FUNDAC

¸ ˜

AO GETULIO VARGAS

ESCOLA DE P ´

OS-GRADUAC

¸ ˜

AO EM ECONOMIA

MARCELO CASTELLO BRANCO SANT’ANNA

RETAIL COMPETITION AND SHELF SPACE

ALLOCATION

MARCELO CASTELLO BRANCO SANT’ANNA

RETAIL COMPETITION AND SHELF SPACE

ALLOCATION

Disserta¸c˜ao submetida a Escola de

P´os-Gradua¸c˜ao em economia como

requesito parcial para a obten¸c˜ao

do grau de Mestre em Economia.

Orientador: Luis H.B. Braido

MARCELO CASTELLO BRANCO SANT’ANNA

RETAIL COMPETITION AND SHELF SPACE

ALLOCATION

Disserta¸c˜ao submetida a Escola de P´os-Gradua¸c˜ao em economia como

requesito parcial para a obten¸c˜ao do grau de Mestre em Economia.

E aprovado em 07/07/2010 pela comiss˜ao organizadora

Luis Henrique Bertolino Braido

Escola de P´os-Gradua¸c˜ao em Economia

Afonso Arinos de Melo Franco Neto

Escola de P´os-Gradua¸c˜ao em Economia

Jos´e Santiago Fajardo Barbachan

Abstract

We develop a model to study shelf space allocation in retail. Retailers compete for consumers not only choosing prices but also by the space allocated to each product on shelves. Our approach depart from the existing literature on shelf allocation, as we model the problem of price setting and shelf allocation in an oligopolistic retail market. We present a simple model of retail competition in which prices are dispersed in the cross-section of stores but shelf allocation is not.

Keywords: Shelf space allocation. Price dispersion. Retail competition.

Resumo

Um modelo ´e desenvolvido para estudar o problema de disposi¸c˜ao interna dos produ-tos em um ponto de venda. Varejistas competem escolhendo pre¸cos e o espa¸co ocupado pelos produtos. Nossa abordagem difere da existente na literatura pois modelamos o problema de apre¸camento em um mercado de competi¸c˜ao oligopolista. Apresentamos uma vers˜ao simplificada do modelo na qual pre¸cos s˜ao dispersos nacross-section de vare-jistas, mas a aloca¸c˜ao dos produtos no ponto de venda, n˜ao.

Contents

1 Introduction 6

2 Literature Review 7

2.1 Shelf space allocation. . . 7

2.1.1 Empirical literature in shelf space allocation . . . 9

2.2 Price dispersion . . . 10

3 Model 13

3.1 A simple example . . . 17

4 Conclusion 23

Appendices 26

A Optimal shelf allocation and pricing 26

B Proof of Proposition 1 28

1

Introduction

Allocating shelf space to products is an ubiquitous problem in retail activity. The existing

literature on this issue points that shelf allocation does matter regarding sales and profits.

Nevertheless, articles dealing with this topic are scarce in the economics literature. The

reason for this is probably the lack of a well established theory of price competition, that

can properly account for an important stylized fact of retailing activity: price dispersion.

One of the benchmarks in price dispersion literature is Varian (1980), in which the

the-oretical possibility of price dispersion in homogeneous products markets is introduced. The

result relies fundamentaly on the assumption that consumers differ on the information they

have on the prices posted by firms. There are the informed consumers who know the

en-tire price array and the uninformed ones who don’t have any information on prices and thus

shop randomly.1 Stores are then divided between charging a high price to extract the surplus from the uninformed consumers and posting a lower price that could win the market for the

shoppers. In this setting, no pure strategy equilibrium can exist. Price dispersion thus arise.

Nevertheless, this hypothesis is not necessary for the emergence of equilibrium price

dispersion. When firms compete in prices with homogeneous goods, but face entry fixed costs

in order to post prices, Sharkey and Sibley (1993) shows that no pure strategy equilibrium

can exist and prices are thus dispersed in equilibrium. In this case stores face the dilemma

between not paying the fixed cost and thus earning zero profits or paying it and risking the

retail war.

We use the model in Sharkey and Sibley(1993) as a benchmark and propose a model to

analyze the problem of shelf space allocation in retail. In our model, stores also face fixed

entry costs but choose both prices and the the amount of space to allocate to each product.

In our model, shelf space is a firm specific limited resource, in the sense that firms may

not buy or produce more of it. In this sense, it may differ from other retail practices such

as in-store advertisement and other services supplied to attract the attention of consumers.

Shelf space affects consumer’s utility function directly so it may be an important channel,

besides prices, through which stores compete.

This approach for modelling the shelf space allocation problem in reatil is not entirely

novel. InAlbeniz and Roels(2007), shelf space is also viewed as a limited resource that affects

consumers demand for the goods supplied by the retailer. Nevertheless, the resemblence

between this work and theirs doesn’t go far beyond. In Albeniz and Roels (2007), there is

a monopolist retailer, and not a set of possible entrants as in our case. Their objective is to

study commonly held practices whosalers may use to assure shelf space to their products.

We present a general framework to study the shelf allocation problem. Unfortunately,

there is not much that can be said by just looking at the general setting. We propose then

a simple example in which prices are dispersed in equilibrium but stores do not randomize

shelf allocation. Literature argues that shelf space allocation in stores tends to be relatively

constant over time and many refer to reallocation costs to explain this fact. In our example,

the in-store space allocation stability emerges naturally from the Nash equilibrium played

by firms.

Our model aims at connecting two different features of retailing activity, price dispersion

in homogenous products markets and the choice of shelf space allocation by firms. In this

sense, before formally introducing our model we present a short survey of existing literature

on shelf allocation of products and price dispersion. This is done is Section 2. Section 3

presents and discusses our model and the refered example.

