A Work Project, presented as part of the requirements for the Award of a Master Degree in Management from the NOVA – School of Business and Economics.

BUSINESS PLAN

DISRUPTING THE FUNERARY INDUSTRY

CAROLINA FERREIRA FIDALGO MARCELINO | 14665 - 2492 HELDER GAMA MOTA | 20328 - 2520

JESSICA GARIDA SOARES | 14905 - 2493 JOANA BARBOSA TABORDA E SILVA | 24621 - 2591

A Project carried out on the Master in Management Program, under the supervision of: David Bernardo

2 Abstract

Death is the only certainty in life. However, the topic is avoided at all costs until the moment we are directly confronted with it. Instead of easiness in a difficult moment, we are faced with an overly dispersed process of looking for a funeral home that will rush through the funeral’s arrangements, often compromising transparency. Most people are not well-prepared; hence everything needs to be decided immediately.

Ambar aims to digitally disrupt, empower and connect industry players with its clients, enabling the comparison of at- and pre-need funeral services, providing legal counselling and storing key information in a one-stop platform.

3 Content

Abstract ... 2

Content... 3

1. Executive Summary ... 1

1. Methodology and Analysis... 5

2. Opportunity ... 5

3. Industry, Market and Competitors ... 9

Mexico ... 10 Portugal ... 17 Spain ... 23 Market Trends ... 32 Competitors Analysis ... 34 Survey Analysis ... 73 Customer Journey ... 84

4. Proposed Solution: Ambar’s Business Model ... 85

The Platform Proposition ... 85

Immediate Services (B2C) ... 86

Preventive Services (B2C) ... 89

Digital Marketing Services (B2B) ... 98

Content (B2C and B2B) ... 100 7. Development & IT ... 102 8. Operations ... 104 Individual Contribution Carolina Marcelino Joana Barbosa Helder Mota Carolina Marcelino Joana Barbosa Joana Barbosa Carolina Marcelino Joana Barbosa Helder Mota

4

Processes ... 104

Implementation Plan ... 106

9. Sales ... 106

10. Advertising and Promotion ... 109

11. CRM Strategy ... 117

12. Management and Organization ... 118

Key Management ... 118

Location ... 119

Culture and Values ... 120

Organizational Chart ... 121

Number of Employees (Year 1) and Employment Costs ... 121

Roles and Responsibilities for Year 1 ... 122

CEO ... 122 Marketing ... 122 Development ... 124 Financial ... 125 Human Resources ... 127 Operations ... 128

Compensation and Other Employees Agreements ... 129

13. Financials ... 129

14. Offering ... 136

15. Future Developments ... 138

16. Appendix 1 – Industry, Market and Competitors ... 141

17. Appendix 2 – Business Model ... 211

Carolina Marcelino Joana Barbosa Carolina Marcelino Helder Mota Joana Barbosa Helder Mota Jéssica Soares Jéssica Soares Jéssica Soares Jéssica Soares Jéssica Soares Jéssica Soares

5

18. Appendix 3 – Financial plan ... 267

19. Table of Content (Tables) ... 297

20. Table of Contents (Figures) ... 301

1 1. Executive Summary

Losing someone you care about can be one of life’s toughest experiences. Nonetheless, in a moment of grief and vulnerability, funeral homes may take advantage of these circumstances and mislead people with funeral propositions that are not always as informative and price-transparent as they should. There are no easy answers when trying to help a bereaved family come to terms with their loss.

For that reason, there is an urgent need to propose funeral related services that understand and meet customer’s unique and specific needs, simply and transparently. In order to achieve this goal, the team purposes Ambar: an online platform that is dedicated to integrate funeral related services, enabling the comparison of at-need and pre-need funeral services and offerings provided by funeral homes, insurance companies and legal advisors that families and friends are looking for.

The new funeral consumer is now more willing to look for a variety of services and experiences than their parents. In fact, not only they are starting to be responsible for preparing their parents’ funeral, but also acknowledging to plan ahead their own ceremony in order to avoid burdening their loved ones with this matter. On the B2B side, there are funeral homes that would like to have an online presence and benefit from a well-defined marketing communication strategy to better target their audience.

The product offering will, therefore, consist in a comparison and request of funeral services to be delivered in a short-time frame by funeral homes and preventive services, such as funeral plans and funeral insurance, as well as solutions for legal advisor and professional counselling and options to store important information that will be shared with key people. Users will also have a dedicated content platform which aims to clarify frequently asked questions about such a delicate matter, therefore enabling value creation for all members. Additionally, for the B2B´s segment – funeral homes – our platform will provide online presence considering our modern

2 media and web-based marketing skills and advertising solutions to help them engage and educate their audience and increase their market exposure, bearing in mind our expertise on the definition and implementation of effective digital marketing strategies.

Ambar will start operating in Mexico, Portugal and Spain due to the relations the team has with the markets, similarities in language and marketing potential, need for transparency and formality and potential for the implementation and development of our digital business idea. The potential can be reflected in the estimated annual death rates, the funeral industry revenues and number of funeral homes for each country. Mexico totalized 582 million euros and a total number of 4951 funerary homes in 2016, with an annual death rate of 600.000 people; Portugal totalized 184 million euros and a total number of 1061 funerary homes in 2015, with an annual death rate of 100.000 people; Spain totalized 1.082 million euros and a total number of 1800 funerary homes in 2015, with an annual death rate of 420.000 people.

There are some specificities of each market that lead to different competitive landscapes. In Mexico, 40% of the market is leaded by informal funeral homes and Gayosso has about 60% of the total market share. In Portugal, the market is so fragmented that the dominant player – Servilusa – only has 5% of the market, the remaining 95% are distributed amongst small and familiar funerary houses. In Spain, insurance companies dominate 60% the market and about 50% of the industry is vertically integrated. In what concerns preventive services offering (funeral insurance/funeral plans) Spain is the leading country among the considered with a 60% penetration rate, followed by Mexico with 4,8% and Portugal with 0,5% (assuming the rest is made on an immediate service basis).

Additionally, the sample retrieved from the study proves the existence of a market gap for an online platform capable of comparing prices from funeral industry providers.

Despite its fragmentation, the global funeral industry appears to be a perpetually profitable market since dying is an assured happening in any living being’s life. Worldwide and specially

3 in the countries where we plan to initiate our business operations the presence of other digital competitors is not extremely large at the moment, with some players in operation intending to inform, simplify and increase transparency of the funerary industry. Still, there is not a single player that offers a cutting-edge technological solution which purpose is to integrate and create a more meaningful funeral experience for families and less demanding for the funeral industry players, in a time of vulnerability and grief and also able to set new standards for personalization and memorialization in the death care profession.

The advertising and promotion actions will focus on innovative campaigns to attract target customers mostly through online channels due to its lower cost and higher return on investment. The strategy will be focused on online channels such as paid search, email marketing, social media and content marketing. Besides, Ambar’s communication will also pass by a below-the-line strategy closer to relevant events to the funerary industry and by being part of associations related to the topic.

In the first year, our sales development team will have two main challenges: not only attracting the final consumer to get to know Ambar and to consider using it in a moment of need (B2C), but also inciting the funeral homes and insurance companies to join our platform and become suppliers (B2B). In order to succeed, Ambar needs a solid base of suppliers so the users find the platform useful in terms of price comparison.

On the second year, our intentions are to develop strategic partnerships with key players in this industry, increase the geographic expansion within each country and attract loyal customers, using customer retention techniques and customer-strategy communications that will allow us to engage with customers and build better long-term relationships.

