THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

M

M

M

A

A

A

S

S

S

T

T

T

E

E

E

R

R

R

S

S

S

I

I

I

N

N

N

F

F

F

I

I

I

N

N

N

A

A

A

N

N

N

C

C

C

E

E

E

E

E

E

Q

Q

Q

U

U

U

I

I

I

T

T

T

Y

Y

Y

R

R

R

E

E

E

S

S

S

E

E

E

A

A

A

R

R

R

C

C

C

H

H

H

After analysing Mota-Engil and its market, the price target FY 11 is €2.47 per share therefore, the recommendation is to buy.

The presence of the IMF in Portugal has been raising concerns on future public projects. The Portuguese government postponed infrastructural projects, such as TGV and the new Lisbon airport. Consequently, Mota-Engil’s revenues are expected to decrease 1.7%. Moreover, the national Sovereign Debt is causing financing difficulties in this division.

Internationalization, both in Africa and Latin America, may be the key for the Engineering & Construction division. Despite

the Portuguese crisis, Mota-Engil may benefit from foreign economic growth which may have a positive impact on its revenues. We expect revenues to grow 25% and 2%, respectively.

In order to diversity from its core business, Mota-Engil will continue to invest in Environment & Services. In line with this, the company is planning to expand its market share in Africa, especially in Angola, due to the country’s strategic plan regarding sanitation services. Nevertheless, logistics will be the main sub-division. Privatizations might increase the company’s activity in Portugal. In 2011, we expect an EBITDA growth higher than 1.3 %.

Mota-Engil changed the transports concession’s division accounting method from full consolidation to equity consolidation.

The recent increase in the Portuguese Sovereign Debt might raise the company’s financing costs.

M

OTA

-E

NGIL

C

OMPANY

R

EPORT

C

ONSTRUCTION

06 JUNE 2011

ANALYST: PEDRO CONTUMÉLIAS

Mst16000281@novasbe.pt

The future behind the curtain

Internationalization will be the key

Recommendation: BUY

Vs Previous Recommendation BUY

Price Target FY11: 2.47 €

Vs Previous Price Target 4.00€

Price (as of 02-Jun-11) 1.68 €

Reuters: EGL.LS, Bloomberg: EGL PL

52-week range (€) 2.73-1.64

Market Cap (€m) 353.82

Outstanding Shares (m) 204.636

Source: Bloomberg.

Source: Bloomberg.

(Values in € millions) 2010 2011E 2012F

Revenues 2004 2210 2351

EBITDA 237 261 278

EBITDA mg 11.83 11.81 11.84

Net Profit 36 31 33

EPS 0.19 0.14 0.16

P/E 8.84 12 10.5

Net Debt/EBITDA 5.13 4.25 4.5

Debt/Equity 2.53 2.2 2.3

EBITDA Margin 11.83% 11.83% 11.83%

Source: Company Report Data. Analyst Estimates

EGL PL PSI20 Index

Company Description:

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)P 2/33

EXECUTIVE SUMMARY ... 3

VALUATION ... 3

COST OF CAPITAL: ... 4

DISCOUNT RATES: ... 4

MACROECONOMIC SITUATION ... 7

COMPANY OVERVIEW ... 8

COMPANY DESCRIPTION ... 8

SHAREHOLDER STRUCTURE ... 9

CONSTRUCTION SECTOR ... 9

MARKET ENVIRONMENT ... 9

PORTUGAL ... 10

EASTERN EUROPE ... 11

AMERICA ... 12

AFRICA ... 12

VALUATION ... 14

ENVIRONMENT & SERVICES ... 14

WASTE MANAGEMENT ... 16

WATER DISTRIBUTION ... 17

LOGISTICS ... 18

MULTI-SERVICES ... 19

VALUATION E&S DIVISION ... 19

ASCENDI ... 20

MARTIFER ... 23

VALUATION MARTIFER ... 25

FINANCIAL STATEMENTS ... 26

APPENDIX – CASH FLOW STATEMENTS ... 28

E&C ... 28

E&S ... 29

ASCENDI ... 29

MARTIFER ... 30

APPENDIX – PORTUGUESE MARKET RISKS ... 30

APPENDIX – PORTUGUESE SOVEREIGN PUBLIC DEBT... 31

APPENDIX – STRATEGIC PLAN 2009-2013 ... 31

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Executive summary

The present report aims to value Mota-Engil, SGPS, S.A. The following paragraphs intend to stress the threats and opportunities that the company will face in E&C, E&S divisions and on its associated companies, Ascendi and Martifer SGPS. The following years will be important to the success of the Mota-Engil. We believe that the potential growth in Africa and America may boost this company’s growth.

It is possible to conclude that its internationalization plan has a positive impact in the E&C division. However, the current Portuguese economic situation will have a negative impact on this division. We believe that the company’s strategy plan to diversify from its core business is, and will be, important to increase its margins. Regarding the E&S division, we consider that the international exposure and the efforts done to maintain its leading position in the market, as well as, the possible privatizations resultant from the memorandum signed between Portugal and Troika will be key factors in this division.

We believe that Ascendi is less exposed to economic risk due to the agreement signed with the national government stating that revenues were based on services availability. In fact, the company faces a competitive advantage by avoiding a revenues variation due to traffic level’s changes.

Finally, we consider that the market is undervaluing Martifer. The company has a high potential growth, mainly in the renewable division, which generates 48% of the company’s revenues. This potential can the explained by the European Union renewable energy technology roadmap and by the expected decrease of the polysilicon spot price.

Our price target FY11 is 2.47 per share.

Valuation

The valuation method chosen was the Sum-of-the-Parts (SOTP) through the Discounted Cash Flow (DCF) Method. The discounted rate applied was the weighted average cost of capital (WACC). To reach the DCF, we forecasted cash flows until 2016, followed by an annuity to forecast the company value until 2021. From that period on, Mota-Engil is expected to reach a plateau phase, with constant WACC, margins and capital turnover. Furthermore, the analysis

Mota-Engil was valued using the Sum-of-the–parts method

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)P 4/33 assumes that all the existing contracts with suppliers and clients of all business divisions would not be revised until its end. We valued each division and associated company separately. To measure the continue value of the company, the approach adopted was a perpetuity.

