INSTITUTO SUPERIOR DE ECONOMIA E GEST ˜

AO

MESTRADO EM: Matem´atica Financeira

L´

evy Processes in exotic options pricing

Diana Catarina Gonc¸alves Enes

Orienta¸c˜ao: Professor Doutor Jo˜ao Miguel Espiguinha Guerra

J´uri:

Professora Doutora Maria do Ros´ario Grossinho Professor Doutor Ernst Eberlein

Abstract

Prices fluctuations in markets, both liquid and illiquid, exhibit discontinuous behaviour. L´evy processes are a natural generalization for stochastic processes with jumps, since they comprehend simultaneously a deterministic component as well as continuous and discontinuous stochastic com-ponents. As it is possible to model asset prices as exponential of L´evy processes, in this work we set the model using two pure jump processes: variance gamma and generalized hyperbolic. While using this class of processes, some important economic characteristics change in relation to the usual Black-Scholes model. The market is no longer complete for a more general L´evy model, with several sources of randomness.

We start by introducing some important results about L´evy processes and follow with a brief exposition on possible equivalent martingale measures.

After this introduction, we estimate the parameters of the distributions, by using market data and the Fourier transform to calculate vanilla option prices, and then minimizing the error be-tween the market and the model prices. With the models calibrated to market data, we use Monte Carlo simulation to price an exotic option on the underlying, with double barriers. The results are compared with the Black-Scholes model and the market prices, requested over the counter to some of the main liquidity providers for that kind of structures.

Resumo

A flutua¸c˜ao de pre¸cos nos mercados, tanto l´ıquidos como il´ıquidos, evidenciam um compor-tamento descont´ınuo. Os processos de L´evy s˜ao uma generaliza¸c˜ao natural para os processos estocsticos com saltos, uma vez que consideram simultaneamente uma componente determin´ıstica, tal como uma componente estoc´astica cont´ınua e descont´ınua. Como ´e poss´ıvel modelizar os pre¸cos dos activos como exponenciais de processos de L´evy, neste trabalho definimos um modelo usando dois processos de saltos puros: o processo variance gamma e o processo hiperb´olico generalizado. Aquando do uso desta classe de processos, algumas caracter´ısticas econ´omicas importantes mudam, em rela¸c˜ao ao modelo usual, de Black-Scholes. O mercado deixa de ser completo com um processo de L´evy mais geral, com v´arias fontes de incerteza.

Come¸camos por introduzir alguns resultados importantes sobre processos de L´evy e seguida-mente apresentamos uma breve exposi¸c˜ao sobre as poss´ıveis medidas equivalentes de martingala.

Ap´os esta introdu¸c˜ao, ´e feita a estima¸c˜ao de parˆametros das distribui¸c˜oes, usando dados de mer-cado e a transformada de Fourier para calcular os pre¸cos das op¸c˜oes mais simples, minimizando no fim o erro entre os pre¸cos de mercado e os pre¸cos do modelo. Com os modelos calibrados com os dados de mercado, usamos simula¸c˜ao de Monte Carlo para fazer o apre¸camento de uma op¸c˜ao ex´otica sobre o activo subjacente, com barreiras duplas. Os resultados s˜ao comparados com o modelo de Black-Scholes e pre¸cos de mercado, solicitados a alguns dos maiores provedores de liquidez a este tipo de estruturas, transaccionadas fora de bolsa.

Palavras-chave: Processos de L´evy; Calibra¸c˜ao de Modelos; M´eodos de Simula¸c˜ao; Distribui¸c˜oes

Contents

List of Figures 4

List of Tables 5

1 Introduction 6

1.1 Motivation and overview . . . 6

1.2 Specificities of L´evy market models . . . 7

1.3 Structure of this thesis . . . 7

2 L´evy Processes and Stochastic Calculus 9

2.1 Main definitions and results . . . 9

2.2 Some examples . . . 15

3 Equivalent Martingale Measures 19

3.1 L´evy Market Model and Incomplete Markets . . . 19

3.2 Esscher Transform and Mean-Correcting Martingale Measure . . . 23

4 Methodology 26

4.1 Fast Fourier Transform . . . 26

4.2 Monte Carlo simulation and subordination method . . . 28

5 Application to an european index 31

5.1 Calibrating the models . . . 31

5.2 Pricing exotic options . . . 32

6 Conclusions 37

7 Appendix A 39

8 Appendix B 40

List of Figures

1 First model calibration of VG distribution . . . 32

2 First model calibration of GH distribution . . . 32

3 Model calibration of VG distribution . . . 33

4 Model calibration of GH distribution . . . 33

5 Market prices minus modeled prices, via VG model . . . 34

6 Market prices minus modeled prices, via GH model . . . 34

7 Difference between Black-Scholes and market prices . . . 35

List of Tables

1 Prices for double knock-out option . . . 35

1

Introduction

1.1

Motivation and overview

Some of the events of the last two decades provide strong evidence that extreme events happen,

whether or not they are considered in our daily perspectives and in estimates about the future: the

Asian financial crisis in 1997, the bursting of the dot-com bubble in 2000, the subprime mortgage

crisis that began in the summer of 2007, leading to events as the bankruptcy of Lehman Brothers

in September 2008 and probably fueling the current sovereign debt crisis in Europe.

Regulators, risk and portfolio managers, derivatives traders, among others, need to deal with

these type of events and, as well as possible, consider them in the models used. For several years,

models that assume the normal distribution for log returns have been used, being severely criticized

in the wake of the latest financial crisis.

Bearing these notes in mind, we will use a more general framework for modeling the logarithm

of the returns of an index, using what are known as pure jump processes. Prices of assets jump:

if overnight there is an earthquake, as recently occured in Japan, it is more likely that the assets

open the following morning with agap down, so the use of a stochastic process that is continuous

does not seem to take these possible realities in consideration.

Geman and Yor (2001) suggested that models for financial series must have a jump component,

but going even further they suggested that these price processes do not need to have a diffusion

component. Usually, the justification for the existence of such a component is that it captures small

moves, which happen much more frequently than large, noticeable jumps. However, some of the

well-known pure jump models are L´evy processes with infinite activity, i.e., withR−∞∞ ν(dx) =∞

(whereν(dx) is the L´evy measure of the process), and they are able to capture both the big jumps

and the small moves: a large number of small jumps in a small interval accounts for the high

activity. Furthermore, the empirical performance of those models is typically not improved by

adding a diffusion component.

So, we will study the Variance Gamma and the Generalized Hyperbolic processes, that have

no Brownian part, i.e., the diffusion component associated to the Brownian motion,c, is 0.

Empirical evidence has led to the following three stylized facts about financial time series for

asset returns:

1. they have heavy tails;

2. they may be skewed;

Volatility clustering refers to the tendency of large changes in asset prices, either negative or

positive, to be followed by large changes, and small changes followed by small changes.

The study of alternatives to the normality assumption goes back a few decades, with works

by Mandelbrot in the 1960s suggesting instead L´evy stable distributions, of which the normal

distribution is a special case.

We have based our approach in Eberlein and Keller (1995), where statistical tests were

per-formed on DAX series and yielded a better fitting of the hyperbolic distributions.

Different distributions could be considered, but since some of the most famous, such as the

Normal Inverse Gaussian and the Hyperbolic distributions, are particular cases of the Generalized

Hyperbolic distribution, the work will be developped in order to model this last one. We will use

a reparametrization that considers four parameters instead of the usual five.

After estimating parameters of these processes, we will apply the results to the pricing of exotic

derivatives, and measure the result against the simulation based on Black-Scholes model, as well

as against prices from the market, gathered over-the-counter.

1.2

Specificities of L´

evy market models

The first concern when calibrating these models must be the number of parameters. Depending

on the model chosen, we can have three to five parameters to estimate, and this calibration to

market should be looked at in detail.

