Revista

de

Administração

http://rausp.usp.br/ RevistadeAdministração52(2017)81–92

Corporate

Governance

Governance

in

agribusiness

organizations:

challenges

in

the

management

of

rural

family

firms

Governan¸ca

em

organiza¸cões

do

agronegócio:

desafios

para

a

gestão

de

empresas

rurais

familiares

Gobernancia

en

las

organizaciones

agroindustriales:

retos

en

la

gestión

de

las

empresas

familiares

rurales

Cláudio

Pinheiro

Machado

Filho

a,b,∗,

Silvia

Morales

de

Queiroz

Caleman

c,

Christiano

Franc¸a

da

Cunha

daFaculdadedeEconomia,Administra¸cãoeContabilidadedaUniversidadedeSãoPaulo,SãoPaulo,SP,Brazil bAvenidaProfessorLucianoGualberto,SãoPaulo,SP,Brazil

cEscoladeAdministra¸cãoeNegóciosdaUniversidadeFederaldeMatoGrossodoSul,CampoGrande,MS,Brazil dFaculdadedeCiênciasAplicadasdaUniversidadeEstadualdeCampinas,Limeira,SP,Brazil

Received23July2015;accepted9May2016 Availableonline11October2016

Abstract

TheruralproductioninBrazilhasexperiencedasignificantcompetitiveimpactwiththestabilizationoftheeconomypromotedbytheRealPlanin 1994.Indeed,theBrazilianagriculturehasachievedefficiencygainsintermsoftechnology,economiesofscaleandgeneralmodernizationofthe activityinthefield.Inthiscontext,theprofessionalmanagementofruralproductionevolved.However,thegovernanceprocessdoesnotevolve inthesamedimension,andthe“governancerisk”isstillpoorlyaddressedintheruralenvironment,whichoftenlimitsthepotentialofoperations. Inthisstudy,wesoughttodeepentheunderstandingofthefactorsthatimpacttheimplementationofgovernancepracticesinruralproperties inBrazil.Basedonaconvenienceandnon-probabilitysample,thisstudyseekstounderstandtheevolutionofthegovernanceprocessonfarms anditscorrelationwiththemanagementpractices.Thisstudyfoundacorrelationbetweentheexistenceofsomeformalmanagementprocesses (forexample,strategicplanningandmorerobustaccountingsystems)andadvancesinthegovernancemechanismsandprocesses,suchasthe establishmentofaboardofdirectors,clearerrulesregardingtheseparationbetweencorporateandfamilyassetsandmoretransparencyinincome statements.Thisstudyalsofoundalackofclarityintheseparationofreturnoncapital(dividend)andcompensationforwork(compensation forservicesprovided)forpartners,heirsandotherfamilymembers.Insummary,weconcludedthatthereistheadoptionofsomegovernance mechanismsintheruralsector,buttheyarestillpoorlydevelopedamongruralproducers,hencetheneedtostimulatethem.

©2016PublishedbyElsevierEditoraLtda.onbehalfofDepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoe

ContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP.ThisisanopenaccessarticleundertheCCBYlicense(http://creativecommons.org/ licenses/by/4.0/).

Keywords:Governance;Familyfirms;Ruralproducers

Resumo

Aproduc¸ãoruralnoBrasilpassouporumimportantechoquedecompetitividadeapartirdaestabilizac¸ãodaeconomiapromovidapeloPlano Realem1994.Comefeito,ganhosdeeficiênciaforamalcanc¸adospelaagriculturabrasileira,emtermosdeutilizac¸ãodetecnologia,economiasde

∗Correspondingauthor.

E-mail:capfilho@usp.br(C.P.MachadoFilho).

PeerReviewundertheresponsibilityofDepartamentodeAdministrac¸ão,FaculdadedeEconomia,Administrac¸ãoeContabilidadedaUniversidadedeSãoPaulo –FEA/USP.

http://dx.doi.org/10.1016/j.rausp.2016.09.004

escalaemodernizac¸ãogeraldaatividadenocampo.Nestecontexto,evoluiuaprofissionalizac¸ãodagestãodaatividade.Noentanto,oprocesso degovernanc¸anãoevoluinamesmadimensãocomo“riscodegovernanc¸a”aindapoucotratadono meiorural,oque muitasvezeslimitaa potencialidadedasoperac¸ões.Nestapesquisabuscou-seaprofundaroentendimentoacercadequaisosfatoresqueimpactamaimplementac¸ãode processosde“Governanc¸a”empropriedadesruraisnoBrasil.Apartirdeumaamostraporconveniênciaenãoprobabilísticabusca-seentendera evoluc¸ãodoprocessodegovernanc¸anaspropriedadesruraisesuarelac¸ãocompráticasdegestão.Constata-seumacorrelac¸ãoentreaexistênciade algunsprocessosformaisdegestão(porexemplo,planejamentoestratégicoesistemasdecontabilidademaisrobustos)eavanc¸osemmecanismos eprocessosdegovernanc¸a,taiscomooestabelecimentodeconselhodeadministrac¸ão,regrasclarasdeseparac¸ãoentreativosdafamíliaeda empresaemaiortransparêncianasdemonstrac¸õesfinanceiras.Nota-se,ainda,poucaclarezanaseparac¸ãodoquevemaseraremunerac¸ãodo capital(dividendo)edotrabalho(prólabore),porpartedesócios,herdeiroseoutrosmembrosfamiliares.Emsíntese,conclui-sequeexistea adoc¸ãodealgunsmecanismosdegovernanc¸anomeiorural,masqueessesaindasãopoucosdesenvolvidosentreosprodutoresagrícolas,sendo necessáriooseuincentivo.

©2016PublicadoporElsevierEditoraLtda.emnomedeDepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoe ContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP.Este ´eumartigoOpenAccesssobumalicenc¸aCCBY(http://creativecommons.org/ licenses/by/4.0/).

Palavras-chave: Governanc¸a;EmpresasFamiliares;ProdutoresRurais

Resumen

LaproducciónruralenBrasilhaexperimentadounimpactocompetitivosignificativodesdelaestabilizacióndelaeconomíaimpulsadaporel PlanRealde1994.Efectivamente, laagricultura brasile˜nahalogradounamayoreficienciaconrelación alusodetecnología,economíasde escalaymodernizacióngeneraldelasactividadesenelcampo.Enestecontexto,sehadesarrolladolagestiónprofesionaldelaactividad.Sin embargo,elprocesodegobernanzanosehadesarrolladoenconsonanciaconel“riesgodegobernanza”,dimensióntodavíapocotratadaenel mediorural,loqueamenudolimitaelpotencialdelasoperaciones.Enesteestudioseintentaprofundizarlacomprensióndelosfactoresque influyenenlaimplementacióndeprocesosde“gobernanza”enpropiedadesruralesenBrasil. Apartirdeunamuestraporconvenienciayno probabilísticaseanalizalaevolucióndelprocesodegobernanzaenpropiedadesruralesysurelaciónconlasprácticasdegestión.Sehaencontrado unacorrelaciónentrelaexistenciadealgunosprocesosformalesdegestión(como,porejemplo,laplanificaciónestratégicaylossistemasmás robustosdecontabilidad)ylosavancesenmecanismosyprocesosdegobernanza,talescomolacreacióndeunconsejoadministrativo,reglas clarasdeseparaciónentrelosactivosdelafamiliaylosdelaempresa,yunamayortransparenciaenlasdemostracionesfinancieras.Senota, además,pocaprecisiónenladistincióndeloqueconstituyelaremuneracióndelcapital(dividendos)ylaremuneracióndeltrabajo,porpartede lossocios,herederosyotrosmiembrosdelafamilia.Enresumen,seconcluyequeexistelaadopcióndealgunosmecanismosdegobernanzaenel mediorural,noobstante,dichosmecanismosnoestánsuficientementedesarrolladosentrelosagricultores,poresolanecesidaddesuincentivo. ©2016PublicadoporElsevierEditoraLtda.ennombredeDepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoe ContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP.Esteesunart´ıculoOpenAccessbajolalicenciaCCBY(http://creativecommons.org/ licenses/by/4.0/).

