Revista

de

Administração

http://rausp.usp.br/ RevistadeAdministração52(2017)443–455

Strategy

and

Business

Economics

Strategic

contractual

relationships

in

the

automotive

sector

Rela¸cões

contratuais

estratégicas

no

setor

automotivo

Relaciones

contractuales

estratégicas

en

la

industria

automotriz

Cleiciele

Albuquerque

Augusto

a,∗,

José

Paulo

de

Souza

a,

Silvio

Antônio

Ferraz

Cário

b aUniversidadeEstadualdeMaringá,Maringá,PR,BrazilbUniversidadeFederaldeSantaCatarina,Florianópolis,SC,Brazil Received16January2016;accepted19December2016

Availableonline8September2017 ScientificEditor:PaulaSaritaBigioSchnaider

Abstract

TheaimofthepresentstudyistounderstandcontractualrelationsthroughthecomplementarityoftheTransactionCostsTheory,MeasurementCosts Theory,andtheResource-BasedView.Initially,wesoughttodefineananalyticalmodelappropriatetothecomplementarityobjective,considering thecategoriesofeachapproach.Thepropositionwas:giventhepossibilityofmeasuringtheattributesofproducts,thecontractualrelationship canbeusedtoguaranteepropertyrightsoverassetsofhighspecificityandstrategicvalue,avoidingthecostsofverticalintegration.Secondly, aqualitativedescriptivecross-cut(2014and2015)studywascarriedout.Inthisphase,thecomplementaritypropositionwasanalyzedbasedon dataobtainedthroughsemi-structuredinterviewswithlogistics,production,andpurchasingmanagersofautomakerslocatedinthestateofParaná, andsomeoftheirdirectsuppliers.Ourpropositionindicatesthatwhenthereisthepossibilityofmeasuringproductattributes,thecontractual relationshipcanbeusedtosecurepropertyrightsofhigh-specificityassetsandstrategicresources,avoidingthecostsofverticalintegration.This propositionwasverifiedbecause,inthecaseofhigh-specificityautoparts,themeasurabilityoftheirdimensionsensuresprotectionofspecificand residualpropertyrights.Inthecaseofstrategicresources,whenthereisapossibilityofmeasurementandcontrol,contractingisallowed,even includingtheacquisitionofinnovationsthatbringcompetitiveadvantage(Bluetooth,integratedGPSwithSDcard,back-upsensor,airbags).It wasobservedthat,eventhoughcompetitiveadvantagesconstitutevaluableandrareresourcesforautomakersattheirlaunch,thisdidnotprevent contracting.VerificationcanofferanalternativepathtorationalTransactionCostsTheory,asproposedbyWilliamson,andtheuseofvertical integrationasaformofcontrollingstrategicresources,recommendedbytheResource-BasedView,whichstillrequiresfurtherstudiesinorderto overcomepersistentlimitationsinthemodel.

©2017DepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoeContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP. PublishedbyElsevierEditoraLtda.ThisisanopenaccessarticleundertheCCBYlicense(http://creativecommons.org/licenses/by/4.0/).

Keywords:Contracts;Measurementattributes;Specificassets;Resourcesandstrategiccapabilities;Automakers

Resumo

Neste artigo, objetivou-se compreender as relac¸ões contratuais por meio da complementaridade da Teoria dos Custos de Transac¸ão, Teoria dos Custos de Mensurac¸ão e Visão Baseada em Recursos. Para tanto, buscou-se definir um modelo analítico adequado ao obje-tivo de complementaridade, considerando-se as categorias de cada abordagem. A proposic¸ão elaborada indica que, na possibilidade de mensurac¸ão dos atributos dos produtos, a relac¸ão contratual pode ser utilizada para garantir os direitos de propriedade sobre ativos de elevada especificidade e recursos estratégicos, evitando-se os custos da integrac¸ão vertical. Em um segundo momento, a partir de uma pesquisa qualitativa descritiva, com recorte no ano de 2015, realizou-se a fase empírica da proposta. Nessa fase, analisou-se a proposic¸ão de complementaridade a partir de dados obtidos por meio de entrevistas semiestruturadas com gerentes de logísticas, produc¸ão e compras das montadoras automotivas localizadas no Estado do Paraná, e alguns de seus fornecedores diretos. A proposic¸ão

∗Correspondingauthorat:AvenidaColombo,5790,CEP87020900,Maringá,PR,Brazil.

E-mail:cleicielealbuquerque@yahoo.com.br(C.A.Augusto).

PeerReviewundertheresponsibilityofDepartamentodeAdministrac¸ão,FaculdadedeEconomia,Administrac¸ãoeContabilidadedaUniversidadedeSãoPaulo –FEA/USP.

https://doi.org/10.1016/j.rausp.2017.08.006

foiratificadaaoseconstatarque,nocasodeautopec¸asdeelevadaespecificidade,acapacidadedemensurac¸ãodesuasdimensõesgaranteaprotec¸ão dedireitosdepropriedadeespecíficoseresiduais.Nocasodosrecursosestratégicos,napossibilidadedemensurac¸ãoecontrole,acontratac¸ão permitiuaaquisic¸ãodediversasinovac¸õesgeradorasdevantagemcompetitiva(bluetooth,oGPSintegradonoveiculo,comcartãoSD,osensorde ré,airbags).Observou-seque,mesmoseconstituindoemrecursosvaliososerarosparaasmontadorasnoseulanc¸amento,essefatonãoimpediu queessesfossemadquiridosporintermédiodacontratac¸ão.Conclui-sequeessaratificac¸ãopodeoferecerumcaminhoalternativoaoracionalda TCT,propostoporWilliamson,eàorientac¸ãopelaintegrac¸ãoderecursos,comoformadecontrole,preconizadopelaVBR,oqueaindacarecede maioresestudosvisandoasuperaraslimitac¸õesaindapresentesnomodeloapresentado.

©2017DepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoeContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP. PublicadoporElsevierEditoraLtda.Este ´eumartigoOpenAccesssobumalicenc¸aCCBY(http://creativecommons.org/licenses/by/4.0/).

Palavras-chave: Contratos;Mensurac¸ãodeatributos;Ativosespecíficos;Recursosecapacidadesestratégicos;Montadorasdeveículos

Resumen

ElpropósitoenesteartículoesentenderlasrelacionescontractualespormediodelacomplementariedaddelaTeoríadelosCostosdeTransacción, TeoríadelosCostosdeMediciónydeVisiónBasadaenlosRecursos.Paraello,sehabuscadoestablecerunmodeloanalíticoapropiadoalobjetivo decomplementariedad,teniendoencuentalascategoríasdecadaenfoque.Laproposiciónelaboradaindicaque,enlaposibilidaddemedición delosatributosdelproducto,larelacióncontractualpuedeutilizarseparaasegurarlosderechosdepropiedaddeactivosdealtaespecificidady recursosestratégicos,evitándoseloscostosdelaintegraciónvertical.Enunasegundaetapa,apartirdeunestudiocualitativodescriptivo,con secciónenela˜no2015,sehallevadoacabolafaseempíricadelaproposición.Enestafase,sehaanalizadolaproposicióncomplementaria,apartir dedatosobtenidospormediodeentrevistassemiestructuradasconlosdirectoresdelogística,producciónyadquisicióndeplantasensambladoras automotricesubicadasenelestadodeParaná,yalgunosdesusproveedoresdirectos.Laproposiciónhasidoratificadaporlaconstatacióndeque, enelcasodeautopartesdealtaespecificidad,lacapacidaddemedicióndesusdimensionesaseguralaproteccióndelosderechosdepropiedad específicosyresiduales.Encuantoalosrecursosestratégicos,enlaposibilidaddemediciónycontrol,lacontrataciónhapermitidolaadquisición deunaseriedeinnovacionesgeneradorasdeventajacompetitiva(bluetooth,GPSintegradoenelvehículo,contarjetaSD,sensordemarchaatrás, airbags).Seadvierteque,aunqueconstituyanrecursosvaliososyrarosparalosfabricantesdeautomóvilesensulanzamiento,estehechonoha impedidoqueéstosfueranadquiridospormediodelacontratación.Seconcluyequedichacomprobaciónpuedeofrecerunmedioalternativoal caminoracionaldelaTCT,propuestoporWilliamson,yalaorientaciónhacialaintegracióndelosrecursos,comomediodecontrol,preconizado porlaVBR.Esnecesarioqueserealicenmásestudiosparasuperarlaslimitacionestodavíapresentesenelmodelo.

©2017DepartamentodeAdministrac¸˜ao,FaculdadedeEconomia,Administrac¸˜aoeContabilidadedaUniversidadedeS˜aoPaulo–FEA/USP. PublicadoporElsevierEditoraLtda.Esteesunart´ıculoOpenAccessbajolalicenciaCCBY(http://creativecommons.org/licenses/by/4.0/).

Palabrasclave: Contratos;Medicióndeatributos;Activosespecíficos;Capacidadesyrecursosestratégicos;Ensambladorasautomotrices

Introduction

Theessential ideaguidingthisworkconcerns the transac-tionalandstrategiccharacteristicswhichinfluencedecisionsto outsourceproductionamongautoassemblyplantsinthestateof Paraná,Brazil.Understandingthemotivationbehindthese deci-sionsindicates pathsfor understandingorganizations intheir formsandlimits,aswellasproductiveandrelationaldynamics. Historically,verticalintegrationanddisintegrationmovements, through contracting, have always been part of the strategic decisionsof automakers, intheir headquarters andextending throughout their subsidiaries, including those in Brazil. An understandingofthemotivatingfactorsbehindthesemovements helpsdefinerelevantsubsidiesforinvestmentdecisionsinthe sector,inboththepublicandprivatespheres(Ferreira&Serra,

2010;Melo,2006).

