RBGN

Review of Business Management

DOI: 10.7819/rbgn.v18i59.2470

67

Received on

04/24/2015

Approved on

04/20/2016

Responsible editor:

Ivam Ricardo Peleias

Evaluation process: Double Blind Review

The application of “fair value” accounting

standards to the income statements of

companies listed in the Portuguese Stock

Index-20 (PSI-20)

Tiago Cardao-Pito

University of Lisbon, ISEG School of Economics and Management, Department of Management, Lisbon, Portugal

Jorge Barros

University of Lisbon, ISEG School of Economics and Management, ADVANCE Research Center, Lisbon, Portugal

Abstract

Purpose – “Fair value” accounting standards are not consensual.

Supporters claim that they ofer a methodology to ind the “correct” value of accounting items, whereas critics contend that “fair value” accounting reduces the reliability of inancial statements through a complex and unpractical method based on subjective information. Still, the impacts of “fair value” accounting upon taxes and public revenues are rarely discussed.

Design/methodology/approach – he Portuguese case allows us to

study taxation and public revenues. hrough European Union norms, “fair value” standards have become mandatory after 2005 for companies listed in European stock-exchanges. Nevertheless, Portuguese corporate tax law was reformulated in 2010 to strongly restrict the use of “fair value” for taxation purposes. We study the use of “fair value” in the Income Statements of the largest companies listed in the Portuguese exchange between 2005 and 2012.

Findings –If Portugal had not adopted “fair value” standards, its tax

revenue would have been higher. Over all analyzed years and in almost all studied companies, average “fair value” adjustments are negative. Although a statistical association between negative adjustments and the economic cycle was found, this statistical association is not very strong. herefore, the economic cycle cannot be used as the only explanation for the use of “fair value”.

Originality/value – This paper demonstrates that discussions

concerning the “fair value” accounting method must not ignore its possible impacts on government taxes and public revenue.

1

Introduction

In 2002, with Regulation EC-1606, later enhanced by Regulation EC-1725/2003, the European Commission sought to harmonize the accounting standards of European Union countries. he main goal was to increase the comparability of organizational financial statements across Europe. Furthermore, the European Commission also took on the objective of reporting several accounting items according to their eventual market value, understood as “fair value”.

From 2005 onwards, these European regulations instruct companies listed in European Stock Exchanges to adopt International Accounting Standards (IAS) produced by the International Accounting Standards Board (IASB). Hence, this supranational accounting body began to produce accounting regulations for the entire European Union. To some extent, European Union countries transferred their accounting standard production skills to the IASB (Sunder, 2011 Oehr & Zimmerman, 2012). he IASB is a supranational institution, based in London, which was created in 2001 to replace the International Accounting Standards Committee (IASC), founded in 1973 by nine countries (Australia, Canada, France, Germany, Japan, Mexico, Netherlands, United Kingdom and Ireland). he IASB also produces accounting standards for many other countries outside the European Union (e.g. Brazil, Australia, Turkey, Mexico, Israel and Canada, among others). he change in accounting standards within the European Union was a complex process. he receptivity to the regulatory modiication has depended upon developments from various countries regarding the accounting policies, as well as of their own economic institutions (Oehr & Zimmerman, 2012).

The IASB believes that traditional accounting, that is, the registration of items and events with reference to historical transaction values, must be replaced, whenever possible, by

the market value of the referred accounting items. In this sense, the IASB deines “fair value” as “the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in a transaction that where there is no relationship between them.” To this end, a market should be used when a comparable market for the item exists. As an alternative, a theoretical model to predict the market value should be used (§ 11, IAS 32).

This drastic change in accounting regulations has not been able to obtain a consensus. Advocates of “fair value” accounting argue that the traditional historical cost criterion provides a static record, especially for non-monetary assets. he “fair value” method, through incorporating market values (those considered as the “fair value”), would provide a more accurate description of companies’ value. On the other hand, critics describe the “fair value” record as a method of subjective accounting measurement and diicult practical application. his method’s subjectivity may, ultimately, be abusively used by less well-intentioned economic agents. Authors that tend to disagree with the use of the “fair value” method argue that it unreasonably complicates the interpretation of accounting information.

accounting standards for tax clearance, seeming to indicate that not all is well in applying “fair value” norms.

To identify records made by the “fair value” method, we have researched the consolidated income statements of those 31 companies over 2005-2012. Note that the turnover of these companies at the end of 2012 was equivalent to 51% of Portuguese GDP. Our indings seem to indicate that the use of the “fair value” method by large Portuguese companies had a negative impact on Portugal’s tax revenues. However, we must note that this tax efect is a consequence of the adoption of “fair value” norms in the Portuguese and European regulatory framework. When companies use this accounting method, generally, they only do so because it is deined in the existing regulations. We contribute to the literature with objective data about advantages and disadvantages of adopting the “fair value” method. Moreover, this study allows us to better understand the impact of adopting the “fair value” method in the results, business taxation and national states’ revenues.

2

Literature review

2.1

he adoption of “fair value” accounting

by largest Portuguese corporations

2 . 1 . 1

The transference of regulator y

competences to a supranational agency

As mentioned earlier, European Union’s countries have transferred their competence of producing accounting standards to the IASB. he European Union adopted the IASB standards on the grounds of seeking to harmonize standards leading to the preparation of inancial statements (Sunder, 2011). he process of reform referred to above has begun with the partial transference of accounting standards production to the IASB. Later, the States have adopted the IASB standards on their countries. In most cases, with full adoption or with small national settings modifications. This “remodeling” is

rather complex and depends on the receptivity of countries and national institutions (Oehr & Zimmerman, 2012).

In Portugal, the entity that has power to adopt IASB standards is the National Accounting Commission – CNC, which represents public and private institutions in the area of accounting. The CNC is an entity with administrative autonomy operating under the umbrella of the Ministry of Finance. Its functions are to issue regulations, opinions and recommendations to harmonize inancial procedures with European and international standards of the same nature, promoting actions in order that those norms are properly applied by the entities subject. With Portugal’s adoption of European regulations, it was through the CNC that since 2005 domestic companies listed on the stock exchange are no longer linked to the previous National Plan of Accounts (POC), and are required to follow International Accounting Standards (IAS / IFRS) when preparing inancial statements1.

2.1.2

he accounting values produced by

the “fair value” method

gained a high autonomy to identify markets or models for accounting values that are to be inscribed in inancial statements. As we will see later, the critics of this valuation methodology seek to demonstrate the complexity and diicult to apply this methodology. On the one hand, a real market value for the item may be nonexistent, only temporary, or highly volatile. On the other hand, the inputs necessary for the calculation of future values estimates may involve high subjectivity with concrete impact on the book values that are to be presented. Both cases can eventually lead to abuse.

