M

ASTERS IN

F

INANCE

E

QUITY

R

ESEARCH

B

ANCO

BPI,

SA

C

OMPANY

R

EPORT

B

ANKING

S

ECTOR

03 JUNE 2013

FRANCISCO DA SILVA CARRILHO DUARTE LOPES

francisco.lopes2011@novasbe.pt

Banco BPI, a good investment?

Opportunity in the heart of the Euro-zone crisis

Recommendation: BUY

Potential + 28.55%

Price Target FY13: 1.33 €

Price (as of 3-Jun-13)Sa 1.03 €

Reuters: BBPI.LS, Bloomberg: BPI PL

52-week range (€) 0.38-1.38

Market Cap (€Mn) 1,433

Outstanding Shares 1,390,000,000

Source: Bloomberg

Source: Bloomberg

(Values in € millions) 2012 2013E 2014F

NII 549 581 710

NIM 1.56% 1.61% 1.90%

Banking Income 1330 1254 1442

Provisions and Impairments 269 389 356

Operational Costs 930 1152 1118

Net Income 249 5 169

Cost-to-Income 48.1% 61% 52.9%

Loans/Deposits ratio 106% 108% 110%

Core Tier 1 15% 15.1% 15.2%

ROE 14.6% 0.23% 7.05%

EPS (€) 0.21 0.004 0.12

Source: Company Data, Nova ER Team

Our recent forecast points towards a final year 2013 price target of 1.33 € per share, representing a potential increase in value of 28.55%.

Besides the € 249 million profit in 2012, € 400 million

were extraordinary, resulting from appreciation in Sovereign Debt Securities. Thus, these were a non-recurrent income.

In 2013 we forecast € 5 million consolidated profit, as Net Interest Income continues to be penalized by higher financing costs and low spreads on mortgage loans contracted the years before.

The domestic activity is expected to be under pressure until economic growth resumes. In 2013 we forecast € 74 million negative results for the Portuguese activity, mainly due to reduced Net Interest Income and still high credit impairments.

BPI’s foreign activity will continue to perform well, as Angola and Mozambique economic performance remains strong, both countries growing above 6%, foreign results will be the engine of the bank at least until 2015.

BANCO BPI,SA COMPANY REPORT

Table of Contents

Banco BPI, SA 3

Description 3

Shareholder Structure 5

Valuation Methodology 6

The Cost of Equity 6

Portugal 8

Portuguese Economy 8

Portuguese Banking System 11

Scenarios for Banco BPI in Portugal 14

Repayment of CoCos 19

Angola 22

Scenarios for BFA in Angola 23

Mozambique 25

Scenarios for BCI in Mozambique 26

Valuation Summary 30

BANCO BPI,SA COMPANY REPORT

Banco BPI, S.A.

Description

Banco BPI (Banco Português de Investimento), SA was founded in the city of Oporto in 1981 originally as an Investment Company; the bank entered the commercial banking activity by acquiring several existing banks during the early nineties, and then grew organically during the mid-nineties and the new century following the growth of the Portuguese economy. The Bank is currently one of the major Portuguese banks and is listed on the main Portuguese Stock Index, PSI 20 and its market capitalization is € 1,441 Million and its total assets are worth € 44,500 Million.

The activity of Banco BPI can be divided into four main segments: commercial banking, investment banking, asset management and insurance. The asset management division operates through the management of several investment and retirement funds and benefits from high-patrimony individuals captured by the commercial banking segment. The insurance segment operates through Allianz and Euler Hermes, which BPI owns 65% and 50% respectively. The investment banking division comprises four different sub-segments: stocks, corporate finance, private equity and private banking; with corporate finance operating in Portugal, Spain, France, Switzerland and South Africa. The commercial banking activity is the most important segment of the Bank, operating in Portugal through Banco BPI, in Angola through Banco de Fomento Angola (where BPI owns 50.1% stake) and in Mozambique through a partnership with CGD (the State owned Portuguese Bank) in Banco Comercial e de Investimentos (where BPI has a 30% stake).

The domestic activity (commercial banking, investment banking and others) is still the most important one, as it represents 77%1 of the banking income of BPI, moreover, 96% of the credit is allocated in the domestic market and 89% of total assets are allocated in Portugal. Within the domestic commercial activity the bank has always been more focused on providing credit to mortgage loans, which represent 81% of total credit and represent a market share of 10.3% in the Portuguese mortgage loans market. Consumer credit can be divided into three main categories: personal credit (5% of total loans), car loans (1.3% of total loans) and credit card loans (1% of total loans). Corporate clients, small and medium enterprises or large multi business corporations, represent only 11% of total loans. This credit structure is not particularly good for BPI, as most of the credit is mortgage loans, which has small, non-negotiable spreads, mostly

1

Source: BPI, annual report 2012 Political consensus in the

BANCO BPI,SA COMPANY REPORT

contracted in the first half of the decade, during the construction boom in Portugal; moreover these loans, due to their nature, have long-term maturities, locking the revenue of the bank for long periods in time. Regarding resources from customers, time deposits are the most important segment, representing 54% of total customer’s resources. Moreover, sight deposits represent 18%, structured products 8.2% and investment funds represent 5.5% of total customer’s resources. In 2012 the domestic activity had higher profits than the international segment for the first time since 2008 (Exhibit 1), mostly due to the appreciation of Portuguese Government Bonds, which pushed results of the domestic activity towards € 160 million, comparing with € 87 million of international results. Since the international crisis origin in 2008 that the Portuguese economy is facing huge difficulties, later worsened by the euro-zone sovereign debt crisis, resulting in the bankruptcy of thousands of companies and cancelation or postponement of numerous investments, making credit impairments to exponentially rise since 2008, being a crucial factor in the negative performance of the domestic activity, comparing to the international counterpart (Exhibit 2).

The international activity of the bank is either developed by its retail business abroad or investment banking services. As expected, the international exposure is primarily concentrated in countries with special ties to Portugal and Portuguese companies, namely ex-colonies or important trade partners. As such, the bank expanded its commercial banking activities to Angola and Mozambique and has branches in France and Spain specially targeting Portuguese communities. In the last few years the International activity has been increasing its importance in

BPI’s net income and banking income (Exhibits 1 and 3).

Comparing to the other Portuguese main private banks, BPI is the smallest but the most capitalized bank and the one with the process of internal restructuring more advanced. In terms of size BPI has € 44,565 million worth of assets, while

BES8 has € 83,691 million and BCP9has € 89,744 million. Regarding total credit

BPI has € 30,519 million, comparing to € 50,399 million from BES and € 61,618 million from BCP. In customer deposits BPI has € 24,600 million, while BES has

€ 34,540 million and BCP has € 49,390 million. In terms of capitalization BPI is

the bank with the highest Core Tier I ratio, 15%, while BES has 10.5% and BCP 12.4%. The transformation ratio, loans-to-deposits ratio, an important measure of

bank’s leverage, BPI has 106%, while BES has 137% and BCP 128%, with

banks obliged to achieve a ratio of below 120% by final year 2014. When looking at the credit at risk of impairment, BPI has 4.2% compared to 9.4% of BES and 13.1% of BCP. In 2012, Return on Equity in BPI was 12.9%, while BES had 1.2% and BCP had an impressive -35.4%. In terms of long-term credit rating, BPI and

Source: BPI official accounts

Source: BPI official accounts

Source: BPI official accounts

Exhibit 1: Domestic and International Results of BPI 2008-2012

Exhibit 2: Credit Impairments in the Domestic and International activities 2008-2012

BANCO BPI,SA COMPANY REPORT

BES are considered BB- and BCP is considered B+, all measured by Standard and Poor’s.