2

Literature Review

2.1 Shelf space allocation

There are few authors in the economics literature that deal with shelf allocation

prob-lems in retail as has been acknowledged by van Dijk et al. (2004). The latter, as does the

majority of works in this topic, falls in the management and operational research fields and

generally tend to have a practical approach. Some management authors, such Bultez and

Naert (1988),Corstjens and Doyle (1981) and Dreze et al.(1994) that deal with this topic

develop models that would help corporate decison makers in allocating shelf space. These

models build on the assumption, not always explicit, that shelf space is wrongly, or not

op-timally, allocated within stores.Corstjens and Doyle(1981) refers to this as being caused by

their arguing are text book moral hazard problems of incentives and control. In this sense,

the methods proposed by this branch of marketing and operational research could be seen

as new technology to help the principal improve profits without the necessity to leave rents

to the store manager.

Nevertheless, Winter (1993) may be seen as an exception to this lack of enthusiasm

of the economics literature with the subject of shelf allocation. The author analyses how

stores compete not only in prices but also by providing special services. In the author’s

view, these special services are time saving for consumers. Thus consumers with higher

productivity would be more inclined to value this kind of service than low productivity

consumers. Prominent shelf space is seen therefore as part of this shopping time saving

services. The main point of the article is to show how resale price maintenance practices by

producers could avoid in part the negative effects of this nonprice competion.2

Management literature in shelf allocation can be loosely divided into a more empirical

branch and into a more theoretical one. In the latter category fall papers like Corstjens

and Doyle (1981), Albeniz and Roels (2007). According to the former, in previous models

operational costs and profit margins accounted for the main factors behind the optimal

choice of shelf space allocation. Some examples of this approach are PROGALI and OBM

which are commercial “rules of thumb” used at that time by retailers.3 These methods completly ignored the effect of changing the visibility of a product in its sales. The main

contribution of Corstjens and Doyle (1981) is to build a model that considers the demand

side of the problem, ignored so far. More specifically, they construct a model that deals

with product space elasticities, profit margins and inventory handling costs. In their view,

the retailer’s problem is to choose the vector of space allocation in order to maximize a

profit function subject to space and availability constraints. Demand was taken as given

and retail competition considerations were not dealt with.Bultez and Naert(1988) basically

extends Corstjens and Doyle (1981) allowing for a broader array of products elasticities.

Interestingly, the predictions of this model fall in between that of two pre-existing models:

2High productivity consumers also incour in higher transportation costs to move to stores. Therefore high

productivity consumer’s nearst store has hercaptive. Stores main struggle is to attract the low productivity consumers, resulting in suboptimally low prices and services quality.

3In PROGALI space is allocated in proportion to total sales. OBM allocates it in proportion to gross

PROGALI and OBM, which are proved to be special cases ofBultez and Naert(1988) model

with proper parameters constraints.

In a recent paper, Albeniz and Roels (2007) uses this same basic model to analyse the

problem of suppliers price setting game. In most of the paper, the single retailer takes the

resale price as given. As in Corstjens and Doyle (1981), she is left to choose just products

shelf allocation. They intend to quantify the inefficiencies arising in the Nash equilibrium of

the game and evaluate commonly held market practices such as pay-to-stay fees4 and supply chain integration. They find that these practices lead to a significant reduction in the chain

inefficiency.

Albeniz and Roels (2007) completly ignore the problem of retail competition. In their

model there is a single retailer that sell several products, each supplied by a distinct

whole-saler, who sets the wholesale price of her own product. Given wholesale prices, the retailer

must choose the shelf space to be allocated to each product.5 Wholesalers then incorporate

future retailer’s actions and set the wholesale price optimally. A Nash equilibrium for the

wholesalers pricing game is derived. In most of the paper, the retailer takes end consumer

prices of the products as given, nevertheless she chooses shelf space allocation as a

monopo-list. Therefore when the authors allow the retailer to choose prices the inefficiency problem

worsens, which happens due to double marginalization.

2.1.1 Empirical literature in shelf space allocation

The empirical literature on shelf space allocation must deal with a difficult task in order

to estimate the importance of shelf space in sales. As related invan Dijk et al.(2004), shelf

space is reallocated within a store unfrequently, giving the econometrician little time variation

of the variable in question. Moreover, there is a serious endogeneity problem in estimating

shelf space sales elasticity through traditional least squares estimators. They argue that

shelf space should be related to other variables, not observed by the econometrician, that

also affect sales. The authors then develop a new method to estimate shelf space elasticities

resorting to spatial econometrics. Their point is that this unobserved variables cause a joint

4The authors define pay-to-stay fees as a “rent charged by retailers to suppliers in exchange for retailing

space”.

5The authors consider both cases when the retail price is given and when the single retailer choose the

spatial dependence of observed variables that can be used to properly control for endogeneity.

They depart from other spatial econometrics works that resort to geographical distance and

build a metric of proximity that takes other variables into account such as household and

store intrinsic characteritics. Data from 5 brands of shampoo in 44 supermarkets from a

large retailer in the Netherlands are used and an avarege shelf space elasticity of 0.21 is

found with their proposed method. They argue that their result is very close to the one

refered in the experimental literature. In fact, Curhan(1972) has found similar results. He

estimates space elasticity using data of 500 different grocery products and gives estimates

for different subsamples of the data. For the whole sample, space elasticity averaged 0.212.

However, contrary to part of the literature in shelf space allocation, space elasticity was

found to be higher for the subsample with increased display area.

The use of experiemts is indeed a recognized way to estimate shelf space elasticities

without the need to resort to endogeneity treatments.Dreze et al.(1994) have employed to

that end experimets in shelf reallocation at a major retail chain in Chicago. Product were

reallocated exogenously, which would allow for consistent estimation. Dreze et al. (1994)

further incorporate in the model other location variables such as facing height and horizontal

distance to the end of the aisle. Product height seems to be the most important of the three

display features analysed and moving products from the worse vertical position to the best

one is said to increase sales on average by 39%.

2.2 Price dispersion

It has long been noted in the economic literature that the law of one price, which deccours

from traditional walrasian equilibrium, is not present in many markets. In retail markets,

for instance, both on the street and on the internet, price dispersion seems to be the rule

and not the exception.

