Funda¸c˜

ao Getulio Vargas

Ensaios em Econometria Aplicada

Tese de submetida `a Escola de P´os-Gradua¸c˜ao em Economia da Funda¸c˜ao

Getulio Vargas como quesito para a obten¸c˜ao T´ıtulo de Doutor em Economia.

Aluno: Rafael Martins de Souza

Orientador: Jo˜ao Victor Issler

Rio de Janeiro

Escola de P´

os-Gradua¸c˜

ao em Economia - EPGE

Funda¸c˜

ao Getulio Vargas

Ensaios em Econometria Aplicada

Tese de submetida `a Escola de P´os-Gradua¸c˜ao em Economia da Funda¸c˜ao

Getulio Vargas como quesito para a obten¸c˜ao T´ıtulo de Doutor em Economia.

Aluno: Rafael Martins de Souza

Banca Examinadora:

Jo˜ao Victor Issler (Orientador, EPGE/FGV)

Prof. Marco Antonio Bonomo (EPGE/FGV)

Caio Ibsen Rodrigues de Almeida (EPGE/FGV)

Marcelo C. Medeiros (DE/PUC-Rio)

Paulo Pichetti (EESP/FGV)

Rio de Janeiro

Abstract

This thesis has three chapters. Chapter 1 explores literature about exchange rate pass-through,

approaching both empirical and theoretical issues. In Chapter 2, we formulate an estate space

model for the estimation of the exchange rate pass-through of the Brazilian Real against the US

Dollar, using monthly data from August 1999 to August 2008. The state space approach allows us

to verify some empirical aspects presented by economic literature, such as coefficients inconstancy.

The estimates offer evidence that the pass-through had variation over the observed sample. The

state space approach is also used to test whether some of the “determinants” of pass-through are

related to the exchange rate pass-through variations observed. According to our estimates, the

variance of the exchange rate pass-through, monetary policy and trade flow have influence on the

exchange rate pass-through. The third and last chapter proposes the construction of a coincident

and leading indicator of economic activity in the United States of America. These indicators

are built using a probit state space model to incorporate the deliberations of the NBER Dating

Cycles Committee regarding the state of the economy in the construction of the indexes. The

estimates offer evidence that the NBER Committee weighs the coincident series (employees in

non-agricultural payrolls, industrial production, personal income less transferences and sales) differently

way over time and between recessions. We also had evidence that the number of employees in

non-agricultural payrolls is the most important coincident series used by the NBER to define the periods

iv

Resumo

A tese est´a dividida em trˆes cap´ıtulos. O cap´ıtulo 1 trata de uma revis˜ao de literatura sobre

pass-through, abordando aspectos emp´ıricos e te´oricos. O segundo cap´ıtulo trata da estima¸c˜ao de

um modelo de espa¸co de estados para estima¸c˜ao dos pass-through da taxa de cˆambio no Brasil de

agosto 1999 a agosto 2008. A abordagem espa¸co de estados permite contemplar alguns aspectos

emp´ıricos apresentados pela literatura econˆomica, tais como a inconstˆancia dos parˆametros. As

estimativas ofereceram evidˆencia de que o pass-through no Brasil variou no per´ıodo estudado.

Ainda, a abordagem por espa¸co de estados permite que se estude os“determinantes” (ou vari´aveis

associadas) do pass-through. Com isto tivemos evidˆencia de que a variˆancia da taxa de cˆambio, a

pol´ıtica monet´aria e o fluxo de com´ercio afetam o pass-through. O terceiro e ´ultimo artigo da tese

trata da constru¸c˜ao de um indicador coincidente e antecedente da atividade econˆomica nos Estados

Unidos da Am´erica. Nele utiliza-se um modelo probit de espa¸co de estados para incorporar as

decis˜oes do NBER Dating Cycles Committee na constru¸c˜ao dos ´ındices. A estimativas ofereceram

evidˆencia de que o comitˆe do NBER pondera as s´eries coincidentes (total de empregados em

atividades n˜ao agr´ıcolas, produ¸c˜ao industrial, renda pessoal menos transferˆencias governamentais

e vendas) de maneira diferente ao longo do tempo e entre as recess˜oes. Tamb´em evidenciou-se que

a s´erie coincidente total de empregados em setores n˜ao-agr´ıcolas ´e a principal s´erie considerada

Agradecimentos

Agrade¸co,

A Deus, por me permitir caminhar at´e aqui, apesar de todas as dificuldades.

Ao meu orientador, Prof. Jo˜ao Victor Issler pelo apoio, incentivo e exemplo profissional. Ao

Prof. Pedro Cavalcanti Gomes Ferreira que abriu as portas da EPGE quando eu era, ainda, um

aluno de gradua¸c˜ao para fazer bolsa de inicia¸c˜ao cient´ıfica.

`

A Funda¸c˜ao Getulio Vargas, `a CAPES e ao CNPq pelo suporte financeiro.

Aos amigos de San Diego, Daniel, Daniel Aiex e Eillen. O conv´ıvio com vocˆes foi inesquec´ıvel.

A gratid˜ao ´e eterna.

A todos os amigos da EPGE. Em especial ao Jos´e Diogo, ao Orlando, ao James, ao Fl´avio,

ao Luiz Felipe, `a Amanda, ao Pedro, ao Gustavo, ao Gabriel e ao Hilton. Obrigado por todos os

momentos.

Aos meus amigos de longa data, Aline e Ralph, que, mesmo quando estavam em pa´ıses distantes,

estivem sempre pr´oximos o suficente para me encorajar e me incentivar nos momentos dif´ıcies.

Aos meus novos colegas de trabalho, Luisa e Gustavo, que pela paciˆencia, incentivo e for¸ca na

reta final.

Aos meus pais, Marlene e Ronaldo, e ao meu irm˜ao Samuel, por todo amor, incentivo,

encora-jamento, participa¸c˜ao... Descrever toda a importˆancia da nossa fam´ılia ´e imposs´ıvel. A gratid˜ao ´e

infinita.

`

A Mozuca, pela sua paciˆencia, benevolˆencia, altru´ısmo, seu trato carinhoso, sua calma, sua

vi

Key words and phrases: Exchange rate pass-through, business cycles, indicators of economic

activity, state space models, Kalman filter.

Palavras-Chave: Pass-throughda taxa de cˆambio, ciclo de neg´ocios, indicadores de atividade

