Vol-7, Special Issue4-June, 2016, pp388-399 http://www.bipublication.com Case Report

The impact of cloud-based information technology in improving organizational

performance in the banking industry

1

Seyedeh Maryam Seyed Khamesi and 2Amir HoushangTajfr

1Faculty of Information Technology Management,

M.S, PNU West Branch of Tehran

2Faculty member of PNU

ABSTRACT

Cloud computing is one of the most important changes in information technology last years. The decision to choose a cloud-oriented architecture for an organization is a significant issue. In fact, cloud computing is a new paradigm and has not obtained its maturity yet. With growing cloud computing, although a lot of great promises are along with it, there are a host of concerns and problems. In this regard, the purpose of conducting this study isevaluating the effect of cloud-based information technology for improving organizational performance in the banking industry;alsoit covers the gap in previous researches that have been impractical.In this research, with understanding the banking business areas, and identifying key performance indicators financial, customer, business process, growth and learning perspectives, based on the balanced score card, effectiveness and value-adding of cloud- orientation approach have been assessed in each ofits perspectives. The study population is consisted of two Iranian banks and three payment services providers. Data collection has been conducted through desk and field study,and its tool had been questionnaire. SPSS statistical software and appropriate statistical tests such as mode and median analysis, ratio or binomial test, and Friedman test have been used in order to analyze the data. Based on the results obtained from the research, cloud-based information technology by affecting the banking business areas improves organizational performance of banks in financial, internal processes and customer perspectives and in general improves organizational performance of banks using the weighted average of perspectives.

Keywords: cloud-based information technology, organizational performance, balanced score card, banking industry.

INTRODUCTION

Cloud computing is one of the hottest technology and business topics today, and the market for cloud services is expected to skyrocket in the next few years. This technology is considered a new phase of evolution in the Internet world. The use of the word "cloud" means that access to various services such as computing infrastructure, applications, business processes and can be used as an online service wherever and whenever needed. The decision to choose cloud oriented architecture for an organization is a big decision. What distinguishes cloud computing from

business can meet the needs of customers of information technology in order to get fast, flexible and real-time services.

The term of "cloud computing" about hosting services mainly means asking for providing remote services. National Institute of Standards and Technology (NIST) defines cloud computing as: "Cloud computing is a model for enabling

ubiquitous, convenient, on-demand network

access to a shared pool of configurable computing resources (e.g., networks, servers, storage, applications, and services) that can be rapidly

provisioned and released with minimal

management effort or service provider interaction. This cloud model is composed of five essential characteristics, three service models, and four deployment models "(Peter M. Mell and Timothy Grance, 2011).

Cloud computing has unique features in which the ability to share resources and infrastructure as well as Access to them without the need for necessary contexts on consumers’ side are the most important ones.Nowadays banks have been directed to use of cloud computing to reduce the investment costs of information technology

infrastructures and changing the capital

expenditures into strategic costs and development costs.Considering the fact that customers and financial institutions are demanding a higher level of interactivity such as online access to information and access to services through desktop and mobile devices, cloud can create a good environment for client-based services. Problem statement

Besides introducing cloud computing in this part, the concept of organizational perspectives and portfolio components in banksintroduced in order to assess the impact of cloud-based information

technology in improving organizational

performance.

A. Cloud Banking

For banks, today’s changing business realities and expanding markets represent tremendous growth potential. Cloud computing can play a significant role in a bank’s efforts to reinvent its business and

operating models. Cloud computing can help increase flexibility and streamline operations. Using cloud technology, banks can drive higher growth and profit margins with improved efficiency ratio and operating leverage. They can align business, operations and technology to drive out complexity and cost. Bank should choose service and delivery models that best match requirements for operational flexibility, cost savings, and pay-as-you-use models. Banks should adopt a gradual evolutionary approach towards cloud computing services, evaluating each project based on the type of applications and nature of the data. We can get better services than traditional computing with reduced costs with the help of cloud computing.Banks and financial institutions in order to move towards cloud computing should identify the type of using and applying cloud and relevant suppliers by dividing services levels and regulatory and security requirements, and considering the importance of costs and consuming resources. Many experts and practitioners in this field believe that adopting a gradual evolutionary approach for moving towards using cloud is the most appropriate strategy. According to this approach, banks and financial institutions evaluate cloud projects by assessing their level of need and demand, and select projects which are less risky to begin migration.

the security and independence in cloud-based services delivery.