2.1.3

The adoption of the “fair value”

method in Portugal

European Commission’s regulation CE 1606/202 has defined that after 1st January

2005 all companies listed in a stock exchange in the European Union’s space must adopt the international accounting norms from IASB. his change has represented a major modiication to the Portuguese accounting and taxation framework. Before 2005, there was an hierarchy of regulations in the country, which puts in the irst and foremost level the National Accounting Plan (POC), on the second level the Accounting Directives (DC), and on the third and least important level the international accounting standards (DC 18). For companies listed after 2005, the international accounting standards have moved straight to the top of the normative hierarchy. In itself, such a vast modiication is an interesting purpose of study.

he concept of “fair value” already existed on the Portuguese normative framework, at least since 1993. However, it had a very small incidence.2 The tax law code for corporate income (CIRC) was supported on the POC, and the POC was based on the historical cost method. For instance, before 2005, several DCs already mention the “fair value” method. For instance, for corporate concentrations (DC 9), or future contracts (DC 17). Published in 1994, DC 13’s deinition for the “fair value” method

is quite similar to the international regulator’s definition. However, lawmakers had specific norms to prevent records by the “fair value” on Income Statements. For example, when used on corporate concentrations, the “fair value” must have been registered directly on the equity. Even for derivative contracts as futures, for which there are active functioning markets from where to extract market prices, the gains and losses could only be registered on Income Statements when the position was closed. Before that, gains and losses should be registered in deferred accounts (DC 17).

When listed companies were required to produce inancial statements observing the international accounting standards after 2005 onwards, they were allowed to make “fair value” records directly onto their Income Statements. hus, with impact upon results before taxes. Some “fair value” records can be made directly each year. Other records are divisible throughout the item’s expected life cycle (Regulation CE 1606/2002 e 1725/2003). Further legislation has clariied that listed companies are no longer restricted by the former POC and related legislation (Art. 11º do DL 35/2005 de 17/2). However, in 2005 the corporate tax code was not reformulated in order to adapt to this modiication at listed companies’ accounting. his code refers that taxable proit is produced by accounting, and these companies have received new accounting rules. Although legislation states that all companies must comply with national accounting normalization, the situation of “fair value” accounting becomes ambiguous for listed companies, since it receives a tacit acceptability status, because the tax code applied then makes no specific mention to “fair value” accounting. his tax code relies on accounting rules that used to be historical cost based. Moreover, banks and insurers receive speciic legislation stating that the international accounting norms are valid either for accounting and taxation (Law # 53-A/2006, de 29/12 and DL # 237/2008, de 15/12).

to deliberately address “fair value” accounting. his tax code modiication was implemented along an extension of the Portuguese accounting normalization whereby the international accounting norms have become mandatory to generally all companies, with the exception of very small companies. However, by then the new tax code strongly prevents the use of “fair value” accounting for taxation purposes. A specific article (Art. 18º) expressly prohibits the use of “fair value” accounting for tax computation, with exception of speciically predicted cases in the new code, which are very restricted. hey include just a few speciic accounting items such as inancial instruments with a price formed in a regaled market, and for which the company’s participation is less than 5% of equity (Art. 18), derivative inancial instruments used to hedge risks (Art. 49), or some speciic biological assets (arts. 20 n. 1 g e 23, n. 1j).

Furthermore, Portuguese lawmakers have become very reserved and cautious about accepting imparities due to the subjectivity concerns that may arise from estimations (Rodrigues, 2011, Castro, 2015). he new tax code predicts the possibility of imparities over ixed assets, intangible asset, some biological assets, and investments (art. 35, n.1c). However, article 38 clariies that these imparities are altogether exceptional in nature. They must be related to natural phenomena, exceptionally fast and impacting technical innovations, or alterations with negative impacts or legal consequences. Furthermore, these imparities are only acceptable when formally validated by the National Tax Revenue Oice (Direcção-Geral dos Impostos), after claimants have presented a demonstration established on evidence that is subject to be conirmed by the Tax Revenue Oice.

herefore, in 2010 Portugal contradicts the spirit of international accounting standards adoption launched in 2005 under the auspices of the European Commission, and where the “fair value” method is understood as a key methodology to identify proits and losses. One

can see, for instance, the case of ixed assets. According to IASB standards (IAS 16), companies must carry out regular revaluations of fixed assets, whereby positive revaluations ought to be registered on the equity, and negative revaluations on Income Statements. However, the Portuguese tax code (CIRC) rejects the use of the “fair value” method as a valuation criterion for ixed assets, which has great impact upon the taxation basis (Amorim, 2016). Concretely, Portugal’s non-integral adoption of international accounting norms for taxation purposes may indicate concern for a possible loss of tax revenues, a subject studied in this paper. he Portuguese case may result in an interesting case study about what may happen when international accounting norms became acceptable both in accounting and taxation for a group of companies.

2.2

Arguments in favor and against the

“fair value” method

In this section, we review key arguments from supporters and critics of “fair value” accounting.

2.2.1

Arguments in favor of “fair value”

accounting

argument, the historical cost method would not have relevance value, that is, relevance for market values (Lev, 1989 Barth, 1994 Barth & Landsaman 1995, Lev & Sougiannis, 1996 Venkatachalam, 1996 Brown, Lo & Lys, 1999 Barth, Beaver & Landsman, 2001 Duke, 2008). A variant of this argument claims that the market value can capture the value of companies’ intangible assets, which would not be observable through the historical cost method (see for example, Canibano, Garcya-Ayuso, Sanchez, 2000 Villalonga, 2000 Holland 2001 , Powel, 2003, Garcia-Ayuso, 2003 Antunes & Alves, 2008).

he “fair value” method has been linked to the recent economic crisis post-2007 in Western societies. However, “fair value” advocates argue that this method cannot be blamed for this inancial crisis, to the extent that this methodology only shows the “real” value of inancial information available for transaction. he “fair value” method is seen as a decisive element in the interactions of inancial agents in the economy because it would help in measuring investors’ exposures to risk of inancial investments. Laux and Leuz (2010) and Barth and Landsman (2010) reinforce the idea by claiming that amounts entered in inancial reports through the “fair value” method are residual in inluencing inancial indicators. hus, they seek to highlight the idea that there is no preponderance of “fair value” in the recent inancial crisis. hose who defend this method say there must be trade-of between relevance and trust in inancial statements produced through the “fair value” system – because, in “normal” economic situations, “fair value” registers “potential expenses/income”, which generate oscillations in the inancial statements and impact the interactions of inancial participants; on the other hand, it is this anticipation that “prevents” large impacts on inancial results and eventual internal crises (e.g. Laux & Leuz, 2009).

