Determinants of corporate debt maturity structure: a study in euro zone countries

DETERMINANTS OF CORPORATE DEBT MATURITY STRUCTURE:

A STUDY IN EURO ZONE COUNTRIES

Estrela da Assunção Ramos Costa

Supervisor:

Prof. Luís Laureano, Assistant Professor ISCTE-IUL Business School, Department of Finance

Dissertation submitted as partial requirement for the conferral of Master in Finance

Determinants of corporate debt maturity structure: a study in euro zone countries

I. Acknowledgments

The elaboration and preparation of the dissertation corresponds to a great challenge and a long process, which includes the support of certain people that I should say thank you.

In this way, first of all I would like to express my gratitude to my supervisor, Professor Luís Miguel da Silva Laureano, not only for all the guidance, but also for all the patience and availability demonstrated over these months, including tips, corrections, criticisms and the provision of some supporting material.

I would like to thank ISCTE in general for the strong academic background given and the assistance and availability provided for the databases used in this work.

To my family, who always accompanied me and believed in me. Thank you very much for all the support and encourage to finish one more step in my academic life.

I would also like to thank my friends for the motivation, understanding and discussion of some ideas.

To finish, thank you to my team job where I am currently working because they motivated me to do this work and understood perfectly that some days I couldn’t work more hours, because of my dissertation.

Determinants of corporate debt maturity structure: a study in euro zone countries

II. Abstract

The main objective of the dissertation is to understand the determinants related with the choice of corporate debt maturity. In general, some countries were affected by the financial crisis of 2008 and different measures were applied in order to overcome the situation. This fact affected their decisions of debt maturity, reason because it will be analyzed whether these choices are, in accordance with the existing theories proposed by the financial literature.

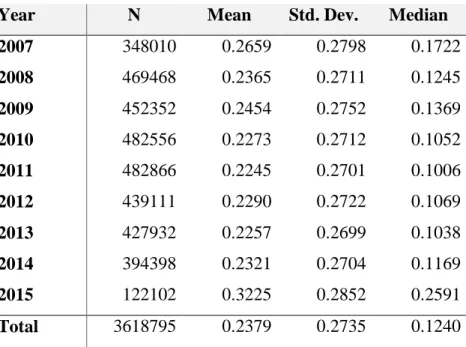

The present study involves a sample with 3.618.795 listed and unlisted firms during the period from 2007 to 2015. The methodology is the panel data and we decided to use different regression techniques, such as OLS and Fixed Effects, evaluating the changes in the determinants of debt maturity of each model. The variables implicit in our analysis are divided in variables that have an impact on firms and countries.

We found that, considering the empirical studies present in the literature review, the firm variables have a significant contribution to the debt maturity. Only taxes, in one of the models presented different values from those expected and, although significant, they are low. For the country variables, we verified that they have a small impact on the maturity of the debt in the period of analysis, such as the inflation rate and the size of the country's banking system. It should be noted because of the financial crisis occurred in 2008, in some variables there was an impact on the fluctuation of the values.

In this way, taking into account the results obtained, it can be verified that the maturity of the firms' debt is determined both by the characteristics of the firms and of each country.

JEL Classifications: G01, G30.

Determinants of corporate debt maturity structure: a study in euro zone countries

III. Resumo

O principal objetivo da dissertação consiste em entender quais os determinantes relativamente à escolha da maturidade da dívida das empresas. De um modo geral, alguns países foram afetados pela crise financeira de 2008, tendo sido aplicadas diferentes medidas de forma a ultrapassar a situação instalada. Tal facto afetou as suas decisões no que respeita à maturidade da dívida, razão pela qual será analisado se de facto estas escolhas estão de acordo com as teorias existentes, propostas pela literatura financeira.

O presente estudo engloba uma amostra de 3.618.795 empresas cotadas e não cotadas no principal mercado bolsista, durante o período de 2007 a 2015. No que respeita à metodologia, utilizou-se dados em painel e diferentes técnicas de regressão, como OLS e Fixed Effects, avaliando a alteração dos determinantes da maturidade da dívida. As variáveis implícitas na nossa análise estão divididas em variáveis com impacto nas empresas e nos países.

Constatámos que, tendo em conta os estudos empíricos presentes na revisão da literatura, as variáveis referentes às empresas têm um contributo significativo para a maturidade da dívida. Apenas os impostos, num dos modelos apresentou valores diferentes dos esperados e apesar de significativos, baixos. No que respeita às variáveis dos países, verificámos que não têm tanto impacto na maturidade da dívida, no período em análise, nomeadamente a taxa de inflação e a dimensão do sistema bancário do país. Importa referir que o facto de ter ocorrido a crise financeira em 2008, em algumas variáveis houve um impacto na oscilação dos valores.

Desta forma, tendo em conta os resultados que obtivemos, pode-se constatar que a maturidade da dívida das empresas é determinada tanto pelas características das empresas, como de cada país.

Classificações JEL: G01, G30.

Determinants of corporate debt maturity structure: a study in euro zone countries

IV. Contents

1. Introduction………... 2. Literature Review………...……….…….

2.1 Firm Impacts……….………. 2.1.1 Impacts of Agency Costs………... 2.1.2 Impacts of Signaling and Asymmetric Information………. 2.1.3 Impacts of Liquidity and Credit Risk………. 2.1.4 Impacts of Taxes……….……… 2.1.5 Impacts of Assets Maturity ……….……… 2.1.6 Impacts of Indebtedness……….……… 2.2 Country Impacts……….………... 2.2.1 Impacts of the Financial System……….……… 2.2.2 Impacts of the Legal System……….……… 2.2.3 Impacts of Macro-Economic Variables……….……. 3. Sample description and variables………..………….………

3.1 Dependent Variable……….……… 3.2 Independent Variables……….……… 4. Methodology……….……… 5. Empirical Results……….……… 5.1 Descriptive Statistics……….………. 5.2 Correlation Analysis……….……… 5.3 Regression Analysis……….……… 5.3.1 Firm impacts on debt maturity ………... 5.3.2 Country impacts on debt maturity ……… 6. Conclusions……….……….. 7. References……….……… 8. Appendixes………...……… 7 9 9 9 12 14 17 19 21 21 22 24 25 26 27 28 34 36 36 45 47 48 51 54 56 59

Determinants of corporate debt maturity structure: a study in euro zone countries

V. Content of Tables

Table 1 – Number of firms analized for each country.

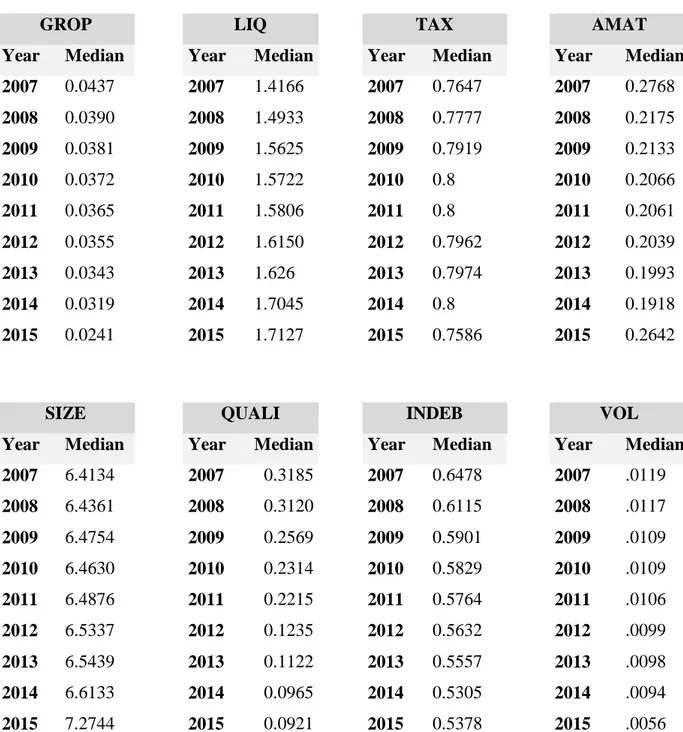

Table 2 – Descriptive statistics for all the sample (firms and country specific variables). Table 3 – Debt maturity evolution for all the sample.