Many authors made efforts in order to reconcile this empirical evidence with the economic

theory in models of price competition that differ from that of Bertrand in some way that allow

for the existence of mixed strategy equilibria. Thus mixed strategies would be responsible

for the price dispersion observed in many markets, as competitive forces would be forcing

Models that explain price dispersion in static equilibria generaly rely on some hypotheses

that prevent the existence of pure strategy equilibria. These hypotheses may loosely speaking

be classified in one (or two) of the three categories: (1) uninformed consumers, (2) fixed costs

and (3) capacity constraints.

Varian (1980) may be considered the classical reference of the first category. In his

model, firms produce a homogeneous good and compete in prices. There are two kinds of

consumers: the informed and the uninformed ones. The informed kind is assumed to buy

the product from the seller who advertise the lowest price, in turn the uninformed ones are

assumed to buy randomly from any firm.6 Thus firms have a captive market of uninformed consumers who will buy its product at any price. In this sense the undercutting rationale

would lead firms to zero profits, which is less that they could achieve by just selling to

the uninformed consumers at monopoly prices. Varian (1980) shows that there is a mixed

strategy equilibrium for this game, that yields firms positive expected profits.

The second hypothesis that can be used to generate price dispersion, as noted earlier, is

the presence of fixed entry costs. If firms must pay a fixed entry fee in order to compete

in prices in some homogeneous good market it is possible that there is not a pure strategy

equilibrium because the constant undercutting Bertrand rationale would lead firms to losses

due to the fixed cost. For all firms not to enter would clearly not be an equlibrium since all

players would rather enter when others do not.

Sharkey and Sibley (1993) introduce the problem of oligopolistic competition with

si-multaneous entry and pricing decisions. When consumers are homogeneous, they argue that

the problem faced by retailers can be viewed as a competition on the profit levels that would

be attained if the retailer won the price war. The idea is that if prices are chosen as to

max-imize the homogeneous consumers utility subject to a profit level, then all of them would

end up buying from the stores with the lowest profit level. Similarly to Stahl (1989), they

point out that when the number of possible entrants increase, expected prices also tend to

increase. This result however is highly dependent on the hypothesis that firms face the same

entry cost. Marquez(1997) considers the implications of this model when firms do not have

the same entry costs and finds that entry is blockaded for all firms except the two with the

lowest fixed cost of entry.

Morgan et al.(2006) offer a clear example of the importance of the fixed cost dimension

in retail competition. The authors introduce in Varian’s model a fixed advertisement cost and

study the theoretical implications of changes in the equilibrium price distribution and then

assess them experimentally. Nevertheless, Morgan et al. (2006) can be seen as a particular

case of the model described byBaye and Morgan (2001).

Baye and Morgan(2001) develop a model of price competition on the internet in which

a monopolist gatekeeper charges fees from advertising firms and shoppers. Firms are local

monopolists in its own towns, but can reach consumers in other towns by advertising in the

gatekeeper’s website. In turn, consumers must choose to drive directly to the local store or

they may choose to pay the gatekeeper’s fee and search the available prices online.Baye and

Morgan (2001) show that there is a mixed strategy equilibrium in which price dispersion

is observed. In essence, they develop a model in which information (as in Varian (1980))

is important as well as fixed costs. Note also that in Baye and Morgan (2001) the mass of

uninformed consumers is formed endogenously and just likeStahl(1989) as a result of search

costs.

Meanwhile, in Braido (2009), the environment approaches that of traditional general

equilibrium. Price dispersion in this setting is the result of a game in which possibly

het-erogeneous (but perfectly informed) consumers choose the store which offers the best (in

his perception) price bundle and firms have possible non-convex costs. An equilibrium is

shown to exist under endogenous tie-breaking rules.7 Braido (2009) then presents a simple

model of retail with fixed costs in which a mixed strategy equilibrium is played by retailers.

The author argues that this model may be insightfull to analyze observed price competition

phenomena such as weekly specials.

One class of models relies on capacity constraints by firms to generate such equilibria.

But as has been shown by Kreps and Scheinkman (1983), under fairly general hypotheses,

capacity precomitment yields Cournot competion outcomes, i.e., without price dispersion in

equilibrium. The authors establish the conditions for the existence of a mixed strategies

equilibrium in a model of price competition but that is not reached under the conditions of

7The author relies in the existence result of equilibrium in discontinuous games with endogenous

the model.

Kruse et al. (1994) work also with the capacity constraint framework and confront

dif-ferent theories that could explain behavior under such conditions with experimental data.

The only theory of static equilibrium tested is the mixed strategy equilibrium just discussed.

The authors also consider competitive price setting, Edgeworth cycle and price colusion. In

the Edgeworth cycle, sellers set prices according to the best response to prices set in the

previous section. Edgeworth cycle is therefore, as noted by Kruse et al. (1994) a

desequi-librium theory as regards agents as not being rational. Their empirical finding is that the

distribution of prices, more specifically its mean, is not independent over time, as it would

be consistent with mixed strategy Nash equilibrium. Nevertheless, price distribution seems

to vary in accordance to the theory due to changes in the capacity.

3

Model

Let us assume that there are L + 1 commodities indexed by l ∈ {0,1,· · ·, L} in the

economy and a continuous mass of identical consumers with unity measure. Consumers are

endowed just withω units of commodity zero, thenum´eraire good. The lastLcommodities

are sold to consumers by N > 1 identical retailers. Consumers have preferences both over

commodities consumption and over the way products are displayed in-store, in this sense

shelf space allocation does matter to consumers. Shelf space is represented bys∈RL+ which

match the indexl of commodities. Thus, consumers preferences are represented by a utility

functionu:R2+L+1→R.

All stores are assumed to have the same constant marginal costs of producing the L

goods, represented by the vector c ∈ RL+ and choose simultaneously the price vector p of

commodities and the vector of in-store space allocation s in order to maximize expected

profits.