Presently,intheBraziliancase,thereisatrendtoward ver-tical disintegration, that is, externalization of production. In recentyears, automakers havestarted focusing on more spe-cializedactivitiesattheproductlevel,prioritizingskillsrelated to the creation of characteristics that differentiate the prod-uct in the consumer market (Cerra & Maia, 2008; Costa &

Henkin,2012;Melo,2006).AccordingtoMelo(2006)andCosta

andHenkin(2012),suppliershaveassumed responsibilityfor

activitiesconsiderednon-strategicbyautomakers,orthosethat requireknowledgedivergentfromthatwhichformsthebasisof automakers’corecompetencies.

Within thisframework ofoutsourcingactivities, the domi-nantgovernancestructureinthecoordinationandattainmentof automakershasbeencontractualarrangementswithdirect sup-pliers(Augusto,2015;Ferrato,Carvalho,Spers,&Pizzinatto, 2006).AccordingtoCasottiandGoldenstein(2008),contracts betweenassemblersandsupplierscanrangebetweenmore dis-tant, as well as closer relationships, such as those in which suppliersinstallthemselvesintheassemblyplant(modular con-sortium).Inthiscase,FerreiraandSerra(2010)affirmthatthe maturity of thissectorfacilitates the choice of thisstructure, sinceitisinsertedinacontextofefficiency,whereconditions reducemarketimperfectionsanddangersintransactions, espe-ciallyopportunisticbehavior.

Sacomano Neto &Iemma, 2004). In addition,these transac-tionsarecharacterizedbythesharingofrisksandinvestments, andbycooperationandpartnershipswithsuppliersinproductive spaces(SacomanoNeto&Iemma,2004).Itisalsoconsidered thatthecontrolandcompetitiveefficiencyofautomakersreduces transactioncostsinrelationtootheragents(Ferreira&Serra,

2010).

Thestudyofcontractualformsmayfindsupportintheories addressedatthemicro-analyticalleveloftheNewInstitutional Economics(NIE),notablytheTransactionCostsTheoryorTCT

(Coase,1937;Klein,Crawford,&Alchian,1978;Williamson,

1975,1985,1996;Zylbersztajn,1995,2009)andthe

Measure-mentCostsTheoryorMCT(Barzel,1997,2002,2005;Coase,

1937;Zylbersztajn,2009).Theseapproacheshavetheirorigin

inan articlebyCoaseentitled“Thenatureof thefirm,” pub-lishedin1937,whichlaidthebasisforthestudyofcontractual organizationalforms.Thissetcomplementsthediscussionon propertyrights.Mahoney(2001)arguesthatBarzel(1989), fol-lowingthe premise put forward byCoase(1960), unifiesthe discussioninvolvingpropertyrightsandorganization,inview ofthedifficultyofsecuringpropertyrightsunderdifficult mea-surementconditions.Thisset, undertheNIE,has beentaken intoconsiderationinthisarticle.

In additiontotransaction(TCT) andmeasurement(MCT) costs,anotherfactortakenasaninfluenceincontracting deci-sionsinthepresentinvestigationreferstostrategicresourcesand capabilities.Inthetreatmentoftheseresources,the Resource-BasedView(RBV)istakenasthetheoreticalapproach.RBV has its origin in Economic theory, especially from the

stud-iesofPenrose (1959)inherwork“The theoryof thegrowth

of the firm.” This approach focuseson the characteristics of organizationalresourcesinordertoclarifywhethertheycanbe strategic,i.e. sourcesofcompetitiveadvantages (Foss,2005).

InBarney’s(1991)perception,toenablethecreationofa

com-petitiveadvantage,theresourcesmustberareandvaluable.To createsustainablecompetitiveadvantages(VCS),inturn,they mustalsobeimperfectlyimitableandirreplaceable.

From this perspective, RBV appears as a complementary approachtoTCT andMCT for theunderstandingof contrac-tual forms. Attempts to address the complementary aspects involving atleast two ofthese approacheshave alreadybeen observed in the Firm Theory literature. One of them is the integrationofRBVwithTCT,indicatingtheinfluenceof strate-gicresourcesinthechoiceofgovernancestructure(Argyres&

Zenger,2008,2012;Augusto,Souza,&Cario,2013;Combs&

Ketchen,1999;Crook,Combs,Ketchen,&Aguinis,2013;Foss,

2005;Jacobides&Winter,2005;Langlois,1992;Leiblein,2003;

Lundgreen,2013;Mahoney,2001;Neves,Hamachera,&

Scav-arda,2014;Saes,2009;Williamson,1999).TCT,inturn,hasalso

beendiscussedthroughlinkstoMCT,showingthatassets mea-surement,insomesituations,becomesmoreoperationalthanits specificity(Barzel,2005;Zylbersztajn,2005,2009).However, weareunawareofanytheoretical–empiricalstudiesthatseekto discussacomplementaryperspectiveonTCT,MCT,andRBV. Thesearchforthecomplementarityofthesetheoriesarises from the identification of their limitations when individually addressedwithin the understandingof governance structures.

The considerationofspecificassetsby TCT,andtheviewof strategic resources within RBV—when taken as fundamental attributes inthe choice of verticalintegration—suggest some provisoswhendisregardingaspectsofmeasurement.Inthiscase, thequestionarises:couldassetsofhighspecificityorstrategic importanceinthetransactionbecontractedifthemeasurement oftheirdimensionswasfeasible?Theanswer,fromthe perspec-tiveoftheMCT,mayofferanalternativepathtotherationaleof theTCT,asproposedbyWilliamson(Williamson,1975,1985), andtoorientationthroughtheintegrationofresourcesasaform of control, as advocated byRBV(Barney, 1991;Foss, 2005;

Peteraf,1993).

Within the framework of this theoretical discussion, it is observedempiricallythat directrelations betweenautomakers andtheirsupplierssuggestthepossibilityofacloser relation-ship,duetotheinterdependenceofresources,optimizationof communication,sharingofrisksandinvestments,andthe devel-opmentofcooperation.Ontheotherhand,thetransactionand measurementcostsinherenttothemanagementofthese trans-actionsandthestrategicrisksrelatedtothesharingofresources andcapabilitiesindicatecoordinationchallengeswhichshould be takeninto consideration. In thisframework,the following researchquestionemerges:Howarethecontractualforms con-figuredintherelationshipsbetweenautomakersandtheirdirect suppliers,consideringthe presence of strategicresources and theresultingtransactionandmeasurementcosts?

Theobjectiveofthisresearchistounderstandhowthe con-tractualformsareconfiguredfromacomplementaryperspective oftransactioncosts,measurementcosts,andstrategicresources, inrelationsinvolvingmanufacturersandtheirdirectsuppliersin thestateofParaná.Itisnoteworthythattheautomotiveindustry inParaná,theobjectofthisstudy,standsoutduetoits transac-tionalandstrategiccharacteristics, whichpresentpossibilities forexploringtheoreticalaspectsofthedifferentapproachesin acomplementaryway.Additionally,itisthestatewiththethird largestautomotivesectorinBrazil(Anfavea,2016).

Inadditiontothisintroduction,thisstudycomprisesa sec-tiongivingthetheoreticalbackgroundonTCT,MCT,andRBV, whichpresentsrelevantaspectsfordiscussionandproposition ofthetheoreticalmodel.Athirdsectiondescribesthe methodo-logicalproceduresadoptedfortheconstructionofthetheoretical modelandtheaccomplishmentofempiricalwork.Inthefourth section,theresultsarepresentedandanalyzed,indicatinghow the findingshaveratified the proposedmodel.Afifthsection dealswithfindingsthatindicatechangesinthinkingabout spe-cific,measurable,andstrategicassetsinthestudyofefficiency andverticalrelationshipsinorganizations,indicatinglimitations thatwillenablefuturework.Finally,thereferencesusedareall listed.

Theoreticalreference

Thetheoryofcontractualfirms,andparticularlythe Trans-actionCostsTheoryandMeasurementCostsTheory,emerged from two important references initiated by Ronald Coase, in 1937and1960.ItcanbeconsideredthatWilliamson’sproposal

Coase’sproposalof1937.Williamsonlocatesthesereferences (TCTandMCT)inwhathecallstheefficiencybranch,withtwo ramifications:the incentiveramification,whereCoase’s influ-enceisquiteclear(1960),andwhichcontemplatestheAgency TheoryaswellasthePropertyRightsTheory;theotherconsists oftransactioncosts,whichinvolvestheexpenseofgovernance andmeasurement.AlthoughWilliamson(1985)himself recog-nizes the direct relationshipof TCT and MCT together with the Property Rights Theory inconsideringthe importance of ownership,heemphasizesthetransactioncostsgeneratedfrom governancechoices.

