Universidade de Trás-os-Montes e Alto Douro

STUDY ON REAL ESTATE APPRAISAL IN THE

URBAN ENVIRONMENT: CASE STUDY - VILA REAL

Master degree Dissertation

Civil Engineering

Bryan Fernandes Matias

Orientador: Sandra Cristina Alves Pereira da Silva Cunha

Universidade de Trás-os-Montes e Alto Douro

Civil Engineering

Master degree dissertation

Study on real estate appraisalin the urban

environment: Case study – Vila Real

Advisor

Dissertation presented to the University of Trás-os-Montes e Alto Douro to obtain a Master's degree in Civil Engineering, carried out under the scientific guidance of Professor Sandra Cristina Alves Pereira da Silva Cunha of the Department of Engineering of the School of Sciences and Technology of the University of Trás-os-Montes e Alto Douro.

Sumário

O presente trabalho tem como principal objetivo, o estudo de fatores formadores de valor em frações de edifícios multifamiliares na cidade de Vila Real e no setor imobiliário, irão ser analisados quais os fatores geradores de valor tidos em conta pelos promotores/ construtores e por aqueles que compram / alugam (utilizadores), aquando de processo de avaliação dessas frações. Será também apresentada uma crítica ao estado em que o valor imobiliário para habitação na cidade de Vila Real se encontra na atualidade e qual a sua tendência.

A análise dos fatores geradores de valor será efetuada através de inquéritos direcionados,numaprimeirafase, a indivíduos com conhecimento na área do imobiliário, promotores, construtores e agentes imobiliários, e numa segunda fase,direcionados aos utilizadores. Os resultados da análise destes inquéritos são de extrema importância uma vez que concedem uma perspetiva sobre como o mercado imobiliário valoriza estas habitações bem como qual foi a sua evolução entre 2004 e 2018 após comparação dos dados recolhidos em 2004.

Estes inquéritos permitiramainda a criação de uma ficha de levantamento das características de habitações para posterior auxiliar no relatório de avaliação de imóveis adequados a esses fatores. Pretende-se que este relatório contenha todos os dados necessários para uma correta avaliação de habitações em Vila Real e obter um valor provável de transação mais próximo do real.

De seguida, a ficha de levantamento é aplicadaa um caso de estudo, a avaliação de uma fração de habitação multifamiliar, utilizando uma base de dados de 101 frações de habitação similares.Aplica-se o método comparativo para determinar o valor possível de transação da fração do caso de estudo, após isto, aplica-se uma análise através de MachineLearning para observar se os valores obtidossão mais próximos dos valores de venda reais.

Palavras-chave:Avaliação imobiliária, fatores geradores de valor, fatores ambientais, métodos de avaliação, machinelearning

Abstract

The main objective of this work is the study of value-forming factors ofdwellings on multifamily buildings in the city of Vila Real and in the real estate sector, which will analyse the value-generating factors taken into account by the promoters / builders and those who purchase / lease (users), during the evaluation process of these fractions. It will also be presented a critique of the state in which the real estate value for housing in the city of Vila Real is nowadays and what it's tendency.

The analysis of the factors that generate value will be carried out through surveys that are initially directed to individuals with knowledge in real estate, promoters, builders and real estate agents, and secondly to users. The results of the analysis of these surveys are extremely important as they give a perspective on how the housing market values these dwellings and how they evolved between 2004 and 2018 after comparing the data collected in 2004.

These surveys also allow the creation of a housing characteristics survey to assist in the assessment report of real estate evaluation.It is intended that this report contains all the necessary data for a correct valuation of dwellings in Vila Real and obtain a probable value of transaction closer to the real.

Next, the survey sheet is applied to a case study, the evaluation of a dwellingon multifamily housing, using a database of 101 similar dwellings. The comparative method is applied to determine the possible transaction value of the case study fraction, after which, an analysis is applied through Machine Learning to observe if the values obtained are closer to the actual sales figures.

Keywords: Real estate appraisal, valuing creating factors, environmental factors, evaluation methods, machine learning.

Acknowledgement

The accomplishment of the present dissertation of Master was only possible with the contribution of several people. Thus, the author expresses the following thanks:

- To the scientific advisor, Professor Ph. D. Sandra Cristina Alves Pereira da Silva Cunha, for the flexibility of attendance for doubts and patience that has always demonstrated throughout the project;

- To relatives, especiallymy parents.

- To the University of Trás-os-Montes and Alto Douro for having provided the necessary conditions for the development of this work.

i GENERAL INDEX GENERAL INDEX ... I INDEX OF FIGURES ... IV TABLE OF CONTENTS ... VI EQUATIONS ... VII NOMENCLATURE ... VIII I. INTRODUCTION ... 2 1.1 Framework ... 2

1.2 Objectives of the work ... 3

1.3 Methodology ... 4

1.4 Structure and content of the dissertation ... 5

II. LITERATURE REVIEW ... 8

2.1 Real estate market ... 8

2.2 Property valuation standards ... 9

2.2.1 Property valuation report ... 11

2.3 Real estate appraisal methods for buying/ selling ... 13

2.3.1 The comparative method ... 15

2.4 Value generating factors ... 16

2.5 Housing price prediction using Machine Learning algorithms ... 15

2.6 Final Considerations ... 19

ii

3.1 Vila Real... 21

3.2 Equipment & Services ... 25

3.3 Final Considerations ... 27

IV. THE MOST VALUABLE FACTORS IN HOUSING PRICE VALUATION FOR THE URBAN AREA OF VILA REAL ... 29

4.1 Survey to the promoters /builders ... 29

4.2 Survey to the users ... 35

4.3 Final Considerations ... 42

4.3.1 Maps ... 43

V. DEVELOPMENT OF THE SURVEY SHEET ... 48

VI. CASE STUDY - PROPERTY SUBJECT APPRAISAL IN THE URBAN AREA OF VILA REAL ... 52

6.1 Property subject one - Traditional appraisal ... 52

6.2 Final Considerations ... 59

VII. MACHINE LEARNING ... 62

7.1 The skew of univariate distributions ... 64

7.2 Understand Data with Visualization ... 65

7.2.1 Histograms... 65

7.2.2 Density Plots ... 67

7.2.3 Box and Whisker Plots ... 69

7.2.4 Scatter Plots ... 71

7.2.5 Correlation Matrix Plot ... 72

iii

7.4 Feature Selection For Machine Learning ... 74

7.5 Evaluate the Performance of Machine Learning Algorithms with Resampling 74 7.5.1 Split into Train and Test Sets ... 74