Financial institutions and banking sector are possibly the most advanced in terms of technology adoption and can use cloud as a key differentiator In the current era of banking and financial intermediation the need of high level business process automation, maturity in the functional portfolio, straight through processing and proven technology outsourcing benefits, BFS institutions stand to benefit significantly from cloud computing capabilities .To overcome the financial risk and cost issues, bank must devise innovating operating models. An imaginative approach is needed to cut cost, reduce risk and control a disintegrated value chain (Avinash Thakur1, Manoranjan Kumar2 and Rajan Kumar Yadav3-2014).

B. Concept of organization performance For examining the concept of organization performance, it is necessary to examine aspects of organizational performance at first. Balanced score card method can be used in order to investigate banks' performance. Balanced score card is a system for performance management that its initial idea was formed in 1990, during the researches of Robert Kaplan and David Norton, in the field of new methods to measure the

organizations' performance.The idea was

developed and evolved a lot over time, as far as now it has been converted from the performance evaluation and measurement tool to a strategic management system. The balanced scorecard suggests that we view the organization from four perspectives, and to develop metrics, collect data and analyze it relative to each of these perspectives:

The Customer Perspective

Customer perspective enables organization to measure and improve, and attend to the main

criteria of measurement of customers' status including satisfaction, loyalty, retention and maintenance, gain new customers and so on.

The internal business processes Perspective Measuring the amount of value creation and the manner of relationship between processes can assist managers in identifying affairs. So it is necessary to identify processes which are vital for achieving the goals of our customers and shareholders, etc.

The Learning & Growth Perspective An organization's ability to innovate, improve and learn is directly tied to its value as an organization. An organization can grow and learn when be able to develop its skills and leadership. It can learn from its mistakes and other organizations' behavior, and be able to create new ways for itself. In perspective of learning and growth, the aim is to provide infrastructures and resources that make possible the realization of objectives of the organization in other aspects.

The Financial Perspective

Proper financial results in companies and organizations are essential for their survival and growth. Measurement and analysis of financial results as an important result of the performance of an organization is one of the necessities for examining the strengths and weaknesses of the organizations. Balanced score card is a tool to show the link between performance measurement system, and objectives, and business strategy of organizations, and through this provide the context to making empowered the necessary infrastructures for development. Based on presented contents, each perspective goals in banks organizational performance that are considered as key indicators for each area have

been divided as follows:

Table 1: perspectives Objectives (Alnajjar and Kalaf, 2012)

Perspective Objectives

Financial

Survival

Growth

The weight of each of the perspectives is also based on the following table Table 2: weight of perspectives (JafariEskandari et al, 2013)

B. Portfolio Components in banking system The complex portfolio is organized into different functional domains based on the lines of business and the products / services being offered. Banks and Financial institutions have developed different levels of maturity – functional, technology, operational as well as service delivery – across these components. Some of these components are already being delivered as a Service from external service providers (Tata Consultancy Services Limited, 2010).

- Delivery Channels:

Provide access to Banks through multiple channels like Front Office applications, Online Banking, Telebanking, ATM, Kiosk, Exchange services, Merchant services and Mobile Banking services.

- Channel Integration:

Comprehensive integration capabilities have been developed to cover all aspects of business services. STP based solutions are currently common across all aspects of banking with near real time response times even for complex transactions like Loan approvals.

