THIS REPORT WAS PREPARED BY “STUDENT’S NAME”, A MASTERS IN FINANCE STUDENT OF THE NOVA SCHOOL OF BUSINESS AND

ECONOMICS, EXCLUSIVELY FOR ACADEMIC PURPOSES.THIS REPORT WAS SUPERVISED BY ROSÁRIO ANDRÉ WHO REVIEWED THE VALUATION METHODOLOGY AND THE FINANCIAL MODEL. (SEE DISCLOSURES AND DISCLAIMERS AT END OF DOCUMENT)

See more information at WWW.NOVASBE.PT Page 1/34

M

ASTERS IN

F

INANCE

E

QUITY

R

ESEARCH

65.5%

6.1%

Jan-15 Mar-15 May-15 Jul-15 Sep-15 Nov-15

52-week cumulative return: Ryanair vs MSCI Europe

RYA LN Equity MXEU Index The European aviation market is in a turning point. The flag

carriers, which at the beginning of the century dominated the European air space, are majorly under austere restructuring processes due to overlong operational inefficiencies, large debt burdens and massive personnel costs. As a consequence, these airliners are cutting back capacity and rethinking the traditional business model for the short-haul segment. Meanwhile, the low-cost carriers display financial capability to make significant investments in fleet to both accommodate the expected growth in passengers at their current routes and to penetrate where flag carriers are reducing capacity.

Ryanair will be the airliner with the largest investment in fleet with over 350 aircrafts to be delivered during the next nine years. Following the restructuring process of Lufthansa and Air Berlin, Ryanair will be adding significant capacity to Germany’s domestic and international markets. Other markets, such as Scandinavia and Central/Eastern Europe are also likely to be key to the expansion of the ultra-low cost carrier, while it will consolidate its market leader position in Southern Europe.

Company description

Ryanair is Europe’s largest airliner with over 90 million passengers carried in fiscal 2015. The carrier operates a comprehensive network of routes across 31 countries with a fleet of more than 300 B737-800 aircrafts. The very efficient cost structure allows Ryanair to offer the lowest average fares in the market, which have an implicit discount of 40% to its closest competitors in Western Europe. The airliner will surpass the 100 million passengers carried this fiscal year and it plans to carry 180 million passengers by 2024. Ryanair has in place orders for additional Boeing 737-800 and the new Boeing 737 MAX 200s, which will increase the fleet to 520 aircrafts in 2024.

RYANAIR

HOLDINGS

PLC

C

OMPANY

R

EPORT

A

IRLINES

I

NDUSTRY

8

J

ANUARY2016

S

TUDENT

:

A

NTÓNIO

C

ALEIA

18296@novasbe.pt

European aviation market in a

restructuring process

Low-cost carriers with a competitive edge

Recommendation: BUY

Vs Previous Recommendation -

Price Target FY16: 23.72€

Vs Previous Price Target -

Price (as of 5-Jan-2016) 15.00 €

52-week range (€) 9.04-15.30

Market Cap (M€) 19,723.85

Outstanding Shares (M) 1,319.3 Source: Bloomberg

Source: Bloomberg

(Values in € millions) 2015 A FY 2016 E FY 2017 F FY

Revenues 5,654 6,465 7,135x EBITDAR 1,530 1,985 2,561

EBITDAR Margin (%) 27.1% 30.7% 35.9%

Net Income 867 1,221 1,623

EPS (€) 0.63 0.91 1.21

Net Debt (256) (317) 157 Net Debt/EBITDA -0.18x -0.17x 0.06x

P/E 20.5x 22.3x 25.6x

ROE 21.5% 30.9% 37.2%

ROA 8.1% 11.9% 14.3%

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 2/34

Table of Contents

EXECUTIVE SUMMARY ... 3

EUROPEAN AVIATION MARKET AT A GLANCE ... 4

RYANAIR HOLDINGS PLC: OVERVIEW ... 5

SHAREHOLDER STRUCTURE ... 7

GROUP STRUCTURE ... 7

RYANAIR’S REVENUES

... 8

RYANAIR’S COSTS

... 9

FINANCING OF AIRCRAFTS ACQUISITION...10

HEDGING ...11

RYANAIR’S STRATEGY

...12

GERMANY ... 13

NORTHERN EUROPE ... 13

GREECE ... 14

CENTRAL AND EASTERN EUROPE ... 15

VALUATION ...16

INCOME STATEMENT ... 16

BALANCE SHEET ... 21

UNLEVERED FREE CASH FLOW (UFCF)... 23

DISCOUNT RATE ... 24

ENTERPRISE VALUE,EQUITY VALUE AND VALUE PER SHARE ... 25

SENSITIVITY ANALYSIS ... 26

VALUING AN OPPORTUNITY: TRANSATLANTIC ROUTES ... 27

FINANCIALS AND VALUATION KPIS ...32

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 3/34 1.09 1.12 1.15 1.18 1.21 1.24 1.28 1.30

1.33 1.35

8.3% 9.4%

10.4% 10.8% 11.2% 11.4%

12.1% 12.4% 12.6% 12.6%

FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 Number of passengers intra-European aviation market (in B)* Ryanair market share

Source: Eurostat, Eurocontrol and Nova Research Tem *It does not include Turkey and Russia

668 839 677 1,786

(460) (790) (1,537) (382) 1,848 (6,000) (4,500) (3,000) (1,500) -1,500 3,000 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024

EBIT Cash Taxes Δ NWC CAPEX Unlevered FCF Values in M€

Source: Nova Research Team

6% 11% 15% 19% 17% 17% 13% 11% 9% 8%

FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024

WACC ROIC

Source: Nova Research Team

14.29 20.98 23.56 19.37 18.31 21.36 19.51 18.01 42.97 25.62 23.87 29.61 23.72 25.32 27.11 28.55

Beta of the industry Average fare elasticity Load factor coefficient Terminal value Aircraft price discounts Route Charges

Airport and Handling…

Oil price

Source: Nova Research Team 2,179

31,558 31,395 31,707

29,379 (163) 312 -5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000

Source: Nova Research Team

Executive Summary

Ryanair is expected to increase its market share in the intra-European air transportation market (excluding Russia and Turkey) from 8.3% as of fiscal 2015 to 12.6% as of fiscal 2024.

The airliner has on order 364 aircrafts (including options), which will be allocated in the short-term majorly to Germany’s domestic and

international markets. In addition, Ryanair is predicted to increase its presence in Scandinavia, Greece and Central/Eastern Europe during the next decade.

Nova Research Team expects that the airliner will carry 170 million passengers by fiscal 2024, below management team projections of 180 million. For fiscal 2016, Ryanair is on track to carry 105 million passengers.

From fiscal 2020 to fiscal 2023 Ryanair is expected to display a negative Unlevered Free Cash Flow (UFCF) due to the acquisition of 163 aircrafts

at total cost estimated to be around 17 B€.

Despite the negative UFCF, this investment in CAPEX creates value to

shareholders since the ROIC continues to be higher than the airliner’s

cost of capital during the period.

Since a significant part of the investment in fleet will be made to replace existing less efficient aircrafts, mainly after fiscal 2020, the annual growth

in seat capacity will start to slow down and so will operating revenues. Consequently, the ROIC will decrease towards the WACC from fiscal 2020 ownwards.

In perpetuity, Nova Research Team expects the ROIC to be equal to

Ryanair’s cost of capital, since the airliner is not likely to hold its cost

advantage indefinitely. From fiscal 2024 onwards, Nova Research Team expects that Ryanair grows annually by 1.5%.

