THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)See more information at WWW.NOVASBE.PT Page 1/27

M

M

M

A

A

A

S

S

S

T

T

T

E

E

E

R

R

R

S

S

S

I

I

I

N

N

N

F

F

F

I

I

I

N

N

N

A

A

A

N

N

N

C

C

C

E

E

E

E

E

E

Q

Q

Q

U

U

U

I

I

I

T

T

T

Y

Y

Y

R

R

R

E

E

E

S

S

S

E

E

E

A

A

A

R

R

R

C

C

C

H

H

H

-30% -20% -10% 0%

BES Vs. PSI20 Vs. SX7P

PSI20 Index SX7P Index BES PL Equity

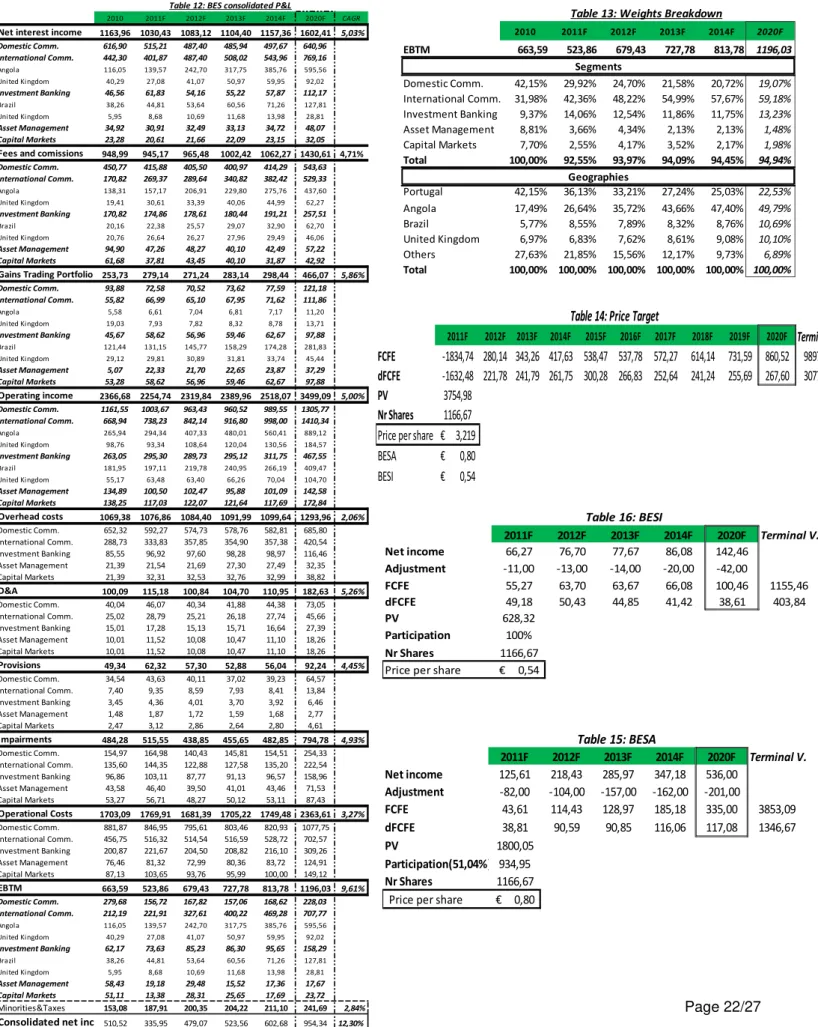

We review our previous PT to 3,22€/sh. Our DCF model assumptions were updated with the MoU, resulting from the formal request of external assistance to the European Commission. Higher pressure on BES asset quality implies increasing costs with provisions and impairments, restricting BES results.

BES NPL coverage above 100%.

As capital markets dried up BES’ announced deleverage program aims to reach a LTD ratio Ye 2012 of 120%. €2,5Bn disposal of international loans is expected.

We expect low loan growth as well as reduced securities holding to help reduce wholesale funding needs further. BES international presence in strong growth emerging economies will continue to deliver strong results key to offset domestic slowdown and sustain future profitability.

Core tier 1 ratio is expected to improve, although staying below 10%, since we forecast negative loans and RWA growth,

lower dividend payments and adverse impacts from pension funds running of. Foresee Capital Increase of ~€1Bn.

BES shares are trading at a discount justified by highly challenging funding prospects with ROE (7,3%) standing below its

cost(12,39%).

B

ANCO

E

SPÍRITO

S

ANTO

SA

C

OMPANY

R

EPORT

B

ANKING

S

ECTOR

6

J

UNE2011

M

ADALENA

C

ARMONA E

C

OSTA

mst16000295@novasbe.pt

A shifting Era...

International results take place

Recommendation: Buy

Potential +17,9%

Price Target FY11: 3,22 €

Vs Previous Price Target 2,83 €

Price (as of 4-Jun-11) 2,73 €

Reuters: BES.LS, Bloomberg: BES PL

52-week range (€) 3,84-2,47

Market Cap (€Mn) 3136,16

Outstanding Shares (Mn) 1166,67

Source: Bloomberg

Source: Bloomberg (03-06-2011)

(Values in € millions) 2009 2010E 2011F

NII 1200,8 1163,9 1030,4

NIM 2,45% 2,29% 2,09%

Banking Income 2419,2 2366,6 2254,7

Operational Costs 1764,4 1703,0 1769,9

Net income 522,11 510,52 335,95

Loans/Deposits 192% 165% 135%

Cost-to-income 43,6% 49,4% 52,9%

Core Tier 1 8,0% 7,9% 8,7%

ROE 10,0% 8,6% 7,3%

P/E(x) 10,91 7,04 13,48

EPS(€) 0,42 0,41 0,26

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 2/27

Table of Contents

Executive Summary ... 3

Portuguese Macroeconomic Environment ... 4

Portuguese Banking System ... 6

BES overview ... 8

BES description ... 8

Shareholder Structure ... 8

Dividend Policy ... 9

Valuation ...10

Domestic Activity ... 10

International Activity ... 12

Angola ... 12

Brazil ... 16

United Kingdom... 16

Group Considerations ...17

Deleverage Program ... 17

Funding ... 17

Cost Policy ... 18

Basel III ... 19

Pension Fund ... 19

Capital Adequacy ... 20

Methodology ...22

Foreign Exchange Risk ...24

Market

Comparables ...25

BES Balance Sheet ...26

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 3/27

Executive summary

Since August 2011 BES shares went down by 28,9% as the sector is currently facing headwinds affecting their Balance Sheet and profitability levels. With

capital markets widely closed owing to the impact of sovereign concerns on the funding market, BES implemented a deleverage program, shrinking its loan book and running off part of its security portfolio. ECB liquidity facilities will work as a funding backstop while reducing the loan to deposit gap, limiting the risk on the liquidity side.