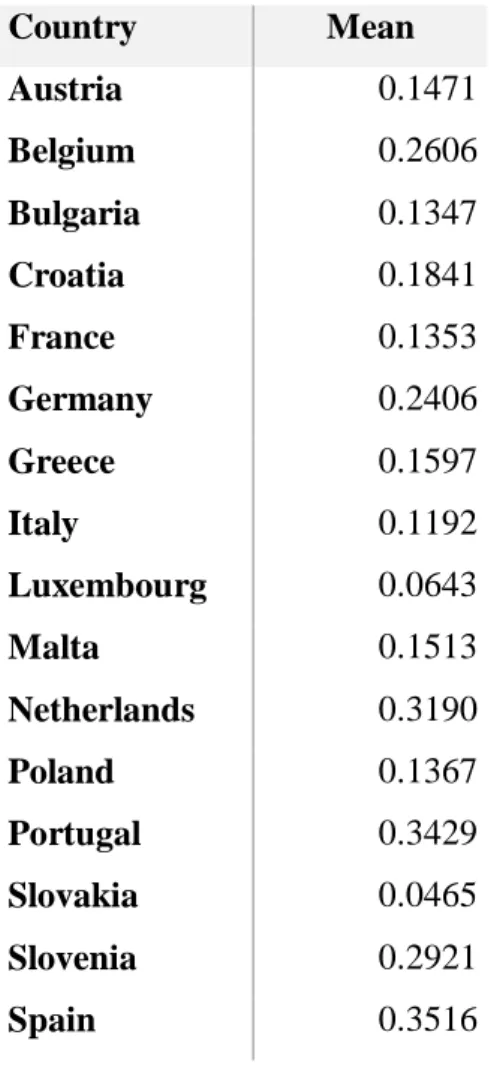

Table 4 – Debt maturity media by country.

Table 5 – Median of each variable of firm impacts, by country. Table 6 – Median of each variable of firm impacts, by year. Table 7 – Index of property rights by country.

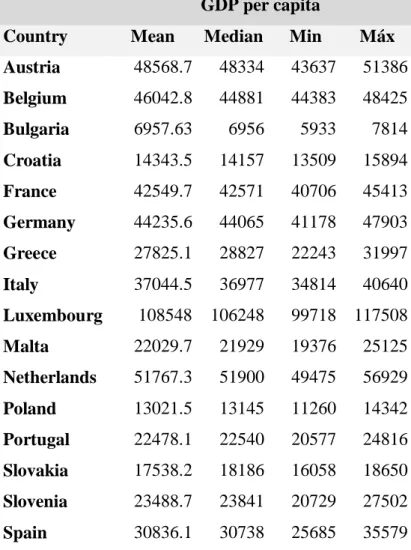

Table 8 – Evolution of GDP per capita and volatility of inflation rate variables of the study. Table 9 – Correlation matrix of the variables included in the study.

Table 10 – Regression coefficients and its statistical significance for the models used. VI. Content of Figures

Figure 1 - Non monotonous relation function between the rating and debt maturity of firms.

VII. Content of Appendix

Appendix 1 – Description of variables.

Appendix 2 – Empirical hypothesis, expected signal and respective source. Appendix 3 – List of ISO codes of the countries used in our study.

Determinants of corporate debt maturity structure: a study in euro zone countries

1. Introduction

The financial decisions of the firms are related not just with the profit, but also with their level of indebtednees of them. The firms should take in account in their decisions their debt and its maturity, they have to choose an adequated maturity to develop their activity and business in the best way.

Some financial theories have started to be studied since the decade of 50’s, from which the authors Modigliani and Miller (1958) developed their theories in this area. During the following periods their theories were being explored and formulated several hypotheses of debt determinants’ choices of the firms. In these hypotheses were considered some factores, like the costs of agency and bankruptcy, asymmetry of information, growth opportunities and taxation. There are several theories that try to explain the key factors that drive firms to make their decisions regarding with debt maturity. The theories studied, although quite different from each other and not considering all the possible hypotheses in financial theory, concluded that there is no single specific theory for the capital structure of a firm, but several separeted theories. In this way, "there is no universal theory of the debt-equity choice, and no reason to expect one" (Myers, 2001: 81)

At the academic level, the discussion on this topic focuses on the factors that influence the capital structure of a firm, such as debt and equity. In addition, the most recent studies have been mostly related to the analysis of determinants that influence the choice of corporate debt maturity, being englobed in these factors are the agency costs (Myers, 1977; Barnea et al.,1980; Guney and Ozkan, 2005), firm liquidity (Diamond, 1991), asset suitability, indebtedness level, information asymmetry and tax quality (Brick and Ravid, 1985; Kane et al., 1985). More recently, studies have been debated with the fact that there are also external factors associated with the firms, related to the countries that affect their decisions. In this way, we can consider factors related to the legal and financial system of a country, macroeconomic factors (Fan et al., 2012), and factors associated with the national culture of the country itself (Zhenf et al., 2012). According to Terra (2001), as there is no univeral theory regarding capital structure, there is also no general theory of equilibrium associated with the maturity of debt. There are some diversified partial explanations that have not been universally classified into a single theory. In this sense, the present work will be based on and will start with the presentation of the various theories studied and that have been developed according to debt maturity. After presenting these same theories, will be presented the sample and methodology used and the analysis of the final

Determinants of corporate debt maturity structure: a study in euro zone countries

results. All of this work will finish with the presentation of the main conclusions obtained, comparing the results verified with the theories discussed in the next chapter.

Determinants of corporate debt maturity structure: a study in euro zone countries

2. Literature Review

The studies about the main factors that influence the capital structure of firms and the impact on their value, emerged mainly after the publication elaborated by Modigliani and Miller (1958). This was based on the thematic of the capital structure of the firms, involving a controversy because of the propositions assumed by the author.

Modigliani and Miller (1958) in their first proposition, under the inexistence of taxes, affirmed that the financing structure of a firm doesn’t affect its own value. In this sense, since some authors have disagreed, several studies about the determinants of the capital structure of firms have been developed over the last decades, including capital and debt. However, it’s equally important to study the analysis of corporate indebtedness, such as the maturity of debt, because the decision of finance firms is not restricted to the choice of equity and debt.

Thus, to understand how the main theories and hypotheses studied affect the choice of financing firms, in this chapter both will be presented, being divided into firm impacts and country impacts.