- Customer Sales and Services

- Customer Information & CRM

- External Interfaces

- Functional & Transaction Processing Systems

- Enterprise Common Services

- Enterprise Application Infrastructure

- Enterprise Application Development

Importance of the issue

Our analysis of the financial organizations and their business operations indicates that there is no single cloud solution model that can meet all the

requirements. We believe that financial

institutions will create and manage afederated service ecosystem of cloud based solutions along with non-cloud based portfolio, leveraging the abstraction control provided by public, private and community cloud deployments. A federated

ecosystem canleverage multiple archetype

implementations, deliver elastic capacity to match business requirements and provide an incremental adoption path building on the success of each increment. This will also enable external business service providers, who themselves would start offering their product solutions on the cloud, to seamlessly integrate with this ecosystem.

Financial institutions and banks essentially take benefits of the most advanced technologies in order to run their business. Business in this field is Revenue Development

Internal Processes

Increase Innovations

Improve Operational Capabilities

Improve Operational Efficiency

Customer

Customer Retention

Attract New Customers

Increase Market Share

Learning & Growth

Improve Employees Capabilities

Improve Employee Satisfaction

Improve Computerized System

Application

Perspective Weight of perspectives

Financial 3.0

Internal process 0.1

Customer 0.5

significantly changed by millisecond alter in response time; so in most of these institutions and institutes, technology plays an important role as a key difference in all products and services as option creates value. Due to the huge amount of investment in the field of modern information technology such as cloud computing services in the banking industry's willingness to use this technology because of some advantages, and their avoid due to some threats has put in doubt the use of clouds in all banking fields such as, e-banking, mobile banking, payment services, and so on. Hence banks know using cloud-based information technology as a strategic decision because of the sensitivity of the business.

Despite the advantages of the clouds, they lead too many risks, including the dissemination of customers' information in the cloud space. Among the advantages of clouds in banks can point out cases such as saving costs, usage-based payments,

business continuity, business and green

information technology agility. But before moving of banks towards the clouds, should be quite familiar with the challenges of this approach.

These challenges can include information

confidentiality, security, laws and regulations, standards, interoperability, quality of services and so on. According to what has just been said and the studies on the technical aspect of cloud computing, and also on publishing multiple surveys concerning the benefits and drawbacks of

cloud in organizations, lack of applied

management researches in cloud-based IT can be observed in different aspects of organizational performance. Therefore, studies for covering the lack and helping the managers with making decisions relating the level, field and form of applying cloud services play an important role. Research literature and background

Researches on cloud computing in banking industry include a review of the literature and surveys relating benefits, and drawbacks of this approach. Some of the late studies are:

The cloud offers a host of opportunities for banks to build a more flexible, nimble and

customer-centric business model that can drive profitable growth and, as a result, should be something that non-IT decision makers at bank understand and appreciate. Cloud computing can help financial institutions improve performance in a number of ways (Laxmi Joshi -2014):

A. Cost Savings and Usage-based Billing With

cloud computing, financial institutions can turn a large up-front capital expenditure into a smaller, ongoing operational cost.

B. Business Continuity With cloud computing,

the provider is responsible for managing the technology.

C. Business Agility and Focus Cloud computing

also allows new product development to move forward without capital in-vestment

Financial institutions should choose service and delivery models that best match requirements for operational flexibility, cost savings, and pay-as-you-use models. We believe that banks should adopt a gradual evolutionary approach towards cloud computing services, evaluating each project based on the type of applications and nature of the data. We can get better services than traditional computing with reduced costs with the help of cloud computing. Another key issue for banks and financial firms is the possibility that their data may be stored in cloud vendor. In this case, both governments and financial firms must determine whether the laws of the country in which the firm operates or the laws of the country in which the data is stored, govern data ownership rights,

consumer privacy practices, confidentiality

interconnected global financial systems and demanding customers. They can use information to enhance customer segmentation techniques and to develop more focused services that are aligned with customer needs. Banks also can optimize their channel investments and differentiate themselves through customer service excellence. Armed with new insights, banking leaders can identify and eliminate the cost of complexity in their operations and use new and existing forms of information to optimize risk.(IBM -2013)

