated in formation schools in Angola for its employees, ME Active School, professional formation actions, for instance.

Summarizing, the key challenges for the group are: internationalization, management capacity, sustained development of Human Resources, growth in the markets and globalization.

59% 21%

14% 6%

Engineering & Construction Environment & Services Transport concessions New Businesses

24%

21% 50%

5%

Engineering & Construction Environment & Services Transport concessions New Businesses

55% 17%

28%

54% 21%

25%

Iberian Peninsula Central Europe

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 14/51

Market Analysis

–

per Business Unit

According to Dominique Strauss-Kahn, IMF Chief, in an article in Financial Times newspaper in April 10, it comes: “The global economy now appears to be on the path of recovery. Though it remains sluggish and uneven, and in need of continued policy support in many advanced economies. Moreover, the costs of the crisis – low growth, high unemployment and sharply higher public debt –will take many years to overcome.”

The first quarter of 2010 was, in global terms, positive for the main World Indexes. Although the year began with good perspectives, they were penalized by the possibility of having Greece in failure and the movements in China to stop the fast economic growth after having an inflation above the expected (these facts brought uncertainty). The indexes were at maximum levels for eighteen weeks and the economic indicators, despite not having been consistently spectaculars,

continued to encourage market participants. The companies’ results came to confirm those

improvements. At the same time, interest rates were kept at historically low levels. However, in Portugal, Spain and Greece capital market was pressured by investors. PSI-20 lost more than 3,5%. Indeed, in small economies (such as Portugal, Spain, and Ireland where Mota-Engil is present) leaving recession would be a slowly phase due to strong budget and current accounts imbalances. But in Euro Area there is another small economy (Slovakia Republic) that despite having had losses of more than 4% last year, contradicts the previous and it is expected to grow almost the value of the previous loss in the current year.

In terms of Mergers and Acquisitions, this first quarter was favorable. Concretely, there were more than 2.034 international transactions and 10 hostile takeovers, which can reveal market recuperation, from its worst period in six years. This market wins growth rhythm in the quarter. Based on Bloomberg data, hostile takeovers grew 5%, when compared to the same period of the previous year (to US $498,24 million); acquisitions in foreign markets more than doubled to US $249 thousand million and announcements of hostile acquisitions grew to $17,46 thousand million (growth of 3,07 times compared to the same last year period). This is essentially related to the

behavior of capital markets previous referred to, whose rise boosts confidence in companies’

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 15/51 Source: Bloomberg Figure 25: Global Activity Trend/Evolution

-5 15

2005 2006 2007 2008 2009 2010e2011e2012e2013e2014e2015e

A

n

n

u

al

%

C

h

an

g

e

Years Real GDP Growth

Europe World Angola Brazil Portugal Peru

Table 1: Activity Breakdown

Activity Breakdown (Jan 1- May 31 2010) (in US$ million)

Per Industry Per Region

Target Industry Volume Count Target Region Volume Count

Telecommunications 79.400 261 Global 785.740 9.085 Insurance 70.120 125 North America 334.220 3.447 Oil&Gas 63.200 337 Asia Pacific 211.070 3.182

Mining 35.510 436 Europe 106.330 1.776

Electric 33.000 91 Latin America & Caribbean 93.320 345 Middle East & Africa 35.840 258

Source: Bloomberg

Table 2: M&A Top Deals (1 Jan – 31 May 2010)

Recent Top Deals (in US$ million)

Target Acquirer Annc

Date

Annc

Value Premium Payment Type

AIA Group Ltd Prudential PLC 03/01/10 35.500 Cash and Stock Curso Global Telecom SAB de CV America Movil SAB de CV 01/13/10 25.740 2.68% Stock Qwest Communications

International CenturyTel Inc 04/22/10 22.160 12.49% Stock American Life Insurance Co MetLife Inc 03/08/10 12.590 Cash and Stock Smith International Inc Schlumberger Ltd 02/21/10 12.340 42.18% Stock

Source: Bloomberg

Market Characteristics, Value and Trends

Each country, each business area has a market with specificities at each moment in time and 2009 was a year of worldwide crisis, which now continues to have its

repercussion despite being in recuperation. Firstly, Mota-Engil is presented in 19 countries so the reality that it faces in each country is different, some opportunities of growth in some ones, a weak period in others in a business area… Looking at real GDP, there is a sign that economies are in recovery after the disaster of 2009 and after 2011 there is a sort of stabilization.

