in forest reserve obligations: a simulation analysis of

options for dealing with habitat heterogeneity

Kenneth M. Chomitz Timothy S. Thomas Antônio Salazar P. Brandão

Abstract: A tradeable development rights (TDR) program focusing on

biodiversity conservation faces a crucial problem: defining which areas of habitat should be considered equivalent. Restricting the trading scope to a narrow area could boost the range of biodiversity conserved but could increase the opportunity cost of conservation.

The issue is relevant to Brazil, where TDR-like policies are emerging. Long-standing laws require each rural property to maintain a legal forest reserve (reserva legal) of at least 20%, but emerging policies allow some tradeability of this obligation. This paper uses a simple, spatially explicit model to simulate a hypothetical state-level program. We find that wider trading scopes drastically reduce landholder costs of complying with this regulation and result in environmentally preferable landscapes.

Keywords: Brazil, conservation, environment, land use, Minas Gerais, tradeable development rights

JEL Classification: R52, Q24

RESUMO: Programas que tenham por objetivo desenvolver um mercado de Direitos Especiais de Propriedade (DEP) enfrentam um problema fun-damental, qual seja a definição de áreas de preservação equivalentes. Caso a definição seja por um conceito muito restritivo, poderá ocorrer uma maior conservação da biodiversidade, porém com um aumento do custo de oportunidade da preservação ambiental.

O assunto é relevante para o Brasil onde programas semelhantes aos DEP estão surgindo. A legislação exige que cada propriedade rural mantenha pelo menos 20% de sua área na forma de florestas (reserva legal), porém algumas políticas nascentes já permitem tipo de negociação de Direitos. Este trabalho usa um modelo espacial simples para simular o efeito de um programa hipotético implantado em um estado. O principal resultado é que uma política menos restritiva para a comercialização dos DEP reduz de forma expressiva, para os produtores rurais, os custos de cumprir a legislação e leva a soluções preferíveis sob o ponto de vista ambiental. Palavras chave: Brasil, conservação, meio ambiente, uso da terra, Minas Gerais, comercialização de direritos especiais de propriedade

I. Introduction

Habitat conservation can be justified on instrumental or intrinsic grounds. The instrumental approach seeks ways to finance conservation of habitats that perform particular “bankable” services such as watershed protection or carbon storage (see e.g. Pagiola, Bishop and Landell-Mills 2002). If successful, this approach will create incentives to preserve some, but not all, habitats. It will promote conservation of moist hillside forests, for instance, and tend to neglect dry forests on plains—even if the latter contain unique biological features.

of species, conservation biologists sometimes advocate a goal of retaining a fixed proportion – ten percent or more -- of each habitat type (Soulé and Sanjayan 1998). In many areas, this goal will not be met without active interventions to protect habitats from agricultural expansion. The costs of these interventions will vary widely, depending on agricultural potential and opportunities. In the developing world, the opportunity cost of conservation may be a few hundred dollars per hectare where the alternative is extensive pasture management or thousands of dollars where the alternative is a high-value perennial crop.

In principle, a transferable development right (TDR) program can minimize the social cost of achieving a target for area conserved, and can reward those undertaking conservation. Such programs have been used on a small scale in the U.S. to preserve farmland and natural areas (Johnston and Madison 1997). On a larger scale, a government could allocate development or conversion rights (denominated in hectares) equivalent to 80 percent of a particular habitat. Trading of these rights would tend to allow conversion of the plots most suitable for agriculture, and retention under natural vegetation of the areas with the lowest oppor-tunity cost. If the rights were freely and equally allocated among property holders (a fiscally inefficient but politically expedient procedure) those who maintained forests would profit from TDR sales. A TDR program is thus the conservation analog of environmental permit programs that regulate air pollution or fisheries access.

The implementers of a TDR program focusing specifically on biodi-versity representation face a crucial practical problem: defining equiva-lence between habitats in different locations.1 The most natural way to

do this in a TDR system is to define zones of equivalence: within each zone, habitat is considered equivalent and substitutable. Science can provide input to this policy issue, but cannot decide it. Forests (or other habitats) can be classified according to a detailed taxonomic hierarchy. Environmental policymakers may differ in their views on how far down the hierarchy to go in determining equivalence. “Lumpers” will favor

1 It has similarly proved difficult to operationalize wetland equivalence for the application

equivalence within high level classifications, allowing substitutability among all neotropical forests, for instance. “Splitters” of different degrees of rigor will favor restricting forest substitutability to finer classifica-tions; for instance, particular types of neotropical forests (e.g., moist neotropical rainforests), forest subtypes based on unique assemblages of species and communities (e.g. the Atlantic Rainforest of Brazil), forests within particular watersheds, or at the limit, forests within a particular microwatershed of a few thousand hectares. Choice of the appropriate level involves a trade-off between the efficiency gains offered by a broad classification, and the potentially greater representation of biodiversity offered by a fine classification. (Consideration of environmental goals other than biodiversity, such as maintenance of hydrological processes, would complicate the trade-off.)

This issue is of particular relevance to Brazil, where TDR-like pro-grams are emerging. The Forest Code of 1965 (and indeed its precursor of 1934) requires each landowner to maintain a proportion of each property under natural vegetation as a legal forest reserve. The proportion ranges from 20 percent in southern Brazil to 80 percent in the Legal Amazon2.