Contact Group believes that banks have changing attitudes towards cloud computing.Over that seven year period, we have observed both a very clear shift in sentiment, with banks much more likely to countenance taking new software applications through the private or public cloud, and a significant increase in adoption. The 2014 survey showed another increase in levels of adoption with the data showing, for example, that banks are more likely than not (56%) to be running email and collaboration tools in the cloud. However, what was very interesting was the change in sentiment. Asked what would prevent more widespread adoption of cloud services in their organizations, 38% reported concerns with data security or confidentiality. This is a much higher reading than in 2013 (29%) and is the highest reading since 2011 and would seem to suggest growing sensitivity to this issue following revelations of NSA monitoring (TemenosGroup-2014). Jafari-Eskandariet al (2014) tried to identify the key stakeholders of Cloud Computing and investigate the different issues associated with Cloud Computing as well as advantages and disadvantages of its adoption. To achieve this, a SWOT analysis was accomplished in which strengths, weaknesses, opportunities as well as threats of cloud computing adoption was appraised. The results of the analysis indicated that the SMEs are able to take advantage of opportunities that Cloud Computing provides to create value networks and provide global market access to their customers. Nevertheless, Cloud Computing services are not free of risks. There is

a real risk of the lack of information and system security if proper actions are not taken to safeguard information and system security. This is a bit more difficult with Cloud Computing due to the potential lack of information and system control compared with traditional computing. More importantly, managers need to carefully evaluate the dependability to external resources and expertise that Cloud Computing creates for SMEs. Hewlett-Packard Enterprise Development

Company provided Banking Reference

Architecture. HP expects most financial

institutions will enter the cloud computing continuum by building private clouds and consuming external noncore services such as email, collaboration tools, and CRM. Over time, as technologies mature and financial institutions evolve their governance and risk models, they will no doubt migrate toward consuming more core “banking type” services.

In fact, HPE believes cloud-based solutions are a fundamental requirement for any financial institution that hopes to build and sustain a

competitive advantage. Banks and other

organizations can leverage cloud and utility services to accelerate the delivery of new products and features to the marketplace. These enhanced capabilities drive agility that allow organizations to preserve capital and better support the most robust risk and security frameworks needed in today’s financial services marketplace.( Larry Ryan- 2015)

Banking & Financial Service Institutions are possibly the most advanced in terms of technology adoption to run their business, to the extent that business is impacted significantly even with millisecond response time variations. Most of these institutions use technology as a key differentiator and almost all their products and services realize their core value proposition through technology. In addition consider each technology innovation with keen interest and in most cases determine the business shelf life of that innovation. Tata Consultancy Services (TCS) (2010) believes that banks and financial institutions will be at the forefront of shaping the evolution and adoption of Cloud Computing.

Research objectives and hypotheses In this study we pursue goals that include the following:

The main purpose:

- Explaining the impact of the cloud-based

information technology compared with the impact of traditional information technology on the improvement of the organizational performance of the banks

Sub-goals:

- Analysis of the banking industry approach in

cloud-oriented.

- Analysis of cloud-oriented Information

technology applications and its impact on banking performance in financial, customer,

internal process and learning and growth perspectives.