Figure 26: Annual Percentual Change of Real GDP Growth

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 16/51 -5

5 15 25

A

n

n

u

al

%

C

h

an

g

e

Years Inflation Rate, Average Consumer Prices

Europe World Angola Brazil Portugal Peru

Source: IMF – World Economic Outlook (April 2010)

Portugal, the main country in terms of Mota-Engil results and backlog, is predicted to grow but there are divergences in terms of the value: 0,3% for IMF, 0,7% for Portuguese Government, 0,4% for Portuguese Central Bank. This means that, for IMF, Portugal is going to evolutes positively but less than half of the average of the Euro Area (1%). This might imply a deep divergence of Portugal, continuing the previous one that took almost 10 years and that was just interrupted last year (Portugal decreased 2,7% while Monetary Union dropped 4,1%). Anyway, previsions make the situation worse for 2011 when Portugal may increase 0,7% (even with a better performance) while Euro Area grows 1,5%.

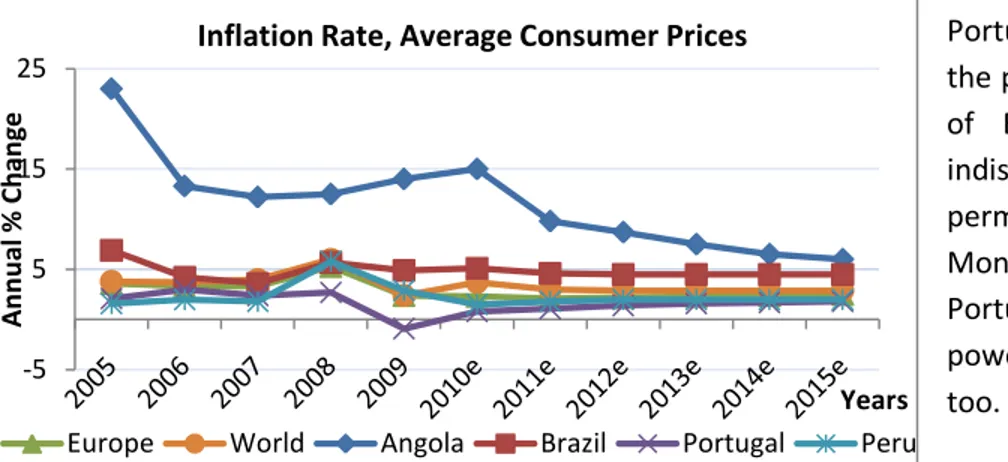

Globally, Europe is going to have the worst performance in terms of real GDP growth while Asia and Pacific takes the best rate (6,8% from 2010 to 2013 and 6,9% afterwards). However, in 2009 Europe was the most hurt by the crisis, immediately followed by Western Hemisphere (-2,3%). According to the information revealed, inflation is expected to be relatively stable in Europe in the medium term, which is essential for the politics conduction.

Figure 27: Annual Percentage Change in Inflation Rate, Average Consumer Prices

Portugal is going to follow the pattern of inflation rate of Euro Area, which is indispensable for its permanence in the Monetary Union. So Portuguese purchasing power remains stabilized too.

Construction - Portugal

Construction was deeply affected by the recession in 2009, being the worst year for construction market in Euroconstruct area in the last 10 years, when it fell 8,4%. For 2010, it is expected a decline of 2,2% and it is predicted a recovery from 2012 onwards. The downturn for Euroconstruct area GDP is approximately 4% while for construction output was even worse, dropping 8,4%, being

€ 1.365 billions then. In this area construction market accounts 11% of GDP, being in the range

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 17/51

there is a dive of 15,2% and 10,2%, respectively according to the previous order. Portugal has a positive performance in monthly comparison (1,4%) as well as Hungary (6%) and the worst performance was Romania.

