A Work Project, presented as part of the requirements for the Award of a Master

Degree in Management from the NOVA – School of Business and Economics.

The European Space Business Academy (ESBA) - A conceptual framework on the

establishment of a space business academy, its potential and purpose in the future

of space research and business education

Lasse Ristow (33318)

A Project carried out on the Master in Management Program, under the supervision

of:

Luis Manuel da Silva Rodrigues

Abstract II

The European Space Business Academy (ESBA) - A conceptual framework on the establishment of a space business academy, its potential and purpose in the future of space research and

business education

Abstract

Considering the surge in commercial downstream activity in space, an academy promoting the professional development of entrepreneurs and managers involved in space businesses combined with research on business-related aspects of industries and firms employing space technology, is an attractive opportunity to explore. In-depth qualitative interviews with representatives from the academy’s founding universities and industry experts reveal great potential for both teaching and research. Teaching activities should commence on executive education level before incorporating under- and postgraduate programs. Likewise, ESBA’s intended researchin form of a holistic database, which maps all actors operating in the European space industry, will allow to better represent the actual economic value that originates from initial space investments.

Keywords

New Space EducationEntrepreneurship Downstream

“Business schools that lead in this sector, by training interested students in the specific challenges and opportunities that space will present, have a chance to shape a sector with

potentially enormous impact.”

- Matthew C. Weinzierl, Harvard Business School

This work used infrastructure and resources funded by Fundação para a Ciência e a Tecnologia (UID/ECO/00124/2013, UID/ECO/00124/2019 and Social Sciences DataLab, Project 22209), POR Lisboa (LISBOA-01-0145-FEDER-007722 and Social Sciences DataLab, Project 22209) and POR Norte (Social Sciences DataLab, Project 22209).

III

Table of Contents

1 Introduction ... 1

2 Literature review ... 3

2.1 “New space” and its catalyst role for space business education ... 3

2.1.1 Actors in space: leveraging private sector efficiencies ... 3

2.1.2 Dawn of the entrepreneurial space age ... 4

2.1.3 Mapping the commercial space industry ... 6

2.2 Space business education – a completely untapped opportunity? ... 9

3 Research methodology ... 11

3.1 Research design ... 11

3.2 Data collection and analysis ... 12

4 Results and discussion ... 14

4.1 Potential of ESBA ... 14

4.1.1 Need for space business education ... 14

4.1.2 Need for space business research ... 17

4.2 Establishing ESBA and discussion of target segments ... 18

4.3 Key success drivers for ESBA ... 20

4.4 A conceptual framework on the establishment of ESBA ... 21

4.5 Limitations and further research ... 22

5 Conclusion ... 23

Introduction 1

1 Introduction

The global space industry, which for the longest time of its existence has centered heavily on government-funded activities, has been undergoing some profound changes. An increasing number of small businesses and start-ups are entering the space industry hoping to set ground in a sector that is projected to grow to $1.1 trillion in revenues by 2040, up from $360 billion, today (Morgan Stanley, 2019). The European Space Agency (ESA) has a history of successful incubation of space start-ups that employ space-derived technology or data in their business models, products and services. As part of their Technology Transfer Programme (TTP) ESA makes space technologies accessible for European industry and thereby enables new earth-bound business models that integrate space technology and satellite data (ESA (a), 2019). Their work serves as a prime example of how space can be utilized in a way that benefits both businesses and society. At the same time, it illustrates the commercial potential that the evolving space economy bears for established and new businesses. The impact of space on the global economy and our society today is unprecedented, yet this sector has not been subject to comprehensive business research so far and has enjoyed only little academic attention. In addition, it is surprising to see that education programs on space and its commercial opportunities for businesses are currently very limited in Europe. For instance, information on the number of European companies, which employ space technology or data, is not systematically collected. At the same time, the emergence of more and more space start-ups will be driving demand for space industry specific education and industry knowledge. Based on these findings the idea of a joint academy, hereinafter called the European

Space Business Academy (ESBA), between ESA and the founding universities Nova School of

Business and Economics, Rotterdam School of Management and St. Gallen University of Applied Sciences evolved. The purpose of this academy should be twofold:

Introduction 2

1) To offer business education and training in the space industry that promotes and fosters

professional development of entrepreneurs and managers involved in space businesses and

2) to foster business research and knowledge creation on business-related aspects of industries and

firms employing space technology as part of their business model.

With ESBA, the four institutions aim to lay the foundation for future business and management education in the evolving European space sector. Still, there is little clarity about the potential of this academy and its feasibility to which this work will contribute. Furthermore, it is uncertain what an effective way could be to establish the academy and gain momentum in future. Therefore, the respective research questions this thesis addresses are:

1. What is the potential of the academy in the areas of teaching and research? 2. How can the envisaged academy be established effectively?

The first chapter focuses on a literature review to elaborate the changing dynamics in the global space industry and their implications for management education in this sector. Furthermore, in order to provide a thorough understanding of the space sector, an industry analysis will quantify the different industry segments and identify drivers for future growth. The literature review concludes with a screening of the idea of space business academies and similar research initiatives. This will not only help to identify best-practice approaches on how to establish a pioneering academy like ESBA but should also enhance the strategic positioning of ESBA taking into account other professional development programs on space business. The subsequent chapter outlines the methodology behind the qualitative research method that was used in the practical component of this work. Next, the results will be discussed and main insights will be highlighted in order to derive a deeper understanding of the academy’s potential and recommendations on how to establish the academy. Finally, the discussion concludes with limitations, and future avenues for research.

Literature review 3

2 Literature review

This chapter is intended to provide an overview on the status quo of the global space industry, its main actors and changing dynamics that are reshaping this industry. A comprehensive exploration of the industry is considered essential as this will help to understand the context under which space business education becomes attractive for academic institutions. Finally, the concept of “space business academies” will be explored to understand which other institutions are involved in space business education and research.

2.1 “New space” and its catalyst role for space business education

The aim of this section is to develop an understanding of the global space industry, its changing dynamics and how this may stimulate the demand for space business education in the future.

2.1.1 Actors in space: leveraging private sector efficiencies

The space industry is characterized by a wide variety of companies and has traditionally been financed by public investments through government organizations (Weinzierl, 2018). In this legacy system, government organizations like NASA used to contract out their work to big private sector commercial engineering companies (e.g. Lockheed Martin, Boeing or Northrop Grumman) which developed the equipment for space missions on their behalf. While this system had been established for some time, the picture had changed radically following decreasing government funding which, in the U.S., shrunk from 4.4% of the U.S. budget in 1966 to merely 0.5% in 2014. A new system was needed in which some of the costs and labour could be offloaded in order to continue fulfilling NASA’s vision of space exploration and study (Camerota, 2016). The space industry we know today is more and more impelled by the idea of leveraging efficiencies of the private sector in order to help achieve goals of public interest. This development is not limited to North America as a similar development can be observed in Europe. Thus, the critical paradigm shift in space is not

Literature review 4

only about the newly discovered scale of commercial activities but much more about the shift in the nature of the relationships between the public and private sector which led to the “New Space” era and set the stage for space entrepreneurs and start-ups which we now encounter.

