Dynamics, Games

and Science

Jean-Pierre Bourguignon

Rolf Jeltsch

Alberto Adrego Pinto

Marcelo Viana

Editors

Volume 1

Series Editors: Irene Fonseca

Department of Mathematical Sciences Center for Nonlinear Analysis Carnegie Mellon University Pittsburgh, PA, USA

Alberto Adrego Pinto Department of Mathematics

collaboration with the Centro Internacional de Matemática (CIM) in Coimbra, Portugal. Proceedings, lecture course material from summer schools and research monographs will be included in the new series.

Alberto Adrego Pinto • Marcelo Viana

Editors

Dynamics, Games

and Science

International Conference and Advanced

School Planet Earth, DGS II, Portugal,

August 28–September 6, 2013

Jean-Pierre Bourguignon IHES Le Bois-Marie Bures-sur-Yvette, France

Rolf Jeltsch

Department of Mathematics ETH ZurichR

Seminar fur Angewandte MathematikR Zurich, SwitzerlandR

Alberto Adrego Pinto Department of Mathematics University of Porto Faculty of Sciences Porto, Portugal

Marcelo Viana

Instituto de Matemática Pura e Aplicada IMPA

Rio de Janeiro, Brazil

ISSN 2364-950X ISSN 2364-9518 (electronic) CIM Series in Mathematical Sciences

ISBN 978-3-319-16117-4 ISBN 978-3-319-16118-1 (eBook) DOI 10.1007/978-3-319-16118-1

Library of Congress Control Number: 2015945812

Mathematics Subject Classification (2010): 37-02, 37-06, 91-01, 91-02 Springer Cham Heidelberg New York Dordrecht London

© Springer International Publishing Switzerland 2015

This work is subject to copyright. All rights are reserved by the Publisher, whether the whole or part of the material is concerned, specifically the rights of translation, reprinting, reuse of illustrations, recitation, broadcasting, reproduction on microfilms or in any other physical way, and transmission or information storage and retrieval, electronic adaptation, computer software, or by similar or dissimilar methodology now known or hereafter developed.

The use of general descriptive names, registered names, trademarks, service marks, etc. in this publication does not imply, even in the absence of a specific statement, that such names are exempt from the relevant protective laws and regulations and therefore free for general use.

The publisher, the authors and the editors are safe to assume that the advice and information in this book are believed to be true and accurate at the date of publication. Neither the publisher nor the authors or the editors give a warranty, express or implied, with respect to the material contained herein or for any errors or omissions that may have been made.

Printed on acid-free paper

other lecturers and speakers and Portuguese mathematicians, but I also visited a museum in Lisbon where I learned more about Prince Henry the Navigator and his school of navigation, where some of the leading geographers, cartographers, astronomers, and mathematicians of the fifteenth century from various parts of Europe came to work; and participants were trained in navigation, map-making, and science, including mathematics. The school of navigation started the Portuguese as well as the European exploration of new lands. So, following the scientific tradition of Portugal, this volume contains the broad mathematical themes of this conference on dynamical systems and game theory. It contains samples of the numerous talks and presentations given at the Advanced School DGS II and the Conference DGS II. The reader will find many interesting topics in dynamical systems and game theory, including many interdisciplinary contributions from economics, population dynamics, ecology, healthcare, disease epidemics, cell biology, and physics. This volume will also encourage and help the reader to explore “new lands” in various scientific areas. Finally, I would like to express my thanks to Alberto Adrego Pinto, Jean-Pierre Bourguignon, Rolf Jelstch, and Marcelo Viana for their efforts in editing and putting together this important volume.

I was quite pleased, and honored, to be asked by Alberto Pinto to speak at the International Conference and Advanced School Planet Earth, Dynamics, Games and Science II (DGS II) and to lecture in the advanced school that accompanied the conference from 28 August to 6 September, 2013. I had met Alberto at several conferences over the previous years and was well aware of the high-quality work that he and many of his Portuguese colleagues were doing in many branches of mathematics and science. So I knew that attending DGS II would be stimulating and rewarding. I was, however, unaware of Alberto’s extraordinary organizational and leadership talents, as were displayed by these events. The extent of the diverse activities organized under Alberto’s leadership as president of the international Center of Mathematics (CIM), together with Irene Fonseca (president of the CIM’s scientific council) and a large number of Portuguese mathematicians, universities, institutions and organizations, is quite remarkable. These activities constitute an outstanding contribution to the international year of the Mathematics of Planet Earth 2013 (MPE 2013), held under the patronage of UNESCO, during which mathematical organizations, universities, and research centers around the world hosted conferences, workshops, schools, and long-term programs intended to showcase the ways in which the mathematical sciences can be useful in addressing our planet’s many problems.

physics. Game theory’s roots were in economics and the contributions in this volume show that its vibrant role in economics continues unabated. More recently, game theory and methodologies inspired by game theoretic ideas have made foundational contributions to other disciplines, the life sciences being a notable example. For example, extensions of game theoretic methods to dynamic settings have been and continue to be developed in order to model and understand evolutionary and adaptive processes in biology, with impacts ranging from the evolution of antibiotic resistance of pathogens to large-scale ecosystems.

This volume serves well to illustrate the many roles that mathematics can play in addressing a wide variety of scientific problems that relate to our planet earth. I am confident that the reader will be inspired by the contributions and will be stimulated to learn more about the goals of MPE 2013. I want to thank Alberto and his fellow editors, Jean-Pierre Bourguignon, Rolf Jelstch, and Marcelo Viana, for their efforts in putting this important volume together.

As the International Center for Mathematics (CIM) celebrated its 20th anniversary on the 3rd of December 2013, it is the perfect opportunity to look back on this past year, which has undoubtedly been one of the most ambitious and eventful ones in its history. With the support of our associates from 13 leading Portuguese universities, our partners at the University of Macau, and member institutions such as the Portuguese Mathematical Society, in 2013 the CIM showed yet again the importance of a forum such as this for bringing together leading Portuguese-speaking scientists and researchers from around the world.

The hallmark project of the year was the UNESCO-backed International Program Mathematics of Planet Earth (MPE) 2013, which the CIM participated in as a partner institution. This ambitious and global program was tasked with exploring the dynamic processes underpinning our planet’s climate and man-made societies, and with laying the groundwork for the kind of mathematical and interdisciplinary collaborations that will be pivotal to addressing the myriad issues and challenges facing our planet now and in the future. The CIM heeded the MPE’s call to action by organizing two headline conferences in March and September of 2013: the “Mathematics of Energy and Climate Change” conference in Lisbon in the spring, and the conference “Dynamics, Games, and Science II” in the fall. Both were held at the world-renowned Calouste Gulbenkian Foundation in Lisbon, one of more than 15 respected Portuguese foundations and organizations that enthusiastically sup-ported the CIM conferences. As well as the conferences themselves, well attended “advanced schools” were held before and after each event: at the Universidade de Lisboa in the spring, and at the Universidade Técnica de Lisboa in the fall.

of the announcement, “and will help strengthen our contacts with the international mathematics community.”