The other concern regards derivatives pricing. The usual theory for derivatives pricing relies on

a change of measure, which is a way to reweight the probabilities of the paths, into a risk-neutral

world. But as we will see, it is not a simple choice to perform this change of measure, nor is it

done in a unique way when dealing with L´evy market models.

1.3

Structure of this thesis

The present thesis is structured in the following way: in chapter 2, we present the basic

defini-tions about L´evy processes and some main results. In this chapter the two processes that will be

modeled are taken as examples and explained further.

Chapter 3 refers to the incompleteness of the market under general L´evy processes and presents

one of the most widely used change of measure: the Esscher transform, as well as a mean-correcting

method that is quite general.

Chapter 4 and chapter 5 are about the methodology and application of these processes to an

algorithms for paths generation are detailed. After calibrating the distributions with vanilla options

prices, we calculate OTC derivatives prices, in this case a double barrier knock out option. The

results are compared with prices from the market, namely prices given by a couple of international

investment banks.

Chapter 6 closes the text with some remarks about the results presented, and some topics for

2

L´

evy Processes and Stochastic Calculus

2.1

Main definitions and results

In this chapter we will account for some relevant results regarding L´evy processes and their

properties, as well as some examples that will be used later on. Since most of the proofs are extense

and out of the scope of the present work, we just mention the results and suggest the reader to

use the detailed bibliography for a deeper understanding of the theory behind these results. In

particular, we refer to Applebaum (2009), Bertoin (1996), Cont and Tankov (2004) and Sato (1999).

Definition 2.1 L´evy ProcessLetX =X(t)t≥0be a stochastic process defined on a probability

space(Ω,F,P). We say that X is a L´evy Process if:

1. X(0) = 0(a.s.);

2. X has independent increments: for every increasing sequence of timest0, ..., tn, the random

variablesXt0, Xt1−Xt0, ..., Xtn−Xtn−1 are independent;

3. X has stationary increments: the law ofXt+h−Xt does not depend ont;

4. X is stochastically continuous, i.e.

∀ǫ >0 :limh→0P(|Xt+h−Xt| ≥ǫ) = 0.

The first remark to be made is that the definition of L´evy process does not imply that it is

a c`adl`ag (continue `a droite limite `a gauche) process, but since every L´evy process has a c`adl`ag

modification which is still a L´evy process, we will assume the c`adl`ag property as in Protter (1990).

There are some very important results related to L´evy processes which allow us to have a better

understanding of their structure and components. In relation to Brownian Motion, L´evy processes

allow for jumps to happen. Those jumps are accounted for by the L´evy measure.

Definition 2.2 Radon measureLetE⊂Rd andǫaσ-algebra. A Radon measureon(E, ǫ) is a measureµ such that for every compact measurable setB∈ǫ, µ(B)<∞.

Definition 2.3 Poisson random measureLet (Ω,F,P) be a probability space, E⊂Rd and µ a given (positive) Radon measure on (E, ǫ). A Poisson random measure on E with intensity

measureµ is an integer valued Radon measure:

(ω, A)7→N(ω, A),

such that

1. For (almost all) ω ∈ Ω, N(ω, .) is an integer valued Radon measure on E: for any bounded

measurableA⊂E, N(A)<∞is an integer valued random variable.

2. For each measurable setA⊂E, N(., A) =N(A)is a Poisson random variable with parameter

µ(A):

∀k∈N,P(N(A) =k) =e−µ(A)(µ(A)) k

k! . (1)

3. For disjoint measurable setsA1, ..., An∈ǫ, the variablesN(A1), ..., N(An)are independent.

From a given Poisson random measure N, it is possible to define the compensated Poisson

random measure Ne by subtracting fromN its intensity measure:

e

N(A) =N(A)−µ(A) (2)

Definition 2.4 L´evy measureLet(Xt)t≥0 be a L´evy process onR. Letν be a Borel measure

defined onR− {0}, such that:

Z

R−{0}

(|y|2∧1)ν(dy)<∞.

Then

ν(A) =E[#{t∈[0,1] : ∆Xt= 06 ,∆Xt∈A}], A∈B(R)

is called the L´evy measure ofX :ν(A)is the expected number, per unit of time, of jumps whose

size belongs to A.

To have a better grasp of a L´evy process, we must introduce an example of a pure jump

process. A process is said to be quadratic pure jump if the continuous part of its quadratic

variation< X >c≡0, in which case its quadratic variation becomes simply

< X >t= X

0<s≤t

(∆Xs)2

Example 2.5 Compensated Poisson Process

First we define the Poisson process: Let (τi)i≥1be a sequence of independent exponential random

variables with parameterλand

Tn=

n

X

i=1

τi.

The process (Nt, t≥0) defined byNt=Pn≥11t≥Tn is called a Poisson process with intensity λ.

Now consider the process:

e

Nt=Nt−λt (3)

which is known as thecompensated Poisson process. The characteristic function of this process is

given by

φNet(u) =E[eiuNet] =exp[λt(eiu−1−iu)]

e

Nthas independent increments and:

E[Nt|Ns, s≤t] =E[Nt−Ns+Ns|Ns] =E[Nt−Ns] +Ns=λ(t−s) +Ns

SoNte has themartingale property:

∀t > s,E[Nt|e Nse ] =Ns.e

The deterministic expression (λt)t≥0 is called the compensator of (Nt)t≥0 since it is the

quan-tity that must be subtracted from the Poisson process to obtain a martingale.

Example 2.6 L´evy Jump-Diffusion Process

It should be specified that we are discussing a L´evy structure in this example, since there

are jump-diffusion processes that are not L´evy processes. We follow Papapantoleon (2008) in the

derivation of the characteristic function for this example.

LetL= (Lt)0≤t≤T be a L´evy jump-diffusion: a Brownian motion plus a compensated Poisson

process. The paths of this process can be described by

Lt=bt+σWt+ (

Nt

X

k=1

Jk−tλκ)

Where b ∈ R, σ ∈ [0,∞), W = (Wt)0≤t≤T is a standard Brownian motion, N = (Nt)0≤t≤T is

a Poisson process with parameter λ and J = (Jk)k>1 is an i.i.d. sequence of random variables

jumps, which arrive according to the Poisson process. All sources of randomness are mutually

independent.

Both Brownian motion and the compensated Poisson process are martingales. Therefore,L=

(Lt)0≤t≤T is a martingale if and only ifb= 0. The characteristic function ofLtis

E[eiuLt] =E[exp(iu(bt+σWt+

Nt

X

k=1

Jk−tλκ))]

=exp[iubt]E[exp(iuσWt)exp(iu(

Nt

X

k=1

Jk−tλκ))]

Given that the sources of randomness are independent, we have

=exp[iubt]E[exp(iuσWt)]E[exp(iu Nt

X

k=1

Jk−iutλκ)]

Since

E[eiuσWt] =e−12σ 2

u2

t, Wt

eN ormal(0, t)

E[eiuPNtk=1Jk] =eλtE[eiuJ−1], NteP oisson(λt)

we get

=exp[iubt]exp[−1

2u

2σ2t]exp[λt(E[eiuJ−1]−iuE[J])]

=exp[iubt]exp[−12u2σ2t]exp[λt(E[eiuJ−1−iuJ])]

and because the distribution ofJ isF

E[eiuPNtk=1Jk] =X

n≥0

E[eiuPnk=1Jk]e−λλ

n

n!

=X

n≥0

(

Z

R

eiuxF(dx))ne−λλ n

n!

=exp(λ

Z

R

(eiux−1)F(dx))

we have

=exp[iubt]exp[−1

2u

2σ2t] exp[λtZ

R

(eiuJ−1−iux)F(dx)].

Now, since t is a common factor, we re-write the above equation as

E[eiuLt] =exp[t(iub−u

2σ2

2 +

Z

R

As we will see below, the characteristic function of the L´evy jump-diffusion process is very

similar to the one of the general L´evy process and contains the most relevant insights, as is the

case for the three components that appear separated: deterministic part, Brownian motion and

pure jump process.