Figure 28: Construction Output in Europe – Monthly Variation (in %)

Source: EUROSTAT – April 2010

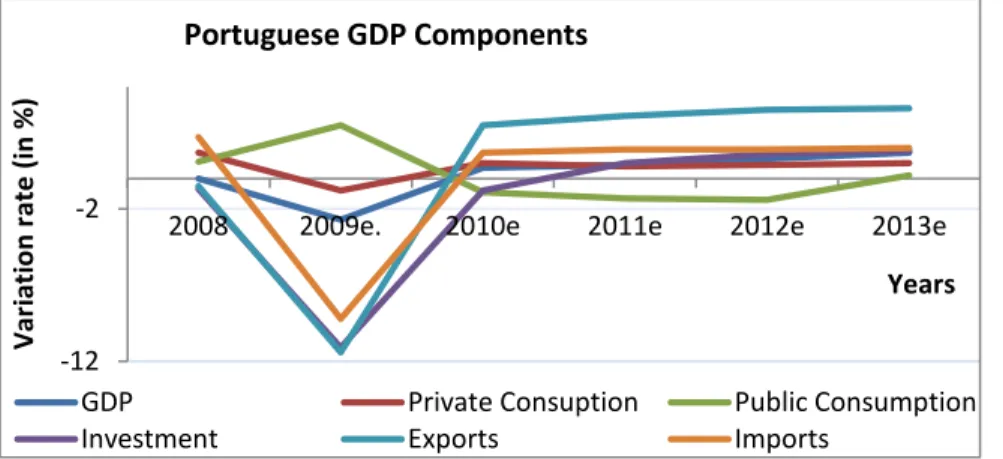

Portugal, the internal market of Mota-Engil, is the main source of results in all its business units (exception to Engineering and Construction where in terms of EBITDA Portugal was exceeded just by Angola in 2009). However, it depends on public investment, having a subsector of public works. Looking at GDP components, we assist that the positive predicted growth for the economy for this and upcoming years comes essentially from exports, investment will grow slowly. And, indeed, according to Stability and Growth Plan in Portugal from 2009 until 2013, it is predicted a gradual reduction of deficit, to be below 3% in 2013 mainly due to expenditures reduction and automatic stabilizers. So, Government is going to choose investments that affect critical factors of competitiveness, such as human resources qualification, business competitiveness, innovation which have high capacity of economy dynamism and with small budget effects. Then, the main projects with high value such as the new airport, logistics and ports, among others that are in the Government Plan until 2017 cannot be started in the short run, despite being considered with high

capability of private capitals’ mobility and revenues generating, and with small impact to the State

(financed by EU funds and private investors too).

Source: INE and Ministry of Finance and Public Administration (in Stability and Growth Plan 2010-2013) -15

-5 5 15

Sep-09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10

%

C

hange

C

om

pare

d

wi

th

P

re

v

ious

M

ont

h

(%

)

Months Construction Output - Monthly Variation

EA16 EU27 Portugal

-12 -2

2008 2009e. 2010e 2011e 2012e 2013e

Var

iat

io

n

r

at

e

(in

%

)

Years Portuguese GDP Components

GDP Private Consuption Public Consumption

Investment Exports Imports

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 18/51 Source: INE, Statistics Portugal, Construction and Public Works Indexes

50 60 70 80 90 100 110 ∆ Pr od uc tion Vo lu m e

Data Reference Period

Index of Production in Construction

Buildings Civil Engineering Projects Total

Table 3: Big Investments in Construction 2008-2017

Table 3: Big Investments in Construction 2008-2017

From the investments listed to be done between 2008 and2017, Mota-Engil has capability and high probability of receiving adjudication, which involves all its business areas and even indirectly through Martifer in the field of energy and renewable energy. However, the consortium “Asterion” (Mota-Engil/Brisa/Somague/BES/BCP/CGD), taking into account its lack of expertise in airport operator can put in risk its chance of gaining New Airport of Lisbon, if not includes also ANA Privatization.

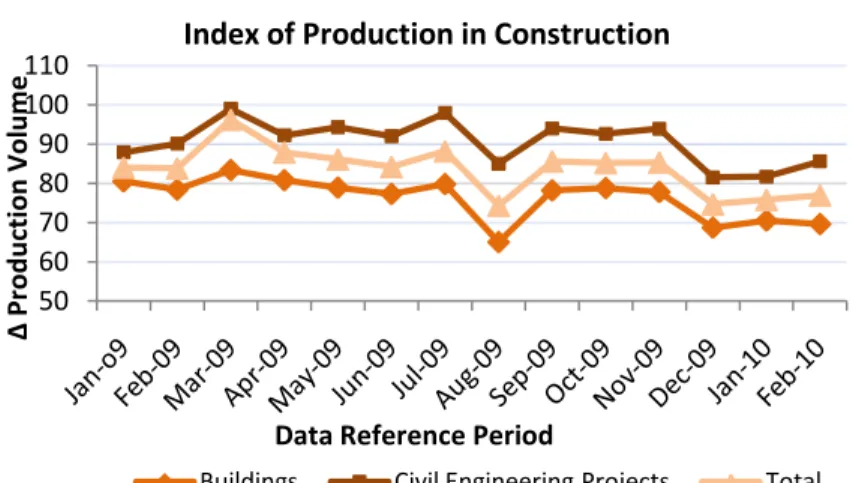

At the moment there is too much uncertainty about when and if the major public investments go in front. At the same time, the production in civil engineering plunges 14,8% at the end of first quarter of 2010 and construction of non residential buildings drops 4,5% due to the association of the reduction of Private Investment and now onwards the contraction of Public Investment.

