THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)See more information at WWW.NOVASBE.PT Page 1/32

M

M

M

A

A

A

S

S

S

T

T

T

E

E

E

R

R

R

S

S

S

I

I

I

N

N

N

F

F

F

I

I

I

N

N

N

A

A

A

N

N

N

C

C

C

E

E

E

E

E

E

Q

Q

Q

U

U

U

I

I

I

T

T

T

Y

Y

Y

R

R

R

E

E

E

S

S

S

E

E

E

A

A

A

R

R

R

C

C

C

H

H

H

The sovereign debt crisis exposed Spanish Bank’s weaknesses, currently being hit across the board. While the Cajas fragilities in terms of solvency have lead them into a restructuring process, banks are struggling to manage mounting funding costs and sluggish economic conditions.

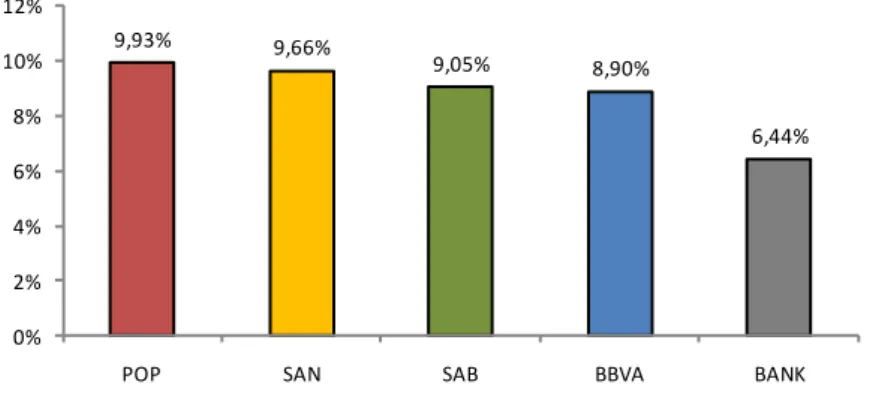

The cost hurdles brought upon banks by the sovereign crisis swerved them away from wholesale debt markets towards deposits, triggering a deposit-luring war. The main drawing was that this has lead to higher funding costs, plummeting customer spreads and margin erosion. POP, one of the most active deposit-capturing banks, has seen its profits drastically reduced over the past few years.

On the asset-side, the economic downturn lead to huge asset-quality issues, especially after the construction bubble burst, with NPL ratio for the sector being found at around 6% and an astonishing 12% regarding the construction sector. POP due to its construction exposure has been one the most heavily hit banks in the sector, which has driven its provisioning efforts upwards and therefore considerable hindering its profits even further.

All in all, we conclude that we are definitely facing some structural changes in the banking sector, were profits are due to be consistently found at diminished levels due to increased funding costs and enhanced regulatory requirements. Despite all this our

recommendation is a hold with a 4.19€ price target.

B

ANCO

P

OPULAR

C

OMPANY

R

EPORT

S

PANISH

B

ANKS

06

J

UNE2011

S

TUDENT

:

D

UARTE

L

IMA

duarte.lima87@gmail.com

Profit turns south

As the sovereign crisis drags on

…

Recommendation: HOLD

Vs Previous Recommendation HOLD

Price Target FY11: 4.19 €

Vs Previous Price Target 4.82 €

Price (as of 6-Jun-11) 3.99 €

Reuters: POP.MC, Bloomberg: POP.SL

52-week range (€) 3.51-5.35

Market Cap (€bn) 5.53

Outstanding Shares (m) 1,390

Other (…)

Source: Analyst estimates

Source: Bloomberg

(€ million) 2010 2011E 2012E

Total Assets 130,140 129,694 127,553

Profit of the Year 590 529 616

ROA 0.45% 0.41% 0.48%

ROE 7.07% 6.28% 6.87%

LTD 121% 118% 113%

NPL Ratio 5.27% 5.82% 6.12%

Coverage Ratio 40.43% 43.00% 47.50%

Tier 1 9.67% 10.00% 11.00%

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 2/32

Table of Contents

Company Overview………..…3

Company Description………..……..3

Commercial Banking………3

Asset Management………..4

Insurance………...4

Institutional and Markets Activity………...5

Shareholder Structure………5

Macroeconomic Overview……….…….7

Spanish Banking Sector……….8

Asset Side………9

Loans and Receivables………...9

Construction Sector……...……….10

Deleveraging………..……….13

Credit Quality………..14

Financial Assets……….17

Liability Side………..18

Funding and Deposits………...18

Solvency………23

Income Statement………24

DuPont Expansion……….24

NetInterestIncome…………...……….25

Credit Impairment………26

NetFees and Commissions………...27

Operational Costs………...………27

Valuation………...………28

Scenarios………..28

Base Scenario………28

Optimistic Scenario………28

Pessimistic Scenario……….…29

Relative Valuation………29

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 3/32

Company overview

Company description

Banco Popular (“POP” hereafter) is the fifth largest Spanish Credit Institution and third largest bank in terms of asset base, focusing chiefly on retail banking. By 2010YE, it had Total Assets of €130,140 million and a Net Interest Income (NII)

of €2,452 million. POP presently has operations running in Spain, Portugal and the USA. Most of the business is conducted in Spain with Portugal accounting for merely 6.8% of the Group’s NII and 8.6% of its Assets, with the remaining being accounted for by Spanish operations. In Spain, the bank has 1,972 branches alongside 12,513 employees, while in Portugal the figures are 1,439 and 237, respectively. Operations in the USA, run through Total Bank since it was acquired by POP in 2007 are still at an embryonic stage with 15 branches, a headcount of 399 and $2 million in assets. Specifically, POP’s operations are split into 4 business areas: Commercial Banking, Asset Management, Insurance and Institutional and Markets

Commercial Banking

POP’s activities are heavily centered around its commercial business activity, while all other units consequently end up being rather peripheral. The bank provides financial services for both households and corporations, with a strong emphasis on SMEs. By the end of 2010 the bank served 6,812,676 customers. Prospects for the sector are gloomy. With the Spanish economy stagnated, credit conceded has also come to a halt after a strong period of growth. On the other hand the sovereign debt crisis has brought along funding hurdles, with funding costs hitting all time-highs. All these factors have been placing downward pressure on Commercial Banking’s Net Income, which recorded by 2010YE a 20.7% drop YoY.

