❊♥s❛✐♦s ❊❝♦♥ô♠✐❝♦s

❊s❝♦❧❛ ❞❡

Pós✲●r❛❞✉❛çã♦

❡♠ ❊❝♦♥♦♠✐❛

❞❛ ❋✉♥❞❛çã♦

●❡t✉❧✐♦ ❱❛r❣❛s

◆◦ ✸✸✹ ■❙❙◆ ✵✶✵✹✲✽✾✶✵

P✉❜❧✐❝ ❉❡❜t ❙✉st❛✐♥❛❜✐❧✐t② ❛♥❞ ❊♥❞♦❣❡♥♦✉s

❙❡✐❣♥✐♦r❛❣❡ ✐♥ ❇r❛③✐❧✿ ❚✐♠❡✲❙❡r✐❡s ❊✈✐❞❡♥❝❡

❋r♦♠ ✶✾✹✼✲✾✷ ✭❘❡✈✐s❡❞ ❱❡rs✐♦♥✮

❏♦ã♦ ❱✐❝t♦r ■ss❧❡r✱ ▲✉✐③ ❘❡♥❛t♦ ❘❡❣✐s ❞❡ ❖❧✐✈❡✐r❛ ▲✐♠❛

❖s ❛rt✐❣♦s ♣✉❜❧✐❝❛❞♦s sã♦ ❞❡ ✐♥t❡✐r❛ r❡s♣♦♥s❛❜✐❧✐❞❛❞❡ ❞❡ s❡✉s ❛✉t♦r❡s✳ ❆s

♦♣✐♥✐õ❡s ♥❡❧❡s ❡♠✐t✐❞❛s ♥ã♦ ❡①♣r✐♠❡♠✱ ♥❡❝❡ss❛r✐❛♠❡♥t❡✱ ♦ ♣♦♥t♦ ❞❡ ✈✐st❛ ❞❛

❋✉♥❞❛çã♦ ●❡t✉❧✐♦ ❱❛r❣❛s✳

❊❙❈❖▲❆ ❉❊ PÓ❙✲●❘❆❉❯❆➬➹❖ ❊▼ ❊❈❖◆❖▼■❆ ❉✐r❡t♦r ●❡r❛❧✿ ❘❡♥❛t♦ ❋r❛❣❡❧❧✐ ❈❛r❞♦s♦

❉✐r❡t♦r ❞❡ ❊♥s✐♥♦✿ ▲✉✐s ❍❡♥r✐q✉❡ ❇❡rt♦❧✐♥♦ ❇r❛✐❞♦ ❉✐r❡t♦r ❞❡ P❡sq✉✐s❛✿ ❏♦ã♦ ❱✐❝t♦r ■ss❧❡r

❉✐r❡t♦r ❞❡ P✉❜❧✐❝❛çõ❡s ❈✐❡♥tí✜❝❛s✿ ❘✐❝❛r❞♦ ❞❡ ❖❧✐✈❡✐r❛ ❈❛✈❛❧❝❛♥t✐

❱✐❝t♦r ■ss❧❡r✱ ❏♦ã♦

P✉❜❧✐❝ ❉❡❜t ❙✉st❛✐♥❛❜✐❧✐t② ❛♥❞ ❊♥❞♦❣❡♥♦✉s ❙❡✐❣♥✐♦r❛❣❡ ✐♥ ❇r❛③✐❧✿ ❚✐♠❡✲❙❡r✐❡s ❊✈✐❞❡♥❝❡ ❋r♦♠ ✶✾✹✼✲✾✷ ✭❘❡✈✐s❡❞ ❱❡rs✐♦♥✮✴ ❏♦ã♦ ❱✐❝t♦r ■ss❧❡r✱ ▲✉✐③ ❘❡♥❛t♦ ❘❡❣✐s ❞❡ ❖❧✐✈❡✐r❛ ▲✐♠❛ ✕ ❘✐♦ ❞❡ ❏❛♥❡✐r♦ ✿ ❋●❱✱❊P●❊✱ ✷✵✶✵

✭❊♥s❛✐♦s ❊❝♦♥ô♠✐❝♦s❀ ✸✸✹✮

■♥❝❧✉✐ ❜✐❜❧✐♦❣r❛❢✐❛✳

Public Debt Sustainability and Endogenous

Seigniorage in Brazil: Time-Series Evidence from

1947-92

¤

Jo~

ao Vict or Issler and Luiz Renat o Lima

Graduat e School of Economics - EPGE

Get ulio Vargas Foundat ion

P. de Bot afogo 190 s. 1125-8

Rio de Janeiro, RJ 2253-900

Brazil

E-mail: jissler@fgv.br

First Version: June, 1997

T his Version: December, 1998

A bst r act

t he budget aft er shocks to eit her revenues or expendit ures? Third, are ex-pendit ures exogenous? T he result s show t hat (i) public de¯ cit is stat ionary (bounded asympt ot ic variance), wit h t he budget in Brazil being balanced almost ent irely t hrough changes in taxes, regardless of t he cause of t he ini-t ial imbalance. Expendiini-t ures are weakly exogenous, buini-t ini-tax revenues are not ; (ii) the behavior of a rational Brazilian consumer may be consist ent with Ricardian Equivalence; (iii) seigniorage revenues are crit ical t o restore intert emporal budget equilibrium, since, when we exclude t hem from t ot al revenues, debt is not sust ainable in econometric t est s.

1. I nt r oduct i on

At least since t he end of WWI I t he Brazilian economy has been plagued wit h chronic public de¯ cit s and relat ively high in° at ion - a typical example of

seigniorage-¯ nanced de¯ cit s. However, there have been very few episodes when a sharp increase in public debt was observed. Using nat ional account s dat a for t he revenue-GDP and t he expendit ure-GDP rat ios from 1947 t o 1992, t his pa-per st udies t hree cent ral issues in public ¯ nance. First , was t he pat h of public debt sust ainable during t his period? Second, if debt is sust ainable, how has t he government hist orically balanced t he budget aft er shocks t o eit her revenues or expendit ures were observed? For example, given an unpredict able increase in expendit ures, t here are two polar forms t o balance t he budget . One is t o in-crease t he present value of t axes and t he ot her is t o dein-crease t he present value of expendit ures. From t he point of view of a rat ional Brazilian t axpayer, it is import ant t o learn t o what ext ent t hese two forms of balancing t he budget have occurred. T hird, what are t he result s of exogeneity t est s for government expen-dit ures and t ax revenues? This last issue is mot ivat ed by t he fact t hat models of seigniorage-¯ nanced de¯ cit s such as Bruno and Fischer(1990), and t he ext ension in Ruge-Murcia(1995), assume respect ively t hat t he ¯ scal de¯ cit and t hat govern-ment expendit ures are exogenous. Moreover, in a more ° exible framework t han Barro(1974), Bohn(1992) shows t hat t he exogeneity of expendit ures is a necessary condit ion for Ricardian Equivalence. Given t hat post -war Brazil seems to ¯ t t he seigniorage-¯ nanced de¯ cit model, and t hat it is desirable t o discuss Ricardian Equivalence here, we ¯ nd it useful t o apply exogeneity t est s t o Brazilian ¯ scal ¯ gures. As far as we know, t his paper is t he ¯ rst work t o do it in t his cont ext .

