Revista

de

Administração

http://rausp.usp.br/ RevistadeAdministração52(2017)268–284

Finance

and

Accounting

Intellectual

capital

in

mergers

and

acquisitions:

a

case

study

in

a

world-class

financial

institution

Capital

intelectual

em

fusões

&

aquisi¸cões:

um

estudo

de

caso

em

uma

institui¸cão

financeira

de

classe

mundial

Capital

intelectual

en

fusiones

y

adquisiciones:

un

estudio

de

caso

en

una

institución

financiera

de

clase

mundial

Ricardo

Vinícius

Dias

Jordão

a,b,c,∗,

Victor

Luiz

Teixeira

Melo

a,

Frederico

Cesar

Mafra

Pereira

a,

Rodrigo

Baroni

de

Carvalho

daFPLEducacional,PedroLeopoldo/MG,Brazil

bCenterforAdvancedStudiesinManagementandEconomics(UE),Évora,Portugal cSwissManagementCenter,Zurich,Switzerland

dPontifíciaUniversidadeCatólicadeMinasGerais,BeloHorizonte/MG,Brazil

Received13May2016;accepted3November2016 Availableonline16May2017

ScientificEditor:WilsonToshiroNakamura

Abstract

TheobjectiveoftheresearchdescribedinthispaperwastoanalysetheimplicationsofthemergerbetweenItaúandUnibancobankson the IntellectualCapital(IC)oftheItaúUnibancoS/ABank.Themethodologycomprisedaqualitativeandquantitativecasestudy,inadescriptive approach,basedoninterviews(formalandinformal)andquestionnairesappliedto225topmanagers(directors,superintendents,regionalmanagers andcommercialgeneralmanagers)originatedfromthesetwobanks.Theresearchwascomplementedwithdirectobservationanddocumental analysis.Thefollowingresultswerefoundafterthemerger:(i)improvementswerenotedinallanalysedindicatorsontheconstituentelements oftheIC(humancapital,structuralcapitalandrelationalcapital),(ii)ItaúUnibancoS/ABankcreated,developedandacquiredknowledgeand know-how,and(iii)thesefactorsinfluencedcorporativeIC,supportingimprovementsinprocesses,systems,technology,brands,productsand mainlyinpeople,corporateimageandtherelationshipofthecompanywiththemarket,promotingsignificantfinancialresults.

©2017DepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoeContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP. PublishedbyElsevierEditoraLtda.ThisisanopenaccessarticleundertheCCBYlicense(http://creativecommons.org/licenses/by/4.0/).

Keywords: Strategy;Mergersandacquisitions;Knowledgemanagement;Intellectualcapital;Valuegeneration

Resumo

Oobjetivodapesquisadescritanesteartigofoianalisarasimplicac¸õesdafusãoentreosbancosItaúeUnibanconocapitalintelectual(CI)do BancoItaúUnibancoS/A.Ametodologiautilizadafoiumestudodecasoqualitativoequantitativo,emumaabordagemdescritiva,baseadaem entrevistas(formaiseinformais)equestionáriosaplicadosa225gestoresdealtonível(diretores,superintendentes,gerentesregionaisegerentes geraiscomerciais)oriundosdessesdoisbancos,sendoenriquecidacomobservac¸ãodiretaeanálisedocumental.Osresultadosindicaramqueapós afusão:(i)melhoriasforamobservadasemtodososindicadoresanalisadosquantoaoselementosconstitutivosdoCI(capitalhumano,capital estruturalecapitalrelacional);(ii)oBancoItaúUnibancoS/Acriou,desenvolveueadquiriuconhecimentoseknow-how;e(iii)queessesfatores

∗Correspondingauthorat:AvenidaLincolnDiogoViana,830–CEP33600-000–PedroLeopoldo/MG,Brazil.

E-mail:jordaoconsultor@yahoo.com.br(R.V.Jordão).

PeerReviewundertheresponsibilityofDepartamentodeAdministrac¸ão,FaculdadedeEconomia,Administrac¸ãoeContabilidadedaUniversidadedeSãoPaulo –FEA/USP.

http://dx.doi.org/10.1016/j.rausp.2017.05.007

influenciaramoCIdobanco,promovendomelhoriasemprocessos,sistemas,tecnologia,marcas,produtose,principalmente,empessoas,imagem corporativaerelacionamentosdaempresacomomercado,ajudando-oaalcanc¸arsignificativosresultadosfinanceiros.

©2017DepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoeContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP. PublicadoporElsevierEditoraLtda.Este ´eumartigoOpenAccesssobumalicenc¸aCCBY(http://creativecommons.org/licenses/by/4.0/).

Palavras-chave:Estratégiascorporativas;Fusõeseaquisic¸ões;Capitalintelectual;Gestãodoconhecimento;Gerac¸ãodevalour

Resumen

ElobjetivoenesteestudioesanalizarlasimplicacionesdelafusiónentrelosbancosItaúyUnibancoenelcapitalintelectual(CI)delBanco ItaúUnibancoS/A.Seutilizalametodologíadeestudiocualitativoycuantitativo,enunenfoquedescriptivo,conbaseenentrevistas(formales einformales)ycuestionariosrealizadosa225 ejecutivosdealtonivel(directores,superintendentes,gerentesregionalesygerentesgenerales comerciales)procedentesdeestosdosbancos.Además,laobservacióndirectayelanálisisdedocumentosenriquecenelestudio.Losresultados indicanquedespuésdelafusión:(i)seobservamejoraentodoslosindicadoresanalizadosencuantoaloselementosconstitutivosdelCI(capital humano,capitalestructuralycapitalrelacional);(ii)elbancoItaúUnibancoS/Ahalogradocrear,desarrollaryadquirirconocimientosyknow-how;

y(iii)queestosfactoresinfluyenenelCIdelbancoypromuevenmejorasenprocesos,sistemas,tecnología,marcas,productosysobretodoenlas personas,enlaimagencorporativayenlasrelacionescomercialesconelmercado,loqueloayudaaalcanzarresultadosfinancierossignificativos. ©2017DepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoeContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP. PublicadoporElsevierEditoraLtda.Esteesunart´ıculoOpenAccessbajolalicenciaCCBY(http://creativecommons.org/licenses/by/4.0/).

Palabrasclave: Estrategiascorporativas;Fusionesyadquisiciones;Capitalintelectual;Gestióndelconocimiento;Creacióndevalour

Introduction

Thethemeofmergersandacquisitions(M&A)hasaroused greatinterestintheacademicandbusinessenvironment,above allbecauseoftheverylargeamountsinvolved,thecontroversy producedandthe growing intensity withwhich thisstrategic optionhasbeenusedinrecentyearsinBrazilandworldwide

(CostaJr. &Martins, 2008; Jordão &Souza, 2013; Vieru &

Rivard,2015).Inspiteoftheincreaseinthevolumeand

rele-vanceof M&Aoperations,thereare stillgaps inthe research thatneedtobeaddressed.Divergencesexistbetweentheresults expectedandthoseeffectivelyachievedwiththeseoperations

(Child, Faulkner, & Pitkethly, 2001; Jordão & Souza, 2013;

Jordão,Souza,&Avelar,2014),especiallythroughthelossof

knowledge(Childetal.,2001;Mayo,2002)andintellectual

cap-ital(IC)(Freire,2012;Freire,Spanhol,&Selig,2014)inalarge

numberof them.Equally, theinternationalliterature has pre-sentedarangeofstudiesdealingwithknowledgemanagement

(KM)andIC(e.g.Andreeva&Garanina,2016;Ferenhof,Durst,

Bialecki,&Selig,2015;Jordão,Novas,Souza,&Neves,2013;

Novas,Alves,&Sousa,2015;Verbano&Crema,2016),these

beingconsideredthemesofgreatimportancebyscholarsandthe market(Jordãoetal.,2013;Novasetal.,2015).Thisisbecauseof thecapacitythatknowledgeassetsusuallypossessof augment-ingthevalueofcorporations(Joia,2000),andtherecognition of ICas themain driverincompanydevelopment(Andreeva

&Garanina,2016; Grimaldi,Cricelli,&Rogo, 2013;Jordão

&Almeida,2016;Jordãoetal.,2013;Luthy,1998;Mouritsen,

Larsen,&Bukh,2001;Novasetal.,2015;Verbano&Crema,

2016).Thisnotwithstanding,thechallengeofunderstandingthe peculiaritiesofICinM&Ahasstilltobeinvestigatedindepth. Recognizingandtakingadvantageofthisgap,theobjective oftheresearchdescribedinthisarticlewastoanalysethe impli-cationsofthemergerbetweenthebanksUnibancoandItaúon

theintellectualcapitaloftheItaú-UnibancoS/Abankresulting fromthisprocess.

The justificationof the researchis the extent towhich its resultscontributetoasubstantialsectionofsociety,asdefended

byJordãoandNovas(2013)andJordão,Pelegrini,Jordão,and

Jeunon(2015).In thissense,thestudy isjustifiedbecause,(i)

ithelpstofillthe above-mentionedgapintheresearch;(ii)it collaboratestowardsanunderstandingofthecreationand main-tenanceofknowledgeinM&A(aquestionthatconcernsalarge partof thebusiness worldandsociety)and(iii)it contributes towardsthe increaseofthe theoreticalbodyofknowledge on thetheme.Basedonwide-rangingresearch,whichmappedthe state of the art on the theme, in databases and portals such as Ebsco, Proquest, Emerald, B-one, Science Direct, Scholar Google,OECD,Scielo,Redalyc,PeriodicalsCapes,among oth-ers, itwasfoundthat specificstudiesanalysingthe effectsof mergerson ICdonot exist.Nevertheless, afew studieswere foundthat recognise the relevanceofthe themeand/or touch

onit,suchasCoff(1999),GuptaandRoos(2001),Capronand

Pistre(2002),Mayo(2002)orFreire(2012),citingitasafuture

opportunityforinvestigation,butwithoutdwellingonit,which againbringsouttherelevanceandoriginalityoftheresearch.

