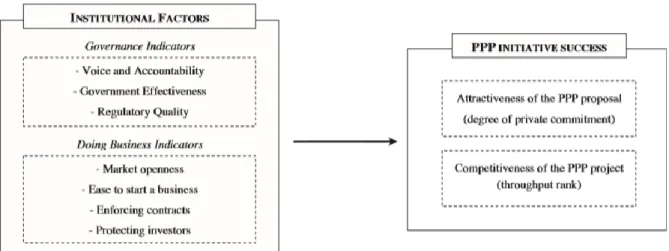

The main aim of the paper is the identification of PPP critical success factors that promote the private sector's involvement in PPP projects in the Russian regions. To determine which PPP critical success factors are most prevalent in the literature and see if they matter in terms of the Russian reality. The main aim of the paper is the identification of PPP critical success factors that promote the private sector's involvement in PPP projects in the Russian regions.

THEORETICAL CONCEPTS OF PPP CRITICAL SUCCESS FACTORS

Universal Critical Success Factors in PPP

One of the Critical Success Factors of widespread PPP discussed in the literature is stakeholder credit that accompanies the successful PPP project from the initiation phase to project completion (Chowdhury, Chen, and Tiong 2015). The compensation value is the value of the real option held by the project company. 2016) address the issue of incentives for private investors' opportunistic behavior in PPP projects.

PPP project’s implementation process and its specific Critical Success Factors

One of the comprehensive explanations of PPP success factors relevant to PPP project phases is the New Institutional Economic Analysis. Investors should also check the pitfalls of the administrative connections between the organizations involved in the project. In conclusion, after an extensive analysis of the universal and specific PPP Critical Success Factors, the most common factors in the literature are identified.

PPP SUCCESS EVALUATION METHODOLOGY

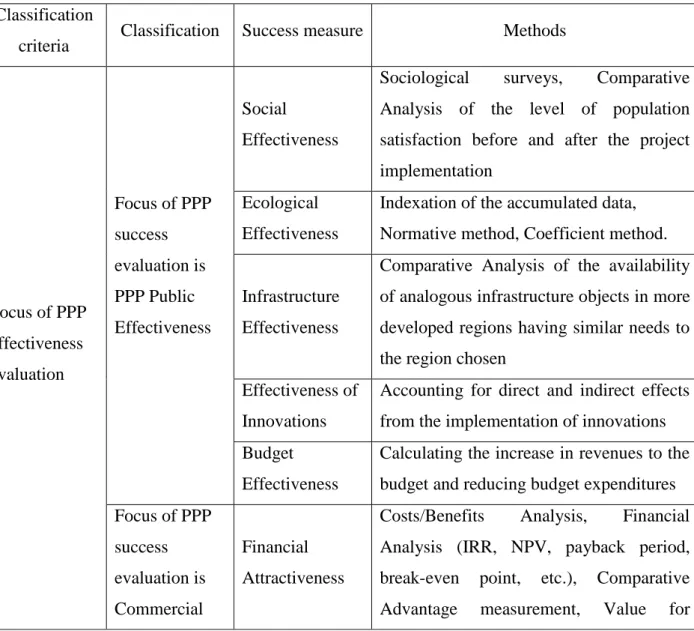

Classification of PPP success evaluation methods

The public partner participating in the economic activity is interested in obtaining social impact from the overall results of the PPP project. Evaluation of these areas can be done through a comparative analysis of the level of satisfaction of the population, before and after the implementation of the project. 26 in the implementation of the project with zero NPV due to the social importance and high public effectiveness of the project.

According to the Russian normative regulation of PPP, the assessment of public effectiveness is interpreted as an assessment of socio-economic impact. Financial effectiveness for the Russian public partner is assessed based on the calculation of Financial Attractiveness and Comparative Advantage. If the project evaluation turns out to be effective for each of these criteria, the next step is to calculate the Comparative Advantage.

Second, the amount of liabilities taken by the public partner in case of the appearance of the PPP project's risk. There are assessment methods from the aspect of the level of PPP development in certain areas. Sociological surveys, Comparative Analysis of the level of population satisfaction before and after the project implementation.