These first two volumes in the series, consisting of review articles selected from work presented at the “Mathematics of Energy and Climate Change” and “Dynamics, Games, and Science” conferences, reflect the CIM’s international reach and standing. Firstly, they are characterized by an impressive roster of mathematicians and researchers from across the United States, Brazil, Portugal, and several other countries whose work will be included in the volumes.

The authors are complemented by the editorial board responsible for this first installment, a world-renowned “quartet” consisting of: president of the European Research Council Jean-Pierre Bourguignon from the École Polytechnique; former Société Mathématiques Suisse and European Mathematical Society president Rolf Jeltsch from the ETH Zurich; current Sociedade Brasileira de Matemática president Marcelo Viana from Brazil’s Instituto Nacional de Matemática Pura e Aplicada; and CIM president Alberto Adrego Pinto from the Universidade do Porto.

While the MPE program was a major focus of the CIM’s activities in 2013, the center also organized a number of further events aimed at fostering closer ties and collaboration between mathematicians and other scientists, mainly in Portugal and other Portuguese-speaking countries. In this context the CIM held the 92nd European Study Group with Industry meeting, part of a vital series held throughout Europe to encourage and strengthen the connections between mathematics and industry. As the MPE program made clear, humanity faces all manner of challenges, both man-made and natural, and though industry is attempting to overcome them, in many cases mathematics and science are far better suited to the task. Yet it is often industry that delivers the kinds of innovative ideas that will launch the next great scientific and technological revolutions, and which academia must adapt to. The potential for dialogue and cooperation between academia and industry is in fact so great that I have now made it one of the core initiatives in my presidency of the US-based Society for Industrial and Applied Mathematics (SIAM).

communicating and broadening the impact of the CIM’s activities with regard to these global challenges.

We thank all the authors of the chapters and we thank all the anonymous referees. We are grateful to Irene Fonseca for contributing the preface of this book. We thank the Executive Editor for Mathematics, Computational Science and Engineering at Springer-Verlag Martin Peters for invaluable suggestions and advice throughout this project. We thank João Paulo Almeida, Ruth Allewelt, Joana Becker, João Passos Coelho, Ricardo Cruz, Helena Ferreira, Isabel Figueiredo, Alan John Guimarães, Filipe Martins, José Martins, Bruno Oliveira, Telmo Parreira, Diogo Pinheiro, and Renato Soeiro for their invaluable help in assembling this volume and for their editorial assistance.

Alberto Pinto would like to acknowledge the financial support of Centro Internacional de Matemática (CIM), Ciência Viva (CV), Calouste Gulbenkian Foundation, Fundação para a Ciência e a Tecnologia, LIAAD-INESC TEC, USP-UP project, IJUSP-UP and Mathematics Department, Faculty of Sciences, University of Porto, Portugal.

Alberto Pinto gratefully acknowledges the financial support to the con-clusion of this project provided by the FCT—Fundação para a Ciência e a Tecnologia (Portuguese Foundation for Science and Technology) within project UID/EEA/50014/2013 and ERDF—European Regional Development Fund through the COMPETE Program (operational program for competitiveness) and by National Funds through the FCT—Fundação para a Ciência e a Tecnologia (Portuguese Foundation for Science and Technology) within Project “Dynamics and Applications” with reference PTDC/MAT/121107/2010.

Bures-sur-Yvette, France Jean-Pierre Bourguignon

Zürich, Switzerland Rolf Jeltsch

Porto, Portugal Alberto Adrego Pinto

Corruption, Inequality and Income Taxation. . . 1 Elvio Accinelli and Edgar J. Sánchez Carrera

Discrete Symmetric Planar Dynamics. . . 17 B. Alarcón, S.B.S.D. Castro, and I.S. Labouriau

Decision Analysis in a Model of Sports Pricing Under

Uncertain Demand. . . 31 Alberto A. Álvarez-López and Inmaculada Rodríguez-Puerta

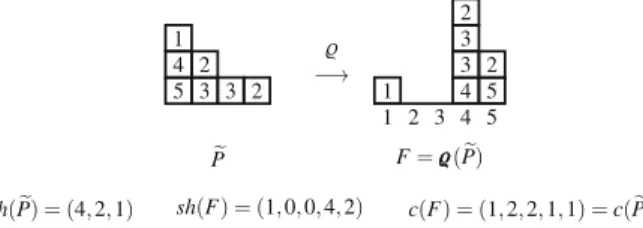

Growth Diagrams and Non-symmetric Cauchy Identities

on NW (SE) Near Staircases. . . 41 Olga Azenhas and Aram Emami

Clustering Techniques Applied on Cross-Sectional

Unemployment Data. . . 71 Carlos Balsa, Alcina Nunes, and Elisa Barros

A Note on the Dynamics of Linear Automorphisms

of a Convolution Measure Algebra. . . 89 A. Baraviera, E. Oliveira, and F.B. Rodrigues

Periodic Homogenization of Deterministic Control Problems

via Limit Occupational Measures. . . 105 Martino Bardi and Gabriele Terrone

On Gradient Like Properties of Population Games, Learning

Models and Self Reinforced Processes. . . 117 Michel Benaim

Wave Interaction with Floating Bodies in a Stratified

Shannon Switching Game and Directed Variants. . . 187 A.P. Cláudio, S. Fonseca, L. Sequeira, and I.P. Silva

A Proposal to Measure the Functional Efficiency of Futures Markets. . . 201

Meliyara Consuegra and Javier García-Verdugo

On the Fundamental Bifurcation Theorem for Semelparous

Leslie Models. . . 215 J.M. Cushing

Review on Non-Perturbative Reducibility of Quasi-Periodically

Forced Linear Flows with Two Frequencies. . . 253 João Lopes Dias

Collateral Versus Default History. . . 273 Marta Faias and Abdelkrim Seghir

Regularity for Mean-Field Games Systems with Initial-Initial

Boundary Conditions: The Subquadratic Case. . . 291 Diogo A. Gomes and Edgard A. Pimentel

A Budget Setting Problem.. . . 305 Orlando Gomes

Dynamic Political Effects in a Neoclassic Growth Model

with Healthcare and Creative Activities. . . 317 L. Guimarães, O. Afonso, and P.B. Vasconcelos

An Introduction to Geometric Gibbs Theory. . . 327 Yunping Jiang

Sphere Rolling on Sphere: Alternative Approach to Kinematics

and Constructive Proof of Controllability.. . . 341 F. Silva Leite and F. Louro

The Dual Potential, the Involution Kernel and Transport

in Ergodic Optimization.. . . 357 A.O. Lopes, E.R. Oliveira, and Ph. Thieullen

Rolling Maps for the Essential Manifold. . . 399 L. Machado, F. Pina, and F. Silva Leite

Singleton Free Set Partitions Avoiding a 3-Element Set. . . 417

Ricardo Mamede

Some Results on the Krein Parameters of an Association Scheme. . . 441

Vasco Moço Mano, Enide Andrade Martins, and Luís Almeida Vieira

A Periodic Bivariate Integer-Valued Autoregressive Model. . . 455

The Macrodynamics of Employment Under Uncertainty. . . 479 Paulo R. Mota and P. B. Vasconcelos

A State Space Model Approach for Modelling the Population

Dynamics of Black Scabbardfish in Portuguese Mainland Waters. . . 499

Isabel Natário, Ivone Figueiredo, and M. Lucília Carvalho

Entropy and Negentropy: Applications in Game Theory. . . 513

Eduardo Oliva

Micro-Econometric Analysis of New Household Formation in Spain. . . 527

Orlando Montoro Peinado

An Adaptive Approach for Skin Lesion Segmentation in

Dermoscopy Images Using a Multiscale Local Normalization. . . 537

Jorge Pereira, Ana Mendes, Conceição Nogueira, Diogo Baptista, and Rui Fonseca-Pinto

Chaotic Dynamics and Synchronization of von Bertalanffy’s

Growth Models. . . 547 J. Leonel Rocha, Sandra M. Aleixo, and Acilina Caneco

Three Dimensional Flows: From Hyperbolicity

to Quasi-Stochasticity.. . . 573 Alexandre A.P. Rodrigues

Dengue in Madeira Island. . . 593 Helena Sofia Rodrigues, M. Teresa T. Monteiro, Delfim F.M.

