M

ASTER

M

ATHEMATICAL

F

INANCE

M

ASTER

’

S

F

INAL

W

ORK

D

ISSERTATION

C

ALIBRATION OF THE

PIIGGS

C

REDIT

S

PREADS

THE IMPACT OF THE 2007-2012

FINANCIAL CRISIS

J

OANA

A

NDREIA

C

OSTA

S

ILVA

M

ASTER

M

ATHEMATICAL

F

INANCE

M

ASTER

’

S

F

INAL

W

ORK

D

ISSERTATION

C

ALIBRATION OF THE

PIIGGS

C

REDIT

S

PREADS

THE IMPACT OF THE 2007-2012

FINANCIAL CRISIS

J

OANA

A

NDREIA

C

OSTA

S

ILVA

S

UPERVISOR

:

R

AQUEL

M

EDEIROS

G

ASPAR

List of Abbreviations

ECB European Central Bank

PCA Principal Component Analysis

PIIGGS Portugal, Ireland, Italy, Germany, Greece and Spain

PIIGS Portugal, Ireland, Italy, Greece and Spain

TS Term Structure

Abstract

ECB (European Central Bank) is daily analyzing the term structure of interest rates (also denominated yield curve) since September 6, 2004. In this analysis the Svensson (1994) model is used to calibrate the yield curve for the euro zone, usually referred to as default-free yield curve.

On the basis of the historical parameters data of the Svensson (1994) model avail-able from ECB, the default-free yield curve are calibrated in the period from September 6, 2004 to March 2, 2015. Moreover it is performed a principal component analysis (PCA) of the default-free yield curve and an analysis of structural break with respect to the temporal evolution of the Svensson (1994) parameters.

The two addressed analyses have as goal to understand the impact of the 2007-2012 financial crisis upon the calibration of the default-free yield curve. With these analyses, we conclude that a change on the behavior of the parameters occurs in 2009 and that the significance of the first three principal components, which explain the most behavior of the default-free yield curve, is much more obvious in the period after this break point.

Approaching an analogous methodology as ECB, the yield curves for Germany and for peripheral countries of the euro zone: PIIGS (Portugal, Ireland, Italy, Greece and Spain) are calibrated. Moreover a PCA of the yield curve of each mentioned country is achieved in three distinct periods. This analysis allows to conclude that in the most countries in study the significance of the first principal components change throughout the 2007-2012 financial crisis. It means that the Svensson (1994) model, used by ECB, can not be the most suitable for the period after this crisis.

Resumo

O BCE (Banco Central Europeu) analisa diariamente, desde 6 de setembro de 2004, a estrutura temporal das taxas de juro (tamb´em designada poryield curve). Nessa an´alise ´e utilizado o modelo deSvensson(1994) para calibrar a yield curve para a zona euro, usualmente denominadadefault-free yield curve.

Com base no hist´orico dos parˆametros do modelo de Svensson (1994) disponibi-lizado pelo BCE, asdefault-free yield curves˜ao calibradas, em cada dia ´util, no per´ıodo de 6 de setembro de 2004 a 2 de marc¸o de 2015. ´E realizada uma an´alise de compo-nentes principais (ACP) dadefault-free yield curvee uma an´alise de quebra de estrutura da evoluc¸˜ao temporal dos parˆametros associados ao modelo deSvensson(1994).

As duas an´alises realizadas tˆem como objetivo perceber o impacto da crise na calibrac¸˜ao da default-free yield curve. Com essas an´alises conclu´ı-se que existe uma mudanc¸a de comportamento dos parˆametros ap´os 2009 e que a significˆancia das trˆes primeiras componentes principais, que explicam a maior parte do comportamento da default-free yield curve, torna-se mais evidente no per´ıodo de 2009 em diante.

Seguindo uma metodologia an´aloga ao BCE, s˜ao calibradas asyield curvespara a Alemanha e para os pa´ıses perif´ericos da zona euro: PIIGS (Portugal, Irlanda, It´alia, Gr´ecia e Espanha), sendo tamb´em realizada uma ACP das yield curves de cada um destes pa´ıses, em trˆes per´ıodos distintos. Essa an´alise permite concluir que, na maior parte dos pa´ıses em estudo, a significˆancia das primeiras componentes principais altera-se com a crialtera-se financeira de 2007-2012, sugerindo que o modelo deSvensson(1994), usado pelo BCE, n˜ao ´e o mais adequado no per´ıodo ap´os essa crise.