Inadditiontotheoriginalityoftheresearch,andtheanalysis modelproposedandapplied,thesubjectgainsbreadthbecause ofthemagnitudeandexpressivenessoftheM&As(Jordãoetal., 2014).Themanagerialchallengesinherenttotheseoperations

(Childetal.,2001),havealsoarousedtheinterestof

administra-torsandacademicsinthetheme,whorecognisethechallenges ofmanagingknowledge(cf.Vieru&Rivard,2015)and dimen-sioning IC, especiallyin M&A, as recently demonstrated by

Freireetal.(2014).Asmanagerialimplicationsoftheresearch,

consideringthesizeandrelevanceoftheorganisationstudied– thelargestfinancialinstitutionintheSouthernhemisphere.

Thearticleinquestionisdividedintoafurthersixsections in addition to this introduction. The second and third sec-tionspresenttheplatformforthetheoreticaljustificationofthe research,broachingthethemesofKMandICwithintheambit ofM&A.Thefourthsectionpresentstheresearchmethodology. Thefifthpresentsthecompanyandtheanalysisoftheresults. Thesixthdiscussesthemandthevalidationoftheresearch pre-suppositions.Finally,intheseventhsection,weproducethefinal considerationsinthelightoftheproposedobjective.

Mergersandacquisitions(M&A):motivationsand challenges

AccordingtoFinkelsteinandCooper(2009),theinternational literature on M&Ais, toa certainextent, fragmentary. Field researchonthestrategyandthefinancestendstofocusonvalue generationmechanismsandonthedeterminantsofperformance of the operation, in particular, on the strategic and financial attributesof thecombinedcompanies.Onthe otherhand,the approachofhumanresources’andorganisationalbehaviour lit-erature toM&Atendstofocusonthe aspectsof post-merger integration,recognizingthe roleof managerial integration,of organisational cultures and social identification between the combinedcompanies.

IntheviewofBrueller,Carmeli,andMarkman(2016),

com-paniesutiliseM&Atoacceleratetheirgrowth,tomakeuseofand expandvaluablecapacities,toaccessassetsthatareexpensive toimitate(including humancapital)andeventoreduce com-petition.Seligmann-Feitosaetal.(2014)postulatesthatM&A operations are understood as competitive movements for the retentionorcreationofstrategic resources,especially intangi-bles,alsobeingperceivedasameansofshorteningthetimefor theaccumulationofsuchresourcesasanalternativetointernal growth(organic).

AlthoughthenumberofM&AprocessedinBrazilandthe worldislarge,andjustifiedmainlybythehopeofanincrease invalueaftertheunion(Childetal.,2001;Jordãoetal.,2014), orasaleverforrapidgrowthincompetitivemarkets(Brueller

etal.,2016;Freireetal.,2014),orameansofacquiring

knowl-edge (Coff,1999;Gupta&Roos, 2001) and/orfor obtaining

synergies (Brueller et al., 2016; Lubatkin, 1983),the rate of failureof thesetransactions after completion ishigh(Barros,

Souza,&Steuer,2003;Childetal.,2001).Theempiricalresults

demonstratethatthemajority(varyingbetween50%and75%) ofM&Aoperationswasnotcapableofgeneratingexpected ben-efitsfor the business afterits realisation(Barros etal., 2003;

Child et al., 2001). Several reasons account for the

difficul-tiesof valuegenerationafter the union.Amongthesearethe erroneousidentificationofpotentialsynergies,thelackofprior planningofthedifferentphasesoftheoperation(Barrosetal., 2003),problemsarisingfromimproperevaluationandestimates, ahighpricepaid(Héau,2001)and, especially,the lossof IC after theunion.The latteriscausedbythe followingfactors: (i)evasionofknowledge(humancapital);(ii)negativeimpact ontheimageand/oronrelationshipswithcustomers,suppliers

andotherstakeholders(relationalcapital);or(iii)difficultiesin integratingthestructuressoastoretainapartofthetacitand per-sonalexplicitknowledge,transformingitintoanorganisational assets(structuralcapital).AccordingtoDurstandEdvardsson

(2012),KMhasaprofoundimpactonthecapacityof

compa-niestofaceuptothepresentandfuturebusinesschallengesand, therefore,ontheirsurvival.

AccordingtoBruelleretal.(2016),M&Asarehighly com-plex and disturbing and, because of that, economic value generation canbecome morefeasible withthe engagementof peoplemanagementpractices(includingmanagementofhuman capital) carried outfrom thestart of theoperation and main-tainedpermanently.Uhlenbruck,Hitt,andSemadeni(2006)and

CapronandPistre(2002)showedthatthedistinctiveresources,

particularlyintangibles,possessedbyacquiringand/oracquired companies, arefundamentalin thevalue creationprocess for shareholdersinM&Aoperations.Uhlenbrucketal.(2006) ana-lysedtheacquisitioneventsofInternetcompaniesandthevalue creation process between acquiring/acquiredcompanies from the sameordifferentindustries,concludingthat theresources ofthetargetcompanyneedtoberelevantfortheacquirersfor suchaprocesstooccur.CapronandPistre(2002)exploredthe conditions under whichthe acquirers would obtain abnormal returnsontheirM&Aoperations.Throughanempiricalstudy, combininganeventstudywithasurveyofthepost-acquisition transferofresources,inasampleof101horizontalacquisitions, theauthorsexploredthetransferofresourcessubsequenttothe union,findingthattheacquirersdidnotachieveabnormalreturns whenonlytheyreceivedresourcesfromthetargetcompanies. In contrast, these authors discovered that buyers can expect abnormalreturnswhentheytransfertheirowntangibleand/or intangible resources to the acquired/merged companies, such asmarketingresources,innovationmanagement,amongothers.

CapronandPistre(2002)concludedthatinthiswaythismutual

transfercouldpotentiatethevaluegenerationprocessbecause the complementarity process of resources and organisational capacitiesisassociatedwithsuperiorpost-unionperformance.

Similarly to such authors, Nair, Demirbag, and Mellahi

(2015)examinedtheimportanceofsubsidiariesinthereverse

transferof knowledge,bymeansof asurvey ofmultinational companies in India. The authors observed that their compe-tencesandcapacitiesplayavitalroleinthisprocess,knowledge transfertothemothercompaniesbeingaffectedbythelevelof collaboration andby the degreeof complexity of the knowl-edge, especially inknowledge intensive andhigh technology companies.

However, Schoenberg and Bowman (2010) stress that one commonimperativeproblemfrequentlymentionedinthe inter-national literature in such situations consists inthe practical difficultiesofpostunionmanagementandinthechallengesof retaininghumancapital intheseorganisations,as wellas the knowledgeaccumulatedovertimebythestaff.

Knowledgemanagementandintellectualcapitalin mergers&acquisitions

GuptaandRoos(2001)observedthatICneedstobeatthe

‘root’ of the synergy andvalue generation processin M&A. Theseauthors concluded that the strength of a navigator for theICresidesinitscapacitytoemphasiseitsownsubjectivity andoffer,simultaneously,anobjectivemeansoflookingatthe strategicutilisationofthemergers’criticalresources.Asimple (open)leadershipstructurewasintroducedtoanalysethe poten-tialofthesynergiesandtherisksinvolved,providingfacilitating conditionsforpost-unionknowledgetransfer.

Stettner and Dovev (2014) analysed the contribution that

businessacquisitionsandstrategicalliances maketowardsthe processesofexploringandutilisingknowledge,inrelationtothe internaldevelopmentofcompetencesthroughthestudyof190 Americansoftwarecompanies.Acquisitionswereconsideredas alternatives forthe creation andsharing of knowledge,being particularly important in the development and innovation of products,processes,systemsandtechnologies,iftheprocessis managedwithcareandinacollaborativeway.Theauthorsfound thatthesetransactions arethemostimmediatewaysof acces-singnewknowledgeandskills,andofextendingthosealready existing,havingconcludedthatthereareadditionalchallenges inthemanagementofsuchprocesses–thatcanbepotentiated whencomplementedbyalliancesandinternaldevelopment.

Ensign,Lin,Chreim,andPersaud(2014),througha

compara-tivecasestudy,observedthatelementsofproximity(geographic, cognitiveandorganisationalquestions)hadasubstantial influ-enceontheprocessesofknowledgetransferandinnovationin M&A.Theysuggestedthattheimpactofeachofthesevaries, andisinfluencedbythetypeofmanagerialinterventionorby thelackofasuitablepost-mergeroracquisitionmanagement.

VieruandRivard(2015)proposedatheoreticalmodeltodeal

withthechallengesofknowledgesharingduringthepost-merger integrationprocessfromtheperspectiveofinformationsystems. Theyconcludedthatthesharingofknowledgeacross organisa-tionalboundariesinvolvesthenegotiationofmultipleaspectsin theKMdomainbetweenpeoplethatfrequentlydonotpossess thenecessarycapacitiestooptimisethisprocess,stressingthat otheraspectssuchaspractices,standards,valuesand organisa-tionalsymbolscan,likewise,haveasignificantimpactonsuch processes.

Zheng,Wei,Zhang,andYang(2015)investigatedthesearch

forstrategic assetsincross-borderM&Athrough a compara-tivecasestudyofChinesemultinationals.Theresultsrevealed thatthesemultinationalsseekassetscomplementaryto activi-tieswheretheyalreadypossesssomedominion,butatamore advancedlevel,tofacilitatetherecognition,valuationanduse ofthetargetcompany’sstrategicassets,organisationallearning

and the capacity of knowledge absorption being essential to thisprocess.Thelimitedintegrationapproachtotheunionwas consideredessentialtoprotectthesestrategicassets,conferring autonomytodirectthecompany’smanagerialteam,theretention oftalentandthecreationofsynergies.

