❊♥s❛✐♦s ❊❝♦♥ô♠✐❝♦s

❊s❝♦❧❛ ❞❡

Pós✲●r❛❞✉❛çã♦

❡♠ ❊❝♦♥♦♠✐❛

❞❛ ❋✉♥❞❛çã♦

●❡t✉❧✐♦ ❱❛r❣❛s

◆

◦

✹✽✽

■❙❙◆ ✵✶✵✹✲✽✾✶✵

❇♦✉♥❞s ❢♦r t❤❡ ♣r♦❜❛❜✐❧✐t② ❞✐str✐❜✉t✐♦♥ ❢✉♥❝✲

t✐♦♥ ♦❢ t❤❡ ❧✐♥❡❛r ❆❈❉ ♣r♦❝❡ss

▼❛r❝❡❧♦ ❋❡r♥❛♥❞❡s

❖s ❛rt✐❣♦s ♣✉❜❧✐❝❛❞♦s sã♦ ❞❡ ✐♥t❡✐r❛ r❡s♣♦♥s❛❜✐❧✐❞❛❞❡ ❞❡ s❡✉s ❛✉t♦r❡s✳ ❆s

♦♣✐♥✐õ❡s ♥❡❧❡s ❡♠✐t✐❞❛s ♥ã♦ ❡①♣r✐♠❡♠✱ ♥❡❝❡ss❛r✐❛♠❡♥t❡✱ ♦ ♣♦♥t♦ ❞❡ ✈✐st❛ ❞❛

❋✉♥❞❛çã♦ ●❡t✉❧✐♦ ❱❛r❣❛s✳

❊❙❈❖▲❆ ❉❊ PÓ❙✲●❘❆❉❯❆➬➹❖ ❊▼ ❊❈❖◆❖▼■❆

❉✐r❡t♦r ●❡r❛❧✿ ❘❡♥❛t♦ ❋r❛❣❡❧❧✐ ❈❛r❞♦s♦

❉✐r❡t♦r ❞❡ ❊♥s✐♥♦✿ ▲✉✐s ❍❡♥r✐q✉❡ ❇❡rt♦❧✐♥♦ ❇r❛✐❞♦

❉✐r❡t♦r ❞❡ P❡sq✉✐s❛✿ ❏♦ã♦ ❱✐❝t♦r ■ss❧❡r

❉✐r❡t♦r ❞❡ P✉❜❧✐❝❛çõ❡s ❈✐❡♥tí✜❝❛s✿ ❘✐❝❛r❞♦ ❞❡ ❖❧✐✈❡✐r❛ ❈❛✈❛❧❝❛♥t✐

❋❡r♥❛♥❞❡s✱ ▼❛r❝❡❧♦

❇♦✉♥❞s ❢♦r t❤❡ ♣r♦❜❛❜✐❧✐t② ❞✐str✐❜✉t✐♦♥ ❢✉♥❝t✐♦♥ ♦❢

t❤❡ ❧✐♥❡❛r ❆❈❉ ♣r♦❝❡ss✴ ▼❛r❝❡❧♦ ❋❡r♥❛♥❞❡s ✕ ❘✐♦ ❞❡ ❏❛♥❡✐r♦ ✿

❋●❱✱❊P●❊✱ ✷✵✶✵

✭❊♥s❛✐♦s ❊❝♦♥ô♠✐❝♦s❀ ✹✽✽✮

■♥❝❧✉✐ ❜✐❜❧✐♦❣r❛❢✐❛✳

Bounds for the probability distribution function

of the linear ACD process

Marcelo Fernandes

Graduate School of Economics, Funda¸c˜

ao Getulio Vargas

Praia de Botafogo, 190, 22253-900 Rio de Janeiro, Brazil

Tel: +55 21 2559 5827

Fax: +55 21 2553 8821

E-mail:

mfernand@fgv.br

Abstract:

This paper derives both lower and upper bounds for the probability

distribution function of stationary ACD(p, q) processes. For the purpose of

illustration, I specialize the results to the main parent distributions in duration

analysis. Simulations show that the lower bound is much tighter than the upper

bound.

JEL Classification:

C22, C41.

Acknowledgements:

I am grateful to Bernardo de S´a Mota for excellent

re-search assistance and to the CNPQ for supporting this rere-search. The usual

1

Introduction

The statistical properties of the autoregressive conditional duration model of

first order are by now quite well known. Engle and Russell (1998) derive not

only the first two moments of the ACD(1,1) model, but also the conditions

un-der which it is stationary and

β

−

mixing. Carrasco and Chen (2002) extend the

latter results so as to consider the more general ACD(p, q) model. Bauwens and

Giot (2000) provide a recursive formula to compute the autocorrelation

func-tion of the ACD(1,1) process with exponential errors. Fernandes and Grammig

(2002) establish conditions for the existence of higher-order moments, strict

stationarity and

β

−

mixing property as well as moment recursion relations and

autocovariance function of a richer class of nonlinear ACD(1,1) processes that

encompasses most autoregressive conditional duration models in the literature.

This note aims at deriving nonasymptotic characterizations of the tail

be-havior of unconditional distribution function of the ACD(p, q) process. More

precisely, I derive both lower and upper bounds for the probability density

func-tion of the durafunc-tion process. These bounds are quite relevant to the analysis of

liquidity risk in that trade and volume durations are intimately related to

mar-ket activity and liquidity (see Gouri´eroux, Jasiak and Le Fol, 1999). Another

interesting application relates to actuarial models of credit risk contagion as in

Focardi (2001).

The remainder of this paper is organized as follows. Section 2 bounds the

probability density function of the ACD(p, q) process without assuming a

partic-ular distribution for the error term. Section 3 sharpens the result by considering

the usual specifications of the density of the error term. Section 4 investigate

the precision of these bounds through a simple simulation study.

2

Bounds

Let

x

t

=

τ

t

−

τ

t

−

1

denote the time spell between two events occurring at times

τ

t

and

τ

t

−

1. Engle and Russell (1998) propose to account for the serial dependence

where

ψ

t

≡

E

¡

x

t

|

Ω

t

−

1

¢

,

ǫ

t

is iid with unity mean, and Ω

t

−

1

is the set including

all information available at time

τ

t

−

1. The ACD(p, q) then assumes that

ψ

t

and

ǫ

t

are stochastically independent, and

ψ

t

=

ω

+

p

X

i

=1

α

i

x

t

−

i

+

q

X

j

=1

β

j

ψ

t

−

j

,

(1)

where

ω >

0,

α

≡

(α1, . . . , α

p

)

≥

0, and

β

≡

(β1, . . . , β

q

)

≥

0. This

param-eter restrictions ensure the nonnegativeness of the duration process, whereas

imposing

γ

≡

P

p

i

=1

α

i

+

P

q

j

=1

β

j

<

1 guarantees stationarity.

I take benefit from the close parallel between ACD and GARCH models in

order to establish both lower and upper bounds of the probability distribution

function. More precisely, I start with a trivial upper bound and then derive a

nontrivial lower bound using the techniques put forth by Pawlak and Schmid

(2001). Denoting by

F

ǫ

the probability distribution function of the error term,

it follows that

Pr(x

t

≤

z) =

E

£

Pr

¡

ψ

t

ǫ

t

< z

|

I

t

−

1

¢¤

=

E

"

F

ǫ

Ã

z

ω

+

P

p

i

=1

α

i

x

t

−

i

+

P

q

j

=1

β

j

ψ

t

−

j

!#

.

(2)

It is readily seen that

Pr(x

t

≤

z)

≤

F

ǫ

(z/ω)

(3)

given that durations are nonnegative as well as

α

and

β

.

As in Pawlak and Schmid (2001), the nontrivial lower bound for the

prob-ability distribution function of the duration process holds only for

z

∈

[0,

z],

¯

where ¯

z

varies according to the distribution of the error term. The reason is

that, to apply Jensen’s inequality to bound (2) from below, one must find the

conditions under which the function

H

(u, v) =

F

ǫ

Ã

z

ω

+

P

p

i

=1

α

i

u

i

+

P

q

j

=1

β

j

v

j

!