2.1 Firm Impacts 2.1.1 Agency Costs

The agency theory emerged after the work of several economists, such as Wilson (1968) and Arrow (1971), who explored the risk of sharing between groups and individuals, when different entities have different attitudes towards this risk. According to Jensen and Meckling (1976) and Ross (1973), the theory of agency costs is related with this problem, being the goal minimizes costs between shareholders and creditors of the firms.

Based on the definition of Jensen and Meckling (1976), the influence of agency cost theory on debt maturity reflects the level of conflict of interest between shareholders and managers, associated with the size of the firm, the problems of under-investment and risk-shifting. Firm size

According to some authors, there is a relationship between the theory of agency costs and the size of the firms, with an impact on the debt maturity choice.

Studies developed by Smith and Warner (1979) proved that smaller firms have more agency problems between shareholders and creditors. According to Stulz and Johnson (1985) and Rajan and Zingales (1995), one way to reduce these conflicts between is to introduce guarantees for debt, which can be overcome by financing short-term debt (Barnea et al., 1980).

Determinants of corporate debt maturity structure: a study in euro zone countries

To justify the relation between the size of the firms and the maturity of the debt, there are associated transaction costs that allow to conclude that short-term debt mainly finances small firms, because of the high transaction costs they face when used long-term debt (Titman and Wessels, 1988).

The public debt market is associated with long maturities, reason because there is a relationship between access to debt and debt maturity (Barclay and Smith, 1995). According to the same authors, smaller firms have limited access to the public debt market. This is due to the existence of an associated fixed costs to generate information for the issuance of public debt, which is why they choose to use private debt (Johnson and Houston, 1997; James, 1996). In this way, smaller firms will choose to finance themselves through private debt, in a larger proportion of short-term debt and at a lower cost, due to lower associated fixed costs.

According to Krishnaswami et al. (1999), large firms that are financed from large debt issues will have a smaller amount of private debt and a larger amount of public debt. Larger firms gain economies of scale by issuing public securities, according to studies by Houston and James (1996), Johnson (1997), Colla, Ippolito and Li (2013), thus preferring the issuance of public and private titles. This is also because, for large issues of debt, the fixed costs associated with public debt are reduced by the lower rates in the public debt market (Carey, et al., 1993). Thus, as a function of the size of the issue, firms with access to the public and private debt market will, ceteris paribus, make their decisions regarding debt financing.

According to Ozkan (2000), larger firms have a lower agency cost because they have better access to the stock market, and the size of the firm and its level of risk can be considered as important factors for the agency problem. The small firms' limited access to long-term debt is because they have a smaller proportion of marketable assets in view of their growth opportunities (Whited, 1992). For Yi (2005), firms with greater future investment opportunities tend to have a smaller size, "agency costs suggest that risk takers in risky businesses have an incentive to lower agency costs through issuance of Debts with lower maturity".

Antoniou et al. (2006) also consider that there is a positive relationship between firm size and debt maturity, based in study for United Kingdom. However, they didn’t find statistical significance for Germany and France.

Several studies developed by Silva and Valle (2008) and Fan et al. (2012) present a positive sign between firm size and long-term debt too. However, there are another studies realized by Scherr and Hulburt (2001), Highfield (2008), García-Teruel and Martínez-Solano (2010) that represent opposite conclusions.

Determinants of corporate debt maturity structure: a study in euro zone countries In this context, we will study the following hypothesis:

Hypothesis 1: the maturity of debt and the dimension of a firm have a positive correlation. Under-investment and risk-shifting problems

The agency costs influence the maturity of the debt, as a consequence of two problems of investment incentive to the shareholders: under-investment and risk-shifting problems (Pettit and Singer (1985), Smith and Warner (1979), Ravid (1996)).

According to Myers (1977), debt financing can affect business growth opportunities, leading to a disincentive of investors - under-investment problem. This is because, when firms are financed through debt, the income generated by their projects is divided between shareholders and creditors. In firms with good opportunities for growth, the creditors get most of the income from the projects, causing shareholders not to invest in projects with positive NPV (net present value). With more growth options in the firm's investment opportunity, the conflict between stockholders and bondholders over the exercise of these options is greater (Stohs and Mouer, 1996).

Additionally, according to the risk-shifting problem, associated to a conflict of interest between equity holders and debt holders, the firms can opt for high-risk projects. The shareholders can extract wealth from debt holders by switching from safer to riskier investments (Barnea et al., 1980), with the objective of generating high rewards to equity holders – who face little additional downside risk but may garner significant extra return.

Myers (1977) argues that there are different ways for firms to mitigate these problems, such as reducing the maturity of their debt, reducing the value of debt or introducing contractual clauses of debt.

According to the author, a firm by reducing the maturity of its debt using short-term debt financing with maturity prior to the exercise of investment options, reduces the under-investment problem. Thus, firms that have higher growth potential should opt for short term debt, and in their capital structure will have less long-term debt (Myers, 1977). In the same sense, studies by Barnea et al. (1980) allow to emphasize that reducing debt maturity allow to control the under-investment problem, as well as to mitigate the conflict of interests between shareholders and creditors.

According to an investigation developed by Johnson (2003), it was verified that there is a relationship between indebtedness, liquidity risk and growth opportunities, regarding the maturity of the debt. The short-term debt contributes to reducing the under-investment problem advocated by Myers (1977) and is associated with a higher liquidity risk. In the issuance of

Determinants of corporate debt maturity structure: a study in euro zone countries

short-term debt, firms do a trade-off between the costs associated with the under-investment problem and the costs associated with liquidity risk. Stulz and Johnson (1985), Ho and Singer (1982) have proved that there are advantages of short-term debt to reduce the under-investment problem and that the firms may opt to retain the ability to issue fixed claims with high priority claims. According to Stulz and Johnson (1985), new investment projects with high-priority claims can limit transfers from stockholders to creditors and thus reduce the incentives for stockholders to renounce these projects. On the other hand, in case of insolvency, these claims have priority (Ho and Singer, 1982). Barclay and Smith (1995), Guedes and Opler (1996) and Ozkan (2000) also found that there is a positive relationship between a firm's growth opportunities and short-term debt.

On the other hand, Smith and Warner (1979) argue that another way of alleviating the under-investment problem is introduce and perfect debt financing contracts, for example through the introduction of covenants. They proved that with covenants firms with a high risk profile, could reduce the problems related to moral hazard and benefit in its capital structure.

In this way, according to the studies mentioned previously by the various authors, firms with good growth opportunities have a tendency to use more short debt and the maturity of debt it's getting smaller, the higher the agency costs.

According with this studies, the next hypothesis will be studied:

Hypothesis 2: Higher growth opportunities, reduce the maturity of debt. 2.1.2 Impacts of Signaling and Asymmetric Information

The asymmetric information and signaling theories are other hypotheses that allow us to explain firm's debt maturity.

According with Myers (1977), when in a transaction one part has better information than the other, we are in a situation with asymmetric information, being able to influence the choice of debt maturity. The signaling theory is useful for describing behavior when two parties have access to different information, but in other way. Typically, one party (the sender) must choose whether and how to communicate and signal the information and the other party (the receiver) must choose how to interpret it. In this context, there are several studies proving that the sign of quality of the firm will affect the choice of the debt maturity and information asymmetry, being able to convey insider information about firm quality.

