Unibanco: Analysis on the

credit products’

consumers and

competitors in Portugal

Mónica Fonseca

Dissertation written under the supervision of Professor Rute Xavier

Dissertation submitted in partial fulfilment of requirements for the MSc in

Management with specialization in Strategy and Entrepreneurship, at the

Title: Unibanco: Analysis on the credit products’ consumers and competitors in Portugal

Author: Mónica Fonseca

Abstract: As credit consumers are getting more informed and more demanding, it is of

paramount importance for institutions to provide more reliable and complete offers that meet their needs. This has potentiated the uprising of other institutions such as fintechs that disrupted the credit offer and challenged Organizations to be more competitive.

Facing this phenomenon, Unibanco has identified the need to analyze the credit demand and identify further and continuous improvement opportunities to maintain current and loyal consumers but also to attract further ones. As such, the scope of this research is to analyze the factors which influence the demand for credit in Portugal, the trends and competitors, and to propose recommendations that potentiate Unibanco’s competitiveness.

Keywords: Credit products, Credit Cards, Loans, Credit Institutions, Consumer Behavior and

Título: Unibanco: Analysis on the credit products’ consumers and competitors in Portugal

Autora: Mónica Fonseca

Resumo: À medida que os consumidores de crédito se tornam mais informados e exigentes, é

de extrema importância que as instituições ofereçam produtos de confiança e com variedade que vão de encontro com as suas necessidades, o que proporcionou a criação de fintechs que desafiaram as instituições que já operavam nesse mercado.

Face a este fenómeno, o Unibanco percebeu a necessidade de analisar a procura de crédito e identificar estratégias para reter e atrair novos clientes. Assim, o âmbito deste estudo tem como objetivo analisar a procura de crédito em Portugal, as tendências, a concorrência e propor uma estratégia que potencie a competitividade do Unibanco.

Palavras-chave: produtos de crédito, cartões de crédito, empréstimos, instituições de crédito,

Acknowledgements

I must firstly thank my caring parents for investing in my education and encouraging me unconditionally. Their support was crucial for my academic success.

I would like to thank my thesis advisor Rute Xavier for always having the office door open when I ran into trouble or needed an orientation in the less inspiring moments. She gave me the autonomy to write my own work, while being present every time I needed.

I want to express my gratitude to Pedro Monteiro and Sónia Fevereiro from Unibanco’s product and loyalty department, that dedicated their time sharing knowledge about the company, industry and discussing important topics for the development of this dissertation.

I would like to express my very great appreciation to my sister Vânia that kept me going on and always motivating me by reminding me my abilities and my value.

Finally, I want to thank all my friends, specially Rui, that supported me and believed in me during these passing months.

Contents

List of Figures ... vi

1. Introduction ... 1

1.1 Banking Sector ... 1

1.2 Problem Statement & Research Questions ... 2

1.3 Scope of Analysis ... 2

1.4 Structure... 2

2. Literature Review ... 3

2.1. Factors influencing the demand for payment methods ... 3

2.2. Segmentation of the demand ... 5

2.3. Positioning ... 6 3. Methodology ... 8 3.1. Demand ... 8 3.1.1. Data collection ... 8 3.1.2. Survey ... 8 3.1.3. Data Analysis ... 9 3.1.4. Sample characteristics ... 10 3.2. Competitors ... 11 3.2.1. Data collection ... 11 3.2.2. Data analysis ... 12

3.3. Recommendations to a New proposed offer ... 12

4. Results and analysis ... 14

4.1. Results of the survey... 14

4.1.1. Credit cards ... 14

4.1.2. Loans ... 24

4.2. Competitors’ Analysis ... 29

4.2.1 Credit Cards ... 29

4.2.2. Debit Cards by Fintechs ... 31

4.2.3. Loans ... 34

5. Recommendations ... 37

6. Conclusion ... 39

7. References ... 40

List of Figures

Figure 1 – Sample Characterization (N = 209) ... 10

Figure 2 - Ownership of credit card by age group ... 15

Figure 3 - Ownership of credit card by average monthly gross income ... 15

Figure 4 - Credit cards owned by individuals with more than one credit card ... 16

Figure 5 - How long did you compare the offers in the market before you choose your credit card? ... 16

Figure 6- Frequency of use of credit card by age group ... 17

Figure 7 - Categories bought with credit card ... 18

Figure 8 - Mode of payment per age group ... 19

Figure 9 - Mode of payment per average monthly gross income ... 19

Figure 10 - Level of importance of credit card agreement’s features by ownership of credit card ... 20

Figure 11- Level of interest of credit card loyalty programs by ownership of credit card ... 22

Figure 12 - Proportion of respondents that would choose the current bank as a provider for a new credit card by ownership of credit card ... 23

Figure 13 - Proportion of respondents that would choose the other bank as a provider for a new credit card by ownership of credit card ... 23

Figure 14 - Proportion of respondents that would choose Unibanco as a provider for a new credit card by ownership of credit card ... 24

Figure 15 - Providers of loans ... 24

Figure 16 - Level of importance of loan agreement’s features by ownership of loans ... 25

Figure 17 - Level of concern about payment default risks by ownership of loans ... 27

Figure 18 - Proportion of respondents that would choose the current bank as a provider for a new loan by ownership of loans ... 28

Figure 19 - Proportion of respondents that would choose the other bank as a provider for a new loan by ownership of loans ... 29

Figure 20 - Proportion of respondents that would choose Unibanco as a provider for a new . 29 Figure 21 - International Processing Fee Competitiveness vs Cash Back and Points Program ... 31

Figure 22 – Free version features from fintech’s offers ... 32

Figure 23 - Second version features from fintech’s offers ... 33

Figure 24 - Last version features from fintech’s offers ... 34

Figure 25 - Interest rate means of all competitors ... 35

Figure 26 - Interest rates Unibanco ... 35

Figure 27 - Digitalization Process ... 35

1. Introduction

1.1 Banking Sector

With the progress of banking technologies and the increase of competitiveness, there is a need for the banking industry to adapt to the current market demand. The banking sector in Portugal is getting more resilient, presenting a significant progress on efficiency, liquidity, asset quality, profitability and solvency 1. Credit market is not an exception as the trends and approaches are

getting more diversified and complex. Due to digital transformation, the relationship between banks, fintechs, and bigtechs are evolving rapidly2.

The credit market is getting more attractive as banks are getting rid of non-performing loans, meanwhile the performing loans component already shows a positive evolution3. Due to recent

favorable financial and economic conditions, the flow of new loans to households has shown a moderate recovery after reaching the lowest level in 20134. Data from Banco de Portugal shows

an increase of 29,1% of consumption credit provided, an increase 5,4% of auto credit provided and an increase 8,9% of cards and overdraft provided to consumers in July 2019 compared to July 2018 5. As competitiveness increases, spreads are consequently falling, while the Euribor

rate is negative. This results in an incentive for consumers to ask for more credit. Besides the decrease of the spread level, most of the mortgage loans in Portugal have variable interest rates, resulting in lower costs for this type of loan6.