The deteriorated Portuguese macroeconomic scenario is putting pressure on BES asset quality owing to its relative large expositions to corporate loans, which we expect to disproportionally benefit from a cyclical recovery in the economy, although it should make it easier for the bank to reprice its book loan to counter higher funding costs, as contrarily to happens with mortgages loans no legal restriction opposes.

BES international result is expected to be the main driver for future results, relying on BES’ already high profitability on the early development stage of the Angolan banking system, leveraging on its strong corporate experience in Portugal. Brazil and United Kingdom are also expected to become two major players on the international scene owing to its presence on a high growth emerging country and on a major financial hub.

Capital adequacy ratio will lock future growth prospects at least until a core tier 1 of 10%, required by Ye2012, is achieved. Decide for high dividend payout ratios while limiting further capital formation is not the solution, once the continue low level of capital ratios will keep penalize BES’s shares price particularly in

the context of Portugal’s perceived high sovereign risk. Fixing the capital position will be crucial of BES to reduce its risk profile and support a re-rating upward, reason why we foresee a capital increase need in order to comply with required core tier 1 capital ratio.

Scarce Capital...

Asset Quality...

International Results...

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 4/27

Portuguese Macroeconomic Environment

Portuguese Economy, on the next following years, will be facing a set of challenges due to the impact of austerity measures towards budget

consolidation and adjustments of serious macroeconomic unbalances. The

systematically Portuguese reliance on debt1 has not leveraged economic growth as expected, with Portuguese GDP consecutively performing below the European average (Exhibit 1). After the Greek bail-out plan, promptly the contagious effects were felt, with financial investors starting penalizing all other countries that, consecutively presented high levels of public and budget deficits. In Portugal, the non approval, in Parliament, of a new Stability and Growth Programme and the consequence resignation of the Government,

resulted on cumulative five ratings downgradesby S&P, Moody’s and Fitch,

and, in a further deterioration of investor sentiment with 10Yr Portuguese Government Bond (main proxy for banks’ funding) spread vs. German Government Bund reaching on May 25Th the historical maximum of 670bp (vs. 370bp earlier in the year) (Exhibit 2), compromising Portuguese Government

ability’s to access, at sustainable prices, capital markets. Increasing constraints associated with external market funding difficulties led to a formal request of

external aid to the European Union.

The widespread difficulties in accessing capital markets, both by private and public entities will require an acceleration of the adjustment between savings

and investment rates. Portugal will not be able to keep financing its economic

growth resorting to leverage with its economic recovery conditioned to an

adjustment of financial leverage levels. In the future, we expect a significant

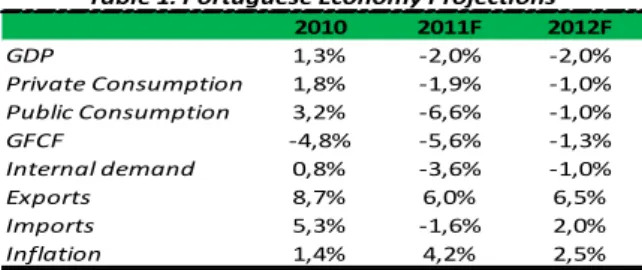

deleveraging program both from the government and private sector with inevitable negative effects about the prospects for economic growth in the short and medium term. A GDP contraction of -2% in 2011 and 2012 is expected owing to unprecedented austerity measures and more restrictive financing conditions. The expected international recovery (global economy is expected to grow 4,4% in 2011)2 will enhance Portuguese exports results (+6% and +6,5% in 2011 and 2012), sparing Portugal of hitting a must worse recession. Private

Consumption is expected to decrease by 1,9% in 2011 strongly conditioned by

1 Indebtedness Level: Government: 92,4%/GDP, Families:147%/Disposable income, Companies 96%/EBITDA

2 Source: International Monetary Fund, 2011 Austerity measures towards

budget consolidation…

Government public debt: 92.4% of GDP…

GDP will contract 2% in 2012…

3,1% disposable income decrease...

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 5/27

2010 2011F 2012F

GDP 1,3% -2,0% -2,0%

Private Consumption 1,8% -1,9% -1,0% Public Consumption 3,2% -6,6% -1,0%

GFCF -4,8% -5,6% -1,3%

Internal demand 0,8% -3,6% -1,0%

Exports 8,7% 6,0% 6,5%

Imports 5,3% -1,6% 2,0%

Inflation 1,4% 4,2% 2,5%

Source: Troika, BoP

Table 1: Portuguese Economy Projections

a 3,1% decrease on families’ disposable income due to more taxation, both direct and indirect, and a stronger degradation of market labour conditions (13,1% unemployment rate, 2011). The aggregated internal demand will decline by 3,6% as public expenditures are seemed to be suspended and a strict cost reduction policy will take place towards a budget deficit reduction from 9,1% to levels previously assumed with EU.

The so-called commodities super-cycle is bringing a steeper raw materials price curve (Exhibit 3), inflating all economic prices. Combining more expensive

input’s prices with an increase of indirect taxation (e.g. VAT), will result in an

acceleration of inflation which is expected to be of 4,2 % in 2011 and 2,5% in 2012. Under this scenario, substantial changes on corporate profit margins are expected.

On 13th of April ECB rose, for the first time since 2009, interest rates applied in deposit facilities (0,5% vs. 0,25%), main refinancing operations (1,25% vs. 1%) and on marginal lending facilities (1,75% vs. 2%). As main European economies are recovering stronger than the expected (German GDP 2011(est.): 2,5%3), it is forecasted that the main indexing used by Portuguese Banks will keep rising (Exhibit 4) in all maturities, although remaining below the average observed prior

to 2008.

Real estate’s prices are assuming a downward trend highlighting interest rates expectations, unemployment reality, the increasing pressure on houses sale houses once liquidity is more valuable in recession periods, and the maintenance of the expected low demand as banks seek to retain liquidity in its balance sheet. The number of transactions is also expected to decrease due to fiscal benefits introduced towards rental markets and owing to the difficulties of families to be considered eligible under a more conservative

credit policy. Real estate prices are expected to decrease by 11,5% 2011 and

2,9% in 2012.

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 6/27

Portuguese Banking system overview

The Portuguese Banking System4 played a significant role on those, Portuguese economy leverage golden days, providing financing through the purchase of government and public entities debt securities (Exhibit 5), while taking advantage of the ability to obtain financing with the wholesale financial markets on very favorable terms, expanding its balance sheet and busting with bank’s results (Exhibit 8).