In Spain, Commercial Banking is conducted through Banco Popular, a hardcore commercial retail bank alongside three other banks: Popular Banca Privada, dedicated to private banking, bancopopular-e, focusing on internet banking and a

0 500.000 1.000.000 1.500.000 2.000.000

2005 2006 2007 2008 2009 2010 Table 1. Total Assets Banks

Source: Company Reports

Table 2. Key Financials – Business Area Breakdown

Source: Company Reports

Figure 1.Commercial Banking Profit Before Tax (€ Thousands)

Source: Company Reports

Financial Institution Total Assets €bn Santander 1,217.5

BBVA 552.7

Caja Ahorros Madrid 328.1 La Caixa Barcelona 285.7 Banco Popular 130.1

Segmentation by Business Area

€ Thousands % € Thousands % € Thousands % € Thousands % € Thousands % Net Interest Margin 2,161,627 88.1 10,977 0.4 38,723 1.6 241,004 9.8 2,452,331 100.0 Profit Before Tax 623,594 74.9 115,356 13.9 45,564 5.5 48,036 5.8 832,550 100.0 Total Assets 90,004,543 69.2 618,721 0.5 1,045,242 0.8 38,471,340 29.6 130,139,846 100.0 Shareholders' Funds 6,249,338 75.7 263,368 3.2 80,214 1.0 1,659,399 20.1 8,252,319 100.0

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 4/32 newly-established bank jointly owned (50% stake) with Crédit Mutuel, which has replaced Banco Popular Hipotecario. In Portugal the group is present through Banco Popular Portugal.

The retail activities serve both Corporations and Private Individuals. Banking for Corporations has been gradually achieving enhanced importance in this business area due to both, its organic growth and its strong profitability, currently accounting for 72% of the total assets and 77% of NII and fees, against 65% and 71.2% in 2009. It is noteworthy that SME’s, defined as companies with Income and Assets ranging from €10-100 million, accounted for nearly 45% of the Commercial Banking Income (including Fees & Commissions). Regarding Banking for Private Individuals, its contribution to the Income suffered a decrease in comparison to 2009 due to the shrinkage felt in mortgage loans, in spite of the 258,487 new customers captured.

Asset management

Asset management relates to investment institution management activities, management of individual and collective pension plans and private banking. The recent economic situation has been hindering this unit, with the widespread lack of confidence driving sizeable funds away from asset management and in turn towards safer fixed income securities and deposits as depicted in figure 21. The tough macroeconomic surroundings have been having a marked negative impact on the activities which by 2010YE accounted for 14% of the profit before tax of the group.

The collective investment institution management services are provided by Popular Gestión and Popular Gestión Privada in Spain, and Popular Gestão in Portugal. Individual and collective pensions plan management is offered through Europensiones (51% stake) and Popular Gestión de Activos, wholly-owned by the Group. The private Banking activity is supplied through Popular Banca Privada (60% stake).

Insurance

This unit relates to pension and insurance products comprehending life, non-life and retirement. The Life business is conducted through Eurovida España and Eurovida Portugal. The Non-Life business is managed by Popular Seguros. Despite the economic environment, the performance of this area has been

1

There was a criterion change in the Asset Management Business unit from 2008 to 2009, explaining the upward movement recorded from 2008 to 2009.

0 40.000 80.000 120.000 160.000

2005 2006 2007 2008 2009 2010

Figure 2. Asset Management Profit

Before Tax (€ thousand)

Source: Company Reports

Figure 3. Insurance Profit Before Tax (€ thousands)

Source: Company Reports

0 10.000 20.000 30.000 40.000 50.000

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 5/32

13,6%

9,4%

7,1%

5,5%

100,0%

Sindicatura de Accionistas de BPE Allianz SE

Américo Amorim Unión Europea de Inversiones

Others 13,1%

9,2%

7,0%

5,4%

5,0% 60,3%

Sindicatura de Accionistas de BPE Allianz SE

Américo Amorim Unión Europea de Inversiones

Crédit Mutuel Others

satisfactory with premiums collected rising 21% YoY, and accounting for 5.5% of

Group’s profit before tax of the period.

Institutional and markets activity

The institutional activity is primarily related to issues such as funding, both in wholesale markets and interbank markets, treasury activities related to financial assets portfolios, held-to-maturity, held for trading and available for sale, hedging operations and tangible and intangible asset management.

The fall in the Profit before tax of the unit can be explained by the new circular released by the bank of Spain extending provisions to assets under the institutional and markets area that were previously not covered by provisioning requirements.

Shareholder Structure

By 2010YE POP had 1,472,481 shares outstanding held by 147,943 shareholders. 59.3% of the shares are held by financial investors, with the remaining being held by foreign investors. Also noteworthy is that employees of the group own roughly 1% of common stock. Additionally, the board of directors by 2010YE held 579.2 million shares i.e. 42.12%, compared to 39.81% in 2009. By 2010YE, POP’s largest shareholders were Shareholders’ Sindicate, Allianz, one of the largest insurance groups worldwide based in Germany, Unión Europea de Inversiones, a Spanish-based company specializing in the acquisition, administration and management of movable and immovable properties and goods, Américo de Amorim, the wealthiest Portuguese individual,

Figure 4. Institutional Profit Before Tax

(€ Thousands)

Source: Company Reports

Figure 5. Banco Popular Shareholder Structure 2010 and 2009 Source: Company Reports

0 20.000 40.000 60.000 80.000 100.000 120.000

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 6/32 and Crédit Mutuel Group, a French mutual bank resultant from the acquisition of CIC in 1998 by Crédit Mutuel.

Following the establishment of the joint venture with Crédit Mutuel, in Nov-10, POP undertook a capital increase of €4.2 million translated in the issuance of 41,258,539 new shares, which stood for roughly 3% of the bank’s capital to be acquired by Crédit Mutuel. Additionally Crédit acquired an additional 2% out of POP’s treasury stock, becoming one of the largest shareholders of the group, holding a 5% stake. This had an impact in both the total number of shares and

voting rights, and drove to the appointment of Crédit Mutuél’s Michel Lucas as a

director at the board meeting held on December the 15th 2010. Following to the capital increase, POP also issued €500 million in necessarily convertible bonds maturing in 2013.

POP’s shares are listed on the four Spanish Stock Exchanges as well as in the Lisbon stock exchange. Particularly POP’s shares are quoted on the IBEX-35 portraying a market cap of €5,530 million corresponding to a roughly 1.56% weight in the IBEX-35. POP is listed on the IBEX-35 alongside other 4 Spanish banks - Santander, BBVA, Bankinter and Sabadell (“SAN”, “BBVA”, “BANK” and

“SAB” hereafter). The Banking System has a 31.5% weight in the IBEX 35. Regarding Stock prices and returns, since Jan-09 after the onset of the crisis, POP is one of the banks that has been coping poorly with the aftermath of the crisis, with its share price dropping 33% from 6.06€ in Jan-09 to 4.07€ in Mar-11. Only Sabadell managed to perform worse, with its price going down 37% over the same period. Unsurprisingly, the most diversified banks, with wider international exposure, Santander and BBVA were the ones dealing better with the slump with Santander recording a 24% increase in its share price and BBVA a 4%. Two of the main issues explaining this plunge were the dramatic increase in funding costs experienced (recall that for a period wholesale markets were in fact closed at times), which was offset in POP’s case by an effort to capture deposits as an alternative source of funding shrinking margins and placing downward pressure on the Net Interest Income, which we will discuss at length

later on. Additionally POP’s exposure to the construction sector, growing NPLs ratios and poor coverage ratios have been attaching a large degree of uncertainty to the banks future which markets have firmly been punishing. All these issues will be dealt with thoroughly later on.