Provisional regulation (Medida Provisoria) 2166-67 of 2001, the opera-tive current rule, allows landholders to satisfy the requirement for one property through legal forest reserve located on another. In some cases, the off-site legal reserve may be owned by another party, opening the way to a market in legal reserve rights. (Note that the legal reserve is distinct from, and augments, the required areas of permanent preserva-tion: forests along streams, on steep slopes, and on hilltops).

Many properties are out of compliance with the legal reserve obliga-tion. Consequently, increased enforcement of the law has led to interest in policies that would permit trade of legal reserve obligations. These would allow landholders with insufficient legal reserve to purchase offsetting reserves at a different site. Such policies immediately raise the question of whether the scope of allowed offsets should be restricted to the same microbasin, or whether a wide scope should be allowed.

This paper uses a simulation model to examine the impacts of

al-2 Landholders are additionally required to maintain vegetation in areas of permanent

ternative trading scopes on landholder compliance cost and on protec-tion of areas of biodiversity interest. It uses data for the Brazilian state of Minas Gerais, an innovator in the use of economic instruments for conservation. It significantly extends an earlier paper (Chomitz 2004) through improved measures of land value, finer geographic resolution, and a wider range of impact measures. While we believe that the results are indicative, we stress that this paper is not intended as an authori-tative analysis for Minas Gerais. However, we hope that with further refinements, the model presented here could allow policymakers and stakeholders in Minas Gerais, in Brazil, and beyond to explore options and issues in policy design.

The next section describes the current situation in Minas Gerais and Brazil. The third presents a stylized model illustrating the potential economic and environmental impacts of instituting alternative TDR schemes. The fourth section operationalizes the model. Section five pres-ents our results with some discussion. A concluding section discusses policy implications, with some attention to institutional issues such as the transactions cost and competitiveness in a market for legal reserve obligations.

II. Brazilian and Minas Gerais context

Since 1965, Brazilian landholders have been obliged to keep a speci-fied proportion of each property under natural vegetation. Currently, this “legal forest reserve” requirement is 20 percent in southern states—where much forest cover has been lost—and is 80 percent in the forest-biome (e.g., non-savanna) areas of the Legal Amazon. Proprietors may use the legal reserve area for limited purposes, including sustainable extraction, but may not clear-cut it. The legal reserve requirement augments another regulation which places under “permanent protection” forested areas on hills or bordering streams and rivers.

op-portunities to cultivate soybeans, vegetables, coffee, or other crops. Strict enforcement of the legal reserve requirement would be extremely expensive in these locales if landholders were required to abandon crop-land or perennials. In heavily-worked properties with little remaining natural vegetation, the rate and quality of natural regeneration might be extremely slow. The isolated and poor-quality stands of regenerated vegetation would provide little biodiversity benefit. In other locales, some forest fragments persist. Often, these fragments represent the last vestiges of the Brazilian Atlantic Forest, a biome which is now reduced to about 7 percent of its original area and consequently harbors important biodiversity found nowhere else (Myers et al 2000). In Minas Gerais, the Atlantic Forest in 2000 had shrunk to 14.5% of its original area, with an annual deforestation rate of more than 0.5% (Fundação SOS Mata Atlântica and INPE 2002). These fragments represent the candidates for nuclei of a regenerated forest, because of the potential to serve as genetic sources for endangered plants and animals. Yet deforestation continues in these forest fragments because returns to agricultural conversion and timber extraction exceed the private benefits of forest maintenance. The legal reserve regulation, by itself, would permit deforestation down to the 20 percent limit, though special regulations restrict deforestation in the Atlantic Forest zone.

In short, strict property-by-property enforcement of the legal reserve limit might be ecologically and economically inefficient in already-defor-ested regions. Property-wise enforcement would impose large compliance costs on profitable farms, with little environmental gain. Property-wise enforcement would fail to provide incentives to maintain and expand the precious remaining areas of primary habitat.

that compensation take place within the same microbasin if possible; and if not, in the same river basin and state3. In 2001, Goiás State issued

implementing regulations allowing off-site legal reserve compensation. In 2002, Minas Gerais adopted a new state forest code, which allows for trading of legal reserve within a microbasin, but allows for some forms of legal reserve offset within a river basin. A more elaborate system of legal reserve enforcement and trading, SISLEG, was put in place in 2000 in the state of Paraná. Each property in the state was required to come into compliance with the legal reserve requirement by the end of 2018. The regulation permitted compliance through on-site regeneration, with forested property of the same owner, or with forested property of a dif-ferent owner. Cross-property compensation was allowed within one of ten zones defined on the basis of river basins – a relatively wide scope. However, SISLEG was discontinued in 2003, after which compensation rules were made more restrictive.