We assume that the vector of s must lie in the simplex, i.e., for all stores P

lsl = 1 and sl ≥ 0 for all l. In real retail, shelf space is far from being a homogeneous good. For

instance, the importance of the shelf space varies with the height of the shelf and the position

in the aisle. This complexity is not fully incorporated in our measure s. Nevertheless, one

of these space quality issues. An important aspect of shelf space in our model is that it is

a limited resource, which cannot be bought or sold in the market. In this sense, shelf space

allocation differs essentially from other retail practices such as advertisement.

Consumers observe retailers prices and the shelf space allocation and then choose the

store most attractive from their point of view. From a standard consumer theory perspective,

consumers choose the store posting the pair (p, s) ∈ R2+L which gives her the highest value

of the indirect utility function. They must do all their shopping at just one store. It is as if

consumers once at a given store faced sufficiently high transportation costs, making driving

to another store unworthy.

Stores are also assumed to bare fixed operational costs Cf > 0, which are incurred

whenever a stores is open for business. Thus if a store does not open for business it gets zero

profit and if it is open and also chosen by the representative consumer its profit is given by:

Π(p, s) = (p−c)·x(p, s)−Cf. (1)

In which x(p, s) is the consumer’s demand function. If it is not chosen by consumers a

store must undergo a loss ofCf, the amount of the fixed cost. We also make the assumption

that the monopoly profit given by (2) is strictly positive.8

Π⋆=

supp,sΠ(p, s)

s.t.PL

l=1sl= 1

(2)

In this setting of homogeneous consumers and firms, constant marginal costs and fixed

operational costs it’s well documented the inexistence of pure strategy Nash equilirium. As it

has been previously stated,Sharkey and Sibley(1993) shows that in such settings everything

works as if stores compete in profit levels.

In equilibrium, as means to attain a profit level ofβ, an entrant must set (p, s) in order to

satisfy the most the consumer. If that was not the case, it would be optimal for a competitor

to make it so and the entrant would certainly loose the retail war. Since stores optimize

price and shelf allocation setting when attaining a certein amount of profitβ, consumers will

8Note that whenN = 1, the monopolist will set the sole vector of prices and shelf space in the economy

allways end up buying from the store that sets the lowest level ofβ.9

(p(β), s(β))∈

arg maxp,s v(p, s, ω)

s.t. Π(p, s) =β,

PL

l=1sl = 1.

(3)

Where v :R2+L+1 → R as usual denotes consumers indirect utility function. First order

conditions for this problem are necessary, but may not be sufficient. That is to say, if a

solution for the problem exists, then it must attend the referred first order conditions. But

not every pair (p(β), s(β)) that attends the first order conditions is a solution to the problem.

Equations (4)-(5) give the necessary first order conditions:

∂v(p, s, ω)

∂pj

+µ[xj(p, s, ω) + (p−c)·

∂x(p, s, ω)

∂pj

] = 0, ∀j= 1, ..., L; (4)

∂v(p, s, ω)

∂sj

+µ[(p−c)·∂x(p, s, ω)

∂sj

] +φ= 0, ∀j= 1, ..., L. (5)

Whereµand φare the Lagrange multipliers for the first and second restrictions,

respec-tively, for the problem given in (3).

Using Roy’s identity and the envelope theorem 10and rewriting the equations (4)-(5) in

a compact manner:11

−x(p, s, ω)∂v(p, s, ω)

∂ω +µ[x(p, s, ω) +

∂x(p, s, ω)

∂p ·(p−c)] = 0; (6)

∂u(x, s, ω)

∂s +µ[

∂x(p, s, ω)

∂s ·(p−c)] +φ= 0. (7)

We now present a mixed strategy equilibrium in which stores randomize in both its entry

decision and in its profit level, and thus in its price setting and goods display strategy. A

9This is assured by the positiveness of µ, the lagrange multiplier associated to the first restriction in

problem3, which gives us a measure of the penalty in terms of consumer utility from a marginal increase in β.

10Roy’s identity: ∂v(·)

∂pj =−xj(·)

∂v(·)

∂ω . Applying the envelope theorem to the consumer’s problem one may get ∂v(·)

∂sj =

∂u(·) ∂sj .

symmetric mixed strategy for this game constitutes of a pair (α, F), in which α ∈ [0,1]

represents the entry probablility and F : [0,Π⋆] → [0,1] represents a distribution function

over the profit level. Stores must be indifferent between choosing any strategy in the support

of equilibrium, therefore it must be the case that stores are indifferent between opening to

business and potentially having a profit ofβ or staying out of business, and thus to earning

zero profit.12 Therefore we must have:13

(1−αF(β))N−1

β+ [1−(1−αF(β))N−1

](−Cf) = 0, (8)

F(β) = 1

α

(

1−

C

f

β+Cf

N1

−1

)

. (9)

Since F(Π⋆) = 1, we can write:14

α= 1−

C

f Π⋆+C

f

N1

−1

. (10)

Thus, profit distribution is given by:

F(β) =

0 ifβ <0,

1−

Cf β+Cf

1

N−1

1−

Cf

Π⋆+Cf

1

N−1

ifβ ∈[0,Π⋆]. (11)

Nevertheless, it is not yet clear how prices and shelf space allocation evolve with the profit

levelβ. In the case where firms choose only prices,Boiteux(1956) was the first, at the best

of our knowledge who presented the problem of a monopolist maximizing consumer’s welfare

subject to a budgetary constraint. Bliss (1988) has also noted that the problem resembles

very much the one of Ramsey distortionary taxation. As the government in the Ramsey

problem, firms would have to set its profit margins in order to raise the desired profit level,

but mininmizing the welfare loss of such distortions. When we introduce this new feature

12Note that there can’t be an equilibrium with α= 0 and Cf bounded. If all stores chose allways not

enter, it would be optimal for a given store to enter and achieve monopoly profit Π⋆.