List of Figures

1 Chow (1960) test. Font: Grob (2003) . . . 7

2 Svensson (1994) historical parameters from ECB calibration . . . 9

3 Functional block diagram: methodology . . . 17

4 Default-free yield curve . . . 19

5 Default-free yield curves . . . 19

6 Parameterβ0and break point . . . 20

7 PCA: default-free yield curve . . . 22

8 Credit spread TS . . . 23

9 Credit spreads TS . . . 25

A. 1 Portugal yield curve . . . 32

A. 2 Portugal yield curves . . . 33

A. 3 Ireland yield curves . . . 33

A. 4 Ireland yield curve . . . 34

A. 5 Italy yield curve . . . 35

A. 6 Italy yield curves . . . 35

A. 7 Germany yield curve . . . 36

A. 8 Germany yield curves . . . 36

A. 9 Greece yield curve . . . 37

A. 10Greece yield curves . . . 38

A. 11Spain yield curves . . . 38

List of Tables

1 Average of available bonds for the PIIGGS . . . 10

2 PCA: default-free yield curve . . . 21

3 PCA: credit spreads TS: 6Sep2005 - 14May2009 . . . 26

4 PCA: credit spreads TS: 15May2009 - 2Mar2015 . . . 26

5 PCA: credit spreads TS: Complete period . . . 26

A. 1 PCA: yield curves - 6Sep2005 - 14May2009 . . . 39

A. 2 PCA: yield curves - 15May2009 - 2Mar2015 . . . 40

Contents

1 Introduction 1

2 Literature Review 3

2.1 Term structure of interest rates modeling . . . 3

2.2 Credit spreads term structure . . . 6

2.3 Structural breaks in time series . . . 6

2.4 Principal component analysis . . . 7

3 Data 8 4 Methodology 11 4.1 Default-free yield curve . . . 11

4.1.1 Structural break . . . 11

4.1.2 Principal component analysis . . . 12

4.2 PIIGGS yield curve and credit spreads . . . 14

4.2.1 Calibration of yield curve . . . 14

4.2.2 Credit spreads term structure . . . 15

4.3 Functional block diagram . . . 16

5 Results 18 5.1 Default-free yield curve . . . 18

5.1.1 Structural breaks in the parameters . . . 20

5.1.2 Principal component analysis . . . 21

5.2 Credit spread TS for PIIGGS . . . 22

Joana Costa Silva Calibration of the PIIGGS credit spreads

6 Conclusion 28

References 29

Chapter 1

Introduction

Interest rates are an important and crucial issue in the financial markets. A great number of activities in the market (like pricing financial assets and their derivatives, managing financial risk or structuring fiscal debt) is determined by the behavior of the term struc-ture of interest rates (also denominated yield curve).

Over the years, several authors have studied methods of fitting the yield curve, finding different classes of models, deterministic or stochastic, to adjust and predict the term structure of interest rates.

Central banks are responsible for maintaining the equilibrium of the economies, controlling mainly the inflation level. It is, thus, essential to pay special attention to the modeling of interest rates.

The main goal of this dissertation is to calibrate the credit spread term structure for some countries in the euro zone. The focus is on the so-called PIIGS, i.e. Portugal, Ireland, Italy, Greece and Spain plus Germany. We focus on the standard PIIGS because they are considered the euro zone countries with the highest credit risk. Germany is additionally considered because it is usually seem as the one with the least credit risk. Germany’s yield curve can be also seem as an alternative to the ECB yield curve and used as a proxy for the euro zone default-free yield curve.

This study uses, therefore, the abbreviation PIIGGS (PIIGS plus Germany) to refer to the countries under analysis.

Joana Costa Silva Calibration of the PIIGGS credit spreads

the Svensson (1994) model is then used to calibrate the PIIGGS yield curve.

We start by doing a daily analysis of the Svensson (1994) parameters for the default-free yield curve. We analyse the evolution of these parameters, comparing their behav-ior before and after the peek of the financial global crisis of 2007-2012. The purpose is to understand if there has been any structural break that can be directly associated with this crisis. In addition, we compute the credit spread TS for each PIIGGS country.

A principal component analysis is performed for the default-free yield curve of the euro area and on the yield curve for each of the PIIGGS countries.

As opposed to the previous literature, the focus of this work is on the credit spreads term structure. Since the recent debt crisis in Europe credit spreads have been at the core of debates. The ECB default-free yield curve and market data of government bonds of PIIGGS are used to calibrate each credit spread TS of these countries. For this, the yield curve for each country is then needed to be calibrated.

This joint analysis of the yield curve and of the various credit spreads TS allows to obtain coherent results, giving rise to more instructive conclusions.

The remaining of this dissertation is organized as follows. Chapter 2 presents the literature review, introducing the more important facts regarding the term structure of interest rates modeling as well as the credit spreads term structure. Additionally, an introduction to the methodology of structural breaks and principal component analysis is also provided.

Chapter 3 describes the data used by ECB on its calibration of default-free yield curve and the data collected for PIIGGS bonds.

Chapter 4 presents the procedure used by the ECB and the methodology employed to calibrate the yield curve and the credit spreads TS for the PIIGGS.

Chapter 2

Literature Review

In this chapter we present the state of the art regarding the main important topics dis-cussed in this dissertation. This chapter as organized as follows.

Section 1 provides an overview about the term structure of interest rates model-ing, specifying the most popular models used for calibrating the yield curve. Section 2 gets an introduction to the credit spreads term structure. Section 3 describes the Chow (1960) test used for analysing the possible structural break in the behavior of the Svensson (1994) parameters. Finally, Section 4 provides an introduction to the PCA method.

2.1

Term structure of interest rates modeling

There are many authors that study the term structure of interest rates.

According to ECB, the yield curve represents the relationship between market default-free remuneration rates and the remaining time to maturity of debt securities.

Cox et al (1985, pp. 385) say “The term structure of interest rates measures the relationship among the yields on default-free securities that differ only in their term to maturity”.

Although most fixed income instruments bear coupons. The yield curve is, by def-inition, a zero-coupon yield curve. That is, it is a curve that associate the yield of zero-coupon bonds (ZCB) to their maturity, at a given moment in time.

Joana Costa Silva Calibration of the PIIGGS credit spreads

bonds and other fixed income to extract the theoretical, arbitrage free, yield curve. This process is called bootstrapping and it allows to obtain several points of the yield curve. Still, several points are far from enough, specially for pricing and hedging.

The yield curve shall be obtained using a uniform methodology for each currency, based on financial instruments traded in liquid and transparent markets. This allow us to avoid technical biases errors and therefore the best way to shape the yield curve is then using government bonds.

Deterministic models allow to fit a parcimonious parametrization to market data. In turn, deterministic models are a key input to most stochastic models.

The majority of models developed surrounding term structure of interest rates can be split into three general classes: no-arbitrage models, equilibrium models and para-metric or statistical models, as stated for Novais (2012).

The most popular deterministic models are the Nelson and Siegel (1987) model and the Svensson (1994) model. These two models are based on the same idea: yield curves are essentially monotonic, humped or, occasionally, S shaped.