Forest reserve maintenance is particularly relevant to Minas Gerais. After suffering substantial forest loss, the Brazilian state of Minas Gerais has become an innovator in forest conservation. Over the past 50 years, forests in this large territory have been cleared to accommodate agricul-tural expansion and to fuel the state’s charcoal-fired iron mills. Forest loss has been particularly severe in the Atlantic Forest region of the state, in the areas near the blast furnaces, and in the fertile “Triangulo” region in the west. In response, during the 1990’s the state adopted two major conservation initiatives: a ban on the use of native forests for iron production, and a revenue-sharing system that rewarded municipalities for creating and maintaining protected areas. Nonetheless, parks and reserves constitute only 0.9% of the state’s territory; another 2.3% of the territory is in multiple-use with some degree of environmental zoning (Costa et al., 1998). Management of legal forest reserves on private lands is therefore of great significance to the state’s overall forest estate.

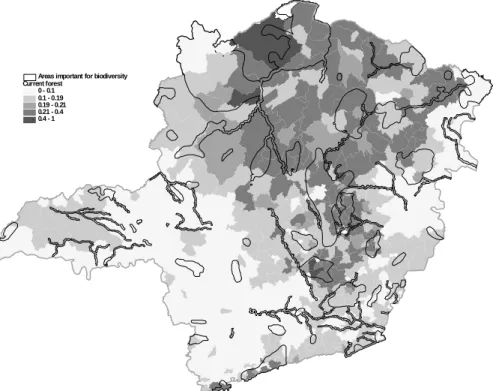

Figure 1 shows remaining forest cover on private agricultural lands, based on municipality-level tabulations from the agricultural census of 1995/96 (IBGE 1998). The state is divided into four biomes, the major ones being the Atlantic Forest to the east, the “cerrado” or savanna to

Figure 1: Forest Cover on private agricultural land, by municipality, 1996

Current forest 0 - 0.1 0.1 - 0.19 0.19 - 0.21 0.21 - 0.4 0.4 - 1

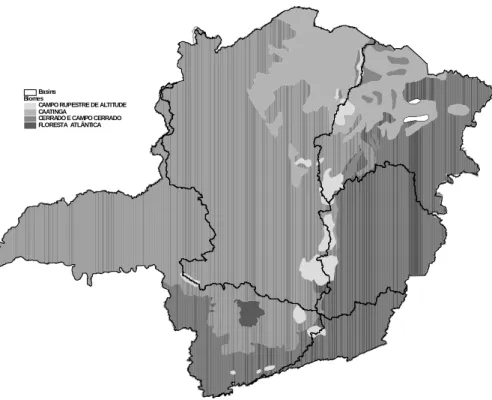

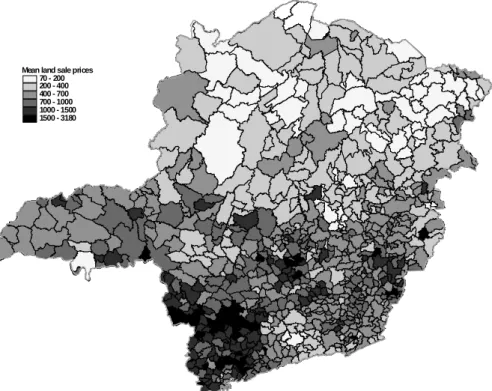

the west, and the “caatinga” in the drier north (Figure 2). Remaining forest cover is below 20% in most of the Atlantic Forest biome and in the agroclimatically favorable portions of the cerrado, to the south and west. Higher forest cover remains in the more arid and remote regions of the cerrado and caatinga. Average land values (Figure 3) are, not surprisingly, inversely related to forest cover4.

III. A simple model of the application of a TDR scheme

to forest regeneration

In areas with inadequate forest cover, the TDR scheme is a device to encourage protection of existing forest and regeneration of new forest. To evaluate its efficiency and effectiveness in doing so, we in-troduce a highly stylized model. Initially, a landholder has a property with total area T, of which A0is in agriculture and F0 in forest. Then, a regulation is introduced (or enforced) requiring the landholder to set aside a proportion ϕ of her property as forest reserve, first from existing forest, and then if necessary by abandoning cultivated land and pasture to forest regrowth. Let g(x) represent the total value of the most valuable x hectares of cultivated land, and h(x) the total value of the most valuable x hectares of forest land. We assume that these values are exogenously determined by agricultural product markets. We make the drastic assumption that forest reserve has no private value due to restrictions on use5. Then compliance with the

regulation costs the landholder:

h(F0)-h(F0- ϕT) (F0>ϕT)

h(F0) +[g(A0)-g(A0-(ϕT-F0))] (ϕT>F0)

Regrowth occurs entirely on properties with low initial forest cover. Because these properties are likely to be the most productive and heavily worked, compliance costs are high and the quality of regenerated forest

4 This is true in part by construction. Mean land values are computed as the weighted

av-erage of prices according to land class, with forest often being the least valuable class.

5 Think of the value of existing, non-reserved forest as representing the sum of option

Figure 2. Biomes and major river basins

Biomes

CAMPO RUPESTRE DE ALTITUDE CAATINGA

Figure 3 Land values

likely to be low, due to compacted soil, nutrient depletion, and absence of seed sources 6.

Now suppose that landholders are allowed to sell forest reserve rights attached to ‘excess’ forest (that is, forest areas in excess of ϕT) and that those with forest reserve deficits may purchase these rights and apply them to their own reserve obligations. This creates a market for forest reserve with market-clearing price p. The landholder’s problem is to satisfy the legal reserve requirement by choosing an agricultural abandonment area 0 ≤ a ≤A0, an on-site forest set-aside area 0 ≤ f≤F0

and a net legal reserve purchase area q (q<0 implies a sale of legal reserve rights) to maximize:

g(A0-a)+h(F0-f)-pq

subject to :

a+f+qϕT and A0 + F0 = T

The maximization problem will differ between forest-deficit and for-est surplus properties, depending on some additional assumptions about allowable transactions.

