Revista

de

Administração

http://rausp.usp.br/ RevistadeAdministração51(2016)266–275

Finance

and

accounting

Agricultural

insurance

mechanisms

through

mutualism:

the

case

of

an

agricultural

cooperative

Mecanismos

de

seguro

agropecuário

via

mutualidade:

o

caso

de

uma

cooperativa

agroindustrial

Mecanismos

de

seguro

agropecuario

por

medio

de

mutualidad:

el

caso

de

una

cooperativa

agroindustrial

Paulo

Alberto

Machinski,

Mauro

Cézar

de

Faria,

Vilmar

Rodrigues

Moreira

∗,

Alex

Antonio

Ferraresi

PontifíciaUniversidadeCatólicadoParaná,Curitiba,PR,Brazil

Received1April2015;accepted29September2015

Abstract

Theaimofthisarticleistoverifyhowthemutualismmodelisappliedincooperativestomitigaterisks.Weconductedasingle,holisticcasestudyof anagribusinesscooperativeinParanáState.ThedatawerecollectedfromJunetoSeptember2014.Fourapplicationsofthemutualismmodelwere identified,specificallytomitigaterisksofweatherforgrain(corn,beansandsoybeans)farmers,deathbylightning,brucellosisandtuberculosisfor cattlefarmersandthevolatilityofpricesforpigfarmers.Throughthemutualismmodel,itwasobservedthatcooperativesfindsolutionsfortheir specificagribusinesssectorproblems.Cooperativecompaniesarethemanagersandcoordinatorsoftheentireinsurancemechanismtoaddress therisksinvolvedintheiractivitiesor/andtheactivitiesoftheirmembers.Themutualismmodelhasbeeneffectiveforcoveringcommonrisks. However,likeregularinsurance,itprovedtobeineffectiveinthecaseofcatastrophes.

©2016DepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoeContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP. PublishedbyElsevierEditoraLtda.ThisisanopenaccessarticleundertheCCBYlicense(http://creativecommons.org/licenses/by/4.0/).

Resumo

Oobjetivodesseartigofoiverificarcomoosistemademutualismoéaplicadoemumacooperativaparaamitigac¸ãoderiscos,comoopc¸ãoà contratac¸ãodesegurostradicionais.Paratanto,foifeitoumestudodecasoúnico,holístico,emumacooperativaagroindustrialnoEstadodo Paraná,comdadoslevantadosentrejunhoesetembrode2014.Foramidentificadasquatroaplicac¸õesdomutualismonacooperativaestudada, especificamenteparamitigac¸ãoderiscosdeintempériesparaprodutoresdegrãos(milho,sojaefeijão);paramitigac¸ãoderiscosdavolatilidadede prec¸osdesuínos;eparaamitigac¸ãoderiscosdemorteporraio,bruceloseetuberculose(bovinos).Foiverificadoquepormeiodamutualidadeas cooperativasconstituemsoluc¸õesparaproblemasprópriosdoseumeioeespecíficosdosetordoagronegócio.Ascooperativassãocoordenadoras eadministradorasdetodoomecanismodeseguromútuoparaatenderaosriscosenvolvidosematividadesdesenvolvidasnelase/oupelosseus

∗Correspondingauthorat:PontifíciaUniversidadeCatólicadoParaná,EscoladeNegócios–PPGCOOP,RuaImaculadaConceic¸ão,1155,80215-901Curitiba,

PR,Brazil.

E-mail:vilmar.moreira@pucpr.br(V.R.Moreira).

PeerReviewundertheresponsibilityofDepartamentodeAdministrac¸ão,FaculdadedeEconomia,Administrac¸ãoeContabilidadedaUniversidadedeSãoPaulo –FEA/USP.

http://dx.doi.org/10.1016/j.rausp.2016.06.004

cooperados.Omutualismosemostroueficazemdiversassituac¸õesidentificadasdesinistros.Entretanto,aexemplodasformasdesegurotradicionais, emcasodecatástrofesosistemanãoalcanc¸aacoberturanecessária.

©2016DepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoeContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP. PublicadoporElsevierEditoraLtda.Este ´eumartigoOpenAccesssobumalicenc¸aCCBY(http://creativecommons.org/licenses/by/4.0/).

Palavras-chave:Seguro;Mutualismo;Gestãoderiscos;Cooperativas

Resumen

Elobjetivoenesteestudiofueverificarcómoseaplicaelsistemademutualismoenunacooperativaconelfindemitigarelriesgo,comouna alternativaalcontratodesegurotradicional.Paraello,sellevóacabo unestudiodecasoúnico,holístico,enunacooperativaagroindustrial ubicadaenelestadodeParaná.Losdatosfueronrecolectadosenelperíodocomprendidoentrejunioyseptiembrede2014.Seidentificaroncuatro aplicacionesdelmutualismoenlacooperativaestudiada,específicamenteparamitigarlosriesgosdelasintemperiesparaproductoresdegranos (maíz,sojayfrijoles/porotos);paramitigarlosriesgosdelavolatilidaddelospreciosdelcerdo;yparamitigarlosriesgosdemuerteporrayos, brucelosisytuberculosis(devacunos).Seencontróque,pormediodelamutualidad,lascooperativasconstituyensolucionesparaproblemas propiosdesuentornoyespecíficosdelaagroindustria.Lascooperativassoncoordinadorasygestorasdetodoelmecanismodeseguromutuopara hacerfrentealosriesgosinvolucradosenactividadesdesarrolladasenlasmismasy/oporsusafiliados.Elmutualismosemuestraeficazendiversas situacionesidentificadasdesiniestros.Sinembargo,comoenlasformasdesegurotradicional,encasodecatástrofes,elsistemanoalcanzala coberturanecesaria.

©2016DepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoeContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP. PublicadoporElsevierEditoraLtda.Esteesunart´ıculoOpenAccessbajolalicenciaCCBY(http://creativecommons.org/licenses/by/4.0/).