In the third year of operations, in order to follow the vision and after securing solid brand awareness and recognition, Ambar could start developing the pet funeral product. In addition to this, we will also start to invest in our online platform both from content and user experience

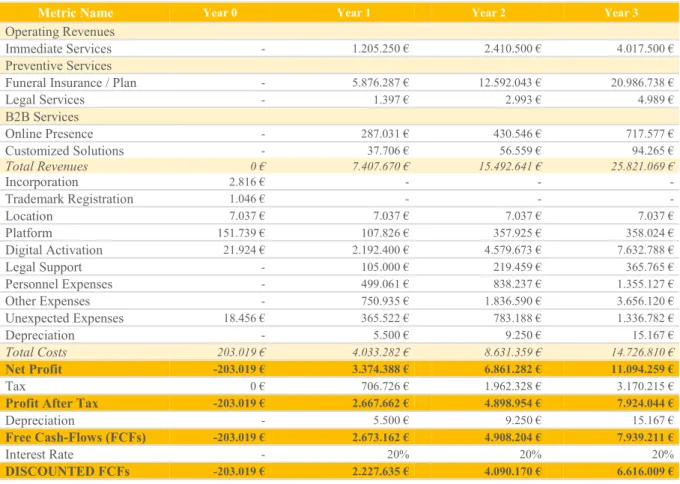

4 perspective, as well as in product development. Moreover, the team will also initiate a well-defined plan for a geographic expansion to other countries such as Brazil, Italy and Sweden. To reach an objective of 25,8 million euros of sales in 2020, the management will propose this project to a selected group of financial investors, through a convertible note of 200,000 euros offering 20% discount in the next investment round. This amount will be fully applied in the development and promotion of the first version of Ambar’s online platform, with 75% invested in the platform and the remaining 25% in the remaining cost items. The initial investment will be recovered in approximately in 1 year and 1 month.

This amount will be fully applied in the development and promotion of the first version of Ambar’s online platform, with 75% invested in the platform and the remaining 25% in the remaining cost items.

The management and the entrepreneur’s team is a crucial factor for determining the successful outcome of the platform. Each one has its own focus and advantages capable of fitting each area of the business. Carolina will be in charge of the operations, Helder is taking the financial and human resources role, Jessica is controlling the sales and marketing team and Joana will be responsible for the platform development.

Regarding the implementation plan and in order to successfully launch the platform, the team will need one month to hire the right people that will kick-off the project. After having a well-defined brand image, a platform mock-up and sales people ready to work, the team can start knocking on funeral home’s doors to present Ambar, while the content of the blog is created and the platform developed. Ambar is intended to be launched at w42 (October) when the minimum viable product (immediate services and digital marketing services) and the test phase are finished. The advertising campaign starts in the same week and continues in an always-on strategy. Finally, long-term developments will be built in order to follow the vision of integrating all pre and post-mortem services in the platform.

5 1. Methodology and Analysis

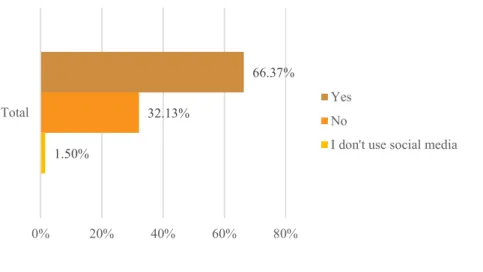

In order to evaluate the potential of this platform, the team started to understand the three markets. There were three interviews: one with Carlos Martins, Sales and Marketing director from Servilusa (market leader in Portugal), another with one manager of Agência Tarzan (traditional funeral home) and one with Carlos Lukac, CEO of Gayosso (market leader in Mexico). A survey was also delivered to a sample of the Portuguese population, with a total of 333 respondents, where the team searched for answers to the products that are to be included on the platform.

Moreover, market research based on articles, official publications from the government, data statistics and Google Trends were crucial to take conclusions and to define the existing and unexplored need and to develop a suitable solution.

We would like to express our gratitude to the mentors António Vieira, partner of JustCRM and currently working for the Abu Dhabi Government, Carla Castro, Head of Digital Channel at Mapfre Seguros and Pedro Trinité, Co-Founder and CEO of ZUVINOVA an IT B2B for their availability and collaboration and mentoring on getting valuable information that contributed to the development and findings of this business plan. Last, but certainly not least, our adviser David Bernardo who shared is market and business entrepreneurial expertise.

2. Opportunity

The Pain

Nowadays, people who are passing through moments of sadness due to the loss of a loved one are pinpointed with funeral propositions that are not always the most transparent. Therefore, traditional funeral homes may take advantage of these emotional periods.

6 The Solution

There is an urgent need for bringing transparency and simplicity to the market. In order to achieve this goal, the team is going to build Ambar: an online platform that enables comparison of at-need and pre-need funeral services and contact with the players of the industry to make the desired arrangement. These include funeral homes comparison for immediate and preventive funeral plans and funeral insurance comparison. In addition to these core products, users will be able to find legal advisors and services that aim to gather life information to be delivered to key people after dying, as well as planning for what users have not done yet. Users will also have a dedicated content platform which aims to clarify goal is to clarify frequently asked questions about such a delicate matter, therefore enabling value creation for all members and empowering consumers with information and transparency.

Digital marketing services and online strategy to funeral homes will be also provided and will work as a source of revenue.

As for the target markets, the platform will be launched in Portugal, Mexico and Spain.

The elected brand name to the platform is Ambar. Considered to be one of the oldest treasures of the world, its colour transmits warmness and it is associated to the preservation of time (Crystal Vaults s.d.). This corresponds to the message that the platform wants to pass to its clients: to help perpetuating their loved ones’ memories.

Existing Market

In the world, there are about 250 births and 100 deaths every minute (World Births and Deaths, Simulated in Real-Time 2017). This population growth will ultimately mean a higher number of deaths to be serviced. The growth in migration and an aging population are demographic factors that fuel this industry.

Despite its fragmentation, with many players tending to be small, family-runned and local businesses, the global funeral industry shows to be a perpetually sustainable market in terms of

7 profitability, since dying is a certain happening in life. On one hand, immediate funeral services are currently dominating the market – called when a person dies. On the other hand, preventive funeral services, usually priced at 20% less the normal service price, are slowly but surely penetrating worldwide markets, with some showing higher maturity than others.

In Mexico, Portugal and Spain, funerals have, traditionally, a major religious influence: Roman-Catholic ceremonies typically involve a viewing or a wake before the funeral service, the funeral service itself, which can take place in a chapel, at home or near the grave, with or without music, a procession to the cemetery and the burial of the body, and may include a reception before and/or after the service at the family’s home, often accompanied with food. Cremation of the deceased is increasingly becoming common, since the acceptance of the practice in the 60s by the Vatican (Connolly 2016) and the percentage tends to be higher in the city centres.

Looking at this from a digital perspective, in the funeral industry there are several online players which aim to use purpose is to use technology to invigorate an ancient industry in order to inform, simplify and bring a higher degree of transparency, by making it easier to compare products, and creating a demand for new services not provided by traditional funeral homes. From the digital competitors analysed and from the needs the market demands or has not yet acknowledged, the team believes that there is an opportunity for a wide-comprehensive collaborative, centralized online platform that combines funeral services and solutions to support users and respective families and friends in difficult circumstances, which come from the death of a loved one.