Comparative Analysis of the availability of analogous infrastructure objects in more developed regions with similar needs to the region selected.

PPP assessment methods at the regional level

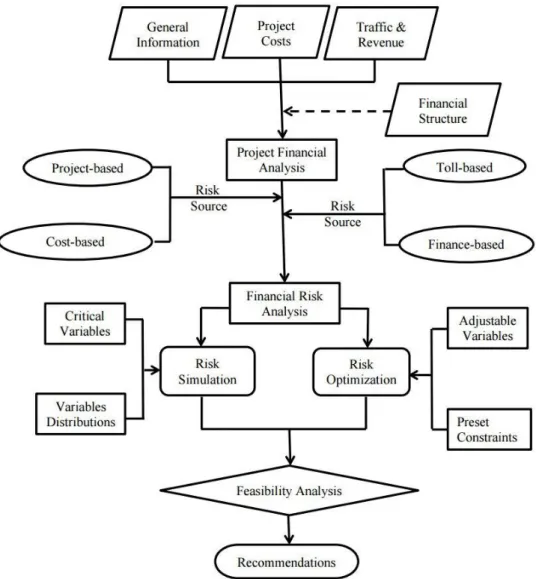

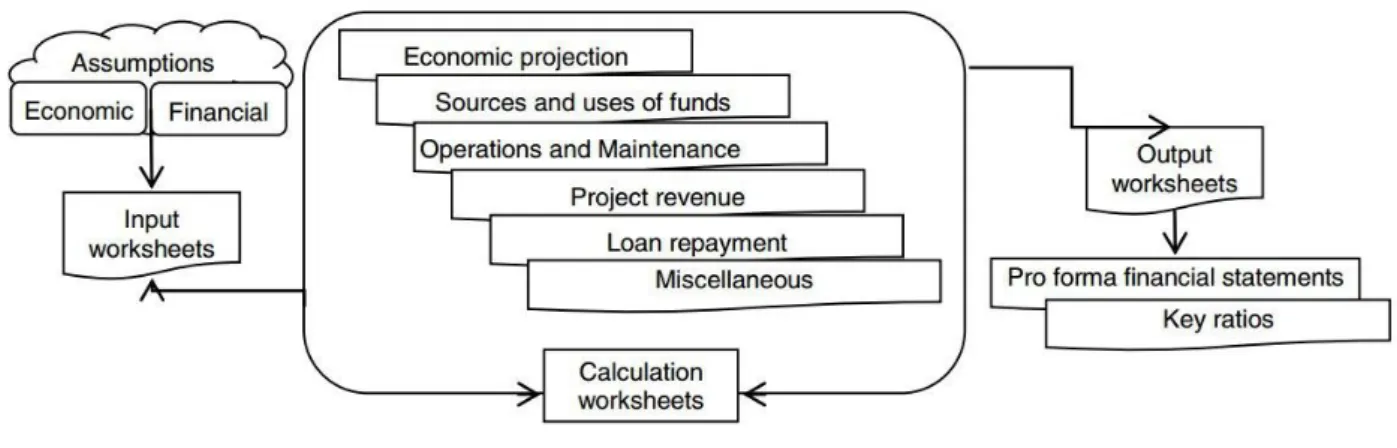

Part of the information is external (eg interest) and cannot be checked by project implementers. Changing the criteria certainly leads to the priority change calculated by the hierarchy method. The weight of the criteria can be changed to be smaller or larger than the previous one.

The Monte Carlo method is a risk simulation tool that makes it possible to propose the probability distributions of these variables. One of the well-known approaches in international and Russian practice is to measure the financial attractiveness of a public-private partnership project by evaluating the generated cash flows (World Bank 2012; OECD 2016, Makarov 2014). PPP development plan and (or) PPP implementation program in the subject of the Russian Federation;.

The attractiveness of investments for the subject of the Russian Federation is based on the assessment of the attractiveness of investments of the regions of Russia by the rating agency Expert RA. The factor has a value, expressed in points, which was exposed based on the assessment of the investment attractiveness of each subject. Basically, these regional techniques are dedicated to the effectiveness of the activities of executive bodies in improving PPPs and developing the investment climate in the regions.