Palabrasclave: Seguro;Mutualismo;Gestióndelriesgo;Cooperativas

Introduction

Infarmingactivities,suchasplantingcropsandraising ani-mals,risks are a serious factor.According toBörner (2006), risksinagriculturestemfromanumberoforigins:risksto pro-duction(climate,pests, sanitaryfactors, etc.); risks involving prices/market(fluctuatingpricesand/ordemand,etc.); institu-tionalrisks(governmentactionsorlackofgovernmentactions, regulations,etc.)andpersonal/humanrisks(accidents,disease, etc.).Forsometypesofrisksthereareefficientmeansof pro-tection, made available on the market or by the government. However, for other types, farmers become the exclusive risk takers(Moreira,Souza,&Duclós,2014).Duetothevarietyof risksandtheiroriginsinagribusinessandtheinherentparticular conditionsofeachtypeoffarmer,thereisnosingle,common managerialstrategythatcanbeusedbyallfarmerstomitigate them,andavarietyoftoolsarerequiredtomanagethem(USDA, 2007).

Forfarmers, managing risks means determining combina-tionsofactionsthatrepresentdifferentlevelsofriskandreturn (Gomes,2000).Somestrategiesaimtoreducerisk,suchas diver-sificationofactivities.Othersaimtoshareand/ortransferrisks, such as future contracts, production contracts and insurance (Moreira,2009).

Forrisksassociatedwithclimateand/orsanitaryproblems, there are tools that help to foresee the occurrence of these risksandanalyzetheirpossibleimpact.However,manyofthe strategiesandtoolsareofteninaccessibletofarmers,especially thosewhooperatesmallfarms.Insurance,particularly agricul-turalinsurance,couldbetherighttoolsforaddressingrisksof production,butthereareanumberofdifficultiesthatfaceboth

insurancecompaniesandfarmers.Theseincludehighpremiums (economically unfeasible), low involvement of government policies (subsidies), imminent exposureto catastrophes, lack of regulationagenciestoguaranteelegitimacyandmaintaina historicaland statistical database andcomplexityin adminis-trativeorganization(experts,technicians,controlmechanisms) (Ozaki,2006).

Analternativetopurchasingtraditionalinsuranceismutual insurance.Inthistypeofmutualism,theinterestedpartiesform groupswiththesamegoalstoestablishafinancialfundorseek a commitmentthat can compensatefor futurelosses intheir sharedactivities.Normally,itfallstocooperativestoorganize, manageandmonitorthistypeofinsurance.

Agricultural cooperatives play a fundamental role in mitigating the risks of agribusiness (Moreira, 2009). As a cooperative becomes the agency that representsthe interests ofthecooperativemembersandworksdirectlytoorganizethe productionchain, concern over thepossible impacts of risks, bothinternalandexternal,isthefrequentobjectofevaluationin themanagementofcooperatives,alongwithseekingsolutions tomitigatethem.

article. This is followed by the case, comments on the data andananalysis,withtheconclusionbringingtothe articleto aclose.

Theoreticalframework

Cooperativesandcooperativism

Acooperativeisanautonomousassociation ofpeople vol-untarily united tosatisfy economic,socialandcultural needs and aspirationsthrough a collectively owned and democrati-cally managed company(ICA, 2013). In Brazil, cooperative societiesaresocietiesofpeople,withtheirownlegal constitu-tion,toprovideservicestotheirmembers.Theirlegalsituation iscurrently defined byLaw 5.764, enactedon 16December, 1971.

Lago(2009)statesthatcurrentagriculturalcooperativism“is aformoforganizationforfarmingandthecoordinationof agri-culturalsystems,”andthat,throughagriculturalcooperativism, membersseektoparticipateinacompetitivemarket by unit-ingtheirproductionunits.Thus,forthoseinvolvedinBrazilian agribusiness,cooperativesfunctionasorganizationsthathelpto formandcoordinatetheprimarysectorandactasintermediaries intherelationshipbetweenproductionandsale.

According to Rodrigues (1997), cooperatives, with their uniquecharacteristics,constitutetheonlysectoroftheeconomy whosedoctrineemphasizesthebalancebetweentheeconomic andthesocial.Thisistheirfirstchallengeinthefaceof globaliza-tion,asefficiencyandcompetitivenessarerequired.Thismeans improvedmanagement,reducedcostsanddifferentialtreatment formembersaccordingtosize,efficiencyandreciprocation.

The capitalstructure of agriculturalcooperatives inBrazil complieswithLaw 5.764/71, whichinits first articledefines cooperativeorganizationsasciviliansocietiesofpeoplerather thancapital.Thus,theircapitaliscomposedofshares,witha limited numberfor eachmember, andthisvaluemaybe pro-portional.Sharescannotbeused bythirdpartieswhoarenot membersofthesociety(Krueger,2004).Attheendofthefiscal year,anysurplusmaybesharedaccordingtothe activitiesof eachmember(thisisknownasacooperativeact),when deliber-atedandauthorizedbytheOrdinaryGeneralAssembly(OGA) ofthecooperative.

According to data from the OCB (2014), in Brazil there are 6603 cooperatives, with over eleven million members andapproximately321,000employees.Farmingandtransport, respectively, account for 23.1%and 16.5%of the total num-berofcooperatives,followedbycredit,with15.9%,andlabor unions,with14.7%.AccordingtoOCEPAR(2014),inParaná, a state with a tradition and vocation for rural activity, 56% ofthe agriculturaleconomyisderivedfromfarming coopera-tives.Thereare 77such cooperatives,with135,000members and responsible for 61,000 direct jobs. The gross turnover of thesecooperatives in2013 wasR$38.6 billion,withanet surplusofR$1.3billion.In2013,thissectorexportedthe equiv-alent of 2.36 billion dollars, representing 42% of the total exportsofBrazilianexportsand13%ofthetotalexportsofthe state.

Insuranceandmutualism

Mutualismisoneofthefundamentalprinciplesthat consti-tutesthebasisofeveryinsuranceoperation.Theunionofalarge numberofpeopleexposedtothesamerisksenablesabalance to be established between the payments by the insured (pre-miums) andthe guaranteeof the insurer (responsibilities), as alltheinsuredpayvaluesthatarelowerthantheinsuredasset in the certainty that those whosuffer losses will receivefull compensationtoreplacetheirasset(CNSEG,2014).