The research hypothesis is as follows:

The main hypothesis:

- Cloud-based technology, improves the

organizational performance of banks.

sub-hypotheses:

- Cloud-based information technology, with

impact on components in banking system

causes to improve organizational

performance in financial perspective

- Cloud-based information technology, with

impact on components in banking system

causes to improve organizational

performance in in internal process

perspective

- Cloud-based information technology, with

impact on components in banking system

causes to improve organizational

performance in customer perspective

- Cloud-based information technology, with

impact on components in banking system

causes to improve organizational

performance in in internal learning and growth perspective

Conceptual model of Research

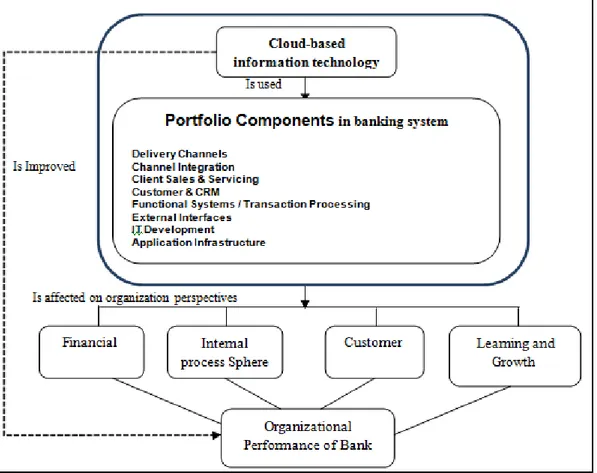

In this study, conceptual hybrid model is depicted according to figure 3 based on the elements and the banking business areas and the indicators of views in banking industry.

Table 3: sections of hybrid conceptual model Dimension of Model

Related variables Confirming experimental studies

Components and banking

business areas in the cloud

context

Portfolio

Components in

banking system

1. Cloud Computing Strategic considerations for

Banking & Financial Services Institutions - Tata

Consultancy Services Limited. (2010).

sights of bank performance

and key performance

indicators in each

perspective

organization

perspectives

1. Designing a Balanced Scorecard to Measure a Bank's Performance- Alnajjar, Sabah, kalaf, khawla H. (2014).

2-Banks' Performance Evaluation Model Based on the Balanced Score Card Approach, Fuzzy

DEMATEL and Analytic Network Process- . Jafari-Eskandari, Meisam, Roudbar, Nasim, Kamfiroozi, Mohammad Hassan. (2013).

Figure 2: Conceptual model of Research Research Methodology

Overall, in this study, research methodology in terms of data gathering non-experimental-survey and in terms of purpose is applied. The research data has been analyzed by using SPSS software. This research has been done in field of banking industry and payment service providers in Iran.

Studied population includes SepahBank,

EghtesadNovinBank and companies of

PardakhtNovin Arian, RayanehKhadamatOmid and Fanava card.The study period is in 2015. Sample of the present study is type of non-probability and selective. The basic intention in this study is evaluation of the impact of cloud-oriented information technology, in improving performance indicators and impact in gaining competitive advantage. However, it is necessary only those to be accepted as sample members that key people of organization are experts in

information technology. According to Krejcie and Morgan sampling table and based on the number of statistical population that is 97, the sample size was estimated at 80 people.

alpha was used to determine the reliability of research and then hypotheses and analysis of results has been discussed by using mode, median, ratio or binomial test and Friedman test.

Table 4: Research results of Cronbach's alpha test Variables Cronbach's alpha Cloud oriented IT effect on the

performance of banks from internal process perspective

0.96

Cloud oriented IT effect on the performance of banks from customer perspective

0.95

Cloud oriented IT effect on the performance of banks from growth and learning perspective

0.96

Cloud oriented IT impact on the performance of banks from financial perspective

0.97

According to alpha calculated in table 4, we can conclude that the survey instrument has acceptable and appropriate reliability.

Findings

in this study to evaluate the data extracted from each of the questionnaires, initially by using the mode and median of responses have been investigated that in connection with any of the questionnaires, how many of replies are more than median (Strongly agree, agree) and how many are less than the median (Strongly disagree, disagree). Then, by using mode, most tendencies to respond options have been identified for each of the questionnaires.