are invest igated using unit -root t est s, coint egrat ion t est s, and calculat ing uncon-vent ional impulse-response funct ions based on Vect or Error-Correct ion Models (VECM's) where a balanced-budget rest rict ion is imposed. The search for a sen-sible t est of exogeneity has lead us t o use t he de¯ nit ions of weak, st rong and super exogeneity in Engle, Hendry and Richard(1983). T hey propose likelihood-based de¯ nit ions of exogeneity which could be t est ed, showing why t he previous con-cept s (pre-det erminedness and st rict exogeneity) were incomplet e or misleading. Exogeneity t est s were conduct ed using t he framework proposed in Johansen(1992, 1995).

T his paper has t hree main ¯ ndings. First , debt is sust ainable, wit h t he budget in Brazil being balanced almost ent irely t hrough changes in t axes, regardless of how t he init ial imbalance was generat ed. Expendit ures are weakly exogenous in t he sense of Engle, Hendry and Richard(1983). Second, t he behavior of a rational Brazilian consumer, wit h Ricardian preferences, is consist ent wit h t he Ricardian Equivalence result (Barro(1974)). Given, for example, a t ax break t oday, since his/ her best forecast for rest oring ¯ scal balance is t hat t he current imbalance will be fully reversed by fut ure t ax increases, consumpt ion and welfare will be unchanged1. Third, we show t hat seigniorage revenues are crit ical to rest ore int ert emporal budget equilibrium, since, when we exclude t hem from t ot al revenues, debt is not sust ainable in economet ric t est s. These result s mat ch t he convent ional wisdom about Brazilian public ¯ nance and are broadly consistent wit h t he t heoret ical model of opt imal seigniorage of Bruno and Fischer(1990), it s ext ension in Ruge-Murcia(1995), and wit h t he empirical ¯ ndings of Past ore(1995), Ruge-Murcia, and Rocha(1997).

T he paper is organized as follows: in Sect ion 2 t he methodology is present ed; in Sect ion 3 t he dat a set is discussed; in Sect ion 4 t he empirical result s are present ed and in Sect ion 5 we conclude.

2. M et hodol ogy

The economet ric t echniques used here t o t est whet her or not debt is sust ainable follow Hamilt on and Flavin(1986), and Bohn(1991). The calculat ions of t he \ un-convent ional impulse-response funct ion" follow Bohn(1991). We discuss a slight

caveat t o his approach. Exogeneity t est s are performed following t he typology in Engle, Hendry and Richard(1983); see also t he t est implement at ion in Jo-hansen(1992, 1995). A brief discussion of t hese t echniques is present ed here for t he sake of complet eness.

T he government budget const raint can be writ t en in t he following form:

Bt + 1 = Gt ¡ Tt + (1 + r )Bt + ²t+ 1; (2.1)

where Tt represent s ¯ scal revenues including seigniorage, Gt represent s ¯ scal

ex-pendit ures excluding debt -service payment s, r is t he \ real-int erest rat e"2on debt

(assumed ¯ xed), Bt is beginning of period public debt , and ²t + 1 is a st at ionary

measurement error inherit ed from assuming t hat rt = r for all t. All t ime series

are measured as a proport ion of GDP.

Wit hout loss of generality, we work with t he following version of equat ion (2.1):

Bt + 1 = G¤t ¡ Tt + Bt + ²t + 1; (2.2)

where G¤

t = Gt + r Bt is a broader version of government expendit ures, including

int erest paid on debt . Disregarding measurement error, and rearranging (2.2) we get :

Bt + 1¡ Bt = G¤t ¡ Tt = D eft; (2.3)

where D eft is t he public de¯ cit in period t. Equat ion (2.3) is t he basis for t he debt

sust ainability test of Hamilt on and Flavin(1986). It shows t hat whenever D eft is

not an int egrat ed series, Bt is di®erence-st at ionary. T hus, debt sust ainability is

t est ed viaa unit -root test on ¢ Bt.

A similar argument can be made from an int ert emporal perspect ive. The government int ert emporal budget const raint is:

Bt = 1 X

j = 0

½j Et h

Tt+ j ¡ G¤t + j ¡ ²t+ j + 1 i

; (2.4)

where ½ = (1+ r )1 is t he one-period discount rat e for fut ure t axes and expendi-t ures. Trehan and Walsh(1988) showed expendi-t haexpendi-t (2.4) holds whenever public debexpendi-t is

di®erence-stat ionary. From (2.3), t his last condit ion implies t hat G¤

t and Tt

coin-t egracoin-t e wicoin-t h coe± ciencoin-t (1; ¡ 1). T his is coin-t he coin-t escoin-t proposed in Bohn(1991) coin-t o check whet her or not debt is sust ainable. Under (rest rict ed) coint egrat ion, t he syst em on Xt = (G¤t; Tt)0, in error-correct ion form is3(Engle and Granger(1987)):

A(L )¢ Xt = ¡ ® ¯

0

Xt ¡ 1+ ¹t = ¡ ® D eft ¡ 1+ ¹t; (2.5)

where ¯ = (1; ¡ 1)0 is t he coint egrat ing vect or, ® is the adjust ment coe± cient vect or of t he error-correct ion t erm, and ¹t is a mult ivariat e whit e-noise process.

To simplify rat ional-expect at ion comput at ions of ¯ scal variables, we can rewrit e (2.5) as a ¯ rst-order syst em of equat ions as follows:

0 B B B B B B B @

¢ Xt

¢ Xt¡ 1

.. . ¢ Xt ¡ k + 1

D eft ¡ k 1 C C C C C C C A = 0 B B B B B B B @ A¤

1 A¤2 ¢¢¢ A¤k ¡ ®

I 0 ¢¢¢ 0 0

..

. ... ...

