THIS REPORT WAS PREPARED BY MIGUEL SILVA, A MASTERS IN FINANCE STUDENT OF THE NOVA SCHOOL OF BUSINESS AND ECONOMICS, EXCLUSIVELY FOR ACADEMIC PURPOSES.THIS REPORT WAS SUPERVISED BY ROSÁRIO ANDRÉ WHO REVIEWED THE

VALUATION METHODOLOGY AND THE FINANCIAL MODEL. (SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)

See more information at WWW.NOVASBE.PT Page 1/30

M

ASTERS IN

F

INANCE

E

QUITY

R

ESEARCH

We initiate coverage of Portucel with a Buy recommendation and a FY15 target price of 3.82€. This represents an overall upside potential of 31.74%, which includes shareholders cash out.

Portucel’s premium strategy brings more cash to

investors. Portucel’s highest quality paper allows for an EBITDA margin twice as high of the northern European peers and five perceptual points higher than Iberian competitors. Additionally,

Portucel’s dividend yield (7%) is considerably higher than industry standards (2%).

Cost saving programs in order to improve EBITDA margins. While most Northern European pulp and paper companies have implemented cost saving programs, although

Portucel’s EBITDA margin is above industry standards, however we expect that Portucel’s similar program to keep this tendency, despite the higher wood demand and consequently higher prices.

Portucel’s noticeable unleveraged balance sheet, will

allow the company to seize more investment opportunities abroad in order to diversify revenue streams.

Company description

Portucel is a Portuguese based company that operates in the pulp and paper sector. Portucel currently has three factories located in

Portugal, which generate the company’s main sources of revenue: pulp, paper and lately, biomass energy generated through the operating activities. Portucel presently exports 90% of its production, being Europe and the USA its main paper markets.

P

ORTUCEL

C

OMPANY

R

EPORT

P

ULP AND

P

APER

4

J

ANUARY2015

S

TUDENT

:

M

IGUEL

S

ILVA

miguel.silva.2012@novasbe.pt

Eucalyptus trees are cash machines

Premium products generate high margins

Recommendation: BUY

Price Target FY15: 3.82 € Upside Potential: 31.74%

Price (as of 4-Jan-15) 3.06 €

Reuters: PTI.LS, Bloomberg: PTI.PS

52-week range (€) 2.66-3.80

Market Cap (€m) 2,137,49

Outstanding Shares (m) 767.5

Source: Reuters

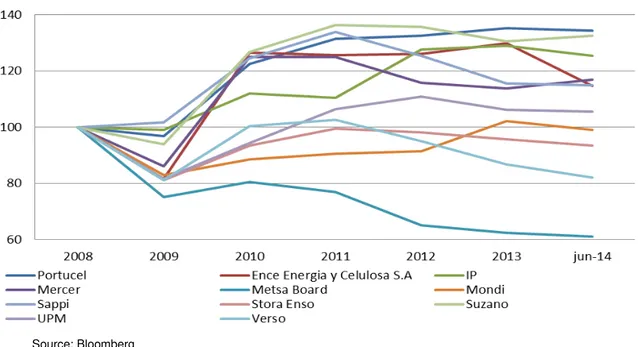

Source: Bloomberg (Index 2008 – Last Price)

(Values in € millions) 2013 2014E 2015F

Revenues 1.531 1.569 1573

EBITDA 337 365 351

Net Profit 210 167 169

EPS (EUR) 0.27 0.22 0.32

P/E (x) 11.2 14.0 13.9

EV/EBITDA (x) 8.8 9.46 9.79

Net Debt/EBITDA (x) 1.14 1.01 0.99

Net Debt/Equity (x) 0.17 0.12 0.11

ROIC (%) 11.6% 10.4% 10.3%

PORTUCEL COMPANY REPORT

PAGE 2/30

Table of Contents

COMPANY OVERVIEW ... 3

COMPANY DESCRIPTION ... 3

Forest Assets ... 4

Integrated Pulp and Premium Paper ... 5

Energy – Biomass ... 6

Mozambique, USA and Other Investments ... 7

SHAREHOLDER STRUCTURE ... 9

THE CEO AND BOARD OF DIRECTORES ... 9

MACROECONOMIC ENVIRONMENT ...10

THE SECTOR: PULP AND PAPER ...12

WOOD: THE RAW MATERIAL ... 12

SOLID PULP MARKET ... 14

PAPER MARKET ... 17

TECHNOLOGIC INCOME: THE BIOMASS ENERGY ... 20

FINANCIALS ...20

VALUATION ...22

DISCOUNT CASH-FLOW MODEL ... 22

MOZAMBIQUE ... 24

SCENARIO ANALYSIS ... 24

SENSITIVITY ANALYSIS ... 25

COMPARABLES – MULTIPLES ... 26

APPENDIX ...27

APPENDIX I - FINANCIAL STATEMENTS (CONSOLIDATE INCOME STATEMENT) . 27 APPENDIX II - FINANCIAL STATEMENTS (CONSOLIDATE BALANCE SHEET) ... 28

APPENDIX III - FINANCIAL STATEMENTS (CONSOLIDATE CASH FLOW STATEMENT) ... 29

DISCLOSURES AND DISCLAIMER ...30

PORTUCEL COMPANY REPORT

PAGE 3/30

Company overview

Portucel started as a small family business firm, in Cacia, by producing raw pine pulp in the early fifties and was then known as Companhia Portuguesa de Celulose. Soon after the pioneering in the breakthrough of the process for production of bleached eucalyptus pulp the company diversified its revenue stream by production fine printing and writing paper (UWF). However, in 1976 Portucel was incorporated after the nationalization of the whole Portuguese pulp and paper industry. By 2001, Portucel, now called Portucel Soporcel Group after the acquisition of several Portuguese mill, was the number one producer of UWF after the acquisition of several Portuguese paper producing companies.

Nowadays, Portucel is the European leading producer of UWF and eucalyptus pulp, being the second main exporter for the Portuguese Economy, having exported 95% of its production in 2013.

Portucel is vertically integrated company, that holds its revenue streams in the forestry, pulp (Bleached Eucalyptus Kraft Pulp - BEKP), paper (uncoated woodfree fine paper – UWF) and energy sector.

Company description

Due to the nature of a vertically integrated company, Portucel holds the full supply chain allowing the company to produce higher operational margins and avoiding price and volume fluctuations.

Leading European manufacture of UWF and

BEKP…

Figure 1: Portucel Revenue by segment as of 2013

Source: Company Reports

Figure 2: Market capitalization (in €) evolution of some pulp and paper company (2006-2014)

Source: Bloomberg 0 2.000 4.000 6.000 8.000 10.000 12.000

2006 2007 2008 2009 2010 2011 2012 2013 2014

Portucel Fibria Ence Altri Metsa Board Stora Enso UPM Financial crises

Fibria merger with several small brazilian mills

Portucel State-of-the-art Paper Mill

PORTUCEL COMPANY REPORT

PAGE 4/30

Forest Assets

Starting from the bottom of the supply chain, Portucel manages 120.000 hectares of agro-forestry, owning only 65.000, which are managed through 1.400 management units spread throughout Portugal. These 120.000 hectares are composed essentially of Eucalyptus (73%), the main raw material used in the production of BEKP pulp. Albeit these massive extent of forestland, only 35%1 are used for inner Group consumption, which means that the Group has less than 20% of self-sufficiency when it comes to its raw material2.