Contents

I

Exchange Rate Pass-Through

1

1 A Discussion on Exchange Rate Pass-Through 2

1.1 Introduction . . . 2

1.2 Empirical Evidences on Exchange Rate Pass-Through . . . 4

1.3 Pass-Through Determinants . . . 8

1.3.1 Macroeconomic Determinants . . . 8

1.3.2 Output Gap . . . 8

1.3.3 Microeconomic Determinants of Pass-Through . . . 11

1.4 The economic model . . . 12

2 Pass-Through Estimation in Brazil 15 2.1 Introduction . . . 15

2.2 Econometric Framework . . . 16

2.2.1 Linear state space models under restrictions . . . 16

2.2.2 Model Selection and Inference . . . 19

2.3 Econometric Setting and Estimation . . . 19

CONTENTS viii

2.3.1 Time Varying Coefficients . . . 19

2.3.2 Determinants . . . 30

2.4 Conclusions . . . 35

II

Coincident and Leading Indexes of Economic Activity

37

3 A State Space Model for Indices of Economic Activity 38 3.1 Introduction . . . 383.2 The model . . . 41

3.2.1 Determining a basis for the cyclical components of coincident variables . . . 41

3.2.2 Estimating a structural equation for the unobserved business cycle state . . 43

3.2.3 The iterated extended Kalman filter and smoother . . . 49

3.2.4 The Kalman Filter and Smoother Instrumental Variables Index . . . 51

3.3 Results . . . 54

3.3.1 The Data . . . 54

3.3.2 The Basis Cycles . . . 54

3.3.3 Estimates . . . 57

3.3.4 Predicting Recessions in Real Time . . . 65

List of Figures

2.1 IPA-OG smoothed coefficient of Δ log𝑒𝑡, Δ log𝑒𝑡−1 and Δ log𝑦𝑡−1. . . 25

2.2 IPA-OGPA smoothed coefficient of Δ log𝑒𝑡, Δ log𝑒𝑡−1and Δ log𝑦𝑡−1. . . 26

2.3 IPA-OGPI smoothed coefficient of Δ log𝑒𝑡, Δ log𝑒𝑡−1(top), Δ log𝑦𝑡−1and Δ log𝑦𝑡−6 (bottom). . . 27

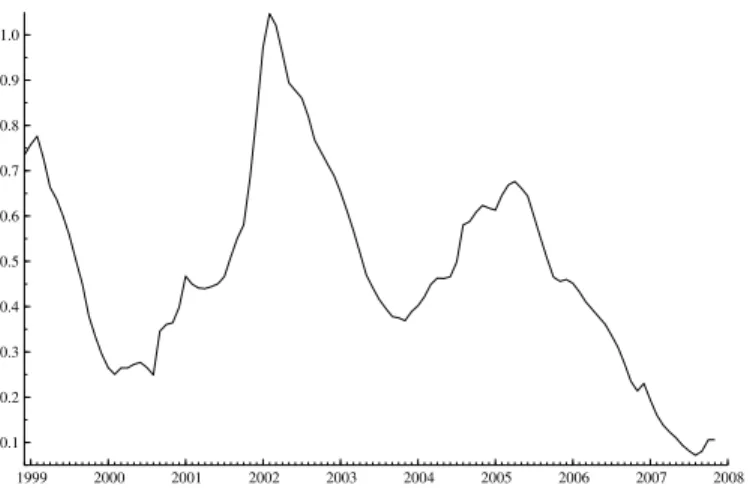

2.4 IPA-OG long run pass-through. . . 28

2.5 IPA-OGPA long run pass-through. . . 28

2.6 IPA-OGPI long run pass-through. . . 29

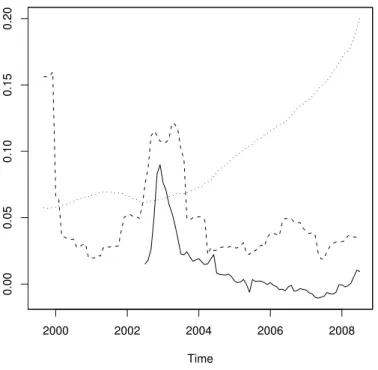

2.7 Tested determinants of pass-through: Monetary policy, (solid line), variance of ex-change rate (dashed line) and international trade (dotted line). . . 31

3.1 Coincident Series. . . 55

3.2 Coincident Cycles (growth rate) plot. . . 58

3.3 Filtered and Smoothed weights. . . 59

3.4 Predicted and Smoothed probabilities using data from 1960:06 to 2007:03. . . 61

3.5 Predicted and Smoothed probabilities using data from 1960:06 to 2007:03. . . 63

3.6 Filtered and Smoothed weights. . . 64

LIST OF FIGURES x

3.7 1990 Recession. . . 66

3.8 2001 Recession. . . 67

List of Tables

2.1 Some quality of fit statistics of the adjusted models. . . 23

2.2 Information criteria observed values for incomplete, null and complete pass-through exchange rate models. . . 24

2.3 P-values of the tests for null and complete pass-through exchange rate. . . 24

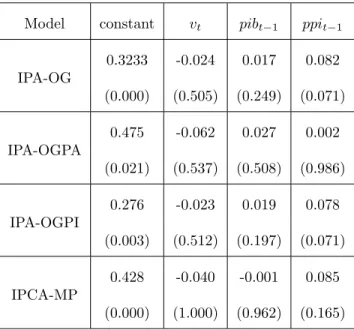

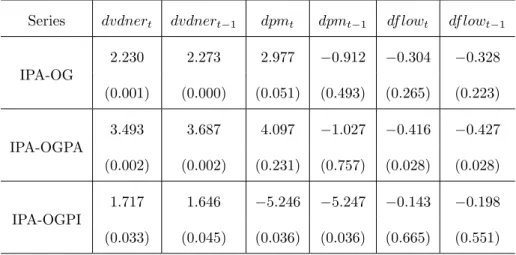

2.4 Estimates of the IPA-OG, IPA-OGPA and IPA-OGPI series (p-values between paren-thesis). . . 30

2.5 Estimated parameters and corresponding p-values (in parenthesis). . . 34

2.6 Estimated parameters and corresponding p-values (in parenthesis). . . 34

3.1 Coincident and leading variables. . . 56

3.2 Squared canonical correlations and canonical-correlation test. . . 57

3.3 Descriptive statistics of the filtered (left) and smoothed (right) coefficients. . . 60

3.4 Accuracy of estimation based on a cut-off point of 0.5. . . 62

3.5 Descriptive statistics of the smoothed weights. . . 65

3.6 Predicted probabilities associated for period from 2007:08 to 2008:07 . . . 69

Part I

Exchange Rate Pass-Through

A Discussion on Exchange Rate

Pass-Through

1.1

Introduction

The exchange rate pass-through degree is the elasticity between exchange rate and domestic prices.

In other words, it is the percentage impact on 1% change in exchange rate into domestic prices.

In an open economy, domestic prices can be affected by external shocks, whether by currency

relative price adjustment or by movements in international supply and demand. The exchange

rate pass-through highlights how sensitive each market is to fluctuations in exchange rate.

The study of exchange rate pass-through has intensified since 1980. The literature focuses on

the behavior of the impact of exchange rate on prices and their determinants. However, the real

motivation for these studies was the study of the Purchase Power Parity Puzzle (PPP). The PPP

CHAPTER 1. A DISCUSSION ON EXCHANGE RATE PASS-THROUGH 3

assumption states that all variation in exchange rate is passed-through into prices. The major

conclusion from empirical studies in the last years is that the PPP is not valid in the short run;

therefore, exchange rate pass-through into prices is less than one. However, there is some evidence

in favor of the validity of PPP on long run.

The pass-through estimation could provide a test for the existence of the purchase power parity.

If the PPP were valid in the long term, the pass-through would be complete and the sum of the

pass-through coefficients would have to sum to one. Otherwise, the long run pass-through would

be incomplete and the effect of variations in exchange rate into prices would be restricted.

The importance of exchange rate pass-through has increased since the adoption of the inflation

targeting regime. Fraga, Goldfajn and Minella (2003) have shown that the problem of having a

high exchange rate pass-through degree is that it implies a greater difficulty for attaining inflation

targets. A greater exchange rate pass-through means that the domestic economy is more sensitive

to external shocks, consequently the impact of exogenous shocks into domestic prices is amplified.

Exchange rate pass-through also seens to affect the inflation forecast. According to Goldfajn

and Werlang (2000), the exchange rate pass-through into prices is directly associated with inflation

forecast error. With a smaller pass-through, the domestic economy is more stable and less affected

by external factors. Therefore, a smaller pass-through means that the difference between inflation

expectations and inflation targets is smaller. In other words, a small pass-through generates a

minor inflation forecast error. Consequently, a small pass-through is associated with a major

transparency of inflation path and a minor volatility in price variations in the economy, rising

social welfare and monetary policy efficiency.

The exchange rate pass-through into prices is one of the main drivers to optimal monetary

inflation volatility is dependent on how sensitive prices are to exchange rate variations. They

begin their argument by explaining that the nature of the trade-off between different exchange

rate regimes is quite different in industrial countries from the trade-off in emerging ones. Using a

DGE Model (Dynamic General Equilibrium Model), they argue that the critical distinction is the

exchange rate pass-through into prices. With very high exchange rate pass-through, policies that

stabilize output require high exchange rate volatility, which implies high inflation volatility. But

with limited or delayed pass-through, this trade-off is less pronounced and a flexible exchange rate

policy that stabilizes output can do so without high inflation volatility.

Another study that emphasizes the importance of exchange rate pass-through in an inflation

targeting regime is that of Fraga, Goldfajn and Minella(2003). They have shown that the problem

of having a high exchange rate pass-through degree is that it implies a greater difficulty for attaining

inflation targets. The larger the exchange rate pass-through, the more sensitive the domestic

economy to external shocks, that is, the impact of exogenous shocks on domestic prices is amplified

by a larger exchange rate pass-through.