Althoughthispaper’sfocusisbasedonWilliamson’s(1985)

proposal,whentreatingmeasurementandgovernanceas inter-dependentinthediscussionoftransactioncosts,itincorporates importantpointsfromthePropertyRightsTheory.Thisis espe-cially true when dealingwithmeasurement andthe formsof organizationnecessarytoguaranteepropertyrights,intermsof residualcontrolrightsandcontractlaw(currentlyknownasthe NewPropertyRightsApproach),withemphasisontheworks

ofGrossmanandHart(1986),Barzel(1989),HartandMoore

(1990)andHart(1995).

Itisnotedthat,intheirvastmajority,inter-organizational rela-tionstakecontractualforms,whichformalizethecommitments between two legally independent organizations. This section describesandcharacterizes thesecontractual forms,and pro-ceedstodiscussandjustifytheminlightoftheTCT,MCT,and RBV.

Contractforms

Ingeneral,governancestructuresaredefinedbythedecision ofacompanytocarryoutanactivityitselfortopurchasefrom anotherindependentcompany.Withinthisframework,

accord-ingtoWilliamson(1985,1996),governancestructurescanbe

classifiedinto:(1)theoptiontobuyinthemarket;(2)own pro-duction,inthehierarchicalform(verticalintegration);and(3) thehybridform(contracts).

Contracts are one of the three main types of governance structuresidentifiedbyWilliamson(1996,p.58).Zylbersztajn

(1995,2009)statesthat contracts,positionedbetweenmarket

andhierarchy,avoidhierarchycostsandalsocontrolvariability andmitigatemarketrisks.

Ménard(2004)statesthathybridformsarepresentedinthe

dailylifeofcompaniesasthealmostverticalintegrationofaset ofsubcontractors:franchisenetworks;strategicalliances; clus-ters;productive,technological,andcommercialjointventures; consortia;andcontractualrelationships.Theauthorpointsout that,over time,contractscanbe improvedduetothe gradual declineofinformationalasymmetry.Inaddition,astheparties becomebetteracquaintedwitheachother,theuseofinformal mechanismssuchasreputation,trust,informationsharing,and mutualaidareincreased,andsubsequentlyusedtocoerceagents. Followingthislineofreasoning,Crooketal.(2013)arguethat managersincreasingly useextra-contractualmeans(relational governance),suchastrustandcross-equityholdingsofcapital, whichallowthemtobuildstablerelationships.

Eventswhichareunderstoodasbreachesofcontractor hold-upsoccurwhenformalcontractualrelationshipsareinterrupted

(Klein,1996;Kleinetal.,1978).Klein(1996,p.444)indicates

thathold-ups“occurwhenunanticipatedeventsdestabilizethe contractualrelationshipoutsidetheself-enforcingrange.”Inthis context,theconceptofopportunisticcontractualbreakis inves-tigated by the authorsbased on rent appropriationincentives arisingfrominvestmentsinspecificassets.Thus,ifapartofthe contractmakesspecificinvestmentswhichgeneraterent,inthe absenceofsafeguardspartofitsvaluecanbeexpropriated ex-postbytheotherparty.DiGregorio(2013)calledthismovement “inter-organizationalvalueappropriation.”

ContractualformsfromtheTCT,MCT,andRBVperspective

Thetreatment ofcontractualformsbasedontheindividual analysisoftheTCT,MCT,andRBVapproachescanhave differ-entresults.AccordingtoWilliamson(1985,1996),inthecaseof TCT,thechoiceofcontractualformoccurswhenmoderate lev-elsofinvestmentinspecificassetsoccur,allowingfortheuseof intermediate-typestructurescapableofrestrainingopportunism, withouttheextracostsofhierarchy.Forhighlyspecificassets, theauthoremphasizesverticalintegrationasthemostefficient optionofstructuretorestrainopportunisticbehavior.

Together with asset specificity, frequency and uncertainty complete the set of transaction attributes that may influence the choice ofcontractual forms(Williamson, 1985,1996).In addition, together withopportunism as a behavioral assump-tion, Williamson (1975) takes Simon’s (1979) concept of limitedrationalityintoconsideration.Thisconceptindicatesthe informationprocessinglimitationsoftheagentsandthe conse-quences ofthisassumptiononthe contractualincompleteness ofthetransaction(Williamson,2002).

For Barzel(2005), when consideringMCT, measurability,

information,andpropertyrightsarefundamentalaspects affect-ing the conductof transactions andthechoice of governance structures. The intention is toensure the benefits of contract control throughmeasurability,availabilityofinformation,and consequentguaranteeofthepropertyrightsofthoseinvolvedin thetransaction.

Thepossibilityofmeasuringattributesoftheproductmakes it possibletousecontractstoregulatethetransaction,sinceit enablesandoffersguaranteesoftherequiredspecificities.Barzel

(2002)emphasizestheinfluenceofinformationasymmetryin

themeasurementprocess(MCT),sincethiscanhaveanimpact onthedistributionofrentsandpropertyrightsofthoseinvolved inthetransaction.

This understandingof propertyrights is aggregated inthe premises associatedwiththe NewPropertyRightsApproach, fromthedistinctionbetweenspecificcontrolrightsandresidual controlrights,whichdefinethepropertyconfigurationofa par-ticularasset,inthetraditionoftheproposalsbyGrossmanand

Hart(1986),HartandMoore(1990),andHart(1995).The

third-partyadjudicationandenforcement.”Theresidualcontrol rights,inturn,areobtainedthroughthelegalownershipofthe assetsandimply,accordingtoHart(1995,p.371):“[...]rightto

decideonusagesoftheassetinuncontracted-forcontingencies.”

ForMonteiroandZylberzstan(2011,p.100),theresidual

con-trolright“correspondstotheagent’sability,inexpectedterms, toconsumethegoodsorservicesassociatedwithagivenasset, directlyorindirectly(i.e.throughexchange).”

Thus,residualcontrolrightscovernotonlytherightstouse assets,butalsotodecideonwhen tousethemor evenwhen tosellthem.Therefore,theeconomicimportanceofownership stemsfromtheabilityoftheownertoexerciseresidualcontrol rightsovertheassets.

AlthoughtherationaleproposedbyWilliamson(1985,1996)

andBarzel(2002,2005)ispresented inastructuredwayand

indicatesananalyticalpathforthechoiceofcontractualforms, some criticisms point to gaps in the presented models. The overvaluation of theinstitution’sfunction as awayof reduc-ingtransactioncostsandthelimiteduseofproductioncostsasa guideforthechoiceofgovernancestructureareaspectsofthis modelwhichhavebeencriticized(Baumol,1986;Pitelis,1994). Theextremesbetweenthemarketapproachandvertical inte-grationhavealsobeenquestioned,sincethesameconditionsof exchange—assetspecificityandopportunismforinstance—that hamper market performance also hinder the performance of hierarchicalexchanges(Barney&Hesterly,2004;Kleinetal.,

1978;Poppo&Zenger,1998).Inaddition,byfocusingoncost

minimizationasessentialfororganizations,firmtheoryendsup consideringstrategiesassecondary(Barney&Hesterly,2004).

BronzoandHonório(2005)criticizetheapproachforbeing

focused primarily on transactions involving physical assets, leavingasideintangibleassetssuchasknowledge economies, dynamiccapabilities,andthereputationoffirms.Barzel(2005), inturn,criticizestheTCTforthelowoperationalizationofassets specificity evaluationas the mainattribute inthe decision to makeor buy, indicatingthat the difficulty of measurementis moreoperable.

TheRBV,ontheotherhand,doesnotdealwithcontracting, emphasizingonlythefunctionofverticalintegrationtojustify thepossessionandprotectionofstrategicresources(Argyres&

Zenger,2012;Barney,1991;Combs &Ketchen,1999;Crook

etal., 2013; Foss& Klein,2010; Jacobides& Winter,2005;

Peteraf,1993).However,inthisstudytheimportanceofthese

featuresinthe designof contractsisassumed, eitherbecause suchresourcescanbetradedorbecauseofitsinfluenceonthe configurationofthecontracts.Inaddition,itisconsideredthat strategicresourcesdonotonlyoccurfrominternalsources,but canalsobepresentduetoacombinationofdifferentexternal factors,thusplacingademandoncontracting.

As for the transaction of strategic resources, Silverman

(1999)pointsoutthattheRBVgenerallyunder-emphasizesthe

possibilitythatcompaniescanexploitresourcesthroughmarket arrangements,focusingonlyonexpandingthefirm’sboundaries. Theauthorpointsoutthatseveralempiricalandtheoretical stud-ieshaveidentifiedconditionsinwhichtechnologicalresources, includingstrategic ones,canbeexploitedthrough contractual means. Contracting, in Silverman’s (1999) view, would be a

viablealternative,unlessthetechnologicalknowledgeinvolved ishighlytacit(wherecontractsaredifficulttotrackandenforce), or easily transferable and weakly protected (in cases where attemptstonegotiatealicensearefraughtwithproblemsrelated totheinformationparadox,andsecrecyisneededforadequate returnstotechnology).

Followingthislineofreasoning,ArgyresandZenger(2012)

statethatRBVfocusesalmostexclusivelyonorganizationsand does notdiscusstheroleofthe marketandcontracts,ortheir comparativedynamicswiththehierarchicalapproachinthe for-mationofinternalcapacities.Inthesameway,PoppoandZenger

(1998,p.19)alsoaffirmthatRBV,aswellastheactualfirm’s

theory:

[...]havefocusedprimarilyonthefailuresofmarketsand

thecontrasting virtuesofhierarchy.However,the focusof thesetheoriesondirectionallyexplainingverticalintegration seemsatleastsomewhatmisplacedgiventheapparenttrends in recentdecades towards disintegration, downsizing, and refocusing.