The remainder of the raw material, that do not come from Portucel owned forestland, originates mostly from the Iberia Peninsula and are in compliance with the high certificate standards of Portucel. Although and due to the fact that the supply in the Peninsula is still insufficient to match the needs of the capacity installed in this area, Portucel is required to import the woodchip from international markets, mainly in South America and more specific in Uruguay and Brazil.

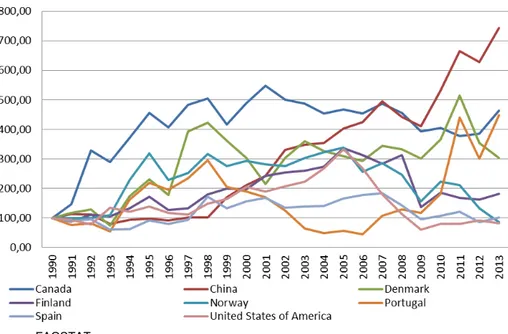

Despite the high investment in countries such as Argentina or Brazil, import quantities overall have increased in the main pulp and paper regions (Europe and Asia) with the exception of the United States of America, which is clearly reducing the import quantity of wood, every other country continues to import more wood. Despite the end product for the wood may vary, the increase in

1

The remaining forestlands are an important piece to reduce greenhouse gases or are sold, however they represent a small amount of Portucel’s turnover.

2According to Portucel’s company report 2013 –

the auto supply of wood is less than 20%, and there for the group has the necessity of recurring to the Iberian and some international markets.

Figure 3: Pulp sales by market (2013)

Source: Company Report

Figure 4: Import of wood by country (Index 1990)

PORTUCEL COMPANY REPORT

PAGE 5/30 imports will strain the price of this commodity and therefore reflect on the operational costs of the pulp and paper companies.

The increasing pressure on the raw material is the main reason why Portucel’s

investment on expanding the pulp and paper capacity in Portugal is at a halt. The expectation is that the investment will be made at an international level which will consequently diversify the company’s revenue stream.

Integrated Pulp and Premium Paper

Clearly Portucel main activities lays on the production of pulp and paper, for that purpose Portucel currently owns three mills, one of which only manufactures pulp while the other two are pulp and paper integrated mills. Although all Portucel owned mills are of the highest standard in quality in Europe, it is clear that the New Paper Mill in Setúbal – About the Future, state-of-the-art mill, is the crown jewel of Portucel, which initiated activity in 2009.

The new mill adds highly competitive advantages, which includes excellent energy consumption, is more eco-efficient and is the most advanced paper mill in southern Europe. This investment goes hand in hand with the company goals of achieving higher EBITDA margins when compared to its European peers which

are, as of 2014, 10% under the Portucel’s EBITDA Margin.

Together, the three mills have make Portucel the leading producer in BEKP3, with a capacity of 1.350.000 air dried tons per year. As of June 2014, 81% of the pulp production is integrated into the production of paper. The BEKP that is not integrated in the paper production is sold to Portuguese companies, such as Renova for the world famous coloured toilet paper, but it’s mostly sold to the Retail European market and in less expression to some cardboard European manufactures, which represents a percentage of around 85 as of 2013.

For several years and since the construction of the paper mill of Setúbal, Portucel became the largest manufacture of UWF paper in Europe, with a production capability of 1.6 million air dried tons of paper, which allows Portucel to generate a turnover of over 1.2M€ in paper. Capacity that allows Portucel to consolidate its commercial strategy of selling its own paper brands, which represents a total of

62% of the Portucel’s paper sales segment. The UWF paper is considered of the highest quality paper, due to its colour and durability and is mostly used in the graphic (printing and writing industry). Additionally, the company manufactures

the world’s most sold premium paper product – Navigator.

The Portucel’s branding strategy with its premium products clearly has a positive impact on Portucel’s sales. Although the advantage is that the risk concerns the

3See section “Paper Market” for informatio

n regarding UWF paper capacity

Figure 5: Paper sales by market (2013)

Source: Company report

Figure 6: EBITDA Margin per region (2006-2014)

Source: Bloomberg

Figure 7: Portucel’s Estimated Market Share 2012

PORTUCEL COMPANY REPORT

PAGE 6/30 price and not the quantity, the company’s revenue have not suffered and inclusively have increased in an amount of 35% since the 2008 financial crises. This represents the second highest growth after Fibria, a Brazilian pulp and paper manufacture, growth that is explained by the merger of several small Brazilian mills.

The fact that the company sales are mostly directed to a market niche (premium market, which market share in 2012 was of 45%4), makes Portucel exposure to a very limited supply growth.

Energy

–

Biomass

The ever evolving technologies in the renewable energy sector allowed Portucel to start exploring biomass energy. Since 2000, Portucel adopted a cost cutting operation regarding its CO2 emissions from fossil fuels, reducing the amount of CO2 emission between 2000 and 2010 by 46%. In line with this cost reduction came the investment in the renewable biomass energy.

This investment not only allowed Portucel to reduce its energy consumption from the Portuguese energy grid, but also added a new source of revenue by exploring the forest and black waste from its paper and pulp production. Portucel biomass plants started supplying the Portuguese grid with energy at a regulated and state funded tariff, which was higher than the energy bought from the grid. This allowed Portucel to have a net gain when it comes to its energy activities,

4According to latest Portucel’s Relation Investor

(2013), in 2012 premium business represents 55% of total sales, which consistes in the highest quality products with a price above market average.

Figure 9: Gross energy

consumption by fuel type (2012)

Source: Eurostat

Figure 8: Revenue evolution (Index 2000)

PORTUCEL COMPANY REPORT

PAGE 7/30 albeit the high energy necessities of the company for the pulp and paper manufacture process.

Currently, Portucel is the largest Biomass energy producer in Portugal, by producing 50% of the production of this type of energy in 2013. Also, this energy investment allowed the company to be responsible for 5%, in 2013, of all electric energy in Portugal, which is mostly generated from forest biomass and sub products of Portucel activities.

By 2013, Portucel investment was able to generated an amount of 2,5 terawatt-hour and all mills produced an amount of 2.358 GWh, of which was sold 2.100 GWh to the Portuguese national grid, meaning that only 10% was used directly

into the production and contributed to the company total turnover of 147M€.

However, it is quite noticeable that the production of this type of energy, special regime production, is quite expensive and according to the Portuguese energy regulator (ERSE5), in 2013, the annual cost of energy in special regime cost twice as much as the indexed price of the regulated market energy.

Any renewable energy is highly dependent on subsidies due to the comparative higher cost in its production and in order to make them competitive to the cheaper fossil fuel subsidies are put in place in order to incentive the energy production that has low carbon dioxide emission and that is renewable. This subsidies are unlikely to change despite the economic difficulties that Portugal is currently going through, mostly because the OCDE is making an effort to reduce the recurring usage of fossil fuel energy and is willing to financially support an increase on the usage of renewable energy6.

Although Portucel is reaching an efficiency usage of the biomass power station of 94% and room to grow is becoming slimmer, the recent investment on the Cacia mill will increase capability of energy slightly. However, the production limit will not increase any further due to the fact that Portucel is not currently investing in expanding its production in Portugal. In this context, our expectation is that the strategy, mentioned above, will remain in the foreseeable future and consequently the energy capability will only increase a shy off the 2.5 TWh per year.

Mozambique, USA and Other Investments

Since 2009, Portucel is investing in a considerably immense project in Mozambique that consists in creating a production facility in this country that will

5

Entidade Reguladora dos Serviços Energéticos.