2.1.2 Dawn of the entrepreneurial space age

The above mentioned monetary factors, power structures and risks made the space sector virtually inaccessible for private businesses. However, an increasing interest from the private sector could be observed in the past decade (Bockel, 2018). Instead of acting as contractors to nation states and national space agencies, private firms are now the key protagonists in an industry which many experts project to be the final economic frontier (Weinzierl, 2018). As a result of these changing dynamics, the space industry’s impact on the economy as a whole is becoming increasingly perceptible and is seen as a new engine for economic growth. Barriers to entry have fallen dramatically which facilitated the access to space for many large corporations and start-ups that make use of space either to offer their services on earth or to generate data for the purpose of commercialization (Alén Space, 2019). According to Bockel (2018) lower entry barriers were, among other factors, driven by “gradual improvements in managerial practices and falling costs and size of technology” allowing to slash down launch and payload costs. For instance, by maximizing standardization in their production, SpaceX was able to notably reduce their unit costs for critical parts and the number of processes necessary for production (ibid.). Furthermore, advances in the design of rocket engines have not only increased combustion stability but also promoted the development of reusable rockets as a gateway to further reduce launch costs (Chaikin, 2012). The vanguard of “New Space” includes companies like SpaceX, Blue Origin and Virgin Galactic. Founded by the billionaires Elon Musk, Jeff Bezos and Richard Branson, they have enjoyed public attention as they became to be known as the first space entrepreneurs. All three of them were able to found their space businesses by leveraging the success of their formerly founded

Literature review 5

companies like PayPal, Amazon and the Virgin Group and thereby finance their space ventures. While private-equity projects like these have grabbed most of the headlines recently, hundreds of smaller space companies, which also benefit from the facilitated access to space, are following their example. Appendix 1 demonstrates the surge in equity investments in the global space industry from 2009 to present. While investors traditionally considered the commercial opportunities of space to be “high risk, high cost, and characterized by long payment periods” (Wakimoto, 2018), this perception of the industry is no longer applicable. The positive long-term investment trend underlines the growing interest in space: While investments in space start-ups between 2000-2012 accounted for around USD 3.688,7 million, total investments in the following five years from 2012-2017 amounted to nearly three times that amount (USD 10.238,3 million) (Bockel, 2018).

The increasing adoption of space applications in fields like telecommunications, navigation, meteorology and earth observation has expanded the array of commercial activities into an increasing number of industries ranging from air traffic control, natural resource management, transport, agriculture, environmental and climate change monitoring to entertainment (OECD, 2011). Many of these activities have already been serving mass markets for a long time, e.g. information technology like satellite television and GPS.

Not only is today’s space industry becoming more competitive, but there is also an emerging trend towards a more globalized space industry with more and more countries engaging in space activity (ibid.). Appendix 2 illustrates that the number of countries with a least one registered satellite in orbit increased from 50 countries in 2008 to 82 in 2018 – an increase of 64% within a decade only. Estimating and forecasting the commercial value of space proves to be challenging since the space industry encompasses various activities and value chains from industries like hardware and digital products which effectively are detached from initial space investments (OECD, 2019). In addition,

Literature review 6

space is an enabler for new industry verticals where companies provide targeted insights and offer specialized services to a specific niche. Therefore, space-based infrastructure, particularly satellites, serve as precursors that enable new space-related applications in segments like location-based services or agriculture (Concini & Toth, 2019). The following section aims to quantify the different market segments of the global space industry using recent industry reports.

2.1.3 Mapping the commercial space industry

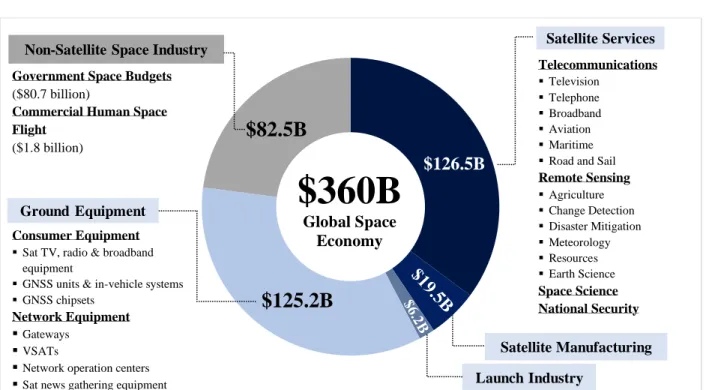

According to a report published by the Satellite Industry Association, the global space economy was estimated at around $360 billion in revenues in 2018 (SIA, 2019). The satellite industry, which represents all revenue-generating commercial space activities, makes up for the largest share of revenues with around $277 billion coming from satellite services ($126.5 billion), satellite manufacturing ($19.5 billion), the launch industry ($6.2 billion) and ground equipment ($125.2 billion), all of which are considered segments of the satellite industry. Finally, government space budgets and investments in commercial human space flight are the two segments which represent the non-satellite space industry. In 2018, these two segments generated around $82.5 billion in revenue, nearly all of which accounts for government budgets (approximately $80.7 billion). Figure 1 on the next page illustrates the size of these segments and the most relevant associated industries. Several investment banks have projected the global space economy to grow to a trillion-dollar industry by 2040, suggesting that today’s revenues may more than triple within the next twenty years. Besides consumer broadband, so-called “second order impacts” will be the main driver for growth (see appendix 3). Second order impacts are the result of further space-enabled downstream activities by internet companies that will be utilizing internet bandwidth from satellites, which thanks to an increasing efficiency and decreasing cost of satellites, could have enormous impact on the industry’s commercial potential going forward (Sheetz, 2018).