Unicre is a specialist Portuguese financial institution in the management, issuance and provision of payment and credit solutions for 45 years 7. Unicre has two core businesses, Unibanco and

Redunicre. Unibanco is a credit institution that offers credit products to other companies, individuals and other economic agents. Redunicre offers terminal installation and the provision of payment services to merchants. Unibanco, is currently facing challenges in capturing the younger generation in Portugal. As Unibanco is not a retail bank, it does not hold deposits of the potential customers resulting in a higher level of bureaucracy, lower credit value granted

1 Overview do sector bancário português, Associação portuguesa de bancos, 2019, accessed November 2, 2019 2 2019 Banking and Capital Markets Outlook: Reimagining transformation, 2019, accessed November 2, 2019 3 Financial Stability Report, 2019, accessed November 5, 2019

4 Banking sector at a glance, Associação portuguesa de bancos, 2018, accessed November 5, 2019

5 https://www.bportugal.pt/page/evolucao-dos-novos-creditos-aos-consumidores-janeiro-de-2017, accessed November 4,

2019

6 https://www.dn.pt/edicao-do-dia/04-set-2018/portugal-tem-do-credito-a-habitacao-mais-barato-da-europa-9797336.html,

accessed November 5, 2019

and higher requirements for the customer. The scope of the present research is based on the challenges faced by Unibanco.

1.2 Problem Statement & Research Questions

The aim of this research is to evaluate what are the credit habits of younger generations compared to the current banking offer in order to design an action plan for Unibanco, by answering to the following questions:

Q1: How to characterize the demand for credit in Portugal? What are the factors most valued by the consumers?

Q2: What is the current differentiation and positioning of the main competitors and Unibanco in this market?

Q3: Should Unibanco develop a new offer and respective positioning?

1.3 Scope of Analysis

In this research will be analyzed the credit demand, through a market segmentation, identification of the respective characteristics and the attributes each segment value the most and a risk sensitive analysis relative to the credit offer. A comparison between the current offer from Unibanco and its competitors will be identified for the target group, considering their consumption habits and preferences. A new approach for attracting each segment to Unibanco will be developed, including the design of new offers and respective positioning.

1.4 Structure

Regarding the structure of this dissertation, the first chapter introduces the context and scope of the research as the problem statement and research questions that will be analyzed. The second chapter contains the literature review that served as base for the current study. The third chapter consists on the methodology used for the analysis of the demand and the competition. The fourth chapter analyses the demand and competition. The fifth chapter consists on a set of recommendations that respond to the challenge assigned by Unibanco. The sixth chapter concludes the research.

2. Literature Review

Several studies were conducted to understand how the payment system is perceived by the young current or potential credit consumers and how the credit providers respond to their needs and preferences. This research will analyze the demand side to understand which credit characteristics Portuguese young consumers value, and the supply side in order to compare the current credit offer of the main competitors of Unibanco. The purpose of this research is to find a solution for Unibanco to build a competitive offer aiming at attracting new potential customers.

2.1. Factors influencing the demand for payment methods

To assess the perceptions and consumption habits of the consumers, several authors conducted researches over the last century in different geographical locations. Throughout time, different types of payment methods were introduced to facilitate the payment process and to persuade consumers to buy more products or services. To understand the demand for the different payment methods, the consumer characteristics, the payment process and payment method characteristics need to be considered.

The consumer behavior has been evolving over the years, especially now with the advent and growth of ecommerce. With the arrival of smartphones and mobile internet in Portugal, the population with access to internet has been increasing yearly as well as the number of people doing online shopping. It was found that “consumers that already use new technology products tend to use electronic forms of payment more than those who do not” (Hayashi, F., & Klee, E., 2003). This trend is more likely to happen in younger generations. Other studies defend that additional factors that potentiate the electronic payment methods usage by consumers are higher level of education (Kennickell, A. B., & Kwast, M. L., 1997), owning a house and having a high job position (Stavins, J., 2001).

The perspectives that consumers have towards the characteristics of each payment method, such as control spending, acceptability by the supplier, ecommerce platform and/or store and transaction time, influence the preference and usage of each payment method (Hirschman, E. C., 1982). Jonker, N. (2005) showed that the consumer characteristics that effects the preference and probability of usage for different payment methods are the gender, age, income, education and degree of urbanization and regional differences and the payment characteristics that influence the choice is the speed of the payment process.

Moreover, according to Hirschman, E. C. (1979), the consumer behavior regarding in-store expenditure and in-store purchasing changes depending on the ownership of different payment methods. The study revealed that a consumer that has access to a credit card or a store-issued card is more likely to spend more money in the store and have a greater incidence of purchase, whether a consumer that owns both cards is also more likely to spend the same amount of money but the incidence of purchase does not increase.

Consumers are demanding more efficient payment methods. Debit card seems to be the preferred one even being more expensive than cash or e-pursue. The payment method that consumers associate more cost and unsafety is the credit card. However, currently most of the ecommerce channels require this payment method. With the development of technology there is a trend for nonusers of electronic payment methods to adopt these (Jonker, N., 2005). The above-mentioned researches lack information regarding the relation of consumer perspectives with the payment method costs. More recent studies were conducted to understand the relation between consumers characteristics, the payment method choice and the respective cost.

A study conducted by Kara, A., & Kaynak, E., & Kucukemiroglu, O. (1994) to explore the perceptions of the college students with considerable income towards the credit cards showed that the factors that most influence the consumer choice for a specific credit card are low interest rates and a deferred payment type. As students believe they will earn more money in the future they prefer to leave the payment for later. It was found that 71 per cent of the people between the ages of 18 and 25 developed their first brand loyalties as teenagers (Yankelovich, Skelly and White, 1980, cited by Kara, A., & Kaynak, E., & Kucukemiroglu, O., 1994). Therefore, the chances of a credit card issuing company to retain young customers for a long period of time is high.

The type of payment method chosen by the consumer is affected by the type of transaction and the average respective value. Electronic payments are less costly than paper payments for consumers. For that reason, cash, credit card and debit card are used for low average values and intensive use. In contrast, checks and money transfers are used for higher average values. Nevertheless, the use of a payment method is always conditioned by the methods accepted by each supplier, ecommerce platform and/or store. (Humphrey, D. B., & Kim, M., & Vale, B., 2001).

2.2. Segmentation of the demand

Segmentation of the market is a procedure where the consumers are separated in several homogeneous groups taking into consideration certain characteristics. This segmentation will then be used as the basis to adapt the marketing strategies for each group in order to better allocate the existing resources (Smith, W. R., 1956). As markets are becoming more competitive, mainly due to the increase of offers by suppliers and the consumer being more demanding when facing so many options, companies tend to follow strategies in order to meet the customer needs. Strategies must be selected to achieve the highest level of effectiveness in the economy, by minimizing the production and marketing costs and increasing the profits. It is possible to segment the market through customer characteristics, but the results may not be conclusive, as the customers with same characteristics may respond differently to marketing variables. In response to that problem, Blattberg, R. C., & Sen, S. K. (1974) states two principal criteria for evaluating alternative bases for segment definition : 1) “the degree to which the segments are likely to respond differently to changes in the firm’s marketing variables”, 2) “the ease with which the segments can be identified in terms of customer characteristic".

To break down the tendency of standardizing the process of segmenting the market, Wind, Y. (1978) analyses two traditional and two newer approaches for segmenting the market. The traditional approaches are the a priori segmentation model and the clustering-based segmentation model. In the first, the researcher should choose in advance the variables to understand the purchase behavior of the consumer for later (after analyzing the results of data collection) get the size, demographic and socioeconomic characteristics of each segment. In the second, the main difference is the way the basis for segmentation is selected. The segmentation results from a clustering analysis. In this approach, factor analysis is frequently used to reduce the original variables primarily used. It is possible to combine both approaches (hybrid approaches) in order to segment a market with a priori conditions or consumers characteristics and do cluster analysis after. The newer approaches are the flexible and the componential segmentation. The first one results from a conjoint analysis study, where new product offerings simulations are made to evaluate which products features each segment prefers. It enables to build segments based on consumers response to alternative products given. The second one, is meant to predict the type of consumer (demographic and psychological attributes levels) that

will be responsive to a specific type of product feature. Conjoint analysis and orthogonal arrays are used in this model to estimate the segments.