6

According to the World Energy Outlook 2014 – IEA (International Energy Agency) the share of renewable energy will rise by 33% by 2040, supplying half of the energy supply growth. Also, Global energy subsides will expand to nearly $230 billion by 2030, whilst today the total amount is $121 Billion.

Diversifying production

geography…

Figure 10: Portucel gross biomass energy production (In GWh)

Source: Company Report

Figure 11: Annual Average Cost

(€/MWh)

Source: ERSE – Informação Sobre Produção em regime especial (PRE) (June 2014)

PORTUCEL COMPANY REPORT

PAGE 8/30 be fully vertically integrated. Currently, the total investment is of 1.8 Billion euros (2 Billion Dollars) and is expected to generate 1 Billion in revenue per year at cruise speed and also will create a total of 7.500 jobs in Mozambique, which will contribute to the growth of the country’s economy.

The project is slated to be operative by late 2022 or early 2023, dependent on current eucalyptus and forestation growth rates, and is expected to produce 1.4 tonnes of BEKP per year and consequently 1.6 tonnes of UWF paper. For this purpose, Portucel was granted, by Mozambique government, 173.000 hectares of forestland in order to plant eucalyptus to fully supply Portucel’s future operations7.

The Mozambique project holds the support of the World Bank Group through an agreement with a consulting institution of the Bank, the International Finance Corporation (IFC). Mozambique project is currently in its second stage, after the performance of several forest tests to evaluate and ensure that all the environmental condition are right for the production of eucalyptus in the concessions forestlands.

The second stage of the project consists in evaluating the environmental and social impact of the projects according to the highest international standards. For this purpose Portucel Soporcel Group is currently ensuring the correct development of the project by running an Environmental and social impact assessment (ESIA).

More recently, the IFC decided to fortify its support to the project and negotiation began to attain a 20% share on the Mozambique mill. The sale of a percentage of the project takes part on the Portucel’s goal on including Mozambique investors, which and for this purpose the company is willing to sell a percentage share of and up to 30%8.

More recently, Portucel communicated an investment of €89 Million in the development and construction of a wood pellet manufacturing facility to supply biomass producers in the United States of America. The plant is expected to start operating in late 2016 and will generate a production of 460 thousand tonnes per year. Associated to this investment is the guarantee of unchanged fixed costs over a ten year period and the guaranty sale of 70% of the production.

7South Africa’s Sappi’s Ngodwana Mill is a fully integrated mill that underwent modernization in 2011, although the

cost of the investment is of a fifth of the current value of the mill ($1.5 Billion), the current value indicates that the

considerable investment of the Portucel’s Mozambique project is in line with what is currently being practiced in Africa.

Despite the difference in value, note that the Mozambique mill will yield a production of more 200 thousand tons of pulp

than Sappi’s Mill.

8

Information retrieved from the third trimester results report. Mozambique project is at

PORTUCEL COMPANY REPORT

PAGE 9/30 Additionally, the new investment in the Cacia mill is a 10 year strategy plan to begin and gain quota on the Portuguese tissue market, with the main objective of taking the first place in Portuguese market share from Renova. However and since the overall strategy plan will only be presented in early 2015 this is just conjectures, but we believe that the tissue and USA market will be the new source of revenue from Portucel, allowing the company not only to diversify geographically but also product wise.

Shareholder structure

Portucel shareholder structure is, since 2004, extremely solid. Semapa9, an industrial Portuguese holding, holds the largest qualified participation in Portucel, owning a 75.85% of the company shares.

The rest of the shareholder structure is composed by a free float of 17.68%, being the reminder treasury shares (6.47%). The buybacks of own share have been occurring since 2008, just after the investment in the Paper Factory of Setúbal are a suitable way of increasing value of the company balance sheet and therefore increase value for the shareholder, at a time where capital is not being used due to the lack of heavy investment.

Although a very stable shareholder structure, it does not imply that it is risk free. The fact that it is fully controlled by another organization, might retrains Portucel from doing viable investment. For instance, if Semapa runs into financial distress, leaving the cash flow machine Portucel with a low capital structure. However, Semapa shows no signal of distress and has also shown steady revenue growth, mostly generated by Portucel. Therefore, we believe that with this current shareholder structure management will not change course on its main strategy and its current investments in Mozambique and in the Biomass plant in USA. This stable shareholder structure is not expected to change in the foreseeable future, thus it does not have an impact on the firm’s value.

The CEO and Board of Directores

Portucel board of directors is composed by five business men that have worked in the pulp and paper sector for a big portion of their professional career and a chairman Pedro Queiroz Pereira. Due to the vast knowledge of the board and the lack of change in the Corporate Governance of the company, it is safe to assume that the investment and value oriented Portucel will continue to strive in the pulp and paper market.

9

Semapa is a portugues holding created in 1991 and detains companies from the cement (Secil) and management of animal products (Etsa) besides the pulp and paper segment which contributes with 77% of the holdings total turnover

(€1.990 Million in 2013, according to company data).

Figure 12: Portucel Shareholder structure (2013)

Source: Company Report

PORTUCEL COMPANY REPORT

PAGE 10/30 The new CEO Diogo da Silveira, which assumed the position early April of this year, is not in the same league, although with a tremendous background in other industries, such as retail and insurances. We believe that the vast experience from the new CEO will bring immense energy to explore new investment opportunities.

Macroeconomic environment

The macroeconomic environment has, obviously, a considerably impact on the activity of any company, including Portucel. According to the OECD10 (Organization for Economic Co-operation and Development), it is expected that

the world’s economic recovery will gain momentum after the noticeably strengthening of the recent years, but it will remain meek when comparing to the past years.

However, the OECD still expresses that the world economy is still vulnerable, due mostly because the global growth, in 2014, is just under 3½ per cent, driven mostly by the emerging market economies, in particularly China. For 2015, the OECD forecasts higher global growth (4%), being the USA mostly responsible with a growth stronger than in the Euro Area or Japan. These figures are highlighted with the decline of the global unemployment rate, being the expected the decline of the rate, for the period of 2014-2015, of only half per cent, remaining above the 7% mark.

The Euro Area, where most of the turnover is generated, is falling behind on GDP growth. Growth has decelerated due to the slow growth of stronger countries such as Germany and France, whilst inflation continues to contribute to slow GDP growth. However, there are indicators that the BCE will advance with its plan to buy European assets, plan similar to the quantitative easing of the USA,

should boost euro’s area economy to keep up the pace with the rest of the regions such as the USA. Notice that without this monetary support, the growth

10

OECD Economic Outlook (2014), Volume 2014/1: Chapter 1 – General Assessment of the Macroeconomic Situation.

Figure 13: GDP Real Growth Estimates (2014-2019)

Source: International Monetary Fund, World Economic Outlook Database, October 2014 Vulnerable economy might

PORTUCEL COMPANY REPORT

PAGE 11/30 will be much weaker, since demand is pressured by successive credit weakness and most European companies are deleveraging and reducing structural costs. Despite the fact that Portucel does not have any market share in Asia, the growth of the China’s economy (around 7.1% in 2015), will help keep paper and pulp prices high in Europe, since this growth will inevitably result in the continuous high consumption of pulp and paper in china, as in previous years11. However, latest statistics of the IMF, show that the property cycle has turned and therefore the consumption levels have diminished when compare to previous year. Consequently this will have an impact of pulp and paper prices, in addition to the risk that China might be changing its pulp and paper sector in order to introduce full integrated mills12.