Literature review 7

Figure 1: Global space industry revenue in 2018 per segment in billion Dollars

(source: own presentation with data from SIA, 2019)

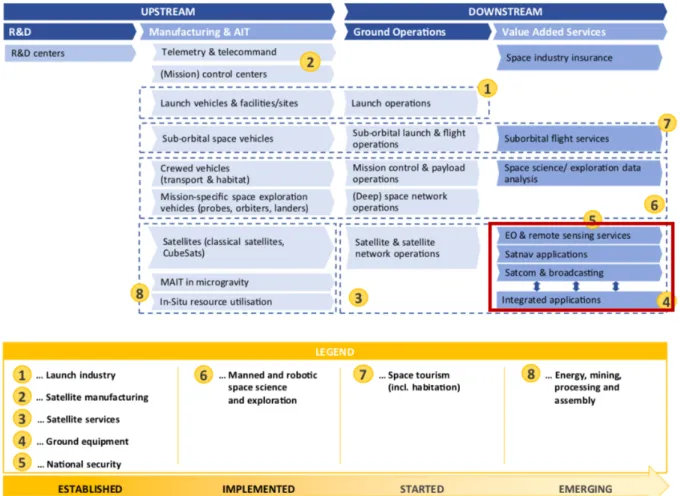

More importantly, the space industry can also be divided into an upstream and downstream segment, depending on the occurrence of each business activity within the value chain (see appendix 4). While the upstream segment includes all activities that lead to the development of space infrastructure, e.g. the research and design, manufacturing, launch, maintenance and repair of spacecraft and equipment, the downstream segment refers to all commercial activities leading to space-based or space-enabled products and services (Strada & Sasanelli, 2018). The largest domains in the downstream segment include earth observation, satellite navigation and satellite communications (Strada & Sasanelli, 2018). Around 53% of revenues in space occurred in the downstream segment in 20161 which is more than upstream activities and government space

budgets combined (ibid.). Beyond that, the aforementioned second order impacts, which represent

future downstream business, emphasize the relevance of this segment further. Lastly, space can also be an enabler for new spin-offs on earth as the areas of application for

1 The upstream segment accounted for around 23.4% of the total revenues of the global space economy in 2016

while government space budgets accounted for the remaining 23.2%.

Satellite Services

Satellite Manufacturing Launch Industry

Ground Equipment

Non-Satellite Space Industry

$360B

Global Space Economy$82.5B

$125.2B

$126.5B Telecommunications ▪ Television ▪ Telephone ▪ Broadband ▪ Aviation ▪ Maritime ▪ Road and SailRemote Sensing ▪ Agriculture ▪ Change Detection ▪ Disaster Mitigation ▪ Meteorology ▪ Resources ▪ Earth Science Space Science National Security Consumer Equipment

▪ Sat TV, radio & broadband equipment

▪ GNSS units & in-vehicle systems ▪ GNSS chipsets

Network Equipment

▪Gateways

▪VSATs

▪Network operation centers

▪Sat news gathering equipment

Government Space Budgets

($80.7 billion)

Commercial Human Space Flight

Literature review 8

innovative space technologies are not limited to space infrastructure. While upstream and downstream activities define the formal borders of the space industry, technology transfer facilitates spillovers from space into other industries which continuously push these traditionally acknowledged industry boundaries. Technology transfer fosters the development of space-related or -derived activities which generally refer to applications that are derived from space but are used in regular industries such as healthcare, automotive or energy. In fact, it is not uncommon for technology, that was initially developed for the purpose of space activities, to be applied in other areas. Many space technologies have enabled spin-off applications which nowadays significantly improve our lives on earth. For instance, Computer-Aided Topography (CAT) and Magnetic Resonance Imaging (MRI) technologies were initially developed to survey the moon's surface but are used in many scanners in hospitals today. Since space technologies are developed to operate in extreme environments (e.g. high temperatures or pressure), they are often superior in strength, durability, low weight, efficiency, reliability, miniaturization and radiation-proof (European Patent Office, 2019). Patents play a critical role in connecting space technologies to earth applications effectively and not only allow investments in R&D to be rewarded but also incentivize future research. The European Patent Office’s (EPO) database “Espacenet” contains around 1,900 European patent applications in the space vehicles and equipment category while many more patents are in turn based on these technologies and applied in earth-bound applications (ibid.). Interestingly, the EPO notes that merely 10% of ESA’s nearly 1,000 patent publications over many years are actually for the use on space vehicles or equipment which underpins the relevance of space technology for non-space applications. Therefore, the economic impact of space-related or derived products, albeit being difficult to quantify, is considerable. Thus, it is no surprise that the number of space-related patents has nearly quadrupled within the past 15 years according to the EPO (2019). ESA alone was able to nurture over 700 start-ups across Europe from healthcare to

Literature review 9

manufacturing, sport to agriculture (ESA (b), 2019) with the support of its business incubation network (appendix 9). Overall, it becomes evident that the more inclusive we are with the concept of the space economy and its various activities, the blurrier the boundaries become that define it.

2.2 Space business education – a completely untapped opportunity?

As pointed out previously, the impact of the space industry on the global economy is unprecedented and caught the attention of new investors and businesses. While the potential for industry is obvious, this section aims to demonstrate that academia will not remain unaffected. A small but increasing number of universities is recognizing the relevance of the evolving industry providing them with a new array of opportunities in research and teaching. Yet, it is worth mentioning that space business related education and research is just starting to spread across the academic landscape and is waiting to find broader acceptance by university faculties, companies and students making it a research area with niche character for the time being.

Appendix 5 illustrates the number of scientific publications in 2000, 2008 and 2016 across different economic regions on space activities and innovation. Using peer-reviewed scientific publications as a proxy for space-related research activity, it becomes evident that this sector is in fact receiving growing attention from academia. While countries affiliated to the OECD made up for the majority of scientific publications and registered the largest absolute growth between 2008 and 2016, the BRICS recorded the largest relative growth between 2000 and 2016 due to significant increases in scientific publication in China as well as India (OECD, 2019) which again reflects a more and more globalized space sector already addressed in chapter 2.1.2.

As part of this chapter, the most relevant institutions, that also focus part of their research and teaching activities on space business, were identified (see appendix 6). Interestingly, most educational programs, either do not sufficiently address the relevance of the downstream segment or purely focus on the upstream segment of space. Other programs solely focus on teaching

Literature review 10

activities while paying little or no attention to the existing gap in research on space business. The most relevant European institutions, which offer professional development programs in the space sector, are the International Space University (ISU) and Toulouse Business School (TBS). ISU offers programs on Executive, Master’s and advanced training level with a curricula that cover “all disciplines related to space programs and enterprises, space science, space engineering, systems engineering, space policy and law, business and management, and space and society” (International Space University, 2019). While ISU’s curriculum addresses many relevant areas of space, the downstream segment is largely neglected by their professional development programs. In contrast, TBS specifically addresses the commercial opportunities for entrepreneurs and businesses in space in their specialized MBA track in “Space Business & Applications” (see Toulouse Business School, 2019). Relevant topics of this program include fundamentals of space business, new space business, innovation strategy in the space sector and space application and downstream services which largely coincides with prospective focus areas of ESBA. Nevertheless, the gap in space business research remains as TBS mainly focuses on teaching activities. Furthermore, both institutions are lacking international reach with both of their programs being limited to one location (Strasbourg and Toulouse respectively). Outside of Europe, Harvard Business School engages in research on business-related aspects of space. A small group of affiliated faculty members produce relevant case studies on central questions and actors in space which are driving discussions in their MBA and Executive Education classes. The underlying aim of this research initiative is to “understand, contribute to, and shape the development of the commercial space economy”. At MIT, the aim of the “Astropreneurship and Space Industry Club” (ASIC) is to create a platform that allows space entrepreneurs to connect with potential investors and industry leaders. Their annual New Space Age conference serves as a gateway for this goal (MIT Sloan School of Management, 2017).