(4)

is convex for all

u

≡

(u1, . . . , u

p

)

≥

0 and

v

≡

(v1, . . . , v

q

)

≥

0. It is

straightfor-ward to show that the Hessian of (4) is convex if

2f

ǫ

(z/M) +

z

M

f

′

where

M

=

ω

+

P

p

i

=1

α

i

u

i

+

P

q

j

=1

β

j

v

j

, given that

∂

2

H

(u, v)

∂u

r

∂u

s

=

α

r

α

s

z

2

M

4

f

′

ǫ

(z/M

) + 2

α

r

α

s

z

M

3

f

ǫ

(z/M)

(6)

∂

2

H

(u, v)

∂u

r

∂v

s

=

α

r

β

s

z

2

M

4

f

ǫ

′

(z/M

) + 2

α

r

β

s

z

M

3

f

ǫ

(z/M)

(7)

∂

2

H

(u, v)

∂v

r

∂u

s

=

β

r

β

s

z

2

M

4

f

′

ǫ

(z/M) + 2

β

r

β

s

z

M

3

f

ǫ

(z/M

)

(8)

for

r

6

=

s. I am now ready to state the main result.

Theorem.

Let

x

t

∼

ACD(p, q)

satisfying the nonnegativeness and stationarity

conditions. Assuming that the density

f

ǫ

of the error term is differentiable then

yields that

F

ǫ

(x)

≤

Pr

µ

x

t

≤

ω

1

−

γ

x

¶

≤

F

ǫ

µ

x

1

−

γ

¶

,

(9)

where the lower bound holds only for

x

∈

£

0,

(1

−

γ)c

¤

with

c

≡

sup

τ >

0

n

2f

ǫ

(x) +

xf

ǫ

′

(x)

≥

0 for all 0

< x < τ

o

.

(10)

Proof.

It ensues from condition (5) that

sup

τ >

0

n

2f

ǫ

(z/M) +

z

M

f

′

ǫ

(z/M

)

≥

0 for all 0

< x < τ

o

=

M

sup

τ >

0

{

2f

ǫ

(x) +

xf

ǫ

′

(x)

≥

0 for all 0

< x < τ

}

=

M c.

(11)

The Hessian of (4) is therefore convex if

z

≤

c

ω

+

p

X

i

=1

α

i

u

i

+

q

X

j

=1

β

j

v

j

.

(12)

This is true for any

α

i

, ui, β

j

, v

j

≥

0 if

z

≤

cω. The result then follows by

applying the Jensen’s inequality to (2) with

z

=

1

−

ω

γ

x.

¥

As is apparent, the applicability of the lower bound depends essentially on

the constant

c, and hence it is interesting to evaluate (10) for the usual

dis-tributions in the ACD literature. I therefore consider in the next section five

particular cases, namely exponential, Weibull, Burr, generalized gamma, and

uniform. In all instances I normalize the distribution so as to impose unity

3

Examples

The ACD modeling aims to match two stylized features in financial

dura-tion data, namely serial correladura-tion and overdispersion.

Engle and Russell

(1998) show indeed that the simple ACD model with exponential errors produce

overdispersion. Further, quasi maximum likelihood methods provide consistent

estimates for ACD process only if based on the exponential distribution (see

Drost and Werker, 2001). It seems therefore natural to start with the

exponen-tial assumption for the error term, which yields

f

E

(x) =

e

−

x

and

f

E

′

(x) =

−

e

−

x

.

By (5), this implies that

c

= 2.

Engle and Russell (1998) argue that the nature of financial durations are

more in line with a decreasing baseline hazard rate function. The exponential

assumption implies however that the baseline hazard rate function is flat. A

natural candidate then is the Weibull distribution with parameter

θ, which

gives rise to either monotonically decreasing (0

< θ <

1) or increasing (θ >

1)

baseline hazard rate functions. The density function of the Weibull distribution

and its first derivative are

f

W

(x) =

θ

Γ(1 + 1/θ)

x

θ

−

1

exp

·

−

x

θ

Γ(1 + 1/θ)

¸

(13)

f

′

W

(x) =

−

f

W

(x)

·

1

−

θ

x

+

θ

Γ(1 + 1/θ)

x

θ

−

1

¸

,

(14)

respectively. Condition (5) then becomes

f

W

(x)

·

2

−

1 +

θ

−

Γ(1 + 1/θ)

θ

x

θ

¸

≥

0,

(15)

which implies that

c

=

h

Γ(2 + 1/θ)

i

1

/θ

. As a sanity check, observe that in the

exponential case

θ

= 1, recovering

c

= Γ(3) = 2. If one assumes that 0

< θ <

1

as in Engle and Russell (1998), then the sup condition in (10) becomes less

stringent than in the exponential context, viz.

c >

2.

Grammig and Maurer (2000) advocate the use of the Burr distribution in

order to accommodate more flexible hazard rate functions. Indeed the Burr

density

f

B

(x) =

θ ξ

θ

B

x

θ

−

1

¡

1 +

κ ξ

θ

B

x

θ

where

θ > κ >

0 and

ξ

B

≡

Γ

¡

1 + 1/θ

¢

Γ

¡

1/κ

−

1/θ

¢

κ

1+1

/θ

Γ

¡

1 + 1/κ

¢

,

(17)

entails a nonmonotonic baseline hazard rate function if

θ >

1. It is easy to show

that

f

′

B

(x) =

f

B

(x)

·

θ

−

1

x

−

µ

1 +

1

κ

¶

κ θ ξ

θ

B

x

θ

−

1

1 +

κ ξ

θ

B

x

θ

¸

,

(18)

and hence

c

=

µ

θ

+ 1

θ

−

κ

¶

1

/θ

ξ

−

1

B

=

µ

θ

+ 1

θ

−

κ

¶

1

/θ

κ

1+1

/θ

Γ(1 + 1/κ)

Γ(1 + 1/θ) Γ(1/κ

−

1/θ)

.

(19)

Special cases of the Burr family of distributions are the Weibull (κ

→

0), the

exponential (κ

→

0, θ

= 1), and the log-logistic (θ > κ

= 1) distributions.

As an alternative to the Burr model, Lunde (1999) puts forward the

gener-alized gamma ACD process, where

ǫ

t

is iid with density

f

G

(x) =

ξ

θκ

G

θx

θκ

−

1

Γ(κ)

exp

¡

−

ξ

G

θ

x

θ

¢

(20)

where

ξ

G

≡

Γ(κ

+ 1/θ)/Γ(κ). The generalized gamma distribution nests the

standard gamma (θ

= 1), log-normal (κ

→ ∞

), Weibull (κ

= 1), exponential

(θ

=

κ

= 1), and half-normal (κ

= 1/2, θ

= 2) distributions.

Although the baseline hazard rate has no closed-form solution, it is possible

to derive its shape properties according to the parameter values (Glaser, 1980).

If

θκ <

1, the hazard rate is decreasing for

θ

≤

1, and U-shaped for

θ >

1.

Conversely, if

θκ >

1, the hazard rate is increasing for

θ

≥

1, and inverted

U-shaped for

θ <

1. Lastly, if

θκ

= 1, the hazard rate is decreasing for

θ <

1,

constant for

θ

= 1 (exponential case), and increasing for

θ >

1. The derivative

of the density is

f

′

G

(x) =

f

G

(x)

·

κθ

−

1

x

−

θ ξ

θ

G

x

θ

−

1

¸

,

(21)

yielding

c

= (κ

+ 1/θ)

1

/θ

Γ(κ)

Γ(κ

+ 1/θ)

.

(22)

It is easy to show that the lower bound is valid for

c

=

√

π

and

c

= 1 + 1/κ

in the particular cases of the half-normal and standard gamma distributions,

Finally, albeit the ACD process with

ǫ

t

∼

U

(0,

2) does not have much appeal

in practice, it entails a very interesting result. Indeed, it turns out that (5) holds

for every value of

x, and so the lower bound is always valid. Figure 1 summarizes

these results by displaying the constant

c

as a function of the distributional

parameters. There are no plots for the exponential, half-normal and uniform

distributions in view that

c

does not vary for them.

4

Sharpness of the bounds

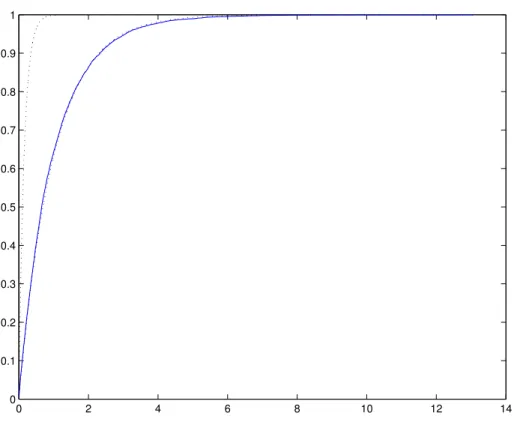

To investigate how tight these bounds are, I perform a simple simulation study

using an ACD(2,2) process with exponential errors. I set

α

= (0.10,

0.05) and

β

= (0.45,

0.25) and normalize the unconditional expected duration to one by

imposing

ω

= 1

−

γ. Next, I initialize (1) with

ψ0

= 1 and simulate 10,000

realizations of the process and then estimate the unconditional cumulative

dis-tribution of the duration process using the empirical disdis-tribution of the last

8,000 observations of the sample. Figure 2 illustrates the fact that, despite

the slackness of the trivial upper limit, the nontrivial lower bound is extremely

sharp and informative. Further simulations show that this result is quite robust

to the specification of the linear ACD process. The simulations also indicate

that by substituting maximum likelihood estimates for the true values of the

parameters, the 95% confidence interval of the lower bound provides a tight

confidence band to the true probability distribution function of the process.