Forest-deficit properties. First consider the response of properties where

F0 -ϕT <0. Suppose for simplicity’s sake (and reflecting likely legislation) that forest-deficit properties are required to place all existing forest un-der reserve (f=F0), and are not permitted to sell permits through forest generated by land abandonment. Their optimization problem is:

choose a to max g(A0-a) -p·(ϕT-a-F0)

where the second term reflects the cost of purchasing permits, and the amount of permits is determined by the choice of a. When p<g’(A0), compliance is achieved entirely through purchase of permits. When p> g’(A0-(ϕT-F0)), compliance is achieved entirely through abandonment of land. For intermediate values of p there is both abandonment and purchase, with g’(A0-a)= p.

Forest surplus properties. If forest surplus properties are not permit-ted to sell permits based on agricultural land abandonment, then they choose f to maximize:

h(F0-f)+ p·(f-ϕT)

6 This generalization may not apply to areas under perennial crops or plantations, some

where the second term reflects the potential revenue from sale of ‘excess’ reserve. Forest-surplus properties will convert all of their excess forest to farmland if p < h’(F0 – ϕT). They will sell all their surplus equal to F0 – ϕT if p > h’(0). For intermediate values of p, they sell F0 > f > ϕT satisfying p = h’(F0 – f). Whether sale of forest reserve rights constitutes an environmental gain depends on one’s evaluation of the likelihood that this land would otherwise have eventually been converted or degraded in the future, and how irreversible that action would be. Posi-tive land values for forests suggest that the option of future conversion is privately valuable, so that retirement of this option may be socially valuable if environmental benefits are taken into account.

If properties are allowed to sell permits based on agricultural land abandonment, then they choose both f and a to maximize

g(A0-a)+h(F0-f )- p(ϕT- a+f)

where there will be interior or corner solutions similar to those of the previous two cases. Here there could be an environmental gain if regeneration on these plots is vigorous and biodiverse due to the prox-imity of seed sources.

This simple model suggests that the environmental and economic impacts of a TDR scheme depend on whether land values and land cover vary substantially within areas deemed biologically homogeneous. Sup-pose, for instance, that agroclimatic conditions determine both land value and biodiversity. Areas favorable to agriculture will have distinct biota, but will tend to have low remaining forest cover and high land value. Demand for reserve rights will be high, but few properties will have sur-plus forest with which to supply that demand. Suppose on the other hand that land values are determined mainly by road access, and that there is substantial variation in road access within biologically homogenous areas. In this case there are substantial gains possible from trade.

IV. Simulation model

Data

Land value. Land value data was kindly provided by Fundação Getulio

Vargas. These data, collected semiannually, represent typical land sales transactions values by municipality for rural land sales, classified by land cover: crops, pasture, fields (campo) and forest. We chose second semester 1996 as the base period. Where observations were missing for this period, values were imputed using data from other periods, adjusted by average interperiod price change. Where data were missing for all periods, values were imputed from the average of neighboring municipalities. The use of land cover as a proxy for land value can be justified by reference to Chomitz et al. (2005), who estimated a hedonic equation for land value using prop-erty level transactions data for an Atlantic Forest area of south Bahia. They found a very strong relationship between land cover and land value7.

Land cover. The 1995-1996 Censo Agropecuário (Agricultural Census)

(IBGE 1998) breaks down land use within agricultural establishments into the following categories: natural forest, planted forest, perennials, annu-als, planted pasture, native pasture, short fallow, productive unutilized (probably long fallow), and nonproductive (e.g., rocks, water, paved ar-eas). IBGE kindly provided us with these data at the level of the census tract; there are 8123 census tracts in 756 municipalities. To link land use data with land value data, we adopted the following rough concordance:

Censo Agropecuario Classification FGV Classification

natural forest forest (matas)

perennials, annuals, planted forest crops (lavouras)

planted pasture, short fallow, productive non-utilized Pasture

natural pasture Campo

Biodiversity priority areas. Biodiversity priority areas for the state were identified through a process described in Costa et al. (1998). A fif-teen-month process involving 121 experts identified conservation priority

7 Chomitz et al used the hedonic equation to impute a land value surface for south Bahia.

areas on the basis of species richness, species endemicity and distribution, threat, and presence of special biological characteristics. Priority maps were made for seven taxonomic groups and combined into a summary map (at a scale of 1:1,700,000) indicating four degrees of importance.

