3

▪

-INTERNATIONAL RESEARCH JOURNAL

ISSN 2303-9868 PRINT

ISSN 2227-6017 ONLINE

-INTERNATIONAL RESEARCH JOURNAL

ISSN 2303-9868 PRINT

ISSN 2227-6017 ONLINE

№

02 (56) 2017

3

- .

12 .

: . .

: . .

: 620075, . , . ,

. 4, . , . 17.

: editors@research-journal.org

: www.research-journal.org

15.02.2017.

900 .

26176.

- .

" ",

623701, . , . , № 1, . 88.

LIX

International Research Journal.

,

,

.

,

,

,

,

,

,

.

CC

: AЭЭrТЛЮЭТШЧ 4.0

International (CC BY 4.0).

Agris.

,

:

№

77 –

51217.

Ч :

а : . . - . , . . - . , Ш . . . . .,

. . . . .

а : . . - . , ., . . - . , ., . ., - . ,

. ., - . , ., . ., - . , .

П а а : . . - . , . . - . , . . - . , . .

- . .

П а : . . - . , . ., - . , ., . . - . .

- а а а :Ш . . - .- . , . . - .- . , . ., - .- . ,

.

а а : . . - . , . . . ., . . - . , ., . .,

- . , .

а : . . - . , . ., - . , ., . ., - . , .,

Ш . ., - . , .

а: . ., - , .

а а : . ., - . , ., . ., - . , .

а : . ., - . , . . ., ., . ., - . , .

а : . . - . , . , ., . ., - . , ., . .,

- . , ё . ., . . , . . .

К я: . ., - , . .

: . ., - , . .

а : . ., - . , . ., - . , .

а : . ., - . , ., . ., - . , ., . ., - . ,

., . . - . , . . - . , . ., - . , .

я а : . ., - .-. , ., . ., - .- . , . ., - .- . , .,

. . - .-. , . ., - .- . , .

а : . ., - . , ., . ., - . , ., . .,

- . .

а : . ., - . , ., . - . .

а : . ., - .- . , .

а : . ., - . , ., ё . ., - . , . . ., . ., . . .

П а : . ., - . , .

а а а : . . . . ., .Ш., - . , . ., - . , .

/ ECONOMICS

... 6

... 9

... 12

METHODOLOGY CONSTRUCTION OF INFORMATION THREATS IMPLEMENTATION MODEL OF ECONOMIC SECURITY ... 15

COMPREHENSIVE METHODS OF ASSESSING THE EFFECTIVENESS OF THE REPRODUCTION OF FIXED ASSETS OF INDUSTRIAL COMPANIES ... 19

– ... 24

... 28

... 31

, , . 2 ... 34

... 37

: ... 41

... 44

... 46

: ... 49

... 51

/ JURISPRUDENCE THE GIFT CONTRACT IN THE SYSTEM OF CIVIL TRANSACTIONS ... 53

БIБ– ББ ... 55

: ... 58

/ PSYCHOLOGY ... 61

... 63

... 65

- ... 68

... 70

... 74

, ... 78

–

. 2.

... 83

... 89

... 94

... 97

... 100

... 105

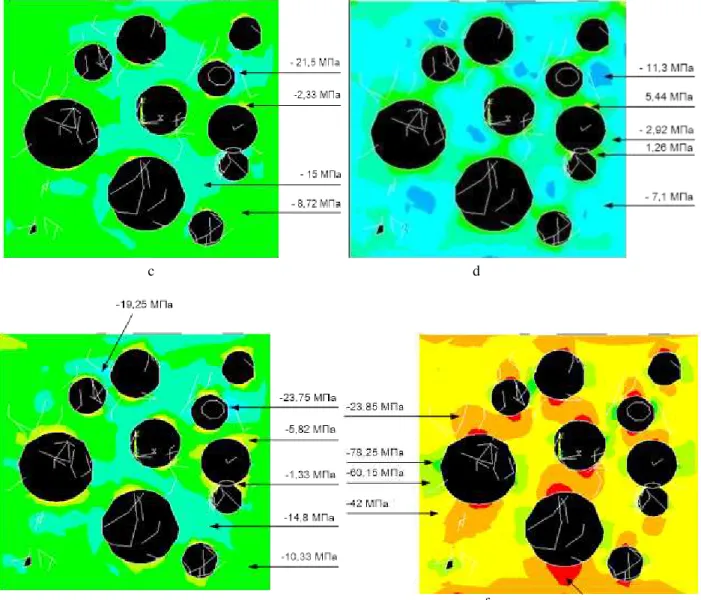

ANALYTICAL REVIEW OF APPROACHES TO THE STRUCTURAL-SIMULATION MODELING OF CONCRETE ... 109

ASPEN PLUS ... 117

... 120

RESEARCH TECHNIQUE FOR SUBCRITICAL CRACK EXTENSION IN ADHESIVE JOINTS ... 124

(SALVIA HISPANICA L.) ... 128

... 132

... 135

... 138

... 142

- ... 145

6

/ ECONOMICS

DOI: 10.23670/IRJ.2017.56.089 .

,

А тация .

.

, .

, , , И

. ,

.

: , , ,

, .

Akbar A.

Postgraduate student, Tyumen State University

HEALTH INSURANCE FINANCING ABROAD AND THE POSSIBILITY OF ITS IMPLEMENTATION IN KAZAKHSTAN

Abstract

The article describes the system of health insurance financing abroad. The experience of developed foreign countries in the organization of the financing system in health insurance and the possibility of its implementation in the Republic of Kazakhstan are discussed. Kazakhstan is just beginning to implement compulsory health insurance system, which leads to certain problems. In this regard, the study of the mechanism of health insurance system in such countries as Germany, the United States of America, and Israel is extremely important. It should be noted that health insurance is one of the mechanisms the state uses to protect the rights and health of its citizens.

Keywords: health insurance, medical services, insurance funds, health insurance, health insurance companies, basic

insurance plan.

. ,

,

ё ,

, .

, :

, ,

, . ,

.

,

, , ,

.

, , ё

0% , .

, , (

) . ,

.

, ,

,

.

,

. ,

, , ,

, .

.

, ,

53200€.

5,5% , 0,9%

. , 4,6% , ,

7

500€ . 38€

. ,

, .

,

.

, Д, . 02Ж.

-. , - 0€,

, ,

, . .

,

. ,

.

(8%), ,

, ,

, .

75% 65%, . . Д6, . 00Ж.

, , ё

884 . ё :

ё ,

, - .

,

, .

,

, , - 4

.

,

.

60% , 3,%, , 60%

, 5%. ,

. 86 ,

- 27 .

, 30$ Д2Ж.

7,8%. - ( ) 000

- 2,2. 9, .

: - 8 ; - 82 . : 3 000 ё .

, , ,

.

,

4- , : ;

; ; Д3, . Ж.

.

. 7.5% ( $2.6 . ), ,

8.3% . 50000$ .

5 : -

90% ; - 80%; -

70%; - 60%; -

Д4Ж.

,

, .

« » .

: , . , ,

ё . (

) 90$ .

,

, . , 0

- 2 .

,

, ,

.

, ,

204 .

,

, , 95$

, % , 206 695$, 2,5%

8

, ё 8%

. , 8%

, 4400$ 29330$ , 4

, ё MОНТМКid [5].