2.2.2

Arguments against “fair value”

accounting

However, there are schools of thought that oppose the adoption of “fair value” accounting standards. he very term “fair value” is considered as inducing errors, because it appears to assign a fair value to a value that is necessarily subjective (Biondi & Suzuki, 2007). Furthermore, it is argued that the economic theory that founds the “fair value” method has weak empirical evidence (Bougen & Young, 2012, Cardao-Pito & Ferreira, 2013). Whittington (2008) claims that if inancial regulators as IASB could accept the fact that we do not live in a world of perfect competition, the model of “fair value” would lose its importance. Furthermore, as it is not good in theory, it would also not be relevant nor logically consistent.

he “fair value” method is regarded by its critics as a diicult and complex method. he complexity is related to a lack of uniform interpretation and direction, often also at the government or institutional level (Jermakowicz & Gornik-Tomaszewski, 2006). he very idea that one can use a quantitative method as the “fair value” to measure accurately the intangibility has characteristics of a paradox. Intangibility by deinition cannot be measured (Cardao-Pito, 2012, 2016). Economics and accounting can only measure the tangible elements associated with intangibility, such as money spent (Cardao-Pito, 2016, Zanoteli, Amaral & Souza, 2015)

the recognition of impairments occurred in very speciic occasions. When comparing assets’ market values to what was actually recorded, several discrepancies were found.

Freedom/availability of information appears here, then, as a potential added value for those who own companies and can inluence the behavior of inancial stakeholders. Nissim (2003) and Ahmed and Takeda (1995) ind that certain banks used “fair value” in loans to inluence the assessment of the market in terms of risk and performance. Decision-making was inluenced by incentives given to managers in advance by shareholders, as if for match-ixing.

here are also some practical diiculties in implementing “fair value” regulations which are often cited by its critics. For example, from the point of view of financial supervision, Marques (2007) notes that “Portugal does not have an auditing standard to establish rules and criteria that must be followed in the auditing of ‘fair value’”.

Furthermore, opponents of the “fair value” method have serious concerns about the possible misuse of this method. In extreme situations, critics claim this method can be used as a tool for results manipulation due to its subjective character, which can often occur due to surrounding reality, and may take on an embodied role depending on the interactions of inancial agents.

2.3

Portuguese Stock Index-20 (PSI-20)

Depending on arguments for and against the “fair value” accounting method, this method is presented as bringing an improvement in accounting standards or an impoverishment of accounting objectivity. he rules imposed by the European Union for inancial stakeholders in recent years can, to some extent, have changed their behavior (Barlev & Haddad, 2003). In our study, we will try to identify the tax impact “fair value” accounting had on companies that were integrated in the Portuguese Stock Index-20 (PSI-20) over the 2005-2012 period. Thisindex includes the Portuguese stock exchange’s largest companies by market capitalization. he capitalization requirements are evaluated periodically (EURONEXT, 2003). here is a “waiting list” to “identify the companies most likely to be included in the index when there is need to carry out an emission replacement sample” (EURONEXT, 2003). Because they are listed in a European stock exchange, all companies included in this index have been linked to IASB standards since 2005.

Appendix I identified the studied companies. Over these eight years, there were 31 companies that took part in the PSI-20 index. he table in Appendix I identiies these companies, while distinguishing the 20 companies that were integrated in the index at the end of 2012. In addition, the table identiies the sector, turnover and net results of those 31 companies in 2012. hese companies are very relevant for the Portuguese economy. Its turnover in 2012 was equivalent to 51% of the Portuguese Gross Domestic Product (GDP). This group of 31 companies includes the four largest Portuguese private banks (Banif, BCP, BES and associated company Espírito Santo Financial Group, and BPI). Note also that there is a relevant group of seven former national enterprises that have been privatized, such as the fuel and gas company (GALP), electricity companies (EDP and EDP Renováveis), the electrical infrastructure (REN) the cement company (Cimpor), the telecommunications company (Portugal Telecom) and the motorway company (BRISA).

3

Research methodology

3.1

Research Aims

As mentioned earlier, this study attempts to identify impact of changes brought by “fair value” accounting standards in the Income Statements of the largest listed Portuguese companies over the 2005-2012 period.

3.2

Database

Our database has been produced with inancial information that is available online3. The collected information shows how the sample’s companies have developed “fair value” accounting operations on their Consolidated Income Statements. We do not seek to identify the initial registration of items in inancial statements, in which, according to IASB, the “fair value” criterion matches the historical cost criterion. IASB’s reasoning is that, at the initial moment, the historical cost tends to coincide with the market value, and, as such, with “fair value”. Our study addresses the subsequent rectiications through the “fair value” method recorded as expenses or income on the Income Statements. Furthermore, we have excluded from the database the provisions of some items that were already accepted by the POC. hose include, for instance, diicult credits from customer, adjustment of stocks, or other items that do not involve the “fair value” methodology. Changes in “fair value” with an impact on business results were categorized into four main ields, namely: i) variation (+/-) on hedging derivatives, ii) variation (+/-) on covered items, iii) impairment losses, and iv) other changes (+ / -) of “fair value”.

In the rubric variation (+/-) on hedging derivatives are inserted variations (explicit and isolated) of “fair value” of these derivatives. Herein are contained variations that afect the company’s results after the initial registration of these instruments, which are constantly being adjusted to the reality of the hedged item;

In the variation (+/-) on covered items were

included the (eligible) subsequent evaluations of the instruments covered, inter alia, cover efectiveness tests (tests that are made periodically to this type of inancial instruments to ensure that coverage corresponds to actual market requirements);

In impairment losses of “fair value” are included all losses or reversals (gains) associated with this criteria, except customers’ impairment losses, as this class is highly reversible regarding the cancellation of these impairments. In other words, the impairment losses associated with customers are associated with the known concept of diicult credits from customers, which was already predicted on the previous POC. In this situation, losses are only recognized when the services billed have not been paid. Such situations do not attend to the core of this study. In this item was also assumed that the impairment losses associated with inventories / stocks have nothing to do with normal or abnormal breakage of stock, but with the devaluation or appreciation of its contents.