Palabrasclave: Gobernanza;Empresasfamiliares;Productoresrurales

Introduction

TheagribusinesssectorinBrazilrepresentsapproximately 22.5%of Brazil’s GDP – based on data of 2013,generating approximatelyUS$81billionoftradesurplusin2014(ABAG, 2015).Itssupplychainsareformedbyawidevarietyof organiza-tions,fromlargemultinationalcorporationsintheagrochemical, foodprocessinganddistribution,energyandfiberindustries,to companiesrelatedtoruralproduction, formedbycooperative organizationsandfamilybusinessesofdifferentsizes.

The term agribusinesswas introduced inthe literature by HarvardUniversityprofessorsJohnDavisandRayGoldberg,in 1957.Thebroaddefinitionofthetermimpliesasystemicview thatexpandsthedimensionofruralproductionitself(Davis&

Goldberg,1957):

A commodity system encompasses all the participants involved in production, processing and marketing of a product.Thissystemincludesthemarketofagricultural sup-plies,agriculturalproduction,storageoperations,processing, wholesale and retail, delimiting a flow that ranges from inputstothefinalconsumer.Theconceptencompassesallthe institutionswhichaffectthecoordinationofthesuccessive

stagesofacommodityflow,suchasthegovernment,futures marketsandtradeassociations(DavisandGoldberg,1957, p.2).

Zylbersztajn(2000)developedtheconceptofagro-industrial

systems(AGS)astheunitofanalysisbasedonproductsofrural origin.Thisanalyticalmodelhighlightsthetransactionsbetween theeconomicagents–industryofagriculturalinputs, agricul-tural andlivestock production; manufacturingandprocessing industry, distribution (wholesaleand retail)and consumers – permeated bytheinstitutionalenvironment(laws,rules, regu-lations)andtheorganizationalenvironment(supportagencies, research,banks,professionalorganizations,etc.).

The focus of this study is the “farm production” sector, addressing the rural production activities. Rural production, specifically,has experienced asignificant competitive impact withthestabilizationoftheeconomypromotedbytheRealPlan

in1994(MachadoFilho,2009).Indeed,theBrazilianagriculture

achievedefficiencygainsintermsoftechnology,economiesof scaleandoverallmodernizationoftheactivityinthefield.The evolutionoftheproductionofgrainsandplantedareaillustrates theevolutionof the sector:Basedon datareleasedbyConab

(2015), between 1990 and 2015, grain production in Brazil

increasedfromapproximately58milliontonsto206.34million tons(estimatesof2014/15crop),thatis,itincreased255.75% inthis26-yearperiod,accountingforan averageannual pro-ductiongrowthof4.64%.Inthesameperiod,theplantedarea increased from approximately 39 million hectaresto an esti-mated57.52 million hectares in the 2014/15 crop, that is, it increasedonly47.48%,indicatinganaverageannualgrowthin plantedareaof 1.50%.Therefore,itcanbeseenthatit repre-sentedahugeyieldgaininlanduseintheperiodsurveyed,from 1.49tonsofgrainperhectarein1990to3.59tonsin2015,that is,anincreaseof140.93%,withanaverageyieldof3.44%per year.

Inthiscontext,theprofessionalizationof managementhas evolved,withincreasinglyprofessionalstructuresaheadofthe farms,whosenatureofactivityrequiresskillsintermsof pro-duction,salesandfinance.Essentially,itinvolvestheadoption ofmorerationalmanagementpracticesratherthanintuitiveand personalistmethods(Lodi,1993).Themanagementofmarket risksandproductioninherentintheagriculturalactivity,isone ofthekeysuccessfactorsoftheactivityinthefield.Asaresult, theprocessofprofessionalizationofmanagementinvolvesthe implementationofformalprocesses of strategicplanning and budgeting,costcontroltools,managementinformationsystems, amongothers.

However, the governance process does not evolve as the increasingprofessionalizationprocessoftheagricultural activ-ityrequires.The“governancerisk”isstillpoorlyaddressedin theruralenvironment,whichoftenlimitsthepotentialof opera-tions.Thegovernanceproblemexploredinthisstudyaddresses thealignmentof interestsbetweenvariousstakeholdersinthe familyorganization.Asthegenerationssucceedoneanotherin thedivisionof assetsandinthe controlof therural property, conflictsof interest are enhanced. Divergences in relation to thevisionofthefutureofthebusiness,expectationsregarding theallocationofprofits,expansionofinvestments,exposureto debt,appointmentoffamilymemberstomanagementpositions, amongothers,indicatethepotentialforconflicts(Alcântara&

MachadoFilho,2014).Thisstudy startswiththepremisethat

themitigationoftheseriskfactorsisassociatedwiththe imple-mentationofgovernanceprocesses,involvingthestructuringof pre-defineddecision-making bodies,levels of authority,rules andagreementsinthemanagementandownershipofthe busi-ness.

Basedontheforegoing,thepurposeofthisstudyisto under-stand which factors impact the formalization of governance processesinruralpropertiesinBrazil.Thisstudyseeksto ana-lyzetheruralactivity,alsoreferredtoascommercialagriculture.

Therelevanceoftheresearchproblempresentedconsistsof understandingtherestrictivefactorsfortheadoptionof gover-nancepracticesintheruralfirmandtheirrelationshipwiththe management practicesof thefirm,oncetheyare essentialfor the consolidationof theprofessionalizationofagribusinessin theruralproperty.

Basedonthat,theoverallpurposeofthisresearchisto ana-lyzetherelationshipbetweenthegovernanceandmanagement practicesadoptedinruralproperties,specificallyseekingto:

(a) Evaluate therelationshipbetween theadoption of formal planninganddecision-makingprocessesandtheexistence oftheboardofdirectors.

(b) Analyze the existence of members’ agreements in rural properties.

(c) Examinethelegalnatureofruralproperties(individualand corporate).

(d) Checktheexistenceofboardofdirectorsinruralproperties. (e) Checktheexistenceofcompensationformanagement ser-vicesandtheprofitsharingmechanisminruralproperties. (f) Studytherelationshipbetweentheageofmanagersandthe

adoptionoffinancialcontroltoolsinruralproperties. (g) Findoutthetypesoffinancialcontrolandaccounting

prac-ticesadoptedinruralproperties.

Theoreticalreflections

Thetheoreticalframeworkproposedinthisresearchinvolves the subject of“Governance” withinthe contextof firms con-trolled by families. An overall review on the subject of Governancewillbepresentedandwewillparticularlyaddress thefamilyfirms.Wewillalsoconsiderthespecificitiesofrural properties.

Theevolutionofgovernance

Inanysituation wherethedecision-makingpoweris trans-ferredorshared,aninformationasymmetryarisestoagreater orlesserextent.Whetherinaprivateorpubliccompany,club, associations,cooperatives,universities,therewillalwaysbea greater or lesser degreeof conflict of interest,resulting from thedelegationofsomekindof power.Inotherwords, “some-one”governsonbehalfof“someone”whohasdelegatedrights to exercisethe power.Minimizing asymmetriesandconflicts of interest inherent in the delegation of power is the central challengeof governancepracticesinanyorganization(Becht,

Bolton,&Roell,2012).