7.5.2 K-fold Cross-Validation ... 75

7.6 Machine Learning Algorithm Performance Regression Metrics ... 75

7.7 Compare Machine Learning Algorithms ... 76

7.8 Improve Results with Tuning ... 81

7.8.1 Random Hyperparameter Grid ... 82

7.8.2 Random Search Training ... 82

7.8.3 Evaluate Random Search ... 83

7.8.4 Grid Search with Cross-Validation ... 84

7.9 Finalise Model ... 84 7.10 Final Considerations ... 85 VIII. CONCLUSIONS ... 88 8.1 Conclusions ... 88 8.2 Future works ... 90 REFERENCES ... 91

iv INDEX OF FIGURES

Figure 1 - District of Vila Real, Portugal. ... 21

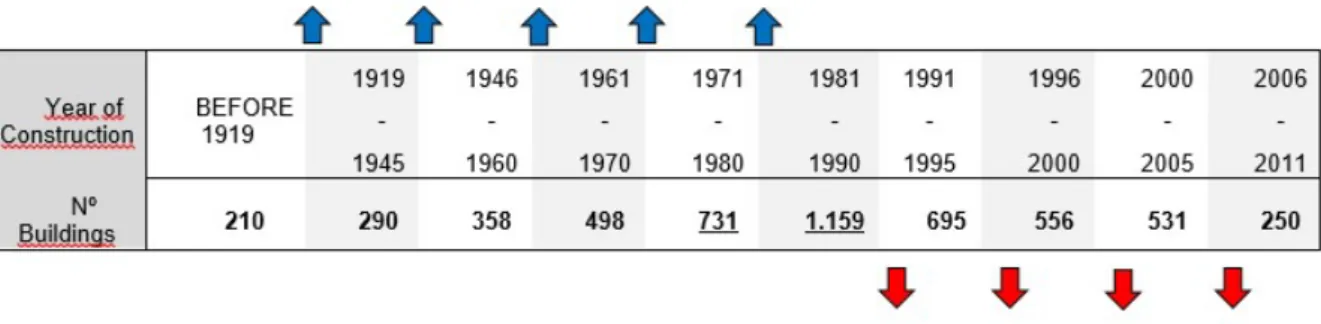

Figure 2 - Evolution of edification in Vila Real the last century. ... 23

Figure 3 - Delimitation (red) of the urban area of Vila Real. ... 24

Figure 4 - Some of the equipment and services that Vila Real offers. ... 25

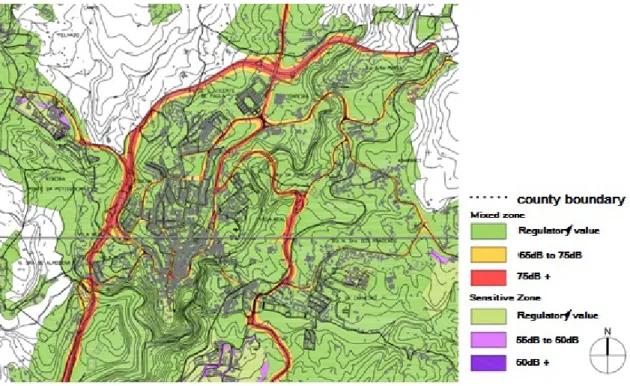

Figure 5 - Acoustic zoning (day) according to the MDP of Vila Real. ... 26

Figure 6 - Acoustic zoning (night) according to the MDP of Vila Real. ... 26

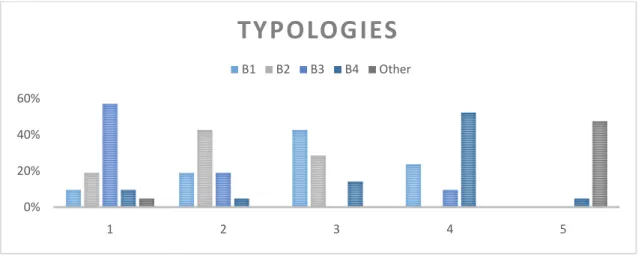

Figure 7 - Promotors/builders opinion regarding most sought typologies for living (from 1 to 5, assigning the value 1 to the most important one and so on). ... 31

Figure 8 - Promotors/builders opinion regarding most sought floor for living (from 1 to 5, assigning the value 1 to the most important one and so on). ... 31

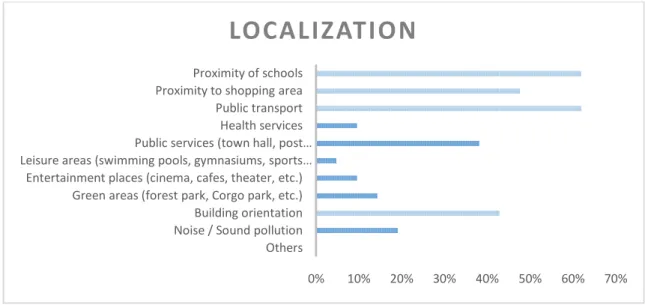

Figure 9 - Promotors/builders opinion regarding most praised localization factors. . 32

Figure 10 - Promotors/builders opinion regarding the common use of the building. 33 Figure 11 - Promotors/builders opinion regarding interior spaces. ... 34

Figure 12 - Promotors/builders opinion regarding the area of the divisions. ... 34

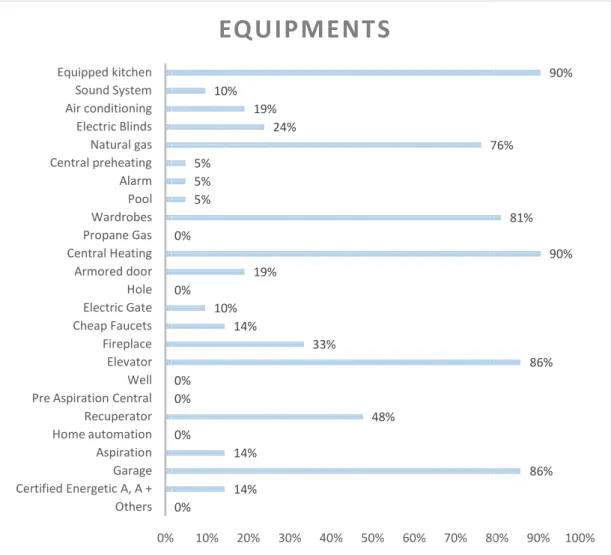

Figure 13 - Promotors/builders opinion on the top priority equipment a house should have. ... 35

Figure 14 - Users opinion regarding most sought typologies for living (from 1 to 5, assigning the value 1 to the most important one and so on)... 37

Figure 15 - Users opinion regarding most sought floor for living (from 1 to 5, assigning the value 1 to the most important one and so on)... 38

Figure 16 - Users opinion regarding most praised localisation factors. ... 38

Figure 17 - Users opinion regarding the common use of the building. ... 39

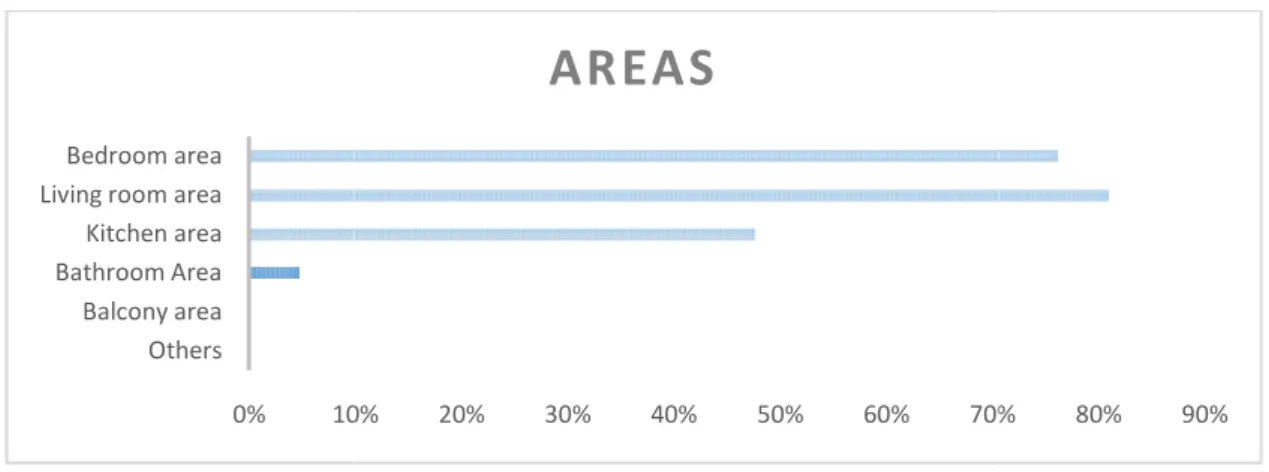

Figure 18 - Users opinion regarding interior spaces. ... 40

Figure 19 - Users opinion regarding the area of the divisions. ... 40

Figure 20 - Users opinion on the top priority equipment a house should have. ... 41