And in other changes (+ / -) of “fair value”

includes all subsequent changes in the inancial instruments that are not hedging derivatives and hedged items, or impairment losses through the “fair value” method.

The methodology for collecting information was to consult the sample’s companies’ management reports in pdf iles. We have used search tools, with the aim of inding the “fair value” expression in each financial statement. We have built a sample comprising 31 companies and 8 years, from which have resulted 243 management eligible yearly reports. Two companies have no reports in the early years4. Of

4

Presentation and discussion of

results

4.1

Utilization of the “fair value” method

at the largest listed Portuguese companies’

Income Statements: an overview

Annex 1 identifies the amount of rectiications through the “fair value” method that has been found in the Income Statements of the sample companies over the 2005-2012 period. he net balance of rectiications has mostly a negative impact on those companies’ results and as such in the tax base and taxes received by Portugal. A negative net balance of rectiications of 6.153 million euros during the studied period

was found, which corresponds to approximately 3.7% of GDP Portuguese of 2012.

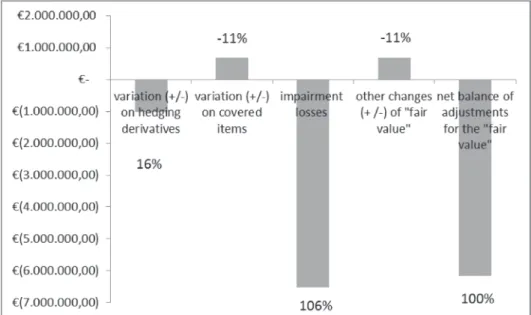

As is evident in Figure 1, the item with greater use and negative impact were the impairment charges through the “fair value” method, representing 106% of the total adjustments. Changes in hedging derivatives also had a negative impact on the results (16% of the total “fair value” over the period). In turn, the other two rubrics in net terms helped to increase the results, but in a very limited way. he variation in the hedged items represent -11%, as well as other changes in “fair value” found that also represent - 11%.

Figure 1. Breakdown of rectiications by “fair value” in the largest Portuguese Companies

Annex 1 also describes the average negative, positive and total adjustments by the “fair value” method in Consolidated Income Statements as a proportion of each company’s assets, along the respective standard deviation. In all these companies, the net annual adjustment is negative, which reduces proits before taxes and eventually the tax basis. It is on average minus 0.3% of total assets (standard deviation 0.9%). At a irst glance, this value may seem relatively small. However,

taxes, given to the fact that these companies include some of the largest companies operating in Portugal. Furthermore, it can be seen in Annex 1 that only one company has a positive net adjustments average in this period, and two other companies have null average. All other companies have a negative average of net “fair value” adjustments, and as such with possible efects of reducing the payable corporate income tax/tax basis. Hence, the vast majority of the largest Portuguese listed companies showed a net increase of expenses through the “fair value” method with efect on results before taxes. Such behavior would only not bring tax consequences if Portugal refused to accept the “fair value” method for quantiication of payable taxes.

4.2

Absolute and relative application

of the “fair value” method to income

statements

In absolute terms, the largest users of “fair value” are essentially the ive inancial sector companies (Banif, BCP, BES, Espírito Santo Financial Group, and BPI) representing 60% of net corrections, and seven former government companies which were privatized (GALP, EDP, EDP Renováveis, REN, Cimpor, Portugal Telecom, BRISA), representing 30% of net corrections. he Figure A in Annex 2 describes the largest users of the “fair value” method over the studied period. he highest concentration of adjustments (87.64%) is in years 2011 (54%) and 2012 (33.7%), that is, after the reformulated corporate tax code in 2010, and not before it. Interestingly, those were the years in which Portugal faced a severe economic crisis. At that time, Portugal was being intervened by what was called the “Troika”, made up of European Central Bank (ECB), European Commission and International Monetary Fund (IMF) members. he eventual decline in tax revenues may have further increased the country’s inancial diiculties.

This finding is confirmed in Annex-2 Figure B. In absolute values, the greatest users of

the “fair value” method are inancial companies and former national enterprises. For example, as other banks, BCP had an estimated impairment on Greek debt of 826.925 million euros, namely, 19.9% of the “fair value” over the 2005-2012 period, and 56.53% of IRC collected in the financial sector over the period under study. Although it is not possible to identify whether these impairments were accepted for tax purposes, the post-2010 tax code accepts “fair value” impairments on inancial investments when the participation on equity is lower than 5%, as it is the case.

However, when “fair value” adjustments are weighted by the companies’ assets, no statistically signiicant relationship between these adjustments and the recently privatized companies has been found. Spearman correlations are merely r = 0.05 (p <0.46) with negative adjustments and -0.07 (p <0.28) with positive adjustments. Still, a statistical association remains with the inancial industry, where the correlation is r = -0.15 (p <0.02) with negative adjustments and 0.43 (p <0.01) with positive adjustments.

4.3

Average effects of “fair value”

adjustments on proits before tax (tax

base)

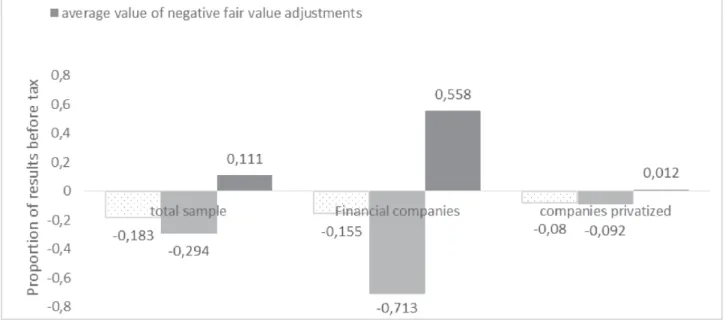

in net terms they are below the overall average. In the former national companies currently privatized a higher value than the sample average was not found. However, in both cases the adjustments to the “fair value” decrease income

before taxes. Once again, the statistical evidence seems to clearly show that the “fair value” adjustments may have had a negative efect on tax revenues collected by Portugal.

Figure 2. Average “fair value” as proportion of results before taxes (tax base) at observations with proits over the

2005-2012 period

Note: Figure 2 considers only observations where the results before tax are positive, and as such there is likely to be payable corporate income taxes.

