Factors affecting an effective communication

strategy for Fnac’s new venture (Nature &

Decouvertes) in Portugal

Michael Marakis

Dissertation written under the supervision of Rute Xavier

Dissertation submitted in partial fulfilment of requirements for the MSc in Business, at the Universidade Católica Portuguesa, January 2020.

ABSTRACT

Title: Factors affecting and effective communication strategy for Fnac’s new venture (Nature

& Decouvertes) in Portugal.

Author: Michael Fábio Marakis

Key Words: Fnac, Nature & Decouvertes, Brand Awareness, New Venture, Corporate Social

Responsibility, Willingness to Purchase, Communication Strategy.

The need to keep up with the demand, to adapt to new market trends and to continuously innovate product line has led Fnac to acquire Nature & Decouvertes. Focused on the expansion of product diversity of the company, arised simultaneously the desire to enter new markets such as Portugal. The purpose of this study was to understand the potential market of N&D in Portugal, the leading consumer trends, the main players, what factors affect the willingness to purchase and how can N&D communicate itself in Portugal. The present dissertation encompassed the review of literature, secondary data research, as well as consumer data collected from an online survey. It considered characteristics from the literature and later adapted by the author, that influenced the willingness to purchase from N&D. The results revealed that consumer trends and the concept of N&D were aligned. The findings from the regressions conducted indicate that the characteristics environmental values, purchase habits, attribution preferences, brand awareness and loyalty card all have a contribution to the willingness to purchase from N&D. Moreover, the feelings and attributes combined the characteristics that contribute to the willingness to pay through the leading platforms used by the respondents, allowed further conclusions regarding the communication strategy.

RESUMO

Título: Fatores que afetam e estratégia de comunicação eficaz para o novo empreendimento

da Fnac (Nature & Decouvertes) em Portugal.

Autor: Michael Fábio Marakis

Palavras-chave: Fnac, Nature & Decouvertes, Brand Awareness, Novos Empreendimentos,

Responsabilidade Social Corporativa, Vontade de Compra, Estratégia de Comunicação.

A necessidade de acompanhar a demanda, de se adaptar às novas tendências de mercado e de inovar continuamente a linha de produtos levou a Fnac a adquirir a Nature & Decouvertes com o objetivo de expandir a diversidade de produtos da empresa e, como tal, surge o desejo de entrar em novos mercados como Portugal. O objetivo deste estudo foi entender o mercado potencial da N&D em Portugal, as principais tendências de mercado e do consumidor, os principais players, que fatores afetam a vontade de comprar e como a N&D pode se comunicar em Portugal. A presente dissertação é formada por uma revisão de literatura, pesquisa de dados secundários e por resultados obtidos com base na informação recolhida por um questionário, onde foi considerado características da literatura e consequentemente adaptadas pelo autor, que influenciaram a vontade de compra na N&D. Os resultados revelaram que as tendências do consumidor estavam alinhadas com o conceito da N&D. De acordo com os resultados das regressões realizadas, as características valores ambientais, hábitos de compra, preferências de atributos, brand awareness e o cartão de fidelidade, todos contribuem para o aumento da disposição de compra da N&D. Além disso, os sentimentos e atributos combinados com as características que contribuem para a disposição de pagar, comunicadas nas principais plataformas utilizadas pelos participantes, permitiram tirar maiores conclusões quanto à estratégia de comunicação.

ACKNOWLEDGEMENTS

Firstly, I would like to thank my thesis advisor, Professor Rute Xavier, for her guidance and support provided throughout this study.

I am deeply grateful for the support of my family. A special thanks to my dad, who has been my biggest inspiration, has always encouraged me, guided me by example and has taught me never to cross my arms. To my mom, who has always believed in me and has to this day, provided me with love and care, inspiring me to do the same with others. Moreover, to my brother Nicholas, my brother Sergio and my sister Fabiana for always being there for me. All the decisions that have led me to where I am today are thanks to them.

Additionally, I would like to thank all my closest friends who, since the very beginning till the end of my studies, have all supported me, helped me to push through and motivated me to do my best.

Also, I am very grateful for the fantastic friends I have met this past year Luiz Mottin and Marco Albuquerque. Their friendship, loyalty, advice and support have inspired me throughout our academic journey.

Finally, I would like to express my gratitude to Rita Silva and Margarida Silva from the Fnac group, who were always very supportive.

TABLE OF CONTENTS

ABSTRACT ... ii

RESUMO ... iii

ACKNOWLEDGEMENTS ... iv

TABLE OF CONTENTS ... v

LIST OF FIGURES ... vii

LIST OF ABBREVIATIONS ... ix

1. INTRODUCTION ... 1

1.2. Structure...3

2. LITERATURE REVIEW ... 4

2.1. Definition of Brand Awareness ...4

2.2. Purchase Decision – three dimensions of consumer reward ...5

2.3. Marketing Communication Strategies - Emergent Market vs Mature Market ...6

2.4. Corporate Social Responsibility (CSR) ...7

3. METHODOLOGY ... 8

3.1.1. External research ...8

3.1.2. Benchmarking - Competitors ...8

3.2. Online Survey ...9

4. ANALYSIS AND DISCUSSION ... 11

4.1. Industry Analysis ...11

4.1.1. Global Economic Trends ...11

4.1.2. Global Retail Trends ...11

4.1.3. Health and Wellness Industry ...12

4.1.4. Global Consumer Trends...12

4.1.5. Competitors – Eco-friendly retails ...23

4.1.5.1. Nature & Decouvertes – “Offering the best of the world, for a better world”. ...23

4.1.5.2. Natura - “There is a bit of Natura in all of us”. ...24

4.1.5.3. Rituals – “Your Body. Your Soul. Your Rituals”. ...24

4.1.4.6. The Body Shop - “Beauty without cruelty”. ...25

4.1.5.7. Patagonia - “We’re in the business of saving our planet”. ...25

4.2. Questioners Analysis and Results ...26

4.2.1. Survey Descriptive Analysis ...26

4.2.2. N&D and competitors ...30

4.2.3. Willingness to Purchase ...31

4.2.4. Research Hypothesis ...31

4.2.5. Procedures ...32

4.2.6. Reliability Analysis ...32

4.2.7. Descriptive Analysis ...34

4.2.8. Multiple Linear Regression ...35

4.2.9. Summary of the Results ...38

CONCLUSIONS ... 42 LIMITATIONS ... 44 BIBLIOGRAPHY... 45 APPENDIXES ... 48 APPENDIX 1: Survey ...48 APPENDIX 2: QR Code ...67

APPENDIX 3: Reliability Analysis ...68

APPENDIX 4: Combination of items in each group ...69

APPENDIX 5: Descriptive Analysis ...69

LIST OF FIGURES

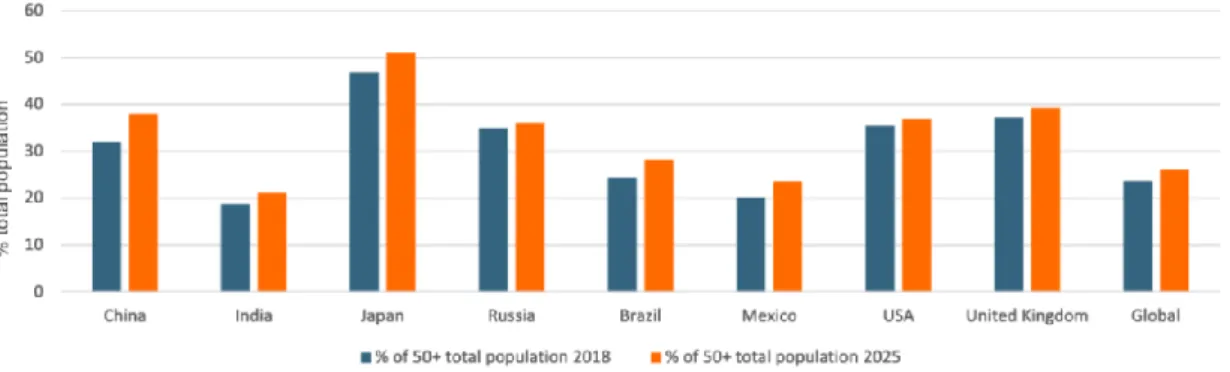

Figure 1 - 50+ Years, a Rapidly Growing Population Segment 2018/2025. Source:

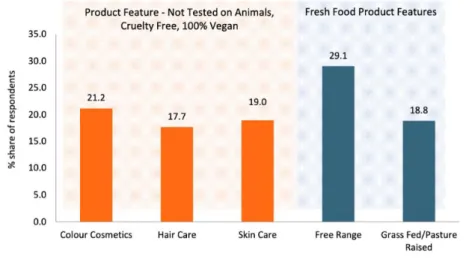

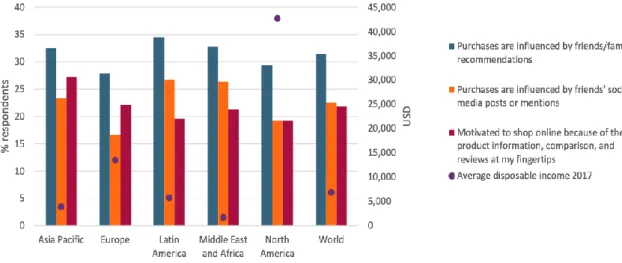

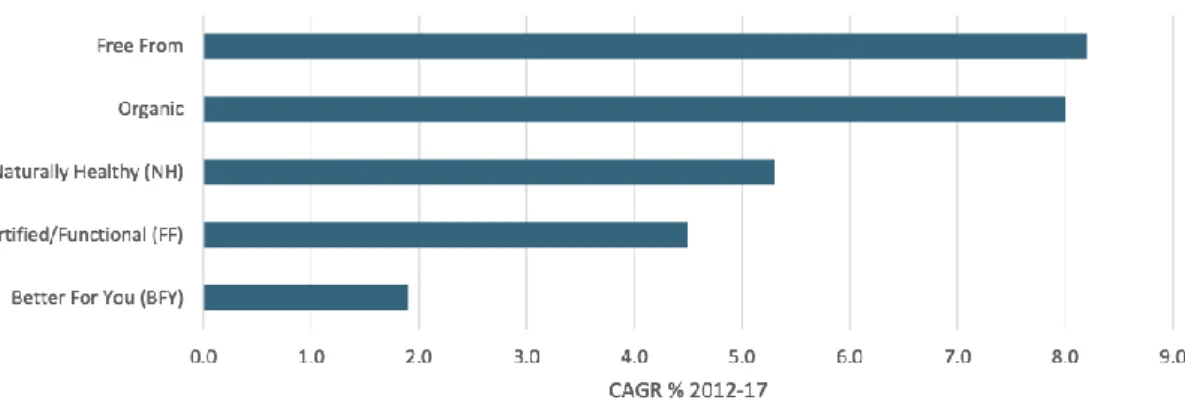

Euromonitor International, 2019. ... 12 Figure 2 - Average world annual Gross Income in USD 2018/2025. Source: Euromonitor International, 2019. ... 13 Figure 3 - Values and Attitudes across Generations. Source: Euromonitor International, 2019. ... 13 Figure 4 – Usage frequency of DIY beauty products. Source: Euromonitor International, 2019... 14 Figure 5 - Vegetarian Population, the ten most significant increases by countries during 2016/17 — source: Euromonitor International, 2019. ... 15 Figure 6 - Product features influencing purchasing decisions of consumers when buying beauty products and fresh/ unprocessed food products — source: Euromonitor International, 2019... 15 Figure 7 - Consumers turn to their peers to inform purchase decisions. Source: Euromonitor International, 2019. ... 17 Figure 8 - Global health and Wellness moves to clean labels and organic, away from BFY. Source: Euromonitor International, 2019. ... 18 Figure 9 - Consumers treat shopping as a way to look after themselves and feel good. Source: Euromonitor International, 2019. ... 19 Figure 10 - % Willing to pay more for Products with Recyclable Packaging. Source:

Euromonitor International, 2019. ... 20 Figure 11 - Household possession of smartphones 2014/2018. Source: Euromonitor

International, 2019. ... 21 Figure 12 - Likelihood of spending money to save time. Source: Euromonitor International, 2019... 21 Figure 13 - Consumer preference for path purchase. — source: Euromonitor International, 2019... 22 Figure 14 - Shopping preference of single vs multiple-member households. Source:

Euromonitor International, 2019. ... 23 Figure 15 - Competitors overview, a summary of the findings above. Source: Own analysis. ... 26

Figure 16 - Descriptive Statistics, n=176 (Gender, Age, Education Level, Employment

Status, Household Income, and Household Size). Source: Survey Data. ... 27

Figure 17 - Question survey results, n=176. Channels used to search for well-being products — source: Survey Data. ... 28

Figure 18 - Question survey results, n=176. Benefits searched in a loyalty card — source: Survey Data. ... 28

Figure 19 - Question survey results, n=176. Feelings expressed after watching the N&D advert — source: Survey Data. ... 29

Figure 20 - Question survey results, n=176. Attributes associated with N&D. Source: Survey Data. ... 29

Figure 21 - Question survey results, n=176. Percentage of people that do not know the brand. Source: Survey Data. ... 30

Figure 22 - Question survey results, n=176. Perceptual map of N&D and its competitors. Source: Survey Data. ... 31

Figure 23 - Hypotheses Framework. ... 32

Figure 24 - Reliability Analysis part1. Source: Survey Data... 33

Figure 25 - Reliability Analysis part2. Source: Survey Data... 34

Figure 26 - Regression of the environmental values on the willingness to purchase. Source: Survey Data. ... 35

Figure 27 - Regression of the purchase habits variables on the willingness to purchase. Source: Survey Data ... 35

Figure 28 - Regression of the attribute preference variables on the willingness to purchase. Source: Survey Data ... 36

Figure 29 - Regression of the brand awareness variables on the willingness to purchase. Source: Survey Data ... 36

Figure 30 - Regression of the loyalty card variables on the willingness to purchase. Source: Survey Data. ... 37

Figure 31 - Regression of the socio-demographic variables on the willingness to purchase. Source: Survey Data. ... 37

Figure 32 - Summary of the results. Source: Survey Data. ... 38

Figure 33 - How N&D can communicate in Portugal. Source: The Author. ... 40

Figure 34 - Link to survey. ... 67

LIST OF ABBREVIATIONS

(AI) – Artificial Intelligence (B-CORP) – Benefit Corporation

(CAGR) – Compound Annual Growth Rate (CGF) – Consumer Goods Forum

(CSR) – Corporate Social Responsibility (DIY) – Do-It-Yourself

(FRP) – Frequency Reward Programs (GDP) – Gross Domestic Product (H) – Hypotheses

(IRP) – Instant Reward Program (JOMO) – Joy Of Missing Out (N&D) – Nature & Decouvertes (RQ) – Research Question (UK) – United Kingdom

1. INTRODUCTION

1.1. Challenge description/context

With the advance in telecommunications technologies, the internet, the increase of travels, the growth of global media, regional unification, falling national boundaries, worldwide investments, production and marketing, the urgency for a company's globalization and the importance to adapt global strategies has become evident (Pauwels, Erguncu, & Yildirim, 2013).

Throughout the years, the impact of companies on the environment has been a great discussion. With the persistent climate changes and with the global warming crisis, consumers have become more aware of how their consumption habits impact the environment.

The French company Fnac, founded in 1954, entered the Portuguese market in 1998. The company managed in a brief period, to establish a successful and elite positioning next to the consumer when it came to all tech-related products, innovation, diversity and customer service. Today, the company has 29 physical stores in Portugal, spread all over the country, located in all prime areas. Thus, it makes it accessible to all, that has allowed it to become the current e-commerce leader in Portugal. Moreover, the company offers other services such as Fnac Lab, Fnac Clinic and several partnership benefits through the usage of the Fnac Card.