Following these theories, Flannery (1986) created a model that allows analyzing the quality signaling of a firm, through the choice of debt, having an impact on its maturity. The model

Determinants of corporate debt maturity structure: a study in euro zone countries

starts from the proposition that long-term debt eliminates interest rate uncertainty, whereas short-term debt requires an interest rate that will reflect the firms's conditions at this time. The model developed demonstrate that if in the moment 0 investors cannot have information about the quality of the firm and distinguish between high or low quality firms in the market, they have asymmetric information and investors will force firms to pay high rates to finance their projects, undervaluing high quality firms. The managers of good quality firms always know that investors will claim high risk premium (credit risk), still higher in the long-term debt, and good firms prefer to issue short term debt. In this way, since the long-term debt price is more sensitive to changes in the value of the firm, if a firm fails to calculate the prices of short- and long-term debt, the impact of long-term debt will be higher. Thus, if the bond market cannot distinguish the quality of the firms, undervalued firms will choose to issue short-term debt that is less undervalued.

In moment 1, firms can renegotiate their debt structure at a reduced cost. On the other hand, overvalued firms will issue overstated long-term debt (Flannery, 1986). However, if investors know the distribution of the firms in the market, information about the quality of the firms and the definition of the coupon rate to require, according to the maturity of debt, the investors are in an efficient capital markets. In this way, the investors will try to infer insider information from firm's financing strategies.

Flannery (1986) argues that firms with large potential information asymmetries are likely to issue short-term debt because of the larger information costs associated with long-term debt. Firms with small potential information asymmetries, will be less concerned about the signaling effects of their debt maturity choice, and are more likely to issue long term debt. The same author argues that for an existence of a Signaling Equilibrium, since those firms with lower quality projects cannot mimic other firms, as the costs of refinancing short-term debt are higher than the overvaluation of their projects, they opt for long-term debt. Additionally, higher quality firms signal their quality, issuing short term debt.

The author also argues that it’s possible to define two types of equilibrium in the model, depending on the existence or not of debt issuance costs. If there are debt issuance costs, good quality firms it’s possible develop a short-term debt issuance strategy that will differentiate them from bad firms, correctly signaling the market on their quality (separating equilibrium). If there is no emission debt costs, the market will undervalue good firms and overvalue more firms (pooling equilibrium). However, Kale and Noe (1990), argues that in the absence of transaction costs, low quality firms always have incentives to mimic high quality firms, which results in another possibility of a pooling equilibrium, contrary to the other by Flannery (1986).

Determinants of corporate debt maturity structure: a study in euro zone countries

The same authors proved that is possible good firms distinguish themselves from bad ones, even in the presence of transactions costs, maintaining a separating equilibrium.

In the same context, Titman (1992) introduced the uncertainty of interest rates and costs of insolvency in the Flannery (1986) model and evaluated how the debt maturity choice can be influenced by the use of interest rate swaps. The author agree that pooling equilibrium can be obtained and noticed that uncertainty of interest rates and costs of insolvency are the key factors for high quality firms.

Subsequently, Diamond (1991, 1993) researched about the relation between asymmetric information, credit ratings and choice of debt maturity. The author argues that firms with favorable private information about future profitability will prefer to issue short-term debt. The lenders are reluctant to refinance the debt if bad news arrives. So, in Diamond's analysis, there are two types of short-term borrowers: those with very good credit ratings and others with poor credit ratings; firms in between are more likely to issue long-term debt. Firms with the highest credit ratings issue short-term debt because of the refinancing risk. Firms with lower credit ratings prefer long-term debt to reduce this refinancing risk and firms with very poor credit ratings, however, are unable to borrow long-term because of the extreme adverse-selection costs. Diamond (1991) also proved that when there is asymmetric information between firms and lenders, the latter would choose short-term debt in order to control better the firms. For the author monitoring is important for reducing information asymmetries and is facilitated by a shorter debt maturity, through which lenders can refuse to renew the loan or modify the terms of supply in order to reduce adverse selection and avoid some incentive problems. When asymmetric information decreases, lenders have less need to monitor their borrowers and can increase debt maturity.

So, in this way, to study the relation between the asymmetric information and signaling theories and the firm's debt maturity we have the following hypothesis:

Hypothesis 3: firms that have positive information will opt for short-term debt to finance their projects. The firms sign their quality issuing short-term debt.

2.1.3 Impacts of Liquidity and Credit Risk

According to credit risk and liquidity risk, Diamond (1991) studied how both can affect a choice of debt maturity. The author provides a model to explain why risky firms with long-term projects might use short-term debt under the existence of asymmetric information.

Diamond (1991) refers to liquidity risk as the risk of a borrower being forced into an inefficient contract, since refinancing is not available. Even if this outcome is not achieved, short-term

Determinants of corporate debt maturity structure: a study in euro zone countries

debt can still cause a loss of project leases, if it has to be refinanced at an excessively high interest rate because of credit market imperfections (Froot, Scharfstein and Stein, 1993). Short-term debt creates liquidity risk, because sometimes the borrower is unable to refinance and the lender liquidates when the borrower would not choose whether he was the sole owner of the firm. On the other hand liquidity risk from short-term debt arises from the borrower's loss of control rents in the case that lenders are unwilling to refinance when bad news arrives. Sharpe (1991), Diamond (1991) and Titman (1992), argue that bad news about a borrower may arrive at the refinancing date, causing investors not to extend credit or to raise the default premium on new debt.

Firms may face some costs of financial disadvantage, when they lose access to credit at attractive prices. While liquidity risk gives to some firms an incentive to borrow long-term loans, they cannot do it because of the rate of return required to compensate investors for hearing to long-term credit risk, may induce substitution in risky projects of low quality (Stiglitz and Weiss, 1981). Thus, low-quality firms can be excluded from the long-term market, and only high-quality credit firms (for example large firms) may end up trying to borrow in the long-term credit market.

Diamond (1991) analyzed how the choice of debt maturity by firms is affected by their rating. According to the author, this choice is made by the trade-off between the preference of the firms for the short-term debt, when they have private information about the future credit rating and liquidity risk. Diamond (1991), in contrast to Flannery (1986) that classified firms according to their quality (good and bad), classifies firms according to their rating into three categories: low, medium and high.

According to Diamond (1991), good firms with private information about future performance and low-risk (high credit ratings) estimate low liquidity costs and choose short-term debt, at relatively low interest rates.

In the same context, Titman (1992) suggests that firms with expectations that the quality of their credit rating improves prefer short-term debt, using swaps to hedge the interest rate risk. The demand for variable rate fixed rate swaps increases in the presence of information asymmetry, while the demand for fixed rate variable rate swaps is smaller in firms with greater information asymmetries. According to the author, these results are consistent with the hypothesis that firms that exchange fixed rate bonds for variable rate bonds are riskier than those that exchange fixed rate variable rates. The analysis suggests that lower-rated firms with expectations of future improvement in their credit ratings prefer to finance themselves in the short term and switch to floating rate fixed rate bonds, firms to increase their value.

Determinants of corporate debt maturity structure: a study in euro zone countries

On the other hand, firms with favorable private information and intermediate risk may choose long-term debt at a higher rate to reduce and avoid their greater liquidity risk of being unable to refinance the debt if they choose short-term debt.

Firms with high-risk (low credit ratings) will prefer long-term debt to reduce their refinancing risk. The author also proved that firms in a stable situation may opt for long-term debt, because they faced major liquidity challenges compared to high-quality firms.