4.4

“Fair value” adjustments and the

economic cycle

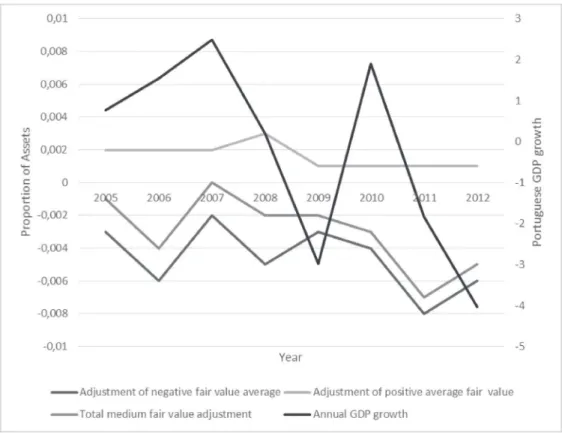

Figure 3 includes all the 243 sample observations. It relates “fair value” adjustments in proportion to the companies’ assets and the Portuguese economic cycle, measured through the Portuguese GDP growth. here is some statistical relationship between the negative “fair value” adjustments and GDP growth, but it is rather small, namely r = 0.13 (p <0.04). his correlation between GDP and net “fair value” adjustments is relected on a correlation of r = 0.17 (p <0.01). However, Figure 3 also anticipates that there is

consistently higher than the positive adjustments in each year of the sample. In 2007 only, positive and negative adjustments are roughly equivalent. his behavior seems to be systematic. It is in line

with the average of the total adjustments being negative for the vast majority of the sample’s companies.

Figure 3. “Fair value” adjustments as a proportion of assets, and the economic cycle

4.5

Discussion of results in the context

of studied literature

As described earlier in the Literature Review, the defenders of the “fair value” accounting method have two major arguments. First, it is argued that this valuation method would be the most appropriate to ind the “correct” value of accounting items. Furthermore, it is claimed that this method would be appropriate to capture intangible assets, which are allegedly observed by market prices, but invisible for traditional accounting methods.

On the other hand, opponents of the “fair value” method draw attention to the inherent subjectivity of these two arguments. Evidently, to know the appropriate value of the accounting items is quite diicult. Changes in market prices

can be very volatile and unpredictable (Schiller, 1981, 2005), are embedded in complex social structures (Granovetter 1985 Lawson, 2012, Polanyi, 1957), and are accomplished by some complex intangible flow human dynamics (Cardao-Pito, 2012, 2016). In contrast, historical inancial facts can be conirmed through formal documentation.

In the years immediately following the adoption of the “fair value” accounting system, our study demonstrates an efective loss of tax revenues to the Portuguese State. If the discussion would remain on the subjective ground of knowing the “correct” value for accounting items, our indings could not be recognized. Although questions regarding the “correct value” of accounting items are indeed much discussed in the literature, the material consequences of diferent policies and accounting standards are generally neglected. In our view, the material consequences are quite relevant in terms of possible alternative methods for inancial reporting.

As noted above, with efect from 2010 onwards, the Portuguese government revamped its corporate income tax code in order to strongly restrict application of the “fair value” method for taxation purposes. Although the “fair value” adjustments are toughly forbidden in most tax computations, this method continues to be applicable for taxation in a few accounting operations. Therefore, it continues to have implications in terms of Portuguese companies’ corporate taxes, even if those implications are much more restricted than if all the international accounting standards were fully operational from a iscal point of view.

5

Conclusions and limitations

5.1

Conclusions

Post-2005 adoption of “fair value” accounting at the largest Portuguese corporations’ Income Statement has resulted in a loss to Portugal’s tax revenues. Such a loss would not occur if the previous accounting methodology was fully in place. his inding is an objective fact. he Portuguese state seems to have identiied the risk of further substantial tax revenue losses deriving from “fair value” accounting. In 2010, the reformulated corporate tax law strongly limits the use of “fair value” accounting for tax purposes, which thus drives against applying international accounting standards to taxation matters.

Although some “fair value” operations are stills condoned, one can note that the Portuguese state has adopted a prudent attitude, if not altogether distrust, in regard to the use of “fair value” in taxation afairs.

Some statistical relationship between negative “fair value” adjustments in Income Statements and the economic cycle was found. However, this relationship is not very strong. Furthermore, there was no signiicant statistical relationship between positive adjustments and the economic cycle. herefore, the economic cycle cannot be considered as the only explanatory factor for accounting records at “fair value”. For companies with positive results, and as such subject to tax on their corporate income, the average net “fair value” adjustments over the 2005-2012 period was negative, representing 18.3% of earnings before tax. If all “fair value” adjustments were accepted from a iscal point of view, this amount would correspond to an equivalent loss in corporate income taxes to Portugal.

Our findings exhibit that although debates about “fair value” and historical cost accounting tend to focus on necessarily subjective discussions related to eventually “correct” values for accounting items, accounting methods have strong repercussions on taxes and public revenues. One needs also to note that companies using “fair value” accounting are only allowed to do so to the extent that regulations enable this possibility. Law makers and regulators make laws and regulations, but can also reflect on the advantages and disadvantages of diferent accounting methods. Decisions must be made after those analyses are carried out. here may be great concern as to the adoption of an accounting methodology such as “fair value” accounting, which contains an explosive mixture of subjectivity and the possibility of reducing taxes to be paid to the country.

segregation at the content and temporal levels. Nevertheless, this study demonstrates the need for further research concerning the possible efects – for contemporary companies and societies – of the adoption of the “fair value” accounting method.

5.2

Limitations

Naturally, limitations exist in a study based upon companies’ public information. “Fair value” operations in income statements can only be detected when expressly mentioned in notes to inancial statements. However, the contents of these notes are not always clear in terms of employed “fair values”. he values attributed to this method are often placed alongside other values with a similar proile. herefore, to avoid giving the investigation any bias, these types of values were not put in the database to avoid duplication. Moreover, when a “fair value” operation is detected, it is sometimes hard to identify what type of fair value has been used (that is, level 1, 2 or 3 according to IFRS 13) because companies infrequently identify the level used. Nonetheless, when accounting items do not have a comparable market, as in the case of many imparities, level 3 must be used. To compare registered values with recoverable values, companies need to use methodologies capable of producing “fair values,” and therefore estimations, even though in some cases those estimations might be close to market reality.

Other limitations refer to the temporal comparability of inancial statements. In some cases inancial statements of diferent years have accounting values for the same items and year that diverge, without an apparent explanation for the variation. Accordingly, we have chosen by presuppose to ind the values for each year on the respective year’s inancial statements.

hus, with a set of considerations and limitations, we have produced an adjusted database, through which the possible information has been extracted. Our study tried to understand the behavior of the largest Portuguese companies as to adopting “fair value” accounting in their Income Statements over 2005-2012. However, we

cannot provide quantitative causal explanations, for instance using regressions to identify empirical variables capable of predicting the use of “fair values” by companies. here are several endogenous components – such as governance models, industries, shareholder composition, capital structure, etc. Our study is restricted to identifying the major variations that have arisen from the “fair value” method in the largest Portuguese companies’ Income Statements. We do not have enough information to conclude what the major motivations from economic agents when using “fair value” accounting are.