Torres, Ana Clara Silva, Carla Sousa, and Cláudia Conceição

The Number of Saturated Numerical Semigroups

with a Determinate Genus. . . 607 J.C. Rosales, M.B. Branco, and D. Torrão

Modern Forecasting of NOEM Models. . . 617 Manuel Sánchez Sánchez

An Overview of Quantitative Continuous Compound Analysis. . . 627

Rui Santos, João Paulo Martins, and Miguel Felgueiras

Varying the Money Supply of Commercial Banks . . . 643

Martin Shubik and Eric Smith

Optimal Control of Tuberculosis: A Review. . . 701 Cristiana J. Silva and Delfim F. M. Torres

A Bayesian Modelling of Wildfires in Portugal. . . 723 Giovani L. Silva, Paulo Soares, Susete Marques, M. Inês Dias,

Minimum H-Decompositions of Graphs and Its Ramsey

Version: A Survey. . . 735 Teresa Sousa

Appendix A: CIM International Planet Earth Events DGS II, 2013. . . 749

Elvio Accinelli and Edgar J. Sánchez Carrera

Abstract It is recognized that corrupt behavior determines the institutional types of an economic system where an institution is ruled out by economic agents (e.g. officials-public or private) abusing their role to procure gain for themselves (rent-seeking activities) or somebody else. In this vein, we study an evolutionary model of institutional corruption. We show that income inequality and income taxation are the main factors (explanatory variables) for fighting institutional corruption. We conclude with some feasible policies on institutions, beliefs and incentives to combat the corruption.

1

Introduction

A large number of papers on the causes and consequences of corruption have been published (for a survey, see [3, 5,7,8], among others). Bardhan [3] notes that corruption appears relevant in undeveloped economies where the organization of the State is inefficient, democratic control of the civil community over government actions is absent, and bureaucrats have wide discretionary power (see also [2]). The literature about the long-run economic consequences of corruption (see [4,11]) focuses on rent seeking in the provision of public services. A government official controls the offer of a service against private demand, and then he/she has some discretionary power on the offer and can restrict it in several ways (e.g. denying permission or delaying its release). Bribes are the extra-price charged by bureaucrats to private customers, and arise like rents. The economic consequences of this phenomenon concern distortions in resources allocation mainly in terms of less private investment, and a reduced rate of human capital formation. For example, Ehrlich [4] states that corruption is an economic activity that requires some political capital. Effort devoted to the accumulation of this kind of knowledge has an alternative use in human capital production. Corruption reduces economic growth through a negative influence on investments in human capital.

E. Accinelli () • E.J. Sánchez Carrera

Autonomous University of San Luis Potosi, San Luis, México e-mail:elvio.accinelli@eco.uaslp.mx;edgar.carrera@uaslp.mx

While a large proportion of corrupt practices are illegal, in this paper we do not consider a legal approach to the definition of corruption since not all corrupt practices are illegal and not all illegal activities are corrupt practices. In fact, Jain [7] identifies three categories of corruption grand involving political elite, bureaucratic involving corrupt practices by appointed bureaucrats, and legislative corruption involving how legislative votes are influenced by the private interest of the legislator. The three types of corruption differ only in terms of the decisions that are influenced by corrupt practices.

However, few are the articles studying strategic fundamentals that cause corrupt behavior in a society. Hence, the aim of this paper is to describe the evolution of corruption behavior in a society. Our approach is based on recognizing of what economists call incentives or psychologists reinforcement for choosing a certain behavior. When individuals need to choose an action or future behavior between several possible, they are pressed by different kind of incentives and penalties. We understand corruption as a possible behavior followed by several individuals in a given population (see [1]). Accinelli and Carrera [1] pointed out that individuals under the pressure of incentives and penalties need to choose one of two antagonistic possible behaviors, being corrupt or non-corrupt. When individuals choose driven by imitation, but they have not complete information, however they must choose and do this base upon its own beliefs.

In this paper we assume that individuals are no completely informed about the payoff of his/her choices, but they are rational in the sense that they choose with higher probability the behavior that they understand has in each moment, the highest expected value. In our model, we consider a distribution of income for the population, and strategic interaction between people who pay taxes and officials who control such tax compliance. The baseline approach of our model comes from [6] that examine the implications of corruptibility and the potential abuse of authority for the effects and optimal design of (potentially non-linear) tax collection schemes. Hindriks et al. find that the distributional effects of corruption and tax evasion are regressive, hence for the poor have little to gain from evading taxes and are at the same time vulnerable to over-reporting of their incomes; for the rich, the converse is true. The government can Levy progressive taxes without reducing its own payoff by creating countervailing incentives in the form of commissions: the parties are tempted to understate income to evade progressive taxes, and tempted to overstate income to raise the commission payments.

that pays taxes increases. Consequently the action to pay taxes is perceived as not prejudicial like in other cases. In this way, any incentives to do not comply with tax obligations tend to disappear and any basis of corrupt auditors. In what follows, we analyze the impact on the decisions made by different social groups, of the possible policies defined by the central planner.

Our goal is to explain the structural evolution of corrupt behavior in a given society as the result of individuals’ decisions influenced by the behavior of the others members of this society. Along this evolutionary process, at every time, individuals make their choices about their future behavior, the result of this process is the social evolution. In particular we analyze the interaction between the tax authority and citizens, to study the evolution of corrupt behavior as the result of individuals’ beliefs and institutional policies.

The remainder of this paper is organized as follows. Section 2 develops a game-theory model related to tax evasion and corruption in the tax inspectorate. Section3 is devoted to study the evolutionary dynamics of corrupt behavior and taxpayers. Finally, Sect.4contains some implications of the results and discusses their application to economy.

2

The Model

Consider an economy where institutions are ruled out by two populations, namely citizens and auditors.