, 4400$ 43320$

29330$ 88200$ , 4 .

.

– 80-85%

, (

), 5-20% .

–90%,

0% . 940

$ Д6Ж.

, . - , ,

, , - – ,

, .

,

. ,

.

,

: , , ,

, , . .

" " . ,

, , ,

.

, .

/ RОПОЫОЧМОЬ

1. . : / . // . - 2006. -

№ . - . 02.

2. . ., . . / . . , . . //

. – 20. - №4. . 72-76.

3. . / . // . - 2008. - №7.- ..

4. . ., . . . / . . , . . //

. – 202. - №9. – . 34-46.

5. . . / . . //

. – 202 - №5 (27).

6. . ., . .

/ . . , . . // : .- 206. - №4. - . 95-06.

/ ReferencesinEnglish

1. Antropov V. Zdravoohraneniye v Germanii: istseleniye dlia vsekh [Healthcare in Germany]: Healing for All / V. Antropov // Sovremennaja Evropa [Modern Europe]. - 2006. – No. . - P. 02. [In Russian]

2. Alekseev V. A., Borisov K. N. Zdravookhraneniye Izrailia [Healthcare of Israel] / V.A. Alekseev, K.N, Borisov // Zdravoohranenie za rubezhom [Healthcare Abroad]. – 20. – No.4. – P. 72-76. [In Russian]

3. Kotenko R. Zdravookhraneniye Izrailia [Healthcare of Israel] / K. Kotenko // Zdorov'e Ukrainy [Health of Ukraine]. – 2008. – No.7. – P.. [In Russian]

4. Halfin R.A., Tadzhiev I.Y. Organizatsiya zdravookhraneniya v SSHA. Chast [Healthcare Organization in the USA. Part ] / R.A. Halfin, I.Y.Tadzhiev // Menedzher zdravoohranenija [Healthcare Manager]. – 202. – No.9. – P. 34-46. [In Russian]

5. Ulumbekova G.E. Reforma zdravookhraneniya SSHA [Healthcare reform in the USA] / G.E. Ulumbekova // Social'nye aspekty zdorov'ja naselenija [Social Aspects of Public Health]. – 202 – No.5 (27). [In Russian]

9

DOI:10.23670/IRJ.2017.56.097

. .1, . .2

1 ,

2 ,

- ( )

А тация

, . ,

,

. ,

, ETA, FTA, FMECA.

.

: , , , .

Aleksandrov A.B.1, Koroleva .S.2

1

PhD in Economics,

2

Assistant of the Department of Management and Advertising St. Petersburg Institute of Technology (Technical University)

METHODOLOGICAL TOOLS OF PREDICTING RISK IN FINANCIAL MARKETS

Abstract

The article investigates the modern methodological tools of predicting risks in the financial markets, the prospects for their development are studied as well. According to performed analysis it was found that there is a wide range of means and methods for forecast management, the choice of specific method depends on many factors. The promising components of methodological tools are: data mining, methods of ETA, FTA, FMECA. In order to formalize the methodological tools of forecasting of risks in the financial markets, author has developed an extended selection algorithm.

Keywords: forecast, risk, financial market techniques.

,

,

,

.

-, - ,

Д1Ж.

, ,

,

: , , . .

,

.

.

Д2Ж.

, ,

- , ,

.

. , - , . , .

, . , . , . . ,

, . , . , . .

,

, , ,

,

,

.

, ,

.

. ,

- , , Д3Ж.

10

. 1 – Д4Ж

, 1993 ., 30 (G30) «Derivatives: Practice sand Principles»

VaR-

. VaR -

, [5].

VaR ,

. , , VaR

, .

, , - ,

« » ,

. 1

VaR.

1 – VaR

-

-,

« »

1,

VaR- - ,

, .

, , ,

.

, , ,

, ,

, , .

, ,

, ,

, , , MS SQL SERVER 2014, NeuralWorks Predict.

,

11

Analysis) - ; FTA (Fault Tree Analysis) - ; FMECA

(Failure Mode Effect and Cause Analysis) - .

, : ,

; , ;

.

,

, ( . . 2).

. 2 –

, , .

,

.

VaR- ,

.

.

/ RОПОЫОЧces

1. ., . // . - 2016. - . 23. - №3. - . 76-82.

2. . ., . ., . . // :

. - 2016. - № - 117-3. - . 38-41. 3. . .

// . . 2016. - №3. - . 12-20.

4. . . //

. - 2015. - №11-1. - . 850-858.

5. AНКЦФШ P., SpЮМСľпФШЯп E., VКХпšФШЯп K. TСО СТsЭШrв КЧН ТНОКs ЛОСТЧН VКR // PrШМОНТК EМШЧШЦТМs КЧН FТЧКЧМО. - 2015. - №24. - . 18-24.

/ References in English

1. Gorbatikov E., Hudko E. Finansovye rynki [Financial markets] // Jekonomicheskoe razvitie Rossii [The economic development of Russia]. - 2016. - V. 23. - №3. - P. 76-82. [in Russian]

2. Shaptala V.G., Litvin M.V., Vetrova Yu.V. Metody ocenki i prognozirovanija riskov [Methods of evaluation and forecasting risks] // Novaja nauka: Teoreticheskij i prakticheskij vzgljad [New Science: Theoretical and practical view] – 2016. - № - 117-3. - P. 38-41. [in Russian]

12

4. Karimov S.M. Osnovy sovremennogo risk menedzhmenta i metodiki upravlenija riskami [The basics of modern risk management and risk management techniques] // Jekonomika i predprinimatel'stvo [Economy and business]. - 2015. - №11-1. - P. 850-858. [in Russian]

5.AНКЦФШ P., SpЮМСľпФШЯп E., VКХпšФШЯп K. TСО СТsЭШrв КЧН ТНОКs ЛОСТЧН VКR // PrШМОНТК EМШЧШЦТМs КЧН FТЧКЧМО. - 2015. - №24. - P. 18-24.

DOI:10.23670/IRJ.2017.56.057

. .

, ,

А тация

.

.

.

, , .

: , , , .

Bastrikova O.I.

PhD in Economics, Associate professor, Ufa State Aviation Technical University

MANAGEMENT INSTRUMENTARIUM OF INTELLECTUAL PROPERTY OF INDUSTRIAL ENTERPRISE

Abstract

The problem of the intellectual property of industrial enterprise management is considered in this paper. The conceptual diagram of the control economic turnover of intellectual objects of industrial property was proposed. The paper describes a mathematical formulation of the problem of optimization of economic turnover. The model defines the basic conditions for the implementation of the property in the licensed trade market, namely the option of market share between the licensor and the licensee, the type and price of the license.

Keywords: intellectual industrial property, management, licensing, modeling.

( ). ,

Д1

.80Ж. Д2, .253Ж.

Д3, .418Ж.

– ,

,

, ,

.

, ,

( .1) Д4, . 180-181Ж. , ,

. - , ,

.

( ) .

– ,

.

,

: ,

, , ,

.

,

,

- . -

- ,

- . , ,

- ,

- ,

13

- (

- )

- - -

:

-

,

-

(

)

:

- -

-

. 1 –

: ,

, .

, ,

, ( ) . ,

- ,

,

. ,

.

, , ,

.

- .