Value Proposition

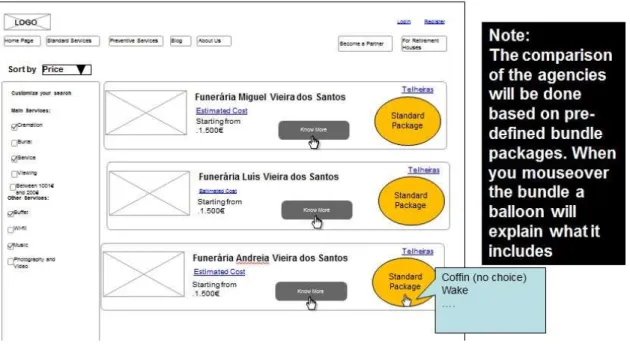

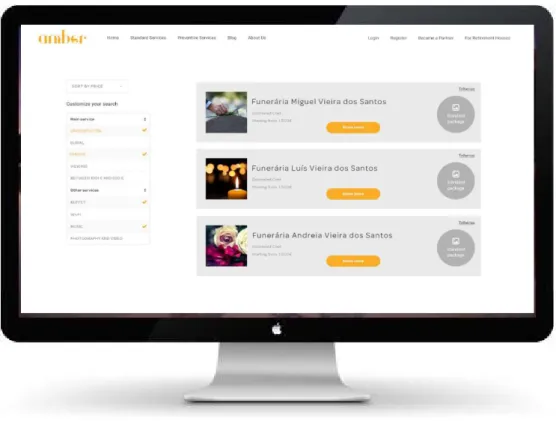

By entering in the website, immediate services users will be able to choose and compare, according to the user location, the funeral home that best fits the user’s interests, according to bundles of services each one can offer. The user will find for immediate services:

8 Promptness since only 3 steps are needed to send a quote to the funeral homes and they are expected to contact the client in the shortest period of time;

Trusted agents capable of delivering a tribute with professionalism and respect – funeral home reviews by past users;

Price transparency for each bundle of services presented to the user, funeral homes are recommended to offer a minimum service level and they will compete on the prices presented for that bundle.

In terms of Preventive services users will be able to:

Take care of the entire process on a single platform – from comparing a preferred end-of-life product, to arranging legal counselling appointments and concentrate important information about themselves;

Help family and friends with the burden of organizing end-of-life arrangements by enabling the comparison between bundle of services according to the preferred instalments process; Be informed – as Ambar enables the acknowledgement of the advantages and benefits of planning their own funeral/end of life and a higher bargaining power over the offered products; Last but not least, by offering digital marketing and online strategy, clients will have the chance of:

Getting higher visibility of their name and products, selling and stimulating their product more efficiently, reduce costs with the acquisition of new clients and getting a personalized product according to the maturity level of the funeral home digital presence and budget.

9 3. Industry, Market and Competitors

Table 1 – Summary of Market Analysis

# Deaths per Year

# Funeral

Homes Opportunities Threats

Avg. Funeral Cost Prevention Services Penetratio n Rate Industry Revenue (yearly) Portugal 100.000 1.061 Preventive services are almost inexistent Traditional mindset 1.000€ 0,5% 184M€ Spain 420.000 1.800 Evolved mindset (people do not avoid the

topic) Preventive service market has reached maturity 2.500€ 60% 1082M€

Mexico 600.000 4.951 Huge market to

be explored

Informal funeral

homes

600€ 4,8% 582M€

Mexico, Portugal and Spain are the three markets chosen due to personal connections, need for transparency, formality and the team believes that each one has a sustainable potential for the implementation and development of our business digital idea. 600,000, 100,000 and 420,000 are, respectively, the estimated number of annual deaths.Regarding funeral industry revenues, Mexico totalizes 582 million euros (2016), Portugal 184 million euros (2015) and Spain 1082 million euros (2015) approximately.

The number of funeral homes per country is surprising when you compare it to the number of deaths per year. In Mexico, there are approximately 4951 funerary houses (2016), in Portugal this number reduces to1061 (2015) and in Spain to 1800 (2015). In what concerns to preventive services (funeral insurance / funeral plans) Spain is in the edge of the curve with 60% penetration rate, followed by Mexico with 4,8% and Portugal with 0,5% (assuming the rest is made on an immediate service basis).

In Mexico, 40% of the market is leaded by informal funeral homes (Stephens 2016) and Gayosso has about 60% of the total market share (provided in an interview with Carlos Lukac). In Portugal, most of the business is made on a word-of-mouth basis, and albeit illegally, there are hospitals that recommend, this or that funeral home in exchange for a commission. Servilusa is the biggest player with 5% of the market.

10 In Spain, insurance companies dominate 60% the market and about 50% of the industry is vertically integrated. Funespanha is the biggest player followed by Memora (the owner of Servilusa).

Mexico

Size and Growth

Estimates say that funeral services in Mexico in 2016 had reached 12 thousand million pesos, the equivalent to 582 million euros at today’s rate (Stephens 2016). This includes the volume generated also by the informal companies which operate in this industry, estimated to be 40% of the market (Stephens 2016). By informal it is meant that there are facilities without conditions, without invoicing the service or making a contract with clients or even ones that reuse coffins. The market is composed by 4951 funeral homes (Flores 2016) and 150 coffins factories (Castillo 2016) (Figure 28).

Examples of players on immediate services are: Gayosso (1875) with 60% of the market and placed in 8th place in profitability in world (retrieved from interview with Carlos Lukac), J.

García López (1981) with about 7% of the market (Stephens 2016), Perches (1958), Jardin Guadalupano, SanMartin; Anemex, Jardines del Recuerdo; Moreh, Funeza, Funerales Hernández, Protecto Deco, Funerales Galia.

To name some funeral homes with prevention funeral plans, the following can be pointed out: J. García López (1981), Gayosso (1875) and Funerales Galia.

Market Trends (Existing and Potential)

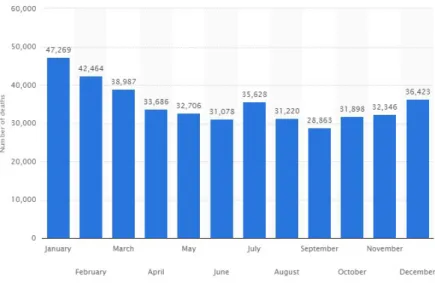

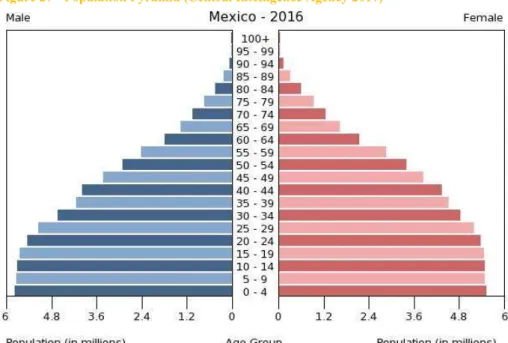

The 127 million Mexicans (The World Bank Group 2015) are, in demographic terms, relatively young. The expansive pyramid (

11 Figure 27) typically represents a country in development, translating a high birth rate, therefore meaning that it is growing and, at the same time, having a low life expectancy (Boucher 2016). The older population, which is almost 7% (Central Intelligence Agency 2017), is expected to grow up to 28% in 40 years (Muciño 2013). Life expectancy at birth is now at 75.9 years (Central Intelligence Agency 2017).

Annually, about 600.000 people die (Ramírez 2017) and 33.000 was the number of deaths in 2015, due to Mexico’s internal drug war (Clavel 2016). It is one of the most dangerous countries in Latin America, behind Venezuela (Clavel 2016) and violence is on the top 5 causes of death (WHO 2014). In terms of religion, more than eighty percent of the population is Roman Catholic (Central Intelligence Agency 2017).

According to data provided by the World Bank, 57.4% of Mexican population are internet users (The World Bank 2015). Additionally, according to an ATKearney study, Mexican e-commerce business has growing potential mainly due to its connected younger generation, surprisingly positioning itself ahead of Spain. The main purpose for online spenders in Mexico, besides finding good deals, is to collect information (ATKearney 2015).

Culturally, el Dia de los Muertos, a mixture of indigenous traditions and Christian All Souls Day and All Saints Day, is celebrated from October 31st to November 2nd. It is inscribed in the

list of Intangible Cultural Heritage of UNESCO since 2008 (UNESCO s.d.). The belief around this tradition is that spirits are allowed to visit the living on the 31st and leave on the 2nd (AJ+

2015). In children’s’ eyes it can be seen as a party, but it is a way of celebrating life, honouring and remembering the deceased (Google México 2016). Altars are made in families’ homes with water, candles, bread of dead (pan de muerto), death items (sugar skulls) and marigolds (The List Show TV 2015), graves are decorated and the deceased’s favourite food is eaten around the grave with the family of the deceased (UNESCO s.d.). The two states where the celebration

12 of this event has the biggest expression are Guerrero and Oaxaca (Educational Videos For Students 2014).

