A Work Project, presented as part of the requirements for the Award of a Master’s

Degree in Finance from the

NOVA School of Business and Economics.

The impact of credit conditions in market liquidity

–

a case for

European stock markets

Annex

Miguel Bordadágua Vieira de Brito, nº 865

A Directed Research Project carried out under the supervision of:

Professor João Pedro Pereira

I.

Core Model

–

Eurozone

Table 1

–

Sources of Endogenous and Exogenous Variables

Variable

Inputs

Source

TO

Number of shares traded (PX_VOLUME)

Bloomberg

Number of shares outstanding

(EQY_SH_OUT)

Bloomberg

AMIHUD

Last Price (PX_LAST)

Bloomberg

Traded volume in Euro (TURNOVER)

Bloomberg

BID_ASK

Bid Price (PX_BID)

Bloomberg

Ask Price (PX_ASK)

Bloomberg

Last Price (PX_LAST)

Bloomberg

TED_EZ

Euribor 3-month

ECB Data Warehouse

EUR Germany Sovereign (FMC 910) Zero

Coupon Yield 3 month (F91003M Index)

Bloomberg

dCUR_DEP

Currency in Circulation

ECB Data Warehouse

Overnight Deposits

ECB Data Warehouse

Deposits with agreed maturity, up to 2 years

ECB Data Warehouse

Deposits redeemable at notice, up to 3

months

ECB Data Warehouse

Deposits with agreed maturity up to 2 years

and redeemable at notice up to 3 months

ECB Data Warehouse

RES_DEP*

ECB Credit Institutions Current Account

(EULPCICA Index)

Bloomberg

ECB Balance Sheet Deposit Facility

(EBBSDEPF Index)

Bloomberg

logNCORE

MFIs Debt Securities Held

ECB Data Warehouse

MFIs Money Market Funds Shares/ Units

ECB Data Warehouse

MFIs Debt Securities Issued

ECB Data Warehouse

MFIs Remaining Liabilities

ECB Data Warehouse

MFIs External Liabilities, Extra Euro Area

ECB Data Warehouse

MRET

Index Last Price (PX_LAST)

Bloomberg

MSTDEV

Index Last Price (PX_LAST)

Bloomberg

dIR

Euro Area Harmonized Index of Consumer

Prices, Annual rate of change

Eurostat

IPI

Euro Area Industrial Production Index

(excluding construction)

–

2010 = 100

Eurostat

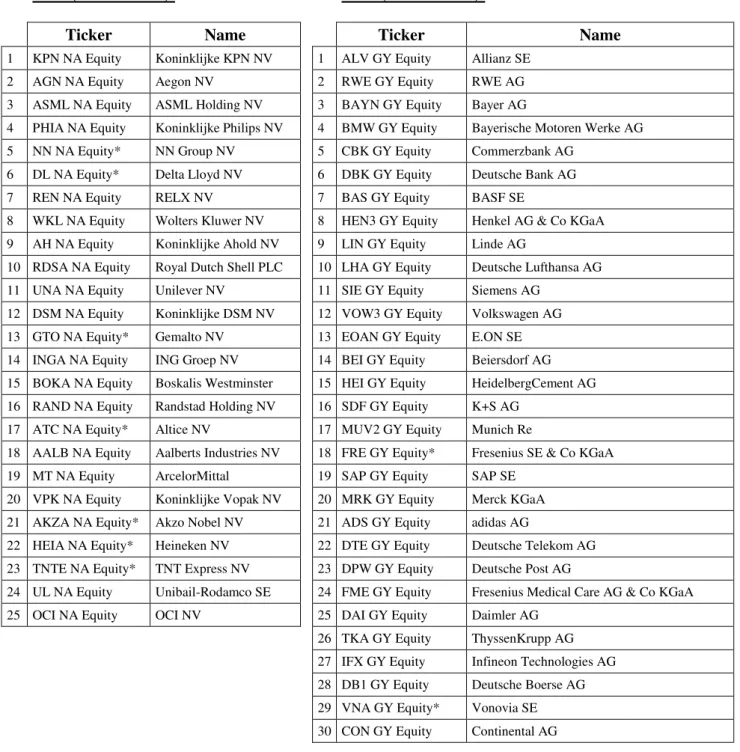

Table 2

–

List of Current Index Composition

AEX (25 Members):

DAX (30 Members):