Finally,Bruelleretal.(2016)identifiedthreegenerictypes ofM&Astrategy–annexationandassimilation,harvestingand protecting, orbindingandpromoting– that canbecombined withthreeknownresultsofpost-mergerintegration(absorption, preservation and symbiosis, respectively). Using a configu-rational perspective and the capacity-motivation-opportunity model,the authorsdevelopedaconceptualtablethathelpsin improving humanresources managerial practices,connecting themtotheM&Astrategies,inanattempttomaximisetheresults ofpost-mergerintegration.

AuthorssuchasSchoenbergandBowman(2010)perceived that a normal andimperative problemfrequently pointed out in international literature in M&A situations consists in the practicaldifficultiesofpost-unionmanagementandinthe chal-lenges of retaining human capital in these organisations, as well as the knowledge accumulatedby people.Mayo (2002)

explainsthatsomecompaniesconsiderhumanresourcesM&A processcostsandnotas elementsincorporatingunique intan-gible assets that addvalue to the organisation. In this sense, the authors explain that because theyare not knowledgeable abouttheICmanagementprocessanditselements,some peo-pleareremovedfromthecompany,takingwiththemacquired knowledge andexperience. Morethanjustlosingthis knowl-edge,however,thereistheriskthattheywillbepickedupand usedbyacompetitorinthemarket.Curiouslyandparadoxically fortheinterestsoftheacquirersinobtainingknowledgerelated tothecustomers,suppliersandmarkets,manyM&Adonot man-agetoachievetheresultsprojectedbecauseofproblemsrelated tothemanagementof intangibleassets(Coff,1999).

Accord-ingtoFreire(2012),thecapacityoftheacquiringcompanyto

eliminateintegrationproblemsisintrinsicallyrelatedtopeople management, culture andknowledge duringthe wholeM&A operation.

Similarly, companiesneed totakecare when dealingwith relationalcapitalinamergeroracquisitionprocess,when the name of theacquired companyisaltered, becauseit canlose part ofits clienteleor haveitstraderelationships affected,as theassociationtoqualityandtothereputationofthecompany couldbe shakenbythechange.Thisoccursbecausethe rela-tionships that the acquired company built up over the years withsuppliers,thecommunity,governmentbodies,canbelost withtheformationofanewcompanyinitsintegrationprocess. Theseideasare inharmonywiththe thinkingof Freireetal.

(2014),for whom M&Ashaveencountered difficultiesinthe

amongotherthings,tothelossofinformationindocumentsand processes caused by the incompatibility between systems. Equally,thebreakinculture,wherepeoplecansharethesame rules,iscitedbyMayo(2002)asoneofthemostcommoncauses ofthedisappearanceofalargepartofthestructuralcapital.The conflictbetweencultures,therefore,iscitedasoneofthecauses offailureinM&Aprocesses.

Inobjectiveterms,Jordãoetal.(2013)understandthatthe conversionprocessoftacitintoexplicitknowledgedescribedby

Nonaka,Toyama,andKonno(2000),althoughcomplex,canbe

facilitatedbyorganisationalcultureandsocialisationactivities. Culturehelpsintheintegrationofpeopleintherulesofthe com-panythat promotesexperiences sharing.Socialisationas well iscitedasaformof conversionof individualtacitknowledge intocollectivetacitknowledgeand,sometimes,fromtacitinto explicit.Theargumentgivenisthattheexchangeofexperiences andskills,startingfromthementalmodelsoftheparticipants, stimulatestheabsorption,creationandsystematisationofnew andoldknowledge bytheseparticipants,inamannersimilar tothatfoundbyBalestrin,Vargas,andFayard(2008).In com-plementaryfashion,DurstandFerenhof(2014)assertthatthe essential ismakingthecompanymanagersawareof therisks thatcanbeassociatedwiththelossofknowledge,considering notonlytheobviousfactorsbutalsoalltheorganisationaland humanaspectsandtheirimplications.

Thesequestionsrevealthenecessityoflookingcriticallyat the roleof KMinreaching theplanned objectivesfor M&A, especiallyrecognizingits strengthandimportance inthe pro-cesses of creation, development, the maintenanceanduse of organisationalknowledge,aswellasinavoidingthelossofthe knowledgeassetsmakingupthepost-unionIC.ICmanagement isdefinedbyViedma(1998)asamorepreciseandefficientform ofconductingagroupofprocessesandsystemsthatpermitsa significant increaseof IC withthe objective of solving prob-lemsmorerapidly,withaviewtopromotingtheattainmentof thecompany’sstrategic objectivesandgeneratingcompetitive sustainableadvantagesforit.Novasetal.(2015),complement thisbyasserting thattomanage ICrequires creativity, devel-opment, renovation, integration, utilisation andmaximisation oftheorganisation‘sintellectualassets.Withthisfulcrum,the organisationshouldbecapacitatedorcapacitateitselftoidentify, measure,manageandcontroltheIC.

Forthepurposes of theresearchdescribed, theconcept of IC adopted was that whichcontemplates the following three factors.Humancapital,representedbyfactorssuchasthe knowl-edge,experience,innovation,thecultureandphilosophyofthe company,andthe skillofthe staffincarryingoutday-to-day tasks,amongotherrelatedelements.Structuralcapital, repre-sentedby factorssuch as theequipment,software, databases, information systems, patents and trademarks, organisational structure, amongotherrelated elements.And relational capi-tal,representedbyfactorssuchasrelationshipswithcustomers, employees,themarket,thecommunity,thegovernment,trade unions,suppliers,amongotherstrategicplayers/partners.This isbecauseinaccordancewithFerenhofetal.(2015),theconcept ofcustomercapitalstressed byStewart(1999)andEdvinsson

andMalone(1997),hasbeensubstitutedbyaadequateapproach

forembracingrelationshipswithallinterestedparties,notonly customers.

AccordingtoJardonandMartos(2012),relationshipscreate knowledgeandthismaterialisesintheIC.Therelationshipsare established fromwithinthecompanytooutsideit,generating value.ThismeansthatthepartofICofpeople,thehuman capi-tal,createsthestructuralcapital(ICinternaltotheorganisation) andthisstructuralcapitalcreatestherelationalcapital(ICwith theenvironment).Intheviewoftheauthorsmentioned,this cir-cularrelationshipisresponsibleforthebasicprocessofcreation and expansion of theknowledge in companies.Accordingto

Novasetal.(2015),itispreciselythroughthecombinationof

theconstituentelementsofIC(human,structuralandrelational capital),thatorganisationsdefineandreachtheirobjectives.

Based ona mapping of the state of the artrelative to the IC question,Ferenhofetal.(2015)asserted that,inthe exist-ing literature,severalmodels are alreadyavailable that could contributetothecorrectdimensioningandanadequate manage-mentofIC.However,therearestillfewmodels(orevennone) for managingICinM&Aprocesses.However, severalothers existthatcanbeadaptedtothiscontext.OneofthemisforIC managementandcontroldevelopedoriginallybyJordão(2011)

and augmentedbyJordãoet al.(2013),whichfacilitatesthis processbyproposingtheintegrationofthemanagerialcontrol system(SCG)withthestrategyandorganisationalculture.This wouldbedonesoastoincludetheexpectationofpeopleinthe establishmentofthissysteminsuchawaythatthecultureacts besidetheknowledgemanagementsystem,collaboratinginthe processofpeople’stacitknowledgeconversionintoindividual andcollectiveexplicitknowledge,untilbeingtransformedinto organisationalknowledge.ThecentralpremiseofthisICcontrol model istomaketheSCGofthecompanymoreefficientand effective,tomeasurethevalueoftheintellectualand/or intangi-bleassetsinfinancialtermsattheorganisationallevel,toobserve thecontributionoftheICtotheaddedmarketvalue.

Thesynthesisoftheempiricalresultsanalysedpermitsusto establish:(i)therelevanceofknowledgeandICintheM&A con-text;(ii)theneedforthemanagementoftheseelementsduring andaftertheprocessofintegration, forpost-unionvalue gen-erationtooccureffectively;(iii)thattherelationshipsbetween theplayersareessentialinthisprocess;(iv)thatthehuman cap-italisthebasisoftheIC;(v)thatthestructuralandrelational capitals needto beworkedon withcareafter the union;(vi) that theacquirersneed totakecareof allthe elementsofIC, controllingandmanagingthemfortheiroperationstobe suc-cessful;and,especially,(vii)thatthereisanalignmentbetween strategyandorganisationalcultureandmanagerialpoliciesfor IC,facilitatingandstimulatingthecreation,systematisationand sharingofinformationandknowledge,aswellasthepersonal andorganisationallearninginM&A.

Researchmethodology

2005). As regards the qualitative and quantitative approach,

GeorgeandBennett(2005)explainedthatoneuniqueapproach

maynotbesufficienttomeetalltherequirementsproposedin thistypeof research,which,accordingtoJick(1979),allows a complementarity of knowledge. According to Cooper and

Schindler(2006),qualitativestudiespermitarichnessofdetail

andcomprehensionof the socialsignificanceof the problem, describingitandanalysingtheinteraction,logicandthedynamic betweenthevariablesandthephenomenonresearched. Quan-titativestudies,intheirturn,accordingtoLavilleandDionne

(2007),are justifiedbecausetheyallowagreater capacityfor

generalisation.