Figure 21 - Evolution of choosing on typology and flooring (2004 vs. 2018) ... 43

v

Figure 23 - Most sought areas for living according to users in 2018 (Blue). ... 45

Figure 24 - Location related factor (Users point of view). ... 46

Figure 25 - Property identification on a real estate appraisal report (Portuguese). .. 48

Figure 26 - Description of the property (Portuguese). ... 49

Figure 27 - Description of the surroundings (Portuguese)... 49

Figure 28 – Market prospection (Portuguese). ... 50

Figure 29 - Property subject location (blue). ... 52

Figure 30 - Blueprint of the property subject 1. ... 53

Figure 31 - Histograms of each attribute. ... 66

Figure 32 - Density plots of each attribute. ... 68

Figure 33 - Box and whisker plots of each attribute. ... 70

Figure 34 – Scatter plots. ... 71

Figure 35 - Correlation matrix plot. ... 73

Figure 36 - Results from Evaluating Algorithms. ... 77

Figure 37 - Compare Algorithm Performance (1). ... 77

Figure 38 - Compare Algorithm Performance (2). ... 78

Figure 39 - Compare Algorithm Performance (3). ... 79

Figure 40 - Compare Algorithm Performance (4). ... 79

Figure 41 - Compare Algorithm Performance (5). ... 80

vi TABLE OF CONTENTS

Table 1 –Prediction errors for asking price (Pow, 2014). ... 16

Table 2 - Number of buildings built in Vila Real the last century. ... 23

Table 3 - Similar properties to property subject 1 (October 2018), the rest of them listed in the annexe D. ... 54

Table 4 - Homogenization factors, the rest of them listed in the annexe D. ... 54

Table 5 - Unitary value of samples after homogenization, the rest of them listed in the annexe D. ... 56

Table 6 - Standard deviation, the rest of them listed in the annexe. ... 56

Table 7 - Amplitude of the confidence interval (€/m2). ... 57

Table 8- Chauvenet table. ... 57

Table 9 - Confidence interval classes. ... 58

Table 10- Output of reviewing statistical summary of the data ... 64

vii EQUATIONS

Equation 1 - Average universe value. ... 56

Equation 2 - Student's maximal UV (trust level 95%). ... 57

Equation 3 - Student's minimal UV (trust level 95%). ... 57

Equation 4 - Chauvenet critical value. ... 58

viii NOMENCLATURE Symbology € - Euro (currency) m - Meter m² - Square meter

€/m² - EUR per square meter

km² - Square kilometre

# - Number

#s - Approximately that number

% - Percentage

ix Abbreviations

B# - Typology (number of bedrooms)

CMVM - SecuritiesMarketCommission (Comissão do Mercado de

Valores Mobiliários)

DGTF - General Direction of Treasury and Finance (Direção-Geral do

Tesouro e Finanças)

EU - European Union

EURIBOR - Euro Interbank Offered Rate

et all - means "and others."

GOVA - European Group of Valuer’s Association

IFRS 13 - International Financial Reporting Standard

INE - National Institute of Statistics

IVSC - International Valuation Standards Committee

MDP - Municipal Director Plan

PTV - Presumed Transaction Value

RICS - Royal Institution of Chartered Surveyors

TMAD - Trás-os-Montes e Alto Douro

UTAD - Universidade de Trás-os-Montes e Alto Douro

UV - Unitary value

1

Chapter I

Introduction

2

I.

Introduction1.1 Framework

The first step of a transaction consists in evaluating what is about to be transacted, in the case of the real estate, its appraisal is of significant importance isthat for most households it represents a lifetime investment.

Maybe due to the lack of information or knowledge, in Vila Real, most of the dwellings in the marketdid notgo through an appropriate appraisal method. Having this in mind, one of the goals of this work is to study the real estate appraisal on an urban environment and present a disruptive idea to facilitate the appraising of a building in such conditions.

The real estate appraisal is a practice that aims to estimate or taxvalue to a building or property and attribute a price for which the subject is most commonly be transacted for or how much it is worth in the current economy. The value attributed can be evaluated according to several perspectives (buying or selling, financing, inheritance sharing, among others) and consequently lead to different values.

The residential market in Vila Real during the decades of the ’90s and 2K was at its peak due to the lowinterest rates, easy access to household’s credits and the excellent employment index at those days, nowadays its way more complicated to achieve those conditions making the real estate market decline to the point as it is known today.

Sandra Pereira (Pereira, 2004), carried out a study in the region of TMAD in the north of Portugal in 2004, the study consisted of: In a first phase, characterizing users preferences, using two type of surveys with the objective of obtaining, on the one hand, the point of view of who sells (real estate agencies and developers/ builders) and on the other, the point of view of whoever uses (buyers/ renters).This characterisation was carried out in eight cities in the region of Trás-os-Montes and Alto Douro (TMAD), Bragança, Chaves, Lamego, Macedo de Cavaleiros, Mirandela, Peso da Régua, Valpaços and Vila Real.

Almost all methods for real estate appraisal rely upon some form of comparison to assess market value.

3 When done in a simplest way, direct capital comparison or upon a range of observation allowing a regression model, it can be referred as “tradition” methods being the most used and the one applied by use in this work the comparative method.

Other methods, “advanced” methods try to analyse the market by mimicking the thought processes of the players in the market in an attempt to estimate the point of exchange, these models tend to be more quantitive in method being the analyse done in this work through Machine Learningconsidered one of this “advanced” methods(Pagourtzi, 2003).

1.2 Objectives of the work

This dissertation will present a study on real estate appraisal on multistoreresidential buildings in Vila Real, Portugal.

The primary goal is to access the average pricing of dwellings on multistoried residential buildings in the urban area of Vila Real, taking in to account thevaluable-forming factors.

Inquiries have been made so it can beunderstand what and which are the main factors taken into account when assessing housing in the city.

The goal is to figure out and present the most valuable factors in housing valuation for the Vila Real households and see if these match with the promoters/builders opinion, real estate appraiser´s opinion and the users or buyer’s opinion. As well as, are these same factors taken into account when using the real estate appraisal methods? (Being the comparative method the most used appraisal method used for buildings in the city). And using new methods?

4

1.3 Methodology

In a first phase, a scientific bibliographical research or literature survey was developed on the real estate sector to familiarisewith the theme itself as well as terminologies used in the field. Then enabled us to study the valuable factors deemed to be important while accessing dwellings on multistore buildings and the real estate appraisal methods used.

After this, we can delimit what we consider to be the urban city of Vila Real and draw or paint which areas are most in demand or which areas fit best to the factors upvoted previously by all.