A concept that is intrinsically related to L´evy processes is that of infinite divisibility. This

means that, ifφ(u) is a characteristic function of a distribution which is infinitely divisible, then

for allninteger,φ(u) is also the n−thpower of a characteristic function. The most well-known

distributions of this kind are the Poisson and Gaussian distributions, since both can be expressed

as a sum ofn independent poisson and gaussian random variables, respectively.

Definition 2.7 Infinitely Divisible DistributionLetX be a random variable taking values in R with law µX. We say that X is infinitely divisible if, ∀n ∈ N, there exist i.i.d. random variablesY1(n), ..., Y

(n)

n such that

X =dY(n)

1 +...+Y (n)

n .

whereX=dY means that X and Y have the same distribution.

The following propositions link infinitely divisible distributions to their characteristic functions

and show the connection between them and L´evy processes.

Proposition 2.8The following statements are equivalent:

1. X is infinitely divisible;

2. the characteristic functionφX of X has an n-th root that is itself the characteristic function

of a random variable, for eachn∈N. We can rewrite this as: φX(u) = (φX1/n(u))n.

Theorem 2.9 L´evy-Kintchine Formula

A law Px of a random variable X is infinitely divisible if there exists a triplet (b, c, ν), b∈R, c≥0, where ν is a measure, ν(0) = 0and

Z

R

(1∧x2)ν(dx)<∞

and

E[eiuX] =exp[iub−u

2c

2 +

Z

R

Conversely any mapping as expressed above is the characteristic function of an infinitely

divis-ible probability measure onR.

Proposition 2.10If X is a L´evy process, then X(t) is infinitely divisible for each t≥0.

A proof of the theorem2.9and of proposition2.10can be found, e.g., in Applebaum (2009). The triplet (b, c, ν) is called the L´evy or characteristic triplet and the exponent

ψ(u) =iub−u

2c

2 +

Z

R

(eiux−1−iux1(|x|<1))ν(dx) (5)

is called the L´evy symbol or the characteristic exponent.

Theorem 2.11 L´evy-Ito DecompositionIfX is a L´evy process, then there exists b∈R, a Brownian motionBwith a diffusion coefficientc≥0and an independent Poisson random measure

N onR+×(R− {0})such that, for each t≥0,

X(t) =bt+cB(t) +

Z

|x|<1

xNe(t, dx) +

Z

|x|≥1

xN(t, dx)

For a proof of this theorem, see Applebaum (2009).

From the L´evy-Kintchine formula and the L´evy-Ito decomposition, is easy to see that a L´evy

process is constitued by three independent parts: a linear deterministic part, which is usually

associated with trend; a Brownian part, also called a diffusion component; and a pure jump part,

where the L´evy measureν(dx) dictates how the jumps occur. Analysing this component further,

there are some important characteristics:

ν satisfiesν(0) = 0,RR(1∧x2)ν(dx)<∞and is related to the expected number of jumps of a

certain size in a time unit.

Ifν(R) =∞then infinitely many small (size<1) jumps occur. The L´evy process hasinfinite activity.

Ifν(R)<∞then almost all paths have a finite number of jumps. The L´evy process hasfinite activity.

Let L be a L´evy process with triplet as above. Ifc = 0 and R|x|≤1|x|ν(dx)<∞then almost

all paths havefinite variation. Ifc6= 0 orR|x|≤1|x|ν(dx) =∞then almost all paths haveinfinite

variation.

If a pure jump L´evy process (no Brownian part) has finite activity, then it has finite variation.

2.2

Some examples

It is useful to have some examples of these processes in mind, so we will present some common

L´evy processes:

Example 2.12 Subordinator Process

Subordinators are a sub-class of L´evy processes, with the property of taking values in [0,∞)

and being increasing processesa.s.. These processes are very relevant because they can be used as

time changes for other processes, so they are often used for building L´evy-based models in finance.

An example of this subordination is the Variance Gamma process.

Theorem 2.13 If X is a subordinator, then for any z ∈R, the characteristic exponent takes the form

ψ(z) =ibz+

Z ∞

0

(eizy−1)ν(dy) (6)

whereb≥0 and the L´evy measure satisfies

ν(−∞,0) = 0

and

Z ∞

0

(y∧1)ν(dy)<∞

Conversely, any mapping fromRd→Cof the form (6) is the characteristic exponent of a subor-dinator.

A proof of this result can be found in Bertoin (1999).

Example: Gamma subordinators

Let (Tt, t ≥0) be a gamma process with parameters a, b >0. For each t ≥ 0, T(t) has the

following density:

fT(t)(x) =

bat

Γ(at)x

at−1e−bx, x ≥0

Then, for everyu≥0:

Z ∞

0

e−uxfT(t)(x)dx= (1 +

u b)

−at=exp[

−ta log(1 + u

Using theFrullani’s integral, see for example Spiegel (1968), withf(x) =ae−x we can rewrite

alog(1 +u

b) =alog( b+u

b ) =

Z ∞

0

ae−bx−ae−(u+b)x x dx

=

Z ∞

0

(1−e−ux)ax−1e−bxdx

Hence,

E[e−uT(t)] =exp[−t

Z ∞

0

(1−e−ux)ax−1e−bxdx]

From this expression we can write the L´evy symbol according to the previous theorem, withb= 0

andν(dx) =ax−1e−bxdx. So, for this L´evy process, the characteristic function is given by:

φu(t) =exp(t

Z ∞

0

(eiux−1)ax−1e−bxdx)

As mentioned before, one of the applications of subordinators istime-changing. A very relevant

property of subordinators is:

Theorem 2.14LetX(t)be a L´evy process andT(t)be a subordinator, independent fromX(t), both defined on a probability space(Ω,F,P).

The processZ = (Z(t), t≥0), defined byZ(t) =X(T(t)),∀t≥0, is a L´evy process.

The proof for this theorem can be found in Applebaum (2009).

The Variance-Gamma process is an application of this theorem, sinceXV G(t) =B(T(t)), where

B(t) is a standard Brownian motion andT(t) is a gamma subordinator which is independent from

the Brownian motion.

The Variance Gamma has three parameters: the volatility and the drift of the Brownian motion,

σandθ, and the variance of the subordinator: ν.

Finally, the characteristic exponent of the VG process is:

ψ(u) =−ν1log(1 + u

2σ2ν

2 −iθνu)

with respective moments:

E[XtV G] =θt

V ar[XV G

Example 2.15 Generalized Hyperbolic Process

These distributions were introduced by Barndorff-Nielsen (1977) and later, in Eberlein and

Keller (1995), the authors applied stochastic processes based on these distributions to Finance.

Further details on applications are given in Eberlein and Prause (2001). Being a normal

variance-mean mixture, they possess semiheavy tails and allow for a natural definiton of volatility models

by replacing the mixing generalized inverse Gaussian (GIG) distribution by appropriate volatility

processes.

This type of distributions owes its name to the logarithm of its density, which is an hyperbola.

Definition 2.16 The one-dimensional generalized hyperbolic (GH) distribution is defined by the following Lebesgue density:

gh(x;α, β, δ, µ, λ) =a(α, β, δ, λ)(δ2+ (x−µ)2)λ−12/2×K

λ−1 2(α

p

δ2+ (x−µ)2)exp(β(x−µ)) (7)

where

a(α, β, δ, λ) = (α

2−β2)λ/2

√

2Παλ−1

2δλKλ(δpα2−β2)

whereKλ is a modified Bessel function of the third kind and x∈R. The domain of variation of the parameters isµ∈Rand

δ≥0, |β|< α if λ >0

δ >0, |β|< α if λ= 0

δ >0, |β| ≤α if λ <0

.