AccordingtoCreswell(2003),aresearchershouldmakeuse of an investigative structure that guides his research project from the identification of the epistemological stance that is the foundation of the philosophical stance of the researcher beforetheobjectoftheresearch,totheproceduresfor gather-ing,analysingandinterpretingthedata.Inthiscase,theresearch nowdescribed,althoughitusesquantitativeelementsandseeks objectivityandneutralitytowardsadetermined knowledgeof reality,canbeconsideredtohaveaninterpretativenaturebecause oftheneedtoknowtheinternalcausesofthephenomena rel-ativetoknowledgeandintellectualcapital–whichareinlarge partsubjectiveelements,reachedinthiscaseviathequalitative partoftheinvestigation.

Thecasemethod,inaccordance withYin(1984),consists inan empirical investigationof a contemporaryphenomenon initsreal life context,when thelimits betweenphenomenon andcontextarenotclearlyevidentandseveralsourcesof evi-denceareused.Thecasestudyallowsaninvestigationinwhich onepreservestheholisticcharacteristicsandsignificanceofthe happeningsofreallife,facilitatingtherealisationofinferences, anditmayproducecontributionsforthebuildingoftheorieson thetheme, potentiating amoreobjective analysisof the rela-tionbetweenthevariablesanalysed.Thisapproach,according

toFreire(2012),was consideredsufficientlysensitiveto

cap-tureandanalysethecomplexityinherenttotheanalysisofICin M&A.

TheunitofanalysisexaminedwasthebankItaú-Unibanco S/A.Theselectionofthecasewasmadebasedonfivecriteria. Itisarelevantcase,involvinglargecompanies,withoperations consolidatedfor morethan two years, whichwent through a mergerprocess,andwhichallowedaccesstoinformation.This latterisaquestionconsideredcrucialbyJordãoetal.(2014), being oneof the greatest difficultiesinthistype of research, becauseit dealswithinformationofastrategic nature,which manycompaniesconsiderconfidential.

Withinthe varioussourcesof evidence existingina com-parativecasestudyofaqualitativeandquantitativenature,as aprimarysourceof evidence, prioritywasgiventothe hold-ingofpersonalinterviewsindepth,supportedbyaninterview guide, associated to a questionnaire, and complemented by bibliographical, documentary researchand direct observation (participant).

Astheinstitutionresearchedhadmorethanfourthousand branchesinthewholeoftheBraziliannationalterritoryin2016, thestudy was limitedto asampleof thispopulation,defined

and chosen by accessibility, in accordance with Cooper and

Schindler(2006).Thechoiceoftheintervieweeswasmadeby

type,thatis,bytheinformationcapacitythattheypossessedon the problembeingexamined,followingthe recommendations

ofCooperandSchindler(2006)tofocusonelements

represen-tativeofthepopulationwithknowledgeof theproblembeing investigated. Therespondents were interviewedinthe formal andinformalmannerbetweenNovember2014andMarch2015, makingexplicittheirperceptionsoftheproblemunderscrutiny. Thus, in developing the research, directors, superintendents, managers ofthe tacticalandstrategic levelwereobserved, in additiontootherpeoplethatlivedthroughthechangesprovoked bythemergerandwhowerequalifiedtogiveanopinionabout possiblechangesinKMand/orICofthebanks.Itisworth men-tioningthatthefocusonpeopleinkeypositionsdidnotrestrict the study’scapacityfor inferences becausesomeof the man-agersmentioned werein positionsof operational,analytic or technicalmanagementatthetimeofthemerger,whichallowed them a mosaic of perceptions about the question before and aftertheoperation.Itisstressedthattheselectionofthe sam-ple,inthiscase,inaccordancewiththetaxonomyproposedby

LavilleandDionne(2007)isnon-probabilistic,andwasmadeby

convenience,astheinvestigationoccurredwithpredetermined respondents.

For the occupiers of strategic positions such as regional branchmanagers(GRA),commercialmodelmanagers(GMC), Uniclass service managers and company managers (GSUE), inadditiontocommercialsuperintendentsanddirectors, inter-viewswereheldwithasemi-structuredguide,posingquestions about theIC,its management,andthe reflexesof the merger processontheICelements.Inparallelwiththeinterviewswith the bank’s strategic, tactical and operational level managers, questionnaires were appliedto commercialgeneral managers fromthetwomacro-regionsofthebankofthefiveexistingin thestate ofMinas Gerais,thesealsobeingselected by acces-sibility. In viewofthe selection ofthe regionsutilised inthe research, the population for the application of the question-naires was consideredto be the 215 branches of the regions ofIpatinga,GovernadorValadares,Barbacena,OuroPretoand theBeloHorizontemetropolitanregion.

Before the data collection, an e-mail was sent request-ingauthorisation fromthesuperintendentsof the tworegions involvedincarryingouttheresearch,toachievegreater secu-rityandtransparencyintheprocess,asoneof theresearchers is an employee of the organisation, being obliged to follow the norms andrules laid out ininternalcirculars. To test the suitability of thequestionnaire, toincrease its reliability,and improve therelevanceof thequestions, apre-testwascarried outwiththreegeneralmanagersandoneRegionalBranch Man-ageratthestartofNovember2014.Thequestionsthatgenerated doubtsorembarrassmentintherespondentswerereformulated. In this way the pre-test helped to check the suitability and reliabilityoftheinstrumentsofdatacollection,improvingthe relevanceofthequestionstothecharacteristicsoftheresearch universe.

averagedurationof 35min,totallingalittle morethan7h of recording–withallthepersonneloccupyingthementioned pos-itions,atcollectiveorindividualmeetings,betweenNovember 2014andMarch2015,inaccordancewiththeavailabilityofthe respondents.However,onlythoserespondentswithmorethan fiveyearsinthecompanywereconsideredvalid,astheywere theoneswhopossessedinformationaboutthecompaniesbefore andafterthemerger.Ofthetotalofrespondents,11%hadless thanfiveyears’service and27% wereabsent fromthe meet-ingsordid notwishtoreply,134 validrespondents therefore remained.

Theinterview guideandthequestionnairewerecomposed of 28 statements based on variables extracted from the lit-erature, referring tothe empirical results of previous studies of ICinM&A, the questions onthe questionnairebeing dis-tributedonascaleoftheascendingLikert-type,with5degrees ofagreement attwomoments:beforeandafterthemerger.It was consideredthat averagesbelow threeindicated disagree-ment.Theinterviewguidewasofthesemi-structuredtype,the questionsbeingusedasaguideforthediscussions.Inthisway, theresearcherhadthelibertytoinsert,excludeand/ormodify aquestionoverthedurationof theinterview,tobetter under-standanyidiosyncraticattitudetothephenomenonanditssocial context.

Tounderstand,therefore,thefirstdegreeICconstruct,formed bytheseconddegreeconstructs(humancapital,structural capi-talandrelationalcapital),thethirddegreeconstructsthatmakeit upshouldbeinvestigated,beinganalysedinthe(i)human cap-ital:inducementtoinnovationandmakinguseofgoodideas, technical and/or managerial knowledge, retention of talent, hiringpolicy andcompetences,worksatisfaction and organi-sationalclimate,personnelturnover,educationofcollaborators, investmentin training,leadership techniques andteam spirit; in(ii)relationalcapital:relationshipswithcustomers,customer retention,aftersalesrelations,recognitionofthecompanyand of itsbrandsbythemarket, partnershipswithother organisa-tions,evolution of thecustomer portfolio andthecreation of newbusiness;andin(iii) structural capital:brand andpatent management,investmentininformationtechnology,efficiency ofinternalprocesses,informationandknowledgetransmission systems, knowledge management system, encouragement for knowledgesharing,useofemployees’ideas,alignmentofthe courses with company strategy and systems for recognition, awardsandpromotionofstaff.

Theresearchpresuppositionsanalysedwere:

(i) ThemergerofItaúandUnibancohadimplicationsforthe ICofthisorganisation;and

(ii) Therewasonaveragealossofknowledgeafterthemerger, inrelationtothatexistingbeforeit.

Afterallthedatahadbeencollectedfromthequestionnaires, thestatisticalcalculationswerecarriedoutwiththerepliesfrom the valid respondents, to assessthe effects of the merger on theIC,confrontingwhattheyperceivedofthequestionatthe twomoments:beforeandafterthemerger.Inthe quantitative

analysis,the averagerankingmethodwasused(RM),as pre-sented by Malhotra (2001), obtaining the RM through the calculation of the weighted average between the replies and seeking tocheck the agreementand disagreementinrelation tothestatementsthatcomprisedthedatacollectioninstrument. Thequalitative analysis(oftherepliesoftheinterviewees) wascarried outusingthemethodofcontentanalysis(Bardin, 2004), whichconsists of a setof techniques used to investi-gatethemeaningofthemessagesoflinguisticcommunications. AccordingtoJordãoandSouza(2013)andJordãoetal.(2014)

thismethodisaviableinvestigationalternative inthistypeof operationasitisameansthroughwhichconnectionsaremade betweenthesituationtobeanalysedandthemanifestationsof discourse,throughoperationsofdismembermentandsemantic, syntacticandlogicalclassification.

Deductionandinductionwereusedalternatelyinthe analyt-icalprocess,theformerprevailingoverthelatter(Jordãoetal., 2014). Asameans of increasing the reliability of the results andtheinternalvalidityofthestudy,theinformationcollected was triangulated withothersourcesof evidence(Jick,1979). Thus,wheneverpossible,informationfromonesourcewas con-fronted withthat fromothersto confirmor refute it(internal validity).Itisstressedthat,inthepresentwork,thisprocedure wasstartedwiththequestionnairesthemselves(wherethedata obtainedwerediscussedcombiningthestatementstoknowthe constructsoftheICinitsvariouslevels)andafterwardswiththe interviews,asvariouspeoplewereheardaboutthesametopic.