Moreover, assuming a constant level of indebtedness, the Diamond (1991) model refers to the existence of two types of firms: (i) those that are financed by short-term debt, with a very high rating, because they cannot access long-term debt due to the fact that the costs related to adverse selection are very high; (ii) those that are financed in the long term and have a very low rating. However, very low-rated firms may have no choice and are forced by creditors to finance themselves with low maturity debt.

According to the same author, in order to avoid future refinancing difficulties and liquidity risk, firms with higher level of indebtedness may prefer debt with greater maturity.

So, from a certain minimum rating level, the costs associated with liquidity risk outweigh the benefits if the firms finance themselves in the short term, and they prefer the long-term debt. However, when the rating is very low, firms may don’t have choice and lenders lead them to finance themselves with lower debt maturity. In this way, the author concludes that there is a non-monotonous function between choosing the maturity of the debt and the credit rating of the firm.

In line with Diamond’s (1991), there are some studies that also proved that there is a non-monotonic relationship between debt maturity and credit ratings (Barclay and Smith, 1995). Jun and Jen (2003) also developed a model proving that according to debt maturity, firms compare refinancing and interest rate costs with short-term debt benefits. The authors determined that interest rate risk in debt renewal increases with short-term debt, increasing the risk of bankruptcy. In the same connection, the authors found that firms that finance themselves in the short term are more exposed to the risk of refinancing and bankruptcy, to the same level of indebtedness since they are more vulnerable to macro and microeconomic conditions. In other wise, Berger et al. (2005) also agree to the studies of Diamond’s (1991) for low-risk firms. However, their evidence for high-risk firms it’s different comparing with the evidence from Diamond’s model. Berger argues that high-risk firms don’t present significantly different

maturities to intermediate-risk firms.

Antoniou et al. (2006) and Ozkan (2002) carried out studies in countries such as the United Kingdom, France and Germany regarding the maturity of the debt, concluding that it is not

Determinants of corporate debt maturity structure: a study in euro zone countries

related to the quality of the firms. Also the authors Stohs and Mauer (1996) and García-Teruel and Martínez-Solano (2010) demonstrated the non-monotonous relationship between debt

maturity structure and firm quality.

Other studies developed by Highfield (2008) have demonstrated a positive relationship between debt maturity and firm quality, with firms at higher risk not having access to long-term debt markets. The author didn’t find conclusions that firms with very high rating and very low rating use more short-term debt compared to firms with intermediate rating.

Hypothesis 4: firms with high liquidity present debt with lower maturity. 2.1.4 Impacts of taxes

Regarding with taxes, since the existence of studies developed by Modigliani and Miller, several authors of the financial literature have shown that they have an impact on the choice of debts maturity.

Modigliani and Miller (1958) studied whether taxes actually influence the capital structure of a firm, proving that in the existence of a perfect capital market, the absence of taxes in the capital structure has no influence on it. The authors justify this fact with the inexistence of a tax relation in the market value of the firm and based on several assumptions, such as, costs of financial distress, agency costs, asymmetric information in an efficient Market and absence of taxes. With the existence of taxes, firms can maximize their value, since there is an incentive for firms to use debt rather than equity as a financing method, if debt costs are deductible and dividends are not (Modgliani and Miller, (1963)). When firms are incurring debt, they have associated interest which results in a tax benefit, when deducted from the results on which the charges are

payable by them.

Later on, new studies emerged proving that there is a disincentive by firms in use the debt, also due to the existence of high tax rates on private investors (Miler, 1977).

In the same context, other authors referred a trade-off theory in which managers can optimize the value of the firm, through an optimum target among the advantages of tax purposes that debt provides and the costs of financial distress that it causes (Kraus and Litzenberger, 1973; Brenan and Schwartz, 1978; Kim, 1978 and Scott, 1976).

For Stiglitz (1974), according to the studies of Modigliani and Miller, assuming the inexistence of bankruptcy costs, perfect markets for all bond maturities, investment decisions as a given and the existence of a general equilibrium, there is an irrelevance not only of capital structure, but also of the structure of debt maturity in firm value. Another studies realized by Brenan and Schwartz (1978) demonstrated that with taxes, firms

Determinants of corporate debt maturity structure: a study in euro zone countries

should opt for short-term debt, because there is not taxable income to deduct the interest on their funding, coming into default.

However, reformulating the model carried out by Brenan and Schwartz (1978), Brick and Ravid (1985) demonstrated that if interest rates present a positive development, firms should opt for long-term debt, because it allows an increase in present value of tax benefits of a firm. The authors developed a theoretical model that relates the implications of taxes in the choice of debt maturity. Assuming an increasing temporal structure of interest rates, given the existence of tax benefits related to the payment of interest and reflecting an increasing risk of default associated with debt maturity, the authors argue that firms prefer to finance themselves with long-term debt, since it allows to increase its value. This is due to the fact that the tax benefits arising from long-term debt are greater than the benefits obtained from the alternative of using short-term debt in the first years of financing.

In the same sense, Brick and Ravid (1985, 1991) argue that when the term structure of interest rates is not flat, the expected value of tax benefits depends on the maturity of debt. If the yield curve is upward sloping, firms increase their value by increasing the amount of long-term debt. A term structure of interest rates with a positive slope implies that, under the unbiased expectations theory, the interest expense from issuing long-term debt is greater than the expected interest expense from rolling short-term debt in early years, and will be lower in later years. For that reason, the benefits of debt are accelerated using long-term debt. Likewise, short-term debt increases the firm's value if the yield curve has a negative slope. Consequently, a positive relationship can be expected between the term structure of interest rates and the proportion of long-term debt according to the tax explanation of debt maturity. In this way, issuing long-term debt reduces the firm's expected tax liability and consequently increases the firm's current market value. Conversely, if the term structure is downward sloping, issuing short-term debt increases firm value. Thus, the tax hypothesis implies that firms employ more long-term debt when the term structure has a positive slope.

Conversely, Kane et al. (1985) developed a model that determined the optimal structure of debt maturity, considering taxes, bankruptcy costs and debt issuance costs. The model shown that optimal debt maturity increases as fiscal debt advantages decrease, issuance costs increase and the volatility of the firm's value decreases.

On the other hand, Lewis (1990) argues that the taxes don’t affect the maturity of debt. The model developed by Brick and Ravid (1985) assumes that firms determine their level of indebtedness before maturity, but according to Lewis (1999), if the level of indebtedness and its maturity have been determined at the same time, the choice of maturity of the debt will be

Determinants of corporate debt maturity structure: a study in euro zone countries

irrelevant. Stohs and Mouer (1996) studied the effects of tax benefits arising from indebtedness on debt maturity, proving a negative relationship between the effective tax rate and its maturity. In this way, the effective tax rate and the volatility of the value of the firm's assets are negatively correlated with the maturity of the debt, but the coefficients obtained are not economically significant. On the other hand, the author didn’t find the correlation between debt maturity and interest rates.

On the other hand, García-Teruel and Martínez-Solano (2010) found a positive correlation between the tax rate and debt maturity, justifying this result with the argument of Emery (2001), which says that firms use short-term debt to avoid the long-term debt maturity, but they don’t care about the fiscal effect on debt maturity.

Antoniou et al. (2006) studied that the relationship between debt maturity and fiscal issues like effective tax rate, temporal structure of interest rates and interest rate volatility, depends of the period and the country.

However, a study about the fiscal impact on the structure of debt maturity of Spanish SMEs, Lopez-Gracia and Mestre-Barberá (2011) concluded, that the effective tax rate is strongly correlated with debt maturity. The authors also confirmed the positive and statistically significant influence of interest rate volatility and the temporal structure of interest rates on debt maturity.