Demand And Supply At The Micro Level

Here we adapt the theoretical model of section 3 to the available data. The unit of observation is the census tract. Census tract i in município j has Tij total hectares in agricultural establishments (excluding unproduc-tive land), of which Fij is in forest, Aij in crops, Cij in native pasture, and Dij in planted pasture. We assume that, within each of these land uses, land is of homogenous quality within município j and has value per hectare Vkj, where k indexes land use. We assume that properties within the census tract can pool their forest holdings for the purpose of satisfy-ing the legal reserve requirement. If fij = Fij / Tij < 0.2, then the unit is out of compliance by a gap G = 0.2 Ti – Fi. Within the census tract, it can come into compliance either by purchasing legal reserve rights or by abandoning productive land to forest regrowth.8 It chooses the least

costly strategy, abandoning successively higher cost land until the op-portunity cost of abandonment is the same as the price of legal reserve. We will assume that out-of-compliance properties are not permitted to use natural regeneration to create “excess” legal reserve for sale.

Let qij(p) be the cumulative non-forest area in tract ij with value per hectare less than p. This distribution is approximated by constructing a step function based on Aij, Cij, and Dij together with their correspond-ing average values Vaj,Vcj, Vdj. For instance, where Vcj<Vdj < Vaj , the inverse of q(.) is given by:

p= Vcj [0<q< Cij]

p= Vdj [Cij<q< Cij+ Dij]

p= Vaj [ Cij+ Dij<q< Cij+ Dij+ Aij]

This crude approximation assumes that heterogeneity in land quality among farms within a municipality is reflected in different allocations

8 We assume that such abandonment satisfies regulations, regardless of the actual quality

of land use rather than in different average valuations of land devoted to particular land uses.

The tract’s demand for legal reserve at price p is dij(p) = max[0, G – qij(p)]. Where fij > 0.2 the census tract is a potential supplier of legal reserve. The supply function is simply sij(p) = 0, if p < Vfj, and equals

Fij – 0.2T, if p > Vfj.

In areas where the aggregate proportion of native forest falls below 20 percent, long-term ecosystem viability may depend on expanding the size of forest patches through natural regeneration of adjacent areas. It may therefore be desirable to allow properties (census tracts) that already have substantial forest cover to supply additional forest reserve through aban-donment and regeneration. Supposing that this option is limited to census tracts with fij > 0.2, the additional supply is given by sadd

ij(p) = qij(p).

Solving For Market Equilibrium And Its Impacts

Aggregation of sij(p) and dij(p) over any specified trading ambit yields estimates of the aggregate supply and demand curves S(p) and D(p). The calculated supply and demand functions are biased approximations of the actual functions. The crude imputation of land values used here does not take account of heterogeneity of land quality. Nor does it al-low for the likely relationship between land cover and land value. Areas with relatively high forest cover are likely to be areas where agricultural potential, and hence land values, are low. (It is for this reason that the forest is still standing.) Hence the derived supply and demand functions are likely to differ systematically from the true functions, with less supply at low prices and less demand at high prices. This bias should be kept in mind when assessing model results.

Equating supply and demand yields an equilibrium price p* and quan-tity Q*. Substitution of equilibrium price into a census tract’s supply and demand functions allows computation of legal reserve bought and sold, expenditures and revenues related to these transactions, of forest area newly-protected as legal reserve, and of areas abandoned to regeneration.

with-out trading. In the baseline, we assume that areas with more than 20 percent forest eventually reduce forest cover to the legal limit (except in the Atlantic Forest biome where deforestation is forbidden),9 and that

areas that are out of compliance use unassisted natural regrowth on abandoned land to come into compliance.

The reduction in compliance cost (relative to property-wise enforce-ment of the legal reserve requireenforce-ment) is given by:

Rents earned by the suppliers of legal reserve are given by:

The hypothetical TDR program potentially benefits the environment by encouraging the conservation and expansion of forest fragments in forest-rich locales. In the baseline scenario, these ecologically valuable areas are allowed to degrade down to the 20 percent limit, while areas that are already severely degraded are allowed to present very poor-qual-ity regeneration to fulfill their reserve requirement. (The regeneration in these areas is likely to be poor because seed sources are lacking and the land has been heavily worked). In the program scenario, standing forest is conserved, and regrowth is encouraged near the forest, where seed sources are plentiful, and the opportunity to reconnect forest fragments is greater. This should lead to higher biomass and carbon densities and to ecosystems better to support minimum viable popula-tions of flora and fauna.

To compute biodiversity impacts, municipality-level impacts were proportionately allocated to biodiversity priority areas that overlapped with the municipality (Unfortunately the census-tract level data was not spatially referenced.)