However, over the last few years, Portugal has been one of the structurally

weakest banking markets, delivering KPI systematically below the European

average (e.g. Portuguese Average ROE 2000-2008 13% vs. 16% Europe)5, with weak economic growth and with the relatively high state ownership in the sector boosting strong competition, resulting in a book loan growing at unfavorable margins. In spite of a downward trend, Portuguese aggregate balance sheet

consistently yield positive growth rate, firstly driven by an expansion of credit

(Exhibit 9), which at this point we can argue that this shown reality of growth not

always reflected the real Portuguese economic conditions

,

and secondly it was the reflex of public involvement, yielding exponential growth rates for banks’ trading portfolios, becoming now, as financial investors penalize Portuguese debt prices, a serious threat to banks results.With the Portuguese Republic rating downgraded, speedily BCP, BES, Santander, BPI and Caixa Geral de Depósitos were classified at the same level: BBB- (31st March S&P), with inevitable negative repercussions on debts quality (Exhibit 6) and on its price (Exhibit 7), obliging them to reduce its historical high dependence on

the wholesale market (Portuguese system LTD 160% vs. European average 130%,

2010) 5

With capital markets virtually closed, the ECB’s6 liquidity dependence largely

increased (Exhibit 10), reaching in June 2010 the highest value of €49Bn7. However,

the continuous use of these measures is unsustainable, given its nature and purpose.

4For the Portuguese Banking system (“System”) we consider: BES, BPI, Santander, BCP and Caixa Geral de

Depósitos. We will be consistent with the terminology throughout the report. 5

Source: BoP, ECB

6ECB‟s liquidity facility was a ECB monetary policy adopted on the context of the international monetary crisis

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 7/27

Current Price* (€)

P/E 11E

P/BV

BES

2,705

10,40

0,43

BPI

1,107

11,07

0,36

BCP

0,49

16,33

0,32

Source: Bloomberg, Nova ER Team

*03-06-11

Table 2: Peers Valuation Metrics

With its near end, banks must pursuit adjustment policies to promote

fundraising alternatives particularly looking to extend its customer and

product base, offering attractive savings applications, reducing their need to

resort to capital markets. The “deposit battle” started in the middle of 2010 is

expected to be tougher with banks willing to sacrifice its interest expense

position. It is worth mention that domestic business seems to be changing with

banks stopping competing for volume, cutting part of the excess growth of recent years and repricing loans at more sustainable levels.

Regarding sector’s composition, we anticipate room to some

consolidation movements, once banks are being trade at discount, as the

Portuguese banking system remains at the spotlight of financial markets, with daily news continuously referring to bank’s vulnerable positions and their respective underperformance. Moreover, given the financial scandal involving a Portuguese institution and the consequent bail-out, Portuguese State wants to sell BPN in the next three months. Two other factors that must be noticed: 1) in such mature industry keep growing organically might become very expensive and unreasonable 2) three Portuguese Banks have market leading franchises in Angola, leaving room for potential value creation through synergies in both geographic markets. BES shares are currently trading at an implied P/E 11E of

10,40x vs.12,41x our coverage and at a discount of 57%, becoming attractive

when comparing with its two main PSI-20 competitors (Table 2).

Considering the beginning of the ultimate stage of domestic financial problems the summer 2010, BES shares went down 28,9%, underperforming PSI-20 by 31,9% and SX7P ( Dow Jones EuroStoxx 600 Banks) by 12,12% reflecting the

widespread lack of confidence on the European Banking system.

Portuguese banks may appear undervalued with valuations standing materially below the book value, comparing badly with the European sector’s 1,2x P/BV multiple.

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 8/27

BES Overview

BES description

Banco Espírito Santo S.A (BES) is private commercial bank headquarters in Portugal. Being the largest Portuguese bank in terms of market capitalization, 3136,16 €Mn8, it weighs ~10% on PSI-20, the main Portuguese stock market index. Since 2006 it is the most international Portuguese bank, and the 3rd in Iberia, present in 23 countries and four continents.

BES is organized in five different primary segments, being Domestic

Commercial banking (includes: Retail, Corporate and Private Sub-segments),

International Commercial banking and Investment banking the most

relevant ones (Exhibit 12). Capital Markets segment encloses all capital

markets transactions’ performed by the group. Foreign relations are established through International commercial bank segment, which primarily includes operations developed in Angola through BES’s subsidiary BESA and United

Kingdom’s branch. BES Investment Bank segment is the link with Brazilian operations (Exhibit 13).

Since its reprivatisation, in 1991, BES is having an increasing performance, leveraged by a strong brand9 that is being present on the Portuguese’s daily life for over 140 years. BES accomplished, in 2010, a market share of 22% (Exhibit 14), being the current market leader in Corporate loans with an expressive market quote of 25,7%10, mirrored on the importance of this sub-segment on domestic operations (Exhibit 15), accounting for 60% of domestic commercial profitability in 2010.

Shareholder structure

Banco Espírito Santo, SA has one of the most stable shareholder structures of the Portuguese banking system since 1991. The major shareholder is BESPAR (40%), a jointly owned sub-holding of Espírito Santo Financial Group (62,7%) with the remaining stake owned by Crédit Agricole (32,6%). ESFG, whose major shareholder is the Portuguese family Espírito

8 Source: Data

9BES leads the „top 10 Portugal 2011 Brands”, being the most valuable brand in Portugal between the companies

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 9/27 Santo, is a holding company operating in the insurance and banking industry and it has its main investments located in Portugal. Crédit Agricole is also a direct shareholder holding a participation of 10,81%, giving to Crédit Agricole a total ownership of 23%. Following its internationalization strategy, BES and Bradesco (second largest private Brazilian bank) became in 2000 strategic partners. Bradesco owns 6,05% of BES shares, while BES has recently sold its 4,1%

participation on the Brazilian bank in order to increase BES capital adequacy

ratio. BES justified this operations saying that the alternative would be sell shares of two main Portuguese companies (PT and EDP), which besides being more costly for the Portuguese economy it would had a reduced impact on the core tier 1 ratio (8bp11 if PT and 3bp8 if EDP), contrasting with 30bp8 effect achieved

with Bradesco. Portugal Telecom currently owns 2,17% of BES’s capital, but as

PT will sell its pension fund to the Portuguese Government, it will be oblige to sell half of this participation. Despite PT shares’ alienation, ESFG together with Credit Agricole will remain the major shareholders as together they own 50,8% of the

bank. The asset management British based company Silchester became, in December 2010, the fourth biggest shareholder with 5% participation. When analyzing the shareholder structure of the main subsidiaries we find that BES owns 100% of Espirito Santo Investment Bank, and while being the major shareholder of BESA, it splits the capital with Portmill, an African company. The five main shareholders totalize 63.03% participation, leaving 36.97% of the

1166,67 million shares free-floating.