According tothe legaldefinitionof insurance, asdeclared inthe CivilCode, Article 1.432,an insurancecontractisone throughwhichoneofthepartiesisobligedbytheotherthrough the payment of a premium, to be compensated for damage resultingfromafuturerisk,asforeseeninthecontract.In gen-eral,insurancecanbedefinedasamechanismfortransferring the highvalue of afutureanduncertain expense(loss) toan advanced,guaranteedpaymentofarelativelylowervalue (pre-mium)(Ozaki,2006).Inaccordancewitheconomicandlegal adaptations, the main requirements or conditions for insura-bility arethat: (i)the expectedloss should becalculableand the premium economically feasible; (ii) the loss should not be willful, i.e., it should be accidental; (iii) the loss threat-ens andconsiderablenumberofthings, assetsor people;and (iv)thereshouldbenocatastrophicloss(Gomes,1998;Ozaki, 2006).

Aninsurancepolicycanincludeafixedorvariablepremium in accordance with the technique employedfor covering the risk(Gomes,1998).Fixedpremiuminsuranceisdonethrough aninsurancecompany,andthedocumentsoftheinsurerandthe insuredare preparedbydifferentpeople.Thepayments made bytheinsuredpartydonotvary,astheyaresetcontractually.

Variablepremiuminsuranceisadjustedamongseveral peo-plewhomutuallyassumeresponsibilityforthelossthatanyof themmightsuffer.Inmutualinsurance,everyinterestedparty is aninsurer of othersandis alsoinsured bythem.Thus,all canbenefitorlose iftheyare entitledtocompensationor are obliged tomake payments toanother party. However,inthis typeofcontract,thepartiesthemselvesdonotactastheinsurers astheybelongtothecompanylegallyestablishedbythe asso-ciationofinterestedparties.Theinsureddonotpayapremium, but rathershares that aresufficient tocompensatefor loss or damage andthe expensesincurredinadministration. Forthis reason,contributionstomutualinsurancecanvary,unlikefixed premiuminsurance.

Methodology

Theresearchstrategythatwasadoptedwasthesinglecase study,adapted when the desireisto answer“how”or “why” inrelationtoagivenphenomenonwhentheresearcherhas lit-tlecontrolovereventsandwhenthefocusisoncontemporary phenomenainagivencontextinreallife(Yin,2010).Thecase thatwaschosenistypicalofthephenomenoninquestionand decisive.Inotherwords,it representsacontextinwhichitis believedthat thepropositions,inthe caseof theassumptions andtheoreticalpostulationsofmutualism,aretrue,which jus-tifiesthesinglecaseinaccordancewithYin(2010).Giventhat theanalysisunitwasanagriculturalcooperativeinParanáState, whichisunderstoodasunique,itisalsoaholisticcasestudy.In thisarticle,toprotecttheidentityoftheorganization,itisonly referredtoasthe“AgriculturalCooperative”.

Primaryandsecondarydatawerecollected.Twosourcesof secondarydatawereused:documentsandarchivedfiles.These documents and files provided an understanding of how pre-miumsandclaimsare calculated,inadditiontothehistoryof applications.Thefinancialstatementsandthehistoryofthe val-uespracticeswerealsoanalyzed.Theprimarydataoriginated fromsemi-structuredinterviewswithmanagersofeachbusiness unitofthecooperative.Thesetof datawasgatheredbetween JuneandSeptember,2014.

Qualitativeanalysesofthedatawereconducted,mainlyusing adocumentanalysistechnique,inadditiontoquantitative anal-ysesandeconomicevaluations,aswillbeseen.

ThecaseoftheAgriculturalCooperative

TheAgriculturalCooperativeislocatedinParanáStateand was founded in 1951. Of Dutch origin, it has units in the municipalitiesof Castro,PontaGrossa, PiraídoSul, Curiúva andVentania,inParanáState,andalsointhemunicipalityof Itaberá,inSãoPauloState.The AgriculturalCooperativehas 782 membersand961 employees, whoproduce cereals such ascorn,wheat,barleyandoatsonalargescale,inadditionto legumes,soy,beansandforage.Italsooperatesinthe industri-alizationofmilk,potatoes,meat,feedandseeds.Theproducts havetheir own brand andthose of third parties.In 2013,its grossturnoverwasR$1.7billion.AccordingtotheGloboRural Ranking(2013),theAgriculturalCooperativesisoneofthe500 largestorganizationsintheagribusinesssector,oneof the50 largestpercategoryandoneofthe10largestinthesector.

The Agricultural Cooperative manages mutual insurance groupsforgrain,pigandmilkfarmers.Forthegrain(soy,corn andbeans)farmers,theAgriculturalCooperativemanagesthe HailMutualInsurance Group,consideredthemostimpactful, andtheagriculturalMutualInsuranceGroup,forotherweather conditions,with coverage for soy andcorn. Forpig farmers, thecooperativemanagestheMutualInsuranceGroupofforthe SlaughterhouseofthePigletProductionUnit,whosepurposeis tomitigatetherisksofvolatileprices.Forthemilkproducers, thegroupthatismanagedistheMutualInsuranceGroupforthe SanitaryConditionsandLightning.Thebackgroundsandmain

characteristicsofeachgrouparedescribedinthenextsection, wherethedataarepresentedandanalyzed.

Presentationanddiscussionofdata

Inthissection,thecollecteddataispresentedandadiscussion andanalysisfortheconclusion.

Ascommentedabove,theAgriculturalCooperativemanages mutualinsurancegroupsforgrain,pigandmilkfarmers. The participationofeachgroupisindividualized,andonlythe coop-erativemembersareinvolved,andnottheirfamilies.Companies canparticipateiftheyarecooperativemembers.Therearetwo formsofadmissiontoamutualgroupoccurs.Thefirstisthatit iscompulsoryinthecaseofacooperativememberfinancinghis harvestwiththecooperative.Thesecondisjoiningfreely.The characteristicsofeachgrouparegivenindetailbelow.

HailMutualInsuranceGroup

TheHailMutual InsuranceGroupwasfoundedin1989at thecooperativeduetotheneedforcoveragebecauseofthemost damagingnaturalphenomenonintheregion,hail.Thisdamage wascoveredbyinsurance,butthesepolicieswereeconomically unfeasibleduetothehighcostofthepremiumandthecomplex waythatthedamagewasmeasured,whichwasnotsatisfactory tothecooperativeanditsmembers.