Cost of Capital:

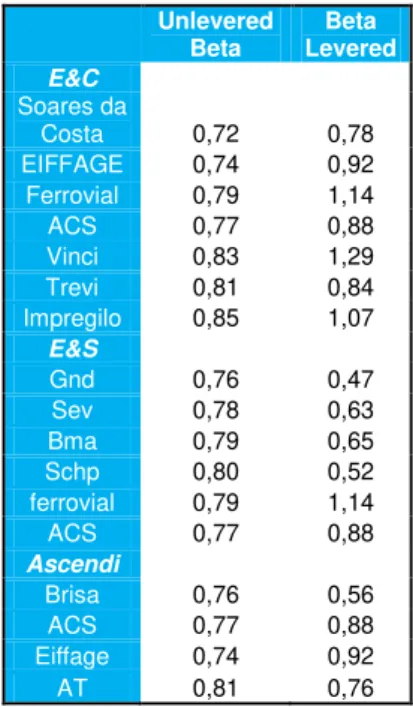

For each division, comparables were selected to identify the re-levered industry betas, to find unlevered betas and to obtain the systematic risk of the company. The selection criterion was based on companies within same industry for each division/associate company. We concluded that the industry risk is similar within Western companies due to the fact that they present in the same markets, belong to the European Union and offer the same kind services. Moreover, the regressions were computed based on daily data for the past 7 years and used STXE 600 index1.

Regarding E&C, heavy construction companies were chosen to assess the un-diversifiable risk. In what concerns the E&S division, comparables were selected based on Mota-Engil’s core activities: waste, water, logistics and multi-services. The same reasoning was applied to find comparables for Ascendi.

The method used to obtain the company’s specific beta was based on levered betas from the set of comparables selected. Firstly, betas were unlevered using Mota-Engil’s forecasted capital structure. Secondly, an arithmetic average was computed to capture the market systematic risk. Finally, we obtained the beta re-levered according to Mota-Engil´s Debt/Equity ratio. Concerning the E&C division, the re-levered beta was 1.26. In addition, the re-levered beta for E&S and Ascendi was 1.23 and 1.2, respectively. Due to its specificity, we obtained Martifer’s betaby regressing the company’s returns with PSI20 Index. The beta obtained was 0.9. A possible conclusion states that the company’s and its associate company’s returns might be strictly influenced by the market.

Discount Rates:

We calculated the discount rates for Mota-Engil based on division and region. To assess the market premium, we captured the specific risk of each country by the difference between the specific country CDS and the German 7 Y CDS. Additionally, we applied the PSI20 index stocks/bonds volatility ratio in order to capture the changes between stocks and bonds volatilities’.

1 Data from 26-04-2004 up to 26-04-2011. Table 1 - Comparable's Betas

Unlevered Beta

Beta Levered

E&C

Soares da

Costa 0,72 0,78

EIFFAGE 0,74 0,92

Ferrovial 0,79 1,14

ACS 0,77 0,88

Vinci 0,83 1,29

Trevi 0,81 0,84

Impregilo 0,85 1,07

E&S

Gnd 0,76 0,47

Sev 0,78 0,63

Bma 0,79 0,65

Schp 0,80 0,52

ferrovial 0,79 1,14

ACS 0,77 0,88

Ascendi

Brisa 0,76 0,56

ACS 0,77 0,88

Eiffage 0,74 0,92

AT 0,81 0,76

Discount rate was based on Mota-Engil division and region Comparables were chosen based on business area and industry risk

Comparables were chosen based on business division and industry risk

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)

Considering that most of the company’s projects abroad are paid in dollars, our free cash flows were adjusted to foreign currency and predicted using the Euro/Dollar forward curve. The same methodology was applied to Ascendi and Martifer.2

Given that most authors defend that it is irrelevant to divide debt by division in economic analysis, we decided to estimate total debt. To obtain the market value of debt, interest rates were forecasted based on the Portuguese yield curve and Euribor forecasts3. This assumption reflects our belief that Mota-Engil’s interest

rate cannot be below the Portuguese sovereign debt, both due to the national economic reality and the absence of the company’s official debt rating. We obtained a €1194m market debt by summing the present values of loan payments4. In what concerns Martifer, the market value of debt obtained was €471m.

To properly assess the market value of equity, we subtracted the market value of debt from enterprise value (EV) of the firm.

As previously explained, each division and associated companies were valued by the DCF method. Regarding the Engineering and Construction division, the WACC obtained was 9%, whereas for Environment and Services, the WACC was 8.88%. In what concerns associated companies, the WACC obtained for Ascendi was 8.81%, whereas for Martifer was 9.91%. The WACC of the engineering and construction division registers the highest value within Mota-Engil’s divisions, mainly due to the Portuguese crisis that the construction market has been suffering.

Revenues were valued by division and region. The importance of each sub-divisions/regions was based on the weight of EBITDA or on revenues by divisions/regions. From 2021 on, perpetuity growth rates5 were chosen in order to obtain realistic growth rates that reflect the industry reality.

In order to value the E&C division, we calculated revenues, from 2011 to 2016, necessary to obtain the company’s free cash flows. The period considered was based on forecasts of the international monetary fund (IMF). Revenues of each region were calculated in order to obtain the consolidated revenues of the

2 Since no relevant information was provided by Martifer’s investments relation department, the referred information was assumed. 3 Data from 02-June-11

4 This debt structure was assumed for E&C and E&S division as well as for Ascendi. 5 We assumed na inflation rate of 1.9%

Cost of debt

Cost of Equity

E&C 10,00% 13,65%

E&S 10,00% 13,63%

Ascendi 10,00% 13,47%

Martifer 10,68% 12,30%

Table 2 – Cost of Debt and Equity

Table 3 – Financial Information

E&C E&S Ascendi Martifer

Rf 3,56% 3,56% 3,56% 3,56%

Beta 1,26 1,23 1,20 0,90

WACC 9,00% 8,88% 8,81% 9,91%

E&C was assumed to follow gross production value and nominal GDP growth

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)P 6/33 division. The E&C division was assumed to follow the gross production value by sub-segment (residential, non-residential and civil engineering) for Portugal and Central European countries, until 2013. From that period on until 2016, we assumed that the gross production value growth would follow the nominal GDP. Additionally, we considered that American countries would follow the nominal GDP growth, based on the gross production value of 2011. Concerning Latin America and African countries, we assumed that the construction sector would follow the nominal GDP growth. We believe the market share of the company will grow 1% in 2012 and 2013, in Africa.

The E&S division, it is composed by four sub-divisions: waste, water, logistics and multi-services. To value this division, we forecasted revenues of each sub-division to obtain the consolidated revenues. Waste and Water sub-sub-divisions were assumed to follow household consumption of each country. The forecasts in the logistics sub-division were considered to follow an average between exports and imports growth. Finally, the multi-services sub-division was estimated to grow in line with the civil engineering market.

The associated company, Ascendi, was assumed to follow half of the Portuguese inflation rate. Concerning Martifer, we believe that the metallic construction division was assumed to grow with the civil engineering market. Regarding the renewable energy division, our estimates were based on the polysilicon price and the European Union strategy for renewable energies until 2020.

The Free Cash Flow forecast6 method depends on public information. This

information is limited and restricted which force us to assume a company’s structure for valuation proposes. To calculate the free cash flows, firstly we forecasted sales7 and other operating items; Secondly, we calculated the NOPLAT by estimating EBITDA and EBIT; Finally, we subtracted the total investment from NOPLAT. Then, we discounted the FCF using the WACC, which was computed through debt after taxes.