:

0

1

i

J

j ji

i

x

y

x

, (1)xi – , i- , i=1,2,…,I –

, , xji– i,

j=1,2,…,J , yi– i- (

i- );

i i

i

y

d

d

, (2)i

d

d

i - ., ,

( ).

14 k k k k k i I i

ki

x

t

w

t

z

T

t

1

, (3)

k=1,2,…,K – , wk zk -

, tki – k

i, tk – k, Tk –

k. ( ): k K k k k K k

k

c

E

c

z

w

1 1

w

c

c

z

kE

K k k k K k

k

1 1

, (4)

k

c

k - k, E –. ( , . .) m i I i

mi

x

B

b

1

, (5)

m=1,2,…,M – .

,

,

:

)

max

(

1 1 1

ji ji

I i J j i i i I i i

i

v

x

F

S

r

p

x

p

, (6)pi – , vi – , ΔF – ,

, pji - i, j,

ri– i( 0,5 – 12%), Si– i

-.

. j, i xji

:

ji ji

i

p

x

r

C

, (7)C – , ,

, , . :

G

x

p

r

G

ji

ji

, (8)G

G

- , ,.

, Д5, . 99-103Ж, Д6Ж .

( ) .

( ).

, ,

(3)-(5) :

p

ji

v

ji

x

ji

F

j

r

i

p

ji

x

ji

0

, (9), , . – , , , , , ( ) . , . - , . / RОПОЫОЧМОЬ

1. . . / . . . - .: , 2003. – 512 .

2. . . / . . . – .:

, 2004. –400 .

15

4. . . / . .

// -

-. . – 2008. – № 2 (54). – . 178– 183.

5. . . " " / . .

, . . // -

-. . – 2008. – № 3-2 (58). – . 94– 104.

6. . . Д Ж /

. . // : . – 2011. – № 29. – . 2. –

URL: http://uecs.ru/uecs-29-292011/item/461-2011-05-26-11-10-44

/ References in English

1. Zinov V. G. Upravlenie intellektualnoy sobstvennostyu [Intellectual property management] / V. G. Zinov. – M: Business, 2003. – 512 p. [in Russian]

2. Karpukhin I. C. Zaschita intellektualnoy sobstvennosti i patentovedenie [Protection of intellectual property and patenting] / S. I. Karpukhin. – M.: International relations, 2004. – 400 p. [in Russian]

3. Lukicheva L. I. Upravlenie intellektualnyim kapitalom [Management of intellectual capital] / L. I. Lucica. – M.: Omega-L, 2007. – 552 p. [in Russian]

4. Bastrikova O. I. Osobennosti upravleniya intellektualnoy sobstvennostyu predpriyatiya [Specific features of management of enterprise intellectual property] / O. I. Bastrikova // Nauchno-tehnicheskie vedomosti Sankt-Peterburgskogo gosudarstvennogo politehnicheskogo universiteta. Ekonomicheskie nauki [Scientific-technical Bulletin of Saint-Petersburg state Polytechnic University. Economic science]. – 2008. – № 2 (54). – P. 178-183. [in Russian]

5. Bastrikova O. I. Litsenzirovanie kak "myagkiy" sposob integratsii ekonomicheskih sub'ektov [Licensing as a "soft" method of integration of economic agents] / O. I. Bastrikova, L. V. Sitnikova // Nauchno-tehnicheskie vedomosti Sankt-Peterburgskogo gosudarstvennogo politehnicheskogo universiteta. Ekonomicheskie nauki [Scientific-technical Bulletin of Saint-Petersburg state Polytechnic University. Economic science]. – 2008. –№ 3-2 (58). – P. 94-104. [in Russian]

6. Sitnikova, L. V. Grafoanaliticheskaya model opredeleniya usloviy litsenzirovaniya [Graphical-analytical model to determine the conditions of licensing] [Electronic resource] / L. V. Sitnikova // Upravlenie ekonomicheskimi sistemami: elektronnyiy nauchnyiy zhurnal [Management of economic systems: electronic scientific journal]. – 2011. – №. 29. – P. 2. – URL: http://uecs.ru/uecs-29-292011/item/461-2011-05-26-11-10-44 [in Russian]

DOI:10.23670/IRJ.2017.56.101

. .

, ,

А тация

. .

; ( ), ;

; ;

.

: , , , , , .

Glotina I.M.

PhD in Economics, Associate Professor, Perm State Agricultural Academy

METHODOLOGY CONSTRUCTION OF INFORMATION THREATS IMPLEMENTATION MODEL OF ECONOMIC SECURITY

Abstract

The paper proposes methodology construction of information threats implementation model of the state economic security. Basic terms of modeling components have been formulated. The developed information model includes types of information threats; vulnerability factors that contribute to their implementation; threat consequences; security objects; security control subjects and forms the basis for ensuring system development of the state economic security.

Keywords: modeling, threat source, vulnerability factors, threats, consequences.

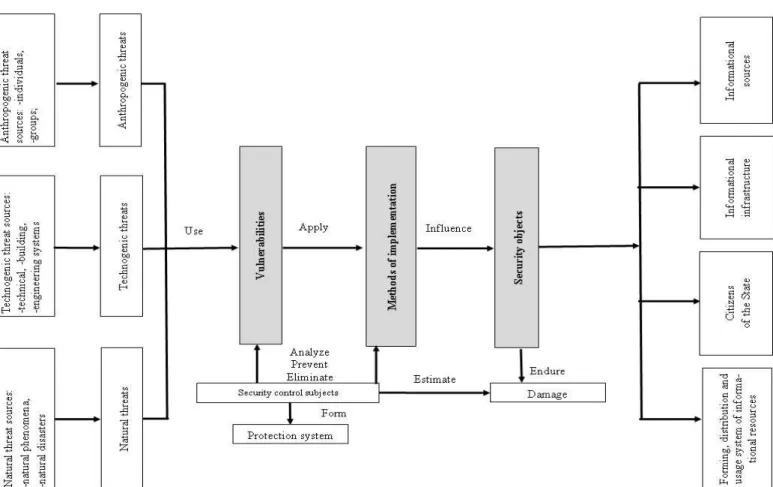

n the modern conditions, the necessity to provide economic security of a state is caused by a high probability level and scale of economic and moral losses, which reasons are directly related to information. The fundamental of efficient security supply for any object is the creation of a true security threat model containing threats that are ranked upon criteria and their sources, as well as potential consequences of threat implementations – harm, damage.

Modeling is the basic element of the system approach to learning processes of nature, society, technical systems, and their management. In general, a security threat model is an informational model including complex of elements that describes object safety condition in the case of occurrence of particular НКЧРОrШЮs ОЯОЧЭs КЧН prШМОssОs, Кs аОХХ Кs ШЛУОМЭ’s rОХКЭТШЧsСТps аТЭС the outside world [1]. Modeling issues are handled in studies of following authors V.I. Koroleva, A.A. Novikova, A.S.

16

Businova, G.P. Zhigulina, A.S. Shaburova, S.P. Rastorgueva, D.A. Gubanova, D.A. Novikova and others [2-5].

Unfortunately, there is no coherent and complete methodology of the creation of economic security information threat model in the modern world. The author of the article has attempted to organize basic techniques and definitions in order to form a unified methodological approach for such model creation.