Nelson and Siegel (1987) concluded that a class of functions that readily generates the typical yield curve shapes are the ones associated with solutions of differential or difference equations. In this way, they described the yield as a function of maturity for the equal roots, for a given trade datet, with the following expression:

yt(τ) =β0,t+β1,t

1−exp −τ λt τ λt

+β2,t

1−exp −τ λt τ λt −exp −τ λt , (2.1)

whereyt(τ)is the yield at timetof a ZCB with maturityτ,β0,t,β1,tandβ2,t andλt

are constants at timet.

The parameters β0,t, β1,t and β2,t can be interpreted the long, short and medium

term components of the yield curve, respectively.λt is a scalar parameter which affects

the weight functions for β1,t andβ2,t, determining the position of the hump, andτ is

the remaining time to maturity.

re-Joana Costa Silva Calibration of the PIIGGS credit spreads

sponsible for the change in shape of the term structure as time,t, so by.

The parameters of the model should have the following properties:β0,t >0,λt>0

andβ0,t+β1,t >0.

Svensson (1994) suggested adding a second factor of hump type, allowing for a term structure with possibly two humps at different maturities. The Svensson parame-terization is:

yt(τ) =β0,t+β1,t

1−exp

−τ λ1,t

τ

λ1,t

+β2,t

1−exp

−τ λ1,t

τ

λ1,t

−exp

−τ λ1,t

+

+β3,t

1−exp

−τ λ2,t

τ λ2,t

−exp

−τ λ2,t

, (2.2) whereβ0,t,β1,tandβ2,tandλt=λ1,tare as in (2.1) andβ3,tandλ2,tis also constants,

at timet.

The restrictions are the same as those applied to the Nelson and Siegel (1987) model, with the addition ofβ3,t>0 andλ2,t>0.

The great majority of the studies is focused on the prediction and the explanatory power of the yield curve models, like for example Dielbold and Li (2005) and the references there in.

Others aim to analyse the macro and/or microeconomics factors responsible for the yield curve evolution. An example of a study of that nature is Afonso and Martins (2010).

From a different perspective, there are also those who focus on the various boot-strapping techniques, looking for the most efficient way of obtain yield curve data points from market data. See, for instead Hlad´ıkov´a and Radov´a (2012) or Annaert et al (2000).

Joana Costa Silva Calibration of the PIIGGS credit spreads

time and make considerations about the impact the financial crisis 2007-2012 had on the parameters dynamics.

2.2

Credit spreads term structure

In the research, it is already common to consider the credit spreads as the difference between the yield curve and the default-free yield curve, available by ECB, for the same maturity.

Many authors argue that there is a relationship between credit spreads and the rating of each country. For example, Bedendo et al (2004, pp. 5) say “As expected, credit spreads are higher on average for lower rating groups, as well as more dispersed”.

In this dissertation, we use the ECB default-free yield curve and market data of government bonds of PIIGGS, to calibrate the credit spread TS for these countries.

2.3

Structural breaks in time series

A structural break happens when there is an unexpected change in the behavior of the time series. When the time series is described by a linear model and we want to verify if a break point occurs throughout the time series, the Chow (1960) test is usually applied to verify the accuracy of such break point. However, when the point where the break occurs is unknown, there are other tests which were developed by Andrews (2003) and Perron (2005) to determine this unknown break point.

Chow (1960) test examines whether parameters of linear regression for one group of data set are equal to those of other set, as stated by Howard (2008). So, the coef-ficients stability of a linear regression model of the typeyi=Xiβi+εi are examined.

This stability is measured through the division of data represented in subsamples (for example,i=1, ...,60 and i=60, ...,100), where this division is defined by the break

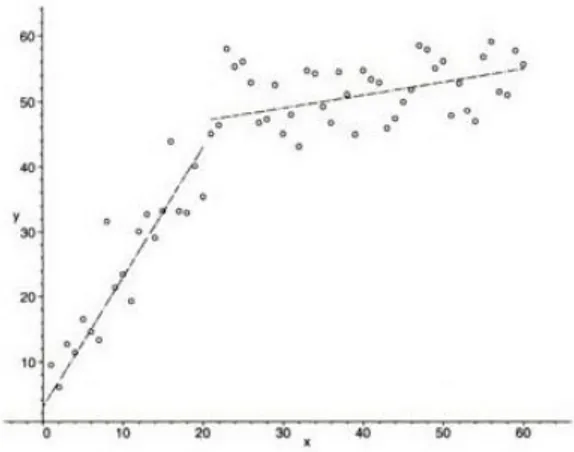

points. Once the coefficients are estimated from the initial subsamples, its compatibil-ity with the data of the original sample (y) can then be tested. Figure 1 illustrates the idea of the Chow (1960) test.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Figure 1: Chow (1960) test. Font: Grob (2003)

are break points in the temporal evolution of the Svensson (1994) parameters which are used to calibrate the default-free yield curve.

2.4

Principal component analysis

The principal component analysis (PCA) is a statistical method frequently used in the study of the dynamics/behavior of a data set, being especially useful to determine the major factors that allow the description or explanation of this behavior. This method consists in transforming linearly a number of possibly correlated variables into a same number of non-correlated variables, the so called principal components.

In this dissertation it is intended to study the dynamics of the default-free yield curve, the yield curve as well as the credit spreads TS of each of the PIIGGS countries. The goal is understanding how many principal components, shall a deterministic model take into account, are sufficient to explain the majority of this behavior. Furthermore it is also intended to determine what explanatory power the principal components have in this behavior.

The basic idea behind the PCA is to study the correlation between variables identi-fying common behavior patterns and mimicking this behavior using the fewest possible non-correlated variables that allows explain a major proportion of the total variability of the data set. The goal is to generate a new set of variables that are a linear combination of the initial set of variables.