The growth in the USA is extremely important for Portucel’s turnover as the company views the USA paper market as a strategic point in its premium brand marketing plan and for diversifying its investment. The Portucel’s market share in the USA is noticeable for bringing high EBITDA margins despite the higher transportation costs. With an expected growth of 2.6% and 3.5% in 2014 and 2015 respectively, the USA market will keep playing a role in Portucel expansion

capacity and therefore in Portucel’s future portfolio.

Inflation wise and according to the OCDE, will remain high for the emerging economies, especially in Brazil and India, which will reflect in higher exports prices. Albeit India has no impact on Portucel’s balance sheet, a portion of the raw materials used in the production activity of the company are imported from South America, with the risk of high inflation on the emerging economies, such as Brazil. Also, production costs will get higher if the eucalyptus Iberian market does not follow the consumption trend in Iberia.

The fact that Portugal is Portucel’s headquarter, does not have a big impact on the company due to the fact that it exports mostly of its production. The Portuguese economy has shown signs of a slowdown, because the higher consumption of the Portuguese felt in the previous trimesters is offset by the increase of imports. Note that Portucel is not susceptible to the Portuguese economy, since and from historical years Portucel did not have any difficulty recurring to the bond market despite the noticeably poor economy that Portugal went through and will probably endure for the next years.

Furthermore, Portugal is currently easing the corporate income tax as well as other taxation burden form companies located in Portugal (corporate income tax

11

Asia, in particularly China, has an extreme impact on the current paradigm of the pulp and paper market, for more

information see section “Solid Pulp Market”.

12For more information see section “Paper Market”.

Figure 14: Inflation Evolution (2013 – 2019)

Source: International Monetary Fund, World Economic Outlook Database, October 2014

China’s role in pulp and

PORTUCEL COMPANY REPORT

PAGE 12/30 reduction from 2013 to 2014 was of two perceptual points, dropping from 25% to 23% and is expected to lower to 21% in 2015), which means that the required remuneration rate will be lower and companies will be able to generate higher cash flows.

The Sector: Pulp and Paper

The value chain for the Pulp and Paper segment is quite extensive and diversified. Although in the beginning it started form the exploration of forest asset, going through mills in order to transform the raw material into pulp, so it could be processed once again into paper or packing process. In the present day, the chain does not stop there and is far more complex.

The by and end products generated by this industry are immense and depends fundamentally on the raw material used. Regardless of the usage of hardwood timber or softwood, the added value to the value chain is enormous but it influences the consumer target of each company in the sector. More recently, some companies have been using recovered paper in their pulp producing, meaning that the companies do not rely sole on timber.

Adding to the integration of recycled paper, the industry show an opportunity on the renewable energy sector, and by using some waste material from its production (biomass), is able to generate biomass energy. Meaning, that nowadays the end product generated by this industry are vast, not only it includes the diverse types of paper and packaging products, but also energy, ashes, labelling products and so on.

Important to note that, according to Bloomberg Market Leaders13, the Forest and paper industry as a total turnover of 178 Billion dollar revenue, this makes the industry the 25th biggest industry in the Bloomberg Market Leader research.

Wood: The Raw Material

The pulp and paper industry rely on the usage of hardwood and softwood timber, due to their different by and end products, although very similar ones, these will generate different qualities of end products. Hardwood timber, retrieved from trees such as oaks, beeches and eucalyptus, are used in the production of writing and printing paper and also tissue paper due to its achieving bulk, smoothness and opacity. Whilst softwood, are retrieved mainly from pine and spruce trees, and are used in the production of packages and containers due to is fibre strength.

13

Bloomberg Industry Market Leaders - http://www.bloomberg.com/visual-data/industries/

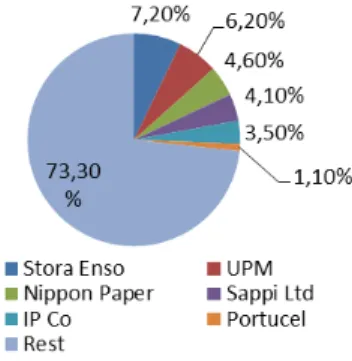

Figure 15: Forest and Paper Market Share by Company

PORTUCEL COMPANY REPORT

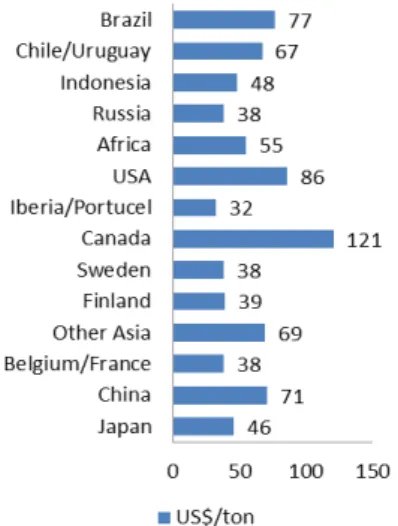

PAGE 13/30 Hardwood timber is noticeably more expensive than softwood and the most common tree used in the hardwood pulp production is eucalyptus, which grows mostly in South Western Europe (mostly in Iberia) and South America. This two facts suit Portucel due to the evermore group needs for eucalyptus timber and because the company’s pulp and paper mills are excellently and logistically well placed. Because Portucel is located in a prime zone for the creation of eucalypts

and is located in the periphery of Europe, Portucel’s costs are low, as we can see reflected in the EBITDA margins. At a time where main companies in the sector are reorganizing its focus to mills that are more financially viable due to its location and shutting down mills with poor access to ports and railroads, fact recently seen in Finish companies UPM and Stora Enso, it’s safe to say that Portucel as an advantage when it comes to location.

However, it is expected that the supply-demand gap of wood in the world will expand until 2020 and will sit in a range between the 205 and 260 million cubic meters of wood. Portucel is aware of the current and the future lack of supply of its main raw material and is not expanding furthermore its pulp and paper capacity in Portugal if the local eucalyptus market is not able to expand in order to fulfil the future capacity.

Albeit the cash flow generated from eucalyptus forestation, the fact that this species of trees is very harshening to the local fauna and flora is why we do not believe on the likelihood of an expansion on the current Iberian production of eucalyptus. In addition, governments and forestry institutions are ever more aware of this fact and are more resistant to any new eucalyptus forestation zone. Although Portucel has enough capital for capacity expansion, the fact that the local raw material market is not able to satisfy any more increase on the usage of wood, leads Portucel to do only short investments in the expansion of its capacity. Example of this restriction is the latest investment in its Cacia mill, which was only initiated after an increase of eucalypts area by Portucel but not

Figure 16: Portugal’s forestland by type (2010)

Source: Instituto de Conservação da Natureza e das Florestas - INF 5, 2010

Figure 18: Global Wood Supply and Demand by 2020 (Million m3)

Source: Mckinsey/Poyry team analysis

Figure 17: Import of Wood by Area (In Millions of cm3)

PORTUCEL COMPANY REPORT

PAGE 14/30 after receiving warnings by the association responsible for the conservation of nature (Quercus) of the hazards risks that an uncontrolled expansion of this type of tree may have.