To understand the evolution of Mota-Engil’s revenues, we analysed its strategic plan for each division. Total investment was calculated based on two main components: net working capital and tangible assets plus depreciation. For each division and associate company, the net working capital was computed to reflect the company’s operational activity.

7

Previously explained for each industry

Nominal Growth Rates

Annuity Perpetuity E&C 5,88% 2,87%

E&S 2,37% 2,34%

Ascendi 0,93% 0,93%

Martifer 4,96% 3,23%

Table 4 – Nominal Growth Rates

E2011 E&C E&S Ascendi Martifer EBITDA

M € 184 82 147 64

EBIT

M € 111 54 79 31

Table 5 – EBITDA and EBIT

Each E&S division was assumed to follow different variables

Martifer’s revenues forecast was based on metallic construction division and renewable division

Martifer’s sales forecast was

€M

Ascendi was assumed to follow the Portuguese inflation rate

Source: Analysts Estimates

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

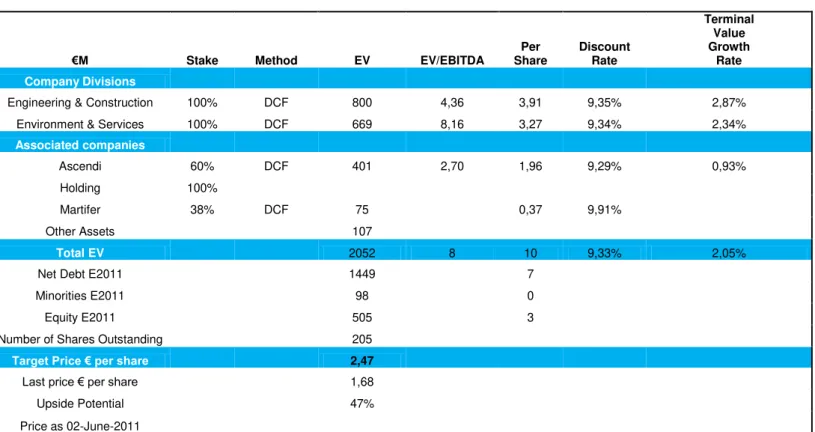

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)€M Stake Method EV EV/EBITDA

Per Share

Discount Rate

Terminal Value Growth

Rate

Company Divisions

Engineering & Construction 100% DCF 800 4,36 3,91 9,35% 2,87%

Environment & Services 100% DCF 669 8,16 3,27 9,34% 2,34%

Associated companies

Ascendi 60% DCF 401 2,70 1,96 9,29% 0,93%

Holding 100%

Martifer 38% DCF 75 0,37 9,91%

Other Assets 107

Total EV 2052 8 10 9,33% 2,05%

Net Debt E2011 1449 7

Minorities E2011 98 0

Equity E2011 505 3

Number of Shares Outstanding 205

Target Price € per share 2,47

Last price € per share 1,68

Upside Potential 47%

Price as 02-June-2011

Macroeconomic Situation

After the crisis of 2008, once again, in 2011, politicians will be the key. In rich countries, budget cuts are a top priority these days, which can cause an increase in taxes and cut spending. The majority of these countries have deficits above 8% of GDP and a gross public debt over 99% of GDP. Sovereign borrowing is increasing at its highest rate in history. The problems related to sovereign debt in Greece and Ireland are affecting bond markets. As a consequence, governments are trying to create a credible path to reduce their deficits in the medium term, without damaging their own recovery. Across Europe, countries are raising retirement ages, creating new rules and new organizations to encourage fiscal honesty. The Eurozone growth is expected be 1% while Eastern Europe countries grow at 2.8%, in 2011.

Different combinations of fiscal austerity and monetary policy may lead to currency wars around the world.

Table 6 – Mota-Engil’s Valuation

Different combinations of fiscal and monetary policy may lead to currency wars

-6,00% -4,00% -2,00% 0,00% 2,00% 4,00% 6,00% 8,00%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Real GDP growth rate - Central Europe

Graph 1- Central Europe Real GDP Growth

Source: Analysts Estimates

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)P 8/33 Emerging countries may benefit from the present slowdown of the develop world. Investment flows are changing from Europe and USA to Africa, Asia and Latin America.

The Portuguese economy has been suffering severe difficulties, in the past years. As a matter of fact, national accounts are restricted by high borrowing costs. Consequently, the Portuguese Economy returns to a recession just after 2010. In fact, gross domestic product is expected to stagnate, until 2020, with a possibly slight recover from then on.

Latin America is predicted to growth at a 4.2% rate, in 2011. Brazil is expected to reinforce its position as a strong economy, presenting high growth rates, mainly explained by the external continuous demand for the country’s commodities. FIFA World Cup 2014, as well as, the Olympic Games 2016 may also contribute to its success.

Africa is expected to grow at 4.5%, in 2011. This region will probably suffer some adjustments caused by a reduction in oil demand. It is also important to refer that some African countries are facing improvements in macroeconomic management tools. Additionally, more discipline is being introduced as a consequence of external financial supports.

Company overview

The company resulted from a merge between Mota & Companhia and Engil, in 2000. Mota-Engil is the largest Portuguese construction company listed in PSI 20 index, operating in Africa, Europe and America. In past years, the company has been trying to expand its international exposure and diversify from its core business, in order to achieve sustainable growth rates and increase its EBITDA margins. In 2010, the company achieved an EBITDA of € 237m and a net profit of € 36m.

Company description

Mota-Engil is a construction company operating in two distinct divisions: Engineering & Construction (E&C) and Environment and Services (E&S). Concerning the E&C division, Mota-Engil has activities in infrastructures, buildings and real estate,

Latin America and Africa are expected to grow above 4% in 2011

Graph 2 - Mota-Engil’s business divisions

Graph 3 - Mota-Engil's Corporate Structure

Portuguese Economy turns to a recession just after 2010

Source: Mota-Engil

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)mainly focus in Angola, Portugal and Poland. Infrastructures and buildings represent more than 90% of the division’s revenues. In terms of EBITDA, Angola is the most relevant country in this division. The E&S division centres its activities in Waste, Water, Logistics and Multi-services, mainly focus in Portugal. Moreover, logistics and waste are the most significant activities within this division. The company changed the accounting method of its transport division from full consolidation to equity consolidation. Furthermore, Mota-Engil has a stake of 37.5% in Martifer, a Portuguese company present in the metallic construction and in renewable energies.

Shareholder structure

With 62%, Mota-Engil is the main shareholder of the company. Privado Holding SGPS, SA controls 5%, Nmás 1 Agencia de Valores SA holds 2% of the company. Moreover, free-float represents 30% of the company. Mota-Engil’s shares are traded in PSI20 index, the Portuguese main index. The company’s shareholder structure reduces stock liquidity and the possibility of a successful public tender, although it raises flexibility and decision making.