With the continuous growth of the Fnac Darty Group in size, branches, innovation, and reputation arise, they simultaneously need to become more ecologically responsible. As a result, in April 2019, the Group acquired the French brand Nature & Decouvertes (N&D). Founded in 1990, this eco-friendly retail chain of organic and nature-inspired products has nearly 100 stores in countries such as France, Belgium, Luxembourg and Germany, with around 1000 employees. It aims to enhance the link between people and nature, and to improve, based on a sensory experience-inspired retail model, their wellness1 (Nature & Decouvertes,

2019).

The focus of the acquisition is to expand the diversity of products offered to consumers while tackling the gap between the organization's products and its perceived environmental concerns. Additionally, the group Fnac aims to convert the entire organization into a more informed choice. While creating a more circular and responsible economy, that consists with the one of N&D, since their implementation of ethical and ecological consumption. Moreover, the brand has the Nature & Decouvertes Foundation, which supports biodiversity, education and local association projects. These reasons have led them to be awarded the Benefit Corporation (B-CORP) label in 2015. Thus, there is an opportunity for cooperation between brands, particularly in France and in the Iberian Peninsula (Martinez, 2019).

Lastly, the focus of this Master Dissertation is to understand what should be the optimal communication strategy for Fnac’s new venture in Portugal, a topic that was suggested by the Group Fnac. This study will be guided and will receive feedback, to support the proper conduct and communication strategy of an already existing brand into a new market.

The following questions suggest a thorough market analysis for the potential well-being products in Portugal and measure the variables which impact the willingness to pay for Nature & Decouvertes:

RQ1 - What is N&D’s potential Market? • What are the market trends?

• What are consumer trends?

• Who are the leading players?

RQ2 - What factors affect the willingness to purchase from N&D? RQ3 - How can N&D communicate itself in Portugal?

1.2. Structure

To further understand this research work, the next chapter reviews the literature. The papers reviewed focus on four main topics:

- The importance of brand awareness; - Incentives on the purchase decision; - Marketing and communication strategies; - The power of Corporate Social Responsibility;

The third chapter explains the methodology, the qualitative and the quantitative methods used as well as the data collection process used to gather the relevant information. The fourth chapter analyses the critical results of the study, followed by a discussion with conclusions and suggestions based on the results obtained, moreover, based on the results successful marketing campaign strategies. The fifth chapter underlines the main conclusions of the findings. Lastly, the final chapter highlights the limitations of this research.

2. LITERATURE REVIEW

2.1. Definition of Brand Awareness

To differentiate the identity of goods or services from those of one’s competitors, a brand uses a given name, sign, symbol, design, term or a combination of them (Kotler, 1997, p. 443). Besides, according to (Jamali & Khan, 2018), brand awareness is the idea perceived by consumers regarding a brand’s products, services, and all other features offered. It is the experience offered by brands to consumers.

Furthermore, according to (Homburg, Klarmann, & Schmitt, 2010), a brand with healthy levels of awareness can be perceived by consumers as an indicator of a firm that is resilient, well distributed and has been in business for a very long time. As so, it reflects a sign of high-quality products that are already purchased by several other consumers. Additionally, brand awareness plays a role in reducing the personal risk for buyers since decision-makers prefer brands with high levels of awareness. As a result, it lowers the chance of being at fault if the decision does not turn out to be as expected. Besides, brand awareness and brand loyalty are considered to have high associations with consumer’s willingness to purchase (Ehsan Malik et al., 2013).

Currently, brands can reach out to consumers and vice versa, directly through social media platforms that allow a greater connection between brands and consumers. While simultaneously enhancing the power of consumers due to social media (Jamali & Khan, 2018).

Moreover, due to social media, in a short period, consumers can co-create and share information brand-related to a significant number of other consumers. This new environment created by social media generates a digital Word of Mouth that can touch a limitless number of additional people. Consequently, it allows content to be instantly viewed and shared when compared with traditional offline environments (Hansen, Kupfer, & Hennig-Thurau, 2018). Therefore, highlighting the importance for brands to be ready to respond at any given situation, as positive experiences shared by consumers regarding a given brand, tend to be very powerful and more efficient than when the company generated (Jamali & Khan, 2018).

2.2. Purchase Decision – three dimensions of consumer reward

According to (Minnema, Bijmolt, & Non, 2017), the instant reward program (IRP) has an immediate and collectable reward system with small rewards per total spending. In contrast, the frequency reward programs (FRP), promises an uncollectible and postponed reward. Both differentiated through collectability and timing. The IRP may be more appealing to consumers when compared to the FRP. Furthermore, the reward timing, the reward collectability and the reward earning base are the three dimensions used by marketing instruments to successfully incentive purchase behaviour in the IRP.

Instant rewards build enthusiasm in consumers and create a motivation to pursue the reward program, strengthening the link between collecting rewards and purchasing (Kivetz, Urminsky, & Zheng, 2006). After the conquer of a small number of rewards, the collectability of rewards permits consumers to feel committed and devoted to complete the entire set of premiums effectively (Gao, Huang, & Simonson, 2014). Besides, the reward earning basis that provides collectable rewards to consumers for their total spending allows the IRP to increase the probability of purchase.

On the other hand, the bonus premiums, highlight the benefits of a specific promoted brand that motivate consumers to acquire the promoted brand to obtain collectable rewards (Chandon, Wansink, & Laurent, 2000).

However, according to (Minnema et al., 2017), IRP and bonus premiums when combined play a significant role on the consumers purchase decision, with IRP contributing mainly on the increase of visits to the store and the bonus premiums being effectively responsible with the increase of the brand choice likelihood. Besides, consumers perceive more value and have a more significant probability of choosing a promoted brand if the promotion combines price discounts with a bonus premium. Both IRP and bonus premiums have stronger effects on active household premium collectors. These might be responsible for consumer's unplanned purchases due to the link of these brands with in-store marketing exposure.

2.3. Marketing Communication Strategies - Emergent Market vs Mature Market

When observing the contrast between emerging markets and mature markets, the impact of marketing communication varies amongst consumers according to how their heart and mind respond to it (Pauwels et al., 2013).

According to (Pauwels et al., 2013), marketing effectiveness is the combination of consumer's awareness of marketing communication, the ability to change their hearts and minds and to modify their purchase habits. Moreover, these components vary among consumers, between countries and also vary between emerging markets and mature markets.

The regulative, cultural and socioeconomic systems, are the three different pillars that interact together, providing structure to society (Burgess & Steenkamp, 2006).

In the regulative context, how consumers respond to marketing communication is revealed by the consumer's protection against poor quality goods (Pauwels et al., 2013). Research has revealed that consumers that feel secured with strong protection rights might expect similar quality from all brands offered by popular retailers (Hollis, 2010). Whereas, consumers tend to explore for more qualitative information regarding a purchase when risk is perceived. Consequently, due to insecurity regarding the quality of a product. (Erdem, Swait, & Valenzuela, 2006; Money, Gilly, & Graham, 1988; Shimp & Bearden, 1982).

Regarding the culture, individualism versus collectivism (Hofstede, 1980), recognizes significance between the individual and the group. According to (Pauwels et al., 2013), the individual is the most important in individualist cultures, making decisions based on their own needs and preferences. In contrast, the group is the most critical unit in collectivist cultures, making their decisions based on the best outcome for the group.

In the socio-economic context, the purchasing power disclosed through an overview of the gross domestic product (GDP) per capita, which exposes the differences concerning emerging country markets from mature country markets. (World Bank, 2010). A barrier is created for consumers to purchase with heart when the GDP is low. If the products considered are not affordable, independently of how likeable the brands are, consumers simply will not purchase them. Nevertheless, in countries such as France, with a high level of individualism, income and

protection against inferior quality products and the likeability of brands result in high responsiveness. Consequently, it reflects the sales converted, having the freedom to do so since they spend a small portion of their income in consumer products (Pauwels et al., 2013).