Citizens are required to pay taxes, however only those following a non-corrupt behavior meet this requirement. We shall say that are evaders, or corrupts, those citizens who do not pay taxes. Consequently, the population of citizens, C, is composed by: tax evaders or corrupt,CC, and tax payer or non-corrupt,CN:There are tax audits done in each period. The task of auditors is to monitor tax compliance of citizens. The population of auditors,P, is composed in turn, by: corrupt,PC, and non-corrupt,PN. Non-corrupt auditors are those that make their job according to the national tax compliance laws. Corrupt auditors do not do their job according to the law, and they take bribes from citizens evaders. Moreover:

1. Citizens are distributed according to their levels of income, denoted by a setY;

and a probability that a citizenx2Chas income lower or equal toy2Y is:

P.y.x/y/DP.y/:

Note that this probability corresponds to the fraction of citizens with income lower than or equal toy:We assume that according to their income level, citizens are divided into ndifferent groups,I1;I2: : : :;In; thusy W C ! I whereI D

2. We consider that the central planner has implemented a proportional taxation policy, so all citizen should pay taxes proportional to their income, .y/y.x/, where0 < .y/ < 1. Byy.x/we denote the income of the citizen x. That is, the central authority sets rates by income levels, i.e. .y/ D .Ii/for all y 2 Ii;i D 1; : : : :;n:So that the total amount paid as tax by ax-citizen with income levely2Iiis equal to .Ii/y.x/.

3. We consider that income distribution is constant over time, but the percentage of taxpayers is time-variant. Hence, in every period of timetwe represent by:

• ˛.t/the share of citizens taxpayers, • .t/the share of non-corrupt auditors.

• ˇ.t/D 1 ˛.t/is the share of tax evaders, andı.t/D1 .t/represents the share of corrupt auditors.

4. In this vein, we state the following.

Definition 1 Let us define the index,c, as a measure of total illegal behavior in the economy, i.e.

c.t/Dˇ.t/Cı.t/:

5. We denote by underliney and yN the lowest and the highest income levels, respectively. Thus the distribution of taxes P˛.y/is supported in the interval

Œy;yN:Total income due to taxes collected in timetis: TtD

Z Ny

y

.y/y.x/dP˛.y/;

The subscript˛indicates that the total of citizens paying .y/y.x/depends on the total share of taxpayers, given by˛.

6. We consider that the tax audit is performed, in each period, on citizens with certain probabilityPA2Œ0; 1. Thus tax evasion is punishable and let us denote bym > 0the fine imposed by a non-corrupt auditor on a citizen tax evader when s/he is audited.

7. The model takes into account the possibility that a briber may bargain with the auditor some money in exchange for not revealing the evasion. This bargain has been succeeded when a corrupt auditor meets an evader, and then the corrupt auditor gets a bribe equal toBN Dk .y/y.x/ > 0,80 <k< 1.

8. However the central authority can detect to the illegal behavior and conse-quently punishing the corrupt auditor. The fine imposed to the corrupt auditor by the central authority isM > 0, andpM 2 Œ0; 1is the probability that the corrupt auditor is detected. Hence, we can state that the sum of the probabilities

9. If a non-corrupt auditor meets a tax evader citizen, s/he is facing the monitoring cost,c.˛; / > 0, by punishing the evader. This cost is a decreasing function of˛;and increasing with ;and convex in both variables. Such a monitoring cost corresponds to the work associated with this process, and it increases as the number of evaders or the number of corrupt officers is increasing. This somehow shows that the incentives to behave legally changes according to the profile distribution of economic agents (see the above Item 3–4, Definition1). To counteract this negative action about the behavior of public officials, can be doing, for instance, paying a premium to those officials who fulfill their duties. In many Latin American countries, there is a prize to presenting a right fiscal report, and it is paid to employees who are not cheating.

10. If corruption is punished, the total amount received by the payment of fines is transferred to improve the social welfare. The total money obtained by the central authority is the sum of the total money of taxes collected plus the total amount received from fines. The total amount of fines is a random variable,W, with expected valueWN:So, the central authority has an expected total national revenue:

RtDTtC NWt> 0:

Individuals, P and C, have some utility due to the tax system and national revenue. That is, utilities of auditors and citizens,

uP.˛;R/ > 0andux.˛;R/ > 0;

depend on the total national revenue,R, and on the share,˛, of taxpayers. Therefore, under the above considerations, if the policy of the central planner is given, then individual (expected money-metric) utility functions (or expected payoffs) are given by:

uCNx.˛/Dux.˛;R/C.1 .y//y.x/; .A/ uCCx.˛; /Dux.˛;R/ PA

mC.1 .y//y.x/C1 .1 k .y//y.x/; .B/

uPC.˛/Dup.˛;R/C.1 ˛/ Pn

iD1k .Ii/y.Ii/ni

PMM; .C/

uPNC.˛; /Dup.˛;R/ .1 ˛/c. /: .D/ (1)

Note that these utilities can change over time if the share populations change, and

citizen tax-evader, with incomey.x/; 0 <k< 1correspond to the proportion of the tax that citizen tax-evader must pay to a corrupt auditor with probability.1 /. With probability, an evader is revealed by a non-corrupt auditor and must pay a finemplus the amount owned. The third one (C) is the utility function of the corrupt auditor. We assume that with probability.1 ˛/the audited citizens are evaders, and in this case the auditor takes bribes. The last one (D) the utility of a non-corrupt auditor. we assume that an honest auditor must perform certain management when confronting an individual evader. This management has a cost, which we assume decreases when the number of honest auditors. This management should only be performed when confronting an individual evader, otherwise we assume it is zero, i.e., @c.˛; /@ < 0: Obviously, the probability to pay this cost, decrease when the number of honest citizen increase. Either because the probability of facing a citizen evader decreases or because the cost is shared between more auditors

Remark 1 A citizen chooses to be a non-corrupt, i.e. he/she is taxpayer, ifuCNx.˛/ >

uCCx.˛; /which holds when:

.y/ y.x/.1CPA/CmPA

y.x/1 PA.k k /;

where .y/is a threshold value indicating a social limit, beyond which the utility of an honest citizen with incomeysurpasses the associated utility to the corrupt behavior. This threshold value makes reference to the highest income tax rate that the central authority should impose for not favoring the evader behavior. Note that

0.y/ < 0 means that citizens with higher incomes are more likely to become evaders.

Remark 2 An auditor chooses to be a non-corrupt ifuPNC.˛; / > uPC.˛/ which

holds when:

pM> .1 ˛/Œ

Pn

iD1k .Ii/y.Ii/niC.1 ˛/c. /

M ;

and so the differenceuPNC.˛; / uPC.˛/is positive and it is increasing either when

pMorMare large enough.

We assume that the level of social welfare increases with the total national revenue and with the share of taxpayers, i.e.

@uj

@R.˛;R/ > 0 and

@uj

@˛.˛;R/ > 0 for all j2 fC;Pg;

and that the functionsuj.˛;R/are concave with respect toR, i.e.

@2uj.˛;R/

where auditors and citizens do not value equally the welfare obtained by taxes, this assumptions is considered in the fact thatuC.˛;R/is not necessarily equal to uP.˛;R/:

Central authority should fix the optimal tax rate assuming that every citizen pay taxes. So this is not longer optimal in the presence of citizens evaders. Suppose the share of taxpayers in timetis˛.t/D˛. Consider in addition thatP˛.Ii/correspond

to the proportion of citizens in the levelIi; i D 1; : : : ;nthat in timet are paying taxes. The level of income of each group (or social class) is symbolized byy.Ii/:

Then in terms of income, the expected amount of tax collected can be written as:

T˛.t/D

n X

iD1

.Ii/Œy.Ii/ y.Ii1/P˛.Ii;t/;

where as we saidP˛.Ii;t/represents the percentage of citizens with incomey.Ii/

that are taxpayers, in timet. While total (potential) amount collected corresponds to:

T˛D1D

n X

1

.Ii/Œy.Ii/ y.Ii1/P˛D1.Ii/

whereP˛D1.Ii/is the share of taxpayers citizen with incomeyIiC1whileP.Ii/is the

total share of individuals with such income in the population, soP.Ii/P˛.Ii;t/for allt;with equality if and only if˛D1:

From now on to facilitate the scripture, if not strictly necessary, we suppress the variabletalthough all values depend on the distribution of populations, which certainly change over time.