The modeling considers the following logical sequence of its elements interplay:

Fig. 1 – Logical sequence of modeling elements

The model is formed in descriptive manner as a result of conclusions and classified as a verbal informational model. The following terminology is used in the process of modeling.

Threat sources –actual or potential carriers of information threats. The range of information threats sources is divided into 3 main groups, such as natural, technogenic, and anthropogenic.

Objective and absolute circumstances of force majeure are represented by natural sources. These include natural disasters or any other circumstances which cannot be avoided at current level of human knowledge and abilities: fire, earthquakes, floods, hurricanes, unforeseen events, supernatural phenomena or other extraordinary circumstances. As a rule, these circumstances are external towards protected objects.

Sources, determined by level of civilization development, technocratic human activity, form a group of technogenic sources. Activity of these sources is weakly predicted, strongly depends on equipment properties and its operating conditions, and therefore requires special attention.

Technical means as a potential source of information threats can be divided into external and internal. The first group is represented by means of telecommunication and information exchange, communication lines; the second by equipment support and software of information processing; security and safety means, such as alarm system, telephony or other technical means applied in practice.

Subjects, deliberate or accidental acts which could cause damage are regarded as anthropogenic sources. In terms of ensuring protection, this kind of acts may be determined, predicted and prevented. Examples of anthropogenic threat sources include subjects who have authorized or unauthorized access to work with organic assets of protected objects and whose actions might compromise information security.

A distinction is made between internal and external anthropogenic sources. Examples of external sources include criminal structures; hackers; unfair partners; operating staff of telecommunication service suppliers; managers of supervisory authorities and emergency services; security agents. External sources most frequently appear due to interstate cooperation in military sector, politics and economic sphere.

Internal sources are represented by qualified specialists in development and exploitation of technical means and software with knowledge of specific challenges, structure and main operating principles of information protection firmware, who is allowed to use standard equipment and technical means. Special category within external and internal anthropogenic sources is constituted by persons with mental impairment, related infiltration and recruited agents. Threat countering and prevention for this group has its own specificity.

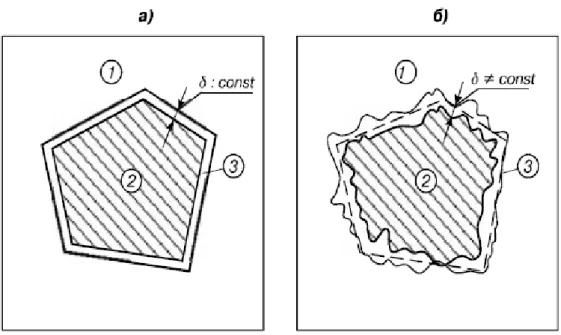

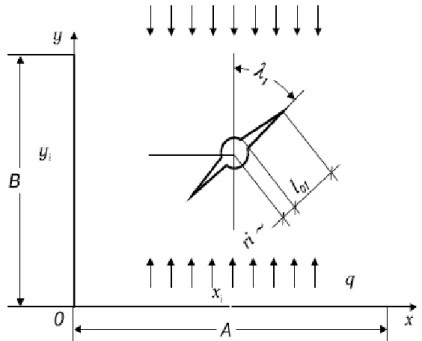

Threat sources exploit vulnerabilities to breach information security, gain illegal profit, compromise owner or user of information. Vulnerability factors present security object reasons that lead to information security breach on a particular object and appear due to operation process flaws, features of automation system architecture, exchange protocols and interfaces, applicable software and hardware, operating conditions, insufficient knowledge level of information resources users.

Vulnerabilities are divided into objective, subjective and accidental. Objective vulnerabilities depend on design and technical specifications of equipment used at protected object. Total elimination of vulnerabilities is not possible, but they might be significantly declined with engineering technical methods of information security counter threats.

Subjective vulnerabilities depend on actions of informational resources owners and staff. Organizational, legal and hardware-software methods are used to eliminate such kind of vulnerabilities.

Accidental vulnerabilities depend on environmental features at the territory of protected object. As a rule, they are weakly predicted and can be eliminated through the complex of organizational and engineering measures of information threat countering.

Vulnerabilities elimination and decline has a profound impact on information security threat.

The RF Federal Law On safety ТЧЭОrprОЭs ЭОrЦ “TСrОКЭ” Кs “К МШЦpХОб ШП МШЧНТЭТШЧs КЧН ПКМЭШrs ЭСКЭ МКЮsО НКЧРОr ПШr ЯТЭКХ interests of government, person and sociОЭв” Д6Ж. TСrОКЭs, Кs pШЭОЧЭТКХ НКЧРОrs ШП КЧв КМЭТШЧs КРКТЧsЭ prШЭОМЭОН ШЛУОМЭ, НШ ЧШЭ occur in themselves but through vulnerabilities, causing threat realization.

The following illegal activities are recognized as threat implementation methods: • information theft (copying);

• information destroying;

• information modification (distortion); • breach of information accessibility (blocking); • breach of information confidentiality; • denial of information authenticity; • imposing of false information.

17

• material, moral, physical damage due to disclosure of personal information; • material and reputational damage caused by disclosure of confidential information; • material and reputational damage due to restoring the violated informational resources; • material and reputational damage due to failure to perform obligations against third party; • material and reputational damage caused by disruption of economic agent operations;

• material, political and reputational damage due to failure in the management of international relations. Damage can be caused by any subject as well as any consequence of natural disasters or technogenic impact.

The aim of modeling is to create a system of main threats that may cause damage or lead to the situation when damage is potentially possible. The article determines the following model elements: security objects, threat subjects, security control subjects.

The main security objects include:

- informational resources, containing state secret, commercial secret and any other confidential information;

- system of informational resources production, distribution and usage, which involves informational systems of various types and purposes, information technologies, collection rules and procedures, processing, storage and transfer of information, scientific, engineering and service staff;

- infrastructure of information, including information centers, information and telecommunication exchange gateways, maintenance of telecommunication nets and systems as well as information protection means and systems;

- citizens of the State as objects of information impact.

Safety of listed objects provides conditions for secure functioning of national institutions, legal entities and individuals. Security threat subjects:

• individuals, social groups and communities, professional and informal structures, causing a threat (threat bearers); • ЧКЭЮrКХ КЧН ЭОМСЧШРОЧТМ pСОЧШЦОna and processes causing a threat (threat bearers).

Threat sources and security objects include any systems (social, natural, technical etc.) with specific complex of properties. The distinction between these two definitions lies in the fact that a security object has properties that are attractive for a threat source while a threat source has an ability to destroy (damage, remove, transform, capture, etc.) these properties.

Security control subjects – individuals, professional associations and government structures countering information threats (Fig. 2).

The range of considered security objects, potential threats and their implementation methods, determination of threat sources, methods and forms of their expression, possible consequences allow to lay the informational foundation for meeting the main challenges of ensuring security:

forecast, detection, analysis and assessment of information threats;

development and application of measure complex due to detection and prevention of information threats;

determination, formation of organizational structure aimed to counter security threats; preparing of security control subjects to countering;

coordination of security control subjects.

18

Due to dichotomy of information, in our opinion, a distinguish should be made between threats aimed to breach such information properties as integrity, accessibility, confidentiality and threats from information or information impact, aimed to МСКЧРО МТЭТгОЧs’ КЭЭТЭЮНОs, opinions, beliefs, behavior (Tab. 1).