An equity value as for the beginning of fiscal 2017 of 31.7 B€ and a value per share of €23.72 was reached.

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 4/34 16.5%

29.5% 34.0% 35.8% 39.6%

2004 2008 2010 2012 2014

Source: CAPA Graph I:

LCCs share of total seats in Europe

9.604 9.75

10.03910.31

10.58810.852

11.16611.397

1.7% 1.5% 3.0% 2.7% 2.7% 2.5% 2.9% 2.1% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0%

8.5 9 9.5 10 0.5 11 1.5 12

2014A 2015E 2016F 2017F 2018F 2019F 2020F 2021F

IFR Flight Movement (in K) Annual growth

Source: Eurocontrol

Graph II:

Forecast of flight movements in Europe*

*departures and arrivals in Europe (excluding Russia) using instrument flight rules

European aviation market at a glance

In the past the European aviation market was characterized by strict regulations, the domination of flag carriers and a large portion of state-owned airports. All these features together contributed to the fragmentation of the European air into national markets, which in turn sustained low competition. Following the Single European Act of 1986, it was created in the 90s a Single Aviation Market for the EU countries, which removed all commercial restrictions for airliners travelling within the region.

The aforementioned deregulation greatly contributed to the strong growth in air transportation in Europe over the last two decades and enabled the expansion of the low-cost segment. Airliners such as Ryanair, EasyJet and Norwegian have been consistently gaining market share in the intra-European market at the cost of the legacy carriers, which have been either going bankrupt or integrating1. Looking forward to improve efficiency and profitability margins, big airliners such as Air France and KLM and Iberia and British Airways have merged2. In addition, Lufthansa enlarged its passengers group by acquiring Austrian Airlines and Swiss3 and, more recently International Airlines Group acquired Aer Lingus. Alongside the bankruptcies and merges/acquisitions, the enlargement of international alliances has been consolidating the European air travelling market. The recovery of Europe from the financial crisis and the posterior debt crisis will impact positively the demand for air travelling in the region. In the short-term, the number of flights in Europe is expected to grow by 1.5% and 3% in 2015 and 2016, respectively. After 2016, the traffic growth is expected to stabilize at around 2.5% with Turkey being the main contributor upon the opening of the new airport in Istanbul in October 2017. However, Europe will face a capacity constraint that will restrict the growth in air traffic. For example, in 2021, 200,000 flights will not

1 These new groups benefit from cuts in overheads, higher presence in core markets and from an extension of routes and capacity.

Ultimately, this integration shall improve efficiency towards the competitors’ levels: low-cost carriers in the intra-Europe market and Gulf carriers in the long-haul segment.

2Air France and KLM merged in 2004. Despite the operational figures of Air France being consistently below KLM’s, until the financial

crisis the merger was successful with the combined operating margin increasing from ~3% as of fiscal 2004 to ~6% as of fiscal 2008. Although the group has returned to a profit in fiscal 2011, it has been unable to reach pre-crisis operating margins. Consequently, in 2014 a restructuring plan was launched, which targeted to reduce the Group’s unit costs between 1% and 1.5% per annum. This restructuring has been hard to implement due to the negotiations with the labour unions.

British Airways (BA) and Iberia merged in 2011 and formed the International Airlines Group. A restructuring plan was launched for Iberia in the following year given the very different operational efficiencies between the airliners. In opposition to Air France-KLM Group, this restructuring process has been successful with a reduction of more than 4,500 jobs and a significant improvement of operational metrics by Iberia. Overall, the group has improved operational margins from 3.3% in 2011 to 5.5% in 2014. Nevertheless, an operational gap still persists between BA and Iberia. Aer Lingus acquisition impact cannot be measured yet given the few time passed by since the integration of the airliner in the group.

3These mergers were successful in expanding Lufthansa’s international network. However, the group is currently confronting a problem

with a large pension deficit.

Single Aviation Market – no commercial restrictions in the

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 5/34 364

323

242

239

209

127

100

69

56

48 Ryanair

easyJet

Norwegian

Wizz Air

Turkish Airlines

Lufthansa

Pegasus…

Aeroloft

Vueling

Sun Express

Graph IV:

Top 10 Euopean airliners by narrow body aircrafts expected deliveries

Source: CAPA, July 2015 *It includes options 245

297

256 238

217 238 157

124 60

2015 2016 2017 2018 2019 2020 2021 2022 2023

Source: CAPA, July 2015 *It includes options

Graph III:

Narrow body aircraft projected deliveries in Europe*

41.5 64.8

77.5 77.5

90.6

Source: Companies last annual fillings

The figures presented correspond to the total passengers carried by each arliner (includes extra EU). Lufthansa does not include Austrian Arlines and Swiss.

Graph V:

Largest European airliners (million passengers)

take-off due to the lack of capacity in European airports, which represents a reduction in the potential growth of 1.7%4.

European airliners will face additional challenges in this new growth spurt. Besides the competition from Gulf airliners in the long-haul segment and the pressure to be cost efficient, European airliners are now faced with the pressure to renew their fleet as concerns about the noise and fuel consumption increase. In addition, LCCs5 are faced with the challenge to continue the expansion into regional and secondary airports without cannibalizing existing revenues and extend their network of primary airports keeping their low-fares policy. Furthermore, an intensification of the competition is expected in the short-haul segment as the narrow body fleet operating in the region increases and as the legacy carriers begin to adopt a hybrid business model.

Big question marks still persist on how supranational institutions and national government will increase airports capacity and on how air traffic in the European sky will be managed in the next decades. Studies on the possibility of a Single European Sky (i.e. like in the US) have shown some progress but it is still far from reaching the transference of the air traffic management from national level to supranational institutions due to States’ reluctance to lose supremacy on this matter. In addition, a simpler and more efficient regulatory structure, lower charges at monopoly airports and lower tax burden on passengers are topics on the agenda of European Commission to be discussed in the next years.

Ryanair Holdings PLC: Overview

Ryanair is an ultra-low-cost airliner operating frequent point-to-point services across Europe and North Africa. Currently it is the biggest European airliner by number of passengers, with 91 million passengers carried in fiscal 2015 and on track to reach 105 million passengers in fiscal 2016. Ryanair operates more than 1,600 daily flights from 76 bases that connect 197 destinations. The airliner holds a fleet of more than 300 Boeing 737-800 which is expected to increase to 520 aircrafts in fiscal 2024. According to the management team, by that time Ryanair will carry c. 180 million passengers, double the amount of passengers flying with the airliner today.

4Source: Eurocontrol seven-year forecast, September 2015. Nova Research Team believes that the impact of these airport restrictions

on the value of Ryanair will be negligible. Ryanair flies from/to airports without slot requirements and the airliner current expansion plan

leaves aside Europe’s mega hubs. Therefore, Ryanair is unlikely to face major capacity constraints. The impact of the airport lack of capacity will be felt by other airliners operating mainly from European hubs (e.g. KLM, Air France, British Airways and Lufthansa). Given the excess demand, two non-mutually exclusive scenarios are possible to occur: a growing demand for alternative means of transportation (e.g. high speed trains) or a shift of demand to regional airports. The latter scenario was not incorporated in Ryanair’s price

recommendation.