0 ¢¢¢ I 0 0

0 ¢¢¢ 0 ¯0 1

1 C C C C C C C A 0 B B B B B B B @

¢ Xt¡ 1

¢ Xt¡ 2

.. . ¢ Xt ¡ k

D eft ¡ k ¡ 1 1 C C C C C C C A + 0 B B B B B B B @ ¹t 0 .. . 0 0 1 C C C C C C C A , (2.6)

or, compact ly as:

Xt¤ = A¤Xt ¡ 1¤ + ¹¤t. (2.7)

where X¤

t = ³

¢ Xt0; ¢ Xt ¡ 10 ; ¢¢¢; ¢ Xt ¡ k+ 10 ; D eft ¡ k ´0

and ¹¤ t =

³

¹0t; 0; ¢¢¢; 0

´0 are nk + 1 vect ors, and A¤is t he [nk + 1] by [nk + 1] loading mat rix of X¤

t¡ 1.

Using (2.7) and (2.4), we can analyze t he e®ect s of unpredict able changes of G¤ t

and Tt on t heir respect ive present discount ed values. De¯ ne t he present discount ed

value of a generic variable z, P V (z)t = P

j ¸ 1

½j z

t + j, an innovat ion in z,zbt = zt ¡

Et ¡ 1zt, an innovat ion on t he present discount ed value of z,P V (z)d t = EtP V (z)t¡ 3Alt hough we are basically using X

t = (G¤t; Tt)

0

Et ¡ 1P V (z)t4, and t he inherit ed measurement error t erm, - t = Et[P V (²)t] ¡

Et ¡ 1[P V (²)t]. Consider Campbell's(1987) ident ity (1 ¡ ½) [zt + P V (z)t] = zt +

P V (¢ z)t, and t he fact t hat ¢Xct = Xct, t o obt ain:

¢cTt + P V (¢ T )d t = ¢Gc¤t + P V (¢ Gd ¤)t + r - t. (2.8)

From (2.8), for an unchanged debt value, and disregarding t he error t erm, any increase in expendit ures (not accompanied by an increase in t axes) would, in t he fut ure, eit her require a decrease in expenditures or an increase in t axes. In present -value t erms, t hese changes should o®set exact ly t he init ial change in expendit ures (a similar result applies for a change in t axes), i.e., ¢Gc¤

t = P V (¢ T)d t¡ P V (¢ Gd ¤)

t

must hold. Not ice that when we consider t he measurement error t erm, t his equa-t ion will noequa-t hold exacequa-t ly. The absoluequa-t e di®erence beequa-tween equa-t he lefequa-t - and equa-t he right -hand side is an increasing funct ion of r . Of course, it holds exact ly when r = 0 (i.e., ½= 1).

Calculat ing t he marginal impact of current innovat ions t o t axes and expendi-t ures on expendi-t he innovaexpendi-t ions of expendi-t he presenexpendi-t discounexpendi-t ed values can be easily done using (2.7). It is st raight forward t o show t hat :

d

P V (X¤)t = X

k ¸ 1

(½A¤)k¹¤t. (2.9)

T he part ial derivat ive of P V (Xd ¤)

t wit h respect t o ¹¤t is simply:

@P V (Xd ¤) t

@¹¤ t

= X

k ¸ 1

(½A¤)k = ½A¤(I ¡ ½A¤)¡ 1. (2.10)

Equat ion (2.10) is what we have labelled t he unconvent ional impulse-response funct ion. It depends only on ½and A¤. T he lat t er can be consist ent ly est imat ed

and t he former can be eit her est imat ed or calibrat ed. Equation (2.10) is \ uncon-vent ional" since it calculat es t he innovat ion present -value response t o shocks to t he syst em. It is t empt ing t o associat e t he l -t h element of t he vect or

hi n

½A¤(I ¡ ½A¤)¡ 1o

, where hi is a select ion vect or, wit h t he response t o a unit

impulse of t he l -t h element of ¹t. Alt hough Bohn(1991) claims t hat t his

impulse-response funct ion requires no ort hogonalizat ion of t he shocks, t he int erpretat ion

4T here is no cont radict ion between t he de¯ nit ion of bz

above embeds t he assumpt ion t hat no ot her element of ¹t changed when it s l -t h

element did. Of course, t his can only be t rue when t he covariance mat rix of t he shocks is diagonal.

T he exogeneity t est s conduct ed here follow t he typology in Engle, Hendry and Richard(1983); see Maddala(1992) for an int roduct ion, Ericsson and Irons(1994) for a more complet e review, and Ericsson and Irons and Johansen(1992, 1995) for t est ing procedures. There are t hree de¯ nit ions of exogeneity: weak, strong, and

super exogeneity. We only discuss t he ¯ rst two here5. T hey are relevant

respec-t ively respec-t o conducrespec-t condirespec-t ional inference and respec-t o perform condirespec-t ional forecasrespec-t ing. Engle, Hendry and Richard proposed de¯ nit ions of exogeneity t hat t ook into account t he paramet ers of int erest , somet hing missing from t he de¯ nit ions of predet erminedness and st rict exogeneity; see Engle, Hendry and Richard(p. 280) and Maddala(1992, p. 391). It does so by decomposing t he joint density of (yt; xt)0int o theproduct of t hecondit ional and marginal densit ies: f (yt jxt)¢f (xt).

Heurist ically, xt is said t o beweakly exogenousfor ¯ (a funct ion of t he paramet ers

of t he condit ional density) if f (xt) cont ains only nuisance paramet ers which are

irrelevant for conduct ing inference on ¯ . T hus, t o do inference on ¯ , we can \ discard" f (xt) and maximize t he likelihood using only t he t erms arising from

f (ytjxt). Weak exogeneity is a necessary condit ion t o have st rong and super

exogeneity. In addit ion, each of t hem require an ext ra condit ion. In part icular, st rong exogeneity requires t hat y does not Granger-cause x.