2.3. Positioning

After segmenting the market, the company should choose a target – i.e. the segment that brings more value to the company – and develop a competitors’ analysis. The positioning of the offer of each competitor will be assessed to identify the critical success factors for Unibanco to be able to attract this new target group. It will be taken into consideration the hypothesis of Hoyer, W. D., & Brown, S. P. (1990), i.e. when consumers are in a multiple product decision situation and only know one brand, they are more likely to choose the brand they know; when a consumer has to choose a product from a wide offer, he/she is less likely to try a new brand if another brand is familiar; even though in a set of products some of those have higher quality the consumer will choose the one he/she is more familiar with even if it has less quality. This shall be considered when recommending the approach to attract new customers.

The theories about how consumers adopt new products stated by Mantel, B. (2000), namely the new product diffusion model and the new market development models, show that if financial institutions want consumers to adopt electronic payment methods they have to make significantly investments to create awareness and diversify their offers among the different segments. This literature proves that the access to a computer increases the likelihood of the consumer to choose an electronic payment method aligned with financial characteristics, income and home ownership. Institutions should concentrate in geographical areas where the population has access to technology to build efficient communication strategies in order to attract new customers.

As said before, facing a competitive market, companies must continuously build competitive advantages and destroy the competitors’ advantages to get their market share. When a target is identified, a company must make a deep study to know the competitors’ strategies in order to identify the trends and possible innovations to gain a competitive advantage. To evaluate the consumer perspectives, the company can graphically position its products and the main competitors’ products regarding pre-established characteristics. D’Aveni, R. A. (2007) suggests drawing a positioning map to compare main competitors’ price-benefit (perceived by consumers). This map should be redesigned on a frequent basis by the company in order to predict the future strategies of the competitors and to build new effective strategies to thrive against them and take their market share. Devlin, J. F., & Ennew, C. T., & Mirza, M. (1995)

conducted a study in UK that shows that the consumers perceive banks and building societies differently. The first more concerned about service delivery and the second being more customer orientated.

Communicating a feature that is not important for the customers and is not really related with the core of the service can lead to misunderstanding by the consumer, changing the brand image to a negative one. As the credit card is becoming more convenient and it is reaching the mature stage, financial institutions should focus on segmentation strategy by creating a communication strategy for each segment (Onkvisit, S., & Shaw, J. J., 1989). In this research, the features that are more important to the potential customers will be identified in order to allow Unibanco to develop a respective communication plan afterwards.

3. Methodology

This section of the research aims to present the methodology used to design recommendations to a competitive solution for Unibanco to attract potential customers.

As previously said, this research will focus on assess the credit habits and needs of current and potential credit consumers in order to segment the market, and develop an analysis of the main competitors to create a recommended offer that enables Unibanco to be more competitive and consequently to gain market share. The credit products that are analyzed in this research are the credit card and the consumption credit.

3.1. Demand

3.1.1. Data collection

To assess the habits and needs of the current and potential credit consumers, a survey using Qualtrics was conducted between November 7 and November 21, in order to get the primary data. It was conducted online for the convenience of respondents and to potentiate the power of network. This survey was spread in two different ways. The first was shared via social networks, namely Facebook, WhatsApp groups and intranet from Unibanco, and the second by asking to random people in Lisbon to answer it using an iPad. Those techniques were selected since it involves no associated costs and are less time consuming; and this is also possible since the data is quantitative.

3.1.2. Survey

The survey conducted is composed by four sections. It is composed by fifty questions in total. Questions are different for users and non-users of credit cards and owner and non-owners of loans. They are identified by answering to direct questions of being or not a user of both credit products. Multiple choice with the option of adding other answer and 5-point Likert scale are used for the individual to answer the survey. The ultimate purpose of the survey is to gather the information regarding the consumption habits of the credit consumers and compare the perceptions of credit consumers and non/consumers regarding credit products.

The first section is related to the demographic factors of the respondents, i.e. gender, age range, location/locality, marital/civil status, number of children, people living in the same house, income range, job situation and possession of bank account.

The second section concerns the possession of credit card. This section intends to assess the respondent’s routine of credit cards usage, the respective payment process and method and the

perception of risk of payment default. The different questions for users and non-users will also allow to compare the perceptions and preferences of current and potential credit customers. The third section concerns about loans from 5 to 50 000 euros. This section enables to understand the reason of hiring those loans and how the borrowers or non- borrowers perceive the contract characteristics and risks associated with payment default. Different questions are conducted for borrowers and non- borrowers.

The last section aims to understand if the fact that an individual knows Unibanco and/or is currently a customer influences the survey results. To avoid any bias, these questions will be asked at the end of the survey.

3.1.3. Data Analysis

The statistical analysis involved measures of descriptive statistics (absolute and relative frequencies, means and their standard deviations) and inferential statistics. The significance level for rejecting the null hypothesis was set at α ≤ .05. Chi-square independence test, Fisher test, Mann-Whitney test and One-Sample Wilcoxon Signed rank test were used.

The statistical analysis was performed using the Statistical Package for Social Sciences (SPSS) version 25.0 software for Windows.

To test if the following variables are statistically independent, a Chi-Square test was conducted: • Age group and ownership of credit card

• Average monthly gross income and ownership of credit card • Age group and frequency of use

• Age group and mode of payment of the amount in debt

• Average monthly gross income and mode of payment of the amount in debt

To test if there are statistically significant differences of the following variables, a Mann-Whitney U Test was conducted:

• Level of importance of credit card agreement’s features by ownership of credit card • Interest on credit card loyalty programs by ownership of credit card

• Level of importance of loan agreement’s features by ownership of loans • Level of concern about payment default risk by ownership of loans

A One-Sample Wilcoxon Rank test was conducted to test if the mean of the following variables is different from the mean of the Linkert Scale available in the survey (3):

• Level of importance of credit card agreement’s features by credit card ownership • Level on interest of loyalty programs by credit card ownership

• Level of importance of loan agreement’s features by loan ownership • Level of concern about payment default risks

A Fisher’s exact test of independence was used to test whether the proportions of the respondents that choose each of the following credit providers are different from other providers:

• Current Bank • Other Bank • Unibanco

3.1.4. Sample characteristics

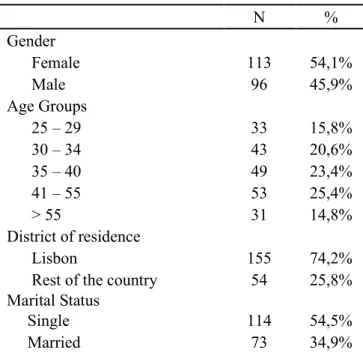

It was used 209 valid answers for the survey’s analysis. The age group more observed is from 41 to 55 years old. The majority were female (54,1%), single (54,5%), childless (54,1%), employed (70,4%), with average monthly gross income from 1230 to 2249 (30,6%) and living with the partner and children (35,4%).