Shareholder Structure

Banco BPI has a solid shareholder structure (Graph 1), where institutional investors own approximately 80% of the bank, giving BPI’s administration an important support when taking strategic decisions. The La Caixa group owns 46.2% of Banco BPI being the largest shareholder, followed by Santoro Financial Holdings with 19.5% (an Angolan Private Company whose CEO is Isabel dos Santos, daughter of José Eduardo dos Santos, the President of the Angolan Republic), the third largest shareholder is the strategic partner Allianz with 8.8% of the shares. Other institutional investors include HVF, Arsopi and AutoSueco. The remaining 20% are free-float traded in the Lisbon Stock Exchange.

Before entering in detail in the valuation of BPI, we want to discuss the availability of the current strategic shareholders to participate in future capital increases. To the La Caixa group, BPI is an extremely important partner, as it

allows the group to provide “Iberian Business Solutions”2

and considers the Angolan subsidiary of BPI (BFA) a “leading position, in an emerging economy experiencing major growth in recent years”. Moreover the group aimsto “support its customers in their foreign trade endeavours and investment projects, anywhere in the world”. In this case, and due to the importance of the Iberian market to the group, we believe that La Caixa will support and subscribe any possible capital increases in the future. Regarding Santoro Financial Holdings (second largest shareholder, 19.5% stake), BPI is an important financial institution in a country with a tight connection to Angola, which can support activities promoted by the company through subsidiaries or partners; moreover Santoro Financial Holding has consecutively increased its participation in the bank in the last few years, and by that we consider the company willing to participate in future capital increases.

2

BANCO BPI,SA COMPANY REPORT

Valuation of Banco BPI, S.A.

Valuation Methodology

In this report we are going to value Banco BPI, S.A by the sum of the parts method, i.e. we will value separately the Portuguese activity, the Angolan activity and the Mozambique’s activity. By using the sum of the parts method we will get a better understanding on which geography most contributes to the value of the bank. Moreover we will use the Free Cash Flow to Equity method, more appropriate to financial institutions, to value the separate operations.

Cost of Equity

The cost of equity is an important measure to discount the expected Free Cash Flow to Equity. In our valuation we will use the Capital Asset Pricing Model (CAPM3) to find the appropriate Cost of Equity. However, we will make a slight modification in the formula in order to capture the systematic risk of the different geographies. Instead of just using the beta of the company as it is usually done, we developed a beta which captures the correlation of BPI with MSCI World (the Index used as the Market Portfolio) and the correlation of the different geographies with the same Index, the Market Portfolio; it is simply done by multiplying both betas. When both betas are multiplied we get a new beta which captures the systematic risk of the stock towards the market portfolio and the systematic risk of the country towards the market portfolio. In this way, we discounted the Portuguese operations with a different Cost of Equity than the

Angolan’s or the Mozambique’s operations, i.e. we used a different cost of equity

for each of the geographies. Below, we carefully describe how we computed the different Cost of Equities and we present its values.

First, we need a Risk-Free Rate, an interest rate at which we can invest our capital and be 100% confident that we will recover our money back. One can possibly argue that, at this moment, in the world, there is simply not any investment that guarantees our money back with 100% certainty, but the market is pricing some Euro-Zone Government Bonds of AAA countries as such investments. As interest rates are historically low, and we are discounting cash-flows that will only occur in the long-term, e.g. the terminal value, we conducted a small study to find a more suitable risk-free rate for both times of crisis and economic expansion. The idea is to find a risk-free rate from a basket of Euro-Zone countries but considering periods of economic expansion, say from 2008 until nowadays. We first selected the four Euro-Zone countries that are classified

3

BANCO BPI,SA COMPANY REPORT

as AAA by the three main Credit Agencies (S&P, Fitch and Moody’s) and we got Germany, the Netherlands, Denmark and Finland4. We then computed the average of the last five years yield to maturity on their respective 10 year Government Bonds, we got 2.69% for Germany, 3.02% for the Netherlands, 3.01% for Finland and 2.86% for Denmark. Our Risk-Free Rate will be the average of these: 2.90%.

Secondly, we computed the usual beta for BPI, using three year, weekly observations and the MSCI World as the Market Portfolio; we got a beta of 1.55,

which indicates that BPI’s stock is 55% more volatile than the Market Portfolio.

Thirdly, we computed the three different betas for each of the geographies, in order to capture the systematic risk of each country:

The “Portuguese beta” was computed by regressing the PSI20 Index, the most

liquid and best representative Index of the Portuguese economy, with the MSCI World. For that we got a beta of 1.16, indicating that the Portuguese market is

16% more volatile than the World’s market, i.e. the Portuguese market responds

with 16% more volatility to external shocks than the World’s Market portfolio. In Angola we don’t have a liquid and representative Index of the Angolan economy; as so, we must choose a proxy in order to capture the country’s systematic risk. In Angola, the oil sector represents 50% of the GDP, and the country exports are completely dominated by oil products; as so, we will use the oil price as the proxy for the Angolan economy. Once again, regressing the Oil price with the MSCI World we got a beta of 0.72.

In Mozambique we have even a further more difficult problem: Mozambique does not have a liquid and representative Index of its economy as with Angola, however Mozambique is currently a country where the agricultural activity accounts for 31% of the GDP, but that is going to change in the near future, as the Natural Gas production is starting to develop, transforming the country’s GDP into something similar to Angola but instead of the oil being the engine of the economy it will be the natural gas. As so, it does not make sense to find the current beta for Mozambique, as it will certainly change in the future. We must look for a country which has the GDP dominated by gas production and by finding its beta we get a good proxy for Mozambique’s future beta; that country would be Algeria, it fits perfectly our criteria (GDP dominated by Gas production, Gas exports dominate total exports, being an African country, proximity to European Countries, amongst others) however there is no stock index in the country. To overcome the difficulty of finding a proxy for Mozambique we must reduce the desired similarity of the countries and broaden our search; two

4

BANCO BPI,SA COMPANY REPORT

countries have both a relevant weight of natural resources in their GDP, in their exports, are developing countries, have liquid stock indexes and have tight relations to Developed countries: Saudi Arabia and Indonesia. And due to the weight of oil in Saudi Arabia (although Saudi Arabia is the world 8th Natural Gas producer) we chose Indonesia. Indonesia is a much more advanced country, with its GDP growing at 6% quickly towards the 1 trillion Euros barrier. Agriculture still accounts 15% of its GDP, with the Gas industry accounting for 12% and the Industry with 24%. The Jakarta stock exchange Index regressed with the MSCI World both in Euros delivers a beta of 0.98.