0% 40% 80% 120% 160% 200%

Jan-09 May-09 Sep-09 Jan-10 May-10 Sep-10 Jan-11 May-11

POP SM Equity SAN SM Equity BBVA SM Equity BKT SM Equity SAB SM Equity

Figure 6. Market Performance Banks

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 7/32

Macroeconomic Overview

Europe, particularly its peripheral economies have not been cooping adequately with the aftermath of the subprime crisis. Particularly, in Spain the huge efforts expended in public spending and investment drove public deficits over the roof to a peak of 11% in 2009, and are now boomeranging in form of a sovereign debt crisis through climbing risk premiums required by holders of sovereign debt, increasing the likelihood of a double dip. Particularly, Greece, Ireland and Portugal more recently, have already been incorporated into IMF-European Union joint bail-out schemes. International Markets have now turned their attention towards the Spanish Economy, as many reckon it to be the next country in need of rescue. Particularly in March 2010 Moody downgraded Spain’s credit rating one notch from to Aa2 with a negative outlook as it considers its future dim growth prospects backdrop too scant for the financial situation to improve noticeably, while at the same time there are concerns that the Spanish Government will in fact be able to improve its finances, despite measures made public last September that included a 7.7% cut in Public Spending and a Public Sector wage cut of 5%. On April 28th S&P followed the same path and downgraded its credit rating from AA+ to AA over the same concerns. The CDS, cost of insuring Spanish debt has been escalating, repeatedly reaching all-time highs, despite showing some improvement since the Portuguese bailout. The confidence crisis is so profound, with the business confidence index showing negative values since Dec-08, that not even news about a public deficit cut to 9.1% in 2010 were able to perk markets up. One reason for such a lack of reaction may be the fact that the reduction altogether lacks clarity, as Spain is a decentralized economy where the autonomous regions have control over their own finances which account for over 50% of public spending.

Notwithstanding, the Spanish GDP seems to be showing some signs of stabilization having actually grown 0.6% QoQ in 4th of 2010, which albeit slight, is still positive, after breaking a 7 quarter consecutive recessionary period in Sep-10. The growth rate in unemployment also shows some signs of stability and is currently situated near 20.6%, having only increased 0.6% since Jun-10, contrasting to the 5% increase experienced over 2010. It is worth mentioning that even though the unemployment rate is extremely high, it should be placed into context, as Spain is the most elastic Eurozone economy, historically recording among the highest unemployment rates in the Europe (around 10%). Still, the Spanish crisis has some particular features that ought not to be overlooked. Due

-6% -4% -2% 0% 2% 4% 6% -32% -24% -16% -8% 0% 8% 16%

0% 4% 8% 12% 16% 20% 24%

Figure 7.SpanishGovernment Deficit

Source: Bloomberg

Figure 8. Business Confidence Index Source: Bank of Spain

Figure 9. Spanish GDP growth

Source: Bank of Spain

Figure 10. Spanish Unemployment Rate

Source: Bank of Spain -4%

-2% 0% 2% 4% 6% 8% 10% 12%

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 8/32 to the high growth experienced prior to the subprime crisis it is suffering from an overwhelming exposure to the construction and real-estate sector, which is not likely to fade overnight and that added to all other factors does not result in a very positive stance in terms of growth perspectives, despite the IMF forecasting a dim recovery, announcing an expected GDP growth of 0.6% for 2011, 1.6% for 2012 and 1.8% for 2013. According to the IMF, unemployment is also to stabilize, foretelling unemployment rates of 19.4%, 18.2% and 17.1% for 2011, 2012 and 2013 respectively.

Finally, let us stress the downside risk that Spain may be entering a two tailed vicious cycle, because if public spending was increased to help the economy re-taking off, the budget deficit would be readjusting through future growth. Yet, with slim future growth perspectives and a debt crisis on hands the outcome surely does not look sparkly.

Spanish Banking Sector

Specifically regarding the Spanish Banking Sector, after the subprime crisis, and by the Sovereign debt crisis, it has been undergoing structural changes. The sector accounts for €3.863 trillion in total assets, of which €2,358 trillion i.e. 61% correspond to the 5 largest banks, while the 25 largest banks account for 84% of the market in terms of assets-base. Consequently, one can claim that it is a somehow fragmented market. Table 3 illustrates loan market share for the 5 largest Spanish banks (excluding Savings Banks), with Santander having the largest share at 12% followed by BBVA with 10%. Popular comes in third holding a 5% share. Nevertheless, much of the fragmentation is due to the fact that the Spanish Financial System is virtually split in half between Banks and Savings Banks (“Cajas” hereafter), as Figure 11 portrays. As we will discuss ahead, if the two types of institutions face most of the same issues brought along by the two Financial Crisis, i.e. Credit Sluggishness, Funding hurdles and Deteriorating Asset Quality, Cajas, which account for nearly half of the sector, feature on top of that a huge solvency issue, which due to the specific nature of these intuitions is leading a comprehensive restructuring of the sector.

Specifically, the Cajas “half” of the sector has historically been even more fragmented than Bank’s “half” of the sector, to a certain extent due to the local profile much of these Cajas carried. Throughout the past decade, Cajas accrued a series of limitations, which came to light once the financial crisis hit the Spanish Financial System, namely, the excess capacity of the sector, (in light of the

Table 3. Market Share in Loans

Figure 11. Market share by type of Financial Institution

Source: Bank of Spain

Source: Company Reports and Bank of Spain Institution Market Share (%)

Santander 12%

BBVA 10%

Popular 5%

Sabadell 4%

Bankinter 2%

45,7% 45,6%

8,6%

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 9/32 forecasted evolution of the sector) and the obstacles to raise capital in a way other than retained earnings.

The Spanish Government decided to go for a thorough restructuring of the sector, and to that end the FROB - Fund for Orderly Restructuring of the Banking Sector was created in 2009, whose primary goal is to conduct and oversee integration processes between institutions and recapitalization plans. The restructuring of the sector has been aggressive, and from the 45 Cajas in Jan-10, Spain currently has 15. According to the Bank of Spain it is estimated that the

Capital shortfall in Cajas amounts to €14,000 million. To settle the situation, Cajas are to present their recapitalization plans, and while to do so some will ask for FROB capital, others are to undergo capital increases through private sector. Despite banks not being the main target of these plans, there is a lot of speculation surrounding the successfulness of the Cajas recapitalization plans, due to their importance to the future of sector (and even the Spanish Economy in what regards a possible IMF bailout).