In parallel,thebank, thebranchesandoffices of the com-panywereanalysed,tolearninmoredetailaboutthespecific factorsofthebusiness(enrichedwithparticipantobservation). Subsequently,triangulationwasusedwhichinvolvedthe anal-ysisofinformationbrochures,informationgarneredfromweb pages on the company’s site, from procedural, quality, train-ing, andcorporate policymanuals,from documentsfrom the banks Itaú andUnibanco priortothe merger, andfrom Itaú-Unibanco S/A subsequent to the merger,in additionto news itemspublishedaboutthesecompaniesinperiodicals, newspa-persandmagazinesfromthetime(documentaryanalysis).For parsimonyreasons,theresultsofthetriangulationhavebeen pre-sentedinsertedintothetext,intheanalysisofresults,withthe newinformationinsertedcorroboratingorrefutingtheprevious. Alsoanalysedwerethenewsitemspublishedinthecompany’s internalnewspaper,theaccountingrecords,thetableswiththe indicatorsofthelasttenyearsandtheinformationobtainedin informalconversations(non-structuredandextrainterview),in additiontocontactsmadesubsequenttotheinterviewsforthe purposeofcomplementingdataandclearingupdoubts.Finally, the results obtained were confronted with the main previous theoreticalandempiricalresults(externalvalidity),toconfirm, complement or contradictthemandhelptowards the genera-tionofnewtheoriesonthesubject.Inthissense,theprocedures suggestedbyEisenhardt(1989)andGeorgeandBennett(2005)

Presentationandanalysisofresults

Inthissection,theanalysisoftheimplicationsofthemerger between the two banks Itaú and Unibanco S/A on the IC of the Itaú-Unibanco S/A, was carried out, with the contex-tualization of the organisation, and with the investigation of possiblechangesintheconstitutiveelementsofthecompany’s IC(human,structuralandrelationalcapital)beforeandafterthe merger.

Contextualizationoftheorganisationstudied

The Itaú-Unibanco S/A is a Brazilian bank founded on 3 November2008throughthemergerofthebanksItaúand Uni-banco S/A, which already were two of the largest financial institutionsinBrazil.

TheimpactofthemergerofItaúandUnibanco,atthetimeit wasfirstannounced,waswidelycoveredbynationaland inter-nationalpublications,throughreportsoftheprocess,viewsand opinionsofspecialists.Accordingtoareportthatappearedinthe newspaperGazetadoPovo(2008),theobjectiveofthemerger wasveryclear:tocreatethelargestbankintheSouthern Hemi-sphereandtheninthlargestintheAmericas,makingitpossible topassbeyondthe limitsof BrazilianTerritorytogain inter-national projection. In the Brazilian market, the merger was receivedasaproofofthesolidityofthenationalbanking sys-tembecausebothbankshadanticipatedthepublicationoftheir thirdquarterresultsfor2008topreventanydoubtsbeingvoiced aboutthefinancialhealthoftheinstitutions.

AccordingtotheAmericannewspaperTheNewYorkTimes

(2008),runningcountertotheworldtendencytowardsa

reduc-tionofthefinanciallevermechanismofthetime,theBancoItaú hadbought,for15billiondollars,itsrivalUnibanco,creating thelargestfinancialinstitutioninLatinAmerica.

Inreality,after themerger,the Itaú-UnibancoS/A became thelargestfinancial groupof the Southernhemisphereof the Globe,astogether,inSeptemberof2008,thetwoinstitutions, possessedassetsamountingtoR$575.1billionreals,asagainst theR$403.5billionoftheBancodoBrasilandR$348.4billion ofBradesco.

AccordingtotheTheNewYorkTimes(2008),theplansfor cutswerenotclearatthetimeoftheannouncementofthemerger (commontoprocessesofconsolidationofthistype),norwasthe controlformatting(whichwasachallengingtask,asbothwere family-ownedbanks),leavingshareholderswithlittle informa-tion,andhavingtohopeforanincreaseinthemarketshareof thenewinstitution,basedonagrowthintheBrazilianeconomy. Initsturn,thePortalG1(2008)dweltonthecomplexityofthe process,whichwastobecarriedoutintwostages,through cas-cadingshareincorporationsuntilthefinaldesiredstructurewas obtained,aswellasthecapitalincreasethroughtheissueofnew shares.

Inadditiontothebank,theprincipalproducts ofthe com-pany are credit cards, insurance, investment banking, retail banking, private banking and asset management. The Itaú UnibancoHoldingS.A.operatesoutsideBrazilthroughits com-panies,inanothertwentycountriesmainlyonthecontinentsof

America,EuropeandAsia.Thebankpossessedatthetimeofthe mergermorethan95thousandemployees,withR$1.1billion oftotalassets,R$100millionnetworth,R$79.6billionmarket value,R$36.4billionEBITDA(earningsbeforeinteresttaxes depreciationandamortisation)andR$20.2billionnetprofit.

Behindthemergerandthedesiretobecomealeadingbank withasustainable performance,itcapitalisedthe components oftheIC,seekingtomakegooduseoftheknowledgeexisting therebeforethe mergerandinvestinginthe maintenanceand improvementofsuchknowledge.Regardingtheinvestmentsin humancapital,thedocumentsandtheintervieweesindicatedthat thebankinvestsintrainingandqualificationofitscollaborators toimprovethequalityofitsservices.Theinterviewswiththe managersofdifferentlevelsshowthatthisknowledgeconverts intomoreandbettersalesandrenderingofservicesandproduces adirectreturnforallthoseinvolved,fromthecustomers(whoare betterserved)tothestaff(intheformofvariableremuneration). Thisgeneratedabetterorganisationalclimate,producinggains for thecompanyanditsshareholdersbecausequalityinsales translatesintoprofitabilityandvaluegeneration.

Afterreviewingthehistoryofthebankthroughdocuments andtestimonies,onecansaythattheinvestmentmadeinthe ele-mentsoftheIChasmadeitpossibletoreachthedesiredposition inthemarket.Theintervieweesbelievethatthisissustainable andlasting,providedthatinvestmentiscontinuedand princi-pallythatresearchandinnovationaremaintained– toremain permanentlyinfrontandgeneratingvalueforallthoseinvolved intheprocess.

The managers interviewed singled out four aspects in the mergerprocess.Strategy(which offers acleardirectivetobe reached); structure (which stimulates the systematisation of knowledge);culture(whichvaluespeople,stimulatesresultsand facilitatesthecreation,retention,systematisationandsharingof knowledge); andthe performance assessment process(which permitsanevaluationof theresultsofthe stimuliinthethree previousaspects).Thisdeservescommendationbecauseofthe factthatthemergeroccurredbetweentwolargecompaniesthat hadconsolidatedtheirpositionontheBrazilianscene,andthat possessedsuchaspectsunderdifferentfoci,butthat,onmerging, becamemutuallycomplementaryonewiththeother.

Analysisofhumancapital

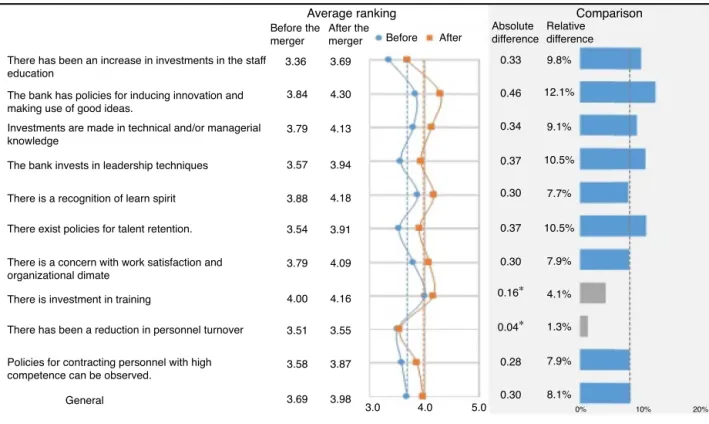

In line withthe presuppositionsof Ferenhof etal.(2015), it waspossibletoverify that thethird-degreeconstructs, also calledtheconstituentfactsofhuman,structuralandrelational capital,underwentmodificationsafterthemerger.Inanalysing, initially,theevolutionofhumancapital,itwasfoundthatthere wasanevolutioninalltheconstituentelementsofthisconstruct afterthemergerinrelationtowhatexistedbefore,ascanbeseen inFig.1.

Human capital

There has been an increase in investments in the staff education

Average ranking Comparison

Before the merger

3.36 3.69 0.33 9.8%

12.1%

9.1%

10.5%

7.7%

10.5%

7.9%

4.1%

1.3%

7.9%

8.1% 0.46

0.34

0.37

0.30

0.37

0.30

0.16∗

0.04∗

0.28

0.30 4.30

4.13

3.94

4.18

3.91

4.09

4.16

3.55

3.87

3.98

3.0 4.0 5.0 0% 10% 20%

3.84

3.79

3.57

3.88

3.54

3.79

4.00

3.51

3.58

3.69

Absolute difference

Relative difference After the

merger Before After

The bank has policies for inducing innovation and making use of good ideas.

Investments are made in technical and/or managerial knowledge

The bank invests in leadership techniques

There is a recognition of learn spirit

There exist policies for talent retention.

There is a concern with work satisfaction and organizational dimate

There is investment in training

There has been a reduction in personnel turnover

Policies for contracting personnel with high competence can be observed.

General

Considering a level of significance of 5%, the differences between the averages before and after the merger were not considered significant.

Fig.1. Tableofaveragegeneralranking–humancapital.

Source:ownpreparationbasedonresearchdata.

wereseenininvestmentintrainingat4.1%andthereduction ofturnoverwithapercentagevariationof1.3%frombeforeto afterthemerger.