Different parametrizations of the GH distribution have been proposed. A particularly useful

one, which has been used in the present work, as suggested in Prause (1999) for feasibility, is known

as the fourth parametrization, which is scale- and location-invariant:

α=αδ,

β=βδ.

x−µparameter:

gh(x;α, β, δ, λ) =a(α, β, δ, λ)(δ2+x2)(λ−12)/2×K

λ−1 2(α

p

δ2+x2)exp(βx) (8)

where

a(α, β, δ, λ) = (α

2−β2)λ/2

√

2παλ−1

2δλKλ(δpα2−β2)

.

For better readibility, we considerζ=δpα2−β2 in the following text.

In the first density function above, we find five parameters (α, β, δ, µ, λ): λdescribes the

cur-vature of the distribution;αis a measure of kurtosis, being this feature an important advantage of

the use of the Generalized Hyperbolic distributions in financial series - its ability to model kurtosis

and excess kurtosis in the studied series;β is a measure of the skewness of the distribution, which

is also a characteristic that is relevant to model; the parameterδ is a size parameter, which is

somehow similar to the standard deviationσ for the normal distribution, asδ relates directly to

the variance:

V ar[XtGH] =tδ2+ (

Kλ+1(ζ)

ζKλ(ζ) +

β2

α2−β2(

Kλ+2(ζ)

Kλ(ζ) −

Kλ+1(ζ)

Kλ(ζ) ))

The remaining parameter -µ- is a location or shift parameter. The expected rate of return is

related toµand to the skewness correction. So if a distribution is symmetric, the rate of return is

equal toµ:

E[XtGH] =µt+t βδ

p

α2−β2

Kλ+1(ζ)

Kλ(ζ) .

An important detail about the GH distribution is that it can be represented as a Normal

variance-mean mixture, according to the subordination mentioned in Geman and An´e (1996):

fGH(x;α, β, δ, λ) =

Z ∞

0

fN ormal(x;µ+βw, w)fGIG(w;λ, δ,pα2−β2)dw (9)

where fGIG means the density of the Generalized Inverse Gaussian. This will be useful when

generating a GH trajectory, as we will see in chapter 4.

The characteristic function of the Generalized Hyperbolic is given by the following expression:

φGH(u;α, β, δ, λ) = ( α

2−β2

α2−(β+iu)2)

λ/2Kλδ

p

α2−(β+iu)2

3

Equivalent Martingale Measures

While pricing derivatives, the probability measures involved are at the very kernel of the

cal-culations. One does not know the real, or objective, probability P of the different events, but fortunately the arbitrage pricing theory shows that it is possible to use a mathematical approach

-change of measure - to overcome this problem, by considering the risk-neutral world. So one needs

to know how to perform this passage from the real world, from where estimates of the distributions

are drawn, to the risk-neutral world, where we have the derivatives pricing formulas.

3.1

L´

evy Market Model and Incomplete Markets

In this chapter we will consider that we are in a filtered probability space (Ω,Ft,P).

Definition 3.1 Let P and Q be two measures on (Ω,Ft). Then P and Q are equivalent

measuresP~Q if

P(A) = 1⇔Q(A) = 1,∀A∈Ft.

If we perform a change of measure on a L´evy process X, it may happen that the resulting

process is no longer a L´evy process: its increments may not be stationary or independent. So, we

will have to look tostructure-preserving changes of measure. Indeed, if two L´evy processesX and

Y have equivalent measures, their parameters show some relations, as we can see from the result

below:

Lemma 3.2Let X be a L´evy process with triplet (b,0, ν)and let y(x) =exp(θx) and suppose that R|x|≥1exp(θx)dν <∞, then the new measureQdefined by the change of triplet according to

(b′=b+

Z

h(y−1)dν, c′ = 0, ν′=y(x)ν(dx))

whereh(y) :=y1|y|≤1 is the Esscher transform ofP.

This result was proved in Keller (1997) and is useful to determine the change of measure in

pure jump processes, which is the present case. Besides, it yields the connection between the L´evy

triplet of the initial process with the result of the transformation of measures.

We now consider a finite set of diferent assets{St0, ..., Snt}, considering thatSt0 is the risk-free

asset, usually a bank account, that evolves in time at a rater, called the risk-free interest rate.

repre-sented as: all discounted values Sbi

t=e−rtSit, i= 0, ..., n of all traded assets are martingales with respect to the probability measure Q.

A probability measure verifyingP~Qand

EQ[S

i T S0 T

Ft] = S i t S0

t

i.e.

EQ[Sbi T

Ft] =Sbit

is called anequivalent martingale measure.

We will present the usual result regarded as the Fundamental Theorem of Asset Pricing, though

for L´evy processes the notion ofarbitrage free should be replaced by the concept ofno free lunch

with vanishing risk. The theorem is proved for this notion of no arbitrage for L´evy processes in an

article by Delbaen and Schachermayer (1998).

Theorem 3.3 First Fundamental Theorem

The model is arbitrage free essentially if and only if there exists a (local) equivalent martingale

measureQ.

Then we must have at least one equivalent martingale measure under which we can price

derivatives. The question then arises of which measure that is and if there is only one. To discuss

the number of possible martingale measures, we introduce the concept of market completeness.

A market is said to be complete if any contingent claim admits a replicating portfolio. Let H

represent the set of all contigent claims with maturity T, market completeness can be described

as:

∀h∈H, ∃(φ0

t, φt) self-financing strategy s.t.

P(h=V0+

Z T 0 φtdSt+ Z T 0 φ0

tdSt0) = 1(P−a.s.)

A mappingX : [0, T]×Ω7→Rd which is measurable with respect to the filtrationF is called a

predictable process. A self-financing strategy is a strategy with no withdrawals nor external

injec-tions of money. The processφtin the integrand needs to be both self-financing and predictable to

Looking at the discounted value of the claim h, we get:

b

h=V0+

Z T

0

φtdSt,b Q−a.s. (sinceP~Q)

We now take expectations and use the fact thatEQ[R0TφtdStb] = 0. This equality holds sinceφtis a self-financing strategy. If the expected value were different from 0, then a self-financing strategy

would generate a profit or a loss, and an arbitrage could be done.

EQ[bh] =EQ[V0+

Z T

0

φtdStb]

=V0+EQ[

Z T

0

φtdStb] =V0

So, in a complete market there is only one price: the value of any contingent claim is given by

the initial capital needed to set up a perfect hedge for the contingent claim.

Theorem 3.4 Second Fundamental Theorem

Assume that the market is arbitrage free and consider a fixed numeraire asset S0. Then the

market is complete if and only if the equivalent martingale measureQ, corresponding to the

nu-meraireS0, is unique.

In the L´evy model we are considering we have:

Riskless asset:

BT =exp(rt)

Risky asset:

St=S0exp(Lt) (11)

whereLtis a L´evy process with the canonical decomposition into a drift, a pure diffusion and a

pure jump process:

L(t) =µt+σWt+Jt (12)

In the above, (Wt)0≤t≤T is a P-standard Brownian motion and (Jt)0≤t≤T is a pure P-L´evy

jump process with random jump measureν(dx, dt). Jtcan be written as

Jt=

Z t

0

Z ∞

−∞

To understand the dynamics of the risky asset, we first introduce:

Theorem 3.5 Ito’s Formula

Let X = (Xt)0≤t≤T be a real-valued semimartingale and f a class C2 function on R. Then, f(Xt)is a semimartingale and we have

f(Xt) =f(X0)+

Z t

0

f′(Xs−)dXs+

1 2

Z t

0

f′′(Xs−)d < X

c >s+ X

0≤s≤t

(f(Xs)−f(Xs−)−f

′(Xs

−)∆Xs).

(13)

A proof of this theorem can be found in Applebaum (2009).

Now we can apply the differential form of the Ito’s formula toStas in (11) withLt as in (12)

and the resulting dynamics of the asset are:

dSt= (µ+1 2σ

2)St

−dt+σSt−dWt+St−dJt+

Z ∞

−∞ [St−e

x

−St−−xSt−]ν(dx, dt) (14)

Aσ-algebra F generated on [0, T]×Ω by all nonanticipating (adapted) left-continuous processes

is called a predictableσ-algebra.