13If a store sets prices and shelf space allocation so that profits are βwhen it wins the retail war, then

the probability that it beats a single store is the probablility that the other store is not entrying or it is entrying and setting its profit aboveβ. This probablity is given by ((1−α) +α(1−F(β))) = (1−αF(β)). The probability that it beats all the other retailers is simply (1−αF(β))N−1. With the complementary probability it inccours just the fixed costCf.

of product disposure we introduce some noise to the Ramsey problem and the implications

of such change are still unclear in the general model, as they would be highly dependent on

preferences. In this sense we turn ourselves to an example in which product disposure has

richer implications.

3.1 A simple example

Consider the case in which there are only three commodities and preferences are defined

by the utility function:

u(x, s) =α1lnx1+α2lnx2+x0+γ1s1x1+γ2s2x2. (12)

In the interior solution, demands are given by:

x1(p, s) =

α1

p1−γ1s1

and x2(p, s) =

α2

p2−γ2s2

. (13)

In this demand system, it is as if prominent shelf space of a product were analogous to

a reduction in perceived prices by consumers. Therefore, if a retailer increases the price of

goodjinδ >0, she could mantain sales constant through an increase ofγjδin goodj’s shelf

space. The parameterγj gives us then a measure of the substitution rate between prices and

shelf space in demand.

Moreover, in this specification, marginal returns in sales from increases in shelf space are

positive, which seems to be in accordance with the literature in shelf allocation. However,

this demand system also presents increasing marginal returns in sales with respect to space

allocated to the item.15 Part of the literature in shelf allocation asserts explicitly the opposite relation between shelf space and demand (e.g., Corstjens and Doyle (1981), Albeniz and

Roels(2007), Dreze et al.(1994)), which could be seen as a drawback of the preference used

in this example.

Firms problem in each profit level β is given by:

15Sincepj−γjsj>0 in the interior solution, ∂2 xj(p,s)

∂s2

j

= 2γ

2

jαj

max

p,s v(p, s, w) (14) s.t. (p−c)·x(p, s)≥β+Cf,

s1+s2 = 1.

Assumption 1 γ2c1+γ1c2 > γ1γ2 and α1+α2 > Cf.

The second inequality in Assumption 1 is simply the assumption made in the general

framework that monopoly profits be strictly positive. Deriving problem (14) first order

conditions and making the same substitutions we have made to reach equations (6)-(7) gives

us:

−xj+µ[xj+ (pj −cj)

∂xj(p, s)

∂pj

] = 0, j= 1,2; (15)

xj+µ[(pj−cj)

∂xj(p, s)

∂sj

] +φ= 0, j= 1,2; (16)

where µand φare the Lagrange multipliers for the first and second restrictions,

respec-tively, in (14).

We note that, as in the general model, these are just necessary conditions for the optimal.

An optimal solution must satisfy these conditions, but not all values of (p, s) that satisfy

them are necessary an optimal for the problem. We recognize that at this point, we can

not discard that this expression may lead to a saddle point and further inquiry is needed

to assure optimality of the analytical solution presented bellow. Second order conditions for

this problem have been checked for a wide range of parameters and the result was allways

inconclusive.16

Note that in this case, ∂x(·)

∂p is exactly the Slutsky matrix due to the absence of income effects. Therefore it possess the usual properties of the Slutsky matrix. We also observe

that in this simple model, demand cross price derivatives are null. Solving the first order

16For this case, second order conditions resume to checking if the two last leading principal minors of

conditions one ends up with the prices and shelf allocation given below. The complete

derivation of equations (17) and (18) are found in AppendixA.

sj =

cj

γj

− αj

α1+α2

γ2c1+γ1c2−γ1γ2

γ1γ2

, j= 1,2; (17)

pj(β) =cj+

αj

α1+α2

(β+Cf)(γ2c1+γ1c2−γ1γ2)

γ−j(α1+α2−(β+Cf))

, j= 1,2. (18)

One interesting feature of the model developed here is that shelf space doesn’t vary

in the cross-section of stores. Retail competition occurs only through prices, which are

dispersed across stores in equilibrium. This result helps us to join two empirical evidences of

retail behavior: that prices are dispersed in homogeneous products markets17and that shelf allocation changes unfrequently.18

Broadly, shelf space allocation is not related with any parameter associated to the profit

level competion problem described by Sharkey and Sibley (1993). The number of firms

competing and the fixed costs associated with each market should not matter to shelf

allo-cation. The only parameters that should matter in terms of shelf allocation are preference

parameters and marginal costs.

Although we have presented the result for this particular case with just three goods, it

is valid in a more general setting. In Proposition 1, we extend the result using the same

functional form but generalizing it for the case in which stores selln goods rather than just

two. The proof is left to Appendix B.

Proposition 1 Consider the game described in Section3. If the consumers’ utility function

is given by:

u(x, s) = n

X

i=1

αilnxi+ n

X

i=1

γisixi+x0. (19)

Then all stores choose the same vectorsin the equilibrium described by the profit distribution

17Pratt et al.(1979) presents evidence of price dispersion in 39 product categories in the Boston area.Baye

and Morgan(2004) presents evidence for price dispersion on the internet. The authors of the latter article maintain a website (http://nash-equilibrium.com/), in which information about price dispersion on the in-ternet is weekly updated and can be accessed with restrictions.

18This fact is acknowledged by van Dijk et al. (2004). They refer to ACNielsen, which states that shelf

function in (11) and by the entry probablility:

α= 1−

Cf Π⋆+C

f

N1

−1

. (20)

Moreover, products with greater marginal costs must also have special attention from

stores with respect to its display in-store. An increase (decrease) in product j’s marginal

cost, increases (decreases) shelf space allocated to it.19

Substituting equations17and18in the demand function13, we may find the equilibrium

quantities:

x⋆1(β) =γ2(α1+α2−(β+Cf))

γ2c1+γ1c2−γ1γ2

, (21)

x⋆2(β) =γ1(α1+α2−(β+Cf))

γ2c1+γ1c2−γ1γ2

. (22)

Empirical literature in shelf space allocation, suchvan Dijk et al.(2004), finds a negative

relation between prices and shelf space allocation. That is, lower price products would be

associated with a higher display in store. Such relation is absent in our results. In the

cross-section of stores, there is no relation between shelf space allocation and prices, given

that shelf space, as argued above, is constant.