References

Bauwens, L., Giot, P., 2000, The logarithmic ACD model: An application to

the bid-ask quote process of three NYSE stocks, Annales d’Economie et de

Statistique 60, 117–150.

Carrasco, M., Chen, X., 2002, Mixing and moment properties of various GARCH

and stochastic volatility models, Econometric Theory 18, 17–39.

Engle, R. F., Russell, J. R., 1998, Autoregressive conditional duration: A new

model for irregularly-spaced transaction data, Econometrica 66, 1127–1162.

Fernandes, M., Grammig, J., 2002, A family of autoregressive conditional

dura-tion models, Ensaios Econˆ

omicos 404, Funda¸c˜

ao Getulio Vargas.

Focardi, S. M., 2001, An actuarial model of credit risk contagion, Discussion

Paper 03, Intertek Group.

Glaser, R. E., 1980, Bathtub and related failure rate characterizations, Journal

of the American Statistical Association 75, 667–672.

Gouri´eroux, C., Jasiak, J., Le Fol, G., 1999, Intra-day market activity, Journal

of Financial Markets 2, 193–226.

Grammig, J., Maurer, K.-O., 2000, Non-monotonic hazard functions and the

autoregressive conditional duration model, Econometrics Journal 3, 16–38.

Lunde, A., 1999, A generalized gamma autoregressive conditional duration

model, University of Aarhus.

1

2

3

4

5

1

1.5

2

θ

c

0.2

0.4

0.6

0.8

1

0

1

2

3

x 10

5

θ

c

0

2

4

6

8

10

0.38

0.39

0.4

0.41

0.42

k

c

0

2

4

6

8

10

0

5

10

15

k

c

0

5

0

5

1

2

3

θ

k

c

0

5

5

10

0

1

2

θ

k

c

Figure 1: The constant

c

as a function of the distributional parameters

coordinates

distribution

(1,1)

Weibull (

θ

≥

1)

(1,2)

Weibull (

θ

≤

1)

(2,1)

log-logistic

(2,2)

gamma

(3,1)

generalized gamma

0

2

4

6

8

10

12

14

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Figure 2: Bounds for the linear ACD probability distribution function

✘✙✟✖☞✍✫✵✴✶✝✠✷✹✸✻✺✹✼✹✽✾❀✿★✼✹✸✻❁★✷✹❁★❂☛✼✹❃❅❄❇❆✙❈☛✷✹❁❉✕✓✾★✸✻✾❉✴❊☞✍❋☛✸✻●❍✽■❂☛✼❑❏✁▲✄▲✄❏✥✴✶✂✁✂◆▼☛❖✹P✁❃✬☎

✁✄✄☎ ☞◗✘✙✆✔✪✜❘❙✑☛✕❚✭✰✆✰❯✵✟★✘✁✕☛❱✦✭✰✘✙✆✔✿★✎✚✫❲✟❳✿☛✆✔✘❨✪✜✘✁☞✵❩❬✎✒✫◆❘✩✑✓✎✒✌✏❭❪✝✠❘❙✫❫✕✙✎✒✭✰✫✬✟❴✛❇☞✵✕☛☞❵✑❛✆✩❘✩✘✙✡✙✟★✑❴✴✞✿★✸✻✷✹❁★✺✹●❜❃✬✺✹✾

❝

☎✁❭✩☎✁✿★✼✹✸✻✸✻✼✹●❍✸✻✷❞❄✜✭✰✼❞❡✳✼✹✸❛✫✬✷✹❁✖❢❣✾★❈✖❤◆❄✜✝✠✷✹✸✐✺✹✼✹✽✾❀✌✏✼✹✸✐●❞✴❊☞✍❋☛✸✻●❍✽■❂☛✼❑❏✄▲✁▲✄❏✥✴✶✂✄❥❦▼✁❖✹P☛❃■☎

✁✄❧✄☎ ✕ ❝ ✟♠✝✠✎✚✑✓✑❛✎✚✌✣❭ ✫❲✎✚✌✣♥✄♦♣❘✩✑✓✎✒✌✏❭q✕ ❝ ✟r✌✏✪✜✟★✘ ✘✙✟★✡✙✟★✑❛✑✓✎✚✆✔✌ ✎✚✌✣✛✔✎✒✡✁☞✵✕✓✆✩✘♠✕✙✆ ✡✙✆✔✌✏✑★✕✙✘✙❘✩✡✁✕ ✡✙✆✔✎✚✌✣✡✙✎✚✛✜✟★✌✜✕❴☞✥✌✏✛s✫✬✟✖☞✍✛✜✎✚✌✣❭❨✎✒✌✏✛✜✎✚✡✓✟☛✑✠✆✔✿t✟★✡✙✆✔✌✣✆✩✝✠✎✒✡❴☞✥✡✁✕✙✎❯✵✎✕✁❱❴✴✉❆✈✾★✇✹✾✍❯✵●❍✺❞❡✳✾★✸✜✎✚❃✬❃■✽✼✹✸✒❄❙✿★✷✹✸✻❃■①★●❍❂ ❯✵✷✹①★●❍❂②✴✶✝✠✷✹●❍✾❀❂✁✼③❏✄▲✄▲✁❏✍✴✠✂✈④✥▼✁❖✹P☛❃■☎

✁✄⑤✄☎ ✑✓✭✰✟★✡✙❘✩✫✳☞✵✕✓✎❯❙✟②☞✵✕☛✕✁☞✍✡✓♥✄✑⑥✆✔✌❪✛✔✟★✪❇✕✓✑☛⑦✜✛✜✆✔✫✬✫❫☞✍✘✙✎❩✹☞✵✕✙✎✒✆✩✌✠☞✍✌✣✛✶✆✩✭■✕✓✎✚✝✠❘✩✝⑧✡✙❘❙✘✙✘✓✟☛✌✣✡✁❱◆☞✍✘✙✟✖☞✍✑❀✴ ☞✍✽✾★●❍❃■●❍✾❉☞✍✸✻✷✹❈✖❢❣✾✖❄✜✝✠✷✹✸✻✺✹●❍✷❑✫❲✼✹✾★❁❉✴✶✝✠✷✹●❍✾❀❂✁✼❑❏✁▲✄▲✁❏✍✴✶⑨✁◆▼☛❖✹P☛❃■☎

✁✄⑨✄☎ ❯✵✎✒✌✜✕☛☞✍❭✔✟❳✡✁☞✍✭✰✎✕☛☞✍✫❫⑦⑩✛✜✎✚✑★✕✙✆✔✘✁✕✓✎✚✆✔✌✏✑❳☞✍✌✏✛✞✛✜✟✖❯✵✟★✫❲✆✩✭✰✝✠✟★✌✈✕❳✴✞✑✓✷✹❶◆❈☛✼✹✽✁❂✁✼❷☞✍❋✁✸✐✼✹❈❴✭✰✼✹❃■❃■✾★✷❞❄⑩✘✓✷❞❸❹✷✹✼✹✽ ✘✙✾★❋②✴✶✝✠✷✹●❍✾❀❂✁✼❑❏✁▲✄▲✁❏✍✴✶✁✂◆▼☛❖✹P☛❃■☎

✁✄❥✄☎ ❭✩✆✰❯❙✟☛✘✓✌✏✝✠✟★✌✈✕✮☞✍✡✁✕✓✎✚✆✔✌✏✑✧✕✓✆❺✑❛❘❙✭✰✭✰✆✔✘✁✕❻✡✙✆✔✿★✿☛✟★✟❼✭✰✘✙✆✔✛✔❘✩✡✙✟★✘✙✑❽✴◗☞✍✌❾✎✚✌✈❯✵✟★✑☛✕✓✎✚❭✰☞✵✕✓✎✚✆✔✌❿✆✔✿ ✭✰✆✩✑❛✑✓✎✒✪✔✫❲✟➀✝✠✟✖☞✍✑✓❘✩✘✙✟★✑⑥✿★✘✙✆✔✝➁✕ ❝ ✟➀✟☛❘✩✘✙✆✔✭✰✟➂☞✥✌➃❘✩✌✏✎✒✆✩✌✠✴➄❭✩✼✹✸✐❶t❖✹❁➀✡✙✷✹✽❸➅✷❞❡✻❄✔✘✙✼✹❁★✷❞❡✳✾➀❭✔☎✄✿★✽➆★✸✻✼✹❃➇❆✈✸✻☎ ✴❊❆✈❈★❁★①★✾❀❂✁✼③❏✄▲✄▲✁❏✍✴✠✂✄▲❦▼✁❖✹P☛❃■☎