Table 5: Data Analysis of the questionnaire

sub-hypotheses (Mod)

Percentage of agree and strongly agree

responses

Percentage of disagree and strongly disagree Cloud-based IT, with impact on components in

banking system causes to improve organizational performance in financial perspective

Agree 53.62 20.1

Cloud-based IT, with impact on components in banking system causes to improve organizational performance in in internal process perspective

Strongly

agree 68.9 13.1

Cloud-based information technology, with impact on components in banking system causes to improve organizational performance in customer perspective

Agree 59.45 23.45

Cloud-based IT, with impact on components in banking system causes to improve organizational performance in in internal learning and growth perspective

Agree 48.23 36.17

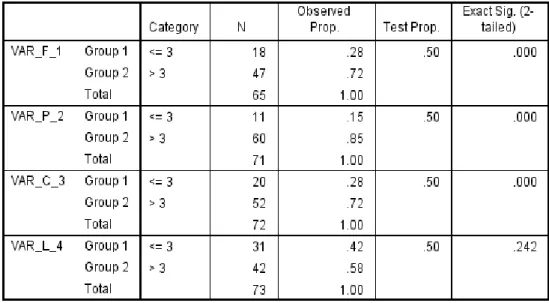

A. Examining the validity of the secondary hypothesis of the research using the binomial test.

In order to evaluate the extracted data from the questionnaires, non-parametric binomial test is used in this study to rate the success of any one of the hypotheses.In this test, the data values are classified into two groups.Disagree and strongly disagree responses in the first group, agreed and strongly agreed in the second group. The zero hypothesisindicates that both relations of the responses are equal. In other words, zero hypothesisindicates that cloud does not affect the organizational performance of the banks. If the

value of the probability of the test is less than 0.05 then zero hypothesis is invalid. It means that

cloud-orientation affects the organizational

Table 6: variables

Performance Perspective Variable Title

Financial VAR_F_1

Internal process VAR_P_2

Customer VAR_C_3

Learning and Growth VAR_L_4

Table 7: The results of the binomial test related to each of the questionnaires with SPSS

B. rankings respondents' perspective based on Friedman

test

Friedman test has been used in order to ranking for the respondents' agreed with impact of cloud-oriented on improving each of the four main variables: financial, internal process, customer and learning and growth. It is observable that due to the output results and respondents' perspective, the impact of cloud-oriented on improving performance in the internal process sphere had been more than the other sights. Table 8: Rank of cloud-oriented impact on improving of the organization perspectives

Perspective Mean Rank based on Friedman test Rank

Internal process 3.872 3.11 1

Financial 3.569 2.56 2

Customer 3.549 2.52 3

Learning and Growth 3.151 1.08 4

C.Examining the validity of the main hypothesis

In this part we talk about the examination of the validity of the main hypothesis of the study through the outcome of the four questionnaires and the weight of the each of the four views.

1. Extracting the mean of the responses to the financial variables 2. Extracting the mean of the responses to the process variables 3. Extracting the mean of the responses to the customer variables

5. Calculating the Weighted mean of the responses

6. Doing the binomial test. The Weighted mean of the responders is calculated in four ways according to the weight of the performance fields.

Table 9- The weighted mean of the score of the responders to the performance perspective Performance

perspective financial

Internal process

customer

Learning and growth

weighted mean

Weight 0.3 0.1 0.5 0.1

Percentage of

agreement 73 84 72 57 72

Percentage of

disagreement 27 16 28 43 28

Table 10: The main hypothesis of binomial test result by using SPSS software

Binomial test results knows correct the main hypothesis of the study. Means cloud-based information technology causes to improve organizational performance of banks by affecting on banking business areas.

DISCUSSION AND CONCLUSION

This study aims to assess the impact of cloud-based IT on the improvement of organizational performance in banking industry in a practical way. Hence the secondary hypothesis adjusted based on the examination of the banks’ performance using four different questionnaires are assessed and evaluated in different areas including financial, process, customer and learning and growth. The result of the study shows that cloud-based IT improves the organizational performance by affecting the banking business fields. The other studies that reviewed the literature confirm this result according to the benefits of cloud . Some studies also show that the Banks move toward cloud cautiously for there are security obstacles. But finally this industry has to move toward cloud if it wants to respond the needs of the customers and if it tends to stay in the competition.

