Vol-7, Special Issue3-April, 2016, pp835-846 http://www.bipublication.com Article

view Re

Reviews of the Structural situation in iranaian banking industry

Ayoub Sarafraz, Somayeh Naseramini jelodarlu, Eslam Nazari* and Jalil Ostovar

Department of Business Management, Bilesavar Branch, Islamic Azad University, Bilesavar, Iran

*Author Correspondence, e-mail: Nazari1362mba@gmail.com

ABSTRACT

Today, organizations should use the environmental opportunities to prepare themselves to deal with threats through recognizing the current position and analyzing their own strengths and weaknesses and through relying on the strengths. This important fact is possible through strategic planning. The present study is applied in terms of its aim and is descriptive - survey in terms of its method. The research participants consist of the managers and employees of the Agricultural Bank and research data was collected using a questionnaire. EFE and IFE matrices were used to evaluate inside and outside factors, SWOT matrix were used to determine the appropriate strategy and QSPM matrix was used to prioritize strategies. According to the obtained results, competitive strategy is the appropriate strategy. At the end, the strategies were prioritized based on the QSPM matrix.

Keywords: competitive strategy, matrix of internal and external factors, SWOT, Agriculture Bank

INTRODUCTION

Today's world is the world of the competition of economic institutions to overcome to the market. Banks also with various strategies try to progress in the competition with other financial banks and institutions in national and international arenas through competitive strategy elements in the planning process (Skandari, 2014, P.161). The banking sector is one of the important economic parts of each country that their proper and rational management leads to the proper implementation of monetary policies and increases social well-being.Banks do their activities through physical branches at the community level. Therefore, the mentioned proper and rational management should be considered at the level of banks' branches (JabalAmeli and Rasulinezhad, 2010, P.108). The banking sector in Iran economy can be seen as the bridge between supply and demand of monetary resources; to the extent that any defects in its structure and its performance ineffectiveness lead to disorder in other sectors (Pazhuyan and Shafeei, 2010, P.82). The Iranian

that guarantee their success and survival in changing and complex environment. Strategic planning provides tools for the organizations to pursue the strategy development and implementation in various aspects and manage their own strategic performance (Amini and KhabbazBavil, 2009, P.19). The present study has been done with respect to the necessity of the existence of strategic planning and its implementation in the agricultural bank of Moghan region, in the hope that at the beginning of a little attempt it can provide the necessary position to realize the banking position of the country in the competitive condition.

1Necessity and importance of research

The effective presence in the financial sector has the direct impact on the economic growth and development, and in addition to the fact that the systematic relations between the financial institutions that form financial markets should be consistent, effective and efficient, the internal structure of these institutions should be designed in a way by which it's possible to see an efficiency increase in the performance of these institutions. But due to the lack of extensive capital market in Iran and the dominant banking system in financing businesses, the way of how this system acts have decisive effect; therefore the necessity of planning and adopting new ways of taking advantage of the available resources in the banking system is more important. This strategy is a necessity due to the existent interactions and disorders in today's relations of organizations' business activities and strategic thinking takes place through proper understanding of the market rules and creative responding to that, which is more important in unstable and evolving today's business environment. Because, the organization's effort to achieve to the effective and developed strategies will not be possible without this thinking (Skandari, 2013, P.125 - 158).Today, managers are successful who don't ignore the rapid environmental changes and proceeds with the strategic planning with respect to the organization's strengths and weaknesses and also opportunities and threats. In fact, today's managers must not only predict the future, but also they must build the future based on their

predictions and prepare themselves to accept the future events. With the seriousness of the implementation of the government's economic development plan, and also with the remarkable development of private banks and their share in the market and bank customers in the country the competition field becomes narrow and special decisions such as using strategic planning for the successful presence in the market has been evidently considered as a necessary need. Given the importance of the subject, researchers of this study want to proceed with the status of Agricultural banks, structure in Moghan through understanding the banking industry in the economy of Iran.

2. Literature review

Pazhuyan and Shafaee (2008), in their study entitled survey of the structure in the banking industry of Iran: the experimental usage of U index of Davis" showed that the inequality extension of the distribution of Banks' market share is less than that of new banks and it equals to 0.0874. This industry is still far from the competitive condition and there is a need to adopt policies to intensify competition in this industry. Cheghini and Jalilvand (2013), in their study entitled "strategy development approach in private banks" has introduced and identified an appropriate solution to organization change of Housing Bank (Maskan Bank).Islami and Ali (2002) have done a study, entitled "optimizing the structure of investment activities in Agricultural Bank". The obtained results indicate that allocating more than 6percent of non-provisional financial resources of agriculture bank, farming, and ranch is a part of the Bank's development objectives that leads to the significant reduction in bank's income. Because, these types of production related activities are associated with greater risks. There is a need for governmental aids, to banks of the country to allocate more resources to the agricultural sector.