9 Despite this law 2.8% of the remaining Atlantic Forest in Minas Gerais was deforested

V. Results

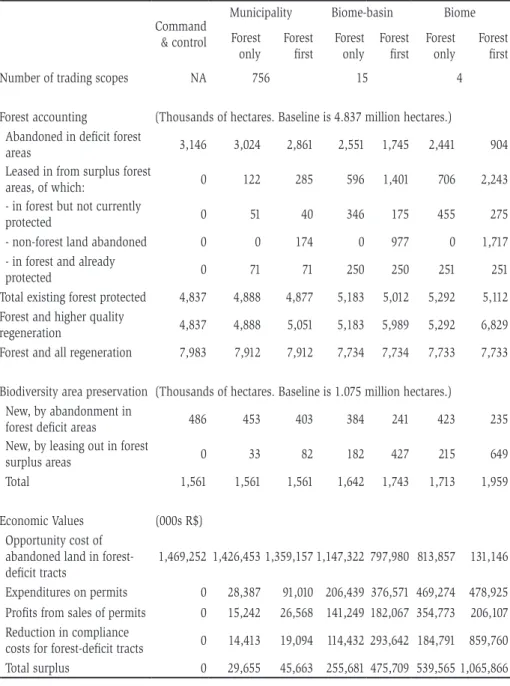

Table 1 compares the impacts of alternative enforcement sce-narios, relative to a baseline of no enforcement of the forest reserve regulation. In the command and control scenario, no trading of forest reserve permits is allowed. Successive scenarios allow trading within expanding geographic scopes: municipality, biome X river basin com-bination, biome. Within each of the geographic trading regimes, two sub-scenarios are simulated. In ‘forest only’, forest surplus properties may sell permits based only on existing ‘excess’ forest. In the ‘forest first’ scenarios, forest surplus properties may also sell permits from abandonment and regrowth on agricultural plots, but only after selling all available permits based on standing forest.

In the command and control scenario, out-of-compliance landholders come into compliance by abandoning 3,146,000 hectares of farmland, at an opportunity cost of R$1.47 billion. All of this is assumed to become low quality regeneration. The municipality-level trading scenarios offer negligible reductions in total compliance cost, as within-municipality trading opportunities are few. (This reflects to some degree the assump-tion of homogenous land prices, for a given land use type, within mu-nicipalities, but also the observed infrequency of coexisting forest-deficit and forest-surplus census tracts within the same municipality.) For the biome-basin scenario, however, trading makes a difference. In the for-est-only sub-scenario, total compliance costs decline by R$256 million relative to the command and control scenario. Forest-deficit properties capture about 45% of this saving. The rest goes to forest-surplus proper-ties, which sell permits based on 346,000 forest hectares placed under new protection, and 250,000 hectares already protected (in theory) by regulations forbidding Atlantic Forest deforestation. In the forest-first sub-scenario of biome-basin trading, there is a further reduction of R$220 million in the social costs of compliance. The bulk of this accrues to the forest-deficit landholders, who now abandon only 1,745,000 hectares, purchasing permits from 977 thousand hectares of regenerating forest in favorable areas. Compared to the forest-only sub-scenario, new protection of existing forest drops from 346 thousand to 175 thousand hectares.

Table 1. Economic and environmental impacts of alternative scenarios

Command & control

Municipality Biome-basin Biome

Forest only Forest first Forest only Forest first Forest only Forest first

Number of trading scopes NA 756 15 4

Forest accounting (Thousands of hectares. Baseline is 4.837 million hectares.)

Abandoned in deficit forest

areas 3,146 3,024 2,861 2,551 1,745 2,441 904

Leased in from surplus forest

areas, of which: 0 122 285 596 1,401 706 2,243

- in forest but not currently

protected 0 51 40 346 175 455 275

- non-forest land abandoned 0 0 174 0 977 0 1,717

- in forest and already

protected 0 71 71 250 250 251 251

Total existing forest protected 4,837 4,888 4,877 5,183 5,012 5,292 5,112

Forest and higher quality

regeneration 4,837 4,888 5,051 5,183 5,989 5,292 6,829

Forest and all regeneration 7,983 7,912 7,912 7,734 7,734 7,733 7,733

Biodiversity area preservation (Thousands of hectares. Baseline is 1.075 million hectares.) New, by abandonment in

forest deficit areas 486 453 403 384 241 423 235

New, by leasing out in forest

surplus areas 0 33 82 182 427 215 649

Total 1,561 1,561 1,561 1,642 1,743 1,713 1,959

Economic Values (000s R$)

Opportunity cost of abandoned land in forest-deficit tracts

1,469,252 1,426,453 1,359,157 1,147,322 797,980 813,857 131,146

Expenditures on permits 0 28,387 91,010 206,439 376,571 469,274 478,925

Profits from sales of permits 0 15,242 26,568 141,249 182,067 354,773 206,107

Reduction in compliance

costs for forest-deficit tracts 0 14,413 19,094 114,432 293,642 184,791 859,760

Notes: a) By law, property owners are required to leave 20 percent of their land in forest. Also, trees are not allowed to be cut in the Atlantic Forest biome. The baseline forest is calculated as the lesser of existing forest and 20 percent of productive land; except in the Atlantic Forest biome, where it is equal to the existing forest.

(b) “Abandoned” refers to any land that was not in forest that is allowed to regenerate naturally to forest. We assume “strong regeneration” occurs in areas that have at least 20 percent of the potentially productive land currently in forest (“forest surplus areas”). Areas with less than 20 percent of the land in forest are called “forest deficit areas”.

(c) Under the trading regimes, the supply price of forested land in the Atlantic Forest biome is set to 0.

(d) “In forest and already protected” represents forested land in the Atlantic Forest biome that is above the 20 percent required in other biomes. We allow sales of permits based on this forest. (e) Biodiversity area preserved is calculated by multiplying the area of abandonment (of deforested land) or protection of forested land, times the proportion of the municipality which is in a biodiversity priority area. The biodiversity area baseline is calculated from the baseline forest area.