1.2

Empirical Evidences on Exchange Rate Pass-Through

A main factor in pass-through estimation is the difficulty of using aggregated data and the known

problem of aggregation bias. This factor favors a disaggregating process for prices, and tries to

capture the exchange rate pass-through for each good or each market. Campa and Goldberg (2005)

present results where estimates are better across industries than across countries with aggregate

data. These authors also say that the major source of pass-through variations are competition

CHAPTER 1. A DISCUSSION ON EXCHANGE RATE PASS-THROUGH 5

across industries. Menon (1996) supports these findings pointing to the aggregation bias, indicating

that disaggregated data provides more accurate estimates and captures the impact of exchange

rates on commodities prices more precisely.

Campa and Goldberg (2005) and Pollard and Coughlin (2005) follow this trend of disaggregated

estimation of pass-through. Their approach permits a more individual analysis for each market,

relating pass-through with market power and degree of competition. This type of analysis allows

more plausible explanations for aggregated pass-through behavior. Campa and Goldberg (2005)

observe that the US has seen a change in composition of certain industries in its import basket.

Industries with a bigger pass-through, such as energy and raw materials, have shown a decrease

in their share in the US imports basket, reducing the aggregate pass-through. The proportion of

tradable and non-tradable goods is important to analyze the aggregate exchange rate pass-through

because tradables are more sensitive to changes in exchange rate than the non-tradables. Therefore,

the greater the share of tradable goods, the higher the exchange rate pass-through.

Some results about pass-through estimation can be seen in Goldberg and Knetter (1997), where

the exchange rate pass-through to US inflation was approximately 50% after 6 months. Campa

and Goldberg (2005) estimate pass-through for 25 OECD countries. They found a pass-through of

26%, in the short term, and 41% in the long term for the US. The average pass-through estimated

for OECD countries in the short and long run was 61% and 77%, respectively.

Sekine (2006) estimated exchange rate pass-through for six developed countries (United States,

Japan, Germany, United Kingdom, France and Italy) by taking into account their time-varying

natures. The author incorporates that characteristic by allowing permanent shifts in pass-through

parameters. He found that pass-through has declined over time in all major industrial countries

estimations.

Calvo and Reinhart (2000) have shown that the pass-through degree of emerging countries is

four times greater than that of developed countries. Additionally, these authors calculate that the

variance of inflation compared with the variation of exchange rate is 43% for emerging countries

and 13% for developed ones.

In the case of the Brazilian economy, there are few studies estimating the exchange rate

pass-through. Belaisch (2003) used a VAR specification controlling for petroleum shocks and estimated

the exchange rate pass-through into IPCA approximately 6% after 3 months. He also estimated

other price indeces and found that the pass-through to IPA (34%) was larger than to IGP (27%),

which is larger than IPCA. Carneiro, Monteiro and Wu (2002) used a non-linear estimation for

pass-through into IPCA, in an attempt to capture possible asymmetries in exchange rate variations

into prices. Their estimate was 6,4%, on average.

Albuquerque and Portugal (2003) used a time varying estimation for the IGP, IPCA and IPA.

They found evidence of time varying pass-through in Brazil, although they used a complicated

period (1980-2002). Their data set was prejudiced by multiple exchange rate regimes, multiple

changes in economic policies and some financial crisis. Their state equation estimates for IPA

were not significant, with the exception of the persistence term. For IPCA, their estimates were

approximately 6% on average. However, since 1995 their exchange rate pass-through to IPCA was

not significantly different from null.

After the estimation of exchange rate pass-through, studies started to explain its behavior and

the reasons for so much variation across countries, across time and across industries. The reasons

could be in the exchange rate pass-through determinants. According to Goldfajn and Werlang

CHAPTER 1. A DISCUSSION ON EXCHANGE RATE PASS-THROUGH 7

exhibit smaller pass-through. Another result is that the exchange rate pass-through changes with

time horizon, reaching its peak at 12 months in the case of Brazil. These authors analyzed four

variables as pass-through determinants: real exchange rate misalignment, initial inflation, output

gap and openness degree. Their results indicate that all variables have important correlations with

exchange rate pass-through, depending on the countries’ characteristics, although real exchange

rate misalignment and inflation environment were the most important.

Inflation is positively correlated to exchange rate pass-through. Empirical evidence suggests

that the larger the inflation persistence, the larger inflation rate. Hence, there is more volatily in

the macroeconomic variables than the exchange rate pass-through.

According to Taylor (2000), a low inflation environment implies a decrease in exchange rate

pass-through. He argues that low and more stable inflation should be associated with less persistent

inflation. Hence, the low inflation and the monetary policy that has delivered it have led to lower

pass-through by a reduction in expected persistence of cost and price movements.

Gagnon and Ihrig (2001) argue that recent adoptions of anti-inflationary policies and the rise in

central bank credibility are important factors to explain the diminishing effects of inflation on the

exchange rate pass-through. When inflation is low and the commitment of the central bank to keep

inflation stable has credibility, the economic agents become less inclined to quickly pass-through

costs variations to prices.

According to Choudri and Hakura (2003) there exists strong evidence of a positive and

sig-nificant relation between average inflation and pass-through. The authors argue that a limited

pass-through gives more freedom for a independent monetary policy, benefiting the

1.3

Pass-Through Determinants

Since there are many studies trying to identify the causes of the exchange rate pass-through, we

summarize some the possible exchange “determinants”, proposed by these studies. According to

Menon (1996), Goldfajn and Werlang (2000), Taylor (2000) and Campa and Goldberg (2002), the

main drivers of price sensibility to exchange rate changes can be inferred. From the Macroeconomic

point of view, the pass-through depends on the openness degree of the economy, the output gap,

inflation persistence and real exchange rate misalignments. From the standpoint of disaggregated

analysis, the exchange rate pass-through is associated with the competition degree of each industry

and with a firm’s market power (with the elasticity price-demand).

1.3.1

Macroeconomic Determinants

1.3.2

Output Gap

The output gap is defined by the deviation of a product in relation to its long term value; in other

words, the difference between observed product and the value it was supposed to be according to

its long term trend. The evidence of past studies shows a positive correlation between pass-through

and output gap. The larger the difference between GNP and its potential, the greater the demand

pressure over prices. This fact generates an inflation environment, raising the probability that

firms pass-through changes in costs into prices. Therefore, in an environment where the output

CHAPTER 1. A DISCUSSION ON EXCHANGE RATE PASS-THROUGH 9

Inflation Environment

According to Goldfajn and Werlang (2000), the variable inflation environment is defined as the

frequency which agents remark their prices based on past inflation. In countries with an inflationary

environment, it is easier for the agents to pass-through cost changes and increase prices. As a result,

the larger the inflationary environment – and the more persistent the inflation – the easier it is

for agents to pass-through exchange rate increases into prices. This reasoning is corroborated by

Taylor(2000), who suggests a correlation between inflation and exchange rate pass-through using

the inflation persistence as a channel of transmission. The model indicates that observed changes

in pass-through, or firms’ market power, are partly originated from changes in the persistence of

expected movements in cost and competitor prices. In this sticky price model, the pass-through

to prices depends on how permanent the increase of cost is. The greater the half-life of a rise in

marginal cost, the more firms will revise prices. For this reason, if exchange rate depreciation is

transitory, firms will pass-through to prices some of this increase in costs. However, the greater the

persistence of exchange rate depreciation, the greater the pass-through will be. Taylor(2000) argues

that persistence in cost changes is related to price stability. Therefore, in a stable environment, the

inflation persistence will be smaller. As a result, the half-life of cost changes will decrease causing

a smaller pass-through.

Openness Degree

The openness degree of an economy depends on the presence of tradable goods, which determine

how sensitive prices are to changes in exchange rates. This degree can be defined as the sum

of imports and exports as a proportion of GNP. In a more open economy, we expect that the

rate pass-through to inflation.

Real Exchange ate Disalignment

According to Goldfajn and Vald´es (1999), a real exchange rate over valuated results a mean factor

on future inflation composition. If the real exchange rate is below its long term value, agents make

up the expectation of future devaluations, adjusting relative prices. However, if exchange rate

variation are not adjusted by relative prices, it will imply an increase in internal inflation in relation

to external inflation. As a result, an over valuated real exchange rate implies future depreciations

because the exchange rate is supposed to meet its steady state in the future. The agents will

take on this expectation of future depreciation, amplifying the effect on prices. Consequently, the

exchange rate pass-through will be negative associated with the difference of real exchange rate

and its long run value. The more over valuated the real exchange rate, the greater the expectations

of future devaluations, which will lead to an increase in the prices.