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 6/34

41 52 50

29 39 42

49 45

25

FY

20162017FY 2018FY 2019FY 2020FY 2021FY 2022FY 2023FY 2024FY Graph VI:

Ryanair aircraft deliveries*

Source: Ryanair annual reports *It includes options

More recently, as Ryanair looks to attract more business travellers and as flag carriers reduce the traffic at their primary airports due to the restructuring processes, the airliner has been expanding its network of primary airports, namely Warsaw, Athens, Lisbon, Glasgow International, Cologne/Bonn, Copenhagen and Berlin. Michael O’Leary, Ryanair’s CEO, expects that half of the growth in the next five years will come from the primary airports.

Nonetheless, the core business of Ryanair is still to offer frequent direct connections to secondary and regional airports near major population centres and travel destinations. This strategy allows the airliner to benefit from lower landing and handling fees, faster turnarounds and higher on-time departures. In addition, these airports do not maintain slot requirements that limit the number of allowed take-offs and landings

.

In order to keep maintenance and personnel training cost low and to leverage its position with Boeing, Ryanair has a policy of purchasing a single aircraft model. The airliner has ordered 380 Boeing aircraft6, of which 200 (including 100 aircraft option) are the new Boeing 737 Max 200 that will increase the seating capacity by 11 to 200 seats as well as reducing the oil consumption by 18% and the noise by 40%. The latter aspects will become valuable assets to Ryanair as the environmental concerns on the industry increase.

In the beginning of fiscal 2015, following the reputation of a less-friendly customer service and after various lawsuits by customers, Ryanair launched the “Always GettingBetter” program. The airliner adopted a quiet flight policy in dawn and night flights, the allocation of seats, the possibility to carry a second bag for free and it cut on airport and luggage fees. Ryanair introduce also new packages at a discount for business travellers and families.

Although Ryanair’s current strategy is to grow organically, the airliner has made some acquisitions in the past. In 2003 it acquired the LCC Buzz from KLM, which increase its presence at London Stansted and allowed for the immediate access to 11 French regional airports. Following the privation of Aer Lingus in 2006, Ryanair acquired a stake of 29.8% in the Irish company. The airliner tried to enlarge its ownership at various times but it was stopped either by Aer Lingus’ shareholders that considered the offer too low or by EU competition authorities. In July of this fiscal year, Ryanair agreed to sell its position in Aer Lingus to IAG for 400 M€7.

6 As of 1st April 2015.

7Ryanair paid 407 M€ for its stake in Aer Lingus and received 18 M€ in dividends during the nine years holding period. This means that

Ryanair made a small profit in its investment in Aer Lingus.

Secondary airports enable lower airport charges, faster turnarounds and higher

on-time departures …

Ryanair’s radar of primary airports…

Ryanair’s M&A activity…

Improving customer experience through AGB

program …

Increasing number of primary

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 7/34 6.1%

6.0% 3.8%

3.2%

4.1%

4.2% 72.7%

Graph VII: Ryanair's shareholder structure

HSBC HOLDINGS PLC

FIDELITY INVESTMENTS

O'LEARY MICHAEL

STANDARD LIFE INVESTMENTS

BAILLIE GIFFORD

BLACKROCK

OTHERS

Source: Bloomberg

Note: As of 31stDecember 2015

Shareholder Structure

As of 31st December 2015, Ryanair had 1,319.32 M one-class ordinary shares outstanding, of which 4% were held by its directors and executive officers, where special emphasis goes to the Ryanair’s CEO, Michael O’Leary, with a stake of 3.8%. The remaining 96% were trading in the market. At the same date, the airliner had 17.7 M share options outstanding with a weighted average exercise price of 6.94€ (in-the-money) and a weighted average maturity of 6 years. Therefore, the airliner has 1,337.02 M diluted shares8.

Ryanair shares are majorly held by investment groups, which have a jointly shareholding of 85.7%. Moreover, the shares are traded in the Irish Stock Exchange, in the London Stock Exchange and in the NASDAQ through ADRs. The airliner distributes frequently returns to its shareholders both through special dividends and share buybacks. Since fiscal year 2008 the firm has returned to its shareholders a total amount of 2,934 M€, of which 1,422 M€ correspond to share buybacks and €1,512 M€ correspond to special dividends. Following the sale of the 29.8% stake in Aer Lingus, Ryanair will distribute in fiscal 2016 an additional 400 M€ to shareholders.

Group Structure

Ryanair Holdings PLC

Ryanair Ltd

Aircraft Branding Ltd

Airport Marketing Services Ltd

Aviation Risk Holdings BV

East Midlands Training Ltd

FR Finance BV

Coinside Ltd

Darley Investments Ltd

FR Hangars Ltd

IM Aviation Risk Holdings Ltd FRC Investments Ltd

Prestwick Aero Ltd

Ryanair UK Ltd

Ryanair.com Ltd

Mazine Ltd Ryanair Ltd

Note: Ryanair is the full owner of all the subsidiaries, except Mazine Ldt where it holds a stake of 75%

8In the calculation of the Ryanair’s value per share (in the next section), it was used the diluted number of shares. Ryanair has a complex group

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 8/34 0%

20% 40% 60% 80% 100%

0 500 1000 1500 2000 2500

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 FY 2013 FY 2014 FY 2015

Revenues (in M€) Load Factor Source: Ryanair Reports and Website *It includes scheduled and ancillary revenues

Graph VIII:

Ryanair's quarterly revenue* and load factor

75% 21%

2% 2% Graph IX:

Ryanair's revenues composition

Scheduled revenues Non-flight scheduled In-flight sales Internet-related

Source: Ryanair Annual Report 2015

FY 2015 FY 2014 FY 2013 FY 2014 FY 2013 FY 2012

Average fare (in €) 47 46 48 89 83 80

Load Factor 88% 83% 82% 91% 89% 89%

1FY starts in April 2FY starts in October

Ryanair1 EasyJet2

Ryanair’s revenues

As for the whole intra-European air transportation industry, Ryanair revenues are characterized by seasonality along the year with a peak during the second quarter and a low during the fourth quarter (i.e. summer and winter, respectively). Furthermore, the air travelling business is dependent on the overall economic performance.

Unlike legacy carriers that rely heavily on the sale of the tickets, the LCCs business model relies both on the sale of tickets and ancillary revenues. These consist in revenues from non-flight scheduled operations, including revenues from excess baggage charges, priority boarding and reserved seating, in-flight sales of beverages, food and merchandise and Internet-related services (i.e. consisting of commissions of products/services sold through Ryanair’s platforms such as car rental, accommodation or travel insurance).

Finally, Ryanair has a “load factor active/price passive” strategy regarding revenues, meaning that its primary goal is to fill in the airplane as much as possible even if that comes at a cost of a lower fare charged9. In the previous fiscal year, Ryanair charged on average 47 € per ticket which granted a load factor rate of 88%. Ryanair has consistently had the lowest fares amongst the European airliners, however, due to its policy of flying to secondary and regional airports, where the demand is more elastic, its load factors have not been as high as the main competitor, EasyJet, which has a larger network of primary airports.

Table I:

Historical average fare and load factor of Ryanair compared to main competitor, EasyJet

Source: Companies annual reports

A new threat in terms of efficiency is arising from Eastern Europe. Despite the slightly higher airfare charged (48€ as of fiscal 2015), Wizz Air displays the lowest average yield per mile among European airliners (5.0 euro cents against 6.1 euro cents of Ryanair). Wizz Air will expand its fleet by 239 aircrafts in the next years and it will be Ryanair’s number one competitor in routes intra-Eastern/Central Europe and routes connecting the region to Western Europe.