The CEO of Gayosso, Carlos Lukac, disclosed in the interview the team had that the funeral industry can be compared with, at least, two industries. On the one hand, immediate or at-need services (push business) can be seen as a hospitality business, where there are three key success factors that sustain a unique competitive advantage for any funeral services provider: firstly, 24-hour customer service is the core element of the relationship with the customer; then, capacity utilization ensures the number of available spots and the average ticket price is the third element, as being the estimated average selling price for funeral services. On the other hand, pre-need or preventive services (pull business) can be seen as a real estate business since bodies are kept in mausoleums, which are built in strategic locations, therefore costing a certain price per square meter (space where coffins or ashes are put into). Finally, the price that composes a certain funeral service varies according to the service requested: since it is a very personalized service, it can range from 9,000 pesos to 300,000 pesos or more, being the average ticket price of that company 50,000 pesos per service.

The average cost of a funeral ranges between 7,500 pesos and 180,000 pesos (Bezanilla 2015), the equivalent to 357€ and 8.589€, which is quite high when compared to the average salary of 4,955 pesos (Trading Economics 2017). However, the IMSS (Mexican Social Services Institute) provides low-cost services capable of addressing this issue. What is more, poor families can get subsidies provided by IMSS, which is the equivalent to two months of minimum wage. In order to receive it, the person must have contributed for the Social Security at least 12 weeks in the previous 9 months before death (Instituto Mexicano del Seguro Social n.d.). For low-income families, Centros de Servicios y Atención Ciudadana is available to fund their funeral services (Izquierdo 2012).

13 Cremation is already present for 4/5 of the population of Mexico City. The low price and lack of space available in bigger cities, as well as the approval for cremation in the 70’s, aligned with the Pope prohibition of keeping ashes at home have been reasons for requesting this service (Ramírez 2017). The Church also prohibits the act of transforming ashes into memorial objects (Juana 2016).

Pre-need services were introduced by Gayosso in 1975 (interview) and nowadays no more than 4% have any kind of plan or insurance covering those costs (Mora 2016). Again, in the interview with Carlos Lukac, if immediate services cost 100 euros, planned services cost 20% less. It is believed, however, that these services may be acquired by 38% of the population (Muciño 2013). In 2016, the demand increased by 20% (Ramírez 2017).

One of the tendencies within the industry is the full services integration in one place (one stop shopping approach), rather than having separate companies for selling cemetery space, coffins or provide funeral services (Muciño 2013). In fact, Gayosso integrates not only wake rooms, but also about 100,000 nichos (Figure 29) in its catalogue.

According to Gayosso’s CEO, the second (macro and long-term) trend is for the market to transition from a typical B2C market to B2B. In the future, the Mexican market will be vertically integrated (insurance companies will own funeral homes like it is already happening in Spain).

In order to avoid informality of the industry, funerals are tax deductible (Muciño 2013). In 2007, a group of rules was set so as to regulate the funeral services practices: NOM-036-SCFI-2007. The Security and Social Services Institute of State workers defined the rules for the procedures to be taken in their funeral services: Reglamento de Servicios Funerarios Del Instituto de Seguridad Y Servicios Sociales de Los Trabajadores Del Estado (2014).

14 The website abogacia.mx provides legal services to users and it is a bridge between users and lawyers. As far as the will service is concerned, anyone that is legally of age (18 years old or 14 if emancipated) is able to grant a will.

As far as funeral events are concerned, Expo Funerario Mexico is one of the most important fairs for players in the industry.

Profitability (Porter 5 Forces) Concerning Porter’s 5 forces (

15 Figure 26), the threat of new entrants may have a high influence on the market. In fact, not only activity licences are easy to get (Flores 2016), but also the demand of funeral plans is expected to increase, hence calling new companies into the market. The need for regulation and inspection could possibly turn in one of two things: either informal companies get out of the market or they turn into formal companies.

Secondly, concerning the bargaining power of suppliers (suppliers of funeral homes), the factors that can influence the medium intensity of this power are related with the concentration of suppliers, which is high given the number of coffin factories; the risk of forward integration, that is higher in insurance companies than in coffin’s factories due to the fact of the former being constantly in touch with clients, therefore understanding their needs.

Thirdly, the bargaining power of buyers in terms of concentration is low since funeral homes sell on a highly fragmented B2C basis. Switching costs depend on the product chosen by the client: in a last-minute funeral, due to the urgency of the need, the client does not have much time to look after the perfect service proposal, therefore compromising the chance of getting a better opportunity (price and quality). If the client is entitled to a funeral plan or funeral insurance, there is always a chance for changing the product. The degree of education on the product has to be taken into account, since the bargaining power increases with the degree of awareness about the product. All of these factors turn into a low bargaining power of buyers. Moreover, the threat of substitutes is low: funeral homes offer different kinds of options but all of them lead to the same end.

Lastly, competitive rivalry may be analysed by the number of competitors in the market, that is high, the number of differentiated products, high as well; customer’s switching costs depend on the product chosen: either immediate or preventive; the exit barriers and fixed costs depends on the size of the business: the bigger, the greater are exit barriers (real estate acquired, number of employees, etc., all have influence). Therefore, this has a medium impact.

16 SWOT Analysis

As far as the SWOT analysis is concerned (Table 54), on an internal level, the key strengths of the industry rely on the variety of the services offered by a funeral home: from immediate services to funeral plans, for every pocket. Secondly, the industry is becoming more and more digital: at least the biggest players are starting to show which services and catalogue they have, (see J. Garcia Lopez website), with innovation on the services, as well, acknowledging that it is important to have an online presence to become more visible, therefore increasing transparency of the market. On the weaknesses side, however, informal funeral homes are still a constant and the need for inspection is urgent, especially due to public health concerns. Concerning the opportunities, the awareness in planning a funeral is increasing and has opportunity for growth not only given the price (20% lower, on average, than immediate services), but also the market that is not yet conquered by these services. Another opportunity stays within the informal funeral homes that can turn into formal ones. In fact, access to licensing funeral homes should, and are, actually, easy to get (Flores 2016). Finally, violence and insecurity in some regions mainly due to organized crime are the biggest threats in Mexico. Key Issues to be Disrupted

Transparency in the market urges to occur: informality and immediate services compromise the consumer in not having the best service and deals.

Planned services are in the growth stage: Awareness in having a pre-need service is increasing and there is the estimation that sales will intensify in the following years.

Market Specifics

Culturally speaking, the Mexicans have the most interesting death approach. Once poet Octavio Paz wrote "The Mexican... frequents it ... caresses it, sleeps with it, celebrates it... he confronts it face to face with patience, disdain or irony." (Paz 1994). In Dia de los Muertos families eat

17 beside the grave and dress costumes to celebrate the lives of the deceased. It is also a way to reflect on life (Google México 2016). As a result, death is not an issue since Mexicans are used to talk about and celebrate it.

Although only 4% of Mexicans own any kind of preventive service, in terms of funeral insurance (Mora 2016), Mexico is the country that is expected to have more companies in the market in 2017, about 18, when compared to Portugal or Spain (Table 64) (Barnes Reports © 2015). In order to increase the usage of these kinds of products, the consumer needs to be made aware and educated about the importance of having it (see Erro! A origem da referência não foi encontrada.).

Many funeral homes have already an online digital presence. The challenge here is to convince companies in using the platform. As a result, the strategy for communicating to the funeral homes that have already an online presence should be focused on the advantage of optimizing their offering.

Portugal

Size and Growth

According to Banco de Portugal (2015) estimates, funeral services in Portugal reached revenues of 184 million euros. The market is composed by 1.061 funeral homes (see Table 42), of which 66% are family business with only one funeral home (average of 4 employees per company). Companies that have more than 1 funeral home only have 34% of the market, with an average of 7 employees per company (Table 42).