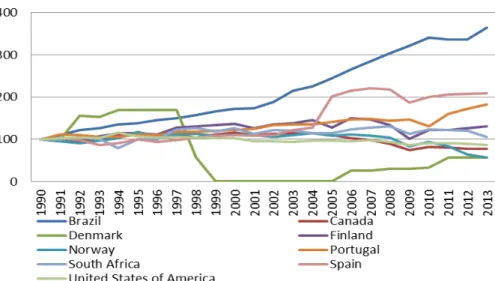

In addition, production of wood, in Iberia, as remained quite steady since 1990 and only in specific countries, such as Finland and Brazil, as the production risen albeit not sufficient, as we can see in the import of wood graph14.

Furthermore, Europe is one the biggest importers of wood, either for pulp production of other timber derived products, being only surpassed, after the financial market crises of 2008, by Asia, China in particular.

More important is the fact that, in the same period range, pulp production as double in most heavy pulp producer countries, for instance Portugal production of pulp as increase by 80% since 1990 and because wood production in Spain and Portugal remained almost steady, the imports have offset the wood price of European countries, such as Portucel. Moreover, pulp demand is expected to increase in the near future and therefore we believe that wood price will increase at a steady pace harming European pulp and paper manufactures EBITDA15.

Solid Pulp Market

The pulp market consumed around 403 million tonnes of fibre (wood chips, barked wood) in 2013, of which was used to produce only 18 million tonnes of eucalyptus pulp, which represents approximately one third of the pulp market.

14See graph in section “Company Description

- Forest Asset”.

15See section “Solid Pulp Market” for more information.

Figure 19: Portucel’s Wood

Price Evolution (€/m3)

Source: Company Data: Analyst Estimates

Figure 20: Production of Wood by Country (Index 1990)

Source: FAOSTAT

PORTUCEL COMPANY REPORT

PAGE 15/30 Most of the eucalyptus manufacture is done the Iberia or in Brazil, due mostly to the warm weather.

Any financial crisis has an impact on many sectors and the pulp and paper sector is no exception. Pulp prices suffered from both the financial crises of 2008 and the sovereign debt crises, although currently prices have returned to their pre-crises value. Portucel pulp sales, although most of the pulp is currently integrated in the UWF paper production where quite resilient when comparing to the evolution of the BHKP price index.

Despite the financial endeavour of the last decade, the pulp sector is remains extremely competitive and is mainly composed by the BHKP (Bleached Hardwood Kraft), the NBSK (Northern Bleached Softwood Kraft) and, in a smaller magnitude, the eucalyptus pulp.

The market is expected to increase by 20% from 2008 to 2018, according to PPPC16, in particularly the demand for eucalyptus pulp which is expected to grow 63% in the same time range. The demand is mostly driven by the increased consumption of tissue in the emerging market, because hardwood pulp (which uses considerable amount of eucalyptus) has several characteristics, such as its softness and fibre length, which make it suitable for this end usage.

Although not the primary source of Portucel’s income, the variance in the pulp market has a significant impact on the company’s paper revenue, due to the fact that any changes in the pulp market may change the paradigm in which the paper market moves. This is due to the fact that the price of pulp may drive the increase or decrease in production of pulp end products. For instance, since

16

Pulp and Paper Products Council – Information retrieved form Fibria Investor Relations Presentation

Fiber Consumption - 403 million tonnes

Pulp - 169 million tonnes

Chemical pulp - 139 million tonnes

Market Pulp - 55 million tonnes

Hardwood - 28 million tonnes

Eucalyptus - 18 million tonnes

Figure 21: Fibre Consumption, Recycled Fibre and Pulp (2013)

Source: Market Pulp, Hardwood and eucalyptus: PPPC Special Research Note – November 2013. / Fibria Investor Relations Presentation

Figure 23: BHKP and NBSK

Pulp Prices (€/ton)

Source: Bloomberg

Figure 24: Pulp Global Supply (Million Tonnes)

Figure 22: Production Pulp by Country (Index 1990)

Source: FAOSTAT

*Others includes Middle East and Africa

PORTUCEL COMPANY REPORT

PAGE 16/30 2012 the BHKP has sustained a steady index price decrease due to increasing new supply originated from South America. However, we believe that prices will keep this pace despite of the future added capacity in South America with a year over year addition of 1.3 to 1.5 million tonnes per year17.

The main driver for pulp demand is the Asian market, dominated by China, which investment in non-integrated paper mills will keep the high demand for pulp. Although the Chinese government is very proactive in trying to promote the wood pulp industry, the sheer fact that most plantation are amongst several communities and farmers, makes the access to new plantation a slow and financial demanding process. As consequence, it is more difficult for the Chinese pulp manufacture to keep up with the pace of local demand and source wood from foreign markets. We believe that despite China’s efforts, their dependence of the European and South American companies will still persist for several years.

However, demand growth is balanced by the generation of supply in South America, in particularly with the new investment in state of the art and high capacity pulp mills from Brazilian companies and the new Uruguayan pulp mill which is a joint venture between two Finish companies UPM and Metsa (Botnia), which is expected to be competed at the end of 2014. In spite of the constant dispute between Argentina and Uruguay regarding the usage of the river Uruguay which wellbeing concerns both countries. The European companies expansion in Uruguay is far from over, due to the considerable amount of raw material located in that area which makes for a sustainable pulp price, but logistical location might be a concern.

Besides the fact that for pulp manufacture the mills have to be located near a water source (commonly a river), a logistical wise location is of extreme importance and is the main reason behind the fact that closures of pulp mills is still in the thousands of tons mark per year, despite the demanding growth of pulp in China. For instance, Finish companies have been reorganizing and consolidating revenue streams in order to improve their cash flow and therefore fortifying the manufacturing process and adding value to their end product. Closures are not only due to the fact that demand suffered from the economic financial crises of the past year, but because wood sourcing and the fact that this market is ruled by the exportation and importation of the products, it makes more sense to consider a location that promotes the efficiency of the variable costs of transportation and wood sourcing.

17

According to company data the following pulp mills are being constructed: Pulp Mill Guaíba II (Completion on 2015); Pulp Mill Klabin (Completion on 2016); APP South Sumatra (Completion on 2017)

Figure 25: Closures of Hardwood Capacity Worldwide (000 tonnes)

Source: PPPC and Fibria / Fibria Relation Investor Relations *As of October 2014

*Others includes Middle East and Africa

Source: Poyry (2013) / Institutional Presentation - Suzano

PORTUCEL COMPANY REPORT

PAGE 17/30 Since the pulp and paper market consists essentially on exportation and importation of commodities, what drives the price and consequently the value of the revenue is the demand and where the demand is located.

The driver for the global demand for pulp is clearly China, with an expected increase, according to consulting company Poyry18, of 8 Million tonnes, which represents a CAGR of 4.4% of the Asian market. This growth will balance the increase of supply in markets that are clearly off balance, such as Europe and South America, markets that have a demand growth that will not fully compensate the supply side. For the European scenario, the increase in supply is only explicable by the fact that the Asia demand will absorb most of the supply-demand gap.

Paper Market

The paper market is expected to produce a total amount of 423 million tonnes in 2014, of which 112 are for printing and writing purposes, being the second biggest category just after Corrugated Newsprint Others.

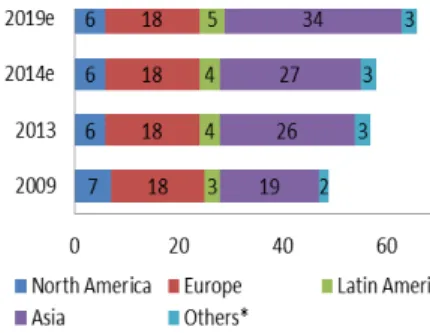

Printing and writing paper demand has been suffering since 2008, as we can see import quantities in North America and in Europe have reduced by 25%, while in Asia there was an increase by 20% since in the same period range. The import quantities seem to have stabilized due to the rapid growth of paper mills in China, supported by the unsustainable growth in consumption.

