Revista

de

Administração

http://rausp.usp.br/ RevistadeAdministração51(2016)331–343

Finance

and

accounting

The

relationship

between

equity

ownership

concentration

and

earnings

quality:

evidence

from

Brazil

A

rela¸cão

entre

a

concentra¸cão

de

propriedade

e

a

qualidade

do

lucro:

evidencias

do

Brasil

La

relación

entre

la

concentración

de

la

propiedad

y

la

calidad

de

los

beneficios

en

empresas

brasile˜nas

Erivelto

Fioresi

de

Sousa

a,∗,

Fernando

Caio

Galdi

baInstitutoFederaldoEspíritoSanto,RodoviaGovernadorJoséSette,Cariacica,ES,Brazil

bFUCAPEBusinessSchool,Vitória,ES,Brazil

Received31August2015;accepted14June2016

Abstract

ThisstudyinvestigatestheinfluenceofownershipconcentrationonearningsqualityofBrazilianfirms.Thistopicisrelevantconsideringthe substantiallylownumberofcompanieswithdiffuseownershipstructureinBrazilincomparisontoUS,wheremoststudiesaboutearningsquality havebeenperformed.TheBraziliansettingpermitsustocomplementGivoly,Hayn,andKatz(2010)analysisbetweenthepotentialexplanations fortherelationbetweenownershipstructureandearningsqualitybasedonboththe“demand”and“opportunisticbehavior”hypothesis.Toexamine thisrelationship,weemploytwomeasuresasproxiesofearningsquality:earningspersistenceandasymmetrictimeliness(conservatism).Our resultsareconsistentwiththe“demand”hypothesisandindicatethatearningsrepresentamoreconsistentindicatoroffutureperformancewhen ownershipstructurebecomesmoredispersed.Ourresultscontributetotheliteraturebecauseitsuggeststhatthequalityofaccountingnumbers havetobeassessedconsideringaspectsrelatedtoownershipconcentration(evenwhenanalyzingearningsfrompublicfirms).Italsocontributes totheinvestmentcommunitybecauseitshowsthatearningsforecastaccuracymaybeinfluencedbyownershipstructure.

©2016DepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoeContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP. PublishedbyElsevierEditoraLtda.ThisisanopenaccessarticleundertheCCBYlicense(http://creativecommons.org/licenses/by/4.0/). Keywords:Earningsquality;Persistence;Conservatism;Ownershipstructure;Brazil

Resumo

Nesteartigo,teve-secomoobjetivoinvestigarainfluênciadaconcentrac¸ãoacionáriasobreaqualidadedoslucrosdasempresasbrasileiras.Este tópicoérelevanteaoseconsideraroreduzidonúmerodeempresascomestruturapropriedadedifusanoBrasil emcomparac¸ãoaosEstados Unidos,ondeamaioriadosestudossobreaqualidadedoslucrosforamrealizados.Ocenáriobrasileironospermitecomplementaraanálisede Givoly,HayneKatz(2010)entreaspotenciaisexplicac¸õesparaarelac¸ãoentreaestruturadepropriedadeequalidadedoslucroscombasetanto nahipóteseda“demanda”quantonahipótesedo“comportamentooportunista”.Paraexaminarestarelac¸ão,nósempregamosduasmedidascomo

proxiesdaqualidadedoslucros:persistênciaeantecipac¸ão assimétrica(conservadorismo).Nossosresultadossãoconsistentescomahipótese de“demanda”eindicamqueoslucrosrepresentamumindicadormaisconsistentededesempenhofuturo,quandoaestruturadepropriedadese

∗Correspondingauthor.

E-mail:erivelto.sousa@ifes.edu.br(E.F.Sousa).

PeerReviewundertheresponsibilityofDepartamentodeAdministrac¸ão,FaculdadedeEconomia,Administrac¸ãoeContabilidadedaUniversidadedeSão Paulo–FEA/USP.

http://dx.doi.org/10.1016/j.rausp.2016.07.006

tornamaisdispersa.Nossosresultadoscontribuemparaaliteratura,porquesugerequeaqualidadedosnúmeroscontábeistemdeseravaliada considerandoaspectosrelacionadosàconcentrac¸ãodepropriedade(mesmoquandoanalisamoslucrosdeempresaspúblicas).Osresultadosdeste artigotambémcontribuemparaacomunidadedeinvestimento,porquemostraqueaprecisãodasprevisõesdelucrospodeserinfluenciadapela estruturadepropriedadedaempresaanalisada.

©2016DepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoeContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP. PublicadoporElsevierEditoraLtda.Este ´eumartigoOpenAccesssobumalicenc¸aCCBY(http://creativecommons.org/licenses/by/4.0/). Palavras-chave: QualidadedoLucro;Persistência;Conservadorismo;Concentrac¸ãoacionária;Brasil

Resumen

Enesteestudioseanalizalainfluenciadelaconcentracióndelapropiedadsobrelacalidaddelosbeneficiosdelasempresasbrasile˜nas.Estetema esrelevantecuandoseconsideraelreducidonúmerodeempresasqueposeenestructuradepropiedaddifusaenBrasilencomparaciónconEstados Unidos,dondesehallevadoacabolamayorpartedelosestudiossobrelacalidaddelasganancias.Elescenariobrasile˜nopermiteaplicarelanálisis deGivoly,HaynyKatz(2010)entrelasposiblesexplicacionesparalarelacióndelaestructuradepropiedadconlacalidaddelosbeneficios,con basetantoenlahipótesisdela“demanda”comoenladel“comportamientooportunista”.Paraexaminardicharelaciónseempleandosmedidas comoproxiesdecalidaddelosbeneficios:lapersistenciaylapuntualidadasimétrica(conservadurismo).Losresultadosconfirmanlahipótesisde “demanda”yse˜nalanquelasgananciasrepresentanunindicadormásconsistentededesempe˜nofuturocuandolaestructuradepropiedadsehace másdispersa.Dichosresultadoscontribuyenalaliteratura,yaquesugierenqueenlaevaluacióndelacalidaddelosnúmeroscontablesdeben tenerseencuentalosaspectosrelacionadosconlaconcentracióndelapropiedad(inclusocuandoseanalizanlosbeneficiosdeempresaspúblicas). Asimismo,contribuyenalacomunidaddeinversores,yaquemuestranquelaprecisióndelospronósticosdegananciaspuedeserinfluenciadapor laestructuradepropiedaddelaempresa.

©2016DepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoeContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP. PublicadoporElsevierEditoraLtda.Esteesunart´ıculoOpenAccessbajolalicenciaCCBY(http://creativecommons.org/licenses/by/4.0/). Palabrasclave: Calidaddelosbeneficios;Persistencia;Conservadurismo;Concentracióndepropiedad;Brasil

Introduction

Agencyproblemsessentiallyarisefromtheseparationofde factoownershipandcontrol betweencorporate insiders (e.g., controllingshareholders)andoutsiders(e.g.,minority sharehol-ders).LafondandRoychowdhury(2008)examinetheeffectof managerialownershiponfinancialreportingconservatismand findevidencethatconservatism,asmeasuredbythe asymmet-rictimelinessofearnings,declineswithmanagerialownership. Complementarily,Givoly,Hayn,andKatz(2010)examinethe differentialearningsqualityofprivateequityandpublicequity firmsandfindthatprivateequityfirmshavehigherquality accru-alsandalowerpropensitytomanageincomethanpublicequity firms,whilepublicequityfirmsreportmoreconservatively.Our study expandsthisanalysis andexaminesthe effectof share-holderconcentrationonearningsqualityinanenvironmentof lowerinvestorprotectioncomparedtopreviousstudies.

Accord-ing toDurnev and Kim(2005),onlyColombia ranks bellow

Brazil interms of legal enforcement. Thus we use Brazil to investigatewhether there isevidence that earningsqualityof firmslistedontheSãoPauloStockExchange(BM&FBovespa) isinfluencedbyownershipstructure.

The ownership structure can playtwo effects on earnings quality(Givolyetal.,2010).Accordingtothe“demand” hypoth-esis, firms with stronger demand for quality reporting from capitalproviderswouldpresenthigherearningsquality.Givoly

et al.(2010) argue that earnings of public equity firms have

of higher quality than earnings of private equity firms due to stronger demand by shareholders and creditors for qual-ityreporting.Onthe otherhand,the“opportunisticbehavior”

hypothesis says that firms with diffuse ownership structure shouldpresent lowerearningsqualitybecausetheir managers havehigherincentivestomanipulateearnings.

OurstudyconsidersasampleofBrazilianlistedfirmsfrom 1999to2014.WeconsiderBrazilasanopportunitytostudythe tensionbetweenthe“demand”and“opportunistic”hypotheses becausemostBrazilianlistedfirmshaveconcentratedcontrol, which diminishes the importance of externalequity funding. However, some listed firms do have truly dispersed control, whichgivesustheopportunitytoassesshowownership concen-trationinfluencesearningsqualityinasettingoflowerinvestor protection.