The table 1, below, summarises the used cost-of-equities:

CAPM per geography

CAPM Portugal Angola Mozambique

Risk-Free Rate 2,90% 2,90% 2,90%

Market Premium 5% 5% 5%

BPI Beta 1,55 1,55 1,55

Country Beta 1,16 0,72 0,98

Cost of Equity 11,88% 8,51% 10,47%

Table 1 : Cost of Equity Source: NOVA ER Team

Portugal

Portuguese Macroeconomic Environment

In the last two years the Portuguese economic and political discussion have been marked by the application of the Memorandum of Understanding (MoU) signed by the Portuguese government and the Troika (European Commission, ECB and IMF) in May 2011. The MoU was signed by the three main Portuguese parties, the Socialist party, the Social-Democrat party and the Popular party, which represent altogether 90% of the seats in the Portuguese national parliament, assuring a huge majority in the application of the measures agreed. Moreover, the Portuguese political stability is seen as a key strength of Portugal in assuring the application of the MoU. The commitment shown by the Portuguese government in the application of the MoU has been much appreciated by investors, originating a steady decrease in the yields of the Portuguese Government Bonds since the beginning of 2012, and the tightening of the spread

Source: Bloomberg

Source: Bloomberg

Exhibit 4: Yields on Portuguese 10 year Government Bonds

BANCO BPI,SA COMPANY REPORT

between the yields on Portuguese and German Government Bonds (Exhibits 4 and 5 respectively)5. Besides Portugal’s credit rating by S&P, Moody’s and Fitch

of BB, Ba3 and BB+ respectively, there have been significant improvements in the access of foreign capital markets by Portuguese companies. In the last semester of 2012 and first semester of 2013 several companies such as Banco Espírito Santo, Brisa, EDP, Mota Engil, PT, REN and Semapa accessed markets by issuing long-term debt, reflecting a reopening of financial markets to stronger and reliable Portuguese companies.

It is important to keep track of the political scene in Portugal. In the event of new elections it is almost certain that Portugal would need a new financial rescue package with important implications in the economic environment, as more austerity would worsen economic conditions which would affect the corporate sector and certainly the banking sector. Besides the MoU was signed by the three main parties, increased instability has risen in the political discussion in the first half of 2013. Repetitive new austerity measures to face unexpected lower tax revenues due to worsened economic conditions has been creating instability in the political scene, as the major opposition party (Socialist party) has demarked itself from the austerity policy and introduced in its political speech the variable economic growth, which in their view (correctly) is essential for Portugal to exit the current recession spiral, however Portuguese citizens must not confuse economic growth with the need for austerity, as public deficit is still over the target of 4.5% by final year 2013. The Socialist party has repeatedly asked for new elections, as the coalition currently in power (Social Democrat party and Popular party) seem to be continuously chasing the deficit target instead of having things under control, and demand higher sacrifices to the Portuguese citizens; moreover there have been signs of internal instability in the coalition, as the Popular party publicly said that it will not tolerate more sacrifices imposed to the retirees, as they have already been asked to contribute with a large share. The President, Mr. Cavaco Silva, has been under pressure, as he is the one with the power to dissolve the national assembly and impose new elections, however that hypothesis is still far away, mainly because although the Socialist party is ahead on recent public polls it does not have a majority of the votes, which would be an even greater cause of political instability in the country. Thus, the political speech in Portugal has become more radicalized and less prone to national consensus, it is true that the probability of new elections is higher than a few months ago, however it is yet a rather remote possibility.

The Portuguese economy, in the process of correction of the structural imbalances, will face the third consecutive year of recession in 2013, with a

5 Source: Bloomberg

BANCO BPI,SA COMPANY REPORT

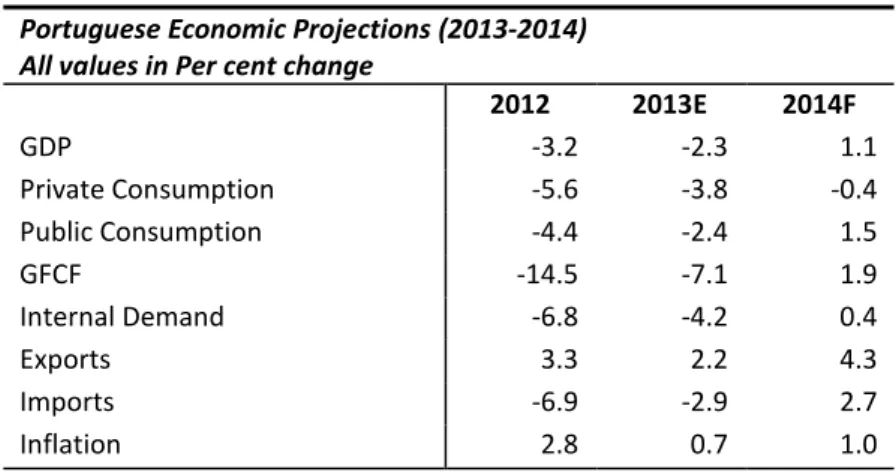

projected GDP contraction of 2.3% (Table 2). The internal demand is going to decrease by 4.2% in 2013, making a cumulative reduction of 17% in the 2011-2013 period, as the private and public entities are still in the process of deleveraging and the economic activity worsens. The private consumption, projected to decrease 3.8% in 2013, is being strongly conditioned by the increased taxation, both direct and indirect, and also the worsening of the labour market conditions, with unemployment rising and breaking records in the

country’s history, 15.7% unemployment in 2012 and 18.3% in 20136, reducing

families disposable income. The public consumption is expected to decrease 2.4% in 2013 as the Government is aiming towards a 4.5% public budget deficit in 2013, to meet the goal established in the MoU with the Troika, however this target might be relaxed towards a larger number as the economic conditions get worse than expected. The gross fixed capital formation has been the most hit economic variable, it is expected to decrease 7.1% in 2013. The depressed economic activity lowers the will and need to invest in new projects or in increasing the capacity of existing projects, negatively affecting this variable. The good news is the adjustment occurring in the external accounts, namely the current account, which was traditionally negative in Portugal and in 2012 turned positive to 0.8% of GDP and is projected to be 3.6% positive in 2013. To this situation is positively contributing the balance of transfers which now represents 5% of GDP and the trade balance which in 2012 was virtually zero and in 2013 became positive by 2.8% and is expected to rise to 3.8% in 2014, as exports keep rising and imports decrease, mainly affected by the reduction in internal demand. Exports have been rising significantly mainly due to the extraordinary behaviour and commitment of Portuguese export companies, which were forced to search new markets for their products as the domestic market declined significantly and upgraded themselves into a more efficient and competitive production of their products; because although exports are rising, that cannot be explained either by the government’s act or impressive external growth, on the contrary, government is still very late in the implementation of structural reforms that would help companies, such as reducing bureaucracy, faster justice system, lower energy costs due to revision of the so called rent contracts, amongst others; while the euro-area, the Portuguese main client, had a recession of 0.6% in 2012 and is expected to have another recession of 0.3% in 2013, which does not favour Portuguese exports. Apart from that, Exports are expected to rise 2.2% in 2013 and 4.3% in 2014, while imports are expected to decrease 2.9% in 2013 and increase 2.7% in 2014. Negatively contributing to the current account is the income balance, which in 2012 was of -3.9% of GDP and is expected to stay

6 Source: International Monetary Fund, World Economic Outlook, April 2013

The Portuguese economy will fall 2.3% in 2013, the third consecutive recession. Investment and private consumption are the most hit variables, decreasing 7.1% and 3.8% respectively.