Figure 1 – Sample Characterization (N = 209)

N % Gender Female 113 54,1% Male 96 45,9% Age Groups 25 – 29 33 15,8% 30 – 34 43 20,6% 35 – 40 49 23,4% 41 – 55 53 25,4% > 55 31 14,8% District of residence Lisbon 155 74,2%

Rest of the country 54 25,8% Marital Status

Single 114 54,5%

Divorced 19 9,1% Widower 3 1,4% Number of children 0 113 54,1% 1 43 20,6% 2 38 18,3% 3 11 5,3% 4 2 1% 5 2 1% Employment Situation Self-employed 28 13,4% Employed 147 70,4% Unemployed 5 2,4% Student 21 10% Other 8 3,9% Income 0 – 499 23 11% 500 – 1249 69 33% 1250 – 2249 64 30,6% 2250 – 3249 34 16,3% > = 3250 19 9,1% Household Alone 32 15,3% Partner 29 13,9%

Partner and children 74 35,4%

Parents 54 25,8%

Other 20 9,5%

Source: Survey Data

3.2. Competitors

3.2.1. Data collection

The data regarding the competitors were collected through the institution’s website and phone line. The main players that operate in the credit market are Bankinter, Cetelem, Cofidis, Credibom and Oney, according to ASFAC8. The competitors selected for the analysis were

jointly defined with Unibanco. The current competitors’ offers were collected directly from the respective website. Both credit card products and loan products were analyzed. For some competitors more than one offer was identified.

Three types of competitors have been taken into consideration, since there are different types of institutions that issue credit products.

The first type of competitors identified are credit institutions. Credit institutions are companies that offer credit products to other companies, individuals and other economic agents. As Unibanco is a credit institution these are defined as the direct competitors. As the credit market is reaching to its maturity stage, differentiation strategy is used by several competitors, in some cases more than one offer of the same competitor is selected for the analysis. These competitors mainly compete through fees and rewards. The credit institutions selected for the analysis were Bankinter, Cofidis, Oney, Puzzle, Sonae and Wizink.

Bank institutions are the second identified type of competitors. As individuals need to own a bank account to get a credit product, banks are considered a competitor that directly offer several credit products for their current customers. Nevertheless, they are also considered as a complement institution for Unibanco, as the latter does not have deposit service. The banks selected for the analysis were Banco CTT, Cetelem and Credibom, as they offer similar credit products and compete directly in the credit market.

The last type of competitors identified are fintechs. These enable consumers to easily open a bank account without asking a local bank, and often offer debit cards without fees. They offer free versions and subscription-based versions with extra features. The fintechs selected for the analysis were Moey, Monese, N26 and Revolut.

3.2.2. Data analysis

After collecting and organizing the data from all competitors, several perceptual maps and tables were created to illustrate the main differences and similarities of all offers. The first perceptual map compares the International Processing Fee Competitiveness and the Loyalty Programs selected for the analysis. Later, several tables were constructed to illustrate the differences between the fintechs identified. Other tables were used to compare the the interest rates practiced by Unibanco and the market interest rates means. The last perceptual map regards the market share and level of digitalization of the loan’s agreements.

3.3. Recommendations to a New proposed offer

After a market analysis of the demand and supply, a set of recommendations will be designed for Unibanco to reach a higher customer base in Portugal. The perceptions of owners and

nonowners of credit products, market trend for this type of offers and the accumulated knowledge of the Organization were considered.

4. Results and analysis

4.1. Results of the survey

The survey was conducted to 209 individuals, from which 162 (77,5%) know Unibanco but only 70 are currently Unibanco’s clients (33,5%). The results may be biased as the online survey was also spread via intranet from Unibanco.

From Unibanco’s clients, 62.7% that already own a credit card provided by Unibanco would acquire a new credit card provided by Unibanco. One in three Unibanco’s current clients that does not own a credit card would acquire a new credit card provided by Unibanco. 57.14% of Unibanco’s clients that already own a loan provided by Unibanco, would hire another loan from Unibanco. And 59.52% of the current Unibanco’s clients that does not own a loan would hire a loan from Unibanco.

4.1.1. Credit cards

From the 209 respondents, 151 (72,2%) own at least one credit card.

The Null Hypothesis to test the statistical independence of the variables Age group and Ownership of credit card using a Chi-Squere was rejected, χ2 (4) = 15.706, p = .003. The Figure

2 represents the ownership of credit card by age group. The age groups that reveals to have a higher proportion of credit card owners are from 35 to 40 years old (81.6%), from 41 to 55 years old (81.1%) and 30 to 34 years old (76.7%). The age group that has a significantly higher proportion of respondents who do not have a credit card is the group older than 55 years old (51.6%).

Figure 2 - Ownership of credit card by age group

Source: Survey data

The Null Hypothesis to test the statistical independence of the variables average monthly gross income and Ownership of credit card using a Chi-Square was rejected, χ2 (8) = 52.735, p = .001.

As the average monthly increases, the proportion of individuals that own a credit card increases. Its observable in Figure - 3 that the ownership of credit card increases as the average monthly gross income increases.

Figure 3 - Ownership of credit card by average monthly gross income

Source: Survey Data

0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% Yes No 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 0 499 500 -749 750 -1249 1250 -1749 1750 -2249 2250 -2749 2750 -3249 3250 -3749 >3750 Yes No Age group

The following analysis is regarding the 151 respondents that own at least one credit card. Regarding the number of credit cards owed by these respondents, 42% said they own just one credit card, while the rest of the respondents owns more than one. From the group that owns more than one card, the second card is mostly provided by Unibanco (52%) or by its direct competitors, illustrated in the following figure:

Figure 4 - Credit cards owned by individuals with more than one credit card

Source: Survey Data – Sample with credit card

When the respondents were asked to evaluate through a Likert scale from 1 (Few time) to 5 (Long time) the time they spend comparing the existed offers in the market before choosing the one they own, the results show that most of the respondents spend few time (65,6%) doing research on the matter and only 1,3% spent long time.

Figure 5 - How long did you compare the offers in the market before you choose your credit card?

1 – Few time 2 3 4 5 – Long time

65,6% 15,2% 14,6% 3,3% 1,3%

Source: Survey Data – Sample with credit card

When the respondents were asked where they learned about their current credit cards, the option most pointed out was through their current bank (45,9%), followed by other not specified (16%) source and recommendation of a friend or family member (10,3%). Taking into account that most of respondents spend few time choosing a credit card, the main reason why the current bank is the most chosen is that when individuals open an account are invited to acquire other products or services, resulting in less time consuming process. As such, the communication

N % Unibanco 61 52.10% WiZink 27 23.10% Cetelem 11 9.40% Sonae (Universo) 9 7.70% Other 5 4.30% Cofidis 4 3.40% Puzzle 0 0.00% Total 117

channel that seems to be more efficient is through the commercial managers of the individual’s bank and cross-selling.

Regarding the option of acquiring an insurance related to the credit cards, only 23,8% answered positively, showing a low level of concern about any unforeseen that could lead to a non-compliance situation. From the respondents that have acquired an insurance, the credit protection insurance was the most pointed with 45,8%, followed by purchase protection insurance (18.8%) and auto insurance (14.6%).

The Null Hypothesis that test if the variables age group and frequency of use of a credit card are statistically independent using a Chi-Square Test was not rejected, χ2 (24) = 26.483, p =, 333. However, the results of the survey show that the frequency of use more observed is weekly (29,8%) and monthly (21,2%). The Figure 6 shows the frequency of use of a credit card by age group.

Figure 6- Frequency of use of credit card by age group

Frequency of use

Daily Weekly Biweekly Monthy

Age Group 25 - 29 5.00% 30.00% 15.00% 10.00% 30 - 34 15.20% 42.40% 3.00% 18.20% 35 - 40 2.50% 37.50% 10.00% 25.00% 41 - 55 23.30% 18.60% 14.00% 23.30% > 55 26.70% 13.30% 13.30% 26.70%

Source: Survey Data – Sample with credit card

The categories most bought with credit card are travels (39,2%), Catering and Bars (38,8%) and Food / hygiene / cleaning (supermarket) (36,8%).