FromtheseminalstudiesofSpenceandZeckhauser(1971)

andRoss(1974),theresearchersofthescienceoforganizations

began to payattention tothe Agency theory, laterdeveloped

byJensenandMeckling(1976)andFamaandJensen(1983).

withtheminimizationofasymmetriesandconflictsofinterest inherentinthedelegationofpower(Shleifer&Vishny,1997).

Theissueregardingthe separationbetweenownershipand control in modern organizations was highlighted in a clas-sic study conducted by the authors Berle and Mean (1932), analyzing the growth of US companies in the 20s, with the disseminationofthecapitaloforganizationsandthedispersed control.Thisstudyholdsaprominentpositioninthe develop-mentoforganizationaltheory,whichwaslaterdeepenedwith thedevelopmentoftheagencytheory,whichdealswithconflicts ofseparationofownershipandcontrol(Demsetz&Lehn,1985;

Jensen&Meckling,1976).

AccordingtoJensenandMeckling(1976),agreater align-mentinagencyrelationshipsoccurswhencertainpremisesare achieved:

• agentshavenohiddeninformation(absenceofinformation

asymmetry),thustheprincipalisawareof whatconstitutes anefficientactionandtheexpectedproduct;

• the principal has complete information with regard to the actionsandresults;

• agentsactatlowrisk(theyareawareofwhattheywillreceive withtheirconductinlinewiththeinterestoftheprincipal).

Organizationscreategovernance mechanismstodeal with thedelegationofpower(MachadoFilho,2006).Inasimplified manner,thegenesisof anorganizationthat isestablishedand growsinthemarketinvolvesafewsteps:The“owner” estab-lishesthecompany–thecompanygrows–theownernolonger operatesalone,thecompanygoesthroughsuccessiveprocesses of delegation. The “owner” is forced to implementincentive andmonitoring mechanisms so that the agents, towhom the ownerdelegated powers,are alignedwithits expectations.In anotherstep,newgenerationssucceedthecontrolofthe orga-nization,andthenewownersstartsharingthedecision-making power.

Thechallengesofgovernanceinfamily-controlled

organizations

Over the generations that succeed in the control of an organization, the dispersion of capital is intrinsic, unless the organizationperishes.Thegovernanceproblembecomesmore complexasthedispersionofcapitaloccurs,whichisatypical problemofcollectiveactionamonginvestorsforequatingthe decisionrightsandtherightsonprofitsgeneratedbythe enter-prise(MachadoFilho,2006).Thatis,asthegenerationssucceed oneanother,newfamilymembers(siblings,cousins,relatives) startsharingthepower.Overthegenerations,thenewmembers “inherit”not onlytheequity interestinthebusiness,butalso “inherit”the membersofthe company.”Usually withvisions completely different in relation to how to manage the busi-ness,predispositiontoassumerisks,distributionofdividends, reinvestments,levelofindebtedness,etc.

Insummary,“governance”hastodowiththedelegationof power:howpowerissharedandhowtheinterestscanbealigned.

In family firms, in whichthe members mayplay the role of

owners andmanagers (principalandagent), theamplification of thegovernanceproblemoccursasthepoweroftheowners isdisseminatedamongthemembersofdifferentgenerationsin thefamilybusiness.

Definitions for family business are presentedin the litera-ture andare basedon bothtangibleandintangible criteriato determineit.Inthispaper,weadoptthefollowingdefinitionfor familybusiness:anorganizationinwhichtheeffectivecontrol ofthebusiness(whetherbyowningthemajorityofcapitalorby members’agreements)isunderthepowerofthefamily(as quo-tas,sharesorasindividuals,asitismostcommoninproperties rural)(Alcântara&MachadoFilho,2014).

Thetheoreticalapproachtodealwithfamilyfirmsinvolves legal,financial,economic,taxandbehavioralaspects.Sharma

(2004) emphasizesthat the literature addressesfour levels of

analysis in family firms: individual, interpersonal, organiza-tionalandsocial.Attheindividuallevel,thestudieshighlight fourcategoriesofinternalstakeholders:founders,heirs,women and non-family employees. The theoretical background of these dimensions, derived from psychological and sociologi-caltheories,approachcharacteristicsofthedifferentprofilesof stakeholders,withemphasisonthecategoriesoffoundersand heirs. The “emotional capital” of individuals infamily firms accounts for asignificant portion of successor failure of the familybusinessoverthegenerations.

Exploratorystudiespointoutthevariables“commitmentto thebusiness”and“integrity”asthemostdesiredattributesofthe foundersinrelationtothecharacteristicsoftheheirs(Chrisman,

Chua,&Sharma,1998).Otherattributesmentionedbythesame

authorsare:(i)theabilitytogainrespectofnon-familymembers ofthecompany;(ii)skillsindecision-making;(iii)interpersonal skills;(iv)experience;(v)intelligenceand(vi)confidence.

At the interpersonal level,the nature and typeof contrac-tualarrangementsarethefocusofanalysisoftheagencytheory

(Jensen &Meckling, 1976).On the one hand,the alignment

betweenownersandmanagerswouldbelesscostly,duetothe presenceoftherelationshipof“trust”andaltruismamong fam-ilymembers.Ontheotherhand,studiesreportthepredominant motivationofself-interestbetweenfamilymembers(Shleifer&

Vishny,1997).

An alternative approach isofferedby Stewardship Theory

(Davis,Schoorman,&Donaldson,1997).Thistheoryisbasedon

humanistandbenignassumptionsofhumannature,incontrastto theself-interestedandopportunisticviewoftheagencytheory.

Steier(2001)proposestheexistence ofacontinuum,whereas

altruismandopportunismact asoppositepoles.Inthissense, theimplementationofgovernancemechanismsissuggestedto mitigatethenegativeeffectsthatmayariseintherelationships withinthefamilygroup,especiallyasthegenerationssucceed oneanother,withthenaturalaffectiveandculturaldistancing.

Asother organizations, familyfirms are dynamic entities. As theyevolve over time, they experience successive stages of development. The firstconceptual model proposedfor the study of family firmsemerged inthe 60s andaddressed two dimensionstohelptheunderstandingoftheoperationof fam-ilyfirms,familyandbusiness.Later,inthe90s,Gersick,Davis,

HamptonandLansberg(1997)proposedanewmodelbasedon

threedimensions:(i)management;(ii)propertyand(iii)family. Thismodelconsidersthetimedimensionthroughthe represen-tationofthesedimensionsindevelopmentaxesinwhichthere isasequenceofstagestobefollowedoverthedevelopmentof thefamilybusiness.

Inadditiontothesechallenges,anissuealsoaddressedinthe familybusinessisrelatedtoagencyproblemsandtheir coordina-tioncostsintherelationshipbetweenagent–principal,whichin thiscaseiswhenthemanager,whoispartofthefamily,canactin self-interest,evenifitimplieslosstotheotherownersmembers ofthesamefamily(Alcântara&MachadoFilho,2014;Chua,

Chrisman,&Sharma,2003;Miller&LeBreton-Miller,2006).

In family firms, an aspect that stands out is inrelation to the trustexisting between the agents. This trustcan be used asagovernancemechanism.Trustfulfillstheneedofmore for-malcontractualarrangements.However,astransactionsbecome recurrentamongtheagents,thereisanerosionofthattrust, giv-ingrisetoopportunisticbehaviors.Whengenerationssucceed oneanother,individuals distancethemselves from their com-monoriginandthecooperationamongthe agents,previously stimulatedbythecloseinteraction,maybeweakenedinthis

pro-cess(Steier,2001).Itissuggested,therefore,thatthechallenges

inherentinagencyproblemsarecrucialtotheestablishmentof governancemechanismsoverthegenerationsthatfollow.