9 The rational for this policy is that the marginal revenue (airfare plus additional ancillary revenues) is higher than the marginal cost for

any aircraft capacity. Therefore, it is optimal to have 100% load factor.

Wizz Air – a new threat for

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 9/34 0.0%

10.0% 20.0% 30.0% 40.0% 50.0%

2011 2012 2013 2014 2015 Graph X:

Fuel Costs as a percentage of operating costs

Air France EasyJet

IAG Ryanair

Source: FT Research

Ryanair1 EasyJet2 Norwegian3 Wizz Air1 IAG3 Lufthansa3 Air France - KLM3 FY 2015 FY 2015 FY 2014 FY 2015 FY 2014 FY 2014 FY 2016

Average yield per mile (in € cents) 6.1 12.5 8.3 5.0 14.2 17.5 17.5

Load Factor 88.0% 91.5% 80.9% 86.7% 80.4% 80.1% 84.7%

1FY starts in April 2FY starts in October 3FY starts in January

Source: Companies annual reports

Ryanair1 EasyJet2 Norwegian3 Wizz Air1 IAG3 Lufthansa3 Air France - KLM3 FY 2015 FY 2015 FY 2014 FY 2015 FY 2014 FY 2014 FY 2016

Staff 6 9 15 5 59 69 94

Airport & Handling 8 21 14 18 27 50 43

Route Charges 6 6 8 - 20 -

-Ownership & Maintenance 7 8 21 14 38 23 51

Marketing, distribution and other 3 7 4 3 26 91 50

Total cost excluding fuel per

passenger (in €) 29 51 62 40 170 233 238

CASM (in € cents) 5.77 9.28 8.67 5.82 12.23 18.86 14.89

1FY starts in April 2FY starts in October 3FY starts in January

Source: Companies annual reports

Table II:

Selected European airliners average yield per mile and load factor

Ryanair’s costs

10The success of Ryanair’s business model depends on its ability to control costs. This enables the airliner to persistently have the lowest cost structure in the industry and thus offer the lowest fares while maintaining a profit. However, the most significant cost for airliners, which is the jet fuel, cannot be totally controlled. Hence, Ryanair has to have some degree of flexibility on the other operating costs such for instance when the price of fuel increases it is possible to cut elsewhere in order to keep its low fares without affecting significantly the earnings. The same is true when the price decreases sharply since Ryanair hedges on average 90% of the expected fuel consumption. As competitors benefit from lower operating costs, the airfares in the market will tend to decrease and, hence, Ryanair needs to have flexibility in the costs to compete with those lower fares. Moreover, as Ryanair has the lowest cost per passenger after fuel expenses, the fuel represents a higher portion of the total operating expenses. Due to this, Ryanair profits would be more sensible to changes in jet fuel price if it was not for its almost full hedging policy.

11

Table III:

Selected European airliners operating costs and cost per available seat mile (CASM)

10 For the LCCs (i.e. Ryanair, EasyJet, Norwegian and Wizz Air) the yield corresponds only to the scheduled revenue divided by the

revenue passenger miles. For the other (flag carriers) it is not possible to make the split between scheduled and ancillary revenues and, hence, it was used the total revenue to compute the yield.

11 For Wizz Air, Lufthansa and Air France-KLM Group it was not possible to split between airport and handling and en-route charges.

The values for Norwegian, IAG, Lufthansa and Air France KLM include long-haul. As a large portion of the flight cost is in landing and taking-off the aircraft, the cost for these airliners is undervalued when compared to the other airliners with shorter average length of passenger haul.

10

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 10/34 43.2%

15.5% 11.9% 10.9% 8.2%

5.1% 2.9% 2.4%

Graph XI: Ryanair's cost structure

Fuel and oil

Airport and handling charges Route charges

Staff costs Depreciation

Marketing, distribution and other Maintenance, materials and repairs Aircraft rentals

Source: Ryanair Annual Report 2015

The charges paid to use the airport facilities and handling services are also important for Ryanair cost management. These charges are expected to increase due to Ryanair’s plan to serve more primary airports. Similarly important are the route charges paid for the air traffic management services. If the Single European Sky initiative is successful the air traffic management services will have a much lower cost to the providers of the service, which may in turn be reflected in lower charges per mile. However, Nova Research Team cannot perceive how likely this scenario is, since there has been ongoing debate on the matter for many years but few progress was made. Therefore, for valuation purposes this scenario was not taken into account.

Labour costs represent a substantial percentage of Ryanair costs and they have a crucial characteristic for the success of the low-cost business model that is being considerably flexible and controllable. Ryanair staff is expected to increase from below 10 million employees in fiscal 2015 to over 16 million employees by fiscal 2024. Regarding staff costs, at the beginning of fiscal 2016 the airliner increased the salaries by 2%. From fiscal 2017 onwards the average annual staff cost is expected to be adjusted to take into account the inflation of the period.

Amongst the low cost carriers Ryanair is the airliner that displays lower cost per passenger excluding fuel expenses. The biggest challenge for Ryanair in the medium-long term is to sustain this cost advantage as it expands its routes to primary airports and as the concerns regarding its working policies increase. Further EU regulation on the employees’ rights can also increase considerably the labour costs. On the other hand, the expectation of lower route charges, the increasing pressure of airliners on supranational institutions to regulate the airport charges, mainly in monopoly airports, and the trend towards the abolishment of air travel tax may more than outweigh the increase in the aforementioned costs.

Financing of aircrafts acquisition

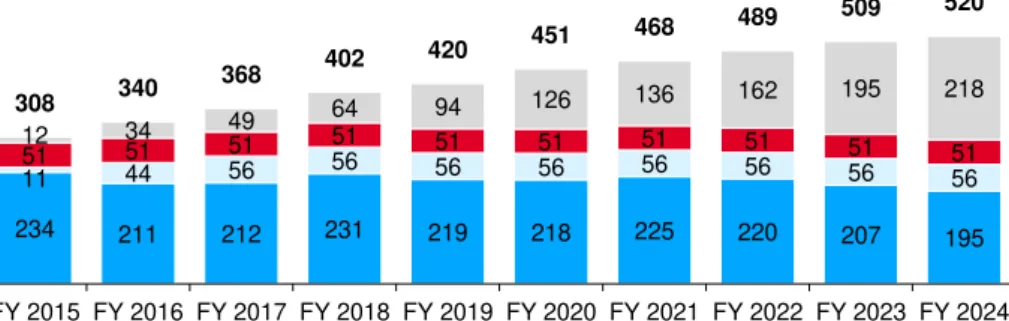

At the end of FY 2015 Ryanair had a fleet of 308 Boeing 737-200 aircraft, the majority financed through the US Export-Import Bank guaranteed loans (202 aircrafts). Other source of financial leasing the airliner uses is the Japanese Operating Leases with a call options (FY 2015: 26 aircrafts) that gives Ryanair the right to acquire the aircraft at a predetermined price after 10.5 years. In addition, in order to reduce the acquisition costs and allow for more financial flexibility, Ryanair sells and leasebacks some aircrafts delivered by Boeing (FY 2015: 51 aircrafts). Another financing instrument issued but not so common is the issuance of bonds. More recently, the firm has issued unsecured Eurobond that enabled it to raise from the market €1.7 billion at a blended interest rate of 1.5%. At last, in a

US Ex-Im Bank guaranteed loans – the base of aircraft

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 11/34 FY 2016 FY 2017 FY 2015 FY 2016 FY 2015 FY 2016 FY 2015 FY 2016

Fuel

Hedging 95% 95% 80% 58% 27% 2% 0% 10%

1FY starts in April 2FY starts in October 3FY starts in January

Source: Companies annual reports

Southwest Airlines3

Ryanair1 EasyJet2 Norwegian3

234 211 212 231 219 218 225 220 207 195

11 44 56 56 56 56 56 56 56 56

51 51 51 51 51 51 51 51 51 51

12 34 49 64 94

126 136 162 195 218

308 340

368 402 420

451 468 489

509 520

-100 200 300 400 500 600

FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024

Graph XII:

Ryanair's projected aircraft financing instruments

No. of aircraft with debt Remaining Financed with Ryanair's own resources Operational Leasing - Sale-and-Leaseback No Outstanding Debt Remaining Source: Nova Research Team

lower proportion of the total number of purchases the airliner uses commercial debt financing (FY 2015: 6 aircrafts).