To obtain the correct valuation of a property, we have to take into account several value-creating factors. In this work, we intend to define these factors based not only on the opinion of the builders and appraisers but also the user's opinion (being this the renters and buyers opinion), as well as to prepare a survey sheet that will permit the data collection that will be used in the real estate appraisal report, fit to these factors. We will also be able to realise if the environmental factors are taken into account in an urban city like Vila Real.

After determining what factors actually influence buyers in their decision to buy a property, we may draw a map of Vila Real urban real estate interest, that is, a map that makes it possible to quickly identify which areas of the city meet best the dignified factors as most important for the vast majority of the interviewees. The map could be, in a near future, completed by discovering the value per m² of each zone (exclusively housing character and based on the offers available in advertisements and real estate agencies). This map should also represent if the vila-realenses give importance to environmental factors such as green spaces and noise pollution.

Next, the survey sheet is applied to a case study, the evaluation of a dwellingon multifamily housing, using a database of 101 similar dwellings. The comparative method is applied to determine the possible transaction value of the case study fraction, after which, an analysis is applied through Machine Learning to observe if the values obtained are closer to the actual sales figures.

5

1.4 Structure and content of the dissertation

The dissertation is divided into eight Chapters, which include the introduction containing the framework, objectives and methodology as the first chapter,in the last chapter the main conclusionsare presented, as well as suggestions for future work.

The 2nd Chapter will be directed to the literature survey, acquiring knowledge on the

real estate market in different points of the world and above all, Portugal. We will also lean on the property valuation standards, getting into appraisal methods in the real estate and the field of finance. After, a discussion about the value generating factors for real estate. Concluding the chapter with works about prediction of housing prices with machine learning.

On the 3rd Chapter, we characterise Vila Real, gathering research on its inhabitants

and as well as its buildings, its equipment’s, services and define the boundary of our case in study.

The 4th Chapter is the analyses of the surveys conducted to promotors/ builders in

the first phase and to those who buy or rent in a second phase (users). This survey is of vital importance for this work since it will reflect the points of view of what value generating factors matter on this subject by two distinct groups, being one, people of knowledge in this sector and the other the ordinary people who buy or rent a property. The survey has similar questions to one conducted in 2004 by Professor Sandra Pereira, and will also compare afterwards the both (2004 surveys vs 2018 surveys) and see if there is an evolution of mentality regarding the real estate sector and what it isthe tendency.

The 5th Chapter will be directed to the elaboration and discussion of a real estate

appraisal report fit to Vila Real, granting importance to the value generating factors deemed necessary through the surveys and afterwardsthe application of this same report on properties of Vila Real to test its reliability.

On the 6thChapter, a property subject in the urban area of Vila Real will be selected

and evaluated. On a first instancewe are homogenising the unitary values by the number of factors found in common with the samples to be compared with and afterwards homogenising the unitary values of the same samples using only one location generating factor defined through the real estate assessing program process.

6

On the 7th chapter several ecosystems where used, namely: the python platform

(that is becoming the dominant platform for machine learning) (Python foundation, 2018), SciPy core modules NumPy, Matplotlib and Pandas (python libraries for mathematics, science and engineering) (Pedegosaet all, 2018), scikit-learn library (python library for machine learning) (Koehrsen, 2018) and datasciencelybrary (DeNero, John, 2015) to arrive at approximate sale prices for a given dwelling in a residential multistoried building

The documents considered of complementary importance are presented in the Annexe.

7

Chapter II

LiteratureReview

8

II.

Literature Review2.1 Real estate market

Real estate market contributes significantly for the economy, and it is one of the most critical markets in the developed economies by providing on one hand rents and investments and the other hand guarantees for banking loans,(Paul E. Carrillo, 2013).

Fernando Tavares et all (Tavares et all, 2012a and 2012b)analysed the evolution of the real estate market in Portugal based on its appraisal. Due to oversupply and in consequence market saturation the residential market has declined steadily after decades of active marketing between the 1990s and the early 2000s.“A proper evaluation of real estate is the first step for adequate decision making.”They demonstrated that property externalities and property layouts have consequences on the housing market value in either way and the lack of information or even it asymmetry may create price distortions, adverse selection and real estate depreciation, influencing this way the property market value.

Steven Levitt et all(Levitt et all, 2008), proved that there are differences between the time to market and the price of a property, when the property is transacted by the owner and by a real estate agent, due to the information asymmetry between the two, having implications for the property, to the owner andthe real estate market. The location also plays a vital role in property evaluation as the pricing differs across locations and regions, reflecting the owner’s preferences (Levitt etall, 2008).

Tavares Moreira et all(Moreira et all, 2014)used the income approach to study the differences in the house prices across municipalities in Portugal.They conclude that property cap rates and market values differ not only within the two largest main cities in Portugal, Lisbon and Porto but also between the two. Moreover, there are also differences across typologies between the regression coefficients of the income generated by the property and its cap rate.

With this said, it “reveals that a wide range of factors influences the residential market”.

9 With the integration process of Portugal in the European Union (EU) in 1986were decreased the exchange risks with other European Union members. Portugal managed to stabilise inflation, and the interest rates reduced. Having the fall of interest rates on housing loans and the existence of subsidised interest rate for the acquisition of the first house created an intense pressure to complete investments in progress. The amount of bad debt in building companies grew up to five times between 2006 and 2011(Tavares et all, 2012b).

For many families, the acquisition of their houses is their greatest asset and a lifelong investment but with the youth unemployment rate increase in Portugal, delaying their financial independence, and with this hold back the acquisition of new homes.

The Euriboris the interest rates at which a panel of European banks borrow funds from one another, provide the basis for the price or interest rate of all kinds of financial products, for instance, the Euribor influences negatively the house prices, which means that the price of houses increases as the Euribor decreases.

2.2 Property valuation standards

There are some responsibility standards at international level in the sector of real estate made by professional organizations such as the European Valuation Standards (EVS, 2016) issued by TEGOVA - The European Group of Valuers' Associations (TEGOVA, 2016), the RedBook, issued by RICS - Royal Institution of Chartered Surveyors and International Valuation Standards, issued by IVSC - International Valuation Standards Committee (RICS, 2017).

These valuation standards point to the application of the International Accounting Standards Board issued in 2011 the International Financial Reporting Standard (IFRS 13) Fair Value Measurement, in particular for properties that are valued at fair value. IFRS 13 was adopted by the European Union as of early beginnings of 2013 and is mandatory for credit institutions and insurance companies. Its use is recommended because it is advantageous to the extent of an internationally recognized fair value valuation standard.In this sense, when evaluating a "fair value" property for financial report purposes, one of the following valuation methods presented in IFRS 13 should be followed:

10

(i) Market approach (Comparative method);

(ii) Cost approach (Cost method);

(iii) Income approach (Income Method);

The Portuguese real estate market commission (CMVM, 2018) oversees and regulates the markets for financial instruments, as well as the agents acting on them, promoting the protection of investors. It regulates the access and exercise of the activity of expert real estate appraisers who provide services to entities of the national financial system applying the Law no. 153/2015, of September 14.It says that an expert appraiser must have a degree, graduation or master's degree appropriate to the evaluation of real estate as well as a civil liability policy regarding the exercise of the appraiser activity. This policy has to have a minimum annual duration and a minimum value of € 500 000 or € 250 000 for appraisers registered for less than three years and for those whose amounts assessed in the previous year are less than € 20 000 000,and it has to have a minimum annual duration.