The utility of a citizenx;q who is a taxpayer, is given by the Eq. (1A), and it can be written as:

uCNx.˛; /Dux ˛;

n X

1

.y.Ii/Œy.Ii/ y.Ii1/P˛.Ii/C NW

!

C.1 .Ij//y.Ij/:

To simplify the notation we denote byjthe optimal tax corresponding to the income level equal to yIj; j D 1; 2 : : : ;ni.e. j D .Ij/:The next proposition offers an

important result.

Proposition 1 As the gap between social classes (measured by the different income levels Ii), is increasing (more income inequality), the greater the tax evasion (more corruption).

central planner) must verify the equations:

@uCNx

@j .1;R.

//D @uCNx

@R .1;R.//

@R

@j.

/

D @uCNx

@R

1;Pn1iŒy.Ii/ y.Ii1/P˛D1.Ii/

Œy.Ij/ y.Ij1/P˛D1.Ij/ y.Ij/D0

(2)

or equivalently,

@uCNx

@R 1; n X

1

iŒy.Ii/ y.Ii1/P˛D1.Ii/

!

y.Ij/

y.Ij/ P˛D1.Ij/D1; (3)

for alljD 1; : : : ;nIwherey.Ij/D y.Ij/ y.Ij1/is the income gap between the

social classesIjandIj1:Note that if we assume˛ D 1, thenP˛D1.Ij/is equal to

the total percentage of citizens with incomeyIj:Given that the utility function is strictly concave inRit follows that @2uCNx

@j2

< 0so,jis a maximum. In conclusion, by Eq. (3) it follows that the number of citizens that are willing to be taxpayers is a decreasing function of the gap between social classesIjandIj1:Hence, as lower is

the gap between social classes, the lower is the tax evasion.

As we argue previously, auditors may have interest in to coexist with evaders (Eqs. (1C) and (1D)). It follows from these equations that the interest of auditors in this complicity tends to decrease when the possibility of being caught in their illegal actions is increasing. This argues in favor of auditing and administrative controls, because they are part of public activities aimed at ensuring the normal functioning of the institutions. Another problem is the cost of establishing a convenient mechanism to punish the illegal activity of evaders and corrupt auditors. As we will prove in the next section, it is possible to establishing an adequate system of monitoring, based on probabilities and fines, enabling to ensure that shares of taxpayers and no-corrupt auditors may evolve positively.

3

On the Evolutionary Dynamics of the Model

behavior of the counterpart, i.e. the corrupt behavior of the citizens is encouraged by the corrupt behavior of the auditors, and reciprocally.

To analyze the evolution of legal behavior by citizens and auditors, we admit that the tax rate imposed by the policy maker is optimal, and then we introduce a dynamical system of imitation based on the well known model of [9], where the parameters of this dynamical system are strongly related with the degree of efficiency of the monitoring system (see Remarks1–3). Therefore, consider that:

1. Citizens imitate the behavior of their leader neighbors or successful people, and they perceive the possibilities to be punished or not. This fact is captured by the parametersbandf in the dynamical system (4), see below. According with their beliefs, they will choose the most profitable behavior. So, this beliefs are strongly related with the perception of the citizens of the governmental efficiency to capture the illegal actions.

2. It is natural also to assume that the growth rate of corrupt auditors, ııP, increases with their relative weight in the auditors’ population and decreases with the number of citizens who are not willing to give bribes. Recall thatˇ D 1 ˛

andD1 ı, and all these variables must be non-negative in every time. 3. If in some time tf,˛.tf/ D 1, then for all t > tf, implies that ı.P t/ < 0 and

P

˛.t/D0. Reciprocally, if in a given time all auditor is corrupt then every citizen is an evader, and then˛.P t/ < 0andı.P t/D0.

To obtain the evolution for the share of corrupt behavior in a given timet D t0;

assuming that int D t0,0 < ˛.t0/ < 1and0 < ı.t0/ < 1:This situation can be

medelled using the following system of differential equations:

P

˛D˛.aCb˛ cı/;

P

ˇD P˛;

P

ıDı.d e˛Cfı/;

P

D Pı:

(4)

wherea;b;c;d;e;f are positive constants, and the magnitude of these parameters are in direct relation with the policy implemented by the central authority, in particular with the amount of fines and the probability that the corrupt behavior can be caught and punished (see Remarks1–2).

identification of these parameters and the role they play in social evolution, can help in the process of fulfilling this goal.

For instance in the first equation, the parametercrepresents the negative weight that the corrupt auditors play in the evolution of the society. It follows that the social influence of this group, measured byc;decreases ifmorp.m/increase. The parameterbrepresents the importance of the imitation inside the subpopulation of the taxpayers, this value increases with the difference: uCIx.˛;I;t/ uCNIx.˛;I/:

We assume that the citizens or auditors, can change their behavior followed up to the present, if and only if there exists in society, a different behavior that may be imitated. This leads us to conclude that if in timetDtf for instance˛.tf/D1then

˛.t/ D 1 for allt tf:Analogously, for the other cases, i.e., if ˇ.tf/ D 1 then

ˇ.t/D1for allt tf and the same for the auditors. So, the dynamical system (4) can be reformulated as:

P

˛D

8 < :

˛.aCb˛ cı/;if 0 < ˛.t0/ < 1

0 8ttf W ˛.tf/D1or˛.tf/D0:

P

ıD

8 ˆ ˆ < ˆ ˆ :

ı.d e˛Cfı/;

0 8ttf W ı.tf/D1orı.tf/D0:

(5)

The parameterb; measures the effect of the imitation in the behavior of the citizens. The growth rate of the legal behavior, is higher when greater the influence of imitation in social behavior, measured byb:

@.˛P ˛/

@˛ Db> 0:

The intensity of this parameters, depends strongly on the difference between the utilities of the tax payers citizens and evaders. This shows that it is possible, for the central authority, to design a policy to ensure legal behavior on the part of citizens, (see Remark1) which as we will see impact favorably also in the behavior of auditors (see below Eq. (6)).

The pernicious effect on the society, of the corrupt behavior of auditors is strongly related with the parameterc:Note that

@.˛˛P/

@ı D c< 0:

activity of the auditors, the corrupt behavior of auditors. This parameter is strongly related with the role that the imitation plays in the society.

@.ııP/

@˛ D e< 0 and @.ııP/

@ı Df > 0: (6)

Note that the incentives of the auditors to follow a corrupt behavior decrease, as increase the percentage of citizens following the legal behavior.