Thus, we exploit the tension between the “demand” and “opportunistic” hypotheses (Givoly et al., 2010) in an envi-ronmentwheremostpublicfirmshaveconcentradedownership andweobservedifferentlevelsofearningsqualityacrossfirms

(Lustosa&Nunes,2010).Wepositthatfirmswillincrease

earn-ings qualitywhen theyevaluate that thebenefits of reporting high-quality numbers exceed the costs, especiallywhen they need external equity funding (i.e.,theyhavediffuse control). Thusweconsiderthatthe“demandhypothesis”willprevailover the “opportunistic behavior”one, resulting in betterearnings qualityoffirmswithdispersedcontrol.

According to Dechow and Schrand (2004), high-quality earningsdisclosurehasthreeadvantages: itbetterreflects the company’soperating performance, itis amoreaccurate indi-cator of thefutureperformanceandit moreclosely indicates theintrinsicvalueofthecompany.Additionally,Dechow,Ge,

andSchrand(2010,p.344)relatethat“higherqualityearnings

performancethatarerelevanttoaspecificdecisionmadebya specificdecision-maker.”Thus,earningspresentedinthe finan-cialstatementsmusthavesufficientreliabilitysothatdecision makerscanusethenumbersforfutureprojections.

Giventheimportanceof reportedearnings,the literatureis concerned with measuring earnings quality and relates it to firms’characteristics.Manyresearchershaveperformed empir-icalstudiestotestthequalityofearningsreportedbycompanies

(Da Costa, Lopes, & Costa, 2006). Thus, the perception of

earnings as a measure of financial performanceof the com-panyimpliesthe analysis ofthe level of managers’ influence ontheresult presentedinthe financial statements,whichcan revealconflictsofinterestbetweenmanagersandinvestors, lead-ingtotheneedtoestablishcontrolmechanismstogovernthis relationship(Dami,Rogers,&Ribeiro,2009).

Ownershipstructureisoneoftheaspectsinfluencingthe lee-wayofmanagersandcorporategovernanceingeneral(Silveira,

Barros,& Famá,2008). Fan andWong (2002) usea sample

of 977 companies in seven East Asian economies and show thatconcentratedownershipandtheassociatedpyramidaland cross-holdingstructures createagency conflictsbetween con-trollingshareholdersandoutsideinvestors.Additionally, they findpositiveassociationbetweenconcentrated ownershipand lowearningsinformativeness.

However, inBrazil justa handfulnumber of public firms havetrulydispersedcontrolandwepositthatthisenvironment support the dominance of the “demand” hypothesis over the “opportunisticbehavior”hypothesisbecauseweobserve differ-entlevels ofearningsqualityacrossfirms(Lustosa &Nunes,

2010).

Inthiscontext,thepresentstudyinvestigatesthefollowing research question: Does different ownership structure across public firms in a setting of low investorprotection influence earningsqualityaccordingtothe“demand”hypothesis?

We first analyze the presence of timely loss recognition (conservatism) in Brazilian listed firms while controlling for ownershipconcentration.Thenweinvestigateearnings persis-tence components considering cash flows and accruals, also controllingforownershipconcentration.

Weconsiderearningspersistence(Sloan,1996),and asym-metric recognition of earnings (Basu, 1997) as proxies for earningsquality.Toestimatetheasymmetrictimeliness,we con-siderand adapt the earningstransitory components reversion modelproposedbyBasu(1997).Theestimationisperformed consideringtwo-stage least squares(2SLS) model toaddress thepotentialendogeneityproblemoftheownership concentra-tion variable. To estimate earningspersistence, we adapt the modelsuggestedbyDechowetal.(2010)(Eq.(6))byadding theexplanatoryvariableownershipconcentration.Ourearnings persistence models are estimated consideringthe generalized methodofmoments(GMM).

Generallyourresultsshowthereisasignificantpositive rela-tionship between timely earnings recognition and ownership concentrationandasignificantinverse relationbetween earn-ingspersistenceandownershipconcentration,indicatingthatas theownershipstructurebecomesmoredispersed,thepersistence ofprofitsincreasesandaccountingconservatismdecreases.This

resultispartiallyalignedwiththepredictionsofthe“demand” hypothesisconsideringalowinvestor protectionenvironment andtheconcentratedownershipstructurethatprevailsin Brazil-ianfirms.

LaPorta,LópezdeSilanes,Shleifer,andVishny(1998)find

thatgoodaccountingstandardsandmeasuresofinvestor protec-tionareassociatedwithlowownershipconcentration,indicating thattheconcentrationisinfactaresponsetoweakinvestor pro-tection.Thissituationcanleadtoincentivesforexpropriationof minorityshareholders(Silveira,2006).

Ourstudyextendspreviousresearchbyfocusingonthe qual-ity of the information disclosed in the financial statements, aiming toinclude the ownership structure as a relevant vari-abletoexplainearningsquality.Webelieveourresultsareof interesttoboththeresearchandtheinvestorcommunities.First, ourresultssuggestthatthequalityofaccountingnumbershasto beassessedandestimatedconsideringaspectsrelatedto owner-shipconcentrationevenwithinthegroupofpublicand/orlisted firms.Second,ourresultsindicatethattheaccuracyofearnings forecastscanbeinfluencedbyownershipstructure,soinvestors andequityanalystsshouldconsiderthischaracteristicintheir models.

Theremainderofthepaperisorganizedasfollows.Section “Literaturereview”providesaliteraturereviewonownership structureandearningsquality.Section“Methodology”discusses theempiricalmethodology,includingoursample,theproxiesof earningsqualityanddevelopsourhypothesis.Section“Results” presentsthetestsandresults.Ourconclusionsareprovidedin Section“Conclusions”.

Literaturereview

Ownershipstructure

DemsetzandLehn(1985)arguethatownership

concentra-tioncanbedeterminedbycharacteristicsofthe companiesor sectors inwhich they operate,such as size, risk and regula-tion.Onelineofresearch,developedbyLaPortaetal.(1998), who studiedthe change inownership structure of companies inseveralcountries,suggeststhatdifferencesinlegalsystems andtheir effectiveapplication cause differencesinownership structure.Theseauthorsfoundthatcountrieswithcommonlaw systems providegreater protectiontoinvestorsthancountries withcodelawsystems.Thus,countrieswithweakinvestor pro-tectionmechanismsdevelopsubstitutesforthislegalprotection, suchasmandatorydividendsandlegalreserverequirements(La

Portaetal.,1998).Inthiscontext,LaPortaetal.(1998)state

thatoneoftheanswerstoweakinvestorprotectionisownership concentration,tryingtominimizethelikelihoodofexpropriation ofshareholdersbymanagers.

ForShleiferandVishny(1997),thepresenceofcontrolling

ofownershipconcentration,giventheintrinsiccharacteristicsof thefirmsorindustries.

TheBrazilianinstitutionalenvironmentischaracterizedby familybusinesses(João,Santos,&Filho,2014;Tres,Serra,&

Ferreira,2014),wheremostfirmshaveconcentratedownership

structures.Thispatterncanbeexplainedbythe“path depend-ence”theory(seeBebchukandRoe(1999)),whicharguesthat thecorporatestructurethataneconomyhasatanypointintime dependspartiallyonpreviousstructurestheeconomyhadin ear-liertimes.InearliertimestheBrazilianeconomicsystemwas basedinthe colonialsystem, inwhichaneconomybased on exportoffarmcommoditiesbylargelandholdersmeanta con-centratedeconomicstructureofcapitalandpower(Comparato

&SalomãoFilho,2008).Hence,onecanarguethatfamilyfirms

followed this“path dependence”, resulting in aconcentrated ownershipstructureinBrazil.AccordingtoCaixeandKrauter

(2013), 41% of Brazilian public firms are family controlled

(whenthefoundingfamilyorasingleinvestoristhecompany’s largestshareholder),27%havenationalprivateownership(when adomesticgroupofinvestorsrepresentshavethemajoritystake, except for the founding investors or their heirs), and 17.6% are controlledby pension funds (when apension fund isthe company’slargestshareholder).SeguraandFormigoni(2014)

verify the level of debt of Brazilian firmsandfind that fam-ily owned firms present lower indebtedness than firms with dispersedownership.

According to LaPorta et al.(1998), protection of minor-ityshareholdersisimportanttomotivatethedispersionofthe ownershipstructure. Inthissense, thelegalenvironmentalso influencesshareholders’decisionstodilutetheircontrol.

Unlikeassuggestedbythetraditionalliteratureoncorporate governance,whereconflictspermeatetherelationshipbetween managersandshareholders,inBraziltheseconflictsaremore often between controlling and minority shareholders (Lopes

& Walker, 2008), a consequence of concentrated ownership

structure,besidestheweakinstitutionalenvironmentinBrazil

(Anderson,1999).AccordingtoSilveira(2006),studiesabout

ownershipstructureusuallyconsideritasaexogenousvariable, whileitshouldbetreatedasanendogenousvariable.Herewe consider andtreat thisissue when we estimate the proposed models.

Earningsquality

Highownershipconcentrationmayworkasacorporate gov-ernance mechanism in the manager-shareholder relationship. However,thepresenceoflargeshareholderscaninfluence earn-ingsquality,sincetheycanpursueprivatebenefitsofcontrolat theexpenseofotherinvestors,whichiscalledtheentrenchment effect(Silveira,2006).AccordingtoDechowetal.(2010),there arethreeimportantcharacteristicstobeobservedinrelationto earningsquality:

First, earnings quality is conditional on the decision-relevanceoftheinformation.Thus,underourdefinition,the term“earningsquality”aloneismeaningless;earnings qual-ityisdefinedonlyinthecontextofaspecificdecisionmodel.