Figure 7 - Categories bought with credit card

Source: Survey Data – Sample with credit card

When asked about how the respondents pay the balance in debt, most of them said they always pay the full amount in debt by the end of the month (64,9%), followed by the option of depending on the month, they alter the payment more if needed (17,9%). It is observable in the Figure – 8 that the payment mode from all age groups tend to be similar.

The Null Hypothesis that test if the variables age group and the payment mode of the amount in debt are statistically independent using a Chi-Square Test was not rejected, meaning that the payment mode does not vary significantly with age, χ2 (12) = 16.468, p = .165.

N %

Travels 82 39.20%

Catering and Bars 81 38.80%

Food / hygiene / cleaning

(supermarket) 77 36.80%

Dressing Room / Footwear /

Accessories 74 35.40%

Fuel 63 30.10%

IT & Accessories / Cell Phones

/ Electronic Devices 51 24.40%

Big and small appliances 50 23.90%

Drugstore 43 20.60%

Television / Video / Sound /

Image 35 16.70%

Cosmetics / Perfumery 35 16.70%

Furniture / Decoration 31 14.80%

Entertainment (cinema / theater

/ ...) 30 14.40%

Toys / Video Games 27 12.90%

Car accessories 22 10.50%

Sport and fitness products 22 10.50%

Formation 17 8.10%

Veterinary and animal expenses 17 8.10%

Figure 8 - Mode of payment per age group End of month Instalment without interests Instalment with interests Depend on the month Age Group 25 - 29 75,0% 0,0% 5,0% 20,0% 30 - 34 72,7% 12,1% 9,1% 6,1% 35 - 40 70.00% 2,5% 5,0% 22,5% 41 - 55 53,5% 7,0% 16,3% 23,3% > 55 53,3% 6,7% 26,7% 13,3%

Source: Survey Data – Sample with credit card

The Null Hypothesis that test if the variables average monthly gross income and mode of payment are statistically independent using a Chi-Square Test was not rejected, meaning that the payment mode does not vary significantly with the average monthly gross income, χ2 (9) =

7,769., P = .569.

Figure 9 - Mode of payment per average monthly gross income in euros

Source: Survey Data – Sample with credit card

0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 500 - 1249 1250 - 2249 2250 - 3249 > = 3250

End of the month

Instalment without interest Instalment with interest Depend of the month

The respondents were also asked to evaluate from 1 (Not useful) to 5 (Very useful) some features of the credit card online platform. All features have a mean higher than 3, revealing that the consumers are getting more demanding regarding the value-added products or services related to the acquired credit card. The features with higher evaluation were high quality and simplicity of the online platform (mean = 3,75), Mobile App to control credit card movements (3,63) and platform in mobile application format (3,58).

From the respondents that own a credit card, only 44,4% own a pre-paid card. These pre-paid cards are creating a new era of competition due to the innovative and competitive advantages these companies are offering that will be explained later in the competition part. Several users are switching from regular credit cards to those pre-paid cards that have no international fees and lower currencies fees in specific situations, such as when they travel abroad.

The following analysis results from the answers of the respondents that don’t own credit cards (54 respondents).

The reason why these individuals don’t own a credit card is mainly because they don’t need it (23%) and do not want to commit to credits (22%). When abroad, the payment method most used by this group is the own debit card (67,2%) and pre-paid card (19%). 43,1% of the individuals of this group owns a pre-paid card.

Objective 1 - Test if the importance of the credit card agreement’s features is influenced the ownership of a credit card.

Figure 10 - Level of importance of credit card agreement’s features by ownership of credit card

When testing the Null Hypothesis of no statistically significant differences on credit card agreement’s features by ownership of credit card, using the Man-Whitney U Test, the following statistically significant differences were found:

• Credit card contract clause clarification session before signing, the respondents with credit card value significantly more this feature, (mean = 4.13 vs 4.10), z = -5.539, p = .001.

• Low interest rates, the respondents without credit card value significantly more this feature, (mean = 4.45 vs 3.52), z = -4.159, p = .001.

• Low commissions, the respondents without credit card value significantly more this feature, (mean = 4.50 vs 3.97), z = -2.699, p = .007.

• Possibility to withdraw money on credit, the respondents without credit card value significantly more this feature, (mean = 2.91 vs 2.23), z = -3.011, p = .003.

This way, the stated objective is partially confirmed.

To test the importance of the features of the credit card agreement’s features that each group values, the midpoint of the Linkert Scale (3) from the survey was used as the baseline for the One-Sample Wilcoxon Rank Test. As such, following results were observed:

The features that are significantly important for the owners of credit card are the Trust in the institution that issued the credit (mean = 4.13, Z = 9.267 , p = 0.001), Credit card order by phone (mean = 3.98, Z = 7.331, p = 0.001), Credit Card Ordering Easiness (mean = 3.97, Z = 7.545, p = 0.001), not pay international processing fees (mean = 3.77, Z = 7.264, p = 0.001), Online Credit Card Order (mean = 3.62, Z = 5.188, p = 0.001), Possibility to withdraw money on credit, (mean = 3.56, Z = 4.613, p = 0.001) and Good customer service (mean = 3.52, Z = 4.417, p = 0.001).

The features that are significantly important for the non-owners of credit card are Credit Card Ordering Easiness (mean = 4.50, Z = 6.194, p = 0.001), Good customer service (mean = 4.45, Z = 6.084 , p = 0.001), Credit card order by phone (mean = 4.33, Z = 5.643, p = 0.001), Low commissions (mean = 4.21, Z = 5.501, p = 0.227), Trust in the institution that issued the credit (mean = 4.10, Z = 5.101, p = 0.001), Not pay international processing fees (mean = 3.91, Z = 4.698, p = 0.001), Possibility to withdraw money on credit, (mean = 3.57, Z = 2.913, p = 0.004), Online credit card order (mean = 3.55, Z = 2.615, p = 0.009).

Objective 2 – Test if the interest on loyalty programs is influenced by the ownership of a credit card

Figure 11- Level of interest of credit card loyalty programs by ownership of credit card

Source: Survey Data – Credit card

When testing the Null Hypothesis of no statistically significant differences on credit card loyalty programs’ interest by ownership of credit card, using the Man-Whitney U Test, the following statistically significant differences were found:

• Receive monthly cash payments from credit card use, the respondents with credit card value significantly more this loyalty program, (mean = 3.95 vs 3.45), Z = -2.319, p = .020.

• Receive money on your account for recommending a credit card to a friend, the respondents without credit card value significantly more this loyalty program, (mean = 3.12 vs 2.66), Z = -1.994, p = .046.

This way, the stated objective is partially confirmed.

To test the interest of loyalty programs of a credit card agreement, the midpoint of the Linkert Scale (3) from the survey was used as the baseline for the One-Sample Wilcoxon Rank Test. As such, following results were observed:

0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 Membership offer

Cash Back Points Moneybox Friend

Reward Friend Reward (€) Other credit products Lik ert Scale 1 t o 5 Credit Card… Credit Card…

The loyalty program that is significantly interesting for the owners and non-owners of credit card is the cash back program (mean = 3.95, Z = 6.962, p = .001; mean = 3.45, Z = 2.163, p = .031). When the respondents were asked if they were going to acquire a new credit card which institution they would choose, the following results were observed:

• 63.6 % of those with a credit card would choose the current bank, and this proportion increases significantly (82.8 %) in the case of the ones without credit card, Fisher's test, p = .008.