Therefore:

Remark 3 Ifı > aC˛b then,˛ < 0P the growth rate of taxpayers will be negative. So, only in the case whereıis large enough it is possible to observe an increased illegal activity of the citizens. This means that in the absence of the corrupt auditors, tax evasion tends to disappear.

Remark 4 If we get that in given period of timetDt0, the number of taxpayers is

large enough,˛.t0/ > cıba, then the citizens prefer to pay taxes. In the case where

˛.t0/ > cbathis preference dos not depend on the number of corrupt auditors. This

possibility is given in the case whereıD1

This show, once again, that the main characteristics of the differential system are strongly related with the policy of incentives chosen by the central planner.

The system (4) represents the structural dynamics of the behaviors of corrupt auditors and taxpayer citizens. According with this evolutionary system the index of corruption in the society (see Definition1) evolves according with de differential equation:

P

c.t/D.1 ˛/P C Pı:

From the dynamical system (5) we obtain de following proposition

Proposition 2 Coexist both corrupt and non-corrupt officials and citizens in the economy. The relative share of every group depend on the policy followed by the central authority.

To see this, the system (4) admits the following nullclines:

W aCb˛ cıD0; W d e˛Cfı D0:

(7)

defined in a closed bounded region, and suppose a positive half path which lies entirely within that region.

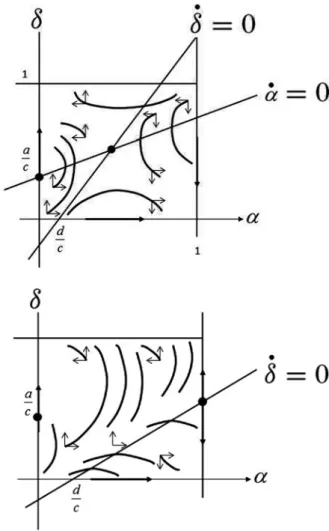

Fig. 1 Nullclines do intersect inŒ0; 1Œ0; 1

Fig. 2 Nullclines do not intersect inŒ0; 1Œ0; 1 with0 <d

c< 1

1. The nullclines do intersect inŒ0; 1Œ0; 1, see Fig.1, and this is the case ifef < 1

andbc < ef:

2. The nullclines do not intersect inŒ0; 1Œ0; 1, these cases are represented in Fig.2and Fig.3, then

a. is below;this is the case ifac < 1andbc < e f;or b. ac > 1andef < 1;or

c. ac < 1andef > 1:

Fig. 3 Nullclines do not intersect inŒ0; 1Œ0; 1

understanding the future evolution of the population. So, if the initial values verify the relationships

0 < ˛.t0/ <

fı.t0/Cd

e

and

1 > ı.t0/ >

aCb˛.t0/

c

then the population evolves in such way that all citizen does not like to be a taxpayer and all auditor is corrupt. But if the initial number of honest citizens is large enough

˛.t0/ >

fı.t0/Cd

e

and

ı.t0/ <

aCb˛.t0/

c

the society evolves to an idyllic world without corruption. However, more realistic are the situations in which:

0 < ˛.t0/ <

fı.t0/Cd

e and 0 < ı.t0/ <

aCb˛.t0/

c

or

˛.t0/ >

fı.t0/Cd

e and ı.t0/ >

aCb˛.t0/

because, in this case, the society evolves to a steady state in which there exists a positive percentage of corrupt auditors and evaders together with a positive percentage of honest auditors and taxpayers see (Fig.1).

The final distribution to which society arrives, in the case given by Proposition2, depends strongly, on the ability of the government to develop successful institutional policies. In terms of our model, choosing a good policy means to implement the right values for the main parameters, see Remarks1–4.

4

Concluding Remarks: Institutions, Beliefs and Incentives

In this paper we show that there is a positive relationship between income inequality and corruption. We also show that the evolutionary dynamics yields results such that corruption prevails and/or coexists with non-corrupt behavior. But we can also get the result of the eradication of corruption and tax evasion.

The evolution of corruption is the result of a free choice made by individuals in a society. This choice is based on beliefs originated in the perception of the actual world. These beliefs may be wrong or not, but define the future behavior of individuals and thus the evolution of society. As [10] explained, all rational model includes explicitly the beliefs, and the decision making as a process in two steps:

1. The step one entails the creation of a model on how the world is and how it evolves in the future. This model establishes relationships between actions an consequences.

2. In the second step, given such a model individuals choose the behavior or the action that they prefer. This choice is an individual fact, and in principle individuals do not consider the social implications of these choices. They do it only taken account their individual beliefs and preferences.

So, what is the role of institutions in this process?

• Institutions must ensure that rational choice is freely made by individuals depending on their personal interests and does not become counterproductive or pernicious in the long period.

• Individuals not fully informed about the future performance of their current behavior can choose rationally according with the information available and their belief, but these can be wrong or incorrect when evaluated in light of the complete information. For this purpose, institutions should design a policy of incentives, rewards and penalties that citizens do choose correctly in full use of their talents and abilities, compensating in this way, for the lack of information available to citizens.

remain in the interior of such basin of attraction. If the central authority is not able to obtain this result, then nothing will change and we are caught in a poverty trap characterized by a system of institutional corruption.

Acknowledgements The author “E. Accinelli” wishes to acknowledge the support of CONACYT through the project CB-167004.

The author “E.J. Sánchez Carrera” wishes to acknowledge the support Secretary of Research and Graduate UASLP through project FAI 2015.

References

1. Accinelli, E., Sanchez, C.E.: Corruption driven by imitative behavior. Econ. Lett.117(1), 84– 87 (2012)

2. Azariadis, C., Lahiri, A.: Do Rich Countries Choose Better Governments? Working paper, UCLA (1997)

3. Bardhan, P.: Corruption and development: a review of issues. J. Econ. Lit.XXXV, 1320–46 (1997)

4. Ehrlich, I.: Bureaucratic corruption and endogenous economic growth. J. Polit. Econ.107(S6), S270–S293 (1999)

5. Gupta, S., Davoodi, H., Alonso-Terme, R.: Does corruption affect income inequality and poverty? IMF Working Paper No. WP/98/76 (1998)

6. Hindriks, J., Keen, M., Muthoo, A.: Corruption, extortion and evasion. J. Public Econ. 74(3), 395–430 (1999)

7. Jain, A.K.: Corruption: a review. J. Econ. Surv.15(1), 71–121 (2001)

8. Li, H., Xu, L.C., Zou, H.: Corruption, income distribution and growth. Econ. Polit. 12(2): 155– 185 (2000)

9. Lotka, A.J.: Elements of Physical Biology. Publisher Williams and Wilkins Company (1925). Reprinted by Dover in 1956 as Elements of Mathematical Biology

B. Alarcón, S.B.S.D. Castro, and I.S. Labouriau

Abstract We review previous results providing sufficient conditions to determine the global dynamics for equivariant maps of the plane with a unique fixed point which is also hyperbolic.

1

Introduction

The Discrete Markus-Yamabe Question is a problem concerning discrete dynamics, formulated in dimensionnby Cima et al. [9] as follows:

[DMYQ(n)]Let f WRn !Rnbe a C1map such that f.0/D0and for any x2Rn , Jf.x/has all its eigenvalues with modulus less than one. Is it true that0is a global attractor for the discrete dynamical system generated by f ?