June 1312. Now, it has 1914 branches and its 1153 branches have proceeded with providing specialized services to agricultural sector in rural and agricultural areas and 761 branches are acting in cities to provides business services and also 36 branches are providing international currency related services (http://www. Poolnews.ir, 2014). In this year, the Agricultural Bank devotes 15percent of its resources to the production chains (Number98 newsletter of Agricultural Bank, 2014, p.3). This action of the Agricultural Bank is in line with the policies of our respectable government to get out of recession and is an important step towards the implementation of stagnant and semi-finished plans (Newsletter, N.96 of agricultural Bank, 2014, P.6). All banks account for 25percent of their resources to the agricultural sector, despite the fact that 90percent of Agricultural Bank's resources are allocated only to the agricultural sector. The rate of interest is 22percent in all banks it has been passed 17percent for Agricultural Bank. This 5percent reduction of interest rate can be effective in the sustainable

development of the agricultural sector. This bank, that has 1900 branches and its 700branches are in the agricultural sector (N.97

Newsletter of Agricultural Bank, 2014, P. 4. Methodology

This study is applied in terms of its aim and it is descriptive-survey in terms of its method. Library and documentary methods, direct observation method and interview with banking experts and preparing a questionnaire in the form of the Delphi method were used to collect research data. Then the researchers set the strengths and weaknesses, opportunities and threat table.Finally, the QSPM matrix is used to prioritize strategies.

5. Introduction Procedure:

Agricultural Bank uses a framework named the comprehensive framework of developing strategy tools and methods that are proper for a variety of organizations in different sizes and help strategist to identify, evaluate and select strategies. This framework has four main stages. Chart1 shows the comprehensive framework to provide strategy:

Determinethe mission And statement of the organization's mission Start stage

The evaluation matrix of external factors. Input stage

The evaluation matrix of internal factors SWOT matrix

Accommodation and

comparison stage Internal and external matrix

Quantitative Strategic Planning Matrix Decision making stage

Source: Ranjbarian et al., 1391

Figure 1: Comprehensive Framework strategy formulate 1.Start stage: the organization's mission

statement is prepared at this stage.

2.Input stage: in this stage all of the needed information and the main factors for

inside and outside the organization has been identified and characterized to provide strategy. This stage involves the evaluation

matrix of internal factors and the evaluation matrix of external factors.

3. Accommodation and comparison stage: at this stage the major internal factors (strengths and weaknesses) andThe major external factors (opportunities and threats) are accommodated by Using tools such as SWOT matrix and internal and external IE matrix to identify strategies that have been in line with the organization's mission and proportionate to internal, external factors.

4. Decision making stage: in this stage: in this stage, the different options of strategies are identified using quantitative strategic planning matrix (QSPM) and then they are evaluated, judged and prioritized in accommodation stage . 5-1. Agricultural Bank's mission statement The mission of a company shows its existence reason and philosophy. Mission statement, states company's identity and existential philosophy in words and is considered as a guideline to provide strategy (Amini and KhabbazBavil, 1388, P.24). The Agricultural Bank's mission statement is providing unparalleled service to any person by the end of 1395. The main values that it thinks about are (Agricultural Bank site, http://www.bki.ir):

Esteem of staff as motivated professional bankers

Using new technologies to provide differentiated services

Strict adherence to Islamic principles and Shariah-based banking system.

Knowledge-driven organizations based on knowledge management

Scientific credibility and expertise in the field of agriculture

Credibility in the international arena. 5-2: input stage

After identifying environmental factors (opportunities and threats) and internal factors (strengths and weaknesses1, IFE and EFE

matrices are used to enter the SWOT matrix (Bashardoost et al., 1390, P.84). A stage it's necessary to try to use the most appropriate necessary information to develop strategies. The inputs of strategy development in thstrategic planning of Agricultural Bank are opportunities, threats, strengths, weaknesses, bank's strategies in the previous periods, strategies or directions of similar banks inside and outside and finally bank's objectives in strategic program. These provide sufficient information to develop SWOT strategies (NezamivandChegini and Jalilvand, 2013, P.52). Figure(1) represent the following steps:

5-2-1: external factors evaluation matrix This matrix tool by which strategies can evaluate environmental, economic, social, political, cultural, legal and technologic factors of market status in a given time period, and it has applied for public, private and governmental organizations. In this matrix, the environmental factors of banks have been identified and evaluated in the form of opportunities and threats in terms of importance. In order to organize external factors in the form of opportunities and threats, a table is used. The steps needed to provide EFE matrix are as follows:1. After identifying external factors, all of the bank's opportunities and threats are recognized, first opportunity and then threats are written.2.In this matrix, each factor is given a

weight score between 0 (for unimportant) and 1 (for very important) according to the expert opinion. The total weights of the entire factor should be equal to1.

3. The existing condition of each factor is determined between1 and 4. Scores are between (4) for very good reaction to (1) for poor reaction. This score indicates to the effectiveness of current strategies in reacting to the aforementioned factors. It should be noted that threats receive (1) and (2) scores and opportunity takes (3) and (4) scores; in this way the score (4) is given to the very strange, (3) to strong, (2) to poor and (1) is given to very poor.

4.The weighted score of each factor is evaluated. The total weighted score show that how the set reacts to the existent and potential factors in the Environment al planning

Int ernal analysis Ext ernal analysis

Weaknesses Opport unit y Threat

St rengt hs

SWOT mat rix Figure 1: SWOT Analysis

external environment. The weighted score 4 shows that the set has an important position among the similar cases. In other words, it represents a response to use opportunities and minimize the effects of threats. The weighted score (1) shows that the weighted strategies of

the set have not been capable to use the opportunities and avoid threats.

The obtained value from the matrix EFE that is (2.47) is less than 2.5. Thus, it represents the overcome of environmental threats to environmental opportunities in bank.

Table 1: Bank external factors evaluation matrix (EFE)

Priority

Score

Rank

Coefficient

External factors (T-O)

Opportunity(o)

3

0.208 4

0.052 Any normalization of Iran's relations with the West

5

0.184 4

0.046 Existence ofSpecialist and inexpensive work force in the market

6

0.156 3

0.052 Rising unemployment (by giving loan for employment can be attracting large

depositors).

1

0.305 5

0.061 The emergence of new technologies in order t accelerate the work

6

0.156 3

0.052 Unmet needofPeoplein the society (in order to coordination with growth acceleration)

4

0.2 4

0.05 Growth of investment in Iran in recent years

7

0.144 4

0.036 Increased interactions with the neighboring country of Iran and The possibility of

increasing branches in these locations

2

0.24 4

0.06 Become a free trade area

8

0.138 3

0.046 The quality of soil for crops

9

0.126 3

0.042 Easy access to the bank branch

Threat(T)

7

0.05 1

0.05 Growth of private banks than state banks

3

0.063 1

0.063 The high ratio of deferred loans

4

0.056 1

0.056 Intensifying competition with private banks

8

0.045 1

0.045 The emergence of banks and financial institutions with advanced facilities and grant

profit by higher rates

7

0.05 1

0.05 Adjacency with private banks in terms of profitability

5

0.053 1

0.053 Having a little share from Market sources

8

0.045 1

0.045 The global economic downturn

6

0.052 1

0.052 Boycott Iranian banks in dealing with some global banks

2

0.08 2

0.04 Bounding Bank by the central bank rules

1

0.12 3

0.0

4

Policy of cheap lending to People on low incomes through banks

2.471 1.00

Total ofExternal factors (T-O)

5-2-2. The internal factors evaluation matrix This matrix is a tool to study internal factors of the organization. In fact, it evaluates strengths and weaknesses of organizational units. The steps needed to provide IFE matrix are as follows:

1.Strengths and weaknesses are determined after identifying internal factors. First the strengths and then the weaknesses are written.

2. In this matrix, each factor gives a weighted score between 0 (for unimportant) to 1(for very important) according to the experts' opinion. The total weights of all of the factors should be equal to (1).

3.The existent status of each factor is determined between1to 4 scores. Scores are between (1) to fundamental weaknesses, (2) to little weakness, (3) to strengths and 4 to very strengths of the given factor. It should be stated

that the weakness takes only (1) and (2) scores and the strength take only (3) and (4) scores; the score 4 is given to very strong, 3 to strong, 2 to weak and 1 to very weak.