A key ingredient of t he weak exogeneity is t he \ separat ion" property for t he paramet ers associat ed wit h t he condit ional and marginal dist ribut ions. This is relevant for showing t hat innovat ions t o t he present discount ed value of x are not a®ect ed by shocks t o t he condit ional mean of y. Consider t he simple exam-ple in Ericsson(1994, pp. 22-24) where Xt = (yt; xt)

0

follows a Gaussian Vect or Aut oregression of order one, convenient ly reparamet erized as:

¢ yt = ¼11yt ¡ 1+ ¼12xt ¡ 1+ "1t

¢ xt = ¼21yt ¡ 1+ ¼22xt ¡ 1+ "2t;

where ("1t; "2t)0» I N (0; - ), \ » I N (¢)" reads independent and normally

dis-t ribudis-t ed random vecdis-t or, where - is a non-diagonal posidis-t ive-de¯ nidis-t e madis-t rix widis-t h

- = (! i j). If t here is one coint egrat ion vect or ¯0= (1; ¡ ±), where ± = ¡ ¼12=¼11 =

¡ ¼22=¼21, ¯0Xt ¡ 1 = (yt¡ 1¡ ±xt¡ 1), ®1 = ¼11, and ®2 = ¼21, t he error-correct ion

form is:

¢ yt = ®1(yt¡ 1¡ ±xt¡ 1) + "1t

¢ xt = ®2(yt¡ 1¡ ±xt¡ 1) + "2t: (2.11)

If we fact or t he joint density of the element s in Xt (given Xt ¡ 1) int o t he condit ional

density of yt given xt (and Xt¡ 1), and t he marginal density of xt (given Xt ¡ 1), we

get :

¢ yt = °1¢ xt + °2(yt ¡ 1¡ ±xt ¡ 1) + º1t

¢ xt = ®2(yt ¡ 1¡ ±xt ¡ 1) + "2t; (2.12)

where °1 = ! 12=! 22, °2 = ®1 ¡ (! 12=! 22) ®2, and º1t » I N (0; ¾2) and "2t »

I N (0; ! 22). First , not ice t hat t he two shocks are now independent , which did

not happen t o shocks in t he reduced form (2.11). Second, we can collect the pa-ramet ers of t he condit ional and marginal models in (°1; °2; ±; ¾2)

0

, and (®2; ±; ! 22)0

respect ively. Since ± is an element of bot h, and ®2 is in t he condit ional model

t hrough °2, t he paramet ers of t he condit ional and marginal models are not

sepa-rable in general.

However, if ®2= 0, xt is weakly exogenous for ¯ 0. In t his case, t he paramet ers

of t he condit ional and marginal models are respect ively (°1; °2; ±; ¾2) 0

and (!22);

t he ¯ rst equat ion is su± cient t o conduct inference on ± and t hus on ¯0= (1; ¡ ±);

t he second equat ion has only t he nuisance paramet er (! 22); and (2.12) simpli¯ es

t o:

¢ yt = °1¢ xt + °2(yt ¡ 1¡ ±xt ¡ 1) + º1t

¢ xt = "2t: (2.13)

Since "2t + i is independent of º1t, 8i , and P V (¢ x)d t is a funct ion of "2t + i,

8i > 1, it cannot be a®ect ed by changes in º1t. This makes weak exogeneity

relevant for inferring how t he government balances t he budget given a shock to eit her t ax revenues or expendit ures. For example, if we ¯ nd t hat expendit ures are weakly exogenous for t he coint egrat ion vect or, as in (2.13), P V (¢ Gd ¤)

t cannot

be a®ect ed by a shock t o t ax revenues (and vice-versa)6. Hence, aft er a shock to

t axes, int ert emporal equilibrium is rest ored via a change in P V (¢ T )d t alone.

Given t he discussion above, a t est for weak exogeneity was proposed by Jo-hansen(1992, 1995). It consist s of an exclusion test for ®2in (2.12). T his is exact ly

t he t est implement ed here.

3. T he D at abase

Sincewe apply unit -root and coint egration t ests t o invest igat e whet her public-debt is sust ainable, it is desirable t o work wit h dat a wit h a long span. Unfort unat ely, Brazil does not have long-span t ime-series dat a on debt . An alt ernat ive is t o use t he fact t hat , Bt + 1¡ Bt = G¤t ¡ Tt = D eft, relying on dat a on G¤t and Tt. FIBGE

provides annual nat ional-account dat a on expendit ures, which include payment s ofnominal int erest on public debt , and cannot be disaggregat ed furt her, and also annual dat a on revenues (excluding seigniorage). T hey cover t he period from 1947 t o 1992. Since G¤

t includes real-int erest expendit ures, not nominal, t here is

a mismat ch between t he dat a and t he t heoret ical framework.

Seigniorage, approximat ed by in° at ion t ax, is ext ract ed from Cysne(1995), and t hen added t o nat ional-account s t ax revenues t o form a series of t ot al t ax revenues7. T he former, and expendit ures, as described above, were divided by

GDP, and labelled Tt and G¤t respect ively.

According t o Ahmed and Rogers(1995), using nominal-int erest payment s in place of r Bt may bias t oward reject ion t he rest rict ed version of t he coint egrat ion

t est between G¤

t, and Tt. Indeed, we may get a coint egrat ing vect or di®erent from

(1; ¡ 1)0, possibly wit h t he coe± cient of G¤t being great er t han unity in absolut e value. This, however, is not t he only problem. Since t he nominal-interest rat e can be t hought of as t he sum of t he real-int erest rat e and t heex-anterat e of in° at ion, we may not get coint egrat ion at all if in° at ion is an int egrat ed process, which is a real possibility for Brazil. In order t o account for t hat problem wit h t he dat a, we increased t he signi¯ cance level of t he coint egrat ion t est from t he usual 5% or 10% levels (Johansen and Juselius(1990)), t o t he 20% level8.

7Seigniorage revenues, i.e., t he change in monet ary base used exclusively t o ¯ nance gov-ernment de¯ cit s, is not available for 1947-92, alt hough monet ary base is. Since high-powered money could change for reasons ot her t han t o ¯ nance government de¯ cit s, we chose not t o use t he ¯ rst -di®erence in monet ary base as a proxy for seigniorage.

8We only use t he 20% level when t est ing sequent ially for t he rank of coint egrat ion: H

4. Em pi r ical R esult s

4.1. U ni t -R oot and C oint egr at i on Test s

Before present ing t he result s of unit -root t est s it should be ment ioned t hat t he fact t hat our series are rat ios, t herefore lying in t he real int erval [0; 1], does not rule t hem out being int egrat ed processes; see Ahmed and Yoo(1989). Figure 1 shows t he dat a set used in t his paper. It is clear t hat all series are smoot h, indicat ing a high level of persist ence. The sample average (in percent age) of t he rat ios G¤ t

and Tt are very close, respect ively 24.8% and 24.4%. Despit e G¤t and Tt showing a

st eady increase since t he beginning of t he sample, G¤

t ¡ Tt shows mean reversion,

especially aft er t he expendit ure and t ax increases of t he mid-eight ies.