It is also important to highlight the influence of strate-gic resources on the routing and configuration of contracts.

ForLanglois(1992),CombsandKetchen(1999),Argyresand

Zenger (2008, 2012), and Saes (2009),RBV focuses on the

identificationofstrategicresourcesbasedontheconditionsthat theseresourcescanpresentfor theacquisitionandsupportof competitiveadvantage.However,inadditiontotheirrolein gain-ingcompetitiveadvantage,strategicresources,especiallythose relatedtolearning,canalsoinfluencethechoiceofgovernance structures.

Langlois (1992,p. 105) states that “[...]one cannothave

a complete theory of the boundaries of the firm without considering in detail the process of learning in firms and markets.” The author considers it essential that a growth theory of the firm should take into account that in the long term, the parties involved go through a learning pro-cess, allowing them to gain more information from each other.

Ontheotherhand,TCTandMCTcanservetosupportthe discussion of coordinationof these resources, providing the-oreticalsupportonwhichgovernance structurescanbemade moreefficientinordertoexploitthestrategicresourcesofthe firm.Withinthisframework,ArgyresandZenger(2008,2012)

also claim that RBVassists managers inunderstanding what resourcesarerequiredinordertotakeapositionandbe compet-itiveinvariousaspects,andorganizationaleconomicsprovides themwithinformationaboutthesupplyandorganizationofsuch resources.

Thus,themeasurementfactoroffersanalternativetovertical integration,inconsideringthecontractualformasanefficient structure to govern atransaction: if the measurement canbe carried out,itis thereforeproposedthat transactionsof high-specificityassets,aswellasstrategicresourcestransactions,can occurbycontract.Moredetailsofthispropositionaregivenin thefollowingsub-propositions:

a) High-specificity assetscanbegoverned bycontracting,as longastheyinvolveeasilymeasuredcontracteddimensions; b) Strategicresourcescanbegovernedbycontracting,provided

theyhaveeasilymeasuredcontracteddimensions.

Di Gregorio (2013) states that resources play a key role

becausetheyareoutcomesofvaluecreationandareexploited intheprocessofvalueappropriation.Withinthissetting,Foss

(2005)emphasizesthattheinteractionbetweenvaluecreation

andvalueappropriationshouldbebetterexplainedinRBV,with firmtheoryasausefulmeansforthispurpose.Accordingtothe author:

Muchofthemoderneconomictheoryof thefirmrevolves around it,the ‘hold-upproblem’ (Hart,1995; Williamson, 1996),beinganimportantmanifestationoftheexpected shar-ing of surplus, impacting on the creation of that surplus (through the effecton investment incentives)(Foss, 2005, p.75).

Foss(2005)arguesthatthisinsightremainsconspicuously

andsurprisinglyabsentinRBV.Whenconsideringasset owner-ship from an economic perspective, Foss and Foss (2004)

recognizethatassetshavemultipleattributes,andthattheycan becapturedinaworldofpositivemeasurementandenforcement costs.Thisimpliesthatthenotionofresourceownershipis prob-lematic.Moreover,asFossandKlein(2010)pointout,itisnot madeclearhowresourcesareconceptualized,dimensioned,and measured,anditisnotmadeclearhowresourcesariseandare alteredbytheactionofindividuals.

Itisthusperceivedthatthepossessionofstrategicresources implies value creation by the ex-ante and ex-post barriers

(Peteraf, 1993)in their construction,without consideringthe

appropriationof value.In anenvironmentwithpositive trans-actioncosts,when consideringTCT andMCT,thisvaluecan be captured simultaneouslyby appropriating rents and prop-ertyrightsovernon-measurabledimensions.Followingthisline ofthought,Silverman(1999)andSaes(2009)indicatethatthe proposition of the RBV, inwhich rare andcostly replication resources are important for generating income, saysvery lit-tle about how theseresources—and which ones— shouldbe broughttogethertocreateandSustainCompetitiveAdvantage (SCA).

Asdiscussed,someofthecriticismsdirectedatfirmtheory refertothe unilateralapproachpresent inthechoiceof com-panyboundaries.Inotherwords,thedefinitionofgovernance structures involvesmorethan the presence of specificassets, measurabledimensions,opportunisticbehavior,andtransaction costs,aspresupposedbyNIE approaches.In-houseresources

andcapabilities,whichgeneratesustainablecompetitive advan-tages,caninfluencetheconfigurationofafirm’sboundaries.

Inshort,identifyingafirm’sstrategicresourcesisnot suffi-cientfordealingwithissuesofvaluecatchmentandgovernance of theseresources. Taking TCT andMCT into consideration contributestominimizethiscriticism,indicatinghowstructures will tendto be configured inorder toensure property rights andproperdistributionofvalueintransactions.Similarly,these features affectthewaythesestructuresare configured.Inthis context, contractualforms appearas mechanisms notonlyto reducetransactioncosts,butalsotoobtainandsustainsuperior competitiveconditions.

WhileTCTandMCTfocusonthetransactionastheunitof analysis,aconsensusontheRBVanalysisunitisnotyet avail-able. WhileBarney (1991)considers strategy,Peteraf (1993)

doessowithresources.Thus,forthepurposeofthisstudy,the transactionismaintainedastheunitofanalysis.However,the strategic conditionof theresourceisinserted asanadditional elementinfluencingthechoiceofcontracting,togetherwith spe-cific assets,and their measurability. The identification of the constructsinthepresentedrationalesandtheirdirectand indi-rect influencesare detailed inthe methodologicalprocedures section.

Methodologicalprocedures

Thepresentresearchisqualitative,andofthedescriptiveand theoretical–empiricaltype,withatransversalcrosscut,carried outin2015.Theobjectofstudywerethemanufacturersof auto-mobiles andlightcommercialvehicleslocated inthe Stateof Paraná andsome of their directsuppliers. As the third most importantautomobilemanufacturingcenterinBrazilafterSão PauloandRioGrandedoSul,therearethreecarandlighttruck manufacturers inParaná, all located in São Josédos Pinhais

(Anfavea,2016),whichwereinvestigatedinthepresentstudy.

Accordingtothissource,theseautomakersjointlyaccountedfor about26%ofthetotalnumberofvehiclessoldintheBrazilian marketin2014.Alltheassemblersinterviewedhaveaneffective participationintheinternationalandnationalmarket,ofwhich onestandsoutnotonlyforitstradition,butalsoforthevolume ofvehiclessold.

In ordertocarryoutthe research,we firstsoughtto iden-tifythebasicprinciplesofeach theoryindividually,andfrom thisdiscussitstheoreticalcomplementaritybasedontheauthors presented.Secondly,theprimarydatawerecollectedand com-paredwiththeproposedcomplementaritymodel.Atalltimes, we sought to meet Reay’s (2014) indications regarding the delineation of qualitative research,namely topresent quality inthedataobtained,makeuseofrelevantliterature,provideand detaileddescriptionsofproceduresanddata.

Conceptualmodelandpropositions

MCT Measurement Costs

Automakers Direct Suppliers

Strategic Resources

Contractual Forms

RBV TCT

Transaction Costs

Fig.1.Theoreticalanalyticalmodel.

Source:Elaboratedbytheauthors.

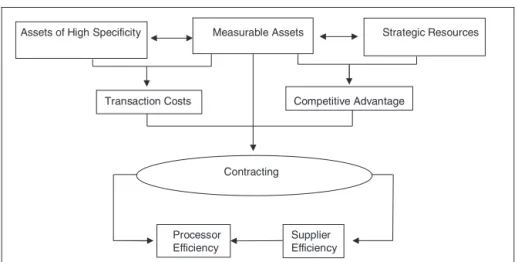

theoreticalrationaleofeachoftheseapproaches,primary influ-entialcategorieswereidentifiedinthedefinitionofcontracting: specificassets;easeofmeasurement;andstrategicresourcesthat generatecompetitiveadvantage.

Thesepointsweretreatedcomplementarilyandinsequence, through the propositionon contracting involving TCT,MCT, andRBV. Thisproposition was based on guidelines put

for-wardbyBacharach (1989),Whetten(2007),Suddaby (2010),

andEnnenandRichter(2010),whichdealwiththeconstruction

oftheoreticalmodels.

Bacharach(1989:498)definesatheoryas“[...]asystemof

constructs[...]inwhichconstructsarerelatedtooneanother

through propositions.” Along the samevein, Whetten(2007)

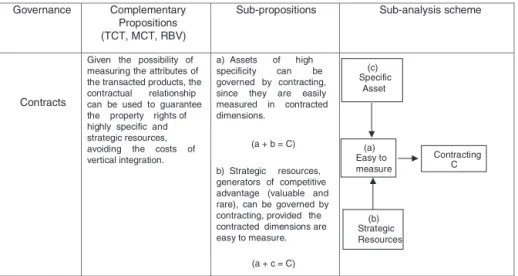

indicates the need to present the constructs and their inter-relationships,asseeninFig.2.Itindicatesthecentralproposition ofthisresearch,itssub-propositions,andtheidentificationofthe influenceandinteractionsbetweenthecategoriesderivedfrom theconstructs.