Variance of Exchange Rate

Large movements in exchange rate are associated with a higher exchange rate pass-through to

prices. If the variance of exchange rate is large, then the cost of changing prices decreases and

price-makers have more incentive to pass-through cost changes to prices. The idea is that if the

cost variation is large, then it is easier for the price maker to pass-through this cost changes to

prices.

Changing listed prices entails menu costs, such as the cost of printing new price lists and

the cost of notifying consumers of new prices. In order to justify the cost of raising prices, the

CHAPTER 1. A DISCUSSION ON EXCHANGE RATE PASS-THROUGH 11

substantial and is not likely to reverse itself, the cost of changing prices will be small in proportion

to the profit generated by the higher price. Furthermore, a significant cost increase affecting all

competitors simultaneously reduces the impact of a price hike on a company’s reputation. Price

changes therefore occur more frequently when exchange rate movements are large.

Devereux and Yetman (2002) developed a simple theoretical model of endogenous exchange

rate pass-through. The model ignores many factors that might limit pass-through, and focuses

exclusively on the role of price rigidities. Their main argument was that exchange rate

pass-through is determined by the types of shocks in the economy and the persistence of the shocks.

For a given size of the menu cost of price changes, firms will choose a higher frequency of price

adjustment if the average rate of inflation is higher and the nominal exchange rate is more volatile.

Thus, large movements in exchange rate and an inflationary environment are associated with a

higher exchange rate pass-through.

1.3.3

Microeconomic Determinants of Pass-Through

A main factor to analyze the exchange rate pass-through into disaggregated prices is the degree

of competition on the price setting sector. When the competition increases in an industry, the

market power of firms diminishes and the producers can pass-through less cost change to consumers

without losing market-share. Therefore, in a highly competitive environment, the exchange rate

pass-through will be limited and the producers will absorb cost increases – accepting less

mark-ups – and will not fully pass-through exchange rate variations to prices, with the intention to

protect market-share. Therefore, there is a negative relation between competition and exchange

rate pass-through.

more elastic the demand, the more consumers will respond to price changes, which implies that

producers have a limited ability to pass-through costs changes. Therefore, the more inelastic the

demand, the more producers will pass-through exchange rate variations into prices. This implies

the existence of a negative correlation between pass-through and elasticity price-demand.

Campa and Goldberg (2005) also argue that the aggregated pass-through have declined because

of the change in composition of certain industries in the import basket. Industries with a larger

pass-through have shown a decrease in their share in the US imports basket. At the same time,

industries with prices that are less sensitive to exchange rate devaluations experience a growth in

market share. The authors give the example of the reduction in the US energy sectors share, which

has an exchange rate pass-through of 70%, and raw materials (pass-through of 64%).

1.4

The economic model

The theoretical framework used to formulate the econometric models in the next chapter is directly

inspired by articles as Olivei (2002), Pollard and Coughlin (2005) and Campa and Goldberg (2002),

among others. The law of one price says that the price of any good, say good 𝑥, denoted by a

common currency should be the same in any two markets:

𝑃𝐻=𝐸𝑃𝐹, (1.1)

where 𝐻 is the home country,𝐹 is the foreign country and𝐸 is the home currency price of the

foreign currency. Given some costs, such as transportation and barriers to trade, the absolute

version of the law of one price usually does not hold. Instead, another version may hold, for

CHAPTER 1. A DISCUSSION ON EXCHANGE RATE PASS-THROUGH 13

𝑃𝐻 =𝛼𝐸𝑃𝐹, (1.2)

where𝛼indicates the deviation from the law of one price.

The model is built assuming that the foreign price of a good 𝑥, 𝑃𝐹, is determined by the

markup over marginal cost,

𝑃𝐹 =𝑀 𝑎𝑟𝑘𝑢𝑝 ⋅ 𝑚𝑐, (1.3)

where𝑚𝑐is the marginal cost.

Markup is a function of industry-specific factors,𝜙, and the general macroeconomic conditions,

proxied by the exchange rate, E, as follows:

𝑀 𝑎𝑟𝑘𝑢𝑝=𝜙𝐸𝛿, (1.4)

where 𝛿 is the elasticity of the exchange rate. Marginal cost 𝑚𝑐 is determined by the prices of

substitutes goods and services,𝑃𝑆, the cost of inputs of good𝑥in the producer country,𝑊, and

income,𝑌, as follows:

𝑚𝑐=𝑃𝜋

𝑆𝑊𝜓

1𝑌𝜓2 (1.5)

Rewriting the above equations, we have:

𝑃𝐻=𝛼𝜙𝐸(1+𝛿) ⋅ 𝑊𝜓1

𝑃𝑆𝜋𝑌𝜓 1

, (1.6)

log𝑃𝐻= log(𝛼𝜙)⋅log𝐸(1+𝛿) ⋅ log(𝑃𝜋 𝑆𝑊𝜓

1𝑌𝜓2), (1.7)

we get a additive model, as follows:

𝑝𝐻 = log(𝛼𝜙) + (1 +𝛿)𝑒+𝜋𝑝

𝑆+ +𝜓1𝑤+𝜓2𝑦, (1.8)

where the small caps represents variables logs.

Goldberg and Knetter (1997) show that the econometric model specification generated in

equa-tion (1.8) is exactly the same as any other widely accepted theoretical approach to study prices and

exchange rate pass-through, such as the pricing-to-market model presented by Krugman (1997).

Chapter 2

Pass-Through Estimation in Brazil

2.1

Introduction

The are few studies estimating the exchange rate pass-through in Brazil. In this chapter we present

a state space model to estimate the exchange rate pass-through in Brazil from August 1999 to

August 2008. The state space framework is suitable to build a econometric model based on the

economic model discussed in section 1.8 that is suitable to address some stylized facts presented

on the literature on exchange rate pass-through.

One of the motivations of the proposed econometric model is that, as argued by Parsley (1995),

stability of exchange rate pass-through is not well tested in common econometric specifications of

pass-through equations. Therefore, the state space formulation is suitable to build linear models

with time varying coefficients, allowing us to fill this gap in the literature. There are recent

contributions using state space models, such as Sekine (2002) and Albuquergue e Portugal (2005),

but they do not cover some key aspects of interest. For example, a importante contribuition of

our study is that we used novel the techniques presented by Pizzinga, Fernandes and Contreras

(2008) and Pizzinga (2009) to estimate the model with constraints in the time varying coefficients

to address the PPP puzzle in this framework.

We go further exploring the proprieties of state space models. We estimated a modified version

of the econometric model to test whether some “determinants” of exchange rate pass-through are

related to variations of the exchange rate pass-through over time. This is possible because we can

specify a movement equation to the time varying coefficients with explanatory variables. Although

our methodology does not allow to claim what is the direction of the casual effects, it offers new

evidence on the so called “determinants” by the literature.

With the purpose of controlling for aggregation bias, we estimate both specifications for different

levels of aggregation of the wholesales Brazilian price index used. The model is estimated for the

IPA-OG series, including its versions for industrial products, the IPA-OGPI, and agricultural

products, IPA-OGPA.

2.2

Econometric Framework

2.2.1

Linear state space models under restrictions

We define alinear Gaussian state space model by the followingmeasurementequation,state

equa-tion and initial state vector:

𝑌𝑡=𝑍𝑡𝛽𝑡+𝑑𝑡+𝜀𝑡 , 𝜀𝑡∼𝑁 𝐼𝐷(0, 𝐻𝑡)

𝛽𝑡+1=𝑇𝑡𝛽𝑡+𝑐𝑡+𝜂𝑡 , 𝜂𝑡∼𝑁 𝐼𝐷(0, 𝑄𝑡)

𝛽1∼𝑁(𝑏1, 𝑃1).

(2.1)

CHAPTER 2. PASS-THROUGH ESTIMATION IN BRAZIL 17

the latter gives the state evolution through a Markovian structure. The random errors 𝜀𝑡 and

𝜂𝑡 are independent (of each other and of 𝛾1), and the system matrices 𝑍𝑡, 𝑑𝑡, 𝐻𝑡, 𝑇𝑡, 𝑐𝑡 and

𝑄𝑡 are deterministic. Notice that𝑑𝑡 and 𝑐𝑡 are generally reserved to the inclusion of exogenous

explanatory variables.