Furthermore, following (Pauwels et al., 2013), consumer's behaviour can be reshaped once consumers develop an awareness of marketing communication, become unbiased to change their current heart and mind and eventually their purchase habits. Moreover, the marketing actions used by Managers focus on reaching an exceptional level of awareness, being easily retained in the minds of consumers, with the final aim of resulting in sales.

2.4. Corporate Social Responsibility (CSR)

Corporate Social Responsibility is the reflection of an organization's status and practices regarding its perceived societal obligations (Brown & Dacin, 1997). The feeling of a "warm glow" felt by consumers when "doing good" through the purchase of products from socially responsible companies, reinforces the firm's necessity to engage with CSR (Andreoni, 1989). Moreover, following a survey, 85% of consumers have a more positive image of a given company or product when it supports a cause that consumers care about (Cone Cause Evolution Survey, 2010). Therefore, companies may invest in CSR to intentionally encourage consumers to purchase their products (Banerjee & Wathieu, 2017).

The results of the global McKinsey survey state that 55% of executives believe CSR to help their companies build reputation and 76% of the executives agree that CSR has a positive impact on long-term shareholder value (McKinsey, 2010).

According to (Bagnoli & Watts, 2003), companies use cause-related-marketing, eco-labelling and corporate donations all as practical tools, that aim to attract socially responsible consumers, with the final goal of maximizing profits that is perceived to be a competitive advantage.

However, according to (Banerjee & Wathieu, 2017), the impact that CSR has on consumers is essential and is considered to be a substitute for product quality. In competitive markets, the numerous amount of players affects the willingness of low-quality firms to invest in CSR, since the low revenues, when compared to a monopoly, results in a reduced budget to encourage

CSR behaviours. Nevertheless, in markets where the consumer's awareness of CSR is relatively high, low-quality firms may still surpass their high-quality competitors.

Additionally, the higher the consumer awareness and engagement with CRS, the more it contributes to increasing the chance of backfire for luxury brands linked with a self-enhancement concept, since the image of exclusivity associated with the brand may be reduced (Torelli, Monga, & Kaikati, 2012).

3. METHODOLOGY

This chapter describes the procedures used to answer the research questions. The collecting process data is accessible in the section of the appendixes.

3.1.1. External research

External research was completed to gather relevant data to examine the well-being market globally. Since the well-being industry e relatively recent when compared to several industries, in order to acquire relevant information, this study encompassed acquiring data from studies made by Deloitte, KPMG and Euromonitor International, which focused on understanding the current global economic trends, their impact on the retail industry, the health and wellness industry and potential market opportunities through the ten new global consumer trends to further understand how the market is shifting in the present, to where it is leading in the future and how retailers are responding to these challenges.

3.1.2. Benchmarking - Competitors

In order to access the knowledge of the Portuguese well-being industry, the author intended to find and understand who were N&D's potential eco-friendly competitors in the Portuguese market. In this research, the aim was to understand what separated one brand from another, their values, their mission, what products they sell, the number of physical stores in Portugal, the causes that they supported, which associations they were linked and how they communicate.

3.2. Online Survey

To further assess the consumer's insight on the well-being market in Portugal, a survey was launched (Appendix 1). The data collected through an online survey, circulated throughout the author's social media platforms such as Facebook, Instagram, WhatsApp and LinkedIn. While simultaneously using a QR code (Appendix 2) that allowed people on the street to participate in the study instantly. The survey had 248 answers. Out of these answers, only 176 were considered valid. All participants were provided with a brief description of the study and with a confidentiality agreement. Through a survey containing eight sections and 30 questions, both available in English as in Portuguese, that were specially created for this specific study. It was available from the 11th of November to the 26th of November 2019.

The survey was composed of 8 different sections: country of living, perceptions about corporate social responsibility, purchase habits regarding well-being products, N&D introduction, N&D’s brand awareness in Portugal, consumer's brand position, loyalty cards perceptions and sociodemographic variables.

The first section contained 1 question to determine if the participant was living in Portugal, excluding automatically the respondents that were not living in Portugal. The interest of the data collected laid among the people living in Portugal.

The second section measured perceptions about corporate social responsibility was composed of 4 questions regarding consumers consumption behaviours, shopping behaviours, interaction with companies and top of mind social/environmental cause.

The third section contained questions in respect of purchase habits regarding well-being products. It was composed with seven questions concerning their shopping frequency, search channels, the importance of sustainable ingredients, product preference, feature preference, brand loyalty and their top of mind.

The fourth section introduced N&D to the participants and announced that it had recently just acquired by Fnac.

The fifth section measured N&D’s brand awareness in Portugal, which was composed of 1 item regarding the brand's familiarity and two items considering the brand's perceptions based on an N&D's advert.

The sixth section included the consumer's brand position. It was composed of 2 questions regarding perceptions of price and quality, followed by another two questions concerning purchase and recommendation.

The seventh section contained loyalty card perceptions. It was composed of 5 questions considering trust, purchase location, loyalty card ownership, and incentives and cross purchasing incentives.

Lastly, the eighth section regarding the sociodemographic variables was composed of 7 questions to create a general profile of the participants. It included gender, nationality, age, education, employment status, household size, and income.

After launching the survey and extracting general data about the variables and responses, the author reorganized and narrowed the number of variables that were used and tested. While reorganizing the survey, the author deleted some variables as they were not relevant for the study, since they did not provide additional information for further conclusions. Also, the author transferred variables from one section to another as they were not appropriately allocated to study that group of independent variables – as an example, the author moved the variable “Trust association” from the loyalty card section to the brand awareness section.

4. ANALYSIS AND DISCUSSION

4.1. Industry Analysis

The first research question dealt with discovering N&D's potential market, with the use of the following sub-questions: What are the market trends?; What are the consumer trends?; Who are the main competitors? Based on secondary data research, the answer to RQ1 is discussed in the following subchapters.

4.1.1. Global Economic Trends

The global economy until early 2018 had been giving signs of economic growth, low inflation, low borrowing costs, easy monetary policy in major markets, recovery in troubled emerging markets and the rise of asset prices. However, during 2018, the following economic trends happened: growth slowed down in China, Japan, and Europe; inflation increased in significant markets; borrowings costs accelerated due to the shift of fiscal and monetary policies implied by major governments; global commodity and equity prices dropped, and a currency depreciation of behalf of major emerging markets. This global economic shift was partly due to a change in the policy of the United States, where the restrictive trade policy, tighter monetary policy, and a more accessible fiscal policy combined. All contributed to the shift of the global economy mentioned above (Deloitte, 2019).

4.1.2. Global Retail Trends

This global economic shift registered during 2018, will impact retailers through a reduction of the consumer spending growth, higher prices for consumers, and disrupting global supply chains (Deloitte, 2019).

Besides, Europe represented a share of 34,8%, resulting in the most significant share of the Top 250 retailers, with 87 companies. Europe's retailers from France, Germany and the UK were responsible for two-thirds of the total regional revenues in FY2017. Moreover, Germany contained the biggest companies with an average size of $24,7 billion, followed by France with an average size of $24,2 billion, both being higher than the average $18,1 billion size of the Top 250 retailers. Furthermore, European retailers continuously search to expand globally. In FY2017, Europe revealed a foreign combined revenue of 42,3% nearly doubled the Top 250 group as a whole, with 23,6% (Deloitte, 2019).

4.1.3. Health and Wellness Industry

According to (Deloitte, 2018), it is thanks to advances in the healthcare industry that consumers are now living longer than ever before, with progress in hygiene and nutrition. Nevertheless, the number of cases of obesity and malnutrition have doubled since 1980, with two billion people globally suffering from malnutrition. Also, healthcare costs have increased over time.