It is known that the answer is affirmative in dimension1and there are counter-examples for dimensions higher than 2, see [8,14].

In dimension 2, Cima et al. [9] prove that an affirmative answer is obtained when f is a polynomial map, and provide a counter example which is a rational map. After this, research on planar maps focused on the quest for minimal sufficient conditions under which the DMYQ has an affirmative answer. Alarcón et al. [6] use the existence of an invariant embedded curve joining the origin to infinity to show the global stability of the origin. Symmetry is a natural context for the existence of

B. Alarcón ()

Departamento de Matemática Aplicada, Instituto de Matemática e Estatística, Universidade Federal Fluminense, Rua Mário Santos Braga, S/N, Campus do Valonguinho, CEP 24020 140 Niterói, RJ, Brasil

e-mail:balarcon@id.uff.br S.B.S.D. Castro

Centro de Matemática da Universidade do Porto and Faculdade de Economia do Porto, Rua Dr. Roberto Frias, 4200-464 Porto, Portugal

e-mail:sdcastro@fep.up.pt I.S. Labouriau

Centro de Matemática da Universidade do Porto, Rua do Campo Alegre 687, 4169-007 Porto, Portugal

e-mail:islabour@fc.up.pt

such a curve, and this led us to a symmetric approach to this problem and to the results in [1–5] that we review in this article.

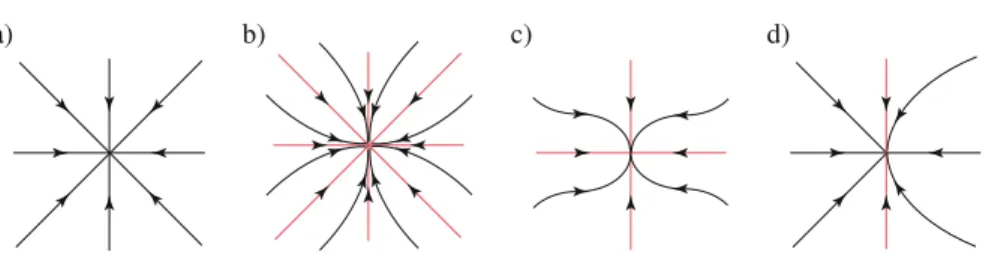

The present article studies maps f of the plane which preserve symmetries described by the action of a compact Lie group. In this setting we characterise the possible local dynamics near the unique fixed point off, that we assume hyperbolic. We establish for which symmetry groups local dynamics extends globally. For the remaining groups we present illustrative examples.

2

Preliminaries

This section consists of definitions and known results about topological dynamics and equivariant theory. These are grouped in two separate subsections, which are elementary for readers in each field, containing material from the corresponding sections of [1–5] and is included here for ease of reference.

2.1

Topological Dynamics

We consider planar topological embeddings, that is, continuous and injective maps defined in R2. The set of topological embeddings of the plane is denoted by Emb.R2/.

Recall that forf 2Emb.R2/the equalityf.R2/DR2may not hold. Since every mapf 2Emb.R2/is open (see [12]), we will say thatf is a homeomorphism iff is a topological embedding defined ontoR2. The set of homeomorphisms of the plane will be denoted by Hom.R2/. WhenH is one of these sets we denote byHC(and

H) the subset of orientation preserving (reversing) elements ofH.

We denote by Fix.f/the set of fixed points of a continuous mapf WR2!R2. Let!.p/be the set of pointsqfor which there is a sequencenj! C1such that fnj.p/!q. Iff 2Hom.R2/then˛.p/denotes the set!.p/underf1.

Letf 2Emb.R2/andp2R2. We say that!.p/D 1ifkfn.p/k ! 1asngoes to1, wherekkdenotes the usual Euclidean norm. Analogously, iff 2 Hom.R2/, we say that˛.p/D 1ifkfn.p/k ! 1asngoes to1.

A mapf 2 Emb.R2/isdissipativeif there exists a compact setW R2 that is positively invariant and attracts uniformly all compact sets. This means thatf.W/

Wand for eachx2R2,

dist.fn.x/;W/!0; as n! 1

uniformly on ballskxk r,r > 0. Observe that in the casef 2 Hom.R2/the

dissipativity off means that1is asymptotically stable forf1.

We say that0 2Fix.f/is alocal attractorif its basin of attractionU D fp 2

attractorifU DR2. The origin is astable fixed pointif for every neighborhoodU

of0there exists another neighborhoodV of0such thatf.V/V andf.V/U. Therefore, the origin is anasymptotically local (global) attractoror a(globally) asymptotically stable fixed pointif it is a stable local (global) attractor. See [7] for examples.

We say that0 2 Fix.f/is alocal repellorif there exists a neighbourhoodV of

0such that!.p/ … V for all0 ¤ p 2 R2 and aglobal repellorif this holds for

VDR2.

The origin is anasymptotically global repellor if it is a global repellor and, moreover, if for any neighbourhoodU of0 there exists another neighbourhoodV of0, such that,Vf.V/andV f.U/.

When the origin is a fixed point of a C1-map of the plane, the origin is a local saddle if the two eigenvalues of Df0, ˛; ˇ, are both real and verify 0 <

j˛j < 1 < jˇj. In case the two eigenvalues are strictly positive the origin is called a direct saddle. We define the origin to be aglobal (topological) saddlefor aC1 homeomorphism if additionally its stable and unstable manifoldsWs.0;f/, Wu.0;f/are unbounded sets that do not accumulate on each other, except at0and

1, and such that

R2n.Ws[Wu[ f1g/DU1[U2[U3[U4;

where for alli D 1; : : : ; 4 Ui R2is open connected and homeomorphic toR2

verifying:

(i) eitherf.Ui/ D Uior there exists an involution' W R2 ! R2 such that.f ı

'/.Ui/DUi

(ii) for allp2Uibothkfn.p/k ! 1andkfn.p/k ! 1asngoes to1. We say thatf 2 Emb.R2/has trivial dynamicsif !.p/ Fix.f/, for allp 2

R2. Moreover, we say that a planar homeomorphism has trivial dynamics if both

!.p/; ˛.p/Fix.f/, for allp2R2.

Letf WRN !RNbe a continuous map. Let W Œ0;1/!R2be a topological

embedding ofŒ0;1/ : As usual, we identifywith .Œ0;1// :We will say that

is an f -invariant rayif .0/D.0; 0/ ; f. / ; and limt!1k.t/k D 1. Proposition 1 (Alarcón et al. [6]) Let f 2EmbC.R2/be such that Fix.f/D f0g.

If there exists an f -invariant ray, then f has trivial dynamics.

Corollary 1 Let f 2 HomC.R2/be such that Fix.f/ D f0g. If there exists an f

-invariant ray, then for each p 2R2, as n goes to˙1, either fn.p/goes to0or

kfn.p/k ! 1.

In order to explain the construction of examples in Sect.5we need to introduce the concept of prime end.

We say thatf W R2 ! R2 is anadmissible homeomorphismiff is orientation

condition follows when the fixed point is not a global attractor. Sincef.U/DU, we can obtain automatically the unboundedness condition if we suppose thatf is area contracting.