85% of companies own 1 funeral home, 13% own 2 funeral homes, 3,5% own between 3 and 5 and only one company owns more than 25 funeral homes (we can conclude it is Servilusa, a company funded by Mémora, a Spanish company) (Table 43).

By analysing the distribution of total number of funeral homes in Portugal, it is possible to see that the districts of Lisboa (15,6%) and Porto (14,1%) are on 1st and 2nd place, followed

18 by Setúbal (6,9%) and Aveiro (6,8%) - see Table 44. The highest number of family businesses (with only one funeral home) are located in Oporto (11%) followed by Lisbon (10%) and Braga (8%). In Lisbon, family businesses correspond to 24% of the market, in Oporto to 67% and in Braga 86% (see Table 44).

The further we move away from the large centres the highest is the presence of these small businesses (makes sense, big corporations profit more from cities where the purchasing power is higher and consequentially the average amount spent on a funeral will be higher).

Regarding the differences between the service provided by large companies and the familiar ones, Servilusa claims to have specialized teams for each function. For example, the person who contacts the family and takes care of the funeral arrangements’ is not the same that takes care of the logistics or picks up the deceased relative. Since the other funeral homes are normally familiar businesses, the person who picks up the phone is the same that prepares the death body and arranges everything with the family.

According to Pordata, an average of 100,000 people die per year (Table 45) and the life expectancy is 79,3 years (Central Intelligence Agency 2016).

While interviewing the Sales & Marketing Director of Servilusa, Carlos Martins, he told us that Servilusa’s market share is around 5% which means that all the other players (there are 1061 funeral homes just in Portugal) have percentages around 0,5%. It is a very fragmented market where some of the funeral homes do not do a funeral per month (especially outside of the urban centres).

Market Trends (Existing and Potential)

While understanding the factors that drive the choice for a funeral home, we found that proximity and recommendation of family/friends are the main influencers (Table 49 and Figure 141). Carlos Martins confirmed that most people know the company because is the

19 largest player in the market and also due to their investment in advertising. He also mentioned that most part of their leads arrives through recommendations.

According to ANEL’s president (National association of mourning companies) the cremation industry is increasing exponentially as well as private ceremonies (more private and intimate). Portugal is still far away from the USA in this matter; where funerals are organized for 8 days after the death date with catering and personalized invitation. However, in Portugal we continue to organize funerals 24 hours after death, attended by many people (even if they are not intimate). According to an article from Público, cremation represents about 6% of the total funeral services (though in Lisbon it’s already 53%, more than the traditional burials) (Lusa 2016). In other European countries, such as Sweden, England or Denmark, cremation already accounts for 70 to 80% of funeral services

The Portuguese consumer is very traditional; they are tight to the catholic funeral even if the family/deceased was not a follower (the funeral “should” have a priest, a chapel, etc.). All the mortuary chapels are close to a church, having a space where the body normally stays for one day. These chapels are usually very cold and lack of decoration (normally only a cross and an altar). Nowadays, Tanatorios start to be a small reality but we still have a long way to go. Another characteristic of the Portuguese market is the dislike of preventive services. Since we are a traditional and superstitious people nobody wants to talk about death. Most part of people takes care of funerals for relatives and do not want to think about their own.

A good example was the advertising campaign launched in 2014 by Fidelidade, “Funeral Protection Insurance plan”. The reaction from media and consumers was negative: classifying it as bad tone, trying to take advantage of people, etc. and it was more a question of positioning for the brand disregarding sales.

By law every funeral home must have a social funeral available for anyone that cannot afford to pay one (379,12€). Also, the state provides a fixed subsidy to cover funeral expenses in the

20 value of 214,93€ (Diário da República 2017) in a maximum refund of three times this value (1.263,96€). Official sources in this matter such as AAFP (Associação de Agentes Funerários de Portugal) leaves some advices to consumers to avoid schemes and lack of transparency: 1) Demand for a detailed budget of the service (not only the final price), 2) Before saying yes ask for the product catalogue with the price discrimination and characteristics and 3) Choose your funeral home yourself; do not let anyone decide on your behalf (Diário da República 2010) (there are rumours of some schemas from hospitals/retirement houses which call a specific company and benefit from this).

In 2016, Congress Center had an exhibition called Expo Funerária with content related to this topic (the entrance was free of charge). Another interesting fact about this industry is the increase of the “Cemetery Tourism” (an organized tour to visit graves of famous people). Despite being a traditional market, internet penetration rate is about 69% (World Bank 2017) and the number of searches for keywords such as “funeral home” is increasing. (Figure 18). Regarding geographical analysis, Beja has more queries on these topics compared to the other districts. The query “cremation” has more impressions on urban centres, corroborating what Carlos Martins mentioned during the interview (Table 50 and Table 51).

Carlos Martins also told us that competition on paid search is getting stronger and all players are bidding in the same keywords (especially in the market leader Servilusa). People are searching on google for what they need, click on the ad and then call to the number available on the website. Even though people search online, Carlos thinks that in Portugal the contact by phone/in person is essential and consumers value that (he mentioned that doing everything on their website would not work in his opinion). The copies of the ads used on Paid Search of some of the funeral homes are highly related to price (ex.: LOW COST funeral from xxx€, 24h services, quality at a low cost, etc. (Table 52).

21 Profitability (Porter 5 Forces)

Regarding the five forces framework by Porter (Table 47) we analysed the entrance of new potential competitors. Since it is a market that drives people away (people are afraid to talk about death) and features challenging logistics, entrance is not easy.

There is only one large corporation (Servilusa) and the others are familiar businesses that pass from generation to generation. We consider as suppliers cemeteries, crematories, coffins and urns providers, and florists. Regarding florists and coffin/urns providers bargaining power is low, but in what concerns of cemeteries and crematories it is medium. The limited amount of such facilities can cause price increases. Since it is such a specific market where communication is almost inexistent and the choice is made through recommendation there is not much rivalry between the funeral homes. Clients choose the provider due to proximity or recommendation. The buyer bargaining power is very low. The client is in a very delicate and fragile position Without the goal of arguing prices and lacking the time to consider the options for too long. The client accepts what is offered without questioning. With digital and comparison sites these scenarios can change. There is no threat of substitutes because people must have a funeral/cremation. Regarding the profitability of the market, the Portuguese average is 20% (Banco de Portugal 2016).

SWOT Analysis

Performing a SWOT analysis for the Portuguese market (Table 46) we understood that the market is very fragmented (more than 1500 funeral homes in a small country like Portugal) an, as such, the market shares are very small. On the one hand, there is no influence in demand of the market (100.000 people die per year and except for extraordinary circumstances, the market size should be relatively fixed). On the other hand, this is a market with good margins and where people avoid entering or thinking about, so the probability of new entries is low. A good opportunity for this industry is the growth of digital and social

22 media completely ignored in this area until now. Another trend could be the incorporation of personalization and internet of things in this business. Moreover, Portugal is far below other countries in what concerns to preventive services (funeral insurance or plan). This digital trend, on the other hand, can decrease the margins of the business because of its transparency. Key Issues to be Disrupted

Transparency in the market urges to occur: people feel that the prices presented by the funeral homes are not transparent. They pay without questioning due to the fragility of the moment.

Preventive services need to be considered: talking about death is a taboo in Portugal. Nobody wants to think or talk about this topic. Educating the population towards insurance/funeral plans could bring a new perspective into this market.

Market Specifics

As aforementioned, Portugal is a very traditional country where people are afraid to talk about death and everything related to this subject. In order to change this mentality, the communication of Preventive Services should be focused on educating consumers towards the need of having this kind of services. Maybe we could do a partnership with some funeral homes and together launch an institutional campaign talking about this topic. Regarding the Immediate Services, we think the approach is to show the advantages of our platform. Young Portuguese people are proficient in using digital, but the same is not true when considering older and middle age people, more so when we are talking about such a delicate subject as death. In order to make people start using our platform we need to make them understand the benefits of comparing all features in making a better choice. On the B2B services the market is also behind other markets and there’s a need of educating the funeral homes towards the importance of building an online presence.