Thegroupusestheproratamutualinsurancemodelandis madeupofmemberswhofarmsoy,cornandbeans.Theentire planted area linked to the cooperative is included. The costs thatarecoveredareonlythoserawmaterialsusedinthe plant-ing of each crop and the operations involved. Thisdoes not include othercosts of profits. If aclaim is made, the cost is sharedinproportiontotheareacoveredbyeachmember.Ifthere arenoclaims,onlytheadministrativeexpenses(administration, reports,consultancy,etc.)aresharedbythemembers.

IntheHailMutualInsuranceGroup,theTotalGross Indem-nityValue(TGIV)forsoyandcorniscalculatedbasedonthe average productivityper hectare (kg/ha).Thisproductivity is definedbythelowestvaluecalculatedbetweentheaverage pro-duction of the cooperative membersandthe productivity per hectare ofthe cooperative membersofthe groupinthe three yearspriortotheclaim.Themethodusedtocalculatethetotal grossindemnityforsoyandcornisshowninEq.(1):

TGIV=

¯

XP–AP 60

·a·AMP (1)

whereTGIV,totalgrossindemnityvalue;XP,average produc-tivity;AP,actualproductivity(kg/ha);a,sizeofareawherethe hailfell;AMP,averagemarketpriceofa60kgsack(ofsoyor corn)inBrazilianreais.

Table1

Hailfallandindemnitiesforsoy.

Year Harvest Membersregistered Areacovered(ha) Claims Indemnity(R$) Sharedcost(R$/ha)

2009 2008/2009 184 35,269.63 3 117,924.22 3.34

2010 2009/2010 197 39,370.20 0 – –

2011 2010/2011 201 49,239.98 17 1,554,584.13 31.57

2012 2011/2012 224 51,042.16 18 468,410.14 9.18

2013 2012/2013 110 29,281.84 6 150,237.09 5.13

2014 2013/2014 73 17,116.53 3 73,278.19 4.28

Averages 165 36,886.72 7.8 394,072.30 8.92

Source:AgriculturalCooperative.

madebetweenthehighestminimumpriceoftheproductisused aspublishedintheHarvestPlanoftheMinistryofAgriculture, FishingandSupplies(MAPA),andtheaveragecommercialprice ofthemonthoftheharvest,aspracticedinthecommercialsector oftheCooperative.ThecalculationoftheTotalGrossIndemnity forbeansisshowninEq.(2):

TGIV=

BCV–

AP

60 ·BP

·a (2)

whereTGIV,totalgrossindemnityvalue;BCV,basiccostvalue (costofproduction,i.e.,fertilizer,seeds,pesticidesand cultiva-tion);AP,actualproduction(kg/ha);BP,basepriceofindemnity;

a,sizeofareawherethehailfell,inhectares.Table1showsthe historyhailfallandtheindemnitiespaidbythefundforsoyfrom 2009to2014.

Table2showsthehistoricalbackgroundofhailfallandclaims fromthefundforcornfrom2009to2014.

On average,during theperiod inquestion, over 7 farmers wereaffectedandmadeclaimsofR$394,072.30,representing anaveragesharedcostofR$8.92/ha,thevaluecontributedby eachmemberofthemutualinsurancegroup.Thehighestclaim perhectarewasR$31.57.Itshouldbenotedthathailfallonthe soycropisfrequent.Duringtheperiodinquestion,therewas onlyoneyearwithout hailstones.Consideringthe numberof occurrences andthe numberofmembersinthemutual insur-ancegroup,onaverage,5%ofthemembersmadeclaimsdueto hailfall,i.e.,theywerealsobenefittedbythemutualinsurancein theproportionalshareofthedamage,showingtheimportance ofthisformofinsurance.

On average, during the period in question, fewer than 2 farmersmade claims,atavalueof R$98,259.45,representing anaveragesharedcostofR$9.96/ha,thevaluecontributedby

eachparticipatingmemberofthegroup.Thehighestindemnity paymentperhectarewasR$33.08.Hailfalloncornislow. Dur-ingtheperiodinquestion,therewere629cooperativemembers andonly9 claims.Thesharedvalueforthegroupasawhole may beconsideredsmall,but significantfor the farmerswho wereforcedtomakeaclaim.

Table3showsthehistoryofhailfallandindemnitypayments fromthefunforthebeancropfrom2009to2014.

Onaverage,duringtheperiodinquestion,fewerthan2 farm-ers made claims, at values of R$285,275.69, representing a sharedcostof R$27.28/ha,thevaluecontributedbyeach par-ticipatingmemberofthegroup.Thehighestclaimperhectare wasR$162.31.Duringtheperiodinquestion,damagewasdone in only2 years. In 2012,the damage causedby hailfall was severeandtheshared costperhectarewas high.In thiscase, therewasaconcentrationofareascoveredbythecooperative, i.e., cooperativememberswithlargeareasregisteredsuffered greaterdamage,leadingtohighercostsfortheothermembers. Ananalysisshowsthedeficiencyofthemutualinsurancein sit-uationsofconcentrationorcatastrophe,wherethemechanism doesnotbenefitallthoseinvolved.

MutualFarmingInsuranceGroup

The MutualFarming Fundwascreatedin2008toprovide coverage for othereventsnotcoveredby thehail group.Itis made up of soyand cornfarmers andprovides coverage for damage resulting from extreme weather such as frost, heavy rainfallsduringtheharvestanddrought,excludingallother cli-maticfactors.Themembersmustparticipateinthegroupwith alltheirplantedarea,bycrop,associatedwiththeCooperative. Itisamutualinsurancemodelwithamembershipfee.

Table2

Hailfallandindemnitiesforcorn.

Year Harvest Membersregistered Areacovered(ha) Claims(N◦) Indemnity(R$) Sharedcost(R$/ha)

2009 2008/2009 143 22,920.73 1 2888.40 0.13

2010 2009/2010 124 13,091.83 0 – –

2011 2010/2011 126 14,255.68 1 24,734.09 1.74

2012 2011/2012 151 17,795.98 5 437,429.12 24.58

2013 2012/2013 56 6783.28 1 1372.05 0.20

2014 2013/2014 29 3722.24 1 123,133.03 33.08

Averages 105 13,094.96 1.5 98,259.45 9.96

Table3

Hailfallandindemnitiesforbeans.