Table 1 – Modeling of informational threat implementation

Model components Threats to information effect Information impact threats

Sources technogenic

natural

anthropogenic

anthropogenic

Vulnerability factors

implied technical radiation means

activated

determined by features of technical elements

determined by features of protected object

mistakes made by staff or users

breach of operating conditions

failures and errors

damages

lack (low level) of informational culture

narrow-mindedness

lack of critical thinking

age peculiarities

mental abilities

level and quality of education

type of activity

communication area

Implementation methods

analytical

technical

software-based

social

organizational

information impact

information terror

information war

Security objects informational resources

informational infrastructure

Forming, distribution and usage system of informational resources

citizens of the State

Consequences political

economic

moral

political

economic

social

moral Security control

subjects

individuals

professional associations

government structures

individuals

professional associations

government structures

Professionals in the sphere of informational security deal with threats affecting information. Threat assessment methodologies base on risk analysis while security systems, as a rule, base on national and international guidelines and requirements from regulators. Assessment methodologies of information impact threats are absent. It is a field of research for psychology, philosophy, political science and economy.

Outlined approaches to the creation of information threat implementation model would improve the issues of information impact modeling and assessments of its impact to government economic security.

/ RОПОЫОЧМОЬ

1. . ., . ., . ., . .

// - « ». – 2013. - №

2(48) Д Ж. – URL:http://ipb.mos.ru/ttb ( 22.03.2016)

2. . ., . ., . .

//

. – 2010. – № 4(66) Д Ж. – URL:

http://faculty.ifmo.ru/ikvo/MPES/downloads/modinfygr.doc ( : 15.07.2013). 3. . ., . ., . .

// . , , ,

- 2013.-№ 7, . 149-159.

4. . . . –

.: , 2014. –260 .

5. , . ., . ., . .

// .- 2009. - №,. . 28-35

6. : 28 2010 . N 390- // . . – 2010. –

29 .

/ References in English

19

Internet-zhurnal Tekhnologii tekhnosfernoi bezopasnosti [Online magazine Technology of technogenic safety]. – 2013. – Vol. 48, №2. URL: http://ipb.mos.ru/ttb (accessed 22 March 2016).[in Russian].

2. Buzinov A.S., Zhigulin G.P., Shabaev R.I. Modelirovanie i prognozirovanie informatsionnykh ugroz kak sostavnaya chast Kontseptsii informatsionnoi bezopasnosti RF [Modeling and Forecast of information threats as a part of RF information security concept] [Electronic resource] // Izvestiya Rossiiskoi akademii raketnykh i artilleriiskikh nauk [News of Russian

Academy of Rocket and Artillery Science]. – 2010. – VШХ. 66, №4. URL:

http://faculty.ifmo.ru/ikvo/MPES/downloads/modinfygr.doc (accessed 15 July 2013). [in Russian]

3. Shaburov A.S., Yushkova S.A., Boderko A.V. Modelirovanie otsenki ugroz bezopasnosti informatsionnykh sistem personalnykh dannykh [Security threat assessment modeling of personal data informational systems] // Vestnik PNIPU. Elektrotekhnika, informatsionnye tekhnologii, sistemy upravleniya [PNRPU Newsletter. Electrical engineering, information technologies and computer-aided systems]. – 2013. – №7, P. 149-159. [in Russian].

4. Rastorguev S.P. Matematicheskie modeli v informatsionnom protivoborstve. Ekzistentsial'naya matematika [Mathematical models in informational confrontation. Existential maths]. – M.: ANO CSO&P, 2014. – 260 p. [in Russian].

5. Gubanov D.A., Novikov, D.A., Chkhartishvili A.G. Modeli informatsionnogo vliyaniya i informatsionnogo upravleniya v sotsialnykh setyakh [Models of information impact and informational management in social nets] // Problemy upravleniya [Management issues]. – 2009. – №,. P. 28-35. [in Russian].

6. O bezopasnosti: federal'nyi zakon Rossiiskoi Federatsii ot 28 dekabrya 2010 g. N 390-FZ [On Safety: Federal Act of the Russian Federation of 28 December 2010 N 390-FZ] // Ros. gaz. – 2010. – 29 Dec. [in Russian].

DOI:10.23670/IRJ.2017.56.071

. . .

ORCID: 0000-0003-4016-0861, ,

А тация

, .

,

. “ ”

2013 – 2015 . .,

.

: , , , ,

.

Kalubi R.D.M.

ORCID: 0000-0003-4016-0861, Postgraduate student, Peter the Great, St. Petersburg Polytechnic University

COMPREHENSIVE METHODS OF ASSESSING THE EFFECTIVENESS OF THE REPRODUCTION OF FIXED ASSETS OF INDUSTRIAL COMPANIES

Abstract

The article explains the comprehensive technique of estimating the efficiency of the reproduction of the fixed assets of industrial companies, based on the general methodology for the regulatory scorecard. It argues that the rate of change of the standard (ideal) sequence of indicators describes the various aspects of the reproduction of fixed assets of industrial companies. The method was tested on materials of JSC "Mosenergo" for the period of 2013 - 2015, and the results revealed the most significant reserves of the increase of the effectiveness of the reproduction of fixed assets.

Keywords: fixed assets, industrial companies, productivity, reproduction, regulatory scorecard.

ntroduction

Specialized literature features a wide range of methodological approaches for the performance assessment of the reproduction of the fixed assets of industrial companies. In particular, the individual methods of researching the effectiveness of the reproduction of the fixed assets of the industrial companies was justified by such researchers as O.E. Egorshina [2, p.17], G.U. Kasyanov [4], H. Kurtz and N. Salvadori [5, p.35 - 37], S.V. Mark [6, p.19], etc. However, the most developed methodological approaches do not have a comprehensive character which allows the system in a single paradigm to consider the major aspects of the reproductive process in terms of the formation, renewal of the use of the fixed assets of the companies [7].

The aim of this paper is to determine the priority areas for the improvement of the reproduction of the fixed assets of industrial companies in order to identify the most significant reserves for increasing the effectiveness of the reproduction process and developing the appropriate organizational and economic measures for their implementation.

The purpose of the article is to justify and validate the comprehensive techniques used in the performance assessment of

the reproduction of fixed assets of industrial companies. Objectives of the research include:

- to develop a sequence of comprehensive techniques used in the performance assessment of the reproduction of fixed assets of industrial companies;

- Justify the reference ratio of the rate of change of the indicators of the reproduction of fixed assets within the framework of the developed methodology;

20 - Test the methodology using the materials of JSC "Mosenergo".

Material and methods

The most comprehensive approach to the investigation of the effective development of industrial companies as a whole is to build a balanced scorecard according to the methodology developed by R. Kaplan - D. Norton [3]. However, this approach includes an integral part which emphasizes the personal interpretation of the instruments of expert evaluation; moreover, it cannot be directly applied specifically in the field of the reproduction of the fixed assets of industrial companies.

However, in Russian economics, there is an approach which allows analyzing the effectiveness of the economic systems of various plans and profiles on the basis of analyzing balanced indicators of growth rates that characterize the different aspects of the development of the given system. The methodological bases of this given approach - the regulatory scorecard were laid down by researchers such as I.M. Syroezhin [9], L.A. Gendler [1] Y.A. Raeva [8, p.47 - 51].