Ruralproperty:organizationalandinstitutionalspecificities

Traditionally,inBrazil,duetothelegalinstitutional environ-ment,ruralproperties(farms)are“individualentities”,although, withtheamendmentoftheBrazilianCivilCodein2002,there is already higher flexibility to convert individual entity into legalentity.However,aseriesofculturalaspects,especiallytax aspects,stillconditionthepredominanceofindividualentityin theruralactivity.Thisisanimportantriskfactorforthelongevity oftheactivities.“Splittingtheproductionunit”amongheirsis verycommon,whichoftenimplieslossofscaleandefficiency intheproduction(MachadoFilho,2009).

Astheruralcompanyevolvesovertime,theperspectiveof continuityof thebusiness reducesoverthe generationsofthe samefamily.Datareleasedbythe2006Agriculturaland Live-stockCensus(CensoAgropecuário2006)(IBGE,2010)indicate that,intermsoflongevity,57%oftheBrazilianruralcompanies haveless than10yearsofexistence,23%between10and21 years,13% between20 and31years, 5%between30and41 yearsandonly2%of theruralcompanieshavemorethan41 yearsofexistence.

InastudyconductedbyAlcântaraandMachadoFilho(2014)

withagroupoffarmers,itwasfoundthat,inpart,themotivations forthecontinuationoftheruralenterprisebytheheirscombine: (i)theaffectiverelationshipbetweenthefamilymembersand

thefamilybusiness;(ii)thefactthattheassetsofthiscompany constitute acapitalreservefor the family;(iii) aprofessional alternativeforthefamily,and(iv)abusinessopportunity.Among thechallengesidentified,thestudyhighlightedtheimplications of the dispersion of the property for the adoption of growth strategiesandthemotivationoftheyoungergenerationto con-tinuethefamilybusiness.Inaddition,itpointsoutgovernance structuresthatemergeinthedevelopmentoftheruralcompany. Ithighlightsthetransitionfromaninformalstructurebasedon trusttomoreformalgovernancestructures,suchasshareholders’ meetingsandboardsofdirectors.

The board of directors stands out amongthe formal gov-ernance mechanisms and practices in family organizations. Traditionally,theboardofdirectorsisresponsibleforthe moni-toring,control,strategicguidanceandinstitutionalsupporttothe organizations(BaileyandPeck,2013;Bechtetal.,2012;Ees,

Gabrielsson, &Huse, 2009; Guerra, Fischmann, &Machado

Filho,2009;Tirole,2006).Infamilyorganizations,anadditional

rolecanbeincorporatedintothe dutiesof theboardof direc-tors:thesearchforbalancebetweentherationalandemotional dimensionsinvolvedinthedecision-makingprocess(Alcântara

& Machado Filho, 2014; Bailey and Peck, 2013; Bammens,

Voordeckers, &VanGils,2011).In thissense,it canbe said

thattheadoptionofthedecision-makingbody,representedby theboardofdirectors,representsanevolutionintheprocessof professionalizationinfamilyfirms.

In addition, an instrument used in the search for balance incorporaterelations isthemembers’agreement.Ideally, the agreement is a contractual mechanism to manage tensions between members and the organization (León, 2006). Espe-cially ina familyorganization, inwhichthe successors have not“choseneach otheras members,”itcanbe suggestedthat themembers’agreementisanimportantstabilizationelement intherelationsbetweenfamilymembers.

Asthepremiseofthisstudy,weconsiderthatthe implemen-tationof the boardofdirectors andtheadoption ofcorporate agreements areinserted intheevolutionary processof gover-nancepracticesandprofessionalizationoffamilyorganizations.

Methodology

This study is based on the analysis of the perception of respondents in relation to the governance practices adopted. Thisresearchis exploratory,withapplications of quantitative researchtechniques,involvingasurveyof secondaryand pri-marydata.Secondarydatawerecollectedfromthebibliographic anddocumentaryresearchandsoughttoprovidethetheoretical basistoaddresstheresearchproblem,aswellasidentify vari-ablesofanalysistointegratethequestionnairethatwasappliedto asampleoffarmersfromMatoGrossodoSulandMatoGrosso. Thisisaconvenienceandnon-probabilitysample,sinceithas norandomnessinitscompositionandwedonotintendtomake statisticalinferencesbasedontheresults(Marconi&Lakatos,

2011).

Table1

Profileofruralenterpriseandentrepreneur.

Activitiesdeveloped Traditionintheruralactivity

Qty % Qty %

Grains 26 74% 1stgeneration 5 14%

Cotton 3 9% 2ndgeneration 11 31%

Cattleraising 26 74% 3rdgeneration 7 20%

Tourism 0 0% >3rdgeneration 12 34%

Others 4 11% Total 35 100%

Grainsandcattleraising 17 49%

Timeintheruralactivity Averageturnover(R$)

Qty % Qty %

Upto25years 9 26% UptoR$500,000/year 3 9%

From25to50years 23 68% R$500,000toR$1million/year 1 3%

>50years 2 6% R$1toR$5million/year 15 44%

Total 34 100% >R$5,000,000/year 15 44%

Total 34 100%

Respondent’sage Parents’education

Qty %

Upto25years 0 0% Elementaryandmiddleschool 7 21%

From25to50years 5 15% Highschool 8 24%

>50years 28 85% Undergraduateschool 12 35%

Total 33 100% Graduateschool 7 21%

Total 34 100%

Children’seducation

Elementaryandmiddleschool 0 0%

Highschool 1 3%

Undergraduateschool 13 45%

Graduateschool 15 52%

Total 29 100%

Source:ResearchData.

“Trainingprogramforownersandheirsofagribusiness compa-nies:Transformingheirsintopartners.”Thistrainingprogram wasofferedbytheNationalRuralEducationService(SENAR) of MatoGrosso do Sul(MS)andMatoGrosso (MT), which conferstheconveniencenaturetothesample.

Therewerefour(4)classesinMatoGrossodoSulandone (1) in Mato Grosso. The programaimed at the development ofheirs,partnersandmanagerstodealwiththechallengesof the longevity of family-controlled companies,with emphasis on governance andsuccession processes inthe rural proper-ties,structuredintosixtyfour(64)hours,distributedinsix(6) modules: (i) business family – challenges of succession; (ii) governanceofthefamilybusiness:challengesofthecorporate structureandbusinessmanagement;(iii)challengesoffinancial managementinfamilyfirms;(iv)strategyinfamilyfirms;(v) corporatelawinruralfamilyfirms,and(vi)taxandaccounting management:challengesofruralfamilybusiness.

Eachquestionnairewasansweredbyonlyonepersonfrom each family group, and who has a leadership profile in the group.Therefore,out of atotalof 120 participants, ourfinal sampleincluded35validquestionnaires,whichishigherthan the amount required,whichis 30 respondents, andsufficient for a quantitative analysis of the data collected according to

the central limit theorem(Hair, Anderson,Tatham, &Black,

2008;Malhotra,2001).Thequestionnairewasstructuredinfour

(4) topics:(i) profileofrural enterpriseandentrepreneur;(ii) governance;(iii)managementprocesses;and(iv)strategyand governance.

The dataanalysiswas performedintwosteps: (i) descrip-tiveanalysisand(ii)multivariateanalysis(chi-squaretestand multiplecorrespondenceanalysisofsignificantvariables).For thedescriptiveanalysis,weassessedthefrequencyofanswers, whichisshowninpercentages.Themultivariateanalysisseeks toidentifyclustersthatcharacterizethesetofproducers inter-viewed. Forthat, aset of hypotheses was initiallyidentified, whoserelationshipofdependenceamongtheproposedvariables was observed by applying aChi-squaretest. The hypotheses and their evaluation (rejected or not) are shown in Table 1. Subsequently, a multiple correspondence analysis of signifi-cantvariableswasmadeseekingtoidentifyclustersamongthe producersinterviewed(Hairetal.,2008).