Noticeable the decrease in imports is followed by the decrease in production in both North America and in Europe. The tender production clearly started after the expansion of Asia capacity in production of paper that is, after 2004. This decrease comes to show the diminishing demand of paper in NA and Europe.

18

Poyry – Consulting Company – Information Retrieved from Suzano Institutional Presentation.

Figure 28: Pulp Demand -Compound Annual Growth Rate

Figure 29: Pulp Supply - Compound Annual Growth Rate

*Others includes Middle East and Africa Source: Poyry (2013) / Institutional Presentation - Suzano

*Others includes Middle East and Africa Source: Poyry (2013) / Institutional Presentation - Suzano

Figure 31: Import Quantities of Printing and Writing Paper (000 tonnes)

Source: FAOSTAT

Figure 27: Cash Costs of BHKP Deliveries to Europe

Source: Hawkins Wright (Outlook for Market Pulp, July 2014)

Figure 30: Paper Market (2014e) (Million Tonnes)

PORTUCEL COMPANY REPORT

PAGE 18/30 As we can see the decrease in European production goes in line with the demand, with an expected annual decrease of 0.4%, between 2014 and 2019. The same can be said regarding North America, with a decrease of 0.7% between the same time range. The main reason for this trend is due to the fact that developed countries have, and since the financial crises, cut back on excessive costs (demand between 2009-2013 has decreased 0.9% and 1.8% in Western EU and NA respectively). In addition, the technological advances do not favour the paper industry, with the increasing usage of personnel computers, smartphone and tablets which are well embedded in modern societies such as the USA and Eastern Europe, which allow for the consumer to purchase digital newspapers and books.

This high tech trend is not followed as aggressively in the emerging countries, with Eastern Europe and Asia increasing their paper demand by 4.1% both. It is expected that by 2035 Chinese paper consumption will reach a staggering 350 million tonnes. Although seemingly good news for European manufactures who are more focused in the export of their merchandise, the fact the supply side will increase in the same rate means that the increased market will be mainly occupied by new and local paper companies.

The increased focus on the European companies in the emerging markets benefits Portucel, leaving room for the company to explore its market without a hectic price competition.

Portucel’s greater capacity is strategic oriented, since it focus mostly on the UWF paper, which shows resilience to the decreasing European demand for paper. Although most of the European capacity is detained by Finish companies, the

matter of the fact is that Portucel’s highest quality paper puts the risk not on the

Figure 33: Production Quantities of Printing and Writing Paper (000 tonnes)

Source: FAOSTAT

Figure 34: Paper Consumption in China (In Millions tonnes)

Source: EPI from FAO, IMF, UNPop

Note: Projected Chinese consumption in 2035 is calculated assuming per-capita consumption will be equal to the current U.S. level, based on projected GDP growth of 8 percent annually.

Figure 32: Paper Demand -Compound Annual Growth Rate

*Others includes Middle East and Africa

Source: Poyry (2013) / Institutional Presentation - Suzano

Figure 35: Paper Supply -Compound Annual Growth Rate

*Others includes Middle East and Africa

Source: Poyry (2013) / Institutional Presentation - Suzano

Figure 36: UWF European capacity per company (tons per year)

PORTUCEL COMPANY REPORT

PAGE 19/30 quantity sold but on the paper price that Portucel can practice in the European paper market19.

The strategic capabilities of Portucel are shown by the fact that despite the decrease in European demand of paper, the uncoated woodfree paper has seen only tender demand decreases and we believe that by 2014 European demand will increase by 1.7%, in spite of the cut backs done by companies and the general population after the financial crises, which are quite noticeably on the other type of paper segment, such as the newsprint and coated mechanical reels which have dropped by 30% since 2008.

The decrease in demand has clearly changed the focused of European paper companies, which are clearly delivering more paper outside Europe. According to statistics developed European Association of Graphic Paper Producer (Euro-Graph), paper delivered to Europe from European countries have dropped, since 2008, on average by 25% across all types of paper.

The PIX A4-copy B, the index which serves as a reference to the UWF paper price worldwide, has declined steady since 2011. Although, we believe that due to the decreased European demand, there will be capacity to exit the market which will allow the recovery of the paper prices by 2017, where there will be an offset between the supply and demand after the sovereign debt crises of 2012. Regarding quantities sold of paper, we expect that Portucel will reach full operational usage by 2021, although the market seems oversupplied, the fact that Portucel serves mostly a niche market will allow for market share acquisition.

19According to company data Portucel’s average operating rate exceeded 96%, which is above the European average of

2012 of 95% (According to Portucel’s Relation Investor presentation (2013))

Figure 41: Portucel’s Price Benefit from Biomass Energy Production

(€/MWh)

Source: Analyst Estimate

Figure 37: Evolution of European Demand by type of Paper (000 tonnes)

Source: EURO-GRAPH; Analyst Estimate

Figure 38: Percentage of Europe deliveries to total deliveries

Source: EURO-GRAPH; Analyst Estimate

Figure 39: Portucel’s Paper Price vis-à-vis PIX A4-Copy B Index (€/Ton)

Figure 40: Portucel’s Sales in quantities (Tonnes) (2007-2021F)

PORTUCEL COMPANY REPORT

PAGE 20/30

Technologic Income: The Biomass Energy

The generation of energy through biomass and cogeneration is a firm trend amongst modern paper and pulp manufactures, not only because it has a low associated variable costs, since companies use a by-product of their production, but it also reduces the ever increasing costs associated with carbon emissions as production of pulp and paper rely on the intense usage of energy.

Although very integrated into the industry, sales are only local and there is not a real price competition when it comes to renewable energy, since these costs are mostly supported by government subsidies to cover the difference between the costs of the more mature fossil fuel market and the recent and more expensive renewable energy technology. The price competition between different types of renewable energy is nonexistent mainly because the cost of each energy is very similar, only the solar energy is extremely expensive20.

The highly financially supported costs represent a menace to the financial sustainability of the recent deployment of the biomass energy plants, particularly in countries suffering from economic recession which are likely to pull out this types of subsidies. A recent example of this menace was the understanding memorandum21, agreed in May 2011, between Portugal, FMI, BCE and the European Union which established a new regulatory tariff which may jeopardize the sustainability of this type of renewable energies. A tariff or a price that does not compensate for the costs of production renders to zero the return on the investment done on the biomass energy plants.

Despite the harshening effects of the economic recession, it is highly unlikely that Portucel and other pulp and paper companies would bring its energy production to a standstill, after having incurred the considerable investment and changes in its mills infrastructures to support the biomass technology, furthermore, energy generated is highly integrated commodity in the production of pulp and paper.

Financials

After the investment in the state of that art paper mill in Setúbal in 2009, which allowed Portucel to became the top European manufacture of uncoated writing paper, with a capacity for 1.6 tonnes per year, Portucel started deleveraging.

Despite the 2013 issue of corporate bonds in the amount of €300 Million, there

20

According to the latest ERSE report (ERSE – Informação Sobre Produção em regime especial (PRE) (June 2014)),

photovoltaic energy costs approximately 330€ per MWh, which is almost three times of the cost of any other renewable

energy.