Let f W R2 ! R2 be an admissible homeomorphism and consider the

compactification of f to the Riemann spheref W S2 ! S2. Hence U S2 D

R2[ f1g. Acrosscut CofU is an arc homeomorphic to the segmentŒ0; 1such

thata;b…UandCP DCn fa;bg U, whereaandbare the extremes ofC. Every crosscut dividesUinto two connected components homeomorphic to the open disk dD fz2CW jzj< 1g.

Letxbe a point inU. For convenience we will consider only the crosscut such thatx…C. We denote byD.C/the component ofUnCthat does not containx. Anull-chainis a sequence of pairwise disjoint crosscutsfCngn2Nsuch that

lim

n!1diam.Cn/D0andD.CnC1/D.Cn/; where diam.Cn/is the diameter ofCnon the Riemann sphere.

Twonull-chainsareequivalentfCngn2N fCngn2Nif givenm2N

D.Cn/D.Cm/andD.Cn/D.Cm/;

fornlarge enough. Aprime endis defined as a class of equivalence of a null-chain and the space of prime ends is

PDP.U/DC=;

whereC is the set of all null-chains ofU.

The disjoint unionU D U[P is a topological space homeomorphic to the closed diskdND fz2CW jzj 1gsuch that its boundary is preciselyP.

It is well studied in [13] that the Theory of Prime Ends implies that an admissible homeomorphismf induces an orientation preserving homeomorphismfWP !P in the space of prime ends. This topological space is homeomorphic to the circle, that isP'TDR=Z, and hence the rotation number offis well defined, sayN2

T. Therotation numberfor an admissible homeomorphism is defined by.f/D N.

2.2

Equivariant Theory

Let be a compact Lie group acting onR2, that is, a group which has the structure of a compactC1-differentiable manifold such that the map !,.x;y/7!

We think of a group mostly through its action or representation onR2. Alinear

actionof onR2is a continuous mapping

R2 !R2

.;p/7!p

such that, for each 2 the mapping that takesptop is linear and, given

1; 2 2, we have1.2p/D .12/p. Furthermore the identity in fixes every

point. The mapping 7! is called therepresentationof and describes how

each element of transforms the plane.

We consider only standard group actions and representations. A representation of a group on a vector spaceVisabsolutely irreducibleif the only linear mappings onVthat commute with are scalar multiples of the identity.

Given a mapf W R2 ! R2, we say that 2 is asymmetryoff iff.x/ D

f.x/. We define the symmetry groupoff as the biggest closed subset of GL.2/

containing all the symmetries off. It will be denoted byf.

We say thatf WR2 !R2is-equivariantor thatf commuteswith if

f.x/Df.x/ for all 2:

It follows that every map f W R2 ! R2 is equivariant under the action of its

symmetry group, that is,f isf-equivariant.

Let˙ be a subgroup of. Thefixed-point subspaceof˙is Fix.˙ /D fp2R2 WpDp for all 2˙g:

If˙ is generated by a single element2, we writeFixhi.

We note that, for each subgroup˙of, Fix.˙ /is invariant by the dynamics of a-equivariant map ([10], XIII, Lemma 2.1).

Whenf is-equivariant, we can use the symmetry to generalize information obtained for a particular point. This is achieved through the group orbitxof a pointx, which is defined to be

xD fxW 2g:

Lemma 1 Let f WR2 !R2be-equivariant and let p be a fixed point of f . Then all points in the group orbit of p are fixed points of f.

Proof Iff.p/Dpit follows thatf.p/Df.p/Dp, showing thatpis a fixed point off for all 2.

The relation between the group action and the Jacobian matrix of an equivariant mapf is obtained through the following

Proof Sincef is-equivariant we havef.:v/ Df.v/for all 2 andv 2V. Differentiating both sides of the equality with respect tov, we obtainDf.:v/ D Df.v/and, evaluating at the origin givesDf.0/ DDf.0/:

3

Symmetries in the Plane

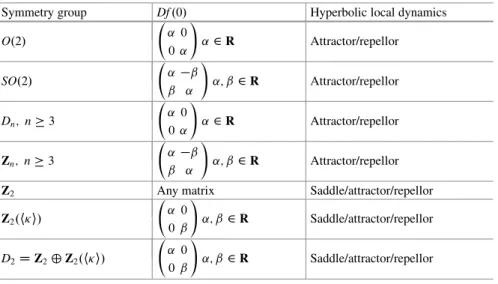

In this section, we describe the consequences for the local dynamics arising from the fact that a map is equivariant under the action of a compact Lie group. These are patent in the structure of the Jacobian matrix at the origin, obtained using Lemma2. Since every compact Lie group inGL.2/can be identified with a subgroup of the orthogonal groupO.2/, we need only be concerned with the groups we list below. Compact Subgroups ofO.2/

• O.2/, acting onR2'Cas the group generated byandgiven by

:zDeiz; 2S1 and :zD Nz:

• SO.2/, acting onR2'Cas the group generated bygiven by

:zDeiz; 2S1:

• Dn,n2, acting onR2'Cas the finite group generated byandgiven by

:zDe2niz and :zD Nz:

• Zn,n2, acting onR2 'Cas the finite group generated bygiven by

:zDe2niz:

• Z2.hi/, acting onR2as

:.x;y/D.x; y/:

Since most of our results depend on the existence of a unique fixed point forf, it is worthwhile noting that the group actions we are concerned with are such that Fix. /D f0g. Therefore, iff is-equivariant thenf.0/D0.

Lemma 3 The standard representation on R2 is absolutely irreducible for O.2/

and Dnwith n3and for no other subgroup of O.2/. Proof The proof follows by direct computation.

• O.2/: the generators of this group are and and it suffices to find the linear matrices that commute with both. A real matrix

a b c d

commutes withif and only ifbDcD0. In order for such a matrix to commute with any rotation it must be

a0 0d

cos sin

sin cos

D

cos sin

sin cos

a0 0d

which holds whena D dor sin D 0 for all 2 S1. Therefore, the action of

O.2/is absolutely irreducible.

• SO.2/: the elements of SO.2/ are rotation matrices which commute with any other rotation matrix, also non-diagonal ones.

• Dn, n 3: see the proof forO.2/. In the last step, we must havea D d or sin2=nD 0which is never satisfied forn 3. Hence, the action is absolutely irreducible.

• Zn,n3: as forSO.2/, any rotation matrix commutes with the rotation of2=n, including non-diagonal ones.

• Z2.hi/: see the proof for 2O.2/to conclude that linear commuting matrices

are diagonal but not necessarily linear multiples of the identity. • Z2: all linear maps commute with Id.

• D2 DZ2˚Z2.hi/: as above,Z2introduces no restrictions and for commuting

withit suffices that the map is diagonal.

The following result is then a straightforward consequence of the previous proof.

Lemma 4 The linear maps that commute with the standard representations of the subgroups of O.2/are rotations and homotheties (and their compositions) for SO.2/

andZn, n 3, linear multiples of the identity for O.2/and Dn, n 3, any linear map forZ2and maps represented by diagonal matrices for the remaining groups.

Proof The only linear maps that were not already explicitly calculated in the previous proof are those that commute with rotations. We have

a b c d

cos sin

sin cos

D

cos sin

sin cos