Research methodology 11

All in all, a specialized degree program that teaches entrepreneurs and industry experts on the commercial opportunities that space offers and how to translate upstream research into downstream applications is very limited and leaves a gap in education that may be highly interesting for business schools to conquer. This is particularly striking since most space industry experts have backgrounds in engineering while lacking the managerial and entrepreneurial skillset which according to Grecu & Denes (2017) is essential today. They note “in the present economic situation, having knowledge of an academic subject is no longer sufficient” and emphasize that especially engineering students benefit from additional entrepreneurial training. Not only does it provide individuals from engineering backgrounds with the ability to recognize commercial opportunities and to commercialize a concept but also to manage resources and to initiate a business venture (ibid.).

3 Research methodology

This chapter outlines the reasoning behind the qualitative research design chosen for this work and the process of the data collection and analysis.

3.1 Research design

Due to the conceptual character of this work and because this research is mainly focused on getting external insights on the academy, a qualitative research design was chosen. In addition, the topic at hand deals with reasoning which requires exploratory research rather than hard statistics (Baarda, 2010). One aim of this work was to gain insights into the potential of the academy in the areas of education and research while another goal was to develop a framework on an effective establishment. The nature of the two research questions required to hold interviews with project stakeholders from the founding universities as well as external industry experts. It is important to highlight that not each of the interviews followed the same interview guideline as not all interviews aimed to answer both research questions of this work. Instead, internal interviews with

Research methodology 12

representatives from the founding universities mainly aimed at comprehending the academy’s purpose, its mission and possible ways to establish the academy while external interviews, which were held subsequently, helped to gain a deeper understanding of the academy’s potential.

3.2 Data collection and analysis

For the collection of primary data, a total of six semi-structured in-depth qualitative interviews were conducted. Open-ended questions were used in order to ensure a variety of insights as well as non-biased responses. Each interview was guided by a pre-defined questionnaire giving each of the interviews a general direction, however, the semi-structured approach allowed to preserve flexibility during the interview and to ask clarifying questions when it was considered necessary. Additionally, the semi-structured interview format allowed the interviewees to tap into the full potential of their knowledge and information in order to advance this research. An iterative process was used for the data collection which allowed to review initial findings and to use this information to ask more specific and clarifying questions during later interviews in relevant areas. The different interview formats (internal and external) will be explained in the following.

2 interviews with representatives from the founding universities (interviewees A and B) were held in order to obtain information about the purpose of the academy and to understand their motivation of getting involved in the first place. Overall, this questionnaire contained 15 questions which were divided into topic clusters. Like in all interviews, the first questions were related to the interviewees current position and how that role was related to the topic under investigation. The subsequent section comprised questions about the rationale behind the academy and under which context the interviewees consider the academy an opportunity that is worthwhile to pursue. The interview continued with questions regarding the academy’s value proposition and relevant target groups. Organizational considerations of the academy were taken into account in the subsequent section with the aim to elaborate more on the role of ESA within the academy and the scope of their

Research methodology 13

collaboration with the founding universities. Concluding, I asked the interviewees about critical success factors for the academy. Finally, the interviewees had the opportunity to address further aspects which have not been sufficiently scrutinized through the questions but still seemed important for them.

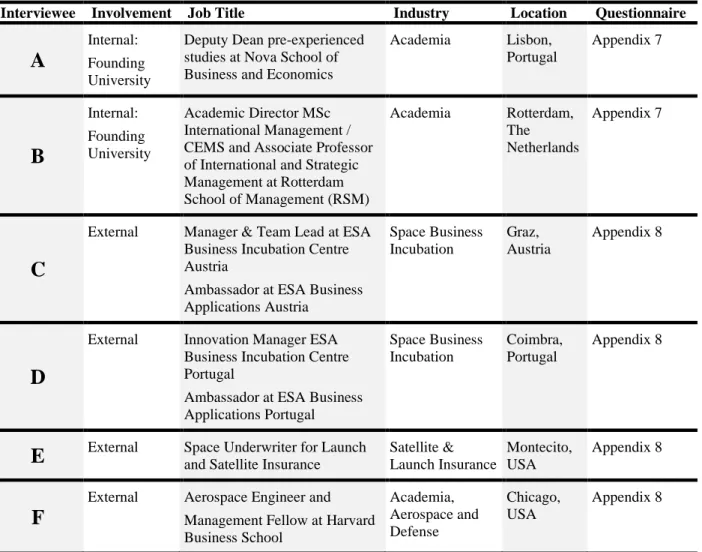

4 further interviews were held with industry experts who have substantial work experience in the downstream segment of the space industry. A separate questionnaire was prepared for the external interviews. It included additional background information about the academy in the introduction. The aim was for the interviewee to have a good understanding of the academy before the interview so that a realistic picture for its potential could be derived and to allow meaningful judgement. The questionnaire for each interview can be found in the respective appendix stated in Table 1 below:

Interviewee Involvement Job Title Industry Location Questionnaire

A

Internal: Founding University

Deputy Dean pre-experienced studies at Nova School of Business and Economics

Academia Lisbon, Portugal Appendix 7

B

Internal: Founding University Academic Director MSc International Management / CEMS and Associate Professor of International and Strategic Management at Rotterdam School of Management (RSM) Academia Rotterdam, The Netherlands Appendix 7C

External Manager & Team Lead at ESA Business Incubation Centre Austria

Ambassador at ESA Business Applications Austria Space Business Incubation Graz, Austria Appendix 8

D

External Innovation Manager ESA Business Incubation Centre Portugal

Ambassador at ESA Business Applications Portugal Space Business Incubation Coimbra, Portugal Appendix 8

E

External Space Underwriter for Launch and Satellite Insurance Satellite & Launch Insurance Montecito, USA Appendix 8F

External Aerospace Engineer and Management Fellow at Harvard Business School Academia, Aerospace and Defense Chicago, USA Appendix 8

Results and discussion 14

In order to ensure a meaningful comparison of all answers from the different questionnaires, the data derived from the interviews was processed in a way that allowed to group all important insights into individual topic categories. These topic categories are equivalent to the individual topic clusters used in the questionnaires to ensure comparability of each interview.

4 Results and discussion

In the following, results from the interviews will be described and discussed. First, potentials and opportunities in the areas of education and research will be presented. The subsequent section discusses how the academy should be established and which educational segment should be targeted in the initial phase. Thereafter, critical success factors will be highlighted and limitations identified. Lastly, a framework for the establishment of ESBA is introduced.

4.1 Potential of ESBA

This section answers the first research question and aims to develop a deeper insight into the overall potential of the academy with respect to teaching and research activities.