Priority Score Rank Coefficient

Internal factors (W-S)

Strengths (S) 4 0.208 4 0.052

1. Service to farmers

5 0.2 4 0.05

2. Government and parliament action in support of affected farmers is significant. 7 0.176 4 0.044

3. The public sector have full government support

6 0.184 4 0.046

4. Dating back Agricultural Bank

9 0.156 3 0.052

5. Pioneering in the payment of banking facilities than other banks

2 0.22 4 0.055

6. Equipped with electronic banking tools

10 0.12 3 0.04

7. Vast geographical coverage

6 0.184 4 0.046

8. Brand Bank

3 0.216 4 0.054

9. Cheap advertising

1 0.248 4 0.062

10.Gaining the trust of people

8 0.172 4 0.043

11.Exclusive 15% of agricultural resources to supply chain management

Weakness (W) 3 0.138 3 0.046

1. The Existence of international sanctions and the obligationBeing a government for governmental banks

2 0.184 4 0.046

2. Lack of optimal use of existing facilities

4 0.126 3 0.042

3. The ineffectiveness of a number of bank branches

9 0.037 1 0.037

4. A breach in the system of online services

8 0.046 1 0.046

5. Lack of awareness about how to use e-banking

6 0.084 2 0.042

6. Failure to use online advertising

2 0.184 4 0.046

7. Adjacency with private banks

7 0.049 1 0.049

8. Not having a clear strategy

5 0.096 2 0.048

9. Lack of attention to customer surveys

1 0.24 4 0.06

10.Government financial policy to expand commercial banking

3.268

1.00

Total ofInternal factors (W-S)

5-2-3: analysis of strategic factors

The results of external and internal factors show that the financial policy of the government to expand commercial banking with 0.25 weighted score is the most important weakness and winning the trust of people with a 0.248 weighted score is the most important strengths. Thus, the advent of technology with the 0.305 weighted score is the most important opportunity and the policy of giving loan with

law interest rate for low income people is the most threat with the 0.12 weighted score. The mean of total weighted scores for external factors is 2.47 and for internal factors is 3.26, these values put the set in the competitive environment. Research finding are identified using external and internal (IE) matrix for banking strategy. As the table 3 shows, banks should use competitive strategies.

5-3. Comparison and accommodation stage After providing strategy through the internal and external matrix, SWOT matrix is used. Assumptions are compared using this matrix and

the appropriate strategies are obtained through comparing these strategies. At the end, the QSPM matrix is used to prioritize strategies of the bank should be considered in the

4

4

2.5 1 1 2.5 Aggressive strategies Conservative strategy it Opportun y Strength Defensive strategies Threats Competitive strategies Weaknes simplementation stage. The involvement of most of the managers, analysts and banking experts are used in the preparation of this report.

5-3-1. The strength-weakness-opportunity-threat(SWOT) matrixStrategic planning models are infinite, but all of

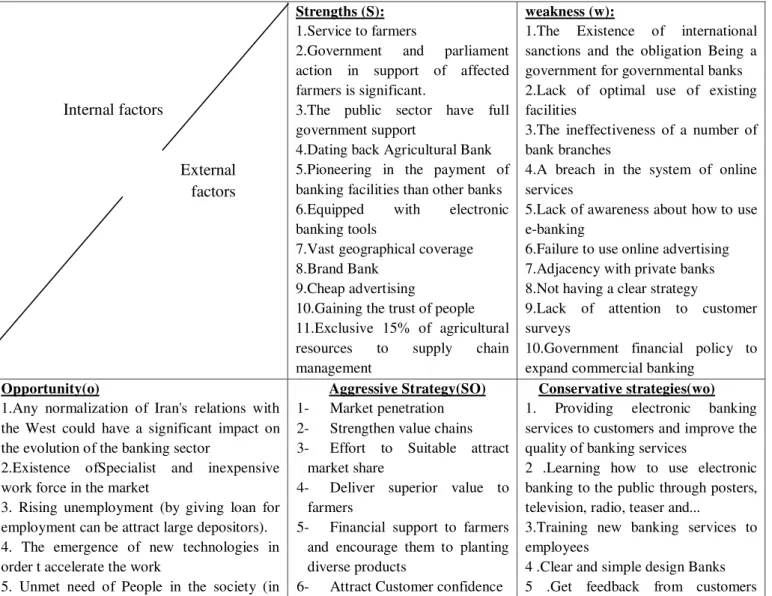

them are inspired from SWOT analyzing model. SWOT method is a systematic thinking to have complete and comprehensive diagnosis of the factors related to a new product, management technology and or planning (Kangas et al., 2004, P.18). Analysis of strengths, weaknesses and opportunities are considered as the wide tools of internal and external environment analysis in order to be successful in supporting and providing a systematic method for strategic decision making situations (Rach, 2007, P.414). After setting the internal and external strategic factors that are bases of providing strategy, SWOT matrix is suggested and is provided to

remove or to reduce weaknesses and threats and to improve strengths of the strategies (Ghazi and Ghadiri, 1390, P.68).