Figure 12 - Proportion of respondents that would choose the current bank as a provider for a new credit card by ownership of credit card

Current Bank Credit card

ownership Total Yes No No N 55 10 65 % 36,4% 17,2% 31,1% Yes N 96 48 144 % 63,6% 82,8% 68,9% Total N 151 58 209 % 100,0% 100,0% 100,0% Source: Survey Data – Credit card

• 19.2% of those who have a card would choose another bank, and this proportion increases but not significantly (31%) in the case of subjects who do not have a card, Fisher's test, p = .095.

Figure 13 - Proportion of respondents that would choose the other bank as a provider for a new credit card by ownership of credit card

Other Bank Credit card

ownership Total Yes No No N 122 40 162 % 80,8% 69% 77,5% Yes N 29 18 47 % 19,2% 31% 22,5% Total N 151 58 209 % 100,0% 100,0% 100,0% Source: Survey Data – Credit Card

• 43.7% of those who have a card would choose Unibanco, and this proportion decreases significantly (27.6%) in the case of the ones who do not have a card. Fisher's, p = 0.040. Figure 14 - Proportion of respondents that would choose Unibanco as a provider for a new credit card

by ownership of credit card Unibanco Credit card

ownership Total Yes No No N 85 42 127 % 56,3% 72,4% 60,8% Yes N 66 16 82 % 43,7% 27,6% 39,2% Total N 151 58 209 % 100,0% 100,0% 100,0% Source: Survey Data -Credit Card

4.1.2. Loans

From the 209 respondents, 59 have already obtained a personal loan of between 5,000 and 50,000 euros from a financial institution. The following analysis results from these respondents. The Figure 15 shows the institutions from which the respondents got the loan. The current bank is the more opted (44,3%), followed by Cetelem (23,2) and Unibanco (13%).

Figure 15 - Providers of loans

N % Current Bank 34 44,3% Unibanco 9 13.00% Cetelem 16 23.20% Wizink 2 2.90% Sonae 0 0.00% Cofidis 7 10.10% Other 1 1.40%

Source: Survey Data - Loans

Regarding how the individuals got know about those credit products, the current bank (39,2%) is the most selected, followed by internet advertisement (9.5%), financial advisors (8,1%), institution website (8,1%) and at the store were the product was purchased (8,1%). The rubric

current bank represents all the financial institutions which provide banking services to the 209 respondents.

From the 59 respondents that own a loan, only 42,4% reveals to have acquired an insurance related to the loan. The insurances most acquired were the Credit Protection Insurance (22,6%) and the Life Insurance (17,7%).

The categories of expenses related to the loan requested were housing works/decoration (24,3%) and car expenses (21,4%). 78% of the expenses mentioned that the costs are related to urgencies rather than frequent and common expenses.

The reasons pointed out by the respondents for asking the loan were illiquidity (40,3%), not wanting to compromise the current liquidity (22,4%), and a better budget management (19,4%). However, it is important to refer that 10,4% of the respondents got a discount when asked the loan. Retail companies (Auto, appliances, etc) are offering promotions when the consumer ask a credit in the payment moment, encouraging those to ask for the credit. This is also noticeable in the survey results.

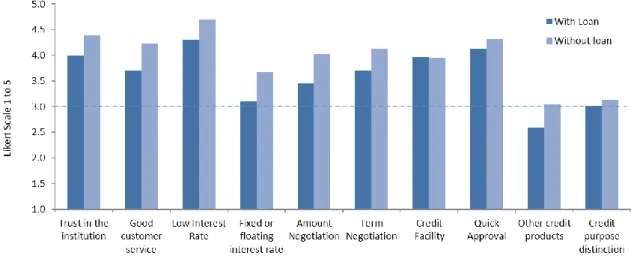

Objective 3 – Test if the importance of the loan agreement features if influenced the ownership of a loan.

Figure 16 - Level of importance of loan agreement’s features by ownership of loans

Source: Survey Data - Loans

When testing the Null Hypothesis of no statistically significant differences on loan agreement’s features by ownership of loans, using the Man-Whitney U Test, the following statistically significant differences were found:

• Trust in the institution, the respondents without loan value significantly more this loyalty program, (mean = 4.4 vs mean = 4.0), Z = -3.073, p = .002.

• Good customer service, the respondents without loan value significantly more this loyalty program, (4.2 vs 3.7), Z = -3,451, p = .001.

• Low Interest Rate, the respondents without loan value significantly more this loyalty program, (4.7 vs 4.3), Z = -2.812, p = .005.

• Choice of fixed or floating interest rate, the respondents without loan value significantly more this loyalty program, (3.7 vs 3.1), Z = -2.765, p = .006.

• Amount Negotiation, the respondents without loan value significantly more this loyalty program, (4.0 vs 3.5), Z = -3.336, p = .001.

• Term Negotiation, the respondents without loan value significantly more this loyalty program, (4.1 vs 3.7), Z = -3.100, p = .002.

• Offer of other credit products with associated advantages, the respondents without loan value significantly more this loyalty program, (3.0 vs 2.6), Z = -2.326, p = .020.

This way, the stated objective is partially confirmed.

To test the importance of the features of the loan agreement’s features that each group values, the midpoint of the Linkert Scale (3) from the survey was used as the baseline for the One-Sample Wilcoxon Rank Test. As such, following results were observed:

The features that are significantly important for the owners of loans, the features are Low interest rates (mean = 4.31, Z = 5.619, p = .001), Quick response by the institution (mean 4,12; Z = 4.993; p = .001), Trust in the institution (mean = 4, Z = 5.335, p = .001), Credit Facility (mean = 3,97; Z = 4.792; p = .001), Term negotiation (mean = 3.69, Z = 4.14, p = .001) Good customer service (mean = 3,69; Z = 3.965; p = .001) and Amount negotiation (mean = 3.46, Z = 2.498, p = 0.012).

On the other side, the features that are significantly important for the non-owners of loans are Low interest rates (mean = 4.7, Z = 10.896, p = .001), Trust in the institution (mean = 4,39; Z = 10.896; p = .001), Quick response by the institution (4.31, Z = 9.559, p = .001), Good customer service (mean = 4,23; Z = 9.514; p = .001), Term negotiation (mean = 4.12, Z = 8.287,

p = .001), Amount negotiation (mean = 4,03; Z = 7.928; p = .001), Credit facility (mean = 3.95,

Z = 7.33, p = .001) and Choice of fixed or floating interest rate (mean = 3.68, Z = 5.064. p = .001).

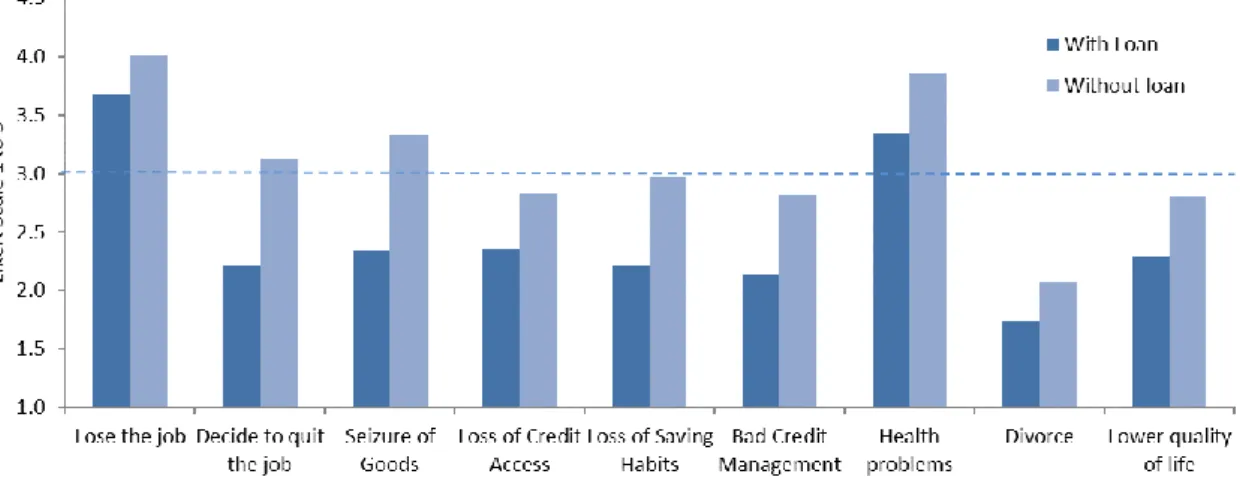

Objective 4 – The level of concern about possible risks associated with payment default of the instalment of credit is influence by the ownership of a loan.