The authors Fan et al. (2012) concluded that firms, in which the tax benefit of debt is higher, tend to use more debt.

However, there are some authors that found no evidence for the negative tax relation, such as Barclay and Smith (1995), Guedes and Opler (1996) and Ozkan (2000 and 2002).

Hypothesis 5: the maturity of debt will increase when the effective tax rate decreases. Hypothesis 6: The maturity of debt and the volatility of the firm’s value are negatively correlated.

2.1.5 Impacts of Assets Maturity / Matching

The maturity of corporate debt can be synchronized with the lifetime of their assets (Morris, 1976). When the useful life of the assets of the firms firms ends, it is necessary to new investments, however, it can happen in a period that their debts are not yet finished.

Morris (1976) presented a theoretical model and assumed that firms opt for short term and long term debt. The long-term maturity of debt policy implies matching the maturity of the debt with the maturity of the assets, avoiding the existence of liquidity problems associated with debt service. Failure to combine the maturity of the debt with the maturity of the assets will lead to

Determinants of corporate debt maturity structure: a study in euro zone countries

an increase in the risk of debt default. If the debt matures after the useful life of the asset, there may be no returns to pay the debt service, on the other hand, if the debt is due before the useful life of the final assets, the firms may not have sufficient liquidity to pay their obligations. In order to minimize exposure to liquidity risk, firms must synchronize the term of their assets and liabilities.

Following Morris's (1976), Stohs and Mouer (1996) studies, firms may run the risk of not having sufficient liquidity to service the debt, if their maturity is less than the maturity of the assets due to the insufficiency of the cash flows generated; or vice versa, if the maturity of the debt is lower than the maturity of the assets, as a consequence of the end of the associated cash flows.

Myers (1977) added that the synchronization of the term of assets and liabilities reduces the costs of agency between shareholders and creditors. According to the author, the problem of underinvestment is due to the agency conflict between shareholders and debt creditors, and can be reduced by the maturity of the assets and liabilities of the firms, guaranteeing that the payment of the debts will be programmed to correspond to the decline of the value of assets. In the same sense, Chan and Kanatas (1985) argue that collaterals can reduce the conflict when borrowers and lenders disagree about the true value of a project. According to authors, it is usually uncertain about the value of collateral than the expected return of a project that has not been undertaken. If collateral is pledged, lenders will feel more confident and will charge lower interest rates with longer maturities.

The authors Hart et Moore (1994) also confirm the matching between debt maturity and asset

maturity, controlling the risks and costs of bankruptcy and verifying that slower depreciations of assets correspond to longer debt maturities.

The importance of the synchronization of the maturities of assets and liabilities was also studied and confirmed by several authors: Stohs and Mauer (1996), Guedes and Opler (1996), Ozkan (2000 and 2002), Graham and Harvey (2001), Antoniou et al. (2006), Körner (2007) and Teruel and Solano (2010). The authors argue that the greater the maturity of a firm’s assets, the greater the maturity of its debt. However, contrary to this, García-Teruel and Martínez-Solano (2010) did not find evidence that asset maturity influences decisions about debt maturity (coefficients present positive and significant values, however close to zero).

However, according with the majority of the studies realized there is a positive relation between the maturity of debt and maturity of the assets that will be tested by the following hypothesis:

Determinants of corporate debt maturity structure: a study in euro zone countries 2.1.6 Impacts of Indebtedness

The levels of corporate indebtedness have a significant impact on their short and long-term financing. According to studies developed by Morris (1992), firms that tend to finance themselves in the long term, have high levels of indebtedness, in order to try to reduce their exposure to the risk of bankruptcy. Similarly, Diamond (1993), Leland and Toft (1996) also consider that firms with a high level of indebtedness use the long-term debt, in order to reduce the frequency with which they are indebted. The authors Leland and Toft (1996) based on a developed theoretical model, proved that the maturity of the debt influences the optimal point of indebtedness of the firms. The model relates the risk of bankruptcy and the optimum capital structure to the maturity of the debt, allowing to conclude that when firms are financed using long-term debt, the level of indebtedness of the firm is greater, whereas if they resort to short-term debt the optimal debt position is lower.

The authors Stohs and Mauer (1996) confirm the evidence proved by the authors mentioned above, adding that since the increase in the use of long-term debt is expected to be more closely monitored, there is an automatic positive relationship between the maturity of debt and corporate indebtedness. Stohs and Mauer (1996) argue that this correlation is automatic because a high amount of long-term debt leads to a higher corporate debt ratio.

In the same context, Johnson (2003) argues that, in order to firms reduce the problem of underinvestment, they reduce debt maturity and their level of indebtedness, minimizing the liquidity risk associated with short-term debt.

There are other authors, such as Scherr and Hulburt (2001), García-Teruel and Martínez-Solano (2010), Antoniou et al. (2006), Teruel and Solano (2010) who concluded that the most indebted firms use more long-term debt. According to authors Kirch and Terra (2012), kmindebtedness has been considered as an endogenous variable, since the level of indebtedness and debt maturity are jointly determined, with respect to the definition of the overall financing structure of the firm.

To test the relation between the level of indebtedness and the maturity of debt, we will use the following hypothesis:

Hypothesis 8: the higher is the level of indebtedness, the higher is the maturity of debt. 2.2 Country impacts

The choice of debt maturity is not only influenced by the variables previously developed according to the firms, but also influenced by variables associated with the institutional

Determinants of corporate debt maturity structure: a study in euro zone countries

According to certain authors who will be referred below in this part, sometimes the information available to investors, the choice of the capital structure of the firm and the maturity of the debt depend on external factors firms, such as, the legal and financial system of a country, its culture and some macroeconomic variables.

In this sense, in this part of the dissertation will be presented the theories and hypothesis studied by some authors, that can also influence the choice of debt maturity.

2.2.1 Impacts of Financial System

According to some authors, there are several factors related to the financial system of a country that influence the choice of the debt maturity of a firms, such as the development and size of the banking system, stock market development and the preference of capital.

Financial institutions have a competitive advantage compared to investors, once they manage to control them (Fama, 1985). Financial institutions increase their competitive advantage by reducing the maturity of corporate debt, achieving greater control over corporate financing, maintaining strong bargaining power, and influencing corporate investment strategies.

When a country's banking sector is developed, short-term financing can be increased, according to studies by the authors Demirgüç-Kunt and Maksimovic (1999). The authors justify this with the advantage that financial institutions can more easily monitor short-term debt, rather than long-term debt, reducing borrowers and lenders. Also according to the author Fan et al. (2012), countries with more developed banking sectors finance firms have a shorter duration of debt, given the competitive advantage of financial institutions in controlling firms. This competitive advantage results by reducing the maturity of corporate debt, gaining greater control over corporate finance, maintaining strong bargaining power, and influencing their investment strategies.

According to the study by Fan et al. (2012), firms in countries with more developed banking sectors have lower debt maturity, although the ratio between financing choices and the size of the insurance industry is weak.

Nevertheless, there are authors that argue that monitoring can provide loans with longer maturities and that debt maturity is positively associated with the size of a country's banking sector. According to the author Diamond (1984), when assessing credit histories and the risk associated with corporate loans, financial institutions can grant credit for longer duration given the monitoring performed. Demirgug-Kunt and Masimovic (1999) also argue that because of

Determinants of corporate debt maturity structure: a study in euro zone countries

the financial institutions that gain competitive advantage and economies of scale, with greater monitoring and control of covenants, it is possible to grant long-term loans.