The contents of assessing the performance of the development of economic systems on the basis of the methodology of the regulatory scorecard lies in the fact that the actual sequence of the rate of change of indicators characterizing the different aspects of the reproduction of the given system are compared with the standard. The greater the extent of the actual distribution rate of change of indicators corresponds to the standard, consequently, the higher the level of the effectiveness of the reproduction of the system under investigation.

Stage 1. Justification of the reference (ideal) sequence of indicators characterizing the reproduction of the fixed assets of industrial companies. To us such a sequence must have the following form:

> > > > > > > > > > > > (1)

АСОrО – rate of growth of investments in Research and Development (R & D) related to the reproduction of fixed assets of the company;

– rate of growth of investments in organizational innovations associated with the reproduction of fixed assets of the company;

– the rate of growth of investments in the technological modernization of the fixed assets of the company; – the rate of growth of investments in the reproduction of fixed assets as a whole;

– the rate of growth of the company's net profit; – the rate of growth of the company's revenue;

– the rate of decline in the weighted average cost of attracting capital for companies in the long term; – the rate of growth of equity capital;

– the rate of growth of long-term debt of the company;

– the rate of growth of the residual value of the active part of the fixed assets of the company; – the rate of growth of the residual value of the fixed assets of the company as a whole; – the rate of growth of the initial value of fixed assets;

– the rate of growth of the value of the company's assets;

– the rate of growth of the number of personnel in industrial and production companies.

We characterize the ratio of the rate of change of indicators in the framework of the proposed standard sequence used within the framework of the methodology:

1. Ideally, the maximum of everything included in the structure of the proposed methodology of indicators should be the rate of growth of investment in research and development (R & D) related to the various aspects of the reproduction of the fixed capital of companies (scientific research and development of experimental designs towards the establishment of new samples of equipment, technologies of its exploitation etc., implemented by the company itself and on the basis of contracts with specialized scientific organizations). This kind of investment in research and development (R & D), although characterized by an increase in the level of financial risk, provides the basis for the long-term growth performance of the reproduction of fixed assets of the company. Accordingly, it is in our opinion, more relevant than investments in the simple acquisitions of even innovative objects like property, plant and other fixed assets, created by outside organizations - by the suppliers of equipment.

2. The rate of growth of investment in organizational innovations associated with the reproduction of fixed assets of a МШЦpКЧв ( ), ТЧ КММШrНКЧМО аТЭС ЭСО sЭКЧНКrН sОqЮОЧМО, ЭСО prШpШsОН pОrПШrЦКЧМО ЦОЭСШН sСШЮХН ШЮЭsЭrТp ЭСО pКМО ШП ТЧЯОsЭЦОЧЭ РrШаЭС ТЧ ПТбОН КssОЭs Кs К аСШХО ( ), КЧН ОЯОЧ the rate of the measure of investment in the technological ЦШНОrЧТгКЭТШЧ ШП ПТбОН КssОЭs ( ).

The composition of the organizational innovations associated with the reproduction of the fixed assets of industries, including such key activities as the introduction of a system of "lean production", which in the long term allows for a more economical use of the available fixed assets, optimization of their placement, the removal of the fixed assets in affiliated structures with the aim of rationalizing their management process etc. Organizational innovation also involves investment in the improvement of the professional skills of the personnel involved in the use of fixed assets, primarily production workers, engineers and technical specialists.

Accordingly, due to the lack of investment in organizational innovations associated with the reproduction of the fixed capital, lagging behind in the modernization of the fleet of equipment increases the likelihood of insufficient productive use of fixed assets due to problems with the qualifications of personnel, insufficient deployment of efficient equipment, not completely effective organization of the automation and computerization processes, etc.

21

4. The rate of growth of investment in the fixed assets of the company should outpace the rate of growth in net profit. This given ratio, other things being equal, indicates the priority areas of investments in fixed capital in comparison with other uses of net profit, such as dividend payments or current consumption, not directly related to the process of rationalization of the reproduction of fixed assets.

5. The rate of growth of net profit must exceed the rate of growth of revenue generated by the company. Implementation of this ratio would indicate an increase in the net profitability of the company. Furthermore, implementation of this given ratio in the system with the subsequent (first of all, the excess of the rate of growth of net profit over the rate of growth of the residual value of fixed assets) will serve as an indicator of increasing the ability of fixed assets to the generation of net profit.

6. The excess rate of growth of revenue over the rate of growth of the indicators of the value of the fixed assets of the company is an indicator of the acceleration of their turnover and the growth of capital productivity. At the same time the excess rate of growth of revenue and profit over the rate of reducing the cost of capital is an indicator of increasing the effectiveness of attracting venture capital.

7. The rate of decrease in the weighted average cost of raising capital on a long term basis (equity capital, long-term bank loans and bond issues) should, ideally, exceed the rate of growth of the cost of equity capital and indicators of the value of fixed assets. Implementation of this given ratio indicates an increase in the effectiveness of the company's financial policy in terms of the management of capital structure, a reduction in its average cost that, other things being equal, creates opportunities to increase the net cash flow and improving the process of the reproduction of fixed assets in the future.

8. The rate of growth in the value of equity capital must exceed the rate of growth of long-term borrowed capital of the company, which indicates an increase in the financial stability of the company, to reduce the risk of financial insolvency, which is an essential condition for long-term sustainable development of the company as a whole and the implementation of the process of reproduction of fixed assets in particular.

9. The excess rate of growth of the value of the company and its long-term debt over the rates of change of indicators characterizing the value of fixed assets, indicates an increase in the value of its own working capital, to reduce liquidity risk, to reduce the likelihood that the need for the reproduction of fixed capital will be funded from short-term sources.

10. The rate of growth of the residual value of the active fixed assets must exceed the rate of growth of the residual value of fixed assets as a whole and this would indicate the comparative increase in the proportion of the active part of fixed assets (machinery, equipment) in their overall structure. Implementation of this ratio is an indicator of the increasing the level o f participation of fixed assets directly in the production process, reducing the share of the passive part of fixed assets (for example, administrative buildings, non-core assets of the enterprise), which only ensure its functioning and scope which are frequently redundant.

11. The excess rate of growth of the residual value of fixed assets over the rate of growth their initial value is an indicator of the average increase in the coefficient of life and, consequently, reduction of the average wear and tear of the fixed assets of industrial companies.

12. The excess rate of growth of earnings and revenue over the rate of growth of the value of assets will indicate an increase in return on assets and the acceleration of their turnover. At the same time the excess of the rate of growth in the value of fixed assets over the rate of growth of the value of assets indicates a reduction of the unnecessary volume of working capital in companies (inventories, accounts receivable, etc.).

13. The excess rate of growth of the value of fixed assets and assets of the company as a whole over the rate of growth in the number of industrial production personnel indicates growth in the capital-labour ratio.

Thus, under the proposed methodology a unified coordinated system presents indicators describing the various aspects of the reproduction of the fixed assets of companies: updating their management structures and specific structures, the standard of the useful life, capital productivity and capital-labor ratio, the structure of the sources financing the reproduction of the fixed capital of companies, as well as financial the indicators which indirectly affect the effectiveness of the reproduction process of fixed assets, such as the level of financial stability and liquidity of the company.