Figure 30: Index of Production in Construction - Non Adjusted (Base 2005) by Type of Project in Portugal; Monthly

To sum up, intense competition from the main internalized construction companies persist in putting pressure on margins and other features of contracts, timetables and guarantees, for instance. Moreover, the global variability of economies humidify demand in many relevant sectors and attracting plus retaining top performing professionals is, without any doubt, a big challenge for the industry.

Type of Infrastructure

Announced Investment (in €millions)

New Airport of Lisbon 3.100

Airports 246

Water, Environment 5.729

Dams 1.568

Energy 1.600

Renewable Energies 7.124

Traditional Railroad 1.494

Logistics 1.875

Metro 1.366

Ports 534

Highway 7.208

TGV 7.650

Third Crossing of the Tejo River 500

Jails, Schools, Hospitals, Justice 2.905

Others (Urban Rehabilitation, Commercial Centers, Tourism) 13.425

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 19/51 -7

-2 3 8 13

A

nnual

% C

hange

Years Real GDP Growth

Poland Slovak Republic Hungary Romania

Source: IMF

0 100 200 300 400 500

Soares da Costa Teixeira Duarte Mota Engil

Val

u

e

s (in

m

il

li

o

n

€

)

Turnover 2009

Source: Companies Reports Construction - Central and Eastern Europe, Angola and Others (Mexico, Peru, Brazil)

In Central and Eastern Europe there are opportunities of growth, specially in Poland, because there is a short of decent roads and in a fewer number, the housing market faces a deficit for about 1,6 millions households and requires renovation for 30% of units. Government is going to

spend € 26 billions by 2013 in the construction of kilometers of roads, motorways and

expressways (3.700 km). This can bring more revenues for Mota-Engil, mainly in Poland (an economy in growth).

Figure 31: Central and Eastern European Countries Real GDP Growth

In Angola, compared to its competitors, Mota-Engil receives the highest revenues. It is in a good position, and has a high backlog as it was referred to before. Concerning GDP growth, it is predicted a 7,1% for 2010 and a decrease in inflation rate that continues over time, which induces investments and allows continuing its growth expansion verified in recent years in this economy in development.

Figure 32: Comparison between Angolan Turnover of Mota-Engil and 2 Competitors

In other countries, such as Peru, Mexico, Brazil, Colombia there are opportunities related with partnerships with municipal councils. Moreover, real GDP growth in these countries is above 4% until 2015e. Brazil is also a special case with some new investment opportunities (case that is going to be developed afterwards).

Environment & Services

Logistics:

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 20/51 Figure 33: Baltic Dry Index Evolution (in USD) Table 4: Container Traffic Evolution

Source: Bloomberg Source: APL, APDL and APA publications

2240 2260 2280 2300

2008 2009

M

il

li

o

n

€

Years Exports to Angola Figure 34: Exports Evolution to Angola

Source: INE Statistical Data The container traffic of the port terminals worsens, excluding Leixões in terms of TEUs and Setubal. The major representativeness of external trade of ports

in Lisbon were Angola (22,4% in exports side) and United Kingdom (10,9% in imports side). The Leixões terminal performance was positive mainly due to the exports to Maghreb that grew 40% yoy in 2009, being almost 200 thousand tons per year, representing 10% of the overall cargo containers. In Setubal, only exports for non European countries have a positive annual variation (45,7%) influencing its positive performance. Anyway, exports to Angola, the major positive influence in all the previous terminals increased just 1,45% y.o.y, in 2009.

The recent challenge for this sub-area (80% of market share) is the integration of the port business with the rail freight and logistics platforms of Caia-Poceirão. Moreover, the group has plans for exploring ports in Africa and Latin America (Paita Port was already an example of success).