Ryanair’s strategy to finance most of its aircraft acquisitions through the U.S. Export-Import Bank enables the airliner to enjoy below-market average interest rates and so reduce the financial expenses. In addition, the unusual issuance of the Eurobond took advantage of historically low interest rates, which in turn will reduce the future interest cost for the airliner. Lastly, the sale and leaseback of aircrafts delivers liquidity in the short-term, however, unlike the abovementioned instruments, it does not create any value to the company when compared to equivalent debt instruments12.

Hedging

Ryanair has a very active hedging policy regarding the oil price. Historically, the company has used jet fuel forwards to hedge between 70% and 90% of the forecasted annual fuel consumption. For fiscal year 2016, the airliner has locked in 95% of the forecasted fuel consumption at $930 per metric ton and, for fiscal year 2017, it has already locked in 95% at $622 pmt. Even though many airliners reduced the percentage of fuel hedging after the drop in oil prices, Ryanair kept having a conservative approach to the commodity.

Table IV:

Selected airliners future fuel hedging

12 The sale and lease-back will decrease on-balance sheet financial leverage, which in turn decreases the beta leveraged of the

company and the cost of capital. Nevertheless, this instrument is more costly than an equivalent amount of debt and so will reduce the free cash flow available to investors. At the end, both effects shall cancel out and the value of the firm will not depend on the amount of operational leasing agreements outstanding.

Lower financing cost, more

value to shareholders …

95% of the fuel consumption

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 12/34 1.4

3.2 3.8 3.9 5.0

5.3 6.9

18.7 18.9

21.3

12% 17% 25% 26% 7% 5% 46% 16% 18% 25%

Morocco Portugal Belgium Poland France Germany Ireland UK Spain Italy

Graph XIII:

Ryanair top 10 countries by deparding seats

Market share Departing seats (in M)

Source: Ryanair results presentation fiscal 2015

The company uses further derivative financial instruments to hedge the exposition to foreign currency and interest rates risks. The foreign currency risk arises primarily with the UK pounds sterling and the US dollar. The company hedges naturally a substantial part of the costs in UK pounds sterling by matching revenues in UK pounds sterling. More significant are the cost arising in US dollars, namely the jet fuel, the aircraft acquisition and maintenance and the aviation insurance, which are hedged using forward currency contracts. The interest rate risk arising from the debt and operational leasings in U.S. dollars is managed by using cross-currency swap contracts that convert the floating interest rate debt in US dollars to fixed interest rate in euros. The part of the debt that is not covered by the aforementioned contracts is hedged by holding floating interest rate deposits in US dollars.

Ryanair’s hedging policy reduces the volatility of earnings and increases its predictability. Therefore, it reduces the overall risk of the firm and, hence, it increases the value of the company to shareholders.

Ryanair’s

strategy

Ryanair holds an average market share of 8.3% across Europe and it has consolidated its position as a market leader in some of Europe’s largest markets such as Italy and Spain, where it holds 26% and 18% market share13, respectively. Moreover, the airliner is expected to increase its average market share in the next nine years to 12.6%. In the short/medium-term Germany will be the main driver for growth, where Ryanair is expected to increase its market share from 4.7% to 20%14. The airliner is also likely to enlarge its market share in Scandinavia, where it cut back capacity to the detriment of the past expansion in Italy. In addition, Ryanair will keep adding capacity in Greece, a favoured vacation destination for many countries in Western Europe where it has a strong presence. In the long-run, the main trigger of growth is expected to be Central and Eastern Europe. The airliner is the market leader in some of these countries (i.e. Poland, Lithuania and Slovakia), nevertheless, other opportunities to grow will surge following the projected economic growth for the region.

13 Ryanair’s FY 2015 results presentation. Market share calculated as a percentage of the departing seats in the country.

14 The passengers carried from Germany represents around 12.5% of the intra-European aviation market (as of 2015, Eurostat).

Therefore, the increase in the market share in the country will mean an increase in the overall market share of 1.9%.

Further hedges of operational

expenses and interest rates …

Lower overall risk – more value

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 13/34

0.96 0.96 0.99 1.09

1.12 1.15 1.18 1.21

1.24 1.28 1.30 1.33 1.35

7.9% 8.2% 8.3% 8.3%

9.4% 10.4% 10.8%

11.2% 11.4% 12.1% 12.4% 12.6% 12.6%

FY

2012 2013FY 2014FY 2015FY 2016FY 2017FY 2018FY 2019FY 2020FY 2021FY 2022FY 2023FY 2024FY

Graph XIV: Ryanair market share

Number of passengers intra-European aviation market (in B)* Ryanair market share

Source: Eurostat, Eurocontrol and Nova Research Tem *It does not include Turkey and Russia

24.6

22.8

12.5

11.7

8.4 2.2%

2.0%

1.1%

1.0%

0.8% Spain

Germany

UK

Italy

France

Graph XV: Top 5 Germany country pairs

Passengers carried

Share of the intra-European market*

Source: Eurostat, as of 2014 *It does not include Turkey and Russia

0 50 100 150 200 250 300

Graph XVI:

Ryanair's weekly departures from Germany

Summer 2012 Summer 2013

Summer 2014 Summer 2015

Source: Flightstatus

34%

17% 10% 6% 5% 3%

25%

Graph XVII: Market shares in Northern Europe

SAS Norwegian

Finnair LH group Winderoe Ryanair Others

Source: CAPA

Germany

Germany is the second largest market for air transportation in Westwern Europe with 112 million departing seats as of 2014, where Ryanair accounts for only 4.7%. Lufthansa is the clear market leader in the country with a market share of 31.9% (41.1% if Germanwings is taken into account), followed by Air Berlin with 12.6% of the departing seats. Germany international and domestic air transportation market has seen negligible penetration of foreign LCCs as the competition from the national flag carrier and national LCCs left few profit opportunities even for efficient airliners like Ryanair and EasyJet. Nevertheless, as a result of the restructuring process of Lufthansa group and Air Berlin, which has meant cutting routes and traffic, there is an opportunity to return to Germany domestic market seven years later and increase the routes and frequency of the flights to Spain and Italy - two favoured destinations for German travellers where Ryanair already has a strong presence. Ryanair has already started a fast expansion and it aims to capture up to 20% of the market. The rapid growth strategy will include primary airports such as Berlin Tegel, Düsseldorf and Munich with connections between them and with other major European hubs. The main airport in the country, Frankfurt Main, will not be part of the network served by Ryanair given the slot requirements, the not feasible Ryanair’s turnaround goal of 25 minutes and the high charges at the airport.