1. Aggressive strategies (SO): Based on Taking advantage of the internal strengths andthe operation of external opportunities

2. Conservative strategies (WO): The operation of opportunities in the external environment to improve internal weaknesses.

3. Competitive strategies (ST): Based on Taking advantage of the most important strengths to eliminate the threat.

Defensive strategies (WT): Based on eliminating weaknesses and threats in order to eliminate vulnerabilities (Ghazi and Qadiri, 1390, p. 6). By considering the above mentioned issues and the views directors of company, strategies for each of the four regions of the SWOT matrixwere selected.

Table 4: SWOT matrix for Bank

weakness (w):

1.The Existence of international sanctions and the obligation Being a government for governmental banks 2.Lack of optimal use of existing facilities

3.The ineffectiveness of a number of bank branches

4.A breach in the system of online services

5.Lack of awareness about how to use e-banking

6.Failure to use online advertising 7.Adjacency with private banks 8.Not having a clear strategy

9.Lack of attention to customer surveys

10.Government financial policy to expand commercial banking

Strengths (S): 1.Service to farmers

2.Government and parliament action in support of affected farmers is significant.

3.The public sector have full government support

4.Dating back Agricultural Bank 5.Pioneering in the payment of banking facilities than other banks 6.Equipped with electronic banking tools

7.Vast geographical coverage 8.Brand Bank

9.Cheap advertising

10.Gaining the trust of people 11.Exclusive 15% of agricultural resources to supply chain management

Conservative strategies(wo) 1. Providing electronic banking services to customers and improve the quality of banking services

2 .Learning how to use electronic banking to the public through posters, television, radio, teaser and ...

3.Training new banking services to employees

4 .Clear and simple design Banks 5 .Get feedback from customers Aggressive Strategy(SO)

1- Market penetration 2- Strengthen value chains 3- Effort to Suitable attract

market share

4- Deliver superior value to farmers

5- Financial support to farmers and encourage them to planting diverse products

6- Attract Customer confidence Opportunity(o)

1.Any normalization of Iran's relations with the West could have a significant impact on the evolution of the banking sector

2.Existence ofSpecialist and inexpensive work force in the market

3. Rising unemployment (by giving loan for employment can be attract large depositors). 4. The emergence of new technologies in order t accelerate the work

5. Unmet need of People in the society (in Internal factors

banking services

6.Expand the regional advertising in the form mass media, websites, booklets and guide books

7.Turn on the market And knowledge of technologies for implementation in bank

8.simplify and shorten the process and the process of doing ba

7- Increasing the number of branches

8- Providing loans for job creation

9- Payment facilities for the implementation of Agriculture Big plans

10- Negotiations with new and old customers for investment in the bank

order to coordinate with growth accelerating) 6.Growth of investment in Iran in recent years 7. Increased interactions with the neighboring country of Iran and The possibility of increasing branches in these locations

8.Become a free trade area 9.The quality of soil for crops 10.Easy access to the bank branch

Defensive strategies (WT)

1.Increase scientific collaboration with universities and research institutes to benefit from the latest scientific-Technology achievements in the field of electronic banking 2. .Maintain existing customers 3.Attract the resources of the advertising market.

Competitive strategies(ST) 1. Surveying the Challenges and solutions availableIn the bank

2. Implementation and execution of strategic planning 3. Attract the Valid financial resources

4. Variety of Services 5. Development Bank Market

Threats (T)

1.Growth of private banks thanstate banks 2.The high ratio of deferred loans

3.Intensifying competition with private banks 4.The emergence of banks and financial institutions with advanced facilities and grant profit by higherrates