Second,thequalityofareportedearningsnumberdepends onwhetherit isinformativeaboutthe firm’sfinancial per-formance,manyaspectsof whichareunobservable.Third, earnings qualityis jointly determined by the relevance of underlyingfinancialperformancetothedecisionandbythe ability of the accountingsystem tomeasure performance. Thisdefinitionofearningsqualitysuggeststhatqualitycould be evaluatedwithrespect toanydecision that dependson an informative representation of financial performance. It does not constrainqualityto implydecision usefulnessin thecontextofequityvaluationdecisions.

Generally the criteria used to calculate earnings involve different degreesof discretionapplied byseniormanagement regarding discretionaryaccruals. In thissense,the ownership structure acts as adisciplinarymechanism intherelationship betweenshareholdersandmanagers(Silveiraetal.,2008),who mightusediscretionaryaccrualstomanageearningsasan oppor-tunisticwaytomeetprivateinterests.

According toGivoly etal.(2010), thequality of account-inginformationisinfluencedbyseveralfactors,mostofwhich stemfromthedemandforsuchinformation.Accordingtothe “demand”hypothesis,firmswithstronger demandfor quality reportingfromcapitalprovidersshouldpresenthigherearnings quality.Thatisacharacteristicoffirmsthathavehigher owner-ship dispersion (Givoly et al., 2010).On the otherhand, the “opportunistic behavior”hypothesis says that firms with dif-fuseownershipstructureshouldpresentlowerearningsquality becausetheirmanagershavestrongerincentivestomanipulate earnings.Furthermore,Brazilianinstitutionalenvironmentdoes notincentivefirmtoreportqualityearnings(Coelho,Galdi,&

BroedelLopes,2010).

Finally, Hope, Thomas, and Vyas(2012) argue that man-agers’actions are notperfectlyobservable bythe owner,and becauseofthatmanagershavetheabilitymanipulateearnings tohideunfavorableperformance.Inthissense,firmswithhigher agencycosts(i.e.,moreconcentratedownershipstructure)are expectedtohavelowerearningsquality.

Demandandopportunisticbehaviorhypothesisand earningsquality

Ball, Kothari, and Robin (2000) argue that timeliness is

defined asthe extenttowhichthe currenteconomic outcome isincorporatedbycurrentaccountingincomeandconservatism istheextenttowhichcurrentaccountingincomeasymmetrically incorporateseconomiclossesandgainsconsidering“bad”and “good”news.AsdocumentedbyWatts(2003a),conservatism referstothecumulativeeffectsrepresentedinthebalancesheet andincomeorprofitsaccumulatedsincethestartofoperations of thecompany. Basu(1997)arguesthatconservatism means thatreportingtheaccountingresultsreflects“badnews”faster than“goodnews”.

Watts(2003a)statesthatconservatismcanlimitmanagers’

Hypothesis

Type of ownership Public firms Private firms

Private equity, Private debt

Private equity (concentrated ownership), Public

debt

Public equity (diffuse ownership), Public debt

“Demand” Hypothesis

Low persistence, Low asymmetric

timeliness recognition

Low persistence, High asymmetric timeliness

recognition

High persistence, Low asymmetric timeliness

recognition Predicted quality of

financial reporting Low Medium High

“Opportunistic Behavior” Hypothesis

High persistence, Low asymmetric

timeliness recognition

Low persistence, High asymmetric timeliness

recognition

Low persistence, Low asymmetric timeliness

recognition Predicted quality of

financial reporting High Medium Low

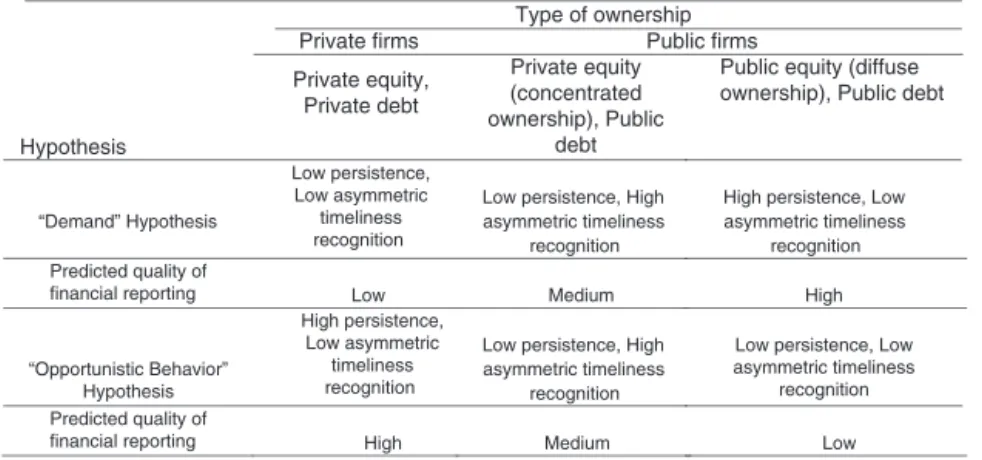

Fig.1.Typeofownershipandexpectedqualityoffinancialreporting. Source:AdaptedfromGivolyetal.(2010).

managers(LaPortaetal.,1998).Ali,Chen,andRadhakrishnan

(2007)recognizethat familyfirms,comparedwithnonfamily

firms,facemoresevereagencyproblemsbetweencontrolling andnon-controllingshareholders.Theseconflictingeffectsare oftenreferredtoas“entrenchmentversusalignment”.

Inthiscontext,weconsiderthatinlinewiththe“demand” hypothesis, firms in markets with greater ownership disper-sion and with greater owner-manager separation (i.e., lower agencyconflicts)havehigher probabilitytoreportbetter lev-elsof earnings quality(Hope etal., 2012), i.e., present high earningspersistence. Additionally, we expect that firms with diffuseownershipandpublicdebtshouldtimelyrecognizeboth lossesandgainswhereasfirmswithconcentratedownershipand public debt should asymmetrically recognize losses, because accordingtoBallandShivakumar(2005),timelyloss recogni-tionmitigatestheagencyproblemsassociatedwithmanagers’ investmentdecisions.Incentivesbetweenshareholdersand cred-itorsarealignedinfirmswithdiffuseownershipandpublicdebt, butmaybeunalignedinfirmswithconcentratedownershipand publicdebt.

On the other hand, the “opportunisticbehavior” hypothe-sis posits that firms with diffuse ownership structure should present lower earnings quality (e.g., lower conservatism and lowerearningspersistence)becausetheirmanagershavehigher incentives to manipulate earnings considering that outsiders haveless access to privateinformationand theymay benefit fromearningsmanagement.

Accordingto(Coelhoetal.,2010),theBrazilianinstitutional environmentdoesnotencouragefirmstoreportqualityearnings, althoughtheneedforfundingmayinducefirmstoimprovetheir reportingsystem.Theempiricalevidenceshowsthatthedegree ofaccountingconservatismdiffersacrosscountriesand accord-ingtopreparers’incentives(Chi&Wang,2010).Inthiscontext,

Fig.1presentsourexpectationsregardingtheearningsquality proxybehaviorusedinthisstudy,consideringboththedemand andopportunisticbehaviorhypothesesdiscussedinGivolyetal.

(2010).

Hence we posit that Brazilian listed firms with higher ownershipconcentrationandpublic debtpresentmoretimely lossrecognition(TLR)incomparisontofirmswithdispersed concentration because debtholders demand TLR to inhibit

managers’ natural optimism. Additionally, we consider that listed firms with dispersed ownership report with neutrality, presentinglowerTLR,sincethemajoragencyconflictsinthe Brazilianmarketarisebetweenthecontrollingshareholdersand minority shareholders (Lopes &Walker,2008) andthe latter havepreferenceforfirmswithhighpayoutratios.Gonzagaand

Costa (2009)find evidencethat dividendpayments are

nega-tivelyrelatedtoconservatism.

DaCostaetal.(2006)arguethatexcessiveconservatismcan

lead to disclosureof informationwith false signals tousers.

Penman andZhang (2002)empiricallydiagnosedlowquality

of earnings resulting from the variation in investments with accountingconservatism,arguingthataccountingconservatism raises questions about the qualityof accounting information andprofit.Thereasonisthat withgrowthininvestment, pro-fits are reduced by creating hidden reserves. These reserves canbereduced, generatingprofits,arisingfromthereduction ofinvestmentsorreducingtheirgrowthrate.

Ontheotherhand,Watts(2003b)showsthataccounting con-servatismisrelatedtothecontractualrelationshipbetweenthe company and creditors, with the intention of ensuring com-pliancewithcontractualcovenants.Thus,conservatismcanbe consideredanefficientmechanismfordeterminingthe param-eters of contracts(Paulo,Antunes,&Formigoni,2008),asit helpstoreducetheopportunisticbehaviorofmanagers(Watts,

2003b).