As we see, the real estate appraisal is a practice that aims to estimate or tax value to a building or property and attribute a price for which the subject is most commonly be transacted for or how much it is worth in the current economy. The value attributed can be evaluated according to several perspectives (buying or selling, financing, inheritance sharing, among others) and consequently lead to different values, in our case, we are going to focus on real estate appraisal on a buying/ selling perspective.

In Portugal, it is recommended to apply the comparative method and always use “market value” for a good transaction for both, seller and buyer(Ministério das Finançase da AdministraçãoPublica).

“Market value” is generally defined as the value at which a property can be traded at the valuation date, after exposure in a free and competitive market, in terms of supply and demand conditions, over a period considered reasonable reference to the transaction of another good of a similar nature in the market in which it operates.And in which all the players act freely and in a weighted way, assuming that they have access to all relevant information, either for the formation of value of the property, or to make a decision on its possible transaction, and have no particular interest guiding its action.

In simpler words, market value can be defined as the amount that the market will be willing to pay for the property.

11 2.2.1 Property valuation report

As any other valid or authentic evaluation, its report is considered the centrepiece of the evaluation of the property and must be prepared in a clear and objective manner and support the options of the appraiser at all stages of the evaluation so it can be submitted to the DGTF(Ministério das Finanças da AdministraçãoPublica).

The evaluation report should contain all relevant information, namely: a) Definitions and concepts;

b) Assumptions and conditions of the evaluation;

c) Methodologies adopted to reach the market value of the property-reported at the valuation date;

d) The concept of value;

e) Land Registry and Cadastral Plan, which are supposed to be attached to the evaluation request, and its copies must be objectively recorded in the report;

f) Legal aspects and current legislation to be considered in the evaluation; g) Type of occupation;

h) Constructive characteristics;

i) Equipment that integrates the property and its inclusion, or not, in the evaluation; j) State of conservation;

l) Areas and their typology - gross, useful, private, leasable, or otherwise, duly characterized;

m) Location;

n) Type of occupation;

o) built environment and accessibility;

12 q) The framework in the instruments of territorial management in force for the place of implantation;

r) Possible alternative potential uses for the property.

Any other aspect considered relevant by the appraiser, namely environmental impact, observed during the survey of the property, even if not referenced in the application for evaluation, should be analysed in the report, mainly if it influences the formation of the value of the property.

It is recommended to introduce an "Index", preferably at the beginning of the report to facilitate the consultation of the report.

The end of the report should include the date of its elaboration, as well as the identification of the evaluator, through a legible signature.

If, after the report has been prepared and submitted to the DGTF, the appraiser finds that there are inaccuracies or inaccuracies in the printed information that may influence the conclusions and the market value determined for the property, the evaluating expert shall, as soon as possible, make such changes as he deems appropriate and forward them to the DGTF.

The real estate appraisal is a process carried out preferably by experts in the field and aims at giving value to a property or habitation for various purposes, and there are therefore several valuation perspectives that may lead to different values — making it imperative to establish the purpose and objective of the evaluation immediately.

In the case of purchase or sale of housing estates like houses, flats or apartments (the most current type of transaction in a city such as Vila Real), the various entities involved in a transaction of this type, need to make an evaluation, the most common being:

- Evaluation in the scope of credit activity; - Tax assessment;

- Evaluation in the scope of transactions; - Evaluation in the scope of investments;

13 After the completed field report, depending on the purpose of the predefined valuation and the value to be determined, a valuation method will be used or applied. It is advisable by IFRS 13 to apply at least one of the three methods listed below to obtain the "fair price" of the property in the real estate appraisal report that is being made.

- Comparative method (more usual); - Cost method;

- Income method.

2.3 Real estate appraisal methods for buying/ selling

Elli Pagourtziet all (Pagourtzi, 2003) defined valuation, in its simplestform, as the determination of the amount for which a property will transact on a particular date. In their opinion, the price of the exchange is often the same whether the buyer has investment or occupation in mind, but the two groups of bidders will be different. Being that for an investor will view worth as the discounted value of the rental stream produced by the asset, while the owner-occupier will see the asset as a factor of production and assign to it worth drove from the property’s contribution to the profits of the business. Nonetheless, both groups of bidders will not neglect the potential resale price of the purchase.Almost all methods rely upon some form of comparison to assess market value.When done in simplest a way, direct capital comparison or upon a range of observation allowing a regression model, it can be referred to as “traditional” methods.Other methods, “advanced” methods try to analyse the market by mimicking the thought processes of the players in the market in an attempt to estimate the point of exchange, these models tend to be more quantitive in the method.

Methods may be grouped as follows (Pagourtzi, 2003): Traditionalvaluationmethods: Comparative method; Income method; Profit method; Cost method; Regressions methods.

14 Advancedvaluationmethods:

Artificial neural networks (ANN’s); Hedonic pricing method;

Spatial analysis method; Fuzzy Logic;

Autoregressive integrated moving average (ARIMA).

Pedro Henriques(Henriques, 2013)advises, whenever possible, to use at least two valuation methods, in order to be able to obtain, by reconciling the different estimated values, the most probable value of the property.Besides using the comparative method, applying the income method or the cost method may have its interest depending on the type of property to appraise. For instance, the income method may be especially suitable for estimating the values of productive properties or that are/ can be leased (annual, monthly, seasonal) to a given income value.As the comparative method, the income method is also widely used in estimating real estate values being more suitable for assessments of productive or leasable properties, urban buildings like housing, offices, commercial units, agricultural buildings and determination of the value of use in surface law.

On his turn, the cost method is applied on buildings rarely sold or transaction which makes this method shine for instance while assessing old buildings, hospitals, schools, museums, castles, libraries, prisons, or even for assessment of constructions, rehabilitation or parts of constructions for the purpose of fixing insurance premiums, indemnities and taxes.In this case, the application of the cost method goes through the definition of all factors that lead to the final value, which are: costs of demolition or rehabilitation of any existing constructions necessary to eliminate or/ and rebuild; construction costs of the buildings; costs of studies; projects; licenses; fees; technical assistance;cost of marketing; financing costs; and profit margins.In this case, it is essential to use the present value because in many cases, it differs from the presumed transaction value (PTV). The present value is the value that quantifies the added value of the part of the work already done(Dutra, 2009).The valuation, in this case, may include the present value and the presumed transaction value (PTV) referring to the date of possible transaction of the property, after the completion of the works.

15 2.3.1 The comparative method

In the comparative method, the valuation value is obtained by comparison with the market values. The higher the number of elements taken for comparison and the degree of comparability the more reliable is the value obtained. For this method to be precise there are important variables that have to be met, such as: there must have been recently a large number of sales in the market under analysis; the transactions made need to have comparable characteristics to the house in analysis; the conditions of sale should be identical; and there should not have external factors that could influence the negotiation.On this method, the most common factors to be taken into account are characteristics of the building like the area, constructive finishes, project quality, comfort degree, layout and typology, potentialities of the urban network, construction year and current status.However, even whit all this prospection, it is not possible to compare the pricing values immediately with one other. In order to be possible the comparison, we have to adjust the values with the homogenization process which consists in treating the reference factors in a way to turn them possible to compare with the property undervaluation (Pagourtzi, 2003).