The Consumer Goods Forum (CGF) members aim to create partnerships with institutions and authorities with the goal promoting healthier lifestyles through hygiene and nutrition awareness. The CGF members companies have reported to obtain results through product reformulation, sugar and salt reduction as well as the reduction of saturated fat, donating meals through food banks, partnering with stakeholders and by helping health and wellness programs reach thousands of schools. According to (Deloitte, 2018), the total revenue of all participating companies went from $971 billion in 2015 to $3,1 trillion in 2017.

The health and wellness industries success depends on companies abilities to detect, track and answer to the latest market trends. Once understood companies could benefit by providing products and services that improve consumers wellbeing.

4.1.4. Global Consumer Trends

Along time consumer's behaviours, values and priorities are continually changing, which as a result, impacts and disrupt business globally. Therefore, according to (Euromonitor International, 2019), there have been identified ten new consumer trends:

1. Age agnostic – over the years, people are living much longer than before. With this arises the desire to remain active, to preserve a youthful attitude and to still contribute to society.

Furthermore, in general, seniors tend to have a much bigger buying power when compared to the rest of the population. Also, among all age groups, they are considered to be the ones with the highest spending power. Many of them aged between 50-59 years are still working, have inherited wealth from their family or occupy already senior positions. They will earn around 28% more when compared to all age groups.

Figure 2 - Average world annual Gross Income in USD 2018/2025. Source: Euromonitor International, 2019.

Moreover, the age agnostic trend shows that older generations prioritize the enjoyment of life and spiritual beliefs. Additionally, 35% of baby boomers (aged between 54-74 years old) agree or strongly agree that they want to enjoy life and not worry about the future. According to the survey, 46% of boomers believe they can make a positive difference in the world. This positive attitude could reflect people's desire to contribute to society throughout their life.

However, according to (Deloitte, 2018) young consumers seem to represent a significant portion of the population in emerging markets. Their needs will determine how companies innovate and adapt in these markets, as their preferences will shape the industry in the following years to come. It involves active customer service, flexible sales channels, sustainability and product quality.

2. Back to basics for status – as consumers, sophistication and expectations grow, so does the search for authenticity, with differentiated products and experiences that allow them to express their individuality. As a result, in 2019, consumers give preference to simplicity, better quality products with a perceived level of status, rejecting generic and massed-produced products. As so, according to a survey (Euromonitor International, 2019), almost half of the consumers globally stated the usage of Do-it-yourself (DIY) beauty products at least once a month. It reflects their aspiration for simplicity, tailor-made and personalized products with the focus of taking back in control the decision of what they consume. It appears as a consequence of all the polemics regarding evidence of unwanted elements in all the goods consumed.

Figure 4 – Usage frequency of DIY beauty products. Source: Euromonitor International, 2019.

Besides, according to a survey conducted (Deloitte, 2018), 77% of the respondents agreed that natural ingredients affected their choices, with consumers shifting to a diet with simple ingredients and fewer processed foods by cutting out high in fat, sugar and sodium foods. Also, more than half affirmed to avoid artificial ingredients, hormones and antibiotics.

3. Consumer Conscious – the continuous search for better positive purchase decisions that can reduce the negative environmental impact has led to the growth of mindful consumers. In 2018, consumers in developed countries had increasingly adopted animal-friendly

behaviours. Veganism had become one of the latest trends, with consumers removing completely of all animal-related products. There is a perception in emerging markets of a correct nutrition and prosperity through the consumption of meat. However, in several countries such as China and India, many middle and high-income, young and urban consumers have adopted to this trend.

Figure 5 - Vegetarian Population, the ten most significant increases by countries during 2016/17 — source: Euromonitor International, 2019.

According to research, the sensitivity regarding animals wellbeing has increased among consumers and is reflected on their shopping behaviours. One-third of the consumers admitted to have searched for "free-range" products. More than one-fifth of the respondents recognized the influence that the features: not tested on animals, 100% vegan and cruelty-free, had on their purchasing decision.

4. Digitally together – technology has continuously evolved the communication sector over the last years, allowing multi-dimensional interactions and experiences. This increasing digital connectivity is highly essential since people can leave their homeland without losing touch with their families. Besides, despite privacy concerns, social media will continue to dominate the online activity. Users will continue to share their activity and location, creating memories that will persist forever.

Furthermore, according to (Deloitte, 2018), product diversity, competitive pricing and ease of purchase are responsible for the shift to online, particularly by young consumers, that simultaneously allows companies to learn and strategically respond to consumer demands.

According to (KPMG, 2019), this trend has helped companies understand consumer emotionally through the usage of customer data and Artificial Intelligence (AI). It is allowing them to provide tailor-made products, services and experiences. Additionally, the increase in AI familiarity among consumers has motivated retailers to develop chatbots that can simulate human conversation through AI. It provides an opportunity for personalized online customer experience.

5. Everyone is an expert – consumers now use several sources of information to pursuit products on their way to purchase. According to (Euromonitor International, 2019) in 2022, the countries that will gather the highest revenues in internet retailing are China, Japan, USA, UK and India. It is where the search term "best" was one of the top keywords searched on Google in these countries, as consumers seek for top quality for the lowest price. Furthermore, consumers are using social media platforms such as Twitter, WhatsApp, Instagram to share information and gain discount codes. Also, aiming for special offers and recommendations on getting the best deals for new products, using more than one font of information to influence their purchasing decision. Additionally, according to (KPMG, 2019) retailers have understood the power and effectiveness of social media to capture their target audience. It has reflected an increase of social media ad spending. As a result, some companies such as Birds Eye allowed consumers to pay their bill by sharing Instagram pictures using their hashtag.

Consumers demand more and more value for their money, as so not only are they more aware of the recommendations coming from their peers as they are also more conscious of price, especially those among a mid/high-range income, particularly in western. Nonetheless, at a global level, lower-income consumers will not be to participative on this “expert” digital trend and are less expected to have internet connection as well as time to participate in this extensive research. Consumers aged 15-40 are most likely to be considered as expert consumers, becoming familiar with using the internet extensively every day (Euromonitor International, 2019).

Figure 7 - Consumers turn to their peers to inform purchase decisions. Source: Euromonitor International, 2019.

According to (KPMG, 2109), this trend has led certain retailers to develop apps that allow price-sensitive consumers to scan a product through a barcode and compare the price on the internet with all nearby stores.

6. Finding the joy of missing out (JOMO) – social networks and mobile connections have become a source of stress globally, with people feeling pressured to promote enjoyment or excitement on social media. As a result, this fear of being left out has recreated the notion of self-time. To boost their mental wellbeing, consumers are more aware of their time. They tend to use it more effectively and select specific activities to do. This need has increasingly led consumers to move offline. They prefer offline experiences that they no longer feel the need of sharing online. Consequently, this trend has boosted the sense of ownership with consumers increasingly searching for in-store products such as books and old-school vinyl records that have increased sales.

Furthermore, it is offline where they are able to disconnect from the virtual anxiety of the internet, searching to improve their skills through offline workshops and for a sense of relaxation through activities and cafés where Wi-Fi is no longer available.

Additionally, in the health and wellness industry, retailers are looking for ways to improve the shopping experience to retain and acquire new consumers. Companies are aiming to promote experiences, solutions and services instead of products. Retailers are differentiating through the use health clinics and on-site specialists that provide diet, nutrition and other advisory services (Deloitte, 2018).

According to (KPMG, 2019), with consumers increasingly looking to spend their money on an experience or an event, companies such as IKEA have set plans in motion. By providing the Big Sleepover to customers, where they can sleepover, consumers can learn sleeping techniques and discover which mattress suits them best.

7. I can look after myself – relates to the trend where consumers seek services that simplify and improve their day to day against illness, discomfort, and unhappiness without having to consult a professional. It is considered a reaction to all the noise, claims and promises put out on social media by brands regarding problem-solving products. As a result, consumers desire to be more mindful by taking control of their own decisions.

Moreover, the foods with "free-from" labels remain the fastest growing category in the packaged food category. However, some alternatives offer consumers to personalize their diet, such as Spoon Guru.