Water, Waste Treatment and Multi-Services

This area depends on the commercial municipal council relationship and its will to do outsourcing of the activities related to sewage and water treatment, waste management and multi-services. The existing contracts are mainly of long term, and in water there are concessions. But the process of increasing new contracts in Portugal is at a slow pace.

Transport Concessions

In Transport Concessions, through Ascendi, its network is extensive and similar to the one of Brisa, its main competitor. It has the highest kilometers travelled.

Container Traffic by Ports

(∆2009/2008)

Nr. Of

Containers TEUs

Santa Apolónia -4,8% -2,9%

Alcantara -16% -13,6%

Leixões -1% 1%

Setubal (Sesimbra also included) 23,1% 27,8%

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 21/51 Table 6: Drivers of Traffic

Source: IMF Table 5: Transport Market Sub-Segments in Kilometers

Player Tolled Network Shadow Toll EP Sub-concessions Total

Brisa Brisa 1.116 Baixo Tejo 68

Brisal 92 Litoral Oeste 112

Atlântico 170

Douro Litoral 129

Brisa Total 1.507 180 1.687

Ascendi AENOR 176 Costa da Prata 105 Douro Interior 245

Lusoponte 24 Beira Litoral e Altas 178 Pinhal Interior 567

Grande Lisboa

61 Grande Porto 55

Ascendi Total 261 338 812 1.411

Sacyr Túnel Marão 30 30

Soares da Costa Beira Interior 178 Transmontana 174

Interior Norte 156

S. Costa Total 334 174 508

Cintra Norte Litoral 130

Algarve 156

Cintra Total 286 286

Edifer/ACS/Dragados Baixo Alentejo 334 334

42% 23% 35% 100%

Source: Estradas de Portugal

The major risk that concessionaires may face is the road traffic, which is driven by the GDP, tariffs, inflation, car ownership, and fuel prices. Despite the GDP decrease, the road traffic has increased from 2008 to 2009.

Growth Rates % 2008 2009 2010E 2011E 2012E 2013E 2014E 2015E

Portuguese GDP 0% -2,70% 0,30% 0,70% 0,80% 1,30% 1,40% 1,40% Portuguese Inflation Rate 2,7% -0,90% 0,80% 1,10% 1,40% 1,60% 1,70% 1,80%

Figure 35: Average Daily Traffic (ADT) Figure 36: Kilometers Travelled

Source: APCAP Source: APCAP

22,77

22,51 22,66

20,96 21,05

20,00 20,50 21,00 21,50 22,00 22,50 23,00

2005 2006 2007 2008 2009

(i

n

th

ou

sa

n

d

s)

Years Average Daily Traffic (ADT)

11,96

11,74

12,32

11,88 11,95

11,4 11,6 11,8 12 12,2 12,4

2005 2006 2007 2008 2009

(in

10⁶ K

m

)

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 22/51

Unlike Brisa and others, which mainly have the concession exploration, Mota-Engil has also the construction of concessions, granting it a more stable position, and synergies between both activities.

From June 1 2010 there is going to be the introduction of tolls in some actual shadow tolls network. This implies a reduction in the traffic of those roads, while increasing it in the ones

without tolls (national roads, for instance). However, this fact is not going to affect companies’

revenues predicted with those concessions. There was a renegotiation of the concessions with the

State in which a “fixed rent” is going to be paid by it to the company and the company transfers

the amount of tolls collected to the State.

Main Players

The main construction companies, at a national level, are: Mota-Engil, Brisa, Somague, Teixeira Duarte, Soares da Costa, OPWAY, Bento Pedroso, Edifer, Monte Adriano and Construtora do Tâmega. At an international level, it should be pointed out some companies, such as: HOCHTIEF AG, VINCI, Skanska AB, STRABAG SE, BOUYGUES, Bechtel, Saipem, TECHNIP, Bilfinger Berger AG, Eiffage and Bovis Lend Lease. In terms of Environment and Services, Suez and Veolia Environment are well-known companies. For Transport Concessions, Brisa, Atlantia, Abertis have a prominent position.

Last year revenues of some competitors in terms of Mota-Engil business areas came majorly from Europe. Moreover, for Engineering and Construction it can be seen a different level of internationalization within this business unit, some with more revenues coming from internal and others from external. In Environment and Services there is also no tendency of the main revenues provenience. However, in Transport Concessions Revenues came mainly from internal market.