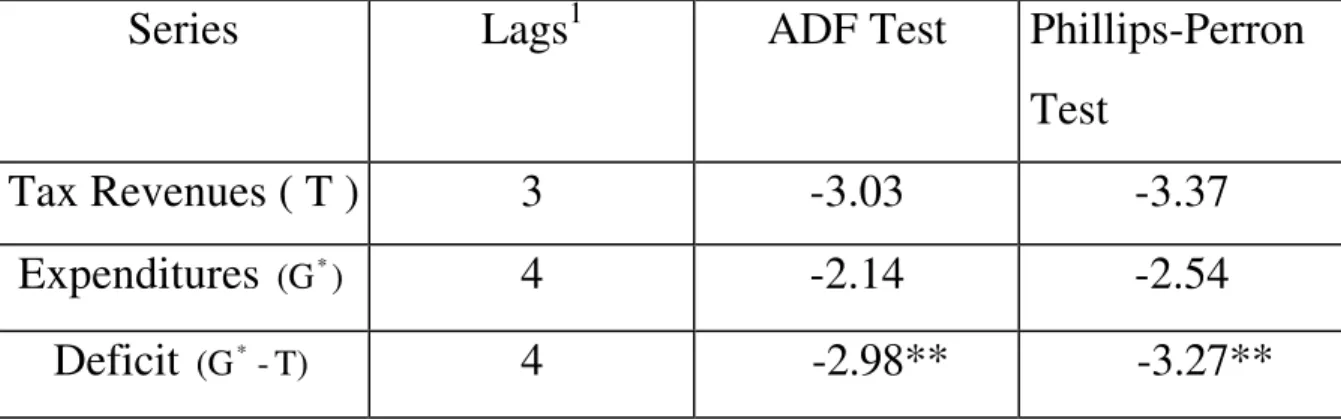

Table 1 shows t he result s of t he unit -root t est s performed: t he Augment ed Dickey-Fuller (ADF) and t he Phillips-Perron t est9. Regardless of t he t est type,

t he result s support one unit root for expendit ures and t axes, whereas t he de¯ cit (G¤¡ T ) is st at ionary even at 1%10.

T he next st ep is t o perform t he coint egrat ion t est between G¤

t and Tt. We used

t he likelihood-based coint egrat ion t est of Johansen(1991). It is well known t hat t he result s of coint egrat ion t est s using t his t echnique depend on t he det erminist ic component s included in t he VAR and on t he chosen lag lengt h. T herefore some pre-t est ing is done in order t o choose t hese. T he lag lengt h was select ed using two types of informat ion crit eria (Schwarz and Hannan-Quinn). To choose t he det erminist ic component s we used t he likelihood rat io t est discussed in Johansen. The pre-t est result s are present ed in Tables 2 and 3.

T he result s in Table 2a are based on a VAR est imat ed wit h an unrest rict ed const ant t erm and the result s in Table 2b on a VAR est imat ed wit hout a const ant . In bot h cases, using t he Schwarz crit erium, t he opt imal lag lengt h is two, but using t he Hannan-Quinn crit erium t he opt imal lag lengt h is t hree. Given t he Mont e-Carlo result s in Gonzalo(1994), we chose t o work wit h t hree lags in t he VAR11.

Test ing t he det erminist ic component s in t he VAR is more subt le, since it requires condit ioning on t he number of coint egrat ing relat ionships t o be performed; see

9T he result s of t he lat t er are especially relevant , since t he dat a clearly show signs of het eroskedast icity.

10Test s for two unit root s reject t his hypot hesis for all t hree series.

Johansen(1991). Table 3 shows t est result s when t he number of coint egrat ing vect ors is one. When t he model wit h an unrest rict ed const ant is t ested against t he one wit h a rest rict ed const ant t he t est st at ist ic is 1.64, dist ribut ed as a Â2

1. Thus,

we cannot reject t he rest rict ed model. The same result was obt ained when we t est ed t he rest rict ed const ant against t he no-const ant model, or t he unrest rict ed const ant versus t he no-const ant model. T hus, we used a VAR wit hout a const ant . T he result s of t he coint egrat ion t est are present ed in Table 4. As discussed above, we used t he 20% signi¯ cance level for t hecrit ical values of t he Trace and t he ¸max st at ist ics. At 20% we reject t he null of no coint egrat ing vect ors and cannot

reject t he null of one coint egrat ing vect or. Alt hough we used t he 20% level, it is wort h ment ioning t hat t he t est st at ist ics for t he null of zero coint egrat ing vect ors are very close t o t he crit ical value at 10%. The point est imat e of t he coint egrat ing vect or is (1; ¡ 0:94) (normalizat ion on expendit ures), which mat ches t he prior t hat using t he nominal-int erest payment s rat her t han t he real-int erest payment s would bias upwards t he absolut e value of t he expendit ures coe± cient . It is nat ural at t his point t o t est t he t heoret ical value of (1; ¡ 1) for t he coint egrat ing vect or. At usual signi¯ cance levels, t his t heoret ical vect or could not be reject ed. Hence, cointegrat ion t ests corroborat e our prior ¯ ndings from unit -root t est s t hat t he de¯ cit is st at ionary, and t hus debt is sust ainable.

4.2. Exogeneit y Test s

Table 5 shows t he result s of t he error-correct ion model est imat es. First , it seems t hat our choice of 3 lags for t he VAR was appropriat e. For t he system as a whole, ¢ G¤

t ¡ 2 is signi¯ cant , while ¢ Tt ¡ 2 is marginally signi¯ cant . Table 6 shows t he

re-sult s of t he weak exogeneity t est s for t he coint egrat ing vect or if t he coint egrat ing rank is one. At usual signi¯ cance levels we found t hat expendit ures are weakly exogenous for t he paramet ers of int erest in t he condit ional model of t ax-revenues, but t he converse is not t rue for revenues12. T he result s in Table 7 clearly

indi-cat e t hat expendit ures Granger-cause t axes and vice-versa at t he 5% signi¯ cance level. At 1%, however, t axes do not precede expendit ures. Therefore, alt hough expendit ures are weakly exogenous, t hey are not st rongly exogenous, since t hey are Granger-caused by t ax-revenues.

12T he fact t hat t he coe± cient of D ef

t ¡ 1on t he ¢ G¤t equat ion is not signi¯ cant led us t o t est t he joint hypot heses t hat t he coint egrat ing vect or and t he adjust ment coe± cient are respec-t ively (1; ¡ 1) and (0; ®). T he Â2

4.3. U nconvent ional I mpulse-R esp onse Funct ion

As discussed above, impulse-response result s are only int erpret able when t he variance-covariance mat rix of t he VECM errors is diagonal. T he correlat ion coef-¯ cient between t he two reduced-form residuals is 0.244. T he log-likelihood rat io st at istic t est ing for a diagonal covariance mat rix is 2.67, wit h a Â21 dist ribut ion.