Dataanalysisandpresentation

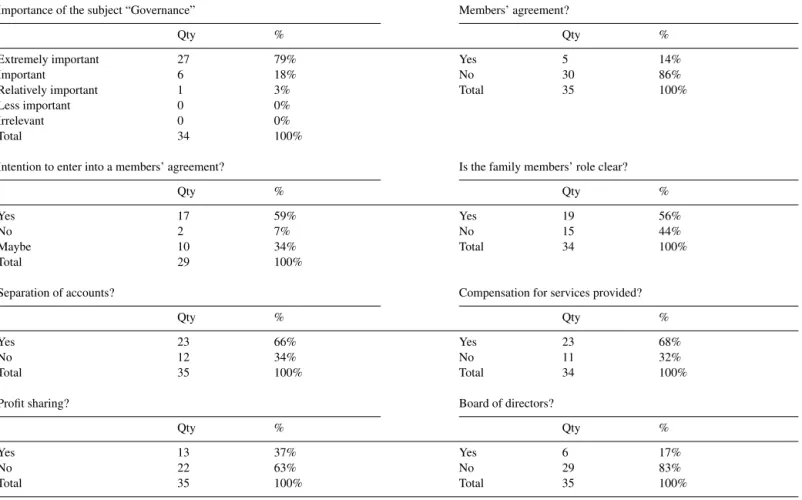

Table2 Governance.

Importanceofthesubject“Governance” Members’agreement?

Qty % Qty %

Extremelyimportant 27 79% Yes 5 14%

Important 6 18% No 30 86%

Relativelyimportant 1 3% Total 35 100%

Lessimportant 0 0%

Irrelevant 0 0%

Total 34 100%

Intentiontoenterintoamembers’agreement? Isthefamilymembers’roleclear?

Qty % Qty %

Yes 17 59% Yes 19 56%

No 2 7% No 15 44%

Maybe 10 34% Total 34 100%

Total 29 100%

Separationofaccounts? Compensationforservicesprovided?

Qty % Qty %

Yes 23 66% Yes 23 68%

No 12 34% No 11 32%

Total 35 100% Total 34 100%

Profitsharing? Boardofdirectors?

Qty % Qty %

Yes 13 37% Yes 6 17%

No 22 63% No 29 83%

Total 35 100% Total 35 100%

Source:ResearchData.

thefrequencyofanswers.Inthesecond step,we trytocreate typologies of rural entrepreneurs consideringthe adoption of governancepracticesandtheprofileoftherespondents.

Descriptionofresults

Thedescriptionofresultsisdevelopedbasedonfourmain topics:(i)profileofruralenterpriseandentrepreneur;(ii) gov-ernance;(iii)management;and(iv)strategyandgovernance.

BasedonTable1,wehavethecharacterizationoftherural entrepreneur.Itwasfoundthat49%ofrespondentsdevelopjoint agricultureandlivestockactivities,areproducerswithtradition inruralactivity(54%above2ndgeneration),andoutofthetotal 74% havemore than25 yearsof activity inthe sector. Most respondents(85%)areaged50+andinrelationtotheirparents’ educationlevel,35% informedthattheyattendedhigher edu-cationand45%attendedmiddleschoolandhighschool.The education level of their children is mostly (97%) undergrad-uates/graduates, and52% of respondents answered that their childrenaregraduates. Theaverageturnover ofenterprisesis aboveR$1million(88%),and44%aboveR$5million.

Table 2 shows a summary of data relating to questions

aboutgovernance.Notethat79%deemsthegovernanceissue extremelyimportant.Inaddition,86%reportedthattheydonot haveamembers’agreement.

Therelevanceofthesubjectandtheintentiontoadvancein thisnewfrontierof managementof rural companiesare con-firmedwhen59%intendstoenterintoamembers’agreement. Ingeneral,for56%oftheproducers,theroleoffamily mem-bersinthegovernanceprocessoftheruralbusinessisclear,and 83%reportedthatthereisnoadvisoryboardthatsupportsthe management/governanceoftheruralenterprise.Regardingthe separationbetweenthemanagers’corporatebankaccountsand personalbankaccounts,66%answeredthatthereisno separa-tionbetweenthem.Outofthetotalrespondents,68%answered thattheircompensationisbasedontheirservicesprovided,and 63% reports that there is no profit sharing inthe end of the company’sfiscalyear.Partof respondentsbelieves thatprofit sharingisnotacommonpracticeandthatiftheyhaveprofits, theyshouldbereinvestedinthecompany.

Table3

Managementofenterprises.

Legalnature Howistheaccountingdone?

Qty % Qty %

Individualentity(IE) 31 89% Noaccounting 1 3%

Legalentity(LE) 2 6% Taxaccountingonly 16 47%

IEandLE 2 6% Managementandtaxaccounting 17 50%

Total 35 100% Total 34 100%

Whereistheaccountingdone? Whataretheexistingformalcontrols?

Qty % Qty %

Specializedfirm 22 65% Productioncosts 26 74%

Atthecompany,withanemployedaccountant. 2 6% Cashflows 25 71% Atthecompany,withanoutsourcedaccountant. 10 29% Balancesheetandincomestatement 13 37%

Total 34 100% Noformalcontrols 5 14%

Separationbetweentreasuryandcontrollership?

Qty %

Yes 3 9%

No 31 91%

Total 34 100%

Source:ResearchData.

business andthe largevolumeof funds transacted. Addition-ally,91%oftherespondentsansweredthattheydonotseparate treasuryactivitiesfromcontrollershipactivities.

In general,74% of the respondents answered that theydo nothaveastructuredstrategicplanning,andthatthe decision-making process is under the responsibility of the managing members(62%).However,thelargemajority(94%)considers strategicplanningextremelyimportant/importanttothe gover-nanceoftheenterprise.Giventheabsenceofanadvisoryboard for 80% of the respondents (Table4),the approvalof strate-gicdecisionsbyanadvisoryboardismadebyonly20%ofthe respondents.Asintheeconomicandfinancialmanagement,it isunderstoodthat,alsoforstrategicmanagement,entrepreneurs

havechallenges toovercome inordertoachieve good gover-nancepractices.

Typologiesofproducers:governance

Hypothesistesting

InordertotestthehypothesesproposedinTable5,twotypes of analysis and/or testswere made: (i) a Chi-square test for hypothesescontainingdiscretevariables(H1,H2,H3andH5); and(ii)anaveragecomparisontest(ttest)withthehypothesis 4(H4),asitcontainsacontinuousvariable(theageofthemain manageroftheenterprise)(Hairetal.,2008).

Table4

Strategyandgovernance.

Structuredstrategicplanning? Whoparticipatesinthedecision-makingprocess?