If all terminal payoffshwith finite variance (h∈L2(FT,Q)) can be represented as

b

h=E[h] +

Z T

0

φtdStb

for some predictable process, the martingale (Stb)t∈[0,T]is said to have thepredictable representation

property. So this property is connected to the concept of market completeness.

Dermoune (1990) proved that the only L´evy processes that possess the predictable

representa-tion property are the Brownian morepresenta-tion and the compensated Poisson process.

Most used L´evy processes (jump-diffusion processes, pure jump processes, etc) lead us to a

model for an incomplete market. Thus, according to the Second Fundamental Theorem, there is

not just one equivalent martingale measure to price contingent claims.

Since we develop the pricing theory in a risk-neutral world, the rate of return on the asset under

measureQmust beµ=r−δ, whereδis the continuous dividend yield rate, and the discounted process (e−(r−δ)tSt)

0≤t≤T is a martingale under this measure. If (b, c, ν) is the L´evy triplet of the

process underPand (b′, c′, ν′) is the L´evy triplet after the change of measure, the following relation holds:

b′=r−δ−c

′

2 −

Z

R

(ex−1−x)ν′(dx) (15)

of the jumps measure ofν under the new measure.

For more details on these aspects see Eberlein and Shiryaev (2008).

3.2

Esscher Transform and Mean-Correcting Martingale Measure

Two examples of groups of martingale measure for L´evy processes that preserve the L´evy

prop-erty of log-returns are: the ones obtained by Esscher transform, and the ones obtained as the

minimal distance martingale measures. For a discussion on the set of possible equivalent

martin-gale measures, see Eberlein and Jacod (1997) and Miyahara (1999). We will look at martinmartin-gale

measures resulting from Esscher transforms.

Definition 3.6Let L be a L´evy process on some filtered probability space (Ω,F,(Ft)t∈R+,P).

We call Esscher transform to any change of P to a locally equivalent measure Qwith a density process Zt=ddQP

Ft

of the form:

Zt=exp(θLt)

mgf(θ)t

where θ∈Rand mgf(u) denotes the moment generating function of L1.

This definition is general about L´evy processes. We present now a result about the application

to stock prices modeled as exponential of L´evy processes, evidencing some conditions for the

existence of such an Esscher transform.

Lemma 3.7 Let the stock price process be given by (11)and let the following assumptions be satisfied:

1. the random variable L1 is non-degenerate and possesses a moment generating function mgf:

u7→E[exp(uL1)]on some open interval (a, b)with b−a >1.

2. there exists a real number θ∈(a, b−1)such that

mgf(θ) =mgf(θ+ 1).

Then, the basic probability measurePis locally equivalent to a measureQsuch that the discounted stock price exp(−rt)St=S0exp(Lt)is a Q-martingale. A density process leading to such a

mar-tingale measureQis given by the Esscher transform density:

Zθ t =

exp(θLt)

with a suitable real constantθ. The value ofθ is uniquely determined as the solution of

mgf(θ) =mgf(θ+ 1) θ∈(a, b).

The proof of this result can be found in Raible (1998), pp.8.

In line with the theory regarding the Esscher transform above, a more simplistic approach is

the so-called mean-correcting measure transformation. As it was seen in the Lemma (3.2) about

changes of measures, only the drift of the distribution is affected, so we can do the change of

measure in the following way.

We set a new characteristic function φ after a transformation of the original characteristic

functionφ:

φ(u) =φ(u)exp(ium)

wheremis the drift parametert to be added.

The new process is:

Xt=Xt+mt

and its L´evy triplet is:

γ=γ+m

σ2=σ2

ν(dx) =ν(dx)

And finally the new density function is:

f(x) =f(x−m).

To apply the mean-correcting method for changing the measure, one estimates the parameters

for the distribution. Then the parametermwill be determined based on the empirical parameters

and the fact that the discounted stock price must be a martingale. In the well-known model of

Black-Scholes, this corresponds to changingm=µ−1 2σ

2tom∗=r−q−1 2σ

2wherem∗is the new

driftmof the process, in a risk neutral world,µis the asset drift,σrepresents the asset volatility

As mentioned in Schoutens (2003), we can generalize this expression:

m∗=m+r−q−logφ(−i)

In the BS model, which is a geometric Brownian motion process, we have logφ(−i) =µ. So we

can set:

m∗=µ−12σ2+r−q−µ

m∗=r−q−12σ2

For the processes being studied this method yields:

m∗V G=r−q−log(1−θν−

1 2σν)

−1

ν

m∗GH =r−q−log((

α2−β2

α2−(β+ 1)2)

ν/2Kν(δ

p

α2−(β+ 1)2)

Kν(δpα2−β2) )

Now we can write the characteristic function for these processes in the risk neutral world:

φT(u) =E[exp(iuLog(ST))]

with

ST =S0exp(XT +m∗)

where Xtcan be a Variance Gamma or a Generalized Hyperbolic process.

Hence,

φT(u) =E[exp(iu Log(S0 exp(XT +m∗)))]

=exp(iu(Log(S0) +tm∗))φ(u)T.

4

Methodology

We will analyse two possible distributions for the log returns of Dow Jones Eurostoxx 50 Index,

based on data from the last month, precisely from August 17th. The table with data used is in

the appendix A.

The first process tested is the Variance Gamma, since it is one of the simplest of the pure

jump processes. The second one, as suggested by Eberlein and Keller (1995), is the Generalized

Hiperbolic, which is also a pure jump process, but as the name suggests, allowing for a more

generalized framework: Normal Inverse Gaussian, Variance Gamma and Hyperbolic processes are

special cases of the GH process. First we need to parametrize our distributions for the european

index. For this purpose, we use the surface of option prices by strike and maturity. Using the Fast

Fourier Transform, described in detail below, we ran the minimization function in matlabfmincon

to find the parameters that minimized the root mean square error:

RM SE=

v u u t X

options

(marketprice−modelprice)2

numberof options (16)

The minimization step for the GH distribution requires additional constraints, because of the

domain for the set of possible parameters. We used the GH distribution with four parameters,

instead of five, following Schoutens (2003) description of the distribution.

After calibrating the distributions from market data, we ran the Monte Carlo simulation to find

the prices of barrier options based on these processes for the underlying index. Both Monte Carlo

simulation steps and barrier options settings are explained further below. Generalized Hyperbolic

is a relatively difficult process to simulate, since its L´evy measure is not known in explicit form

while the probability density is only known for one time scale, and even in this case it requires

special functions. It is possible to simulate a discretized trajectory using the fact that GH can be

obtained by subordinating Brownian motion with a generalized Inverse Gaussian subordinator and

these random variables are easier to simulate because their probability density function is analytic.

4.1

Fast Fourier Transform

The Fourier transform of a function f is

Ff(v) =

Z ∞

−∞

And its inverse is given by

F−1f(x) = 1 2π

Z ∞

−∞

e−ixvf(v)dx

We will considerk=log(K) for the strike andst=log(St) for the spot price of the underlying

asset.

Let the risk-neutral density ofsT be qT(s). Then the characteristic function of this density is

given by

φT(u)≡

Z ∞

−∞

eiusqT(s)ds (17)

And we can use the above mentioned density to write the call value

CT(k)≡

Z ∞

k

e−rT(es−ek)qT(s)ds (18)

But this call value function is not square integrable, since the value of the integrand tends to a

fixed value ask→ −∞. So Carr and Madan (1998) transformed the call price:

cT(k)≡exp(αk)CT(k) (19)

forα >0 in order to have an exponential decrease in the function as k moves to−∞.