Ticker

Name

Ticker

Name

1 KPN NA Equity Koninklijke KPN NV 1 ALV GY Equity Allianz SE

2 AGN NA Equity Aegon NV 2 RWE GY Equity RWE AG

3 ASML NA Equity ASML Holding NV 3 BAYN GY Equity Bayer AG

4 PHIA NA Equity Koninklijke Philips NV 4 BMW GY Equity Bayerische Motoren Werke AG

5 NN NA Equity* NN Group NV 5 CBK GY Equity Commerzbank AG

6 DL NA Equity* Delta Lloyd NV 6 DBK GY Equity Deutsche Bank AG

7 REN NA Equity RELX NV 7 BAS GY Equity BASF SE

8 WKL NA Equity Wolters Kluwer NV 8 HEN3 GY Equity Henkel AG & Co KGaA

9 AH NA Equity Koninklijke Ahold NV 9 LIN GY Equity Linde AG

10 RDSA NA Equity Royal Dutch Shell PLC 10 LHA GY Equity Deutsche Lufthansa AG

11 UNA NA Equity Unilever NV 11 SIE GY Equity Siemens AG

12 DSM NA Equity Koninklijke DSM NV 12 VOW3 GY Equity Volkswagen AG

13 GTO NA Equity* Gemalto NV 13 EOAN GY Equity E.ON SE

14 INGA NA Equity ING Groep NV 14 BEI GY Equity Beiersdorf AG

15 BOKA NA Equity Boskalis Westminster 15 HEI GY Equity HeidelbergCement AG

16 RAND NA Equity Randstad Holding NV 16 SDF GY Equity K+S AG

17 ATC NA Equity* Altice NV 17 MUV2 GY Equity Munich Re

18 AALB NA Equity Aalberts Industries NV 18 FRE GY Equity* Fresenius SE & Co KGaA

19 MT NA Equity ArcelorMittal 19 SAP GY Equity SAP SE

20 VPK NA Equity Koninklijke Vopak NV 20 MRK GY Equity Merck KGaA

21 AKZA NA Equity* Akzo Nobel NV 21 ADS GY Equity adidas AG

22 HEIA NA Equity* Heineken NV 22 DTE GY Equity Deutsche Telekom AG

23 TNTE NA Equity* TNT Express NV 23 DPW GY Equity Deutsche Post AG

24 UL NA Equity Unibail-Rodamco SE 24 FME GY Equity Fresenius Medical Care AG & Co KGaA

25 OCI NA Equity OCI NV 25 DAI GY Equity Daimler AG

26 TKA GY Equity ThyssenKrupp AG

27 IFX GY Equity Infineon Technologies AG

28 DB1 GY Equity Deutsche Boerse AG

29 VNA GY Equity* Vonovia SE

30 CON GY Equity Continental AG

CAC 40 (40 Members):

FTSE MIB (40 Members):

Ticker

Name

Ticker

Name

1 OR FP Equity L'Oreal SA 1 A2A IM Equity A2A S.p.A.

2 DG FP Equity Vinci SA 2 ATL IM Equity Atlantia SpA

3 ALU FP Equity Alcatel-Lucent 3 AZM IM Equity* Azimut Holding Spa

4 FP FP Equity TOTAL SA 4 BMPS IM Equity Banca Monte dei Paschi di Siena S.p.A.

5 AI FP Equity Air Liquide SA 5 BP IM Equity* Banco Popolare Societa Cooperativa Scarl

6 CS FP Equity AXA SA 6 BPE IM Equity Banca popolare dell'Emilia Romagna, Società cooperativa.

7 BNP FP Equity BNP Paribas SA 7 BZU IM Equity Buzzi Unicem SpA

8 BN FP Equity Danone SA 8 CNHI IM Equity* CNH Industrial N.V.

9 CAP FP Equity Cap Gemini SA 9 CPR IM Equity Davide Campari - Milano SpA

10 CA FP Equity Carrefour SA 10 EGPW IM

Equity* Enel Green Power S.p.A. 11 AC FP Equity Accor SA 11 ENEL IM Equity Enel SpA

12 SGO FP Equity Cie de Saint-Gobain 12 ENI IM Equity Eni SpA

13 VIV FP Equity Vivendi SA 13 EXO IM Equity* Exor S.p.A.

14 EI FP Equity Essilor International SA 14 FCA IM Equity* Fiat Chrysler Automobiles N.V.

15 MC FP Equity LVMH Moet Hennessy Louis

Vuitton SE 15 FNC IM Equity Finmeccanica SpA

16 ML FP Equity Cie Generale des

Etablissements Michelin 16 G IM Equity Assicurazioni Generali S.p.A. 17 KER FP Equity Kering 17 ISP IM Equity Intesa Sanpaolo S.p.A.