Figure 17 - Level of concern about payment default risks by ownership of loans

Source: Survey Data - Loans

When testing the Null Hypothesis of no statistically significant differences level of concern regarding payment default by ownership of loans, using the Man-Whitney U Test, the following statistically significant differences were found:

• Lose the job, the respondents without loan concern significantly more about this risk, (4.01 vs 3.68), Z = -2.280, p = .023.

• Decide to quit the job, the respondents without loan concern significantly more about this risk, (3.13 vs 2.22), Z = -4.079, p = .0001.

• Seizure of Goods, the respondents without loan concern significantly more about this risk, (3.33 vs 2.34), Z = -3.980, p = .0001

• Loss of Credit Access, the respondents without loan concern significantly more about this risk, (2.83 vs 2.36), Z = -2.168, p = .030

• Loss of Saving Habits, the respondents without loan concern significantly more about this risk, (2.97 vs 2.22), Z = -3.345, p = .001

• Bad Credit Management, the respondents without loan concern significantly more about this risk, (2.81 vs 2.14), Z = -3.006, p = .003

• Health problems that make me impossible to work, the respondents without loan concern significantly more about this risk, (3.85 vs 3.34), Z = -2.544, p = .011

• Divorce, the respondents without loan concern significantly more about this risk, (2.08 vs 1.75), Z = -1.960, p = .050.

• Lower quality of life, the respondents without loan concern significantly more about this risk (2.80 vs 2.29), Z = -2.420, p = .016.

This way, the stated objective is confirmed.

To test the level of concern of a payment default that each group values, the midpoint of the Linkert Scale (3) from the survey was used as the baseline for the One-Sample Wilcoxon Rank Test. As such, following results were observed:

The risks of payment default that the owners of a loan attribute significant concern are losing the job (mean = 3.68, Z = 3.738, p = .001) and Health problems (mean = 3.34, Z = 1.763, p = 0.078).

The risks of payment default that the non-owners of a loan attribute significant concern are losing the job (mean = 4.01, Z = 7.92, p = .001) and Health problems ( mean = 3.34, Z = 6.631,

p = .001), Seizure of goods (Z = 3.33, Z = 2.362, p = .018), and decide to quick the job (mean

= 3.13, Z = 0.724, p = .469).

When the subjects were asked if they were to hire a personal loan which institution they would choose, the following results were observed:

• 88.1% of those who have already hired a personal loan would choose the same bank in which they are clients, and this proportion is similar (88%) to those who never hired a personal loan, Fisher test, p = 1,000.

Figure 18 - Proportion of respondents that would choose the current bank as a provider for a new loan by ownership of loans

Current Bank Own a Loan

Total Yes No No N 7 18 25 % 11,9% 12,0% 12,0% Yes N 52 132 184 % 88,1% 88,0% 88,0% Total N 59 150 209 % 100,0% 100,0% 100,0% Source: Survey Data - Loans

• 30.5% of those who have already hired a personal loan would choose another bank in which they are not customers, and this proportion is relatively similar (37.3%) to those who have never hired a personal loan, Fisher test, p = .422.

Figure 19 - Proportion of respondents that would choose the other bank as a provider for a new loan by ownership of loans

Other Bank Own a Loan

Total Yes No No N 41 94 135 % 69,5% 62,7% 64,6% Yes N 18 56 74 % 30,5% 37,3% 35,4% Total N 59 150 209 % 100,0% 100,0% 100,0% Source: Survey Data - Loans

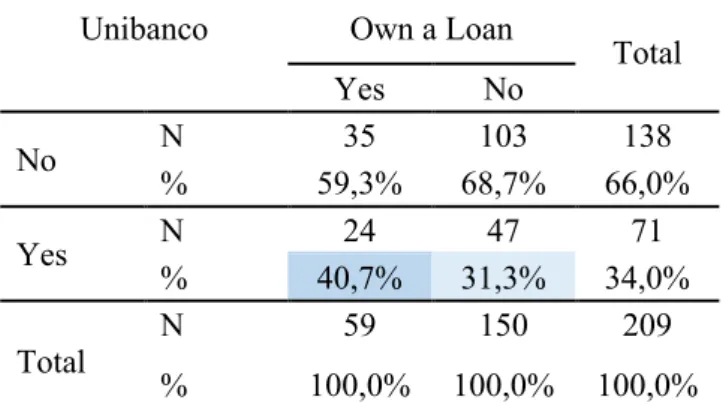

• 40.7% of those who have already hired a personal loan would choose Unibanco, and this proportion is relatively similar (31.3%) to those who have never hired a personal loan, Fisher's test, p = .256.

Figure 20 - Proportion of respondents that would choose Unibanco as a provider for a new Unibanco Own a Loan

Total Yes No No N 35 103 138 % 59,3% 68,7% 66,0% Yes N 24 47 71 % 40,7% 31,3% 34,0% Total N 59 150 209 % 100,0% 100,0% 100,0% Source: Survey Data - Loans

4.2. Competitors’ Analysis

4.2.1 Credit Cards

For the credit card offer, the institutions that were selected were Bankintercard, Banco CTT, Cetelem, Cofidis, Puzzle, Sonae and Wizink. The credit cards that are analysed were selected

due to no requirement of owning an account in the institution, meaning that a non-client can acquire only that credit-card product. For the consumption credit offer (i.e. loans), the institutions that were selected were Cetelem, Credibom, Cofidis, Bankinter, Sonae and Oney. These institutions were selected as they directly compete with Unibanco in this product line. To compare the attractiveness of the current offers for the competitors previously stated, a perceptual map was used to illustrate it. The first perceptual map, Figure 21, compares the competitiveness of the International Processing Fee (that is significant relevant for the nonowners of credit cards, with mean = 3.91) and the relevance for two different loyalty programs (Cash back and Points Program). The APR, that is a percentage value that includes repayment charges, commissions and interest payments, taxes and compulsory insurance, was not used for the analysis as all the offers have the same percentage. The Cash Back program is more relevant compared to the Points program, for the nonowners of credit card, meaning that the credit card offers that include the first option are scored higher. Although the Points program is not significant relevant, it was used for the analysis, as several competitors offer that loyalty program. The offers that reveal to be more appealing are Bankintercard and Cofidis+1, as they do not charge International Processing Fee and offer the Cash Back program. For the offers that include a Cash Back program, Cetelem reveals a lower International Processing Fee than Cofidis Card. The offers that include the Points program, Sonae presents a lower International Processing Fee (1.635%), followed by Unibanco (2%) and Wizink (2%), and Banco CTT shows a higher fee (2.7%). Puzzle charges no International Processing fee but has no loyalty program. Nevertheless, a potential client can be persuaded to acquire a specific credit card based on the membership offer. In this sense, Unibanco offers a higher value offer, a toaster that costs 160 euros in a retail store, followed by Bankinter and Cetelem that offers a Cash Back program during the first year that can accumulate 120 euros, Wizink offers 60 euros and Cofidis 50 euros in offers.