We then apply the Fourier Transform tocT(k):

ψT(v) =

Z ∞

−∞

eivkcT(k)dk (20)

But our objective will be using the risk neutral density of the asset to determine the call price:

CT(k) =exp(−αk)

π

Z ∞

0

e−ivkψ(v)dv

where

ψT(v) = e

−rTφT(v−(α+ 1)i) α2+α−v2+i(2α+ 1)v

The discretization method suggested by Madan and Carr for the last integral uses the

trape-zoidal method:

CT(k)≈exp(π−αk)ℜ[

NX−1

j=0

where

vj =η.j

andη is the interval for the integration grid

j = 0...N−1

∧ w=

0.5 if j= 0∨j=N−1

1 otherwise

The options used are centered at the money (K= 1 ork= 0):

ku=−b+λu u= 0...N−1

with

λ= 2b

N−1

And then

CT(ku)≈ exp(π−αk)ℜ[

NX−1

j=0

e−iηj(−b+λu)ψT(vj)ηwj]

with the constraint

ηλ=2π

N.

If the parameterη is small, meaning that the discretization step of the integral is small, then

the strikes gridkwill admit a larger step.

Using the Simpson’s rule we get:

CT(ku) =exp(−αku)

π ℜ[ NX−1

j=0

e−i2Nπ(j−1)(u−1)eibvjψ(vj)η/3[3 + (−1)j−δj

−1] (22)

withδn the Kronecker delta function that is unity forn= 0 and zero otherwise.

4.2

Monte Carlo simulation and subordination method

In order to simulate a L´evy process, in general we have the following possible methods:

1. Specifying a L´evy triplet (b, c, ν).

2. SpecifyingL1 by an infinitely divisible distribution as the distribution of the increments at

3. Time-changing Brownian motion with an independent increasing L´evy process

(subordina-tor).

All these methods require some knowledge about the properties of the processes involved. The

first method is the most demanding in terms of calibration to market data, since by knowing the

L´evy triplet, we gain insight of the whole structure of the process, and determining these

parame-ters is quite difficult. The most common methods are the second and the third options. But the

second option requires an explicit form for the L´evy measure.

We will use the third method: we will simulate a Brownian motion and then an independent

subordinator: a gamma subordinator for the Variance-Gamma process and a Generalized Inverse

Gaussian for the Generalized Hyperbolic process.

First, we will explain the process for the generation of a variance gamma process:

We use the following subordination method for the generation of discretized paths for fixed

timest1, ..., tn for a Variance Gamma process with parameters (σ, θ, ν):

1. Use Matlab function gamrnd to generate n independent gamma random variables γi with

parameters ∆t

ν , where ∆t is the fixed time space between two adjacent observations, on an

annual basis. The options being priced need equally spaced observations because they happen

on a daily basis.

2. Consider∀0≤i≤n: ∆Si=νγi.

3. GenerateN1, ..., Nn i.i.d random variables through matlab functionnormrnd.

4. Set ∆Xi =σNi√∆Si+θγi.

5. The desired path is given by

X(ti) =

i

X

k=1

∆Xk.

For the generation of the GH process, we use the expression (9). Simply put, we construct a

Normal distribution time-changed by a General Inverse Gaussian distribution:

XGH

t =νt+βτ(t) +Bτ(t)

where B is a Brownian motion, andτ(t) follows aGIG(λ, δ, γ) process, withγ=pα2+β2.

presented in Dagpunar (1989):

1. Set auxiliary function

g(y) = 12βy3−y2(βm

2 +λ+ 1) +y(m(λ−1)−

β

2) +

βm

2

2. Sety1=m.Repeaty1= 2y1 untilg(y1)>0

3. Sety0=m, y+=m.Repeat

y=y+

y+= 0.5(y0+y1)

Ifg(y+)<0 Then y0=y+ Elsey1=y+

Until|y+−y|<0.00001y+

4. Resety0= 0;y1=m;y−= 0. Repeat

y=y−

y−= 0.5(y0+y1)

Ifg(y−)<0 Then y1=y− Elsey0=y−

Until|y−−y|<0.00001y−

5. a= (y+−m)(ym+)(λ−21)exp(−β4(y++y1+ −m−m−1))

b= (y−−m)(y−

m)

(λ−1 2 )exp(−

β

4(y−+ 1

y− −

m−m−1))

c=−β4(m+ 1

m) + λ−1

2 log(m)

6. Repeat

generateR1, R2random variables that follow independent uniform distributions in (0,1)

y=m+aR2

R1 +b 1−R2

R1

Untily >0 and−log(R1)≥ −0.5(λ−1)log(y) + 0.25β(y+ 1/y) +c

And the resulting number y follows the desired Generalised Inverse Gaussian distribution.

After using these methods to generate the VG and GH processes for all simulations on Monte

Carlo engine, we apply the function of the payoff for the option contract in hand. All the different

payoffs from each run are summed. In the end, we take the value of the option as the sum of the

5

Application to an european index

As mentioned in the first chapter, the methodology previously described was applied to the DJ

Eurostoxx 50 index, which is an index constituted by blue-chip stocks from countries in the EMU,

each stock having a maximum weight of 10%. It is a very liquid index, with both high volumes in

futures and options trading.

Since our main objective was the pricing of an exotic option with maturity of one year, we used

the grid of traded options with maturities up to December 2012. Quotes were taken at the 17th

August 2011.

5.1

Calibrating the models

The estimation of the distribution parameters for both models was done by the minimization

of the distance between the relevant option prices of the grid (strike x maturity) calculated using

FFT method and the market surface.

The first thing to notice is that this optimization procedure is very tricky and computationally

dependent. The function used for the calibration of the distribution was from matlab: fmincon.

It attempts to find a constrained minimum of a scalar function of several variables starting at an

initial estimate. This is generally referred to as a constrained nonlinear optimization or nonlinear

programming. Essentially, considering some limitations, such as the number of times to rerun the

function to be minimized, or the variation looked for, it searches a local minimum starting from

an estimation given by the user. The first naive attempt at running the optimization yielded the

results found in Figure 1 and Figure 2, for VG and GH processes respectively.

After running different initiations for the function, the results achieved improved substantially,

as can be seen in Figures 3 and 4. The modeled prices were nearer to the observed prices, and the

larger differences came from larger maturities or deep out-of-the-money options.

The surface of the differences between modeled prices and quoted prices are shown in Figure 5

and 6. The values for errors with VG have a higher range than the one with GH, which demonstrates

a better fit of the later model.

The highest difference was found in VG model: 13 euros, or 4% of the option value, as opposing

to Black-Scholes model results. Figure 7 shows the surface of discrepancies between BS prices and

observed prices. Here the errors are clearly larger than in the previous two models.

The calibration process might be improved with more robust computational tools.

Figure 1: First model calibration of VG distribution

Figure 2: First model calibration of GH distribution

estimation are presented on Figure 8.

5.2

Pricing exotic options

The options chosen to be priced were double barrier knock-out options, more precisely: a

Figure 3: Model calibration of VG distribution

Figure 4: Model calibration of GH distribution

money is just the sum of a put and a call at the same strike value K.

Let DB denote the down-and-out barrier and UB the up-and-out barrier of the options. The

strangle with a dual directional out barrier can be described as:

H =max(0, ST−K, K−ST)1DB<St<U B,0≤t≤T

Figure 5: Market prices minus modeled prices, via VG model

Figure 6: Market prices minus modeled prices, via GH model

It was not considered the forward start possibility. The pricing was performed on the 17th of

August, after close, considering the strike equal to Eurostoxx50 index closing value and the up and

down barriers were 130% and 70% of the strike, respectively.

We asked the price for this option to different possible counterparties, and priced it using Monte

Carlo simulation for both the VG and GH models as well as for the Black-Scholes assumptions.

Figure 7: Difference between Black-Scholes and market prices

Figure 8: Parameters estimation

the underlying price (jumps). Double barrier was used instead of single barrier because an analytic

closed formula is not known, only adaptations that require Laplace transformations calculations,

that are fast to compute and don’t require scenario simulation, such as Monte Carlo, but still

require convergence results for the calculations. So, the use of Monte Carlo can still be considered

adequate.