18 UG FP Equity Peugeot SA 18 LUX IM Equity Luxottica Group SpA

19 PUB FP Equity Publicis Groupe SA 19 MB IM Equity Mediobanca Banca di Credito Finanziario S.p.A.

20 RNO FP Equity Renault SA 20 MED IM Equity Mediolanum S.p.A.

21 SAF FP Equity Safran SA 21 MONC IM

Equity* MONCLER 22 FR FP Equity Valeo SA 22 MS IM Equity Mediaset SpA

23 SOLB BB Equity Solvay SA 23 PC IM Equity Pirelli & C. SpA

24 TEC FP Equity Technip SA 24 PMI IM Equity Banca Popolare di Milano Scarl

25 ENGI FP Equity* Engie SA 25 PRY IM Equity* Prysmian S.p.A.

26 EDF FP Equity* Electricite de France SA 26 SFER IM Equity* Salvatore Ferragamo SpA

27 ORA FP Equity Orange SA 27 SPM IM Equity Saipem SpA

28 MT NA Equity* ArcelorMittal 28 SRG IM Equity Snam S.p.A.

29 EN FP Equity Bouygues SA 29 STM IM Equity STMicroelectronics NV

30 ALO FP Equity Alstom SA 30 STS IM Equity* Ansaldo STS SpA

31 VIE FP Equity Veolia Environnement SA 31 TEN IM Equity* Tenaris S.A.

32 SAN FP Equity Sanofi 32 TIT IM Equity Telecom Italia S.p.A.

33 GLE FP Equity Societe Generale SA 33 TOD IM Equity Tod's SpA

34 SU FP Equity Schneider Electric SE 34 TRN IM Equity* TERNA - Rete Elettrica Nazionale Società per Azioni

Ticker

Name

Ticker

Name

35 LHN FP

Equity* LafargeHolcim Ltd 35 UBI IM Equity* Unione di Banche Italiane Scpa 36 AIR FP Equity Airbus Group SE 36 UCG IM Equity UniCredit S.p.A.

37 LR FP Equity* Legrand SA 37 UNI IM Equity Unipol Gruppo Finanziario S.p.A.

38 ACA FP Equity Credit Agricole SA 38 US IM Equity* UnipolSai Assicurazioni S.p.A.

39 RI FP Equity Pernod Ricard SA 39 WDF IM

Equity* World Duty Free S.p.A.

40 UL NA Equity* Unibail-Rodamco SE 40 YNAP IM

Equity* YOOX NETAPORT

* Stock was not included in the sample due to insufficient or anomalous data

Table 3

–

Eigenvalue Condition for Stability Test

Eigenvalue Modulus

.9710492 .971049

.9244298 + .1150402i .93156

.9244298 - .1150402i .93156

.8573963 + .0176548i .857578

.8573963 - .0176548i .857578

-.5573717 + .5434439i .778456

-.5573717 - .5434439i .778456

.3670674 + .6740792i .767542

.3670674 - .6740792i .767542

.6621561 + .3684825i .75778

.6621561 - .3684825i .75778

-.2533921 + .6703983i .716688

-.2533921 - .6703983i .716688

.0530029 + .6958666i .697882

.0530029 - .6958666i .697882

-.6247098 + .188423i .652507

-.6247098 - .188423i .652507

.1429587 + .633995i .649913

.1429587 - .633995i .649913

-.5446347 + .3070601i .62523

-.5446347 - .3070601i .62523

-.5317061 .531706

.2334185 + .4747528i .529032

.2334185 - .4747528i .529032

.04926243 + .480974i .48349

.04926243 - .480974i .48349

.3355127 + .08015326i .344954

.3355127 - .08015326i .344954

All the eigenvalues lie inside the unit circle.

Impulse Response Functions

Graph 1

–

Response of AMIHUD to

TED_EZ

Graph 2

–

Response of BID_ASK to

dCUR_DEP

Graph 3

–

Response of TO to RES_DEP

Graph 4

–

Response of AMIHUD to

RES_DEP

Graph 5

–

Response of BID_ASK to logNCORE

II.