Our next step is to characterize the equilibrium distribution of prices. First, note that

given consumer’s utility function, there is no solution to the monopolist problem. In order

to clarify, we recour to the expression of firms profit. Incorporating the demand function

into the profit expression, one gets:

π(p, s) =(p1−c1)α1

p1−γ1s1

+(p1−c1)α1

p1−γ1s1

−Cf, (23)

π(p, s) = p1α1

p1−γ1s1

− c1α1

p1−γ1s1

+ p2α2

p2−γ2s2

− c2α2

p2−γ1s2

−Cf. (24)

19Derivingsjwith respect tocj:

∂sj ∂cj =

1 γj

α−j α1+α2

For any given vector sin the simplex, when both prices tend to infinity, profit tends to

α1+α2−Cf, which is then the supremum of the set of attainable profits. It is easy to see

this if we restrain ourselves to the case where there is no shelf allocation, and demand is

given byx(p) = α

p. The amount of money spent in the cosumption of the good is fixed in α. In this case, there is also no solution to the firms profit maximization problem, but it is clear

that the supremum of the set of possible profits must be α. The latter is “attained” when

price tends to infinity, while the quantity sold tends to zero, which also carries to zero the

cost of production. Therefore the full amount spent by the consumer can be appropriated

by the monopolist. In our example the intuition is analogous, as prices increases to infinity

the effect of shelf space allocation is minimized to irrelevance.

The amount spent by the consumers in the firms’ products is given by:

p(β)·x⋆(β) = (γ2c1+γ1c2)(α1+α2)−γ1γ2(β+Cf))

γ2c1+γ1c2−γ1γ2

. (25)

The complete calculation of equation 25 is left to AppendixC. We note that:

lim β→α1+α2−Cf

p(β)·x⋆(β) =α1+α2. (26)

Additionally, we remark that the expenditure function (25) is decreasing in the level of

β. Therefore, consumers spend the most in goods 1,2 when the level of β is the lowest. In

order to perfectly characterize the equilibrium we must make Assumption 2, which assures

us that the solution to the consumer’s problem will be the interior one given by the demand

functions (13). For that, we just need the total expenditure in goods 1,2 to be strictly less

then the consumer initial endowment of the n´umeraire good, ω.

Assumption 2

(c1γ2+c2γ1)(α1+α2)−γ1γ2Cf

c1γ2+c2γ1−γ1γ2 < ω

In this model, as the number of retailers increase, expected prices also increase. This

result is common in many models of price competition and have, as far as we know, first

been pointed out by Stahl (1989). The intuition behind this is actually very simple. The

expectation of firms profits must be equal to zero, regardless of the number of competitors.

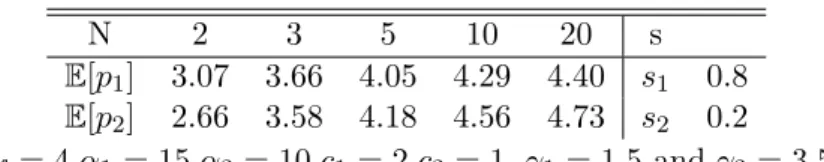

Table 1: Expected prices and the number of firms

N 2 3 5 10 20 s

E[p1] 3.07 3.66 4.05 4.29 4.40 s1 0.8

E[p2] 2.66 3.58 4.18 4.56 4.73 s2 0.2

cf = 4,α1 = 15,α2 = 10,c1 = 2,c2 = 1,γ1= 1.5 and γ2 = 3.5

of this section. Moreover, when the number of competitiors increase, the probability of

winning the attention of the representative consumer reduces, given that all of the firms

have the same probabilityex-ante to be victorious. Therefore, we must have an increase in

the expected prices to maintainex-ante profits equal to zero. In Table1, we give a numerical

example20 in which we vary the number of market participants while maintaining constant

all other parameters. As noted, expected prices are higher as the number of firms increase.

Consumers just buy from the store with the best combination of prices and in-store space

allocation. As shelf space will be constant in the entire distribution of prices, this translates

into consumers buying from the lowest prices store or, as refered, from the store with the

lowest profit. In this sense, what really matters in terms of consumer’s welfare is the expected

value of the lowest price, which greatly differ from those given in table1.

The distribution function of the minimum β, in other words, the distribution function of

the profit attained by the firm which wins the price war,Fmin:R→[0,1], is defined as:21

Fmin(β) =

0 β <0

1− Cf β+Cf

1

N−1

−

Cf

α1+α2 N1

−1

1−

Cf

α1+α2 N1 −1 N

β ∈[0, α1+α2−Cf]

1 β > α1+α2−Cf

(27)

In Table 2 we present the expected values of the lowest prices set by firms. As seen in

the table, they are decreasing in the number of firms. Since consumers just buy from the

20We acknowledge that this example was computed based just on necessary first order conditions and

subject to the same problems regarding sufficiency stated previously.

21In order to find this function, one must remember that:

Fmin(β) =P rob[βj> β ∀j∈ {1, ..., N}],

= 1−(1−F(β))N.

lowest price store, the price paid by them is decreasing inN. This result might not be quite

intuitive if one accounts for the fact that firms must pay a fixed cost to post prices in the

market. Nevertheless, as N increases, the probability of entry, given previously byα falls.

Therefore, an increase in the number of possible entrants in the market benefits ex-ante

the consumer if she is risk neutral. Since firms allways work with ex-ante zero profits, an

increase inN increases welfare in the economy with risk neutral participants.