23 Spain

Size and Growth

24 Figure 19), Spain is a very attractive market. The last available data reveals that 422,568 deaths occurred in 2015 (Figure 20). According to EL PAÍS (Casas 2017), there are 1,800 funeral homes in the country, and this market represents a total amount of 1.082.825.179€ (2015) in revenues, although the eight largest firms control 20% of the sector (

25 Figure 21).

In practical terms, this means that around 60% of burials are now managed by insurance companies, therefore increasing the bargaining power of the insurance companies in relation to the funeral homes. The links between insurance companies and funeral homes are now limiting competition in the sector, with three companies, Ocaso, Santa Lucía, and Mapfre, controlling around 73% of the funeral business in Spain.

The big three insurance companies have bought dozens of small funeral companies over recent years, giving them a leading role in the funeral sector. Although insurance companies are not allowed to perform any activity different from the insurance activity, the lack of regulation in relation to the terms of the funeral insurance that can be provided is allowing them to initiate a process of vertical integration.

Market Trends (Existing and Potential)

It is estimated that a family will demand this type of services just one time at each period of 12-15 years (Gobierno de España 2010). An interesting aspect is that, in Spain, it is the norm to plan ahead for your funeral. It is all part of making things easier for the family and loved ones (MurciaToday 2016).

Funeral costs have increased in last years, and now the average estimated price rounding the 3,500€. In consequence of the sophistication of the industry, it is expected a decline in the costs with the casket in favour of other funeral accessories.

Spain is a very peculiar market, because more than 60% of the population has some kind of funeral insurance, a considerable value if compared with United States (7%) or the European average (20%) (Alcaide Casado 2009).

Under the Spanish law, when someone dies the police must be called and a doctor contacted. The doctor will issue a temporary certificate – after which the doctor or the police will contact a local funeral director (or tanatorio) to attend to the deceased. The funeral director will ask for

26 a ‘release form’ to be signed and in many cases this form turns out to be part of a service contract, one that does not disclose prices until after all the arrangements have been made. This contract with the funeral director also often takes away any control over the funeral arrangements (for instance, the control over the location of the funeral).

Additionally, Spanish law dictates that Spanish nationals must be interred within 72 hours and autopsies are only carried out in extreme circumstances. This speed of the process also makes more advantageous to plan ahead the funeral, in order to avoid any undesired ‘surprises’ for the family.

Given that seguros de decesos (funeral insurance) are so common in Spain, the queries for keywords such as “decesos” are high and following a positive growth trend (

27 Figure 23). It must be referred that the three biggest insurance companies at this field (Santa Lucia, Ocaso, Mapfre) in Spain appear at the top of searches related to funeral insurance (Figure 24).

The funeral insurance offered to families is essentially insurance for the provision of the services, so the only contractual obligation for the insurance companies is to ensure that these services are provided, not being required to provide any monetary compensation to families if some of the following situations happen:

Existence of more than one funeral insurance for the same deceased;

Realization of the funeral services without the prior knowledge of the insurance company; Realization of the funeral services not knowing that the deceased had contracted a funeral

insurance;

Use of funeral homes different from the one made available by the insurer.

Indeed, it is not clearly stated in law that families of the beneficiary of a funeral insurance have freedom of choice in relation to the chosen funeral home. There are several cases of insurers that have used this argument (the utilization of a different provider of the services from the one indicated by them) as an argument for not following the contractual provisions.

The fact that the insurer will manage and pay all the funeral services provided can be a disincentive to opt for a funeral home different from the one offered by the insurer, as families would incur in considerable additional costs, that would need to be paid in a short period of time.

The funeral industry in Spain faced a liberalization process in 1996, however there are still some legal barriers and restrictions to the entrance and provision of funeral services, as there are a lot of authorizations and requirements that need to be met in order to be allowed to provide funeral services in the country.

28 Another problem in this market (and as stated before) is the lack of transparency. The asymmetric information that is produced by the market can lead to situations where the clients cannot effectively exercise their right to freely choose the funeral home, and/or situations where they unintentionally contract more services than the necessary.

These problems of information are also present in the market of funeral insurance, given that the lack of any legislation governing this specific type of insurance allows insurance companies to define the funeral homes that provide the services to their clients, affecting their clients’ freedom of choice and reducing the competition in the funeral industry.

In Law 25/2009, of December, 22, it was defined that the Spanish government would prepare a report and analyse what legislative changes should be made in order to ensure the free choice of the providers of funeral services, including the cases where funeral insurance is contracted, and to promote the reduction of other barriers that derivate from the existing law.

This report about the Funeral services in Spain was prepared by the Spanish Ministries of Economy and Health and made public in June 28, 2010. After that, the government of José Luis Rodríguez Zapatero – from Spanish Socialist Workers' Party (PSOE) - was preparing draft legislation aimed, among other things, at obliging insurance companies to offer clients greater choice when deciding on burial and funeral arrangements. The legislation was approved in June 2011, but was stalled by a change of government in November of that year.

Since then the People's Party (PP) is the governing party and no other changes in the legislation regulating the industry were debated.

This being said, the funeral industry structure and the existent funeral process show a clear influence of the laws governing all the services related to death.

Relatively to social preferences, the funeral rites have evolved, now integrating a higher diversity related to:

29 The dislocation of the wake from the family’s house to professional facilities – the tanatorios (indeed now Spain has a tanatorio’s culture higher than any country in Europe); An increasing cremation trend (20%), aligned with the Anglo-Saxon countries, in detriment

of countries mainly influenced by the Catholic religion.

At the moment, the market faces an internal competition between funeral homes trying to show that each one of them is the most innovative in the funeral market.

However, the technological innovation that can be more disruptive is clearly platforms of price comparison between funeral homes, given that the lack of price transparency is the main driver of the huge margins existent in the market.

With a biannual frequency, the city of Valencia has the Funesmostra – International Exposition of Funeral Products and Services. The 14th edition is happening in 2017, and various segments

and products of this industry are present there (Figure 22). Profitability (Porter 5 Forces)

Regarding the five forces framework by Porter (Figure 25), the team performed an analysis of the entrance of new potential competitors. Although being a market with good margins, it is not easy to start providing funeral services in Spain, given all the amount of regulations and authorizations required. Relatively to the suppliers’ group crematories, cemeteries, coffins, urns, and florists can be included. As all these supplies are essential to the realization of a funeral/cremation, funeral homes lose some of their bargaining power to the suppliers. Since it is such a specific market where the biggest insurers of funeral insurance dominate more than a half of the funeral industry, there is an increasing rivalry between the funeral homes trying to obtain market share in the remaining part of the market (not dominated by the insurance companies). The buyer power is medium: (i) If without a funeral plan/insurance – the client is in a very delicate and fragile position without aim to argue values or prices as well as with little time to think and decide on the process. (S)he accepts what is offered without questioning. (ii)

30 In Spain is very common to start planning ahead the funeral, so the buyer has more time to search the best plans and to negotiate them. There is no threat of substitutes because a decent funeral/cremation is the common tribute to the deceased people.

SWOT Analysis

31 Table 53) we understood that the market is composed by many funeral homes, even though people are really engaged with the main funeral homes (the biggest eight have an aggregated weight of 20%). Clearly a strength of this market (for instance, comparing with the Portuguese market) is that Spanish people do not see death and funeral planning as taboo topics and they are more aware of preventive services. A good opportunity for this industry is the willingness of the funeral homes (mainly small companies that have a really small market share, obtaining profits lower than the expected given the overall market dimension) to adhere to any kind of innovation that could improve their visibility at the market, as innovation is being used by them as a component of marketing strategy, too. However, any potential disruptive initiative that increases transparency and that deteriorates the margins of the industry (due to price competition) will face the opposition of the big insurance companies.