5.Adjacency with private banks in terms of profitability

6.Having a little share from Market sources 7.The global economic downturn

8.Boycott Iranian banks in dealing with some global banks

9. Bounding Bank by the central bank rules 10.Policy of cheap lending to People on low incomes through banks

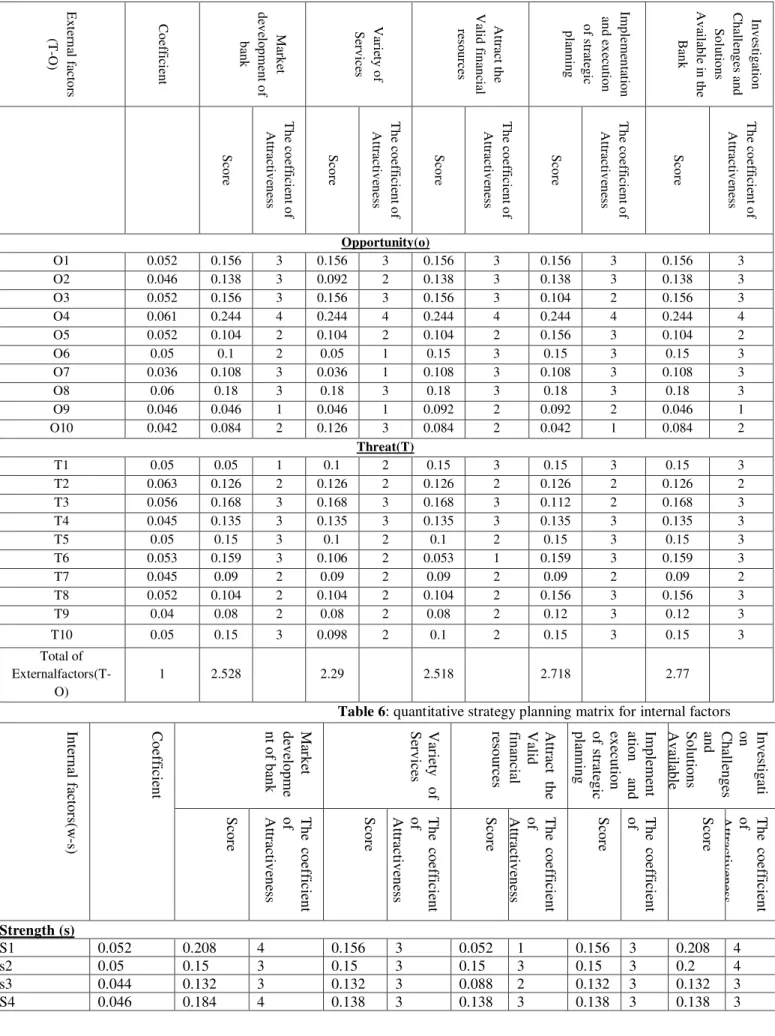

5-3-2. Quantitative strategic planning matrix:

with respect to the evaluation matrix of internal and external factors, the strategies that should be considered are ST strategy. Now, through forming quantitative strategic planning matrix the existent strategies are prioritized in the ST source of SWOT matrix. The steps needed to from strategic planning quantitative matrix are as follows:

1) External opportunities and threats and internal strengths and weaknesses of the bank are listed in the right side of the QSPM. Then the scores of each critical factors of success are entered in the second column with respect to IFE and EFE matrix.

2) With regard to the second stage of formulizing (that is the comparison and accommodation stage), the operable and workable strategies or synthetic ST strategies that the aim is prioritizing them are written in the law row of QSP matrix. Each strategy

consists of two columns, coefficient and the attractiveness score of the strategy.

3) Experts and officials allocate scores 1-4 to the related strategies based on effectiveness and attractiveness of each internal and external factor, these scores are called attractiveness score. If the considered agent has no effect on strategy development and selection, it will take indifference or zero score.

4) The strategy coefficient is computed through multiplying the weight of each factor in the attractiveness score.

5) To obtain total attractiveness of each strategy, column numbers of attractiveness of each strategy are collected.

6) Strategies are prioritized based on the score obtained from the attractiveness of each strategy, from the highest score to the lowest score. The prioritized strategies have been