Construction Sector

The following paragraphs will describe an overview of the construction market, and subsequently, a brief explanation of the valuation approach. Mota-Engil is present in Portugal, Central Europe, Africa and America. This division is suffering a reduction of its relevance in Portugal along with an increasing international exposure, both in terms of revenues and EBITDA.

Market environment

After the crises of 2008, and as an attempt to stimulate the economy, the Portuguese government invested in infrastructures. Large-scale public projects

EBITDA 2010 2011E 2012E 2013E 2014E 2015E 2016E

Portugal 42 35 35 42 44 45 46

Central Europe 8 9 11 11 12 13 14

Africa 107 134 150 160 168 183 196

America 5 5 5 5 5 6 6

Total 204 219 236 261 272 291 308

Free-float 31%

Nmás de Valores

5%

Privado Holding

2% Mota

Family 62%

Shareholder Structure

0,00% 10,00% 20,00% 30,00% 40,00% 50,00% 60,00%

2009 2010 E2011 E2012 E2013 E2014 E2015 E2016

Portugal Central Europe Africa America

After the crisis of 2008 the Portuguese government invested in infrastructure

Graph 4 - Mota-Engil's Shareholder Structure

Graph 5 – E&C’s Total Revenues

Table 7 – E&C EBITDA Breakdown

Source: Mota-Engil

Source: Mota-Engil; Analysts Estimates

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)P 10/33 create employment in the short term and might boost the economic growth in the long-run.

The World Economic Forum estimates an increase in the investment around the world due to a combination of factors: population growth, urbanization and the past underinvestment. This increase will come from developing economies, which have a higher fiscal flexibility and a greater need for infrastructural improvement. It is important to refer that Brazil is expected to spend €758 billion on infrastructures, between 2011 and 2014. Mota-Engil has 59% of its revenues in civil engineering, whereas 40% in non-residential and 1% in residential buildings. In line with this, the analysis will be mainly focused in civil engineering and non-residential buildings.

Portugal

In 2011, the civil engineering output is expected to decrease 2.34%. Moreover, the memorandum of understanding signed between Portugal and Troika establishes some regulations to reduce costs in this division. Due to this, significant projects were postponed, in order to improve public accounts and, consequently, the country’s external financing. Despite the Portuguese economic reality, the contract concerning the high-speed train between Lisboa-Madrid was signed. However, the second part of the project, adjudicated to Mota-Engil (Lisboa-Poceirão) was suspended. Portugal is suffering some setbacks in some important PPP projects, mainly in the road sector. Nevertheless, the reduction of public costs related with infrastructural projects is not a new issue. The reduction of the public investment in this sector led to a decrease of company’s margins, like EBIDTA. In fact, the government budget for construction sector registers a decreasing trend since 2004. Moreover, excluding 2009, the value of adjudicated projects is decreasing.

Regarding the non-residential market, the output is expected to decrease 2.89%. However, some relevant initiatives will occur, such as school modernization. The deterioration of the political environment associated with the current economic crisis might decrease the investor’s confidence, and consequently, reduce the buildings permits and project deferrals until an economic recovery. This recovery is expected to start in 2013, but due to the present economic scenario, and the extremely high dependency on the behaviour of national exports, the forecasts are associated with a high risk. In what concerns public investment, the number of contracts is expected to decrease for the following years: 2012 and 2013. 0%

5% 10% 15% 20%

1996 1998 2000 2002 2004 2006 2008 2010 2012

GFCF / TOTAL GDP Total Gross Value Production as % of GDP

Since 2004, the government budget for the construction sector is decreasing

-3,00% -2,00% -1,00% 0,00% 1,00% 2,00% 3,00% 4,00% 5,00% 6,00%

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

E 2 0 1 1 E 2 0 1 2 E 2 0 1 3 E 2 0 1 4 E 2 0 1 5 E 2 0 1 6

Real GDP growth rate 0 500 1000 1500 2000 2500

2009 2010 2011E 2012E 2013E 2014E 2015E 2016E

E&C Revenues

E&C Revenues

€M

Graph 6 – E&C’s Total Revenues

increase on investment

–

e on

Graph 8 – Portuguese Real GDP Growth Rate

Source: Mota-Engil; Analysts Estimates

Source: Bloomberg Source: EuroConstruct

Graph 7 – GFCF vs GPV

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Regarding the housing market, new production is expected to decrease, as a consequence of the current economic scenario. Once again, reconstruction and maintenance will be the only activities to grow within this market, in the next 10 years. Concerning construction, Mota-Engil’s market share8 is 0.13% for the residential market, 6.2% for the non-residential market and 4.99% for the civil engineering market. We believe the company’s market share to remain stable for the following years.

Portugal is losing its importance, both in terms of sales and EBITDA. In fact, revenues decreased from €879 million, in 2009, to €664 million, in 2010. We expect this reduction to continue until 2012. Due to the economic crisis, EBITDA margins are expected to decrease in the next years.

Eastern Europe

Regarding Eastern Europe, Mota-Engil is mainly present in Poland in the civil engineering market. The following paragraphs will focus on this specific country and market.

In 2010, the civil engineering market has suffered some difficulties to accomplish its financial plan, causing a stagnation of the market. However, from 2011 on, this market is expected to grow above 6%, in nominal terms, mainly due to: airfield runways, sport objects, water objects and other civil engineering works. According to the Polish government estimations’, between 2008 and 2010, the government spending in civil engineering was 33%, clearly below expectations. In line with this, spending is expected to be transferred to the new programme prepared by the Ministry of Infrastructure. Local government wants to: develop the Polish road network; construct, extend and maintain a system of anti-flood protection of the coast areas; construct a breakwater for the external program until 2013; construct a water road from Vistula to Gdansk until 2013; prepare and complete the Programme for the Euro 2012. Moreover, the recent economic development is increasing the country’s needs concerning reparation and construction of power units. It is expected an investment by fuel companies on transfer infrastructures. Furthermore, until 2015, the country will increase its investment on the national airports. However, after 2012, it is expected a reduction of civil engineering market growth rate, caused by the completion of many projects created for the EURO 2012.

8

Sales & Services /Total Gross Production Value.

0 10000 20000 30000 40000 50000 60000

2007 2008 2009 2010 2011 2012 2013

Czech Republic Hungary Poland Slovak Republic

€M

Polish government plans to develop several projects mainly, until 2013

Civil Engineering market is expected to decrease after the EURO 2012

0 200 400 600 800 1000

2009 2010 E2011 E2012 E2013 E2014 E2015 E2016

Revenues

€M

Graph 9 – Evolution of Portuguese E&C Total Revenues

Graph 10 – Eastern European

Countries’s Gross Production Value

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)P 12/33 In Eastern Europe, we expect Mota-Engil to have a double-digit increase of revenues in 2011 and 2012 and a growth rate of 6%, in nominal terms, until 2016. The company’s market share is not expected to suffer any changes in this market and EBITDA margins will remain constant in the next years.