Also in the context of the development of a country's financial system, some authors argue that it does not have a relevant influence on the choice of debt maturity. Kirch and Terra (2012) argue that, given the arguments and previous studies, the results seem to be contradictory, as is the case with the authors Demirgüç-Kunt and Maksimovic (1999) and, financial system of a country, simple indicators are used instead of compound indices to measure the development of a financial system

On the other hand, the size and development of the stock market also influences the choice of debt maturity. According to Dermirguc-Kant and Maksimovic (1999), a developed stock market leads to the transmission of important information not for the financial institutions, as for the creditors and for the fact that there is more information about the risk of the listed and lesser firms. However, given the further development of the bond market, there are more opportunities for investors to diversify, with firms eventually choosing to use equity rather than debt.

The studies developed by Demirguc-Kunt and Maksimovic (1999), proved that the size and development of the banking system and stock market were associated with the size of the firm and had an impact on the choice of debt maturity. In small firms, it’s the size of the banking sector that influences the choices of debt maturity, that is, in countries with larger banking sectors, small firms have lower short-term debt. Regard to large firms, the most influence of their choices is the development and size of the stock market. In countries with more developed capital markets, large firms use more debt maturity. However, the level of activity in the shareholder market dimension has no influence on the choices of small firms.

Finally, another financial factor that also influences the choice of the maturity of corporate debt is associated with the preference of capital providers, according to studies by Fan et al. (2012), focused on banks, insurance firms and pension funds. The author compared the choice of maturity of the debt of 39 countries, concluding that the choice of maturity of the debt of these countries is directly related to the maturity of the liabilities of the firm. It has been found that in countries with large insurers and pension funds, they tend to have liabilities with a longer maturity and are mostly funded in the long term. In countries with a large banking system, firms tend to have lower maturity liabilities, with banks preferring to lend in the short term.

Hypothesis 9: in countries with larger banking system, firms tend to have lower debt maturity.

Determinants of corporate debt maturity structure: a study in euro zone countries

Hypothesis 11: the maturity of corporate debt is high in countries with larger and more

active stock markets.

2.2.2 Impacts of Legal System

The legal system is based on a set of rules and legal norms for the functioning of firms, state and society of a given country, which allow reducing and mitigating possible conflicts between them, being associated with sanctions in case of non-compliance. According to some authors, the choice of debt maturity is related to factors associated with the legal system of a country. The first studies in this sense were developed by Diamond (1991, 1993) and Rajan (1992), arguing that if a country presents a legal system characterized as inefficient and the costs of using it are high, firms tend to finance themselves through short-term debt. The fact that firms finance themselves with a lower maturity, leads to a small capacity for creditors to be deceived, since the financing period is short and there is more accurate monitoring. On the other hand, the authors also argue that the existence of an efficient legal system is very important for the assets of firms that depreciate during their life.

In the same sense, according to the authors Demirguc-Kunt and Maksimovic (1999) firms use more long-term debt when they operate in countries with legal systems classified as more effective, since their assets also have a greater maturity. According to the same authors, as referred in the chapter about agency costs discussed earlier, there are conflicts of interest between managers and external investors, which affect the choice of debt maturity. Fan et al. (2012) consider that the quality of a country's legal system can lead to a decrease in the agency problems between shareholders and external investors, which has an impact on corporate financing choices. This is justified by the existence of rules concerning contracts between firms and investors, by the relevant and appropriate choice of financial assets for the firm and by the control of investors, as regards the exercise of their legal rights.

On the other hand, Fan et al. (2012) also argue that in countries where there is greater corruption and the legal system is less effective, with laws that are difficult to apply or weak, firms tend to be financed through short-term debt.

According to several authors, the legal system can be evaluated based on two types of law: civil-law and common-law (La Porta, Lopez-de-Silanes, Andrei Shleifer and Robert Vishny, 1998). The authors argue that developed countries, with more effective laws and commo-law, have a greater protection of the rights of creditors. On the other hand, the high efficiency of a country's legal system is positively correlated with debt maturity (Demirgüç-Kunt and Maksimovic, 1999).

Determinants of corporate debt maturity structure: a study in euro zone countries

Another relevant factor in a country's legal system that affects the maturity of debt is related to the compliance with contracts for firms and creditors. If, there are firms not financed by the financing contracts of the division, for example, because of bankruptcy, the legal system allows a guarantee for the granting of credits and the recovery of the flows invested by creditors (Bae and Goyal, 2009). In this way, compliance with the contracts by the firms, leads to a greater availability to credit.

In this way, to test the relation between the legal system and maturity of debt we have the following hypothesis:

Hypothesis 12: the maturity of debt will be higher, if the legal system of a country is higher too.

Hypothesis 13: the type of legal system (common law and civil law) has an impact in the maturity of debt.

2.2.3 Impacts of Macro-Economic Variables

As there are microeconomic variables that influence the choice of debt maturity, macroeconomic variables also have an impact on debt maturity (Zhang and Sorge, 2010). According with some authors, the rate of inflation and its volatility, as well as the level of development of a country’s economy, are macroeconomic variables that influence the choice of the maturity of a firm's debt.

Demirguc-Kunt and Maksimovic (1999) and Zhang and Sorge (2010) affirmed the rate of inflation influences the value of the currency and the long-term debt interest rate. The higher the rate of inflation, lower the maturity of the debt. On the other hand, if the uncertainty of the inflation rate is higher, lower is the credibility of creditors in grant long-term credits, because financial institutions do not make so much money available. Miller (1997) proved that countries with political instability have a greater tendency to increase the uncertainty of inflation and, consequently, the existence of a greater number of firms that resort to short-term financing. Regard to the interest rate volatility, Kirch, Terra and Fan et al. (2012) argued that there is a positive relation between the volatility of the rate of inflation and the short-term debt. According to the authors, higher uncertainty of the rate of inflation in the future, leads the creditors to resort short-term debt, reducing the availability of long-term financing.

Another important macroeconomic variable is related to the level of development of the economy of a country. According to the authors Demirguc-Kunt and Maksimovic (1999) and Fan et al. (2004), firms located in a developing country have a higher debt maturity than firms operating in developed countries. On the other hand, Myers (1977) and Barne et al. (1980)

Determinants of corporate debt maturity structure: a study in euro zone countries

demonstrated the relationship between growth opportunities and the level of development of a country's economy with debt maturity. They argue that firms turn to short-term financing when they have great growth opportunities that depend on the wealth of the economy where they operate.

Hypothesis 14: The higher the rate of inflation, the lower the maturity of the debt.

Hypothesis 15: The lower the volatility of the inflation rate, the higher the maturity of debt. Hypothesis 16: Firms located in a developing country have a higher debt maturity than firms operating in developed countries.

3. Sample description and variables 3.1 Sample

To development this study we selected listed and unlisted firms from 16 countries of the European Union. We excluded from our sample the other countries from European Union, because it was just considered the countries with the minimum of the same number of observations per year, to avoid the missing values. The period for this sample refers to the years from 2007 to 2015 and includes 3.618.795 observations.