Chapter 3

Data

Daily, ECB determines the term structure of default-free interest rates for the euro zone using the Svensson (1994) model, as mentioned above. That calibration uses AAA bonds issued in euros by governments of euro area and subject to the several con-straints. Some of these constraints are: only fixed coupon bonds with a finite maturity or zero coupon bonds and actively traded central government bonds and with a maxi-mum bid-ask spread per quote of three basis points. More details are available at the ECB technical notes, accessible on ECB website.

In order to reflect a sufficient market depth, ECB fixes the residual maturity brackets as ranging from three months up to and including 30 years.

Figure 2 shows the historical parameters of euro area default-free yield curve, pro-vided by ECB in its website.

In order to perform a coherent comparison between our results on the PIIGGS yield curve calibration and the ECB default-free yield curve, we consider the same con-straints about coupons and maturities of the government bonds for these countries.

So, for PIIGGS we consider all fixed coupon bonds issued in euros, from September 6, 2004 to March 2, 2015. For each bond we collect information about the coupon rate, maturity date, trade date and the clean price at the moment of closure of the trade market. This data can be extracted from Bloomberg, a database that provides current and historical financial quotes.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Figure 2: Svensson (1994) historical parameters from ECB calibration

curve. Table 1 shows the average of the bonds, per day, in each year of the period in study.

Note that the data sets of the 2004 and 2015 years have less observations than the remaining years. Indeed, the period in study starts at September 6, 2044 and ends at March 2, 2015. However the average of the available bonds of the years in study, are comparable with other bonds average. The average of the available bonds, in each year, is calculated taking into account the number of trading days in study for each year.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Average of available

Portugal Ireland Italy Germany Greece Spain bonds (per day)

2004 12.95 8.01 9.99 33.93 16.65 25.19 2005 13.42 8.05 9.02 33.84 14.82 24.83 2006 13.93 6.16 7.07 32.24 13.97 23.53 2007 13.47 6.11 6.01 33.21 13.13 23.19 2008 13.97 5.55 6.01 33.14 11.06 23.31 2009 14.97 8.34 6.34 32.75 9.76 24.86 2010 15.26 10.28 7.25 33.15 6.80 28.57 2011 14.63 9.86 16.65 34.66 4.21 31.72 2012 13.39 11.30 20.37 36.23 2.85 31.32 2013 13.39 21.20 22.53 37.41 0.00 33.47 2014 12.58 22.09 23.28 39.18 2.46 36.59 2015 12.00 24.10 23.84 39.83 4.00 39.07 Total 13.66 11.75 13.20 34.96 8.31 28.80

Chapter 4

Methodology

In this chapter, we describe the methodology used to obtain the main results of this dissertation. Section 1 presents a structural break method for analysing the structural change in the behavior of historical parameters by ECB. Furthermore, a PCA method is described. Section 2 provides an explanation of the methodology used for the calibra-tion of both yield curve and credit spreads TS. Seccalibra-tion 3 makes an funccalibra-tional diagram block (graphical diagram), for a better perception of the used methodology.

4.1

Default-free yield curve

4.1.1

Structural break

A structural break analysis is performed to check if there is a structural break in the behavior of the parameters throughout the period of the financial crisis 2007-2012. This analysis is performed using the Chow (1960) test.

It is known that throughout the period 2007-2012, the world economy faced a worse financial crisis which had effects in around whole world including in Europe. Because of that it is expected a structural break in this period. Then it is possible to use the Chow (1960) test with this period as an estimation of the range where the break point occurs.

Joana Costa Silva Calibration of the PIIGGS credit spreads

for the break points, the Chow (1960) test checks the presence of a structural break in each trading day of the period 2007-2012. For example, at the beginning an analysis is accomplished comparing the slope of the linear regression that best fits the values of the parameters in the subsample from September 6, 2004 to January 2, 2007 with the slope of the regression that best fits the values of the parameters in the subsample from January 3, 2007 to March 2, 2015. Whether both slopes are similar, the Chow (1960) test accepts the null hypothesis which asserts that the coefficients are equal and therefore a structural break does not occur in January 2, 2007.

4.1.2

Principal component analysis

If a structural break occurs in the behavior of the Svensson (1994) parameters it makes sense to perform a PCA for default-free yield curve. Furthermore is performed a PCA for the yield curve and for the credit spreads TS for each PIIGGS country.

We use PCA to analyse the behavior of the three curves for the whole period and the sub-periods before and after the structural break. It allows to understand if the first principal components become more or less significant after the financial crisis 2007-2012.

In order to do the PCA we consider observations of the default-free yield curve, yield curve and credit spreads TS in different maturities and in several trading days.

In order to facilitate the techniques used and improve the performance of the soft-ware we decided to implement the analysis for 32 different maturities, analyzing the daily behavior of the three curves in the three referred periods.

The methodology for performing the PCA at the default-free yield curve, for the whole period, is followed presented. The way in which this methodology is applied at both yield curve and credit spreads TS for each PIIGGS country is analogous, as well as for the other two sub-periods.

Joana Costa Silva Calibration of the PIIGGS credit spreads

months, 6 months and annual maturities between 1 and 30 years.

Thus, we have a matrix Xn×m containing the default-free yield curve values. In

order to measure the variation of the data set inX we resort to the covariance of matrix X given by:

1

n−1(X−µ)

T(X−µ)

whereµ is a vector containing the mean of each column ofXandT is the transpose matrix.

As Guedes (2008) argues, given the fact that PCA is not invariant to scale, the data used to perform the PCA, in this case the default-free yield curve data represented in matrixX, should be subject to standardization so that the principal components are not affected by the variable with the greatest variance. The variables should, therefore, be subtracted their average and divided by the standard deviation.