4.1.1 Need for space business education

One purpose of ESBA will be to provide business education and training in the space industry to promote and foster professional development of entrepreneurs and managers involved in space businesses. Overall, all interviewees recognize the need for business education in the space industry and do believe that an educational program focusing on downstream activities is relevant in its content. C states that offering a professional development program focusing on downstream activities of space makes a lot of sense as this particular segment has the highest capabilities to generate substantial return on investment in the short term. C elaborates that countries have made and are making huge investments in space and thereby stimulate the creation of knowledge, data

Results and discussion 15

and technology which has great potential to be reused in other industries. Consequently, not using these resources would entail a lost opportunity from C’s point of view. At the same time, C cautions that the downstream segment is very diverse and that “start-ups operating in there target regular markets such as mobility or energy” for instance. All these different markets, however, are affected by space in different ways which to some extent should be reflected in the educational program. As a possible way C suggests aggregating certain industries or verticals that have similar connection points with space within the program to make it more relevant for specific industries and participants of the program. As representative of ESA’s Business Incubation Centre in Portugal, D has supported many space start-ups during their incubation phase. D raises the point that many of these start-ups, however, realize that they require specific training and skills once they have produced their first prototype or want to introduce the product to the market. In that sense, interviewee D expresses great interest in the educational program of ESBA and in “feeding the pipeline” of the academy with entrepreneurs from their start-ups as candidates once ESBA’s educational program is on the market. Since the contract between ESA and the business incubation centre Coimbra, that D is representing, will be renewed soon, D suggests that this would be a suitable timing for Nova SBE get formally involved and to arrange a first meeting between both parties. Any educational program that would be available for entrepreneurs and businessmen, who would like to engage in downstream activities, would be very interesting, D notes. In addition, D expresses an interest in a more practically oriented component at the academy related to satellite imagery. Based on D’s experience, there are many entrepreneurs with viable business ideas that employ space data but lack the knowledge on how to work with it. Therefore, D believes that a postgraduate course that addresses the development of skills on space data utilization would be a valuable addition to ESBA’s course portfolio. By setting a stronger emphasis on technical expertise with respect to the utilization of space technology and especially data, ESBA would also be able

Results and discussion 16

to differentiate from purely business focused MBA programs, D argues. Interviewee E observes that “students are more interested in space than before” due to the fact that space and especially its applications is more and more in the press and in our daily life which may stimulate the demand for programs offered by ESBA. E agrees with D that while the business side of established space companies in the upstream segment does not need special attention in terms of special education, it is essential to educate people in the potential of downstream applications of satellites. For example, these can help to track the ice melting on glaciers or to observe the ozone hole (environmental purposes), make airplane routes more efficient and thereby save fuel (business purposes), help firefighters to detect hot-spots or to alert people of hurricanes far in advance (disaster assistance). Interviewee F, a space economist from Harvard Business School has been involved in the space industry for many years and is currently exploring the opportunity to offer a joint course at Harvard and MIT that covers the fundamentals of space business. F believes that a sound understanding of the space industry is a prerequisite as it is fundamentally complex and difficult to understand. While this more specialized course should primarily aim at Masters students, F considers a Bachelors enrollment capability useful to reach a broader mass of students. Thus, interested Bachelor students would be able to take extra credit points and further develop in this promising field. F further notes that by getting multiple universities involved at ESBA one could “decrease the risk, increase the number of people involved, the resources and the perspectives” and thereby enrich the educational program. At the same time, F stresses that with every additional institution the complexity of bureaucracy increases tenfold. While setting up the class at Harvard would be a relatively quick process, F notes that trying to set up a joint program with MIT would inevitably become a two- to three-year process.

Results and discussion 17

4.1.2 Need for space business research

As representative of one of ESBA’s founding universities, B states that an initial research component of the academy should address the currently existing lack of information on firms operating in the space industry that employ space technology. This should be realized by creating a database with the aim to better map the industry, its actors and ultimately the overall value that is created including all downstream activities. The OECD affirms this lack of transparency and states that “governments that fund space programmes should better track who is doing what in the space industry and beyond, via regular industry surveys and analysis of existing administrative data. This includes mapping the many actors along the value chains in their national space economy.” (OECD, 2019). Interestingly, C highlights that the origin of most space technologies developed in Europe is already systematically mapped and refers to ESA’s Technology Transfer Broker Network. Besides identifying market needs in the European industry where there is potential for space technology exploitation, the network also maps all technology providers in Europe (including corporates, SMEs or research institutes). Nonetheless, it remains unclear where a specific space technology is ultimately applied and may create further economic impact. D and F affirm the need for such research and argue that we do not quite understand where else some of the space technologies are actually used. F refers to a conference on which a paper was published that aimed at determining the actual value of the space industry. Its underlying hypothesis was that the way we map the space industry today results in a value that is considerably smaller than the actual value that is currently being created. Consequently, F adds, we are not able at the moment to truly represent the economic outputs from national investments back to society. In addition, D emphasizes that the existing lack of information could have a huge impact on how future investments will be allocated. These public investments, which not only flow into education but also into other space-related programs, may be jeopardized because of the fact that there is no

Results and discussion 18

accurate information available and is thus granted to other sectors according to D. Therefore, developing a database that allows for a comprehensive mapping of the European space industry would be highly valuable for ESA according to D who adds that ESA would not only be happy to contribute to such project but would also be willing to pay to get access. The main challenge of the database lies in the combination of various sources of information in order to develop a holistic picture of the industry since those companies that are affiliated with ESA’s Broker Network and Business Incubation Centres reflect only a selected number of companies of the industry. Even though ESA is able to provide information on “their” start-ups, additional information is needed and must be aggregated. The Copernicus Program, for instance, as the largest space data provider for earth observation, gives public access to its data for commercial use, allowing the formation of data-enabled business models and start-ups. Other start-ups that employ space technology are funded by European Commission grants exclusively in which ESA is not involved. It turns out that information on companies operating in the downstream space industry is currently not available in a consolidated form but rather distributed across different silos all of which must be incorporated in the proposed database to derive a holistic picture. Overall, the research component of ESBA is considered important and economically valuable by the interviewees.