For a given time series of size 𝑛and any 𝑡,𝑗, ℱ𝑗 ≡𝜎(𝑌1, . . . , 𝑌𝑗), ˆ𝛽𝑡∣𝑗 ≡𝐸(𝛽𝑡∣ℱ𝑗) and ˆ𝑃𝑡∣𝑗 ≡

𝑉 𝑎𝑟(𝛽𝑡∣ℱ𝑗). TheKalman filtering consists of recursive equations for these first and second order

conditional moments. The formulae and their respective deductions corresponding to predicting

(𝑗 =𝑡−1), filtering (𝑗 =𝑡) and smoothing (𝑗 = 𝑛), as detailed in the estimation of unknown parameters in the system matrices by (quasi) maximum likelihood, can be found in Harvey (1989)

and Durbin and Koopman (2001).

Now, suppose the following: for each 𝑡, 𝐴𝑡𝛽𝑡 =𝑞𝑡, where 𝐴𝑡 is a known 𝑘×𝑚 fixed matrix

and 𝑞𝑡 = (𝑞𝑡1, . . . , 𝑞𝑡𝑘)′ is a 𝑘×1 observable vector, may be random. Also suppose that 𝑞𝑡 is

ℱ𝑡-measurable. A restricted estimation of this type can be achieved under therestricted Kalman filtering, presented in Pizzinga and Fernandes (2008) and summarized in the following algorithm:

Let𝑡be an arbitrary time period.

1. Re-write the linear restrictions as

𝐴𝑡,1𝛽𝑡,1+𝐴𝑡,2𝛽𝑡,2= [𝐴𝑡,1𝐴𝑡,2]

(

𝛽𝑡,′1, 𝛽′𝑡,2 )′

=𝑞𝑡, (2.2)

where𝐴𝑡,1 is a 𝑘×𝑘full rank matrix.

2. Solve (2.2) for𝛽𝑡,1:

3. Take (2.3) and replace it in the measurement equation of model (2.1):

𝑌𝑡 = 𝑍𝑡,1𝛽𝑡,1+𝑍𝑡,2𝛽𝑡,2+𝜀𝑡

= 𝑍𝑡,1(𝐴−1𝑡,1𝑞𝑡−𝐴−1𝑡,1𝐴𝑡,2𝛽𝑡,2)+𝑍𝑡,2𝛽𝑡,2+𝜀𝑡

= 𝑍𝑡,1𝐴−1𝑡,1𝑞𝑡−𝑍𝑡,1𝐴−1𝑡,1𝐴𝑡,2𝛽𝑡,2+𝑍𝑡,2𝛽𝑡,2+𝜀𝑡

⇒𝑌𝑡∗ ≡ 𝑌𝑡−𝑍𝑡,1𝐴−1𝑡,1𝑞𝑡=(𝑍𝑡,2−𝑍𝑡,1𝐴−1𝑡,1𝐴𝑡,2)𝛽𝑡,2+𝜀𝑡

≡ 𝑍𝑡,∗1𝛽𝑡,2+𝜀𝑡.

4. Postulate a transition equation for the unrestricted state vector 𝛽𝑡,2 and finally get the

followingreduced linear state space model:

𝑌∗

𝑡 =𝑍𝑡,∗2𝛽𝑡,2+𝜀𝑡 , 𝜀𝑡∼(0, 𝐻𝑡)

𝛽𝑡+1,2=𝑇𝑡,2𝛽𝑡,2+𝑐𝑡,2+𝑅𝑡,2𝜂𝑡,2 , 𝜂𝑡,2∼(0, 𝑄𝑡,2)

𝛽1,2∼(𝑎1,2, 𝑃1,2).

(2.4)

5. Apply the usual Kalman filter to the model in (2.4) and obtain ˆ𝛾𝑡,2∣𝑗, for all𝑗 ≥𝑡.

6. Reconstitute the estimates ˆ𝛽𝑡,2∣𝑗:

ˆ

𝛽𝑡,1∣𝑗=𝐴−1𝑡,1𝑞𝑡−𝐴−1𝑡,1𝐴𝑡,2𝛽ˆ𝑡,2∣𝑗. (2.5)

As Pizzinga and Fernandes (2008) claim, an interesting feature of this approach is that there is

no need to worry about specifying the state vector equation until the reduced form is achieved in the

4th step of the described algorithm. This avoids any risk of obtaining an augmented measurement

equation that is theoretically inconsistent with the original state equation. Another good property

that should be noted, and that will be used later in this paper, is that the reduced restricted

Kalman filtering enables us to investigate the plausibility of the assumed linear restrictions by

CHAPTER 2. PASS-THROUGH ESTIMATION IN BRAZIL 19

2.2.2

Model Selection and Inference

One of the purposes of this study is to identify the most adequate number of lags in the exchange

rate. The hypotheses of completeness (or absence) of exchange rate pass-through will also be

verified. To accomplish this we use the following steps:

1. Diagnostic tests with the (standardized) residuals.

2. Information criteria, such as𝐴𝐼𝐶 and𝐵𝐼𝐶.

3. Predictive power by comparing𝑃 𝑠𝑒𝑢𝑑𝑜𝑅2 and𝑀 𝑆𝐸 measures.

Finally, the statistical significance of the parameters of measurement and state equation will

be tested under a likelihood ratio (𝐿𝑅) testing approach. Since both the reduced and the

com-plete model maintain the standards of good properties of maximum likelihood estimation (cf.

Pagan, 1980), it follows that, asymptotically, 𝐿𝑅≡2 [𝑙𝑜𝑔𝐿𝑀 𝑎𝑥,𝐶𝑜𝑚𝑝−𝑙𝑜𝑔𝐿𝑀 𝑎𝑥,𝑅𝑒𝑑]∼𝜒21, where

𝑙𝑜𝑔𝐿𝑀 𝑎𝑥,𝑅𝑒𝑑 represents the maximum of the log-likelihood for a model with a particular

explana-tory variable dropped from the specification.

2.3

Econometric Setting and Estimation

2.3.1

Time Varying Coefficients

The dependent series are the Wholesale Price Index, Global Supply (IPA-OG), Wholesale Price

Index, Global Supply - Industrial Products (IPA-OGPI) and Wholesale Price Index Global Supply

- Agricultural Products (IPA-OGPA) all created by the Getulio Vargas Foundation in Brazil. The

IPA are the best proxy for a producer price index in Brazil and for this reason they are used in

the Pizzinga and Fernandes (2008) technique can be. The monthly average commercial exchange

rate (bid), the monthly GDP, both published by Banco Central do Brasil (the institution that has

a similar role to the American FED in Brazil) and the American PPI, Industrial Commodities

are the explanatory variables. These variables are chosen because they are good proxies to the

variables presented in equation 1.8. The GDP is proxy for income, the PPI is proxy for the cost of

production in the foreign country. As the indexes analyzed work are aggregates of many different

goods, no substitute index prices was adopted in this study.

The sample has data from August 1999 to August 2008. A longer period would be desirable,

however Brazilian economic history lacks longer periods of economic stability. For example, from

March 1994 to January 1999 Brazil experienced the adoption of the Real Plan to fight high inflation.

Much of the strength of this new plan was set on the fixed exchange rate system. However,

a sequence of international crises in the nineties made Brazil change this regime for a floating

exchange rate with inflation targeting regime in February 1999. As it always takes time for economic

agents to adapt themselves to new environments and since we also need to use some lags in the

exchange rate to correctly specify our model, we decided to estimate the proposed model using

observations since August 1999.

Since we decided to investigate whether exchange rates had a contemporaneous effect on

Brazil-ian wholesale prices, it is necessary to correctly deal with a possible endogeneity between the log

difference of exchange rate and the price indexes. This is done using the results in Kim (2006).

The instrumental variables used for the growth rate of the exchange rate are lags in the growth

rate of the exchange rate itself, lags in growth rate of the American PPI, industrial commodities,

lags in growth rate of Brazilian consumer price index, IPC, and the Brazilian IPA-OG. Among

CHAPTER 2. PASS-THROUGH ESTIMATION IN BRAZIL 21

auxiliary regressions.