Northern Europe

Altogether, the Nordic countries had almost 70 million departing seats in 2014, where Norway stands out with around 26 million seats. The Nordic air scape is clearly dominated by the flag carrier of Sweden, Norway and Denmark – SAS. With a share of 34% of the seats departing from the Nordic countries, SAS is the market leader in each of these countries, except in Finland were Finnair carries

“RYANAIR HOLDINGS PLC” COMPANY REPORT PAGE 14/34 0 50 100 150 200 250 300

Denmark Finland Sweden Norway Graph XVIII:

Ryanair's weekly departures in Northern Europe

Summer 2012 Summer 2013 Summer 2014 Summer 2015

Source: Flightstatus 4.7 9.0 9.4 9.9 45.2 0.4% 0.8% 0.8% 0.9% 4.1% Netherlands Germany UK Spain Intra-Northern Europe Graph XIX:

Top 5 Nothern Europe country pairs

Share of the intra-European market* Passengers Carried

Source: Eurostat, as of 2014 *It does not include Turkey and Russia

0 40 80 120 160

Athens Chania Thessaloniki Graph XXI:

Weekly Departures Greece

Summer 2012 Summer 2013

Summer 2014 Summer 2015

Source: Flightstatus 2.0 2.6 5.1 5.6 6.3 0.2% 0.2% 0.5% 0.5% 0.6% Greece United Kingdom Germany Italy France Graph XX: Top 5 Greece country pairs

Share of the intra-European market* Passengers Carried

Source: Eurostat, as of 2014 *It does not include Turkey and Russia

almost 60% of the passengers. Finland is also characterized by a very low penetration of LCC, since the segment represent less than 20% of the total market when compared to a European average of around 40%. Norwegian Air Shuttle is per excellence the LCC of Scandinavia with an overall market share of 17% and there has been low penetration of foreign LCCs such as Ryanair and EasyJet which hold a market share inferior to 5%.

SAS and Finnair have gone through a restructuring process recently, of which Norwegian took advantage to increase its presence in the region. Despite this attractive scenario, Ryanair has been taking capacity out of Scandinavia since 2012/2013, particularly in Sweden where it had built a wide network of 20 regional and primary airports. This is a consequence of the aircraft reallocation towards Italy - where Ryanair entered the domestic market - and Ireland - after the abolishment of the air travel tax. Additionally, Ryanair has been reallocating the capacity inside the region from regional airports to the main hubs in Scandinavia: Copenhagen, Stockholm Skavsta, Gothenburg City Airport and Oslo Rygge. It is predictable that Ryanair expands in the attractive Scandinavian market in the medium-term as the deliveries of the new Boeing 737 start taking place, namely by serving routes to Spain and the UK. However, the airliner might be unable to compete in the larger Intra-Northern Europe market given the established presence of the national carriers such as SAS, Nowergian and Finnair.

Greece

Unlike any other country in the Balkans, Ryanair has been building in the recent past a significant presence in Greece, being the second largest airliner by seat capacity in the country, just behind the national flag carrier Aegean Airlines. Greece has seen one of the fastest penetrations of LCCs, mainly at the cost of the previously stated-owned Olympic Air. The share of international seats taken by LCCs grew from 21% in 2009 to 40% in 201415. Nevertheless, the domestic market continues to be largely dominated by legacy carrier, namely the merged Aegean Airlines and Olympic Air, counting with a slightly presence of Ryanair. Ryanair has been expanding its domestic and international routes to/from Greece and serves currently 11 airports with 3 bases. In the sequence of the global strategy to increase the network of primary airports, in 2013 Ryanair started flying to Greece’s busiest airport, Athens International, and it has been increasing capacity in Athens since then. It is predictable that Ryanair leverages further its presence in Athens to smooth the seasonality in revenues coming from the

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 15/34 3.1%

1.7%

2.7%

3.0%

2.5%

3.0%

2.8%

3.0%

3.5%

2.5%

2.1% Bulgaria

Croatia

Czech Republic

Estonia

Hungary

Latvia

Lithuania

Poland

Romania

Slovakia

Slovenia

Graph XXII: Real GDP CAGR14-20

Source: Economist Intelligence Unit

8.2%

26.7% 26.2% 30.2%

4.4% 5.2% 4.0% 4.9%

2004 2010 2012 2014

Graph XXIII: LCCs share of total seats

Eastern/Central Europe (To / From) Eastern/Central Europe (Within) Source: CAPA

country, while at the same time it increases the connections during peak season from the UK, France, Italy and Germany to the country’s summer destinations.

Central and Eastern Europe

After the widespread economic downturn all over Europe following the financial crisis in 2007, Central and Eastern Europe is fastest growing region in Europe. Nevertheless, it is still characterized by a low families’ disposable income that is predictable to increase as the economy grows. Moreover, the intra-Central/Eastern European countries market still has a limited size and is dominated by the national flag carriers and the largest LCC in the region, Wizz Air. Therefore, with the economic upspring, the demand for air travelling for both intra-region and connections to the Western will increase and significant opportunities will arise for Ryanair due to the low penetration of LCCs and the few sizable legacy carriers currently operating in these countries that display financial health. Poland is the largest market for air travelling in the region with over 12 million departing seats as of 2014. Ryanair currently serves 11 airports and is the number one carrier in the country with a market share of 26%. Ryanair’s previous strategy of serving only secondary airports has driven it away from Poland’s busiest airport (and one of the busiest in the whole region), Warsaw Chopin. Although the current strategy foresees an enlargement of the primary airports network, it should not pass in the medium-term by Warsaw Chopin since Wizz Air has gained a significant market share in the airport and it currently serves the major hubs in Western Europe. Moreover, the competition from the already restructured and with a fast-growing plan Lot Polish Airlines will limit Ryanair’s ability to conquer further market share in the country and its strategy will pass by consolidating its position in the connections to the Western, while looking for opportunities in the connections to other Eastern countries.

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 16/34

41 52 50

29 31

17 21 20 11

8

25 28 25 14

41

52 50

29

39 42

49 45

25

FY

2016 2017FY 2018FY 2019FY 2020FY 2021FY 2022FY 2023FY 2024FY

Graph XXIV: Aircraft planned deliveries

Orders Options

Source: Ryanair Annual Report 2015

Valuation

In order to reach the value of Ryanair shares, it was initially projected an income statement and balance sheet for every year until fiscal 2024. Nova Research Team believes the margins and CAPEX levels will stabilize by then and, hence, a perpetuity formula was applied to compute the present value of the cash flow generated by the airliner from fiscal 2025 onwards.

Besides the projections of the established business in Europe, a business plan was designed for the possibility of Ryanair operating transatlantic routes16. The value of both European and transatlantic segments was calculated separately and since we cannot perceive how likely the latter scenario is, its value is solely indicative. Therefore, our price recommendation focuses only on Ryanair’s established segment.