Year Harvest Membersregistered Areacovered(ha) Claims Indemnity(R$) Sharedcost(R$/ha)

2009 2008/2009 108 8542.81 0 – –

2010 2009/2010 115 8916.00 0 – –

2011 2010/2011 169 14,561.95 3 20,275.33 1.39

2012 2011/2012 126 10,420.81 8 1,691,378.81 162.31

2013 2012/2013 56 5661.32 0 – –

2014 2013/2014 50 4007.86 0 – –

Averages 104 8685.13 1.8 285,275.69 27.28

Source:AgriculturalCooperative.

Description SOJA MILHO

Coverage level (CL) for a farmer with a history 60% 65%

Coverage level (CL) for a farmer with no history 1800 kg/ha 5500 kg/ha

Indemnity ceiling (BCV) R$ 1610.00/ha R$ 2406.00/ha

Membership fee 2.50% 3.00%

Fig.1.Ratesofcoverageofthemutualfarmingfund.

Source:AgriculturalCooperative.

Theneedtocreatethisgroupwasseenwhenseveredamage during two consecutive harvestsas aresult of heavy rainfall in 2004/2005 and a drought in 2005/2006, leaving coopera-tivemembersheavilyindebtandforcedtorenegotiatedebts. Asolutionwassoughtthrough officialinsurance,butthisdid notmeet the needsof the members,the main barriersbeing: (i) high insurance premiums; (ii) average productivity based ontheBrazilianInstituteofGeographyandStatistics(IBGE), whicharebeyondtherealityof thecooperative,althoughitis therecognizedbenchmarkintechnologywithhighaveragesof agriculturalproductivity;(iii) andthe methodsfor measuring damage (inofficialinsurance, the valueis determined bythe farmerwhen, on average,there are largeand highly produc-tiveareastooffsetlosses,i.e.,tohaveanaverageproduct,the proposalwouldincludemeasurementbysizeofplotoflandor glebe).Facedwiththesedifficultieswithregularinsurance,the MutualFundwasformedtocoverthecostsofrawmaterialsup tothecostoffinancingtheplantingofthecrop.

Thereferencevalueforindemnityisthevalueoftheinputs oftheBCV,suchasseeds,fertilizersandpesticides.Ifthereis damage(claims),thevalueiscoveredbythemembershipfees collectedforthe fundthroughouttheperiod,andthelimiton thevalueofcoveragefordamageissetbythecurrentbalance

of the fund, as shown inFig. 1. If thereis not damage, any administrative expenses (administration, reports, consultancy, etc.)willbepaidbythefund.

Themaximumindemnifiablelimit,themaximum indemnifi-able price and the totalgross indemnity for soy or corn are calculatedusingthefollowingequations:

MIL=

¯

XPCoop·CL

60 (3)

MIP= BCV

MIL (4)

TGIV=

( ¯XPA3years·CL)–AP

60

·MIP·a (5)

whereMIL, maximumindemnifiable limit(R$/ha); ¯XPCoop, averagegeneralproductivityofthe cooperativeforthe period (kg/ha);CL,coveragelevel;MIP,maximumindemnifiableprice (R$/sack);BCV,basiccostvalue(costofproduction:fertilizers, seeds,pesticidesandcultivation);TGIV,totalgrossindemnity value; ¯XPA3years,averageproductivityofcooperativemember inthelast3 years(kg/ha);AP,actualproductivity(kg/ha); a, area(ha)wherethedamagewasdone.

Table4

Eventsandindemnitiesfromthemutualfarmingfundforsoy.

Year Harvest Membersregistered Coverage(R$) Premiums(R$) Claims(N◦) Indemnity(R$)

2009 2008/2009 163 26,699,280.00 552,074.24 1 73,833.84

2010 2009/2010 170 35,737,005.60 893,425.74 4 97,336.31

2011 2010/2011 130 36,346,560.00 904,946.51 – –

2012 2011/2012 131 32,561,828.00 814,045.70 1 64,802.27

2013 2012/2013 92 26,836,277.00 670,907.42 – –

2014 2013/2014 39 12,581,924.60 314,548.12 5 123,577.41

Averages 121 28,460,479.20 691,657.96 1.83 59,924.97

Table4 showsthehistoryofeventsthatledtoclaimsfrom themutualfarmingfundforthesoycropfrom2009to2014.

Intheperiodinquestion,anaverageofR$691,657.96was collectedinpremiums,withfewerthan2claimsandanaverage ofR$59,924.97inindemnitypayments.Thehighestindemnity per harvest was R$123,577.41. The total value of premiums collectedduringtheperiodwas R$4,149,947.73for atotalof R$359,549.83inindemnitypayments,i.e.,9%ofthetotal col-lectedwasused.Ifthetotalcoverageof R$170,762,875.20is considered,thebalanceofthefundwouldbeinsufficient,asthe indemnitiesarelimitedtothisamount.Thisaspectisaddressed inthe“NormsfortheFunctioningoftheMutualFarmingFund andtheMutualHailFund”,whichweredraftedbythe cooper-ativeandagreeduponbyallthemembersofthegroup.InItem 2,“Adaptationofthe FunctioningoftheMutual Farmingand MutualHailFundGroups”,Letter(c)thevalueofcoveragefor damageislimitedtotheexistingbalanceofthefund.

Regarding thenumber of membersregistered andthe fre-quencyofclaims,therewasanaverageof1.52%,showingthe lowfrequencyofdamage.Therefore,therelationshipbetween the low levels of occurrenceof damage andthe values paid inindemnitiesshowhowsignificantthe fundis,as thevalues indemnifiedwereexpressive.

Table 5 shows the historyof eventsthat led to indemnity paymentsfromthemutualfarmingfundforcornfrom2009to 2014.