We now present our state space model for the exchange rate pass-through for a given index

price. The model is composed by a measurement equation, namely,

Δ log 𝑝𝑡=∑𝑚𝑘=0𝛽𝑘𝑡Δ log 𝑒𝑡−𝑘+𝛽(𝑚+1)𝑡Δ log𝑝𝑡−1+𝜓0+𝜓1Δ log 𝑝𝑝𝑖𝑡−1+𝜓2Δ log 𝑦𝑡−1+𝜀𝑡,

𝜀𝑡∼𝑁 𝐼𝐷(0, 𝜎2)

(2.6)

and state equation, as follows:

𝛽𝑡+1=𝛽𝑡+𝜂𝑡, 𝜂𝑡∼𝑁 𝐼𝐷(0, 𝑄). (2.7)

The former equation linearly relates the observed monthly log-variation of the domestic price index

to the log-variation of exchange rate from time 𝑡 to time 𝑡−𝑚 and to the American Producer Price Index,𝑝𝑝𝑖 and to a demand variable,𝑦𝑡−1. The coefficients of Δ𝑙𝑜𝑔 𝑒𝑡−𝑘 in equation (2.8)

are the state coefficients and their dynamics are given in equation (2.9).1 The lagged term𝑝

𝑡−1is

introduced to deal with persistence observed in the inflation indexes. As proposed by Kim (2006),

we added residual terms from the auxiliary regression in the measurement equation to control

for endogeneity. The matrix𝑄𝑚×𝑚 is set diagonal for simplicity. As in Sekine(2006), the estate

equation implies that all shocks have permanent effect on the time varying coefficients. Although,

it seems a oversimplifying assumption, it has many advantages. For example, small variance terms

in matrix 𝑄 provides evidence that the constant coefficients is the most adequate formulation.

The exchange rate through literature has many studies arguing that the exchange rate

pass-through is declining over time. Therefore, a stationary moving average formulation in the estate

1

Many attempts were made with different lags structures in the explanatory variables. The lag structure adopted

equation would imply a undesirable mean reversion behavior on the coefficients movement that is

not supported by the literature. Finally, specifications with up to 12 lag exchange rate terms were

tested. An AR(1) formulation for the coefficients would have (at least) 24 more parameters than

the adopted in this study, which would imply in a worthless computational enforce.

As proposed by Kim (2006), we added residual terms from the auxiliary regression in the

mea-surement equation to control for endogeneity. The reducing method from the previous subsection

has been used in order to impose the restrictions of the Purchasing Parity (PPP) or Producer

Currency Pricing (PCP) hypotheses, that is, ∑𝑚+1

𝑖=0 𝛽𝑖𝑡 = 1, and of the Local Currency Pricing

(LCP) hypothesis, i.e. null pass-through ∑𝑚

𝑖=1𝛽𝑖𝑡 = 0. The completeness of the exchange rate

passing-through means that all the variation of the exchange rate is passed to the domestic prices.

This is a key question for Economic Theory, since accepting it is implies accepting the PPP

hy-pothesis. On the other hand, the accepting that null exchange rate pass-through model is the

most adequate scenario implies that the exchange rate movements do not have an effect in the

domestic prices, and it follows that the monetary authority need not be concerned with exchange

rate movements to make monetary policy with price indexes.

The proposed model shows a good fit for all IPA-OG cited series, as can be seen in table 2.1,

below. For IPCA-MP the goodness of fit was not good, as expected. Since ICPA-MP is a index

of controlled prices, its movements are determined by political decisions, contracts and other ways

not considered by our economic model. Besides that, the estimation results for this series are

present to illustrate the methodology propose by Pizzinga and Fernandes (2008). For IPA-OGPI

series we included a 6 lags term for the dependent variable to control for autocorrelation pattern

in the residuals.

CHAPTER 2. PASS-THROUGH ESTIMATION IN BRAZIL 23

Table 2.1: Some quality of fit statistics of the adjusted models.

Model Pseudo𝑅2 MSE

IPA-OG 0.635 0.616

IPA-OGPA 0.378 3.796

IPA-OGPI 0.711 0.461

IPCA-MP 0.014 2.513

pass-through hypotheses are acceptable for the data, as seen in table 2.3. According to the values

of the AIC and BIC criteria, we have no evidence that both hypothesizes of none and full exchange

rate pass-though are the most adequate for the IPA-OG, IPA-OGPA and IPA-OGPI. Therefore, we

have evidence that there exist a partial exchange rate pass-through in Brazil in the sample period

for these series. The exception is the series IPCA-MP, the monitored consumer prices index. Since

the prices are controlled by the government, we do not expect to have a pass-through greater than

zero for this series, as we are using monthly data. 2. This is confirmed by the results. The model

for IPCA-MP shows some evidence that its exchange rate pass-through is zero in the long run, as

indicated by the AIC and BIC information criteria. This is a excepted result as the government

decisions regarding prices rely more on political aspects than on economic ones.

According to previous findings, the relation between exchange rate changes and inflation seems

to be statistically significant for different prices indexes series analyzed in this study, as can be seen

in Figures 2.1, 2.2 and 2.3. From these figures, we have evidence that coefficients have vared in

Brazil since 1999. Moreover, these figures indicate that this relation is declining over time, which

2

In Brazil, the controlled prices, such as rent, public transportation, educational, among others, have a annual

schedule of readjustment. Additionally, the political agenda decides whether some cost raise will passed through

Table 2.2: Information criteria observed values for incomplete, null and complete pass-through

exchange rate models.

Series Criterium unrestricted no pass-through full pass-through

IPA-OG

AIC 2.065 2.461 3.082

BIC 2.338 2.684 3.306

IPA-OGPA

AIC 3.987 4.119 5.077

BIC 4.260 4.343 5.300

IPA-OGPI

AIC 2.129 3.191 2.940

BIC 2.452 3.464 3.213

IPCA-MP

AIC 2.685 2.683 4.049

BIC 2.958 2.907 4.272

Table 2.3: P-values of the tests for null and complete pass-through exchange rate.

suggests that the estimates with constant pass-through coefficients are not valid.

Our results suggest that the contemporaneous effect of dollar variation in the analyzed index

prices variations is greater than zero. Its estimated values are mostly constant over time, but

the lagged effects are varying for the IPA-OG, IPA-OGPA and IPA-OGPI series. Therefore, it

is important to point out that almost all of the exchange rate pass-through verified is due to the

amount of the lagged exchange rate variation passed through to prices. This is reinforced by the fact

that the confidence interval for the smoothed coefficient of lagged exchange rate variation contains

zeros in some periods and does not in others. This may favor the macroeconomic environment

effect over pass-through. Some possible explanations for this are that depending on the credibility

CHAPTER 2. PASS-THROUGH ESTIMATION IN BRAZIL 25

2000 2001 2002 2003 2004 2005 2006 2007 2008

0.1 0.2

2000 2001 2002 2003 2004 2005 2006 2007 2008

−0.25 0.00 0.25

2000 2001 2002 2003 2004 2005 2006 2007 2008

0.55 0.60 0.65 0.70

Figure 2.1: IPA-OG smoothed coefficient of Δ log𝑒𝑡, Δ log𝑒𝑡−1and Δ log𝑦𝑡−1.

change the speed of his price adjustment. These hypotheses are going to be investigated later.

The inclusion of the lagged dependent variable with a time varying parameter helps us

inves-tigate whether there is variability of inflation persistence. For example, there are some authors

that argue that persistence in the inflation rate is greater during high inflation periods. If were

the case, the higher long run pass-through during high inflation periods could be a consequence

of higher persistence. Our estimates show that this is not the case for the series analyzed.

Al-though constant, the persistence is very high and statistical significant, around 0.60, for every

series. The lagged 6 IPA-OGPI term in Figure 2.3 is not significant, however it controls for serial

autocorrelation in the residuals. Therefore, we decide to keep it in the model to avoid inconsistent

estimators.

The estimates shown in figures 2.4, 2.5 and 2.6 are the long run estimates for the pass-through.