Followingtheargumentsthatexcessiveconservatismin earn-ingsreportingprovidespoorinformationtothecapitalmarkets, hypothesisH1is:

H1. Accordingtothe“demand”hypothesis,publicfirmswith

concentratedownershippresenthigherconservatismthanthose withdiffuseownershipstructure.

Earningspersistenceisgenerallyconsideredtobean impor-tant feature of accounting quality because it enables more accurateforecasts.AccordingtoLipe(1990),earnings persis-tenceisthedegreetowhichunexpectedchangesincurrentperiod earningsaffectthenextperiodearnings.Dechowetal.(2010)

bestindicatoroffuturecashflowsandthereforeprovidethemost useful information for valuation models. Richardson, Sloan,

Soliman,andTuna(2005)commentthatempiricalfindings

gen-erallyconfirmthatlessreliableaccrualsleadtolowerearnings persistence, inturnleadingtosignificant security mispricing. Additionally,Sloan(1996)arguesthatpersistencedependsboth ontheaccountingmeasurementsystemandfirms’performance, anddisentanglingtheroleofeachisnotaneasytask.

AccordingtoPimentelandAguiar(2012),earnings persis-tence has an important role to predict firm value, so it is a desirablequalityofearnings.However,intheBraziliancapital market fewstudieshaveanalyzedthe importanceof earnings persistence. Pimentel and Aguiar (2016) analyze the role of earningspersistenceinvaluation accuracyandasaproxyfor long-termmarketorientationintheBrazilianmarket.Theyfind anegativerelationshipbetweenearningspersistenceand valua-tionerrors,indicatingthatfirmswithhigherpersistenceprovide moreaccuratevalueestimatesthanfirmswithlowpersistence.

Additionally,PimentelandAguiar(2012)analyzequarterly earningspersistenceanditsrelationshipbetweenthecorporate governance standards andfirm size. They find that firm size seemstobe animportantdeterminant ofearningspersistence andthatearningspersistenceisdifferentforfirmswith differ-entcorporategovernancestandards.Coelho,Aguiar,andLopes

(2011)analyzethe relationshipbetween earningspersistence,

industrystructureandmarketshareandfindthatthecombined effectofindustrystructureandmarketsharedoesnotguarantee abnormalfutureearnings.

The“demandhypothesis”(Givolyetal.,2010)considersthat publicfirmswithpublicdebtandpublicequitypresentstrong demandforqualityexternalreportingfrombothequityanddebt holders.Weconsiderthat publicfirmswithdiffuseownership controloperatinginalowerinvestorprotectionenvironmentlike Brazilhaveincentivestoreportearningsthataccuratelypredict futureperformance.Thus,oursecondhypothesisis:

H2. According to the “demand” hypothesis, public firms,

researchershaveshownthatprofitsproducesmallerforecasting errorsthanthecashflowvaluationmodels:sinceprofitsaremore stronglyassociatedwithstockreturnsthancashflow,profitsare morepersistentthancashflowandarelessvolatilethanthecash flowcomponent.Thusaccrualscanprovideusefulinformation, despitethefacttheyarelesspersistent.

Inthissenseweadoptthedefinitionofearningsquality pre-sentedinDechowetal.(2010),inwhichqualityofprofitexists onlyifitisinformativeaboutfirm’sperformance,andwe for-mulateoursecondhypothesis:

H0(ii). Firmswithdispersedcontrolpresenthigherpersistence

offutureearningsrelativetocurrentearnings.

Methodology

Data

Our sample comprises companieslisted onthe São Paulo Stock Exchange (BM&FBovespa), covering the period from

1999to2014.Accountingandmarketdatawereobtainedfrom theEconomaticadatabase.

Weexcludedfromthesamplefinancialservicesandinsurance firms, duetotheirspecificaccountingrules.Additionally, we excludedfirmsthatdidnotpresentinformationaboutownership concentrationconsistentlythroughouttheperiod.

Thus,we keptinthe samplethe companiesthat presented informationaboutownershipconcentrationforatleastsixyears. Tomitigatetheeffectsofextremeobservations(outliers)in theeconometricmodels,wewinsorizedthefollowingvariables at 2.5%: operating profit,operating cashflow, totalaccruals, earningspershare,andreturn.

FollowingDemsetz andLehn(1985),ourmeasureof con-centration(ConcA1)isgivenbythepercentageofsharesowned

by thelargestshareholder.To expandthe concept of concen-tration, we also used the percentage of shares owned by the five largestshareholders(ConcA5).Thisisbecause managers

oftenholdshares.Therefore,the fractionof sharesowned by the largestshareholderisnotareliablemeasureofthedegree ofinvestorprotection.However,managerstypicallydonotown enoughsharestobecountedamongthefivelargestshareholders

(Demsetz&Villalonga,2001).

Thus,bothmeasureswerecalculatedas:

Log

percentageconcentration 100−percentageconcentration

Endogeneityproblem

The econometric models applied in this study use as an explanatory variable of the quality of earnings that assume ownershipconcentrationisavariableexogenoustothemodel. However, there is a possibility that the variable is endoge-nous (correlated with the error term, cov(xj,u)(xj,u)=/ 0

(Wooldridge,2006))comparedtonetincome,i.e.,aparticular

ownership structure may resultin profit disclosurewithhigh quality. However, the earnings disclosure quality can attract investors to the companyand modify the ownership concen-tration.

As documented by Silveira (2006),previous authors have claimed that the type of occurrence mentioned results from the phenomenon of reverse causality,which is toincorrectly interprettheeffectasbeingthecause.

Themorerecentliteraturehasshownthatownershipstructure isanendogenousvariable(Cho,1998;Demsetz&Villalonga,

2001; Himmelberg, Hubbard, & Palia, 1999). For instance,

Himmelbergetal.(1999),followingDemsetzandLehn(1985),

investigatedevidencethattheownershipstructureisdetermined by endogenousvariableslikesize,economic sectorandother performancevariables.Theyfoundthatownershipconcentration isexplainedbyvariableslinkedthefirmcharacteristics.

Wooldridge(2006)arguesthatifoneestimatestheregression

variables,generatinganarrayoffittedvaluesforeachregression, andinthesecondstagethemodelisestimatedforthe depend-entvariableonthebasisofestimatedvaluesoftheexplanatory variables.

Asymmetrictimelinessmodel

Toestimatetheindicatorsofconservatism,westartedwiththe modelofreversaloftransitorycomponentsinearningsproposed

byBasu(1997):

Earnit Pt−1

=β0+β1Dit+β2REit+β3DitREit+εit (1)

whereEarnit denotesearningspershareoffirmiinperiodt, Ditisadummyvariablethattakesthevalue“1”iftheeconomic

returnisnegativeand“0”ifpositive,REitistheeconomicreturn

offirmiinperiodt(theeconomicreturnisgivenbyPt−Pt−1)

andPt−1isthesharepriceattheendoflastyear.

InEq.(1),thecoefficientsβ1andβ3capturetheasymmetric

recognition of economic returnby accountingprofit (conser-vatism),whilethecoefficientβ2capturesthetimelyrecognition

ofeconomicreturninbookincomestream,inotherwords,it reflectsthetimelinessofaccountingincome.

AccordingtoBasu(1997),β3ispositiveandsignificant

statis-ticallyif“badnews”isrecognizedinprofitbefore“goodnews”, indicating the presence of conservatism. Finally, the dummy variableDitisusedtotestthehighersensitivityofnetincome

accountingtonegativereturnsthantopositiveones.

Ifanegativeeconomic returnisincorporatedmore signif-icantly by the accounting profit than a positive return, this indicatestheexistenceofconservatisminrecognizingeconomic return,sothatβ3willbelargerandmorestatisticallysignificant

thanβ2(DaCostaetal.,2006).

InEq.(1),referringtothemodelofBasu(1997),β3ispositive

andsignificantstatisticallyif“badnews”isrecognizedinprofits before“goodnews”,indicatingthepresenceof conservatism. Finally,thedummyvariableConcA1∗CFOisusedtotestthe

highersensitivityofnetincomeaccountingtonegativereturns thantopositiveones.

Ifanegativeeconomic returnisincorporatedmore signif-icantly by the accounting profit than a positive return, this indicatestheexistenceofconservatisminrecognizingeconomic return,sothatβ3willbelargerandmorestatisticallysignificant

thanβ2(DaCostaetal.,2006).

InEq.(1),referringtothemodelofBasu(1997),weadded thevariableownershipconcentration ConcAki,t we addedthe

variableownershipconcentration ConcAki,t,where“k”isthe

indexdenotesiftheconcentrationismeasuredbythe percent-ageof shares owned by the largest shareholder (k=1) or by thepercentageofsharesownedbythefivelargestshareholders (k=5).

The estimation was performed using the two-stage least squares(2SLS)model toresolve theproblemof endogeneity of the ownership concentration variable. The endogene-ity test was performed to test the significance of the coefficients,andtheresultsshowedevidenceoftheexistenceof

endogeneityat1%.