Table 2: Expected values of the lowest prices and the number of firms

N 2 3 5 10 20

E[pmin1 ] 2.21 2.19 2.16 2.13 2.12

E[pmin2 ] 1.33 1.29 1.24 1.20 1.18

cf = 4,α1 = 15,α2 = 10,c1 = 2,c2 = 1,γ1= 1.5 and γ2 = 3.5

4

Conclusion

There are few works in economics concerned with the problem of shelf space allocation.

We present two possible reasons for this. First, data about shelf space allocation may be

scarce and difficult to obtain.22 Second, there is still no consensus on a good theory to

explain price dispersion and therefore about retail competition, which is mainly price driven.

In this sense, this work is an attempt to shed some light on the problem of in-store display

of products from a purely economics persperctive.

We have presented a new way to look at this problem. The in-store allocation of products

is modeled directly in consumers’ utility function which impose the importance of shelf space

allocation to retailers. Fixed costs prevent existence of pure strategy equilibria in the retail

competition game just as in Baye and Morgan (2001) and Sharkey and Sibley (1993),

therefore some kind of dispersion must follow. Unfortunately, it can’t be said anything

further by just looking at the general model as it is highly dependent on the functional form

of the utility function. We have chosen then to present a simple version of the model for a

special case of the utility function.

In this special case, an interesting result emerge. Although retailers are able to choose

22Even these data is obtained it may not be a simple object. For instance, the display of products in-store

any vector of shelf space allocation in the simplex, it is shown that shelf space allocation

does not to vary in the cross-section of stores. It is not optimally in equilibrium to carry over

the retail competition to the decision on shelf allocation. Retail competion resumes itself to

competion on prices, which are therefore dispersed in the equilibrium. As argued, we have

managed to reconcile with this model two distinct stylized facts about retail competion: that

prices are dispersed in equilibrium and that shelf space allocation changes unfrequently.

References

Albeniz, V. and G. Roels, “Competing for Shelf Space,” SSRN eLibrary, 2007.

Baye, M.R. and J. Morgan, “Information gatekeepers on the internet and the

compet-itiveness of homogeneous product markets,” American Economic Review, 2001, pp. 454–

474.

and , “Price Dispersion in the Lab and on the Internet: Theory and Evidence,”RAND

Journal of Economics, 2004, pp. 449–466.

Bliss, C., “A theory of retail pricing,” The Journal of Industrial Economics, 1988, 36 (4),

375–391.

Boiteux, M., “Sur la gestion des monopoles publics astreints `a l’´equilibre budg´etaire,”

Econometrica, Journal of the Econometric Society, 1956, 24(1), 22–40.

Braido, L.H.B., “Multiproduct price competition with heterogeneous consumers and

non-convex costs,” Journal of Mathematical Economics, 2009, 45, 526–534.

Bultez, A. and P. Naert, “SH.ARP: Shelf allocation for retailers’ profit,” Marketing

Science, 1988, pp. 211–231.

Corstjens, M. and P. Doyle, “A model for optimizing retail space allocations,”

Manage-ment Science, 1981, 27(7), 822–833.

Curhan, R.C., “The relationship between shelf space and unit sales in supermarkets,”

Dreze, X., S.J. Hoch, and M.E. Purk, “Shelf management and space elasticity,”Journal

of Retailing, 1994,70, 301–301.

Kreps, D.M. and J.A. Scheinkman, “Quantity precommitment and Bertrand

competi-tion yield Cournot outcomes,” The Bell Journal of Economics, 1983, pp. 326–337.

Kruse, J.B., S. Rassenti, S.S. Reynolds, and V.L. Smith, “Bertrand-Edgeworth

competition in experimental markets,”Econometrica: Journal of the Econometric Society,

1994, pp. 343–371.

Marquez, R., “A note on Bertrand competition with asymmetric fixed costs,” Economics

Letters, 1997, pp. 87–96.

Morgan, J., H. Orzen, and M. Sefton, “A laboratory study of advertising and price

competition,”European Economic Review, 2006, 50(2), 323–347.

Pratt, J.W., D.A. Wise, and R. Zeckhauser, “Price differences in almost competitive

markets,” The Quarterly Journal of Economics, 1979,93(2), 189–211.

Sharkey, W.W. and D.S. Sibley, “A Bertrand model of pricing and entry,” Economics

Letters, 1993, 41(2), 199–206.

Simon, L.K. and W.R. Zame, “Discontinuous games and endogenous sharing rules,”

Econometrica: Journal of the Econometric Society, 1990, pp. 861–872.

Stahl, D.O., “Oligopolistic pricing with sequential consumer search,” The American

Eco-nomic Review, 1989, pp. 700–712.

van Dijk, A., H.J. van Heerde, P.S.H. Leeflang, and D.R. Wittink,

“Similarity-based spatial methods to estimate shelf space elasticities,” Quantitative Marketing and

Economics, 2004, 2 (3), 257–277.

Varian, H.R., “A model of sales,”The American Economic Review, 1980, pp. 651–659.

Winter, R.A., “Vertical control and price versus nonprice competition,” The Quarterly

Appendices

A

Optimal shelf allocation and pricing

From the first order condition and using the fact that ∂xj

∂sj =−γj

∂xj

∂pj:

−xj+µ[(pj −cj)

∂xj

∂pj

] =−φ

γj

, j= 1,2. (28)

Subtracting equation (28) from (15):

µxj =

φ γj

j= 1,2⇒ x1

x2 = γ2

γ1

. (29)

Substituting equation (29) in the first restriction of the optimization problem given by

(14) one ends up with:

x2[

γ2

γ1

(p1−c1) + (p2−c2)] =β+Cf, (30)

1

γ1 α2

p2−γ2s2[γ2(p1−c1) +γ1(p2−c2)] =β+Cf. (31)

From equation (15):

xj(µ−1) +µ(pj−cj)

∂xj

∂pj

=0, (32)

xj (pj−cj)∂x∂pjj

= µ

1−µ, (33)

pj−γjsj

pj −cj

= µ

µ−1, j= 1,2. (34)