America

Regarding America, Mota-Engil is present in Mexico and in Peru, although this region has a slight significance for the E&C. In this sub-division, our projections were not divided by the previous sub-segments: civil engineering, and residential & non-residential buildings. However, the company wants to increase its market share on this region. In 2010, Mota-Engil increased its activity in this region by 98%.

Currently, the company holds a portfolio of €251 million in Peru including a €59.5 million project in Mina de Ouro, in 2011. Moreover, in Mexico, the company expects to increase its growth by taking advantage of the Mexican National Infrastructure Programme through its Mexican subsidiary, Idinsa. Furthermore, the company is expecting to enter in the Brazilian market, which has a huge potential due to the FIFA World Cup 2014 and the Olympic Games 2016. Brazil is not included in our estimations for this sub-division. Both, Peru and Mexico are expected to grow at a rate higher than 4%, in real terms.

In XXI century we will assist to the increasing role of Latin America. Mota-Engil is expected to increase its market share mostly in Peru, due to the high growth rate the country will face between 2011 and 2013, which in the construction sector is higher than 3%,in nominal terms. From 2013 to 2016, the country’s growth rate is expected to increase more than 4%. Consequently, we predicted an increment in revenues for the following years, in this sub-division. However, we adopted a conservative approach by maintaining EBITDA margin constant at 6.02%, for the following years next years. Mota-Engil’s market share is expected to grow 0.1%, in 2012 and in 2013.

Africa

Mota-Engil is present in some countries in Africa, mainly in Angola. For more than 64 years, the company developed important relations with the local government and companies. Despite the global crisis, Angola is expected to grow

0,00% 1,00% 2,00% 3,00% 4,00% 5,00% 6,00% 7,00% 8,00% 9,00% 10,00%

2010 2011 2012 2013 2014 2015 2016 Peru Mexico Average construction growth rate

EBITDA margin in Angola was 16.1%, in 2010

0 50 100 150 200 250 300 350 400 450

2009 2010 2011 2012 2013 2014 2015 2016

Central Europe

Central Europe

€M

Graph 11 – Evolution of Central

Europe’s E&C Total Revenues

Growth Rate

Graph 12 – Peru & Mexico - Real GDP and Construction Growth

Graph 13 –Evolution of America’s E&C Total Revenues

Growth Rate 0 20 40 60 80 100 120

2009 2010 E2011 E2012 E2013 E2014 E2015 E2016

America

America

€M

Source: Bloomberg; Analyst Estimates Source: Analyst Estimates

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)in the next years. In line with this, the company expects to raise its market share in this country, by focusing on new industrial activities associated with construction. As previously explained, the macroeconomic environment of some African countries improved in the last years and Angola is not an exception. The financial support agreement with the IMF is imposing some discipline to the country’s policies. Moreover, the oil and diamond markets will increase by 7% in real terms, in 2011. The strategic plan, for the next years, predicts a massive infrastructure reconstruction and rehabilitation to support economic development and to deliver public services. Angola plans to reconstruct highways, bridges, cities, and also develop the fishery sector by investing in infrastructures, until 2013. Despite the potential growth of this country, companies usually deal with payment delays, which may cause some working capital problems. However, the risk of default may be reduced by oil revenues which provide a long-term financing. Mota-Engil’s EBITDA margin in Angola was 16.1%, in 2010.

Mota-Engil is also present in other markets such as Malawi, Mozambique and Cape Verde, mainly in maintenance and highway construction. Such countries plan to improve their infrastructures in order to develop their economy. All these countries will growth at a rate higher than 5%, in real terms. Regarding Mozambique, the group increased its turnover in 262%. In addition, in 2011, we expect Mota-Engil to increase its spending about €150 million. The African market presents a particularity that deals with the fact that the main Portuguese construction companies are partners in several consortiums.

The previous conclusions were made under the assumption that the market would grow along with the nominal GDP, for all the present African Countries. In this sub-division, the company operates in infrastructures, residential and non-residential markets. Regarding the operational performance, this region is expected to increase, both in terms of revenues and market share. In fact, the market share is expected to increase 1%, in 2012 and 2013. EBITDA margin is expected to be stable in 17.09%, in the following years.

Revenues

Breakdown 2009 2010 E2011 E2012 E2013 E2014 E2015 E2016

Portugal 53,14% 41,53% 36,24% 33,78% 32,99% 32,47% 31,44% 30,73%

Central Europe 17,35% 14,95% 15,68% 16,60% 16,73% 17,01% 16,98% 17,08%

Africa 30% 39% 44% 45% 46% 46% 47% 48%

America 2,54% 5,19% 4,70% 4,46% 4,35% 4,27% 4,12% 4,02%

0 50 100 150 200 250

2009 2010 E2011 E2012 E2013 E2014 E2015 E2016 EBITDA

€M

0,00% 5,00% 10,00% 15,00% 20,00% 25,00% 30,00% 35,00% 40,00%

2009 2010 E2011 E2012 E2013 E2014 E2015 E2016

Malawi Mozambique São Tomé and Príncipe Cape Verde

Mota-Engil is expected to increase its market share in Angola

Graph 14 – African Countries’ Real GDP

Graph 15 – E&C EBITDA in Africa Growth Rate

Table 8 – E&C Revenues Breakdown

Source: Bloomberg

Source: Mota-Engil; Analyst Estimates

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)P 14/33

Valuation

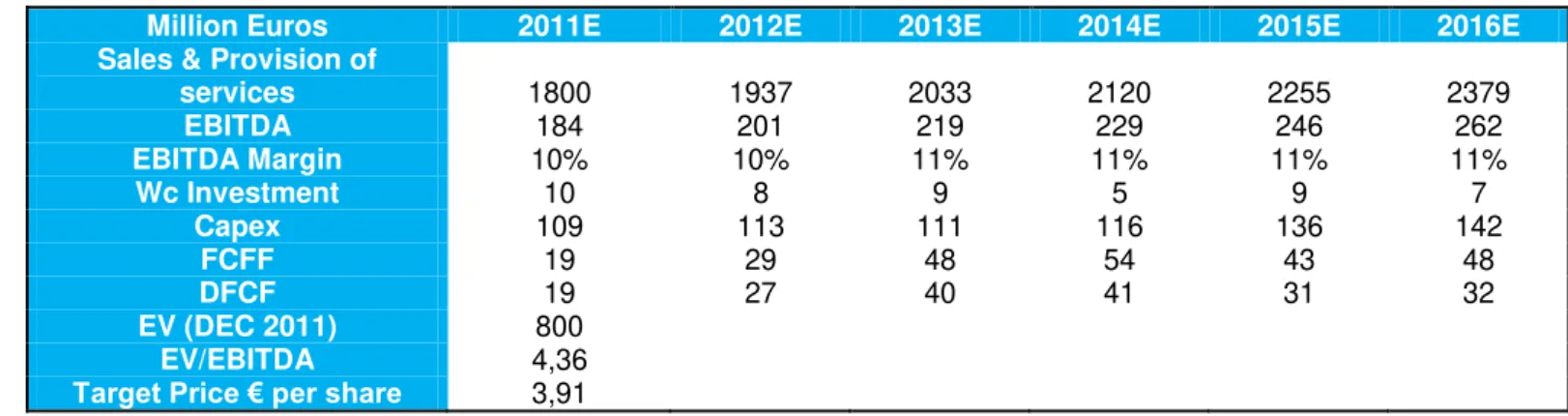

In the E&C division, capital expenditures are estimated to grow in the next years. This represents an annual increase of investments, which may expand the company opportunities’ in this division. In fact, we expect capital expenditures to be €142 million, in 2016.