Qty % Qty %

Yes 9 26% Managingmembers 21 62%

No 25 74% Managingandnon-managingmembers 7 21%

Total 34 100% Managingmembersandselectedemployees 4 12% Managingandnon-managingmembersandemployees 2 6%

Total 34 100%

Arethedecisionsapprovedbytheboard? Importanceofstrategicplanning

Qty % Qty %

Yes 6 20% Extremelyimportant 14 41%

No,becausethereisnoBoard 24 80% Important 18 53%

No,despitetheexistenceofaBoard 0 0% Relativelyimportant 1 3%

Total 30 100% Lessimportant 1 3%

Irrelevant 0 0%

Total 34 100%

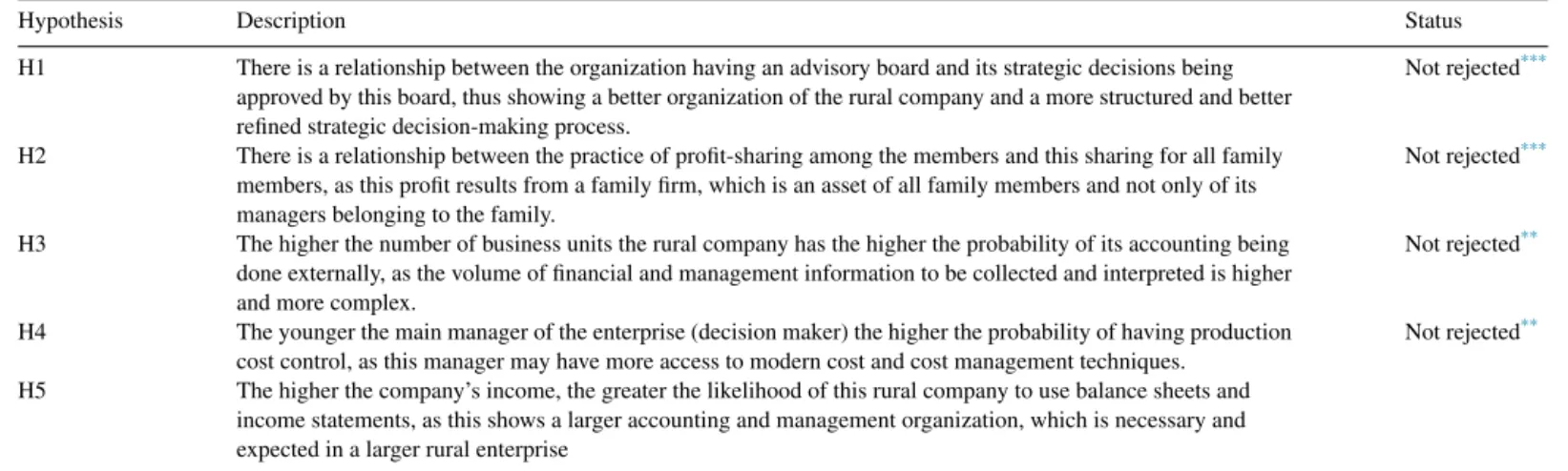

Table5

Summaryofthehypothesestestesandresults.

Hypothesis Description Status

H1 Thereisarelationshipbetweentheorganizationhavinganadvisoryboardanditsstrategicdecisionsbeing approvedbythisboard,thusshowingabetterorganizationoftheruralcompanyandamorestructuredandbetter refinedstrategicdecision-makingprocess.

Notrejected***

H2 Thereisarelationshipbetweenthepracticeofprofit-sharingamongthemembersandthissharingforallfamily members,asthisprofitresultsfromafamilyfirm,whichisanassetofallfamilymembersandnotonlyofits managersbelongingtothefamily.

Notrejected***

H3 Thehigherthenumberofbusinessunitstheruralcompanyhasthehighertheprobabilityofitsaccountingbeing doneexternally,asthevolumeoffinancialandmanagementinformationtobecollectedandinterpretedishigher andmorecomplex.

Notrejected**

H4 Theyoungerthemainmanageroftheenterprise(decisionmaker)thehighertheprobabilityofhavingproduction costcontrol,asthismanagermayhavemoreaccesstomoderncostandcostmanagementtechniques.

Notrejected**

H5 Thehigherthecompany’sincome,thegreaterthelikelihoodofthisruralcompanytousebalancesheetsand incomestatements,asthisshowsalargeraccountingandmanagementorganization,whichisnecessaryand expectedinalargerruralenterprise

*Significanceat10%level. ** Significanceat5%level. ***Significanceat1%level.

4

2

0

–2

–4

–6

–4 –3 –2 –1 0 1

Inf

or

mality in profit shar

ing (4.6%)

Informality in planning (76.7%)

Strategic planning (SP)?

PS(ManPartn)

AB(Yes)

SDAB(Yes)

Advisory board (AB)? Profit sharing (PS)? Strategic decisions approved by the board (SDAB)?

Profit sharing {PS} (Who)?

PS(Yes)

SP(Yes) PS(FamPartn)

Fig.1.Multiplecorrespondenceanalysisofthevariablesanalyzedinthefirst twohypothesesproposedandtestedinthisresearch(H1andH2).

Source:Researchdata.

Asit canbeseeninTable5,thefivehypotheses proposed

werenot rejected, andtwo of thesehypotheses (H3 andH4) werenotrejectedwithalevelofsignificanceof5%andthreeof thesehypotheses(H1,H2andH5)hadtheirnorejectionatthe levelof1%.

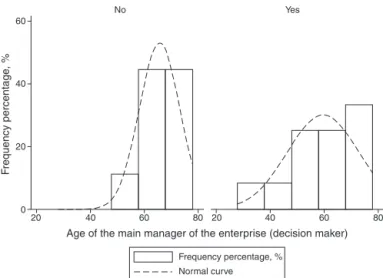

Multiplecorrespondenceanalysis

Fordidacticpurposesandforabetterunderstandingofthese relationships,examinedandanalyzedinthehypothesesabove, wedeveloped amultiple correspondenceanalysisinthe vari-ablesanalyzedinthefirsttwohypotheses(H1andH2)(Fig.1) andalsointhevariablesoftwootherhypotheses(H3andH5) (Fig.2).Forbeingtheonlyhypothesisproposedhereandtested containingacontinuousvariable,hypothesis4 (H4)was ana-lyzedthroughthenormaldistributionofitsdata(ageofthemain manageroftheenterprise)comparedtothefactofwhetheror notthemanagementcontrolofproductioncostsisused(Fig.3) (Hairetal.,2008).

4

3

2

1

0

–1

–2

ARC

AO

_≤500m

1PU

BS_IS(No)

1M-5M 1-3PU

ASAO 500m-1M >5PU

>5M

BS_IS(Yes) 3-5PU

Reduced size of the enterprise (67.7%)

Accounting f

or

mality (12.7%)

–3

–4 –2 –1 0 1 2

Production units (PU)? Turnover (R$)? Balance sheet (BP) and income statement (IS) {BS_IS}?

Accounting location

Fig.2.Multiplecorrespondenceanalysisofthevariablesanalyzedinthetwo hypothesesproposedandtestedinthisresearch(H3andH5).

Source:Researchdata.

InFig.1,itcanbeseenthattheclusters/groupscanbe identi-fiedwiththesevariablesintwodimensions.Thefirstdimension, with the explanatory power of 76.70% of variance of these questions, wasnamedas planning informality,mainlydueto thefactthat alloptionsof non-adoptionof thepractices stud-ied hereStrategic Planning {SP (No)}; advisory board {CO (Não)};strategic decisionapprovedbyBoard{SDAB (No)}; andprofitsharing{PS(No)}arelocatedonthepositivesideof thisscale,thusindicatingthatthegreaterthisscaleisthegreater thestrategicinformalitypresentedintheseruralenterprises.

Theseconddimension,withanexplanatorypowerof4.60% ofvarianceofthequestions,correspondstoprofitsharing

infor-mality as the main factor to categorize this dimension was

No

F

requency percentage

, %

60

20 40

0

Yes

40

20 60 80 20 40 60 80

Age of the main manager of the enterprise (decision maker)

Frequency percentage, % Normal curve

Fig.3.Regulardistributionofthemanager’sageandadoptionofproduction costcontrol(H4).

Source:Researchdata.

family,thecompany{Profitsharing(PS)[FamPartn]}, regard-lessofthefactthatthismemberisorisnotpartofthecompany’s management–demonstratinggreatermanagerialinformalityin thedistributionofthefinancialsurplusobtained.