The crit ical values are 3.84 and 2.71 at 5% and 10% respect ively. Thus, we do not reject the null of ort hogonal innovat ions, and no ort hogonalizat ion t echnique is used for reduced-form residuals.

Unconvent ional impulse-response funct ions were calculat ed using (1; ¡ 1) as t he coint egrat ing vect or and t he adjust ment fact or in t he form (0; ®)13. From t he VECM with two lags, insigni¯ cant regressors were delet ed based on t heir robust t-tests14. Based on t hese rest rict ed VECM est imates, and using (2.10), t he marginal

impacts of innovat ions t o G¤

t and Tt onP V (¢ Gd ¤)t andP V (¢ T)d t were calculat ed.

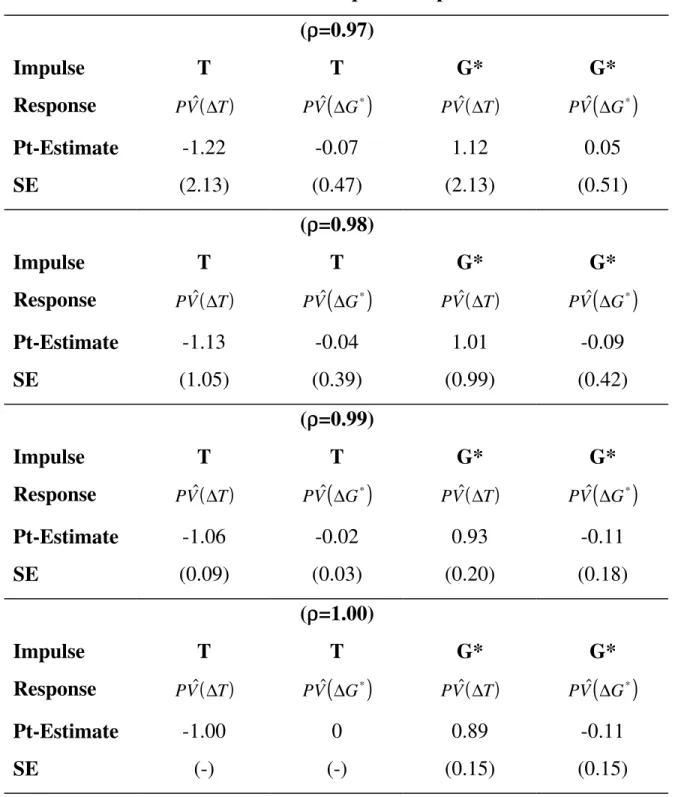

Table 8 shows t he impulse-response result s for t he following values of ½: ½= 0:97, ½ = 0:98, ½ = 0:99, and ½ = 1. To be able t o t est hypot heses on t he impulse-response paramet ers, we performed a Mont e-Carlo experiment wit h 1,000 replicat ions for each value of ½. The sample size used for each replicat ion is t he same as t hat of t he original dat a, and pre-sample observat ions were drawn to avoid dependence on t heir values. St andard errors of point -est imates were t hen comput ed and are included in Table 8.

Table 8 has two int erest ing result s. First , it is clear t hat expendit ures change very lit t le when we consider innovat ions in eit her expendit ures or revenues. For ½= 1, and t hus wit h no measurement error, 89% of expendit ure-generat ed de¯ cit s are eliminat edviaan increase in t axes, versus only 11% of decrease in fut ure ex-pendit ures. Not ice t hat t he former is not st atist ically di®erent from 100% and t he lat t er not st at ist ically di®erent from zero. Second, alt hough it is impossible t o infer consumer behavior from ¯ scal dat a, impulse-response result s are consis-t enconsis-t wiconsis-t h Ricardian-Equivalence behavior for Brazilian consumers (Barro(1974, 1989)) wit h t he appropriat e preferences. This is t rue since a change in t axes, not accompanied by a change in expendit ures, will be o®set 100% by a change in fut ure t axes. T hus, Ricardian consumers using VAR's t o infer t he meaning of a t ax break (hike) t oday will not change t heir opt imal consumpt ion allocat ion, since t hey expect t his t ax break (hike) t o be o®set by an equivalent increase (decrease)

13T he est imat e for ® is 0.25.

in fut ure t axes. T his result is a direct consequence of t he weak exogeneity of expendit ures for t he cointegrat ion vect or15.

T hese two basic result s are also obt ained for ½6= 1. For example, for ½= 0:99, point est imat es of @P V (¢ T )c t

@Gc¤ t

and @P V (¢ Gc ¤)t

@Gc¤ t

are 93% and -11% respectively, and

are st at ist ically equal t o 100% and zero respect ively. Moreover, @P V (¢ T )c t

@cG¤ t

is st ill st at istically equal t o -100%. For ot her values of ½6= 1, impulse-response est imat es are not very di®erent from t he result s above, alt hough not precisely est imat ed.

It is always appropriat e t o ask what is t he proper value of ½= (1+ r )1 t o use for t he sample period 1947-1992. Since ¯ scal variables are expressed as a proport ion of GDP, r should be int erpret ed (t o a logarit hmic approximat ion) as t he di®erence between t he real-int erest rat e on debt and t he growt h rat e of GDP. Due t o t he lack of long-span dat a on int erest rates, we can only conject ure here what is t he most appropriat e value of ½: during t his period, t he relat ively high in° at ion rat e, coupled wit h a relat ively high growt h rat e for GDP, would indicat e t hat r ' 0 is a reasonable value for r . Therefore, we propose using ½' 1.

Our last empirical t est checks whet her or not seigniorage was import ant for long-t erm ¯ scal balance. We perform a coint egrat ion t est wit h t he same revenue series as before wit h seigniorage revenues excluded, using, again, t he same signi¯ -cance level (20%). T he result s are present ed in Table 9. We ¯ nd no coint egrat ion in t his case. Not ice t hat t he Trace and t he ¸max st at ist ic are much smaller t han

t heir crit ical values at 20%.

T he evidence for Brazil suggest s t hat debt is sust ainable and t hat expendi-t ures are weakly exogenous. Thus, expendi-t he counexpendi-t ry followed much more closely a spend-and-t ax t han a t ax-and-spend policy. Indeed, our impulse-response result s suggest s t hat , given a shock t o expendit ures, t he present value of t axes will fully accommodat e t his imbalance rest oring long-run equilibrium. Given t hat seignior-age is crit ical for t he exist ence of equilibrium, it was probably t hrough seigniorseignior-age revenues t hat most expendit ure increases were ¯ nanced. In t his case Brazilian in-° at ion is simply a consequence of t he type of spend-and-t ax policy followed in t he post -war period.