Robustness Check Model

–

UK

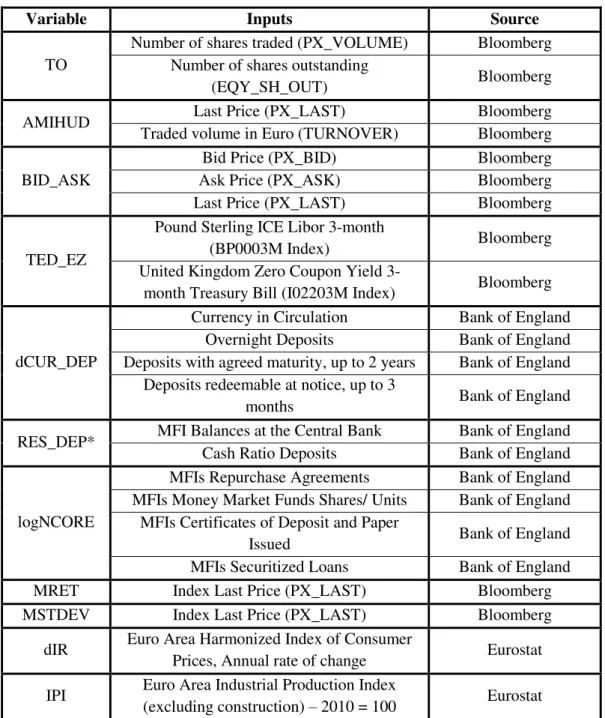

Table 4

–

Sources of Endogenous and Exogenous Variables

Variable

Inputs

Source

TO

Number of shares traded (PX_VOLUME)

Bloomberg

Number of shares outstanding

(EQY_SH_OUT)

Bloomberg

AMIHUD

Last Price (PX_LAST)

Bloomberg

Traded volume in Euro (TURNOVER)

Bloomberg

BID_ASK

Bid Price (PX_BID)

Bloomberg

Ask Price (PX_ASK)

Bloomberg

Last Price (PX_LAST)

Bloomberg

TED_EZ

Pound Sterling ICE Libor 3-month

(BP0003M Index)

Bloomberg

United Kingdom Zero Coupon Yield

3-month Treasury Bill (I02203M Index)

Bloomberg

dCUR_DEP

Currency in Circulation

Bank of England

Overnight Deposits

Bank of England

Deposits with agreed maturity, up to 2 years

Bank of England

Deposits redeemable at notice, up to 3

months

Bank of England

RES_DEP*

MFI Balances at the Central Bank

Bank of England

Cash Ratio Deposits

Bank of England

logNCORE

MFIs Repurchase Agreements

Bank of England

MFIs Money Market Funds Shares/ Units

Bank of England

MFIs Certificates of Deposit and Paper

Issued

Bank of England

MFIs Securitized Loans

Bank of England

MRET

Index Last Price (PX_LAST)

Bloomberg

MSTDEV

Index Last Price (PX_LAST)

Bloomberg

dIR

Euro Area Harmonized Index of Consumer

Prices, Annual rate of change

Eurostat

IPI

Euro Area Industrial Production Index

(excluding construction)

–

2010 = 100

Eurostat

Table 5

–

List of Current Index Composition

FTSE 100 (101 members):