Asset Side

Loans & Receivables

During the growth period experienced prior to the crisis, banks enlarged their loan books dramatically, with the highly cyclical construction and real estate sectors playing a huge role in this increase, which naturally lead to huge leaps in both corporate and household indebtedness. Particularly, Figure 12 shows that from Dec-04 to Dec-08 the Spanish loan book nearly doubles. In the aftermath of the subprime crisis which has been taking a heavy toll at the Spanish Economy due to the growth and employment the construction and real estate sector was generating prior to the burst, and emphasized with setting off of the sovereign crisis, the Spanish Loan Book’s expansion as come to a halt. Feeble macroeconomic indicators, with unemployment at historically high levels and slim GDP forecasts have driven household and corporate confidence to bottoming levels. Moreover, on top of the lower credit demand, the sovereign crisis, translated into lack and enhanced cost of funding, which together with the deteriorating credit quality of borrowers, has lead banks to follow a much tighter lending profile. Particularly as depicted in Figure 132, in order to offset lower quality borrowers and higher funding costs banks have been trying transfer these to consumers by re-pricing their loans books. Particularly, the picture shows that

2

From 2010 onwards we were unable to obtain data on BBVA’s loan book spreads regarding its Spanish Operation

Figure 12. Banking Sector Loan Volumes (€ bn)

Source: Bank of Spain

Figure 13. Loan Book Spreads

Source: Company Reports and Bloomberg 0,00% 1,00% 2,00% 3,00% 4,00% 5,00% M a r-07 Ju n -07 S e p -07 De c -07 M a r-08 Ju n -08 S e p -08 De c 0 8 M a r-09 Ju n -09 S e p -09 De c -09 M a r-10 Ju n -10 S e p -10 De c -10 Ja n -11

Santander Sabadell Bankinter Popular BBVA

-2% 0% 2% 4% 6% 8% 0 400 800 1.200 1.600 2.000

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 10/32 loan book spreads against the 12 month Euribor for the 5 largest Spanish Banks have increased considerably from Mar-07 to Mar-11.

Noteworthy that in spite of the difficult situation both in credit supply and credit demand, the decrease in loan books is not as pronounced as one would expect, which we lay on two factors: i) Level of household loans has not undergone a sharp decrease as they are longer-term loans; ii) Credit extension profile many institutions have been following in order to avoid/shape NPL’s and writeoffs. Concerning POP, as one can gather through figure 15, its loan book followed an identical trend to the sector’s, going from €51,500 million in 2004 to €98,213 million in 2010. Taking a more thorough look at POP’s loan book breakdown by 2010YE, one can witness that 71% of loans conceded were directed towards corporations while the remaining towards Individuals, as shown in Figure 15. Particularly, due to its large emphasis towards corporate loans, namely SMEs, in comparison to other banks (as we will discuss more thoroughly later on) the

bank’s exposure to longer-term housing loans is diminished leading to a lower maturity/duration of its loan book. In fact, credit granted for house purchase represents around 35.9% of total loans for the sector, while it represents only 15.34% of POP’s loan book.

Regarding loan book spreads, has shown in figure 13 POP has been very successful in managing its spreads and passing along to the customer the increased cost of funding and deteriorating credit quality in comparison to its peers. This is mainly due to two reasons: Firstly its loan book accounts for a heavier weight of corporate loans which are much more profitable than home purchasing mortgage loans and, thus naturally incorporate higher spreads. Secondly, as the maturity of these loans is much shorter, they allow for a more flexible and faster re-pricing. Specifically, out of POP’s €98,213m loan book by 2010YE, €38,141m were conceded during 2010, obviously leading to a faster re-pricing.

Construction Sector

The evolution in the construction sector is of the utmost importance to the Spanish Economy, both from Macroeconomic perspective, as well as from financial perspective, with the sector making up a large chunk of bank’s loan books. Hence, due to the specific weight of the sector in banks loan books we feel it is crucial to undertake a deeper analysis of the sector. After roughly a decade of marked growth and mounting prices, in which construction became the main booster of the Spanish growth during that period the sector is currently Individuals

28,7%

Corporations 28.1% SMEs

43.2% Source: Company Reports

51.844 66.323

77.328

86.843 90.148 97.363 98.213

2004 2005 2006 2007 2008 2009 2010

Figure 14. POP’s LoanVolumes (€ m)

Source: Company Reports

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 11/32 undergoing a lengthy adjustment period undergoing successive quarters of decline.

By 2010, the construction sector represented 14.4% of the Spanish GDP and 8.2% of total employment. Having reached its peak over 2007, the construction took a long-lasting plunge thereafter, declining 5% in 2008, 11% in 2009 and an additional 15% in 2010. The growth of the sector throughout these years much of it was financed through bank loans, with the sector gaining an increasingly heavier weight in banks’ loan portfolios, reaching a maximum of 17.5% of loans conceded. Obviously, the sudden slowdown of the economy much of it attributed to construction bubble burst has been leading to a decline of their weight in loans outstanding, standing at 11.6% in 2010YE, as depicted in figure 17. The sudden halt has left the sector with a heavy burden in terms of NPLs perhaps the major hurdle the Spanish financial system is to overcome, which will be dealt with later on. In fact the fall in loans to the construction sector would be much larger, were it not for the credit extension profile many banks have been following in order to mold NPL ratios and Write-offs.

Particularly, regarding POP, bank’s loans to construction and property development amounted to over 18% of the loans outstanding, contrasting to the 11.6% average for the sector. Hence due to the huge exposure POP has to the construction sector one can gather the importance of the future prospects of the sector for POP. In order to evaluate the sector and its prospects, we split it into three segments: civil engineering, residential sector, which is directly linked to the housing market and the non-residential sector.