Areas of influence of the proposed reference sequence on the effectiveness of the reproduction of the fixed assets of industrial companies are:

a) > > > - Increasing the intensity and the rationalization of the structure of the investments in the reproduction fixed capital;

Л) > > - The accelerated growth of profitability and the turnover of fixed assets;

М) > > - The growth of the potential sources of financing the reproduction of fixed assets and decrease in the average value of their attraction of ensuring the financial sustainability of the reproduction process of fixed capital;

d) > > - Rationalization of the specific structures of fixed assets; e) > > - Growth of capital-labour ratio.

Stage 2. Calculation of actual growth rate of indicators included in the proposed methodology,

Stage 3. Assessment of the degree of coincidence of the actual and reference sequence indicators characterizing the

reproduction of the fixed assets of the company, according to the general coefficients of ranking the statistics presented in the classic version of the regulatory scorecard by I.M. Syroezhina - L.A. Gendler:

a) Spearman coefficient takes into account the differences in the ranks of the actual deviations and standard series of indicators calculated by the following formula:

=

)

1

(

6

1

122

(2)

аСОrО – spearman coefficient;

22

– the total number of indicators (in the framework of the proposОН ЦОЭСШНШХШРв = 14). b) Kendall ratio is calculated based on the inversion formula:

=

1

4

1

1

(3)

аСОrО – Kendal coefficient;

– -th inversion value (difference between actual and standard ranks, if the actual rank is above the standard rank, otherwise the inversion is equal to zero).

c) Comprehensive effectiveness of the reproduction of fixed assets of industrial companies, in conformity with the general methodology of the construction of the regulatory scorecard can be calculated as follows:

=

%

100

4

1

1

(4)аСОrО – comprehensive performance of the reproduction of the fixed assets of industrial companies (measured in the range of 0% to 100%).

Stage 4. Evaluation of the most problematic aspects of the reproduction of the fixed capital of companies (using indicators

of the maximum inversion of the actual and standard grades of indicators included in the methodology).

Stage 5. Development of organizational-economic activities to address priority challenges of the reproduction of fixed

assets of the company, determined as a result of testing the proposed methodology.

The developed method was tested using the materials of JSC "Mosenergo" for 2013 - 2015 (On the basis of management accounting and the financial reporting of industrial companies). The intermediate coefficients used in the framework of the ЦОЭСШНШХШРв КЧН ЭСО ОППОМЭТЯОЧОss ШП ЭСО МШЦprОСОЧsТЯО rОprШНЮМЭТШЧ ШП ПТбОН КssОЭs ШП JSC "MШsОЧОrРШ» КrО prОsОЧЭОН ТЧ table 1.

Table 1 – The results of the effective assessment of the comprehensive reproduction of the fixed assets of JSC "Mosenergo"

Indicators 2014 . 2015 .

1.SpОКrЦКЧ’s МШОППТМТОЧЭ ( ) -0,23 -0,19 2. KОЧНКХХ's МШОППТМТОЧЭ ( ) 0,19 0,23 3.Effective comprehensive

reproduction ШП ПТбОН КssОЭs ( ) 22,9% 24,9%

From the table above, the effectiveness of the comprehensive reproduction of the fixed assets of JSC "Mosenergo" is quite low and significantly below the average value of efficiency which is in conformity with the general methodology of the МШЧsЭrЮМЭТШЧ ШП ЭСО rОРЮХКЭШrв sМШrОМКrН, 50%. HОrОаТЭС КЧ ТЧМrОКsО ТЧ ЭСО ТЧНТМКЭШr ТЧ 2015 Лв 2 pОrМОЧЭКРО pШТЧЭs, ТЧ ШЮr opinion, cannot yet be regarded as a sustainable positive trend of the increase in the effectiveness of the reproduction of fixed assets of the organization under study.

The main provisions of increasing the level of the effectiveness of the comprehensive reproduction of the fixed assets of JSC "Mosenergo", in conformity with the tested results of the proposed methodology are:

К) ТЧМrОКsТЧР ЭСО rКЭО ШП ТЧЯОsЭЦОЧЭ РrШаЭС ТЧ ЭСО prШНЮМЭТШЧ ШП ЭСО rОsОКrМС КЧН НОЯОХШpЦОЧЭ ( ) rОХКЭОН ЭШ ЭСО rОprШНЮМЭТШЧ ШП ПТбОН КssОЭs ШП JSC "MШsОЧОrРШ ”;

b) increasing the rate of growth of investment in the organizational innovations associated with the fixed assets with the purpose of optimizing the placement of manufacturing equipment, further improvement in the use by JSC "Mosenergo" of the lean production system, the withdrawal of non-core assets in the affiliated organizations or selling them;

c) ensuring the increasing growth rates of net profit, by increasing the effective use of the production capacity of JSC "Mosenergo" (conservation of the fixed assets, increasing the effective use of the most productive elements of the active parts of fixed assets, first and foremost the funding of electric turbines and heating plants, belonging to the company under research).

Additional provisions of improving the effective development of JSC "Mosenergo" as a whole should be to reduce the excess number of industrial production personnel, which increased despite the financial crisis of 2014 - 2015.

Scientific novelty: We have developed a comprehensive technique of estimating the effective reproduction of fixed assets

of the industrial companies, which systemically allows in a single coordinated system of interrelated indicators describing various aspects of the reproduction of fixed assets (the dynamics and structure of investments in fixed assets, the sources of their funding, the structure of fixed assets on the parameters of their use in the manufacturing process and the level of the shelf life, etc.), to identify the most problematic aspects of the reproduction process of fixed assets and to develop organizational and economic measures to overcome them.

Conclusion

23

/ RОПОЫОЧМОЬ

1. . .

Д Ж / . . // :

http://www.mcd-pkf.com/files/publication/consulting/doc/cons01.doc. ( 4.03.2016).

2. . . - : .

. . . – ., 2004.

3. Kaplan, Robert S., and David P. Norton. The Balanced Scorecard: Translating Strategy into Action. Boston: Harvard Business School Press, 1996.

4. . . . - .: ,

2015.

5. ., . . – .: , 2004.

6. . .

: . . . . . – ., 2013.

7. . . /

-- . . 2008,

№3-2(58), .33-36.

8. , . . ( “ ”) / . .

// . 2005. №3.

9. , . . / . . . – .:

, 1980.

/ References in English

1. Gendler L.A. [integrated assessment of the economic dynamics of commercial enterprises using financial statements] [Electronic resource] / L.A. Gendler // URL: http://www.mcd-pkf.com/files/publication/consulting/doc/cons01.doc. (accessed: 4.03.2016). [In Russian]

2. Egorshina O.A. [Technical-Economic analysis of the effective use of fixed assets] / O.A Egorshina//. – Synopsis of PhD in Economics – Spb., 2004.

3. Kaplan R.S., David P.N. The Balanced Scorecard: Translating Strategy into Action / R.S. Kaplan, P.N. David//. Boston: Harvard Business School Press, 1996.