Some of these factors were identified in Chapter 1 in a review of research aimed at identifying such factors.

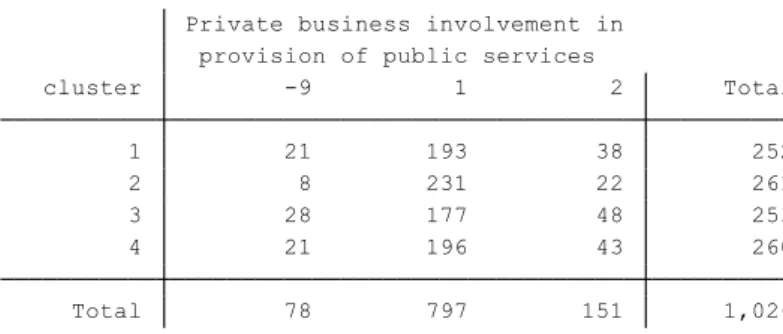

Research methodology

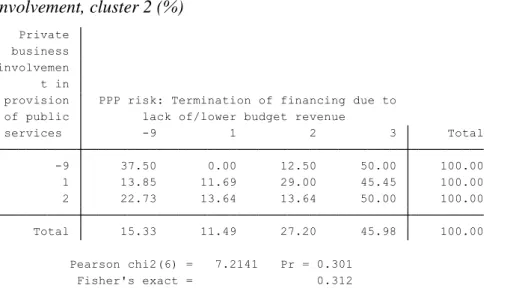

The number -9 means that no answer was given to the question about participation in the public service by the surveyed company. The second cluster consists of 261 respondents, of which 231 are involved in public services. The last, the fourth cluster, has 260 persons, of which 196 persons participate or participate in public services.

The importance of the status of participation in the provision of public services should be determined. A positive answer implies that the respondent company participated or is currently involved in the provision of public services, in other words, has such experience. In order to answer the main research question, it is particularly whether there is a correlation between the investors' attitude towards the level of PPP Critical Success Factors development in the region and their involvement in the provision of public services there.

The initial hypothesis of the research is that investors participating in the provision of public services evaluate the development of critical success factors of a public-private partnership more positively than do non-participating investors. This test calculates the "exact" probability that the data occurs in the studied data set, given that no association exists. Social support" is "PZP risk: people dissatisfied with the provision of public services by private companies", the factor "Project feasibility" is "PZP risk: assessment of transparency and openness of PPP", the factor "Government support" is "PZP risk: Positive changes in regional legislation in the last 2-3 years' (European Bank for Reconstruction and Development 2014a).

IDENTIFICATION OF FACTORS INCREASING BUSINESS INVOLVEMENT IN THE PROVISION OF PUBLIC SERVICES IN THE RUSSIAN REGIONS.