Dividend Policy

BES intends to distribute, in an annual basis, dividends that represent at least

50% of the consolidated net income12

, although such intention is highly subordinated to market, financial and BES performance conditions. Analyzing the effective payout ratio from 2005 to 2010, the average distribution stands at

34,97% with the lowest value hitting 19,89% in 2008.

As the Portuguese banking system is facing a particular challenging environment, Bank of Portugal recommended, at the end of 2010, to not

distribute dividends in favor of increasing capital adequacy ratios. BPI and BCP

followed this recommendation, while BES opted for a moderated policy, distributing only 28,79% of the 2010 consolidated net income. We forecast this

11 NOVA ER Team Calculations

12 BES official Dividend Policy statement Sold Bradesco participation...

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 10/27 policy to remain moderate in 2011(payout ratio of 20%), taking into account the uncertainty surrounding market and macroeconomic conditions and the need to maintain high solvency levels. BES’s shares are attractive when comparing with its two main competitors on PSI-20, as it distributes dividends in a more consistent form (Exhibit 19), but when comparing with bank’s profitability (Exhibit 20) BES kept a high dividend payout ratio further limiting capital formation leading us to reason about bank’s pressure in delivering short-term results, which in turn might become inconsistent with its short-term performance,

contributing to increase bank’s risk exposure as it relies in other sources of

financing, compromising BES ability to grow as given its high value of RWA additional growth has to be supported by more capital. A new era of dividend policies is expected, as new capital requirements are to take place demanding banks to increase in its balance sheet eligible capital. Banks will hold dividends rather than going for more costly measures like capital increases.

Valuation

On our valuation methodology we have defined, on a weight’s net income contribution basis, to separately and carefully analyse the following BES components: Domestic commercial activity (Portugal), Investment Banking (Brazil, United Kingdom) and International Commercial Banking (Angola, United Kingdom).

Domestic Activity

Domestic commercial segment accounted in 2010 for 41,12% of the Group’s consolidated net income (Exhibit 12), being the Corporate banking activity the most relevant one, reflecting the group’s strong market positioning (Exhibit 15), although becoming less profitable on a year basis, (Exhibit 21) it is still very important to forecast the future behavior of this segment, as Group’s future main challenges will lie and arise from the continued development of domestic operations. BES’s loan portfolio is primarily composed by domestic loans (Exhibit 23), of which 65% are corporate loans (Exhibit 24). The bank exposition

to foreign retail loans is nearly null being the aggregated credit portfolio composed, in 2010, by 73,2% of corporate loans, with no major exposure to one sector, being the highest level of concentration 15,2%13 to the service sector.

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 11/27 2010 2011F 2012F 2013F 2014F 2020F CAGR

Domestic Retail Loans -1,21% -2,00% 0,50% 1,00% 1,50% 6,00% 3,81%

Domestic Corporate Loans 2,96% 0,10% 0,50% 3,00% 6,50% 9,00% 5,97%

Foreign Loans 10,36% -10,00% 7,00% 8,00% 9,00% 14,00% 11,30%

Loan Porfolio 5,15% -4,15% 2,15% 3,83% 5,97% 10,13% 7,07%

Table 3: Loan Portfolio Growth

2010 2011F 2012F 2013F 2014F 2020F CAGR

Net interest income 616,9 515,2 487,4 485,9 497,7 641,0 2% Fees and Comissions 450,8 415,9 405,5 401,0 414,3 543,6 3% Gains Trading Portf. 93,9 72,6 70,5 73,6 77,6 121,2

Banking Income 1161,5 1003,7 963,4 960,5 989,5 1305,8 3%

Depreciations 40,0 46,1 40,3 41,9 44,4 73,1 Provisions 34,5 43,6 40,1 37,0 39,2 64,6 Impairments 155,0 165,0 140,4 145,8 154,5 254,3 Overhead Costs 652,3 592,3 574,7 578,8 582,8 685,8

Operating expenses 881,9 846,9 795,6 803,5 820,9 1077,7 3%

EBT 279,7 156,7 167,8 157,1 168,6 228,0 4%

Source: NOVA ER Team

Table 4: Domestic Commercial Activity P&L (€Mn)

A significant materialization of the credit risk is expected (Exhibit 25), stronger at retail level, as consumers in economic precariousness (less resistant to economic shocks), were able to access this credit segment prior to the 2008 crisis, but also at the corporate level owing to serious difficulties that companies will have in obtaining financing, leading to a forecasted overdue ratio of 2,53%

Ye2011 (+38bp), provisions efforts of 4%, and an increase on the impairment

amount of 645bp, compromising group’s consolidated result. BES credit’s default

ratio tends to be lower than the system’s average due to its relative low

exposition to retail loans, allowing coverage of overdue loans of 161% in 2010. Further on this report, we will carefully address the scope and magnitude of the so-called deleverage program14, but for our Loans growth forecast we already incorporate the expected effects of the target Loan to Deposit ratio of 120% by Ye 2012. Apart from already high loan penetration, which limits further volume growth, we expect rising funding costs to limit capacity for loan growth. With sovereign funding at 670bp over the German Bund, it is hard to see BES able to fund any cheaper.

We forecast negative growth for the credit portfolio (Exhibit 26). From all credit segments, we forecast that Foreign Loans (CAGR15 11,30%) will boost, in the future, BES credit portfolio (Table 3).

14 BES deleverage program aims to run off part of its international loans, mainly those award to project finance

investments

15 All Compounded Annual Growth Rates (CAGR) are Real growth rates. We will be consistent with the terminology

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 12/27

Portugal Spain

UK

Brazil

Angola Total

2005

74,91% 10,05% 0,00%

1,42%

11,13%

97,51%

2006

76,93% 5,21% 0,17%

1,52%

15,35%

99,19%

2007

82,36% 5,71% 0,00%

1,83%

10,07%

99,98%

2008

55,19% 2,67% 0,06%

4,23%

37,76%

99,91%

2009

1,19% 0,11% 0,07%

97,75%

0,88%

100,00%

2010

0,06% 5,51% 11,68%

8,11%

31,57%

56,93%

Source: NOVA ER Team

Table 5: Capex Breakdown

In the future we do expect that domestic business will become less relevant on the consolidated net income (Table 13) as domestic market is already saturated with too many players and high competition and if everything being equal, no

relevant changes in the future are expected in terms of domestic growth.

Besides, the Portuguese economy will not be a good performer on the next few years and banks tend to be the mirror of the economy.

International Activity

Domestic operations are losing weight against those developed in foreign countries, mainly due to increased profitability and size of those carried abroad

(Exhibit 28). This trend reversal comes as the result of BES’s

internationalization strategy strongly oriented to the South Atlantic Axis,

namely to Africa (Angola and Maghreb countries) and Latin America (Brazil). The

group’s international presence is primarily focused on areas where it holds competitive advantage, trying to leverage its good position, at the corporate

level, exploiting markets with high growth potential and cultural affinities.