✁✄➈✄☎ ☞➉✝✠✆✩✛✜✟★✫➊✆✔✿❚✡✁☞✍✭✰✎✕✁☞✥✫◆☞✍✡✙✡✙❘✩✝✠❘❙✫❫☞✵✕✓✎✚✆✔✌❽☞✍✌✣✛✧✘✙✟★✌✈✕✁✱✲✑✓✟★✟★♥✄✎✚✌✣❭➃✴✧✭✰✷✹❈★✽✾s✪✜✷✹✸✻✼✹✽✽●❄③✑❛✷✹❶t❈★✼✹✽✈❂☛✼ ☞✍❋☛✸✻✼✹❈❀✭✰✼✹❃■❃✬➆☛✷✣✴❊❆✈❈★❁★①★✾❀❂✁✼❑❏✁▲✄▲✁❏✍✴✶❧✁▲◆▼☛❖✹P☛❃■☎

✁❧✄▲✄☎ ✕ ❝ ✟♠✝✠✎✚✑✓✑❛✎✚✌✣❭ ✫❲✎✚✌✣♥✄♦♣❘✩✑✓✎✒✌✏❭q✕ ❝ ✟r✌✏✪✜✟★✘ ✘✙✟★✡✙✟★✑❛✑✓✎✚✆✔✌ ✎✚✌✣✛✔✎✒✡✁☞✵✕✓✆✩✘♠✕✙✆ ✡✙✆✔✌✏✑★✕✙✘✙❘✩✡✁✕ ✡✙✆✔✎✚✌✣✡✙✎✚✛✜✟★✌✜✕❴☞✥✌✏✛s✫✬✟✖☞✍✛✜✎✚✌✣❭❨✎✒✌✏✛✜✎✚✡✓✟☛✑✠✆✔✿t✟★✡✙✆✔✌✣✆✩✝✠✎✒✡❴☞✥✡✁✕✙✎❯✵✎✕✁❱❴✴✉❆✈✾★✇✹✾✍❯✵●❍✺❞❡✳✾★✸✜✎✚❃✬❃■✽✼✹✸✒❄❙✿★✷✹✸✻❃■①★●❍❂ ❯✵✷✹①★●❍❂②✴❊❆✈❈★❁★①★✾❀❂✁✼③❏✄▲✄▲✁❏✍✴✠❏✄➈❦▼✁❖✹P☛❃■☎

✁❧✈④❲☎ ✫✬✟★✌✣✛✜✟☛✘❿✫✬✎☞✍✪✜✎✚✫❲✎✕☛❱➋✎✚✌➋✕ ❝ ✟❻✡✙✆✔✌✏✑❛❘❙✝✠✟★✘➌✡✙✘✓✟☛✛✜✎✕❿✝t☞✥✘✙♥✄✟✖✕❻✴➍✟★✽●❍❃■✷✹❋☛✼❞❡✻❡✳✷➎✎✒✾★❃■❃■✷❞❄✦❭✩●❍❈★✽●❍✷✹❁★✷ ✭✰✷✹✽❈★❶t❋☛✾❉✴❊☞✍P☛✾★❃❅❡✳✾❀❂☛✼❑❏✄▲✁▲✄❏✥✴✶❏✄▲❦▼☛❖✹P✁❃✬☎

✁❧✄❏✄☎ ✛✜✟☛✡✓✎✚✑✓✎✒✆✩✌➃✘✙❘❙✫❲✟★✑◆☞✍✌✣✛s✎✒✌✏✿★✆✔✘✙✝t☞✵✕✓✎✚✆✔✌➏✭✰✘✙✆✰❯❙✎✚✑✓✎✒✆✩✌✣♦➐✝✠✆✩✌✣✎✕✓✆✔✘✙✎✚✌✣❭✉❯❙✟★✘✙✑✓❘✩✑⑥✝t☞✍✌✣✎✚✭✰❘✩✫✳☞✵✕✓✎✚✆✔✌ ✱✵✟★✽●❍❃✬✷✹❋✁✼❞❡✻❡❫✷❑✎✚✾★❃■❃✬✷❞❄✜❭✔●❜❈★✽●❍✷✹❁★✷❑✭✰✷✹✽❈★❶◆❋✁✾❉✴❊☞✥P✁✾★❃❅❡❫✾❀❂✁✼❑❏✁▲✄▲✁❏✍✴✶✂✁⑨◆▼☛❖✹P☛❃■☎

✁❧✄✂✄☎ ✆✩✌ ✡✙✟★✘✁✕☛☞✍✎✚✌ ❭✔✟☛✆✔✝✠✟✖✕✙✘✓✎✚✡➑☞✥✑✓✭✰✟★✡✁✕✓✑➒✆✔✿➓✭✰✆✩✘☛✕✙✿★✆✔✫✬✎✒✆ ✆✔✭■✕✓✎✚✝✠✎✚✑★☞✵✕✓✎✚✆✔✌q➔❵✎✕ ❝ ❝

✎✚❭

❝

✟☛✘ ✝✠✆✩✝✠✟★✌✈✕✙✑❀✴✶❭✔❈★❃❅❡✳✷❞→➐✾❀✝✠☎✁❂✁✼✣☞✵❡✳①★✷❞➣❬❂✁✼❞❄✈✘✙✼✹❁★✷❞❡✳✾❀❭✩☎↔❸➅✽➆★✸✻✼✹❃⑩❆✙✸✻☎❲✴✠✑✓✼❞❡✳✼✹❶◆❋✁✸✻✾❀❂☛✼❑❏✁▲✄▲✄❏✥✴✶❏✙④✍▼☛❖✹P✁❃✬☎

✁❧✄✄☎ ✝✠✟★✌✏✑❛❘❙✘✁☞✍✌✣✛✜✆ ☞ ✭✰✘✙✆✩✛✜❘✩↕✁✤✍✆ ✡✙✎✚✟★✌✈✕✙➙✒✿☛✎✒✡✁☞ ✎✒✌✜✕✓✟★✘✙✌✜☞✥✡✙✎✚✆✔✌✜☞✥✫ ✟★✝ ✟★✡✙✆✔✌✣✆✩✝✠✎☞ ✛✜✟ ✭✰✟★✑✓➛✔❘❙✎✚✑★☞✍✛✜✆✩✘✓✟☛✑➜✟s✛✜✟☛✭■☞✥✘✁✕✁☞✥✝✠✟☛✌✈✕✓✆✩✑➜✪✜✘✁☞✍✑❛✎✚✫❲✟★✎✚✘✙✆✔✑❚✱✥❆✈✾★✇✹✾✉❯❙●❍✺❞❡✳✾★✸✍✎✚❃■❃✬✽✼✹✸✒❄⑩✕✓✷❞❡✳●❍✷✹❁☛✷✶✡✙✷✹✽❂✁✷✹❃ ❂✁✼③✫✬●❍❶t✷✣☞✍✺✹①★➝❑✭✰●❍✽✽✷✹✸☛✴✠✑✓✼❞❡✳✼✹❶◆❋✁✸✻✾❀❂☛✼❑❏✁▲✄▲✄❏✥✴✶✂✁➈◆▼☛❖✹P✁❃✬☎