References

Ahmed, A. & Takeda, C. (1995). Stock market valuation of gains and losses on commercial banks’ investment securities: An empirical analysis. Journal of Accounting and Economics, 20(l), 207–225.

Amorim, J. C. (2012). O justo valor e as suas implicações iscais. Anais do Encuentro AECA “Nuevos caminhos para Europa: El papel de las empresas y los gobiernos”, Barcelos, Portugal, 15.

Antunes, T. & Alves, A. (2008). he Adequacy of the Enterprise Resources Planning (ERP) Systems for the Creation of Intangible Managerial Accounting Information: an exploratory study. RBGN-Revista Brasileira de Gestão de Negocios, 12(37), 161-174.

Barlev, B. & Haddad, J. (2003). Fair value accounting and the management of the irm. Critical Perspectives on Accounting, 14(2), 383–415.

Barth, M. (1994) Fair value accounting: Evidence from investment securities and the market valuation of banks. Accounting Review, 69(1), 25.

Barth, M. & Landsman, W. (1995). Fundamental issues related to using fair value accounting for inancial reporting. Accounting Horizons, 9(4), 97-107.

Barth, M. & Landsman, W. (2010). How did inancial reporting contribute to the inancial crisis? European Accounting Review, 19(3), 399–423.

Biondi, Y. & Suzuki, T. (2007). Socio-economic impacts of international accounting standards: An introduction. Socio-Economic Review, 5(l), 585–602.

Bougen, P. Y. I. (2012). Fair value accounting: Simulacra and simulation. Critical Perspectives on Accounting, 23(4-5, 390-402.

Brown, S., Lo, K., & Lys, T. (1999). Use of R-squared in accounting research: measuring changing in value relevance over the last four decades. Journal of Accounting and Economics, 28(1), 83–115.

Canibano, L., Garcia-Ayuso, M., Sanchez, P. (2000). Accounting for intangibles: a literature review. Journal of Accounting Literature, 19(1), 102-130.

Cardao-Pito, T. & Ferreira, J. (2013). Accounting and mainstream economics: Two inconvenient truths. Working Project ISEG, Universidade de Lisboa. 2013 Under review for publication.

Cardao-Pito, T. (2012). Intangible Flow

heory. American Journal of Economics and

Sociology, 71(2), 328-353.

Cardao-Pito, T. (2016). A law for the social sciences regarding us human beings. Journal of Interdisciplinary Economics, 28(2).

Castro, J. (2015). O tratamento contabilístico-iscal dos ativos intangíveis. Tese. Universidade Católica Portuguesa. Porto.

Código do Imposto sobre o Rendimento das Pessoas Coletivas. (2013). Redação que vigorou até

31/12/2013. Recuperated from http://info. portaldasinancas.gov.pt/pt/informacao_iscal/ codigos_tributarios/circ_rep/

Comissão do Mercado de Valores Mobiliários. (2013). Prestação de contas: Contas anuais. Recuperated from http://web3.cmvm.pt/sdi/ emitentes/contas_anuais.cfm

Decreto-Lei n. 35/2005, de 17 de fevereiro de 2005. Transpõe para a ordem jurídica interna a Directiva n.º 2003/51/CE, do Parlamento Europeu e do Conselho, de 18 de Junho, que altera as Directivas n.os 78/660/CEE, 83/349/ CEE, 86/635/CEE e 91/674/CEE, do Conselho, relativas às contas anuais... Recuperated from http://www.pgdlisboa.pt/leis/lei_mostra_ articulado.php?nid=523&tabela=leis

Decreto-Lei n. 160/2009, de 13 de julho de 2009. Aprova o regime jurídico de organização e o funcionamento da Comissão de Normalização Contabilística e revoga o Decreto-Lei n.º 367/99, de 18 de Setembro. Diário da República, 1ª série (133), 4449-4453. Recuperated from http://www.cnc.min-financas.pt/pdf/ DL_160_2009_13Jul_CNC.pdf

Decreto-Lei n. 237/2008, de 15 de dezembro 2008. No uso da autorização legislativa concedida pelo artigo 51.º da Lei n.º 67-A/2007, de 31 de Dezembro, estabelece um regime transitório de adaptação das regras de determinação do lucro tributável em sede de IRC à nova regulamentação contabilística aplicável ao sector segurador e procede à segunda alteração ao Decreto-Lei n.º 35/2005... Recuperated from http:// www.pgdlisboa.pt/leis/lei_mostra_articulado. php?nid=1034&tabela=leis

from http://eur-lex.europa.eu/legal-content/ PT/TXT/HTML/?uri=CELEX:32001L0065 &from=PT

Directriz Contabilística n. 1/91, janeiro 1 9 9 2. Tr a t a m e n t o c o n t a b i l í s t i c o d e concentração de actividades empresariais. Recuperated from http://www.cnc.min-financas.pt/_siteantigo/Directrizes/Dir01_ concentra%C3%A7%C3%B5es.pdf

Directriz Contabilística n. 9, novembro 1992. Contabilização nas contas individuais da detentora de partes de capital em filiais e associadas. Recuperated from http://www. cnc.min-inancas.pt/_siteantigo/Directrizes/ Dir09_contabiliza%C3%A7%C3%A3o%20 de%20partes%20de%20capital.pdf

Directriz Contabilística n. 10, novembro 1992. Regime transitório da contabilização da locação financeira. Recuperated from http://www. cnc.min-inancas.pt/_siteantigo/Directrizes/ Dir10_regime%20transitorio%20de%20 loca%C3%A7%C3%A3o.pdf

Directriz Contabilística n. 13, julho 1993. Conceito de justo valor. Recuperated from http://www.cnc.min-inancas.pt/_siteantigo/ Directrizes/Dir13_justo%20valor.pdf

Directriz Contabilística n. 17, maio 1996. Contratos futuros. Recuperated from http:// www.cnc.min-financas.pt/_siteantigo/ Directrizes/Dir17_fu_contratos%20futuros.pdf

Duque, J. (2008). Em defesa do justo valor. Revista Contabilidade, 105, 34–35.