Based on these variables, it is possible to identify a few clusters:

(a) Thereisarelationshipbetweenthe non-adoptionof gov-ernancepracticesandmanagementprocesses(dashedand dottedcircle{-.-.-}farrightofFig.1)].

(b) Thereisarelationshipbetweentheadoptionof “strategic planningpractices{SP(Yes)}”,thedecisiontoimplement profitsharing{PS(Yes)}andthisprofitsharingbenefitall familymembers{PS(FamPartn)(dottedcircle{...},inthe middleofFig.1).

(c) Thereisacloserelationshipbetweentheexistenceof advi-soryboard{AB(Yes)}andstrategicdecisionsapprovedby the Board{SDAB (Yes)}(dashed circle {—},far leftof

Fig.1).

(d) Itcanbeseenthatdespitenotbeinginsertedinanycircle of proximity,the option“profitsharingonlyamong man-agingpartners”{PS(ManPartn)}hasagreaterproximityto thedashedcircle(—),thatis,withtheoptionsrelatingto theexistence ofadvisory board{AB(Yes)} andstrategic decisionsapprovedbytheboard{SDAB(Yes)}.

InFig.2,itcanbeseenthattheclusters/groupscanbe identi-fiedwiththesevariablesintwodimensionsunderanalysis.The firstdimension,withexplanatorypowerof67.70%ofvariance of these questions, was named as reduced size of the

enter-prise,mainlydue tothe fact that,according tothe statistical

analyzes,thevariablesthatmostcontributedtothecreationof thisdimensionwere:(a)thenumberofproductionunits(PU); (b)thecompany’srevenues(R$).Notethatthesmallerthesize oftheruralenterpriseunderanalysisthehigherthevaluesinthis scale,asitcanbeseeninthecaseofacompanywithonlyone productionunit(1PU)andwithturnoveruptoR$500,000per

year(≤500m)inapositiveendofthisscaleandonthenegative

end,thosewithmorethanfive(5)productionunits(>5PU)and aturnoverexceedingR$5millionperyear(>5M).

Theseconddimension,withexplanatorypowerof12.70%of variancesofthequestions,correspondstotheformalityof

draft-ingtheaccountingoftheruralenterprise.Themainfactorthat

assistedinthiscategorization,throughstatisticalanalysis,was theplacewheretheaccountingoftheruralenterpriseswasheld. Thisdimensioncanberepresentedbyitsextremes:(a)upperend –accountingoffice(AO),positivevalues;accountingconducted intheruralcompany(ARC)valuevirtuallyzeroonthisscale; (b)lowerend–accountingconductedwithsupportfroman out-sourced accounting firm,hererepresentedby negativevalues (AOS).

Based on these variables, it is possible to identify a few clusters:

(a) Thereisarelationshipbetweenthe“Non-adoptionof bal-ancesheetandincomestatements”{BS IS(No)},“sizeof theruralcompanybetween03and05productionunits”(3-5 PU)and“accountingconductedatanaccountingfirm”(AF) (dashedanddottedcircle{–.–.),intheuppersideofFig.2. (b) There is a greater relationship (greater proximity to its points)between “use of balance sheetand income state-ment”{BP DRE(S)} and“larger ruralenterprises” {with morethan 5 production units (>5UN) andwith revenues greaterthanR$5million(>5M)}(dashedcircle{----},far leftofFig.2).

(c) Thereisarelationshipbetween“theaccountingoftherural enterpriseisconducted,butwiththesupportofan account-ingfirm”(AF),andruralpropertieswithturnoverbetween R$500,000andR$1million(500m–1M).Companieswith turnoverbetweenR$1millionandR$5million(1M–5M) andcompaniesbetween 01and03 productionunits (1–3 PU),that is,consideredas “middle sized”do nothire an accountanttodothe company’saccounting(AC)(nextto thedashed circle) andalsodonot hirethe servicesof an accountingfirm(AF)(dashedanddottedcircle{.-.-}).That

is, middle-sized companies tend to do the accounting at thefarm’sofficewiththeassistanceofanaccountingfirm (ContTerceiri){onlydottedcircle(...)}.

Fig.3showsthat,besidesthefactthattheaverageageamong thosewhoadopt themanagement controlof productioncosts andthosewhodonotaredifferent(asalreadyattestedbythe non-rejectionofhypothesisH4),thereisanasymmetryinthe dis-tributionofthepercentageoffrequencyofrespondentswhodo notperformthismanagementcontrol,especiallyconcentrating intheolderagegroups.

Finalconsiderations

creditorsandbusinesspartnershaveincreasedtheirrequirements forruralpropertiestoadvanceingovernanceprocessesasa crit-icalfactorforthesustainabilityoftheruralactivityinthelong term.

Ontheotherhand,theadoptionofgovernancemechanisms thatregulatetherelationsofpowerandthealignmentofinterests isstill poorlydeveloped inthe ruralproducers’ environment. Thisgovernanceriskbecomesmoresevereasfamilygenerations succeedinthecontrolofthepropertyandsharepower.

Asseeninthisstudy,thereisacorrelationbetweenthe exist-enceofsomeformalmanagementprocesses(suchasmorerobust strategic planning and accounting systems) and advances in thegovernancemechanismsandprocesses,suchasthe estab-lishmentofaboardofdirectors,clearerrulesof separationof corporateandfamilyassetsandmoretransparencyinfinancial statements.Thereisalsolittletransparencywithregardtothe separationofwhatisreturnoncapital(dividend)and compensa-tionforwork(compensationforservicesprovided)formembers, heirsandotherfamilymembers.

Therefore,it can be seen that this study empirically con-tributed to demonstrate, through the models and analysis proposedandperformedherein,thattheremaybevarious rela-tionships among the most different business decisions, from those that were often perceived as independent, such as the developmentofstrategicplanning {SP(Yes)},thedecisionto performprofitsharing{PS(Yes)}andtheprofitsharing bene-fitsallfamilymembers{PS(FamPartn)};totheconfirmation ofdependenceonsomerelationshippreviouslyexpectedbythe literaturereview,suchasthestrategicdecisionsapprovedbya board{SDAB(Yes)}andhavinganadvisoryboard(AB),both connectionsexposedinmoredetailinFig.1.

Likewise,itcanbeseenthattherelationshipsofdependence andindependencebetweenthecompanysizeandaccounting for-malitywereempiricallydemonstrated(Fig.2),fromthemost expected, according to the literature, such as the connection betweenthe companies withmore than 05 -productionunits (>5PU),companieswithturnoverexceedingR$5million(>5M) andthelackofuseofbalancesheet(BS)andincomestatements {BS IS(No)}.

Finally,webelievethatthisresearchhascontributedtofuture studiesinthisresearchfieldbyobservingthatallfivehypotheses proposedhere(H1–H5)werenotrejected,whichmayguidenew inquiriesand/orquestionsforfuturestudiesontopicsrelatedto theonepresentedinthispaper.

Itisalsonotedthat,althoughtheresearchsamplewas inten-tional, consisting of participants of the training programs of SENAR MS and SENAR MT, presuming that they already hadsomepredispositiontoaddressthetopicsrelatedto “Gov-ernance,” the fact that 97% consider this topic important or extremelyimportantisstillverysignificant.

Theresultsencouragethedebateabouttherelevanceofthe theme.Theremaybespeculationonthelackofdissemination ofknowledgeandstudiesinvolvingruralproducersregarding therelationshipbetweengovernanceandsustainabilityofrural enterprises.