Figure 21 - International Processing Fee Competitiveness vs Cash Back and Points Program

Source: Institutions Website and Institutions call centers

4.2.2. Debit Cards by Fintechs

The fintechs considered for the analysis are Moey, Revolut, Monese and N26. Moey offers sonly card version compared to Revolut, Monese and N26 which offer three versions with different prices and advantages that will be compared further.

Regarding the free versions, the only card that requires a delivery fee is Monese Simple (4.5 pounds). Regarding the currency conversion rate, Moey and N26 do not limit the maximum amount spent abroad before charging an international processing fee. By contrast, Revolut Standard and Monese Simple limit an amount of 6000 and 2000 euros respectively for purchases abroad without charging conversion rates. When it comes to recommendation rewards, only Moey do not offer a reward benefit. All offers have the contactless technology. Regarding the delivery time, Moey is the more time efficient, followed by N26. As being a Portuguese fintech, Moey has an advantage on the delivering time. Revolut Standard and N26 offer a savings package, working as a term deposit. For these free versions only Revolut Standard allows the customer to acquire a daily low-cost travel insurance. There are Mobile Apps available for the four offers but only N26 does not offer a virtual card. The Figure 22 illustrates all differences and similarities.

96.5% 97.0% 97.5% 98.0% 98.5% 99.0% 99.5% 100.0% 100.5% 0.0000 1.0000 2.0000 3.0000 4.0000 5.0000 Price c o mp eti ti ve n es s

Evaluation of loyalty programs Likert Scale 1 to 5

Figure 22 – Free version features from fintech’s offers

Money Standard Revolut Monese Simple N26

Membership Cost 0 0 4.5 £ deliver 0

Subscription Fee 0 0 0 0

Limits

Currency Conversion N.A. 6,000 € 2,000 £ N.A.

% 0.50% 2% 1.7%

International Withdraw 0 200 € 200 £ N.A.

% 1.70%

Reward

Cash Back

Currencies 150+ 8 19

Contactless

Waiting time 2 weeks 2 weeks 10 days

Savings package > 2000€

Insurance > 1£

App

Virtual Card

Source: Website of the institutions

The next set of offers that will be analyzed are the Revolut Premium, Monese Classic and N26 You. The only card that requires a delivery fee is Monese Classic (4.5£). The prices for these versions are 4.95 pounds, 7.99 and 9.90 euros. Only N26 You charges international processing fee (1.7%), but on the other hand is the only card that does not charge international withdraw fee. All the cards offer rewards for recommendation and have contactless technology. Monese Classic is the only option that do not offer savings package and travel insurance. There are Mobile Apps available for the three offers, but N26 is the only that does not offer a virtual card. The Figure 23 illustrates all differences and similarities.

Figure 23 - Second version features from fintech’s offers Revolut Premuim Monese Classic N26 You

Membership Cost 0 4.5 £ delivery 0

Subscription Fee 7.99 € 4.95 £ 9.90 €

Limits

Currency Conversion N.A. N.A. N.A.

% 1.7%

International Withdraw 400 € 800 £ N.A.

% 2%

Reward

Cash Back

Currencies 150+ 8 19

Contactless

Waiting time 2 weeks 2 weeks 10 days

Savings package > 2,000 €

Insurance

App

Virtual Card

Source: Website of the institutions

Regarding the premium solutions (costliest, but more beneficial versions), the prices practiced by these players are 13.99 euros for Revolut Metal, 14.95 pounds for Monese Premium, and 16.90 euros for N26 Metal. An added advantage is a higher limit of withdraw for the Revolut Metal and no withdraw limit for Monese Premium. Other advantage is the Cash Back program offered by Revolut Metal. The added advantage of the N26 Metal is the access to selected discounts and offers from partner brands and exclusive access to unique Metal Experiences. The Figure 24 illustrates all differences and similarities.

Figure 24 - Last version features from fintech’s offers

Revolut Metal Premium Monese Metal N26

Membership Cost 4.5 £ delivery 0 0

Subscription Fee 13.99 € 14.95 £ 16.90 €

Limits

Currency Conversion N.A. N.A. N.A.

% 1.7%

International Withdraw 600 € N.A. N.A.

%

Reward

Cash Back EU 0.1%/G1%

Currencies 150+ 8 19

Contactless

Waiting time 2 weeks 2 weeks 10 days

Savings package > 2,000 €

Insurance

App

Virtual Card

Source: Website of the institutions

4.2.3. Loans

The Figure 25 refers to the mean of Unibanco and its competitors interest rates for five different time ranges of personal loans and the Figure 26 refers to the Unibanco interest rates for the same time-ranges. In blue are the charges for the respective amounts that Unibanco practice a more competitive price than the mean. For the rest of the amounts and time ranges, Unibanco reveals to be less competitive compared with the mean values, and the competitiveness of the other players vary from time-ranges, practicing similar interest rates. All competitors offer different insurance for credit protection associated with it. The interest rate competitiveness changes by time range and amount. Nevertheless, Cetelem and Sonae present more competitive interest rates in more combinations.

Figure 25 - Interest rate means of all competitors

24 60 84 96 120

TAN TAEG TAN TAEG TAN TAEG TAN TAEG TAN TAEG

5000 7.72% 11.53% 9.62% 12.18% 9.15% 11.32%

7500 7.75% 11.37% 8.73% 10.96% 9.11% 11.07% 9.97% 11.87% 10.00% 12.00% 10000 7.75% 11.28% 8.75% 10.88% 9.07% 10.95% 8.95% 10.73% 10.04% 11.88% 50000 7.62% 10.90% 8.58% 10.50% 9.04% 10.69% 9.43% 11.09% 9.38% 10.85%

Source: Simulators from the institution’s websites Figure 26 - Interest rates Unibanco

24 60 84 96 120

TAN TAEG TAN TAEG TAN TAEG TAN TAEG TAN TAEG

5000 9.20% 13.40% 8.50% 11.00% 10.80% 13.40%

7500 9.40% 13.40% 8.50% 10.80% 10.00% 12.20% 10.00% 12.10% 10.00% 12.00% 10000 9.40% 13.30% 8.50% 10.70% 10.00% 12.10% 10.00% 12.00% 10.00% 11.90% 50000 9.40% 13.00% 8.50% 10.40% 10.00% 11.80% 10.00% 11.70% 10.00% 11.60%

Source: Simulator from the institution website

After analyzing the interest rates, another important factor is how digital the process of hiring a loan is. The steps considered for this analysis were the following:

Source: Author

The first step consists in consulting in the website the possible combinations regarding the payment term and amount. All competitors and Unibanco, excluding Bankinter allow any person to simulate a credit online. Bankinter only allow that for the current clients. The request phase consists in digitally send through the website the application with the required documents for assessment. All competitors and Unibanco, excluding Bankinter allow to request a loan through the website. The approval is manly done by phone, only Unibanco send a letter in case of disapproval. The last step consists in signing the contract through a digital signature. Cetelem is the only institution that allows it. In the Figure 28, its observable that Unibanco is less competitive in the digital than the majority of its main competitors. Regarding the market share, Unibanco has lower market share than the ones with a higher level of digitalization excluding Oney. However, it is important to mention that Unibanco is currently running a pilot project to implement a digital process for consumption loans.

Simulator Request Approval Contract

Figure 28 - Market Share vs Level of Digitalization

Source: Unibanco - ASFAC – Data from August 2019 - Adapted

-5% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% -20% 0% 20% 40% 60% 80% 100% 120% M ar ke t Sh ar e Level of digitalization