The civil construction sector is highly dependent on works adjudicated by the government and hence on its public infrastructure investments budget. In 2009

€39.1bn were awarded. Still, on account of the tough situation in Spanish public finances, and in order to achieve a 3% government deficit by 2013, the budget for public infrastructure contemplates €14.6bn, a 33% decrease compared to the

€21.2bn in 2010 and €22.1bn in 2009. Hence, one can easily gather that the outlook for civil engineering is bleak since public investment, the main driver of the segment will definitely not undergo any increases over the forthcoming years. The non-residential sector, as it encompasses buildings for distinct sectors of activity, from industrial to commercial, educational, etc. is highly cyclical in nature, and depends a lot upon prospects for the economy, confidence and in credit availability. The sector has been undergoing decline, particularly a 6% in 2008 and 14% in 2009. Taking into account the current state Spanish economy,

0,0 200,0 400,0 600,0 800,0 1000,0 1200,0 De c -00 M a y -01 O c t-01 M a r -02 A u g -02 Ja n -03 Ju n -03 N o v -03 A p r -04 S e p -04 F e b -05 Ju l-05 De c -05 M a y -06 O c t-06 M a r -07 A u g -07 Ja n -08 Ju n -08 N o v -08 A p r -09 S e p -09 F e b -10 Ju l-10 De c -10 Services Construction Industry Agriculture

Source: Bank of Spain

Source: Bank of Spain

Figure 16. Employment in Construction

6% 7% 8% 9% 10% 11% 12% 13% 14% M a r-00 O u t-00 M a i-01 D e z -01 Ju l-02 F e v -03 S e t-03 A b r-04 N o v -04 Ju n -05 Ja n -06 A g o -06 M a r-07 O u t-07 M a i-08 D e z -08 Ju l-09 F e v -10 S e t-10

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 12/32 leading to a situation of spare capacity and the lack of credit availability which will be dealt with later on, the engagement on new non-residential construction does not look promising, and we foresee a persistence in the downward trend the sector has been experiencing, though less accentuated due to some (slight) upturn the expected recovery of the Spanish Economy.

Regarding the housing sector, it is more sensitive for banks than the two aforementioned sectors, as banks not only engage in financing the construction of new houses, but are involved as well in financing home purchases. Particularly

15.34% of POP’s loan book is credit for house purchase, and additionally, on the

construction side, out of the €17.8bn it has loaned to construction industry, €5.69bn are dedicated to house construction. If on one side demand is weak and decreasing due to the economic situation where lower disposable income, sky-scraping unemployment levels, tighter credit availability, interest rates’ evolution, and thrashed consumer confidence, at the same time there is still a considerable oversupply and thus residential construction is following a downward trend as well. The main drawing is that housing supply/demand dynamics will only be recouped when the absorption of oversupply is completed which we do not see taking place before only 2013 i.e. slim demand, with still a lot of completed houses to absorb leads to weakness in new building construction. Another factor worthwhile to consider is that, as it is still widely regarded that prices will experience further drops, as they have been droping for twelve consecutive quarters as portrayed in Figure 19, house purchasing decisions may be postponed. It is estimated by the BoS that the oversupply of houses amount to1.5 million units (which was increased in 2009). Still despite the sector showing negative trends on the supply and demand side, the implications of these are different. Home purchase mortgage loans, are long term loans (over 15 years) and less profitable. The fact is that despite not having many new mortgage loans, the new loans conceded are likely to replace the existing ones about to mature and thus the impact on the size of the loan book is likely to be moderated, as shown in Figure 18. The main impact is that the re-pricing of the mortgage loan book is lengthier as spreads are fixed at the time the loan is contracted and are valid until the maturity of the loan, and as no new loans are being captured, the re-pricing becomes even lengthier. Figure 20 displays how spreads have been evolving in what regards home purchasing mortgage loans, and one can observe that despite higher funding costs, mortgage loans do not exhibit considerable spread leaps. The importance is that at a time where Spanish bank’s funding costs have risen, re-pricing must be done as quickly as possible in order to avoid -5% -1% 3% 7% 11% 15% 0 200 400 600 800

Dec-04 Nov-05 Nov-06 Nov-07 Nov-08 Nov-09 Nov-10 Total Mortgage Loans Growth Rate

-5% -1% 3% 7% 11% 15% 1.600 1.800 2.000 2.200

Dec-05 Nov-06 Nov-07 Nov-08 Nov-09 Nov-10 Housing Prices sqm Growth Rate

Figure 18. Mortgage Loans(€ bn)

Source: Spanish Mortgage Association

Source: Spanish Mortgage Association and Bank of Spain Source: Spanish Mortgage Association

Figure 19. Housing Prices sqm (€)

0% 1% 2% 3% 4% 5% 6% 7% D e c -03 D e c -05 D e c -07 Ju n -08 D e z -08 Ju n -09 D e z -09 Ju n -10 D e z -10 F e b -11

Mortgage Interest Rates Spread to 12 Month Euribor

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 13/32 further profitability decrease. The fact is that with the halt of the housing market

will leave Popular with much of its circa €15bn loans to housing with unchanged

spreads driving profitability down. In terms of construction the problem is different; first and foremost the size of its loan book will not see noticeable additions in terms of the construction industry due to the evolution predicted. More importantly, the existing loans for construction that have been finished but not been acquired are leading to huge NPL ratios as we will analyze later on.

Loan Book Prospects - Deleveraging Process

We foresee a plunge in loan book values for the forthcoming years due to the deleveraging process we expect the Spanish Economy to undergo. As previously mentioned loans conceded by banks were an extremely important driver of the growth the Spanish economy underwent over the past 10 years, with Spanish Private Sector debt to GDP currently standing at 230%, having experienced an extremely fast leveraging process, escalating from 140% in 2000 as shown in figure 21. Comparing to other mature European economies, Spain stands as the 2nd most leveraged mature European Economy, standing right behind Portugal, with Germany appearing at the bottom of the list with its Private Sector Debt to GDP standing at circa 100%.

Taking into account Spanish Economic situation, we believe this level of private indebtedness is unbearable and we predict that over the forthcoming years, the Spanish economy will endure a deleveraging process until it reached a sustainable equilibrium level, which we predict to be around 175%, similar to the levels recorded between 2004. There have been prior examples of the deleveraging processes. Northern European Economies, Sweden, Finland and Norway during the 1990s undertook severe deleveraging processes. These processes usually took approximately 5-6 years.

Noteworthy, that the deleveraging process can be achieved through a reduction in the amount of debt outstanding, as well as through (Nominal) GDP growth. The problem is that in the Spanish case, with low current and forecasted levels of GDP growth and inflation, most of the deleveraging will go through reducing the amount of debt outstanding i.e. reducing loan books. Hence, using as a

Table 4. Spanish Deleveraging Process

Private Debt Nominal GDP Target Debt to GDP % Change in Private Debt

2011 2,396 1,085 221% -1.9%

2012 2,342 1,119 209% -2.3%

2013 2,288 1,157 198% -2.3%

Source: Bank of Spain, IMF and Barclays Capital

Figure 21. Private Debt to GDP

120% 140% 160% 180% 200% 220% 240%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 14/32 benchmark the Scandinavian deleveraging, aiming at reaching a 175% Private Debt to GDP we assume a rather simplistic 5 year straight line deleveraging process, with Private Debt to GDP dropping by 14% yearly. As portrayed in the table, and taking into account GDP growth for Spanish Economy (according to IMF forecasts), we see a 2% decrease in loan books in 2011 and 2.3% in 2012 and 2013 respectively. Obviously, due to their higher rotation, we believe corporate loans will drive the adjustment (we already witness some contraction in corporate loan books by sector of activity in figure 17, namely in construction). Table 4 presents the results of the deleveraging process considered.