Itisunderstoodthatthisstudyhasimportantlimitations.The intentionalnature,thetypeandsizeofthesampledonotallow

extrapolations,therefore,theanalysisofthehypothesistesting shouldbeunderstoodinthiscontext.Also,themethodologyof thestudywasessentiallyexploratoryandquantitative,without aqualitative basisthat couldcaptureindepth aseries of ele-mentsonthevariablesinquestionandtheir relationshipwith thescopeofresearch(ruralproducers).Favorably,itisargued thatthisstudy,despitetheselimitations,advancesbyproposing abetterunderstandingoftheprofileofproducers,establishing typologiesthatcanbedeepenedinfuturestudies.

In terms of methodology, it gives the opportunity toboth qualitativestudies(especiallycasestudies),whichcanexplore aseriesofvariablesindepth,andquantitativestudies,seeking tounderstandtheregularitiesinlargerpopulations.Therefore, wesuggestunderstandingtheregularitiesinrelationtothe seg-mentofoperationintheruralactivity,geographicpresence,size andcomplexityoftheruralactivity,backgroundofthefamilies of producers(culturalandethnicalbackground),amongother examples.

Specifically,wehighlightthefollowingforfuturestudies:(a) analyzingtheexistence andformsofcompositionand perfor-manceof boards(board ofdirectors, advisoryboard) inrural properties;(b)examiningthecompensationmechanismsofthe governing boardsinruralproperties; (c)studying the mecha-nismstoequatetheprocessofsuccessioninruralproperties;(d) evaluatingtheperspectivesofthedifferentgenerationsinvolved inthesuccessionprocessinruralproperties;(e)evaluatingthe mainlegalandcorporatebarriersthataffectthesuccession pro-cessinruralproperties.

Insummary,weproposeabroadresearchagendainvolving governanceandsuccessioninfamily-controlledorganizations, especiallythesegmentofruralproducers.Thegapofstudiesin relationtothesesubjectsopensupopportunitiesforresearchers fromdifferentareasofknowledge.

Conflictsofinterest

Theauthorsdeclarenoconflictsofinterest.

References

ABAG(2015).ABAG(Associ¸acãoBrasileiradeAgribusiness)–Site institu-cional.Availableatwww.abag.org.br.Accessed10.09.12

Alcântara,N.B.,&MachadoFilho,C.A.P.(2014).OProcessodeSucessão noControledeEmpresasRuraisBrasileiras:UmEstudoMulticasos. Orga-niza¸cõesRurais&Agroindustriais,UFLA,16(1),139–151.

Becht,M.,Bolton,P.,&Roell,A.(2012).Corporategovernanceand con-trol.NBERworkingpaperseries.Availableat:www.nber.org/papers/w9371. Accessed10.02.12

Berle,A.,&Mean,G.C.(1932).Themoderncorporationandprivateproperty. NewYork:CommerceClearingHouse.

Bailey,B.C.,&Peck,S.I.(2013).Boardroomstrategicdecisionmakingstyle: Understandingthe antecedents corporategovernance:An international review.pp.131–146.

Bammens,Y.,Voordeckers,W.,&VanGils,A.(2011).Boardsofdirectorsin familybusinesses:Aliteraturereviewandresearchagenda.International JournalofManagementReviews,13(2),134–152.

Chrisman,J.J.,Chua,J.H.,&Sharma,P.(1998).Importantattributesof suc-cessorsinfamilybusiness:Anexploratorystudy.FamilyBusinessReview, 11(1),19–34.

Coase,R.H.(1937).Thenatureofthefirm.Economica,4(16),386–405.

Conab (Companhia Nacional de Abastecimento). (2015). Relatório de acompanhamento dasafra Brasileira – Siteinstitucional.. Available at

www.conab.gov.br.Accessed10.05.15

Davis,J.H.,&Goldberg,R.(1957).Aconceptofagribusiness.pp.136.Boston: HarvardUniversity.

Davis,J.H.,Schoorman,F.D.,&Donaldson,L.(1997).Towardsastewardship theoryofmanagement.AcademyofManagementReview,22(1),20–47.

Demsetz,H.,&Lehn,K.(1985).Thestructureofcorporateownership:Causes andconsequences.JournalofPoliticalEconomy,93(6),1272–1277.

Ees,H.,Gabrielsson,J.,&Huse,M.(2009).Towardabehavioraltheoryof boardsandcorporategovernance.AnInternationalReview,17(3),307–319.

Fama,E.,&Jensen,M.(1983).Separationofownershipandcontrol.Journal ofLawandEconomics,26,1–31.

Gersick,K.,Davis,J.A.,Hampton,M.M.,&Lansberg,I.(1997).Generation togeneration:Lifecyclesonfamilybusiness.pp.310.Boston:Harvard BusinessSchool.

Guerra,S.,Fischmann,A.D.,&MachadoFilho,C.A.P.(2009).Anagendafor boardresearch.CorporateOwnershipandControl,6(3),196–202.

Hair,J.F.,Jr.,Anderson,R.,Tatham,R.L.,&Black,W.C.(2008).Análise multivariadadedados.pp.593.PortoAlegre:Bookman.

Instituto Brasileiro de Geografia e Estatística – IBGE (2010). Censo Agropecuário 2006. Available at: www.ibge.gov.br/home/estatistica/ economia/agropecuaria/censoagro/2006/default.shtm.Accessed30.03.10 Jensen,M.,&Meckling,W.(1976).Theoryofthefirm:Managerialbehavior,

agencycostsandownershipstructure.JournalofFinancialEconomics,3(4), 305–360.

León,R.M.(2006).Shareholderagreementsinclosecorporationsandtheir enforcement(LLMThesisandessays).UniversityofGeorgiaLaw.Available athttp://digitalcommons.law.uga.edu/stullm/89

Lodi,J.B.(1993).AEmpresaFamiliar(4aed).SãoPaulo:Pioneira.

MachadoFilho,C.A.P.(2006).Responsabilidadesocialegovernan¸ca:Odebate easimplica¸cões.pp.192.SãoPaulo:Thomson.

MachadoFilho,C.A.P.(2009).Governanc¸anasOrganizac¸õesdoAgronegócio. InJ.R.FontesFilho,&R.W.Lancelloti(Eds.),(Organizadores)– Gover-nan¸caCorporativaemtemposdecrise(pp.111–127).SãoPaulo:IBGC, SaintPaul.

Malhotra,N.K.(2001).PesquisadeMarketing:Umaorienta¸cãoaplicada.Porto Alegre:Bookman.

Marconi,M.deA.,&Lakatos,E.M.(2011).TécnicasdePesquisa.SãoPaulo: Atlas.

Miller, D.,&LeBreton-Miller,I.(2006).Familygovernanceandfirm per-formance:Agency,stewardshipandcapabilities.FamilyBusinessReview, 19(1),73–87.

Ross,S.A.(1974).Theeconomictheoryofagencyandtheprincipleofsimilarity. Holland:EssaysonEconomicBehaviorunderUncertainty.

Sharma,P.(2004).Anoverviewofthefieldoffamilybusinessstudies:Current statusanddirectionsforthefuture.FamilyBusinessReview,17(1),1–36.

Shleifer,A.,&Vishny,R.W.(1997).Asurveyofcorporategovernance.Journal ofFinance,52(2),737–783.

Steier,L.(2001).Familyfirms,pluralformsofgovernanceandtheevolvingrole oftrust.FamilyBusinessReview,14(4),353–368.

Spence,M.,&Zeckhauser,R.(1971).Insurance,informationandindividual action.AmericanEconomicReview,56(2),380–387.

Tejon,J.L.,&Xavier,C.(2009).Marketing&Agronegócio:Anovagestão– diálogocomasociedade.pp.336.SãoPaulo:PrenticeHall.

Tirole,J.(2006).Corporatefinance.Princeton:PrincetonUniversityPress.