IDENTIFICATION OF FACTORS BOOSTING BUSINESS INVOLVEMENT INTO

Dominant PPP risks in the Russian regions according to investors’ opinion

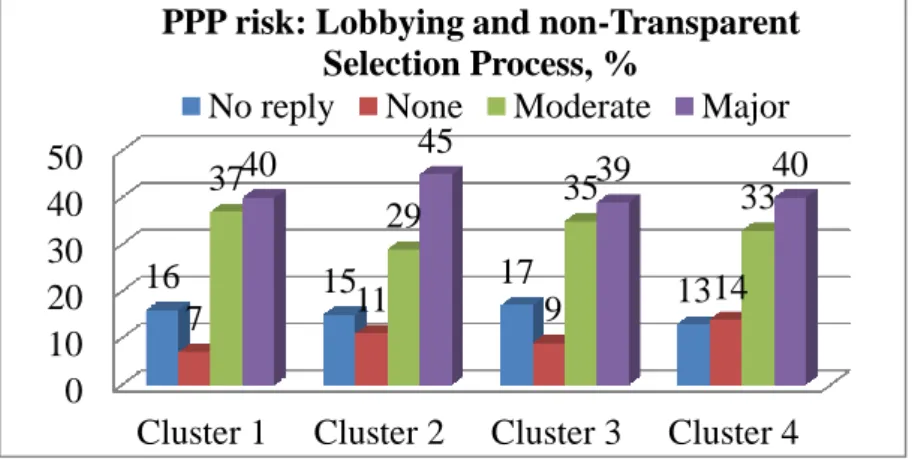

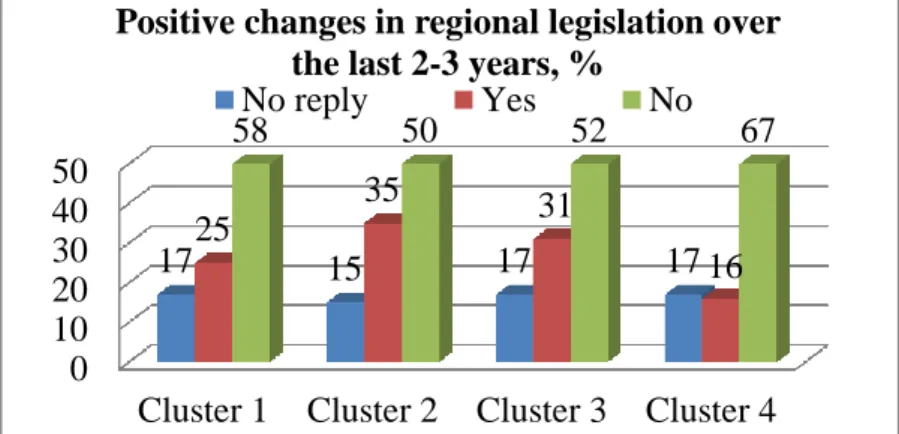

For the rest, the tendency of respondents to change their minds about the transition from a cluster with a higher level of PPP development to lower level clusters, as described in the Lobbying risk study, persists. It can be assumed that when assessing the relationship between firms' involvement in the provision of public services and their risk assessment, the results for financial and lobbying risks will coincide in the same clusters. The fewest proportion of respondents (compared to the other clusters) that are inclined to believe that changes in regional legislation that have a positive impact on the development of PPPs have occurred are in cluster 4.

Moreover, the highest share of respondents who tend to reject positive changes in legislation is also in group 4, to compare with the answers in the other groups. In addition, observing the distribution of responses' proportion within group 4, 67% of the respondents believe that there are no positive changes in the regional legislation regarding PPP development. Basically, this figure 10 goes along with PPP rating which is lower in the regions that form group 4, compared to how it assesses conditions of PPP development in regions that form the other groups.

43 When we look at respondents' perceptions of how society assesses the quality of public services provided by companies, the overall picture is more positive. The proportion of respondents who believe that there is no risk of social dissatisfaction at all is almost two times higher in clusters 2, 3 and 4 than in cluster 1, the cluster most developed by PPS. There is a very low frequency of responses from respondents who rely on absolute openness and transparency of the PPP process of project realization in the regions of Russia.

This shows that, in the respondents' opinion, the level of development of PPP CSFs needs to be improved to meet their expectations.

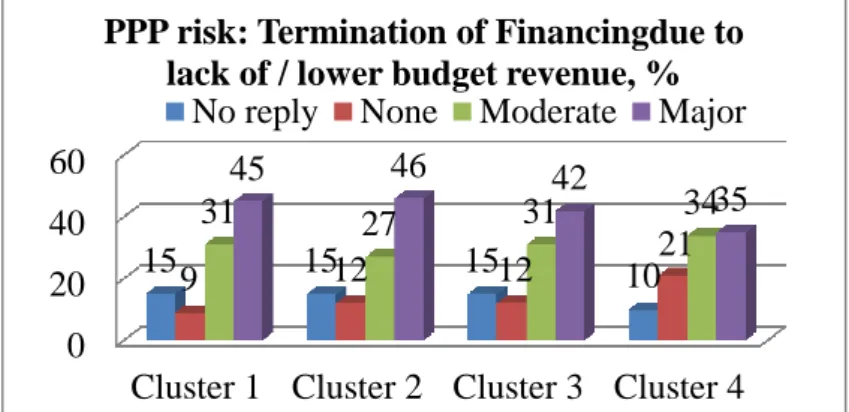

Interconnection between business involvement in provision of public services and how