This division was valued based under the assumptions that EBITDA margins will be constant among all the sub-divisions, expect in Portugal. The market share will increase in America and in Africa. Moreover, the forecasts were based in Euroconstruct estimations and GDP growth rates, as previously explained. We valued E&C assets in €3.91 per share.

Environment & Services

The following paragraphs will describe an overview of the construction market, and subsequently, a brief explanation of the valuation approach.

In order to diversify from its core business, Mota-Engil invested in E&S division, especially in waste management, water distribution, logistics and multi-services, mainly in Portugal and Angola. However, they are also present in other European, American and African countries, such as Brazil and Poland.

Million Euros 2011E 2012E 2013E 2014E 2015E 2016E

Sales & Provision of

services 1800 1937 2033 2120 2255 2379

EBITDA 184 201 219 229 246 262

EBITDA Margin 10% 10% 11% 11% 11% 11%

Wc Investment 10 8 9 5 9 7

Capex 109 113 111 116 136 142

FCFF 19 29 48 54 43 48

DFCF 19 27 40 41 31 32

EV (DEC 2011) 800

EV/EBITDA 4,36

Target Price € per share 3,91

0 5 10 15 20 25 30 35 40 45

2009 2010 E2011 E2012 E2013 E2014 E2015

Título do Gráfico

Waste Water Logitics Multiservices M€

Table 9 – E&C Valuation

Graph 16 – E&S’s Total Revenues EBITDA

Source: Mota-Engil; Analyst Estimates

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)The company may take advantage of the investment made by the EU in Poland, both in water and waste sub-divisions, which might increase the company’s revenues in the country. Moreover, the polish government wants to raise its energetic efficiency, which may increase the national competitiveness in this country. In Africa, Mota-Engil might take advantage of the economic growth, where there is huge necessity for improvement in water supply and sanitation systems. Regarding Brazil, some improvements have to be made in these areas. As previously explained, we concluded that the sub-division of waste and water depends mostly on household consumption, since its clients are households. We expect the household consumption to increase in Brazil, Angola and Poland and to decrease in Portugal, in 2011 and stagnated, until 2020.

The E&S was partially affected by the current Portuguese crisis. Between 2009 and 2010, the EBITDA margin increased in all sub-divisions, except in water distribution and multi-services. The E&S was partially affected by the current Portuguese crisis. According to the Organisation for Economic Co-operation and Development (OCDE), Portugal has to increase the efficiency and quality of its environment policies. The “OCDE Environment Performance Review Portugal 2011” report states that domestic waste is affecting the water quality and the industrial & urban waste is increasing. Some of the measures adopted by the Portuguese government, regarding environmental taxes, will improve the fiscal sustainability. Also, the economic activity may increase associated with the environmental market.

However, the national legislative elections will have impacts on this division. Partido Social Democrata (PSD) wants to increase the efficiency in energy consumption. Either position will benefit Mota-Engil, which might take advantage of the new government initiatives.

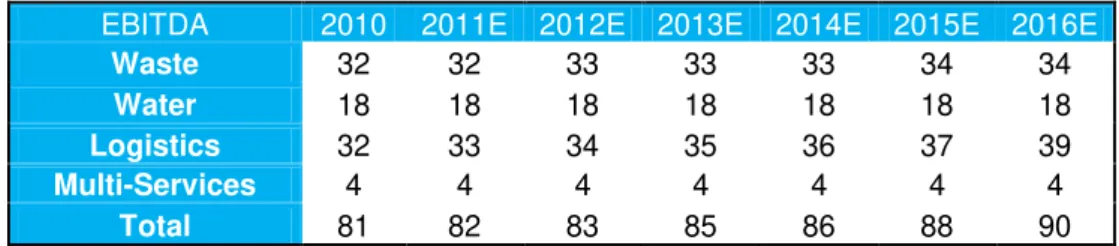

As previously explained, waste and water sub-divisions are assumed to follow household consumption. However, the last sub-division is relatively stable, since it depends mostly on concession contracts with boroughs. We assume multi-services sub-division to follow the civil engineering division. As mentioned before, logistics was assumed to follow the country’s imports and the exports. In fact, external transactions are highly sensitive to the economic reality, both at national and international levels. In 2010, logistics were the most relevant sub-division for the company, followed by waste, water and multi-services, both in terms of revenues and EBITDA. We expect this trend to remain constant.

-20,00% -10,00% 0,00% 10,00% 20,00%

Change of Imports of Goods Change of Exports of Goods

PSD election may have a positive impact on E&S

Portuguese’s fiscal

sustainability will improve

Portuguese’s fiscal

Portuguese’s fiscal

Portuguese’s fiscal

Graph 17 – Private Consumption vs Real GDP

Growth Rate

Graph 18 – Change in Imports and Exports

Growth Rate

Source: OCDE 2011 Report

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)P 16/33

Waste Management

Waste management, in Portugal, has a relatively low level of privatization when compared to other European countries. The memorandum of understanding between Portugal and Troika predicts privatizations for this sub-division. These structural changes might represent the acquisition of some public companies, and may increase of the Mota-Engil’s market share. Moreover, Industrial and urban waste are expanding in Portugal, which can cause an increase of the company’s revenues. However, we expect EBITDA margin to remain stable, in the next years. The economic crises that the country is facing may affect the financial stability of some companies in this division, although the economic sustainability is expected to remain unchanged. Mota-Engil owns Suma subgroup, a market leader in the national waste market, with more than ten years of experience. The company owns 50% of waste management market share, in industrial and commercial synergies. As a consequence of its strategic internationalization plan, Suma is present in foreign markets. In fact, this company is present in Poland, a highly competitive country given that projects are award by the condominium.

Regarding Mota-Engil’s international exposure, the company acquired, in 2010, Vista Waste Management in Angola, a services providing company for waste collection, environmental education and urban cleaning. It is important to keep in mind that waste is one of the main priorities in Angola, for the following years. As for Brazil, Mota-Engil owns Geo Vision, a company with operations in general waste management.