Figure 8 - Global health and Wellness moves to clean labels and organic, away from BFY. Source: Euromonitor International, 2019.

Besides, this trend is a form of self-care, that conveys that this idea is attainable with the right equipment. This shift towards sustainability reflects the growth of a moralized shopping. As a result, consumers can obtain a form of self-care.

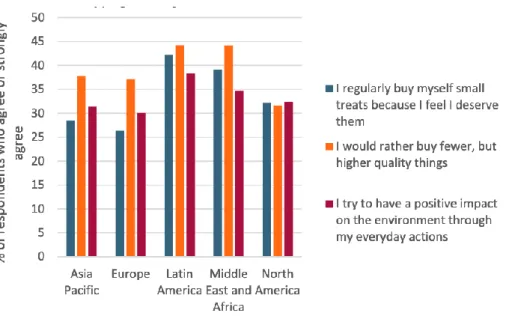

Figure 9 - Consumers treat shopping as a way to look after themselves and feel good. Source: Euromonitor International, 2019.

8. I want a plastic-free world – the desire for a plastic-free world has continued to grow with consumers becoming more aware of the collateral impacts of their consumptions. Also, the microplastics found in beauty, personal and home care products, all together end up polluting our planet. Several campaigns such as the "Blue Planet Effect" or the footage from "Great Pacific Garbage Patch" has encouraged people to take action, participating in conservation projects and campaigns.

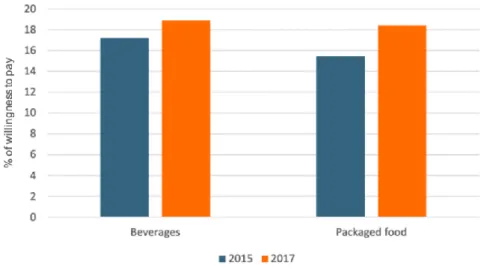

Consequently, with consumers becoming increasingly sensitive concerning plastic waste created by their shopping behaviours, so has their willingness to pay highly increased for eco-friendly and recyclable products, being highly considered in beverage products, packaged food, and fresh food.

Figure 10 - % Willing to pay more for Products with Recyclable Packaging. Source: Euromonitor International, 2019.

Moreover, according to (KPMG, 2019) with sustainability no longer being an option, retailers are shifting to more meaningful sustainability commitments. These solutions align with the values that both consumers and companies desire, with companies such as Ekoplaza launching in Amsterdam the world’s first plastic-free aisle.

9. I want it now – consumers are seeking for ways to make life easier, finding gratification in efficiency-driven lifestyles as they increasingly occupied. Discovering complementary experiences to their current lifestyles allows them to gain additional time for their social and professional lives. Therefore, consumers value all innovative apps that allow them to reduce waiting time and avoid queues.

Also, the digital trend of using mobile app technology has mainly been adopted by younger consumers. When compared to older generations, younger consumers expected to use three times more banking apps and two times more ride-sharing services. Dominant players will rise as the digital economy continues to grow, especially in South and Southeast Asia.

Figure 11 - Household possession of smartphones 2014/2018. Source: Euromonitor International, 2019.

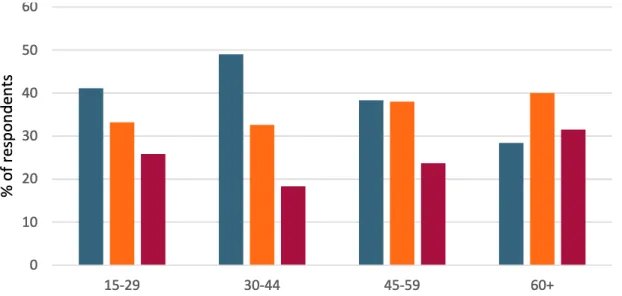

Additionally, people aged from 30-44 years old are most representative in the efficiency-driven lifestyle trend. From these, around half are willing to spend more on services and products that help them save time, especially in urban cities with a high development rate. In 2017, over 60% of Indian participants were willing to spend more money to save time, while around 54% of Chinese participants shared the same interest.

Moreover, women appear to benefit the most from time-saving products and services since over 45% of the women participants confessed to being always under pressure to get chores completed when compared to about 40% of men.

The tendency to purchase online products from groceries, children products to home care and cleaning products had grown from 57% in 2013 to 66% in 2017.

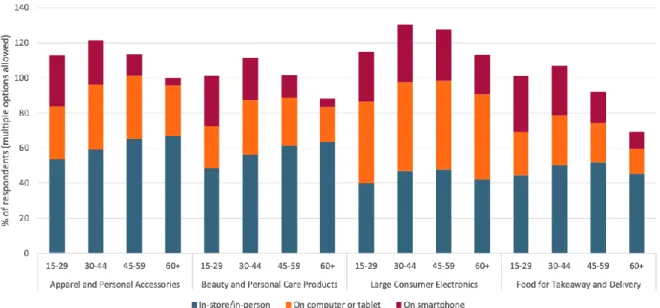

Figure 13 - Consumer preference for path purchase. — source: Euromonitor International, 2019.

10. Loner living – this latest trend is expected to grow worldwide, with single-person household increasing representing a compound annual growth rate (CAGR) of 1,9% in the following decade, with baby boomers representing the most significant portion of this trend. Thanks to China's previous one-child policy has made generated a gender gap, with 30 million more men than women, where more than a quarter of Chinese men in their 30's will have never married by 2030. Additionally, the single-person household increase results from the high global rate of divorces, a carrier focused preference, personal development and travel over early marriage. Consequently, this results in the preference of living in urban surroundings rather than in the suburban areas where it is more favourable to start a family.

According to the Euromonitor Lifestyles Survey, the buying habits and preferences of seniors tend to drive this trend. The number of senior loners easily outnumber younger generations, that makes it hard to differentiate what influences senior purchasing habits from the younger generations. Nevertheless, the younger generations might still one day decide to live with someone or even start a family. Besides, there is a big disparity in consumer's preference for

well-known brands when compared to those living alone. Also, loners value convenience and affordability over "high quality", "durable", "on-trend" or “natural”. They tend to prioritize financial security as they tend to bear the full cost of housing and utilities which alters the way loners purchase. Simple and functional products tend to be favoured by loners as do smaller packages and are not so inclined to a given brand or loyalty program.

Figure 14 - Shopping preference of single vs multiple-member households. Source: Euromonitor International, 2019.

4.1.5. Competitors – Eco-friendly retails

4.1.5.1. Nature & Decouvertes – “Offering the best of the world, for a better world”.

After visiting the US, the Lemarchand family had the idea of creating a business to respect both nature and people, and in 1990, Nature & Decouvertes was born in France. Through its wide range of eco-friendly well-being products, from fragrances, organic teas, organic essential oils, massages, yoga and relaxation, books decorations, home garden, travel and outdoor equipment to workshops, the company goal is to promote an engaging and optimistic lifestyle to all generations, to spend time, think and participate all together in the outside world. Additionally, the brand helps to share new cultures and identities, uses science and innovation to improve well-being, helps consumers to make better decisions and live in harmony by sharing knowledge through workshops and education. Besides, the brand contributes 10% of profits to its N&D Foundation and all N&D cards created revert into €1 contribution to the N&D Foundation that aim to support environmental causes, environmental awareness and local associations (Nature & Decouvertes, 2019).

4.1.5.2. Natura - “There is a bit of Natura in all of us”.

Founded in 1992 by Sergio Durany and Montse Clarasó, the Spanish brand Natura, a store that sells mainly women’s clothing and accessories, was first opened in Barcelona. It focused on creating a space that would gather several cultures together. Their stores are known to provide a sensorial experience store with light, music, scents, objects, and clothing that takes costumers on a journey to several places around the world. In 1996, the first Natura store was opened in Portugal and currently withholding 53 of the 200 stores in the Iberian Peninsula, with the majority located in large Shopping malls. Natura's five core values are simplicity, solidarity, sustainability, harmony, and freedom. Furthermore, they aim to provide a harmonious, natural and caring lifestyle guided by a conscious, responsible and supportive consumption, always linked to nature and its best (Natura, 2018). They compete with N&D in the organic essential oils, fragrances, decorations, woman’s clothing and accessories.