Facing a deleveraging process we feel that only healthier banks will be able to keep their loan books flat. Banks whose funding and solvency situation is stable will naturally be one step ahead of the others. On account of the aforementioned reasons, we see POP being able to keep its loan book flat and hence attaining some market share gains. The main reason is that, as we will discuss more thoroughly further ahead, over the past couple of years we have seen POP increasingly focused on capturing deposits and reducing its commercial gap, which puts it rather at ease (as it reduced its dependence on debt markets) even though it faces rather high funding costs on wholesale debt markets. On top of that, in what regards solvency POP is the soundest bank in the system. At any rate, we see POP trying to defend the reduction in LTD ratio it was able to grasp during the last two years instead of being focused on increasing its loan book in an adverse environment, albeit its comfortable equity situation. Thus, we forecast a flat loan book for POP for 2011, 2012 and 2013. What´s more, we reckon large Spanish Banks in general being able to keep the size of their loan books or at least not suffer substantial reductions and we foresee the troubled Cajas as the ones hit the hardest with the deleveraging process over the forthcoming years, suffering loan book and market share shrinkage.

Credit Quality

Regarding Credit Quality, its evolution is critical for the sector. The extraordinary growth experienced in the construction sector through spectacular expansions in securitization (namely asset-backed securities and mortgage-backed securities) and looser credit standards drove to a situation of over-exposure from the banking sector towards construction and property development.

In fact, the burst of the subprime bubble saw NPLs starting a long-lasting escalation, driven by huge credit deterioration, particularly in the construction sector. Figure 22 shows the climb experienced by NPLs since Jan-08. 0%

1% 2% 3% 4% 5% 6% 7%

0 20 40 60 80 100 120

Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Total NPLs NPL Ratio

Source: Bank of Spain

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 15/32 Specifically, the NPL ratio for the sector rose from a meager 1% in Jan-08 to 6.2% recorded last February, which means that there were €18,400 million in NPLs then, comparing to €112,300 million now. If we take a more detailed look at NPL ratios by sector of activity, we can observe that these ratios tend to be higher in the most cyclical sectors. While Agriculture and Industry show NPL ratios of 4.3% and 4.4%, respectively, cyclical sectors such as Services and Construction portray ratios of 8.4% and 12.1%. Amongst the two, construction poses as the biggest problem, after the bubble burst NPLs in construction soared due to the persistent contraction in the sector. Hence, we can witness that despite much of the dramatic NPL situation in Spain being due to the economic slowdown in the Spanish economy, its enhanced magnitude is certainly attributed to the situation the construction sector is going through. Still, and even though NPL growth has been recording increasingly smaller growth rates, we still see the sector having to deal with forthcoming (though smaller) increases in the level of NPL, even though the amount of NPLs will always depend on the amount of loan write-offs. Our perspective is accounted for by 3 main reasons. First and foremost, despite the stabilization and dim recovery which started in Jun-10 and is expected to go on in Spanish economy (albeit the hurdles the sovereign debt crisis may post), the evolution Construction Sector which records an 12.1% NPL ratio and makes up 11.5% of loans conceded towards productive activities by the sector will be crucial, and taking into consideration our previous analysis of the sector, with a lot of oversupply yet to be absorbed we don’t see NPL ratio undergoing any marked declines, even though we see a slowdown in net additions to NPLs, which has already been observed in 2010, comparing to 2009. What’s more, NPL ratio evolution also tends to be closely tied to the evolution of unemployment rates as depicted Figure 24, and since forecasts of evolution in unemployment do not point towards a sizeable decline in the near future we do not expect it to exert significant downward pressure on NPLs. Finally, adding up to the aforementioned reason, since the onset of the crisis interest rates have been found at historically low levels, and recently the ECB seems to be bringing rates up again, which obviously may have a negative rate on default rates, especially in residential mortgages, which as we will see have been posting small NPLs ratio up until now). Hence instead of falling, it is more likely that we see default rates persisting.

Regarding POP, Credit quality is most certainly the biggest challenge the bank has to overcome. If we take a more careful glance at the sector, looking at the major banks, we can see POP is the most troubled bank in what regards NPLs, 0%

4% 8% 12% 16%

Dec-07 Jun-08 Dec-08 Jun-09 Dec-09 Jun-10 Dec-10 Agriculture Industry Construction Services

Figure 25. NPL ratio Banks

Source: Company Reports

Figure 26. Coverage Ratio Banks

Source: Company Reports

Figure 23. NPL ratio by activity

0% 2% 4% 6%

Banco Popular Banco Sabadell Banco Bankinter Banco BBVA Banco Santander

30% 40% 50% 60% 70% 80% 90% 100% 110%

Banco Popular Banco Sabadell Banco Bankinter Banco BBVA Banco Santander

Figure 24. Unemployment vs NPLs

0% 5% 10% 15% 20% 25%

Jan-08 Jun-08 Dez-08 Jun-09 Dez-09 Jun-10 Dez-10 Unemployment Rate NPL Ratio

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 16/32 recording the highest ratio amongst the largest banks, at 5.4%, only to be overtaken by Sabadell in Mar-11, at 5.5%. BBVA Spain shows an NPL rate of 5.0%, having managed to stabilize it since 2009YE, while Santander’s stands at 4.6%. Bankinter shows an above average asset quality, chiefly due to its diminished exposure to construction and real estate, with its NPL ratio being found at 3%.

Notwithstanding, POPs problems are not circled to its 5.4% NPL ratio. Additionally, POP portrays the smallest coverage amongst top banks, at 41.7% in Mar-11, which combined with one of the largest NPL ratios in the sector points out to additional provisioning being required above its peers, placing enhanced pressure on profits.

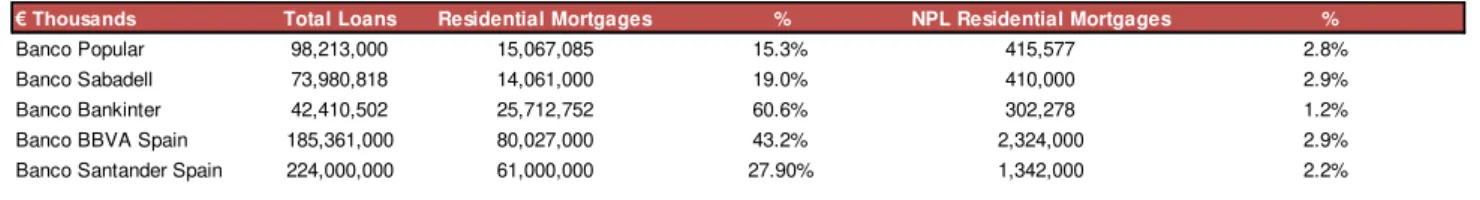

Plus, if POP’s exposure to the corporate sector (including construction sector) puts it ahead of other banks in terms of speed of re-pricing and spread profitability in comparison to other banks, much more exposed to less profitable house purchasing mortgage loans, which is important due to increased funding costs, on the other hand, it also makes it a much more cyclical bank as its exposure to sectors whose performance is directly linked to the performance of the economy is higher, and hence it is riskier in terms of macroeconomic exposure. Particularly, as portrayed in Table 4, of the 5 largest Spanish Banks, POP has the lowest exposure to residential housing market, making up for only 15.3% of its loan book, contrasting with Bankinter’s 60.3% exposure.