IntheviewofEnnenandRichter(2010,p.208):“Thetotal

economicvalueaddedbythecombinationoftwoormore com-plementary factorsin aproduction systemexceeds the value thatwouldbegeneratedbytheapplicationof thesefactorsof productioninisolation.”Thisconceptisappliedinthepresent study andindicates that the sumof the result of each theory individually,intheunderstandingofcontractualchoice,has dif-ferentresultswhen consideringthe complementarity of these

theories.Without consideringthepossibility ofmeasurement, thepresenceofspecificassetsorstrategicresourceswouldper seindicateaneedforverticalintegration,notcontracting.

Following thisline of thought, Suddaby (2010) highlights four fundamental notions that should be considered inorder to obtain clarity in a theoretical construction, which this study adheresto. Thefirstistopresentdefinitions capableof persuasively creating precise categoricaldistinctions between concepts. In thissense,we soughttoselect anddelimit cate-goriesforeachapproachelaboratedinthisinvestigation:specific assets(TCT);measurableassets(MCT);andresources(RBV). Thesecondistooutlinetheconceptualcircumstancesandscope conditionsunderwhichtheconstructionwillorwillnotapply. Asfarasthisisconcerned,wesoughttodefinetheconceptual aspectsrelatedtocontracting,linkedtothetheoryof thefirm andRBV,aswellasthesectorunderinvestigation.

The third notion indicated by Suddaby (2010), in conver-gencewithWhetten(2007),istoshowthesemanticrelationwith otherrelatedconstructs.Thisrelationbetweentheconstructs, andrespectivecategories,wasworkedoutintheformulationof thesub-propositions,asseeninFig.2.Thefourthandfinalnotion istodemonstrateadegreeofcoherenceorlogicalconsistency of theconstructioninrelationtothegeneraltheoretical argu-ment.Itcanbeseenthatthepropositionandsub-propositions constructed aredirectlyrelatedtothe objective of theoretical complementarity of the present investigation, whose reason-ing isindicatedinFig.3.Itshows how propositions“a”and “b”influence the configurationof governance structures,and consequentlytheefficiencyofthesegmentsinvolved.

Primaryandsecondarydatacollection

Afterformulatingourpropositions,westartedwithprimary datacollection,whichwascarriedoutthroughsemi-structured interviewswiththepurchasing,quality,andlogisticsmanagers ofthethreeautomakersintheStateofParaná.Inaddition,we interviewed the logistics managers of seven direct suppliers as well as the industrial and automotive coordinators of the

Governance Complementary Propositions (TCT, MCT, RBV)

Sub-propositions Sub-analysis scheme

Contracts

Given the possibility of measuring the attributes of the transacted products, the contractual relationship can be used to guarantee the property rights of highly specific and strategic resources, avoiding the costs of vertical integration.

a) Assets of high specificity can be governed by contracting, since they are easily measured in contracted dimensions.

(a + b = C)

b) Strategic resources, generators of competitive advantage (valuable and rare), can be governed by contracting, provided the contracted dimensions are easy to measure.

(a + c = C)

Contracting C

(b) Strategic Resources

(a) Easy to measure

(c) Specific

Asset

Fig.2.Propositions,sub-propositionsandschemeofanalysis.

Measurable Assets

Assets of High Specificity Strategic Resources

Competitive Advantage Transaction Costs

Processor Efficiency

Contracting

Supplier Efficiency

Fig.3.Complementaritymodel—influenceofspecific,measurable,andstrategicassetsinthedefinitionandefficiencyofcontractualgovernancestructures.

Source:Elaboratedbytheauthors.

Federation of Industries of the State of Paraná (FIEP). The selectionofintervieweeswasmadeaccordingtotherelevance of the areas of purchase, quality, and logistics based on the relationship with direct suppliers of auto parts. The FIEP coordinators, in turn, were included as key agents in the interviews to provide a systemic and impartial view of the assemblers. All the interviewees,a totalof fifteen, hadmore thantenyear’sexperienceinthearea,reflectingtheircapacity tocontributetotheobjectiveofthisstudy.

The interviewswerecarried out duringthe firstquarter of 2015,attherespectiveofficesoftheassemblersandsuppliers andattheFIEPheadquarters,alllocatedintheregionofSão JosédosPinhaisinParanástate.Sincethepurchasingareaof oneoftheautomakersisbasedinSãoPaulo,theinterviewwith itsmanagerwasheldatthisoffice.Threeinterviewswerealso carried outwith logisticsmanagers ofdirect supplierswhose headquartersarelocatedinSãoPaulo.

The interviews,whichamountedtofifteen hoursof recor-ding, were transcribed and are available in electronicmedia. Twospecificinterviewguideswereformulated:onedirectedat themanagersoftheautomakersandtheFIEPcoordinators,and anotherforthemanagersofautopartsupplycompanies.These interview guides,which sharea similarstructure, were elab-oratedandorganizedintothreegroupsof questions.Thefirst groupwasintendedtocharacterizethecompaniesunderstudy, notablyinvolvingcharacteristicsofcontractedproducts.Aspects relatedto transactioncosts,measurement costs,andstrategic resourcesmadeupthesecondsetofquestions.Inthethirdset, questionsthat dealtdirectlywiththe measurementof specific assetsandstrategic resourceswere added, inordertoanswer ourpropositionsandsub-propositions.Secondarydata,inturn, werecollectedthroughwebsitesandinstitutionsspecializedin thetreatmentofindustrydata,suchasANFAVEA,andthrough studiesthatdiscussedtheindustry’sdynamics.

Results

Consideringtheobjectiveoutlinedforthisresearch,this sec-tionseekstodeveloppropositionsandsub-propositionsaswell

as offertheoreticalandempirical analysisrelatedtothe com-plementarityof TCT,MCT, andRBVinthe configurationof contractualforms.Toaccomplishthis,theinterviewswith rep-resentativesoftheautomakers,theirdirectsuppliers,andFIEP weretakenasourreference.

Thepropositionaboutcontractingconsidersthat,giventhe possibilityofmeasuringtheattributesoftheproducts,the con-tractual relationshipcanbe used toguarantee propertyrights overbothassetsofhighspecificityandstrategicresources, gen-eratingcompetitiveadvantageandtherebyavoidingthecostsof verticalintegration.

This proposal was confirmed by the automotive sector of Paraná.Despitethehighlevelofspecificityoftransactedauto parts,thecontractualrelationshipwasidentifiedaspredominant intheinterviews.Inthiscase,evenhighlyspecificorstrategic assets—generators of competitive advantage—are transacted throughcontracts,ratherthanthroughverticalintegration. Mea-surability wasconsidered by the interviewees as an essential factorforusingcontractstoconducttransactionsforautoparts of high specificity and which are generators of competitive advantage. The assertions of these analyses, relatingto sub-propositions(a)and(b),aredetailedbelow.

Sub-proposition(a):specificandmeasurableassets

Ingeneral,contractscanbeusedtoobtainautopartsintwo differentsituations:standardizedassetsandspecificassets.Inthe caseofstandardizedassets,whosepresencewaspreviously

rati-fiedbyMelo(2006),andCostaandHenkin(2012),respondents

were unanimousin stating that their acquisition could occur through themarket,butthisoptionisunsuitablefor automak-ers giventhe need for traceability.Thus,contractsemerge as mechanismstoensurethistraceability,andensuretheproperty rightsofmanufacturers,ashighlightedbyFerratoetal.(2006),

CasottiandGoldenstein(2008),andAugusto(2015).However,

Thisisclearlydemonstratedbytheresponseofthemanager of SupplyCompany 3:“Sincethe contractcan guaranteethe assemblersthatwewilldeliver,whywilltheytake responsibil-ityformakingthesestandardized,morebasicparts?It’smuch cheaperandsmartertoleaveituptous.”LogisticsManagerof AutomakerA–Badds:

Thecontractguaranteesourrightsveryeffectively,because there are many ways to guarantee; this is all very well planned,everylittlethingisdetailedandwe knowwhatto detail.Thereisalotofcontrolandifthesupplierdoesnot comply,he will bethe loser.He will befined andhewill be replaced,so thecostis veryhighforhim toriskdoing so.Forhimit’smuchmoreinterestingtohavealong-term relationshipwiththeautomaker,becausehisvolumeofsales increasesalot.Iworkedeightyearsinengineeringandnever saw any problemrelated to the leaking of information or anything.Iftheydo,theywillbreak[thecontract].

Thesituationis thesamewhenitcomes tohighly specific autoparts. In the first case, evenwhen dealing with transac-tionsforhigh-specificityautoparts,whichwouldjustifyvertical integrationgiventhe possibility of opportunistic behavior, as proposedbyWilliamson(1985,1996),andMénard(2004),there wasstillapredominanceofcontractualrelations.This predom-inance is justified, according to respondents, by the existing safeguards, stemming fromthe possibility of measuring auto partsandreducingtransactioncosts,asstatedbyFerreiraand

Serra(2010).Therefore,as emphasizedbyBarzel(2005),the

presenceof feasiblemeasurementinthe autopartspurchased bythe automakers(color,weight,width,andtechnical speci-ficationsingeneral), makes it possibleto havea satisfactory guaranteeofpropertyrightsoverthem.

TheQualityManagerof AutomakerA–Bclarifies:“Ihave averyspecificautopart,but Icontract,so youaskme why? BecauseIhavemoreadvantageincontracting,Ihavethemeans ofcontrol;whyshouldIproduceifsomeonedoesitbetterand I cancontrol?” Likewise, the Logistics Manager of Supplier Company5 claims:“Thequestionis:whynotcontract?Even forspecificparts,theycontrolallthedetails.Ifthereisa mis-take,theyfindoutwitharecall,andworse,theycantrackevery componentthatweandoursuppliersputin.”