4.1.5.3. Rituals – “Your Body. Your Soul. Your Rituals”.

The brand Rituals founded in 2000, aims to promote a lifestyle intended to transform the daily routine into significant and memorial experiences. They aim to bring joy to consumers through their aromatic oils and honeymoon scents. Their fragrances based on the knowledge and culture of Asia, which allows them to create well-being products for personal care or home. Rituals since the beginning have remained a cruelty-free brand against animal testing, with clean and safe products, a design fit to reduce waste and their environmental impact. Moreover, Rituals supports the Tiny Miracles initiative that helps fight poverty with sustainable solutions through education, healthcare, awareness and income generation methods. Also, through the Soulschool initiative, that aims to provide a combination of yoga, meditation and mindfulness classes to 2 million kids till 2023 (Rituals, 2019). They compete with N&D in well-being products.

4.1.5.4. Kiehl’s - “Since 1851”.

The very first store created in New York City in 1851, and only later in 1894, a young and ambitious pharmacist John Kiehl purchased the apothecary labelled it "Kiehl's Pharmacy". The brand has managed to maintain resilient along time due to its product know-how and ingredient transparency. It offers a wide range of premium personal care products, with a "try before you use" culture that has remained intact for more than 95 years. It is known by its spirit to support noble causes, giving back to communities to support environmental issues, AIDS research, and children's causes. (Kiehls, 2019). The brand aims to guaranty high quality and effectiveness,

with products based on high concentrations of natural ingredients. While avoiding as much as possible the usage of artificial dyes, treat all consumers as friends to make them feel at home, and support good causes and the community in which they operate (Kiehls Portugal, 2019). They compete with N&D in cosmetic and personal care products.

4.1.5.5. Decathlon - “Sports for all”.

The idea of offering a great variety of cheap sports products started in the suburbs of Lille in 1976. Its high demand led Decathlon eventually to expand to Portugal in 2000. The brand currently owns 29 stores all over Portugal, that are strategically positioned. It allows them to cut costs with logistics resulting in the offer of high-quality products at a lower price and becoming accessible to all consumers. Decathlon commits reducing their impact on the environment mainly through their Decathlon Foundation, by collecting all used items and by inserting eco-friendly practices into their production line as well as in the companies culture (Decathlon, 2019). They compete with N&D in travel equipment.

4.1.4.6. The Body Shop - “Beauty without cruelty”.

Founded in 1967 by Anita Roddick, the English brand was born in Littlehampton, England. The Body Shop is a brand of cosmetics that has over 2800 stores spread across 60 countries, and currently, withhold 30 stores in Portugal (The Body Shop Portugal, 2019). This beauty brand is one of the pioneers in corporate activism, that believes it can make a positive impact. As so it uses five core values: against animal testing, self-esteem promotion, enhancement of communities' sustainability by trading with them, the protection of human rights and the protection of our planet (Costa, 2017). They compete with N&D in cosmetics and personal care products.

4.1.5.7. Patagonia - “We’re in the business of saving our planet”.

Yvon Chouinard started in 1957 by selling pegs used in mountain climbing. By 1966 the increase of demand led to the opening of the first store initially labelled as Chouinard Equipment in partnership with Tom and Doreen Forest. In 1972 the store launched an apparel line named "Patagonia" that was later in 1979, soon after the Chouinard's partnership came to an end with the Frosts, Patagonia was its own company. This business that was created by group climbers, surfers and their minimalist style promoted is reflected on the companies values, creating a product line based on utility and simplicity (Reinhardt, Casadesus-Masanell

& Kim, 2010). They aim to produce goods that cause no unnecessary harm, with reparability and durability. They can be recycled so that the material remains in use, contributing to saving the planet Patagonia (Patagonia, 2019). They compete with N&D in travel equipment.

Figure 15 - Competitors overview, a summary of the findings above. Source: Own analysis.

4.2. Questioners Analysis and Results

The second research question dealt with discovering what factors affect the willingness to purchase from N&D whereas the third research question focused on understanding how can N&D communicate itself in Portugal. Based on the online survey, the answer to RQ2 and RQ3 are discussed in the following subchapters.

4.2.1. Survey Descriptive Analysis

The sample had a total of 176 valid respondents, where 86,2% of the total participants were Portuguese. 57,2% of the total participants were female, whereas 42,8% were male. However, it is possible to assess that 85,5% of the respondents were aged between 18 and 34 years old and were 78,6% possessed high levels of education. Second, 49,7% of the respondents were still students, and 35,2% were full-time employed. Regarding the household income, 20,8% earned more than €3500 while 54,1% earned less than €1999, and were 25,2% of the respondents had a household size of 2 persons and 46,5% had a household size from 3 to 4 persons.

Brands Main Platform Tagline B-Corp Main Products Local Associations Target Physical stores in Portugal

Competes with N&D in:

Nature & Decouvertes Webpage "Offering the best of the

world for a better wolrd". Yes Well-bieng. N&D Foundation. Women -

-Natura Webpage "There is a bit of Natura in all of us". Yes

Women's clothing and accessories.

Environmental

causes. Women 53

Women's clothing and accessories, decoration, organic essential oils

and fragrances. Rituals Webpage "Your Body. Your Soul.

Your Rituals". No Well-bieng.

Little Miracles,

Soulschool Men and Women 26 Well-being products. Kiehl's Webpage "Since 1851". No

Cosmetics and personal care products. Environmental causes, AIDS research and Children causes.

Men and Women 6 Cosmetics and personal care products. Decathlon Webpage "Sports for all". No Sports

equipment.

Decathlon

Foundation. Men and Women 29 Travel equipment. The Body Shop Facebook "Beauty without cruelty". Yes

Cosmetics and personal care products.

Animal cruelty

causes. Women 30

Cosmetics and personal care products. Patagonia Webpage "We're in the business to

save our home planet". Yes

Extreme sports gear.

1% of sales to

Figure 16 - Descriptive Statistics, n=176 (Gender, Age, Education Level, Employment Status, Household Income, and Household Size). Source: Survey Data.

42.8% 57.2%

Gender

Male Female 1.9% 41.5% 44.0% 6.3% 4.4% 1.9% 0.0% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% <18 18-24 25-34 35-44 45-54 55-64 >65Age Group

1.3% 18.9% 47.2% 31.4% 1.3% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0%Education level

35.2% 2.5% 3.1% 49.7% 8.2% 1.3% 0.0% 20.0% 40.0% 60.0% Emplyed Full-time(40h+) Emplyed Part-time(20h+) Unemployed Student Self-employed OtherEmployment Status

10.7% 12.6% 17.6% 13.2% 7.5% 6.3% 11.3% 20.8% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% <€599 €600-€999 €1000-€1499 €1500-€1999 €2000-€2499 €2500-€2999 €3000-€3499 >€3500Household Income

19.5% 25.2% 24.5% 22.0% 6.3% 2.5% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 1 2 3 4 5 >5Household Size

Moreover, when searching for well-being products, the respondents were asked to select the channels used. Were 58,5% of the respondents choose “online search”, 51,1% selected “family and friends”, 44,9% “point of sale” and 29% of the respondents agree to use Instagram as a search channel.

Figure 17 - Question survey results, n=176. Channels used to search for well-being products — source: Survey Data.

Furthermore, when asked to select particular benefits in a loyalty card, 83,5% stated to look for "Discounts", 36,4% looked for points, 23,3% agreed to look for "incentives for products", and 7,4% agreed for "early bird releases".