Key Issues to be Disrupted

Big insurance companies dominate the market: small insurance companies and all funeral homes not associated to the three big insurers have incentives to present their services in a digital platform, where they could compete side-by-side with the big suppliers of funeral insurance.

Spanish people look actively for funeral plans: this cultural behaviour is an additional incentive to create a digital platform to which all the online searches related to funeral plans could be canalized.

Increasing of prices favours comparison websites towards transparency: this trend is increasing the willingness of people to look for the best prices.

Market Specifics

As it was described at the Spanish funeral industry analysis, it is the norm in Spain to plan ahead for your funeral (more than 60% of the population has some kind of funeral insurance).

32 This fact must be worth of great attention because it means that there are strong links between insurance companies and funeral homes that are, therefore, limiting competition on the funeral market.

The maintenance of the lack of laws regulating the funeral insurance and also the existence of no rules limiting the “informal” vertical integration between these two sectors (and no expectations relatively to future changes in the laws) naturally implies that our communication focus should be primarily oriented towards the preventive services and, secondly, to the immediate services, in order to be aligned with the market demand. The segment of the funeral insurance expects to generate a total sales volume of 5.1 million euros in 2017 (Table 63). Spain has a lot of funeral homes operating there. However, despite being a country with a high level of purchases made online [67% of Spanish internet users shop online (Ecommerce News Europe n.d.)], the funeral industry has not a strong online presence. Consequently, our communication strategy for Spanish business clients must be focused on the advantages of being online, on the optimization of their online presence and offering (when already having an online presence), and on value added services, in order to engage firms and potentiate our B2B segment.

Market Trends

The following points express some of the trends of the funeral industry:

Personalization - People want to make the funeral service something meaningful and unique. Personalization is increasing in every market but in the funeral industry it means to have a ceremony that reflects mainly hobbies, passions and interests of the person who passed away. Preventive Services - Nobody wants to think about death and funerals but eventually we all have to. Planning a funeral allows the individual to choose things in their own way and avoid family to be preoccupied with it. A great advantage of these preventive services is the financial part, since preparing the funeral will alleviate the monetary burden for the family.

33 Vertical Integration - according to Gayosso’s CEO, the tendency is to insurance companies acquire funeral homes, and these acquire cemeteries, and so on, as it is what is happening in Spain.

Cremation - The choice for cremation is increasing. Besides the lack of space in cemeteries, people think that cremation is less painful than traditional burial (the overall process of the coffin going into the ground, and the first earth shovel falling into the coffin). What is more, the possibility to spread the ashes in meaningful places creates a unique and more personal moment.

Funerals at Home - Experts advocate that this type of funeral helps the family to process their grief. Also, it cuts down many of the funeral costs, which could be an incentive for families using the platform. Comparing to the home birth, people say that these strong experiences should be lived at a private and intimate place with the closest relatives.

Technology - Internet is being spread over all industries and funeral homes are not an exception. They have started to develop their own websites and investing in digital advertising (paid search mostly). Some of these websites contain not only the contacts, but also testimonials, inventory, prices, etc. Other trend is the possibility to broadcast the funeral to the relatives that are abroad and could not attend the ceremony.

Green Funerals - The green movement has increased in the past years and will continue to grow. In this area, being green means choosing environmental and eco-friendly products and services. Some examples of green funerals can be plant a tree from ashes, biodegradable clothes for the dead or even the catering and the flowers used on the ceremony.

Innovation - Some of the initiatives include, personalized urns, send ashes to the space or ocean, transform the deceased’s ashes into diamonds which can be incorporated in a ring or collar, to conserve the DNA of the deceased, send condolences services through the Web, ceremonies with music, preparation of life’s digital histories with the photos of the deceased.

34 Competitors Analysis

Within the digital funeral platforms currently operating, several brands (not all but some) were identified and segmented according to their offerings and business purpose: to service immediate needs, preventive needs or/and B2B needs.

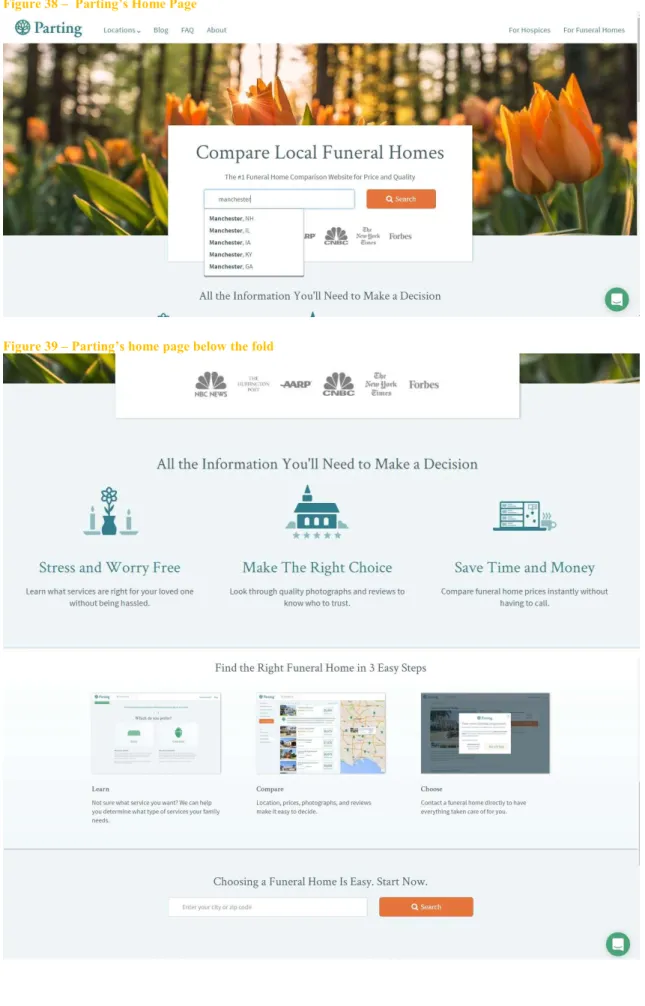

Até Sempre – it allows users to make tributes to departed people, check information about a funeral’s schedule date and also order flowers and tribute books, among other things; Parting – it is a directory that allows users to view articles, photos, reviews and prices of

funeral homes and mortuaries without any additional cost;

JoinCake – it offers planning services to help users making decisions for all aspects of their end-of-life plans, store and share them with key people, concerning health, funeral and memorial, legal and financial and legacy issues;

Everplans – it allows users to archive everything their loved ones will need should something happen to the user;

Tellmebye – it is a management tool solution for funeral homes, e-commerce platform for flowers, products and donations, which also offer funerary homes’ customers the opportunity to benefit from a private spot to remember beloved ones;

Redfuneraria – it provides support for mourners and services to ensure the user’s well-being before, during and after a person departed. It also provides funeral homes and other players within the industry the option to advertise their offerings on their platform and diversify their revenue streams;

Willing – it allows users to do a quick will only by answering to their instructions;

Passare – it functions as a collaborative centre for families and funeral homes plan for funeral arrangements.

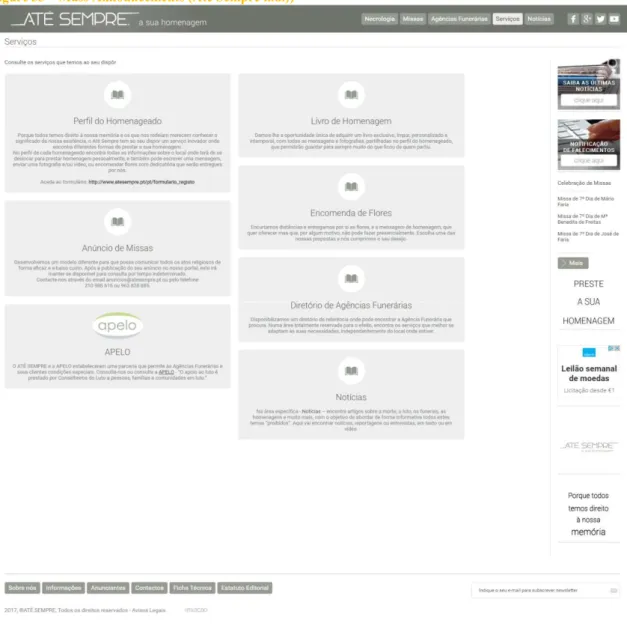

35 Até Sempre

Até Sempre created in 2014 (see landing page in Figure 30) wants to facilitate tributes to departed people. Users are able to leave a message in the form of text or image on each tribute page of each deceased (Figure 31). What is more, users can check when the wake and funeral will be, as well as in which cemetery the deceased will remain. Moreover, there are options to order flowers and pay it with a Multibanco reference and order tribute books with all the messages, as well. This part is very simple to use and instructions are clearly made. For flowers and tribute books the user has two options for each.