It is int erest ing t o compare our result s t o t hose of ot hers who invest igat ed public-¯ nance issues in Brazil. Past ore(1995) t est s debt sust ainability using t he t echniques of Hamilt on and Flavin(1986) on a short -span ¯ scal dat a set . From

unit -root t est s, he ¯ nds t hat t he ¯ rst di®erence of public debt is st at ionary. Since t his series is equal t o D eft (see (2.3)), his result s and ours are ident ical.

Rocha(1997), also using a short -span dat a set , concludes t oo t hat debt is sust ain-able. Since all t hese result s are achieved using di®erent t echniques, di®erent series, and di®erent samples, t hey complement each ot her in con¯ rming t he convent ional wisdom about Brazilian public ¯ nance.

As far as we know, one of t he original cont ribut ions of t his paper is t o t est for exogeneity of ¯ scal dat a, showing t hat expendit ures are exogenous for a high-in° at ion count ry such as Brazil. This assumpt ion is implicit in t he seminal t heo-ret ical paper of Bruno and Fischer(1990) on opt imal seigniorage for high-in° at ion count ries16. T here, cent ral banks choose opt imal seigniorage condit ional on a

given de¯ cit . Of course, t his condit ional opt imizat ion relies on t he exogeneity of expendit ures, which was validat ed here for Brazil under proper economet ric t est s. When we consider t he fact t hat debt was only sust ainable when seigniorage was included as a government revenue, it becomes clear t hat t he fundament al charact er of Brazilian public ¯ nance was t hat of endogenous seigniorage used to accommodat e expendit ure increases. Indeed, t his conclusion is a common feat ure of t he work of Past ore(1995), Ruge-Murcia(1995), Rocha(1997), and ours.

5. Concl usi ons

This paper present s t est s on t he sust ainability of Brazilian public debt for t he post -war period - 1947-92. They show t hat debt is sust ainable only if seigniorage is included as a government revenue. In t his case, exogeneity t est s suggest t hat expendit ures are exogenous. Unconvent ional impulse-response result s show t hat , regardless of how an init ial ¯ scal imbalance is originat ed (shocks t o expendit ures or revenues), it is eliminat ed t hrough a change in t axes. This last result is con-sist ent wit h Ricardian-Equivalence behavior for Brazilian consumers wit h proper preferences. Based on t he evidence, we ¯ nd t hat Brazil has followed closely a spend-and-t ax policy in t he post -war era, wit h seigniorage having a crucial role in balancing t he budget . As a consequence, Brazilian in° at ion was consist ent ly high during t his period.

A brief re° ect ion on t he st at us of t he Real Plan is appropriat e. Since t he beginning of t he plan in July 1994, seigniorage revenues have decreased sharply.

R efer ences

[1] AHMED, S. and B.S. Yoo, 1989. \ Fiscal Trends and Real Business Cycles" , Working paper: Pennsylvania St at e University, University Park, PA.

[2] AHMED, S. and J.H. Rogers. \ Government Budget De¯ cit s and Trade De¯ cit s: Are Present Value Const raint s Sat is¯ ed in Long-t erm Dat a?" Jour-nal of Monetar y Economics, 36, pp. 351-374, 1995.

[3] BARRO, Robert J., \ Are Government Bonds Net Wealt h?" Journal of Po-litical Economy, Vol. 82, pp. 1095-1117, 1974.

[4] Barro, Robert J., \ The Ricardian Approach t o Budget De¯ cit s," Journal of Economic Perspectives, v3(2), 37-54, 1989.

[5] BOHN, Henning, \ Budget Balance Through Revenue or Spending Adjust -ment s? Some Hist orical Evidence for t he Unit ed St at es." Journal of Mone-tary Economics, 27, pp. 333-359, 1991.

[6] BOHN, Henning, \ Endogenous Government Spending and Ricardian Equiv-alence," Economic Jour nal, vol. 102, pp. 588-597, 1992.

[7] Bruno, M., and Fischer, S., 1990, \ Seigniorage, Operat ing Rules, and t he High In° at ion Trap," Quarter ly Jour nal of Economics, vol. 105(2), pp. 353-374.

[8] Campbell, J., \ Does Saving Ant icipat e Declining Labor Income? An Alt er-nat ive Test of t he Permanent Income Hypot hesis," Econometr ica, vol. 55(6), pp. 1249-73, 1987.

[9] CYSNE, Rubens Penha. \ O Sist ema O¯ cial e a Queda das Transferencias In° acion¶arias." Working paper: Graduat e School of Economics - EPGE, Get ulio Vargas Foundat ion, 1995.

[10] ENGLE, R.F., and Granger, C.W.J., 1987, \ Coint egrat ion and Error Cor-rect ion: Represent at ion, Est imat ion and Test ing," Econometr ica, vol. 55, pp.251-276.

[12] Ericsson, N.R., 1994, \ Test ing Exogeneity: An Int roduct ion," in Ericsson, N.R. and Irons, J.S., Edit ors,Testing Exogeneity. Oxford: Oxford University Press.

[13] ERICSSON, N.R. and IRONS, J.S., 1994, \Testing Exogeneity" , Oxford: Ox-ford University Press.

[14] GONZALO, J., 1994, \ Five Alt ernat ive Met hods of Estimat ing Long Run Relat ionships," Jour nal of Econometrics, vol. 60, pp. 203-233.

[15] HAMILTON, J. and M. Flavin, \ On t he Limit at ions of Government Borrow-ing: A Framework for Empirical Test ing." Amer ican Economic Review, 76, 808-819, 1986.

[16] JOHANSEN, S., 1991, \ Est imat ion and Hypot hesis Test ing of Coint egrat ed Vect ors in Gaussian Vect or Aut oregressions" , Econometr ica, vol. 59-6, pp. 1551-1580.

[17] Johansen, S.(1992), \ Coint egrat ion in Part ial Syst ems and t he E± ciency of Single-equat ion Analysis," Jour nal of Econometr ics, vol. 52(3), pp. 389-402.

[18] JOHANSEN, S., 1995, \Likelihood-Based I nference in Cointegrated Vector Auto-regressive Models," Oxford: Oxford University Press.

[19] Johansen, S. e Juselius, K ., \ Maximum Likelihood Est imat ion and Inference on Coint egrat ion - wit h Applicat ions to t he Demand for Money," Oxford Bulletin of Economics and Statistics, vol. 52, pp. 169-210, 1990.