We expect an increase of Mota-Engil’s market share in Angola and Brazil and a decline in Poland and Portugal, for the following years. The relationship that Mota-Engil has with local companies and with the government might reinforce the company’s position in Angola. Waste management is the second largest sub-division of E&S, with revenues of €119 million, in 2010. We believe that revenues

EBITDA 2010 2011E 2012E 2013E 2014E 2015E 2016E

Waste 32 32 33 33 33 34 34

Water 18 18 18 18 18 18 18

Logistics 32 33 34 35 36 37 39

Multi-Services 4 4 4 4 4 4 4

Total 81 82 83 85 86 88 90

EBITDA

Margin 2010 E2011 E2012

Waste 26,89% 26,89% 26,89%

100 110 120 130 2009 2010 E 2 0 1 1 E 2 0 1 2 E 2 0 1 3 E 2 0 1 4 E 2 0 1 5 E 2 0 1 6

Waste

Waste M€Mota-Engil has a market share of 50% in this division

Waste is a strategic priority in Angola

Table 10 – E&S EBITDA Breakdown

Table 11 – Waste Division: EBITDA Margin

Graph 18 –Waste division’s Total Revenues

increase on

Source: Mota-Engil; Analyst Estimates

Source: Mota-Engil; Analyst Estimates

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)will increase until 2016 and EBITDA margins are expected to remain stable at 27%, in the following years.

Water Distribution

The water distribution sub-division in Portugal suffers from a relatively low level of privatization. As it was previously mentioned, the memorandum of understanding between Portugal and Troika encouraged privatizations in general. This might represent the acquisition of some public companies and a possible increase of the company’s market share. In Portugal, there is a considerable disparity in terms of the prices caused by the different prices applied by management entities. In some locations, costs are higher than tariffs. Also, there is a difference in prices between management entities, across the country. On average, the price of water supply is higher for the consumer in concessions, when compared municipalities by €48 per 120m3 of consumption. The average price of a concession is nearly €131.61 and €83.61 for municipalities9

. Regarding sewage, concessions are cheaper than SMAS and EP but more expensive than municipal supply. The cost a sewage supply concession for the consumer is, on average, €54.51 for 120m3 of consumption. Mota-Engil has activities in water supply and sewage concessions controlled by the subsidiaries of Indaqua Subgroup, the second largest sub-division within E&S.

As previously explained, water distribution was assumed to follow household consumption. Due to the current Portuguese economic crisis, household consumption is estimated to decrease, in 2011. Consequently, Indaqua is expected to reduce its revenues by 0.66%, in nominal terms. From 2012 on, this subsidiary will probably increase its revenues and maintain its EBITDA margin around 23%. Mota-Engil’s main competitive advantage, in this sub-division, is the knowhow acknowledged by the company regarding concessions and project financing. According to the memorandum of understanding signed between the IMF and Portugal, the national government should prepare an inventory of assets owned by municipalities to examine the scope for privatization. Moreover, Indaqua might be able to improve municipalities’ water networks and to reduce the water supply prices. We expect Indaqua to maintain its market position, due to its experience in the field and the maturity of the market. Regarding foreign

9 Fonte:APDA.

EBITDA

Margin 2010 E2011 E2012

Water 23,38% 23,38% 23,38%

Portugal has a considerable description in prices along the country

Mota-Engil has activities in water sub-division controlled by the subsidiaries of Indaqua

Table 12 – Water Division: EBITDA Margin

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)P 18/33 markets, Indaqua is planning to expand its activity to countries such as Poland, Angola, Peru and Brazil.

Logistics

Despite the 2008 global crises, we expect an increase in transportation of merchandise at a global level. The continuous globalization of international markets will assure, and support a growth rate around 3% of the logistic sub-division, in Portugal. The infrastructural structure of this sub-division has some bottlenecks that should be solved to improve the competitiveness of Portuguese companies. Logistics, as a trading base between Portugal and the rest of the world, may contribute to the economic development of the country. Portugal has to increase the merchandize traded and to organize the transportation market to raise its competitiveness. To achieve these goals, the national government defined a strategy based on the development of logistics, along with the market needs. The strategy defined by the government for this sub-division gives an important role to the private sector, which is expected to promote and manage some infrastructures that already exist and to create new ones.

As private company, Engil has a crucial role in this sub-division. Mota-Engil’s main activities, in this sub-division, are related to road-rail terminals, integrated logistics and carriage of goods by rail. As a market leader in Port’s containers terminals, Mota-Engil has revenues of €159 millions, in 2010. This division is the most exposed to changes in the global economy. Logistics are dependent on Portuguese imports and exports. Despite, the current economic situation, the company improved its results, both in terms of revenues and EBITDA, mainly caused by the growth in the Portuguese exports. Over the past years, Mota-Engil gained most of the ports concessions’. Therefore, the company’s market share is near 80% concerning containers handling. The principal sub-division subsidiary in logistics is TERTIR, market leader in port container handling.

We expect an increase in revenues and EBITDA due to the probable evolution of national exports and imports. From 2013 to 2016, exports are expected to increase more than 4.5% and imports are expected to increase more than 2.5% for the same period. The EBITDA margins are expected to remain stable around 20%. Moreover, we expect TERTIR to maintain its leading position in this market due to the integrated logistics solutions that the company is providing. In fact, the

0,00%

2,00%

4,00%

6,00%

E2011 E2012 E2013 E2014 E2015 E2016

Logistics

Logistics is expected to grow around 3% in Portugal for the following years

0 50 100 150 200 250

2009 2010 E2011 E2012 E2013 E2014 E2015 E2016

Logistics

Logistics

€M

Graph 19 –Logistics division’s Total Revenues

increase on

Logistics will contribute to the Portuguese economic growth

Graph 20 –Logistics division’s Change in EBITDA

Source: Mota-Engil; Analyst Estimates

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)company invested in integrated solutions, which promotes cross-cutting and integration of assets, in port areas. In 2010, Mota-Engil won a concession in Peru, which is a signal of the internationalization effort that is being made.

Multi-Services

Regarding multi-services sub-division, Mota-Engil has a number of companies engaged in the provision of services, although they are not part of the company’s core business. Mota-Engil offers services such as building and facility maintenance, rehabilitation of pipelines, green spaces, car parks, and electronic markets among others, mainly in Portugal. This sub-division deals with a high competition level, mainly caused by the fact that the majority of the projects do not require a considerable investment. In fact, Mota-Engil does not have a competitive advantage in this market due to the fact that are already companies specialized in this type of services. Multi-services reduced its sales from 2009 to 2010. The EBITDA margin decreased from 7.55% to 6.9%, in the same period. We expect the company’s EBITDA margin to be constant for next years. Given that, most services provided by this sub-division complement civil engineering projects, we expect a reduction in Mota-Engil’s revenues, for the next 2 years, and a slight increase from 2013 on.