After this, the constant of proportionality 1

n−1 multiplied by the matrix X

TX

re-flects the variance of each spot rate associated with each variable, i.e. maturity. It is possible to transform the data set in a system with zero covariance using the eigenvalues and eigenvectors of matrixXTX.

The key to the use of the eigenvalues and eigenvectors is to be able to writeXTX= PDP−1, whereDis the diagonal of the matrix of themeigenvaluesλ1≥...≥λm≥0,

useful in the acquirement of the principal component of significance order, and P is the square matrix of themeigenvectors. Each column of matrix P, Pi, i=1, ...,32, is

linearly not-correlated to other columns, i.e.PiTPj=0, for eachi6= j, being associated

with the eigenvaluesλ1,λ2, and so on.

The eigenvalues are equal to the proportion of variance explained by each compo-nent.

It would be necessary to know the value of all themprincipal components in order to fully explain the overall system variance. However, considering the most significant principal components it is possible to explain the key behavior of the variance of the system, with little information being lost in the process.

Joana Costa Silva Calibration of the PIIGGS credit spreads

observations of the yield curve and the credit spreads TS, respectively. Furthermore, the two sub-periods are also considered to perform the PCA for the three mentioned curves.

4.2

PIIGGS yield curve and credit spreads

4.2.1

Calibration of yield curve

The yield curve of each PIIGGS country is obtained first bootstrapping each data set of country bonds and then using the Svensson (1994) model.

The idea is to resort to indirect methods for obtaining the Svensson (1994) model parameters. As stated in Gaspar (2009), these methods involve the following three steps:

1. Calculate dirty price through coupon rate, maturity date, clean price and trade date for a set of k bonds. For computing dirty price it is necessary to calculate the accrued interest;

2. Estimate the theoretical price applying the following equation:

ˆ

Pj(t) = ∑N

i=1

CFj(ti)exp(−(ti−t)R(t,ti;β))

whereCFj(ti)are the cash flows of bond jin trade datet andR(t,ti;β)is

calcu-lated using the Svensson equation, withβ= (β0,t,β1,t,β2,t,β3,t,λ1,t,λ2,t)a vector

of unknown parameters.

3. Finally, the parameters will be obtained through the minimum square method:

β =arg min ∑k

j=1

(Pˆj(t)−Pj(t))2

Joana Costa Silva Calibration of the PIIGGS credit spreads

In other words, having the theoretical prices and dirty prices, the parameters

β = (β0,t,β1,t,β2,t,β3,t,λ1,t,λ2,t) are obtained by minimizing the difference between

theoretical prices and dirty prices, for each bond and trading day. This minimization should take into account the restrictions of the Svensson (1994) model.

Then, we obtain the optimal parameters for each country considered and for each trading day throughout the period 6 September, 2004 to 2, March, 2015.

With these parameters, it is possible to calibrate the yield curve for PIIGGS.

4.2.2

Credit spreads term structure

Using the default- free yield curve made available by ECB, the credit spreads TS of each country is obtained.

The credit spread term structure is simply obtained as the difference between the yield curve calibrated for each country and the ECB default-free yield curve. Then, the expression for the credit spread TS is as follows:

CSt(τ) =β0,t−β0∗,t+

β1,tλ1,t

1−exp

−τ λ1,t

−β1∗,tλ1∗,t 1−exp −τ

λ1∗,t

!!

τ +

+

β2,tλ1,t

1−exp

−τ λ1,t

−β2∗,tλ1∗,t 1−exp −τ

λ1∗,t

!!

τ −β2,texp

−τ λ1,t

+

+β2∗,texp −τ

λ1∗,t

! +

β3,tλ2,t

1−exp

−τ λ2,t

−β3∗,tλ2∗,t 1−exp −τ

λ2∗,t

!!

τ −

−β3,texp

−τ λ2,t

+β3∗,texp −τ

λ2∗,t

!

(4.1)

Where β ={β0,t,β1,t,β2,t,β3,t,λ1,t,λ2,t} is the vector of parameters of the yield

curve from each country andβ∗={β0∗,t,β1∗,t,β2∗,t,β3∗,t,λ1∗,t,λ2∗,t}is the vector of

param-eters of the default-free yield curve.

Joana Costa Silva Calibration of the PIIGGS credit spreads

β1∗,t>0,λ1,t>0,λ1∗,t>0,λ2,t>0,λ2∗,t >0.

The limiting values of credit spreads as τ gets large is β0,t−β0∗,t and as τ gets

smaller isβ0,t−β0∗,t+β1,t−β1∗,t.

In other words, when the maturity date approaches zero, the credit spreads tends to the valueβ0,t−β0∗,t+β1,t−β1∗,t. As the maturity date assumes higher amounts, the

credit spreads approaches the straight lineβ0,t−β0∗,t, and this is one asymptote of the

graph of credit spreads.

Nothing guarantees that the horizontal straight lineβ0,t−β0∗,t+β1,t−β1∗,t assumes

positive values, consequently the credit spreads curves may tend to a negative values as the maturity assumes higher values.

An other question is the fact that the credit spreads curve may be negative when maturity date approaches zero, becauseβ0,t−β0∗,t+β1,t−β1∗,t may be negative, since

we have no guarantee thatβ0,t>β0∗,t andβ1,t>β1∗,t.

Although credit spreads TS are the difference between two Svensson (1994) expres-sions, they are not defined by a Svensson (1994) expression.

4.3

Functional block diagram

Figure 3 describes the methodology used to obtain the results presented in Chapter 5. We start by analyzing the evolution of the default-free yield curve parameters cali-brated by ECB, and verifying if there is a structural break in their behaviors, after the financial crisis 2007-2012.