Ticker

Name

Ticker

Name

1 HSBA LN Equity HSBC Holdings PLC 36 NXT LN Equity Next PLC

2 BATS LN Equity British American Tobacco PLC 37 SKY LN Equity Sky PLC

3 BP/ LN Equity BP PLC 38 GLEN LN Equity* Glencore PLC

4 GSK LN Equity GlaxoSmithKline PLC 39 CNA LN Equity Centrica PLC

5 RDSA LN Equity* Royal Dutch Shell PLC 40 IAG LN Equity International Consolidated Airlines Grou

6 VOD LN Equity Vodafone Group PLC 41 RBS LN Equity Royal Bank of Scotland Group PLC

7 AZN LN Equity AstraZeneca PLC 42 ITV LN Equity* ITV PLC

8 DGE LN Equity Diageo PLC 43 RR/ LN Equity Rolls-Royce Holdings PLC

9 LLOY LN Equity Lloyds Banking Group PLC 44 SN/ LN Equity Smith & Nephew PLC

10 BT/A LN Equity BT Group PLC 45 OML LN Equity Old Mutual PLC

11 RDSB LN Equity Royal Dutch Shell PLC 46 LAND LN Equity Land Securities Group PLC

12 RB/ LN Equity Reckitt Benckiser Group PLC 47 WOS LN Equity Wolseley PLC

13 BARC LN Equity Barclays PLC 48 BLND LN Equity British Land Co PLC/The

14 PRU LN Equity Prudential PLC 49 MKS LN Equity Marks & Spencer Group PLC

15 SAB LN Equity SABMiller PLC 50 WTB LN Equity Whitbread PLC

16 NG/ LN Equity National Grid PLC 51 CPI LN Equity Capita PLC

17 BG/ LN Equity BG Group PLC 52 KGF LN Equity Kingfisher PLC

18 IMT LN Equity Imperial Tobacco Group PLC 53 LSE LN Equity London Stock Exchange Group PLC

19 ULVR LN Equity Unilever PLC 54 SL/ LN Equity* Standard Life PLC

20 RIO LN Equity Rio Tinto PLC 55 PSON LN Equity Pearson PLC

21 SHP LN Equity Shire PLC 56 UU/ LN Equity United Utilities Group PLC

22 AV/ LN Equity Aviva PLC 57 BNZL LN Equity Bunzl PLC

23 WPP LN Equity WPP PLC 58 CCL LN Equity Carnival PLC

24 BLT LN Equity BHP Billiton PLC 59 TW/ LN Equity Taylor Wimpey PLC

25 CPG LN Equity Compass Group PLC 60 SGE LN Equity Sage Group PLC/The

26 LGEN LN Equity Legal & General Group PLC 61 AAL LN Equity Anglo American PLC

27 BA/ LN Equity BAE Systems PLC 62 IHG LN Equity* InterContinental Hotels Group PLC

28 ARM LN Equity ARM Holdings PLC 63 BDEV LN Equity Barratt Developments PLC

29 CRH LN Equity CRH PLC 64 PSN LN Equity Persimmon PLC

30 SSE LN Equity SSE PLC 65 BRBY LN Equity* Burberry Group PLC

31 TSCO LN Equity Tesco PLC 66 DLG LN Equity* Direct Line Insurance Group PLC

32 REL LN Equity RELX PLC 67 MNDI LN Equity* Mondi PLC

33 STAN LN Equity Standard Chartered PLC 68 TUI LN Equity* TUI AG

34 ABF LN Equity Associated British Foods PLC 69 SVT LN Equity Severn Trent PLC

35 EXPN LN Equity* Experian PLC 70 AHT LN Equity Ashtead Group PLC

Ticker

Name

Ticker

Name

71 GKN LN Equity GKN PLC 87 GFS LN Equity* G4S PLC72 JMAT LN Equity Johnson Matthey PLC 88 SBRY LN Equity J Sainsbury PLC