2.4 Housing price prediction using Machine Learning algorithms

Traditionally, property prices are determined by professional appraisers. The disadvantage of this method is that the appraiser is likely to be biased due to interest from the lender, mortgage broker, buyer, or seller. Therefore, an automated prediction system can serve as an independent third party source that may be less biased.

For the buyers of real estate properties, an automated price prediction system can be useful to find under/overpriced properties on the market. Theautomated price prediction system can be useful for first-time buyers with relatively little experience and suggest purchasing offer strategies for buying properties.

Previous analyses have found that the prices of houses in that dataset is most strongly dependent on its size and the geographical location. Basic algorithms such as linear regression can achieve 0.113 prediction errors using both intrinsic features of the real estate properties (living area, number of rooms and others) and additional geographical features (sociodemographic features such as average income, population density, and others)

Pow et al. (Pow, 2014), predicted the selling prices of properties using regression methods such as linear regression, Support Vector Regression (SVR), k-Nearest

16 Neighbours (kNN), and Regression Tree/Random Forest Regression. They predicted the asking price with an error of 0.0985 using an ensemble of kNN and Random Forest methods. Adding geographical features reduced the prediction error by approximately 0.02 (0.13 to 0.11 across the algorithms) an increase in the amount of data will lead to better prediction error.

In their study, properties with prices below $10,000 were not included in the analysis since they were likely to be errors in original data recording or the retrieval process. Also, properties over four times the interquartile range were considered to be outliers.

kNN and Random Forest Regression performed significantly better than the baseline linear algorithm (linear regression and linear SVR).

Table 1 –Prediction errors for asking price (Pow, 2014).

This is possible due to their ability to account for nonlinear interactions between the numerical features and the price targets. Also, the version of kNN implemented using the geographical distance resembles the appraisal technique used by real estate agents and therefore mimicking human methods with machine learning.

2.5

Value generating factorsThe evolution of house prices follows a downward trend by regions and by typology being that B3 apartments (three bedrooms) are less expensive in €/m² then the B2 (two bedrooms) and this, in turn, is less expensive than the B1 (one bedroom): the larger the area, the lower the value per m². This rule does not apply to B4 and B5 apartments, for these typologies belong to different market segments.

The value of a house, for example, is related to several variables such as area, the standard of finishing, number of rooms or location. But the environmental quality of its surroundings, such as panoramic view, air pollution or noise rarely are taken into account on the houses pricing valuation.

17 Knowing that attributes such as pollution and noise, present negative value, since they compromise the environmental quality of the place when valuing, Benakoucheet all, (Benakouche et all, 1994)presented a method to calculate how much those attributes or factors are “worth”. This method is only valid knowing the value of the house and the difference between the others, creating this way a hedonic value for those attributes, valuing this way the property.What is essential in this hedonic values method is to clearly separate the environmental effect of those generated by other factors (location in relation to public services, real estate improvements), which requires the collection of information about a vast number of similar properties with and without influence of the one we desire to measure (much like the comparative method).

António Pereira (Pereira, 2013) defended that depreciation is a factor that cannot be negligible in the process of assessment and that the ageing is the main factor of depreciation. He stated depreciation might occur physically or functionally, being the physical depreciation due to ageing and constant use or due to accidental breakdowns (deterioration). The functionality depreciation occurs from inadequacy (design and execution failures), obsolete (out of usage) and annulment (inadaptability to other purposes). He ended up by proposing tables with the possible "weight" that each depreciation has in the property in order to enrich the comparison factors using more variables during the act of valuation applying comparison methods.

Norbert Hochheim(Hochheim, 2001)defined and evaluated environmental attributes of the urban centre of the Florianópolis, Brazil. He considered that the environmental variables relevant were, the noise or sound pollution, panoramic view, distance to green areas and distance to main squares and avenues. Nonetheless, they also took into account the “tradition” factors or the more commonly taken into account in the comparative method. For last but not least important an external survey was conducted of all the elements of the sample, with the following aspects: precise location of the building, accessibility, availability (completed or under construction), apparent age, conservation status, finishing standard, number of blocks, safety and the characteristics of the environment. The survey carried out allowed the verification of some information of interest, mainly regarding the location of the building and the existence of a panoramic view.

The existence of green areas is a necessity in cities, which provide benefits regarding environmental quality. Urban afforestation contributes to the control of solar radiation, humidity and air temperature, wind and rain action, mitigating air and noise

18 pollution, providing shade, economically valuing properties and providing well-being to the population.

After the analysis of the influence of the environmental variables, Hochheim and Uberti, separating the apartments in three groups depending on the number of bedrooms, demonstrated that those factors evaluated the unit value of the apartments significantly, resulting in a valuation in the unit value of the B2 apartments in 27%, B3 apartments in 26% and the B4 apartments the equivalent of 24%.

Eduard Hromada(Hromada, 2016)presented an innovative method based on the comparative method for real estate valuation called “historical market price”. It used mathematics, statistics and database-founded with algorithms for valuation where the Input data comes from specialised software which gathers, analyses and evaluates data connected with the real estate market. This software, called EVAL calculates monthly indexes of change in real estate market prices and sorts them by category of real estate and location. This tool allows for detailed analysis of market price development (may it be rents or sales) in monthly periods. Nowadays it also records most of the real estate advertisements published online in all municipalities in the Czech Republic.

This method has the same flaws or limitations as the comparative one which is the necessity of having accurate data or information concerning the actual purchase prices from previous transactions of evaluated properties. Still, it has the advantage of speedy processing the Input data about price level in a location by merely drawing from the EVAL’s offline database giving the appraiser more to rely on than his research.

Carlos da Silva (Silva, 2012) shared a study on the determination of location value and a model capable of providing mass evaluation using spatial statistics techniques.

He reduced the number of variables related to the market value (building

components of the property) resulting in improvement during the

evaluation.Environmental, social and economic factors are difficult to model, compromising the reliability of the evaluation. Therefore, Carlos Silvacombined geostatistical methods with spatial regression to estimate the value of the location of property (spatial regression to homogenise the values and then analysing and modelling by geostatistical methods).He is showing that it is possible to carry out mass evaluations for the vast majority of the properties from a reduced number of variables but where the prior knowledge of the location value is fundamental.

19 The location value can be defined as the part of the value of a property that depends only on its location (deducting from its total value the components of the constructive characteristics of the property).

2.6 Final Considerations

With the conclusion of this 2nd Chapter we have seen that although the real estate

market in the world has its similarities when it comes to the process of how toevaluate a property (real estate appraisal methods), it depends mostly on the economy which the market is, also influencing on its turn the economy.

Where reviewed the methods that have been used for estimating real estate property´s value. The existing literature considers that the comparable method is accurate and reliable estimated method. Many researchers have their reservations about method´s reliability because of the subjectivity of the key variable choice. In cases where there is lack of data, the method can be used. Other methodologies are also presented that can resolve the problem of estimating the value of properties. These methodologies can provide estimates of the value of individual property features. This offers a scientific basis for the price adjustments and does not rely on the judgment and experience, or inexperience, of the appraiser or agent.

The value generating factors considered important do change from country to country, city to city, yet, some variables seem to be gaining more and more importance everywhere,and Vila Real is no exception.

These relevant variables are the noise or sound pollution, panoramic view, distance to green areas and distance to main squares and avenues, being this considered environmental variables or factors. It has been seen for instance, in Brazil, trough Hochheim and Uberti, that these factors represent almost 25% of the housing price in some cases.