4.2 Establishing ESBA and discussion of target segments

To examine the second research question, the interviewees were asked which measures should be taken in order to effectively establish ESBA and to gain momentum. Establishing the academy is closely connected to the question which of the educational segments stated in appendix 8 should be initially targeted. Both A and B have expressed their preference in a top-down approach. This approach implies to initially offer the academy’s educational program to a selected group of executives. Teaching activities should then be combined with research activities proposed in 4.1.2 before space-related teaching activities are incorporated into Masters and Bachelors programs. 3

Results and discussion 19

out of 4 industry experts, who were interviewed, share the same opinion and determine executives to be the most attractive target segment for the initial phase. C believes that the ESBA’s educational program would be more appealing to executives or experienced professionals who come straight from the business environment. C also argues that ESBA’s program has higher potential to directly impact innovation and business success through this target group which would help to build a reputation quickly. Master’s students on the other hand “would have to be very passionate about this industry to study a degree like this, otherwise they would be limiting themselves in terms of job opportunities in future”, D argues. In that sense and due to the fact that there may not be enough content for a whole degree on Masters level, a specialized class on space business may be more interesting to students who are in the early stage of their education according to F which will be elaborated later. D also notes that by targeting executives and professionals first the academy would have greater exposure from the start as the outcome in form of learnings, that the participants acquire from the program, will be directly applied in the real business world and would therefore go into the market quicker. For D it all comes down to making sure that the first class of the academy becomes a success by carefully selecting the highest potential candidates from relevant companies. D further suggests that once successful companies recognize that they received good training from the academy, this will open the opportunity to also target different types of participants and attendees including Masters students. By “feeding the academy naturally” with participants, which according to D means targeting executives first followed by Masters students, the academy could be established more effectively as the outcomes will become visible relatively quick. In contrast, F considers Masters students the most attractive and proposes a bottom-up approach. F argues that executives may have an interest in the program, however, from a business or career perspective they are already established which may keep them from taking time out to learn about something that they are not entirely sure whether it is going to benefit them. Instead, F

Results and discussion 20

argues that capturing students who are currently in the educational cycle would be easier to attract than someone who is already firmly established in their business. As mentioned in section 4.1.1, F believes that offering a class that delivers a fundamental understanding of the space industry to a greater number of students on under- and postgraduate level would benefit ESBA the most.

4.3 Key success drivers for ESBA

As a fundamental requirement A and B emphasize that leadership commitment from all parties is critical to realize ESBA. In addition, B stresses the importance of having a clear formulation of what the target group should be for ESBA’s educational program and how this it can be reached. Sinc space start-ups are not listed in a chamber of commerce under a specific code, according to B, the identification specific companies that may have an interest in ESBA’s educational program remains challenging. Hence, ESA’s Business Incubation Center Network may be a valuable resource that could act as an intermediary to feed ESBA’s pipeline in the initial phase as proposed in chapter 4.1.1 by interviewee D. C adds that the involvement of relevant industry players such as industry associations and further country-specific space agencies would be essential for ESBA’s research since these organizations group a lot of space companies already. By getting them to participate in ESBA’s research as partners, a higher engagement with the space community could be safeguarded, C argues. As an example for industry associations C refers to the ASD (AeroSpace and Defense Industries Association of Europe). Getting such players involved will also help to create a viable business case for ESBA according to F. From F’s experience in academia in the U.S., the decision on whether a course will be offered or not always fundamentally goes back to its revenue. Thus, a viable business case, which can prove that ESBA is going to generate a positive economic outcome, is key to justify its need and to get approval from the universities. F recommends to involve people from industry (e.g. from ESA or Airbus) in this process to secure funding as this could help to showcase the need for the type of education ESBA will offer.

Results and discussion 21

D underlines the ambivalence of the term “success” and notes that it can be measured in different ways. In that sense, D advises against measuring the academy’s success on the basis of pure turnover or number of graduates. For D, long-term sustainable success for the academy “is all about nurturing the network” of alumni instead. Thus, the quality of the alumni should be prioritized over quantity which will also help to build up credibility. This should be done by carefully selecting the most promising candidates for the program to ensure that “the future sharks” will receive training at the academy, D notes. Provided that the academy retains good relationships with its alumni, D suggests that “they will not just recognize that what they learned had an impact on their future success but they will also be willing to further support financially” since they will reflect upon their experience at ESBA and relate their success with what they have learned. D also notes that using an already existing network may be an interesting option and mentions the CEMS community in that respect. According to D, there may be synergies worthwhile to explore which may also provide specific leads to the academy. As a globally represented cooperation of leading business schools and multinationals the CEMS network could therefore serve as another gateway to reach the academy’s target group for its educational program. “Many people do not realize that they are part of this big family of downstream companies”, states D, which is why it would be useful to create a connection point for them in form of a platform that fosters the exchange in the downstream ecosystem of space. Interviewee E also recognizes the importance of having a network and emphasizes that “a dedicated and specialized institution will bring people with same interests together and help establish good contacts for the future of the student”.

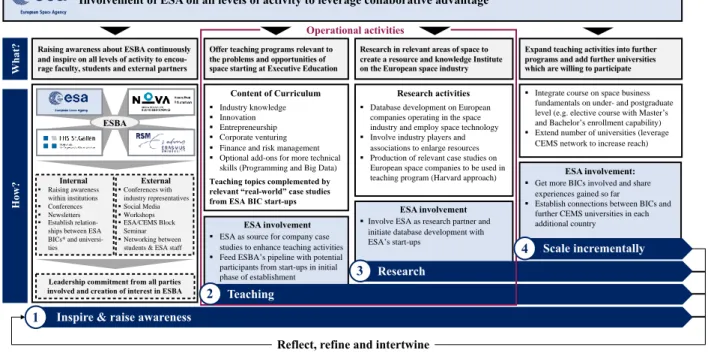

4.4 A conceptual framework on the establishment of ESBA

Another aim of this thesis, besides assessing the academy’s potential, which was elaborated previously, was to develop a framework on how ESBA could be established effectively. In its essence, the proposed framework, which is based on the insights from the interviews, illustrates a

Results and discussion 22

four-step process: 1) Inspire and raise awareness, 2) teaching, 3) research and 4) incremental scaling. Involving ESA as key partner along all four steps was considered important by all interviewees to leverage the collaborative advantage of the academy and to increase the relevance of both teaching and research activities. The success of ESBA will partially depend on incremental growth. Furthermore, ESBA’s leadership is recommended to run the academy as a joint venture between the founding universities and ESA which will preserve sufficient flexibility to adapt to non-foreseeable circumstances which may arise as the academy matures. At the same time, it will provide a foundation for effective cooperation between all parties and as this form of alliance guarantees easy access to each partners’ knowledge and resources while costs and risks are shared equally between them. Further, political or legal constraints, which ESBA may encounter in case of a higher commitment cross-border alliance, can more easily be circumvented.