BANCO BPI,SA COMPANY REPORT

at that level until 2014. Besides the significant improvement in external accounts, this subject has been away from the main public and political debate, which is much more focused in the macroeconomic effects of the austerity policy, namely the unemployment and the economic recession.

Portuguese Economic Projections (2013-2014) All values in Per cent change

2012 2013E 2014F

GDP -3.2 -2.3 1.1

Private Consumption -5.6 -3.8 -0.4

Public Consumption -4.4 -2.4 1.5

GFCF -14.5 -7.1 1.9

Internal Demand -6.8 -4.2 0.4

Exports 3.3 2.2 4.3

Imports -6.9 -2.9 2.7

Inflation 2.8 0.7 1.0

Table 2 : Portuguese Economy Data Source: Bank of Portugal

The economy of the euro-zone decreased 0.6% in 2012 and is expected to decrease 0.3% in 2013 with a modest growth of 1% in 20147. The fact that the euro-zone is economically weak does not favour the Portuguese exports, as the main buyers of Portuguese products are Spain (25%), Germany (13.5%), France (12.1%) and the United Kingdom (5.1%).

Portuguese Banking System

The main banks in the Portuguese Banking system are Banco Espírito Santo (BES)8, Banco Comercial Português (BCP)9, Banco Português de Investimento (BPI) and the state-owned Caixa Geral de Depósitos (CGD). Contrary to large European banks who have operations worldwide and to whom domestic revenue is a small proportion of the entire revenue, Portuguese banks are still much dependent on domestic results as it still is their primary market; as so, the entire banking system suffers when the domestic economy enters in recession, as results from branches and subsidiaries located abroad do not yet have a large weight on the banks activity. Regarding the stock performance of the main Portuguese banks (Exhibit 6) we observe that, since the beginning of 2013, BCP is the bank with the highest appreciation, 40% year to date, BPI is appreciating 4% and BES is losing 20%. Moreover, BPI’s appreciation is in line with PSI 20

7

Source: International Monetary Fund, World Economic Outlook, April 2013

8

Bloomberg ticker: BES PL

BANCO BPI,SA COMPANY REPORT

index and SX7P index (major banks in Europe), while both BCP and BES have been deviating in different trajectories from the main Portuguese Index. The fact that BPI is in line with PSI 20 and SX7P indexes for at least 2 months is in itself a very interesting fact, which might indicate that the share is now reacting only to Portuguese and European economic and political news, while internal factors matter less at this point. In the opposite way, both BCP and BES shares’ behaviour indicate that internal factors still matter in the shares’ valuation. BCP’s appreciation in 2013 is quite impressive when compared to its peers and because investors should worry on the capacity of the bank to pay back its loan to the Portuguese government (subordinated convertible debt); or else, the state will become a shareholder with a large share of the bank, diluting all other shareholders10.

Exhibit 6 - Stock market performance of major Portuguese banks, PSI 20 and SX7P Indexes.

Regarding the past year, banks had a challenging year, as they had to meet a Core Tier 1 ratio of 10% by the end of 201211. To achieve this target BPI and BCP had to resort to the credit line made available by the government, € 1,500

million and € 3,000 million respectively, along with issuance of new capital while

the state-owned CGD increased its capital by 1,650 million Euros. BES was the only bank that did not required funds from the state in order to comply with the regulatory obligations; instead it issued new capital, by the amount of 1,000 million Euros12. It is important to notice that both BPI and BCP have a strict schedule do repay the money accessed through the credit line, otherwise the

10Notice that BCP accessed the state’s credit line by the amount of 3,000 million euro, repayable in 5 years; otherwise it

will convert into ordinary shares.

11

Condition imposed in the MoU

12 Source: BES, 2012 annual report

Source: Bank of Portugal

BANCO BPI,SA COMPANY REPORT

state will become shareholder of the banks, and will have an important stake, diluting all other investors.

In 2013 banks are facing two great challenges that will have a significant impact in their balance sheets and will weight negatively on results: loan impairments and the deleverage program aiming towards a transformation ratio (loan to deposit ratio) of 120% by year end 201413. Due to the worsening of the macroeconomic environment in the last five years, the default on credit payments have been increasing (Exhibit 7) and it is expected to keep rising as new austerity measures impact the economy throughout the year of 2013. The evolution of non-performing loans is expected to follow close the economic conditions, as so, it is expected that the last quarter of 2013 will be the turning point in non-performing loans, hopefully initiating a steady decrease of credit loan defaults. Regarding the achievement of the required Loan to Deposit ratio of 120% by year end 2014, banks have been making a strong effort in deleveraging their operations since the second semester of 2010 (Exhibits 8 and 9); in June of 2010 the transformation ratio of the whole system was 151% and in June 2012 it was already 124%, a 27pp reduction in two years. If we look at the total credit given by banks we can see a clear reduction since June 2010 and June 2012, as total credit decreased from 345,000 million Euros to 325,000 million Euros, respectively. Moreover, these are another evidence of the harsh adjustments being made by the Portuguese economy in the process of deleveraging and structural reforms.

Since capital markets closed to Portuguese banks, these have relied mainly on ECB funding, exponentially increasing their exposition to the ECB (Exhibit 10); however, since the second half of 2012, banks have seen the risk of their debt consecutively decreasing, in line with what had been happening with the Portuguese public debt and have started to decrease their exposition to ECB funding, as other financing alternatives appear. An example of that was that BES issued a 3 year, 750 million Euros Bond, in October 2012, re-opening debt markets for Portuguese banks. Moreover, we might witness, during 2013, more Portuguese bank’s debt issues.

13 Conditions imposed to European banks

Exhibit 9: Total credit in the Portuguese Banking System Source: Bank of Portugal

Source: Bank of Portugal

Exhibit 8: Loan-to-Deposits ratio in the Portuguese Banking System

Source: Bank of Portugal

BANCO BPI,SA COMPANY REPORT

Valuation of Banco BPI in Portugal

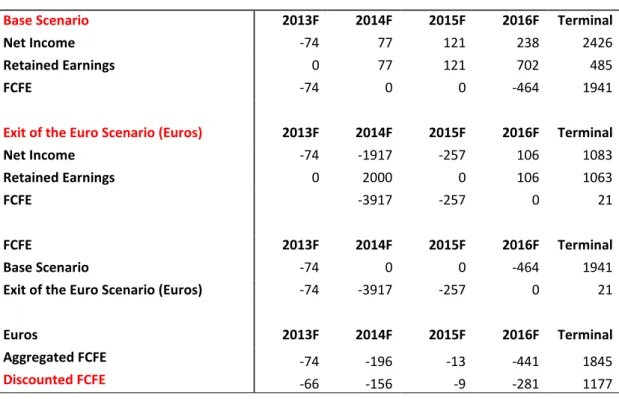

To value Banco BPI in the domestic market we developed two scenarios: the scenario under which the expected macroeconomic variables materialize, which

we call “Base Scenario” and the scenario under which Portugal leaves the Euro

-Zone and returns to the old currency the Portuguese Escudo, which we call “Exiting the Euro Scenario”. In our valuation we attribute a 5% probability of Portugal leaving the Euro. When analyzing the possibility of Portugal leaving the Euro we took into account two things: the yields on Portuguese government bonds and a few studies/opinions related to the subject. The consistent decrease in yields of Portuguese government bonds leads to think that the market is each and each day attributing a lower probability of things going wrong in Portugal, and consequently of leaving the Euro. In addition, several economists attributed between 1% to 25% probability of Portugal leaving the Euro during the past 12 months, with Paul Krugman and Roubini amongst them. Moreover, along our valuation report on BPI, we embraced a cautiously pessimistic view of the bank, as the bank is struggling in a depressed economy full of problems. Thus, we believe that 5% probability of Portugal leaving the Euro is adequate, when looking at the current economic, political and social environments.