Knowing these facts, we may proceed to the next step which is characterisingVila Real and establish if the city and its inhabitants are “well served” on environmental quality standards.

20

Chapter III

Characterisation of the urban study area – Vila

Real

21

III.

Characterisation of the urban study area – Vila Real3.1 Vila Real

The study area covers the urban city of Vila Real, Portugal, geographically located in the centre of the northern region of the country. It is surrounded by the Marão and Alvão mountains at the height of approximately 450m. As any other medieval countries, the city was first established near a river being the valley of the Corgo River its “birth” place(Duarte, 2013).

22 With an area of about 370 km², Vila Real is today the seat and district capital, appearing as the most important city in the region of Trás-os-Montes e Alto Douro. The municipality consists of thirty Parishes of which only three are urban (São Dinis, São Pedro and NossaSenhora da Conceição). Vila Real started first expanding and grew to

the north till the 19th century to a place designated as Pioledo. With the construction of

the metallic bridge at the beginning of the 20thcentury, it started to evolve also to the

other river bank of the Corgo, shortly after, the railway station (nowadays out of use) was built to the east. It was only then in 1925 that the town was elevated to the category of city. Despite attempts to organise the city growth, it was not possible,and the city, like many others, continued to grow without any effective plan(Duarte, 2013).

The growth of the city nowadays is regulated by the municipal director plan (MDP) which was reformulated and approved on February, 20 of 2011 with theprimary objectives being:

a) The strengthening of territorial cohesion, by the affirmation of the city as the leading regional centre for the provision of services, the adoption of a properly hierarchical multipolar development model, the increase of internal and external mobility;

b) The preservation of environmental quality and the natural built;

c) The restructuring and strengthening of economic sectors through the restructuring and enhancement of existing endogenous resources and implementation of a policy to promote entrepreneurship.

In the urban city, today live 24.157 inhabitants (CENSOS, 2011 – INE).Regarding the population of the urban parishes, it is verified that either the parish of São Dinis and São Pedro registered growth and that the parish with most inhabitants is NossaSenhora da Conceição with 8885 inhabitants.

From the total number of inhabitants, 11,450 are male and 12,707 female (data of the five parishes considered urban), in a total of 7,305 family nuclei. Concerning the population of the urban parishes, it is verified that the parish of SãoDinis and São Pedro registered growth and that the parish with the most significant number of inhabitants is NossaSenhora da Conceição with 8,885 inhabitants according to the CENSOS, 2011 of the National Institute of Statistics (CENSOS, 2011 - INE).

23 Another relevantaspect is that only 11,180 of the 24,157 inhabitants of the urban city are employed (data obtained from 2011). Being also relevant to mention that of the total population in the urban area of Vila Real, 5,053 inhabitants are under 19 years of age, 15,470 are between the ages of 20 and 64 (accounting for approximately 64% of the total urban population) and 3,634 are over 65 years of age according to the National Institute of Statistics (CENSOS, 2011 - INE).

Looking now at the existing buildings in the study area, the INEpoints out that there are a total of 5,278 residential buildings. Of which 2,992 are buildings with 1 or 2 floors, 1,676 buildings have 3 or 4 floors and 610 buildings with 5 or above floors.

Regarding the year of construction of these buildings, we can verify that the urban area of Vila Real has buildings that are over a centenary old.

Table 2-Number of buildings built in Vila Real the last century.

As can be seen in table 1, there was a greater buildability progressively until the 90s of the last century, with particular emphasis in the years 1970 to 1990. After this, there was a significant "break" in new constructions, and the buildability of new residential buildings started decreasing to the point as it is nowadays.

24 The city has been gaining a prominent place in the offer of structures to the most varied levels may they be commercial, cultural and leisure. In addition to having higher education and scientific research centres such as the University of Trás-os-Montes and Alto Douro (UTAD) (founded in 1972 as Polytechnic Institute of Vila Real) that brings added value in several areas and the real estate sector is one of them.

Also, its access to other major cities has been improved recently with the new tunnel of Marão and the A4 road network, thus opening a "door" for future business investments to be implemented in the city of Vila Real, contributing to greater employability and in this way facilitate access to real estate loans and fixation of households.

With this, for our study, we will consider five parishes, São Dinis, São Pedro, NossaSenhora da Conceição, Mateus and Lordelo, establishing the following area of Vila Real.

25

3.2 Equipment & Services

Vila Real being district capital is characterised by having a large number of equipment and services that are fundamental to the population in general, which is one of the main reasons why it is considered the district capital. Having these characteristics and conditions makes the city appealing for the installation of "new families “and the permanence of the resident ones.

Following is a description of some of the equipment and services that Vila Real has to offer:

Figure 4-Some of the equipment and services that Vila Real offers.

Having all of this equipment’s has its advantage for most of Vila Real inhabitants. For some, living next to a bus terminal for example or having one of the building facades turned to a busy road or street may cause some discomfort for its resident.Which can lead to a devaluation instead of an appreciation of the property (even if its location, at first sight, looks good while distancing from most of the equipment mentioned above).

26 Figure 5-Acoustic zoning (day) according to the MDP of Vila Real.

27

3.3 Final Considerations

The city has been gaining a prominent place in the offer of structures to the most varied levels, having this characteristics and conditions makes the city appealing for the installation of "new families “and the permanence of the already resident ones.

Vila Real may be considered well served when it comes to environmental quality standards, it has a great park with important dimension and still in expansionin its city centreand the significant noise or sound pollution in the city are the busy routes as we saw in the acoustic zoning according to theMDP.

In the next chapter, it will be conducted a survey containing simple yet essential questions about decision maker factors who influence the buyers in Vila Real and compare them to the ones deemed necessary in 2004.

28

Chapter IV

The most valuable factors in housing price valuation for

the urban area of Vila Real

29

IV. The most valuable factors in housing price valuation for the urban area of

Vila Real

For a better understanding of how to make a real estate appraisal report and which aspects should be contained in it, we developed a survey containing simple yet essential questions about decision maker factors who influence the most buyers in Vila Real, having this way a report fit to the city in the study.

This survey will be conducted just like Sandra Pereira’s one, on a first time directed to promotors/ builders and after this to the users (being these respondents the actual buyers and renters in town which will give us a more accurate perception of the value generating factors that are taken into account in Vila Real.)

4.1 Survey to the promoters /builders

In 2004, Sandra Pereira (Sandra Pereira, 2004) conducted a similar survey on her master degree dissertation in eight different cities of northern Portugal and Vila Real was one of them.

Firstly, the survey was directed to real estate mediators and builders operating in those cities. Vila Real, for instance, had a total of fifteen respondents being that six of them were builders / Promoters and nine real estate agencies.

The survey conducted in 2004 had six groups of questions, covering the following aspects:

• Group 1: most sought typology; • Group 2: most wanted floor;

• Group 3: space surrounding the building; • Group 4: common spaces of the building; • Group 5: organisation of interior spaces; • Group 6: size of interior spaces;

• Group 7: constructive aspects.

The first survey was directed for people with knowledge and experience in the field of real estate in Vila Real, such as real estate agencies and appraisers, building contractors, investors and users, such as renters or buyers.