58.5% 51.1% 44.9% 29.0% 16.5% 12.5% 8.5% 6.8% 6.3% 4.0% 00% 10% 20% 30% 40% 50% 60% 70% Onl ine sear ch Fam ily a nd F riend s Poin t of s ale Inst agra m Adv ertis men ts You tube Face book Onl ine Mag azin e/N ewsp aper Blo g/Fo rum Cus tom er s ervi ce Channels used to search for well-being products

83.5% 36.4% 23.3% 7.4% 1.1% 00% 10% 20% 30% 40% 50% 60% 70% 80% 90%

Discounts Points Incentives for

products

After observing an N&D advert, the respondents were asked to select the feelings expressed, was 73,3% stated "Calm", 54% agreed to feel "Positive", 34,7% "Sentimental" and 34,1% felt "Happy".

Figure 19 - Question survey results, n=176. Feelings expressed after watching the N&D advert — source: Survey Data.

Additionally, after watching the advert, the respondents were asked to indicate the attributes associated with the brand N&D, where 64,8% attributed "Sustainability", 59% agreed with "comfort", and 36,9% corresponded the brand with "Reliability".

Figure 20 - Question survey results, n=176. Attributes associated with N&D. Source: Survey Data.

73.3% 54.0% 34.7% 34.1% 26.7% 22.2% 20.5% 17.0% 8.5% 5.7% 4.0% 3.4% 3.4% 2.3% 2.3% 0.6% 00% 10% 20% 30% 40% 50% 60% 70% 80% Calm Posi tive Sent imen tal Hap py Safe Satis fied Sinc ere Ene rgiz ed Neu tral Inde pend ent Am used Exc ited Ala rmed Ann oyed Other Neg ativ e Feelings expressed after whatching N&D advert

64.8% 59.0% 36.9% 20.5% 19.3% 10.2% 9.1% 8.5% 8.0% 6.3% 5.1% 3.4% 00% 10% 20% 30% 40% 50% 60% 70% Sust aina bilit y Com fort Rel iabi lity Inno vatio n Safe ty Prac ticab ility Stre ngh Uni quen ess Pow er Des ign Perf orm ance Fun

4.2.2. N&D and competitors

According to the results of the survey, 61,9% of the respondents did not know the brand Kiehl’s, 60,6% did not know the brand N&D, 41,3% Patagonia, 15% Natura, 11,3 The Body Shop, 10,6 % Rituals, and 1,9% did not know the brand Decathlon.

Figure 21 - Question survey results, n=176. Percentage of people that do not know the brand. Source: Survey Data.

When asked to rate the eco-friendly brands in terms of price from 1 “lowest price” to 7 "the highest price”, from the 98,1% of the respondents that knew the brand Decathlon stated that the brand had the lowest price. From the 88,7% that knew The Body Shop, the 85% that new Natura and the 89,4% that knew Rituals agreed that they had an above-average price. Lastly, from 58,7% of the respondents that knew the brand Patagonia, the 38,1% that knew Kiehl’s and the 39,4% that knew N&D agreed that they had high prices were N&D represented the highest.

In terms of quality, when asked to rate from 1 “lowest quality” to 7 "the highest quality", from the 98,1% of the respondents that knew the brand Decathlon stated that the brand had an average quality. From the 88,7% that knew The Body Shop, the 85% that new Natura and the 89,4% that knew Rituals agreed that they had an above-average quality. Finally, from 58,7% of the respondents that knew the brand Patagonia, the 38,1% that knew Kiehl’s and the 39,4% that knew N&D agreed that they had high quality were Kiehl’s and N&D appeared to be the highest. 61.9% 60.6% 41.3% 15.0% 11.3% 10.6% 1.9% 00% 10% 20% 30% 40% 50% 60% 70%

Kiehl's N&D Patagonia Natura The Body Shop Rituals Decathlon

Figure 22 - Question survey results, n=176. Perceptual map of N&D and its competitors. Source: Survey Data.

4.2.3. Willingness to Purchase

This paper aimed to predict which factors affected an effective communication strategy for Fnac's new venture N&D in Portugal. So to answer the research question, a dependent variable was studied, which was the willingness to purchase. By understanding the factors contributing to the willingness to purchase from N&D, one can later take the conclusion of effective strategies to implement effective communication. From the data collected regarding this topic, the average value of the willingness to purchase was (4,28) with an SD of 1,378 (Appendix 6).

4.2.4. Research Hypothesis

For this study, six hypotheses were created to understand if the environmental values, purchase habits, attribute preferences, brand awareness, loyalty card, and socio-demographic variables affect the dependent variable willingness to purchase (Figure 23).

𝑯𝟏: Environmental values influence the willingness to purchase from N&D. 𝑯𝟐: Purchase habits influence the willingness to purchase from N&D. 𝑯𝟑: Attribute preferences influences the willingness to purchase from N&D. 𝑯𝟒: Brand awareness influences the willingness to purchase from N&D.

𝑯𝟓: The loyalty card influences the willingness to purchase from N&D. 𝑯𝟔: Socio-demographics influences the willingness to purchase from N&D.

Natura 85%

Kiehl's 38.1%

The Body Shop 88.7% N&D 39.4% Rituals 89.4% Decathlon 98.1% Patagonia 58.7%

Perceptual Map

High Price Low Price High Quality Low QualityFigure 23 - Hypotheses Framework.

4.2.5. Procedures

Once all the results were collected, it was included into SPSS to perform an in-depth analysis. Initially, all items were named accordingly to match the features they were meant to explain and were then allocated to a specific categorial group. Additionally, all items considered to be inverted were reversed through the coding in order to guaranty consistency among the measurement between variables with different features. The letter "r" was used to identify those items (Appendix 4). Also, multiple linear regressions were computed. The focus of the analysis was to identify which variable group was more significant in predicting the willingness to purchase from N&D.

Nevertheless, a descriptive analysis of the different variable groups and a reliability test was executed previous to the main study.

4.2.6. Reliability Analysis

After examining the participant's answers, there was a recognition that several questions were studying one latent variable on the same scale – CSR (Appendix 3). As a result, the Cronbach’s Alpha was used in this study to measure internal consistency among composed items, that measure the same general construct and move together when composed with others (Pallant,

2005). A composed item should have a Cronbach Alpha above (0,7) in order to be considered reliable and accepted by investigators (Pallant, 2005; Leech, Barrett & Morgan, 2005). The original three composed items of the Cronbach Alpha were studied with a Likert Scale. As a result, the Cronbach Alpha was not reliable, lower than (0,7) for all the three composed items studied.

Figure 24 - Reliability Analysis part1. Source: Survey Data.

Nevertheless, a thorough analysis was made to comprehend if the removal of items could impact the result of the Cronbach Alpha. The Cronbach Alpha for Consumer behaviours and Interaction with companies could not be improved with the removal of one item. In contrast, the Shopping behaviour would have a final Cronbach Alpha superior to (0,7) if the item SBH5: “When considering buying a product, the price-performance ratio is more relevant to me than sustainability” were deleted from the analysis. It resulted in a reliable, composed item. Since all the remaining items of the corrected item-total correlation value were higher than (0,4), one can assume that each item is practically explaining the expected composite value (Pallant, 2005).

However, the author decided to group all the composed items (consumer behaviours + shopping behaviours + Interaction with companies) by creating a fourth composed item, labelled as Environmental Values (ENV). Initially, with a Cronbach Alpha lower than (0,7), the fourth composed item was not considered to be reliable. Nevertheless, by eliminating six of the included items: CBH1, CBH2, CBH4, SBH5, IWC1 and IWC3, the fourth composed item with (0,802) was considered to have good internal consistency reliability. Since all the remaining items of the corrected item-total correlation value were approximately higher than

Eliminate SBH5 0,759 Shopping behaviors SBH1, SBH2, SBH3, SBH4, SBH5, SBH6 0,626 Interaction with companies

IWC1, IWC2, IWC3,

IWC4 0,454

Cronbach Alpha never became > 0,7 Revaluation

Improved Cronbach

Alpha

Composed Items Items included Cronbach

Alpha

Consumer behaviors CBH1, CBH2, CBH3,

CBH4, CBH5 0,521

Cronbach Alpha never became > 0,7