Income Statement

Scheduled Revenues

The scheduled revenues were computed according to the following bottom-up approach:

Scheduled Revenues = Passengers carried * Average fare

where Passengers carried = Available seats * Load factor

where Available seats = Average no. of aircrafts * Average sectors flown by aircraft * no. of passengers by aircraft

Available seats

In what concerns the average number of aircrafts, Nova Research Team broke down further the analysis into deliveries occurring during the fiscal year, disposals of aircrafts, aircrafts grounded during the winter and wet leases. Regarding aircraft deliveries, Ryanair ordered from Boeing 272 aircrafts: 172 Boeing 737-800 to be delivered until fiscal 2019 and 100 Boeing 737 MAX 200 to be delivered between fiscal 2020 and fiscal 202417. Moreover, the airliner still holds an option to buy further 100 Boeing 737 MAX 200 until fiscal 2024.18 Secondly, as the fleet increases Ryanair plans to dispose less efficient aircrafts. It is expected that these disposals occur after the peak season, which matches with Ryanair’s half of the fiscal year. In addition, Ryanair grounds every winter aircrafts because of both weak demand and to perform longer maintenance work. Supported on historical

16Referred hereafter also as “transatlantic segment”; “transatlantic business”; “transatlantic project”

17 As of April 1st, 2015

18 By analysing historical deliveries, Nova Research Team found that the average month of delivery was August, which was assumed to

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 17/34 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2024

Average no. aircrafts 311 350 372 396 415 497

Average sectors flown by aircraft 1,940 1,940 1,940 1,940 1,940 1,940

No. passengers per aircraft 189 189 189 189 189 192

Available Seats FY (in M) 114 128 137 145 152 185

Source: Nova Research Team

R Square 56%

Adjusted R Square 53%

Observations 17

Coefficients std. error P-value Lower 95% Upper 95%

Intercept 1.093 0.065 0.000% 0.954 1.231

Av. Fare without Inflation (0.006) 0.001 0.056% -0.009 -0.003

311 350

372 396 415

453 473 490 497

FY

2016 2017FY 2018FY 2019FY 2020FY 2021FY 2022FY 2023FY 2024FY Graph XXV:

Forecasted average number of aircraft operating during the year

Deliveries Disposals

Grounded Wet leases

Average no. Aircrafts

Source: Ryanair Annual Reports and Nova Research Team

analysis, it was assumed that the airliner will ground 40 aircrafts in fiscal 2016, which will increase to 64 in fiscal 2024. Al last, Ryanair usually wet leases aircrafts during the summer to accommodate demand. As the fleet will increase significantly, it is not predictable that there will be need to use short-term leases from fiscal 2017 onwards. Following the aforementioned approach, it is expected an average annual growth of the fleet of 6% from fiscal 2016 until fiscal 2024. Regarding the average number of sectors flown by each aircraft during the year, Nova Research Team does not expect major changes relative to the past. It is predictable that Ryanair expands its network of routes in Eastern/Central Europe and in the Nordic region. At the same time, Ryanair will enhance its position in domestic markets by flying more frequently and by expanding the airports served within countries such as Germany, Spain, Italy and Greece. Overall, Nova Research Team believes that the average annual sectors flown by each aircrafts will keep constant throughout the analysis period at 1,940 sectors.

Finally, regarding aircraft capacity, each Boeing 737-800 can carry 189 passengers, while the Boeing 737 MAX 200 will increase the capacity to 200 passengers. The average number of seats during the year was weighted on the number of each type of aircraft operation during that fiscal year.

The number available seats are expected to increase from 114 million in fiscal 2016 to 185 million in fiscal 2024, which represents an average annual growth of 6.3% during the period.

Table V:

Available seats per fiscal year breakdown

Load factor

Theoretically, the load factor is very dependent on both demand and average fares charged. Since none of the proxies used for demand (growth in EU’s GDP and growth in RPK in Europe) was statistically significant to explain past variations in the load factor, the latter was computed based on the following regression:19

Load factor = α + β* Average fare + ϥ, where the average fare is adjusted for inflation

19 In the sensitivity analysis performed latter in this chapter, it was built a 95% confidence interval for Ryanair’s share value based on the

lower 95% and upper 95% confidence thresholds for the average fare without inflation coefficient.

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 18/34

12,990 13,700

16,000

€ €

105 120 128 136

142 155 162 168 170

114 128

137 145 152

167 175 182

185

92.0% 93.5% 93.6% 93.4% 93.0% 92.8% 92.4% 92.2% 92.0%

9.4% 10.4% 10.8% 11.2% 11.4% 12.1% 12.4% 12.6% 12.6%

0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 140.0% 160.0% 180.0% 200.0%

-20 40 60 80 100 120 140 160 180 200

FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024

Graph XVI:

Forcasted passengers carried by Ryanair and implict market share

No. Passengers (in M) Available Seat Miles (in M) Load Factor Market Share* Source: Nova Research Team and Eurostat

*It does not include Turkey and Russia

Nova Research Team projections are in line with Ryanair’s management team for the short-run. Nevertheless, we took a more conservative approach for a longer time horizon: we expect Ryanair to carry 170 million passengers by fiscal 2024, while the management team believes the airliner will carry around 180 million passengers by then. This corresponds to a market share in the intra-European aviation market (excluding Russia and Turkey) of 12.6% by fiscal 2024. Currently Ryanair holds an 8.3% market share, which means that Nova Research Team expects a penetration of 4.3% over the course of the next nine years.

Average Fare

The average fare charged by Ryanair is very dependent on its operating cost. Since the airliner has a “load factor active/ yield passive” strategy, the fares are majorly set in a cost plus a margin basis rather than looking at competitors price offering for the same routes. Therefore, Nova Research Team performed a regression for the elasticity of the average fare charged in relation to the cost of each available seat per mile (CASM):20

ln (average fare) = α + β1* ln (CASM) + ϥ

Ancillary Revenues

The ancillary revenue was computed by multiplying the average ancillary revenue by the number of passengers carried during the fiscal year. Since the partnership

20 Similarly to the load factor regression, it was computed a 95% confidence interval to the average fare.

R Square 66%

Adjusted R Square 63%

Observations 17

Coefficients std. error P-value Lower 95% Upper 95%

Intercept 5.497 0.315 0.000% 4.826 6.167

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 19/34

4,932 5,358 5,750 6,233 6,709 7,527 8,096 8,635

8,995

1,533 1,778 1,920

2,069 2,198 2,448

2,605 2,758 2,861

6,465 7,136 7,670

8,301 8,907

9,975 10,701

11,393 11,856

-2,000 4,000 6,000 8,000 10,000 12,000 14,000

FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024

Graph XXVII:

Breakdown project operating revenues

Scheduled Revenues (in M€) Ancillary Revenue (in M€) Source: Nova Research Team

-0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0

2007 2011 2015 2019 2023

Graph XXVIII:

Forecasted european brent price, jet fuel price and USD/EUR FOREX rate

Europe Brent (US$ per Gallon)

Average Rynair's jet price (€per Gallon) Market exchange rate (USD/EUR) Source: World Bank (Forecast October 2015) and Nova Research Team

with Hertz ended during fiscal 201621 and the airliner was left without a car partnership for July and August, at the time it established a new partnership with CarTrawler22, we expected a decrease in the average ancillary revenue for fiscal 2016 between 5% and 10%23. From fiscal 2017 onwards Nova Research Tem expects that the average ancillary revenue will keep constant at fiscal 2016 levels (in a real basis) due to the use of global system distribution services. Finally, the average ancillary revenue was adjusted to take into consideration the expected inflation rate for each fiscal year.

Fuel and Oil Expenses

Fuel and oil expenses are an exceptionally important cost for any airliner and account for almost half of Ryanair’s operating expenses. This caption was computed with the following reasoning:

Fuel and oil expenses = av. jet fuel price * av. consumption per mile * total miles flown

Ryanair hedged 95% of the expected jet fuel consumption for fiscal 2016 and fiscal 2017 at US$ 2.93 and US$ 1.97 per US gallon, respectively. The airliner had also locked the exchange rate related to 95% of the expected jet fuel expenses for the same period at 1.33 US$/€ and 1.19 US$/€, respectively. For the remaining part of the expected consumption, Ryanair will purchase jet fuel at the market future spot price. Since jet kerosene is not widely covered by analysts and as it has had a correlation with the price of Europe Brent close to one, Nova Research Team assumed that the expected variation in the price of jet kerosene would

21Recently Ryanair started using global distribution services (e.g. Amadeus and Travelport), which give travel agents direct access to all of its fares. This means that tickets can be purchased without having to go through the airline’s website, where Hertz’s services were advertised. Hertz accused Ryanair of breaching the contract and ended the long-lasting relationship between the two parties.