0% 20% 40% 60% 80% 100%

Revenues by geographical area in 2009

Europe America Africa Asia/Middle East Oceania

Figure 17: Revenues by Geographical Area in 2009

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 23/51 Figure 38: Engineering & Construction Level of

Internationalization According to Revenues of 2009

0% 10% 20% 30% 40% 50% 60% 70% 80%

90% %

Companies E & C Internationalization 2009

Internal Market

0% 20% 40% 60% 80% 100%

Strabag SE Veolia

Environnement

Mota-Engil

%

Companies E & S Internationalization 2009

Internal Market External Market

Figure 39: Environment & Services Level of Internationalization According to Revenues of 2009

Source: Companies reports Source: Companies reports

0% 20% 40% 60% 80% 100%

Concessions Vinci

Soares da Costa

Mota-Engil %

Companies TC Internationalization 2009

Internal Market External Market

Figure 40: Transport Concessions Level of Internationalization According to Revenues of 2009

Source: Companies Reports

Table 7: Competitors’ Credit Risk

Source: S&P 500

Mota-Engil does not have a credit rating given by a credit rating agency which is commonly justifiable by the argument that the company acts in a risky industry which involves high leverage ratios. However, some competitors have the ratings presented bellow.

Companies Ratings (in S&P)

Vinci S.A. BBB+

Strabag SE BBB-

Bouygues, S.A. A-

Technip BBB+

Veolia Environment BBB+

Brisa BB-

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 24/51

Success Conditions and Growth Opportunities

According to Luís Filipe Pereira, President of the Executive Commission of Efacec and Best Leader Awards 2010/Internationalization Leader, strategic leadership is essential for the development of a company, even more if the company is in the process of internationalization that needs to compete in foreign markets, open and usually more competitive. Some operational and tactic mistakes can be reversed but if a company made a mistake in terms of defining how to compete, where and the way to do it, so all organization is in risk. So in an international context, there is a superior need to define objectives to achieve, to establish priorities, to form teams, to motivate and remunerate human resources.

There are some main worries in CEOs’ mind when carrying on a company strategy, which makes all sense because markets are, in part, unpredictable, not controlled by them and, when taking a decision, the result can diverge from the expected. But in any case there are usually success conditions.

EV1/EBITDA EV1/Revenues Net Debt/EBITDA

Net Debt/Equity

Net

Debt/Assets ROE ROA EBITDA margin 2008 2009 2008 2009 2008 2009 2008 2009 2008 2009 2008 2009 2008 2009 2008 2009

Vinci 4,22 4,14 0,61 0,64 3,15 2,76 1,70 1,31 0,43 0,36 17,6% 15,3% 4,44% 4,22% 14,6% 15,5%

Strabag SE 3,37 3,19 0,18 0,17 2,64 2,21 0,57 0,49 0,17 0,16 5,6% 6,0% 1,70% 1,92% 5,3% 5,5%

Eiffage GB 2,55 2,50 0,24 0,24 9,45 9,88 4,47 4,81 0,46 0,50 11,1% 7,3% 1,15% 0,76% 9,4% 9,6%

Soares da

Costa N.A. N.A. N.A. N.A. 7,02 7,54 4,37 5,19 0,44 0,44 5,9% 8,8% 0,59% 0,75% 10,3% 9,6%

Teixeira

Duarte 1,88 1,68 0,27 0,28 9,86 9,50 5,46 3,90 0,58 0,57 -121,8% 22,5% -12,99% 3,27% 14,5% 16,4%

Sacyr 2,17 2,93 0,25 0,23 4,48 3,78 1,03 0,58 0,10 0,08 -9,7% 17,3% -0,91% 2,49% 11,3% 7,7%

Average

Construction 2,83 2,89 0,31 0,31 6,10 5,94 2,93 2,71 0,36 0,35 -15,2% 12,9% -1,00% 2,24% 10,9% 10,7%

Abertis 4,25 3,93 2,60 2,43 6,23 5,99 2,97 2,53 0,63 0,59 14,5% 12,5% 3,08% 2,93% 61,3% 61,9%

Atlantia 4,14 3,98 2,52 2,43 4,61 4,71 2,45 2,44 0,55 0,53 18,4% 16,2% 4,16% 3,50% 60,8% 61,0%

Brisa 6,65 6,13 4,31 4,36 7,61 6,94 2,69 2,33 0,66 0,63 11,2% 11,2% 2,73% 3,05% 70,4% 71,1%