Base Scenario

The key assumption of the base scenario is that macroeconomic conditions will follow the current expectations of the behavior of the economy in the years to

come. According to IMF’s latest economic report14

, the Portuguese economy will only start growing in 2014, a very slow growth of 0.64%, followed by another modest growth in 2015 and 2016 of 1.5% and 1.8% respectively. Regarding total investment, it is forecasted to grow 3% in 2014, 9% in 2015 and 8% in 2016, following a huge contraction in the period 2008-2013 of 42%; on the other hand, gross national savings have increased 48% in the same period.

Regarding the bank’s activity we forecast a decrease in loans granted in 2013 of 4.7%, with corporate loans decreasing 5.6% and consumer loans decreasing 4.5%15 as both the investment and GDP reach the bottom of their values during the 2008-2013 period, -42% for investment and -8% for cumulative GDP growth. Only from 2014 onwards we forecast an increase in corporate and consumer loans: corporate loans will increase 8% in 2014, 9.3% in 2015 and 11.3% in 2016, following the rise in investment, better economic prospects, the effect of the structural reforms and as the government’s pro-economic and pro-investment growth measures take action. Regarding consumer loans we also forecast

14

Source: International Monetary Fund, World Economic Outlook, April 2013.

15

We also forecast foreign loans to decrease 2.5% in 2013.

The Valuation of the Domestic Activity attributes a 5%

probability of Portugal leaving the Euro.

BANCO BPI,SA COMPANY REPORT

growth for the same period, with consumer loans increasing 8%, 8.4% and 9.3% in 2014, 2015 and 2016 respectively.

Non-performing loans are still one of the most serious problems of the bank, which is far from being solved. In 2012 loan impairments rose from € 135 million in 2011 to € 254 million, this represents 0.91% of total loans. In 2013 we forecast loan impairments to decrease to € 174 million, and further more in 2014 to € 156 million, € 153 million in 2015 and € 150 million in 2016. We believe that loan impairments have reached their peak in 2012 as it was the hardest recession during this three year period of recessions. In 2013 and 2014 we expect that loan impairments decrease steadily as the economic conditions and corporate financing conditions improve, letting companies finance their daily activities, which have been almost impossible for a large number of companies in 2011 and in 2012, leading to mass bankruptcy in the corporate sector.

In respect to deposits, we expect 2013 to be a year of slight growth of deposits, only 3.5%. Deposits are subject to opposite forces, in one hand, the decline of GDP and consequent decline in families’ income are putting pressure on deposits, on the other hand, gross savings are increasing and the banking system is looking to deposits as a way of financing, since financial markets are still almost close for Portuguese banks. So, it is in these set of forces that deposits are depending on, moreover, it is our prediction that the strong growth of gross savings and the willingness to capture deposits will overcome the downward pressure on deposits. In the years to come we forecast a steady growth of deposits, 2.4%, 8% and 10% for 2014, 2015 and 2016 respectively. It is extremely important to have an idea on what will be the interest rates charged by the bank on loans and what will be the interest rates paid for deposits when predicting a crucial source of revenue for the bank, the net interest income. We begin by describing our forecast of future Euribor rates (Exhibit 11), which in turn will be responsible for the determination of both interest rates on loans and deposits. Our analysis was based on inflation expectations and expected GDP growth in the euro-zone, which will be very modest, with inflation under 1.75% from 2013 until 2016 and GDP slowly growing at an annual average of 1% until 2016, in this way, our forecasts for Euribor rates reflect the slow economic recovery. Our analysis assume an Euribor 3 month of 0.3% in 2013, 0.75% in 2014, 1% in 2015 and 1.5% in 2016; an Euribor 6 month of 0.5% in 2013, 1% in 2014, 1.5% in 2014 and 2% in 2016 and an Euribor 12 month of 0.75% in 2013, 1.25% in 2014, 1.75% in 2015 and 2.25% in 2016.

As discussed before as one of the problems of the Portuguese banking system, banks are facing huge difficulties as financing costs rose in the last three years but many of the consumer long-term loans are contracted with extremely low and

Exhibit 11: Euribor Rates Forecasts

Source: NOVA ER Team

BANCO BPI,SA COMPANY REPORT

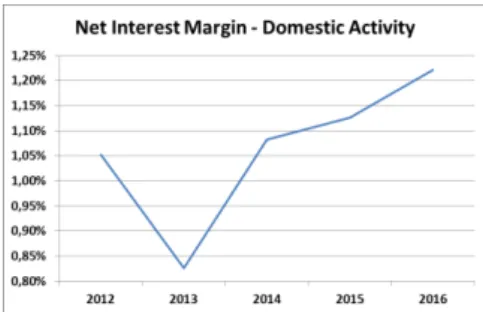

even zero % spreads, crushing net interest margins, which in 2013 is expected to be 0.83% in the domestic activity, slowly increasing in the years to come (Exhibit 12). On the contrary, in the case of the corporate loans, many of the debt is in form of current accounts and short maturity loans, whose new contracts can be changed must easier than those of consumer loans. As a consequence, banks are demanding higher spreads to corporate loans, as it is the only alternative to face the new financing costs, as most of the consumer loans are long-term and impossible to change the contracted terms (e.g. Mortgage loans). In our valuation we take this situation into account, where interest rates on consumer loans increased slower than on corporate loans.

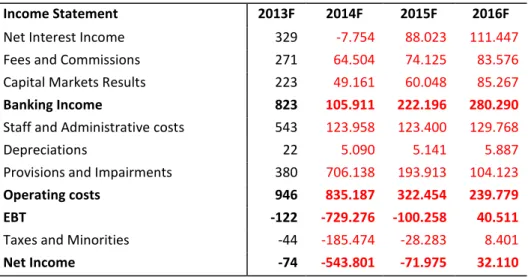

We forecast that in 2013 the domestic activity will have negative results of € 74

million, mostly penalized by reduced margins due to the rising costs of financing and locked contracts on mortgage loans, with net interest income totalizing € 317 million. Fees and commissions will stay in line with previous years amounting to € 244 million. The main contributor to 2011’s negative results and 2012’s profit is the activity developed by the capital markets division. In 2013 we also forecast good results in this division as Portuguese government bonds held by the bank keep appreciating and yields declining, we estimate a result of € 214 million. On the bank’s expenses both administrative and staff costs and depreciations will remain in line with previous years, representing altogether € 544 million. Total impairments will decrease to € 347 million. The banking income will be € 775 million and total costs will sum € 891 million, leading to negative earnings before

taxes and minorities of € 116 million. The table 3, below, represents our

estimates for the domestic activity until 2016:

Banco BPI (Mn Euro) - Domestic Activity

Income Statement 2013F 2014F 2015F 2016F

Net Interest Income 317 426 473 560

Fees and Commissions 244 265 288 318

Capital Markets Results 214 224 242 267

Banking Income 775 914 1002 1145

Staff and Administrative costs 522 494 494 515

Depreciations 22 23 24 25

Provisions and Impairments 347 307 333 289

Operating costs 891 824 851 829

EBT -116 90 151 316

Taxes and Minorities -42 13 30 78

Net Income -74 77 121 238

Table 3 : Forecast of Domestic Activity Source: NOVA ER Team

Exhibit 12: Net Interest Margin in the Domestic Activity

BANCO BPI,SA COMPANY REPORT

Exiting the Euro Scenario

Some economists argue that the main problem of Portugal is the Euro for several different reasons: First, the Euro is a strong and appreciated currency which makes many of the Portuguese industry uncompetitive under the global competition, partially because our industry adds low added value to its products, making the cost of production an important variable to compete in foreign markets. Secondly, with its own currency, Portugal would be able to expand public consumption, which is in their view is essential to start the recovery of the economy and stop the rising of unemployment. Other reasons are many times presented in favor of leaving the Euro. Moreover, there is also the possibility of Portugal being forced to leave the Euro, if the European Union decides not to finance Portugal furthermore and if financial markets are closed to the country. Although remote, there is the real possibility of this scenario to happen, which would have a major impact in BPI, changing all our forecasts of the domestic activity.

We assume that Portugal would leave the Euro in the near future, namely in January 1st 2014 to facilitate. In that moment it is almost certain that deposits would be converted to the returned Portuguese Escudo and frozen for at least a few days to avoid bank runs, moreover, all domestic or foreign loans would be converted to Escudos as well. The main problem for the bank would be the debt issued in Euros in financial markets, which would probably stay denominated in Euros, implying an increase identical to the devaluation of the Escudo.

When thinking of the macroeconomic conditions resulting from the exiting of the euro, we looked carefully at the Argentinian example and its crisis of 1999-2002 and inferred the consequences on the Portuguese economy. We predict that GDP will fall 10% in 2014, and then growth resumes at 4% in 2015 and 2016. Total investment will fall by 25% in 2014 as response to the abrupt fall in GDP; it will remain unchanged in 2015 and will grow 25% in 2016. As with what happened in Argentina, inflation will soar to 15% in 2014, but then slowing to 8% in 2015 and 5% in 2016. Unemployment rate will reach 25% according to our forecasts, but then starts decreasing at 1.5 percentage points per year. In relation to the exchange rate of the Euro/Escudo we believe that at the moment of the conversion, by political decision the Escudo would return to its pre-Euro value, which is 200.482 Escudos per Euro. However, we believe the Escudo would devalue significantly in the next few days, with several studies pointing to devaluations between 25%-50%; moreover, the Argentinian currency devalued 66% during the currency crisis. In our valuation we will assume a devaluation of

The internal discussion on whether Portugal should leave the Euro or not is not finished, as both sides recognize pros and cons on either option.

Leaving the Euro would cost the reborn Portuguese

BANCO BPI,SA COMPANY REPORT

40%, implying an exchange rate moving from 200.482 Escudos per Euro to 283.65 Escudos per Euro.

Regarding the bank’s activity we forecast a decrease in loans granted of 9% to the corporate sector and a reduction of 11% in the consumer loans, both in 2014, with investment reduction and GDP negative growth clearly crushing any new investment prospect. In 2015 and 2016 the situation improves clearly, as investment and GDP start growing, with corporate loans increasing 4% in 2015 and 12.5% in 2016, consumer loans will increase 3% and 10% in 2015 and 2016 respectively. In respect to non-performing loans, we expect an exponential rise in 2014 to 15%, as what happened in Argentina in 2000 and 2001, due to the GDP and investment shrunk, combined with unemployment rise, which directly affects non-performing loans, but also the instability caused by the change of currency and devaluation process. In the following years we expect this number to come down to 5% in 2015 and 3% in 2016, as a better macroeconomic environment and the regain competitiveness of the economy starts generating employment and investment growth.

Like in Argentina during the crisis and even more recently in Cyprus, bank deposits will be frozen for at least a few days in order to avoid bank runs. Moreover, all deposits will be converted to Escudos and depositors will suffer the devaluation in their savings. Although being frozen, we forecast a decline of 4% in deposits in 2014, as a result of the instability created by the change of currency and the fact that some agents moved part of their savings to other products, namely gold or foreign investments. In 2015 and 2016 we forecast growth of deposits of 5% and 11% respectively, as the economic conditions improve and the money returns to the traditional deposits.

BANCO BPI,SA COMPANY REPORT

Banco BPI (Mn Euro and Mn Portuguese Escudo) – Domestic Activity

Income Statement 2013F 2014F 2015F 2016F

Net Interest Income 329 -7.754 88.023 111.447

Fees and Commissions 271 64.504 74.125 83.576

Capital Markets Results 223 49.161 60.048 85.267

Banking Income 823 105.911 222.196 280.290

Staff and Administrative costs 543 123.958 123.400 129.768

Depreciations 22 5.090 5.141 5.887

Provisions and Impairments 380 706.138 193.913 104.123

Operating costs 946 835.187 322.454 239.779

EBT -122 -729.276 -100.258 40.511

Taxes and Minorities -44 -185.474 -28.283 8.401

Net Income -74 -543.801 -71.975 32.110

Table 4 : Forecast of Domestic Activity Source: NOVA ER Team

Banco BPI (Mn Euro) – Domestic Activity

Income Statement 2013F 2014F 2015F 2016F

Net Interest Income 329 -27 314 368

Fees and Commissions 271 227 265 276

Capital Markets Results 223 173 214 282

Banking Income 823 373 793 927

Staff and Administrative costs 543 437 441 429

Depreciations 22 18 18 19

Provisions and Impairments 380 2.489 692 344

Operating costs 946 2.944 1.151 793

EBT -122 -2.571 -358 134

Taxes and Minorities -44 -654 -101 28

Net Income -74 -1.917 -257 106

Table 5 : Forecast of Domestic Activity Source: NOVA ER Team

The repayment of the CoCos

BANCO BPI,SA COMPANY REPORT

Core Tier I ratio of 15%. These CoCos amounted to € 1,500 million at the issue

date, but BPI repaid immediately € 200 million16

and more recently three other

repayments of € 100 million, € 200 million and € 100 million respectively, leaving

nowadays € 900 million outstanding of the convertible bonds. During the period of the convertible bonds (5 years) BPI has to pay increasing interests to the State, 8.5%, 8.75%, 9%, 9.5% and 10% per year respectively. If the loan is not fully repaid at the due date, the amount outstanding will convert to capital, diluting every other shareholder. The board of directors of BPI wants to repay the CoCos as soon as possible, to avoid partial nationalization; however it is not an easy task under the current economic environment.

Hereinafter we will describe the possible repayment schedule of the CoCos by BPI according to our estimates. We assume that BPI in Portugal will repay the CoCos on its own, without touching Angola’s or Mozambique’s subsidiary’s results. In this way we get a better perception on how difficult it is for the domestic activity of the bank to face the current macroeconomic conditions and what is the true value of the domestic activity on its own; without misleading the final price target calculation, as the foreign activity is compensating for lower domestic returns.