21

Understanding memorandum - Goods and services markets, http://www.portugal.gov.pt/

Figure 42: Differential between

Annual cost of Biomass (€/MWh)

and Index Price

Source: Analyst Estimate; ERSE – Informação Sobre Produção em regime especial (PRE) (June 2014)

Figure 43: Annual Average Cost per type of technology in Portugal

(€/MWh)

PORTUCEL COMPANY REPORT

PAGE 21/30 was not any more investment in the same magnitude due to the wood source in Iberia is still scarce.

We do not perceive any shift in Portucel’s CAPEX in the Portuguese segment, in the next foreseeable years, which is in line with the rest of the European industry, which are investing in expanding capacity in South America and other emerging countries. Noticeably, Northern European paper and pulp companies seem to be striving for a more solid financial structure, since is clearly that their profitability is below par in the recent years. Although, the industry has no trouble in obtaining new funds in order to support the big investment in the magnitude of the thousand millions.

We estimate that Portucel’s net debt to equity will not deviate much from the current value (0.25x), which is only matched by the Spanish pulp producer ENCE (0.25x). It is noticeable however, that South American companies such as Fibria and Suzano, are extremely leverage (1.41x and 2.17x respectively), which is representative of the recent investment done in Brazil in order to expand overall capacity, meaning that most of the future supply will clearly be generated from this region.

Regarding Portucel operational activity in Portugal, we do not expect any big changes, due to the fact that investment in capacity will be little or next to none and operational efficiency is reaching maximum levels. The growth of Portucel cash flow will be generated mostly by improving the operational efficiency, until it reaches the 100% mark, and in cost reduction programs which will affect the variable costs.

Despite the clearly operational effectiveness of Portucel, we expect EBITDA margins to suffer some heat and drop until they stabilize on the 20% mark, this is mostly due to the higher price of wood, which Portucel is trying to offset by

Figure 46: Estimate evolution of Portucel’s Net debt (In 000 €) and Net Debt to Equity (At Market Values)

Source: Company reports and Analyst estimate

Figure 44: Net Debt to Equity Ratio (as of 31/12/2013) (At Market Values)

Source: Bloomberg

Figure 45: EV to Sales evolution (2006-2014E) (At Market Values)

Source: Bloomberg; Analyst Estimate

Figure 47: EBITDA Margin evolution (2006-2014E)

PORTUCEL COMPANY REPORT

PAGE 22/30 cutting costs at the operational level by being more efficient. This costs cutting and efficiency programs have been adopted by the Finish and Norway companies that have their profit successively below market expectation. However, the estimated 20% margin is still 8% above the EBITDA margins of the USA and Northern European companies, reflecting mostly on the competitive advantage of the strategy developed by Portucel.

Valuation

Our estimate regarding the value of Portucel is of 3.82€, value that includes capital gains and shareholder cash out, which represents a BUY recommendation taking into account its current price of 3.06€. Based on the reached value and the current price, the upside potential is of 31.74%.

Discount Cash-Flow Model

The value estimated was reached by using a Discounted Cash Flow (DCF) method with the aggregation of the three different businesses’. This approached endorsed for better results due to the simplicity of the business, because as most companies in these industries, Portucel is a fully vertically company and integrated and interdependent business (paper, pulp and energy). Since the

completion of the Cacia paper mill, Portucel’s paper business represents more than 80% of the total turnover. Consequently, the combined assessment of the three businesses would yield the most accurate results.

In addition, two different scenarios where build in order to reflect the risks inherent to the industry as well as to take into account the unpredictably of the markets. The base scenario will represent 92.5% of the final valuation.

Portucel’s cost of equity was estimated using the capital asset pricing model (CAPM)22 while applying a market risk premium of 5.5%23. As for the riskless asset and as the cash flow is reported in euros, we believe the best proxy is the 15 years German Bund (0.823%)24. However, due to the fact that the European Central Bank is buying sovereign debt, the impact on the yields has been considerable. The buying of assets is clearly having an effect on all sovereign yields, which is supposed to. However more financially solid countries, such as

22

23According to Professors’ Pable Fernandez’s market survey done in 2013, the consensus for the required average

market risk premium, by both finance and economic teachers as well as analysts, in mature markets sets in a range of 5.3% and 6%. Source: Fernandez, Pablo; Aguirreamalloa, Javier and Corres, Luís; 2013 –Market Risk Premium used in for 51 countries in 2013: A Survey with 6,237 answers.

24

German Bund - 15 Year Maturity - According to Bloomberg as of 03/01/2015. Increase in pulp demand

PORTUCEL COMPANY REPORT

PAGE 23/30 Germany, also benefit, leading to a sovereign bonds with a yield that do not reflect the true return demanded by the investor.

In order to reach Portucel’s cost of Debt, we used the spread over the riskless asset, which according to Prof. Damodaran and taking into account the last issue of corporate bonds of Portucel, of €300 Million in May 2013, which had a

attributed rating by the major credit analyst (Standard & Poor’s and Moody’s) of BB-. According to Prof. Damodaran the spread for a BB credit rating is of 4%. Taking to account that the riskless asset has a yield to maturity of 1.28%, we reach a cost of debt of 5.28%.

Based on the five year monthly returns against the MSCI World Index, in Euros,

Portucel’s levered Beta was of 0.86, when weighted against the five year debt to equity25 ratio we reached a unlevered beta of 0.76. The unlevered beta of the industry that we estimated, based on the same period as the above, was of 0.7626. Concluding that Portucel’s Beta is very similar to the industry, therefore we assumed that Portucel’s future unlevered Beta will be within the same parameters has of the past five years, that is, of 0.76.

Regarding our estimate of the future Portucel’s capital structure (net debt to

equity), we assumed that the capital structure is what the company will strive to achieve in the long term, which is of 15%. We believe that this assumption is reasonable, given that historical data shows that management strives for a low capital structure.

Taking the above data into account, we reach a weighted average cost of capital (WACC)27 of 5.31%, which was used to discount the cash flows estimated. Thereafter, the cash flow were estimated in current prices, in Euros, until the year on year growth of the cash flows stabilized, which in the base scenario was until the year 2021. From that period onward and in order to reach the Enterprise Value of Portucel the terminal value was calculated based on a growth rate of 1.0%. We consider this rate to be plausible, given that the main market where Portucel operates, the European market, will not increase in demand. However, we do believe that, given the segment where Portucel operates, the premium paper, the company will gain market share in Europe. In addition, this rate implies

25

Value obtained at market values, considering that debt is recognized at its fair value.

26

This value was obtained by the averaging the unlevered beta of 13 companies, ranging from South America to Africa. To obtain the unlevered beta of the 13 companies, we regressed their monthly returns on the MSCI World Index, being the timeframe of the said returns where the past 5 years (2008-2014). The unleveraging of each companies was done

using each company’s capital structure at market values (net debt to equity), assuming that the net debt of each company reported in the financial statements was at fair value. Source: Koller, Tim; Goedhart, Marc, Wessels, David; Valuation – Measuring and Managing the Value of Companies.

27

The WACC was calculated using the following formula , assuming that the evolution of debt will follow in line with corporate performance.