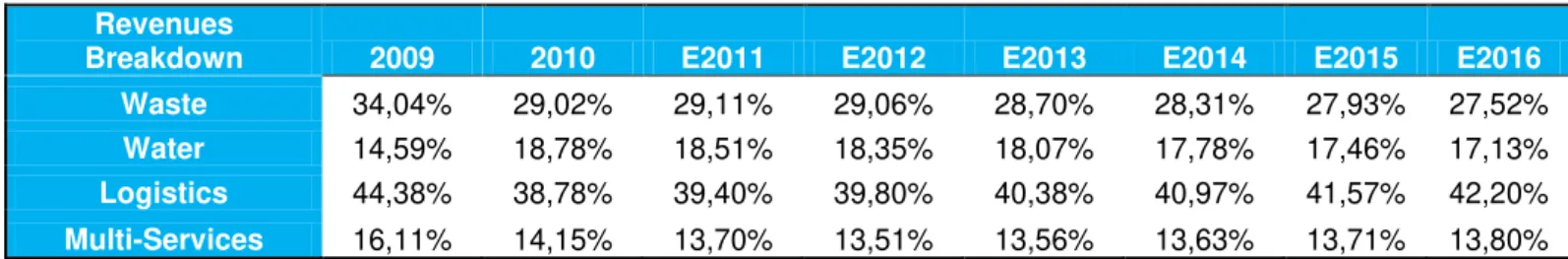

Revenues

Breakdown 2009 2010 E2011 E2012 E2013 E2014 E2015 E2016

Waste 34,04% 29,02% 29,11% 29,06% 28,70% 28,31% 27,93% 27,52%

Water 14,59% 18,78% 18,51% 18,35% 18,07% 17,78% 17,46% 17,13%

Logistics 44,38% 38,78% 39,40% 39,80% 40,38% 40,97% 41,57% 42,20%

Multi-Services 16,11% 14,15% 13,70% 13,51% 13,56% 13,63% 13,71% 13,80%

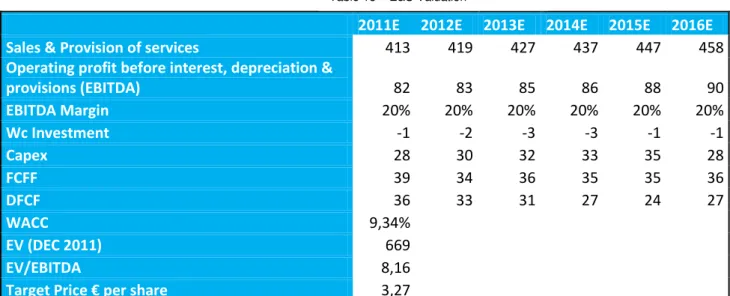

Valuation E&S division

Capital expenditures are estimated to be around €30 million. It represents a significant amount to maintain, or even increase, the company’s position in this market. In fact, we expect capital expenditures to be €28 million, in 2016.

CAPEX Breakdown

E2011

E2012

E2013

E2014

E2015

E2016

E&S

28

30

32

33

35

28

3,6 3,8 4 4,2 4,4

2009 2010 E201

1

E2

0

1

2

E2

0

1

3

E2

0

1

4

E2

0

1

5

E2

0

1

6

Multi-services

Segment

EBITDA

€M

Multi-Services division faces a tough competition in the market

Graph 21 – Multi-Services EBITDA Evolution

Table 13 – E&S Revenues Breakdown

Table 14 – E&S CAPEX Breakdown

Source: Mota-Engil; Analyst Estimates

Source: Mota-Engil; Analyst Estimates

MOTA-ENGIL COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)P 20/33 This division was valued under the assumption that EBITDA margins will be constant among all the sub-divisions and the market share will remain stable. Concerning forecasts, we assumed water and waste to follow household consumption growth. For logistics, we computed an average between imports and exports. The growth path in multi-services is expected to be similar to the civil engineering division, as previously explained. E&S assets value € 3.27 per share.

2011E

2012E

2013E

2014E

2015E

2016E

Sales & Provision of services

413

419

427

437

447

458

Operating profit before interest, depreciation &

provisions (EBITDA)

82

83

85

86

88

90

EBITDA Margin

20%

20%

20%

20%

20%

20%

Wc Investment

-1

-2

-3

-3

-1

-1

Capex

28

30

32

33

35

28

FCFF

39

34

36

35

35

36

DFCF

36

33

31

27

24

27

WACC

9,34%

EV (DEC 2011)

669

EV/EBITDA

8,16

Target Price € per share

3,27

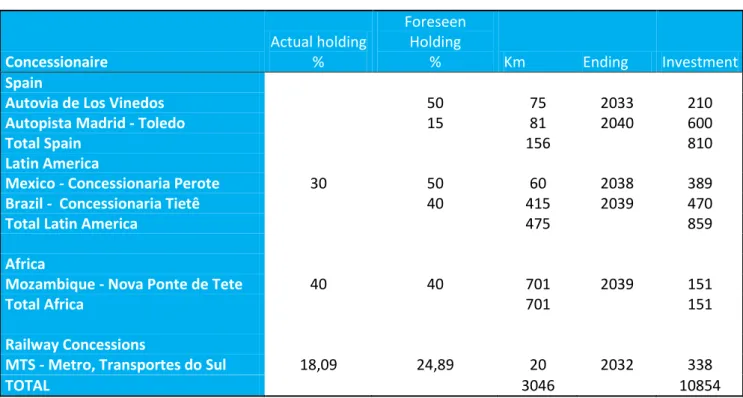

Ascendi

The following paragraphs will describe an overview of the transport concession market, and subsequently, a brief explanation of the valuation approach. In the transport concession area, Ascendi is a Mota-Engil’s associated company and results from a partnership between Banco Espírito Santo Group and Mota-Engil Group. Ascendi is present in Portugal, Spain, Latin America and Africa. The company’s portfolio is composed by €11 billion of global investment, more than €850 million assets, near 3.000 km in road and has 1.500 km under exploration. The revenues associated to this are worth €117 million, in 2009 and the Net Debt/EBITDA ratio was 12.4x, in 2009, as a consequence of number of concessions phase.

Given that Mota-Engil changed its accounting method for transport concession from full consolidation to equity consolidation, the visibility of this division was reduced. As a consequence, no audited public information is available for analysts in what concerns Ascendi’s financial data. Based on that, and 158

160 162 164 166 168 170 172 174

2010

2011E 2012E 2013E 2014E 2015E 2016E

Sales & Provision of services

Revenues M€

Table 15 – E&S Valuation

Graph 22 – Ascendi’s Total Revenues

increase on

Source: Mota-Engil; Analyst Estimates