73 STJ LN Equity St James's Place PLC 89 MRW LN Equity Wm Morrison Supermarkets PLC

74 BAB LN Equity Babcock International Group PLC 90 ADN LN Equity Aberdeen Asset Management PLC

75 TPK LN Equity Travis Perkins PLC 91 SDR LN Equity Schroders PLC

76 ISAT LN Equity* Inmarsat PLC 92 HL/ LN Equity* Hargreaves Lansdown PLC

77 III LN Equity 3i Group PLC 93 ADM LN Equity* Admiral Group PLC

78 HMSO LN Equity Hammerson PLC 94 CCH LN Equity* Coca-Cola HBC AG

79 DC/ LN Equity* Dixons Carphone PLC 95 INTU LN Equity Intu Properties PLC

80 RSA LN Equity RSA Insurance Group PLC 96 MGGT LN Equity Meggitt PLC

81 ITRK LN Equity* Intertek Group PLC 97 MERL LN Equity* Merlin Entertainments PLC

82 EZJ LN Equity easyJet PLC 98 HIK LN Equity* Hikma Pharmaceuticals PLC

83 RMG LN Equity* Royal Mail PLC 99 ANTO LN Equity Antofagasta PLC

84 BKG LN Equity Berkeley Group Holdings PLC 100 SPD LN Equity* Sports Direct International PLC

85 SMIN LN Equity Smiths Group PLC 101 FRES LN Equity* Fresnillo PLC

86 RRS LN Equity Randgold Resources Ltd

* Stock was not included in the sample due to insufficient or anomalous data

Table 6

–

Summary Statistics

No. of

Observations Mean

Standard

Deviation Min Median Max

TO_UK 69 0.002290 0.000527 0.001445 0.002200 0.004382

AMIHUD_UK 69 0.000009 0.000005 0.000004 0.000009 0.000031

BID_ASK_UK 69 0.001492 0.000340 0.001075 0.001386 0.002371

TED_UK 69 0.002120 0.001851 -0.001000 0.001600 0.007500

dCUR_DEP_UK 69 0.000081 0.000419 -0.002400 0.000100 0.000900

dRES_DEP_UK 68 0.000999 0.003965 -0.008999 0.000742 0.010989

dNCORE_UK 68 -8528.800 24704.40 -72277.00 -6345.500 63604.00

MRET 69 0.002305 0.036664 -0.072662 0.005356 0.081065

MSTDEV 69 0.009291 0.004078 0.0028253 0.008729 0.022775

dIR_UK 69 -0.043478 0.290273 -0.600000 -0.100000 0.700000

Table 7

–

Correlation Matrix

TO_UK AMIHUD_UK BID_ASK_UK TED_UK dCUR_DEP_UK dRES_DEP_UK dNCORE_UK

TO_UK 1.0000

AMIHUD_UK 0.2596 1.0000

BID_ASK_UK 0.3569 0.6633 1.0000

TED_UK 0.0079 0.5381 0.6898 1.0000

dCUR_DEP_UK 0.0458 -0.0530 -0.0157 0.0678 1.0000

dRES_DEP_UK -0.1095 0.1445 0.2902 0.5420 0.1671 1.0000

dNCORE_UK -0.1053 -0.1154 -0.2233 0.0099 -0.1763 0.1154 1.0000

MRET_UK -0.2235 0.0329 0.0974 -0.0008 -0.0182 0.3199 0.0397

MSTDEV_UK 0.5416 0.4012 0.3670 0.2730 -0.0049 0.0102 -0.0632

dIR_UK 0.0473 -0.0136 0.0450 -0.1888 0.0952 -0.0960 0.0600

dIPI_UK -0.1380 -0.0650 -0.0753 -0.0310 -0.0656 -0.0928 0.0902

MRET_UK MSTDEV_UK dIR_UK dIPI_UK

MRET_UK 1.0000

MSTDEV_UK -0.4135 1.0000

dIR_UK -0.0257 0.0273 1.0000

dIPI_UK -0.0719 -0.1068 0.0027 1.0000

Table 8

–

Augmented Dickey-Fuller Stationarity Tests

Variable / Null Hypothesis H0: Unit Root

Turnover Rate (TO_UK) -5.000***

(0.000) Amihud Illiquidity Ratio

(AMIHUD_UK)

-4.712*** (0.001) Effective Bid-Ask Spread

(BID_ASK_UK)

-5.610*** (0.000)

Eurozone TED Spread (TED_UK) -3.065**

(0.029) Currency to Deposit Ratio

(dCUR_DEP_UK)

-9.567*** (0.000) Reserves to Deposit Ratio

(RES_DEP_UK)

-6.190*** (0.000) MFIs Non-Core Funding Liquidity

(dNCORE_UK)

-8.865*** (0.000)

Stock Market Return (MRET_UK) -12.904***

(0.000) Stock Market Standard Deviation

(MSTDEV_UK)

-4.883*** (0.000)

Inflation Rate (dIR_UK) -9.779***

(0.000)

Industrial Production Index (dIPI) -12.455***

(0.000)

Table 9

–

VAR Order Selection Criteria

Sample: 2010m4

–

2015m9

Number of Observations = 66

lag

LL

LR

df

p

FPE

AIC

HQIC

SBIC

0

1941.96

1.9e-34

-57.7865

-57.3277

-56.6254

1

2067.18 250.45

49

0.000 1.9e-35* -60.0963* -58.9951* -57.3095*

2

2106.98

79.6*

49

0.004 2.8e-35

-59.8176

-58.074

-55.4051

Note: * denote optimal values for each criterion

Endogenous: dCUR_REP_UK, dRES_DEP_UK, TED_UK, dNCORE_UK, TO_UK, AMIHUD_UK, BID_ASK_UK

Exogenous: dIR_UK, dIPI_UK, MRET_UK, MSTDEV_UK, _cons

Table 10

–

Lagrange-Multiplier Test for Residual Autocorrelation

Lag

Chi-Square Statistic

df

Prob. > Chi-Square Statistic

1

60.7909

49

0.12036

2

55.4913

49

0.24337

H0: No autocorrelation at lag order