Earnit Pt−1

=(β11+ui)+β12Dit+β13REit+β14DitREit

+β15ConcAKit+β16(ConcAKit∗REit)

+β17(ConcAKit∗DitREit)+β18Log(Assetit)+εit

ConcAKit=β21+β22Log(Assetit)+β23ADRt+β24Dit

+β25REit+β26DitREit+ 10

j=1

δjYear+ε2 (2)

Asan instrument of ownershipconcentration variable, we usedthelogarithmofassetsLog(Asset)asameasureof com-panysize.AccordingtoHimmelbergetal.(1999),larger com-panies’shareholderscanbebetterprotectedbymoredispersed concentration. However,largecompaniescanalsoexperience moresevereagencyconflictsduetodispersedownership.

Alsoweusedthevariable“ADR”,whichindicateswhether thefirmhasAmericanDepositaryReceipts(ADRs),inorderto identify theimpactof changesinthe regulationof ownership concentration.Wealsoincludedadummyvariable,YEAR,to capturethemacroeconomiceffectsoftheperiod.

InthemodelpresentedinEq.(5),thecoefficientCFO cap-tures therelationshipof profit withthe company’sownership concentration. Our main interest in Eq. (2) is to identify if

β17>0andβ17>β14·β16<β17.Ifβ17>0andβ17 >β14,

β16<β17thereisevidencethatinthepresenceofhigher

owner-ship concentration, negative economic returns have higher associationwithearnings,whichisexpectedconsideringourH1.

Earningspersistencemodel

BasedonthemodelsuggestedbySloan(1996)andDechow

etal.(2010)(Eq.(6)),anditsformulationdecomposingincome

intoitscomponentsoperatingcashflowandaccruals(Eq.(7)), weaddedtheexplanatoryvariableofthestudy,theshareholding concentration:

Earnt+1=α+β1Earnt+εt+1 (3)

Earnt+1=α+β1Acct+β2FCOt+εt+1 (4)

In theseequations, “Earn” isdefined as operating income scaled by total assets (Sloan, 1996). Thus, according to the author, β in Eq. (6) measures the persistence of the rate of returnonassets.InEq.(7),β1<β2,whichimplieslowerprofit

persistenceisattributedtothetotalaccrualcomponent. Asafirststep,weestimatedthepersistenceoffutureearnings relativetocurrentearningsintheformatbelow:

Earnt+1=α+β1Earnt+β2ConcAKt

+β3(ConcAKt∗Earnt)+εt+1 (5)

whereEarnt+1is earningsinyeart+1;Earnt isearningsin

ConcAkt,where“k”representstheindexdenotingifthe

concen-trationismeasuredbythepercentageof sharesownedbythe largestshareholder(k=1)orbythepercentageofsharesowned bythefivelargestshareholders(k=5).

InEq.(5),thecoefficientβ3capturestherelationshipofprofit

withthecompany’sownershipconcentration,i.e.,thevariation of the profit goes through the ownership concentration. The coefficientβ2indicateswhetherthereisanystatistically

signif-icantrelationshipbetweentheindependentvariablesownership concentrationandaccountingprofit.

FollowingthemethodproposedbySloan(1996),we decom-posed the profit into its components and added the variable ownershipconcentration:

Earnt+1=β0+β1Acct+β2FCOt+β3ConcAKt

+β4(ConcAKt∗Acct)

+β5(ConcAKt∗FCOt)+εt+1 (6)

Todeterminethevaluesofthevariableaccruals,wefollowed

Sloan(1996),whostatesthatthetotalaccrualscanbecalculated

usinginformationfromthebalancesheetandincomestatement:

Acc=(CA−cash)−(CL−STD−TP)−Dep

(7) whereCAisthechangeincurrentassets;Cashisthechange in cash and cash equivalents; CL is the change in current liabilities;STDisthechangeindebtincludedincurrent lia-bilities;TPisthechangeinincometaxespayableandDepis depreciationandamortization.

Priorto2007,thecashflowwascalculatedbythedifference ofnetincomeandaccrualsusingtheindirectmethod,as com-mented byDechow, Sloan,andSweeney(1995). Forperiods ending after 2007(when disclosure of a cash flow statement

startedtobemandatoryinBrazil)wecollectedthisinformation consideringthedirectmethod,i.e.,directlyfromthecashflow statement. Allthe informationwascollect fromEconomatica database.

To estimate earnings persistence coefficients, we used a dynamic panel model,whichcanpose someestimation prob-lems. Forour purposes, theseare the presence of the lagged dependent variableas an explanatory variable, causing prob-lems of autocorrelation, and the grouping of the panel data onashortertimescale(smallT)andalargernumberoffirms (largeN).

Arellano and Bond (1991) developed estimators to solve

panel models for smallT andlarge N, which consists of the use of the generalized method of moments (GMM). Instead of this estimator, we employed an equivalent estimator, that of Arellano–Bover/Blundell–Bond, which leads to an addi-tional hypothesis, that the first difference of the instruments is not correlated with the fixed effects, which increase the numberof instrumentsandincreasesefficiency,allowing cor-rection of the estimation bias caused by the lagged variable, and accepts variables that are not strictly exogenous, mean-ing accepting a certaindegreeof endogeneity andcorrecting it.

As documented by Dechow et al. (2010), more persistent profits causeshigherstockvalues,soincreaseintheestimate of persistenceisassociatedwithpositivereturnsinthecapital market.

Results

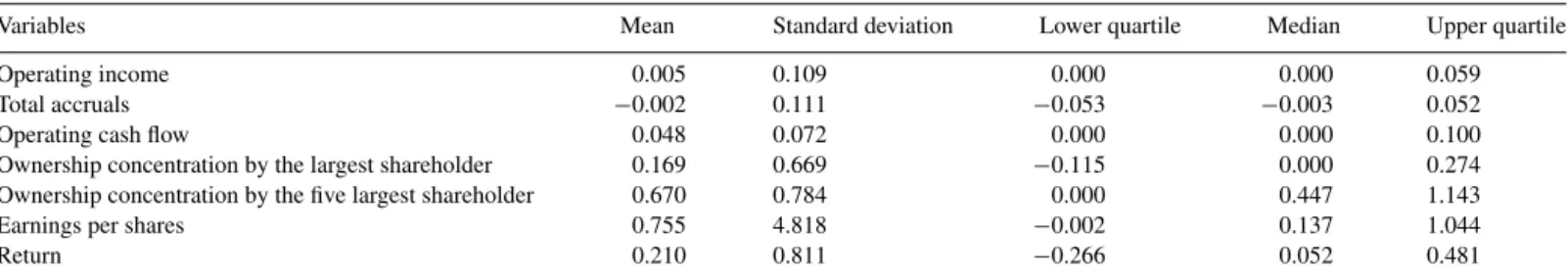

Table1 providesdescriptivestatistics.Weobservethat the

meanofownershipconcentrationsuggeststhatownership struc-tureishighlyconcentratedinBrazil,asfoundinpriorstudies

(Black, DeCarvalho, &Sampaio, 2014;Coelho etal., 2010;

Dalmácio & Corrar,2007). The mean of the returnis 0.210,

Table1

Descriptivestatistics.

Variables Mean Standarddeviation Lowerquartile Median Upperquartile

Operatingincome 0.005 0.109 0.000 0.000 0.059

Totalaccruals −0.002 0.111 −0.053 −0.003 0.052

Operatingcashflow 0.048 0.072 0.000 0.000 0.100

Ownershipconcentrationbythelargestshareholder 0.169 0.669 −0.115 0.000 0.274 Ownershipconcentrationbythefivelargestshareholder 0.670 0.784 0.000 0.447 1.143

Earningspershares 0.755 4.818 −0.002 0.137 1.044

Return 0.210 0.811 −0.266 0.052 0.481

Source:authors.

Variables:

Operatingincome–isearningsinyeart,scaledbytotalassets.

Totalaccruals–isthetotalaccrualscanbecalculatedusinginformationfromthebalancesheetincomestatement:TA=(CA−Cash)−(CL−STD−

TP)−Dep.CAisthechangeincurrentassets;Cashisthechangeincashandcashequivalents;CListhechangeincurrentliabilities;STDisthechange indebtincludedincurrentliabilities;TPisthechangeinincometaxespayableandDepisdepreciationandamortization,scaledbytotalassets.

Operatingcashflow–isthecashflow,calculatedbythedifferenceofnetincomeandaccruals,scaledbytotalassets.

Ownershipconcentrationbythelargestshareholder–isownershipconcentrationmeasuredbythepercentageofsharesownedbythelargestshareholder.

Ownershipconcentrationbythefivelargestshareholder–isownershipconcentrationmeasuredbythepercentageofsharesownedbythefivelargestshareholders.

Earningspershares–denotesearningspershareoffirmiinperiodt,scaledbypriceinperiodt−1.

Table2

Regressiontoasymmetrictimelinessandtimelylossrecognition.

Variables Pred.

Sign

%ofsharesheldbythelargestshareholder %ofsharesheldbythefivelargestshareholders

Coeff.Est. z-stat. Coeff.Est. z-stat.