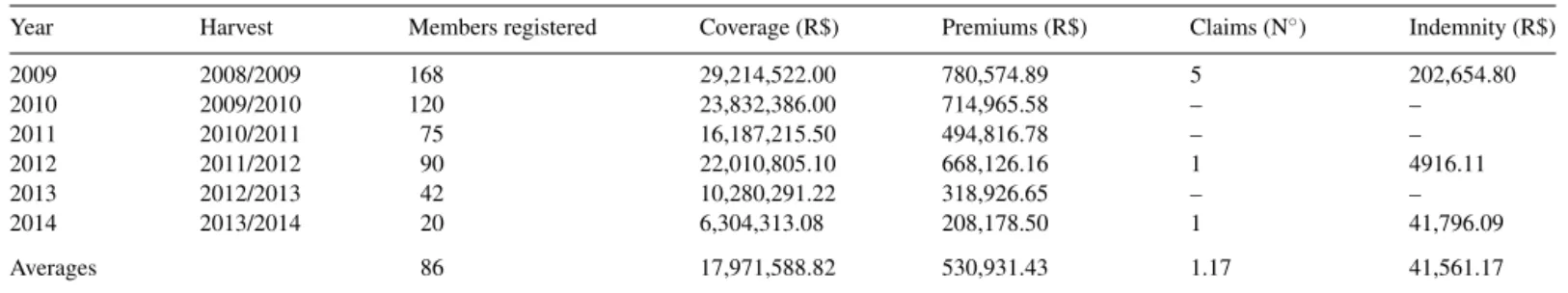

Onaverage,fortheperiodinquestion,R$530,931.43were collected in premiums,with fewerthan 2 claims on average andindemnitypaymentofR$41,561.17onaverage.Thehighest amountofindemnitypaymentsperharvestwasR$202,654.80. Judgingbytheconditionsofthemutualfund,thevaluecollected wouldbeinsufficienttocoveracatastrophe.Thetotalcoverage fortheperiodwasR$107,829,532.90,andthepaymentfor dam-agewouldceasewhenthebalanceofthefundwasexhausted.

Thebalanceofthefundisadministeredinaccordancewith the“NormsfortheFunctioningoftheMutualFarmingFundand theMutualHailFund”,draftedbythecooperativeandagreed uponbythe membersof the groupinItem2, “Adaptationof theFunctioningoftheMutualFarmingandMutualHailFund Groups”,Letter(b)IndividualizationoftheFund:the individ-ualmonitoringoftheMutualFarmingFundisauthorized,and the percentage contributed by each farmer over timecan be inspected”.Thus,thecooperativehopestokeeprecordsofthe balanceofthefundandbeabletoknowwhichmembershave contributedtoit.Incasesofclaims,ifthebalanceofthemember

isnegative,itispossibletochargehigherratestocompensatefor usingitorevenchargelowerratesfromthosewhohavenever usedittocoverdamage.Ifthereisabettersituationoradequate conditionsintheofficialinsurancesystem,thefundcanbe liq-uidatedandthebalancereturnedtothemembers.Itcouldalso beincorporatedintothereservefundsofthecooperative.

MutualInsuranceGroupofSlaughterersatthePiglet ProductionUnit

Thisinsurancewascreatedin2006forthepurposeof min-imizing the risks of volatilepig priceson themarket. It was createdinthewakeofanoutbreakoffootandmouthdiseasein ParanáStatein2005.In2006,therewasafallinthepriceofpork, whichlasteduntilmid-2007.Thisledtodebtsandrenegotiation thedebtsofmembers.

Thefundwasconstitutedbycooperativememberswhoare slaughterersatthepigletproductionunit.Themembersinclude theirentirebreedingstock.Thesystemensuresthatwhenporkis soldthepricewillcoverthedirectproductioncosts.The differ-encebetweenweeklysalepricesandthestandardcostthatwill bepaidtothememberformsthefund,whichcanbeeither nega-tiveorpositive,andattheendofthelotitissharedproportionally tothevolumeofporkthatissold.

In themutualfundoftheslaughterersatthepiglet produc-tionunit,themutualinsurancemitigatestherisksofvolatilepig prices.Thesystemwasestablishedbythecooperativemembers at thepiglet productionunit andwasdesigned toensure that whentheslaughteredanimalsaresoldthememberswillreceive apricethatcoversthedirectcostsofproduction.Thedifference betweenweeklysalespricesandthestandardcostthatwillbe paidtothememberformsafundthatcanbeeitherpositiveor negativeand,attheendofthelot(periodindaysofthecycle betweendeliveryofapigthatweighsbetween20and24kgand thepigachievingaweightof100kg),issharedproportionallyto thevolumeofporksold.Theindemnityisbasedontheresults of thefund. Atthetimeofdelivery of theproductforsale,a “mutualstandardprice”isset.Attheendofthelot,whenthe entiregroupofpigsisdelivered,therealaveragesalepriceis calculatedandtheresultisshared.

The valueofthe reservefundof themutualinsurance,the totalvalueofthemutualfund,theaveragepriceofporkonthe market,theentitlementvalue,thevaluereceivedbythemember

Table5

Occurrenceofdamageandindemnitiesfromthemutualfarmingfundforthecorncrop.

Year Harvest Membersregistered Coverage(R$) Premiums(R$) Claims(N◦) Indemnity(R$)

2009 2008/2009 168 29,214,522.00 780,574.89 5 202,654.80

2010 2009/2010 120 23,832,386.00 714,965.58 – –

2011 2010/2011 75 16,187,215.50 494,816.78 – –

2012 2011/2012 90 22,010,805.10 668,126.16 1 4916.11

2013 2012/2013 42 10,280,291.22 318,926.65 – –

2014 2013/2014 20 6,304,313.08 208,178.50 1 41,796.09

Averages 86 17,971,588.82 530,931.43 1.17 41,561.17

andtheindemnifiablevaluearecalculatedusingthefollowing equations:

MRf=(PMSw–SSP)·QSs (6) TVRf=MRf1+MRf2+···+MRFn (7)

PSMl= (PMSw1

·QSs1)+(PMSw2·QSs2)+···+(PMSwn·QSsn) QSs1+QSs2+···+QSsn (8)

EVm=PSMl·QSs (9)

VRc=SSp·QSs (10)

Vind=EVm·VRc (11) where VRc, value received from cooperative member; SSp, standardmutualswineprice;QSs,quantitysold;MRf,mutual reservefund;PSMw,priceofswineonthemarketthat week; PMSl, price of swine lot on the market; TVRf, total value of reserve fund;EVm, entitlement value for members; Vind, indemnifiablevalue.