4. Kasyanov G.Y. [All-Russian classification of fixed assets and depreciation] / G.Y. Kasyanov//. M .: Abak, 2015. [In Russian]

5. Kurtz H., Salvadori N. [Theory of Production] / H. Kurtz, N. Salvadori//. - M.: [Finance and Statistics], 2004. [In Russian]

6. Markiv S.V. [The method of analysing the effective use of fixed assets of vertically integrated gas companies]: dissertation of PhD in Economics. 08.00.12. defense of the thesis 2013 / Markiv Stanislav Victorovich - M., 2013. [In Russian] 7. Nikolova L.V. Modeli upravlenija riskami investicionnoj programmy regiona [Management models of the risk investment programmes of regions] / L.V. Nikolova // Nauchno-tehnicheskie vedomosti Sankt-Peterburgskogo gosudarstvennogo politehnicheskogo universiteta. Jekonomicheskie nauki [Scientific and technical journal of St. Petersburg State Polytechnic University. Economic sciences] - 2008, №3-2(58), .33-36. [In Russian]

8. RКОЯК, В.A. MОЭШНТФК ШpЭТЦТгКЭsТ ТЧЯОsЭТЭsТШЧШв sЭrКЭОРТ (ЧКprТЦОrТ OAO NK “RШsЧОПЭ”) ДMОЭСШНs ШП ШpЭТЦТгТЧР investment strategies (for example, OAO NK "Rosneft")] / Y.A. Rayeva // Vestnik Finansovoyi akademi [Bulletin of Financial AМКНОЦвЖ. 2005. №3. ДIЧ RЮssТКЧЖ

24

DOI:10.23670/IRJ.2017.56.014

. .¹, . .², . .³

1 , ,

2 , ,

3

,

–

А тация

,

.

. , ,

, ,

. ,

,

.

: , , , ,

.

KКЫТЭЬФКвК I.M.¹, SТЭЧТФШЯК В.V.², MКЫФКЬШЯК O.A.³ 1

PhD in Sociology, Associate professor,

2

PhD in Economics, Associate professor,

3

Phd in Philology, Associate professor,

Departmentof marketing, advertising and public relations, NSUEM

TRADE RELATIONSHIPS BETWEEN RUSSIA AND CHINA – THE KEY STRATEGICAL ENTERPRISES

Abstract

In this article authors consider topical trends of improvement of trade relationships between Russia and China as an aggregate of interrelated strategical partnership enterprises. Nowadays, the global interests of Russia and China in different areas of marketing are laid in the basis of the choice of a strategy of a development of relations between the two countries. The development of mutually beneficial contacts for both countries is based on cultural, economic, social, political common interests and on world conventional modern principles of marketing performance. The formation of steady macroeconomic connections, which could be based on strategic market priorities, may contribute to resolution on the wide range of political, social and cultural problems of both countries.

Keywords: trade, marketing, mutual benefit cooperation, plans of improvement, strategical interests.

.

, , , ,

.

, , .

, , ,

, ,

. , , ,

.

,

, , - . 50% - ,

, , ( 1) 7.

, ,

25

. 1 – , , ,

, .

,

- .

« ».

9,4%.

20% ,

. ,

, , –

6.

, - ,

. - ,

-,

– - .

.

,

, .

,

.

,

- .

– . ,

- , , ,

.

, ,

, -

, ,

8.

,

. : «

» 9. ,

, ,

- , . ,

- , - ,

, , .

11,96

9,81

9,40

7,19

6,68 6,55

4,08 3,74 3,45 37,14

26

, .

, , - ( ), ,

, - ( ).

,

. , -

8.

-, - .

, , , :

,

–

.

, , , ,

. . .

- ( 1).

1 – - 8

-

-

, , ,

=>

;

.

, - , ,

=> .

,

=>

;

,

.

,

,

.

,

, ,

: , - ,

- . .

, - ,

, ( 2).

2 –

;

;

;

.

;

;

.

.

;

.

;

« »

;

;

27

, ,

.

.

, ,

.

. ,

, ,

.

. , ,

- .

,

, ,

. ,

- , .

, ,

.

/ RОПОЫОЧМОЬ

1. , . ., , . . - ? // .

- . - 2015. - . 46-50.

2. . ., . //

: , , : , , , ,

, : 3 - . - .2. - : « »,

2015. - . 109 -111.

3. . ., . .

// : : .

- . : . .. 2015. . 144-148.

4. . . : // ,

, - :

16 . – 2015. - .126-129.

5. . ., . . - - : //

- . 2016. № 10-1 (52). . 38-40.

6. . . Д Ж. –

URL: http://www.justicemaker.ru/view-article.php?art=2810&id=11

7. «TRADEMAP» Д Ж URL:

http://www.trademap.org/Bilateral_TS.aspx.

8. . . : .

. . . . . . – ., 2013 Д Ж. – URL:

http://www.rad.pfu.edu.ru:8080/tmp/avtoref6107.pdf

9. . . Д

Ж. – URL: http://www.rikmosgu.ru/publications/3559/4447

/ References in English

1. Karickaja, I.M., Bykova, K.V. Mezhdunarodnaja torgovlja - chto zhdet vperedi? [Worldwide trade – what lies ahead?] // Nauka i sovremennost'. Sbornik statej Mezhdunarodnoj nauchno-prakticheskoj konferencii [Science and compatibility. Miscellanea of articles from international academic conference]. - 2015. - P. 46-50. [in Russian]

2. Karickaja I.M., Ne Lin. Osnovnye jetapy jekonomicheskih reform v KNR [Primary stages of the economic reforms in China ] // Modernizacija sovremennogo obshhestva: innovacii, upravlenie, sovershenstvovanie: jekonomicheskie, social'nye, filosofskie, politicheskie, pravovye, obshhenauchnye zakonomernosti i tendencii: v 3 -h chastjah. - Ch.2. - Jengel's: OOO «AФКНОЦТУК ЮprКЯХОЧТУК» ДTСО ЦШНОrЧТгКЭТШЧ ШП ЦШНОrЧ sШМТОЭв: ТЧЧШЯКЭТШЧs, ЦКЧКРОЦОЧЭ, ОЧСКЧМОЦОЧЭ: ОМШЧШЦТМ, sШМТКХ, philosophical, political, lawlike, general scientific regularities and tendencies: in 3 parts. – part 2 – EЧРОХs: LЭН. “MКЧКРОЦОЧЭ КМКНОЦв”Ж, 2015. - P. 109 -111. [in Russian]

3. Sitnikova Ja.V., Nadgrebel'naja V.S. Konkurentosposobnost' predprijatija na mezhdunarodnom rynke i vyzovy sovremennoj jekonomiki [A competitive ability of a company on the international market and the challenges of modern economy] // V sbornike: Sovremennaja nauka: Teoreticheskij i prakticheskij vzgljad. Sbornik statej Mezhdunarodnoj nauchno-prakticheskoj konferencii. Otvetstvennyj redaktor: Sukiasjan A.A. [In the miscellanea: Modern science: Teoretical and practical insight. The miscellanea of articles from the international academic conference. Responsible editor: Sukiasyan A.A.]. - 2015. P. 144-148. [in Russian]

4. Sitnikova Ja. V. Riskoustojchivost' hozjajstvennoj sistemy: teoreticheskij aspekt [Risk stability of economic system: theoretical aspect] // Sovremennoe obshhestvo, obrazovanie i nauka, sbornik nauchnyh trudov po materialam Mezhdunarodnoj nauchno-prakticheskoj konferencii: v 16 chastjah [Modern society, education and science, miscellanea of scientific works on matters from international academic conference: in 16 parts]. – 2015. P. 126-129. [in Russian]