Figure 48: Portucel’s WACC/ROIC

Source: Analyst Estimate

Table 1: Portucel’s WACC

Cost of Equity Value Risk-free rate 0,82%

Market Risk Premium 5,50%

Beta Unlevered 0,76

Beta Levered 0,86

Cost of Equity 5,57%

Unlevered Cost of Equity 5,02%

Cost of Debt Value

BB- /Ba3 Rating 4%

Pre-Tax Cost of Debt 5%

Corporate Income Tax 26%

Cost of Debt 4%

Target D/E (Market Values) Value

D/E Target 15%

WACC 5,31%

PORTUCEL COMPANY REPORT

PAGE 24/30 a pay-out rate of 10%, which is consistent to what Portucel has been practicing over the past years.

Mozambique

Portucel’s project in Mozambique, which is going to be, resembling the operations in Portugal, a fully integrated forest, pulp, paper and energy project, will represents an investment of €1.8 Billion and will generate, at cruise speed, revenues above the million mark.

However, due to the fact that the project does not seem to have any specific contingent factors that specifically favour Portucel, besides the fact the Mozambique was a colony of Portugal and therefore the language barrier does not exist, we consider that the net present value (NPV) of this project is zero. It is important to note that any project that does not have any differentiation regarding product or any competitive advantage, which in other words means that there is no entry barrier for competition, and therefore the project will not have any pure economic profit and therefore the NPV of the project should be considered zero.

At this early stage of the Portucel’s strategy in Mozambique, there is not substantial evidence of any entry barrier for competition or any genuine competitive advantage and therefore the project does not have an impact on the valuation of Portucel.

Scenario Analysis

In order to incorporate all inherent risk that are common in the pulp and paper industry and the risk of unforeseeable events, two alternative scenarios were built. This analysis is important due to the fact that an accurate assessment on the value of a company should also take into account the perceptive risk of an event that might hit the economy or, even more specifically, the paper and pulp industry. The first scenario was built with the assumption that the economic recovery would be below analysts and our expectation. The second scenario was built in order to encompass the fact that the world is entering into a digital era. Although we consider that both scenarios have a low probability (first scenario holds a probability of 5%, while the second a probability of 2.5%).

The first scenario, weak economic recovery, will cover the risk of a lower recovery or even a drawback of the economies of countries that are still recouping from the sovereign debt crises, primarily located in peripheral Europe, such as Portugal. These economies have been deploying austerity measures in order to cut back public costs after years of excessive debt and ill spending of public money. However, austerities measures did not have the impact that the IMF was expecting and, for instance, in Portugal recovery is below expectation

Table 2: Scenario Analysis

Scenario Prob.

Expected Share

Price

Base Case 92.5% 4,02

Economic

Weak Recovery 5.0% 1,92 Paper becomes

obsolete 2.5% 0,28 Expected Value 100% 3,82

PORTUCEL COMPANY REPORT

PAGE 25/30 due to the fact that citizens are refraining from spending and consequently small and medium companies are facing difficulties. The impact on paper demand would be severe, since in the developing countries such as Western Europe and USA, where the digital era is more entrenched in the society, cutting superfluous costs, such as premium paper or even writing paper, would be the first thing companies and households would do. Besides, in this scenario, we assume that

Portucel’s paper prices and quantities sold will fall slightly while wood costs would still increase but at a slower pace due to the decrease of demand of European companies. The overall impact of this scenario would be of 51%,

resulting in value of €1.94.

The second scenario, although extremely unlikely assumes that paper will become obsolete within the next 30 years, as a harshening effect on the

Portucel’s value. In this scenario, Portucel would successively produce lower quantities of paper while prices dropped year after year, which consequently would result in higher sales of BHKP, but pulp prices would also deteriorate due to the offset on the supply side due to the less demand generated by paper companies. This scenario yield a result of €0.23 per share, although we do believe on the fact that is an hypothesis that as low chances of happening and therefore we only attributed a 2.5% probability of happening.

Sensitivity Analysis

Due to the fact that the DCF method is extremely dependent on its inputs which are, for any valuation, the WACC, the terminal growth and the main key drivers that affect the free cash flow of the firm. These key drivers vary and are specific to each industry which is, for Portucel, the price of paper and the cost of debarked wood. Therefore we included in our analysis, on our base scenario, a sensitivity analysis on the impact of the terminal growth, which are composed by the ROIC (Return on invested capital) and RR (Reinvestment Rate) in addition to

a sensitivity analysis on the impact of paper price on Portucel’s value.

The analysis on the terminal growth rate components, ROIC and RR, yield a value range of between 3.87€-4.1€, that is, when we vary both ROIC and the RR in 10% both higher and lower. Regarding the analysis on the price of paper, which consists in the main driver of the source of revenue that is currently 80% of

Portucel’s total turnover, we reach the conclusion that, as expected the impact on the final value is tremendous. Making the price of paper vary between a range of -5% and 5%, the overall impact on Portucel’s value is of approximately 14%. However and considering that paper price have stabilized after both financial and sovereign crises, we do not expect the price of paper to vary in such significant amounts in the foreseeable future.

Table 3: Sensitivity analysis of terminal growth components on

Portucel’s value (€/Share)

ROIC (% Change)

-10% -5% 0% 5% 10%

RR ( % C h a n g e )

-10% 3,87 3,91 3,94 3,97 4,01

-5%

3,91 3,94 3,98 4,01 4,05

0%

3,94 3,98 4,01 4,05 4,09

5% 3,97 4,01 4,05 4,09 4,14

10%

4,01 4,05 4,09 4,14 4,18

Source: Analyst Estimate

Figure 49: Sensitivity analysis of

paper price on Portucel’s value (€/Share)

PORTUCEL COMPANY REPORT

PAGE 26/30

Comparables

–

Multiples

In order to asses Portucel’s current and future performance, we used key comparable metrics from Portucel and its peers that operate in either the paper or pulp industry.

Portucel’s gearing is currently very low, however the unleveraged capital structure is highly related to the lack of investment done in the recent years, thus

Portucel’s, presently, holds a net debt to equity ratio smaller than what is practiced in this industry. Consequently, the low financial interests make Portucel a cash machine to its investors with a dividend yield superior to its peers and to industry standards.

The operational effectiveness of Portucel, which is better represented by the multiple Enterprise value to EBITDA (EV/EBITDA), is currently in par with the industry, however we believe that the company will recoup and achieve a ratio (average of 10,5x over the forecasted period of the base scenario) that competes with Brazilians industry and will be three points above current industries standard, which is of 7.77x.

Table 4: Sensitivity analysis of paper price on Portucel’s value (€/Share)

Market Capitalization EV/EBITDA P/E Net Debt to Equity (2013) Dividend Yield (2013)

Portucel 2.137 7,74 6,50 0,14 7,63%

Domatar 1.768 5,28 6,82 0,62 2,23%

ENCE 384 15,45 N/A 0,25 N/A

Fibria 4.391 4,52 26,62 1,41 N/A

IP 15.602 7,46 8,54 0,46 2,55%

Mercer 526 8,19 86,26 1,52 N/A

Metsa Board 1.057 8,30 13,33 0,53 2,86%

Mondi 6.060 7,68 13,24 0,20 2,91%

Sappi 1.552 6,94 37,92 1,44 N/A

Stora Enso 4.940 6,16 102,58 0,59 4,11%

Suzano 3.228 9,50 34,85 0,48 N/A

UPM 5.790 5,69 11,68 0,51 4,89%

Altri 410 8,14 10,86 1,27 1,88%

Average 3.680 7,77 29,93 0,72 2,23%

Source: Bloomberg

Figure 50: Evolution of EV/EBITDA (2014-2021)