Average Transport Concessions

5,01 4,68 3,14 3,08 6,15 5,88 2,70 2,43 0,61 0,58 14,7% 13,3% 3,32% 3,16% 64,2% 64,7%

Suez

Environment 3,33 3,40 0,57 0,57 2,84 3,05 1,43 1,42 0,30 0,28 12,8% 9,1% 2,70% 1,80% 17,0% 16,8%

Veolia

Environment 2,57 2,67 0,30 0,31 4,03 3,82 1,73 1,49 0,34 0,30 4,2% 5,8% 0,82% 1,17% 11,5% 11,4%

Average Environment

& Services

2,95 3,04 0,43 0,44 3,43 3,44 1,58 1,46 0,32 0,29 8,5% 7,4% 1,76% 1,48% 14,2% 14,1%

Mota-Engil2 1,42 1,45 0,24 0,21 5,95 7,52 5,43 6,09 0,75 0,76 11,7% 21,3% 1,62% 2,67% 16,7% 14,3%

1

EV is an approximation through market capitalization

2Includes the consolidation of Transport Concessions Source: Companies Reports

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 25/51

0% 20% 40% 60% 80%

Lack of Stability in Capital Markets Protracted Global Recession Inability to Finance Growth Exchange Rate Volatility Over-Regulation

CEOs Main Worries about Economic and Financial Risks

Global Engineering & Construction

Source: Price Water House Coopers – 13th Annual Global CEO Survey

Figure 41: Engineering & Construction CEOs Main Worries about Various Economic and Financial Risks

Going abroad for internationalization assumes too many risks that can be reduced if there is a partnership, or any takeover, with high knowledge of the local market, with know-how that complements itself, with previous good financial performance, with good relations with the local State, making it easier to have access to some main value creation projects. The value of advantages is higher than the weaknesses. However, these success conditions are at some point controlled by the companies, if they have done a previous analysis of the other (at a micro-level). At a macro-level there are economies with its GDPs, proper growths, external factors that conditions the overall performance of companies indirectly. No economy is equal, so some grew more at a certain length of time while in others it happens later on. So, internationalization reduces the risk of being in an economy of small growth, of restricted market conditioning all its results while others are in strong expansion. For instance, in the second quarter of 2010 US GDP is expected to grow 2,3% while in the major three economies of Euro Area is predicted just 1,9%. There are some good opportunities that can be caught in specific business areas in different countries.

Other matter of success can be works in consortium when the possibility of gaining a project alone seems improbable. Taking part in a consortium, as an all, the group is more valuable, capable to

take a bigger step, complementary companies’ issues in some aspects, saving development as well as money. That is, capable to bid and win high value added projects. Just important to take into consideration if there are different interests/objectives between the construction companies and operators (it may have impact in the quality of civil work, for example); some duplication of activities and resources; internal problems in communication plus assignment of responsibilities intra-group. For example, Mota-Engil takes part in Altavia Consortium for the High Speed Train Concession and in Asterium Consortium for New Lisbon Airport and ANA Privatization. This increases its chance of gaining value in the projects due to the aggregation of expertise and dimension.

Mota-Engil diversifying its markets through internationalization is reducing risks inherent to the dependence of having just the internal one.

Private and Confidential Mota-Engil | Market Analysis – per Business Unit 26/51 recent projects in an amount of € 71 millions in Peru. In the American continent, the group is also presented in USA, Mexico and Brazil.

For instance, Brazilian construction sector can grow 7,1% or 8,8% in 2010 according to Amaryllis Romano (Economist of Tendencies) or Getúlio Vargas Foundation, respectively. This probable improvement is due to the mortgages expansions, investments growth and habitation deficit, not forgetting World Cup 2014 and Olympiads 2016 that require important infrastructures constructed. Foreign investments are going to play an important role but there are increases in public and private investments, at the same time. Last year, from January until October, construction sector received 5,4% of the total amount received in the country that was applied to building construction (5,5 million houses in habitation deficit yet), infrastructures construction and engineering and architecture. The main investors are usually US or European groups that are seeing Brazil as a potential attraction in the sector. Camargo Corrêa Group, Mota-Engil competitor, considered this boom prediction in construction sector and it is buying spaces for future development of houses, mainly in the low/economic rent segments where demand is explosive. Mota-Engil Brazil had had some experience in transport concessions (Marechal-Leste in San Paulo State) and it reveals also some growth opportunities in ports and environment (waste, for example) sector. In fact, Brazil shows much more opportunities because it has the second phase of Growth Acceleration Program 2011-2014 led by its Federal Government and its value is US$220 Billion.