The process for creating a profile for the deceased is made through a form (Figure 32). That is the way for making it appear in the landing page (Figure 30). (S)he is also able to promote Mass events at a low cost (this is what is announced in

36 igure 33) but they are able to provide it for free, as it is said in Figure 34. Besides this, the platform has space for mourning counsellors sponsored by APELO (Associação do Apoio à Pessoa em Luto), a funeral homes directory (

37 Figure 35) and a news page divided in articles, opinion, interviews, reports and video (Figure 36). The user is able to receive a newsletter and notifications for deceased in the residence council (Figure 37).

Até Sempre is also reachable through Facebook, Google Plus, Twitter and Youtube.

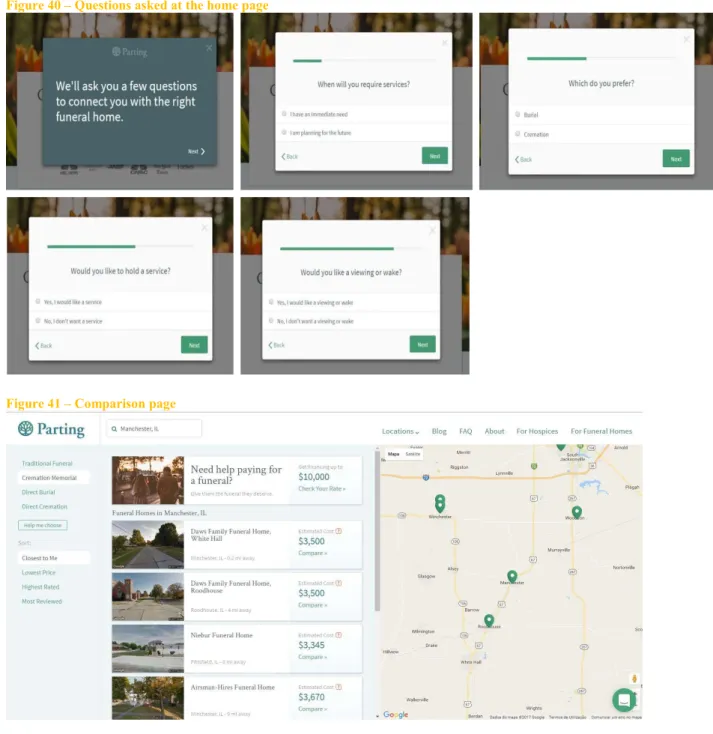

After answering all the questions, the user goes to the comparison price landing page (Figure 41). The filters are displayed on the left side and a map on the right (similar to Airbnb). We would add a clear call-to-action in a different color for each option to increase the usability. After choosing the quote, the user arrives to a landing page of the chosen funeral home (Figure 42). On the right side, a summary of the quote is displayed and also a call-to-action to “Contact Funeral Home”. After clicking, the pop-up that appears has clear fields and also has a predefined text already written (Figure 43). Besides the core of the website, the comparisons, Parting also has a blog/FAQ section (Figure 44). On this FAQ section, there is no info above the fold. The image should be resized to solve this problem (not seeing any information increases the bounce rate). This same problem happens on mobile especially on the home page (see Figure 45 and a suggested optimization on

38 Figure 46).

Parting also has an “about us” tab, a “For hospices” and a “For funeral homes”. The first one provides information about the founders which increases the confidence in the platform. The “for hospices” section is targeted for hospices (and retirement houses?) and incentivizes people to order pamphlets to “prepare the end of life with parting’s help”. The last section “for funeral homes” incentivizes new funeral homes to join the website by “getting additional cases today”. In our opinion, what could be improved in parting would be the layout and the user experience. The current one it’s very formal and with shape. We would do something modern, still sober but with a pleasant design.

Despite being a funeral comparison site and of course it has to have a sober look, isn’t mandatory that it looks formal and boring.

Everplans

Everplans™ is a NY company founded in 2010 (Cruchbase n.d.). As it is written on their landing page, “An Everplan is a secure, digital archive of everything your loved ones will need should something happen to you.” (Everplans™ n.d.). What is more, they want to offer advice for key areas of life, including death planning.

The website is divided into 3 main sections: “For Individuals”, “For Your Business” and “Resources and Guides”.

The B2C section is then divided in 4 parts: Dashboard, My Everplan, Deputies and Resources & Guides. The dashboard comprises to-do lists where Everplans™ asks users to describe every data of themselves: from basic ID data to how they want their funeral to be (Figure 77,

39 Figure 78). If “Funeral Preferences” is clicked, the client is forwarded to another page, where it describes the section and explains the importance of sharing this kind of information with family (

40 Figure 79). Finally, the user can upload the information (

41 Figure 80,

42 Figure 81,

43 Figure 82).

On the “To-Do Next” section, they want to drive customers to add their information to the platform, step-by-step (

44 Figure 79). The user is redirected to the process above.

All of this information does not make sense until is shared, that is why the company advises to add a Deputy that can have access to the information. The user is then able to choose the levels of access (Figure 84).

Security of data is an important point here. After some time being logged in into the account, the webpage returns to its login point, therefore decreasing the likelihood of someone stealing confidential information.

The Resources & Guides section is divided into subsections: the Planning Categories (see Figure 86) aim at providing simple and clear information on how to prepare each “box” of our lives, by providing free content articles; and Resources. There are a few interesting tools. The first one is the Funeral Update page. It lets share with whoever we want, by email, who has deceased and when the funeral event will occur (

45 Figure 87). The second tool is the “Local Funeral Guides”. by clicking on a city, it is possible to see price levels, ratings and religions offered by Funeral Homes, Crematories (religion does not apply here) and Cemeteries. However, they do not offer it for each state and offer only a few funeral homes, nor describe what are the values, in USD, for each place (Figure 90). Last but not least, newsletters contain tips and links to continue using the website.

In terms of pricing, they offer a 30-day trial period and then users may be able to keep information for 75$/year (Figure 88 and

46 Figure 89).

As far as the B2B section is concerned, what Everplans™ wants to offer is a tool “to help increase retention across generations, establish new relationships, and strengthen existing ones.”. Its purpose is to sell it to insurers and financial advisors in their own branded image where they could help the client reach an Everplan™. The benefits for B2B were already explained.

In conclusion, the user experience could be better achieved by simplifying the process. They seem they are not focusing in one plan, but in many; and maybe there is some lack of integration. For instance, they put the planning tool for Individuals in a corner, and the Funeral Update tool in another. What is more, they do not provide accurate information on how does a funeral cost in that specific funeral home. Design is clear but not consistent.

JoinCake

What they state: “100% of people will die, yet most people do not plan for it.” (Cake n.d.). Cake tries to make it easy for people to think about death. The objective is to offer users an easy preference planning service that they can store and share with Key People. Similarly to Everplans™, the planning relies on key areas of life: health, funeral and memorial, legal and financial and legacy. They even have personalized counselling services that help users planning their end-of-life matters (

47 Figure 47 and Figure 48). The website is then divided in 5 main areas (besides the landing page): Profile, Decks, Concierge, Feedback and Resources.