The forest-only variant shows relatively little difference in the land cover mix from biome-basin trading: newly protected forest increases in area from 346 thousand to 455 thousand hectares. But by exploiting cross-basin (but within-biome) differences in land value, the biome-wide trading scenario reduces costs by an additional R$284 million compared to biome-basin. Finally, compliance costs are drastically reduced in the final scenario, the forest-first variant of biome-wide trading. Compared to the command-and-control scenario, total opportunity costs are reduced by over R$1 billion, most of which accrues to forest-deficit landholders. The savings accompanies a massive shift of 1.7 million hectares from land under low-quality regeneration to land under high-low-quality regeneration. Compared to the forest-only variant of biome-wide trading, this environmental benefit is slightly offset by a decline in new protection of standing forest, from 455 hectares to 275 thousand hectares. Forest-surplus landholders real-ize reduced aggregate profits from permit sales in the forest-first variant, despite the much greater hectarage of permits delivered.

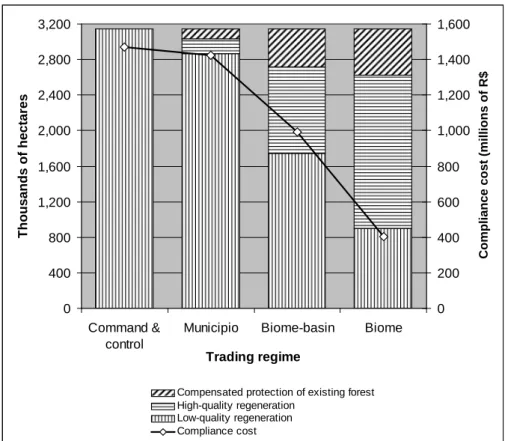

Figure 4 summarizes the main results, showing only the forest-first variants. Expansion of the trading ambit results in substantial social sav-ings; both forest-deficit and forest-surplus landholders benefit as the ambit expands. Wider trading also results in a better overall quality of new addi-tions to the forest reserve system. Under command-and-control, the new reserves are entirely composed of low-quality regeneration. Much of this area will regenerate weakly, if at all, yielding little biodiversity or carbon sequestration benefit. Under biome-wide trading, low-quality regeneration is reduced to just 29% of the expanded reserve area. This almost certainly implies some gain in carbon sequestration and improvement in biodiver-sity-friendly habitat. But does expansion of the trading ambit lead to poor targeting or poor geographical balance in the biodiversity benefits?

Figure 4. Summary of Economic and Environmental Impacts of Alternative Trading Scopes

0 400 800 1,200 1,600 2,000 2,400 2,800 3,200

Command & control

Municipio Biome-basin Biome

Trading regime

Thousands of hectares

0 200 400 600 800 1,000 1,200 1,400 1,600

Compliance cost (millions of R$)

Compensated protection of existing forest High-quality regeneration

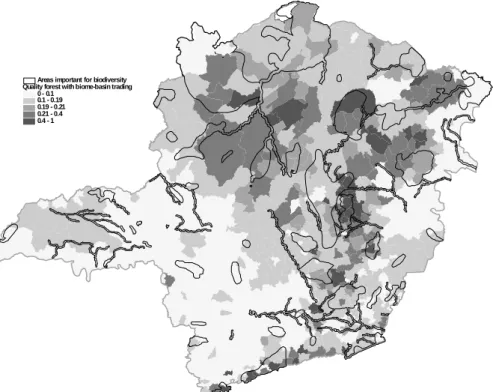

Figure 5. “Good-quality” forest cover with biome-basin trading

Quality forest with biome-basin trading 0 - 0.1

0.1 - 0.19 0.19 - 0.21 0.21 - 0.4 0.4 - 1

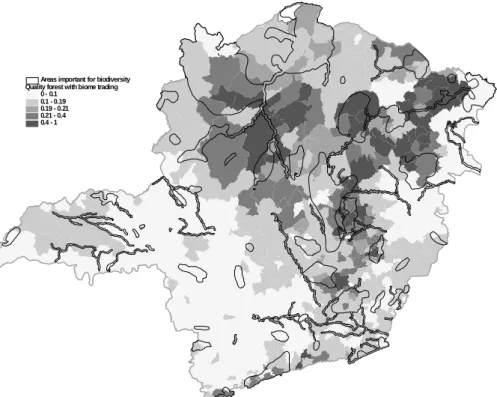

Figure 6. “Good-quality” forest cover with biome-wide trading

Quality forest with biome trading 0 - 0.1

0.1 - 0.19 0.19 - 0.21 0.21 - 0.4 0.4 - 1

biome-wide trading. Biome-wide trading has large beneficial impacts on forest extent in the north and east of the state, both inside and outside biodiversity priority areas. Biome-basin trading yields superior results only in some small corners of the southwestern portion of the state. In this fertile agricultural area, permit prices soar to over R$1100 per hectare when trading is restricted to the biome-basin combination, eliciting some supply from the few remaining forest-surplus tracts.

VI. Discussion and conclusions

The simulation results show that a tradeable legal reserve program could dramatically reduce the opportunity costs of protecting and regenerating a desired aggregate level of forest cover, when the trading scope extends beyond the strictly local area (e.g. municipality or micro-watershed). Trad-ing beyond the local level also results in superior environmental results, including greater protection of existing forest remnants, and encouragement of higher-quality regeneration. These outcomes should be better both for biodiversity and for carbon sequestration. These results may be generalized to other forest-poor areas, since they follow from the strong association between favorable agroclimatic and market access conditions, high prior levels of forest conversion, and high land values, and high degrees of spatial autocorrelation in all these variables (Chomitz et al 2004).