In cluster 1, there is no statistical relationship between the status of respondents' involvement in the provision of public services and their perception of the risk of funding termination. Of those participating in public service in Cluster 1, 10% believe that the risk of funding termination due to lower/lack of budget revenues does not exist at all, and 45% of respondents consider it high. The analysis of the relationship between estimating the risk of Termination of Financing and involvement in public services in cluster 2 shows a situation similar to that in cluster 1.

Examination of cluster 3 shows the correlation between the level of assessment of the risk of termination of funding and participation in the public service. It is striking that almost half of the participating respondents (45%) consider the risk of termination of financing to be high. About 7% and 8% of the participants and non-participants, respectively, believe that this risk is not represented in their region.

A large proportion of participants assesses this risk as moderate (41%), while a large proportion of non-participants assess the risk as high (45%). When looking at the distribution of risk assessment ratios, almost half of the participants (45%) rate this risk as moderate. In cluster 1, there is a connection between the attitude towards the quality of the entire process of providing public services (the factors that make up the quality are fully described in the research methodology paragraph) and the participation status.

The estimate of the risk as none is up to 3% among participants and 7% among non-participants.

The portrait of the Russian regional investors relatively to their Critical Success Factors’

The success of the project strongly depends on the maturity of managers on critical success factors (Babatunde, Perera and Lei 2016). In the field of PPP, Critical Success Factors are important focus areas for successful realization of PPP projects. The most common PPP Critical Success Factors in the literature are Financial Availability, Social and Government Support, Project Feasibility and Transparent Selection Process.

Key Success Factors of Public-Private Partnerships in Infrastructure Development: A Chinese Perspective.” Journal of Construction Engineering and Management ASCE: 484-495. A Theoretical Review of Critical Success Factors (CSFs) of Community College Entrepreneurship Programs.” International Journal of Sustainable Development and World Policy. A Review of Studies on Key Success Factors for Public-Private Partnership (PPP) Projects from 1990 to 2013.” International Journal of Project Management.

2014a. "The Methodology of the National Assessment of the Investment Climate in Russian Regions." The Agency of Strategic Initiatives. The perception of critical success factors for PPP projects in different stakeholder groups.” Review on Entrepreneurship and Economics. Government-led critical success factors in PPP infrastructure development.” Project and asset management in the built environment.

Identifying the critical success factors for relationship management in PPP projects.” International Journal of Project Management.

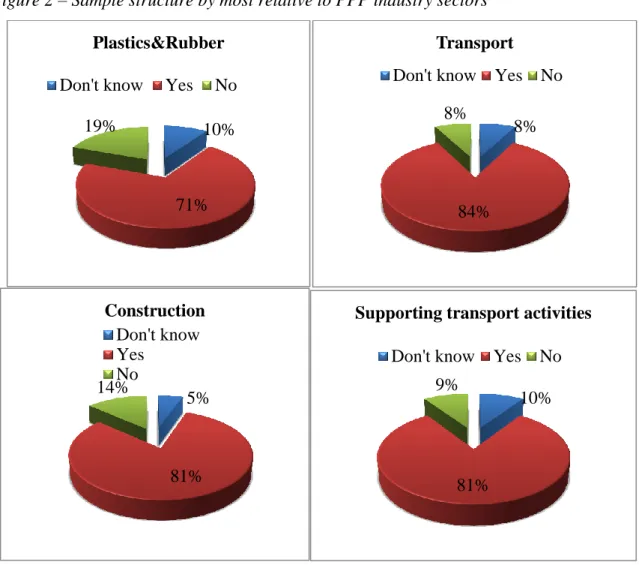

Sample structure by industry sectors

Sample structure by most relative to PPP industry sectors

Sample structure by industry regions