PanelA–TotalSample

Cons −1.498*** −4.44 −5.081*** −3.67

Dit − −0.538 −1.36 −0.755** −2.14

RE + 0.374 1.58 1.738*** 2.98

Dit∗RE − −2.966*** −3.46 −8.209*** −3.57

ConcA1 + 14.225*** 4.78 – –

ConcA1∗RE + −4.210*** −4.20 – –

ConcA1∗Dit∗RE ? 15.566*** 4.59 – –

ConcA5 + – – 7.322*** 3.46

ConcA5∗RE + – – −2.371*** −2.88

ConcA5∗Dit∗RE ? – – 9.153*** 3.24

Log(Asset)t − −0.052*** −4.34 −0.036** −2.35

No.Obs. 2.593

PanelB–SmallCompanies

Cons −1.181* −1.90 −2.135 −0.88

Dit − −1.442** −2.16 −1.485** −2.12

RE + −0.321 −0.85 −0.563 −0.62

Dit∗RE − −2.671** −2.11 −3.245 −0.87

ConcA1 + 2.339 0.63 – −

ConcA1∗RE + 0.061 0.06 – −

ConcA1∗Dit∗RE ? 2.392 0.58 – −

ConcA5 + – – 1.747 0.51

ConcA5∗RE + – – 0.593 0.52

ConcA5∗Dit∗RE ? – – 0.770 0.19

Log(Asset)t − −0.026 −1.32 −0.011 −0.51

No.Obs. 829

PanelC–BigCompanies

Cons −1.350*** −3.42 −6.499*** −4.77

Dit − 0.075 0.13 −0.112 −0.26

RE + 0.562* 1.65 3.016*** 4.70

Dit∗RE − −1.993 −1.58 −10.103*** −4.18

ConcA1 + 22.280*** 6.02 – –

ConcA1∗RE + −8.180*** −5.53 – –

ConcA1∗Dit∗RE ? 25.471*** 5.68 – –

ConcA5 + – – 10.332*** 4.80

ConcA5∗RE + – – −4.332*** −4.58

ConcA5∗Dit∗RE ? – – 14.795*** 4.64

Log(Asset)t − −0.085*** −5.41 −0.075*** −3.49

No.Obs. 1.764

Earnit/Pt−1=(β11+ui)+β12Dit+β13REit+β14DitREit+β15ConcAKit+β16(ConcAKit∗REit)+β17(ConcAKit∗DitREit)+β18Log(Assetit)+εit

ConcAKit=β21+β22Log(Assetit)+β23ADRt+β24Dit+β25REit+β26DitREit+

10

j=1

δjYear+ε2

Variables:Earnitdenotesearningspershareoffirmiinperiodt,Ditisadummyvariablethattakesthevalue“1”iftheeconomicreturnisnegativeand“0”ifpositive, REitistheeconomicreturnoffirmiinperiodt(theeconomicreturnisgivenby[Pt−Pt−1]/Pt−1)andPt−1isthesharepriceattheendoflastyear,ConcAki,t,is

ownershipconcentrationwhere“k”istheindexthattellsiftheconcentrationismeasuredbythepercentageofsharesownedbythelargestshareholder(k=1)orby thepercentageofsharesownedbythefivelargestshareholders(k=5),Log(Asset)isthelogarithmoftotalassetsasameasureofcompanysize.

* Significanceat10%.

** Significanceat5%.

***Significanceat1%.

similartothat foundbyDaCostaetal.(2006),aswellasthe meanoftheoperatingincome.

Asymmetrictimelinessandtimelylossrecognition

Table2showstheresultsestimatedbytheregressionmodel

of Basu (1997), as modified by insertion of our explanatory

variable,ownershipconcentration.

Results in Table 2 indicate that firms with concentrated ownership recognize more asymmetrically their gains and losses. Table2,panel A,showsapositiveβ15,indicatingthat

companyownershipconcentrationrelatespositivelywith earn-ing in Brazil. The main coefficient of our analysis is β17×

(ConcAn∗Dit∗RE).β17 is positiveandsignificant andalso

bigger than β14, showing evidence that in the presence of

higherassociationwithearnings,whatisexpectedconsidering ourH1.

Regardingtherelationshipwithownershipconcentration,the resultsaresimilarforboththeconcentrationmeasuredasa per-centageofsharesownedbythelargestshareholderConcA1and

the percentage of shares owned by the five largest sharehol-dersConcA5.Forbothmeasures, thecoefficientshavevalues

statisticallysignificantat1%.

The results showthat as the ownershipstructure becomes more concentrated, there tends to be greater conservatism. Accordingtotheliterature,thisindicatesthepossibilityof pro-viding less reliable information tothe market withregard to profit as an effective indicator for predicting future earnings

(Penman&Zhang,2002).

This may stem from the fact that conservatism acts as a mechanismtomitigateagencyconflictsbetweenminority share-holdersandcontrollingshareholders(Ahmed,Billings,Morton,

&Stanford-Harris,2002).Although documentedby Gonzaga

andCosta(2009),whenagencyconflictsaremoreintense,the

demandforconservatismmayincreaseduetotheneedfor align-mentofinterestsbetweenthesegroupsofshareholders.

According to the “demand” hypothesis, public firms with concentratedownershippresenthigherconservatismthanthose withdiffuseownershipstructure.Accordingtothe “opportunis-tic behavior”hypothesis, managers havehigher incentives to manipulate earnings when the firms have diffuse ownership

structure (Givoly et al., 2010). Thus, conservatism arises as an efficientmechanismtocontrolthe parametersof contracts

(Pauloetal.,2008),andtoreducetheopportunisticbehaviorof

managers(Watts,2003b).

Wecomplementouranalysisbyclusteringthemodelbyfirm size.Wesplitoursampleintobigfirmsandsmallfirms consid-ering“big”firmstheonesthatareabovethemedianofthesize, measure bytotalassets,and“small”firmsthat arebelow the median.Thus,wefoundthatthebigfirmsaremoresensitiveto theownershipstructure.Usingmeasuresofownership concen-trationaslargestshareholderandthefivelargestshareholders, we foundthat inbiggercompaniesastheownershipstructure becomesmoreconcentrated,thepresenceofaccounting conser-vatismisstronger.Thepresenceofconservatismforthisgroup ishigherthanwhenanalyzingthesamplewithallfirms.

The results show that for larger companies there was no accountingconservatisminthesample.However,theownership concentrationisstatisticallysignificantonlyforlarger compa-nies.Webelievethatthisresultstemsfromthefactthatbigfirms tendtohaveownershipstructuresstronglyconcentratedin fam-ilyhands,whichimplieslowerinformationasymmetry(Easley,

Hvidkjaer,&O’hara,2002).

Considering the results for the Brazilian capital market, hypothesis H1 isnot rejected,according towhichcompanies

withdispersedcontroland/oronlycommonsharestendtobeless conservativethanthosewithconcentratedownershipstructure.

Table3

Regressionofearningspersistence.

Variables Pred.

Sign

%ofsharesheldbythelargestshareholder %ofsharesheldbythefivelargestshareholders

Est.Coeff. t-stat. Est.Coeff. t-stat.

PanelA–TotalSample

Earn + 0.532*** 51.97 0.514*** 86.50

ConcA1 − −153.499*** −4.67 – –

ConcA5 − – – −91.273*** −7.17

ConcA1∗Earn − −0.039*** −6.26 – –

ConcA5∗Earn − – – −0.026*** −9.35

No.Obs. 3.671

PanelB–SmallCompanies

Earn + 0.887*** 3.53 1.599 0.31

ConcA1 − −195.526*** −11.48 – –

ConcA5 − – – −179.162*** −5.02

ConcA1∗Earn − −0.243* −1.92 – –

ConcA5∗Earn − – – −0.597 −0.23

No.Obs. 1.494

PanelC–BigCompanies

Earn + −0.074*** −35.69 −0.075*** −109.17

ConcA1 − −3.383*** −41.63 – –

ConcA5 − – – 21.931*** 8.85

ConcA1∗Earn − 0.035*** 35.51 – –

ConcA5∗Earn − – – 0.049*** 30.08

No.Obs. 2.177

Earnt+1=α+β1Earnt+β2ConcAKt+β3(ConcAKt∗Earnt)+εt+1

Variables:Earnt+1isearningsinyeart+1;Earntisearningsinyeart,andthevariableownershipconcentrationiscontrolledbyConcAkt,where“k”denotesifthe

concentrationismeasuredbythepercentageofsharesownedbythelargestshareholder(k=1)orbythepercentageofsharesownedbythefivelargestshareholders (k=5).

* Significanceat10%.

Theresultsshowthecoefficientβ17ishigherthanβ14,for

boththetotalsampleandthesampleofbigcompanies,indicating thatconcentratedownershipfirmsrecognizelosses asymmetri-callyinrelationtodispersedfirms(i.e.,concentratedfirmsare moreconservative).Inotherwords,thisresultshowsthat con-centratedfirms present higher association between economic returnand earningswhen returns are negative. Thisresult is robustforthetwodifferentmeasuresofownershipconcentration weconsiderinourestimation.