30 Was decided to characterise user preferences by separating the survey in two, so we may obtain on the one hand the point of view of those who sell (real estate agencies and constructors/ builders), and on the other the point of view of the users (buyer/ renter).

Being this said, questions like what typologies are the most wanted. What floor do buyers prefer? Which factors related to the location and the layout of the building do they give importance? Would they favour location over the layout or otherwise? Which equipment related to the construction of the building is more important in the choice of housing?

After the survey done, the data collected was as follows:

Regarding the first question were able to define which typologies and floors do the real estate of Vila Real properties tend to be most sought after and therefore more valued. Each respondent sort the typologies in decreasing order of influence in the choice of housing decision (from 1 to 5, assigning the value 1 to the most important one and so on).

As the first chart demonstrates, Vila Real being a growing family town, the most sought and unsurprisingly typology is the B3, raising 57% of the respondents to place it on the top regarding the choice of house. At second comes B2 having 43% of the respondents to place it as the second most important typology, followed right after by the B1 with the same percentage of the respondents to place it third. We noticed that properties with more than four bedrooms are less sought.

The results are almost the same as the results of the surveys conducted in 2004, where the most sought typologies were B3 and B2 with 53,3% and 40% respectively.

Figure 7-Promotors/builders opinion regarding most sought typologies for assigning the value 1 to the most important one and so on).

In the second chart, the answers of the respondents were more dispersed be concluded that the groun

second and above floors are the most wanted ones.

most of the buildings do not go beyond four floors and do not have

are also quite aged, having roofs damaged in need of works scaring this way potential buyers from acquiring the last floors.

The conclusions were a little bit different from the ones in 2004 where said that the last floors are the most sought one with 40%

26,7%.

Figure 8-Promotors/builders opinion regarding most sought floor for assigning the value 1 to the most important one and so on).

0% 20% 40% 60% 1 0% 10% 20% 30% 40% 1 Ground Floor

Promotors/builders opinion regarding most sought typologies for living assigning the value 1 to the most important one and so on).

the answers of the respondents were more dispersed

that the ground floor and last floor are the least sought and that the first, second and above floors are the most wanted ones. This can be because

most of the buildings do not go beyond four floors and do not have an

ing roofs damaged in need of works scaring this way potential last floors.

a little bit different from the ones in 2004 where

said that the last floors are the most sought one with 40% followed by the first floor with

Promotors/builders opinion regarding most sought floor for living assigning the value 1 to the most important one and so on).

2 3 4

TYPOLOGIES

B1 B2 B3 B4 Other

2 3 4

FLOORS

Ground Floor 1st Floor 2nd Floor Above 2nd Floor Last Floor

31 living (from 1 to 5,

the answers of the respondents were more dispersed,but it can d floor and last floor are the least sought and that the first, because in Vila Real an elevator. They ing roofs damaged in need of works scaring this way potential

a little bit different from the ones in 2004 where the promoters by the first floor with

living (from 1 to 5,

5

5 Last Floor

The second question was oriented the choice of housing, the location is a

seen on the chart below the most praised location are those in and public transportation ha

these. Few are the ones that

such as the proximity of green areas or noise. These conclusions are almost the same

of schools was preferred by 100% of the respondents.

Figure 9-Promotors/builders opinion regarding most praised

For the frequent use of the building that has

housing, it was revealed in the third question by the respondents of the survey that the existence of outdoor parking lot and the building havi

While they do not prioritise

their property, they do like and want them to this way environmental attributes in the urban city.

In 2004, having green areas in the exterior was preferred by 87,6% of respondents.

Proximity to shopping area Public services (town hall, post Leisure areas (swimming pools, gymnasiums, sports Entertainment places (cinema, cafes, theater, etc.)

Green areas (forest park, Corgo park, etc.) Noise / Sound pollution

was oriented on the location of the building. When it comes to the choice of housing, the location is a significantaspect taken into account. As

on the chart below the most praised location are those in the proximity of schools public transportation had a tie of respondent’s opinion with 62% of them

these. Few are the ones that evaluated the environmental attributes of the urban such as the proximity of green areas or noise.

These conclusions are almost the same as the ones from 2004, where the by 100% of the respondents.

Promotors/builders opinion regarding most praised localization

use of the building that hassignificant importance in the choice of housing, it was revealed in the third question by the respondents of the survey that the existence of outdoor parking lot and the building having a lift is a must have

living near green areas, when it comes to the streets nearby their property, they do like and want them to be arborized and more “green”, valuing this way environmental attributes in the urban city.

In 2004, having green areas in the exterior was preferred by 87,6% of

0% 10% 20% 30% 40%

Proximity of schools Proximity to shopping area Public transport Health services Public services (town hall, post … Leisure areas (swimming pools, gymnasiums, sports … Entertainment places (cinema, cafes, theater, etc.)

Green areas (forest park, Corgo park, etc.) Building orientation Noise / Sound pollution Others

LOCALIZATION

32 on the location of the building. When it comes to aspect taken into account. As can be proximity of schools of them favouring l attributes of the urban centre

the ones from 2004, where the proximity

localization factors.

importance in the choice of housing, it was revealed in the third question by the respondents of the survey that the ng a lift is a must have (90%). green areas, when it comes to the streets nearby and more “green”, valuing

In 2004, having green areas in the exterior was preferred by 87,6% of the

Figure 10-Promotors/builders opinion regarding the

On the fourth question, was

interior spaces. Surprisingly, when it comes to the preferences on how the ro

outside oriented (having a garage balconies or terraces 76%

question, the respondents want being these the divisions where they

can be established that location and orientation are the choosing a house.

Having a garage was also

like balconies and terraces came second with 66,7% back in 2004. The kitchen area was preferred by 100% of the answers

to the living and bedroom.

Outdoor Parking Facility Existence of elevator Location of the stairwell Garbage collection Existence of videocassette Existence of outdoor green spaces Others

Existence of entrance hall Proximity of living room / kitchen Existence of outdoor spaces (balconies, terraces)

Existence of indoor parking space

Promotors/builders opinion regarding the common use of the building.

On the fourth question, was approached the distribution of the

. Surprisingly, when it comes to the interior layout, most, do not have preferences on how the rooms are distributed, being the three aspects most valued outside oriented (having a garage with 81%, having beautiful views 71%

76%). Nonetheless, for the area of the divisions on the fifth question, the respondents want more significant areas for the living room and kitchen

ng these the divisions where they spend most “useful” time in family households. that location and orientation are the most importan

Having a garage was also anessential space with 93,3% and having exterior spaces like balconies and terraces came second with 66,7% back in 2004. The kitchen area by 100% of the answers, and now the promotors give more importance

0% 10% 20% 30% 40% 50% 60% 70% Outdoor Parking Facility

Existence of elevator Location of the stairwell Garbage collection Existence of videocassette Existence of outdoor green spaces Others

USES

0% 10% 20% 30% 40% 50% 60% Existence of entrance hall

Proximity of living room / kitchen Existence of outdoor spaces (balconies, terraces) Separate laundry Location of WC's Existence of pantry Existence of indoor parking space Landscape / Views Others

LAYOUT

33 use of the building.

the most important interior layout, most, do not have aspects most valued 71% and having the divisions on the fifth areas for the living room and kitchen spend most “useful” time in family households. It most important aspects while

space with 93,3% and having exterior spaces like balconies and terraces came second with 66,7% back in 2004. The kitchen area the promotors give more importance

80% 90% 100%