In viewof the above considerations, it is validtoassume thathigh-specificity assetscanbegovernedbycontracting as longas theyhave clearmeasurable dimensions,thus validat-ing the sub-proposition.In other words, evenin the case of thehigh-specificityassetscharacteristicoftheautomotive

sec-tor(Williamson,1985,1996),contractingandcontrolinhibits

opportunistic behavior, given the possibility of measurement

(Barzel,2005),favoringthepartieswithaguaranteeofproperty

rights.

Itisworthnotingthattheintervieweesaffirmthat measure-mentcannotalwaysbeexact,sothereisacertainmeasureof tolerancepracticedbytheautomakers.Thissituationis exem-plified by the Purchasing Manager of Assembler A-B: “My measurementmightnotalwaysbeaccurate,butifitgoespast me,itcanbeaccepted,becauseitiswithinwhatwequoteor pro-duce,soinawayIguaranteethatIamnotlosingintheexchange:

sometimesthereareacceptablelosses.”Typically,tolerancein erroracceptancerelatestotherecognitionthat suppliershave theabilitytomeetthestateddesignspecifications.

Sub-proposition(b):strategicandmeasurableresources

Inadditiontospecificassets,severalstrategicresources gen-erating competitive advantage are also transacted, and even developed, in the relationships between the automakers and theirsuppliers.Itisworthrememberingthattheresourcesthat generatecompetitiveadvantages,usingBarney’sclassification

(1991),arethoseconsideredrareandvaluable,andthusdiffer

fromthegeneratorsofSCAthat,besidesthesecharacteristics, mustalsobedifficulttoimitateandreplace.

Itisworthnotingthatintheprocessofourinvestigation sev-eral resourcesgenerating competitiveadvantage,whichtoday arecommonamongcompetitors,wereconsideredinnovativeat thetime(Bluetooth,integratedGPSwithSDcard,reversing sen-sor,airbags,amongothers).Insuchcases,theseareconsidered valuableandrareresourcesforautomakers(Barney,1991).At thetimeofrelease,manyofthesefeatureshadbeendeveloped jointlywiththemoreinnovativesupplierspresentinthesector.It wasnotedthatthecontrolexercisedbytheautomakers,enabled by means of measurement, issatisfactory through a contrac-tualrelationshipbecauseitallowstheexerciseofspecificrights

(Barzel,1997)and,inmostcases,residualcontrolrights(Hart,

1995;Monteiro&Zylberzstan,2011).

Respondents reported that specificcontrol rights are exer-cisedinallautopartstransactions,including caseswherethe supplier is responsible for mold development and auto parts manufacturing.In these cases,control is ensured through the design of the contract and the existing legal apparatus, sup-portingBarzel’sproposition(2002,2005).Insituationswhere the automakeris responsiblefor the developmentofthe auto partmold,andsituationsinwhichthisdevelopmentoccursin conjunction withthe supplier, the assembler also obtains the ownershipofthemold,exercisingresidualcontrolrights(Barzel,

1989;Crooketal.,2013;Grossman&Hart,1986;Hart,1995;

Hart&Moore,1990).Therefore,theautomakercandecideon

theuseofsomeautopartsinsituationsnotforeseenbycontract, becauseitownstheproperty.

TheLogisticManagerofAssemblerA–Bsupportthis state-ment:“Whethertheautomakerpassesamoldtothesupplieror whether it isjointly developed,the automakeralways retains ownership: the mold is at the supplier but it belongs to the automaker,soiftheywanttopickitupandtakeitaway,they can. Allautomakers arelike this.”The possibilityof specific control,andalsoresidualcontrol,throughcontractual relation-shipsthereforemakescontractingfeasible. Thischaracteristic oftransactionsisexplainedbytheFIEPIndustrialDevelopment Coordinator: “Normallythe structureisverysynergistic,very ingrained,wheretheautomakerpullsallitssuppliersand con-trolseverything,inmanycaseseventhemoldsoftheautoparts. Theresponsibilityofactionisonthesupplier,buttheassembler mayowntherightsoverthemoldinsomecases.”

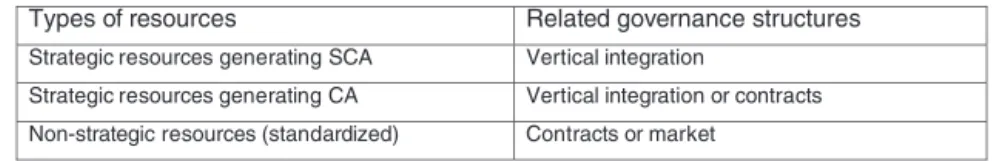

Types of resources Related governance structures

Strategic resources generating SCA Vertical integration

Strategic resources generating CA Vertical integration or contracts

Non-strategic resources (standardized) Contracts or market

Fig.4.Strategicresourcesandgovernancestructures,basedontheautomotivesector.

Source:Elaboratedbytheauthors.

theyparticipatetogetherwithusinthedevelopmentofamore differentiatedpartforthemarket,andtheyinfiltratesomuchthat theycancontroleachitem,becausetheyknowhowto.Theypay ustodevelopthecarpart,butthenthepropertyrightsofthecar part are theirs.” Thus,contracting also occurs inthe case of strategicautoparts,generatingcompetitiveadvantage,because theautomaker acquireslegalrights,andoftenresidual rights, overthem.

Inthecaseoftransactingmorevaluableorrareautoparts, suchasBluetoothandGPS,qualitycontrolisevenmore effec-tive andis often developed inconjunction withthe supplier. In thiscase, measurement is used tocontrol the dimensions relatedtothequalityoftheseautopartsinthetransactions,given their importance for the generation of competitiveadvantage attheir launch.Thiscontrolby measurementisusually exer-cised, according tothe interviewees, because the automakers mustguaranteethequalityaspectsofautopartsofthisnature, sincefailurewoulddirectlyaffecttheirimageinthemarket.The QualityManagerofAutomakerCstates:

In thecase ofauto partsthat havespecificmeasurements, from the simplest tothe most strategic, where control of specificationsispossible,foreachlotthatcomesinfromthe supplierwehavesamplestakentotheMeasurementRoom. Theretheygothrougha3Dx-raythatconfirmstheirexact measurements in relation to what they should be for the requestedproject. Soeverything iscontrolledthere, thick-ness, size, width, raw material, height, everything that is measuredgoestheretobecheckedforanyfault,beforethat partisplacedinthecar.Inthecaseoflargesuppliers–the morestrategic[thepart],thegreaterthecontrol.

The validity of the sub-proposition (b) is evident, in that strategicresourcesgeneratingcompetitiveadvantages(valuable andrare) canalsobe governedbycontracting, providedthey haveclearmeasurabledimensions.Althoughthespecific prop-erties of each transacted auto part, valuable or rare, suggest the possibility of opportunistic behavior (Klein et al., 1978;

Williamson,1985,1996),andinformationasymmetryispresent

in transactions to a greater or lesser degree (Barzel, 2002;

Ménard,2004),thepossibility ofmeasurementallowsforthe

useofcontracts.

Strategic,specific,andmeasurableresourcesand contracting:ageneralanalysis

Theuseofcontractsintherelationshipbetweensuppliersof autopartsandautomakersisviableduetothemeasurabilityof specificandstrategicassets,limitingtheappropriationofvalue. Itisobservedthat,inatransaction,theconsiderationofresources

viewedasstrategic solvestheproblempointedoutbyBarney

andHesterly(2004),regardingthelackofprimaryfocusofTCT

on strategic aspects of the company. On theother hand,it is evidentthatthelimitationofRBV,aspointedoutbyFossand

Foss(2004),Foss(2005),andFossandKlein(2010),regarding

the issueof creation andappropriationof strategic resources, canalsobemitigatedbyconsideringmeasurementtoguarantee propertyrights.Inaddition,itsusereduceshold-upproblemsin contractualrelations,asdiscussedbyKleinetal.(1978).

Consideringthetreatmentofstrategicresourcesinisolation, someguidelinescanbeproposedregardingthechoiceof pos-sible governance structures to coordinate transactions, when the generationof competitiveadvantage,or not,istaken asa variable.Thisproposalisbasedonthepropositionof comple-mentarity,andoffersanopportunitytominimizethelimitations of RBV,whichfocusesonorganizationsanddoesnotdiscuss theroleofthemarketandcontractsincapacity-building.Fig.4

identifies this alignment, considering the strategic resources generatingcompetitiveadvantage,theVCSgenerators,and non-strategicresources,inrelationtopossiblegovernancestructures for their coordination and protection. It is observed that the RBV,consideredinthecontextofgovernance,issubjecttothe variationofmechanismsfortheprotectionofstrategicresources. Thepossibilityofcontrolbyautomakersoverthe specifica-tionsandmeasurabilityofautopartswhichgeneratecompetitive advantageisduetotheknowledgeandskillstheyhavegained throughouttheoutsourcingprocess.Insomesituations,however, contractingmaybeanoptionforautomakersduetotheirlackof knowledgeorlackofcapacitytodominatetheproduction pro-cess.Measurementmechanismscanalsobeenhancedthrough atrustingandjointlearningrelationshipwiththesupplier, dis-couragingtheinappropriatecaptureofrentbybothparties.In addition, safeguards arise inthe face of the learning process related tothe recurrence intransactions, improving the mea-surement mechanismsandthereby promotingpositive effects oncontracting.