Inanalysingthesestatementsinthelightoftheinterviewsand documents,itwasfoundthatthebankinvestsintechnicaland managerialknowledgeandthatitisthisthatproducesanincrease intechnicalknowledge,andstimulatesinnovationthroughusing the goodideasof the collaborators themselves.These results corroboratethefindings ofBontis(2001),whoperceivedthat humancapitalisthemostimportantelementintheorganisation, asitformstheinterfacebetweentheotherdimensionsoftheIC andcollaboratestoimprovetheorganisationwithitsfragmented viewoftheprocesses.Oneofthemanagersstatedthat:

Humancapitalanditsreflexesontherecognitionand percep-tionofcreationanddevelopmentintheprocesscanbeseen intheBankthat,afterthemerger,therewascreationoftools forperfecting,agreateralignmentwiththevisionandvalues ofthecompany,theestablishmentofameritocraticprocess, andgreaterinvestmentandpreparationofthecollaborators (GRA2).

Asregardssatisfactionandtheretentionofhumancapitalin theorganisation, itcould beseenthat,after themerger, there was,accordingtothestrategiclevelmanagers,“agreater con-cernwithpoliciesfortheretentionoftalent”.Therepliesonthe questionnairesconfirmthisaspect,aswellasthesignificant con-cernwithworksatisfactionandorganisationalclimate,asmall reductioninpersonnelturnoveralsobeingseentohaveoccurred.

Oneofthepossiblesolutionsforthislastaspectwouldbeforthe companytoinvestmoreintheaspectsofworksatisfactionand organisationalclimatewiththeobjectiveofreducingitsturnover, inlinewiththefindingsofBontis(2001)andMayo(2002)who considerthecompany’scollaboratorsitsmostpreciousassets.

The documentaryanalysisrevealed thatthe internalcareer processhadbecomemoredynamic,asthebankstartedtobase itselfontechnicalandmeritocraticprocessesinpersonnel pro-motion.Directobservationconfirmsthatthecollaboratorscan seeknewcoursesandtrainingprogrammesthat,iftheymake itpossibleforthemtoachievebetterresults,facilitatethe pro-motionprocess.Thisprocesstowardsmeritocracyisevidentin consideringtheremarksofonerespondent,whostatesthat:

Afterthemerger,camethemeritocracy,whichvalorisesand recognizespeopleequallyandchoosesthebest-prepared col-laboratorstoassumenewfunctions(GRA2).

Lubatkin,andVery(1994),Mayo(2002),Barrosetal.(2003)

andJordãoetal.(2014).

Altogether,inconsideringtheconstructsformedthroughthe statementsthatmakeuphumancapital,arelationshipbetween them can be seen, especially that the stimulus to innovation andto the formation of IC inthe organisation, the practices ofcontracting,trainingandformingpersonnel,andthestimulus forthedevelopmentofleadershipandteams,werefactorsthat influencedpositivelypersonalandprofessionalsatisfaction,and consequentlytheretentionofhumancapital.Theseresultsgo beyondwhatonehadgatheredfromtheliteraturefromauthors

suchasCoff(1999),Mayo(2002),Freire(2012)andFreireetal.

(2014).

Thetriangulationbetweentherepliestothequestionnaires, the documents, direct observation, the formal interviews and informalconversations,allthisclearlyindicatedthatthemanner inwhichtheorganisationmanagedthe ICelements,avoiding their possible loss, as found empirically by Coff (1999) and

Mayo(2002),resultedinaseriesof benefitsfor thecompany

inrelationtothecreation,retentionanddevelopmentofhuman capitalinItaú-UnibancoS/A,afterthemerger.

Thetestimoniesasawholerevealedthat,inrelationtohuman capital,thereweremanycoursesandmuchtrainingofferedto staffatalllevels, todivulge the newpolicies, processes, sys-temsandprocedures, tosharethesystematised knowledge in thenewlymergedorganisation,basedonthepriorexperienceof mergersand/oracquisitionsinItaúasinUnibanco.

TheseresultscomplementtheideasofChildetal.(2001)and

Barrosetal.(2003)forthroughtheutilisationofsuch

experi-encesisafundamentalfactorinthesuccessoftheprocessesin combinationsofcompanies.Therecognitionoftheperception ofthecreationanddevelopmentofhumancapitalinthemerger processcanbesynthesisedinthefollowingtestimony:

Afterthemerger,therewasacreationoftoolsforperfecting, agreateralignmentwiththevisionandvaluesof the com-pany,theestablishmentofameritocraticprocessandgreater investmentandpreparationofthecollaborators(GRA1).

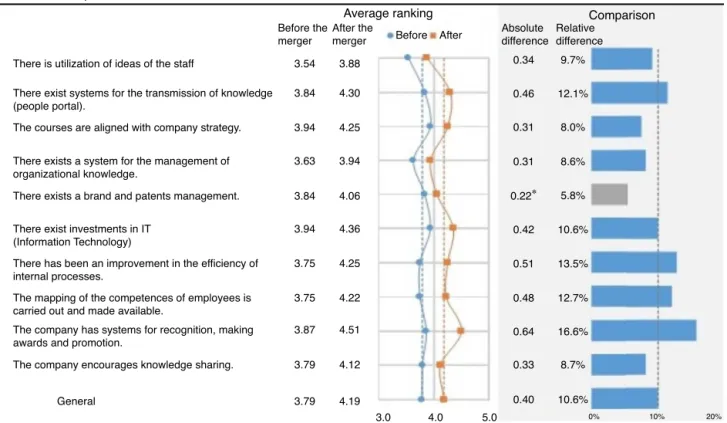

Analysisofstructuralcapital

Inanalysingthethirddegreeconstructscreatedfromthe rela-tionshipsbetweenthestatementsofthestructuralcapital(Fig.2), itcanbestatedthatthefactorsrelatedtothesystemsfor recogni-tion,awardingandpromoting,totheimprovementandefficiency oftheinternalprocesses,andtothemappingofstaff competen-cies,werethefactorsthatpresentedgreaterevolutionoftheRM afterthe merger,withincreasesof 16.6%,13.5%and12.7%, respectively.

Thenotableimprovementinthesestructuralcapital indica-torshelpstoexplaintheevolutionof the humancapital,as it reinforcesthe idea that Itaú-Unibanco S/A seeks not only to mapknowledgeandthecompetencesofitsstaff,acentral ques-tion highlighted byMayo (2002) andFreire(2012), butalso toaugmentthisknowledge,linkingittobetterresultsthrough anincreaseintheefficiencyoftheprocessesalignedtosystems forrecognition,awardsandpromotion,complementingwhathas

alreadybeingdiscussed.Ontheotherhand,theanalysisofFig.2

revealsthattheexistenceofamanagementsystemofbrandsand patentsandthealignmentofthecourseswiththeorganisational strategywerethefactorsthatpresentedlowerevolutioninthe RMafterthemergerwithincreasesof5.8%and8.0%, respec-tively.Itisrelevanttopointoutthattheimprovementsinthese indicatorswereconsiderable,themoreespeciallybecauseone ofthegreatestdifficultiesinthemanagementofICisprecisely thestructuringoftheknowledgeexistinginthecompanyinto structuralcapital.

It waspossibletoverify thesystematisation of knowledge andIC,whichcouldbeseenthroughtherelationshipbetween the statementsofincrementsintheexistence ofabrandsand patentsmanagementsystem,increasesininvestmentin informa-tiontechnologyandimprovementsintheefficiencyofinternal processes.Itcanbeseenthatthecompanymaintainssystemsto map andmake available the competences of its staff, all the marks of all four statements being over 4, indicating strong agreementwiththisquestionafterthemerger.

The documentary analysis confirms the finding that the companyobtained improvementsinthe systematisationof its knowledgeandincreaseinitsIC.Thetestimoniescorroborated thisaffirmation(inthequestionofKM)andcomplementedit(in thequestionoftheIC),inlinewiththeresultsofMayo(2002)

whoperceivedthatthemanagementofknowledgeelementsand informationsystemsfavoursbothvaluegeneration,as wellas improvementsintheinternalprocessesinM&A.Thisquestion wasevidentinthereportsoftheinterviewees,especiallyinthose ofdirectoratelevel.Oneofthemexplainedthat

Thestructural capitalcreatedafter themergercanbeseen intheinnovations,intheimprovementsinsystemsand pro-cesses,andalsointheotheraspectsofcompanystructural capital,singling out especiallythe opportunity of synergy thataroseandwhichwasimplementedinappropriaterelated areas with the explicit objective of capitalising the best practicesbetweenthe two companies(Commercial Super-intendent).

In analysing the statements on the systems of knowledge transfer,of the managementof organisational knowledgeand those relative tothe stimulusgiven tothe sharing of knowl-edge, asignificant evolution of all theseaspects canbe seen after the merger. Thetestimonies indicatedthat the company tookinitiativestowardsknowledgesharingandIC,in particu-lar,thoserelatedtothetransmission,sharingofinformationand knowledge,andpracticesforthemanagementofsome intangi-bleassets,alongwiththelinesofthethinkingofDavenportand

Prusak(1998).Thedirectobservationsconfirmedthe

presuppo-sitionsofNonakaandTakeuchi(1995)forwhomthecreation of newknowledgeinthe companyisaprocessthat demands intense andlaboriousinteractionbetweenall themembersof theorganisation.

Structural capital

There is utilization of ideas of the staff 3.54 3.88 0.34 9.7%

12.1%

8.0%

8.6%

5.8%

10.6%

13.5%

12.7%

16.6%

8.7%

10.6% 0.46

0.31

0.31

0.22∗

0.42

0.51

0.48

0.64

0.33

0.40 4.30

4.25

3.94

4.06

4.36

4.25

4.22

4.51

4.12

4.19 3.84

3.94

3.63

3.84

3.94

3.75

3.75

3.87

3.79

3.79 There exist systems for the transmission of knowledge (people portal).

The courses are aligned with company strategy.

There exists a system for the management of organizational knowledge.