Internationalization strategy is being strongly pursuit by BES since the beginning of 2005 (Table 5), by investing in markets where it can provide a complete range of services mainly to Iberian companies that pretend to internationalize their businesses. In this sense we may expect new investments and acquisitions in

African countries, like it happened in 2010 with the acquisition of 40% of Aman

Bank and 25% of Moza Bank.

Angola

Since the beginning of its activities, 2001, BESA is pursuing an impressive organic growth path, operating through 3116 branches and opening on average 5 branches per year. BESA’s results continue leveraging BES international net profit, remaining the second geography responsible for consolidated net profit (Exh. 13:17,82% in 2010). With an aggregated market share of ~12%17 and 20%12 in corporate loans, BESA is the market leader12 on credit’s activity

followed by BAI with 19,1%12 market share.

16Source: BESA Annual Report, 2010

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 13/27 With the end of the 27 year-long- civil war, Angola’s government engaged in a long -term project aiming reconstruction, (e.g. build 61km of Highway, rehabilitation of

Luanda’s housing, improving the sewage system of Luanda City)18. By that time, due to the cultural and language proximity, Angolan authorities imported jobs and

services from Portuguese, Spanish and Brazilian companies, mainly on the

construction sector, as they didn’t owned the necessary resources. The narrowing of commercial trade between these three economies allowed BES to strategically

positioning itself in Angola’s market serving as a reference bank with knowledge and

established businesses on these three countries, leveraging on its previous experience on corporate banking activities.

Although Angola was hit hard by the 2009 oil prices collapse with economic growth coming to a standstill, since the begging of 2010 it has shown signs of strong

recovery, with GDP growth rising to 7,4% (Exhibit 29) owing to the resurgence of

economic activity throughout the country. Moreover, as a rich country in natural resources, we forecast that Angola’s economy will largely beneficiate of the

so-called “commodity super-cycle”. The large dimension of Angola economic growth (~17,5%19 GDP p.a.) is allowing BESA to also achieve high growth rates, (Exhibit: BESA Balance Sheet), mainly driven by a credit activity expansion, reaching in 2010

a balance sheet worth 85% of BAI’s20 assets (Exhibit 31), and delivering impressive ROE values comparing with its peers (Exhibit 30). BESA’s activity is highly

concentrated at the corporate level with 90% of the credit granted being allocated

to companies, of which 20% and 15% for the construction and transportation sector, respectively

With 12 million inhabitants, 40,5% of the population is estimated to be below

the poverty line, and only 12,5% of the population has access to the banking system

explained by the complex administrative system in opening bank accounts and obtaining loans. Agriculture accounts only for 9% (Exhibit 32) of Angola’s GDP but it

employees 85% of total labor force (Exhibit 33) while oil production and its

supportive industries account for 85% of GDP and employees only 11% of total labor force. This unequal distribution explains one of the highest Gini coefficients in the world: 0.6821.

18 Source: Plano de Desenvolvimento, Ministerio Obras Públicas de Angola 19

Source: World Bank official website

20 Banco Africo de Investimento is the biggest operating in Angola in terms of Balance Sheet size

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 14/27

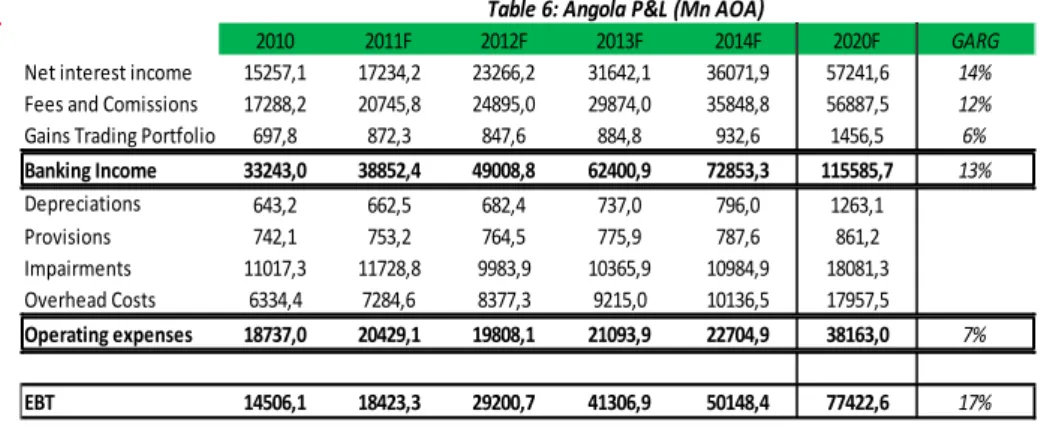

2010 2011F 2012F 2013F 2014F 2020F GARG

Net interest income 15257,1 17234,2 23266,2 31642,1 36071,9 57241,6 14%

Fees and Comissions 17288,2 20745,8 24895,0 29874,0 35848,8 56887,5 12%

Gains Trading Portfolio 697,8 872,3 847,6 884,8 932,6 1456,5 6%

Banking Income 33243,0 38852,4 49008,8 62400,9 72853,3 115585,7 13%

Depreciations 643,2 662,5 682,4 737,0 796,0 1263,1

Provisions 742,1 753,2 764,5 775,9 787,6 861,2

Impairments 11017,3 11728,8 9983,9 10365,9 10984,9 18081,3

Overhead Costs 6334,4 7284,6 8377,3 9215,0 10136,5 17957,5

Operating expenses 18737,0 20429,1 19808,1 21093,9 22704,9 38163,0 7%

EBT 14506,1 18423,3 29200,7 41306,9 50148,4 77422,6 17% Source: NOVA ER Team

Table 6: Angola P&L (Mn AOA)

This reality seems to be changing with non-oil sectors performing above the

expected, i.e., manufacture industry grew 20%22 in 2010 and it expected to grow

25% in 2011 (contributing 7,2% for GDP). Overall we do expect that the non-oil sector to grow 16% in 2011 primarily at the manufacture and financial services industry. This changing reality, can lead to a dramatic turnover in Angola’s

demography, allowing more people to be employed in sectors with higher

value-add, making a greater number of individuals able to have access to banks, developing the nearly immature retail banking business allowing BESA to

enhance its contacts with other segments, i.e. retail banking activities and

corporate domestic activity, which we foresee with no major implication, as BESA is a very liquid bank with a Loan-to-Deposits ratio systematically below 50% (47,9% in 2010) strongly contrasting with European average of 140%23, opening room for further balance sheet expansion through increasing its credit activity.