The results are presented below and are given in percentage, so we would not be dependent on

traded notional for these pricing. Indeed, over-the-counter quotes in percentage are very common:

Table 1: Prices for double knock-out option BS model VG model GH model Cntp. 1 Cntp. 2

Option Price 4.13% 7.26% 8.17% 8.47% 8.75%

As expected, the assumptions of BS applied to a Monte Carlo simulation to price this structure

It is referred in several articles that stochastic volatility modeling is becoming more and more

popular in the industry, and the prices that we received from market participants are likely to be

the result of such models. By using models with jumps we have obtained values that were closer

to market values. L´evy processes can also be used for stochastic volatility modeling, though this

6

Conclusions

In this thesis we assumed the price of an European index follows an exponential L´evy process,

and estimated the parameters for the Variance Gamma and Generalized Hyperbolic processes,

which are pure jump processes. When comparing the results of the estimated processes for vanilla

options pricing with the usual Black-Scholes model, we achieved better results. Results were better

overall, across maturities and strikes. It is worth noticing that the largest differences were observed

with deep out-of-the-money options, and higher maturities.

The exponential GH process evidenced a more stable approximation of the options market

surface. This was in line with our expectations, since the Variance Gamma is a special case of a

GH distribution. This fact enforces the idea that, though VG might be a clear improvement in

relation to a continuous diffusion model, the use of a more flexible process is justified.

Usually, other special cases such as the NIG or the Hyperbolic processes are estimated, but

one can generate the Generalized Hyperbolic by subordination of a Brownian motion with a GIG

process, enabling a structure that is not dependent on some pre-defined assumption for some of

the parameters.

The calibration to market prices consumes a lot of computational and numerical effort. The

work performed to calibrate the models showed the relevance of using strong estimation techniques,

as depending on predefined minimization toolboxes might yield an unsatisfactory calibration.

We used the calibrated models to price a double barrier option. This is a structure that is path

dependent and very sensitive to volatility. After analysing the prices with Monte Carlo simulation

for a diffusion model, both jump processes under study and the market prices for this derivative, we

found that the market prices were closer to the exponential L´evy models than to the exponential

Brownian motion.

After the completion of this work, some questions naturally arise. In the options surface there

were some discrepancies on out-of-the-money options, with longer maturities. One could study

whether the inclusion of stochastic volatility would diminish these differences considerably. Other

models could be studied as well, to test whether these differences would fade, like the CGMY or

Meixner processes. Additionally, posterior to an exotic option pricing, it could be tested whether a

hedging strategy supported by an exponential L´evy process would generate significant divergences

from the usual delta hedging supported by the Brownian motion.

Though superhedging is a possibility when considering hedging strategies, as it guarantees no

market, so further analysis in possible hedging strategies may be required for incomplete markets,

such as L´evy market models, as mentioned before. Besides, other tools such as fractional calculus

or Malliavin calculus might be required for dealing with more complex derivatives, or with barrier

options, where infinite derivatives might occur often, if the underlying approaches the barrier.

Stochastic volatility models may consider Brownian motion with a volatility parameter that

follows a stochastic process, may be a result of a subordination of a Brownian or L´evy process

by another L´evy process. A comparison between these models would be useful, since the effort

in calibrating these models depends on the type of process and the quantity of parameters to

be estimated, and the feasibility of the application will depend on this, so the gain of additional

7

Appendix A

DJ Eurostoxx50 Call Option Prices

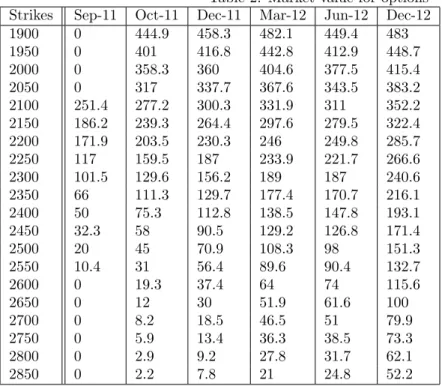

Listed below are 110 option prices on the DJ Eurostoxx50 index, at 13:05 of the 17th August, 2011. The index was at 2328.53. Estimated dividend yield for the next 12 months, according to Bloomberg data, was 5.10% and the interest rate for swaps on the euro, for maturity of 2 years, was 1.5341%.

Table 2: Market value for options Strikes Sep-11 Oct-11 Dec-11 Mar-12 Jun-12 Dec-12

1900 0 444.9 458.3 482.1 449.4 483

1950 0 401 416.8 442.8 412.9 448.7

2000 0 358.3 360 404.6 377.5 415.4

2050 0 317 337.7 367.6 343.5 383.2

2100 251.4 277.2 300.3 331.9 311 352.2

2150 186.2 239.3 264.4 297.6 279.5 322.4

2200 171.9 203.5 230.3 246 249.8 285.7

2250 117 159.5 187 233.9 221.7 266.6

2300 101.5 129.6 156.2 189 187 240.6

2350 66 111.3 129.7 177.4 170.7 216.1

2400 50 75.3 112.8 138.5 147.8 193.1

2450 32.3 58 90.5 129.2 126.8 171.4

2500 20 45 70.9 108.3 98 151.3

2550 10.4 31 56.4 89.6 90.4 132.7

2600 0 19.3 37.4 64 74 115.6

2650 0 12 30 51.9 61.6 100

2700 0 8.2 18.5 46.5 51 79.9

2750 0 5.9 13.4 36.3 38.5 73.3

2800 0 2.9 9.2 27.8 31.7 62.1

8

Appendix B

Matlab - most relevant code

function y = bs(x, r,q, sig, t)

d1 = (-log(x) + (r - q + 0.5 * sig2)∗t)/(sig∗sqrt(t));

d2 =d1−sig∗sqrt(t);

n1 =normcdf(d1);

n2 =normcdf(d2);

y= (exp(−q∗t)∗n1−x.∗n2∗exp(−r∗t));

function principal= VGcalibration(v0)

%Definition of the global variable

global OptPrice strike SpotsizeSsizeT lstrike pricesnorm r q a N eta b lambda alpha u x T B A;

%matrix of the prices of european call options

OptPrice = [0 444.9 458.3 482.1 449.4 483; 0 401 416.8 442.8 412.9 448.7; ...

0 358.3 360 404.6 377.5 415.4; 0 317 337.7 367.6 343.5 383.2; ...

251.4 277.2 300.3 331.9 311 352.2; 186.2 239.3 264.4 297.6 279.5 322.4; ...

171.9 203.5 230.3 246 249.8 285.7; 117 159.5 187 233.9 221.7 266.6;...

101.5 129.6 156.2 189 187 240.6; 66 111.3 129.7 177.4 170.7 216.1;...

50 75.3 112.8 138.5 147.8 193.1; 32.3 58 90.5 129.2 126.8 171.4;...

20 45 70.9 108.3 98 151.3; 10.4 31 56.4 89.6 90.4 132.7; 0 19.3 37.4 ...