It is also noteworthy that, as expected residential mortgages show small NPL ratios, namely 2.8% regarding POP. Contrastingly, it is worth to mention that the increased exposure to residential mortgages explain why Bankinter has the lowest NPL ratio among the top 5 banks.

€ Thousands Total Loans Construction Construction in % NPL Construction NPL ratio Construction

Banco Popular 98,213,000 17,840,158 18.2% 2,586,804 14.5%

Banco Sabadell 73,980,818 10,170,000 13.7% 1,544,000 15.2%

Banco Bankinter 42,410,502 2,451,811 5.8% 291,275 11.9%

Banco BBVA Spain 185,361,000 16,608,000 9.0% 3,543,000 21.3% Banco Santander Spain 224,000,000 27,000,000 12.1% 4,590,000 17.0% Source: Company Reports

Table 6. Construction and Real Estate Loans

Source: Company Reports

Table 5. House purchasing loans Banks

€ Thousands Total Loans Residential Mortgages % NPL Residential Mortgages %

Banco Popular 98,213,000 15,067,085 15.3% 415,577 2.8%

Banco Sabadell 73,980,818 14,061,000 19.0% 410,000 2.9%

Banco Bankinter 42,410,502 25,712,752 60.6% 302,278 1.2%

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 17/32

POP has €17,840 million in loans to construction and property development, representing 18.16% of its loan book. The bank holds €2,587 million NPLs in construction, which is translated into 14.50% NPL ratio in construction i.e. above the 12.1% average. That is, on top of bearing an above-average exposure to construction that represents 11.7% of total loans to the sector, its NPL ratio regarding the sector is above average. POP’s NPLs in construction make up for

42% of the bank’s total NPLs. Furthermore, the bank also disclosed that it has

additional €2,642 million substandard loans in construction (defined by the BoS as loans showing some weakness, associated to the fact they are to a specific troubled group or sector, or if these weaknesses are apparent in certain

operations, even if these operations don’t classify individually for classification as

doubtful or write-off). To get a glimpse of how cyclical the bank is regarding the sector and macroeconomic evolution, in the worst case scenario, in which all substandard loans would turn into Non-performing, the bank would reach an astonishing 30% NPL ratio in construction and property development.

To sum up with, POP’s future performance is much more tied to how the

economy and the construction perform, turning POP into an even-more cyclical bank compared to its peers, and due to the picking up NPLs are forecasted to experience, at least until construction and real estate sectors bottom out, which we predict will happen in 2012, the bank will need to raise additional provisioning in order to increase its coverage, and its margins will be hurt.

Final notes regarding collateral, most of the loans granted to the construction sector are a mortgage-backed loans, which means that the value of the loan is covered by the value of the collateral. Specifically, out of the €17,840 million POP

has to the construction sector €13,400 million are offset by the value of the

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 18/32

65,6% 34,4%

Available for Sale Held to Maturity

Financial Assets

Regarding POP’s financial assets, including the available for sale (other portfolios are residual so we incorporate them into the available for sale portfolio) and held-to-maturity portfolios, the increase these have been experienced, from € 5.9 bn in 2007 to 18.3 bn in 2010 is mainly credited to acquisitions of Debt Securities, chiefly Spanish Public Debt. Since most of the portfolios are composed by fixed income securities (over 96% as depicted in figure 29), most of the income these generate is either linked to a rate plus a given spread or attached to a coupon. Consequently we see their evolution in terms of income as being related the Euribor rate progress, rather than on how the macroeconomic backdrop plays out (obviously, any increases in income from the trading portfolio will be offset certain extent by supplementary expenses in marketable debt securities). Furthermore, except for the HTM portfolio, all other financial assets are marked-to-market, which means that depending on how rates progress, we should have either gains or impairments on these assets, with the extent of the gain/loss linked to the duration of the portfolios. Specifically, the held-to-maturity portfolio has a 4.05 duration, which becomes irrelevant in seeing that it is not marked-to-market. The potential gains/losses are generated through the other portfolios. Nevertheless, all securities in the trading portfolio whose time to maturity goes beyond 3 years have been hedged through Interest Rate Swaps, and hence their duration is merely 0.5 years, and therefore we do not see any relevant gains/losses taking place owed to interest rate wobbles. Taking a deeper look at the securities

maturing, we witness that over 2011 we have € 3.7bn expiring from the Available for Sale portfolio and € 311 expiring from the HTM portfolio. In spite of the funding constraints we predict will persist, we consider the that the financial assets maturing over 2011 will be “rolled over” since as we will discuss further on, all refinancing need in terms of debt securities in 2011 have already been carried out during the 1st quarter of the year. Hence, we see POP maintain its investing in the acquisition public debt securities, as nowadays they make up for an attractive investment on account of their yields. Hence, we see the Available for Sale and HTM totaling only a slightly smaller amount by 2011YE. As for 2012 and 2013, we forecast a gradual shriveling in the portfolios for two main reasons: 1) Considering a scenario of slender recovery one expects yields on Spanish Debt Securites to drop, becoming a less attractive investment onwards, 2) POP has a huge amount of marketable debt securities (€ 8bn) maturing in 2012 which will naturally thwart its investment muscle through enhanced funding needs, and, in line with the diminished dependence on wholesale markets strategy the bank Spanish Debt

45,4%

Foreign Public Debt 7,2% Debt Issued

by Credit Institutions

24,2% Other Debt Securities; 19,9%

Equity Instruments

3,3%

33%

22%

44%

7%

3%

89%

Up to 1 year 1-5 years Over 5 years Figure 28. Maturity breakdown HTM and Avaliable for Sale portfolios

Source: Company reports

Source: Company reports

Figure 29. Composition of the HTM and Avaliable for Sale portfolios

Figure 30. Financial Assets by Allocation

Source: Company reports 5.885.676 6.443.543

15.067.456

18.266.410

2007 2008 2009 2010

Figure 27. POP’s Financial Assets (€

thousands)

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 19/32 has been and intends to keep following, we disregard the possibility of re-enlarging that same dependence in 2013. Notwithstanding the shrinkage will not

be pronounced, as over the next 5 year POP only has € 2.6 bn in financial assets maturing (altogether), less than in 2011 alone. All in all, we see POP’s financial

assets amounting to €17.2 in 2011, €15.6 in 2012 and €15.4 in 2013.