In the base scenario, we assume that the amount outstanding of CoCos in final year 2013 is € 900 million, as we forecast a negative net income for that year, not allowing for further repayments. In 2014 we forecast a net income of € 77 million which by law decree must be fully allocated to the repayment of CoCos, as the decree states that during the period of the loan, while there is still an amount to be repaid to the State, the banks are not allowed to distribute dividends. In this way in final year 2014 the CoCos outstanding are still worth € 823 million. In 2015 the net income is expected to be € 121 million, reducing the CoCos to € 702 million. In 2016, the domestic activity will have positive results of € 238

million, implying a reduction in CoCos to € 464 million by final year 2016. As the

CoCos must be fully repaid after five years of the issue date, June 2017, we believe the bank will have to raise capital somewhere in the second semester of 2016 to make sure it fully repays the State’s loan by the due date. We estimate that capital increase operation to aim towards a € 450 - € 500 million new capital target, assuring the full repayment of the CoCos, and avoiding partial nationalization. The detailed repayment schedule can be seen in the exhibit 13 below:

16

BANCO BPI,SA COMPANY REPORT

Under the leaving the Euro scenario, the repayment is much more difficult for BPI, as the bank suffers huge losses in 2013, 2014 and 2015, but particularly in 2014. Until 2015 the remaining € 900 million worth in CoCos will remain unchanged, as the bank is struggling to finance its equity, setting aside the CoCOs matter for a while. However in 2016 the bank will already be able to repay part of the loan, € 106 million, leaving € 794 million to be repaid. As we analyzed before, under this scenario, we already forecast a capital increase of € 2,000 million in 2014, but in 2016 we see no other alternative but to raise capital again to repay the remaining CoCos in the amount of € 738 million17. The detailed repayment schedule can be seen in exhibit 14 below:

17

BANCO BPI,SA COMPANY REPORT

Angola

Angola has become a fast-growing economy since the end of its civil-war in 2002. Prior to that, 26 years of civil-war following the Independence from Portugal led to a significant destruction of the public infrastructure, as well as economic enterprises. Since 2002 the Angolan economy grew at an average annual rate of more than 11%, turning Angola into one of the fastest growing countries in the world. Moreover, the economic growth is expected to keep its strong momentum, with real GDP expected to rise at an average annual rate of 6% from 2013 until 2018, investment rising at an average annual rate of 6% and inflation at 8% per annum for the same period18. Although Angola is growing impressively, it is still a poor country, with a huge required transformation still ahead. It has been only a decade since the country started to rebuild roads, schools, hospitals, public sanitation, etc. The Angolan GDP is much dependent of the oil sector, which represents 47% of the product, followed by 30% of non-transacted services, 10% agriculture and only 6% of non-oil industry. According to independent oil-experts Angola, with its recent oil discoveries, might have significant production for the next 50 years, reaching the production of 2 million barrels per day in 2014. Agriculture will also be an important sector in the near future, completely abandoned, of all agricultural area only 6% is now explored, when explored can make Angola one of the main agricultural powers in Africa. Communications and construction also play an important role in the Angolan economy, and will remain important as the country keeps rebuilding itself after the long and devastating civil-war.

The competition in the banking sector has allowed a growing access of the population to the Angolan banking system in the country, as the major banks seek to be present in the 18 domestic provinces. Moreover, we developed a study in which we forecast the Angolan population access to the banking system until 2017. According to our study population access to banks in Angola will increase from 34% in 2013 to 70% in 2017, which will represent 16 million persons with access to banking services (Exhibit 15). The increase in access of banks, by the Angolan population will increase at an annual average rate of 31% per year (Exhibit 16). This study gives us an indication of the potential of the Angolan market for banks, as it is a country in fast development.

Banco de Fomento Angola (BFA) is the Angolan subsidiary of BPI. Angola is a country with significant ties to Portugal by historical reasons; both countries share the same language, a huge presence of Portuguese companies are currently working in Angola, trade and residence authorization agreements make possible

18

Source: International Monetary Fund, World Economic Outlook, April 2013.

Exhibit 15: Population access to banks in Angola

Source: NOVA ER Team

Exhibit 15: Population access to banks in Angola

BANCO BPI,SA COMPANY REPORT

the significant trade made between the two countries and the large community of Portuguese citizens living in Angola and vice-versa, so it was an obvious geography for BPI to expand its foreign operations. BFA is currently the fourth bank in Angola by assets, having a market share in deposits of 16.4% and

leadership positions in the ATM’s and APT’s segment. The bank has 158

branches and more than 2000 employees.

Scenarios for BFA in Angola

Angola is a promising country, which lately has been focused in rebuilding its infrastructure and developing the living conditions of its population, mainly with the income generated by the oil industry. Angola has become an important oil exporter, selling more than 2 million barrels a day, but also extremely dependent on oil prices. One of the important issues that will influence the Angolan economy prospects in the future is the possible discovery of new wells and the oil price. Another important question is the succession of the current President, José Eduardo dos Santos, who rules Angola since 1979. Nowadays his authority is recognized and respected by everyone, i.e. military officials and other members of the Angolan elite; however, if the Angolan succession is not prepared while José Eduardo dos Santos is still alive, to assure a quiet and peaceful succession, and for some reason José Eduardo dos Santos dies in the meanwhile, there might be a huge problem in the succession of the country, as the military elite fight amongst themselves to succeed the current president, possibly leading the country to another civil-war.

In the case of the valuation of the Angolan subsidiary, as for the Mozambique’s subsidiary, we built four different scenarios: a bad, a disappointing, a normal and a good scenarios. The valuation of the different scenarios can be seen in the Valuation Summary section, on page 29.

BANCO BPI,SA COMPANY REPORT

and 15% for 2015 and 2016. Government bonds will suffer a haircut of 60% in 2014 and 20% in 2015, resulting in more impairments, which will deeply penalize

the bank’s results. Total loans decrease 15% in 2014 and in 2015, suffering from

the decrease in investment and the closure of some business. As of customers’ deposits we forecast a 25% reduction in 2014, followed by 2% rise in the following years, resulting from money withdraws as a protective measure taken by individuals and companies who have money in the bank. Moreover, this situation is dependent on possible restrictive measures taken by the National Bank of Angola, not allowing money withdraws, however in the case of a situation like this it is highly probable that the elites will take their money out of the country in the days before the decision by the National Bank is made.

The bank’s results will be extremely negative in 2014 and in 2015:

-123,000,000,000 Kwanzas in 2014 and –20,000,000,000 Kwanzas in 2015, with 2016 being slightly positive. Defaults on loans and government bonds are the main cause of these results, with impairments in 2014 being over 200,000,000,000 Kwanzas, compared to 4,638,000,000 Kwanzas in 2013. The main source of revenue of the bank, net interest income, will decrease 48% to 14,023,000,000 Kwanzas in 2014 and further 34% in 2015. BFA’s equity is completely evaporated in 2014, imposing an emergency capital increase of, at least, 200,000,000,000 Kwanzas or over 900,000,000 Euros at the new exchange rate of 218 Kwanzas per Euro.