EURONEXT. (2003). Regras de cálculo dos índices PSI. EURONEXT, [S.l.],. Disponível em: <http://www1.eeg.uminho.pt/ economia/caac/pagina%20pessoal/Disciplinas/ Disciplinas%2005/bancaria/psi20.pdf>. Access on: Sept. 19, 2013.

Garcia-Ayuso, M. (2003). Factors explaining the ineicient valuation of intangibles, Accounting, Auditing and Accountability Journal, 16(1), 57–69.

Granovetter, M. (1985). Economic action and social structure: the problem of embeddedness. American Journal of Sociology 91(3), 481-510.

Hilton, A. & O’Brien, P. C. (2009). Inco Ltd.: Market value, fair value, and management discretion. Journal of Accounting Research, 47(1), 179–210.

Holland, J. (2001). Financial institutions, intangibles and corporate governance. Accounting, Auditing & Accountability Journal, 14(4), 497-529.

IAS 16, December 2003. Property, plant and equipment. Recuperated from http://www. iasplus.com/en/standards/ias/ias16

IAS 32, 21 June 2002. Financial instruments: Presentation. Recuperado de http://www. iasplus.com/en/standards/ias/ias32

IAS 39, February 2011. Financial instruments: Recognition an measurement. Recuperated from http://www.iasplus.com/en/standards/ ias/ias39

IFRS 9, July 2014. Financial instruments. Recuperated from http://www.iasplus.com/ en-us/standards/international/ifrs-en-us/ifrs9

IFRS 13, January 2013. Fair value measurement. Recuperated from http://www.iasplus.com/en/ standards/ifrs/ifrs13

Jermakowicz, E. (2004). Efects of adoption of International Financial Reporting Standards in Belgium: The evidence from BEL-20 companies. Accounting in Europe, 1(1), 51–70.

Jermakowicz, E. & Gornik-Tomaszewski, S. (2006). Implementing IFRS from the perspective of EU publicly traded companies. Journal of International Accounting, Auditing and Taxation, 15(l), 170–196.

Recuperated from http://www.dgpj.mj.pt/ sections/leis-da-justica/pdf-ult2/lei-53-a-2006-de-29-de/downloadFile/ile/Lei_53-A.2006. pdf?nocache=1213778623.57

Lev, B. (1989). On the usefulness of earnings and earnings research: Lessons and directions from two decades of empirical research. Journal of Accounting Research, 27(1), 153–192.

Lev, B. & Sougiannis, T. (1996). The capitalization, amortization, and value-relevance of R&D. Journal of Accounting and Economics, 21(1), 107–138.

Laux C. & Leuz, C. (2009). he crisis of fair value accounting: Making sense of the recent debate. Accounting, Organizations and Society, 34(1), 826–834.

Laux C. & Leuz, C. (2010), Did fair value accounting contribute to the inancial crisis? Journal of Economic Perspectives, 24(1) 93–118.

Lawson, T. (2012). Ontology and the study of social reality: emergence, organisation, community, power, social relations, corporations, artefacts and money. Cambridge Journal of Economics, 36(2), 345-385.

Marques, M. (2007). O “justo valor” e a sua auditoria. Revista Auditores, 38, 20 – 32.

Martins, G. (2006). On Reliability and Validity. RBGN-Revista Brasileira de Gestao de Negocios, 8(20), 1-12.

Nissim, D. (2003). Reliability of banks’ fair value disclosure for loans. Review of Quantitative Finance and Accounting, 20, 355–384.

Oehr, T., Zimmerman, J. (2012). Accounting and the welfare state: he missing link. Critical Perspectives on Accounting, 23(1), 134–152.

Polanyi, K. (1958). he Great Transformation: he Political and Economic Origins of Our Time. Boston: Beacon Press 1957.

Posner, Elliot. Sequence as explanation: he international politics of accounting standards. Review of International Political Economy, 17(4), 639–664.

Powel, S. (2003). Accounting for intangible assets: current requirements, key players and future directions. European Accounting Review. 12(4), 797–811.

Power, M. (2010). Fair value accounting, inancial economics and the transformation of reliability. Accounting and Business Research, 40(3), 197–210.

Pulido, P. (2012). Instrumentos Financeiros Contabilizados de acordo com a IFRS 9 e principais questões de auditoria. Revista Auditores, 56, 25.

Regulamento (CE) n. 1606, de 19 de julho de 2002. Relativo à aplicação das normas internacionais de contabilidade. Recuperated from http://eur-lex.europa.eu/legal-content/ PT/TXT/HTML/?uri=CELEX:32002R1606 &from=PT

Regulamento (CE) n. 1725, de 21 de setembro de 2003. Que adota certas normas internacionais de contabilidade, nos termos do Regulamento (CE) n. 1606/2002 do Parlamento Europeu e do Conselho. Recuperated from http://eur-lex. europa.eu/legal-content/PT/TXT/HTML/?ur i=CELEX:32003R1725&qid=146351186680 3&from=ptRodrigues, A.M.G. (2011). Activos Intangíveis - Algumas Relexões Contabilísticas e Fiscais. Estudos em memória do Prof. Doutor J. L. Saldanha Sanches. Coimbra Editora.

Shiller, R. (1981). Do Stock Prices Move Too Much to Be Justiied by Subsequent Changes in Dividends? American Economic Review, 71(June), 421–435.

Shiller, R. (2005). Irrational exuberance. .2nd edition, Princeton University Press. NJ.

Venkatachalam, M. (1996). Value-relevance of banks derivatives disclosures. Journal of Accounting and Economics 22, 327–355.

Villalong, B. (2000). Intangible resources, Tobin’s q, and sustainability of performance diferences. Journal of Economic Behaviour and Organization, 54(2), 205-230.

Whittington, G. (2008). Fair value and the IASB/ FASB – conceptual framework project: An alternative view. Abacus, 44(2), 139–168.

Zanoteli, E. J., Amaral, H. F., & de Souza, A. A. (2015). Intangible assets and the accounting representation crisis. Advances in Scientiic and Applied Accounting, 8(1), 003-019.

Supporting Agencies:

ADVANCE Research Center at ISEG, and Portuguese national funding agency for science, research and technology (FCT) Project UID/SOC/04521/2013.