From equations (29) and (34):

γ1α1 γ2α2

= p1−γ1s1

p2−γ2s2

= p1−c1

p2−c2

Substituting equation (35) in (31):

1

γ1

α2

p2−γ2s2 [γ2

γ1α1

γ2α2

(p2−c2) +γ1(p2−c2)] =β+Cf, (36)

(α1+α2)(p2−c2)

p2−γ2s2

=β+Cf, (37)

(α1+α2)(p2−c2) =(β+Cf)(p2−γ2s2), (38)

[α1+α2−(β+Cf)]p2 =(α1+α2)c2−γ2(β+Cf)s2, (39)

p2=

α1+α2

α1+α2−(β+Cf)

c2−

γ2(β+Cf)

α1+α2−(β+Cf)

s2. (40)

In a similar manner:

p1 =

α1+α2

α1+α2−(β+Cf)

c1−

γ1(β+Cf)

α1+α2−(β+Cf)

s1. (41)

From equations (40), (41) and the second restriction in (14):

(p1−c1) =

β+Cf

α1+α2−(β+Cf)

c1−

γ1(β+Cf)

α1+α2−(β+Cf)

(1−s2), (42)

(p2−c2) =

β+Cf

α1+α2−(β+Cf)

c2−

γ2(β+Cf)

α1+α2−(β+Cf)

s2. (43)

Substituting equations (42) and (43) in (31):

1

γ1

α2

p2−γ2s2

(β+Cf)(γ2c1+γ1c2−γ1γ2)

α1+α2−(β+Cf)

=β+Cf, (44)

α2

γ1

γ2c1+γ1c2−γ1γ2

α1+α2−(β+Cf)

=p2−γ2s2. (45)

From equation (40):

p2−γ2s2 =

α1+α2

α1+α2−(β+Cf)

c2−

γ2(α1+α2)

α1+α2−(β+Cf)

s2. (46)

α2

γ1

(γ2c1+γ1c2−γ1γ2) =(α1+α2)(c2−γ2s2), (47)

s2=

c2

γ2 − α2

γ1γ2

γ2c1+γ1c2−γ1γ2

α1+α2 . (48)

Similarly,

s1= c1

γ1

− α1

γ1γ2

γ2c1+γ1c2−γ1γ2 α1+α2

. (49)

Finnaly, one may obtain prices by substituting (48) and (49) in (40) and (41), respectively:

p1=c1+ α1

α1+α2

β+Cf

α1+α2−(β+Cf)

γ1c2+γ2c1−γ1γ2 γ2

, (50)

p2=c2+

α2

α1+α2

β+Cf

α1+α2−(β+Cf)

γ1c2+γ2c1−γ1γ2

γ1

. (51)

B

Proof of Proposition

1

In the case ofngoods, the steps followed to compute the equilibrium shelf space allocation

and prices are very similar to those taken when stores sell just two goods. Firms problem is

basically the same as the one given by equation (14).

Note that the first steps taken in Appendix A don’t require the two goods assumption

and are true in thengoods case.

We are then left with a new set of equations:

xi

xj =γj

γi

, ∀i, j= 1,· · · , n; (52)

γiαi

γjαj

=pi−γisi

pj −γjsj

= pi−ci

pj−cj

, ∀i, j = 1,· · · , n. (53)

Substituting again the previous equations in the first restriction of the maximization

γi

αi

pi−γisi

X

j

pj−cj

γj

=β+Cf, ∀i= 1,· · · , n. (54)

From equation (53), we have that:

∀j,(pj−cj) = (pi−ci)

γjαj

γiαi

∀i; (55)

which can replace the appropriate terms in equation (54). Doing this gives us:

pi−ci

pi−γisi

X

j

αj =β+Cf, (56)

(pi−ci)

X

j

αj =(pi−γisi)(β+Cf), (57)

pi =

P

jαj

P

jαj −(β+Cf)

ci−

γi(β+Cf)

P

jαj−(β+Cf)

si, (58)

pi−ci =

β+Cf

P

jαj −(β+Cf)

ci−

γi(β+Cf)

P

jαj−(β+Cf)

si, (59)

pi−ci =

β+Cf

P

jαj −(β+Cf)

[ci−γisi]; ∀i= 1,· · ·, n. (60)

We may replace (59) in equation (54) and obtain:

γi

αi

pi−γisi

β+Cf

P

jαj−(β+Cf) [X

j

(cj−γjsj)], ∀i= 1,· · · , n. (61)

But pi−γisi can be writen as:

pi−γisi =

(ci−γisi)Pjαj

P

jαj−(β+Cf)

(62)

Substituting in equation (61), we come up with the following system of equations:

γiαi (ci−γisi)Pjαj

X

j

(cj−γjsj)

=1, ∀i= 1,· · ·, n; (63)

X

j

Regard that the system above determines the full vector of shelf space allocation s and

that the system does not depend onβ, the firms’ profit level, which is, in the end, the random

component of firms strategy.

C

Consumers’ expenditure in the firms’ products

Using equations (21), (22) and (18):

X

j=1,2

xj(β)pj(β) =

c1+

α1

α1+α2

(β+Cf)(γ2c1+γ1c2−γ1γ2)

γ2(α1+α2−(β+Cf))

γ2(α1+α2−(β+Cf))

γ2c1+γ1c2−γ1γ2)

+

c1+

α2

α1+α2

(β+Cf)(γ2c1+γ1c2−γ1γ2)

γ1(α1+α2−(β+Cf))

γ1(α1+α2−(β+Cf))

γ2c1+γ1c2−γ1γ2)

.

(65)

Which greatly simplifies to

X

j=1,2

xj(β)pj(β) =

(c1γ2+c2γ1)(α1+α2−(β+cf))

c1γ2+c2γ1−γ1γ2

+ (β+cf), (66)

= (γ2c1+γ1c2)(α1+α2)−γ1γ2(β+Cf))

γ2c1+γ1c2−γ1γ2