22 CarTrawler is an Irish online platform that connects a large number of car rental companies (including Hertz) to the final customer. 23 Car rental revenues represent around 10% of the total ancillary revenue.

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 20/34 2,040

1,755 1,8082,028

2,2322,536

2,7632,990 3,181

468 527 561 596 624 682 712 738 749 2.16

1.65 1.60 1.69 1.78 1.89 2.00 2.12 2.26

(0.50) 0.50 1.50 2.50 3.50 4.50 5.50 6.50

-500 000 500 000 500 000 500 000 500 000

FY

2016 2017FY 2018FY 2019FY 2020FY 2021FY 2022FY 2023FY 2024FY Graph XXIX:

Forecasted fuel and oil expenses and its KPIs

Fuel and Oil Expenses (in M€) Total Miles Flown (in M)

Average fuel price (€per US Gallons) Source: Nova Research Team

correspond to the expected variation in the price of Europe Brent24. In addition, the exchange rate at which the jet fuel will be bought was assumed to be the 1.11 US$/€ for fiscal 2016 and 1.06 US$/€ for fiscal 201725. Ultimately, from 2018 onwards the average price of jet fuel is based solely in World Bank expectations for the Europe Brent price converted to euros at the future spot USD-EUR exchange rate.

Although Ryanair has been decreasing the average consumption per aircraft in last three years, as the airliner will expand the network of primary airport that have traffic congestions and longer turnarounds, Nova Research Team assumed that the consumption will keep constant at 2015 levels, which was 2.01 US gallons per mile flown. From fiscal 2020 onwards, the fuel consumption is expected to decrease as the delivery of the new Boeing 737 MAX 200 start taking place. This aircraft is expected to be up to 18% more fuel efficient, which will translate in a reduction on the average consumption per mile to 1.88 US gallons by fiscal 2024. For the total miles flown, it was multiplied the number of available seats during the fiscal year by the average length of passenger haul. The latter is predicted to remain at 776 miles since Ryanair will compensate longer hauls with more domestic flights.

The fuel and oil expenses will increase significantly during the period due to Ryanair’s expansion of the fleet. Nevertheless, the airliner is expected to benefit from low oil prices, such that the weight of this caption will reduce from an historical average26 of 35% to around 26% during the forecasted period.

EBITDAR

In FY 2018 Ryanair shall reach a remarkable EBITDAR margin of 36.1% supported on the full benefit of low oil prices27. The margin will drop afterwards, mainly due the expected increase in the airport and handling charges. All the other captions are expected to maintain a roughly constant weight relative to operating revenues. During the forecast period it is expected an average EBITDAR margin of 32.5%, which is 880 basis points above the historical average (i.e. from fiscal 2008 to 2015). This improvement on the EBITDAR margin results mainly from the steep reduction of the weight of oil and fuel expenses during the forecast period.

24 Based on the forecast of World Bank in October 2015.

251.11 US$/€ corresponds to the average between the exchange rate from March 2015 until December 2015 and the Euro futures price

in CME for March 2016; 1.06 US$/€ corresponds to the average of the euro futures price trading in CME for the period correspondent to fiscal 2017; from fiscal 2018 onwards the exchange rate was computed based on the relative purchasing power parity.

26 This average was computed from fiscal 2008 until fiscal 2015.

27 Ryanair has hedged the future fuel consumption at a higher price than current expected future price for the commodity. Therefore, just

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 21/34

1,985 2,561

2,766 2,867 2,968 3,216 3,335 3,417 3,387

30.7% 35.9% 36.1% 34.5% 33.3% 32.2% 31.2% 30.0% 28.6%

-40.0% -30.0% -20.0% -10.0% 0.0% 10.0% 20.0% 30.0% 40.0%

-1,000 2,000 3,000 4,000 5,000 6,000

FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024

Graph XXX:

Forecasted EBITDAR and EBITDAR margin

EBITDAR (in M€) EBITDAR Margin (%) Source: Nova Research Team

Balance Sheet

Property, Plant and Equipment

Ryanair will increase the fleet by more than 200 aircrafts in the next nine years with the acquisition of 172 Boeing 737-800 aircrafts until fiscal 2019 and 200 Boeing 737 MAX 200 aircrafts between fiscal 2020 and fiscal 202428. Nova

Research Team observed an implicit discount on CAPEX for fiscal 2015 of around 40%, which was considered to hold for all aircrafts acquired under the Boeing contract of 2013 (i.e. relative to the acquisition of the Boeing 737-800 until fiscal 2019). Regarding the Boeing 737 MAX 200, Ryanair’s CEO stated that these aircrafts will be acquired under less favourable commercial terms, but still at a discount from the list price. From the analysis of historical debt, Nova Research team found implicit discounts on aircraft acquisitions ranging from 10% to 40%. Therefore, for the deliveries taking place after fiscal 2019, it was considered a discount of 10% relative to the listed price of 104 M€29. In addition, the price of the

aircrafts will increase annually by the inflation rate in the US.

The other items of the PPE caption (i.e. Hangars and buildings, Fixtures and fittings, Motor vehicles, etc.) will also increase to accommodate the expansion of the fleet. Nonetheless, the impact of these items in the overall level of CAPEX are still insignificant. The CAPEX will escalate with the delivery of the new Boeing 737 MAX 200, which is expected to cost around 17 B€ spread over five years.

“RYANAIR HOLDINGS PLC” COMPANY REPORT

PAGE 22/34

1,253 1,552 1,889 910

3,253 3,964

4,731

3,647

1,312

33 40 44

18 35 42

49 37

13

-1,000 2,000 3,000 4,000 5,000

5 25 45 65 85 105 125 145 165

FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024

Graph XXXI:

Forecasted aicraft delivery and CAPEX

CAPEX (in M€) Aircrafts acquired during the year Source: Nova Research Team

4,032 4,662 5,959 6,147

8,461 11,184

14,476 16,236 15,318

77 116 214 187 255

466 626

759 780

(100) 100 300 500 700 900 1,100 1,300 1,500

-2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000

FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024

Graph XXXII:

Forecast debt and interest expense

Current Maturities of Debt Non-Current Maturities of Debt Interest Expense

Values in M€

Source: Nova Research Team

Debt

Ryanair has financed most of its aircrafts acquisitions through the Ex-Im US Bank guaranteed loans. Except in fiscal 2016 and 2017 where all/some aircraft will be acquired with the proceeds from the issuance of the Eurobonds, it is predictable that Ryanair finances the aircrafts with debt, mainly through aforementioned instrument. These debt facilities have generally had 12 years to maturity with annual amortizations of the initial capital. It was assumed that they are remunerated at the 6M-EURIBOR plus a spread of 1.83%. The interest rate is expected to increase throughout the period (FY 2016: 1.3% to FY2024: 4.9%) as inflation reaches its long-term equilibrium of 2% and as the real EURIBOR interest rate converges to the pre-crisis level of around 1%.