✁❧✄❧✄☎ ✿★✆✩✘✙✟★✎✒❭✩✌❻✛✜✎✚✘✙✟★✡✁✕❼✎✒✌✜❯❙✟★✑☛✕✓✝✠✟★✌✜✕❼✑❛✭✰✎✚✫❲✫✬✆✰❯✵✟★✘✙✑❛♦✔☞✍✛✜✛✜✎✕✓✎✚✆✔✌✈☞✍✫✠✫✬✟★✑❛✑✓✆✔✌✏✑➞✿★✘✙✆✔✝➟☞➠✡✙✆✩❘✩✌✜✕✓✘✁❱ ✑☛✕✓❘❙✛❇❱⑥✱②✘✙✼✹❁★✷❞❡✳✾❳❭✩☎✓✿☛✽✾☛✸✐✼✹❃❷❆✈✸❜❄✣✝✠✷✹✸✻●❍✷❊✭✰✷✹❈★✽✷❊✿★✾★❁➂❡❫✾☛❈★✸✻✷❞❄➇✘✙✾★P✁➝✹✸✻●❍✾❴❭✔❈★✼✹✸✻✸✻✷❊✑❛✷✹❁➂❡❫✾☛❃✥✴✞✑❛✼❞❡✳✼✹❶t❋☛✸✻✾❴❂☛✼ ❏✄▲✁▲✄❏✥✴✶✂✄▲❦▼✁❖✹P☛❃■☎

✁❧✄⑤✄☎ ☞➡✡✙✆✩✌✈✕✓✘✁☞✍✡✁✕✓✎❯❙✟⑥✝✠✟✖✕ ❝ ✆✔✛➃✿★✆✔✘✦✡✙✆✔✝✠✭✰❘❬✕✓✎✚✌✣❭➄✕ ❝ ✟✉✑☛✕☛☞✵✕✓✎✚✆✔✌✜☞✍✘☛❱✞✑✓✆✔✫✬❘➐✕✙✎✒✆✩✌❽✆✩✿❀✕ ❝ ✟✉✟★❘❙✫❲✟☛✘ ✟★➛✩❘➐☞✵✕✙✎✒✆✩✌➊✱❬➔◗●❍✽❸➅✸✻✼✹❂☛✾❀✫✬☎✁✝✠✷✹✽❂✁✾★❁★✷✹❂☛✾➂❄ ❝ ❈★❶t❋☛✼✹✸✒❡✳✾❀✝✠✾★✸✻✼✹●❍✸✻✷✣✴✶✑✓✼❞❡✳✼✹❶◆❋✁✸✐✾❀❂✁✼❑❏✁▲✄▲✁❏✍✴➃④↔◆▼☛❖✹P☛❃■☎

✁❧✄⑨✄☎ ✕✙✘☛☞✍✛✜✟➢✫✬✎✒✪✜✟☛✘☛☞✍✫✬✎❩✹☞✵✕✓✎✚✆✔✌➁☞✍✌✏✛❼✕

❝

✭■☞✍❘❙✫❲✆❊✱✵✪✜✼✹✸✻❁★✷✹✸✻❂☛✾❀❂☛✼❑✑✓❖❑✝✠✾✖❡✳✷❞❄✈✝✠✷✹✸✻✺✹✼✹✽✾❀✿★✼✹✸✻❁★✷✹❁★❂✁✼✹❃➇✴✶✆✔❈➂❡❫❈☛❋☛✸✻✾❀❂☛✼❑❏✄▲✁▲✄❏✥✴✶✂✄⑨❦▼☛❖✹P✁❃✬☎

✁❧✄➈✄☎ ✿★✆✩✘✙✟★✎✒❭✩✌➜✿★❘❙✌✣✛✜✎✚✌✣❭⑥✕✙✆⑥☞✥✌➢✟★✝✠✟☛✘✓❭✩✎✒✌✏❭❨✝t☞✥✘✙♥✄✟✖✕✓♦★✕ ❝ ✟◆✝✠✆✩✌✣✟✖✕✁☞✥✘✁❱➄✭✰✘✙✟★✝✠✎✚❘✩✝❻✕ ❝ ✟★✆✔✘✁❱❴☞✍✌✣✛ ✕ ❝ ✟➞✪✜✘✁☞✵❩❬✎✚✫❲✎☞✥✌❾✡✁☞✥✑✓✟✖⑦s④❲➈✁➈✈④✲✱❲④❲➈✁➈✄❥✞✱✠✡✙✷✹✸✻✽✾☛❃ ❝ ✷✹❶◆●❍✽❡✳✾★❁❚❯✵☎⑩☞✍✸✻✷✁✖❢❣✾✖❄❳✘✙✼✹❁★✷❞❡✳✾➜❭✔☎③✿★✽✾★✸✻✼✹❃✠❆✈✸✻☎⑩✴ ✆✩❈✖❡✳❈★❋☛✸✻✾❀❂☛✼❑❏✄▲✁▲✄❏✥✴✶✄⑤❦▼✁❖✹P☛❃■☎

✁⑤✄▲✄☎ ✘✙✟★✿★✆✩✘✙✝t☞❼✭✰✘✓✟➂❯❙✎✚✛✜✟★✌✣✡✙✎✗✍✘✓✎☞✍♦➐✟★✝⑧✪✜❘❙✑✓✡☛☞➞✛✜✟❦✎✒✌✏✡✓✟☛✌✈✕✓✎❯❙✆✩✑ ✭■☞✍✘✁☞❨☞✵✕✓✘✁☞✍✎✒✘➊✆❴✕✙✘✁☞✥✪✰☞✥✫ ❝ ☞✍✛✜✆✩✘ ☞✍❘❬✕✄✂✔✌✏✆✔✝✠✆✶✱②✑✓✷✹❶◆✷✹❁➂❡❫①☛✷③✕✓✷✹✷✹❶➠✛✜✷✹✸✒❡✐❄✣✝✠✷✹✸✻✺✹✼✹✽✾❳✡✙➆★✸✒❡✳✼✹❃◆✌✏✼✹✸✻●❄✣✿★✽✷❞→➐●❍✾❳✝✠✼✹❁★✼❞➤↔✼✹❃❷✴❪✌✣✾✖→➐✼✹❶t❋☛✸✻✾❳❂☛✼ ❏✄▲✁▲✄❏✥✴✶❏✄❥❦▼✁❖✹P☛❃■☎

✁⑤✈④❲☎ ✛✜✟☛✡✓✟☛✌✈✕❺➔◗✆✔✘✙♥➁☞✍✌✣✛ ✕ ❝ ✟➉✎✒✌✏✿★✆✔✘✙✝t☞✍✫➁✑❛✟★✡✁✕✙✆✔✘➋✎✚✌ ✪✜✘✁☞✵❩❬✎✚✫➞✴ ✝✠✷✹✸✻✺✹✼✹✽✾ ✡✙➆★✸✒❡✳✼✹❃➎✌✣✼✹✸✻●❀✴ ✌✏✾✖→➐✼✹❶◆❋✁✸✐✾❀❂✁✼❑❏✁▲✄▲✁❏✍✴➃④✁④❲❧❦▼✁❖✹P☛❃■☎

✁⑤✄❏✄☎ ✭✰✆✩✫❲➙✕✓✎✚✡☛☞➓✛✜✟❵✡✙✆✰✕✁☞✍✑ ✟❵✎✚✌✣✡✙✫❲❘❙✑★✤✍✆➁✕✙✘☛☞✍✪❇☞✍✫ ❝ ✎✚✑★✕✁☞ ✛❇☞✍✑❻✭✰✟★✑✓✑✓✆✰☞✍✑❻✡✙✆✔✝ ✛✜✟★✿★✎✚✡✙✎✆☎☛✌✣✡✙✎☞❾✱ ✝✠✷✹✸✻✺✹✼✹✽✾➊✡✓➆☛✸❜❡✳✼✹❃❳✌✏✼✹✸✻●❄✩☞✍✽✼✞✝❬✷✹❁★❂✁✸✐✼⑥✭✰●❍❁✖❡✳✾➊❂☛✼⑥✡✙✷✹✸✒→✰✷✹✽①★✾➂❄

❝

✼✹❃✬❃■●❍✷⑥❭✔❈★●❍✽①★✼✹✸✻❶t✾➊✡✓✾☛❃✳❡✳●❍✽✽✷➀✴➜✌✣✾➂→✰✼✹❶t❋☛✸✻✾ ❂✁✼③❏✄▲✄▲✁❏✍✴✠⑤✄⑨❦▼✁❖✹P☛❃■☎

✁⑤✄✂✄☎ ✑✓✟★✫❲✟➂✕✓✎❯❙✎✚✛❇☞✍✛✜✟♣✟➎✝✠✟★✛✜✎✚✛❇☞✍✑ ✛✜✟➎➛✔❘❬☞✍✫❲✎✚✛❇☞✍✛✜✟➎✛❇☞ ✟★✛✔❘✩✡✁☞✍↕✁✤✥✆➋✪✔✘☛☞✍✑✓✎✒✫✬✟★✎✚✘☛☞ ④↔➈✄➈✄❧↔✱❫❏✁▲✄▲✈④➃✱ ✝✠✷✹✸✻✺✹✼✹✽✾❀✡✙➆★✸✒❡❫✼✹❃✢✌✣✼✹✸✻●❄❇☞✍✽✼✞✝❬✷✹❁★❂☛✸✻✼❑✭✰●❍❁✖❡✳✾❀❂☛✼❑✡✙✷✹✸✒→➐✷✹✽①☛✾❉✴✠✌✏✾✖→➐✼✹❶◆❋✁✸✻✾❀❂☛✼❑❏✁▲✄▲✄❏✥✴✶✂✁✂✈④✥▼✁❖✹P☛❃■☎