64 74 115.6; 0 12 30 51.9 61.6 100; 0 8.2 18.5 46.5 51 79.9;

0 5.9 13.4 36.3 38.5 73.3; 0 2.9 9.2 27.8 31.7 62.1; 0 2.2 7.8 21 24.8 52.2];

%Strikes

strike= (1900:50:2850);

%Maturity of the considered options

T = [0.0806982 0.1765886 0.3300133 0.5793283 0.8286434 1.3464516];

Spot= 2328.53;

%parameters of the model

%risk free rate and dividend (annualized)

r = 0.01534;

q = 0.05109561;

%number of strikes and maturities for grid

sizeS = length(strike);

sizeT = length(T);

%log of the strike normalized by the spot

lstrike= log(strike/Spot);

%normalized matrix of prices

pricesnorm = OptPrice / Spot;

%integration grid - log strike grid

a = 600*2; % integration between 0 and a for the inverse Fourier transform

N = 4096*2; % strikes for FFT

A = zeros(sizeT, N);

B = zeros(sizeT, sizeS);

eta = a/N; % integration grid

b = pi/eta; % limits of the log-strike (-b,+b)

lambda = 2*pi/a; % step of the log strike

% Carr and Madan paramater (to avoid integration problem in 0) - 0.75 is

% suggested by Wim Schoutens in ”Levy Processes in Finance”

alpha = 0.75;

% integration grid

% log strike grid

x = -b + (0:N-1) * lambda;

f = @rootsqdif;

%Activate the following lines may improve precision for the minima search

options=optimset(’LargeScale’,’on’,’display’,’iter’,’TolFun’,1e-10,’TolX’,1e-10);

%search for the minima. The two vectors represent the range of the search

sigmam=f mincon(f, v0,[],[],[],[],[0.0050.0050.005],[151515],[], options);

maturF=[]; strikeF=[]; mktF=[]; calcul=[];

for j=1:sizeS

for l=1:sizeT

if OptPrice(j,l) ˜=0

strikeF = [strikeF, strike(j)];

marcheF = [mktF, OptPrice(j,l)];

calcul = [calcul , Spot*B(l,j)];

maturF = [maturF,T(l)];

end;

end;

end;

plot(strikeF,mktF,’o’,strikeF,calcul,’+’)

xlabel(’Strike’,’FontSize’,12)

ylabel(’Price ($)’,’FontSize’,12)

titre = ’Calibration: o market prices; + VG model’;

title(titre,’FontSize’,12,’FontWeight’, ’bold’)

print -dwin calibrationVG2011.eps

principal = sigmam;

Generalized hyperbolic generation:

%GH trajectories

function y = pathGH(Spot,r,q,x,alpha, beta, delta, lambda,n,deltat)

a =alpha2-beta2;

b =alpha2- (beta+ 1)2;

m = x*(r-q) + x * log((a/b)ˆ(lambda/2)*besselk(lambda,delta*sqrt(b))/besselk(lambda,delta*sqrt(a)));

%GIG number generator for the subordination

gig = GIGrn(delta2

t,lambda, alpha, beta,deltat, n);

Bm = normrnd(0,1,[1 n]);

% GH increments generation

deltax = Bm.*(gig.(1/2))+beta*gig;

v1 = zeros(1,n);

for i = 2:n;

v1(i)=v1(i-1)+deltax(i);

end;

%exponential of GH with drift to remain risk neutral

v2 = Spot*exp(v1).*(exp(m));

y = [max(v2), min(v2), v2(n)];

function z = GIGrn(lambda, a, b, delta, n)

gamma = sqrt(a2+b2);

beta = sqrt(gamma * delta);

m = (lambda-1 + sqrt((lambda−1)2+beta2)) / beta;

y1 = m;

y1= 2*y1;

while rootsg(y1,beta,m,lambda)<= 0

y1= 2*y1;

end;

y0 = m;

y2 = m;

y = y2;

y2 = 0.5 * (y0 +y1);

if rootsg(y2,beta,m,lambda) 0

y0=y2;

else

y1 = y2;

while abs(y2 - y)>= 0.00001*y2

y = y2;

y2 = 0.5 * (y0 +y1);

if rootsg(y2,beta,m,lambda) 0

y0=y2;

else

y1 = y2;

end;

end;

y0 = 0;

y1 = m;

y3 = 0;

y = y3;

y3 = 0.5 * (y0 + y1);

if rootsg(y3,beta,m,lambda) 0

y1 = y3;

else

y0 = y3;

end;

while abs(y3-y)>= 0.00001*y3

y = y3;

y3 = 0.5 * (y0 + y1);

if rootsg(y3, beta,m,lambda) 0

y1 = y3;

else

y0 = y3;

end;

end;

a1 = (y2 -m)*(y2/m)ˆ(0.5*(lambda-1))*exp(-0.25*beta*(y2+1/y2-m-1/m));

a2 = (y3 -m)*(y3/m)ˆ(0.5*(lambda-1))*exp(-0.25*beta*(y3+1/y3-m-1/m));

c = -0.25*beta*(m+1/m)+0.5*(lambda-1)*log(m);

value = zeros(1,n);

for i=1:n

r2 = unifrnd(0,1);

y = m + a1 * (r2/r1) + a2 * (1-r2)/r1;

while ˜(y ¿0 & -log(r1)¿=-0.5*(lambda-1)*log(y)+0.25*beta*(y+1/y)+c)

r1 = unifrnd(0,1);

r2 = unifrnd(0,1);

y = m + a1 * (r2/r1) + a2 * (1-r2)/r1;

end;

value(1,i) = y;

end;

References

Applebaum, D. (2009). L´evy Processes and Stochastic Calculus. Cambridge University Press.

Barndorff-Nielsen, O. E. (1977). Exponentially decreasing distributions for the logarithm of particle

size. Proceedings of the Royal Society of London, A353:pp. 401–419.

Bertoin, J. (1996). L´evy Processes. Cambridge University Press.

Bertoin, J. (1999). Subordinators: examples and applications. Ecole d’Et´e de Probabilit´es de St.

Flour XXVII, Lectures Notes in Mathematics 1717:4–79.

Carr, P. and Madan, D. (1998). Option valuation using the fast fourier transform. Journal of

Computational Finance, 2:pp. 61–73.

Cont, R. and Tankov, P. (2004).Financial Modelling With Jump Processes. Chapman & Hall/CRC.

Dagpunar, J. (1989). An easily implemented generalised inverse gaussian generator.

Communica-tions in Statistics - Simulation and Computation, 18:pp. 703–710.

Delbaen, F. and Schachermayer, W. (1998). The fundamental theorem of asset pricing for

un-bounded stochastic processes. Math. Ann., 312:pp. 215–250.

Dermoune, A. (1990). Distribution sur l’espaces de p. l´evy et calcul stochastique.Ann. Inst. Henri

Poincar´e, 26:pp. 101–119.

Eberlein, E. and Jacod, J. (1997). On the range of options prices. Finance Stoch., 1:pp. 131–140.

Eberlein, E. and Keller, U. (1995). Hyperbolic distributions in finance. Bernoulli, 1:pp. 281–299.

Eberlein, E. and Prause, K. (2001). The generalized hyperbolic model: financial derivatives and

risk measures. In: Mathematical Finance - Bachelier Congress 2000. H. Geman, D. Madan, S.

Pliska, and T. Vorst (eds.). Springer Verlag.

Eberlein, E., P. A. and Shiryaev, A. N. (2008). On the duality principle in option pricing:

semi-martingales setting. Finance Stoch., 12:pp. 265–292.

Geman, H. and An´e, T. (1996). Stochastic subordination. RISK, September.

Geman, H., M. D. and Yor, M. (2001). Time changes for l´evy processes. Math. Finance, 11:pp.

79–96.

Miyahara, Y. (1999). Minimal entropy martingale measures of jump type price processes in

in-complete asset markets. Asia-Pacific Financial Markets, 6:pp. 97–113.

Papapantoleon, A. (2008). An introduction to l´evy processes with applications in finance.

arXiv:0804.0482v2.

Prause, K. (1999).The Generalized Hyperbolic Model: Estimation, Financial Derivatives, and Risk

Measures. PhD thesis, University of Freiburg.

Protter, P. (1990). Stochastic integration and differential equations. Springer: Berlin.

Raible, S. (1998). L´evy processes in finance: theory, numerics and empirical facts. PhD thesis,

University of Freiburg.

Sato, K. (1999).L´evy Processes and Infinitely Divisible Distributions. Cambridge University Press.

Schoutens, W. (2003). L´evy Processes in Finance: Pricing Financial Derivatives. John Wiley &

Sons, Inc.