So now that we know that cloud-based IT can improve the Banks’ performance, the head managers of the banks can reach these goals by taking this approach:

Offering new Banking products

Reducing costs

Increasing customer orientation

Focusing on nuclear activities

Outsourcing costly activities

Reaching goals in less amount of time

But in order to reach these goals, managers should be aware of:

The concepts and models of cloud

The challenges of cloud

Threats and Opportunities of using cloud

Cloud-based Organizational architecture

Cloud-based services

Cloud-based outsourcing

Services offered by Cloud service providers

The environmental readiness to enter the

cloud context

Domestic and foreign laws and regulations

regarding cloud

Agreements on the level of services in cloud

Based on our results here come some suggestions for the future studies:

Offering a model for cloud-based banking

Offering a model for cloud-based payment

Advances in Cloud-based data processing in

the banking industry

REFERENCES

1. Kaplan, Robert, Norton, Peter. (2004). Strategy

Maps: Converting Intangible Assets into Tangible Outcomes. Translator Hossein Akbari and others (2005). Tehran: Asia

2. Kavis, Michael. (2014). Architecting the

Cloud_ Design Decisions for Cloud

Computing Service Models (SaaS, PaaS and IaaS). New York: Wiley

3. Mell, Peter & Grance, Timothy. (2011). NIST

Definition of Cloud Computing. USA:

National Institute of Standards and Technology

4. Thakur, Avinash, Kumar, Manoranjan, Kumar,

Yadav Rajan. (2014). Cloud Computing: Demand and Supply in Banking, Healthcare and Agriculture. IOSR Journal of Computer Engineering (IOSR-JCE), (16) 3, 96-101.

5. Alnajjar, Sabah, kalaf, khawla H. (2014).

Designing a Balanced Scorecard to Measure a

Bank's Performance: A Case Study,

International Journal Business Administration, Volume 3, Issue 4, (PP. 44-53), (ISSN 1923-4007): Iraq

6. Jafari-Eskandari, Meisam, Roudbar, Nasim,

Kamfiroozi, Mohammad Hassan. (2013). Banks' Performance Evaluation Model Based on the Balanced Score Card Approach, Fuzzy DEMATEL and Analytic Network Process. International Journal of Information, Security and System Management, (2) 2,191-200.

7. Tata Consultancy Services Limited. (2010).

Cloud Computing Strategic considerations for Banking & Financial Services Institutions: Mumbai

8. Frost & Sullivan in Collaboration with Fujitsu. (2013). CLOUD COMPUTING Creating Value For Businesses Across The Globe.

9. Rayan, Larry. (2012). Bank on the power of

cloud-based services. : Hewlett-Packard

Development Company. USA

10.Joshi, Laxmi. (2014). Cloud Computing use in

E-banking, International Journal of Scientific & Engineering Research, Volume 5, Issue 1, (ISSN 2229-5518): Saudi Arabia

11.IBM, Sales and Distribution Thought

Leadership White Paper. (2013). Cloud computing for banking Driving business model transformation. USA

12.Patani, Sahil; Kadam, Sumesh; V.Jain, Prateek.

(2014). Cloud Computing in the banking sector: A survey. International Journal of

Advanced Research in Computer and

Communication Engineering. Vol. 3, Issue 2. (ISSN: 2278-1021) .India

13.Ghaffari, Kimia, S. Delgosha, Mohammad,

Abdolvand, Neda, (2014) .Towards Cloud Computing: A SWOT Analysis on Its Adoption SMEs. International Journal of Information Technology Convergence and Services (IJITCS). ) Vol.4, No.2. IRAN: Tehran

14.Temenos Headquarters SA. (2015). Cloud

banking: a question of collaboration: Geneva

15.Natarajan, Ramakrishnan and Sekha, Sourav.