✁⑤✄✄☎ ✪✜✘✁☞✵❩❬✎✚✫❲✎☞✥✌ ✝t☞✍✡✙✘✓✆✩✟★✡✙✆✔✌✏✆✔✝✠✎✚✡✓✑➒➔◗✎✕ ❝ ☞ ❝ ❘❙✝t☞✥✌ ✿✖☞✍✡✙✟★♦♣✝✠✟✖✕✓✘✙✆✩✭✰✆✔✫❲✎✕☛☞✍✌ ✡✓✘✙✎✚✑❛✎✚✑☛⑦ ✭✰✆➐❯❙✟★✘✁✕☛❱◆☞✍✌✣✛✠✑✓✆✔✡✙✎☞✍✫✵✕✁☞✍✘✓❭✩✟✖✕✓✑➀✴✶✝✠✷✹✸✐✺✹✼✹✽✾❀✡✙➆★✸✒❡✳✼✹❃❷✌✏✼✹✸✐●❞✴✶✌✏✾✖→➐✼✹❶◆❋✁✸✐✾❀❂✁✼❑❏✁▲✄▲✁❏✍✴✶⑤✙④✍▼☛❖✹P☛❃■☎

✁⑤✄❧✄☎ ✭✰✆✩✪✜✘✙✟✖❩✹☞✵⑦❦☞✵✕✓✎❯❙✆✩✑❻✟✮✑★☞✠✟❙✛✜✟✮✌✣✆⑧✪✜✘✁☞✍✑❛✎✚✫❚✱s✝✠✷✹✸✻✺✹✼✹✽✾✮✡✓➆☛✸❜❡✳✼✹❃➞✌✏✼✹✸✻●❄◆➔◗✷✹P✁❁★✼✹✸✉✫✬☎➀✑❛✾☛✷✹✸✐✼✹❃❚✴ ✛✜✼❞➤↔✼✹❶t❋☛✸✻✾❀❂☛✼❑❏✄▲✁▲✄❏✥✴✶❏✄➈❦▼✁❖✹P☛❃■☎

✁⑤✄⑤✄☎ ✎✚✌✣✿★✫✳☞✍↕☛✤✍✆ ✟ ✿★✫✬✟☛✡⑩✎✒✪✔✎✒✫✬✎✒✛❇☞✍✛✜✟❾✑★☞✍✫✳☞✥✘✙✎☞✍✫◗✱◗✝✠✷✹✸✻✺✹✼✹✽✾ ✡✙➆★✸✒❡✳✼✹❃➠✌✏✼✹✸✻●❄❽✝✠✷✹❈★✸✌☞❍✺✹●❍✾ ✭✰●❍❁★①★✼✹●❍✸✻✾➎✴ ✛✜✼❞➤↔✼✹❶t❋☛✸✻✾❀❂☛✼❑❏✄▲✁▲✄❏✥✴➃④❲⑤❦▼✁❖✹P☛❃■☎

✁⑤✄⑨✄☎ ✛✜✎✚✑☛✕✓✘✙✎✒✪✔❘➐✕✙✎❯✵✟❚✟☛✿★✿★✟★✡✁✕☛✕✙✑➞✆✔✿❨✪✜✘✁☞✵❩❬✎✚✫❲✎☞✥✌♣✑☛✕✓✘✙❘❙✡✁✕✓❘❙✘☛☞✍✫✠✘✙✟★✿★✆✩✘✙✝✠✑❨✱◆✝✠✷✹✸✻✺✹✼✹✽✾❚✡✙➆★✸✒❡✳✼✹❃✠✌✣✼✹✸✻●❄ ❆✈✾★❃■➝③✝✠❖✹✸✻✺✹●❍✾❀✡✙✷✹❶t✷✹✸✻P☛✾❉✴✶✛✜✼❞➤↔✼✹❶◆❋✁✸✻✾❀❂☛✼❑❏✁▲✄▲✄❏✥✴✶✂✁❥◆▼☛❖✹P✁❃✬☎

✁⑤✄❥✄☎ ✆➊✕✙✟★✝✠✭✰✆✞✛❇☞✍✑s✡✓✘✙✎☞✍✌✣↕✁☞✍✑❴✱❉✝✠✷✹✸✻✺✹✼✹✽✾❴✡✙➆★✸✒❡✳✼✹❃❦✌✣✼✹✸✻●❄⑩✛✜✷✹❁☛●❍✼✹✽✷t✡✙✾★❃❅❡✳✷✢✴✦✛✔✼❞➤➂✼✹❶t❋☛✸✻✾❴❂✁✼t❏✄▲✄▲✁❏➀✴➞④❲ ▼✁❖✹P☛❃■☎

✁⑤✄➈✄☎ ✟★✝✠✭✰✫✬✆✰❱✈✝✠✟★✌✈✕➄☞✥✌✏✛➜✭✰✘✙✆✔✛✜❘❙✡✁✕✓✎❯❙✎✕☛❱➏✎✚✌❵✪✜✘✁☞✵❩❬✎✒✫❴✎✚✌➏✕ ❝ ✟➊✌✣✎✚✌✣✟✖✕✙✎✒✟★✑✠✱⑩❆✙✾☛❃✬➝⑥✝✠❖✹✸✻✺✹●❍✾➊✡✓✷✹❶t✷✹✸✻P☛✾✖❄ ✝✠✷✹✸✻✺✹✼✹✽✾❀✡✙➆★✸✒❡❫✼✹❃✢✌✣✼✹✸✻●❄✜✝✠✷✹❈★✸✌☞❍✺✹●❍✾❀✡✙✾★✸✒❡✳✼❞➤✥✘✓✼✹●❜❃➇✴✶✛✜✼❞➤↔✼✹❶◆❋✁✸✻✾❀❂☛✼❑❏✁▲✄▲✄❏✥✴✶✂✁❏◆▼☛❖✹P✁❃✬☎

✁⑨✄▲✄☎ ✕ ❝ ✟✮☞✍✫❲✎☞✍✑❛✎✚✌✣❭ ✟★✿★✿★✟☛✡☛✕✁⑦ ✕ ❝ ✟♣✿★✟➂❆✙✟★✘❿♥✄✟★✘✙✌✣✟★✫➢☞✍✌✏✛➠✕✓✟★✝✠✭✰✆✩✘☛☞✍✫✬✫❫❱ ☞✍❭✩❭✔✘✙✟★❭✰☞✵✕✙✟★✛➋✫❲✆✩✌✣❭ ✝✠✟★✝✠✆✩✘✁❱⑥✭✰✘✙✆✔✡✙✟★✑✓✑❛✟☛✑❀✱❙✫✬✼✹✾★❁★✷✹✸✻❂☛✾❀✘✙☎✄✑❛✾☛❈✖➤↔✷✣✴❊❆✈✷✹❁★✼✹●❍✸✻✾❀❂☛✼❑❏✄▲✁▲✄✂✥✴✶✂✄❏❦▼✁❖✹P☛❃■☎

✁⑨✈④❲☎ ✡✙❘❙✑★✕✙✆✞✛✜✟❴✡✙✎✒✡✙✫✬✆✦✟★✡✙✆✔✌✍✂✩✝✠✎✒✡✙✆✦✌✏✆✦✪✜✘✁☞✥✑✓✎✚✫❀✟★✝❾❘❙✝❿✝✠✆✔✛✜✟★✫✬✆✦✡✙✆✔✝❿✘✓✟☛✑★✕✙✘✓✎✚↕✁✤✍✆⑥☞✧✡✙✘✏✎★✛✜✎✕✓✆ ✱✢✪✔❖✹✸✐❋✁✷✹✸✻✷➀❯✵✷✹❃✬✺✹✾★❁☛✺✹✼✹✽✾☛❃❳✪✜✾★✷❞→➐●❍❃❅❡✳✷ ❂✁✷ ✡✙❈★❁★①☛✷❞❄②✭✰✼✹❂✁✸✐✾➊✡✙✷❞→➐✷✹✽✺✹✷✹❁✖❡✳●✓✿☛✼✹✸✐✸✻✼✹●❍✸✻✷❦✴s❆✈✷✹❁★✼✹●❍✸✻✾⑥❂☛✼ ❏✁▲✄▲✁✂t✴ ❏✈④✥▼✁❖✹P☛❃■☎