2000 2001 2002 2003 2004 2005 2006 2007 2008 0.00

0.25 0.50

2000 2001 2002 2003 2004 2005 2006 2007 2008

0.0 0.5

2000 2001 2002 2003 2004 2005 2006 2007 2008

0.5 0.6

Figure 2.2: IPA-OGPA smoothed coefficient of Δ log𝑒𝑡, Δ log𝑒𝑡−1 and Δ log𝑦𝑡−1.

over time. Although there are some periods in which it is not verified (i.e. from 2002 to 2003 and

from 2005 to 2006), its value keeps declining until where we see slightly increase 2008.

The high persistence produces high variations in the long run pass-through. For example, it

reaches values as high as 0.90 during the crisis period of 1999 and 2002 for all studied series. It

highlights the importance of the autoregressive term in the measurement equation for the long run.

The agricultural prices have had a step decline since 1999. Since the two peaks of 1999 and

2002, the long run pass-through has declined and converged to almost 0.20. One of the possible

explanations to this is a increase in the competition.

Industrial prices have a similar behavior, with more intense decline. After reaching values

around 1 in 2002, the exchange rate pass-through estimated values were around 0.1, 10% of the

value in the crisis period. It is important to notice that there was a peak in the decreasing trend

CHAPTER 2. PASS-THROUGH ESTIMATION IN BRAZIL 27

2000 2005

0.00 0.05 0.10 0.15 0.20

2000 2005

−0.2 0.0 0.2

2000 2005

0.55 0.60 0.65

2000 2005

0.00 0.05 0.10 0.15

Figure 2.3: IPA-OGPI smoothed coefficient of Δ log𝑒𝑡, Δ log𝑒𝑡−1(top), Δ log𝑦𝑡−1 and Δ log𝑦𝑡−6

(bottom).

the same time, world demand was growing sharply. This led to an increase in demand of industrial

goods because of a lack of competition. Therefore, cost movements and exchange rate changes

were more easily passed through to prices, including exchange rate changes. That is a possible

reason why the pass-through increased in this period. The central bank was forced to implement

a strong restrictive monetary policy that caused a reversion in inflation expectations and reduced

the exchange rate pass-through.

An important fact is the increase in pass-through in 2003 before the Brazilian elections. The

fear of macroeconomic policy changes caused a decrease in foreign investments. The expectation

was that the exchange rate would be devalued for a long time, consequently, agents anticipated

this expected devaluation and changed their prices. However, they realized that economic policies

2000 2001 2002 2003 2004 2005 2006 2007 2008 0.1

0.2 0.3 0.4 0.5 0.6 0.7 0.8

Figure 2.4: IPA-OG long run pass-through.

2000 2001 2002 2003 2004 2005 2006 2007 2008

0.2 0.3 0.4 0.5 0.6 0.7 0.8

CHAPTER 2. PASS-THROUGH ESTIMATION IN BRAZIL 29

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0

Figure 2.6: IPA-OGPI long run pass-through.

through this valuation of domestic currency.

These results strongly reinforce the belief that the pass-through is declining in Brazil for

whole-sale prices. It is important to note that 1999 and 2002 were periods of much domestic uncertainty.

In January 1999, Brazil shifted from fixed to a flexible exchange rate regime and suffered a strong

crisis of credibility. According to the Calvo and Reinhart (2000) both lack of credibility and

volatility of exchange rate are linked to a high exchange rate pass-through.

We tested whether the explanatory variables are significant in the model and we found that none

of the coefficients in the measurement equation were significant at the usual levels of significance.

Likelihood tests were conducted for the constant coefficients in the model. The results in Table

Table 2.4: Estimates of the IPA-OG, IPA-OGPA and IPA-OGPI series (p-values between

paren-thesis).

Model constant 𝑣𝑡 𝑝𝑖𝑏𝑡−1 𝑝𝑝𝑖𝑡−1

IPA-OG

0.3233 -0.024 0.017 0.082

(0.000) (0.505) (0.249) (0.071)

IPA-OGPA

0.475 -0.062 0.027 0.002

(0.021) (0.537) (0.508) (0.986)

IPA-OGPI

0.276 -0.023 0.019 0.078

(0.003) (0.512) (0.197) (0.071)

IPCA-MP

0.428 -0.040 -0.001 0.085

(0.000) (1.000) (0.962) (0.165)

at the usual significance levels3.

2.3.2

Determinants

Some of the changes in the Brazilian economy appear to have exacerbated fluctuations in exchange

rates. The liberalization of capital flows in the last two decades and the increase in the scale of

cross-border financial transactions have increased exchange rate movements. Currency crises in

emerging market economies are unique examples of high exchange rate volatility. In Brazil, these

large movements in exchange rate may be associated with greater pass-through to prices as seen

in Figure 2.7.

Given the results presented in the previous section, we reformulate the model. Since the

3

CHAPTER 2. PASS-THROUGH ESTIMATION IN BRAZIL 31

2000 2002 2004 2006 2008

0.00

0.05

0.10

0.15

0.20

Time

Figure 2.7: Tested determinants of pass-through: Monetary policy, (solid line), variance of

ex-change rate (dashed line) and international trade (dotted line).

coefficients of the contemporaneous effect of the exchange rate on the wholesale price indexes are

mostly constant, we decide to introduce them with constant coefficients. The same was done to

the persistence coefficients. In addition, all variables statistically null in the former model were

excluded from the actual one. The only exception was the error term to control for endogeneity

of the contemporaneous log difference of exchange rate pass-through. Futhermore, we tried to test

the importance of some determinants of exchange rate pass-through. For this purpose, we made

changes in state equation and we introduced some explanatory variables in the state equation. As

Δ log 𝑝𝑡=𝛽1𝑡Δ log 𝑒𝑡−1+𝜓0+𝜓1Δ log 𝑒0+𝜓2Δ log𝑝𝑡−1+𝜀𝑡, 𝜀𝑡∼𝑁 𝐼𝐷(0, 𝜎2) (2.8)

𝛽𝑡+1=𝛽𝑡+𝛾𝑑𝑡+𝜂𝑡, 𝜂𝑡∼𝑁 𝐼𝐷(0, 𝑄). (2.9)

The former equation linearly relates the observed monthly log-variation of price to the log-variation

of exchange rate from time𝑡to time time𝑡−1 and to its own value at time𝑡−1. The coefficient

of Δ𝑙𝑜𝑔 𝑒𝑡−1 in equation (2.8) is the state coordinate and its dynamics are given in equation (2.9).

This equation now has the explanatory variable (or “determinant”),𝑑𝑡, with coefficient 𝛾and an

error term with variance𝑄.

Guided by the literature presented in the previous sections, we tested four explanatory variables

for the latent exchange rate pass-through coefficients: the difference between the exchange rate

variance of daily log returns from time𝑡 to time 𝑡−1, 𝑑𝑣𝑑𝑛𝑒𝑟𝑡; the variation of the ratio of the

inflation expectation and the inflation target set by the central bank from time𝑡 to time 𝑡−1,

𝑑𝑝𝑚𝑡; the log difference of the trade flow (given by the sum of exports and imports) divided by

the real GDP from time𝑡to time𝑡−1,𝑑𝑙𝑓 𝑙𝑜𝑤𝑡; and the log difference of the Brazilian IPCA (a

consumer price index computed by the Brazilian Census Bureau, IBGE) from time𝑡to time𝑡−1. We also included one lag for each variable because all these variables are likely to be endogenous.

The coefficient gamma represents the effect of each “determinant” over the dynamic of exchange

rate pass-through.

The monetary policy measure is the change in inflation expectation over the inflation target.

In an inflation targeting regime, the central bank uses one monetary policy rule to accommodate

inflation expectations close to the target set before. In an attempt to identify the success of the

CHAPTER 2. PASS-THROUGH ESTIMATION IN BRAZIL 33

average of the difference of inflation expectations of 12 months ahead over the inflation target. To

control for the monetary policy’s forward looking behavior, we set a moving weight, as follows

𝑝𝑚𝑡= (1/12)(𝐸𝑡(𝜋𝑡+12)−¯𝜋𝑡+12) + (1−𝑗/12)(𝐸𝑡+1(𝑡+ 13)−𝜋𝑡+13), (2.10)

for𝑗= 1, . . . ,12.