shown in the table

Table 5: quantitative strategy planning matrix for external factors In v es tig at io n Ch al len g es an d So lu tio n s A v ai la b le in th e Ban k Imp leme n ta tio n an d ex ec u tio n o f st ra teg ic p la n n in g A ttract th e V al id fi n an ci al res o u rces V ari et y o f Serv ice s Mark et d ev el o p men t o f b an k Co effi ci en t E x tern al fact o rs (T -O ) T h e co eff ici en t o f A ttract iv en es s Sco re T h e co eff ici en t o f A ttract iv en es s Sco re T h e co eff ici en t o f A ttract iv en es s Sco re T h e co eff ici en t o f A ttract iv en es s Sco re T h e co eff ici en t o f A ttract iv en es s Sco re Opportunity(o) 3 0.156 3 0.156 3 0.156 3 0.156 3 0.156 0.052 O1 3 0.138 3 0.138 3 0.138 2 0.092 3 0.138 0.046 O2 3 0.156 2 0.104 3 0.156 3 0.156 3 0.156 0.052 O3 4 0.244 4 0.244 4 0.244 4 0.244 4 0.244 0.061 O4 2 0.104 3 0.156 2 0.104 2 0.104 2 0.104 0.052 O5 3 0.15 3 0.15 3 0.15 1 0.05 2 0.1 0.05 O6 3 0.108 3 0.108 3 0.108 1 0.036 3 0.108 0.036 O7 3 0.18 3 0.18 3 0.18 3 0.18 3 0.18 0.06 O8 1 0.046 2 0.092 2 0.092 1 0.046 1 0.046 0.046 O9 2 0.084 1 0.042 2 0.084 3 0.126 2 0.084 0.042 O10 Threat(T) 3 0.15 3 0.15 3 0.15 2 0.1 1 0.05 0.05 T1 2 0.126 2 0.126 2 0.126 2 0.126 2 0.126 0.063 T2 3 0.168 2 0.112 3 0.168 3 0.168 3 0.168 0.056 T3 3 0.135 3 0.135 3 0.135 3 0.135 3 0.135 0.045 T4 3 0.15 3 0.15 2 0.1 2 0.1 3 0.15 0.05 T5 3 0.159 3 0.159 1 0.053 2 0.106 3 0.159 0.053 T6 2 0.09 2 0.09 2 0.09 2 0.09 2 0.09 0.045 T7 3 0.156 3 0.156 2 0.104 2 0.104 2 0.104 0.052 T8 3 0.12 3 0.12 2 0.08 2 0.08 2 0.08 0.04 T9 3 0.15 3 0.15 2 0.1 2 0.098 3 0.15 0.05 T10 2.77 2.718 2.518 2.29 2.528 1 Total of Externalfactors(T-O)

Table 6: quantitative strategy planning matrix for internal factors

4 0.208 4 0.208 4 0.208 3 0.156 3 0.156 0.052 S5 5 0.275 3 0.165 3 0.165 3 0.165 4 0.22 0.055 S6 3 0.12 3 0.12 3 0.12 3 0.12 3 0.12 0.04 S7 2 0.092 3 0.138 2 0.092 2 0.092 3 0.138 0.046 S8 3 0.162 2 0.108 2 0.108 2 0.108 2 0.108 0.054 S9 4 0.248 3 0.186 3 0.186 3 0.186 2 0.124 0.062 S10 3 0.129 2 0.086 2 0.086 2 0.086 3 0.129 0.043 S11 Weakness (w) 2 0.092 2 0.092 2 0.092 4 0.184 4 0.184 0.046 W1 2 0.092 4 0.184 2 0.092 2 0.092 3 0.138 0.046 W2 3 0.126 2 0.084 2 0.084 2 0.084 3 0.126 0.042 W3 3 0.111 3 0.111 2 0.074 3 0.111 3 0.111 0.037 W4 3 0.138 3 0.138 2 0.092 2 0.092 3 0.138 0.046 W5 2 0.084 2 0.084 2 0.084 2 0.084 2 0.084 0.042 W6 2 0.092 3 0.138 4 0.184 2 0.092 4 0.184 0.046 W7 2 0.098 2 0.098 4 0.196 3 0.147 3 0.147 0.049 W8 3 0.144 3 0.144 3 0.144 3 0.144 3 0.144 0.048 W9 3 0.18 3 0.18 2 0.12 2 0.12 3 0.18 0.06 W10 3.069 2.84 2.555 2.639 3.105 1

Total of External factors (s-w)

Table 5: Priorityof Competitive strategies

P rior ity T ot al S cor e S cor e of the at tr ac tive ne ss ext er na l f ac tor s S cor e the at tr ac tive ne ss of int er na l f ac tor s S tr at egi es 1 8.50113 2.77 3.069

Investigation Challenges and Solutions Available in the Bank

3 7.71912

2.718 2.84

Implementation and execution of strategic planning

4 6.43349

2.518 2.555

Attract the Valid financial resources

5 6.04331

2.29 2.639

Variety of Services

2 7.84944

2.528 3.105

Market development of bank CONCLUSION AND

RECOMMENDATION:

Banks should be improved in order to achieve top and better position in the banking system of a country, with planning to recognize the existenting status and determine objectively. In the present study, with regard to strengths, weaknesses, threats and opportunities of the banks it was recognized that the Agricultural bank should use competitive strategies. In this regard, strategies were prioritized, as follows: survey of the existent challenges and solutions in bank environment, the development of the banking market, implementation and execution of strategic planning, attraction of reliable financial resources, and services diversification. If the strategic planning system is implemented and designed properly, quickly and over a few years you can see the realization of all the goals

of the bank. According to the results of the study, the following recommendations are possible:

1). The Bank should change its policies, products and services or its objective;

2) Thus the physical orientation of the bank's growth and development should be in the technology field not in the establishment of more branches;

3) Farmers are the best customers who have relations with banks and increase their income and also promote its position, so, the bank should offer them valuable service and create attraction because they are the most loyal customers of the bank. The financial expansion of this bank and the way of allocating

4). The Centrality of the bank's policies and programs should be based on increasing the competitive capability to offer more, better and chapter services to customers in order to attract more financial resources;

5). Given all of the parameters affecting on the program, the comprehensive participation of employees at different levels should be considered in defining and developing strategic element;

6). New services should be created and introduced in the short term;

7) International banking and international financing should extend;

8). The needed condition of the external banks in Iran should be created with the extension purpose;

9). It has been recommended to expand international and regional banking with the cooperation of governmental and private banks in Iran with the banks of other countries;

10). Privatization, merger and purchase in the banking industry and the financial market of Iran in order to increase competition and efficacy in this market;

11) Increasing activity in the stock market.

REFERENCES

1. Eskandari E., (2013), "the implementing arrangement and implementation of strategic planning with an emphasis on banking area", poyesh, the second year Number Six, pp. 144-167.

2. Amini MT, khabazBaviel S., (2009), "strategy formulation as a comprehensive framework of strategies Case study: automotive Tabriz Sahand", Journal of Business Management, Volume 1, Issue 2, Summer 1388, PP. 17 32.

3. Bashardost O, Shojaee M, M., (2011), "Planning of Quantitative Strategies and solutions to improve brand position using the matrix QSPM ", Journal of Industrial Technology, Number Seventeen,PP. 81-92. 4. PazhooyanJamshid and Shafi A., (2008),

"Analysis of the structure of the banking industry: an empirical application index Davies U", Journal of Quantitative

Economics (former economic studies), Volume 5, Issue 4, PP. 81-105.

5. Jabalameli F., Rasolinejad E., (2010), "Using a network analysis process model in the ranking of bank branches: the case of bank", a research and economic policies, Year XVIII, No. 55, PP. 124-107 .

6. Newsletters Agricultural Bank, (2014), "Agricultural Bank of Iran with 81 years of experience in agricultural development has an important role", No. 97, S1-8.

7. newsletters Agricultural Bank, (2014), "Up to 15 percent of Agricultural Bank of dedicated production chains", No. 96, PP.1-8.

8. newsletters Agricultural Bank, (2014), "The Role of Agricultural Bank, the province's economic development is impossible to ignore", No. 97, PP.1-8.

9. Ranjbarian B, Khazaeipool J., BalvyyKhane jam H., (2012) "Analysis of the strengths, weaknesses, opportunities and threats of foreign tourism in Isfahan province using Fuzzy Analytical Hierarchy Process", Journal of Planning and Development Tourism Year first, NO.1, pp.13-34.

10. Salami H., Bahrami. A., (2002), "optimal combination of investment activities in the Agricultural Bank", Jaleh, Dorud Iran's Agricultural Science, Volume 34, Number 2, pp.401-408.

11. Alipur H.R, M. Farid, (2013), " Evaluation of Job Satisfaction Branch of the Agricultural Bank", Studies Quantitative Management, Issue II, PP.111-126.

12. Ghazi Iran, Ghadir N., (2011), " assess the ability of the Geotourism Desert National Park by using strategy programming f Freeman model ", Environmental Studies, thirty-seventh year, No. 60, pp.65-78.

13. Nezamivandch., Jalilvand H. M., (2013), "Banks specialized in strategy formulation approach", scanning, the second No. VI, pp. 42-66.

15. http://www.poolnews.ir/fa/news ,Published in 2014.

16. Kaganus. M, Kangas. J, Kurttila. M (2004). "The Use of Value Focused Thinking and the A’WOT Hybrid Method in Tourism Management", Tourism Management, vol. 25 (4), 499–506.