The disappointing scenario (2) is a scenario which represents the activity of the bank in the case of a deterioration in the macroeconomic conditions, namely a decrease in the GDP growth prospects and lower investment than the predicted, i.e. a general macroeconomic slowdown. This situation can result from a permanent decrease in the price of oil in the global markets which deeply affects the Angolan economy, highly dependent on oil production and exports. A permanent decrease in oil prices is not completely irrational, as alternative energy sources appear, namely the Shale Gas in the United States, possibly leading to a new wave of cheap energy as happen with oil from the end of the second world war until the oil shocks of the seventies.

BANCO BPI,SA COMPANY REPORT

still quite impressive, 25% per year since 2014 until 2016, however far below the 36% return on equity from 2008 until 2013.

The normal scenario (3) is the scenario under which all IMF expectations over the Angolan economy materialize: GDP will grow at 7% from 2014 until 2016, investment will decline 3% in 2014 and then will grow 3% in 2015 and in 2016. The bank is expected to have good results under this scenario, the most likely one, as the return on equity will be 31% per year from 2014 until 2016, however the bank is strongly capitalized, with 20% of its net income going to reserves. In the normal scenario loan impairments will be 5.78% per year throughout the period of analysis, maintaining the average of the past periods which had similar macroeconomic conditions. Credit loans will grow at an annual average rate of 21% from 2014 until 2016, with customer deposits rising 8% per year in the same period; significantly lower than the growth rate of loans, as the bank is trying to increase its loan-to-deposit ratio, which is 25% in 2013, which in turn will improve the net interest margin.

BANCO BPI,SA COMPANY REPORT

Mozambique

Mozambique has lately turned into a fast-growing economy, with real GDP expected to rise at an average annual rate of 8% from 2013 until 2018, investment growing at an average annual rate of 12% and inflation below 6% for the same period19. Besides the impressive Macroeconomic projections, Mozambique is still a very poor country, listed 165 in the World Bank´s Human Development Index, with 31% of GDP coming from agriculture and fishery, employing 77% of the labor force, with only 8% employed in Industry and 15% in services. The Mozambique’s economy is expected to suffer huge transformations in the next few years, as the Natural Gas and Coal explorations develop, turning the country into an important exporter of such raw materials. The development of further important industries such as cement, furniture, food and beverages will also be important in the diversification of the country’s exports. The development of the industry sector will require better communication routes, namely through the construction of roads, railways, ports and airports; moreover the investment on renewable energy will force the construction of new dams providing larger energy independence of the country. The development of tourism is also a strategic objective that the government is willing to focus on.

Banco Comercial e de Investimentos (BCI) is the Mozambique’s subsidiary of BPI. Mozambique is a natural geography for BPI to develop its foreign activity as the country has tight relations with Portugal, namely sharing the same language, having bilateral trade agreements, innumerous Portuguese companies are operating in Mozambique and a large share of Portuguese citizens are living in Mozambique and vice-versa. BCI is the second largest bank operating in Mozambique by banking revenue, with a market share of 30.22% in loans and 29.18% in deposits, serving over 550.000 clients and 128 branches across the country20.

Scenarios for BCI in Mozambique

Although Mozambique is in the pace of modernization and stabilization of its economy, it is still a developing country, subject to a large number of factors that might change the macroeconomic environment and affect the activity of BCI, such as: Political and social unrest due to poor living conditions, leading to a decrease in GDP, investment and rise of inflation; or the Discovery of new natural Gas wells and consequent rise in GDP growth and investment. The last two scenarios are extreme and opposite, but possible for Mozambique in the near

19

Source: International Monetary Fund, World Economic Outlook, April 2013

20

BANCO BPI,SA COMPANY REPORT

future, and as so, we must account for it in our BCI’s projections. In this way, we

analyzed and took into account in the valuation of BCI four different scenarios, with different probabilities, depending on the characteristics of each of the

scenarios. We built projections for the bank’s activity under each of the scenarios

and then computed the expected FCFE weighting the different scenarios. We constructed a bad, a disappointing, a normal and a good scenarios. The valuation of the different scenarios can be seen in the Valuation Summary section, on page 29.

The bad scenario (1) reflects the remote but existing possibility of a political or social unrest, leading to a change of government and possibly of regime, implying huge instability in the country. In this scenario, we foresee a tremendous impact at the macroeconomic level, with a reduction in GDP of 10% for 2014, 5% in 2015 and 0% GDP growth in 2016; for investment we forecast a reduction of 25% in 2014 and 2015 and 0% in 2016, and finally a very important variable the exchange rate; which we assume to devalue 50%, from 42 Metical per Euro in 2013 to 66 Metical per Euro in 2014, something common in events such as revolutions and very unstable periods. At the bank’s level, the situation can be more or less severe depending on the measures taken by the new government, regarding the freezing of deposits and the payment of Government Bonds. Moreover we forecast an 80% haircut in Government Bonds in 2014, and another 20% in 2015, implying huge impairments to be recognized by the bank. Regarding the Loans portfolio, we forecast a great rise in general credit defaults, 10% in 2014 and 5% in 2015; and also a decrease in loans granted of 15% in 2014 and 2015; as the instability in the country freezes any new investments, and the severe recession will imply several defaults. As for deposits, the policy adopted by the Central Bank will be crucial in terms of freezing deposits for some

days, in order to avoid bank runs; however we introduced a partial deposit’s run

of 20% in 2014, as a response to the instability, followed by 0% and 4% growth in 2015 and 2016 respectively, as confidence returns.

BANCO BPI,SA COMPANY REPORT

The disappointing scenario (2) reflects the possibility of a decrease in the expected GDP growth and investment growth resulting from a deceleration of the global and regional economies, with less demand for Mozambique’s exports and also internal factors that might decrease the economic prospects. In this scenario we foresee at the macroeconomic level a GDP growth of 2% throughout 2014, 205 and 2016; for investment we forecast a 20% growth in 2014 followed by 0% growth in 2015 and -5% in 2016. At the bank’s level, we forecast a rise in credit defaults to 4% in 2014 and 3% in 2015 and in 2016. The credit loans evolution will be less optimistic than what the “normal scenario” expects, with loans increasing 30% in 2014 and 10% in 2015 and 2016. As for deposits, we forecast an increase of 12% per year. In this scenario no share capital increase is necessary, however the return on equity is lower than in previous years, 16% in 2014 and in 2015 and 24% in 2016, comparing to an average of 25% from 2008 until 2013.

The normal scenario (3) reflects the possibility of maintenance of the expected GDP and investment growth rates as forecasted by the IMF in its world economic outlook: GDP growth of 8% from 2014 until 2016 with investment growing 54% in 2014, 5% in 2015 and -1% in 2016. In this case, at the bank’s level, we forecast loan impairments to follow the past years behavior, around 2.72% per year. Regarding credit loans we forecast growth rates of 50% in 2013, 20% in 2015 and 14% in 2016, reflecting the high investment expected to occur in the country and great GDP growth prospects. Customer deposits will grow around 20% along the years of 2014, 2015 and 2016, giving the bank a loan-to-deposit ratio of 95% in those same years. In this scenario the bank will be capable of delivering high returns to its investors, 26% return on equity from 2013 until 2016.

The good scenario (4) reflects the possibility of an increase in the expected GDP and investment growth rates, as a result of more Natural Gas wells

discovered and further momentum on the Mozambique’s economy as well as