There exists a brand and patents management.

There exist investments in IT (Information Technology)

There has been an improvement in the efficiency of internal processes.

The mapping of the competences of employees is carried out and made available.

The company has systems for recognition, making awards and promotion.

The company encourages knowledge sharing.

General

Considering a level of significance of 5%, the differences between the averages before and after the merger were not considered significant. Average ranking

Before the merger

After the

merger Before After

Comparison Absolute

difference Relative difference

0% 10% 20%

3.0 4.0 5.0

Fig.2.Tableofaveragegeneralranking–structuralcapital.

Source:ownpreparationbasedonresearchdata.

thanbefore.Thereisstill,however,alotofworktodoonthis question.

The direct observations and the documents indicated that thecompanymotivatesitsstafftogivetheiropinion,showing itsrecognitionfor theworkthroughitssystemofrecognition andawardsandthisencouragesthemtocreatemoreideasand proposeimprovementstoprocessesthat,withtime,are trans-formed into structural capital benefiting the company itself. These findings, in part, coincide with, and complement the ideasofDavenportandPrusak(1998)andNonakaandTakeuchi

(1995),thatorganisationalknowledgestartswithdatathat,when

organisedandinterpreted,resultininformationthat,initsturn, contributestothe processof individual andcorporate knowl-edgegeneration, possiblystimulating,inthewords of Jardon

andMartos(2012),theformationofstructuralcapital.

Inconsideringthethreepreviousthird-degreeconstructsand relatingthemamongthemselves,itwasfoundthatthecompany succeedsincreating,systematizingandsharingitsknowledge through practices that stimulate the IC.It should be pointed outthatthetestimonies,thedocumentsanddirectobservation revealthat thecompanydoes nothaveaspecificplanforthe managementof theelementsofthe IC,butseeksoutthebest managerialpracticesandcreatesadifferentiationinthemarket, usingtechniquestosuchend.

Inchecking whethertherewerelossesofstructural capital afterthemerger,itcouldbeseeninthereportsoftheinterviewees thatquestionsoccurredthatimpactedthiselementoftheICand alsooftherelationalcapital.Oneofthedirectorsstatedthat:

Problemswereperceivedsuchasthelossofconveniencefor thecustomer,consideringthatUnibancotreatedthemasif theywereintheirownhomes.Problemswereperceivedof integrationbetweenthe distinctsystems inthe twobanks, inadditiontooverloadingintheprocessingofinformation bythesystems.Anexampleofthepossibledemandnot cal-culatedconsistsinthequantityofdataandinformationthat might evenbeduplicated, consideringthat onesameCPF mightbe acustomerof thetwo banks.Thisgenerated the needtoinvestintheincreaseofthetechnologicalpark,for theincreaseindemandthathadoccurredtobeabsorbedand toserveasabasisforfuturerestructurings(Director1).

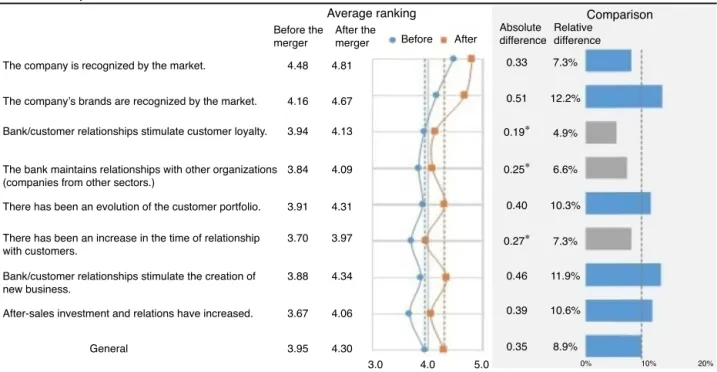

Analysisofrelationalcapital

Finally,inanalysingtheevolutionoftherelationalcapital,it wasfoundthattherewasalsoanevolutioninalltheconstitutive elements ofthisconstruct,post-merger,inrelationtothe pre-mergersituation(Fig.3).Thestatementswheretherewasgreater evolutionintheRMwerethosethathaddealtwiththe recog-nition ofbrandsbythe market,the effectsof therelationship onthecreationofnewbusiness,andtheincreaseinafter-sales investmentwithanevolutionintheRMaftertheunionof12.2%, 11.9%and10.6%,respectively.

Relational capital

Average ranking Before the

merger

After the

merger Before After

Comparison Absolute

difference Relative difference

Considering a level of significance of 5%, the differences between the averages before and after the merger were not considered significant. The company is recognized by the market.

The company’s brands are recognized by the market.

Bank/customer relationships stimulate customer loyalty.

The bank maintains relationships with other organizations (companies from other sectors.)

There has been an evolution of the customer portfolio.

There has been an increase in the time of relationship with customers.

Bank/customer relationships stimulate the creation of new business.

After-sales investment and relations have increased.

General

4.48 4.81 0.33 7.3%

12.2%

4.9%

6.6%

10.3%

7.3%

11.9%

10.6%

8.9% 0.51

0.19∗

0.25∗

0.27∗

0.46

0.39

0.35 0.40 4.67

4.13

4.09

4.31

3.97

4.34

4.06

4.30 4.16

3.94

3.84

3.91

3.70

3.88

3.67

3.95

3.0 4.0 5.0 0% 10% 20%

Fig.3.Tableofaveragegeneralranking–relationalcapital.

Source:ownpreparationbasedonresearchdata.

afterthemerger,respectively.Evenso,incheckingoverthe con-structsofrelationalcapital,ascanbeobservedinFig.3,onecan seethattherewasanevolutioninthestatementsrelatedtothe bank/customerrelationship,showingthatthisstimulates,inpart, thelatter’sloyalty.Onecanseealsoanincreaseinthelengthof customerrelationships andinvestmentsintheafter-sales rela-tionship.The testimoniesallowedus torelate theincrease of thelengthofthecustomerrelationshipandtheinvestmentsin after-salesrelationshipswithanincreaseinloyaltyonthepart ofthecustomers.

Thefactorrecognitionandbrandvaluecanbeperceivedby thestatementstodealwiththerecognitionofthecompanyby themarketandwhetherthecompany’sbrandsarerecognised, andinanalysingresultsofthequantitativeresearch,wecansee thattherewasanevolutionofthesequestionsfrompreto post-merger.Thedirectobservationsindicatedthatthisrecognitionis moreevidentwhenoneconsidersthesizeofthecompanyafter themergerwhenitbecamenotonlyoneofthelargestbanksinthe worldandthelargestfinancialconglomerateinLatinAmerica, butalsothelargestfinancialconglomerateinthewholeofthe Southernhemisphere.

Thesizeofthebankandthesignificanceofthisforthe mar-ketwasaverybigchange.The numberof servicepointsand branchesalso grew a lot,whichprovidedfacility and conve-nienceforcustomers(GRA1).

The testimonies indicated that the other constructs, even those related to human or structural capital, were elements whichhelpedtostrengthenrecognitionofthecompanybythe market,especiallytakingintoaccounttheworkingpolicyof Itaú-UnibancoS/A,thenumberofservicesoffered,andtheservice

points that contribute toan increase in company recognition andbrandvalue.Theevolutionofthisaspectcanbereaffirmed throughoneofthereportsbecause

the bank’s activitieshave been focused on increasing the value of its brand inthe sense of becoming a protagonist intheinternalandregionalmarketsandalsoan important playerontheworldstage(GMC).

Finalising,as inthe othercases, here alsoan evolutionin thecustomerportfoliowasobserved,anincreaseinthenumber ofpartnershipsofthebankwithotherorganisations,an incre-mentinthebank/customerrelationship,favouringthecreation ofnewjobs.Thedirectobservationanddocumentaryanalysis revealedthatthisrelationshipwaspossiblebecauseofthe prox-imitybetweenthesefactorsasthesepartnershipsandstimuliin thecreation ofnewbusiness haveresulted inthe evolutionof thecustomerportfolio.

The bodyofquantitativeresults demonstratesthat,infact, there was evolution in all the constructs and sub-constructs formingtheintellectualcapital,andthatthestructuralcapital, surprisingly,wastheaspectinwhichoneobservedthegreatest averageevolutionafterthemerger,(10.6%increase),inrelation totheprevioussituation,stressingthatonlyinoneofthe ele-mentsthatcompriseitwasalowerincreaseseen.Thesurprise ispreciselybecauseofthedifficultymentionedintheliterature

(e.g.Jordão,2015;Nonaka&Takeuchi,1995)ofsystematizing

construct,humancapital,demonstratedthelowestpost-merger evolutionwithanaverageincreaseof8.1%,withalower incre-mentintwoindicatorsthatcompriseitandtheonlyconstruct wherethere was afactor that had almostzero evolution,the turnover,withonlya1.3%increasepost-merger.

Afterthequantitativeanalysis(oftheevolutionofthe indi-cators)andqualitative analysis (of the formal interviewsand informal conversations, documentsanddirect observation),it couldbeobservedthatItaú-UnibancoS/Aknewhowtomanage therisksinherenttothelossofICinthemergerprocess, con-tradictingtheobservationsofChildetal.(2001),Mayo(2002),

Barrosetal.(2003)andFreireetal.(2014)whofoundthatoneof

thebigproblemsinM&Aprocesseswasthelossofknowledge thataccompaniedthem.Inthepresentcase,thisisprobablydue totheexperienceandtheknow-howacquiredinpriormergers andacquisitionsbybothparticipatinginstitutions.Thisaspect confirms andcomplementsthe results of Zhenget al.(2015)

whoobservedthatthepriorpossessionofknowledgeand rele-vantcompetencesiscrucialtothesuccessfulacquisitionofnew strategicassets,stressingtheroleofKMfortheidentification, transfer,absorptionofknowledgeinM&A.