Mishkin (2008) stated that the correlation between inflation and the rate of nominal exchange

rate depreciation can indeed be high in an unstable monetary environment in which nominal shocks

fuel both high inflation and exchange rate depreciation. Furthermore, the evidence suggests that

even countries where inflation and exchange rate depreciation appear to be fairly closely linked

over time, have experienced a sizable decline in pass-through following the adoption of improved

monetary policies. To test if the credibility of the Brazilian Central Bank has been decreasing the

exchange rate pass-through, we created a monetary policy variable as the inflation expectation (by

Boletim FOCUS) over the inflation target. The credibility and the efficiency of the monetary policy

tend to hinder the ability of price makers to adjust their prices. In an stable inflation environment,

the agents are less likely to adjust their prices.

Taylor (2000) argues that the exchange rate pass-through has a positive relation to the

per-sistence of costs changes. If the volatility of changes in exchange rates is associated with its

persistence, smaller volatility periods will be followed by a smaller degree of pass-through. The

volatility in exchange rate can represent uncertainty in the economy, where large exchange rate

movements could more be easily passed through to prices.

Our results show a statistical significant association between exchange rate volatility and

pass-through. In periods with high uncertainty, large variations in exchange rate are positively correlated

Table 2.5: Estimated parameters and corresponding p-values (in parenthesis).

Series 𝑑𝑣𝑑𝑛𝑒𝑟𝑡 𝑑𝑣𝑑𝑛𝑒𝑟𝑡−1 𝑑𝑝𝑚𝑡 𝑑𝑝𝑚𝑡−1 𝑑𝑓 𝑙𝑜𝑤𝑡 𝑑𝑓 𝑙𝑜𝑤𝑡−1

IPA-OG

2.230 2.273 2.977 −0.912 −0.304 −0.328 (0.001) (0.000) (0.051) (0.493) (0.265) (0.223)

IPA-OGPA

3.493 3.687 4.097 −1.027 −0.416 −0.427 (0.002) (0.002) (0.231) (0.757) (0.028) (0.028)

IPA-OGPI

1.717 1.646 −5.246 −5.247 −0.143 −0.198 (0.033) (0.045) (0.036) (0.036) (0.665) (0.551)

Table 2.6: Estimated parameters and corresponding p-values (in parenthesis).

Series 𝑑𝑙𝑛𝑡𝑟𝑎𝑑𝑒𝑓 𝑙𝑜𝑤/𝐺𝐷𝑃𝑡 𝑑𝑙𝑛𝑡𝑟𝑎𝑑𝑒𝑓 𝑙𝑜𝑤/𝐺𝐷𝑃𝑡−1 𝑑𝑙𝑛𝐼𝑃 𝐶𝐴𝑡 𝑑𝑙𝑛𝐼𝑃 𝐶𝐴𝑡−1

IPA-OG

−0.178 −0.179 −0.005 −0.005 (0.551) (0.569) (0.484) (0.423)

IPA-OGPA

−0.535 −0.565 −0.007 −0.006 (0.033) (0.026) (0.322) (0.291)

IPA-OGPI

−0.224 −0.136 −0.001 −0.002 (0.447) (0.666) (0.858) (0.817)

pass-through dynamics for all price indexes, more strongly agricultural prices. The trade openness

variable is only significant for exchange rate pass-through to agricultural prices. If an economy

is more open to foreign goods, it will face more competition and market power of producers will

decrease. For the whole IPA and for industrial products, the increase in imports share is less

pronounced and the effect over pass-through decline is not statistically significant. In the case of

CHAPTER 2. PASS-THROUGH ESTIMATION IN BRAZIL 35

the sector and reduced the propensity to pass-through cost changes to prices.

For the monetary policy variable, we found mixed results. For agricultural prices, the monetary

policy did not explain the pass-through. However, the exchange rate pass-through to industrial

prices was negatively associated with the monetary policy, where a large misalignment between

inflation expectations and the target is related to a smaller pass-through. We found that credibility

and a smaller deviation of expectation over the inflation target decrease the incentives to readjust

prices for the IPA only.

The variable𝑑𝑙𝑛𝐼𝑃 𝐶𝐴was introduced as an attempt to capture the inflationary environment.

With this variable we did not obtain evidence that the inflation environment affects the exchange

rate pass-through, as shown by table 2.6.

2.4

Conclusions

In this paper we estimated the evolution of the exchange rate pass-through for some wholesale

indexes prices in Brazil with a Gaussian state space model.

Using our formulation we were able to investigate some important aspects as endogeneity

be-tween exchange rate pass-through and the indexes prices, aggregation effects and persistence

vari-ation over time. We were also able to investigate the significance of some possible “determinants”

of exchange rate pass-through.

The estimates shown suggest that the the short run and long run exchange rate pass-through

are declining over time. Around 2002, the presidential election year President Lula ran for office,

the short run pass-through had risen to approximates one. Since then, the short run pass-through

variable are constant over time, indicating that the persistence of inflation is not varying. This

implies that if the long run pass-through changes over time, it is be due to the variation of the

short run pass-through.

We did not find strong evidence that there are important endogeneity from Brazilian wholesale

price indexes on exchange rate.

The data for the wholesales indexes does not support the null and the full exchange rate

pass-through hypotheses. This reinforces the belief that there exists a positive, although incomplete,

exchange rate pass-through in Brazil. For illustration propose, we estimated our model to a

Brazilian price index for monitored prices. In this case the estimates confirmed our previous belief

that there is no exchange rate pass-through for monitored prices.

Finally, we motivated and tested the importance of set exchange rate pass-through determinants

suggested by the literature on exchange rate pass-through. We obtained strong evidence that the

variance of exchange rate causes a greater pass-through to prices. We also obtained evidence that

some variables are able to explain the pass-through of some index prices but not of others. For

example, we found evidence that adjusting monetary policy led to a reduction in the pass-through

to industrial prices but not to agricultural prices. On the other hand, an increase in trade flow

results in a decrease the pass-through to agricultural prices but not to industrial prices. We had

Part II

Coincident and Leading Indexes of

Economic Activity

A State Space Model for Indices

of Economic Activity

3.1

Introduction

Traditionally, business-cycle research has focused on sophisticated econometric models aiming to

capture the main features of either GDP or of the four coincident variables that the NBER is

said to follow (employment, industrial production, income and sales) to estimate coincident and

leading indices of economic activity, establish business-cycle turning points, as well as to estimate

their respective probability of occurrence; see Stock and Watson (1988a, 1988b, 1989, 1991, 1993a),

Hamilton (1989), Kim and Nelson (1998), Harding and Pagan (2003), Hamilton (2003), and

Chau-vet and Piger (2008),inter-alia. Arguably, these models mis a key variable that should be included

in them – the NBER decisions on U.S. turning points as determined by its business-cycle dating

CHAPTER 3. A STATE SPACE MODEL FOR INDICES OF ECONOMIC ACTIVITY 39

committee. Although this information is usually available with a considerable lag, there is no

reason not to include it ex-post on econometric models. This point was forcefully made in Issler

and Vahid (2006).

There has been a recent trend of incorporating NBER dating-committee decisions into different

business cycle econometric models. Although some of these contributions are independent, they all

recognize that one should not discard the informational content of these decisions when constructing

econometric models; see Birchenhall et al. (1999), Dueker (2005), Issler and Vahid, and Chauvet

and Hamilton (2006). A key aspect of the NBER dating committee is that there are some changes in

its members through time. Additionally, shocks hitting the economy affect GDP and key economic

variables that the NBER is said to follow in a different manner, either happens because these

shocks vary across time (i.e., supply shocks in one recession and demand shocks in another) or

because some of these relationships are indeed not stable. Thus, in building econometric models

using the NBER-committee decisions we should consider the possibility of time-varying weights in

econometric relationships.

Our first original contribution is to propose a state-space model with time-variable weights

using the decisions to construct coincident and leading indices of economic activity for the U.S.

economy. Our model is a probit regression of NBER decisions on the coincident series, where

instrumental-variable techniques are needed to consistently estimate time-varying weights of this

index. In estimation, we apply the extended iterated Kalman filter and use the Rivers and Voung

(1988) procedure to correct for simultaneity. Also, we account for the fact that NBER decisions

on whether there is or not a recession at time𝑡 is made well into the future, i.e., in time𝑡+ℎ,

ℎ >0.