Earningspersistence

Theempiricaltestsforthe persistenceofearningsare pre-sentedinTable3,whichshowstheregressionresultsofEq.(5), investigatingtheperformanceoffutureearningsincurrent earn-ings.ConsistentwiththefindingsofSloan(1996),oursample

showsapositiverelationshipbetweenfutureandcurrentprofit, withcoefficientsequalto0.532and0.514forthetwomeasures of ownership concentration respectively. Both are significant atthe 1%level, thusindicatingpersistence andsustainability ofearnings,sothattheirperformanceisnotmerelytransitory, showingthatthisprofitisagoodindicatorforvaluationmodels. TheresultsseemtocorroboratethefindingsofPimenteland

Aguiar (2012)inanalyzingtheearningspersistence

consider-ingitsrelationshipwithfirmsizeintheBrazilianmarket.Our findingssuggestthatthesizecanbeanimportantdeterminant ofearningspersistence.Inthissense,thisresultshowsthatin theBraziliansetting,earningspersistencemayincrease valua-tionaccuracyandthusbemoreimportantinvaluationdecisions

(Coelhoetal.,2011;Pimentel&Aguiar,2012,2016).

Theresultsoftheestimatorsfortheownershipconcentration variableshowedtheexpectedsignsandanegativerelationship

Table4

Regressionoftheearningspersistenceconsideringthedecompositionintocashflowandaccruals.

Variables Pred.

Sign

%ofsharesheldbythelargestshareholder %ofsharesheldbythefivelargestshareholders

Est.Coeff. t-stat. Est.Coeff. t-stat.

PanelA–TotalSample

Acc + 155.987*** 7.22 8.787 0.07

CFO + 244.497** 2.07 19.975 0.11

ConcA1 – −38.782*** −2.65 – –

ConcA5 – – – −36.768*** −2.60

ConcA1∗Acc – 325.209*** 4.12 – –

ConcA1∗CFO – 1353.367*** −4.64 – –

ConcA5∗Acc – – – 256.009** 2.02

ConcA5∗CFO – – – 602.384*** 4.33

No.Obs. 3.671

PanelB–SmallCompanies

Acc + 141.291** 2.49 −76.436 −1.63

CFO + 583.869 1.14 295.119 0.65

ConcA1 – −120.291** −2.30 – –

ConcA5 – – – −92.090** −2.03

ConcA1∗Acc – 642.492*** 2.74 – –

ConcA1∗CFO – 3969.205*** 4.03 – –

ConcA5∗Acc – – – 620.124*** 6.66

ConcA5∗CFO – – – 1965.147*** 4.21

No.Obs. 1.494

PanelC–BigCompanies

Acc + 236.091*** 9.66 344.998*** 8.84

CFO + 180.124*** 7.71 256.439*** 7.13

ConcA1 – −5.128 −0.86 – –

ConcA5 – – – 10.360*** 2.88

ConcA1∗Acc – −56.678** −2.07 – –

ConcA1∗CFO – 3.246 0.09 – –

ConcA5∗Acc – – – −274.699*** −8.00

ConcA5∗CFO – – – −143.088*** −5.53

No.Obs. 2.177

Earnt+1=β0+β1Acct+β2FCOt+β3ConcAKt+β4(ConcAKt∗Acct)+β5(ConcAKt∗FCOt)+εt+1

Variables:Earnt+1isearningsinyeart+1;Accisthetotalaccrualscanbecalculatedusinginformationfromthebalancesheetandincomestatement:TA= (CA−∆Cash)−(CL−STD−TP)−Dep.CAisthechangeincurrentassets;Cashisthechangeincashandcashequivalents;CListhechangein currentliabilities;STDisthechangeindebtincludedincurrentliabilities;TPisthechangeinincometaxespayableandDepisdepreciationandamortization. CFOcashflowwascalculatedbythedifferenceofnetincomeandaccruals,andthevariableownershipconcentrationiscontrolledbyConcAkt,where“k”denotesif

theconcentrationismeasuredbythepercentageofsharesownedbythelargestshareholder(k=1)orbythepercentageofsharesownedbythefivelargestshareholders (k=5)

** Significanceat5%.

withrespect tofutureearnings, indicatingthat the higherthe ownershipconcentration,thelowerthepersistenceand sustaina-bilityoffutureprofits.

Our results also show that when we split the sample into bigfirmsandsmallfirms,thepersistenceoffutureearningsin currentearningsisstrongerforsmallfirmsthanforbigfirms, specifically for the group of the shares owned by the largest shareholder.

Toenlargetheperceptionofthisrelationship,Table4presents theestimatedresultsforregression9,applyingthe decomposi-tionofearningsassuggestedbySloan(1996).Liketheresults

ofSloan(1996),oursampleshowedthattheperformancegainis

morepersistentthanthecashflowcomponentfortheBrazilian capitalmarket.

Theownershipconcentrationissignificantatalevelof1%for thebothmeasuresofownershipconcentration,thepercentage ofsharesownedbythelargestshareholderandthepercentage ofsharesownedbythefivelargestshareholders.

Theresultsindicate,asinthepreviousmodel,asignificant andnegativerelationwiththeperformanceoffutureearnings, reinforcingtheevidencethatthegreatertheownership concen-tration,thelowerthepersistenceofearnings.

Whenanalyzingtherelationshipofownershipconcentration withthe persistence of accrualsin earnings, it isstatistically significantforboththelargestshareholderasforthefivelargest shareholders,asistherelationshipofownershipconcentration withoperatingcashflow,significantat1%.However,justforthe fivelargestshareholders,inthesampleofthelargercompanies, therelationisnegative,indicatingthatastheownershipstructure becomesmoreconcentrated,thecashflowgenerationtendsto decrease.

Basedontheresultspresented,theearningspersistenceis dif-ferentforfirmswithdifferentownershipconcentrationandthe firmsizeinfluencestheeffectofownershipstructureinthe earn-ingspersistence.Inthiscontext,weconcludethatthefindings donotrejecthypothesisH2,accordingtowhichfirmswith

dis-persedcontrolhavehigherpersistenceoffutureearningsrelative tocurrentearningsintheBraziliancapitalmarket.

Conclusions

In this paper, we analyzed the existence of a relationship betweentheownershipstructure(ownershipconcentration)and earningsqualityinBrazil,wheremostfirmshavehigh owner-shipconcentration.Wepositthatthisenvironmentsupportsthe “demand”hypothesis instead of the “opportunisticbehavior” hypothesis.Tomeasureearningsquality,weuseasproxies con-servatismandearningspersistence.

Our results indicate that accounting conservatism grows as the ownership structure becomes more concentrated. The previousliteraturehighlightstheimportance ofunderstanding accounting conservatism in financial reporting,as this influ-encestheeconomicandfinancialanalysisofcompanies.Since, theBrazilianinstitutionalenvironmentfavorsweakprotection ofminority investors,conservatismmaybearesponsetothis situation.

Thus, the minority shareholders maydemand greater effi-ciencyincontractualrelations,whereconservatismcanactto reducetheopportunisticbehaviorregardingthefinancial infor-mationtakenasabasisforcontracts.Inthecontextofthisstudy, asmuchoftheliteratureemphasizes,conservatismcanleadto biasedmarketinformation.

Regardingthemeasureofpersistence,ourresultsshowthatas theownershipstructurebecomesmoreconcentrated,persistence ofprofitandhenceitssustainabilitybecomelesspersistent,so the profitshownintheseconditionsdoesnot providereliable informationforvaluationprocesses.

Whenwedecomposethecurrentearningsintoitscomponents operatingcashflowandaccruals,theresultsindicatethatthe per-sistenceofprofitishigherinthecashflowcomponentandshows thatastheownershipstructurebecomesmoreconcentratedwith lesspersistenceofprofit.

Previousresearchhasshownthatpersistenceisimportantin itseconomicaspects,asevidencedbythelevelofsustainability ofprofits,andthereforecanstronglyimpactreturns.

Ourresultscontributetoacademiabecausetheysuggestthat thequalityofaccountingnumbershastobeassessedconsidering aspectsrelatedtoownershipconcentration(evenwhenanalyzing earningsofpublicfirms).Theyalsocontributetotheinvestment communitybyshowingthatearningsforecastaccuracymaybe influencedbyownershipstructure.

It is important to note that our study does not explicitly capture the presence andrelevance of institutional investors. Anotherlimitationofourstudyisinthesmallparticipationof firmswithdispersedownershipinthesample.Thisisaninherent limitationduetotheownershippatterninBrazil.

Thelowvariabilityofthesampleinrelationtodispersedfirms potentiallyleadstoincreaseinthevarianceofcoefficients.Inthis sense,itisimportanttomentionthattheresultsoftheseparate sub-samplesofsmallandbigfirmsmayhavebeeninfluenced by the low variability of the explanatory variable ownership concentration.

Finally,regardingfutureresearch,werecommendanalyzing theinfluenceofownershipconcentrationonfinancialreporting qualityusingadditionalmetrics,aspresentedbyDechowetal.

(2010).

Conflictsofinterest

Theauthorsdeclarenoconflictsofinterest.

Acknowledgements

FernandoGaldiacknowledgesfinancialsupportfromFAPES (Fundac¸ãodeAmparoàPesquisaeInovac¸ãodoEspíritoSanto).

References

Ahmed,A.S.,Billings,B.K.,Morton,R.M.,&Stanford-Harris,M.(2002).

Theroleofaccountingconservatisminmitigatingbondholder-shareholder conflictsoverdividendpolicyandinreducingdebtcosts.TheAccounting Review,77(4),867–890.