Table 9: Growth Acceleration Program – Phase 2 (2011-2014)

Type of Infrastructure Announced Possible Private

Investment (in US$ Million)

Urban Sector Mobility (Subway, Light Rail Vehicle, Bus Rapid Transit, Bus Lane projects)

10.300

Ports (Dredge, Port Seabed) 498

Housing 40.700

Electric Power 36.200

Oil 106.700

Natural Gas 4.600

Shipbuilding Industry 20.800

Total US $219.798 Million

Source: Dredging Today - Brazil

Private and Confidential Mota-Engil | Divestment Opportunity 27/51

credit line of Portugal (Habit Cape Verde and Pro-dwelling and Rehabilitate), local government will construct 8.500 houses and recover half of the investment, and in return it will give fiscal, par fiscal, customs incentives to construction companies and municipalities that adhere to the project. Cape Verde is a potential market, where it is possible to develop new projects without the need of credit resort. This is a country that awakens more interest by the Portuguese investors, according to the President of the Business Association of the Region of Lisbon, António Ferreira de Carvalho. Angola should grow 10% this year, with the recuperation of the petroleum resources sector and the predicted investments in the public sector and international investors, according to the estimates of the BES Research, which is positive due to the growing weight of Mota-Engil Angolan works.

In Ireland Mota-Engil is growing in terms of construction. This March it was announced that its participated, GLAN AGUA, signed 2 contracts to the construction to 20 years of 25 water treatment stations, € 55,2 millions involved. This signature has a special meaning because it integrates a new project’s format in design, construction and operation and they are two of the biggest projects released in 2009 in this country (GLAN AGUA takes part of Mota-Engil Environment and Services since 2008).

To conclude, an opportunity that the Portuguese President of Republic referred to in a speech this April was to make a deeper link between Portugal and Czech Republic, economic cooperation, in which Portugal can benefit from its ability in infrastructures construction, renewable energies, telecommunications that are fulcra for Czech development and in exchange the other country benefits from the connections of Portuguese companies with African and Latin America ones. Mota-Engil is presented there; maybe from now onwards its business cooperation between companies must be strong and leads to better profits and margins for both.

Divestment Opportunity

The opportunity analyzed in this chapter is a total divestment of Mota-Engil Group in Martifer, selling its 37,50% position. The proceeds of this divestment will immediately result in debt reduction. Thus, giving more capacity to raise medium-term debt to finance new projects [such as the New Airport of Lisbon new, the participation in ANA, the participation in High Speed Railways (TGV) consortium, the equity participation in new grants of highways, among others] if these major investments will be put in place in the near future and/or awarded by this company. Otherwise, it can be used for future acquisitions at an international level or even reinforce its financial position in ones partially owned at the time (its core business).

Proposed Divestment Transaction (Buyer and Seller Perspective)

Private and Confidential Mota-Engil | Divestment Opportunity 28/51 0% 10% 20% 30% 40% 50% 60%

Looking for Cash Dispose of Non-Performing Assets Increase Focus on Core Business

Most Important Factor in Planning a Divestment?

Source: Ernst & Young Report: “Divesting in Turbulent Times – Achieving Value in

a Buyers’ Market”, 2009

the current market conditions plus valuations and make a review about the best ways to finance future investments.

Indeed, companies undertake divestments to guarantee their business future and as a way to fund strategic investments (acquisitions included). So that it is in line with the Mota-Engil strategic plan (according to the strategic puzzle aimed to promote value creation, business and geographical diversification).

Figure 42: Inquire Results about the Most Important Factors Considered in Planning a Divestment

“Under the current economic

circumstances, and given the

company’s financial position,

paying down debt is the most important for us when planning a

divestment”, a Media Company

responsible said. For Mota-Engil, with this divestment, it will have the opportunity to improve its leverage ratios, repaying debt will mean auto financing of new future projects related to its core business. The value per share of Martifer for Mota-Engil is 3,13€ while in the market it is being transacted at

1,75€.

So, as Martifer brings fewer benefits for Mota-Engil than before (just synergies in one division – Metallic Construction), Mota-Engil should sell its participation and at the same time reducing its net debt, improving its leverage ratios in the short-run for possible future investments in core business. As actual market price is below the value for Mota-Engil, and expecting to have a