Figure 2: A conceptual framework on the establishment of ESBA (own presentation)

4.5 Limitations and further research

As with most qualitative studies, the results outlined above come along with some limitations. First, the interviewed industry experts were selected based on the author’s perception of their suitability

ESA involvement:

§ Get more BICs involved and share experiences gained so far

§ Establish connections between BICs and further CEMS universities in each additional country

ESA involvement

§ ESA as source for company case studies to enhance teaching activities § Feed ESBA’s pipeline with potential participants from start-ups in initial phase of establishment

Offer teaching programs relevant to the problems and opportunities of space starting at Executive Education

Content of Curriculum

§ Industry knowledge § Innovation § Entrepreneurship § Corporate venturing § Finance and risk management § Optional add-ons for more technical

skills (Programming and Big Data)

Teaching topics complemented by relevant “real-world” case studies from ESA BIC start-ups

Research in relevant areas of space to create a resource and knowledge Institute on the European space industry

Research activities

§ Database development on European companies operating in the space industry and employ space technology § Involve industry players and

associations to enlarge resources § Production of relevant case studies on

European space companies to be used in teaching program (Harvard approach)

Expand teaching activities into further programs and add further universities which are willing to participate

ESA involvement

§ Involve ESA as research partner and initiate database development with ESA’s start-ups

Research

§ Integrate course on space business fundamentals on under- and postgraduate level (e.g. elective course with Master’s and Bachelor’s enrollment capability) § Extend number of universities (leverage

CEMS network to increase reach)

Inspire & raise awareness

Teaching Scale incrementally 3 2 4 1

Involvement of ESA on all levels of activity to leverage collaborative advantage

Reflect, refine and intertwine

Raising awareness about ESBA continuously and inspire on all levels of activity to encou-rage faculty, students and external partners

ESBA External § Conferences with industry representatives § Social Media § Workshops § ESA/CEMS Block Seminar § Networking between

students & ESA staff

Leadership commitment from all parties involved and creation of interest in ESBA

Internal § Raising awareness within institutions § Conferences § Newsletters § Establish

relation-ships between ESA BICs* and universi-ties W ha t? H ow ?

* BIC = Business Incubation Centre

Conclusion 23

to answer the questions under investigation and can therefore be criticized for selection bias. Second, even though the results revealed that executives and professionals from non-space firms are among the most promising target groups, it remains unclear whether ESBA’s educational program will find acceptance among them. Therefore, the level of interest in the academy from the perspective of non-space firms has yet to be examined. Further research should also focus on the identification of growth segments in the industry that may be attracted to ESBA’s educational program. Even though the venture capital landscape is not as far developed for space start-ups in Europe as in the U.S., it may be fruitful to include the more critical view of space-dedicated VC funds into the research of ESBA to better map out growth segments of the industry.

5 Conclusion

Building on a total of six interviews with representatives from ESBA’s founding universities and space industry experts, this thesis aims to develop a deeper understanding of the academy’s potential in the areas of space business education and research and proposes a concept on how to establish the academy. The economic impact of space-related downstream activities is expanding on a global scale and reaches industries where a connection with space is hardly imaginable. Even though the interviewees did not all agree on which educational segment should be prioritized, the results suggest that business education in the space industry will be relevant for all of them. The results further suggest that once the program is firmly established and running on executive education level, it should be expanded into Master’s and perhaps even Bachelor’s programs. The results also reveal that there may not be sufficient content for an entire degree on space business and demand may be lacking due to the fact that students will fear that the specialized degree will limit them in their career opportunities. Therefore, the most suitable format for Master’s and Bachelor’s students could be an introductory class on the fundamentals of space primarily targeting Master’s students with Bachelor’s enrolment capability as suggested in chapter 4.1.1 by

Conclusion 24

interviewee F. ESBA should also address the development of skills on space data utilization as a more technically oriented teaching component as these skills were identified as a shortcoming in many ESA start-ups. With respect to the research component, ESBA identified a critical gap that is worth dedicating resources to. While there is a good understanding of the technology offer across Europe, more light must be shed on the downstream scope of application which means identifying those companies which employ space technology and data. Having this information at hand will help to accurately represent the actual economic value that is created from initial space investments and in return attract further investment in future. Another focus should be set on building a strong network consisting of alumni and stakeholders from the space industry to foster the transfer of knowledge and to create an international platform for people involved in space-related activities. ESBA’s relevance and success will largely depend on its capabilities to create a networking platform that is mutually beneficial for the academy and existing networks such as CEMS and ESA’s Business Incubation Centre Network. Finally, ESBA is addressing a gap in education and research that is considered important not only by the interviewees: As part of Portugal’s 2030 research, innovation and growth strategy published by Fundação para Ciência e a Tecnologia (2018), a key strategic axis is to “continue to build national capacity and skills, through scientific research, innovation and education and scientific culture, allowing the long-term sustainability of infrastructures, services and space applications”. ESBA has the potential to be an important contribution towards achieving this goal and should strive to play an active part in shaping the future of business education and research in Portugal’s space industry and beyond.

References 25

6 References

Alén Space. (2019, October 21). How to Do Business in Space? Retrieved September 13, 2019, from Alén Space: https://alen.space/space-business/#oportunidades

Baarda, B. (2010). Research: This is it. Guidelines for setting up, doing and evaluating

quantitative and qualitative research. Groningen: Noordhoff Uitgervers.

Bockel, J.-M. (2018, November 17). Economic and security committee (ESC): The future of the

space industry: General Report. France: NATO Parliamentary Assembly. Retrieved from

https://www.nato-pa.int/download-file?filename=sites/default/files/2018-12/2018%20-

%20THE%20FUTURE%20OF%20SPACE%20INDUSTRY%20-%20BOCKEL%20REPORT%20-%20173%20ESC%2018%20E%20fin.pdf

Camerota, C. (2016, May 11). Who owns space? Retrieved October 28, 2019, from hbs.edu: https://www.hbs.edu/news/articles/Pages/who-owns-space-weinzierl.aspx

Chaikin, A. (2012, January). Is SpaceX Changing the Rocket Equation? Retrieved September 16, 2019, from Air & Space: https://www.airspacemag.com/space/is-spacex-changing-the-rocket-equation-132285884/?all

Concini, A. d., & Toth, J. (2019). The future of the European space sector: How to leverage

Europe’s technological leadership and boost investments for space ventures.

Luxembourg: European Investment Bank.

Cookson, C. (2014, November 12). ESA is a serious player capable of taking on Nasa. Retrieved September 7, 2019, from The Financial Times: https://www.ft.com/content/34ce9086-6a63-11e4-bfb4-00144feabdc0

ESA (a). (2019, September 23). Technology Transfer Programme. Retrieved September 7, 2019, from esa.int:

http://www.esa.int/Our_Activities/Telecommunications_Integrated_Applications/TTP2/T echnology_Transfer_Process

ESA (b). (2019). 500 new European companies from space. Retrieved December 04, 2019, from http://www.esa.int/Applications/Telecommunications_Integrated_Applications/Technolog y_Transfer/500_new_European_companies_from_space

Etzkowitz, H. (2014). The second academic revolution: The rise of the entrepreneurial university and impetuses to firm foundation. In T. J. Allen, & R. P. O'Shea, Building Technology

Transfer within Research Universities: An Entrepreneurial Approach (pp. 12-32).

Cambridge: Cambridge University Press.