✁⑨✄❏✄☎ ✕ ❝ ✟⑧✡✙✆✔✑☛✕✓✑ ✆✔✿⑧✟★✛✜❘❙✡✁☞✵✕✓✎✚✆✔✌✈⑦➜✫❲✆✩✌✣❭✩✟✖❯❙✎✕☛❱ ☞✍✌✏✛ ✕ ❝ ✟❺✭✰✆✰❯✵✟★✘✁✕☛❱ ✆✩✿❺✌✈☞✵✕✓✎✚✆✔✌✏✑❺✱❽✭✰✼✹❂☛✸✻✾ ✡✙✷❞→➐✷✹✽✺✹✷✹❁✖❡✳●✹✿★✼✹✸✻✸✐✼✹●❜✸✐✷❞❄✜✑✓✷✹❶◆❈☛✼✹✽✬❂✁✼✣☞✍❋✁✸✐✼✹❈❀✭✰✼✹❃■❃■✾★✷✏✴t❆✈✷✹❁★✼✹●❍✸✻✾❀❂✁✼③❏✄▲✄▲✁✂✍✴✠✂✈④✥▼✁❖✹P☛❃■☎

✁⑨✄✂✄☎ ☞ ❭✔✟★✌✏✟★✘✁☞✥✫✬✎❩✹☞✵✕✙✎✒✆✩✌➓✆✔✿❽❆✙❘❙✛✜✛✒✑✐✑ ✝✠✟✖✕

❝

☞✍❋☛✸✻✼✹❈❀✭✰✼✹❃■❃✬✾☛✷✣✴✶✿★✼❞→➐✼✹✸✻✼✹●❍✸✻✾❀❂☛✼❑❏✄▲✁▲✄✂✥✴✶✂✄▲❦▼✁❖✹P☛❃■☎

✁⑨✄⑤✄☎ ☞ ✝✠✆✔✌✏✟✖✕☛☞✍✘✁❱❿✝✠✟★✡ ❝ ☞✥✌✏✎✒✑✓✝ ✿★✆✔✘❿✑ ❝ ☞✍✘✙✎✒✌✏❭➍✡✁☞✥✭✰✎✕☛☞✍✫✬♦⑥✛✔✎☞✍✝✠✆✔✌✏✛➉☞✥✌✏✛➌✛❇❱✙✪✰❯❙✎✚❭➋✝✠✟★✟✖✕ ♥✄✎❱✈✆✰✕✁☞✍♥✁✎↔☞✥✌✏✛t➔◗✘✓✎✚❭ ❝ ✕➀✴✶✘✙●❍✺✹✷✹✸✻❂☛✾❀❂☛✼❑✆✩☎✁✡✙✷❞→➐✷✹✽✺✹✷✹❁✖❡✳●❞✴✠✿☛✼❞→✰✼✹✸✻✼✹●❍✸✻✾❀❂✁✼③❏✄▲✄▲✁✂✍✴❪④❲⑤❦▼✁❖✹P☛❃■☎

✁⑨✄⑨✄☎ ✎✚✌✈☞✍✛❇☞➉✡✙✆✩✌✣✛✜✎✕✓✎✚✆✔✌✏✑➏✎✚✝✠✭✰✫❫❱❨✕

❝

☞✵✕➢✭✰✘✙✆✩✛✜❘✩✡✁✕✙✎✒✆✩✌➡✿★❘❙✌✣✡✁✕✙✎✒✆✩✌➡✝✠❘❙✑★✕➜✪✜✟❳☞✥✑☛❱✈✝✠✭■✕✓✆✰✕✙✎✒✡✁☞✍✫❲✫✳❱ ✡✙✆✔✪✔✪❇✱✲✛✔✆✔❘❙❭✔✫❫☞✍✑➀✱❙✭✰✷✹❈★✽✾❀✪✜✷✹✸✻✼✹✽✽●❄✜✑❛✷✹❶t❈★✼✹✽■❂☛✼✏☞✍❋☛✸✻✼✹❈❀✭✰✼✹❃✬❃■✾★✷✏✴✶✝✠✷✹✸✁✹✾❀❂☛✼❑❏✁▲✄▲✄✂✥✴✶❦▼✁❖✹P☛❃■☎

✁⑨✄❥✄☎ ✕✙✟★✝✠✭✰✆✔✘✁☞✍✫ ☞✍❭✔❭✔✘✙✟★❭➐☞✵✕✓✎✚✆✔✌ ☞✍✌✣✛ ✪❇☞✍✌✣✛✰➔❵✎✚✛❇✕

❝

✑❛✟★✫✬✟★✡✁✕✓✎✚✆✔✌ ✎✚✌ ✟★✑☛✕✓✎✚✝t☞❙✕✙✎✒✌✏❭ ✫❲✆✩✌✣❭ ✝✠✟★✝✠✆✩✘✁❱❦✱❙✫✬✼✹✾★❁★✷✹✸✻❂☛✾❀✘✙☎✄✑❛✾☛❈✖➤↔✷✣✱✵✝✠✷✹✸✁✹✾❀❂☛✼❑❏✁▲✄▲✄✂✥✴➃④↔➈◆▼☛❖✹P✁❃✬☎

✁⑨✄➈✄☎ ☞❺✌✣✆✰✕✙✟❨✆✔✌♣✡✙✆✔✫✬✟✉☞✍✌✏✛✧✑☛✕✓✆✩✡✙♥✁✝t☞✍✌✧✱◆✭✰✷✹❈★✽✾❨✪✜✷✹✸✻✼✹✽✽●❄❑✑✓✷✹❶t❈★✼✹✽✜❂☛✼❳☞✍❋☛✸✻✼✹❈s✭✰✼✹❃■❃■✾★✷❴✴➃☞✥❋✁✸✻●❍✽✜❂☛✼ ❏✄▲✁▲✄✂✥✴✶❥◆▼☛❖✹P☛❃■☎

✁❥✄▲✄☎ ☞ ❝ ✎✚✭✰✯✰✕✓✟☛✑❛✟❊✛❇☞✍✑✶✟☛✡⑩✭✰✟★✡✁✕✁☞❙✕✙✎❯❛☞✍✑✶✌✈☞✮✟★✑★✕✙✘✙❘➐✕✙❘✩✘✁☞❪☞➃✕✓✟★✘✙✝✠✆✦✛✜✟✢❆✈❘✩✘✙✆✩✑✶✌✣✆✦✪✜✘✁☞✍✑✓✎✒✫✬♦❬❘❙✝t☞ ☞✍✭✰✫❲✎✚✡✁☞✍↕☛✤✍✆➉✛✜✟➞✝✠✆✔✛✔✟★✫❲✆✩✑➡✛✜✟✦❯❬☞✍✫❲✆✩✘➁✭✰✘✙✟★✑✓✟★✌✜✕✓✟❨✱t☞✍✽✼✞✝❬✷✹❁☛❂☛✸✻✼➜✝✠✷✹●❍✷➢✡✙✾★✸✻✸✐✼✹●❜✷➏✫✬●❍❶t✷❞❄③❆✈✾★✇✹✾ ❯✵●❍✺❞❡✳✾★✸❛✎✚❃■❃✬✽✼✹✸☛✴✠✝✠✷✹●❜✾❀❂☛✼❑❏✁▲✄▲✄✂✥✴✶✂✁▲◆▼☛❖✹P✁❃✬☎

✁❥✈④❲☎ ✆✩✌❵✕ ❝ ✟➊➔◗✟★✫❲✿➂☞✥✘✙✟✞✡✙✆✩✑★✕✙✑❽✆✩✿✞✪✜❘❙✑❛✎✚✌✣✟★✑✓✑✧✡☛❱✈✡✙✫❲✟★✑❽✎✒✌❵✕ ❝ ✟✦❏✄▲❲✕ ❝ ✡✙✟★✌✜✕✓❘❙✘☛❱➃✱❷❆✈✾★✇✹✾⑥❯❙●❜✺❞❡❫✾☛✸ ✎✚❃✬❃■✽✼✹✸✒❄❬☞✵❸➅✾★❁★❃■✾❷☞✥✸✻●❍❁☛✾★❃❀❂☛✼◆✝✠✼✹✽✽✾t✿★✸✻✷✹❁★✺✹✾✖❄✩✆✩❃✬❶t✷✹❁★●↔✕✓✼✹●✝❬✼✹●❍✸✻✷➀❂✁✼➀✡✙✷✹✸✒→✰✷✹✽①★✾◆❭✔❈★●❜✽✽➝✹❁✍✴s✝✠✷✹●❍✾❦❂✁✼➀❏✄▲✁▲✄✂ ✴✶❏✄➈❦▼☛❖✹P✁❃✬☎