Separately, the PIIGGS government bonds are used to calibrate yield curves for each country. This calibration requires, in particular, computing the dirty prices and theoretical prices under the Svensson (1994) model, for each bond. This procedure is performed every trading day between September 6, 2004 to March 2, 2015.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Finally, we calibrate the credit spread TS for each of the PIIGGS countries, using the results obtained in previous steps. The required data for this step are the yield curve for each country and the default-free yield curve. A PCA is also made for the credit spreads TS in the same periods of the yield curve PCA.

Chapter 5

Results

This chapter presents the main results obtained in this work.

The purpose of the Section 1 is to study the time evolution of the default-free yield curve and the Svensson (1994) model parameters daily calibrated by ECB. Whereas, Section 2 provides the results obtained on the credit spreads TS calibration for each PIIGGS country.

5.1

Default-free yield curve

Considering the Svensson (1994) parameters we aim to understand if there is a change in the behavior of the parameters with 2007-2012 financial crisis.

Some examples regarding the default-free yield curve during the period in research, are presented in Figure 4.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Figure 4: Default-free yield curve

The behavior of the default-free yield curve shows a change in 2009, presenting a considerable decreasing.

Figure 5: Default-free yield curves

Figure 2 shows the parameters of the euro area yield curve calibrated by ECB. By analyzing this figure it seems there is a change of the parameters behavior. This change seems to occur in the period which belongs into the 2007-2012 financial crisis.

Joana Costa Silva Calibration of the PIIGGS credit spreads

applying the Chow (1960) test.

5.1.1

Structural breaks in the parameters

In the Figure 6 we present the parameterβ0and the structural break obtained by

apply-ing the Chow (1960) test. It is possible to note that in 2009 there is a structural break estimated by the Chow (1960) test.

Figure 6: Parameterβ0and break point

Analysing the parameterβ0, the estimated structural break appears at May 14, 2009,

when the Chow (1960) test is applied. Therefore the structural break will appear a little before. Through analyzing the parameter behavior we can note that there is a strong break on its value at December 4, 2008, which makes sense because it is relatively close to the date of the bankruptcy of Lehman Brothers Holdings Inc. which had effects on the financial markets around the world.

The Chow (1960) test compares and verified if the slope coefficients of the two linear regressions related to the two subsamples are near.

For the remaining examined parameters, the slope of the two linear regressions is not significantly different and so the Chow (1960) test discloses a non-presence of a structural break. Then none structural break appears besides that the independent coefficients of both linear regression for each subsamples are considerably distinct.

Joana Costa Silva Calibration of the PIIGGS credit spreads

5.1.2

Principal component analysis

The results of PCA for default-free yield curve are reported in Table 2.

Default-free Yield Curve Principal Principal Principal Principal Component 1 Component 2 Component 3 Component 4 Sep 6, 2004 to

82.145% 15.592% 1.893% 0.289% May 14, 2009

May 15, 2009 to

95.189% 3.992% 0.540% 0.191% Mar 2, 2015

Sep 6, 2004 to

93.646% 5.831% 0.377% 0.101% Mar 2, 2015

Table 2: PCA: default-free yield curve

Analyzing the significance of the first principal components which explain the great part of the default-free yield curve behavior, it is possible to verify that in the period be-fore the structural break, the first four principal components are responsible by 99.92% of the default-free yield curve behavior.

In the period after the structural break, the first four principal components are re-sponsible for around the same percentage of the behavior of the default-free yield curve. Besides that it is important to highlight that the first principal component has much more explanation weight in that period than in the preceding structural break period.

When the analysis is made on the whole studied period (from September 6, 2004 to March 2, 2015) it is visible that they are responsible by 99,95%. Besides this dif-ference between the three periods is not significant, it is noticeable that in the whole studied period, the first three components have more weight than the same number of components in the periods before or after the structural break. It can probably mean that after the structural break (May 14, 2009) a model composed by three factors can be enough to calibrate the default-free yield curve, because the first principal component is much more significant.

The sensitivities of each rate versus their maturity from default-free yield curve, as analysed by Litterman and Scheinkman (1991), is shown in the Figure 7, for the first three principal components obtained, in the three distinct periods.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Figure 7: PCA: default-free yield curve

curve behavior. Indeed the weight factor of this component on the yield curve is almost the same in all maturities. This first component can be considered the level.

Relatively to the second principal component (PC2), its weight factor on the yield curve is not constant. An increase on the PC2 value means a increase on the short term rates and an decrease on the long term rates. This component can be interpreted as the steepness of the yield curve.

Finally, the PC3 modulates the yield curve curvature and moreover it is this com-ponent which has the lowest weight factor on the yield curve behavior.

5.2

Credit spread TS for PIIGGS

As already mentioned, the credit spread TS are obtained by the difference between the yield curve of the country in analysis and the default-free yield curve.

Figure 8 shows the credit spreads TS of the PIIGGS countries at four distinct dates. These dates are selected considering the start and end date of the studied period, as well the most remarkable events of 2007-2012 financial crisis.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Figure 8: Credit spread TS

as shown in Figure A.7. Some days present even negative credit spread, which means that their bonds have a risk ratio below the considered default-free rate.

Contrary to what happens with German bonds, from 2011, the Portuguese bonds show a lot of risk, having a very high credit spread. This shows the economic instability felt in the country during this period. In fact, in 2011, the rating of Portugal was BBB-, the lowest since 2004.

Ireland only shows a more relevant credit spread in 2011, at the crisis, remaining mostly stable and close to zero in the most of the rest of the studied period. In 2009, the yield curve behavior changed, presenting higher rates on the long maturities. This situation is reversed in 2011, where the long term rates have decreased.

Italy shows a credit spread TS superior in the period after 2009. In that period, the yield curve behavior turns to be more unstable meanly for the short term rates.

Due to the financial situation of the Greece, there is not bonds emission after a certain date (March 15, 2011).