European Patent Office. (2019). Patents and space technologies. Retrieved December 06, 2019, from https://www.epo.org/news-issues/technology/space/space-satellite.html

Fundação para Ciência e a Tecnologia. (2018, March 12). Portugal Space 2030: A research,

innovation and growth strategy for Portugal. Retrieved December 04, 2019, from

https://www.fct.pt/ptspace2030/index.phtml.en

Grecu, V., & Denes, C. (2017). Benefits of entrepreneurship education and training for engineering students. MATEC Web of Conferences.

Harvard Business School. (2019). Economics of Space: Space Research at Harvard Business

School. Retrieved October 7, 2019, from hbs.harvard.edu:

https://economicsofspace.hbs.harvard.edu

International Space University. (2019). What is ISU? Retrieved October 7, 2019, from isunet.edu: http://www.isunet.edu/blog/what-is-isu/85

References 26

Lee, S., & Osteryoung, J. S. (2004). A Comparison of Critical Success Factors for Effective Operations of University Business Incubators in the United States and Korea. Journal of

Small Business Management, 418-426.

MIT Sloan School of Management. (2017, March 1). MIT New Space Age Conference to explore

the emerging space economy. Retrieved October 7, 2019, from mitsloan.mit.edu:

https://mitsloan.mit.edu/press/mit-new-space-age-conference-to-explore-emerging-space-economy

Morgan Stanley. (2019, July 2). Space: Investing in the final frontier. Retrieved September 19, 2019, from morganstanley.com: https://www.morganstanley.com/ideas/investing-in-space OECD. (2011). The space economy at a glance 2011. Directorate for Science, Technology and

Industry.

OECD. (2019, October 10). The Space Economy in Figures How Space Contributes to the Global

Economy. Retrieved October 3 2019, from OECD-iLibrary:

https://www.oecd- ilibrary.org/sites/c5996201-en/1/2/1/index.html?itemId=/content/publication/c5996201-en&mimeType=text/html&_csp_=ffe5a6bbc1382ae4f0ead9dd2da73ff4&itemIGO=oecd& itemContentType=book

Sheetz, M. (2018, June 22). Morgan Stanley sees ‘a pattern forming’ of the space industry

developing like self-driving cars. Retrieved November 12, 2019, from CNBC.com:

https://www.cnbc.com/2018/06/22/morgan-stanley-space-investment-pattern-forming-like-autonomous.html

SIA. (2019, October 15). 22nd state of the satellite industry report. Retrieved October 17, 2019, from SIA.org: https://www.sia.org/wp-content/uploads/2019/05/2019-SSIR-2-Page-20190507.pdf

Space Angels. (2019, October 22). Space Investment Quarterly Q3 2019. Retrieved October 15 2019, from Space Angels: https://www.spaceangels.com/post/space-investment-quarterly-q4-2018

Strada, G. M., & Sasanelli, N. (2018). Growing the Space Economy: The Downstream Segment

as a Driver. Retrieved November 19, 2019, from

http://www.piar.it/report09today/Strada2018.pdf

Toulouse Business School. (2019). Space Business & Applications. Retrieved October 7, 2019, from tbs-education.fr:

https://www.tbs-education.fr/en/programs/mba- programs/aerospace-mba/what-tbs-aerospace-mba/strong-specialized-tracks/space-business-applications

Wakimoto, T. (2018, January 22). How to reduce US space expenses through competitive and

cooperative approaches. Retrieved September 28, 2019, from The Space Review:

http://www.thespacereview.com/article/3412/1

Weinzierl, M. (2018). Space, the Final Economic Frontier. Journal of Economic Perspectives,

Volume 32, 173–192.

Williams, A. (2017, March 17). Space — the final frontier for investors. Retrieved September 25, 2019, from The Financial Times: https://www.ft.com/content/05f24014-07e1-11e7-97d1-5e720a26771b

Wylie, I. (2017, February 20). MBAs in space: rocket science absorbs business school thinking. Retrieved September 9, 2019, from The Financial Times:

Appendix I

Appendix

Appendix 1: Cumulative equity investments in space from 2009 to present

(source: Space Angels, 2019, p. 4)

Appendix 2: Number of countries with a registered satellite in orbit from 1957-2018

Appendix II

Appendix 3: The development of the global space economy from 2015-2040 (in $t)

Appendix III

Appendix 4: Space sector value chain divided into upstream and downstream segments

Appendix IV

Appendix 5: Number of scientific publications in space literature, per economic region

(source: OECD, 2019)

Appendix 6: Most relevant institutes with focus on space business research and education

(source: own presentation with information from the institutes)

Institution Location Description

Economics of Space: Space Research at Harvard Business School (Lead by Professor Matthew C. Weinzierl) Boston, USA

Mission: “to understand, contribute to, and shape the development of the commercial space economy.” “Harvard Business School is investing in research on this dynamic sector. In particular, members of the faculty will be producing a series of case studies on important questions and actors in space to be used in both MBA and Executive Education classes.”

(Harvard Business School, 2019)

MIT Sloan School of Management:

Astropreneurship and Space Industry Club (ASIC)

Cambridge,

USA “The aim of the MIT Astropreneurship and Space Industry Club is to create a platform that will advance growth of the private space industry sector by promoting entrepreneurship and providing the connection between “new space” organizations, academia, funding, and the talent pools of MIT. The club is driven by people who share these two passions: space and entrepreneurship.”

(MIT Sloan School of Management, 2017)

International Space University (ISU) Programs include: § Master of Space Studies § Two-month Space Studies Program Strasbourg,

France “The International Space University develops the future leaders of the world space community by providing interdisciplinary educational programs to students and space professionals in an international, intercultural environment.

ISU also serves as a neutral international forum for the exchange of knowledge and ideas on challenging issues related to space and space applications.

ISU programs impart critical skills essential to future space initiatives in the public and private sectors while they:

Appendix V § Five-week Southern Hemisphere Program § Executive Space Course § Inspire enthusiasm

§ Promote international understanding and cooperation § Foster an interactive global network of students,

teachers and alumni

§ Encourage the innovative development of space for

peaceful purposes: to improve life on Earth and advance humanity into space.”

(International Space University, 2019)

Toulouse Business School: Specialized MBA Track in Space Business and Applications Toulouse,

France “This Specialized Track aims at providing knowledge, tools and techniques allowing participants to leverage the changes in space business as well as to participate in Main Space business.”

“This specialized track offers challenging opportunities to enhance participants’ managerial skills towards the space sector. It gives a specialization to MBA level facilitating experienced executives to take over business responsibilities in embracing the scope of Main Space and New Space business.

Content:

• Fundamentals of space business and applications • Global history of space

• Strategic and economic review of space markets • New Space business

• Innovation strategy in space sector: the case of Space X and CubeSats

• Emergence of a space markets and analysis of threat for incumbents

• Space applications and downstream services • Main space business

• Partnering in Space: Challenges and opportunities • Defence and acquisition: application to space

• Presentation of international turnkey contracts for telecommunication satellites or Business plan and financing

• Space funding • Company visit