Itshouldbepointedoutthatnoteverythingwasconsidered bythecollaboratorsasbenefits,andthatthereweresomelosses duringtheprocess.Examplesofthesewerethedismissalofstaff, thereductionof segments,lackof motivationwiththelossof labourbenefits(insomecases),inadditiontocomplaints rela-tivetotoolsandmethodologiesthatpersonnelusedandwhich werediscontinued.Inaddition,theproblemscitedinthe inter-viewsincludethelossofcustomersduetoalackofidentification because of the newconfiguration of the bank, difficulties in retainingtalent whichdid notadapt afterthe mergerprocess, reductioninthestandardofserviceandlossofcustomersdue toproductsbeingdiscontinued,inlinewiththefindingsofCoff

(1999),Mayo(2002)andFreireetal.(2014).

Considering everything, one can observe that the process thatstartedwithsmallmergersand/oracquisitionsinthebanks Itaú or Unibanco generated its own expertise on the theme, creatingIC.Atthepresenttime,Itaú-UnibancoS/Apossesses aknowledge andknow-howthat allowsit togrow, learnand generatevalueintheprocess,puttingexperienceintopractice onceagaininthislarge-scaleoperationand,inthisway, devel-opingnewprocesses andgeneratingmoreknowledgethat, in itsturn,producesanincreaseandperfectingof theIC dimen-sionsderiving fromboth organisations.The results produced consistinimprovementsinthe processes,inthepersonnel,in thesystems,inthetechnology,inthebrands,intheproductsand principallyinthecompanyimageandinitsrelationshipwiththe market.

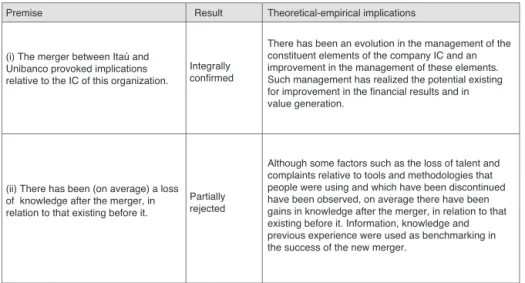

Discussionoftheresultsandanalysisofthe presuppositions

Inanalysingthefirstpresuppositionoftheresearch investiga-tion,itwasfoundthat,infact,themergerbetweenthebanksItaú andUnibancocausedimplicationsfortheICofthisorganisation becausetherewasanevolutionoftheaveragerankingindices,as betweentheperiodspriortoandsubsequenttothemerger.Some

indicatorshadgreaterandmoresignificantdifferencesthan oth-ers,butingeneral,itwasfoundthatalltheitemsevolved.Inthe qualitativeanalysis,wefoundanevolutioninthemanagement oftheconstituentelementsoftheIC,leadingtoacomplete con-firmationofthefirstsupposition.Thismeansthat,fromthepoint ofviewoftheresearchrespondents,therewasimprovementin themanagementpracticesoftheelementsthatmakeupthe com-panyIC,confirmingandcomplementingthepresuppositionsof

CasselandHackl(2000)whopostulatedthat theevolutionof

themanagementpracticesoftheICelementswouldbring sub-stantialbenefitsasregardsthevalue,andgenerationofwealthof companies.ItshouldbepointedoutthatamongtheICelements observed,theonethatobtainedthelargestaverageevolutionwas surprisingly (because of the difficulty of companies in struc-turingknowledgeinsystems,technologiesandprocesses) the structural capital,followedbyrelationalcapital,andlastly,by humancapital,consideringthepercentagevariationoftheRM prior topost-merger, corroborating,partially,andaugmenting thefindingsofFreireetal.(2014)–whohadalreadyproduced alistofintangibleassetstobeprioritisedintheintegration,in generatingM&Aprocessesinharmonywiththeresultsofthe study.

In analysingthesecondinvestigation presuppositionof the research, it was found that on average,there was no loss of knowledge and IC after the merger, compared to the previ-oussituation.Althoughtherearereportsoflossofinformation andIC,duetothemergerprocessbetweenthebanksItaúand Unibanco,somethingwhichwasfound,alsosurprisingly,asa generaltendency, wasagreatgaininthesefactors, leadingto the partialrejectionofthe secondpresupposition.Thisis sur-prisingbecausethepresentresultisnotinconformitywiththe understandingofinternationalliterature(e.g.Coff,1999;Mayo, 2002)andtheBrazilianliterature(e.g.Freireetal.,2014),and extendswhatoneknowsonthesubject.Inpractice,thissurprise arisesfromthefactthat,inthepresentcontext,Itaú-Unibanco S/ApossessesasingularIC,producedbythepriorexperiences inM&Aofeachofthebanks,generatingaprocessofinternal benchmarkingthatmakesitpossibletogrow,learnandgenerate valueaftertheunion.

ThefollowinggivesanideaoftheeffectsofIConfinancial performance andvalue generation in thiscompany. Areport appearinginthemagazineExamestatesthat,goingagainstthe generaltrendof the2014–2016crisis,Itaú-Unibanco S/Anot onlymanagedtocircumventtheeconomicdifficulties,butalso registered arecord gainin2015,obtaining thelargestannual profit ever obtained byacompanyinBrazil, of 23.35billion reals(Exame,2016).

Thisbecomesmoreevidentbasingoneselfonthequalitative investigation carried out withstrategic level managers in the bank,whereonefoundthat,inpractice,thegoodpointsofeach bankweretakenadvantageof,corroboratingandamplifyingthe results ofthe internationalliteratureobtained byLarssonand

Lubatkin (2001) – who perceived that post-union integration

Premise Result Theoretical-empirical implications

(i) The merger between Itaú and Unibanco provoked implications relative to the IC of this organization.

Integrally confirmed

There has been an evolution in the management of the constituent elements of the company IC and an improvement in the management of these elements. Such management has realized the potential existing for improvement in the financial results and in value generation.

(ii) There has been (on average) a loss of knowledge after the merger, in relation to that existing before it.

Partially rejected

Although some factors such as the loss of talent and complaints relative to tools and methodologies that people were using and which have been discontinued have been observed, on average there have been gains in knowledge after the merger, in relation to that existing before it. Information, knowledge and previous experience were used as benchmarking in the success of the new merger.

Fig.4.Synthesisofthepremisesoftheresearch,resultsandimplications.

Source:ownpreparationbasedonresearchdata.

thepotential benefits of culturalmixing.In thissense, itwas seenthatculturaldifferences,asalsooperationalandstrategic betweenthebanksItaúandUnibancowererecognised,worked on,managed and overcome, institutinga culture of the new, mergedinstitution’sown.Morethanthis,suchfindingsconflict withtheresultsofthenoteworthystudyofChildetal.(2001), contradictingandcomplementingthem,rememberingthatthe mentionedauthors explainthatthe conditions existingbefore aM&A cannotexplain – except inavery limited sense and withoutstatisticallysignificant consistency– theperformance subsequenttotheunion.

Inthepresentcase,however,thetestimoniesandthe comple-mentaryanalysisofthefinancialresultsrevealedthattheprior experiencewasfundamentalbothintheimprovementofthe per-formance,asalsoforthevaluegenerationprocess.Theseauthors postulatethatthemanagersshouldfocustheirattentiononthe rulesofpost-acquisitionmanagement,which,frequently,have beenneglectedbythem–afactconfirmedinthefieldresearch.

Childetal.(2001)emphasisethatsuchrulesareresponsible,in

largepart,forthesuccessoftheacquisitiontransactionsinthe value-generationlogic,whichalsowasasignificant observed result.Asynthesisofthepresuppositions,resultsand implica-tionscanbefoundinFig.4.

Thetriangulationofthequantitativeresults,theformal testi-moniesandinformalconversations,withthedirectobservations and documentary analysis, revealed that, over time, Itaú-UnibancoS/A modified its managerial practices andadopted control system, in addition to promoting an integration pro-cessoforganisationalfunctions,ofpersonnel,ofprocessesand company activities, by means of different mechanisms, cor-roboratingtherefore partof thefindings of JordãoandSouza

(2013) and Jordão et al. (2014). The bank directors tried to

facilitatethetransmissionofinformation,improvethequalityof communication,supplytheparametersfortheassessmentand measurementofperformance,andinlinewithJordão,Melo,and

SousaNeto(2016),promotetheintegrationoftheorganisational

structure,collaboratetowardsculturalmeetingandmixingand,

mostimportantly,facilitatestrategicimplementationandvalue generation,generatingIC.

Other evidence that should be elucidated is the circular relationshipexisting betweenthe ICdimensions,inline with theresultsofJardonandMartos(2012);andtherelationships existingbetweenthethird-degreeelementsoftheformationof these constructs. For example, it is possible to see relation-ships between larger quantities of training and courses with motivation,loyalty,relationshipsandresults,impactingonthe satisfactionofstaffandcustomers,increasingthequantityand qualityofbusinessandmarketrecognition.

Equally,investmentinstructuralcapitalimpacteddirectlythe efficiencyofinternalprocesses,proportioningmorereliability andrapidity,makingitadifferentialforthebank,andincreasing customersatisfaction–whichrevertedinnewbusinessthrough thealreadyexistingreliabilityinthecustomer/bankrelationship. Afterdiscussingthepresuppositionsandproducingthemain results,itcanbeseenthatthemannerinwhichItaú-Unibanco S/Aconductedtheintegrationprocessandthemannerinwhich itmanagedtheICelementsimpactedpositivelyontheresults of the process with improvements in performanceand value generation.Itcouldfurtherbeseenthatthemanagementofthe mentionedelements,althoughstillincipient,wasconsideredone of the main reasons that the bank’s objectiveswere reached: whichistobealeadingbankinsustainable developmentand customersatisfaction.

Finalremarks