Joana Costa Silva Calibration of the PIIGGS credit spreads

The graphics of the yield curves for PIIGGS are presented in Appendix, from Figure A.1 to Figure A.12.

In order to get a general view about the behavior of the PIIGGS credit spread TS throughout the studied period, it is presented in Figure 9, a graphic of the credit spread term structure for all trading days for each country.

After 2009, the Portugal credit spread TS follows an increase tendency, reaching the peek in 2011. This behavior is the opposite of the Germany, where its credit spreads decrease in that period.

Considering the period of the 2007-2012 financial crisis, the yield curve of the Ireland is very unstable. Indeed, in that period, the yield curve is very unpredictable, with strong transitions between negative and positive values. Moreover, sometimes it takes extreme values as it is possible to note in Figure A.4. This situation stems from the crisis where in that period the number of bonds available for market negotiation is low. It results in a inaccuracy of the Svensson (1994) parameters needed for the calibration of the yield curve and therefore for the calibration of the credit spread TS.

About short maturities, some short term rates for Germany are more higher. It happens because the number of bonds for short maturities is lower. Therefore the op-timization of the yield curve parameters are inaccuracy and sometimes incorrect. This inaccuracy is also observed in the credit spread TS.

With respect to the Greece, the yield curve was only calibrated until March 15, 2011 because after this date there are not more than 6 bonds and because of that it is not possible to optimize the parameters of the Svensson (1994) model. Therefore, the credit spread TS is not also calibrated after this date.

Such as the Ireland situation, the optimization of the parameters needed for the cal-ibration of the yield curve is not correct because the number of bonds available for market negotiation is low. Therefore the Greece yield curve provides exorbitant values such also the credit spread TS. In Figure A.9, it is easy to verify that in the last obser-vation months the credit spreads term structure already are too large and inadequate.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Figure 9: Credit spreads TS

5.2.1

Principal component analysis of credit spreads TS

The principal components of each yield curve for each country are obtained and the significance of the first four principal components are presented in Tables A.1 to A.3.

The PCA of credit spreads TS for each PIIGGS countries are obtaining, in the same line to the PCA of each country yield curve. The significance of the first four principal components are presented in Tables 3 to 5.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Country Principal Principal Principal Principal Component 1 Component 2 Component 3 Component 4 Portugal 69.005% 16.858% 5.755% 5.289%

Ireland 79.301% 12.053% 6.986% 0.819% Italy 55.531% 33.363% 5.016% 3.475% Germany 77.521% 11.173% 6.072% 2.708% Greece 83.336% 12.997% 2.367% 0.625%

Spain 82.554% 7.473% 5.010% 2.740%

Table 3: PCA: credit spreads TS: 6Sep2005 - 14May2009

Country Principal Principal Principal Principal Component 1 Component 2 Component 3 Component 4 Portugal 92.215% 5.292% 1.762% 0.346%

Ireland 60.951% 29.195% 5.357% 3.021% Italy 52.785% 26.337% 13.486% 4.385% Germany 82.006% 8.316% 3.885% 3.403% Greece 78.475% 13.194% 5.275% 2.744%

Spain 94.915% 3.584% 1.140% 0.231%

Table 4: PCA: credit spreads TS: 15May2009 - 2Mar2015

Country Principal Principal Principal Principal Component 1 Component 2 Component 3 Component 4 Portugal 93.570% 4.478% 1.458% 0.260%

Ireland 68.505% 20.729% 5.341% 3.685% Italy 59.721% 19.563% 15.007% 3.604% Germany 81.441 % 8.836% 3.349% 3.076% Greece 77.045% 15.7094% 4.654% 2.367%

Spain 96.363% 2.510% 0.825% 0.190%

Joana Costa Silva Calibration of the PIIGGS credit spreads

first principal component in the sub-period after the crisis.

However by observing the significance of the first principal component for Ger-many, Portugal and Spain, we can see that they are lower at the period September 6, 2004 to May 14, 2009

Chapter 6

Conclusion

We made an analysis of the evolution of the ECB parameters and applied an struc-tural break test of these parameters. We conclude that, in 2009 , there are on break in the behavior of the Svensson parameters and for this one break in the behavior of the default-free yield curve. The yield curves for PIIGGS were calibrated and the analysis of these curves allows an initial perception of the economic situation of each country.

The credit spreads TS were calibrated for the same countries. Their analysis en-able a better risk perception associated with each countries government bonds, thus its economic and financial situation.

The yield curve behavior is more unstable after the financial crisis period, 2007-2012, that swept Europe and the parameters of the Svensson model reveal a significant instability after this crisis.

It was made a PCA analysis which suggests that only three components are enough to explain the behavior of the default-free yield curve. It is also important to note that the explanation power of the first three principal components are more significant in the whole studied period when compared with the sub-periods. It means that after the crisis probably it is not necessary to use a model with more than three parameters.

With respect to the credit spreads TS, the PCA reveals a different impact of the crisis on the countries in study. Indeed some countries are more affected by the crisis than others. It is concluded because occurs a high significant change on the explanation power of each principal component for each PIIGGS country.

Joana Costa Silva Calibration of the PIIGGS credit spreads

References

Afonso, A. and Martins, M. (2010). Level, Slope, Curvature of the Sovereign Yield Curve, and Fiscal Behavior.European Central Bank, Working Paper Seriesno 1276.

Andrews, D. (2003). Tests for parameters instability and structural change with unknown change point: a corrigendum.Econometria71 (1), 395-397.

Annaert, J., Ceuster, M. K. and Jonghe, F. (2000). Modelling European Credit Spreads.Research Report.

Bedendo, M., Cathcart, L. and El-Johel, L., (2004). The shape of the term structure of credit spreads: on empirical investigation.Tanak business school.

Cox, J., Ingersoll, J. E. and Ross, S. A. (1985). A theory of the term structure of interest rates.Econometria53 (2), 385 - 408.