The informationobtained,identifyingthe contractual rela-tionshipsrelatedtothestrategiccapabilitiesoftheautomakers, confirms the influence of trust on relationships as a non-contractual mechanism, as discussed in Ménard (2004) and

Crook etal. (2013). They also highlight the influence of the

learning process on the organizational transactions of strate-gic resources generating competitive advantages, applied in thiscasetothemeasurementaspects.asdiscussedbyLanglois

(1992),CombsandKetchen(1999),Saes(2009),andArgyres

andZenger(2008,2012).Inthesameway,information,treated

in Barzel(2002),assumes aprimary role inthe sector,since

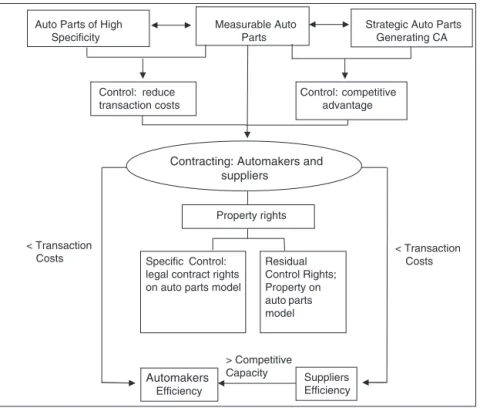

Measurable Auto Parts Auto Parts of High

Specificity

Strategic Auto Parts Generating CA

Specific Control: legal contract rights on auto parts model

Residual Control Rights; Property on auto parts model

Control: competitive advantage

Property rights

Suppliers Efficiency

Automakers

Efficiency

< Transaction Costs

> Competitive Capacity

Contracting: Automakers and suppliers

< Transaction Costs

Control: reduce transaction costs

Fig.5.Complementaritymodel:highlyspecificandmeasurableassetsandstrategicresourcesinthedefinitionandefficiencyofthecontractualstructures:empirical aspects.

Source:Elaboratedbytheauthors.

Given the above, it is clear that even in the presence of autopartswithhighspecificityandwhichgeneratecompetitive advantage,whichwouldjustifyverticalintegration,thehybrid formwaspredominantinthecompaniesstudied.Thiscanbe explainedbythepresenceofahighlevelofdevelopment,and theuseofcontrolmechanisms,measurement,andguaranteeof ownershipoftheseautoparts,inadditiontothesuperior capac-ityofmarketsupply.Inthiscase,althoughthereisanincrease inmeasurementandtransactioncosts duetothe wideuse of contractsinthesector,the productioncostswouldbeavoided ifverticalintegrationwereused.Thetheoretical–empirical rea-soninginherenttotheuseofcontractsisexpressedinFig.5.

Itisworthnotingthateachstrategicresourcepointedoutby the automakersbears somecontribution from suppliers, who have developed knowledge through their frequent participa-tioninthe constructionof thesedifferentials.Inthiscase,the automakerisalwaysresponsiblefordirectingthestrategy,but thesupplierplaysanessentialroleinitsviability.Moreover,in somecases,thedifferentialdevelopedbytheautomakeris con-servedbecausetheycontrolthespecificationsoftheautoparts, andoftenthesupplier’schainofproduction.

Conclusions

Thepurposeofseekingabetterunderstandingofcontractual relations through complementarity, involving the TCT,MCT, andRBV theories, was carried out through the development of the theoretical model andits validation through empirical research.

As a result, it was observed that the proposition of com-plementarity over contractual forms indicates that specific assetsandstrategicresourcescanbegovernedbycontracting, since they are easy to measure.From thispremise, the sub-propositions about contracting involved the presence of: (a) specificassetsandeaseofmeasurement;and(b)aconditionof strategicresources,generatorsofCA,andeaseofmeasurement. Thesub-proposition(a)wascorroboratedbythefindingthat contracting occursevenin thecaseof auto partswithahigh levelofspecificity.However,thisoptionisjustifiedby measur-ability,ensuringtheprotectionofspecificandresidualproperty rights,aswellasavoidingthecostsofverticalintegration.The verificationofthesub-proposal(b)wasduetothepossibilityof measurementandcontrol,andthuscontractingwasusedinthe acquisitionofseveralinnovationscapableofgenerating compet-itiveadvantage(Bluetooth,GPSintegratedinthevehiclewith SDcard,reversingsensor,airbags).Itwasobservedthateven thoughtheseadvantagesconstitutedvaluableandrareresources forautomakersattheirlaunch,companieswereabletoprevent acquisitionthroughcontracting.

It was noticed that, once the contract was chosen as an optiontocoordinatespecificassetsorstrategicresources gener-atingcompetitiveadvantage,itsuseprovidessomeadvantages. Besidescapturingordevelopingassetsandresourcesforwhich the automaker has no expertiseor capacity(RBV), contract-ingprovides protectionagainst opportunisticbehavior(TCT), throughcontractualsafeguards.Italsodefinesthemeasurement mechanismsandcontroloveracquiredautoparts(MCT).

ofthecontractualfirmallowsfortheinclusionofnew theoreti-calorientationstotheefficiencyarm,asproposedbyWilliamson

(1975,1985),andtothecontrolofstrategicresources,as

pro-posedbyRBV.Whenconsideringthemeasurementofspecific andstrategicassetsinthemodelproposedbytheauthor,anew assumptioniscreated—amodificationofthepredictiverationale establishedtoexplainthechoiceofcontractualforms.

Amongthepossiblelimitationsofthisresearchisthefocus on only three automotive manufacturers, since the consider-ationofotherautomakerscouldcomplementthefindings.Future studies should extend research to other automakers in order toadvancedevelopmentsintheproposedmodel. Methodolog-ically, quantitative research can be structured to explain the cause-effect relationships involving the choice of contracting fromtheproposedmodel.Fromthepropositionof complemen-taritypresented in thisarticle, future studiescan explorethe rationalerelatedtoverticalintegrationandthechoiceofmarket relations,consideringstrategicaspectsandtransactioncosts.

Thesesuggestionsandnewideas,involvingthe complemen-tarityofthenotionoftransactioncostsandstrategyindefining firm boundaries, present arich pathof discussion and possi-bilities. The present research,despite the inherenttheoretical andempiricallimitations,soughttotakeafurtherstepinthis direction.Ultimately,thegoalisthatnewquestionsarise,and withthemnewchallengesforresearchersindiscussionsabout organizationalboundariesandcontractualforms.

Conflictsofinterest

Theauthorsdeclarenoconflictsofinterest.

References

Anfavea– Associac¸ão Nacional dosFabricantesde Veículos Automotivos. (2016).Anuárioda IndústriaAutomotivaBrasileira2015..Available at http://www.anfavea.com.br/Accessed20.01.16

Argyres,N.,&Zenger, T.(2008).Capabilities, transactioncosts,andfirm boundaries:Adynamicperspectiveandintegration.SocialScienceResearch Network(SSRN).

Argyres,N.,&Zenger,T.(2012).Capabilities,transactioncosts,andfirm bound-aries.OrganizationScience,23(6),1643–1657.

Augusto,C.A.(2015).Estruturasdegovernan¸canosetorautomotivonoEstado doParaná:Implica¸cõessobaconsidera¸cãodoscustosdetransa¸cão,custos demensura¸cãoerecursosestratégicos.Brasil:TesedeDoutorado, Pro-gramadePós-Graduac¸ãoemAdministrac¸ão,UniversidadeFederaldeSanta Catarina.

Augusto,C.A.,Souza,J.P.,&Cario,S.A.F.(2013).Estruturasdegovernanc¸a erecursosestratégicosemdestilariasdoestadodoParaná:Umaanálisea partirdacomplementaridadedaECTedaVBR.RevistadeAdministra¸cão (SãoPaulo,Online),48,179–195.

Bacharach,S.B.(1989).Organizationaltheories:Somecriteriaforevaluation.

AcademyofManagementReview,14,496–515.

Barney,J.(1991).Firmresourcesandsustainedcompetitiveadvantage.Journal ofManagement,17(1),99–120.

Barney,J.B.,&Hesterly,W.(2004).EconomiadasOrganizac¸ões:Entendendo arelac¸ãoentreasorganizac¸õeseaanáliseeconômica.InS.R.Clegg,C. Hardy,&W.R.Nord(Eds.),Handbookdeestudosorganizacionais:A¸cões eanáliseorganizacional.SãoPaulo,SP:Atlas.

Barzel,Y.(1997).Economicanalysisofpropertyrights(2nded.).Cambridge: CambridgeUniversityPress.,175pp.

Barzel,Y.(1989).Economicanalysisofpropertyrights.Cambridge:Cambridge UniversityPress,122.

Barzel,Y.(2002).Standardsandtheformofagreement.Budapeste,Hungria: 3rdInternationalSocietyforNewInstitutionalEconomics–ISNIE. Barzel, Y.(2005).Organizationalformsandmeasurementcosts.Journalof

InstitutionalandTheoreticalEconomics,161,357–373.

Baumol,W.J.(1986).Williamson’stheeconomicinstitutionsofcapitalism.The RANDJournalofEconomics,17(2),279–286.