Other factors like the implementation of Angola Stock Market Exchange or the complex judiciary system largely contribute to increase banks risk aversion level, also explaining the undeveloped banking system. Although it is really important to take into consideration that deep constitutional revisions are being made towards a market economy with a more developed banking system. We estimate that BESA results will be the main driver of BES results in the future (Table 6 and Table 13 for future weights) given BESA’s high profitability and strong expected long-term economic growth, benefiting from the structural growth trend in the country which is driving banking activity.

.

22 Source: World Bank official website

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 15/27

Brazil

Brazil operations are primarily concentrated in Corporate Finance, Capital Markets, Asset management and Brokerage activities. Characterized by large and well-developed agricultural, mining, manufacturing, and service sectors,

Brazil's economy outweighs that of all other South American countries,

expanding its presence in world markets. Since 2003, Brazil has steadily improved its macroeconomic stability, building up foreign reserves, and reducing its debt profile by shifting its debt burden toward real denominated and domestically held instruments. With 205 Million inhabitants, Brazil has a large

labor pool characterized by a young population structure: 63% of the population

at the stage of 15-64 years. As a result of a strong investment policy in education, literacy rate stands at 88% of total population and 87% of population lives in urban areas. This allowed having 66% of population employed on the

services sector (Exhibit 35), the larger contributed to Brazil gross output

(Exhibit 36), leading to an unemployment rate of 8% (Exhibit 34).

As a result of significant economic improvements, we have been observing an intensification of commercial trade between Portugal and Brazil (which grew 45%24 on the first quarter of 2011) as it starts reflecting the disposable income

increase of Brazilian families. It becomes really important to understand the

reasonableness of Brazil’s sustainable economic growth, as BES’s operations, having a very narrow scope of operations, are highly dependent on Brazil’s future financial situation. Brazil will host two major sports events, in 2014 and 2016, which will have a distinguished impact on the economy since the government has to prepare its country both at the infrastructure and social level. By the end of 2009, Lula da Silva25 launched a program aiming to reduce the violence and reallocate the so-called “favelas”, one of the main social issues in Brazil.

From the economic point of view, the government expects to spend around R300Bn26 until 2015 on infrastructures, airports improvements and roads rehabilitation. The low indebtedness rates (government debt: 45% of GDP), are

opening room for value creation through higher rates of public and private

24

Source: AICEP official Website

25 Lula da Silva is the former President of the Federative Republic of Brazil

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 16/27

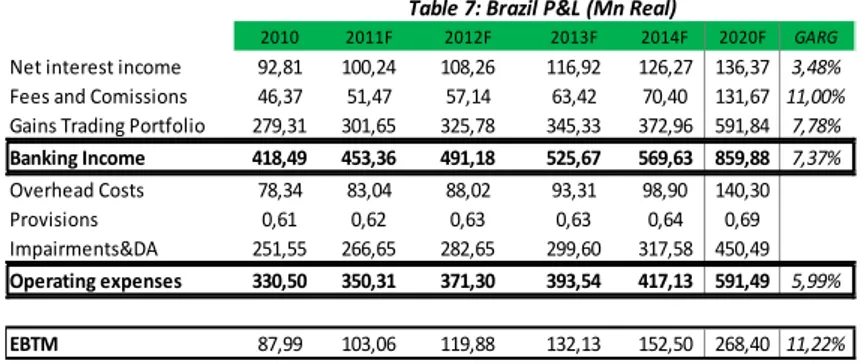

2010 2011F 2012F 2013F 2014F 2020F GARG

Net interest income 92,81 100,24 108,26 116,92 126,27 136,37 3,48%

Fees and Comissions 46,37 51,47 57,14 63,42 70,40 131,67 11,00%

Gains Trading Portfolio 279,31 301,65 325,78 345,33 372,96 591,84 7,78%

Banking Income 418,49 453,36 491,18 525,67 569,63 859,88 7,37%

Overhead Costs 78,34 83,04 88,02 93,31 98,90 140,30

Provisions 0,61 0,62 0,63 0,63 0,64 0,69

Impairments&DA 251,55 266,65 282,65 299,60 317,58 450,49 Operating expenses 330,50 350,31 371,30 393,54 417,13 591,49 5,99%

EBTM 87,99 103,06 119,88 132,13 152,50 268,40 11,22%

Source: NOVA ER Team

Table 7: Brazil P&L (Mn Real)

investment, delivering impressive economic growth opportunities for the Brazilian economy. These two major events are launching the economy into a period of

high dynamism boosted by public constructions, followed by a greater

development of the services sector. Applying financial theory, Bovespa (main Brazilian Stock Market Index) incorporates all this information bringing more dynamism to the stock exchange market (Exhibit 37). Companies will take a ride on this period, seeking to expand its business towards a value creation policy, allowing investment bank services to gain a whole new development path (Table 7), as Brazil’s economy seems to be entering in a new era towards a more developed economy.

United Kingdom

BES concentrates a commercial branch and an investment bank branch in the United Kingdom. The London commercial Branch focuses its business on wholesale banking at European market, leveraging on being centered on a financial world center. The results of this segment are very sensitive to

macroeconomic conditions (Exhibit 38) as they are linked with bank’s funding

activities, which we estimate that for the next two following years, to be penalized due to current unfavorable financial markets conditions (Table 9). On the beginning of 2010, Espirito Santo Investment Bank took a step further on its internationalization strategy buying 50,1% (with exercise option of buying the remained 49,9% by 2013) of Execution Noble, an investment bank headquarters in London, focused in capital markets activities with a strong presence on the

major world financial markets (New York, Hong Kong, Shanghai and Mumbai).

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 17/27

2010 2011F 2012F 2013F 2014F 2020F GARG

Net interest Income 4,66 6,18 5,42 5,52 5,79 11,22 6,84% Gains trading Portfolio 25,62 26,23 26,79 27,07 28,68 38,63 4,39% Fees and Comissions 18,27 23,45 22,78 23,78 25,07 39,15 5,86% Operating Income 48,55 55,86 54,99 56,37 59,54 88,99 5,31% Overhead Costs 25,67 29,08 29,28 29,48 29,69 34,94 Provisions 0,86 1,09 1,00 0,93 0,98 1,61 Impairments&DA 16,78 18,06 15,43 16,03 16,98 27,95 Operating expenses 43,31 48,22 45,72 46,43 47,65 64,50 3,28%

EBTM 5,24 7,63 9,28 9,94 11,88 24,49 13,83% Source: NOVA ER Team

Table 8: United Kingdom Invest Bank P&L (Mn Libras)