The data obtained about the characteristics of the firms were collected from the Amadeus database and, in order to determine all the variables, includes the net income, equity, depreciations, total assets, current assets, current liabilities, income after and before taxes, tangible fixed assets and operational cash flow.

About the information for each country, a number of sources have been used, such as the International Monetary Fund, World Federation of Exchanges database, World Bank, the European Central Bank, the OECD, Transparency International and International Financial Statistics and data files.

Determinants of corporate debt maturity structure: a study in euro zone countries

Table 1 – Number of firms analized for each country.

3.2 Variables

3.2.1 Dependent Variable

The dependent variable defined to develop the model is the maturity of the debt: MATDEBT. According with some authors, debt maturity is measured by the debt maturity of a given maturity over total debt. However, depending on the author, the maturity of debt differs because there are some definitions.

Based on the accounting and several empirical studies, Barclay and Smith (1995) refer to long-term debt when the maturity has more than three years, while Ozkan (2000 and 2002) defines the long-term debt with a maturity of more than five years. The authors Stohs and Mauer (1996) consider the weighted average of all debt and Scherr and Hulburt (2001), Barclay et al. (2003), Antoniou, Guney and Paudyal (2006), Stephan et al. (2011) and Fan et al. (2012) measured long-term debt considering the minimum of one year. In another approach, Guedes and Opler (1986) use the maturity of the bonds issued to measure the long term debt. In this specific case, the approach used is the long-term debt as the proportion of debt that matures after one year, from the Amadeus Databasis:

Countries Number of firms

Austria Belgium 6.992 1.073.056 Bulgaria 49.553 Croatia 97.573 France Germany 799.981 126.920 Greece 33.439 Italy 153.134 Luxembourg 5.079 Malta 103 Netherlands 3.377 Poland 50.425 Portugal 123.169 Slovakia 129.598 Slovenia 39.239 Spain 927.157 TOTAL 3.618.795

Determinants of corporate debt maturity structure: a study in euro zone countries

𝑀𝐴𝑇𝐷𝐸𝐵𝑇𝑖𝑡 = Long − term debt (> 1 𝑦𝑒𝑎𝑟)

Total debt (3.1)

3.2.2 Independent Variables

In this section will be presented all of the independent variables (variables of firm impacts and country impacts), to be included in the empirical models and how they will be used to explain the choices of debt maturity.

3.2.2.1 Variables of firm impacts Firm size

According with the literature and some empirical studies, there are several indicators to represent the firm size variable.

Opler (1996), Scherr and Hulburt (2001), Ozkan (2000 and 2002), Antoniou et al. (2006), Körner (2007) and Kirch and Terra (2012) proved that is possible use the logarithm of sells as a measure of the size of firm. Stohs and Mauer (1996) and García-Teruel and Martíney Solano (2010) use as indicator the market value of a firm logarithm and Antoniou et al. (2006) and Fan et al. (2012) use the ln of book value of the assets.

In our study, to measure and verify the positive relationship between the maturity of debt and size of the firms referred in the literature, it will be used the book market of assets logarithm.

𝑆𝐼𝑍𝐸 = ln(book value of assets) (3.2)

Growth opportunities

Myers (1977) studied that it is possible minimize the problem of sub-investment, issuing short-term debt, this is benefitial for the firms with more opportunities of investments. In this sense, there is a negative relation between the opportunities of investment and the maturity of debt and, according with some empirical studies, there are indicators to measure it.

Often, the authors use the ratio market-to-book to measure the investment opportunities of the firms, such as Guedes and Opler (1996), Stohs and Mauer (1996), Ozkan (2000 and 2002), Scherr and Hulburt (2001), Fan et al. (2012).

Scherr e Hulburt (2001) proved that there are other variables to measure the growth opportunities: the ratio measured by the proportion of the number of employers in a firm related

Determinants of corporate debt maturity structure: a study in euro zone countries

with the investigation and development of activities, to measure the investment in intangible assets; the tax of the historical growth of sells; the investment in fixed tangible assets, measured by the ratio between depreciations and total asset.

Heyman et al. (2008) also uses the ratio of the growth historical of the asset tax, assuming that the firms that grew are the firms with more opportunities of growth in the future.

According with Körner (2007), there is other measure to test the potential growth of the firms, the ratio between the annual expense of depreciation and the book value of the asset.

In our study, to verify the assumption that the maturity of debt has a positive correlation with the growth opportunities, we will use the ratio between the depreciation and the book value of the asset, by Körner (2007):

𝐺𝑅𝑂𝑃 = depreciations

book value of the asset (3.3)

Asymmetric information and quality of the firm

There is a relationship between firm quality and debt maturity, since in equilibrium higher quality firms issue more debt in the short term and, on the other hand, lower quality firms issue more debt in the long term (Flannery, 1986). According to the author, in the presence of debt issue costs, firms can signal the market correctly. In this sense, good firms can develop a strategy of issuing short-term debt, which will differentiate them from bad firms in the market. In order to measure the relationship between debt maturity and firm quality, several indicators have been studied by some authors. Stohs and Mauer (1996) and Cai et al. (2008) used as an indicator the ratio between the change in earnings per share in period t and t + 1 and the share price in period t. Cai et al. (2008) also use the profitability of the asset as an indicator (EBIT / asset).

Ozkan (2000 and 2002), as an indicator of firm quality, uses the ratio between the difference of the results in period t + 1 and period t, with the results in period t. Antoniou et al. (2006) use two indicators: the ratio between net debt and share capital and the ratio of the sum of net results to depreciation (net free assets) and the net debt of the firm.

More recently, Stephan et al. (2011) used to measure the quality of the firm, the rotation of the asset (sales / total assets). In these case, we are considering the return on equity ratio (ROE):

𝑄𝑈𝐴𝐿𝐼 = Net income

Determinants of corporate debt maturity structure: a study in euro zone countries Liquidity

According to the author Diamond (1991) firms with better quality should prefer the short term financing. In fact, it may happen that cash flows generated by firms are not sufficient to meet their obligations, and these can have problems if they resort to short-term debt. In this way, there are ratios that allow calculation of liquidity, such as the current ratio:

𝐿𝐼𝑄 = Current assets

Current liabilities (3.5)

Effective tax rate

When the effective tax rate is low, firms issue long-term debt (Brick and Ravid, 1985). However, according to the literature and empirical studies performed by other authors, a mix of results was verified.

There are several indicators that allow us to study the correlation between the effective corporate tax rate and the maturity of the debt. Stohs and Mauer (1996), Ozkan (2000 and 2002), Antoniou et al. (2006) and Cai et al. (2008) use the ratio between actual taxes paid and pre-tax income as an indicator. López-Gracia and Mestre-Barberá (2011) also use this indicator, but to do not include firms with negative results in the sample to avoid errors in conclusions about the effective tax rate. In addition, the authors also use the ratio between profit tax and operational cash-flow.

Thus, following most authors, we will use the ratio between taxes paid and pre-tax income to measure the relationship between the effective tax rate and the maturity of debt.

𝑇𝐴𝑋 = Income taxes

Income before taxes (3.6)

Volatility of firm’s value

According with some studies, firms that present greater volatilities in their value, tend to have higher costs and risks of going bankrupt in the future.

Kane et al. (1985) considers that if firms use short-term debt and have frequent changes in their capital structure, they are able to reduce restructuring and bankruptcy costs. In this way, the author establishes a negative relation between the maturity of the debt and the volatility of the value of the firm.