✁❥✄❏✄☎ ✘✙✟✖✕✙✆✔✘✙✌✣✆✩✑➏☞✥✌✏✆✔✘✙✝t☞✍✎✒✑❵✟➏✟★✑☛✕✓✘✁☞✵✕✄✎★❭✩✎☞✍✑❵✡✙✆✔✌✜✕✓✘✁✗✍✘✙✎☞✍✑➏✱✉✝✠✷✹✸✻✺✹✾✠☞✍❁✖❡✳✾★❁★●❜✾❪✪✜✾★❁☛✾★❶◆✾➂❄◆✎→➐✷✹❁★✷ ✛✜✷✹✽✽✑❍☞✍P☛❁☛✾★✽✳✴❊❆✈❈★❁★①★✾❀❂✁✼❑❏✁▲✄▲✁✂✍✴✶❏✁⑨◆▼☛❖✹P☛❃■☎

✁❥✄✂✄☎ ✟✖❯✵✆✔✫✬❘✩↕✁✤✍✆❪✛❇☞◗✭✰✘✙✆✔✛✔❘➐✕✙✎❯✵✎✒✛❇☞✍✛✜✟❀✕✓✆✰✕✁☞✍✫➀✛✜✆✔✑s✿✖☞✵✕✓✆✩✘✓✟☛✑➄✌✈☞❵✟★✡✙✆✔✌✏✆✔✝✠✎☞✮✪✔✘☛☞✍✑✓✎✒✫✬✟★✎✚✘☛☞✍♦✙❘❙✝t☞ ☞✍✌✈✗✍✫✬✎✒✑✓✟✉✡✙✆✔✝✠✭■☞✍✘✁☞✵✕✓✎❯❬☞➜✱✵❯❙●❜✺❞❡❫✾☛✸➇❭✔✾★❶t✼✹❃✳❄✣✑✓✷✹❶t❈★✼✹✽❇❂☛✼③☞✍❋☛✸✻✼✹❈❳✭✰✼✹❃■❃✬✾☛✷❞❄ ✿★✼✹✸✻❁★✷✹❁★❂☛✾❀☞❵☎✁❯✵✼✹✽✾☛❃✬✾❑✴ ❆✈❈★❁★①★✾❀❂✁✼❑❏✁▲✄▲✁✂✍✴✶✁❧◆▼☛❖✹P☛❃■☎

✁❥✄✄☎ ✝✠✎✚❭✔✘✁☞✍↕✁✤✥✆➐⑦✜✑❛✟★✫✬✟★↕✁✤✍✆➄✟➀✛✜✎✚✿★✟★✘✙✟★✌✏↕✁☞✥✑ ✘✙✟★❭✔✎✚✆✔✌✜☞✥✎✚✑✉✛✔✟❀✘✓✟☛✌✣✛❇☞➜✌✣✆✶✪✔✘☛☞✍✑✓✎✒✫➇✱❙✟★❁★✼✹❃❅❡✳✾★✸✓❂☛✷❑✘✙✾★❃✬✷ ❂✁✾★❃❀✑❛✷✹❁➂❡❫✾☛❃❉❆✙❈★❁☛●❍✾★✸✒❄❙✌✏✷✹➝✹✸✐✺✹●❜✾❦✝✠✼✹❁★✼❞➤↔✼✹❃❑✿★●❍✽①★✾✖❄❙✭✰✼✹❂☛✸✻✾❦✡✙✷❞→➐✷✹✽✺✹✷✹❁✖❡✳●☛✿★✼✹✸✻✸✻✼✹●❍✸✻✷②✴❳❆✈❈★❁★①★✾◆❂☛✼➀❏✄▲✄▲✁✂✢✴s❏✄✂ ▼✁❖✹P☛❃■☎

✁❥✄❧✄☎ ✕

❝

✟◗✘✙✎✚✑❛♥➡✭✰✘✓✟☛✝✠✎✒❘❙✝ ✆✔✌➍✪✜✘✁☞✵❩❬✎✚✫❲✎☞✥✌➟❭✔✆✰❯✵✟★✘✙✌✣✝✠✟★✌✜✕➉✛✜✟★✪✰✕☛⑦❪④↔➈✄➈✁⑤❲✱❫❏✁▲✄▲✁❏➞✱✉☞✍❁★❂✁✸✐➝✮✑✓✾★✷✹✸✻✼✹❃ ✫✬✾★❈★✸✻✼✹●❍✸✻✾✖❄✜✿★✼✹✸✻❁★✷✹❁★❂✁✾❀❂☛✼ ❝ ✾★✽✷✹❁★❂✁✷❑✪✜✷✹✸✻❋☛✾★❃■✷✏✱❳❆✙❈☛❁★①★✾❀❂☛✼❑❏✄▲✁▲✄✂✥✴➃④❲⑤❦▼✁❖✹P☛❃■☎

✁❥✄⑤✄☎ ✿★✆✩✘✙✟★✡✁☞✥✑☛✕✓✎✚✌✣❭➏✟★✫✬✟★✡✁✕✓✘✙✎✒✡✙✎✕☛❱✞✛✜✟★✝t☞✍✌✏✛❪❘❙✑❛✎✚✌✣❭➃❭✔✟★✌✏✟★✘✁☞✥✫✬✎❩❬✟☛✛✞✫❲✆✩✌✣❭❪✝✠✟☛✝✠✆✔✘✁❱ ✱✥✫❲✷✹✺✹●❜✸❬❆✈✾★✸✻P☛✼ ✑✓✾★✷✹✸✻✼✹❃✳❄✜✫✬✼✹✾★❁★✷✹✸✻❂☛✾❀✘✙✾★✺✹①★✷❑✑✓✾★❈✖➤↔✷✏✴❊❆✙❈★❁☛①★✾❀❂☛✼❑❏✄▲✁▲✄✂✥✴✶❏✄❏❦▼☛❖✹P✁❃✬☎

✁❥✄⑨✄☎ ❘❙✑❛✎✚✌✣❭ ✎✚✘✓✘✙✟★❭✩❘✩✫✳☞✍✘✓✫✳❱ ✑❛✭■☞✍✡✙✟★✛ ✘✙✟✖✕✙❘✩✘✙✌✏✑♠✕✙✆ ✟☛✑★✕✙✎✒✝t☞✵✕✓✟♠✝✠❘✩✫✳✕✓✎✱✲✿✖☞✍✡✁✕✓✆✩✘ ✝✠✆✔✛✜✟★✫✬✑❛♦ ☞✍✭✰✭✰✫❲✎✚✡✁☞✵✕✓✎✚✆✔✌❚✕✓✆❨✪✜✘✁☞✵❩❬✎✚✫❲✎☞✥✌➢✟★➛✩❘✩✎✕☛❱➄✛✰☞❙✕✁☞✞✱✈✗✍✽→✰✷✹✸✻✾❷❯❙✼✹●❍P✁✷❞❄❙✫✬✼✹✾★❁★✷✹✸✻❂☛✾t✘✙✾★✺✹①★✷❦✑✓✾★❈✖➤↔✷✍✴✉❆✈❈★❁★①★✾ ❂✁✼③❏✄▲✄▲✁✂✍✴✠❏✄⑤❦▼✁❖✹P☛❃■☎

✁❥✄❥✄☎ ✪✜✆✩❘✩✌✏✛✜✑✠✿★✆✩✘❊✕

❝

✟◆✭✰✘✙✆✔✪✰☞✥✪✔✎✒✫✬✎✕✁❱➄✛✜✎✒✑☛✕✓✘✙✎✚✪✜❘❬✕✓✎✚✆✔✌➏✿★❘✩✌✏✡✁✕✓✎✚✆✔✌➏✆✔✿✥✕

❝

✟◆✫❲✎✚✌✣✟✖☞✍✘t☞✍✡✙✛➄✭✰✘✙✆✔✡✙✟★✑✓✑ ✴✶✝✠✷✹✸✻✺✹✼✹✽✾❀✿★✼✹✸✻❁★✷✹❁★❂☛✼✹❃⑩✴❊❆✙❈★✽①★✾❀❂✁✼❑❏✁▲✄▲✁✂✍✴➃④↔▲◆▼☛❖✹P☛❃■☎