About the Authors:

1. Tiago Cardao-Pito, PhD in Business Administration from the University of Strathclyde, U.K.

E-mail: tcp@iseg.ulisboa.pt

2. Jorge Barros, MSc in Management from the University of Lisbon, Portugal.

E-mail: jorgebarros_018@hotmail.com

Contribution of each Authors:

Contribution Tiago Cardão - Pito Jorge Barros

1. Deinition of research problem √ √

2. Development of hypotheses or research questions ( empirical studies ) √ √

3. Development of theoretical propositions ( theoretical Work ) √ √

4. heoretical foundation/Literature review √ √

5. Deinition of methodological procedures √ √

6. Data collection √

7. Statistical analysis √ √

8. Analysis and interpretation of data √ √

9. Critical revision of the manuscript √ √

10. Manuscript Writing √ √

ol. 18, No. 59, p. 67-86, Jan./Marc. 2016

The application of “fair value” accounting standards to the income statements of companies listed in the Portuguese Stock Index-20 (PSI-20)

value” [values 000] in the period, and average values and annual variability of these adjustments According to their assets.

Firm Sector

Volume of business VB (2012)*

Net Income (2012)*

Total “fair value” adjustments [2005-2012]

“Fair Value” adjustments as a proportion of assets

Net adjustment average S. D.

Negative adjustment

average

S. D.

Positive adjustment

average

S. D.

Altri Manufacturing 530,107.00 52,205.00 -11,394.00 -0.001 0.003 -0.001 0.003 0.000 0.001 Banif Financial 184,192.00 -576,353.00 inferior do formulário-205,014.00 Parte -0.002 0.003 -0.002 0.003 0.000 0.000

BCP Financial 1,596,806.00 -1,483,362.00 -1,449,272.00 -0.002 Parte inferior

do formulário 0.003 -0.013 0.007 0.011 0.007

BES Financial 2,632,150.00 119,836.00 -562,041.00 -0.001 0.001 -0.001 0.001 0.000 0.000

BPI Financial 1,330,012.00 249,135.00 -869,481.00 -0.003 0.005 -0.007 0.006 0.004 0.002

Brisa Motorways 564,964.00 46,022.00 -393,611.00 -0.009 0.010 -0.009 0.010 0.000 0.000

Cimpor Cement 1,509,956.00 -425,712.00 -254,345.00 -0.004 0.014 -0.006 0.014 0.001 0.002

Coina Media 99,632.00 4,247.00 -7,502.00 -0.004 0.005 -0.004 0.005 0.000 0.000

Corticeira Amorim Manufacturing 534,240.00 31,733.00 -13,812.00 -0.003 0.007 -0.005 0.006 0.002 0.003

EDP Energy 16,339,854.00 1,182,155.00 -677,468.00 -0.002 0.003 -0.002 0.003 0.000 0.000

EDP Renováveis Energy 1,157,796.00 136,050.00 -98,918.00 -0.002 0.002 -0.002 0.002 0.000 0.000

Espírito Santo Financial Grp. Financial 3,535,751.00 482,706.00 -594,281.00 -0.001 0.001 -0.002 0.002 0.001 0.002

Galp Energia Energy 18,507,037.00 343,300.00 -203,209.00 -0.003 0.002 -0.004 0.003 0.001 0.002

GLINTT / PARAREDE Software 91,124.00 1,247.00 -4,509.00 -0.004 0.003 -0.004 0.003 0.000 0.000

Grupo Media Capital Media 135,484.00 11,939.00 -19,098.00 -0.006 0.009 -0.007 0.009 0.001 0.001

Impresa Media 226,064.00 -4,889.00 -52,377.00 -0.014 0.027 -0.014 0.027 0.000 0.000

INAPA Manufacturing 963,994.00 -5,856.00 -43,268.00 -0.008 0.023 -0.008 0.023 0.000 0.000

Jerónimo Martins Distribution 10,875,897.00 366,268.00 -37,436.00 -0.001 0.003 -0.002 0.002 0.001 0.002

Mota Engil Construction 2,243,167.00 74,007.00 -26,658.00 -0.001 0.001 -0.001 0.001 0.000 0.000 Novabase Software 212,075.00 9,761.00 -4,888.00 -0.003 0.004 -0.003 0.004 0.000 0.000

Portucel Manufacturing 1,501,615.00 211,169.00 -37,910.00 -0.002 0.003 -0.003 0.002 0.001 0.001 Portugal Telecom Mult & Tlcm 6,392,631.00 325,617.00 -246,444.00 -0.002 0.007 -0.004 0.004 0.002 0.003

Reditus Software 124,379.00 280.00 -837.00 -0.001 0.002 -0.001 0.002 0.000 0.000

REN Energy 588,973.00 123,892.00 -1,035.00 0.000 0.000 0.000 0.000 0.000 0.000

Semapa Manufacturing 1,952,588.00 170,560.00 -64,173.00 -0.002 0.002 -0.003 0.002 0.001 0.001 Soares Costa Construction 801,849.00 -47,512.00 -3,606.00 0.000 0.001 0.000 0.001 0.000 0.000

Sonae Distribution 5,378,523.00 71,690.00 -94,554.00 -0.001 0.018 -0.012 0.011 0.011 0.010 Sonae Indústria Manufacturing 1,321,030.00 -100,052.00 -224,833.00 -0.017 0.012 -0.019 0.013 0.002 0.005 Sonaecom Mult & Tlcm 825,438.00 75,432.00 -16,197.00 -0.001 0.001 -0.001 0.001 0.000 0.000

Teixeira Duarte Construction 1,383,326.00 26,057.00 90,125.00 0.003 0.008 -0.003 0.003 0.007 0.006 ZON Mult & Tlcm 852,086.00 36,888.00 -25,346.00 -0.002 0.003 -0.002 0.003 0.000 0.000

Total 84,392,739.00 1,508,460.00 -6,153,391.00 -0.003 0.009 -0.005 0.009 0.001 0.004

Comparison GDP Portugal 2012 51% -4%

Notes:

i) O Portuguese Stock Index- 20 (PSI-20) integrates the 20 companies with the highest capitalization in the

Annex 2 – Use the “fair value” for the large Portuguese companies over the 2005-2012 period

A - Breakdown by items

B - Companies that have the largest net “fair value” adjustments in absolute values

Notes

1 International Accounting Standards (until 2000), and

International Financial Report Standards (after 2001).

2 Diretriz Contabilística n.º 13 (DC 13, § 2), Diretiva

2001/65/CE, § (11) – Jornal Oicial das Comunidades Europeias L283/29.

3 Financial statements. CMVM, [S.l.], [between 2005 and

2013]. Available in: <http://web3.cmvm.pt/sdi2004/ emitentes/contas_anuais.cfm>. Access: Jan. to Jun. 2013.

4 EDP Renováveis and REN, two companies previously

integrated in the energy public company, EDP, which was privatized.

5 Note that according to the international accounting