Table6 shows asurvey of the claims from23 lotsover a periodof eightyearsof thecommercialization ofslaughtered animals.

Asshown,duringtheperiodinquestion,anaverageof 5.2 farmersmadeclaimsfor656,250kgofpigandreceivedan aver-agerestitutionfromthemutualfundastheequalizationofprices ofR$139,597.50.Thesevaluesshowsituationsinwhich farm-ersobtainedasalespricebelowtheaveragecostofthegroup. Consideringthesharedvalues,thehighvolatilityofpigpricesis evident,incomparison,themaximumsharedvaluewassixtimes

higherthantheminimumvalue.Intheperiodinquestion,a com-parisonbetweenthenumberofparticipationsandthenumberof claimsdemonstratestherelevanceofthismutualismgroupto theswinefarmersinthecooperative.

MutualInsuranceforSanitaryProblemsandLightningfor MilkFarmers

The mutual insurance for sanitary problemsand lightning wascreatedintheearly1980stosupportaprogramtoeradicate brucellosisandtuberculosisintheherdsofthemembersofthe cooperative.Anotheraimwastominimizethelossescausedby lightning,acommonphenomenonintheregion,affectingthe mortalityoftheherd.Thesefactorsmeantthatitwasnecessary toassumedebtswiththecooperativetoreplacethelivestockand thelostvolumeofmilk.Inthecaseofdisease,whentheclaimfor indemnityhelpsthefarmertoavoidsellingtheherdandthe pos-siblespreadofdiseases,thisreducestheriskofcompromising theinstitutionalbrandofthecooperative.

Inthemutualfundforsanitationandlightning,thecoverage isforlossesresultingfromthedeathofanimalscausedby light-ning,natural phenomenathatare verycommonintheregion, andbrucellosisandtuberculosis.Theprincipleaimofthemutual insuranceistoensurecompensationforfarmerswhohavelost theirherdduetothesediseasesorastheresultoflightning.The valueofindemnityperanimalunitcorrespondsto60%of the averagetotalannualproductionofcowsontheproperty.This valueisobtainedbycalculatingthevolumeofmilksuppliedin thelast12months,thenumberofcowsintheherd(milkcows

Table6

Compositionofvolumesclaimedforthecommercializationofpigs.

Year Lot No.ofparticipations Coverage(kg) Coverage(R$) No.ofclaims Claims(kg) Claims(sharedinR$)

2006 1st 16 1038.87 2,493,842.06 5 630,000 144,900.00

2nd 16 1028.16 2,658,067.78 5 630,000 170,100.00

2007 3rd 16 1019.08 3,103,852.02 3 378,000 79,380.00

4th 16 1009.19 2,679,764.18 6 756,000 120,960.00

5th 16 1082.16 1,991,636.43 3 378,000 86,940.00

2008 6th 16 1092.46 2,081,723.71 2 252,000 80,640.00

7th 20 2164.31 4,113,925.20 4 504,000 70,560.00

8th 20 2186.63 4,828,942.65 2 252,000 45,360.00

2009 9th 20 2124.15 4,660,243.49 7 882,000 202,860.00

10th 20 2250.89 5,106,132.62 6 756,000 151,200.00

11th 20 2274.09 5,673,281.67 9 1,134,000 283,500.00

2010 12th 20 2206.46 6,480,188.02 4 504,000 115,920.00

13th 28 4769.86 10,706,589.02 5 630,000 176,400.00

14th 28 4807.30 9,926,709.99 5 630,000 119,700.00

2011 15th 28 4953.31 11,305,150.10 3 378,000 83,160.00

16th 28 4902.77 12,573,000.15 7 882,000 246,960.00

17th 28 4997.05 11,736,930.47 9 1,134,000 260,820.00

2012 18th 28 4801.68 8,991,357.38 4 504,000 105,840.00

19th 28 4953.31 11,975,692.04 4 504,000 65,520.00

20th 28 4945.54 15,453,810.89 2 252,000 60,480.00

2013 21st 28 5091.34 16,147,712.85 6 756,000 128,520.00

22nd 28 4855.63 12,334,978.38 8 1,008,000 191,520.00

23rd 28 4997.05 14,521,370.73 7 882,000 132,300.00

2014 24th 28 5038.85 18,430,938.04 9 1,134,000 226,800.00

Averages 5.2 656,250 139,597.50

Table7

Compositionofvolumesofclaimsfordeadanimals.

Year Semester No.ofparticipations Coverage(heads) Coverage(R$) No.ofclaims Claims(heads) Claims(sharesinR$)

2008 1 248 18,290 64,015,000.00 1 11 22,032

2 232 18,150 63,525,000.00 0 0 0

2009 1 235 18,388 64,358,000.00 2 45 155,257

2 239 19,050 66,675,000.00 1 20 69,003

2010 1 241 18,420 73,680,000.00 0 0 0

2 246 18,338 73,352,000.00 2 91 367,806

2011 1 246 18,416 82,872,000.00 1 24 89,477

2 250 18,774 84,483,000.00 3 18 67,108

2012 1 256 18,846 84,807,000.00 1 15 58,178

2 276 19,458 87,561,000.00 0 0 0

2013 1 288 20,120 100,600,000.00 1 10 46,141

2 292 21,292 106,460,000.00 1 12 55,369

2014 1 294 21,324 106,620,000.00 2 179 836,420

Averages 1.2 32.7 135,907

Source:AgriculturalCooperative.

anddrycows)andtheaveragepricepaidtothefarmeroverthe sameperiod.

Theaveragetotalcowproductionperyearontheproperty andtheindemnifiablevaluearecalculatedusingthefollowing equations:

TCp= Tp

UA·TPind·QtAc (12)

Vind=TCp·60%·Pr (13)

whereTCp,averagetotalannualcowproduction;Tp,total deliv-eredproductioninthelast12months(L);UA,averageannual numberofcattleinanimalunit;TPind,technicalparameterfor indemnityofanadultcattleunit,asdescribedinFig.2;QtAc, quantityofanimalclaims;Vind,indemnifiablevalue;Pr,base milkpriceforthemonth.