Reduction in opportunity costs is important not just from the view-point of economic efficiency, but perhaps more importantly, from a politi-cal economy viewpoint. Much of the cost reductions would potentially accrue to large landholders in rich agricultural regions. But benefits also accrue to landholders in less prosperous regions who have protected their forests, and to agricultural workers. Together this builds a power-ful constituency for instituting the program. Conversely, there would be little support for a command-and-control program that imposed costs on these stakeholder groups.

forests are already depleted in high-market-value areas. Here the wider am-bit offers much greater aggregate environmental benefits and much greater social savings. The savings are large enough that a small portion could be used to finance targeted interventions (such as purchase of land for parks) in ecosystems that might otherwise be underrepresented. Similar consider-ations apply when considering whether to allow permit supply only from standing forest, or also from regeneration. Similarly, extending the trading regime to allow supply of permits from high-quality regeneration ‘crowds out’ a small amount of protection of standing forest, but stimulates the creation of a much greater extent of restored forest, while realizing considerable sav-ings. Again, in principle, some of the savings could be devoted to targeted acquisition of standing forest in underrepresented ecosystems.

Could such a system work in practice? Practical operation of a trad-ing system requires a transparent, trustworthy institution that minimizes low transactions and monitoring costs, and avoids collusion or market manipulation. Market manipulation is a worry especially for markets with small ambits, where buyers may be few but powerful in both political and economic spheres. Transactions costs are potentially a problem if buyers must seek out sellers in a thin market, and if buyers retain liability for compliance on a distant property. Monitoring and enforcement costs could be high if tens or hundreds of thousands of properties have to be inspected.

for false reporting. This minimizes monitoring costs. Third, since within-ambit markets deal in a homogeneous commodity, auctions would be an efficient way to transfer legal reserve rights. This would be especially apt if the main reason for the market is to allow land-owners with insufficient forest to come into compliance. Buyers and sellers would submit sealed bids to a central clearinghouse, which would check validity of offered legal reserve against the official state records – presumed to be computerized. The clearinghouse would compute the market-clearing price, exactly in the manner used in this paper’s simulation, debit the sellers’ holdings, and credit the buyers’ holdings in the state database. This obviates the need for bilateral transactions and greatly reduces transactions costs.

Are such programs feasible in places that lack Brazil’s tradition of a quantitative conservation requirement for every landholder? Certainly the existence of that tradition makes it easier to reach consensus on an initial allocation of permits. But it may also be possible to agree on such a rule in areas where forests have been widely cut despite legal prohibitions; or in forest-rich regions where publicly owned lands are only now coming under development pressure. In any case, the evolution of TDR-like systems in Brazil alone is reason enough for serious policy and research attention to the issue. Refinement of the model presented here – with finer spatial detail on land values, more realistic modeling of ‘business as usual’ land use trends, and ecologically-informed modeling of the vigor of natural regeneration -- could help to inform public discussion and decisions on legal reserve trading and related policies.

VII. References

Bernardes, Aline T. 1999. “Some Mechanisms for Biodiversity Protec-tion in Brazil, with Emphasis on their ApplicaProtec-tion in the State of Minas Gerais”. Paper prepared for the Brazil Global Overlay Project, Develop-ment Research Group, World Bank.

Chomitz, Kenneth M. 2004 “Transferable Development Rights and For-est Protection: An Exploratory Analysis”. International Regional Science Review 27(3):348-373.

Chomitz, Kenneth M.., Keith Alger, Timothy S. Thomas, Heloisa Or-lando, and Paulo Vila Nova. 2005 “Opportunity costs of conservation in a biodiversity hotspot: the case of southern Bahia” Environment and Development Economics10(3): 293-312

Fundacão SOS Mata Atlântica and Instituto Nacional Pequisas de Epaci-ais. 2002. Atlas Dos Remanescentes Florestais Da Mata Atlântica Período 1995-2000. São Paulo: Fundacão SOS Mata Atlântica.

IBGE 1998. Censo Agropecuario: Minas Gerais. Rio de Janeiro: IBGE.

Johnston, R. and Madison, M. “From landmarks to landscapes: A review of current practices in the transfer of development rights”. Journal of the American Planning Association, 63(3): 365-378, 1997.

Myers, Norman, Russell A. Mittermeier, Cristina G. Mittermeier, Gustavo A. B. da Fonseca and Jennifer Kent. 2000. “Biodiversity hotspots for conservation priorities”. Nature 403:853-858.

National Research Council 2001. Compensating for Wetland Losses under the Clean Water Act. Washington DC: National Academy Press.

Pagiola, Stefano, Joshua Bishop, and Natasha Landell-Mills. 2002. Selling Forest Environmental Services: Market-based Mechanisms for Conserva-tion and Development. London: Earthscan.

Soulé, Michael E. and Sanjayan, M. A. 1998. “Conservation Targets: Do They Help?” Science 279: 2060-2061

Whigham, Dennis F. 1998. “Ecological issues related to wetland pres-ervation, restoration, creation, and assessment.” Science of the Total Environment 240, 31-40.