[20] Lucas, Robert E., 1976, \ Economet ric Policy Evaluation: a Crit ique,"

Car negie-Rochester Conference Ser ies on Public Policy, vol. 1, pp. 19-46.

[21] MADDALA, G.S., 1992, "I ntroduction to Econometrics," Englewood Cli®s: Prent ice-Hall, 2nd. Edit ion.

[23] Rocha, Fabiana, \ Long-Run Limit s on t he Brazilian Government Debt ," Re-vista Brasileira de Economia, vol. 51(4), pp. 447-470, 1997.

[24] Ruge-Murcia, F., 1995, \ Government Expendit ure and t he Dynamics of High In° at ion," Working Paper: Universit¶e de Mont r¶eal.

Figure 1

Expenditures (Including Nominal Interest Paid on Debt) and

Revenues (Including

Seigniorage

) as a Proportion of GDP

Gt* =Gt +rBt

and

Tt- 0 . 1 0 - 0 . 0 5 0 . 0 0 0 . 0 5 0 . 1 0 0 . 1 5 0 . 2 0

0 . 1 0 . 2 0 . 3 0 . 4 0 . 5 0 . 6

5 0 5 5 6 0 6 5 7 0 7 5 8 0 8 5 9 0

Table 1

Unit-Root Tests

Series

Lags

1ADF Test

Phillips-Perron

Test

Tax Revenues ( T )

3

-3.03

-3.37

Expenditures

(G )*4

-2.14

-2.54

Deficit

(G - T)*4

-2.98**

-3.27**

Notes: (1) The number of lags applies only to the ADF test. The final choice was made

based on the t-test of significance of the last lagged first-difference. (2) The lag truncation chosen for the Bartlett kernel was 3. For (G )*

Table 2

VAR Lag Truncation

(a)

VAR

Order

Constant

Linear

Trend

Schwarz

Criterium

Hannan-Quinn

Criterium

1

unrestricted

no trend

-14.21

-14.36

2

unrestricted

no trend

-14.25

-14.52

3

unrestricted

no trend

-14.24

-14.61

4

unrestricted

no trend

-13.98

-14.45

(b)

VAR

Order

Constant

Linear Trend

Schwarz

Criterium

Hannan-Quinn

Criterium

1

no constant

no trend

-14.21

-14.31

2

no constant

no trend

-14.39

-14.60

3

no constant

no trend

-14.36

-14.68

Table 3

Deterministic Components Test (VAR(3))

Model VAR

Order

Constant

Linear

Trend

Restricted Vs.

Unrestricted

Model

Test

Statistic

1

3

unrestricted

no trend

2 versus 1

1.64

2

3

restricted

no trend

3 versus 2

2.02

3

3

no constant

no trend

3 versus 1

3.66

Notes: Results conditioned on the existence of one cointegrating vector. The critical value

Table 4

Johansen’s Cointegration Test (

Seigniorage

Included as Revenues)

Test Statistic

(Critical Value at the 20% Level)

Cointegrating

Vector

λmax

Trace

(Expend., Taxes)

Κ =0 Κ ≤1 Κ =0 Κ ≤1

9.185*

1.638

10.82*

1.638

(7.58)

(1.82)

(8.45)

(1.82)

(1.0, -0.94)

Cointegration Restriction Test

Restriction

( )

1,−1 χ2( )

1 =150.;

p-value

: 22.14%

Table 5

Vector Error Correction Model Estimates

EQ. 1

(

∆ G*t)

EQ. 2

(

∆T

t)

Regressor

Est. Coeff.

t

-stat

t

-prob

Est. Coeff.

t

-stat

t

-prob

∆ G*t−1

0.17964

(0.19)

0.987

0.3298

0.23177

(0.09)

2.04

0.0474

∆ G*t−2

-0.73603

(0.22)

-3.558

0.0010

-0.1790

(0.12)

-1.39

0.1720

∆

T

t-1-0.30270

(0.36)

-1.163

0.2521

-0.3066

(0.14)

-1.89

0.0657

∆

T

t-20.61572

(0.43)

2.459

0.0186

0.15161

(0.12)

0.97

0.3362

Def

t-10.07624

(0.21)

0.503

0.6179

0.25661

(0.07)

2.72

0.0097

Table 6

Adjustment-Coefficient Weak Exogeneity Test

Null Hypothesis

Test Statistic

P-Value

Tt

is weakly exogenous for the

parameter of interest of the

G*t

conditional model

7.36

0.0067**

G*

t

is weakly exogenous for the

parameter of interest of the

Ttconditional model

1.11

0.29

Table 7

Granger-Causality Test

VAR(3)

Null Hypothesis

P-Value

T

tdoes not Granger-cause

G*

t

0.023*

G*

t

does not Granger-cause

T

t0.0000**

Notes: The symbols (*) and (**) represent rejection of the null at the 5 and 1%

Table 8: Unconventional Impulse-Response Function

(

ρρ

=0.97)

Impulse

T

T

G*

G*

Response

PV$( )

∆T PV$(

∆G*)

PV$( )

∆T PV$(

∆G*)

Pt-Estimate

SE

-1.22

(2.13)

-0.07

(0.47)

1.12

(2.13)

0.05

(0.51)

(

ρρ

=0.98)

Impulse

T

T

G*

G*

Response

PV$( )

∆T PV$(

∆G*)

PV$( )

∆T PV$(

∆G*)

Pt-Estimate

SE

-1.13

(1.05)

-0.04

(0.39)

1.01

(0.99)

-0.09

(0.42)

(

ρρ

=0.99)

Impulse

T

T

G*

G*

Response

PV$( )

∆T PV$(

∆G*)

PV$( )

∆T PV$(

∆G*)

Pt-Estimate

SE

-1.06

(0.09)

-0.02

(0.03)

0.93

(0.20)

-0.11

(0.18)

(

ρρ

=1.00)

Impulse

T

T

G*

G*

Response

PV$( )

∆T PV$(

∆G*)

( )

PV$ ∆T PV$

(

∆G*)

Pt-Estimate

SE

-1.00

(-)

0

(-)

0.89

(0.15)

-0.11

(0.15)

Notes: Standard errors calculated using a Monte Carlo, where the Data Generating

Table 9

Johansen’s Cointegration Test (

Seigniorage

Excluded as

Revenues)

Test Statistic

(Critical Value at the 20% Level)

Cointegrating

Vector

λmax

Trace

Κ =0 Κ ≤1 Κ =0 Κ ≤1

7.305

0.0454

7.351

0.0454

-(10.04)

(1.66)

(11.07)

(1.66)

Notes: The symbol (*) indicates rejection of the null at the 20% significance level. The