2010 2011F 2012F 2013F 2014F 2020F GARG

Net interest income 53,1 48,2 58,5 61,0 65,3 92,3 7%

Fees and Comissions 17,1 26,9 29,0 34,1 38,2 52,9 8%

Gains Trading Portfolio 16,7 7,0 6,8 7,1 7,5 11,7 6%

Banking Income 86,9 82,1 94,2 102,1 111,0 156,9 7%

Depreciations 2,5 2,9 2,5 2,6 2,8 4,6

Provisions 0,7 0,9 0,9 0,8 0,8 1,4

Impairments 13,6 14,4 12,3 12,8 13,5 22,3

Overhead Costs 34,6 40,1 42,9 42,6 42,9 50,5

Operating expenses 51,4 58,3 58,6 58,8 60,0 78,7 3%

EBTM 35,5 23,8 35,6 43,4 51,0 78,2 14% Table 9: United Kingdom Commercial Activity P&L (Mn Libras)

Group considerations

Deleverage Program

In light of scarcity of liquidity, at competitive prices (Exhibit 39), in the wholesale markets (due to sovereign concerns), BES has implemented in the second half of 2010 a strict plan to deleverage its balance sheet, focusing in growing its core deposits which should provide liquidity to cope with debt maturities in a scenario of continued lack of well functioning markets, and aiming to reach a loan to

deposits ratio of 120% by Yend 2012, through the disposal of international

project finance loans (which besides being large size loans are classified as very risky assets) whose require BES to hold more scarce liquidity on its balance sheet.

Funding

BES plans to use the proceeds of the deleverage plan to pay the maturing debt. In 2011 the debt maturing will be of €4,327Bn, while the total amount of total international portfolio subject to deleverage program stands at €2,5Bn. To cope with this funding gap, BES announced the issue 3y €1,25Bn unsubordinated

debt, resorting to state’s guarantee. The yield of this debt is expected to be similar to the price paid for 3y Government bond which on 20th May was of 10,17%. The annual guarantee fee is of 0,948% representing a cost of €35,55Mn by the end of this three year emission. The remaining gap amount will be fund through the use of ECB facilities which has been important to cope with short

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 18/27

term liquidity management, due to the mismatch maturities between debt

repayment dates ( 60% due of on 1stQ) and disposal of international loans (only

€1,Bn was sold on the 1stQ). The amount of deposits to be repaid is estimated to be very low28 once customers are opting to reallocate its deposits savings, enjoying BES high remuneration due to effort’s result to diversify its funding base. Actually deposits, on the Portuguese banking system,are experiencing its

historical maximums (reaching €9,4Mn on 1stQ of 2011)29

,as customers seem to have lost their trust in allocate their savings with Portuguese state products, shifting to bank’s deposits, which on BES are expected to grow 19% (€5,7Mn) in 2011. We believe BES funding structure is changing (Exhibit 41) and, by the Ye 2011, deposits will represent 51% of that structure. As BES aims to reduce its ECB depend to 5% of net assets, we should look for bank’s future debt repayment amounts (Exhibit 40). In 2012 BES financial obligations will be of

€4,1Bn standing at the frontier of the desired target. This is an amount that we consider to be manageable as the ECB liquidity facilities provides a solid

funding backstop, providing planning security to BES while it reduces the loan

to deposit gap and runs off its securities portfolio, mitigating liquidity risk. Nevertheless, as ECB moves to a less generous liquidity regime it is expected that the cost of this source will increase. If we believe that from 2012 onwards this funding source will cease to exist, BES will need to resort to other funding

sources (~€7Bn), which in case of a persistent expensive access to capital

markets, either can burn its net interest income or lead the bank to engage or in a capital increase or other deleverage program, with inevitable serious repercussions at profitability level.

Cost Policy

Whilst cost-to-income ratio becomes the main challenge, management is implementing a strong program of cost cutting aiming to close 20 branches

until the end of 2011, reducing its fixed cost in €53mn. Nevertheless, we anticipate the aggravation in the ratio of 650bp conditioned by the expansion and consolidation of new units (e.g. Execution Noble), the costs of deleverage, and the costs of integrating domestic employees on the Portuguese social security

system.

28 Repayable deposits obligation in 2011 is of €8,2Mn 29 Source: BoP

Sovereign debt crisis is promoting deposits...

ECB facilities mitigate liquidity risk...

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

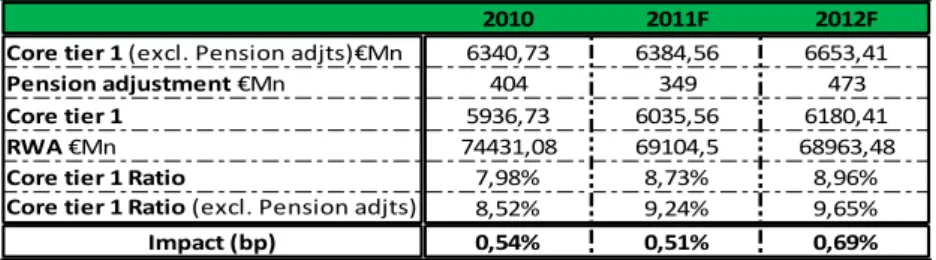

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 19/27 2010 2011F 2012F

Core tier 1 (excl. Pension adjts)€Mn 6340,73 6384,56 6653,41 Pension adjustment €Mn 404 349 473 Core tier 1 5936,73 6035,56 6180,41

RWA €Mn 74431,08 69104,5 68963,48

Core tier 1 Ratio 7,98% 8,73% 8,96% Core tier 1 Ratio (excl. Pension adjts) 8,52% 9,24% 9,65% Impact (bp) 0,54% 0,51% 0,69% Source: Nova ER Team

Table 18: Impact on Capital Ratios excluding Pension Deficits

Basel III

BES deleveraged process is reinforced by the implementation of Basel III which will be more demanding in capital adequacy and liquidity regulation issues. These new rules will have a negative impact on bank’s profitability, but will reinforce its stability. Bank of Portugal, on the beginning of the year established a minimum core tier 1 ratio of 8% for 2011 which was raised to 9%, and 10% in 2012 due to the agreement between the Portuguese Government and the

so-called “Troika” 30

. By the end of 2010, BES had a core tier 1 of 7,9%, which was

reinforced to 8,2% following the strategic sale of Bradesco stake on 28th April 2011. With the continued reduction of its Risk Weighted Assets (RWA) we expect the bank to finish the year with a core tier 1 ratio of 8,73%

Pension Fund

On times where capital adequacy are at the spotlight it is important to deep analyze a topic that still impacts BES capital levels: charges on core tier 1 capital due to pension adjustments. BES core capital ratio excluding deficit goes up by 51bp and 69bp in 2011 and 2012 respectively (Table 18).

This table is calculated under the assumption that the dividend payout ratio will be of 20% for the next two years, our estimated net income for the same period is €815,02Mn, Risk Weighted assets will decrease, and the expected charges of

€349Mn and €473Mn are those recurring from deferred actuarial losses. Even with no pension charges, by 2012 the core tier 1 ratio would lag the targeted outcome.