Bronzo, M.,&Honório,L.(2005).Oinstitucionalismo eaabordagemdas interac¸õesestratégicasdafirma.RAE-eletrônica,4(1),1–18.

Casotti,B.P.,&Goldenstein,M.(2008).PanoramadoSetorAutomotivo:As mudanc¸asestruturasdaindústriaeasperspectivasparaoBrasil.InBNDES Setorial(3rded.,pp.147–188)(28),set.

Cerra,A.L.,&Maia,J.L.(2008).Desenvolvimentodeprodutosnocontextodas cadeiasdesuprimentosdosetorautomobilístico.RevistadeAdministra¸cão Contemporânea,Curitiba,12(January/March(1)),155–176.

Coase,R.H.(1937).Thenatureofthefirm.Economica,London,NewSeries,

4(November(16)),386–405.

Coase,R.H.(1960).Theproblemofsocialcost.JournalofLawandEconomics,

3,1–44.

Combs,J.G.,&Ketchen,D.J.(1999).Explaininginterfirmcooperationand performance: Toward a reconciliation of prediction from the resource-based-viewandorganizationaleconomics.StrategicManagementJournal, Chichester,20(September(9)),867–888.

Costa,R.M.,&Henkin,H.(2012).EstratégiasCompetitivaseDesempenho da IndústriaAutomobilísticanoBrasil.In40◦ Encontroda Associa¸cão

NacionaldosCentrosdePós-Gradua¸cãoemeconomia–ANPEC. Crook,T.R.,Combs,J.G.,Ketchen,D.J.,Jr.,&Aguinis,H.(2013).Organizing

aroundtransactioncosts:Whathavewelearnedandwheredowegofrom here?AcademyofManagementPerspectives,27(1),63–79.

DiGregorio,D.(2013).Valuecreationandvalueappropriation:Anintegrative multi-levelframework.JournalofAppliedBusinessandEconomics,15(1), 39–53.

Dias,A.V.C.,Galina,S.V.R.,&Silva,F.D.(2008).Análisecontemporâneada cadeiaprodutivadosetorautomobilístico:Aspectosrelativosàcapacitac¸ão tecnológica.InXIXEncontroNacionaldeEngenhariadeProdu¸cão. Ennen,E.,&Richter,A.(2010).Literatureoncomplementaritiesin

organiza-tions:Thewholeismorethanthesumofitsparts–Orisit?Areviewofthe empirical.JournalofManagement,36(1),207–233.

Ferrato,E.,Carvalho,R.Q.,Spers,E.E.,&Pizzinatto,M.K.(2006). Relaciona-mentoInterorganizacionaleHold-UpnoSetorAutomotivo:UmaAnálise soboEnfoquedaEconomiadosCustosdeTransac¸ão.RevistadeGestão USP,13(1),75–87.

Ferreira,M.P.,&Serra,F.A.R.(2010).Makeorbuyinamatureindustry? ModelsofclientsupplierrelationshipsunderTCEandRBVperspectives.

BrazilianAdministrationReview,7(1),22–39.

Foss,K.,&Foss,N.J.(2004).ThenextstepintheevolutionoftheVBR: Integrationwithtransactioncosteconomics.ManagementRevue,Mering,

15(1),107–121.

Foss,N.J.(2005).Theresource-basedview:Aligningstrategyandcompetitive equilibrium.InNicolaiJ.Foss(Ed.),Strategy,economicorganization,and theknowledgeeconomy:Thecoordinationoffirmsandresources.Oxford: OxfordUniversityPress.

Foss,N.J.,&Klein,P.G.(2010).Critiquesoftransactioncosteconomics: Anoverview.InP.G.Klein,&M.E.Sykuta(Eds.),TheElgarcompanion totransactioncosteconomics(pp.263–272).Cheltenham:EdwardElgar Publishing,Incorporated.

Grossman,S.,&Hart,O.(1986).Thecostsandbenefitsofownership:A the-oryofverticalandlateralintegration.JournalofPoliticalEconomy,94, 691–719.

Hart,O.(1995).Firms,contracts,andfinancialstructure.Oxford,England: OxfordUniversityPress.

Hart,O.,&Moore,J.(1990).Propertyrightsandthenatureofthefirm.Journal ofPoliticalEconomy,98,1119–1158.

Klein,B.,Crawford,R.G.,&Alchian,A.A.(1978).Verticalintegration, appro-priablerents,andthecompetitivecontractingprocess.JournalofLawand Economics,21(2),297–326.

Klein,B.(1996).Whyhold-upsoccur:theself-enforcingrangeofcontractual relationship.EconomicInquiry,XXXIV,444–463.

Langlois,R.N.(1992).Transaction-costeconomicsinrealtime.OxfordJournal –IndustrialandCorporateChange,1(1),99–127.

Leiblein,M.J.(2003).Thechoiceoforganizationalgovernanceformand perfor-mance:Predictionsfromtransactioncost,resource-based,andrealoptions theories.JournalofManagement,29(6),937–961.

Lundgreen,T.F.(2013).Applyingthetransactioncosttheory,resource-based viewandinstitutionaltheoryinentrymode.ThecaseofaDanishretailer enteringRussia(Masterthesis).SchoolofBusinessandSocialSciences, AarhusUniversity.

Mahoney,J.(2001).Aresource-basedtheoryofsustainablerents.Journalof Management,27,651–660.

Melo,A.A.de.(2006).Rela¸cõescliente-fornecedornaindústriaautomotiva: Motiva¸cões,estrutura¸cãoedesenvolvimento.TesedeDoutorado,Programa dePós-Graduac¸ãoemAdministrac¸ão,UniversidadeFederaldoRioGrande doSul,Brasil.EscoladeAdministrac¸ão.

Ménard,C.(2004).Theeconomicsofhybridorganizations.Journalof Institu-tionalandTheoreticalEconomics,Berlin,160(3),345–376.

Monteiro,G.F.A.,&Zylberzstan,D.(2011).DireitosdePropriedade,Custos deTransac¸ãoeConcorrência:OModelodeBarzel.EconomicAnalysisof LawReview,Brasília,2(1),95–114.

Neves,L.W.A.,Hamachera,S.,&Scavarda,L.F.(2014).Outsourcingfrom theperspectivesofTCEand RBV: Amultiplecasestudy. Production,

24(July/September(3)),687–699.

Penrose,E.T.(1959).Thetheoryofthegrowthofthefirm.NewYork:John Wiley.

Peteraf,M.A.(1993).Thecornerstonesofcompetitiveadvantage:Aresource basedview.StrategicManagementJournal,14,179–191.

Pitelis,C.(1994).Ontransactioncosteconomicsandthenatureofthefirm.

ÉconomieAppliquée,(3),109–130.

Poppo,L.,&Zenger,T.(1998).Testingalternativetheoriesofthefirm: Transac-tioncost,knowledge-based,andmeasurementexplanationsformake-or-buy decisionsininformationservices.StrategicManagementJournal,19(9), 853–877.

Reay,T.(2014).Publishingqualitativeresearch.FamilyBusinessReview,27(2), 95–102.

SacomanoNeto,M.,&Iemma,A.F.(2004).EstratégiaseArranjosProdutivos daIndústriaAutomobilísticanosMercadosEmergentes:OCasoBrasileiro.

RevistadeAdministra¸cãodaUNIMEP,2(3),127–139.

Saes, M. S. M. (2009). Estratégias de diferencia¸cão e apropria¸cão da quase-rendanaagricultura:Aprodu¸cãodepequenaescala.SãoPaulo: Annablume,Fapesp.

Silverman,B.S.(1999).Technologicalresourcesandthedirectionof corpo-ratediversification:Towardanintegrationoftheresource-basedviewand transactioncosteconomics.ManagementScience,45(8),1109–1124. Simon,H.A.(1979).Rationaldecisionmakinginbusinessorganizations.

Amer-icanEconomicReview,Nashville,69(4),493–513.

Suddaby,R.(2010).Editor’scomments:Constructclarityintheoriesof manage-mentandorganization.AcademyofManagementReview,35(3),346–357. Whetten,D.A.(2007).Modelingtheoreticalpropositions.InA.S.Huff(Ed.),

Designresearchforpublication(pp.217–250).California:SagePublication, Incorporation.

Williamson,O.E.(1975).Marketsandhierarchies:Analysisandantitrust impli-cations.NewYork:FreePress.

Williamson,O.E.(1985).Theeconomicinstitutionsofcapitalism:Firms, mar-kets,relationalcontracting.NewYork:FreePress.

Williamson,O.E.(1996).Themechanismsofgovernance.NewYork:Oxford UniversityPress.

Williamson,O.E.(1999).Strategyresearch:Governanceandcompetence per-spective.StrategicManagementJournal,20(12),1087–1108.

Williamson,O.E.(2002).Thetheoryofthefirmasgovernancestructure:From choicetocontract(workingpaper).

Zylbersztajn,D.(1995).Estruturasdegovernan¸caecoordena¸cãodo Agribusi-ness:Umaaplica¸cãodaNovaEconomiadasInstitui¸cões.Brasil:Tesede livredocência,DepartamentodeAdministrac¸ão–FaculdadedeEconomia, Administrac¸ãoeContabilidadedaUniversidadedeSãoPaulo.

Zylbersztajn,D.(2005).Measurementcostsandgovernance:Bridging per-spectivesoftransactioncosteconomics.Barcelona,Espanha:International SocietyfortheNewInstitutionalEconomics–ISNIE.