Dielbold, F. X. and Li, C. (2005). Forecasting the Term Structure of Government Bonds Yields.University of Pennsylvania.

ECB,Techinal notes. Available in: http://www.ecb.europa.eu/stats/money/

yc/html/technical_notes.pdf[Access: 2015/2/14].

Ferreira, S. and Gaspar, R. M., (2013). Spillovers across PIIGS bonds. CEMAPRE Working Paper.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Grob, J. (2003). Lecture Notes in Statistic: Linear Regression. 175, Springer.

Hlad´ıkov´a, H. and Radov´a, J., (2012). The Structure Modelling by Using the Nelson-Siegel Model.European Financial and Accounting Journal7 (2), 36-55.

Howard, B. L., (2008). Using the Chow test to analyse regression discontinuities. Tutorials in Quantitative Methods for Psychology, 4 (2), 46-50.

Litterman, R. and Scheinkman, J. (1991). Common Factors Affecting Bond Re-turns.Journal of Fixed Income1, 54 - 61.

Nelson, C. R., and Siegel, F. (1987). Parsimonious Modeling of Yield Curves. The Journal of Business60, 473-489.

Novais, O. (2012). O impacto das Crises Financeiras na Previs˜ao da Estrutura Temporal das Taxas de Juro: o caso da Zona Euro. Trabalho Final de Mestrado, Uni-versidade Cat´olica Portuguesa.

Perron, P. (2005). Dealing with structural breaks. Boston University.

Svensson, L. E. O., (1994). Estimating and Interpreting forward interest rates : Sweden 1992-1994. National Bureau of Economic Research, Technical Reports, 4871.

Appendix A

Yield curve for PIIGGS

The results of the yield curve, used for the calibration of the credit spread TS for each of the six countries cited, are then presented . For a more discernible analysis, it is our choice to put the yield curve and the default-free yield curve on the same graphic.

Portugal yield curve

Figure A. 1: Portugal yield curve

Joana Costa Silva Calibration of the PIIGGS credit spreads

considerably higher. During this period, Portugal and Greece have shown the highest credit spread TS among the countries studied.

Figure A. 2: Portugal yield curves

Ireland yield curve

The Ireland’s yield curves behavior is very similar to the Portugal’s curves. Though, the distance from the default-free yield curve is noticeably shorter.

Usually, countries with the same rating tend to present similar yield curves behav-iors. Once the PIIGS are almost always in the same rating group, their yield curves have the same tendency.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Figure A. 4: Ireland yield curve

Italy yield curve

Excluding the period of 2009, Italy’s yield curves exhibits a similar behavior to Por-tugal’s yield curve, when compared with the default-free yield curves. In 2009, the two yield curves diverge mainly in the short and long maturities. In that date, the yield curve provide a inadequate behavior.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Figure A. 5: Italy yield curve

Figure A. 6: Italy yield curves

Germany yield curve

Joana Costa Silva Calibration of the PIIGGS credit spreads

Figure A. 7: Germany yield curve

curves are below the risk-free yield curves, which shows that the government bonds of Germany have a risk lower than the interest rate considered riskless.

Considering the studied period, the yield curve for Germany is presented in Figure A.8.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Greece yield curve

At the beginning of the period, the behavior of the Greece yield curve is very similar than the other studied countries. In 2009, the yield curve start to present a different shape of the default-free yield curve.

Figure A. 9: Greece yield curve

Joana Costa Silva Calibration of the PIIGGS credit spreads

Figure A. 10: Greece yield curves

Spain yield curve

Excluding Germany, the Spain yield curves are the one presenting the best conformity with the default-free yield curve, among the studied countries.

It should also be noted that in general the yield curve of the several countries is greater than the default-free yield curve and the yield curve for Germany, showing the similar situation of PIIGS relatively to market remuneration rate.

Joana Costa Silva Calibration of the PIIGGS credit spreads

Figure A. 12: Spain yield curve

Principal component analysis of yield curve

The principal components of each yield curve for each country are thus obtained and the significance of the first four principal component are presented in Tables A.1 to A.3.

Country Principal Principal Principal Principal Component 1 Component 2 Component 3 Component 4 Portugal 84.260% 11.284% 2.741% 1.321%

Ireland 73.389% 13.376% 9.614% 2.904% Italy 62.405% 23.858% 9.270% 2.649 % Germany 86.928% 11.856% 0.734% 0.362%

Greece 75.499% 19.404% 4.472% 0.365% Spain 84.542% 14.120% 1.040% 0.182 %

Table A. 1: PCA: yield curves - 6Sep2005 - 14May2009

Joana Costa Silva Calibration of the PIIGGS credit spreads

Country Principal Principal Principal Principal Component 1 Component 2 Component 3 Component 4 Portugal 93.693% 4.254% 1.353% 0.350%

Ireland 68.648% 22.114% 5.361% 2.769% Italy 65.759% 16.223% 12.080% 3.464% Germany 94.808% 3.358% 1.423% 0.318% Greece 78.606% 13.073% 5.264% 2.745%

Spain 95.076% 3.839% 0.861% 0.149%

Table A. 2: PCA: yield curves - 15May2009 - 2Mar2015

Country Principal Principal Principal Principal Component 1 Component 2 Component 3 Component 4 Portugal 92.226% 5.546% 1.578% 0.344%

Ireland 68.960% 20.356% 5.333% 3.338% Italy 60.523% 17.570% 13.718% 4.210% Germany 95.422% 4.164% 0.274% 0.084% Greece 77.534% 14.546% 5.038% 2.535% Spain 84.924% 13.746% 1.112% 0.145%

Table A. 3: PCA: yield curves - Complete period

verified. Nevertheless the second principal component has low significance in the pe-riod May 15, 2009 to March 2, 2015.