But, the value to be charged to core tier 1 capital may change, owing to

securities price’s volatility impacting, at a greater or lower extend the observed capital ratios. Prior to the crisis we saw the main risk coming from pension fund’s

30 Troika contemplates the team formed by IMF, EFSF and BCE. Basel III reinforces the

deleverage program...

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 20/27 Scenario Core Capital (€Mn) Core Tier 1 Ratio

P/O 100% 5911,55 8,60%

P/O 20% 6180,41 8,96%

P/O 0% 6247,60 9,05% Source: NOVA ER Team

Table 10: Potential Capital Increase need to comply with Capital Adequacy (2012)

717,37 655,83

Capital Increase Need(€Mn)

962,35

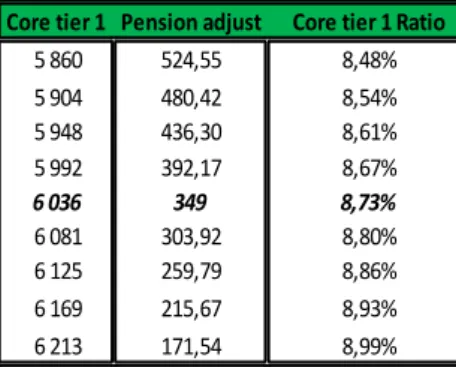

Core tier 1 Pension adjust Core tier 1 Ratio

5 860 524,55 8,48% 5 904 480,42 8,54% 5 948 436,30 8,61% 5 992 392,17 8,67%

6 036 349 8,73%

6 081 303,92 8,80% 6 125 259,79 8,86% 6 169 215,67 8,93% 6 213 171,54 8,99%

Source: Nova ER Team

Table 19: Pension fund sensitivity (2011) €Mn

equity exposure, however, as a result of the sovereign debt crisis, exposure to fixed income securities and, especially to government bonds is the major concern, with increased volatility having a direct impact on asset’s fair value.

BES’s pension fund composition is changing (Exhibit: Pension Fund

Composition), with the bank decreasing its exposure to fixed income

securities (-69% Ye2010) and increasing its exposure to variable income (+7%

Ye2010). Although our main concern lies on government securities price volatility, we do not discard future losses arising from equity exposures owing to the weak performance of the Portuguese equity market on these last few months. Under the same previous assumptions we run a sensitivity analysis to assess the impact that fluctuations in prices of pension fund’s assets, in 2011, have on core tier 1. Every 2% move on pension funds market value, impacts the ratio in 6bp (Table 19), although, even with 8% appreciation in 2011, the total

value to be charged to core tier 1 would be of €171Mn, yielding a 8,99% ratio.

Capital Adequacy

While management has no control on future market movements, fixing BES

capital position is crucial to reduce its risk profile and support an upward re-rating. In this sense, we ran a very simple simulation to measure potential capital increases needs, in order to achieve the 10% core tier 1 ratio by 2012, having

pay-out ratio as a control variable. We add another assumption to those

previous one: there will be pension adjustments of 51 and 69bp in 2011 and 2012 respectively. The following table summarizes our calculations:

Even on the extreme scenario of retaining all dividends on the following two

years, BES will lag behind the desired result. On Ricardo Salgado words: “BES will only perform a capital increase in last resort”, we allow for possible scenario

where BES would engage in a risk asset’s reduction (besides that already

considered by the current deleverage program). As not retaining earning is a very unrealistic scenario, we will only consider the two other cases. If BES decides not to distribute dividends, under our assumptions, it would need to reduce its assets

0% P/O 20% P/O

RWA(€Mn) 68957,83 68881,79

Target RWA(€Mn) 61932,76 61068,64

Asset reduction(€Mn) 7025,07 7813,14

% of Loan Portf 13,93% 15,50%

Estimated NII impact (350bp) (382bp)

Source: NOVA ER Team

Table 11: RWA Reduction to comply with Capital Adequacy (2012)

BANCO ESPÍRITO SANTO SA COMPANY REPORT

THIS

DOCUMENT

IS

NOT

AN

INVESTMENT

RECOMMENDATION

AND

SHALL

BE

USED

EXCLUSIVELY

FOR

ACADEMIC

PURPOSES

(SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)Page 21/27

Core tier 1 Pension adjust Core tier 1 Ratio

5 960 693,19 8,64% 6 004 649,06 8,71% 6 048 604,94 8,77% 6 093 560,81 8,83%

6 180 473 8,96%

6 181 472,56 8,96% 6 225 428,43 9,03% 6 269 384,31 9,09% 6 313 340,18 9,15%

Source: Nova ER Team

Table 20: Pension fund sensitivity (2012) €Mn

in ~€7bn; otherwise it would need to run off ~€8Bn, with serious negative effects

on BES profitability levels (Table 11).

As we want to estimate the range of possible capital increase size, we used the actuarial assumptions used by the company to assessed a proxy for the Group’s pension responsibilities in 2012 (€2250Mn) and, assuming a dividend policy of 20% we allow the market value of the pension’s assets to fluctuate between 8% and -8% (Table 20). Under our calculations, BES will need a capital increase

between €586,45Mn and 938,15Mn until 2012.

To finalize, it is important to highlight that pension fund does not constitute a risk for our valuation in the future, as capital deductions from deferred pensions

losses are running off in 2012, and all workers hired from January 2008 are

already covered by the Portuguese Social Security System, and from January 2011 onwards, BES will only remain responsible for the pension’s retirement of those previously hired, being all the other responsibilities covered by the Portuguese system. This will allow the bank to reduce the size of its

pension funds more quickly, and potentially even reduce their current pension

fund obligations in return of higher contributions to the government.

When we talk about sovereign debt crisis we also should concern with bank

trading portfolio composition (Exhibit Securities Portfolio Breakdown). Besides

Government Bonds, all other securities are classified at fair value through profit or loss implying fair value loss recognition. The majority of share are from Portuguese companies (Portugal Telecom e Energias de Portugal), whose share price can be affected given the necessary deleverage process from the private sector, which along with austerity measures will negatively impact companies future economic growth and financial performance. Bond’s are classified as financial assets held for sale having a direct impact on future impairment costs.

During 2010 BES’ exposure to Portuguese debt increased substantially with banks being the main government financing source, although Portuguese banks held amounts below the European average (4% of total assets for the Portuguese system Vs.6,5% for Europe, 2010)31. By December 2010 BES was the second

Portuguese bank holding the lowest amount of Portuguese debt (€2,2Bn)

and the one with the lowest exposure to Greek debt. Owing to a conservative risk management policy BES reduced, on the 1stQ of 2011, its exposure to Portuguese debt to €1,6Bn and ran off its Greek participation, exonerating BES

from the consequences of the almost certain debt Greek hair-cut.