Theclaimsmadein13semestersareshowninTable7. Intheperiodinquestion,therewasanaverageof1.2farmers withanaverageclaimof32.7headsofdeadcows.Theaverage valuesof restitutioninthe formindemnitiesfromthe mutual fundwasR$135,907.Ananalysisoftheamplitudeoftheshared values,withaminimumofzeroandmaximumof836,420shows thatthe risksinvolvedinthisactivityare linkedtoconditions thatcanbemonitoredbutnotcontrolledandcanhappentoany cooperativemember.

Animal Months of age Parameter

Female ≤ 6 0.3

> 6 and ≤ 12 0.5

> 13 and≤ 24 0.7

> 24 1.0

Male Not indemnifiable –

Fig.2.Parametersforindemnifyingadultbovineunits. Source:AgriculturalCooperative.

Conclusion

Inallthecasespresented,therewasatleastonerecurring con-ditionofinsurabilityandtheeffectivenessofthemutualsystem was evident.Itwasalsoobservedthat,likeregularinsurance, thesystemisnotefficientinsituationsofcatastrophe,eitherin theformofsharingthecostofdamageorwithaguaranteefund. Inthisarticle,themaincharacteristics,formsofcalculation andhistoriesofthevaluesofclaimsofthemutualgroups man-agedbythecooperativeinquestionwerepresented.Thegroups weremadeupofmilk,grainandpigfarmers.

Themutualhailgroup,whichisthemosttraditionalgroup managedbythecooperative,hasforsometimebeenan impor-tantsafetynetforsoy,cornandbeanfarmersincaseofdamage. Themutualfarmingfund,whichiscomplementarytothemutual hailfund,hasalsoworkedeffectivelyinthecoverageofdamage andhasseenitsbalancegrowovertheyears.

Inthecaseofthesystemimplementedfortheslaughterhouse at the pigletproductionunit, thissystemminimizes the risks fromthemarketthatresultfromvaryingsalesprices.The coop-erativealsobenefitsfromthisprotectionbecauseitreducesthe creditriskof thecooperativemembersandhelpstoguarantee that theycanhonortheircommitments.Nevertheless,the sys-tem doesnotguaranteeprices,butisanequalizerthat adjusts thesalespricetothatoftheaveragepigcommercializedwithin agivenperiod.In extremesituations, wherelossescanaffect everyoneinthegroup,thesystemisnotcapableofcoveringall thefinancialneedsincurred.

thesystemwouldnothavesufficientresourcestomeetallthe financialneedsofthegroup.

Duetothehighfrequencyrateofdamageinfarming activi-ties,protectionsystemssuchasinsuranceandmutualismprovide greatersecurityforfarmers.Thisarticledemonstratedthe impor-tance of the mutualism systems practiced by an agricultural cooperativebyanalyzingpracticalcasesofseveraltypesofrisk.

Conflictsofinterest

Theauthorsdeclarenoconflictsofinterest.

References

Börner,J.(2006).A bio-economic modelof small-scale farmers’ landuse decisionsandtechnologychoicein theeasternBrazilianAmazon (Doc-toraldissertation). Bonn,Deutschland: Rheinischen-Friedrich-Wilhelms-UniversitätzuBonn.Retrievedfromhttp://hss.ulb.uni-bonn.de/dissonline Caffagni, L.C., & Marques,P. V.(1999). Seguroagropecuário noBrasil:

instituic¸õeseproblemas.Pre¸cosAgrícolas,14,16–18.

CNseg–Confederac¸ãoNacionaldasEmpresasdeSegurosGerais, Previdên-ciaPrivadaeVida,SaúdeSuplementareCapitalizac¸ão.(2014).Glossário.. Retrievedfromhttp://www.cnseg.org.br/cnseg/servicos-apoio/glossario/# Gomes,O.(1998).Contratos.RiodeJaneiro:Forense.

Gomes,A.G.(2000).Administrac¸ãodeRiscos:Comoproteger-secontrariscos naagricultura.InAgrianual2000:AnuáriodaAgriculturaBrasileira.São Paulo:InstitutoFNP.

ICA.InternationalCo-OperativeAlliance.(2013).Blueprintforaco-operative decade..Retrievedfromhttp://ica.coop/sites/default/files/attachments/ICA %20Blueprint%20-%20Final%20-%20Feb%2013%20EN.pdf

Krueger,G.(2004).Cooperativismoeonovocódigocivil(2nded.).Belo Hori-zonte:Mandamentos.

Lago,A.(2009).Fatorescondicionantesaodesenvolvimentode relacionamen-tosintercooperativos(Doctoraldissertation).PortoAlegre:Universidade FederaldoRioGrandedoSul.

Moreira,V.R.(2009).GestãodosRiscosdoAgronegócionoContexto Coop-erativista(Doctoraldissertation).SãoPaulo:EscoladeAdministrac¸ãode EmpresasdeSãoPaulo,Fundac¸ãoGetúlioVargas.

Moreira,V.R.,Souza,A.,&Duclós,L.C.(2014).Avaliac¸ãoderetornoseriscos nacomercializac¸ãodomilho:estudodecasousandovalue-at-risk.Revista deEconomiaeSociologiaRural,52,303–322.

OCB – Organizac¸ão das Cooperativas do Brasil (2014). Retrieved from http://www.ocb.org.br/site/cooperativismo/principios.asp.

OCEPAR – Organizac¸ão das Cooperativas do Estado do Paraná (2014). Retrieved from http://www.paranacooperativo. coop.br/ppc/index.php/sistema-ocepar/2011-12-05.

Ozaki,V.A.(2006).Omutualismocomoformadegestãoderisconaagricultura.

RevistaPolíticaAgrícola,2,49–55.

RevistaGloboRural.(2013).AnuáriodoAgronegócio2013.RiodeJaneiro: EditoraGlobo.

Rodrigues,R.(1997).Novosrumosdocooperativismo.InAnaisdoCongresso BrasileirodeCooperativismo(p.11).

USDA. (2007). United States Department of Agriculture. Risk manage-ment. Farm Bill Theme Papers.. Retrieved from http://www.usda.gov/ documents/Farmbill07riskmgmtrev.pdf