Anderson,C.W.(1999).Financialcontractingunderextremeuncertainty:An analysisofBraziliancorporatedebentures.JournalofFinancialEconomics, 51(1),45–84.

Arellano,M.,&Bond,S.(1991).Sometestsofspecificationforpaneldata: MonteCarloevidenceandanapplicationtoemploymentequations.The ReviewofEconomicStudies,58(2),277–297.

Ball,R.,Kothari,S.,&Robin,A.(2000).Theeffectofinternationalinstitutional factorsonpropertiesofaccounting earnings.JournalofAccountingand Economics,29(1),1–51.

Ball,R.,&Shivakumar,L.(2005).EarningsqualityinUKprivatefirms: Com-parativelossrecognitiontimeliness.JournalofAccountingandEconomics, 39(1),83–128.

Basu,S.(1997).Theconservatismprincipleandtheasymmetrictimelinessof earnings.JournalofAccountingandEconomics,24(1),3–37.

Bebchuk,L.A.,&Roe,M.J.(1999).Atheoryofpathdependenceincorporate ownershipandgovernance.StanfordLawReview,127–170.

Black,B.S.,DeCarvalho,A.G.,&Sampaio,J.O.(2014).Theevolutionof corporategovernanceinBrazil.EmergingMarketsReview.

Caixe,D.F.,&Krauter,E.(2013).Ainfluênciadaestruturadepropriedadee con-trolesobreovalordemercadocorporativonoBrasil.RevistaContabilidade &Finan¸cas,24(62),142–153.

Chi,W.,&Wang,C.(2010).AccountingconservatisminasettingofInformation Asymmetrybetweenmajorityandminorityshareholders.TheInternational JournalofAccounting,45(4),465–489.

Cho,M.-H.(1998).Ownershipstructure,investment,andthecorporatevalue: Anempiricalanalysis.JournalofFinancialEconomics,47(1),103–121.

Coelho,A.C.,Aguiar,A.B.d.,&Lopes,A.B.(2011).Relationshipbetween abnormal earningspersistence, industry structure,and market share in Brazilianpublicfirms.BAR–BrazilianAdministrationReview,8(1),48–67.

Coelho,C.A.,Galdi,F.C.,&BroedelLopes,A.(2010).Thedeterminantsof earningsquality:ThecaseofBrazilianpublicandprivatefirms.InAvailable atSSRN1541628.

Comparato,F.K.,& SalomãoFilho, C.(2008).. Opoderde controlena sociedadeanônima(Vol.xvii)Forense:Opoderdecontrolenasociedade anônima.

DaCosta,F.M.,Lopes,A.B.,&Costa,A.C.D.O.(2006).Conservadorismo emcincopaísesdaAméricadoSul.R.Cont.Fin.–USP,SãoPaulo,17(41), 7–20.

Dalmácio,F.Z.,&Corrar,L.J.(2007).Aconcentrac¸ãodocontroleacionário eapolíticade dividendosdasempresas listadasnaBovespa: uma abor-dagemexploratóriaàluzdateoriadeagência.RevistadeContabilidade eOrganiza¸cões,1(1),16–29.

Dami,A.B.T.,Rogers,P.,&Ribeiro,K.C.S.(2009).EvidênciasEmpíricas noGraudeConcentrac¸ãoAcionária.Contextus-RevistaContemporâneade EconomiaeGestão,5(2),21–30.

Dechow,P.,Ge,W.,&Schrand,C.(2010).Understandingearningsquality:A reviewoftheproxies,theirdeterminantsandtheirconsequences.Journalof AccountingandEconomics,50(2),344–401.

Dechow,P.M.,&Schrand,C.M.(2004).Earningsquality.Charlottesville (Virginia):CFAInstitute.

Dechow,P.M.,Sloan,R.G.,&Sweeney,A.P.(1995).Detecting earnings management.AccountingReview,70(2),193–225.

Demsetz,H.,&Lehn,K.(1985).Thestructureofcorporateownership:Causes andconsequences.TheJournalofPoliticalEconomy,93(6),1155–1177.

Demsetz,H.,&Villalonga,B.(2001).Ownershipstructureandcorporate per-formance.JournalofCorporateFinance,7(3),209–233.

Durnev,A.,&Kim,E.(2005).Tostealornottosteal:Firmattributes,legal environment,andvaluation.TheJournalofFinance,60(3),1461–1493.

Easley,D.,Hvidkjaer,S.,&O’hara,M.(2002).Isinformationriskadeterminant ofassetreturns?TheJournalofFinance,57(5),2185–2221.

Fan,J.P.,&Wong,T.J.(2002).Corporateownershipstructureandthe infor-mativenessofaccountingearningsinEastAsia.JournalofAccountingand Economics,33(3),401–425.

Givoly,D.,Hayn,C.K.,&Katz,S.P.(2010).Doespublicownershipofequity improveearningsquality?Theaccountingreview,85(1),195–225.

Gonzaga,R.P.,&Costa,F.M.(2009).Arelac¸ãoentreoconservadorismo contábileosconflitosentreacionistascontroladoreseminoritáriossobreas políticasdedividendosnasempresasbrasileiraslistadasnaBovespa.Revista Contabilidade&Finan¸cas,20(50).

Himmelberg,C.P.,Hubbard,R.G.,&Palia,D.(1999).Understandingthe determinantsofmanagerialownershipandthelinkbetweenownershipand performance.JournalofFinancialEconomics,53(3),353–384.

Hope,O.-K.,Thomas,W.B.,&Vyas,D.(2012).Financialreportingqualityin USprivatefirms.

João,B.d.N.,Santos,T.B.d.S.,&Filho,W.G.C.(2014).Pesquisaem Governanc¸aCorporativaeEmpresasFamiliares:umaagendadepesquisa. RevistaOrganiza¸cõesemContexto,10(19),131–153.

LaPorta,R.,LópezdeSilanes,F.,Shleifer,A.,&Vishny,R.(1998).Lawand finance.JournalofPoliticalEconomy,106,1113–1155.

Lafond,R.,&Roychowdhury,S.(2008).Managerialownershipandaccounting conservatism.Journalofaccountingresearch,46(1),101–135.

Lipe,R.(1990).Therelationbetweenstockreturnsandaccountingearnings givenalternativeinformation.AccountingReview,65(1),49–71.

Lopes,A.B.,&Walker,M.(2008).Firm-levelincentivesandthe informative-nessofaccountingreports:AnexperimentinBrazil.InAvailableatSSRN 1095781.

Lustosa,P.R.B.,&Nunes,D.M.S.(2010).Estimativascontábeisequalidade dolucro:análisesetorialnoBrasil.RevistadeEduca¸cãoePesquisaem Contabilidade(REPeC),4(2),43–61.

Paulo,E.,Antunes,M.T.P.,&Formigoni,H.(2008).Conservadorismocontábil nascompanhiasabertasefechadasbrasileiras.RevistadeAdministra¸cãode Empresas,48(3),46–60.

Penman,S.H.,&Zhang,X.J.(2002).Accountingconservatism,thequalityof earnings,andstockreturns.TheAccountingReview,77(2),237–264.

Pimentel,R.C.,&Aguiar,A.B.d.(2012).Persistenceofquarterlyearnings:An empiricalinvestigationinBrazil.BrazilianBusinessReview,SpecialEdition BBRConference,38–54.

Pimentel,R.C.,&Aguiar,A.B.d.(2016).Theroleofearningspersistence invaluationaccuracyandthetimehorizon.RevistadeAdministra¸cãode Empresas,56(1),71–86.

Richardson,S.A.,Sloan,R.G.,Soliman,M.T.,&Tuna,I.(2005).Accrual reliability,earningspersistenceandstockprices.JournalofAccountingand Economics,39(3),437–485.

Segura,L.C.,&Formigoni,H.(2014).Influenceofcontrolandfamily manage-mentintheindebtednessofBrazilianopenbusiness:Aquantitativestudy. BrazilianBusinessReview,11(6),50.

Shleifer,A.,&Vishny,R.W.(1997).Asurveyofcorporategovernance.The JournalofFinance,52(2),737–783.

Silveira, A.D.M.d.(2006). Governan¸cacorporativa e estruturade pro-priedade: determinantese rela¸cãocomodesempenho dasempresasno Brasil.SaintPaulInstituteofFinance.

Silveira,A.D.M.d.,Barros,L.A.B.d.C.,&Famá,R.(2008).Atributos corporativoseconcentrac¸ãoacionárianoBrasil.RevistadeAdministra¸cão deEmpresas,48(2),51–66.

Sloan,R.G.(1996).Dostockpricesfullyreflectinformationinaccrualsand cashflowsaboutfutureearnings?AccountingReview,71(3),289–315.

Tres,G.,Serra,F.,&Ferreira,M.P.(2014).OtempodemandatodoCEOe odesempenhodasempresas:Umestudocomparativodeempresas famil-iares e não-familiares brasileiras. RevistaGestão & Tecnologia, 14(3), 5–31.

Watts,R. L.(2003a). Conservatismin accountingpartI: Explanationsand implications.AccountingHorizons,17(3),207–221.

Watts,R.L.(2003b).ConservatisminaccountingpartII:Evidenceandresearch opportunities.AccountingHorizons,17(4),287–301.