Liability Side

Funding and Deposits

We consider funding alongside the deteriorating asset quality to be the main hurdles the Spanish banking sector has to overcome in order to get back on track (obviously for Cajas the situation is distinct and solvency will most definitely play a major role). As we have previously gathered, the growth the Spanish Economy underwent prior to the subprime crisis, entailed a huge leap in loan volumes, with banks enlarging their loan books spectacularly. The question is the way in which banks financed loans granted over this period. Excluding shareholders’ funds, banks can finance themselves in three main ways: i) Money Market, ii) Deposits and iii) Wholesale Debt Markets.

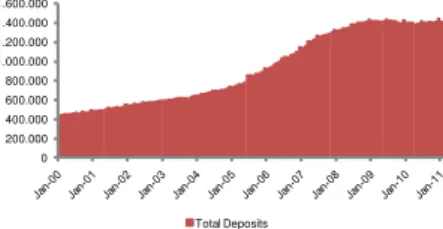

In order for us to get a glimpse of the big picture, the issue was that the growth loan books experienced was so pronounced, that Spanish National Savings, translated into deposits, were unable to finance new loans banks were to concede. Hence banks resorted heavily to other funding vehicles, particularly, wholesale debt markets, increasing their dependence on capital markets exponentially. Particularly Figure 31 shows how the commercial gap portrayed by the loans to deposits ratio evolved during the expansionary period from 2000 until 2007. The banking system went from a 111% ratio to a 135% ratio. The ratio is itself a measure of liquidity as it shows how dependent (or not) banks are on Interbank and Wholesale debt markets. 35% of loans in excess of deposits represent funding need of over €446,000 million. The figure shows the degree to which Spanish banks captured funds in wholesale debt markets to finance the new loans granted. Specifically, from 2000 to 2007 there was a 731% increase in debt securities issue throughout the sector.

Specifically, the evolution of POP’s funding gap and dependence on wholesale

debt markets until 2007 is portrayed in Figure 33. POP’s loans to deposits ratio went from 127% in 2002 to 226% in September 2007, which stands for a funding

gap of €47,716 million. Naturally, as the figure illustrates, the funding gap was

being financed by a great deal through debt securities, that at the time amounted 120% 140% 160% 180% 200% 220% 240% 0 5.000 10.000 15.000 20.000 25.000 30.000 35.000 40.000 45.000 50.000

POP Debt Securities POP Loans to Deposits

Figure 31. LTD ratio Sector

Source: Bank of Spain

Source: Company Reports 100% 105% 110% 115% 120% 125% 130% 135% 140%

Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07

Loans to Deposits

0 50.000 100.000 150.000 200.000 250.000 300.000 350.000 400.000 450.000 500.000 Ja n -00 Ju l-00 Ja n -01 Ju l-01 Ja n -02 Ju l-02 Ja n -03 Ju l-03 Ja n -04 Ju l-04 Ja n -05 Ju l-05 Ja n -06 Ju l-06 Ja n -07 Ju l-07 Debt Securities

Figure 32. Debt Securities Sector (€ m)

Source: Bank of Spain

Figure 33. POP’s LTD and Debt

BANCO POPULAR COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)PAGE 20/32 to €43,739 million. Thus, we can see how the bank’s liquidity situation was precarious with its loans to deposits ratio standing at an astonishing 226%, well above an already liquidity-wise exposed financial system.

The problem has been that since the onset of the crisis, wholesale markets have had trouble functioning, and never resumed the same level they did before the crisis. The situation grew far worse when the sovereign crisis broke. Particularly, since the Greek debt crisis in Mar-10 a contagion effect has been felt throughout Europe’s peripheral economies, namely those recording the highest budget deficits, and as a result wholesale markets shut down for Spanish triggering yet another liquidity crisis. Banks unable to resort to wholesale markets, and with huge funding gaps used ECB’s extraordinary liquidity measures, which increased their weight in the Spanish Banking System, which has since then been slowly drained out. Notwithstanding, by July 2010 markets reopened and Spanish Institutions have been progressively able to issue debt, albeit at a much higher cost than prior to the crisis.

The contagion of the Greek has already led to bail-out in Ireland and Portugal through upward and downward spirals in sovereign CDSs and Ratings, respectively important to stress how the banking sector’s situation is entangled in governments CDS and ratings and issues and thus the evolution of the Spanish situation in wholesale debt markets will be extremely dependent upon how the sovereign debt crisis plays out.

Thus, with an enormous funding gap and a liquidity crisis in hands, Spanish banks, kept alive through the oxygen pump, the extraordinary liquidity measure (whose date of withdrawal continues to add further uncertainty to the banking sector) have been driven to change their funding mix going back to the origins i.e. reducing their wholesale funding dependence due to the cost and difficulty/inability to issue debt and close in on their funding gaps. Naturally the solution was to start capturing deposits as shown in figure 34. Obviously with banks competing against one another, a deposit war broke out. Specifically, Figures 35 and 36 show the deposit war has lead to banks engaging in negative spreads in order capture some loans,. cutting margins and therefore placing downward pressure on NII. So, all of the sudden, deposits that had been set aside for so long became extremely valuable for banks and the rates offered on them started climbing. Concretely, in a two-year period concerning household deposits the spread plummeted from 0.49% to -1.32%, and regarding corporate deposits, they dropped from 0.62% to -0.20% over the same period, which -1%

0% 1% 2% 3%

POP San BBVA Sab Banki

Figure 35. Household Deposits Rate and Spread

Source: Bank of Spain

Figure 36. Corporate Deposits Rate and Spread

Source: Company Reports and Bloomberg 0 200.000 400.000 600.000 800.000 1.000.000 1.200.000 1.400.000 1.600.000 Total Deposits

Source: Company Reports: Bank of Spain

Figure 34. Deposits for the Sector (€ m)

Figure 37. Deposit spreads vs Euribor 12 months Banks

Source: Bank of Spain -2% -1% 0% 1% 2% 3% 4% 5% De c -03 De c -04 De c -05 De c -06 De c -07 M a r-08 Ju n -08 S e p -08 De z-08 M a r-09 Ju n -09 S e p -09 De z-09 M a r-10 Ju n -10 S e p -10 De z-10 Ja n -11 F e b -11 M a r-11

Household Deposits Rate Spread VS Euribor 12m

-2% -1% 0% 1% 2% 3% 4% 5% De c -03 De c -04 De c -05 De c -06 De c -07 M a r-08 Ju n -08 S e p -08 De z-08 M a r-09 Ju n -09 S e p -09 De z-09 M a r-10 Ju n -10 S e p -10 De z-10 Ja n -11 F e b -11 M a r-11